UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-22255

Columbia ETF Trust II

(Exact name of registrant as specified in charter)

290 Congress Street

Boston, MA 02210

(Address of principal executive offices) (Zip code)

Daniel J. Beckman

c/o Columbia Management Investment Advisers, LLC

290 Congress Street

Boston, MA 02210

Ryan C. Larrenaga, Esq.

c/o Columbia Management Investment Advisers, LLC

290 Congress Street

Boston, MA 02210

(Name and address of agent for service)

Registrant's telephone number, including area code: (800) 345-6611

Date of fiscal year end: Last Day of March

Date of reporting period: September 30, 2024

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

0001450501falseN-CSRSColumbia ETF Trust IIN-1A2024-09-300001450501columbia:C000159357Member2024-04-012024-09-3000014505012024-04-012024-09-300001450501columbia:C000159357Member2024-09-300001450501columbia:C000159357Membercolumbia:TaiwanSemiconductorManufacturingCoLtdMinusUSAMinus6889106CTIMember2024-09-300001450501columbia:C000159357Membercolumbia:SamsungElectronicsCoLtdMinusUSAMinus6771720CTIMember2024-09-300001450501columbia:C000159357Membercolumbia:RelianceIndustriesLtdMinusUSAMinus6099626CTIMember2024-09-300001450501columbia:C000159357Membercolumbia:ICICIBankLtdMinusUSAMinus45104G104CTIMember2024-09-300001450501columbia:C000159357Membercolumbia:HDFCBankLtdMinusUSAMinus40415F101CTIMember2024-09-300001450501columbia:C000159357Membercolumbia:InfosysLtdMinusUSAMinus456788108CTIMember2024-09-300001450501columbia:C000159357Membercolumbia:InternationalHoldingCoPJSCMinusUSAMinusB1K9VV1CTIMember2024-09-300001450501columbia:C000159357Membercolumbia:HonHaiPrecisionIndustryCoLtdMinusUSAMinus6438564CTIMember2024-09-300001450501columbia:C000159357Membercolumbia:SKHynixIncMinusUSAMinus6450267CTIMember2024-09-300001450501columbia:C000159357Membercolumbia:AlRajhiBankMinusUSAMinusB12LZH9CTIMember2024-09-300001450501columbia:C000159357Memberus-gaap:RealEstateSectorMember2024-09-300001450501columbia:C000159357Memberus-gaap:HealthcareSectorMember2024-09-300001450501columbia:C000159357Memberoef:UtilitiesSectorMember2024-09-300001450501columbia:C000159357Memberoef:ConsumerDiscretionarySectorMember2024-09-300001450501columbia:C000159357Memberoef:ConsumerStaplesSectorMember2024-09-300001450501columbia:C000159357Membercolumbia:CommunicationServicesSectorMember2024-09-300001450501columbia:C000159357Memberus-gaap:EnergySectorMember2024-09-300001450501columbia:C000159357Memberoef:MaterialsSectorMember2024-09-300001450501columbia:C000159357Membercolumbia:IndustrialsSectorMember2024-09-300001450501columbia:C000159357Membercolumbia:FinancialsSectorMember2024-09-300001450501columbia:C000159357Memberoef:InformationTechnologySectorMember2024-09-300001450501columbia:C000159357Membercolumbia:CountryOtherCTIMember2024-09-300001450501columbia:C000159357Membercountry:MY2024-09-300001450501columbia:C000159357Membercountry:ID2024-09-300001450501columbia:C000159357Membercountry:MX2024-09-300001450501columbia:C000159357Membercountry:AE2024-09-300001450501columbia:C000159357Membercountry:ZA2024-09-300001450501columbia:C000159357Membercountry:SA2024-09-300001450501columbia:C000159357Membercountry:BR2024-09-300001450501columbia:C000159357Membercountry:KR2024-09-300001450501columbia:C000159357Membercountry:IN2024-09-300001450501columbia:C000159357Membercountry:TW2024-09-300001450501columbia:C000101379Member2024-04-012024-09-300001450501columbia:C000101379Member2024-09-300001450501columbia:C000101379Membercolumbia:TrentLtdMinusUSAMinusBDDRN32CTIMember2024-09-300001450501columbia:C000101379Membercolumbia:ZomatoLtdMinusUSAMinusBL6P210CTIMember2024-09-300001450501columbia:C000101379Membercolumbia:MahindraMahindraLtdMinusUSAMinus6100186CTIMember2024-09-300001450501columbia:C000101379Membercolumbia:BajajAutoLtdMinusUSAMinusB2QKXW0CTIMember2024-09-300001450501columbia:C000101379Membercolumbia:ITCLtdMinusUSAMinusB0JGGP5CTIMember2024-09-300001450501columbia:C000101379Membercolumbia:HindustanUnileverLtdMinusUSAMinus6261674CTIMember2024-09-300001450501columbia:C000101379Membercolumbia:MarutiSuzukiIndiaLtdMinusUSAMinus6633712CTIMember2024-09-300001450501columbia:C000101379Membercolumbia:NestleIndiaLtdMinusUSAMinusBQB8GH3CTIMember2024-09-300001450501columbia:C000101379Membercolumbia:TitanCoLtdMinusUSAMinus6139340CTIMember2024-09-300001450501columbia:C000101379Membercolumbia:TataConsumerProductsLtdMinusUSAMinus6121488CTIMember2024-09-300001450501columbia:C000101379Memberoef:ConsumerStaplesSectorMember2024-09-300001450501columbia:C000101379Memberoef:ConsumerDiscretionarySectorMember2024-09-300001450501columbia:C000101379Membercountry:US2024-09-300001450501columbia:C000101379Membercountry:IN2024-09-300001450501columbia:C000088095Member2024-04-012024-09-300001450501columbia:C000088095Member2024-09-300001450501columbia:C000088095Membercolumbia:TaiwanSemiconductorManufacturingCoLtdMinusUSAMinus6889106CTIMember2024-09-300001450501columbia:C000088095Membercolumbia:AlibabaGroupHoldingLtdMinusUSAMinusBK6YZP5CTIMember2024-09-300001450501columbia:C000088095Membercolumbia:KweichowMoutaiCoLtdMinusUSAMinusBP3R2F1CTIMember2024-09-300001450501columbia:C000088095Membercolumbia:SamsungElectronicsCoLtdMinusUSAMinus6771720CTIMember2024-09-300001450501columbia:C000088095Membercolumbia:RelianceIndustriesLtdMinusUSAMinus6099626CTIMember2024-09-300001450501columbia:C000088095Membercolumbia:HDFCBankLtdMinusUSAMinusBK1N461CTIMember2024-09-300001450501columbia:C000088095Membercolumbia:MeituanMinusUSAMinusBGJW376CTIMember2024-09-300001450501columbia:C000088095Membercolumbia:SKHynixIncMinusUSAMinus6450267CTIMember2024-09-300001450501columbia:C000088095Membercolumbia:ICICIBankLtdMinusUSAMinusBSZ2BY7CTIMember2024-09-300001450501columbia:C000088095Membercolumbia:ChinaConstructionBankCorpMinusUSAMinusB0LMTQ3CTIMember2024-09-300001450501columbia:C000088095Memberus-gaap:RealEstateSectorMember2024-09-300001450501columbia:C000088095Memberus-gaap:HealthcareSectorMember2024-09-300001450501columbia:C000088095Memberoef:UtilitiesSectorMember2024-09-300001450501columbia:C000088095Memberoef:ConsumerStaplesSectorMember2024-09-300001450501columbia:C000088095Memberus-gaap:EnergySectorMember2024-09-300001450501columbia:C000088095Memberoef:MaterialsSectorMember2024-09-300001450501columbia:C000088095Membercolumbia:IndustrialsSectorMember2024-09-300001450501columbia:C000088095Membercolumbia:CommunicationServicesSectorMember2024-09-300001450501columbia:C000088095Memberoef:ConsumerDiscretionarySectorMember2024-09-300001450501columbia:C000088095Memberoef:InformationTechnologySectorMember2024-09-300001450501columbia:C000088095Membercolumbia:FinancialsSectorMember2024-09-300001450501columbia:C000088095Membercolumbia:CountryOtherCTIMember2024-09-300001450501columbia:C000088095Membercountry:ID2024-09-300001450501columbia:C000088095Membercountry:MX2024-09-300001450501columbia:C000088095Membercountry:AE2024-09-300001450501columbia:C000088095Membercountry:ZA2024-09-300001450501columbia:C000088095Membercountry:SA2024-09-300001450501columbia:C000088095Membercountry:BR2024-09-300001450501columbia:C000088095Membercountry:KR2024-09-300001450501columbia:C000088095Membercountry:TW2024-09-300001450501columbia:C000088095Membercountry:IN2024-09-300001450501columbia:C000088095Membercountry:CN2024-09-30iso4217:USDxbrli:sharesiso4217:USDxbrli:sharesxbrli:pureutr:Dcolumbia:Holding

Columbia EM Core ex-China ETF

Semi-Annual Shareholder Report | September 30, 2024

This semi-annual shareholder report contains important information about Columbia EM Core ex-China ETF (the Fund) for the period of April 1, 2024 to September 30, 2024. You can find additional information about the Fund at columbiathreadneedleus.com/resources/literature. You can also request this information by contacting us at 1-800-426-3750.

What were the Fund costs for the reporting period?

(Based on a hypothetical $10,000 investment)

Fund | Cost of a $10,000 investment | Cost paid as a percentage of a $10,000 investment |

|---|

Columbia EM Core ex-China ETF | $9 | 0.17%Footnote Reference(a) |

| Footnote | Description |

Footnote(a) | Annualized. |

Fund net assets | $1,254,208,486 |

Total number of portfolio holdings | 331 |

Portfolio turnover for the reporting period | 13% |

Columbia EM Core ex-China ETF | SSR274_00_(11/24) | 1

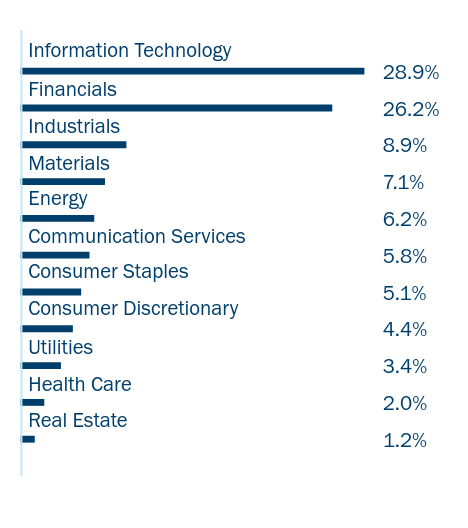

Graphical Representation of Fund Holdings

The tables below show the investment makeup of the Fund represented as a percentage of the Fund net assets. Derivatives are excluded from the tables unless otherwise noted. The Fund’s portfolio composition is subject to change.

Taiwan Semiconductor Manufacturing Co. Ltd. (Taiwan) | 12.0% |

Samsung Electronics Co. Ltd. (South Korea) | 4.2% |

Reliance Industries, Ltd. (India) | 2.2% |

ICICI Bank Ltd. (India) | 1.9% |

HDFC Bank Ltd. (India) | 1.9% |

Infosys Ltd. (India) | 1.7% |

International Holding Co. PJSC (United Arab Emirates) | 1.3% |

Hon Hai Precision Industry Co. Ltd. (Taiwan) | 1.3% |

SK Hynix, Inc. (South Korea) | 1.2% |

Al Rajhi Bank (Saudi Arabia) | 1.1% |

Value | Value |

|---|

Real Estate | 1.2% |

Health Care | 2.0% |

Utilities | 3.4% |

Consumer Discretionary | 4.4% |

Consumer Staples | 5.1% |

Communication Services | 5.8% |

Energy | 6.2% |

Materials | 7.1% |

Industrials | 8.9% |

Financials | 26.2% |

Information Technology | 28.9% |

Value | Value |

|---|

Other | 9.9% |

Malaysia | 2.2% |

Indonesia | 3.0% |

Mexico | 3.8% |

United Arab Emirates | 4.2% |

South Africa | 4.3% |

Saudi Arabia | 6.4% |

Brazil | 6.8% |

South Korea | 13.3% |

India | 18.8% |

Taiwan | 27.5% |

Availability of Additional Information

For additional information about the Fund, including its prospectus, financial information, holdings, federal tax information and proxy voting information, visit the Fund’s website included at the beginning of this report or scan the QR code below.

Columbia Management Investment Advisers, LLC serves as the investment manager to the ETFs. The ETFs are distributed by ALPS Distributors, Inc., which is not affiliated with Columbia Management Investment Advisers, LLC, or its parent company, Ameriprise Financial, Inc.

Columbia Threadneedle Investments (Columbia Threadneedle) is the global brand name of the Columbia and Threadneedle group of companies.

© 2024 Columbia Management Investment Advisers, LLC.

Not FDIC or NCUA Insured • No Financial Institution Guarantee • May Lose Value

Columbia EM Core ex-China ETF | SSR274_00_(11/24) | 2

Columbia India Consumer ETF

Semi-Annual Shareholder Report | September 30, 2024

This semi-annual shareholder report contains important information about Columbia India Consumer ETF (the Fund) for the period of April 1, 2024 to September 30, 2024. You can find additional information about the Fund at columbiathreadneedleus.com/resources/literature. You can also request this information by contacting us at 1-800-426-3750.

What were the Fund costs for the reporting period?

(Based on a hypothetical $10,000 investment)

Fund | Cost of a $10,000 investment | Cost paid as a percentage of a $10,000 investment |

|---|

Columbia India Consumer ETF | $41 | 0.75%Footnote Reference(a) |

| Footnote | Description |

Footnote(a) | Annualized. |

Fund net assets | $483,881,821 |

Total number of portfolio holdings | 31 |

Portfolio turnover for the reporting period | 4% |

Columbia India Consumer ETF | SSR279_00_(11/24) | 1

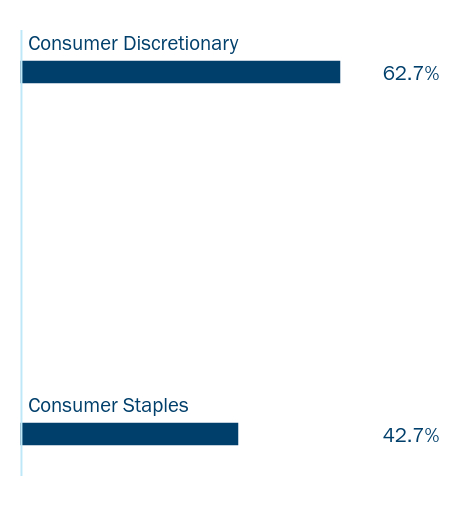

Graphical Representation of Fund Holdings

The tables below show the investment makeup of the Fund represented as a percentage of the Fund net assets. Derivatives are excluded from the tables unless otherwise noted. The Fund’s portfolio composition is subject to change.

Trent Ltd. (India) | 7.4% |

Zomato Ltd. (India) | 6.9% |

Mahindra & Mahindra Ltd. (India) | 6.6% |

Bajaj Auto Ltd. (India) | 5.6% |

ITC Ltd. (India) | 5.1% |

Hindustan Unilever Ltd. (India) | 4.9% |

Maruti Suzuki India Ltd. (India) | 4.7% |

Nestle India Ltd. (India) | 4.3% |

Titan Co. Ltd. (India) | 4.1% |

Tata Consumer Products Ltd. (India) | 4.0% |

Value | Value |

|---|

Consumer Staples | 42.7% |

Consumer Discretionary | 62.7% |

Value | Value |

|---|

United States | 1.1% |

India | 105.4% |

Availability of Additional Information

For additional information about the Fund, including its prospectus, financial information, holdings, federal tax information and proxy voting information, visit the Fund’s website included at the beginning of this report or scan the QR code below.

Columbia Management Investment Advisers, LLC serves as the investment manager to the ETFs. The ETFs are distributed by ALPS Distributors, Inc., which is not affiliated with Columbia Management Investment Advisers, LLC, or its parent company, Ameriprise Financial, Inc.

Columbia Threadneedle Investments (Columbia Threadneedle) is the global brand name of the Columbia and Threadneedle group of companies.

© 2024 Columbia Management Investment Advisers, LLC.

Not FDIC or NCUA Insured • No Financial Institution Guarantee • May Lose Value

Columbia India Consumer ETF | SSR279_00_(11/24) | 2

Columbia Research Enhanced Emerging Economies ETF

Semi-Annual Shareholder Report | September 30, 2024

This semi-annual shareholder report contains important information about Columbia Research Enhanced Emerging Economies ETF (the Fund) for the period of April 1, 2024 to September 30, 2024. You can find additional information about the Fund at columbiathreadneedleus.com/resources/literature. You can also request this information by contacting us at 1-800-426-3750.

What were the Fund costs for the reporting period?

(Based on a hypothetical $10,000 investment)

Fund | Cost of a $10,000 investment | Cost paid as a percentage of a $10,000 investment |

|---|

Columbia Research Enhanced Emerging Economies ETF | $26 | 0.49%Footnote Reference(a) |

| Footnote | Description |

Footnote(a) | Annualized. |

Fund net assets | $54,692,332 |

Total number of portfolio holdings | 203 |

Portfolio turnover for the reporting period | 89% |

Columbia Research Enhanced Emerging Economies ETF | SSR277_00_(11/24) | 1

Graphical Representation of Fund Holdings

The tables below show the investment makeup of the Fund represented as a percentage of the Fund net assets. Derivatives are excluded from the tables unless otherwise noted. The Fund’s portfolio composition is subject to change.

Taiwan Semiconductor Manufacturing Co. Ltd. (Taiwan) | 4.9% |

Alibaba Group Holding Ltd. (China) | 4.6% |

Kweichow Moutai Co. Ltd. (China) | 3.4% |

Samsung Electronics Co. Ltd. (South Korea) | 3.0% |

Reliance Industries, Ltd. (India) | 2.4% |

HDFC Bank Ltd. (India) | 2.3% |

Meituan Class B (China) | 2.1% |

SK Hynix, Inc. (South Korea) | 1.5% |

ICICI Bank Ltd. (India) | 1.5% |

China Construction Bank Corp. Class H (China) | 1.4% |

Value | Value |

|---|

Real Estate | 1.7% |

Health Care | 2.3% |

Utilities | 3.1% |

Consumer Staples | 5.2% |

Energy | 5.6% |

Materials | 5.8% |

Industrials | 6.2% |

Communication Services | 6.4% |

Consumer Discretionary | 15.8% |

Information Technology | 19.6% |

Financials | 27.8% |

Value | Value |

|---|

Other | 7.6% |

Indonesia | 1.7% |

Mexico | 2.1% |

United Arab Emirates | 2.4% |

South Africa | 2.8% |

Saudi Arabia | 3.8% |

Brazil | 4.5% |

South Korea | 11.2% |

Taiwan | 16.5% |

India | 22.2% |

China | 25.4% |

Availability of Additional Information

For additional information about the Fund, including its prospectus, financial information, holdings, federal tax information and proxy voting information, visit the Fund’s website included at the beginning of this report or scan the QR code below.

Columbia Management Investment Advisers, LLC serves as the investment manager to the ETFs. The ETFs are distributed by ALPS Distributors, Inc., which is not affiliated with Columbia Management Investment Advisers, LLC, or its parent company, Ameriprise Financial, Inc.

Columbia Threadneedle Investments (Columbia Threadneedle) is the global brand name of the Columbia and Threadneedle group of companies.

© 2024 Columbia Management Investment Advisers, LLC.

Not FDIC or NCUA Insured • No Financial Institution Guarantee • May Lose Value

Columbia Research Enhanced Emerging Economies ETF | SSR277_00_(11/24) | 2

Item 2. Code of Ethics.

Not applicable.

Item 3. Audit Committee Financial Expert.

Not applicable.

Item 4. Principal Accountant Fees and Services.

Not applicable.

Item 5. Audit Committee of Listed Registrants.

Not applicable.

Item 6. Investments.

(a) The registrant’s “Schedule I – Investments in securities of unaffiliated issuers” (as set forth in 17 CFR 210.12-12) is included in Item 7 of this Form N-CSR.

(b) Not applicable.

Item 7. Financial Statements and Financial Highlights for Open-End Management Investment Companies.

Not

FDIC

or

NCUA

Insured

No

Financial

Institution

Guarantee

May

Lose

Value

Semiannual

Financial

Statements

and

Additional

Information

September

30,

2024

(Unaudited)

Columbia

EM

Core

ex-China

ETF

Columbia

India

Consumer

ETF

Columbia

Research

Enhanced

Emerging

Economies

ETF

Portfolio

of

Investments

3

Statement

of

Assets

and

Liabilities

17

Statement

of

Operations

18

Statement

of

Changes

in

Net

Assets

19

Financial

Highlights

21

Notes

to

Financial

Statements

24

Approval

of

Investment

Management

Services

Agreement

35

PORTFOLIO

OF

INVESTMENTS

Columbia

EM

Core

ex-China

ETF

September

30,

2024

(Unaudited)

(Percentages

represent

value

of

investments

compared

to

net

assets)

Investments

in

Securities

The

accompanying

Notes

to

Financial

Statements

are

an

integral

part

of

this

statement.

Common

Stocks

-

96.8%

Issuer

Shares

Value

($)

Brazil

-

4.4%

Ambev

SA

1,110,101

2,666,297

B3

SA

-

Brasil

Bolsa

Balcao

1,577,761

3,102,909

Banco

BTG

Pactual

SA

864,983

5,284,436

Banco

do

Brasil

SA

805,263

4,019,069

Banco

Santander

Brasil

SA

999,526

5,210,721

BRF

SA

(a)

201,599

875,503

Caixa

Seguridade

Participacoes

S/A

563,682

1,506,036

Cia

Siderurgica

Nacional

SA

389,959

923,018

Embraer

SA

(a)

421,191

3,710,113

Hapvida

Participacoes

e

Investimentos

SA

(a),(b)

1,542,474

1,132,964

Localiza

Rent

a

Car

SA

187,043

1,408,198

Lojas

Renner

SA

314,947

1,044,464

PRIO

SA

210,744

1,676,804

Rede

D'Or

Sao

Luiz

SA

(b)

228,664

1,298,721

Suzano

SA

250,602

2,505,192

TOTVS

SA

252,351

1,323,432

Vale

SA

965,192

11,256,261

Vibra

Energia

SA

307,248

1,320,211

WEG

SA

479,403

4,788,044

Total

55,052,393

Chile

-

0.4%

Empresas

Copec

SA

451,330

3,025,957

Latam

Airlines

Group

SA

112,891,327

1,454,675

Total

4,480,632

China

-

0.1%

Airtac

International

Group

33,991

980,639

Colombia

-

0.1%

Interconexion

Electrica

SA

ESP

179,776

735,637

Egypt

-

0.1%

Commercial

International

Bank

-

Egypt

(CIB)

500,617

875,821

Greece

-

0.3%

Eurobank

Ergasias

Services

and

Holdings

SA

727,317

1,670,519

National

Bank

of

Greece

SA

169,467

1,451,785

Total

3,122,304

Hungary

-

0.5%

MOL

Hungarian

Oil

&

Gas

PLC

90,437

678,049

OTP

Bank

Nyrt

76,077

3,989,276

Richter

Gedeon

Nyrt

49,206

1,519,654

Total

6,186,979

India

-

18.8%

Adani

Ports

&

Special

Economic

Zone

Ltd.

299,468

5,175,216

Adani

Power

Ltd.

(a)

256,219

2,006,153

Adani

Total

Gas

Ltd.

70,918

665,587

Axis

Bank

Ltd.

469,228

6,899,452

Bharat

Electronics

Ltd.

905,372

3,080,163

Bharat

Heavy

Electricals,

Ltd.

434,821

1,451,284

Bharat

Petroleum

Corp.

Ltd.

239,282

1,056,337

Bharti

Airtel

Ltd.

493,769

10,072,914

CG

Power

&

Industrial

Solutions

Ltd.

158,918

1,439,438

Coal

India

Ltd.

607,363

3,697,394

GAIL

India,

Ltd.

585,742

1,679,545

HDFC

Bank

Ltd.

ADR

375,754

23,507,170

Hindalco

Industries

Ltd.

354,299

3,197,099

Hindustan

Petroleum

Corp.

Ltd.

178,870

940,334

ICICI

Bank

Ltd.

ADR

786,186

23,467,652

IDBI

Bank

Ltd.

2,196,472

2,285,293

Common

Stocks

(continued)

Issuer

Shares

Value

($)

Indian

Oil

Corp.,

Ltd.

887,959

1,908,871

Indian

Railway

Finance

Corp.

Ltd.

(b)

562,201

1,064,812

Indus

Towers

Ltd.

(a)

238,946

1,119,294

Infosys

Ltd.

ADR

968,476

21,567,960

InterGlobe

Aviation

Ltd.

(a),(b)

20,488

1,170,451

ITC

Ltd.

1,504,551

9,302,762

Jio

Financial

Services

Ltd.

(a)

798,224

3,339,536

Kotak

Mahindra

Bank

Ltd.

205,838

4,553,791

NHPC,

Ltd.

917,129

1,039,142

NMDC,

Ltd.

366,874

1,072,193

NTPC

Ltd.

1,129,471

5,973,438

Oil

&

Natural

Gas

Corp.

Ltd.

937,262

3,328,461

Oil

India,

Ltd.

168,114

1,164,844

PB

Fintech

Ltd.

(a)

62,725

1,212,528

Power

Finance

Corp.

Ltd.

401,383

2,337,614

Power

Grid

Corp

of

India

Ltd.

1,009,860

4,252,074

Punjab

National

Bank

604,227

773,010

Rail

Vikas

Nigam

Ltd.

178,983

1,135,073

REC

Ltd.

369,208

2,442,993

Reliance

Industries,

Ltd.

793,205

27,952,487

State

Bank

of

India

GDR

76,949

7,163,952

Suzlon

Energy,

Ltd.

(a)

2,744,870

2,622,000

Tata

Consultancy

Services,

Ltd.

191,781

9,768,556

Tata

Motors

Ltd.

697,331

8,110,304

Tata

Power

Co.

Ltd.

(The)

502,845

2,895,816

Tata

Steel

Ltd.

2,214,272

4,453,580

Vedanta

Ltd.

708,230

4,332,562

Wipro

Ltd.

462,842

2,990,478

Yes

Bank

Ltd.

(a)

3,105,420

833,041

Zee

Entertainment

Enterprises

Ltd.

(a)

393,657

646,847

Zomato

Ltd.

(a)

1,383,979

4,513,554

Total

235,663,055

Indonesia

-

3.0%

Amman

Mineral

Internasional

PT

(a)

3,031,177

1,856,946

Barito

Renewables

Energy

Tbk

PT

3,894,633

1,697,792

Chandra

Asri

Pacific

Tbk

PT

1,844,703

1,032,619

PT

Adaro

Energy

Indonesia

Tbk

4,899,914

1,233,070

PT

Astra

International

Tbk

9,773,896

3,260,117

PT

Bank

Central

Asia

Tbk

18,755,208

12,790,457

PT

Bank

Mandiri

Persero

Tbk

15,049,306

6,883,517

PT

Bank

Rakyat

Indonesia

Persero

Tbk

10,824,848

3,539,168

PT

GoTo

Gojek

Tokopedia

Tbk

(a)

309,449,868

1,348,989

PT

Telkom

Indonesia

Persero

Tbk

21,395,375

4,225,375

Total

37,868,050

Kuwait

-

1.0%

Al

Ahli

Bank

of

Kuwait

KSCP

909,609

810,528

Boubyan

Bank

KSCP

920,801

1,719,432

Gulf

Bank

KSCP

1,773,822

1,760,747

Kuwait

Finance

House

KSCP

1,399,837

3,283,483

Mabanee

Co

KPSC

666,678

1,828,041

National

Bank

of

Kuwait

SAKP

752,555

2,176,924

National

Industries

Group

Holding

SAK

1,247,265

911,188

Total

12,490,343

Malaysia

-

2.2%

CIMB

Group

Holdings

Bhd

710,940

1,387,915

Dialog

Group

Bhd

4,439,217

2,314,615

Genting

Malaysia

Bhd

1,742,375

1,022,565

IHH

Healthcare

Bhd

4,046,524

7,026,340

Inari

Amertron

Bhd

2,223,861

1,564,011

Malayan

Banking

Bhd

1,167,940

2,968,355

Public

Bank

Bhd

956,114

1,057,325

PORTFOLIO

OF

INVESTMENTS

(continued)

Columbia

EM

Core

ex-China

ETF

September

30,

2024

(Unaudited)

The

accompanying

Notes

to

Financial

Statements

are

an

integral

part

of

this

statement.

Common

Stocks

(continued)

Issuer

Shares

Value

($)

Tenaga

Nasional

Bhd

2,889,999

10,120,428

YTL

Corp.

Bhd

1,222,700

744,265

Total

28,205,819

Mexico

-

3.8%

America

Movil

SAB

de

CV

Series

B

7,756,237

6,390,329

Arca

Continental

SAB

de

CV

201,480

1,892,280

Coca-Cola

Femsa

SAB

de

CV

175,349

1,559,195

Fibra

Uno

Administracion

SA

de

CV

1,068,777

1,249,687

Fomento

Economico

Mexicano

SAB

de

CV

Series

UBD

544,293

5,396,837

Grupo

Aeroportuario

del

Centro

Norte

SAB

de

CV

145,324

1,233,423

Grupo

Aeroportuario

del

Pacifico

SAB

de

CV

Class

B

123,061

2,146,442

Grupo

Aeroportuario

del

Sureste

SAB

de

CV

Class

B

58,443

1,661,788

Grupo

Bimbo

SAB

de

CV

Series

A

990,267

3,423,145

Grupo

Carso

SAB

de

CV

Series

A1

150,783

937,682

Grupo

Financiero

Banorte

SAB

de

CV

Class

O

827,887

5,891,758

Grupo

Financiero

Inbursa

SAB

de

CV

Class

O

(a)

565,545

1,286,772

Grupo

Mexico

SAB

de

CV

Series

B

1,034,234

5,791,647

Grupo

Televisa

SAB

Series

CPO

1,485,356

755,484

Industrias

Penoles

SAB

de

CV

(a)

70,495

939,861

Prologis

Property

Mexico

SA

de

CV

465,785

1,530,518

Qualitas

Controladora

SAB

de

CV

96,054

754,486

Wal-Mart

de

Mexico

SAB

de

CV

1,749,818

5,281,947

Total

48,123,281

Philippines

-

1.1%

Ayala

Corp.

215,005

2,576,415

Ayala

Land,

Inc.

2,155,843

1,408,055

Manila

Electric

Co.

468,077

3,660,251

SM

Investments

Corp.

328,802

5,609,364

SM

Prime

Holdings,

Inc.

1,842,826

1,062,204

Total

14,316,289

Poland

-

1.1%

Bank

Polska

Kasa

Opieki

SA

28,479

1,090,521

ORLEN

SA

80,705

1,175,348

Powszechna

Kasa

Oszczednosci

Bank

Polski

SA

479,282

6,993,772

Powszechny

Zaklad

Ubezpieczen

SA

457,786

5,021,410

Total

14,281,051

Qatar

-

1.3%

Barwa

Real

Estate

Co.

1,270,727

995,711

Commercial

Bank

PSQC

(The)

1,192,839

1,441,497

Masraf

Al

Rayan

QSC

2,372,470

1,609,448

Qatar

Fuel

QSC

598,254

2,505,733

Qatar

Gas

Transport

Co.,

Ltd.

1,298,640

1,551,520

Qatar

Insurance

Co.

SAQ

1,512,438

913,860

Qatar

Islamic

Bank

QPSC

421,006

2,468,684

Qatar

National

Bank

QPSC

918,424

4,275,552

Qatar

Navigation

QSC

313,327

970,703

Total

16,732,708

Russia

-

0.0%

Gazprom

PJSC

(a),(c),(d),(e),(f)

251,024

0

GMK

Norilskiy

Nickel

PAO

ADR

(a),(c),(d),(e)

19,108

0

LUKOIL

PJSC

(c),(d),(e),(f)

14,277

0

Mobile

TeleSystems

PJSC

ADR

(a),(c),(d),(e)

49,482

0

Total

0

Common

Stocks

(continued)

Issuer

Shares

Value

($)

Saudi

Arabia

-

6.4%

ACWA

Power

Co.

36,410

4,800,444

Advanced

Petrochemical

Co.

(a)

71,094

735,311

Al

Rajhi

Bank

587,963

13,666,997

Alinma

Bank

575,126

4,369,326

Almarai

Co.

JSC

157,724

2,320,831

Arab

National

Bank

248,325

1,264,330

Bank

AlBilad

197,518

2,074,481

Bank

Al-Jazira

(a)

301,851

1,380,755

Banque

Saudi

Fransi

274,162

2,353,259

Catrion

Catering

Holding

Co.

28,477

842,605

Co.

for

Cooperative

Insurance

(The)

36,920

1,452,629

Dar

Al

Arkan

Real

Estate

Development

Co.

(a)

369,590

1,536,921

Etihad

Etisalat

Co.

140,592

1,926,328

Mobile

Telecommunications

Co.

Saudi

Arabia

389,480

1,137,895

Riyad

Bank

335,000

2,225,356

SABIC

Agri-Nutrients

Co.

41,574

1,316,573

Sahara

International

Petrochemical

Co.

162,241

1,269,332

Saudi

Arabian

Mining

Co.

(a)

269,165

3,501,427

Saudi

Arabian

Oil

Co.

(b)

1,274,512

9,207,036

Saudi

Awwal

Bank

314,409

2,904,055

Saudi

Basic

Industries

Corp.

162,152

3,237,507

Saudi

Industrial

Investment

Group

185,413

967,742

Saudi

Investment

Bank

(The)

321,821

1,118,661

Saudi

Kayan

Petrochemical

Co.

(a)

277,452

621,261

Saudi

National

Bank

(The)

841,013

7,689,595

Saudi

Telecom

Co.

498,465

5,806,611

Savola

Group

(The)

(a)

83,774

602,948

Total

80,330,216

South

Africa

-

4.3%

Absa

Group

Ltd.

113,796

1,158,530

Anglo

American

Platinum

Ltd.

28,428

1,023,408

Bid

Corp.

Ltd.

173,669

4,462,031

Bidvest

Group

Ltd.

(The)

249,017

4,230,941

FirstRand

Ltd.

1,862,089

8,975,199

Gold

Fields

Ltd.

263,687

4,113,563

Harmony

Gold

Mining

Co.

Ltd.

237,861

2,458,875

Impala

Platinum

Holdings

Ltd.

(a)

257,579

1,446,299

Mr

Price

Group

Ltd.

90,750

1,423,036

MTN

Group

Ltd.

526,705

2,806,750

Naspers

Ltd.

Class

N

47,683

11,607,452

Sasol

Ltd.

158,373

1,066,542

Shoprite

Holdings

Ltd.

284,491

4,883,026

Sibanye

Stillwater

Ltd.

(a)

981,155

1,016,313

Standard

Bank

Group

Ltd.

193,038

2,714,798

Total

53,386,763

South

Korea

-

13.3%

Alteogen,

Inc.

(a)

6,973

1,743,650

Amorepacific

Corp.

7,506

847,776

Celltrion,

Inc.

48,240

7,208,149

Doosan

Enerbility

Co.

Ltd.

(a)

122,273

1,674,627

Ecopro

BM

Co.

Ltd.

(a)

11,441

1,614,181

Ecopro

Co.

Ltd.

(a)

24,775

1,678,569

Hana

Financial

Group,

Inc.

110,750

4,979,812

Hanmi

Semiconductor

Co.

Ltd.

9,840

814,921

Hanwha

Aerospace

Co.

Ltd.

6,039

1,371,555

Hanwha

Industrial

Solutions

Co.

Ltd.

(a)

6,690

170,358

HD

Hyundai

Electric

Co.

Ltd.

6,180

1,557,169

HLB,

Inc.

(a)

36,155

2,369,415

HMM

Co.

Ltd.

132,327

1,875,063

PORTFOLIO

OF

INVESTMENTS

(continued)

Columbia

EM

Core

ex-China

ETF

September

30,

2024

(Unaudited)

The

accompanying

Notes

to

Financial

Statements

are

an

integral

part

of

this

statement.

Common

Stocks

(continued)

Issuer

Shares

Value

($)

HYBE

Co.

Ltd.

7,684

991,863

Hyundai

Mobis

Co.

Ltd.

9,223

1,533,993

Hyundai

Motor

Co.

36,934

6,891,409

Kakao

Corp.

111,516

3,082,743

KakaoBank

Corp.

76,917

1,244,012

KB

Financial

Group,

Inc.

114,700

7,095,840

Kia

Corp.

70,549

5,389,497

L&F

Co.

Ltd.

(a)

7,994

693,828

LG

Chem

Ltd.

12,330

3,361,356

LG

Electronics,

Inc.

42,234

3,368,514

Meritz

Financial

Group,

Inc.

21,495

1,596,058

NAVER

Corp.

48,414

6,271,570

POSCO

Future

M

Co.

Ltd.

6,857

1,310,889

POSCO

Holdings,

Inc.

20,025

5,895,561

Samsung

C&T

Corp.

14,606

1,539,120

Samsung

E&A

Co.

Ltd.

(a)

62,316

1,048,369

Samsung

Electro-Mechanics

Co.

Ltd.

33,095

3,353,282

Samsung

Electronics

Co.

Ltd.

1,113,397

52,362,098

Samsung

SDI

Co.

Ltd.

15,299

4,428,134

Shinhan

Financial

Group

Co.

Ltd.

167,788

7,121,078

SK

Hynix,

Inc.

115,956

15,482,081

SK

Innovation

Co.

Ltd.

(a)

16,813

1,505,546

SK

Square

Co.

Ltd.

(a)

18,431

1,138,812

SK

Telecom

Co.

Ltd.

27,669

1,182,761

Woori

Financial

Group,

Inc.

97,654

1,157,480

Total

166,951,139

Taiwan

-

27.5%

Accton

Technology

Corp.

117,275

1,971,476

Acer,

Inc.

1,336,054

1,722,497

Advantech

Co.

Ltd.

122,729

1,246,816

Alchip

Technologies

Ltd.

23,876

1,490,057

ASE

Technology

Holding

Co.

Ltd.

648,110

3,092,431

Asia

Vital

Components

Co.

Ltd.

121,021

2,256,249

Asustek

Computer,

Inc.

150,325

2,626,822

AUO

Corp.

(a)

2,517,938

1,356,575

Catcher

Technology

Co.

Ltd.

569,057

4,252,666

Cathay

Financial

Holding

Co.

Ltd.

1,931,740

4,059,239

Chailease

Holding

Co.

Ltd.

268,915

1,389,335

Chang

Hwa

Commercial

Bank

Ltd.

8,528,808

4,824,093

China

Airlines

Ltd.

784,639

533,068

China

Steel

Corp.

4,930,422

3,606,695

Chipbond

Technology

Corp.

1,382,026

2,904,104

Chunghwa

Telecom

Co.

Ltd.

2,106,363

8,353,169

CTBC

Financial

Holding

Co.

Ltd.

7,150,660

7,772,825

Delta

Electronics,

Inc.

437,380

5,258,815

E

Ink

Holdings,

Inc.

186,760

1,729,123

E.Sun

Financial

Holding

Co.

Ltd.

2,127,943

1,886,111

Elite

Material

Co.

Ltd.

77,834

1,099,388

eMemory

Technology,

Inc.

21,182

1,760,342

Eva

Airways

Corp.

1,463,762

1,734,507

Evergreen

Marine

Corp.

Taiwan

Ltd.

257,130

1,633,139

Far

Eastern

New

Century

Corp.

6,070,874

7,366,425

Far

EasTone

Telecommunications

Co.

Ltd.

1,994,794

5,717,151

Faraday

Technology

Corp.

105,527

886,992

Formosa

Chemicals

&

Fibre

Corp.

1,206,263

1,656,175

Formosa

Petrochemical

Corp.

1,180,778

1,966,315

Formosa

Plastics

Corp.

2,127,031

3,595,853

Fortune

Electric

Co.

Ltd.

43,419

862,988

Fubon

Financial

Holding

Co.

Ltd.

1,207,769

3,450,060

Gigabyte

Technology

Co.

Ltd.

235,445

1,923,199

Global

Unichip

Corp.

15,922

553,432

Hon

Hai

Precision

Industry

Co.

Ltd.

2,787,647

16,516,323

Common

Stocks

(continued)

Issuer

Shares

Value

($)

Innolux

Corp.

(a)

2,364,454

1,206,640

Inventec

Corp.

600,356

817,637

KGI

Financial

Holding

Co.

Ltd.

2,152,713

1,122,392

Largan

Precision

Co.

Ltd.

42,073

3,376,848

Lite-On

Technology

Corp.

611,137

1,921,480

Lotes

Co.

Ltd.

21,943

960,329

Makalot

Industrial

Co.

Ltd.

254,116

2,802,410

MediaTek,

Inc.

341,358

12,674,250

Mega

Financial

Holding

Co.

Ltd.

1,305,168

1,620,814

Nan

Ya

Plastics

Corp.

3,425,208

4,978,736

Novatek

Microelectronics

Corp.

162,494

2,659,754

PharmaEssentia

Corp.

(a)

50,532

1,015,542

President

Chain

Store

Corp.

422,107

3,934,766

Quanta

Computer,

Inc.

502,192

4,189,363

Realtek

Semiconductor

Corp.

76,706

1,141,628

Taiwan

Business

Bank

12,484,794

6,292,401

Taiwan

Mobile

Co.

Ltd.

1,988,227

7,225,004

Taiwan

Semiconductor

Manufacturing

Co.

Ltd.

4,959,785

149,985,441

Tatung

Co.

Ltd.

(a)

530,426

823,802

Unimicron

Technology

Corp.

356,317

1,621,337

Uni-President

Enterprises

Corp.

2,645,971

7,290,812

United

Microelectronics

Corp.

3,362,255

5,715,934

Walsin

Lihwa

Corp.

748,857

828,211

Wan

Hai

Lines

Ltd.

294,223

911,123

Wistron

Corp.

611,342

1,951,102

Wiwynn

Corp.

27,311

1,480,049

Yageo

Corp.

85,107

1,675,435

Yang

Ming

Marine

Transport

Corp.

627,161

1,367,422

Total

344,645,117

Thailand

-

1.9%

Bangkok

Expressway

&

Metro

PCL

NVDR

4,612,657

1,168,306

Bumrungrad

Hospital

PCL

NVDR

246,929

2,064,296

Central

Retail

Corp

PCL

NVDR

1,143,438

1,101,595

Charoen

Pokphand

Foods

PCL

NVDR

1,890,571

1,410,107

CP

ALL

PCL

NVDR

2,997,998

6,102,676

Delta

Electronics

Thailand

PCL

NVDR

1,304,900

4,339,190

Gulf

Energy

Development

PCL

NVDR

1,614,100

2,859,256

Kasikornbank

PCL

NVDR

308,884

1,439,907

Krung

Thai

Bank

PCL

NVDR

2,233,736

1,430,035

Minor

International

PCL

NVDR

1,074,091

942,990

Thai

Oil

PCL

NVDR

590,508

940,519

Total

23,798,877

Turkey

-

1.0%

Akbank

TAS

706,464

1,272,936

BIM

Birlesik

Magazalar

AS

154,419

2,241,491

Eregli

Demir

ve

Celik

Fabrikalari

TAS

905,183

1,416,531

KOC

Holding

AS

140,833

775,282

Sasa

Polyester

Sanayi

AS

(a)

5,406,830

680,060

Turk

Hava

Yollari

AO

(a)

364,492

3,038,566

Turkiye

Is

Bankasi

AS

Class

C

1,730,035

711,502

Turkiye

Petrol

Rafinerileri

AS

519,540

2,358,558

Yapi

ve

Kredi

Bankasi

AS

714,056

645,814

Total

13,140,740

United

Arab

Emirates

-

4.2%

Abu

Dhabi

Commercial

Bank

PJSC

747,367

1,713,267

Abu

Dhabi

Islamic

Bank

PJSC

645,985

2,237,117

Abu

Dhabi

Ports

Co.

PJSC

(a)

1,273,943

1,772,352

ADNOC

Drilling

Co.

PJSC

808,251

1,040,846

Adnoc

Gas

PLC

2,299,666

1,990,999

Aldar

Properties

PJSC

1,002,106

2,051,684

PORTFOLIO

OF

INVESTMENTS

(continued)

Columbia

EM

Core

ex-China

ETF

September

30,

2024

(Unaudited)

The

accompanying

Notes

to

Financial

Statements

are

an

integral

part

of

this

statement.

Common

Stocks

(continued)

Issuer

Shares

Value

($)

Alpha

Dhabi

Holding

PJSC

(a)

411,354

1,287,931

Commercial

Bank

of

Dubai

PSC

678,644

1,230,539

Dubai

Investments

PJSC

1,067,973

607,695

Dubai

Islamic

Bank

PJSC

1,442,430

2,474,084

Emaar

Properties

PJSC

1,375,564

3,265,701

Emirates

Integrated

Telecommunications

Co.

PJSC

505,764

961,131

Emirates

NBD

Bank

PJSC

543,732

3,005,107

Emirates

Telecommunications

Group

Co.

PJSC

857,120

4,317,103

First

Abu

Dhabi

Bank

PJSC

1,544,653

5,778,255

International

Holding

Co.

PJSC

(a)

146,453

16,228,252

Modon

Holding

PSC

(a)

1,145,489

1,181,977

Multiply

Group

PJSC

(a)

1,236,953

794,775

NMDC

Group

PJSC

77,507

542,739

Total

52,481,554

Total

Common

Stocks

(Cost:

$1,081,684,044)

1,213,849,407

Preferred

Stocks

-

2.5%

Issuer

Shares

Value

($)

Brazil

-

2.4%

Banco

Bradesco

SA

Preference

Shares

1,637,681

4,420,638

Gerdau

SA

Preference

Shares

463,334

1,625,047

Itau

Unibanco

Holding

SA

Preference

Shares

1,370,361

9,086,587

Itausa

SA

Preference

Shares

3,303,548

6,715,317

Petroleo

Brasileiro

SA

Preference

Shares

1,212,951

8,020,560

Total

29,868,149

Chile

-

0.1%

Sociedad

Quimica

y

Minera

de

Chile

SA

Preference

Shares

Class

B

42,614

1,770,481

Total

Preferred

Stocks

(Cost:

$31,282,772)

31,638,630

Money

Market

Funds

-

0.9%

Issuer

Shares

Value

($)

Goldman

Sachs

Financial

Square

Funds

—

Treasury

Instruments

Fund,

Institutional

Shares,

4.891%

(g)

10,706,636

10,706,636

Total

Money

Market

Funds

(Cost:

$10,706,636)

10,706,636

Total

Investments

in

Securities

(Cost:

$1,123,673,452)

1,256,194,673

Other

Assets

&

Liabilities,

Net

(1,986,187)

Net

Assets

1,254,208,486

PORTFOLIO

OF

INVESTMENTS

(continued)

Columbia

EM

Core

ex-China

ETF

September

30,

2024

(Unaudited)

The

accompanying

Notes

to

Financial

Statements

are

an

integral

part

of

this

statement.

GMK

Norilskiy

Nickel

PAO

ADR

Mobile

TeleSystems

PJSC

ADR

Notes

to

Portfolio

of

Investments

(a)

Non-income

producing

investment.

(b)

Represents

privately

placed

and

other

securities

and

instruments

exempt

from

Securities

and

Exchange

Commission

registration

(collectively,

private

placements),

such

as

Section

4(a)(2)

and

Rule

144A

eligible

securities,

which

are

often

sold

only

to

qualified

institutional

buyers.

At

September

30,

2024,

the

total

value

of

these

securities

amounted

to

$13,873,984,

which

represents

1.11%

of

total

net

assets.

(c)

Represents

fair

value

as

determined

in

good

faith

under

procedures

approved

by

the

Board

of

Trustees.

At

September

30,

2024,

the

value

of

these

securities

amounted

to

$0,

which

represents

less

than

0.01%

of

net

assets.

(d)

Valuation

based

on

significant

unobservable

inputs.

(e)

Denotes

a

restricted

security,

which

is

subject

to

legal

or

contractual

restrictions

on

resale

under

federal

securities

laws.

Disposal

of

a

restricted

investment

may

involve

time-consuming

negotiations

and

expenses,

and

prompt

sale

at

an

acceptable

price

may

be

difficult

to

achieve.

Private

placement

securities

are

generally

considered

to

be

restricted,

although

certain

of

those

securities

may

be

traded

between

qualified

institutional

investors

under

the

provisions

of

Section

4(a)(2)

and

Rule

144A.

The

Fund

will

not

incur

any

registration

costs

upon

such

a

trade.

These

securities

are

valued

at

fair

value

determined

in

good

faith

under

consistently

applied

procedures

approved

by

the

Fund’s

Board

of

Trustees.

At

September

30,

2024,

the

total

market

value

of

these

securities

amounted

to

$0,

which

represents

less

than

0.01%

of

total

net

assets.

Additional

information

on

these

securities

is

as

follows:

(f)

As

a

result

of

sanctions

and

restricted

cross-border

payments,

certain

income

and/or

principal

has

not

been

recognized

by

the

Fund.

The

Fund

will

continue

to

monitor

the

net

realizable

value

and

record

the

income

when

it

is

considered

collectible.

(g)

The

rate

shown

is

the

seven-day

current

annualized

yield

at

September

30,

2024.

Abbreviation

Legend

ADR

American

Depositary

Receipts

GDR

Global

Depositary

Receipts

NVDR

Non-Voting

Depository

Receipts

PJSC

Private

Joint

Stock

Company

Fair

Value

Measurements

The

Fund

categorizes

its

fair

value

measurements

according

to

a

three-level

hierarchy

that

maximizes

the

use

of

observable

inputs

and

minimizes

the

use

of

unobservable

inputs

by

prioritizing

that

the

most

observable

input

be

used

when

available.

Observable

inputs

are

those

that

market

participants

would

use

in

pricing

an

investment

based

on

market

data

obtained

from

sources

independent

of

the

reporting

entity.

Unobservable

inputs

are

those

that

reflect

the

Fund’s

assumptions

about

the

information

market

participants

would

use

in

pricing

an

investment.

An

investment’s

level

within

the

fair

value

hierarchy

is

based

on

the

lowest

level

of

any

input

that

is

deemed

significant

to

the

asset's

or

liability’s

fair

value

measurement.

The

input

levels

are

not

necessarily

an

indication

of

the

risk

or

liquidity

associated

with

investments

at

that

level.

For

example,

certain

U.S.

government

securities

are

generally

high

quality

and

liquid,

however,

they

are

reflected

as

Level

2

because

the

inputs

used

to

determine

fair

value

may

not

always

be

quoted

prices

in

an

active

market.

Fair

value

inputs

are

summarized

in

the

three

broad

levels

listed

below:

Level

1

—

Valuations

based

on

quoted

prices

for

investments

in

active

markets

that

the

Fund

has

the

ability

to

access

at

the

measurement

date.

Valuation

adjustments

are

not

applied

to

Level

1

investments.

Level

2

—

Valuations

based

on

other

significant

observable

inputs

(including

quoted

prices

for

similar

securities,

interest

rates,

prepayment

speeds,

credit

risks,

etc.).

Level

3

—

Valuations

based

on

significant

unobservable

inputs

(including

the

Fund’s

own

assumptions

and

judgment

in

determining

the

fair

value

of

investments).

Inputs

that

are

used

in

determining

fair

value

of

an

investment

may

include

price

information,

credit

data,

volatility

statistics,

and

other

factors.

These

inputs

can

be

either

observable

or

unobservable.

The

availability

of

observable

inputs

can

vary

between

investments,

and

is

affected

by

various

factors

such

as

the

type

of

investment,

and

the

volume

and

level

of

activity

for

that

investment

or

similar

investments

in

the

marketplace.

The

inputs

will

be

considered

by

the

Investment

Manager,

along

with

any

other

relevant

factors

in

the

calculation

of

an

investment’s

fair

value.

The

Fund

uses

prices

and

inputs

that

are

current

as

of

the

measurement

date,

which

may

include

periods

of

market

dislocations.

During

these

periods,

the

availability

of

prices

and

inputs

may

be

reduced

for

many

investments.

This

condition

could

cause

an

investment

to

be

reclassified

between

the

various

levels

within

the

hierarchy.

PORTFOLIO

OF

INVESTMENTS

(continued)

Columbia

EM

Core

ex-China

ETF

September

30,

2024

(Unaudited)

The

accompanying

Notes

to

Financial

Statements

are

an

integral

part

of

this

statement.

Fair

Value

Measurements

(continued)

Investments

falling

into

the

Level

3

category

are

primarily

supported

by

quoted

prices

from

brokers

and

dealers

participating

in

the

market

for

those

investments.

However,

these

may

be

classified

as

Level

3

investments

due

to

lack

of

market

transparency

and

corroboration

to

support

these

quoted

prices.

Additionally,

valuation

models

may

be

used

as

the

pricing

source

for

any

remaining

investments

classified

as

Level

3.

These

models

may

rely

on

one

or

more

significant

unobservable

inputs

and/or

significant

assumptions

by

the

Investment

Manager.

Inputs

used

in

valuations

may

include,

but

are

not

limited

to,

financial

statement

analysis,

capital

account

balances,

discount

rates

and

estimated

cash

flows,

and

comparable

company

data.

The

Fund's

Board

of

Trustees

(the

Board)

has

designated

the

Investment

Manager,

through

its

Valuation

Committee

(the

Committee),

as

valuation

designee,

responsible

for

determining

the

fair

value

of

the

assets

of

the

Fund

for

which

market

quotations

are

not

readily

available

using

valuation

procedures

approved

by

the

Board.

The

Committee

consists

of

voting

and

non-voting

members

from

various

groups

within

the

Investment

Manager's

organization,

including

operations

and

accounting,

trading

and

investments,

compliance,

risk

management

and

legal.

The

Committee

meets

at

least

monthly

to

review

and

approve

valuation

matters,

which

may

include

a

description

of

specific

valuation

determinations,

data

regarding

pricing

information

received

from

approved

pricing

vendors

and

brokers

and

the

results

of

Board-approved

valuation

policies

and

procedures

(the

Policies).

The

Policies

address,

among

other

things,

instances

when

market

quotations

are

or

are

not

readily

available,

including

recommendations

of

third

party

pricing

vendors

and

a

determination

of

appropriate

pricing

methodologies;

events

that

require

specific

valuation

determinations

and

assessment

of

fair

value

techniques;

securities

with

a

potential

for

stale

pricing,

including

those

that

are

illiquid,

restricted,

or

in

default;

and

the

effectiveness

of

third-party

pricing

vendors,

including

periodic

reviews

of

vendors.

The

Committee

meets

more

frequently,

as

needed,

to

discuss

additional

valuation

matters,

which

may

include

the

need

to

review

back-testing

results,

review

time-

sensitive

information

or

approve

related

valuation

actions.

Representatives

of

Columbia

Management

Investment

Advisers,

LLC

report

to

the

Board

at

each

of

its

regularly

scheduled

meetings

to

discuss

valuation

matters

and

actions

during

the

period,

similar

to

those

described

earlier.

The

following

table

is

a

summary

of

the

inputs

used

to

value

the

Fund’s

investments

at

September

30,

2024:

Level

1

($)

Level

2

($)

Level

3

($)

Total

($)

Investments

in

Securities

Common

Stocks

Brazil

55,052,393

–

–

55,052,393

Chile

4,480,632

–

–

4,480,632

China

980,639

–

–

980,639

Colombia

735,637

–

–

735,637

Egypt

875,821

–

–

875,821

Greece

3,122,304

–

–

3,122,304

Hungary

6,186,979

–

–

6,186,979

India

235,663,055

–

–

235,663,055

Indonesia

37,868,050

–

–

37,868,050

Kuwait

12,490,343

–

–

12,490,343

Malaysia

28,205,819

–

–

28,205,819

Mexico

48,123,281

–

–

48,123,281

Philippines

14,316,289

–

–

14,316,289

Poland

14,281,051

–

–

14,281,051

Qatar

16,732,708

–

–

16,732,708

Russia

–

–

0

(a)

0

(a)

Saudi

Arabia

80,330,216

–

–

80,330,216

South

Africa

53,386,763

–

–

53,386,763

South

Korea

166,951,139

–

–

166,951,139

Taiwan

344,645,117

–

–

344,645,117

Thailand

23,798,877

–

–

23,798,877

Turkey

13,140,740

–

–

13,140,740

United

Arab

Emirates

52,481,554

–

–

52,481,554

Total

Common

Stocks

1,213,849,407

–

0

(a)

1,213,849,407

Preferred

Stocks

Brazil

29,868,149

–

–

29,868,149

Chile

1,770,481

–

–

1,770,481

Total

Preferred

Stocks

31,638,630

–

–

31,638,630

PORTFOLIO

OF

INVESTMENTS

(continued)

Columbia

EM

Core

ex-China

ETF

September

30,

2024

(Unaudited)

The

accompanying

Notes

to

Financial

Statements

are

an

integral

part

of

this

statement.

Fair

Value

Measurements

(continued)

Level

1

($)

Level

2

($)

Level

3

($)

Total

($)

Money

Market

Funds

10,706,636

–

–

10,706,636

Total

Investments

in

Securities

1,256,194,673

–

0

(a)

1,256,194,673

See

the

Portfolio

of

Investments

for

all

investment

classifications

not

indicated

in

the

table.

The

Fund

does

not

hold

any

significant

investments

(greater

than

one

percent

of

net

assets)

categorized

as

Level

3.

(a)

Rounds

to

zero.

PORTFOLIO

OF

INVESTMENTS

(Consolidated)

Columbia

India

Consumer

ETF

September

30,

2024

(Unaudited)

(Percentages

represent

value

of

investments

compared

to

net

assets)

Investments

in

Securities

The

accompanying

Notes

to

Financial

Statements

are

an

integral

part

of

this

statement.

Notes

to

Consolidated

Portfolio

of

Investments

Common

Stocks

-

105.4%

Issuer

Shares

Value

($)

Consumer

Discretionary

-

62.7%

Apparel

Retail

-

7.4%

Trent

Ltd.

397,762

35,953,019

Apparel,

Accessories

&

Luxury

Goods

-

4.1%

Titan

Co.

Ltd.

434,201

19,813,104

Automobile

Manufacturers

-

15.1%

Mahindra

&

Mahindra

Ltd.

866,514

32,001,601

Maruti

Suzuki

India

Ltd.

142,856

22,566,820

Tata

Motors

Ltd.

1,582,063

18,400,176

Total

72,968,597

Automotive

Parts

&

Equipment

-

8.4%

Bharat

Forge

Ltd.

478,149

8,653,341

Bosch

Ltd.

17,929

8,061,276

Samvardhana

Motherson

International

Ltd.

4,926,598

12,427,423

Tube

Investments

of

India

Ltd.

227,346

11,763,352

Total

40,905,392

Hotels,

Resorts

&

Cruise

Lines

-

3.0%

Indian

Hotels

Co.

Ltd.

1,755,579

14,343,998

Motorcycle

Manufacturers

-

16.2%

Bajaj

Auto

Ltd.

185,186

27,282,375

Eicher

Motors

Ltd.

273,100

16,380,052

Hero

MotoCorp

Ltd.

267,508

18,234,963

TVS

Motor

Co.

Ltd.

484,360

16,413,953

Total

78,311,343

Restaurants

-

6.9%

Zomato

Ltd.

(a)

10,276,406

33,514,318

Tires

&

Rubber

-

1.6%

MRF

Ltd.

4,632

7,656,153

Total

Consumer

Discretionary

303,465,924

Consumer

Staples

-

42.7%

Distillers

&

Vintners

-

2.5%

United

Spirits

Ltd.

644,154

12,221,064

Common

Stocks

(continued)

Issuer

Shares

Value

($)

Food

Retail

-

3.9%

Avenue

Supermarts

Ltd.

(a),(b)

314,020

19,096,853

Packaged

Foods

&

Meats

-

14.7%

Britannia

Industries

Ltd.

243,596

18,423,925

Marico

Ltd.

1,087,769

9,026,531

Nestle

India

Ltd.

642,054

20,609,396

Patanjali

Foods

Ltd.

195,533

3,927,985

Tata

Consumer

Products

Ltd.

1,345,912

19,223,930

Total

71,211,767

Personal

Care

Products

-

12.9%

Colgate-Palmolive

India

Ltd.

272,720

12,381,238

Dabur

India

Ltd.

1,227,534

9,158,029

Godrej

Consumer

Products

Ltd.

772,101

12,838,061

Hindustan

Unilever

Ltd.

679,580

23,990,114

Procter

&

Gamble

Hygiene

&

Health

Care

Ltd.

19,459

3,871,923

Total

62,239,365

Soft

Drinks

&

Non-alcoholic

Beverages

-

3.6%

Varun

Beverages

Ltd.

2,392,437

17,309,223

Tobacco

-

5.1%

ITC

Ltd.

3,975,883

24,583,210

Total

Consumer

Staples

206,661,482

Total

Common

Stocks

(Cost:

$364,927,488)

510,127,406

Money

Market

Funds

-

0.2%

Issuer

Shares

Value

($)

Goldman

Sachs

Financial

Square

Funds

—

Treasury

Instruments

Fund,

Institutional

Shares,

4.891%

(c)

914,899

914,899

Total

Money

Market

Funds

(Cost:

$914,899)

914,899

Total

Investments

in

Securities

(Cost:

$365,842,387)

511,042,305

Other

Assets

&

Liabilities,

Net

(27,160,484)

Net

Assets

483,881,821

(a)

Non-income

producing

investment.

(b)

Represents

privately

placed

and

other

securities

and

instruments

exempt

from

Securities

and

Exchange

Commission

registration

(collectively,

private

placements),

such

as

Section

4(a)(2)

and

Rule

144A

eligible

securities,

which

are

often

sold

only

to

qualified

institutional

buyers.

At

September

30,

2024,

the

total

value

of

these

securities

amounted

to

$19,096,853,

which

represents

3.95%

of

total

net

assets.

(c)

The

rate

shown

is

the

seven-day

current

annualized

yield

at

September

30,

2024.

Fair

Value

Measurements

The

Fund

categorizes

its

fair

value

measurements

according

to

a

three-level

hierarchy

that

maximizes

the

use

of

observable

inputs

and

minimizes

the

use

of

unobservable

inputs

by

prioritizing

that

the

most

observable

input

be

used

when

available.

Observable

inputs

are

those

that

market

participants

would

use

in

pricing

an

investment

based

on

market

data

obtained

from

sources

independent

of

the

reporting

entity.

Unobservable

inputs

are

those

that

reflect

the

Fund’s

assumptions

about

the

information

market

participants

would

use

in

pricing

an

investment.

An

investment’s

level

within

the

fair

value

hierarchy

is

based

on

the

lowest

level

of

any

input

that

is

deemed

significant

to

the

asset's

or

liability’s

fair

value

measurement.

The

input

levels

are

not

necessarily

an

indication

of

the

risk

or

liquidity

associated

with

investments

at

that

level.

For

example,

certain

U.S.

government

securities

are