(a Delaware Limited Liability Company)

|

Schedule of Investments

|

1-7

|

|

Statement of Assets, Liabilities and Members’ Capital

|

8

|

|

Statement of Operations

|

9

|

|

Statements of Changes in Members’ Capital

|

10

|

|

Statement of Cash Flows

|

11

|

|

Notes to Financial Statements

|

12-20

|

|

Board of Managers

|

21-22

|

|

Fund Management

|

23

|

|

Other Information

|

24

|

|

Privacy Policy

|

25-26

|

|

Description of Investment

|

Initial

Investment Date |

Cost

|

Fair

Value |

% of

Members’ Capital |

|||||||||

|

Private Company:

|

|||||||||||||

|

Consumer:

|

|||||||||||||

|

Ooma, Inc. a,b

|

|||||||||||||

|

Palo Alto, California

|

|||||||||||||

|

162,287 shares of

|

|||||||||||||

|

Series Alpha Preferred Stock

|

Oct. 2009

|

$

|

371,317

|

$

|

642,784

|

6.65

|

%

|

||||||

|

Sonim Technologies, Inc. a,b

|

|||||||||||||

|

San Mateo, California

|

|||||||||||||

|

180,208 shares of

|

|||||||||||||

|

Series B Preferred Stock

|

Nov. 2009

|

167,180

|

122,281

|

1.26

|

%

|

||||||||

|

Sonim Technologies, Inc. a,b

|

|||||||||||||

|

San Mateo, California

|

|||||||||||||

|

440,312 shares of

|

|||||||||||||

|

Series A Preferred Stock

|

Nov. 2012

|

174,794

|

398,040

|

4.12

|

%

|

||||||||

|

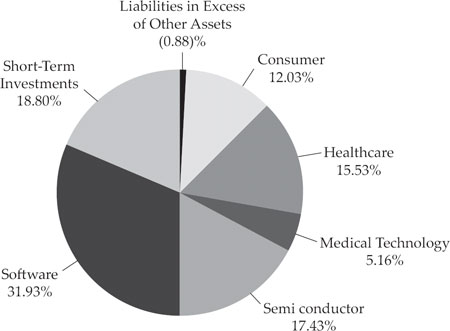

Total Consumer

|

713,291

|

1,163,105

|

12.03

|

%

|

|||||||||

|

Healthcare:

|

|||||||||||||

|

Clinipace, Inc. a,b

|

|||||||||||||

|

Raleigh, North Carolina

|

|||||||||||||

|

3,816,881 shares of

|

|||||||||||||

|

Series C Preferred Stock

|

Sep. 2011

|

500,000

|

1,500,533

|

15.53

|

%

|

||||||||

|

Medical Technology:

|

|||||||||||||

|

Lineagen, Inc. a,b

|

|||||||||||||

|

Salt Lake City, Utah

|

|||||||||||||

|

12,000 shares of

|

|||||||||||||

|

Common Stock

|

Jul. 2011

|

—

|

12,000

|

0.12

|

%

|

||||||||

|

Lineagen, Inc. a,b

|

|||||||||||||

|

Salt Lake City, Utah

|

|||||||||||||

|

336,117 shares of

|

|||||||||||||

|

Series B Preferred Stock

|

Jul. 2011

|

300,000

|

336,117

|

3.48

|

%

|

||||||||

|

Description of Investment (Continued)

|

Initial

Investment Date |

Cost

|

Fair

Value |

% of

Members’ Capital |

|||||||||

|

Medical Technology (Continued):

|

|||||||||||||

|

Lineagen, Inc. a,b

|

|||||||||||||

|

Salt Lake City, Utah

|

|||||||||||||

|

150,000 shares of

|

|||||||||||||

|

Series C Preferred Stock

|

Nov. 2013

|

$

|

150,000

|

$

|

150,000

|

1.56

|

%

|

||||||

|

Total Medical Technology

|

450,000

|

498,117

|

5.16

|

%

|

|||||||||

|

Semiconductor:

|

|||||||||||||

|

GainSpan Corporation a,b

|

|||||||||||||

|

San Jose, California

|

|||||||||||||

|

312,500 shares of

|

|||||||||||||

|

Series C Preferred Stock

|

Sep. 2011

|

250,000

|

312,500

|

3.23

|

%

|

||||||||

|

GainSpan Corporation a,b

|

|||||||||||||

|

San Jose, California

|

|||||||||||||

|

156,292 shares of

|

|||||||||||||

|

Series D Preferred Stock

|

Jun. 2012

|

140,663

|

156,292

|

1.62

|

%

|

||||||||

|

GainSpan Corporation a,b

|

|||||||||||||

|

San Jose, California

|

|||||||||||||

|

70,263 shares of

|

|||||||||||||

|

Series E Preferred Stock

|

Jan. 2014

|

69,896

|

70,263

|

0.73

|

%

|

||||||||

|

GainSpan Corporation b

|

|||||||||||||

|

San Jose, California

|

|||||||||||||

|

Convertible Promissory Note

|

|||||||||||||

|

Principal of $21,285,

|

|||||||||||||

|

3.00%, 6/30/2015

|

Dec. 2014

|

21,285

|

21,333

|

0.22

|

%

|

||||||||

|

Luxtera, Inc. a,b

|

|||||||||||||

|

Carlsbad, California

|

|||||||||||||

|

2,203,210 shares of

|

|||||||||||||

|

Series C Preferred Stock

|

Apr. 2012

|

301,413

|

106,304

|

1.10

|

%

|

||||||||

|

Magnum Semiconductor, Inc. a,b

|

|||||||||||||

|

Milpitas, California

|

|||||||||||||

|

134,219 shares of

|

|||||||||||||

|

Series E-1 Preferred Stock

|

Jun. 2010

|

161,063

|

161,063

|

1.67

|

%

|

||||||||

|

Description of Investment (Continued)

|

Initial

Investment Date |

Cost

|

Fair

Value |

% of

Members’ Capital |

|||||||||

|

Semiconductor (Continued):

|

|||||||||||||

|

Magnum Semiconductor, Inc. b

|

|||||||||||||

|

Milpitas, California

|

|||||||||||||

|

Convertible Promissory Note

|

|||||||||||||

|

Principal of $2,207,

|

|||||||||||||

|

8.00%,12/31/2015

|

Oct. 2013

|

$

|

2,207

|

$

|

2,418

|

0.02

|

%

|

||||||

|

Quantenna Communications, Inc. a,b

|

|||||||||||||

|

Fremont, California

|

|||||||||||||

|

1,893,223 shares of

|

|||||||||||||

|

Series D Preferred Stock

|

Apr. 2010

|

150,000

|

513,840

|

5.32

|

%

|

||||||||

|

Quantenna Communications, Inc. a,b

|

|||||||||||||

|

Fremont, California

|

|||||||||||||

|

673,734 shares of

|

|||||||||||||

|

Series E Preferred Stock

|

Oct. 2010

|

75,000

|

182,858

|

1.89

|

%

|

||||||||

|

Quantenna Communications, Inc. a,b

|

|||||||||||||

|

Fremont, California

|

|||||||||||||

|

256,158 shares of

|

|||||||||||||

|

Series F-1 Preferred Stock

|

Nov. 2011

|

39,084

|

69,524

|

0.72

|

%

|

||||||||

|

Quantenna Communications, Inc. b

|

|||||||||||||

|

Fremont, California

|

|||||||||||||

|

323,534 shares of

|

|||||||||||||

|

Series F-1 Preferred Stock

|

Feb. 2014

|

87,581

|

87,810

|

0.91

|

%

|

||||||||

|

Total Semiconductor

|

1,298,192

|

1,684,205

|

17.43

|

%

|

|||||||||

|

Software:

|

|||||||||||||

|

Clustrix, Inc. a,b

|

|||||||||||||

|

San Francisco, California

|

|||||||||||||

|

9,667 shares of

|

|||||||||||||

|

Common Stock

|

Dec. 2010

|

250,001

|

9,667

|

0.10

|

%

|

||||||||

|

KnowledgeTree, Inc. a,b

|

|||||||||||||

|

Raleigh, North Carolina

|

|||||||||||||

|

59,695 shares of

|

|||||||||||||

|

Series B Preferred Stock

|

Jun. 2012

|

250,002

|

250,002

|

2.59

|

%

|

|

Description of Investment (Continued)

|

Initial

Investment Date |

Cost

|

Fair

Value |

% of

Members’ Capital |

|||||||||

|

Software (Continued):

|

|||||||||||||

|

KnowledgeTree, Inc. a,b

|

|||||||||||||

|

Raleigh, North Carolina

|

|||||||||||||

|

9,425 shares of

|

|||||||||||||

|

Series B1 Preferred Stock

|

Jan. 2014

|

$

|

39,472

|

$

|

39,472

|

0.41

|

%

|

||||||

|

KnowledgeTree, Inc. b

|

|||||||||||||

|

Raleigh, North Carolina

|

|||||||||||||

|

Convertible Promissory Note

|

|||||||||||||

|

Principal of $39,472,

|

|||||||||||||

|

6.00%, 3/31/2015

|

Sep. 2014

|

39,472

|

40,135

|

0.42

|

%

|

||||||||

|

Kontiki, Inc. a,b

|

|||||||||||||

|

Sunnyvale, California

|

|||||||||||||

|

45,670 shares of

|

|||||||||||||

|

Common Stock

|

Jan. 2012

|

—

|

22,264

|

0.23

|

%

|

||||||||

|

Kontiki, Inc. a,b

|

|||||||||||||

|

Sunnyvale, California

|

|||||||||||||

|

333,334 shares of

|

|||||||||||||

|

Series B Preferred Stock

|

Jul. 2010

|

250,000

|

130,000

|

1.35

|

%

|

||||||||

|

Kontiki, Inc. a,b

|

|||||||||||||

|

Sunnyvale, California

|

|||||||||||||

|

837,247 shares of

|

|||||||||||||

|

Series C Preferred Stock

|

Jan. 2012

|

297,310

|

326,527

|

3.38

|

%

|

||||||||

|

Posit Science Corporation a,b

|

|||||||||||||

|

San Francisco, California

|

|||||||||||||

|

2,415,460 shares of

|

|||||||||||||

|

Common Stock

|

Dec. 2009

|

200,000

|

77,372

|

0.80

|

%

|

||||||||

|

Posit Science Corporation a,b

|

|||||||||||||

|

San Francisco, California

|

|||||||||||||

|

642,875 shares of

|

|||||||||||||

|

Series AA Preferred Stock

|

Sep. 2010

|

11,893

|

20,593

|

0.21

|

%

|

|

Description of Investment (Continued)

|

Initial

Investment Date |

Cost

|

Fair

Value |

% of

Members’ Capital |

|||||||||

|

Software (Continued):

|

|||||||||||||

|

Sailthru, Inc. a,b

|

|||||||||||||

|

New York, New York

|

|||||||||||||

|

171,141 shares of

|

|||||||||||||

|

Series A Preferred Stock

|

Sep. 2011

|

$

|

299,999

|

$

|

839,912

|

8.69

|

%

|

||||||

|

SugarSync, Inc. a,b

|

|||||||||||||

|

San Mateo, California

|

|||||||||||||

|

278,500 shares of

|

|||||||||||||

|

Series BB Preferred Stock

|

Dec. 2009

|

150,000

|

—

|

0.00

|

%

|

||||||||

|

SugarSync, Inc. a,b

|

|||||||||||||

|

San Mateo, California

|

|||||||||||||

|

579,375 shares of

|

|||||||||||||

|

Series CC Preferred Stock

|

Feb. 2011

|

350,000

|

308,998

|

3.20

|

%

|

||||||||

|

SugarSync, Inc. a,b

|

|||||||||||||

|

San Mateo, California

|

|||||||||||||

|

73,119 shares of

|

|||||||||||||

|

Series DD Preferred Stock

|

Dec. 2011

|

68,001

|

68,001

|

0.70

|

%

|

||||||||

|

SugarSync, Inc. b

|

|||||||||||||

|

San Mateo, California

|

|||||||||||||

|

Convertible Promissory Note

|

|||||||||||||

|

Principal of $127,400,

|

|||||||||||||

|

4.00%, 11/15/2013

|

May 2013

|

127,400

|

135,811

|

1.40

|

%

|

||||||||

|

Univa Corporation a,b

|

|||||||||||||

|

Austin, Texas

|

|||||||||||||

|

939,541 shares of

|

|||||||||||||

|

Series I Preferred Stock

|

Oct. 2010

|

432,114

|

792,322

|

8.20

|

%

|

||||||||

|

Univa Corporation b

|

|||||||||||||

|

Austin, Texas

|

|||||||||||||

|

Convertible Promissory Note

|

|||||||||||||

|

Principal of $22,616,

|

|||||||||||||

|

8.00%, 01/31/2017

|

May 2014

|

22,616

|

23,715

|

0.25

|

%

|

||||||||

|

Total Software

|

2,788,280

|

3,084,791

|

31.93

|

%

|

|||||||||

|

Total Private Company

|

5,749,763

|

7,930,751

|

82.08

|

%

|

|

Description of Investment (Continued)

|

Cost

|

Fair

Value |

% of

Members’ Capital |

|||||||||

|

Short-Term Investments:

|

||||||||||||

|

Federated Prime Obligations Fund #10, 0. 03% c

|

$

|

1,816,738

|

$

|

1,816,738

|

18.80

|

%

|

||||||

|

Total Short-Term Investments

|

1,816,738

|

1,816,738

|

18.80

|

%

|

||||||||

|

Total Investments (United States)

|

$

|

7,566,501

|

$

|

9,747,489

|

100.88

|

%

|

||||||

|

Liabilities in Excess of Other Assets

|

(85,205

|

)

|

(0.88

|

%)

|

||||||||

|

Members’ Capital

|

$

|

9,662,284

|

100.00

|

%

|

||||||||

| a | Non-income producing. |

| b | Portfolio holdings are subject to substantial restrictions as to resale. |

| c | The rate shown is the annualized 7-day yield as of December 31, 2014. |

|

Assets

|

||||

|

Investments in private companies, at fair value (cost $5,749,763)

|

$

|

7,930,751

|

||

|

Short-term investments, at fair value (cost $1,816,738)

|

1,816,738

|

|||

|

Receivable for investment sold

|

3,165

|

|||

|

Interest receivable

|

47

|

|||

|

Total assets

|

$

|

9,750,701

|

||

|

Liabilities and members’ capital

|

||||

|

Management fee payable

|

$

|

37,082

|

||

|

Professional fees payable

|

28,657

|

|||

|

Accounting and administration fees payable

|

20,000

|

|||

|

Custodian fees payable

|

1,428

|

|||

|

Other expenses payable

|

1,250

|

|||

|

Total liabilities

|

88,417

|

|||

|

Members’ capital

|

9,662,284

|

|||

|

Total liabilities and members’ capital

|

$

|

9,750,701

|

||

|

Components of members’ capital:

|

||||

|

Capital contributions

|

$

|

10,514,912

|

||

|

Accumulated net investment loss

|

(2,041,800

|

)

|

||

|

Accumulated net realized loss on investments

|

(991,816

|

)

|

||

|

Accumulated net unrealized appreciation on investments

|

2,180,988

|

|||

|

Members’ capital

|

$

|

9,662,284

|

||

|

Net asset value per unit

|

$

|

84.26

|

||

|

Number of authorized units

|

Unlimited

|

|||

|

Number of outstanding units

|

114,678.93

|

|||

|

Investment income

|

||||

|

Interest

|

$

|

234

|

||

|

Total investment income

|

234

|

|||

|

Operating expenses

|

||||

|

Management fee

|

96,076

|

|||

|

Professional fees

|

32,762

|

|||

|

Accounting and administration fees

|

20,000

|

|||

|

Managers’ fees

|

17,500

|

|||

|

Custodian fees

|

5,819

|

|||

|

Other expenses

|

7,411

|

|||

|

Total operating expenses, before management fee waiver

|

179,568

|

|||

|

Management fee waived

|

19,613

|

|||

|

Net expenses

|

159,955

|

|||

|

Net investment loss

|

(159,721

|

)

|

||

|

Net realized loss and change in unrealized appreciation on investments in private companies

|

||||

|

Net realized loss on investments in private companies

|

(271,990

|

)

|

||

|

Net change in unrealized appreciation on investments in private companies

|

935,396

|

|||

|

Net realized loss and change in unrealized appreciation on investments in private companies

|

663,406

|

|||

|

Net increase in members’ capital resulting from operations

|

$

|

503,685

|

||

|

Members’

Capital |

||||

|

Members’ capital, at June 30, 2013

|

$

|

7,888,941

|

||

|

Net investment loss

|

(333,434

|

)

|

||

|

Net realized loss on investments in private companies

|

(101,991

|

)

|

||

|

Net change in unrealized depreciation on investments in private companies

|

1,705,083

|

|||

|

Members’ capital, at June 30, 2014

|

$

|

9,158,599

|

||

|

Net investment loss

|

(159,721

|

)

|

||

|

Net realized loss on investments in private companies

|

(271,990

|

)

|

||

|

Net change in unrealized appreciation on investments in private companies

|

935,396

|

|||

|

Members’ capital, at December 31, 2014

|

$

|

9,662,284

|

||

|

Cash flows from operating activities:

|

||||

|

Net increase in members’ capital resulting from operations

|

$

|

503,685

|

||

|

Adjustments to reconcile net increase in members’ capital resulting from operations to net cash used in operating activities:

|

||||

|

Purchases of investments

|

(93,774

|

)

|

||

|

Net proceeds on sales of investments

|

15,186

|

|||

|

Net proceeds on sale of short-term investments

|

201,612

|

|||

|

Net realized loss on investments in private companies

|

271,990

|

|||

|

Net change in unrealized appreciation on investments in private companies

|

(935,396

|

)

|

||

|

Decrease in receivable for investment sold

|

54,750

|

|||

|

Increase in interest receivable

|

(16

|

)

|

||

|

Decrease in management fee payable

|

(4,072

|

)

|

||

|

Decrease in professional fees payable

|

(24,843

|

)

|

||

|

Increase in accounting and administration fees payable

|

10,000

|

|||

|

Decrease in custodian fees payable

|

(372

|

)

|

||

|

Increase in other expenses payable

|

1,250

|

|||

|

Net cash used in operating activities

|

—

|

|||

|

Net change in cash

|

—

|

|||

|

Cash at beginning of period

|

—

|

|||

|

Cash at end of period

|

$

|

—

|

||

| 1. | ORGANIZATION |

| 2. | SIGNIFICANT ACCOUNTING POLICIES |

| a. | Basis of Accounting |

| b. | Cash |

| c. | Valuation of Portfolio Investments |

| 2. | SIGNIFICANT ACCOUNTING POLICIES (Continued) |

| c. | Valuation of Portfolio Investments (Continued) |

| ● | Level 1 – quoted prices (unadjusted) in active markets for identical assets and liabilities |

| ● | Level 2 – other significant observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, credit risk, etc.) |

| ● | Level 3 – significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments) |

| 2. | SIGNIFICANT ACCOUNTING POLICIES (Continued) |

| c. | Valuation of Portfolio Investments (Continued) |

|

Level 1

|

Level 2

|

Level 3

|

Total

|

|||||||||||||

|

Private Company1

|

||||||||||||||||

|

Convertible Promissory Notes

|

$

|

—

|

$

|

—

|

$

|

223,412

|

$

|

223,412

|

||||||||

|

Preferred Stock

|

—

|

—

|

7,586,036

|

7,586,036

|

||||||||||||

|

Common Stock

|

—

|

—

|

121,303

|

121,303

|

||||||||||||

|

Total Private Company

|

—

|

—

|

7,930,751

|

7,930,751

|

||||||||||||

|

Short-Term Investments

|

1,816,738

|

—

|

—

|

1,816,738

|

||||||||||||

|

Total

|

$

|

1,816,738

|

$

|

—

|

$

|

7,930,751

|

$

|

9,747,489

|

||||||||

| 1 | All private companies held in the Fund are Level 3 securities. For a detailed break-out of private companies by industry classification, please refer to the Schedule of Investments. |

|

Convertible

Promissory Notes |

Preferred Stock

|

Common Stock

|

Total

|

|||||||||||||

|

Balance as of July 1, 2014

|

$

|

246,030

|

$

|

6,819,120

|

$

|

123,607

|

$

|

7,188,757

|

||||||||

|

Net Realized Gain/(Loss)

|

—

|

(271,990

|

)

|

—

|

(271,990

|

)

|

||||||||||

|

Change in Unrealized

Appreciation/(Depreciation) |

(83,375

|

)

|

1,021,075

|

(2,304

|

)

|

935,396

|

||||||||||

|

Transfers In/(Out) of Investment Categories*

|

—

|

—

|

—

|

—

|

||||||||||||

|

Gross Purchases

|

60,757

|

33,017

|

—

|

93,774

|

||||||||||||

|

Gross Sales

|

—

|

(15,186

|

)

|

—

|

(15,186

|

)

|

||||||||||

|

Balance as of December 31, 2014

|

$

|

223,412

|

$

|

7,586,036

|

$

|

121,303

|

$

|

7,930,751

|

||||||||

| * | Transfers in or out of investment categories reflect changes in investment categories and are represented by their balance at the beginning of the period. |

| 2. | SIGNIFICANT ACCOUNTING POLICIES (Continued) |

| c. | Valuation of Portfolio Investments (Continued) |

|

Type of Investment

|

Fair

Value as of

December 31, 2014

|

Valuation

Technique |

Unobservable

Input |

Weighted

Average |

Range

|

Impact

to

valuation from an Increase in Input |

||

|

Convertible Promissory Notes

|

$

|

223,412

|

Most Recent

Capitalization

|

Private

Financing

|

N/A

|

N/A

|

N/A

|

|

|

Preferred Stock

|

4,693,464

|

Market Comparable

Companies

|

Forward Revenue

Multiple

|

3.5x

|

1.9x -6.4x

|

Increase

|

||

|

Discount Rate

|

19%

|

15% -50%

|

Decrease

|

|||||

|

2,892,572

|

Most Recent

Capitalization

|

Private

Financing

|

N/A

|

N/A

|

N/A

|

|||

|

Common Stock

|

87,039

|

Market Comparable Companies

|

Forward Revenue

Multiple

|

2.6x

|

2.5x-3.5x

|

Increase

|

||

|

Discount Rate

|

32%

|

15%-35%

|

Decrease

|

|||||

|

34,264

|

Most Recent

Capitalization

|

Private

Financing

|

N/A

|

N/A

|

N/A

|

|||

|

Total Private Company

|

$

|

7,930,751

|

||||||

| 2. | SIGNIFICANT ACCOUNTING POLICIES (Continued) |

| d. | Investment Income |

| e. | Fund Expenses |

| f. | Income Taxes |

| g. | Distributions |

| h. | Use of Estimates |

| 3. | ALLOCATION OF MEMBERS’ CAPITAL |

| 4. | MANAGEMENT FEE AND RELATED PARTY TRANSACTIONS |

| 5. | ACCOUNTING, ADMINISTRATION AND CUSTODIAL AGREEMENT |

| 6. | INVESTMENT TRANSACTIONS |

| 6. | INVESTMENT TRANSACTIONS (Continued) |

| 7. | INDEMNIFICATIONS |

| 8. | COMMITMENTS |

| 9. | RISK FACTORS |

| 10. | FINANCIAL HIGHLIGHTS |

|

Per Unit Operating Performance:

|

||||

|

Net Asset Value, September 1, 2009

|

$

|

100.00

|

||

|

Income/(loss) from investment operations:

|

||||

|

Net investment loss

|

(4.81

|

)

|

||

|

Net change in unrealized depreciation on investments in private companies

|

(7.28

|

)

|

||

|

Total from investment operations

|

(12.09

|

)

|

||

|

Net Asset Value, August 31, 2010

|

$

|

87.91

|

||

|

Income/(loss) from investment operations:

|

||||

|

Net investment loss

|

(3.36

|

)

|

||

|

Net change in unrealized appreciation on investments in private companies

|

2.00

|

|||

|

Total from investment operations

|

(1.36

|

)

|

||

|

Net Asset Value, August 31, 2011

|

$

|

86.55

|

||

|

Income/(loss) from investment operations:

|

||||

|

Net investment loss

|

(2.78

|

)

|

||

|

Net change in unrealized appreciation on investments in private companies

|

2.82

|

|||

|

Total from investment operations

|

0.04

|

|||

|

Net Asset Value, August 31, 2012

|

$

|

86.59

|

||

|

Income/(loss) from investment operations:

|

||||

|

Net investment loss

|

(2.59

|

)

|

||

|

Net realized loss and change in unrealized depreciation on investments in private companies

|

(15.21

|

)

|

||

|

Total from investment operations

|

(17.80

|

)

|

||

|

Net Asset Value, June 30, 2013

|

$

|

68.79

|

||

|

Income/(loss) from investment operations:

|

||||

|

Net investment loss

|

(2.91

|

)

|

||

|

Net change in unrealized appreciation on investments in private companies

|

13.98

|

|||

|

Total from investment operations

|

11.07

|

|||

|

Net Asset Value, June 30, 2014

|

$

|

79.86

|

||

|

Income/(loss) from investment operations:

|

||||

|

Net investment loss

|

(1.39

|

)

|

||

|

Net realized loss and change in unrealized appreciation on investments in private companies

|

5.79

|

|||

|

Total from investment operations

|

4.40

|

|||

|

Net Asset Value, December 31, 2014

|

$

|

84.26

|

||

| 10. | FINANCIAL HIGHLIGHTS (Continued) |

|

|

For the six

months ended December 31, 2014 (Unaudited) |

For the

year ended June 30, 2014 |

For the

period from September 1, 2012 to June 30, 2013* |

For the years ended August 31, |

For the

period from September 1, 2009 (commencemnet of operations) to August 31, 2010 |

|

| 2012 | 2011 | |||||

|

Total return

|

5.51%2

|

16.09%

|

(20.56)%2

|

0.05%

|

(1.55)%

|

(12.09)%

|

|

Members’ capital, end of period (000’s)

|

$9,662

|

$9,159

|

$7,889

|

$9,930

|

$9,925

|

$10,081

|

|

Portfolio turnover

|

0.08%2

|

0.54%

|

0.00%2

|

8.00%

|

0.00%

|

0.00%

|

|

Net investment loss:

|

||||||

|

Before reimbursement of placement agent fees

|

(3.39)%3

|

(3.70)%

|

(3.58)%3

|

(3.15)%

|

(3.84)%

|

(13.76)%

|

|

After reimbursement of placement agent fees

|

(3.39)%3

|

(3.70)%

|

(3.58)%3

|

(3.15)%

|

(3.84)%

|

(13.34)%

|

|

Net expenses 1:

|

||||||

|

Before reimbursement of placement agent fees

|

3.39%3

|

3.71%

|

3.62%3

|

3.29%

|

3.94%

|

13.92%

|

|

After reimbursement of placement agent fees

|

3.39%3

|

3.71%

|

3.62%3

|

3.29%

|

3.94%

|

13.50%

|

| * | At a Board meeting held on August 23, 2012, the Board approved the change in fiscal year-end for the Fund from August 31 to the June 30 effective as of the end of the fiscal year ended August 31, 2012. |

| 1 | Net expenses before and after waiver of the management fee for the period ended December 31, 2014 were 3.81% and 3.39% respectively, for the year ended June 30, 2014 were 3.99% and 3.71%, respectively. Net expenses before and after waiver of the management fee for the period from September 1, 2012 to June 30, 2013 were 3.78% and 3.62%, respectively. Net expenses before and after waiver of the management fee for the year ended August 31, 2012 were 3.46% and 3.29%, respectively. Net expenses before and after waiver of the management fee for the period from September 1, 2010 to August 31, 2011 were 3.98% and 3.94%, respectively. There was no management fee waived for the period from September 1, 2009 (commencement of operations) to August 31, 2010. |

| 2 | Not annualized. |

| 3 | Annualized. |

| 11. | SUBSEQUENT EVENTS |

|

Name and Date of Birth

|

Position(s) Held

with the Fund |

Length of Time

Served |

Principal Occupation(s) During Past 5 Years and

Other Directorships Held by Manager |

Number of

Portfolios in Fund Complex1 Overseen by Manager |

|

INTERESTED MANAGERS

|

||||

|

David B. Perkins2

July 18, 1962

|

President and Chairman of the Board of Managers

|

Since Inception

|

President and Trustee, each fund in the Fund Complex (2004 to Present); Chief Executive Officer of Hatteras Funds, LLC from 2014 to present and Founder of Hatteras Investment Partners LLC and its affiliated entities (“Hatteras Funds”) in 2003.

|

20

|

|

Peter M. Budko2,3

February 4, 1960

|

Manager

|

Since 2014

|

Partner, American Realty Capital, an investment advisory firm (2007 to present); Chief Executive Officer, BDCA Adviser, an investment advisory firm (2010 to present); Director, ARC Realty Finance Trust, Inc. (2013 to present); Director, RCS Capital Corp (2013 to present).

|

20

|

|

INDEPENDENT MANAGERS

|

||||

|

H. Alexander Holmes

May 4, 1942

|

Manager; Audit Committee Member

|

Since Inception

|

Founder, Holmes Advisory Services, LLC, a financial consultation firm (1993 to Present).

|

20

|

|

Steve E. Moss, CPA

February 18, 1953

|

Manager; Audit Committee Member

|

Since Inception

|

Principal, Holden, Moss, Knott, Clark & Copley, PA, accountants and business consultants (1996 to Present); Member Manager, HMKCT Properties, LLC (1996 to Present).

|

20

|

|

Gregory S. Sellers

May 5, 1959

|

Manager; Audit Committee Member

|

Since Inception

|

Chief Financial Officer, Imagemark Business Services, Inc., a provider of marketing and print communications solutions (June 2009 to Present); Chief Financial Officer and Director, Kings Plush, Inc., a fabric manufacturer (2003 to June 2009).

|

20

|

|

Name and Date of Birth

|

Position(s) Held

with the Fund |

Length of Time

Served |

Principal Occupation(s) During Past 5 Years and

Other Directorships Held by Manager |

Number of

Portfolios in Fund Complex1 Overseen by Manager |

|

INDEPENDENT MANAGERS (Continued)

|

||||

|

Joseph A. Velk3

May 15, 1960

|

Manager; Audit Committee Member

|

Since 2014

|

Managing Member, Contender Capital, LLC, an investment firm (2000 to present).

|

20

|

|

Joseph E. Breslin

November 18, 1953

|

Manager; Audit Committee Member

|

Since 2012

|

Private Investor (2009 to Present); Chief Operating Officer, Central Park Credit Holdings, Inc. (2007 to 2009); Chief Operating Officer, Aladdin Capital Management LLC (February 2005 to 2007).

|

20

|

|

Thomas Mann

February 1, 1950

|

Manager; Audit Committee Member

|

Since 2012

|

Private Investor (2012 to Present); Managing Director and Group Head Financial Institutions Group, Société Générale, Sales of Capital Market Solutions and Products (2003 to 2012).

|

20

|

| 1 | The “Fund Complex” consists of the Fund, Hatteras Master Fund, L.P., Hatteras Core Alternatives Fund, L.P., Hatteras Core Alternatives TEI Fund, L.P., Hatteras Core Alternatives Institutional Fund, L.P., Hatteras Core Alternatives TEI Institutional Fund, L.P., Hatteras Global Private Equity Partners Institutional, LLC, Hatteras GPEP Fund II, LLC, Hatteras Alternative Mutual Funds Trust (consisting of five funds), Underlying Funds Trust (consisting of five funds), and HCIM Trust (consisting of two funds). |

| 2 | Deemed to be an “interested” Manager of the Fund because of his affiliations with the Adviser. |

| 3 | Became Manager effective July 1, 2014. |

|

Name and Date of Birth

|

Position(s) Held

with the Fund |

Length of Time

Served |

Principal Occupation(s) During Past 5 Years and

Other Directorships Held by Officer |

Number of

Portfolios in Fund Complex1 Overseen by Officer |

|

OFFICERS

|

||||

|

J. Michael Fields

July 14, 1973

|

Secretary of each fund in the Fund Complex

|

Since Inception

|

Mr. Fields is Chief Operating Officer of Hatteras Funds and has been employed by Hatteras Funds since its inception in September 2003.

|

N/A

|

|

Andrew P. Chica

September 7, 1975

|

Chief Compliance Officer of each fund in the Fund Complex

|

Since Inception

|

Mr. Chica joined Hatteras Funds in November 2007 and became the Chief Compliance Officer of Hatteras Funds and each of the funds in the Fund Complex in 2008.

|

N/A

|

|

Robert Lance Baker

September 17, 1971

|

Treasurer of each fund in the Fund Complex

|

Since Inception

|

Mr. Baker joined Hatteras Funds in March 2008 and is currently the Chief Financial Officer of

Hatteras Funds.

|

N/A

|

| 1 | The “Fund Complex” consists of the Fund, Hatteras Master Fund L.P., Hatteras Core Alternatives Fund, L.P., Hatteras Core Alternatives TEI Fund, L.P., Hatteras Core Alternatives Institutional Fund, L.P., Hatteras Core Alternatives TEI Institutional Fund, L.P., Hatteras Global Private Equity Partners Institutional, LLC, Hatteras GPEP Fund II, LLC, Hatteras Alternative Mutual Funds Trust (consisting of five funds), Underlying Funds Trust (consisting of five funds), and HCIM Trust (consisting of two funds). |

|

FACTS

|

WHAT DOES HATTERAS FUNDS DO WITH YOUR PERSONAL INFORMA TION?

|

||

|

Why?

|

Financial companies choose how they share your personal information. Federal law gives consumers the right to limit some but not all sharing. Federal law also requires us to tell you how we collect, share, and protect your personal information. Please read this notice carefully to understand what we do.

|

||

|

What?

|

The types of personal information we collect and share depend on the product or service you have with us. This information can include:

● Social Security number

● account balances

● account transactions

● transaction history

● wire transfer instructions

● checking account information

When you are no longer our customer, we continue to share your information as described in this notice.

|

||

|

How?

|

All financial companies need to share customers’ personal information to run their everyday business. In the section below, we list the reasons financial companies can share their customers‘ personal information; the reasons Hatteras Funds chooses to share; and whether you can limit this sharing.

|

||

|

Reasons we can share your personal information

|

Does Hatteras

Funds share?

|

Can you limit

this sharing?

|

|

|

For our everyday business purposes –

such as to process your transactions, maintain your account(s), respond to court orders and legal investigations, or report to credit bureaus |

Yes

|

No

|

|

|

For our marketing purposes –

to offer our products and services to you |

No

|

We don’t share

|

|

|

For joint marketing with other financial companies

|

No

|

We don’t share

|

|

|

For our affiliates’ everyday business purposes –

information about your transactions and experiences |

Yes

|

No

|

|

|

For our affiliates’ everyday business purposes –

information about your creditworthiness |

No

|

We don’t share

|

|

|

For our affiliates to market to you

|

No

|

We don’t share

|

|

|

For non-affiliates to market to you

|

No

|

We don’t share

|

|

|

Questions?

|

Call (919) 846-2324 or go to www.hatterasfunds.com

|

||

| What we do | ||

|

Who is providing this notice?

|

Funds advised by Hatteras. A complete list is included below.

|

|

|

How does Hatteras

Funds protect my

personal information?

|

To protect your personal information from unauthorized access and use, we use security measures that comply with federal law. These measures include computer safeguards and secured files and buildings.

|

|

|

How does Hatteras

Funds collect my

personal information?

|

Federal law gives you the right to limit only

● provide account information

● open an account

● give us your contact information

● make a wire transfer

● tell us where to send the money

We also collect your information from others, such as credit bureaus, affiliates, or other companies.

|

|

|

Why can’t I limit

all sharing?

|

Federal law gives you the right to limit only

● sharing for affiliates’ everyday business purposes—information about your creditworthiness

● affiliates from using your information to market to you

● sharing for non-affiliates to market to you

State laws and individual companies may give you additional rights to limit sharing.

|

|

| Definitions | ||

|

Affiliates

|

Companies related by common ownership or control. They can be financial and nonfinancial companies.

● Our affiliates include RCS Capital Holdings, LLC, RCS Capital Corporation, Hatteras Funds,

LLC, a registered investment adviser; Hatteras Capital Distributors, LLC, a registered broker

dealer; and unregistered funds managed by Hatteras such as Hatteras GPEP Fund, L.P. and

Hatteras Late Stage VC Fund I, L.P.

|

|

|

Nonaffiliates

|

Companies not related by common ownership or control. They can be financial and nonfinancial companies.

● Hatteras Funds doesn’t share with non-affiliates so they can market to you.

|

|

|

Joint marketing

|

A formal agreement between nonaffiliated financial companies that together market financial products or services to you.

● Hatteras Funds doesn’t jointly market.

|

|

| List of funds providing this notice | ||

|

Hatteras Core Alternatives Fund, L.P., Hatteras Core Alternatives TEI Fund, L.P., Hatteras Core Alternatives Institutional Fund, L.P., Hatteras Core Alternatives TEI Institutional Fund, L.P., Hatteras Global Private Equity Partners Institutional, LLC, Hatteras VC Co-Investment Fund II, LLC, Hatteras GPEP Fund II, LLC, Hatteras Alternative Mutual Funds Trust and HCIM Trust.

|

||

|

(a)

|

Schedule of Investments in securities of unaffiliated issuers as of the close of the reporting period is included as part of the report to members filed under Item 1 of this form.

|

|

(b)

|

The registrant did not need to divest itself of securities in accordance with Section 13(c) of the Investment Company Act of 1940, as amended (the “1940 Act”), following the filing of its last report on Form N-CSR and before filing of the current report.

|

|

(registrant) HATTERAS VC CO-INVESTMENT FUND II, LLC

|

|

By (Signature and Title)*

|

/s/ David B. Perkins |

|

|

|

|

|

David B. Perkins, President

|

|

|

|

|

(principal executive officer)

|

|

| Date | March 9, 2015 | ||

|

By (Signature and Title)*

|

/s/ David B. Perkins |

|

|

|

|

|

David B. Perkins, President

|

|

|

|

|

(principal executive officer)

|

|

| Date | March 9, 2015 | ||

|

By (Signature and Title)*

|

/s/ R. Lance Baker |

|

|

|

|

|

R. Lance Baker, Treasurer

|

|

|

|

|

(principal financial officer)

|

|

| Date | March 9, 2015 | ||

* Print the name and title of each signing officer under his or her signature.