As filed with the Securities and Exchange Commission on October 2, 2024.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_________________________

FORM

(Amendment No. 2)

_________________________

OR

For the fiscal year ended

OR

OR

Commission file number:

_________________________

_________________________

| N/A | The Federative Republic of | |

| (Translation of Registrant’s Name into English) | (Jurisdiction of Incorporation or Organization) |

500

CEP 05118-100

São Paulo

(Address of Principal Executive Offices)

Chief Financial Officer

500

CEP 05118-100

São Paulo

Telephone:

Email:

(Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person)

_________________________

Securities registered or to be registered pursuant to section 12(b) of the Act: None

Securities registered or to be registered pursuant to Section 12(g) of the Act: None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act:

|

Title of Each Class |

||||

|

2.500% Senior Notes due 2027* |

||||

|

5.125% Senior Notes due 2028* |

||||

|

6.500% Senior Notes due 2029* |

||||

|

3.000% Senior Notes due 2029* |

||||

|

5.500% Senior Notes due 2030* |

||||

|

3.750% Senior Notes due 2031* |

||||

|

3.000% Sustainability-Linked Senior Notes due 2032* |

||||

|

3.625% Sustainability-Linked Senior Notes due 2032* |

||||

|

5.750% Senior Notes due 2033* |

||||

|

4.375% Senior Notes due 2052* |

||||

|

6.500% Senior Notes due 2052* |

____________

* JBS USA Holding Lux S.à r.l., JBS USA Food Company and JBS Luxembourg Company S.à r.l., wholly-owned subsidiaries of the Registrant, are the co-issuers of these notes, which are fully and unconditionally guaranteed on a senior unsecured basis by the Registrant and its wholly-owned subsidiaries JBS Global Luxembourg S.à r.l. and JBS Global Meat Holdings Pty. Limited.

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of December 31, 2023:

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities. Act. Yes ☐

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. Yes ☐

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or an emerging growth company. See definition of “large accelerated filer,” “accelerated filer,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ | Accelerated filer ☐ | | ☒ | |||||

| Emerging growth company | |

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 13(a) of the Exchange Act. ☐

____________

† The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report.

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements.

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| U.S. GAAP ☐ | International Financial Reporting | Other ☐ | ||

|

| ||||

| Accounting Standards Board ☒ |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow. ☐ Item 17 ☐ Item 18

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No

EXPLANATORY NOTE

JBS S.A. (the “Company”) is filing this Amendment No. 2 (this “Amendment No. 2” or “Form 20-F/A”) to its Annual Report on Form 20-F for the fiscal year ended December 31, 2023, as originally filed with the U.S. Securities and Exchange Commission (the “SEC”) on March 27, 2024 (the “Original Annual Report”), as amended on August 15, 2024 (“Amendment No. 1”), to address comments from the Staff of the SEC in relation to Amendment No. 1.

Accordingly, the Company is replacing in the following sections of Amendment No. 1 in their entirety, including JBS S.A.’s audited consolidated financial statements as of December 31, 2023 and 2022 and for each of the years in the three-year period ended December 31, 2023, and the related notes thereto, and the report of KPMG Auditores Independentes Ltda., independent registered public accounting firm, on such consolidated financial statements:

• Part I — Item 3. Key Information — D. Risk Factors;

• Part I — Item 4. Information on the Company — A. History and Development of the Company — The Corporate Restructuring and the Proposed Equity Transaction;

• Part I — Item 4. Information on the Company — A. History and Development of the Company — Recent Developments;

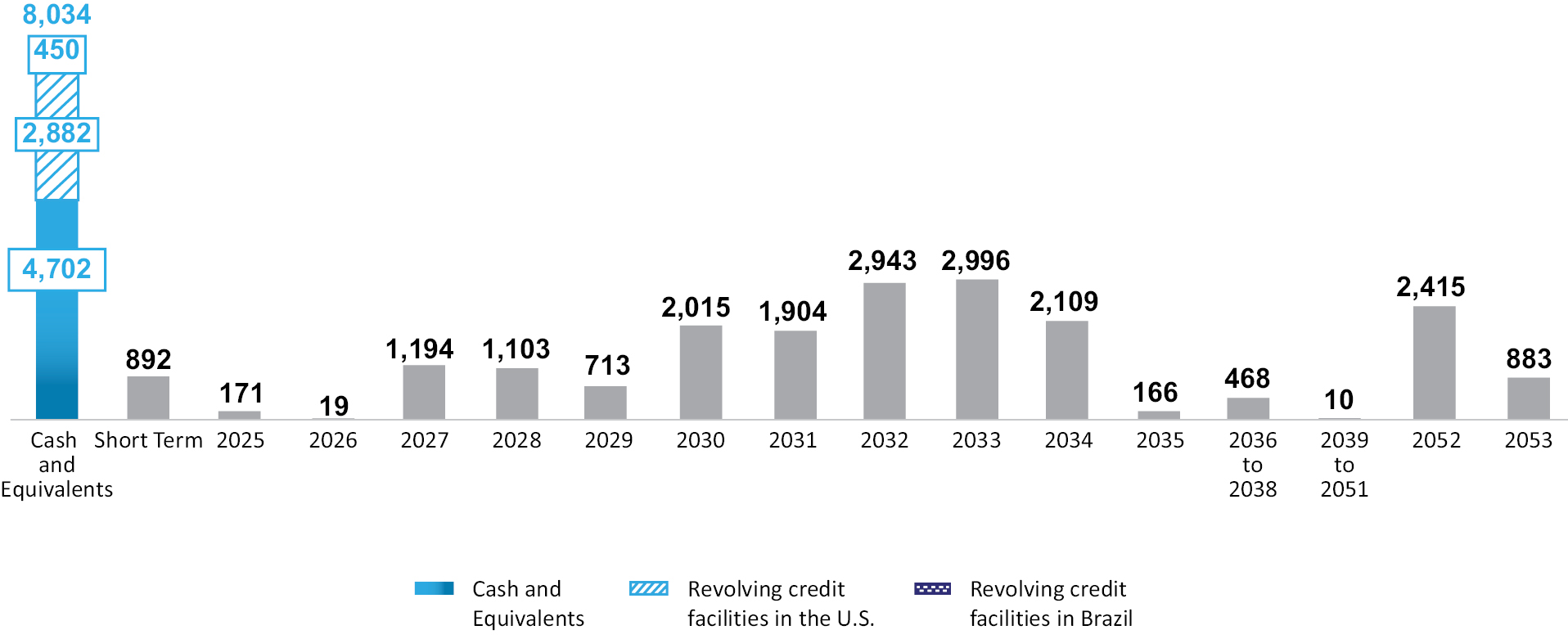

• Part I — Item 5. Operating and Financial Review and Prospects — B. Liquidity and Capital Resources — Description of Material Indebtedness;

• Part I — Item 7. Major Shareholder and Related Party Transactions — A. Major Shareholders;

• Part I — Item 8. Financial Information — A. Consolidated Statements and Other Financial Information — Dividends and Dividend Policy;

• Part III — Item 18. Financial Statements; and

• Part III — Item 19. Exhibits.

This Amendment No. 2 speaks as of the date of the Original Annual Report and has not been updated except as required to reflect the revisions stated above. Other than as set forth above, this Amendment No. 2 does not, and does not purport to, amend, update or restate in any way any other item contained in the Original Annual Report or Amendment No. 1 as filed with the SEC. As a result, this Amendment No. 2 does not reflect any events, results or developments that occurred after the filing of the Original Annual Report on March 27, 2024, unless otherwise stated. Accordingly, this Amendment No. 2 should be read in conjunction with the Company’s other filings with, and reports furnished to, the SEC subsequent to March 27, 2024.

TABLE OF CONTENTS

|

Page |

||||

|

ii |

||||

|

v |

||||

|

vii |

||||

|

1 |

||||

|

Item 1. |

1 |

|||

|

Item 2. |

1 |

|||

|

Item 3. |

1 |

|||

|

Item 4. |

28 |

|||

|

Item 4A. |

88 |

|||

|

Item 5. |

88 |

|||

|

Item 6. |

128 |

|||

|

Item 7. |

135 |

|||

|

Item 8. |

140 |

|||

|

Item 9. |

147 |

|||

|

Item 10. |

148 |

|||

|

Item 11. |

173 |

|||

|

Item 12. |

173 |

|||

|

219 |

||||

|

Item 13. |

219 |

|||

|

Item 14. |

Material Modifications to the Rights of Security Holders and Use of Proceeds |

219 |

||

|

Item 15. |

219 |

|||

|

Item 16. |

219 |

|||

|

Item 16A. |

219 |

|||

|

Item 16B. |

220 |

|||

|

Item 16C. |

220 |

|||

|

Item 16D. |

221 |

|||

|

Item 16E. |

Purchases of Equity Securities by the Issuer and Affiliated Purchasers |

221 |

||

|

Item 16F. |

221 |

|||

|

Item 16G. |

221 |

|||

|

Item 16H. |

221 |

|||

|

Item 16I. |

Disclosure Regarding Foreign Jurisdictions that Prevent Inspections |

221 |

||

|

Item 16J. |

221 |

|||

|

Item 16K. |

221 |

|||

|

223 |

||||

|

Item 17. |

223 |

|||

|

Item 18. |

223 |

|||

|

Item 19. |

223 |

|||

|

229 |

||||

i

CERTAIN DEFINED TERMS

Except where the context otherwise requires, in this annual report:

• “JBS S.A.” refers to JBS S.A., a Brazilian corporation (sociedade anônima).

• “JBS Group,” “we,” “our,” “us,” “our company” or like terms refer to JBS S.A. and its consolidated subsidiaries, unless the context otherwise requires or otherwise indicated.

• “JBS USA” refers to JBS USA Holding Lux S.à r.l., a private limited liability company (société à responsabilité limitée) incorporated and existing under the laws of Luxembourg. JBS USA is an indirect wholly-owned subsidiary of JBS S.A. JBS USA Lux S.A. was merged into JBS USA on December 21, 2023, with JBS USA as the surviving entity.

In addition, in this annual report, except where otherwise indicated or where the context requires otherwise:

• “Australia” means the Commonwealth of Australia.

• “BNDES” means the Brazilian Economic and Social Development Bank (Banco Nacional de Desenvolvimento Econômico e Social — BNDES).

• “BNDESPar” means BNDES Participações S.A., a corporation (sociedade por ações) incorporated under the laws of Brazil and wholly owned by BNDES. For more information, see “Item 7. Major Shareholder and Related Party Transactions — A. Major Shareholders.”

• “B3” or “São Paulo Stock Exchange” means B3 S.A. — Brasil, Bolsa, Balcão.

• “Brazil” means the Federative Republic of Brazil.

• “Brazilian Central Bank” means the Central Bank of Brazil (Banco Central do Brasil).

• “Brazilian Corporation Law” means the Brazilian Law No. 6,404/76, as amended.

• “Brazilian real,” “Brazilian reais” or “R$” means the Brazilian real, the official currency of Brazil.

• “Co-Issuers” means JBS USA, JBS USA Food Company and JBS Luxembourg Company, wholly-owned subsidiaries of JBS S.A. and co-issuers of the JBS USA Registered Notes.

• “CMN” means the Brazilian Monetary Council (Conselho Monetário Nacional).

• “CVM” means the Brazilian Securities Commission (Comissão de Valores Mobiliários).

• “direct controlling shareholders” means J&F and JBS Participações.

• “DOJ” means the U.S. Department of Justice.

• “EUR” or “€” means the Euro, the official currency of the European Economic Area.

• “Exchange Act” means the United States Securities Exchange Act of 1934, as amended.

• “Huon Acquisition” means JBS USA’s acquisition of Huon Aquaculture Group Ltd (“Huon”), an Australian salmon aquaculture business. The Huon Acquisition was completed on November 17, 2021.

• “IASB” means the International Accounting Standards Board.

• “IFRS” means International Financial Reporting Standards.

• “IBAMA” means the Brazilian Institute of the Environment and Natural Resources (Instituto Brasileiro de Meio Ambiente e dos Recursos Naturais Renováveis).

• “J&F” means J&F Investimentos S.A., a corporation (sociedade por ações) incorporated under the laws of Brazil. J&F is controlled by our ultimate controlling shareholders. See “Item 7. Major Shareholder and Related Party Transactions — A. Major Shareholders.”

ii

• “JBS Australia” means Baybrick Pty Limited, an Australian proprietary limited company. JBS Australia is an indirect wholly-owned subsidiary of JBS S.A.

• “JBS Canada” means JBS Food Canada ULC, a Canadian unlimited company. JBS Canada is an indirect wholly-owned subsidiary of JBS S.A.

• “JBS Finance Luxembourg” means JBS Finance Luxembourg S.à r.l., a private limited liability company (société à responsabilité limitée) incorporated and existing under the laws of Luxembourg. JBS Finance Luxembourg is an indirect wholly-owned subsidiary of JBS S.A.

• “JBS Luxembourg Company” means JBS Luxembourg Company S.à r.l., a private limited liability company (société à responsabilité limitée) incorporated and existing under the laws of Luxembourg. JBS Luxembourg Company is an indirect wholly-owned subsidiary of JBS S.A.

• “JBS Participações” means JBS Participações Societárias S.A., a corporation (sociedade por ações) incorporated under the laws of Brazil. JBS Participações is controlled by our ultimate controlling shareholders. See “Item 7. Major Shareholder and Related Party Transactions — A. Major Shareholders.”

• “JBS USA Registered Notes” means the following 11 series of notes issued by the Co-Issuers: (1) 2.500% Senior Notes due 2027; (2) 5.125% Senior Notes due 2028; (3) 6.500% Senior Notes due 2029; (4) 3.000% Senior Notes due 2029; (5) 5.500% Senior Notes due 2030; (6) 3.750% Senior Notes due 2031; (7) 3.000% Sustainability-Linked Senior Notes due 2032; (8) 3.625% Sustainability-Linked Senior Notes due 2032; (9) 5.750% Senior Notes due 2033; (10) 4.375% Senior Notes due 2052; and (11) 6.500% Senior Notes due 2052. The JBS USA Registered Notes are fully and unconditionally guaranteed on a senior unsecured basis by the Parent Guarantors.

• “King Acquisition” means JBS S.A.’s acquisition of King’s Group (“King”), a global producer of bresaola, with a presence in Italy and the United States. The King Acquisition was completed on February 4, 2022.

• “Luxembourg” means the Grand Duchy of Luxembourg.

• “Margarine and Mayonnaise Business Acquisition” means Seara’s acquisition of Bunge Alimentos’ margarine and mayonnaise businesses in Brazil. The acquisition was completed on November 30, 2020.

• “Mexico” means the United Mexican States.

• “Moy Park” means Moy Park Holdings (Europe) Ltd., a private company incorporated under the laws of Northern Ireland. Moy Park owns the companies that comprise the “Moy Park” business based in the United Kingdom, France and the Netherlands. Moy Park is a wholly-owned subsidiary of PPC.

• “the Netherlands” means the European part of the Kingdom of the Netherlands.

• “Parent Guarantors” means JBS S.A. and its wholly-owned subsidiaries JBS Global Luxembourg S.à r.l. and JBS Global Meat Holdings Pty. Limited. The JBS USA Registered Notes are fully and unconditionally guaranteed on a senior unsecured basis by the Parent Guarantors.

• “Pilgrim’s Food Masters Acquisition” means PPC’s acquisition of the specialty meats and ready meals businesses of Kerry Group plc, which have subsequently changed their name to Pilgrim’s Food Masters (“PFM”). The specialty meats and ready meals businesses are manufacturers of branded and private label meats, meat snacks and food-to-go products in the United Kingdom and Ireland and an ethnic chilled and frozen ready meals business in the United Kingdom. The Pilgrim’s Food Masters Acquisition was completed on September 24, 2021.

• “PPC” means Pilgrim’s Pride Corporation, a Delaware corporation. JBS S.A. beneficially owns approximately 83% of PPC’s outstanding common stock.

• “Rivalea Acquisition” means JBS Australia’s acquisition of Rivalea Holdings Pty Ltd and Oxdale Dairy Enterprise Pty Ltd. (“Rivalea”), a hog breeding and processing business in Australia. The Rivalea Acquisition was completed on January 4, 2022.

iii

• “Seara” means Seara Alimentos Ltda., a Brazilian limited liability company (sociedade limitada). Seara and its subsidiaries produce poultry, pork and processed foods in Brazil. Seara is an indirect wholly-owned subsidiary of JBS S.A.

• “SEC” means the United States Securities and Exchange Commission.

• “Securities Act” means the United States Securities Act of 1933, as amended.

• “Sunnyvalley Acquisition” means JBS USA’s acquisition of Sunnyvalley Smoked Meats, Inc. (“Sunnyvalley”), a producer of a variety of smoked bacon, ham and turkey products for sale to retail and wholesale consumers under the Sunnyvalley brand. The Sunnyvalley Acquisition was completed on December 1, 2021.

• “TriOak Business Acquisition” means JBS USA’s acquisition of the TriOak Foods (“TriOak”) business. TriOak is an American pork producer and grain marketer. The TriOak Business Acquisition was completed on December 2, 2022.

• “U.K.” or “United Kingdom” means the United Kingdom of Great Britain and Northern Ireland.

• “ultimate controlling shareholders” means Messrs. Joesley Mendonça Batista and Wesley Mendonça Batista.

• “U.S.” or “United States” means the United States of America.

• “U.S. dollars,” “US$” or “$” means U.S. dollars, the official currency of the United States.

• “USDA” means the United States Department of Agriculture.

• “Vivera Business Acquisition” means JBS USA’s acquisition of the business of Vivera Topholding BV (“Vivera”), a manufacturer of plant-based food products in Europe. Vivera offers products under the Vivera brand, as well as private labels, in more than 25 countries. The Vivera Business Acquisition was completed on June 17, 2021.

iv

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This annual report includes statements reflecting assumptions, expectations, intentions or beliefs about future events that are intended as “forward-looking statements” as defined under the Private Securities Litigation Reform Act of 1995. All statements included in this annual report, other than statements of historical fact, that address activities, events or developments that we or our management expect, believe or anticipate will or may occur in the future are forward-looking statements. These statements represent our reasonable judgment on the future based on various factors and using numerous assumptions and are subject to known and unknown risks, uncertainties and other factors that could cause our actual results and financial position to differ materially from those contemplated by the statements. You can identify these statements by the fact that they do not relate strictly to historical or current facts. They use words such as “anticipate,” “estimate,” “project,” “forecast,” “plan,” “may,” “will,” “should,” “could,” “expect” and other words of similar meaning. In particular, these include, but are not limited to, statements of our current views and estimates of future economic circumstances, industry conditions in domestic and international markets and our performance and financial results.

Among the factors that may cause actual results and events to differ from the anticipated results and expectations expressed in such forward-looking statements are the following:

• the risk of outbreak of animal diseases, more stringent trade barriers in key export markets and increased regulation of food safety and security;

• product contamination or recall concerns;

• fluctuations in the prices of live cattle, hogs, chicken, corn and soymeal;

• fluctuations in the selling prices of beef, pork and chicken products;

• developments in, or changes to, the laws, regulations and governmental policies governing our business and products or failure to comply with them, including environmental and sanitary liabilities;

• currency exchange rate fluctuations, trade barriers, exchange controls, political risk and other risks associated with export and foreign operations;

• changes in international trade regulations;

• our strategic direction and future operation;

• deterioration of economic conditions globally and more specifically in the principal markets in which we operate;

• our ability to implement our business plan, including our ability to arrange financing when required and on reasonable terms and the implementation of our financing strategy and capital expenditure plan;

• the successful integration or implementation of mergers and acquisitions, joint ventures, strategic alliances or divestiture plans;

• the competitive nature of the industry in which we operate and the consolidation of our customers;

• customer demands and preferences;

• our level of indebtedness;

• adverse weather conditions in our areas of operations;

• continued access to a stable workforce and favorable labor relations with employees;

• our dependence on key members of our management;

• the interests of our ultimate controlling shareholders;

• reputational risk in connection with U.S. and Brazilian civil and criminal actions and investigations involving our ultimate controlling shareholders, and the outcome of these actions;

v

• economic instability in Brazil and a resulting reduction in market confidence in the Brazilian economy;

• political crises in Brazil;

• the declaration or payment of dividends or interest attributable to shareholders’ equity;

• the ongoing war between Russia and Ukraine and the Israel-Hamas conflict, including higher prices for commodities, such as food products, ingredients and energy products, increasing inflation in some countries, and disrupted trade and supply chains as a result of disruptions caused by these conflicts;

• unfavorable outcomes in legal and regulatory proceedings and government investigations that we are, or may become, a party to;

• the risk factors discussed under the heading “Item 3. Key Information — D. Risk Factors”;

• other factors or trends affecting our financial condition, liquidity or results of operations; and

• other statements contained in this annual report regarding matters that are not historical facts.

In addition, there may be other factors and uncertainties, many of which are beyond our control, that could cause our actual results and events to be materially different from the results referenced in the forward-looking statements. Many of these factors will be important in determining our actual future results. Consequently, any or all of our forward-looking statements may turn out to be inaccurate.

We caution investors not to place undue reliance on any forward-looking statements, which speak only as of the date made. Except as required by law, we undertake no obligation to publicly update any forward-looking statements, whether as a result of new information, future events or otherwise.

All forward-looking statements contained in this annual report are qualified in their entirety by this cautionary statement.

vi

PRESENTATION OF FINANCIAL AND OTHER INFORMATION

Financial Statements

JBS S.A. maintains its books and records in Brazilian reais, which is its functional currency. JBS S.A.’s consolidated financial statements included in this annual report are presented in U.S. dollars. JBS S.A.’s consolidated financial statements included in this annual report include the consolidation of the financial statements of all of its subsidiaries which are prepared using each subsidiary’s respective functional currency. At the entity level, transactions in foreign currencies other than the functional currency of the entity are initially measured using the exchange rates prevailing at the dates of each transaction. Foreign currency monetary items in the statement of financial position are translated using the closing exchange rate as of the reporting date. Foreign exchange gains and losses resulting from the settlement of such transactions and from the remeasurement at period end of foreign currency monetary assets and liabilities are recognized in the consolidated statement of income, under the captions “Finance income” or “Finance expense.”

This annual report includes financial information derived from JBS S.A.’s audited consolidated financial statements as of December 31, 2023 and 2022 and for each of the years in the three-year period ended December 31, 2023, and the related notes thereto, which are included elsewhere in this annual report. We refer to these as “JBS S.A.’s audited financial statements.”

JBS S.A.’s audited financial statements have been prepared in accordance with International Financial Reporting Standards (IFRS), as issued by International Accounting Standards Board (IASB).

Revision of Financial Statements

JBS S.A.’s audited financial statements have been revised to amend certain disclosures in the previously issued 2023 consolidated financial statements, as follows:

• Note 19 — Provision for legal proceedings: we improved the disclosures to provide more details on the presentation of expenses related to provisions for legal proceedings; and

• Note 20 — Equity: We revised the disclosed amount of PPC’s net income for 2021.

As a result of the revision of the notes described above, Note 28 — Subsequent events was updated considering the financial statements’ authorization date.

Non-GAAP Financial Measures

We have disclosed certain non-GAAP financial measures in this annual report, including Adjusted EBITDA and Adjusted EBITDA Margin. These non-GAAP financial measures are used as measures of performance by our management and should not be considered as measures of financial performance in accordance with IFRS. You should rely on non-GAAP financial measures in a supplemental manner only in making your investment decision. There is no standard definition of non-GAAP financial measures, and JBS S.A.’s definitions may not be comparable to those used by other companies.

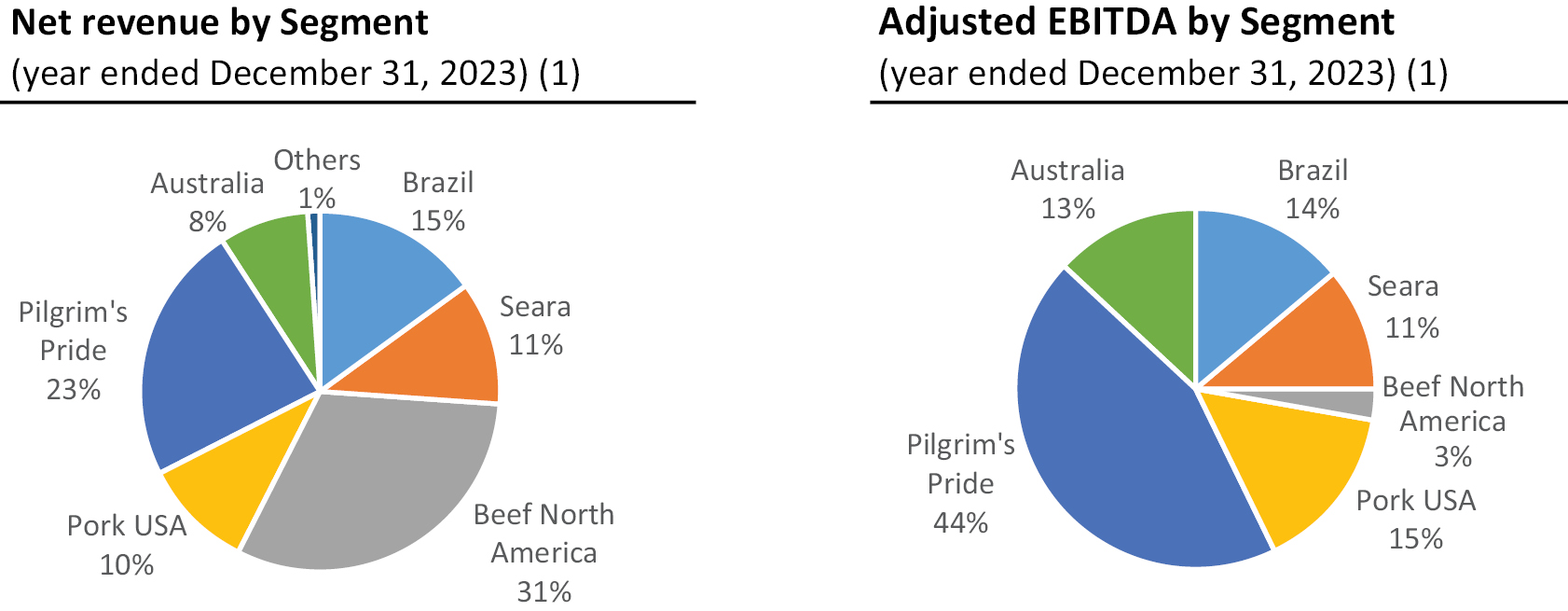

Adjusted EBITDA and Adjusted EBITDA Margin

Adjusted EBITDA is calculated by making the following adjustments to net income, as further described in this annual report (see “Item 5. Operating and Financial Review and Prospects — B. Liquidity and Capital Resources — Reconciliation of Adjusted EBITDA”): exclusion of net finance expenses; exclusion of current and deferred income taxes; exclusion of depreciation and amortization expenses; exclusion of share of profit of equity-accounted investees, net of tax; exclusion of antitrust agreements expenses; exclusion of donations and social programs expenses; exclusion of J&F Leniency expenses refund; exclusion of impairment of assets; exclusion of restructuring expenses; and exclusion of certain other operating income (expense), net.

vii

Adjusted EBITDA Margin is calculated by dividing Adjusted EBITDA by net revenue.

The use of Adjusted EBITDA, instead of net income, and Adjusted EBITDA Margin, instead of net margin, have limitations as analytical tools, including the following:

• Adjusted EBITDA and Adjusted EBITDA Margin do not reflect changes in, or cash requirements for, working capital needs;

• Adjusted EBITDA and Adjusted EBITDA Margin do not reflect interest expense, or the cash requirements necessary to service interest or principal payments, on debt;

• Adjusted EBITDA and Adjusted EBITDA Margin do not reflect income tax expense or the cash requirements to pay taxes;

• Although depreciation and amortization are non-cash charges, the assets being depreciated and amortized will often have to be replaced in the future, and Adjusted EBITDA and Adjusted EBITDA Margin do not reflect any cash requirements for such replacements;

• Adjusted EBITDA and Adjusted EBITDA Margin do not reflect historical cash expenditures or future requirements for capital expenditures or contractual commitments; and

• Adjusted EBITDA and Adjusted EBITDA Margin include adjustments that represent cash expenses or that represent non-cash charges that may relate to future cash expenses.

For more information about Adjusted EBITDA and Adjusted EBITDA Margin and the adjusting items JBS S.A. used to calculate Adjusted EBITDA and Adjusted EBITDA Margin, see “Item 5. Operating and Financial Review and Prospects — B. Liquidity and Capital Resources — Reconciliation of Adjusted EBITDA.”

Industry and Market Data

Certain market and industry data included in this annual report have been obtained from third-party sources that we believe to be reliable, such as the USDA. We have not independently verified such third-party information and cannot assure you of its accuracy or completeness. While we are not aware of any misstatements regarding any market, industry or similar data presented herein, such data involves risks and uncertainties and is subject to change based on various factors, including those discussed under “Cautionary Statement Regarding Forward-Looking Statements” and “Item 3. Key Information — D. Risk Factors.”

Nothing in this annual report should be interpreted as a market forecast.

Brands

This annual report includes trademarks, trade names and trade dress of other companies. Use or display by us of other parties’ trademarks, trade names or trade dress or products is not intended to and does not imply a relationship with, or endorsement or sponsorship of us by, the trademark, trade name or trade dress owners. Solely for the convenience of investors, in some cases we refer to our brands in this annual report without the® symbol, but these references are not intended to indicate in any way that we will not assert our rights to these brands to the fullest extent permitted by law.

Rounding

Certain figures and some percentages included in this annual report have been subject to rounding adjustments. Accordingly, the totals included in certain tables contained in this annual report may not correspond to the arithmetic aggregation of the figures or percentages that precede them.

viii

PART I

ITEM 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS

Not applicable.

ITEM 2. OFFER STATISTICS AND EXPECTED TIMETABLE

Not applicable.

ITEM 3. KEY INFORMATION

A. [Reserved]

B. Capitalization and Indebtedness

Not applicable.

C. Reasons for the Offer and Use of Proceeds

Not applicable.

D. Risk Factors

For purposes of this section, when we state that a risk, uncertainty or problem may, could or will have an “adverse effect” on us or “adversely affect” us, we mean that the risk, uncertainty or problem could have an adverse effect on our business, financial condition, results of operations, cash flow and/or prospects, except as otherwise indicated. You should view similar expressions in this section as having similar meaning.

Risk Factors Summary

The following is a summary of some of the principal risks we face. You should carefully consider the information about these risks set forth below together with the other information included in this annual report.

Risks Relating to Our Business and Industries

• Our results of operations may be adversely affected by fluctuations in market prices for, and the availability of, livestock and animal feed ingredients.

• Outbreaks of animal diseases may affect our ability to conduct our business and harm demand for our products.

• Any perceived or real health risks related to the food industry could adversely affect our ability to sell our products. If our products become contaminated, we may be subject to product liability claims and product recalls.

• Changes in consumer preferences and/or negative perception of the consumer regarding the quality and safety of our products could adversely affect our business.

• We face competition in our business, which may adversely affect our market share and profitability.

Risks Relating to the Markets in Which We Operate

• Deterioration of global economic conditions could adversely affect our business.

• Our exports pose special risks to our business and operations.

• We are subject to ordinary course audits in the jurisdictions where we operate and changes in tax laws and unanticipated tax liabilities, in either case, could adversely affect the taxes we pay and therefore our financial condition and results of operations.

• We are exposed to emerging and developing country risks.

1

• Market fluctuations could negatively impact our operating results, and our business may be adversely impacted by risks related to hedging activities.

Risks Relating to Our Debt, the JBS USA Registered Notes and the Parent Guarantees

• We are not prohibited from incurring significantly more debt.

• The Co-Issuers’ and the Parent Guarantors’ obligations to repay secured debt, and the obligations of JBS USA’s non-guarantor subsidiaries to repay their debt and other liabilities will have priority over the Co-Issuers’ obligations under the JBS USA Registered Notes and the Parent Guarantors’ obligations under their guarantees of the JBS USA Registered Notes.

• Covenant restrictions under certain of our other debt agreements may limit our ability to operate our business.

• Obligations under the JBS USA Registered Notes and the related guarantees will be subordinated to certain statutory liabilities.

• The indentures governing the JBS USA Registered Notes provide for the release of the guarantees of the JBS USA Registered Notes, our ability to substitute JBS USA as an issuer, and our ability to release JBS USA Food Company as an issuer of the JBS USA Registered Notes.

Risks Relating to Our Business and Industries

Our results of operations may be adversely affected by fluctuations in market prices for, and the availability of, livestock and animal feed ingredients.

Our operating margins depend on, among other factors, the purchase price of raw materials, primarily livestock and animal feed ingredients, and the sales price of our products. These prices may vary significantly, including during short periods of time, due to a number of factors, including beef, pork and poultry supply and demand and the market for other protein products. Raw materials accounted for a majority of the total cost of products sold during the year ended December 31, 2023. The supply and market for livestock depend on a number of factors that we have little or no control over, including outbreaks of diseases such as bovine spongiform encephalopathy (commonly referred to as mad cow disease) (“BSE”), and foot and mouth disease (“FMD”), the cost of animal feeding, economic and weather conditions.

Livestock prices demonstrate a cyclical nature both seasonally and over longer periods, reflecting the supply of, and demand for, livestock on the market and the market for other protein products such as fish. These costs are determined by constantly changing market forces of supply and demand, as well as other factors over which we have little or no control. These other factors include:

• import and export restrictions;

• changing livestock and grain inventory levels;

• economic conditions;

• crop and animal diseases; and

• environmental, occupational health and safety and conservation regulations.

We do not generally enter into long-term sales arrangements with our customers with fixed price contracts, and, as a result, the prices at which we sell our products are determined in large part by market conditions. A majority of our livestock is purchased from independent producers who sell livestock to us under marketing contracts or on the open market. A significant decrease in beef, pork or chicken prices for a sustained period of time could have a material adverse effect on our net revenue. Also, a portion of our forward purchase and sale contracts are measured at fair value such that the related unrealized gains and losses are reported in profit or loss earnings on a quarterly basis. Such losses would adversely affect our earnings and may cause significant volatility in our earnings.

2

Profitability in the processing industry is materially affected by the commodity prices of animal feed ingredients, such as grain, corn and soybeans. The production of feed ingredients is positively or negatively affected due to various factors, primarily by the global level of supply inventories and demand for feed ingredients, the agricultural policies of the United States and foreign governments and weather patterns throughout the world. Market prices for feed ingredients remain volatile. High prices for animal feed ingredients may have a material adverse effect on our operating results.

Accordingly, we may be unable to pass on all or part of any increased costs we experience from time to time to consumers of our products directly, in a timely manner or at all. Additionally, if we do not attract and maintain contracts or marketing relationships with independent producers and growers, our production operations could be disrupted, adversely affecting us.

Outbreaks of animal diseases may affect our ability to conduct our business and harm demand for our products.

Supply of and demand for our products can be adversely impacted by outbreaks of animal diseases, which can have a significant impact on our financial results. Outbreaks of diseases affecting animals, such as BSE, FMD and various strains of influenza, which may be caused by factors beyond our control, or concerns that these diseases may occur and spread in the future, could significantly affect demand for our products, consumer perceptions of certain protein products, the availability of livestock for purchase by us and our ability to conduct our operations, including as a result of cancellations of orders by our customers or governmental restrictions on the import and export of our products to or from our suppliers, facilities or customers. For example, in February 2023, Brazil suspended beef exports to China following one confirmed case of atypical mad cow disease in Brazil. This suspension lasted approximately one month. Although this suspension did not have a material adverse effect on us given that sales of beef from Brazil to China represented less than 3% of JBS S.A. total consolidated net revenue in the year ended December 31, 2023, another case or outbreak of mad cow disease in the markets where we produce beef that leads to a more geographically widespread and/or longer lasting suspension of our beef sales may have a more significant adverse effect on results of operations. Moreover, outbreaks of animal diseases could have a significant effect on the livestock we own by requiring us to, among other things, destroy any affected livestock and create negative publicity that may have a material adverse effect on customer demand for our products. In addition, if the products of our competitors become contaminated, the adverse publicity associated with such an event may lower consumer demand for our products.

Any perceived or real health risks related to the food industry could adversely affect our ability to sell our products. If our products become contaminated, we may be subject to product liability claims and product recalls.

We are subject to risks affecting the food industry generally, including risks posed by the following:

• food spoilage or food contamination;

• consumer product liability claims;

• product tampering;

• the possible unavailability and expense of product liability insurance; and

• the potential cost and disruption of a product recall.

Our products have in the past been, and may in the future be, exposed to contamination by organisms that may produce food borne illnesses, such as E. coli, listeria monocytogenes and salmonella. These organisms and pathogens are found generally in the environment and, as a result, there is a risk that they could be present in our products. These organisms and pathogens can also be introduced to our products through tampering or as a result of improper handling at the further processing, foodservice or consumer level. Once contaminated products have been shipped for distribution, illness or death may result if the products are not properly prepared prior to consumption or if the organisms and pathogens are not eliminated in further processing.

Our systems designed to monitor food safety risks may not eliminate the risks related to food safety. We have little, if any, control over handling procedures once our products have been shipped for distribution. If any of our products are determined to be contaminated, spoiled or inappropriately labeled, whether or not we are at fault, we may voluntarily recall, or be required to recall, our products. A widespread product recall could result in significant losses due to the costs of a recall, the destruction of product inventory and lost sales due to the unavailability of product for

3

a period of time. We may also be subject to increased risk of exposure to product liability claims and governmental proceedings, which may result in penalties, injunctive relief and plant closings. Any of these occurrences may have an adverse effect on our financial results.

We may be subject to significant liability in the jurisdictions in which our products are sold if the consumption of any of our products causes injury, illness or death. Such liability may result from proceedings filed by the government’s attorney’s office, consumer agencies and individual consumers. Even an inadvertent shipment of contaminated products may be a violation of law. We may have to pay significant damages to consumers or to the government and such liability may be in excess of applicable liability insurance policy limits.

In addition, adverse publicity concerning any perceived or real health risk associated with our products could also cause customers to lose confidence in the safety and quality of our food products, which could adversely affect our ability to sell our products. We could also be adversely affected by perceived or real health risks associated with similar products produced by others to the extent such risks cause customers to lose confidence in the safety and quality of such products generally.

Changes in consumer preferences and/or negative perception of the consumer regarding the quality and safety of our products could adversely affect our business.

The food industry is generally subject to changing consumer trends, demands and preferences. Trends within the food industry frequently change, and our failure to anticipate, identify or react to changes in these trends could lead to reduced demand and prices for our products, among other concerns, and could have a material adverse effect on our business, financial condition and results of operations.

We could also be adversely affected if consumers lose confidence in the safety and quality of our food products or ingredients, or in the food safety system generally. Negative perceptions concerning the health implications of certain food products, or ingredients or loss of confidence in the food safety system generally, could influence consumer preferences and acceptance of some of our products and marketing programs. Negative perceptions and failure to satisfy consumer preferences could materially and adversely affect our product sales, financial condition and results of operations.

We face competition in our business, which may adversely affect our market share and profitability.

The beef, pork and chicken industries are highly competitive. Competition exists both in the purchase of live cattle and hogs and grains, and in the sale of beef, pork and chicken products. In addition, our beef, pork and chicken products compete with other protein sources, such as fish. We face competition from a number of beef, pork and chicken producers in the countries in which we operate.

The principal competitive factors in the animal protein processing industries are operating efficiency and the availability, quality and cost of raw materials and labor, price, quality, food safety, product distribution, technological innovations and brand loyalty. Our ability to be an effective competitor depends on our ability to compete on the basis of these characteristics. In addition, some of our competitors may have greater financial and other resources than us. We may be unable to compete effectively with these companies, in which case our market share and, consequently, our operations and results may be adversely affected.

Our growth (organic and inorganic) may require substantial capital and long-term investments.

Our competitiveness and growth depend on our ability to fund our capital expenditures. We cannot assure you that we will be able to fund our capital expenditures at reasonable costs due to adverse macroeconomic conditions, our performance or other external factors, which could have a material adverse effect on our business, financial condition and results of operations.

We may pursue additional opportunities to acquire complementary businesses, which could further increase leverage and debt service requirements and could adversely affect our financial situation, especially if we fail to successfully integrate the acquired business.

We intend to continue to pursue selective acquisitions of complementary businesses in the future. Inherent in any future acquisitions are certain risks such as increasing leverage and debt service requirements and combining company cultures and facilities, which could have a material adverse effect on our operating results, particularly during the

4

period immediately following such acquisitions. Additional debt or equity capital may be required to complete future acquisitions, and there can be no assurance that we will be able to raise the required capital. Furthermore, acquisitions involve a number of risks and challenges, including:

• diversion of management’s attention;

• potential loss of key employees and customers of the acquired companies;

• an increase in our expenses and working capital requirements;

• failure of the acquired entities to achieve expected results;

• our failure to successfully integrate any acquired entities into our business; and

• our inability to achieve expected synergies and/or economies of scale.

These opportunities may also expose us to successor liability relating to actions involving any acquired entities, their respective management or contingent liabilities incurred prior to our involvement and will expose us to liabilities associated with ongoing operations, in particular to the extent we are unable to adequately and safely manage such acquired operations. These transactions may also be structured in such a manner that would result in our assumption of obligations or liabilities not identified during our pre-acquisition due diligence.

Any of these factors could adversely affect our ability to achieve anticipated cash flows at acquired operations or realize other anticipated benefits of acquisitions, which could adversely affect our reputation and have a material adverse effect on us.

Failure by us to achieve our sustainability performance targets may result in increased interest payments under future financings and harm to our reputation.

As described in “Item 5. Operating and Financial Review and Prospects — B. Liquidity and Capital Resources — Description of Material Indebtedness — Fixed-Rate Notes — Sustainability-Linked Bonds,” certain of our debt instruments contain certain sustainability performance targets of JBS S.A., JBS USA or PPC that if unsatisfied will result in an increase in the interest rate payable on the respective debt instruments. Achieving these sustainability performance targets or any similar sustainability performance targets we may choose to include in future financings or other arrangements will require us to expend significant resources. In 2021, we became the first major global meat and poultry company to set climate reduction goals by 2040. As part of these environmental aspirations, we signed on to the United Nations Global Compact’s Business Ambition for 1.5°C initiative, which aligns with the most ambitious aim of the Paris Agreement to limit global warming. While we are dedicated to working towards these climate reduction goals, they are ambitious and success in achieving these goals will require collaboration and alignment, as well as resources and efforts by experts, shareholders, customers, governments, and partners throughout our supply chain. Our goals will also require advanced technologies, tools, and solutions. The mere setting of these goals may subject JBS S.A. and its affiliates and, in some instances already has subjected JBS USA, to criticism, investigations, regulatory enforcement, litigation, or other risk. For example, in February 2024, the Attorney General of the State of New York filed a civil complaint against our subsidiaries, JBS USA Food Company and JBS USA Food Company Holdings, in the Supreme Court of the State of New York, County of New York, alleging that consumers in New York were misled by statements in which we expressed our goal of reducing greenhouse gas emissions and striving to achieve Net Zero by 2040. This legal proceeding is ongoing. Although we believe the complaint lacks legal and factual merit and intend to vigorously defend the case, we cannot ensure that we will prevail or that the complaint will not increase the risk of related lawsuits by securityholders. For additional information, see “Item 8. Financial Information — A. Consolidated Statements and Other Financial Information — Legal Proceedings — Other Proceedings.” In addition, a failure by us to achieve these goals could harm our reputation, which could have a material adverse effect on our results of operations, financial condition and liquidity.

Failure by us to meet the commitments we have made regarding our cattle and grain supply chains in Brazil may have a material adverse effect on our business and reputation.

While we have tools at our disposal to perform monitoring of the commitments we have made regarding our cattle and grain supply chains in Brazil and to which we are subject by Brazilian law and/or our internal policies, no assurance can be given that our monitoring efforts will be effective in every instance. For example, as mentioned

5

under “Item 4. Information on the Company — B. Business Overview — Regulation — Brazil — Brazilian Forest Code,” rural landowners are required to self-report electronic geo-referencing data to the Rural Environmental Registry (Cadastro Ambiental Rural) (“CAR”), in order to demonstrate compliance with Federal Law No. 12.651 (Código Florestal) (the “Forest Code”). In addition, as further discussed under “Item 4. Information on the Company — B. Business Overview — Cattle and Grain Supply Chains and Deforestation — Seara Sustainable Grain and Oil Sourcing Policy,” Seara’s Sustainable Grain and Oil Sourcing Policy establishes guidelines for promoting and developing a deforestation-free supply chain for its primary grain and oil supply chains. This policy supports the conservation of native vegetation and sustainable use of agriculturally productive areas in Brazil. Currently, the policy monitors only direct suppliers to Seara. For the Amazon biome, Seara sources soy and its derivatives only from signatories of Brazil’s Amazon Soy Moratorium, which requires it to only purchase from suppliers that have records of zero deforestation in the biome.

To the extent that any of our suppliers provides incorrect or incomplete information to the CAR or to us as part of their reporting requirements, we may inadvertently purchase cattle or grain from non-conforming suppliers in violation of our policies, thereby subjecting ourselves to potential liabilities. See “— We may not be able to ensure that our raw material suppliers are in compliance with all applicable environmental and labor laws and regulations, which could adversely affect our business, financial condition and results of operations.” Similarly, for purposes of monitoring our compliance with our commitment to avoid engaging with suppliers operating on embargoed land or that have been found to be in violation of Brazilian laws prohibiting slave-like conditions for workers, we rely on databases compiled and provided by Brazilian governmental ministries and other governmental entities. To the extent that such ministries or other entities do not maintain complete and regularly updated lists, we may inadvertently do business with one or more suppliers that are in violation of these requirements, which would also be in violation of our internal policies, which in turn could subject us to related liabilities. Our ability to monitor compliance by our indirect suppliers across all obligations is necessarily more limited than our ability to monitor compliance by our direct suppliers due to the inherent challenges associated with our access to full information in the supply chain, such as livestock origin, prior to our direct suppliers taking ownership. Failure by us to meet the commitments we have made regarding our cattle and grain supply chains in Brazil may have a material adverse effect on our business and reputation. For more information about our cattle supply monitoring commitments and compliance efforts, see ““Item 4. Information on the Company — B. Business Overview — Cattle and Grain Supply Chains and Deforestation.”

We are subject to interest rate fluctuations, which may be harmful to our business.

A portion of our debt is subject to interest rate fluctuations, including fluctuations in: (1) the Secured Overnight Financing Rate (“SOFR”) and the Euro Interbank Offered Rate (“EURIBOR”) and (2) Brazilian financial market rates or inflation rates, such as the Interbank Deposit Certificate (Certificado de Depósito Interbancário) (“CDI”) and the Long-Term Interest Rate (Taxa de Juros de Longo Prazo) (the “Brazilian TJLP rate”) (Brazil’s long-term interest rate published quarterly by the Brazilian National Monetary Council). We are also exposed to exchange rate risk because we have assets and liabilities and future cash flows and earnings denominated in foreign currencies. See “Item 11. Quantitative and Qualitative Disclosures About Market Risk.” Fluctuations in exchange rates and interest rates are caused by a number of factors that are beyond our control.

If interest rates, such as SOFR, EURIBOR, the CDI and Brazilian TJLP rates, or exchange rates increase significantly, our finance expenses will increase and our ability to obtain financings may decrease, which may materially adversely affect our results of operations.

Unfavorable decisions in legal, administrative, antitrust or arbitration proceedings and government investigations may adversely affect us.

We are defendants in legal, administrative, antitrust and arbitration proceedings arising from the ordinary conduct of our business, particularly with respect to civil, tax, labor and environmental claims, which may be decided to our detriment, and we are involved in various government investigations. For more information regarding our proceedings and investigations, see “Item 8. Financial Information — A. Consolidated Statements and Other Financial Information — Legal Proceedings.” In addition, we cannot guarantee that new lawsuits (judicial or administrative of any nature) or investigations against us, Messrs. Joesley Mendonça Batista and Wesley Mendonça Batista (our ultimate controlling shareholders) and managers, will not arise. For example, certain news media in Brazil have reported that in December 2023, the Brazilian State of Rondônia commenced legal proceedings seeking damages against JBS S.A., among other parties, for allegedly illegally purchasing cattle raised in protected areas in the Amazon region. To date, we have not received service of process in connection with these reported proceedings.

6

Applicable laws and regulations could subject us and our managers to civil and criminal penalties, including debarment from contracts concluded with the public administration and prohibition to celebrating new ones and loss of fiscal benefits, which could materially and adversely affect our product sales, reputation, financial condition and results of operations. Adverse rulings that have material economic or reputational impacts on us or impede the execution of our growth plan may adversely affect our financial condition and results of operations. In addition, unfavorable decisions in proceedings or investigations involving us and our ultimate controlling shareholders and managers may affect our image and business.

For certain lawsuits, we were not required to and have not established any provision on our statement of financial position or have established provisions only for part of the amounts in dispute, based on our judgments as to the likelihood of winning these lawsuits. For example, as of December 31, 2023, we had ongoing proceedings in the aggregate amount of US$6.0 billion (US$4.1 billion as of December 31, 2022), which refer to civil, tax and labor proceedings whose loss potential is possible (but not more likely than not), for which no provisions were recognized. We cannot guarantee that the provisioned amounts (if any) will be sufficient to cover the costs and expenses of the corresponding proceedings, which could adversely impact our business and operating results.

We may not be able to ensure that our raw material suppliers are in compliance with all applicable environmental and labor laws and regulations, which could adversely affect our business, financial condition and results of operations.

The raising of cattle and other livestock is at times associated with deforestation, invasion of indigenous lands and protected areas and other environmental and human rights concerns. Most of the cattle we process are bred and raised by our suppliers. If we are unable to ensure that the suppliers of the cattle we use in our production process are in compliance with all applicable environmental and human rights laws and regulations, we may be subject to fines and other penalties that may adversely affect our image, reputation, business, financial condition and results of operations. For example, the European Union has adopted a new regulation to curb the European Union market’s impact on global deforestation and forest degradation around the world, as well as protecting the rights of indigenous peoples. The European Union Deforestation Regulation (the “EUDR”) mandates extensive due diligence on the value chain for all operators and traders dealing with certain products derived from cattle, cocoa, coffee oil palm, rubber, soya and wood. Penalties for non-compliance will be laid down under national law, but must be effective, proportionate and dissuasive. In due course, the intention is for the EUDR to be subject to criminal penalties, but under the EUDR itself, penalties may include fines and confiscation of products, among other things. The EUDR entered into force on June 29, 2023, and its main obligations will be applicable in December 2024. If we are unable to ensure that we are in compliance with the EUDR, we may be subject to fines and other penalties. For more information about the EUDR, see “Item 4. Information on the Company — B. Business Overview — Regulation — Europe — European Union Deforestation Regulation.”

Furthermore, Brazilian Environmental Policy Act, outlined in Federal Law No. 6,938/1981, regulates civil liability for damages caused to the environment and sets forth strict liability on the subject matter. Therefore, we may become party to environmental liability proceedings amongst any damage originator. As the majority of cattle processed by us are bred by third parties and subcontractors, we may be significantly impacted if third parties and subcontractors cause environmental damages in the implementation of their activities on our behalf.

See also “— Media campaigns related to food production; regulatory and customer focus on environmental, social and governance responsibility; and increased focus and attention by the U.S. government and other stakeholders on the meat processing industry and ESG-related issues could expose us to additional costs or risks.”

We are subject to various risks relating to worker safety.

Given the nature of our operations, the type of work performed by our employees, and the number of plants and employees that we have throughout the world, we are subject to various risks relating to worker safety. We cannot ensure that accidents will not occur. If our efforts to improve worker safety and reduce the frequency and number of workplace accidents are not successful, we may become subject to lawsuits, regulatory or administrative investigations and inquiries, fines and penalties, and our business, financial condition and results of operations may be adversely affected.

7

For example, a U.S. House of Representatives Select Subcommittee held a hearing in December 2022 entitled “Preparing For And Preventing The Next Public Health Emergency: Lessons Learned From The Coronavirus Crisis.” This hearing was accompanied by a final report of the same name, which describes an investigation of the largest companies in the U.S. meatpacking industry, including our subsidiary JBS USA Food Company, in the context of the Trump Administration’s response to the risks faced by these companies’ workers during the COVID-19 pandemic. JBS USA Food Company has complied with the document requests made in 2021 as part of the investigation.

We may also suffer reputational harm due to the actions of unrelated companies that do not adhere to applicable worker safety laws in the provision of services to us. For example, the U.S. Department of Labor commenced an investigation into allegations of child labor at certain of our facilities in August 2022. While this investigation did not result in any finding that we were employing any underage workers at any of our facilities, a federal judge granted a temporary restraining order against one of our suppliers. While such supplier is not affiliated with us, the investigation found that it had used underage workers to provide cleaning and sanitation services in the fulfillment of sanitation and cleaning contracts that it was performing at JBS facilities. Such supplier has entered into a consent order and judgment pursuant to which it has agreed to comply with child labor laws at all of the facilities where it provides services.

Additionally, we have from time to time had incidents at our plants involving worker health and safety. These have included ammonia releases due to mechanical failures in chiller systems and worker injuries and fatalities involving processing equipment and vehicle accidents. We have taken preventive measures in response; however, we can make no assurance that similar incidents will not arise in the future. New environmental, health and safety requirements, stricter interpretations of existing requirements, or obligations related to the investigation or clean up of contaminated sites, may materially affect our business or operations in the future.

While we adhere and require adherence from suppliers to all applicable worker safety laws throughout our global operations, no assurance can be given that we will not be materially adversely affected to the extent that companies that provide services to us do not demonstrate the same commitment to such laws. In addition, no assurance can be given that our reputation for worker safety will not be adversely affected by governmental investigations or other inquiries in the future.

We depend on our information technology systems, and any failure of these systems could adversely affect our business.

We depend on information technology systems for significant elements of our operations, including the storage of data and retrieval of critical business information, and within our supply chain. We also depend on our information technology infrastructure for digital marketing activities and for electronic communications among our locations, personnel, customers, and suppliers. Although our information systems are protected with robust backup systems, including physical and software safeguards and remote processing capabilities, our information technology systems and those of our supply chain are vulnerable to damage from a variety of sources, including network failures, malicious human acts, and natural disasters. Moreover, despite network security and back-up measures, some of our servers are potentially vulnerable to physical or electronic break-ins, computer viruses, and similar disruptive problems. In addition, certain software used by us is licensed from, and certain services related to our information systems are provided by, third parties who could choose to discontinue their relationship with us. Failures or disruptions to our information technology systems or those used by our third-party service providers could prevent us from conducting our general business operations, and adversely affect our ability to process orders, maintain proper levels of inventories, collect accounts receivable, pay expenses, and maintain the security of our company and customer data. Any disruption or loss of information technology systems on which critical aspects of our operations depend could have an adverse effect on our business, results of operations, and financial condition.

For example, on May 30, 2021, we were the target of an organized cybersecurity attack (the “Cyberattack”), affecting some of the servers supporting our North American and Australian information technology systems. JBS USA’s backup servers were not affected. JBS USA and PPC’s operations in North America and Australia were affected. PPC’s operations in Mexico and the United Kingdom were not impacted and conducted business as normal. Upon learning of the intrusion, we contacted federal officials and activated our cybersecurity protocols, including voluntarily shutting down all affected systems to isolate the intrusion, limit the potential infection and preserve core systems. Restoring systems critical to production was prioritized. In addition, the encrypted backup servers, which were not affected by the Cyberattack, allowed for a return to full operations within two days. As of June 3, 2021, JBS USA and PPC had resumed production at all of their facilities. Our response, IT systems and encrypted backup servers allowed

8

for a rapid recovery from the Cyberattack. As a result, the loss of food produced was limited to less than one day of production. We are not aware of any evidence that any customer, supplier or employee data had been compromised or misused as a result of the Cyberattack. Since the Cyberattack, we have been working to improve our cybersecurity posture in order to minimize our risk and attack surface. We have identified good practices we had in place before the Cyberattack, and we have identified and completed items and actions that were needed to remediate.

Further, we store highly confidential information on our information technology systems, including information related to our products. If our servers or the servers of the third party on which our data is stored are attacked by a physical or electronic break-in, computer virus or other malicious human action, our confidential information could be stolen or destroyed. Any security breach involving the misappropriation, loss or other unauthorized disclosure or use of confidential information of our suppliers, customers, or others, whether by us or a third party, could disrupt our operations, subject us to civil and criminal penalties, have a negative impact on our reputation, expose us to liability to our suppliers, customers, other third parties or government authorities and increase our cyber-security protection and remediation costs. Any of these developments could have an adverse impact on our business, financial condition and results of operations. In addition, if our supply chain cybersecurity is compromised as a result of third-party action, employee error, malfeasance, stolen or fraudulently obtained log-in credentials or otherwise, our business may be harmed and we could incur significant liabilities. We mitigate this risk by having a diversified supply chain. There can be no assurance that we will be able to prevent all of the rapidly evolving forms of increasingly sophisticated and frequent cyber-attacks. Moreover, our efforts to address network security vulnerabilities may not be successful, resulting potentially in the theft, loss, destruction or corruption of information we store electronically, as well as unexpected interruptions, delays or cessation of service, any of which would cause harm to our business operations. The vulnerability of our systems and our failure to identify or respond timely to cyber incidents could have an adverse effect on our operations and reputation and expose us to liability or regulatory enforcement actions.

The loss of members of our senior management or our inability to attract and retain qualified senior management personnel could have an adverse effect on us.

Our ability to maintain our competitive position depends in large part on the performance of our senior management team, mainly because of our business model and our acquisition strategy. As a result of factors such as strong global economic conditions, we may lose key employees or face problems hiring qualified key employees. In order to retain key employees, we may have to make significant changes in our compensation policy to remain competitive, which would increase our costs. There is no assurance that we will succeed in attracting and retaining qualified senior management personnel. Also, decisions in any administrative proceedings involving our current managers may prevent them from remaining in their positions at our company. The loss of the services of any member of our senior management or our inability to attract and retain qualified personnel could have an adverse effect on us.

Our performance depends on favorable labor relations with our employees and our compliance with labor laws. Any deterioration of those relations or increase in labor costs could adversely affect our business.

As of December 31, 2023, we had approximately 270,000 employees worldwide. Certain of these employees are represented by labor organizations, and our relationships with these employees are governed by collective bargaining agreements. We may not reach new agreements without union action and any such new agreements may not be on terms satisfactory to us. In addition, any new agreements may be for shorter durations than our historical agreements. Moreover, additional groups of currently non-unionized employees may seek union representation in the future. If we are unable to negotiate acceptable collective bargaining agreements, we may become subject to union-initiated work stoppages, including strikes. Any significant increase in labor costs, deterioration of employee relations, slowdowns or work stoppages at any of our locations, whether due to union activities, employee turnover or otherwise, could have a material adverse effect on our business, financial condition, results of operations and cash flows.

Labor shortages and increased turnover or increases in employee and employee-related costs could have adverse effects on our profitability.

We and our third-party vendors have experienced increased labor shortages at some of our production facilities and other locations. Several factors have had and may continue to have adverse effects on the labor force available to us and our third-party vendors, including government regulations, which include laws and regulations related to workers’ health and safety, wage and hour practices and work authorization. Labor shortages and increased turnover rates within the Company and our third-party vendors have led to and could in the future lead to increased costs, such

9

as increased overtime to meet demand and increased wage rates to attract and retain employees and could negatively affect our ability to efficiently operate our production facilities or otherwise operate at full capacity and could result in downtime of our production facilities. An overall or prolonged labor shortage, lack of skilled labor, increased turnover or labor inflation for any of the foregoing reasons could have a material adverse impact on our operations, results of operations, reputation, liquidity or cash flows.

The consolidation of a significant number of our customers could adversely affect our business.

Many of our customers, such as supermarkets, warehouse clubs and food distributors, have consolidated in recent years, and consolidation is expected to continue. These consolidations have produced large, sophisticated customers with increased buying power who are more capable of operating with reduced inventories, opposing price increases, and demanding lower pricing, increased promotional programs and specifically tailored products. These customers also may use shelf space currently used for our products for their own private label products that are generally sold at lower prices. In addition, in periods of economic uncertainty, consumers tend to purchase more lower-priced private label or other economy brands. To the extent this occurs, we could experience a reduction in the sales volume of our higher margin products or a shift in our product mix to lower margin offerings. Because of these trends, we may need to lower prices or increase promotional spending for our products. The loss of a significant customer or a material reduction in sales to, or adverse change to trade terms with, a significant customer could materially and adversely affect our product sales, financial condition and results of operations.

Our ultimate controlling shareholders have influence over the conduct of our business and may have interests that are different from yours.

Our direct controlling shareholders are J&F and JBS Participações, which are in turn wholly owned by our ultimate controlling shareholders, Messrs. Joesley Mendonça Batista and Wesley Mendonça Batista. See “Item 7. Major Shareholder and Related Party Transactions — A. Major Shareholders.” In addition, if the Proposed Equity Transaction is completed, immediately following its completion, as a result of the dual-class structure of JBS N.V. (each JBS N.V. Class A Common Share is entitled to one vote at a general meeting of shareholders of JBS N.V. and each JBS N.V. Class B Common Share is entitled to 10 votes at a general meeting of shareholders of JBS N.V.), the voting power of our ultimate controlling shareholders will increase from 48.48% to 84.85% (assuming the ownership structure of JBS S.A. on the Last Trading Day is the same as on March 15, 2024), and their ability to influence our company will be greater as a result of such concentrated control. See “Item 4. Information on the Company — A. History and Development of the Company — The Corporate Restructuring and the Proposed Equity Transaction — Risk Factors — The dual class structure of the JBS N.V. Common Shares has the effect of concentrating voting control with our Class B shareholders and limiting our other shareholders’ ability to influence corporate matters and could discourage others from pursuing any change of control transactions that holders of JBS N.V. Class A Common Shares may view as beneficial.”

Relatives of our ultimate controlling shareholders perform certain management and leadership roles at JBS S.A. and related companies. Mr. José Batista Sobrinho, the founder of JBS S.A. and the father of our ultimate controlling shareholders, serves as the Vice-Chairman of JBS S.A.’s board of directors and has served on the JBS S.A. board of directors since 2007. Mr. Wesley Mendonça Batista Filho, who is the son of Mr. Wesley Mendonça Batista and the grandson of Mr. José Batista Sobrinho, serves as the Chief Executive Officer of JBS USA since May 2023, and has served as an executive officer of JBS S.A. since 2017 and in other senior management positions in JBS Group companies in the past, including as Chief Executive Officer of Seara Alimentos. He also serves on the board of directors of various JBS Group companies. In addition, Mr. Henrique Mendonça Batista, who is also Wesley Mendonça Batista’s son, serves as the President of Huon, an Australian salmon processing company acquired by JBS S.A. in 2021. Messrs. Joesley Mendonça Batista and Wesley Mendonça Batista may serve as members of the board of directors of, or in other senior management positions at, JBS Group companies or affiliates. For example, in February 2024, they were appointed to fill vacancies on the board of directors of PPC, and in April 2024, they were elected by majority vote of the shareholders of JBS S.A. to serve on JBS S.A.’s board of directors for the ongoing term ending in 2025. In addition, at this time, we expect that they will serve on the board of directors of JBS N.V. effective on the date of the listing of the JBS N.V. Class A Common Shares on the NYSE, as well as on the board of directors of J&F. In 2017, Messrs. Joesley Mendonça Batista and Wesley Mendonça Batista, among others, entered into collaboration agreements (acordos de colaboração premiada) (the “Collaboration Agreements”) with the Brazilian Attorney General’s Office (Procuradoria-Geral da República), and J&F, on behalf of itself and its subsidiaries, entered into a leniency agreement (the “Leniency Agreement”) with the Brazilian Federal Prosecution

10