UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 20-F

(Mark One)

|

¨

|

REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR 12(g) OF THE SECURITIES EXCHANGE ACT OF 1934

|

OR

|

þ

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the fiscal year ended December 31, 2013

OR

|

¨

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the transition period from ___________ to ___________

OR

|

¨

|

SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

Date of event requiring this shell company report _________________________

Commission file number: 001-34532

CHINA GERUI ADVANCED MATERIALS GROUP LIMITED

--------------------------------------------------------------------------------------------------------------------------------------------

(Exact Name of Registrant as Specified in Its Charter)

Not Applicable

(Translation of Registrant’s Name Into English)

British Virgin Islands

(Jurisdiction of Incorporation or Organization)

1 Shuanghu Development Zone

Xinzheng City

Zhengzhou, Henan Province 451191

People’s Republic of China

--------------------------------------------------------------------------------------------------------------------------------------------

(Address of Principal Executive Offices)

Mingwang Lu

1 Shuanghu Development Zone

Xinzheng City

Zhengzhou, Henan Province 451191

People’s Republic of China

Tel: 86-371-62568634; Fax: 86-371-67718787

Email: mingwang.lu@geruigroup.com

--------------------------------------------------------------------------------------------------------------------------------------------

(Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

|

Title of Each Class

|

|

Name of Each Exchange On Which Registered

|

|

Ordinary Shares, no par value

|

|

NASDAQ Global Select Market

|

Securities registered or to be registered pursuant to Section 12(g) of the Act.

None

(Title of Class)

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act.

(Title of Class)

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report (December 31, 2013): 59,522,910 ordinary shares

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.Yes ¨ No þ

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. Yes ¨ No þ

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.Yes þ No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer.

Large Accelerated Filer o Accelerated Filer þ Non-Accelerated Filer o

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

U.S. GAAP þ International Financial Reporting o Other o

Standards as issued by the International

Accounting Standards Board

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow. o Item 17 o Item 18

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).Yes o No þ

CHINA GERUI ADVANCED MATERIALS GROUP LIMITED

Annual Report on Form 20-F

Year Ended December 31, 2013

TABLE OF CONTENTS

| |

PART I

|

|

Page

|

|

| |

|

|

|

|

|

Item 1.

|

Identity of Directors, Senior Management and Advisers

|

|

|

1 |

|

| |

A. Directors and Senior Management

|

|

|

1 |

|

| |

B. Advisors

|

|

|

1 |

|

| |

C. Auditors

|

|

|

1 |

|

|

Item 2.

|

Offer Statistics and Expected Timetable

|

|

|

1 |

|

| |

A. Offer Statistics

|

|

|

1 |

|

| |

B. Method and Expected Timetable

|

|

|

1 |

|

|

Item 3.

|

Key Information

|

|

|

1 |

|

| |

A. Selected Financial Data

|

|

|

1 |

|

| |

B. Capitalization and Indebtedness

|

|

|

2 |

|

| |

C. Reasons for the Offer and Use of Proceeds

|

|

|

2 |

|

| |

D. Risk Factors

|

|

|

3 |

|

|

Item 4.

|

Information on the Company

|

|

|

21 |

|

| |

A. History and Development of the Company

|

|

|

21 |

|

| |

B. Business Overview

|

|

|

22 |

|

| |

C. Organizational Structure

|

|

|

27 |

|

| |

D. Property, Plants and Equipment

|

|

|

27 |

|

|

Item 4A.

|

Unresolved Staff Comments

|

|

|

28 |

|

|

Item 5.

|

Operating and Financial Review and Prospects

|

|

|

28 |

|

| |

A. Operating Results

|

|

|

28 |

|

| |

B. Liquidity and Capital Resources

|

|

|

35 |

|

| |

C. Research and Development, Patents and Licenses, Etc

|

|

|

40 |

|

| |

D. Trend Information

|

|

|

40 |

|

| |

E. Off-Balance Sheet Arrangements

|

|

|

40 |

|

| |

F. Tabular Disclosure of Contractual Obligations

|

|

|

42 |

|

| |

G. Safe Harbor

|

|

|

42 |

|

|

Item 6.

|

Directors, Senior Management and Employees

|

|

|

42 |

|

| |

A. Directors and Senior Management

|

|

|

42 |

|

| |

B. Compensation

|

|

|

44 |

|

| |

C. Board Practices

|

|

|

47 |

|

| |

D. Employees

|

|

|

50 |

|

| |

E. Share Ownership

|

|

|

50 |

|

|

Item 7.

|

Major Shareholders and Related Party Transactions

|

|

|

52 |

|

| |

A. Major Shareholders

|

|

|

52 |

|

| |

B. Related Party Transactions

|

|

|

52 |

|

| |

C. Interests of Experts and Counsel

|

|

|

52 |

|

|

Item 8.

|

Financial Information

|

|

|

52 |

|

| |

A. Consolidated Statements and Other Financial Information

|

|

|

52 |

|

| |

B. Significant Changes

|

|

|

53 |

|

|

Item 9.

|

The Offer and Listing

|

|

|

53 |

|

| |

A. Offer and Listing Details

|

|

|

53 |

|

| |

B. Plan of Distribution

|

|

|

54 |

|

| |

C. Markets

|

|

|

54 |

|

| |

D. Selling Shareholders

|

|

|

54 |

|

| |

E. Dilution

|

|

|

54 |

|

| |

F. Expenses of the Issue

|

|

|

54 |

|

|

Item 10.

|

Additional Information

|

|

|

54 |

|

| |

A. Share Capital

|

|

|

54 |

|

| |

B. Memorandum and Articles of Association

|

|

|

54 |

|

| |

C. Material Contracts

|

|

|

60 |

|

| |

D. Exchange Controls

|

|

|

60 |

|

| |

E. Taxation

|

|

|

61 |

|

| |

F. Dividends and Paying Agents

|

|

|

64 |

|

| |

G. Statement by Experts

|

|

|

64 |

|

| |

H. Documents on Display

|

|

|

64 |

|

| |

I. Subsidiary Information

|

|

|

65 |

|

|

Item 11.

|

Quantitative and Qualitative Disclosures About Market Risk

|

|

|

65 |

|

|

Item 12.

|

Description of Securities Other Than Equity Securities

|

|

|

66 |

|

| |

A. Debt Securities

|

|

|

66 |

|

| |

B. Warrants and Rights

|

|

|

66 |

|

| |

C. Other Securities

|

|

|

66 |

|

| |

D. American Depositary Shares

|

|

|

66 |

|

| |

PART II

|

|

|

|

|

|

Item 13.

|

Defaults, Dividend Arrearages and Delinquencies

|

|

|

67 |

|

|

Item 14.

|

Material Modifications to the Rights of Securities Holders and Use of Proceeds

|

|

|

67 |

|

|

Item 15.

|

Controls and Procedures

|

|

|

67 |

|

|

Item 16A.

|

Audit Committee Financial Expert

|

|

|

69 |

|

|

Item 16B.

|

Code of Ethics

|

|

|

69 |

|

|

Item 16C.

|

Principal Accountant Fees and Services

|

|

|

69 |

|

|

Item 16D.

|

Exemptions From the Listing Standards for Audit Committees

|

|

|

70 |

|

|

Item 16E.

|

Purchases of Equity Securities by the Issuer and Affiliated Purchasers

|

|

|

70 |

|

|

Item 16F.

|

Change in Registrant’s Certifying Accountant

|

|

|

70 |

|

|

Item 16G.

|

Corporate Governance

|

|

|

70 |

|

|

Item 16H.

|

Mine Safety Disclosure

|

|

|

70 |

|

| |

PART III

|

|

|

|

|

|

Item 17.

|

Financial Statements

|

|

|

71 |

|

|

Item 18.

|

Financial Statements

|

|

|

71 |

|

|

Item 19.

|

Exhibits

|

|

|

71 |

|

INTRODUCTORY NOTES

Use of Certain Defined Terms

Except as otherwise indicated by the context and for the purposes of this report only, references in this report to:

|

●

|

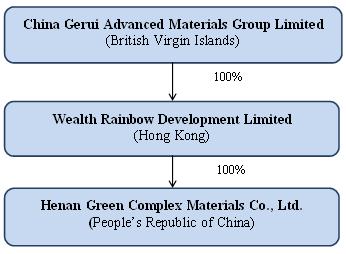

“China Gerui” “we,” “us,” or “our,” and the “Company,” are to the combined business of China Gerui Advanced Materials Group Limited, a BVI company, and its consolidated subsidiaries, Wealth Rainbow and Henan Green;

|

|

●

|

“Wealth Rainbow” is our wholly-owned subsidiary Wealth Rainbow Development Limited, a Hong Kong company;

|

|

●

|

“Henan Green” is Wealth Rainbow’s wholly-owned subsidiary Henan Green Complex Materials Co., Ltd., a PRC company;

|

|

●

|

“Zhengzhou Company” is Henan Green’s related party and former owner, Zhengzhou No. 2 Iron and Steel Company Limited, a PRC company;

|

|

●

|

“COAC,” refers to China Opportunity Acquisition Corp., a Delaware corporation that merged with and into China Gerui;

|

|

●

|

“BVI” refers to the British Virgin Islands;

|

|

●

|

“Hong Kong” refers to the Hong Kong Special Administrative Region of the People’s Republic of China;

|

|

●

|

“PRC” and “China” refer to the People’s Republic of China;

|

|

●

|

“SEC” refers to the Securities and Exchange Commission;

|

|

●

|

“Exchange Act” refers to the Securities Exchange Act of 1934, as amended;

|

|

●

|

“Securities Act” refers to the Securities Act of 1933, as amended;

|

|

●

|

“Renminbi” and “RMB” refer to the legal currency of China; and

|

|

●

|

“U.S. dollars,” “dollars” and “$” refer to the legal currency of the United States.

|

Forward-Looking Information

This annual report contains forward-looking statements and information relating to us that are based on the current beliefs, expectations, assumptions, estimates and projections of our management regarding our company and industry. When used in this annual report, the words “may”, “will”, “anticipate”, “believe”, “estimate”, “expect”, “intend”, “plan” and similar expressions, as they relate to us or our management, are intended to identify forward-looking statements. These statements reflect management’s current view of us concerning future events and are subject to certain risks, uncertainties and assumptions, including among many others: our potential inability to achieve similar growth in future periods as we did historically, a decrease in the availability of our raw materials, the emergence of additional competing technologies, changes in domestic and foreign laws, regulations and taxes, changes in economic conditions, uncertainties related to China’s legal system and economic, political and social events in China, a general economic downturn, a downturn in the securities markets, and other risks and uncertainties which are generally set forth under Item 3 “Key information—D. Risk Factors” and elsewhere in this annual report. Should any of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those described as anticipated, estimated or expected in this annual report.

All forward-looking statements included herein attributable to us or other parties or any person acting on our behalf are expressly qualified in their entirety by the cautionary statements contained or referred to in this section. Except to the extent required by applicable laws and regulations, we undertake no obligations to update these forward-looking statements to reflect events or circumstances after the date of this annual report or to reflect the occurrence of unanticipated events.

PART I

|

ITEM 1.

|

IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS

|

A. Directors and Senior Management

Not applicable.

B. Advisors

Not applicable.

C. Auditors

Not applicable.

|

ITEM 2.

|

OFFER STATISTICS AND EXPECTED TIMETABLE

|

A. Offer Statistics

Not applicable.

B. Method and Expected Timetable

Not applicable.

A. Selected Financial Data

The following table presents selected financial data regarding our business. It should be read in conjunction with our consolidated financial statements and related notes contained elsewhere in this annual report and the information under Item 5 “Operating and Financial Review and Prospects.” The selected consolidated statement of income data for the fiscal years ended December 31, 2013, 2012 and 2011, and the selected consolidated balance sheet data as of December 31, 2013 and 2012 have been derived from our audited consolidated financial statements that are included in this annual report beginning on page F-1. The selected consolidated statement of income data for the fiscal years ended December 31, 2010 and 2009, and the selected consolidated balance sheet data as of December 31, 2011, 2010 and 2009 have been derived from our audited consolidated financial statements that are not included in this annual report.

Our consolidated financial statements are prepared and presented in accordance with generally accepted accounting principles in the United States, or U.S. GAAP. The selected financial data information is only a summary and should be read in conjunction with the historical consolidated financial statements and related notes contained elsewhere herein. The financial statements contained elsewhere fully represent our financial condition and operations; however, they are not indicative of our future performance.

(In thousands of U.S. Dollars, except number of shares and per share data)

| |

|

Fiscal Year Ended December 31,

|

|

| |

|

2013

|

|

|

2012

|

|

|

2011

|

|

|

2010

|

|

|

2009

|

|

|

Statement of Income Data:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenue

|

|

$

|

165,829

|

|

|

$

|

265,486

|

|

|

$

|

341,778

|

|

|

$

|

253,866

|

|

|

$

|

218,903

|

|

|

Gross profit

|

|

|

4,063

|

|

|

|

56,945

|

|

|

|

101,578

|

|

|

|

75,997

|

|

|

|

65,807

|

|

|

Operating (loss)/income

|

|

|

(8,930)

|

|

|

|

42,331

|

|

|

|

83,537

|

|

|

|

66,950

|

|

|

|

60,315

|

|

|

Net (loss)/income before income taxes

|

|

|

(13,996)

|

|

|

|

38,030

|

|

|

|

79,582

|

|

|

|

63,021

|

|

|

|

58,200

|

|

|

Net (loss)/income

|

|

|

(14,137)

|

|

|

|

26,133

|

|

|

|

57,621

|

|

|

|

47,083

|

|

|

|

43,448

|

|

|

Weighted average ordinary shares - basic

|

|

|

59,540,872

|

|

|

|

58,543,076

|

|

|

|

56,297,652

|

|

|

|

43,891,670

|

|

|

|

33,751,844

|

|

|

Weighted average ordinary shares – diluted

|

|

|

59,540,872

|

|

|

|

58,543,076

|

|

|

|

56,297,652

|

|

|

|

46,655,721

|

|

|

|

37,675,479

|

|

|

Basic (net loss)/earnings per share

|

|

$

|

(0.24)

|

|

|

$

|

0.45

|

|

|

$

|

1.02

|

|

|

$

|

1.07

|

|

|

$

|

1.29

|

|

|

Diluted (net loss)/earnings per share

|

|

$

|

(0.24)

|

|

|

$

|

0.45

|

|

|

$

|

1.02

|

|

|

$

|

1.01

|

|

|

$

|

1.15

|

|

|

Balance Sheet Data:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total current assets

|

|

$

|

454,062

|

|

|

$

|

495,040

|

|

|

$

|

445,186

|

|

|

$

|

227,915

|

|

|

$

|

146,638

|

|

|

Total assets

|

|

|

626,558

|

|

|

|

673,370

|

|

|

|

601,076

|

|

|

|

329,004

|

|

|

|

184,350

|

|

|

Total current liabilities

|

|

|

314,404

|

|

|

|

343,302

|

|

|

|

302,648

|

|

|

|

161,192

|

|

|

|

97,307

|

|

|

Total liabilities

|

|

|

327,430

|

|

|

|

343,302

|

|

|

|

302,648

|

|

|

|

161,192

|

|

|

|

97,307

|

|

|

Stockholders’ equity

|

|

|

299,129

|

|

|

|

330,067

|

|

|

|

298,428

|

|

|

|

167,812

|

|

|

|

87,043

|

|

|

Average exchange rate (USD/RMB)

|

|

|

6.1412

|

|

|

|

6.2990

|

|

|

|

6.4475

|

|

|

|

6.7604

|

|

|

|

6.8303

|

|

|

First quarter ended March 31

|

|

|

6.2169 |

|

|

|

6.2997 |

|

|

|

6.5738 |

|

|

|

6.8262 |

|

|

|

6.8371 |

|

|

Second quarter June 30

|

|

|

6.1454 |

|

|

|

6.3335 |

|

|

|

6.4774 |

|

|

|

6.8115 |

|

|

|

6.8273 |

|

|

Third quarter September 30

|

|

|

6.1226 |

|

|

|

6.3314 |

|

|

|

6.3973 |

|

|

|

6.7579 |

|

|

|

6.8297 |

|

|

Forth quarter December 31

|

|

|

6.0801 |

|

|

|

6.2313 |

|

|

|

6.3417 |

|

|

|

6.6459 |

|

|

|

6.8272 |

|

|

Closing exchange rate (USD/RMB)

|

|

|

6.0537 |

|

|

|

6.2301 |

|

|

|

6.2939 |

|

|

|

6.6000 |

|

|

|

6.8270 |

|

The following table shows, the high and low exchange rates (USD/RMB) for each month during the previous six months:

|

Period

|

|

High

|

|

|

Low

|

|

|

March 2014

|

|

|

6.2273 |

|

|

|

6.1183 |

|

|

February 2014

|

|

|

6.1448 |

|

|

|

6.0591 |

|

|

January 2014

|

|

|

6.0600 |

|

|

|

6.0402 |

|

|

December 2013

|

|

|

6.0927 |

|

|

|

6.0537 |

|

|

November 2013

|

|

|

6.0993 |

|

|

|

6.0903 |

|

|

October 2013

|

|

|

6.1209 |

|

|

|

6.0815 |

|

| |

|

|

|

|

|

|

|

|

|

(1) Annual averages are calculated using the average of month-end rates of the relevant year. Quarter averages are using the average of the exchange rates on the last day of each month during the period.

|

| |

B. Capitalization and Indebtedness

Not applicable.

C. Reasons for the Offer and Use of Proceeds

Not applicable.

D. Risk Factors

An investment in our capital stock involves a high degree of risk. You should carefully consider the risks described below, together with all of the other information included in this annual report, before making an investment decision. If any of the following risks actually occurs, our business, financialcondition or results of operations could suffer. In that case, the trading price of our ordinary shares could decline, and you may lose all or part of your investment.

Risks Related to our Business

If we become directly subject to the recent scrutiny, criticism and negative publicity involving U.S.-listed Chinese companies, we may have to expend significant resources to investigate and resolve the matter which could harm our business operations, stock price and reputation and could result in a loss of your investment in our stock, especially if such matter cannot be addressed and resolved favorably.

Recently, U.S. public companies that have substantially all of their operations in China have been the subject of intense scrutiny, criticism and negative publicity by investors, financial commentators and regulatory agencies, such as the United States Securities and Exchange Commission, or the SEC. Much of the scrutiny, criticism and negative publicity has centered around financial and accounting irregularities and mistakes, a lack of effective internal controls over financial accounting, inadequate corporate governance policies or a lack of adherence thereto and, in many cases, allegations of fraud. As a result of the scrutiny, criticism and negative publicity, the publicly traded stock of many U.S. listed Chinese companies has sharply decreased in value and, in some cases, has become virtually worthless. Many of these companies are now subject to shareholder lawsuits, SEC enforcement actions and are conducting internal and external investigations into the allegations. It is not clear what effect this sector-wide scrutiny, criticism and negative publicity will have on our company, our business and our stock price. If we become the subject of any unfavorable allegations, whether such allegations are proven to be true or untrue, we will have to expend significant resources to investigate such allegations and/or defend our company. This situation will be costly and time consuming and distract our management from growing our company. If such allegations are not proven to be groundless, our company and business operations would be severely damaged and your investment in our stock could be rendered worthless.

A significant percentage of our revenues are derived from sales to a limited number of large customers and our business will suffer if sales to these customers decline.

We currently sell high precision steel products to more than 20 major customers in the Chinese domestic market. For the fiscal years ended December 31, 2013 and 2012, sales revenues generated from our top 10 customers amounted for 29.6% and 30.8% of total sales revenues, respectively, and sales to our largest single customer for the same periods amounted to 6.8% of our total sales revenues in both years. We do not enter into long-term contracts with our customers and therefore cannot be certain that sales to these customers will continue. The loss of any of our largest customers would likely have a material negative impact on our sales revenues and business.

Our customers operate in highly competitive markets, and they may be willing to accept substitutes in lieu of our products.

Our customers and other users of cold-rolled steel products operate in highly competitive markets, which are becoming increasingly cost-conscious. Cold-rolled precision steel competes with other materials, such as aluminum, plastics, composite materials and glass, among others, for industrial and commercial applications. Customers have demonstrated a willingness to substitute other materials for cold-rolled steel. If our customers increasingly utilize substitutes for cold-rolled steel products in their operations, sales of our products will decline and our business and results of operations will suffer.

We may be unable to fund the substantial ongoing capital and maintenance expenditures that our operations require.

Our operations are capital intensive and our business strategy is likely to require additional substantial capital investment. We completed an underwritten public offering in November 2009 and a private placement financing in June 2010 in which we raised total net proceeds of approximately $43 million.

As of December 31, 2013, we have used the net proceeds from the aforementioned financings to expand our cold-rolled steel processing capacity from 250,000 metric tons per annum to 500,000 metric tons per annum, to add 200,000 metric tons per annum of capacity to our 50,000-metric ton-per-annum chromium plating line so as to be capable of producing additional 250,000 tons of cold-rolled steel per annum, and to build a new 30,000 metric tons per annum of capacity of laminated steel production. The total capital expenditure for these expansion projects was approximately $45 million. We will also need to use capital to test and optimize our new production lines in order to bring them into full operation, maintain the condition of our equipment, and comply with environmental laws and regulations.

On February 26, 2013, the Company's subsidiary, Henan Green acquired land use right with totaling 24.94 acres from a related party, Zhengzhou Company, among which 6.69 acres of land has been leased to Henan Green in prior years with annual rent of $12,867, $11,428 and $9,909 for the years end December 31, 2012, 2011 and 2010, respectively. The payment of acquisition was fully settled as of June 30, 2013 and the transfer of land use right is still in process. The total consideration is of approximately $43.6 million (RMB 268,000,000). In addition, if any party breaches its representations and warranties provided in the asset transfer agreement, the breaching party is required to pay the other parties for damages in an amount of approximately $0.16 million (RMB 1 million).

Our capital expenditure plans and estimates are subject to change as determined by our management and we may determine that we do not have sufficient cash on hand to fund these initiatives without seeking external capital funds. Sourcing external capital funds for these purposes are key factors that have constrained and may in the future constrain our growth, production capability and profitability. To the extent that we finance our capital expansion and maintenance projects with debt financing, we may become subject to financial covenants or operating covenants that restrict our ability to freely operate our business or take actions that are desired by shareholders, such as the payment of dividends. If we elect to finance our capital expansion and maintenance plans through equity financing, our shareholders may experience dilution or may have their voting or economic rights as shareholders subordinated to a senior class of stock. In either event, we may be unable to find external sources of financing on favorable terms or at all. Our failure to obtain external financing for our capital expansion and maintenance projects can severely impede our growth plans and strategy and impair our revenue, earnings and overall financial performance.

The recent global economic crisis could further impair the steel industry thereby limiting demand for our products and affecting the overall availability and cost of external financing for our operations.

The repetition, continuation or intensification of the recent global economic crisis and turmoil in the global financial markets have adversely impacted our business, the businesses of our customers from whom we generate revenues and our potential sources of capital financing. Our high precision, cold rolled steel products parts are primarily sold to customers who operate in the food and industrial packaging, construction and household decorations materials, electrical appliances, and telecommunications wires and cables industries. The global economic crisis harmed most industries and has been particularly detrimental to the steel industry. Since virtually all of our sales are made to end users in other industries, our sales and business operations are dependent on the financial health of both the steel industry and other industries in which our customers operate. Therefore, our business could suffer further if our customers continue to experience, difficulties in their respective industries or a downturn in their business. Presently, it is unclear whether and to what extent the economic stimulus measures and other actions taken or contemplated by the Chinese government and other governments throughout the world will mitigate the effects of the crisis on the steel industry and other industries that affect our business. Although these conditions have not presently impaired our ability to access credit markets and finance our operations, the impact of the current crisis on our ability to obtain capital financing in the future, and the cost and terms of same, is unclear.

A downturn or negative changes in the highly volatile steel industry has harmed our business and profitability.

Steel consumption is highly cyclical and generally follows general economic and industrial conditions, both worldwide and in various smaller geographic areas. Pricing can be volatile as a result of general economic conditions, labor costs, competition, import duties, tariffs and currency exchange rates. The steel industry has historically been characterized by excess world supply and wide fluctuations in results of operations both in China and globally. This has led to substantial price decreases during periods of economic weakness, which have not been offset by commensurate price increases during periods of economic strength. Substitute materials are increasingly available for many steel products, which may further reduce demand for steel. Additional overcapacity or the use of alternative products could further hurt our results of operations.

We are subject to risks associated with changing technology and manufacturing techniques, which could place us at a competitive disadvantage.

Our ability to implement our business plan and to achieve the results projected by management will depend on management's ability to anticipate technological advances in our industry and implement strategies to take advantage of technological change. We may be unable to address technological advances or introduce new designs or products that may be necessary to remain competitive within the steel industry.

We produce steel products that are characterized by stringent performance and specification requirements that mandate a high degree of manufacturing and engineering expertise. We believe that our customers rigorously evaluate our services and products on the basis of a number of factors, including, but not limited to:

|

●

|

technical expertise and development capability;

|

|

●

|

reliability and timeliness of delivery;

|

|

●

|

product design capability;

|

|

●

|

operational flexibility;

|

Our success depends on our ability to continue to meet our customers’ changing requirements and specifications with respect to these and other criteria. There can be no assurance that we will be able to address technological advances or introduce new designs or products that may be necessary to remain competitive within the precision steel industry.

Our revenues will decrease if there is less demand for the end product in which our products are utilized.

Our finished steel products mainly serve as key components in food and industrial packaging, construction and household decorations materials, electrical appliances, and telecommunications wires and cables. Therefore, we are subject to the general changes in economic conditions affecting the food and industrial packaging, construction and household decorations materials, electrical appliance, and telecommunications wires and cables industries. If our customers which operate in these industries experience a downturn in their business or if they utilize substitutes for our products in their manufacturing operations, demand for our products and our business results will suffer.

Environmental compliance and remediation could result in substantially increased capital requirements and operating costs.

Steel manufacturing and processing operations are subject to numerous Chinese provincial and local laws and regulations relating to the protection of the environment. We are subject to regulations regarding emissions and waste disposal and management. These laws continue to evolve and are becoming increasingly stringent. The ultimate impact of complying with such laws and regulations is not always clearly known or determinable because regulations under some of these laws have not yet been promulgated or are undergoing revision. Our business and operating results could suffer if we were required to increase our expenditures to comply with any new environmental regulations affecting our operations.

Our level of indebtedness may make it more difficult for us to fulfill all of our debt obligations and may reduce the amount of cash available for maintaining and growing our operations, which could have an adverse effect on our revenues.

Our total debt under existing bank loans, sale-lease back financing obligation and lines of credit as of December 31, 2013 was approximately $296 million. Our obligations under certain of our notes payable /short term bank loans are guaranteed by our land use rights and buildings on which we conduct our operations. We had $376 million in total cash (including certificate of deposit) of which $115 million was restricted cash as of December 31, 2013. We have elected to reserve the use of such cash for our capital expansion program and have recently renewed certain existing bank loans and lines of credit. This indebtedness and the incurrence of any new indebtedness could (i) make it more difficult for us to satisfy and pay our existing liabilities and obligations, which could in turn result in an event of default, (ii) require us to dedicate a substantial portion of our cash flow from operations to debt service payments, thereby reducing the availability of cash for working capital, capital expenditures, acquisitions, general corporate purposes or other purposes, (iii) impair our ability to obtain additional financing in the future for working capital, capital expenditures, acquisitions, general corporate purposes or other purposes, (iv) diminish our ability to withstand a downturn in our business, the industry in which we operate or the economy generally, (v) limit our flexibility in planning for, or reacting to, changes in our business and the industry in which we operate, or (vi) place us at a competitive disadvantage compared to competitors that have proportionately less debt. If we are unable to meet our debt service obligations, we could be forced to restructure or refinance our indebtedness, seek additional equity capital or sell assets. We may be unable to obtain financing or sell assets on satisfactory terms, or at all, which could cause us to default on our debt service obligations, be subject to foreclosure on such loans, and lose possession of the land and buildings in which we conduct our operations. Additionally, we could incur additional indebtedness in the future and, if new debt is added to our current debt levels, the risks above could intensify.

During 2013, we were not in compliance with the financial covenants. The terms of the loans prohibit making advances or providing guarantees to other unrelated parties without prior consent of the bank. Although the banks have not called the loans or assessed a penalty on us for these violations, there is no assurance that the banks will not call the loans because there is no standstill agreement reached between us and the banks. We do not believe that any penalty will be assessed by the banks for these violations. In addition, as of December 31, 2013, we provided guarantees for certain non-related parties. We believe that if those non-related parties are unable to repay its debt or guarantees, we may be required to pay up to $132.1 million related to their debt and guarantees. No provision has been made in our financial statements for this obligation as we have not been called upon to date to perform under our guarantee and we believe the chances are less than probable.

We face significant competition from competitors with greater resources, and we may not have the resources necessary to successfully compete with them.

The steel manufacturing and processing business is highly fragmented and competitive. We compete with a large number of other steel manufacturers and processors in China, on a region-by-region basis, and with foreign steel manufacturers, such as POSCO Steel, on a worldwide basis. Our competitors are of various sizes, some of which have more established brand names and relationships in certain markets than we do. We generally are not in direct competition with China’s large state-owned steel companies in the high-end precision cold-rolled steel sector because those companies concentrate on the production of hot-rolled steel and relatively commoditized cold-rolled steel. As such, they are more often a raw material supplier to us, rather than a competitor. We are one of a limited number of specialty precision cold-rolled steel producers in China. However, part of our newer production capacity has not yet reached optimum customization, including strip thickness, and to an extent has been competing with commodity cold-rolled steel produced by large state-owned steel companies while we optimize this capacity to produce fully specialized products. In addition, differences in the type and nature of the specialty precision steel products in China’s steel industry are relatively small and, coupled with intense competition from international and local suppliers and customer price sensitivity, competition can be fierce. Our competitors may increase their market share through pricing strategies that damage our business. Since our industry is capital-intensive, our competitors may be able to successfully compete with us if their financial resources, staff and facilities are substantially greater than ours, placing us at a competitive disadvantage to these larger companies.

Any decrease in the availability, or increase in the cost, of raw materials could materially reduce our earnings.

Our business operations depend heavily on the availability of various raw materials and energy resources, primarily hot-rolled steel coil, but also chromium, tin, zinc, oil paint and electricity. Steel coil has historically accounted for approximately 84% of our total cost of sales. The availability of raw materials and energy resources may decrease and their prices may fluctuate greatly. We purchase a large portion of our raw materials from a selected number of suppliers, but we currently do not have long-term supply contracts with any particular supplier to assure a continued supply of raw materials. While we maintain good relationships with these suppliers, the supply of raw materials may nevertheless be interrupted on account of events outside our control, which will negatively impact our operations. If these or any other important suppliers are unable or unwilling to provide us with raw materials on terms favorable to us, we may be unable to produce certain products. This could result in a decrease in profit and damage to our reputation in our industry. So far we have been able to pass most raw material cost increases on to our customers. However, if our raw material and energy costs increase to such an extent that we cannot pass these higher costs on to our customers in full or at all, our margins will suffer. Although we currently benefit from favorable pricing in some of these supply contracts, if market prices for these raw materials decline, we may not be able to take advantage of decreasing market prices, and our profit margins may suffer.

Starting 2012, we began to offer our customers an increased number of products, including precision cold-rolled steel, chromium-plated and laminated cold-rolled steel of both narrow- and wide- strip. Our raw material may evolved from just narrow-strip to both narrow- and wide-strip hot-rolled coils and finished cold-rolled steel (for chromium-plating and laminating processing), thus posing changed demand on our suppliers for flexibility of type and timeliness of delivery. Any failure of our suppliers to meet our afore-mentioned demand may adversely impact our operation and ability to fulfill sales contracts in a timely manner.

We produce a limited number of products and may not be able to respond quickly to significant changes in the market or new market entrants.

Cold-rolled specialty precision steel manufacturing is a relatively new industry in China. Previously, our customers which manufacture durable goods have relied solely on imports from Japan, Korea, the European Union and the United States. We believe the average quality and standards of products of China’s high precision steel industry lags behind international standards. While we offer five series and over 20 types of high-precision steel products and believe we have developed a nationally recognizable brand, there are many other specialty precision steel products of similar nature in the market. While we began to export products to Turkey and India in 2012 and to United States and Taiwan in 2013, we have not yet developed an internationally recognizable brand for specialty steel products. If there are significant changes in market demand and/or competitive forces, we may not be able to change our product mix or adapt our production equipment quickly enough to meet customers’ needs. Under such circumstances, our narrow band of precision steel products and/or new market entrants may negatively impact our financial performance.

Increased imports of steel products into China could negatively affect domestic steel demand and prices and reduce our profitability.

While China’s steel production has increased rapidly in recent years, we believe that domestic production continues to be insufficient to meet demand for high-end steel products. As a result, China is expected to continue to import a significant portion of its steel products. Foreign competitors may have lower raw material costs, and are often owned, controlled or subsidized by their governments, which allows their production and pricing decisions to be influenced by political and economic policy considerations as well as prevailing market conditions. Import levels may also be impacted by decisions of government agencies, under trade laws. Increases in future levels of imported steel could negatively impact future market prices and demand levels for our precision steel products.

While virtually all of our operations, customers and sales are in China, some limited administrative matters are geographically dispersed so any deterioration of general business conditions in China may make it difficult or prohibitive to continue to operate or expand our business.

Our manufacturing operations are located in China and some of our administrative matters are handled in Hong Kong and the BVI. We have regulatory filing obligations in the United States. The geographical distances between our facilities create a number of logistical and communications challenges, including time differences and differences in the cultures in each location, which makes communication and effective cooperation more difficult. In addition, because of the location of the manufacturing facilities in China, our operations could be affected by, among other things:

|

●

|

economic and political instability in China, including problems related to labor unrest;

|

|

●

|

lack of developed infrastructure;

|

|

●

|

variances in payment cycles;

|

|

●

|

overlapping taxes and multiple taxation issues;

|

|

●

|

employment and severance taxes;

|

|

●

|

compliance with local laws and regulatory requirements;

|

|

●

|

greater difficulty in collecting accounts receivable; and

|

|

●

|

the burdens of cost and compliance with a variety of foreign laws.

|

Moreover, inadequate development or maintenance of infrastructure in China, including adequate power and water supplies, transportation, raw materials availability or the deterioration in the general political, economic or social environment could make it difficult, more expensive and possibly prohibitive to continue to operate or expand our facilities in China.

Our rapid expansion could significantly strain our resources, management and operational infrastructure which could impair our ability to meet increased demand for our products and hurt our business results.

To accommodate our anticipated growth, we will need to expand capital resources and dedicate personnel to implement and upgrade our accounting, operational and internal management systems and enhance our record keeping and contract tracking system. Such measures will require us to dedicate additional financial resources and personnel to optimize our operational infrastructure and to recruit more personnel to train and manage our growing employee base. If we cannot successfully implement these measures efficiently and cost-effectively, we will be unable to satisfy the demand for our products, which will impair our revenue growth and hurt our overall financial performance.

Our production facilities are subject to risks of power shortages which may impair our ability to meet our customers’ needs.

Our manufacturing processes are extremely specialized and depend on critical pieces of equipment and a constant availability of energy to power them. Many cities and provinces in China have suffered serious power shortages in recent times, largely as a result of the growth and commercialization of formerly rural regions of China. Many of the regional grids do not have sufficient power generating capacity to fully satisfy the increased demand for electricity driven by continual economic growth and persistent hot weather.

In 2011, China announced new guidelines aiming to reduce energy use and carbon emissions per unit of industrial value added output by 4 percent in 2011 compared to 2010 levels. The target levels are slightly higher than those pledged by China in its recently released 12th Five Year Plan and are part of China's plan to cut energy consumption and carbon emissions per unit of gross domestic product by 18 percent over the next five years. In 2012 and 2013, electricity supplies were cut back to many industrial producers around China. Local governments have also occasionally required local factories to temporarily shut down their operations or reduce their daily operational hours in order to reduce local power consumption levels.

While we have not experienced any severe or lengthy power outages in the past as a result of power outages or administrative measures, we do not have any back up power generation systems. If we are affected by administrative measures or power outages in the future, we may experience material production disruption and delays in our delivery schedule. In such event, our business, results of operation and financial conditions could be damaged.

Unexpected equipment failures may damage our business due to production curtailments or shutdowns.

Highly specialized machinery is used in our manufacturing processes which cannot be repaired or replaced without significant expense and time delay. On occasion, our equipment may be out of service as a result of unanticipated failures which may result in plant shutdowns or periods of materially reduced production. Interruptions in production capabilities will inevitably increase production costs and reduce our sales and earnings. In addition to equipment failures, our facilities are also subject to the risk of catastrophic loss due to unanticipated events such as fires, explosions or adverse weather conditions. Furthermore, any interruption in production capability may require us to make large capital expenditures to remedy the situation, which could have a negative effect on our profitability and cash flows. We do not have business interruption insurance to cover losses as a result of equipment failures. In addition, longer-term business disruption could result in a loss of customers. If this were to occur, our future sales levels, and therefore our profitability, could decline.

We might fail to adequately protect our intellectual property and third parties may claim that our products infringe upon their intellectual property.

As part of our business strategy, we intend to accelerate our investment in new technologies in an effort to strengthen and differentiate our product portfolio and make our manufacturing processes more efficient. Our primary focus will be to develop new and better technologies to allow us to manufacture higher valued-added products, such as chrome finished, zinc-plated and galvanized products. As a result, we believe that the protection of our intellectual property will become increasingly important to our business. We expect to rely on a combination of trade secrets, trademarks and copyrights to provide protection in this regard, but this protection might be inadequate. For example, our future patent applications might not be approved or, if allowed, they might not be of sufficient strength or scope. Conversely, third parties might assert that our technologies infringe their proprietary rights. In either case, litigation could result in substantial costs and diversion of our resources, and whether or not we are ultimately successful, the litigation could hurt our business and financial condition.

We face risks associated with future investments or acquisitions.

A component of our growth strategy is to invest in or acquire businesses complementary to ours that will enable us, among other things, to expand the products we offer to our existing target customer base, and that will provide opportunities to expand into new markets. We may be unable to identify suitable investment or acquisition candidates or to make these investments or acquisitions on a commercially reasonable basis, if at all. If we complete an investment or acquisition, we may not realize the anticipated benefits from the transaction. Integrating an acquired company or technology is complex, distracting and time consuming, as well as a potentially expensive process. The successful integration of an acquisition would require us to:

|

●

|

integrate and retain key management, sales, research and development, and other personnel;

|

|

●

|

incorporate the acquired products or capabilities into our offerings both from an engineering and sales and marketing perspective;

|

|

●

|

coordinate research and development efforts;

|

|

●

|

integrate and support pre-existing supplier, distribution and customer relationships; and

|

|

●

|

consolidate duplicate facilities and functions and combine back office accounting, order processing and support functions.

|

The geographic distance between the companies, the complexity of the technologies and operations being integrated and the disparate corporate cultures being combined may increase the difficulties of combining an acquired company or technology. Acquired businesses are likely to have different standards, controls, contracts, procedures and policies, making it more difficult to implement and harmonize company-wide financial, accounting, billing, information and other systems. Management’s focus on integrating operations may distract attention from our day-to-day business and may disrupt key research and development, marketing or sales efforts.

Our acquisition strategy also depends on our ability to obtain necessary government approvals that may be required. We may be unable to complete a business combination transaction efficiently or on favorable terms due to complicated merger and acquisition regulations implemented in China.

We do not carry any business interruption insurance, product liability or recall insurance or third-party liability insurance.

Operation of our business and facilities involves many risks, including equipment failures, natural disasters, industrial accidents, power outages, labor disturbances, business interruptions, property damage, product liability, personal injury and death. We do not carry any business interruption insurance or third-party liability insurance for our business to cover claims in respect of product liability, personal injury or property or environmental damage arising from accidents on our property or relating to our operations. Therefore, our existing insurance coverage may not be sufficient to cover all risks associated with our business. As a result, we may be required to pay for financial and other losses, damages and liabilities, including those caused by natural disasters and other events beyond our control, out of our own funds, which could have a material adverse effect on our business, financial condition and results of operations.

Our business will suffer if we lose our land use rights. Should our expenditures and efforts to strengthen our land use rights by acquiring from land use rights from Zhengzhou Company , a related party, be perceived as a waste of resources or non-arms’-length transaction, we may be subject to greater regulatory scrutiny or shareholder litigation risks.

There is no private ownership of land in China and all land ownership is held by the government of China, its agencies, and collectives. In the case of land used for business purposes, land use rights can be obtained from the government for a period up to 50 years, and are typically renewable. Land use rights can be granted upon approval by the land administrative authorities of China (State Land Administration Bureau) upon payment of the required land granting fee, the entry into a land use agreement with a competent governmental authority and certain other ministerial procedures. Henan Green used to hold land use rights for some of its occupied properties and leases the land and the building on which its main facilities are located from third parties. On February 26, 2013, we entered into an asset transfer agreement to acquire the land use rights of Company’s related party, Zhengzhou Company, which is the owner of a land use right with respect to 24.94 acres (151.4 Chinese mu), on which our existing production lines and warehouses are located. The total consideration is approximately $43.6 million. The process of transferring land use rights to Henan Green from Zhengzhou Company is not completed as of the report date. The purpose of this transaction is to ultimately reduce our overall risk position by reducing our dependence on third parties for our land use rights. However, if a regulator or shareholder disagrees with this view and seeks to invalidate this transaction or sue for damages, we may need to engage in expensive litigation or other measures to defend our actions, which we may lose, and our efforts to bolster our land use rights may be frustrated. Even if this transaction is not invalidated or otherwise challenged, substantial additional funds may need to be paid in order to transfer the land use rights, which may have a material adverse effect on our financial condition. We also have obtained land use rights and permission to construct facilities on additional land of approximately 49.42 acres, adjacent to our present facilities, from the Zhengzhou local government. If the Chinese administrative authorities determine that we have not fully complied with all procedures and requirements needed to hold a land use certificate, we may be forced by the Chinese administrative authorities to retroactively comply with such procedures and requirements, which may be burdensome and require us to make payments, or such Chinese administrative authorities may invalidate or revoke our land use certificates entirely. If the land use right certificates needed for our operations are determined by the government of China to be invalid or if they are not renewed, we may lose production facilities or employee accommodations that would be difficult or even impossible to replace. Should we have to relocate, our workforce may be unable or unwilling to work in the new location and our business operations will be disrupted during the relocation. The relocation or loss of facilities could cause us to lose sales and/or increase costs of production, which would negatively impact our financial results.

We may be exposed to potential risks relating to our internal controls over financial reporting and our ability to have the operating effectiveness of our internal controls attested to by our independent auditors.

Companies that file reports with the SEC, including us, are subject to the requirements of Section 404 of the Sarbanes-Oxley Act of 2002, or SOX 404. SOX 404 requires management to establish and maintain a system of internal control over financial reporting and annual reports on Form 10-K or Form 20-F filed under the Exchange Act to contain a report from management assessing the effectiveness of a company’s internal control over financial reporting. Separately, under SOX 404, as amended by the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010, public companies that are large accelerated or accelerated filers must include in their annual reports on Form 10-K or Form 20-F an attestation report of their regular auditors attesting to and reporting on management’s assessment of internal control over financial reporting. Non-accelerated filers and smaller reporting companies are not required to include an attestation report of their auditors in annual reports.

A report of our management and an attestation report of our auditor is included under Item 15 “Controls and Procedures” of this report. Although our management believes that our internal control over financial reporting was effective as of December 31, 2013, we can provide no assurance that we will comply with all of the requirements imposed by SOX 404 and we will receive a positive attestation from our independent auditors in the future. In the event we identify significant deficiencies or material weaknesses in our internal controls that we cannot remediate in a timely manner or we are unable to receive a positive attestation from our independent auditors with respect to our internal controls, investors and others may lose confidence in the reliability of our financial statements.

Failure to comply with the U.S. Foreign Corrupt Practices Act and Chinese anti-corruption laws could subject us to penalties and other adverse consequences.

Our executive officers, employees and other agents may violate applicable law in connection with the marketing or sale of our products, including China’s anti-corruption laws and the U.S. Foreign Corrupt Practices Act, or the FCPA, which generally prohibits United States companies from engaging in bribery or other prohibited payments to foreign officials for the purpose of obtaining or retaining business. In addition, we are required to maintain records that accurately and fairly represent our transactions and have an adequate system of internal accounting controls. Foreign companies, including some that may compete with us, are not subject to these prohibitions, and therefore may have a competitive advantage over us. The PRC also strictly prohibits bribery of government officials. However, corruption, extortion, bribery, pay-offs, theft and other fraudulent practices occur from time-to-time in the PRC. We have adopted a general FCPA policy in our Code of Ethics and intend to implement measures to ensure compliance with the FCPA and Chinese anti-corruption laws by all individuals involved with our company. However, our employees or other agents may engage in such conduct for which we might be held responsible. If our employees or other agents are found to have engaged in such practices, we could suffer severe penalties and other consequences that may have a material adverse effect on our business, financial condition and results of operations. In addition, our brand and reputation, our sales activities or the price of our ordinary shares could be adversely affected if we become the target of any negative publicity as a result of actions taken by our employees or other agents.

We rely heavily on our key management personnel and the loss of their services could adversely affect our business.

Our executive management team has a specialized knowledge of steel markets and works closely with our customers to provide products to exact specifications. Our Chairman and founder, Mr. Lu, has twenty-six years’ experience in the steel industry in China. In addition, the executive management team has an average of sixteen years of industry experience. Their long tenure with the company and the industry has enabled the management team to build close relationships with suppliers and customers. The expertise of management and technical innovation of the company give it a strong competitive advantage. We currently have employment agreements with our management team but we do not maintain key person insurance on these individuals. The loss of Mr. Lu’s services or any of our other management poses a risk to our business. We may not be able to attract or retain qualified management on acceptable terms in the future due to the intense competition for qualified personnel in our industry and as a result, our business could be adversely affected.

Risks Related to Doing Business in China

Substantially all of our operating assets are located in China and substantially all of our revenue is derived from our operations in China, so our business, results of operations and prospects are subject to the economic, political and legal policies, developments and conditions in China.

The PRC’s economic, political and social conditions, as well as government policies, could impair our business. The PRC economy differs from the economies of most developed countries in many respects. China’s gross domestic product has grown consistently since 1978. However, we cannot assure you that such growth will be sustained in the future. If, in the future, China’s economy experiences a downturn or grows at a slower rate than expected, there may be less demand for spending in certain industries. A decrease in demand for spending in certain industries could impair our ability to remain profitable. The PRC’s economic growth has been uneven, both geographically and among various sectors of the economy. The PRC government has implemented various measures to encourage economic growth and guide the allocation of resources. Some of these measures benefit the overall PRC economy, but may have a negative effect on us. For example, our financial condition and results of operations may be hindered by PRC government control over capital investments or changes in tax regulations.

The PRC economy has been transitioning from a planned economy to a more market-oriented economy. Although in recent years the PRC government has implemented measures emphasizing the use of market forces for economic reform, the reduction of state ownership of productive assets and the establishment of sound corporate governance in business enterprises, a substantial portion of productive assets in China is still owned by the PRC government. In addition, the PRC government continues to play a significant role in regulating industry development by imposing industrial policies. It also exercises significant control over PRC economic growth through the allocation of resources, controlling payment of foreign currency-denominated obligations, setting monetary policy and providing preferential treatment to particular industries or companies.

If the PRC imposes restrictions designed to reduce inflation, future economic growth in the PRC could be severely curtailed which could hurt our business and profitability.

While the economy of the PRC has experienced rapid growth, this growth has been uneven among various sectors of the economy and in different geographical areas of the country. Rapid economic growth often can lead to growth in the supply of money and rising inflation. In order to control inflation in the past, the PRC has imposed controls on bank credits, limits on loans for fixed assets and restrictions on state bank lending. Imposition of similar restrictions may lead to a slowing of economic growth, a decrease in demand for our steel products and generally damage our business and profitability.

Fluctuations in exchange rates could harm our business and the value of our securities.

The value of our securities will be indirectly affected by the foreign exchange rate between U.S. dollars and RMB and between those currencies and other currencies in which our sales may be denominated. Because substantially all of our earnings and cash assets are denominated in RMB and our financial results are reported in U.S. dollars, fluctuations in the exchange rate between the U.S. dollar and RMB will affect our balance sheet and our earnings per share in U.S. dollars. In addition, appreciation or depreciation in the value of RMB relative to the U.S. dollar would affect our financial results reported in U.S. dollar terms without giving effect to any underlying change in our business or results of operations. Fluctuations in the exchange rate will also affect the relative value of any dividend we issue that will be exchanged into U.S. dollars as well as earnings from, and the value of, any U.S. dollar-denominated investments we make in the future. Since July 2005, RMB has not been pegged to the U.S. dollar. Although the People’s Bank of China regularly intervenes in the foreign exchange market to prevent significant short-term fluctuations in the exchange rate, RMB may appreciate or depreciate significantly in value against the U.S. dollar in the medium to long term. Moreover, it is possible that in the future PRC authorities may lift restrictions on fluctuations in RMB exchange rate and lessen intervention in the foreign exchange market.

Very limited hedging transactions are available in China to reduce our exposure to exchange rate fluctuations. To date, we have not entered into any hedging transactions. While we may enter into hedging transactions in the future, the availability and effectiveness of these transactions may be limited, and we may not be able to successfully hedge our exposure at all. In addition, our foreign currency exchange losses may be magnified by PRC exchange control regulations that restrict our ability to convert RMB into foreign currencies.

Exchange controls that exist in the PRC may limit our ability to utilize our cash flow effectively.

We are subject to the PRC’s rules and regulations on currency conversion. In the PRC, the State Administration for Foreign Exchange, or SAFE, regulates the conversion between RMB and foreign currencies. Currently, foreign investment enterprises, or FIEs, are required to apply to the SAFE for “Foreign Exchange Registration Certificates for FIEs.” With such registration certificates, which need to be renewed annually, FIEs are allowed to open foreign currency accounts including a “current account” and “capital account.” Currency conversion within the scope of the “current account,” such as remittance of foreign currencies for payment of dividends, can be effected without requiring the approval of SAFE. However, conversion of currency in the “capital account,” including capital items such as direct foreign investment, loans and securities, still require approval of SAFE. Further, any capital contributions to Henan Green by its offshore shareholder must be approved by MOFCOM or its local counterpart. We cannot assure you that the PRC regulatory authorities will not impose further restrictions on the convertibility of RMB. Any future restrictions on currency exchanges may limit our ability to use our cash flow for the distribution of dividends to our shareholders or to fund operations it may have outside of the PRC.

In August 2008, SAFE promulgated Circular 142, a notice regulating the conversion by FIEs of foreign currency into RMB by restricting how the converted RMB may be used. Circular 142 requires that RMB converted from the foreign currency-dominated capital of a FIE may only be used for purposes within the business scope approved by the applicable government authority and may not be used for equity investments within the PRC unless specifically provided for otherwise. In addition, SAFE strengthened its oversight over the flow and use of RMB funds converted from the foreign currency-dominated capital of a FIE. The use of such RMB may not be changed without approval from SAFE, and may not be used to repay RMB loans if the proceeds of such loans have not yet been used. Violations of Circular 142 may result in severe penalties, including substantial fines as set forth in the SAFE rules.

Because Chinese law governs many of our material agreements, we may not be able to enforce our rights within the PRC or elsewhere, which could result in a significant loss of business, business opportunities or capital.

Chinese law governs many of our material agreements, some of which may be with Chinese governmental agencies. We cannot assure you that we will be able to enforce any of our material agreements or that remedies will be available outside of the PRC. The system of laws and the enforcement of existing laws and contracts in the PRC may not be as certain in implementation and interpretation as in the United States. The Chinese judiciary is relatively inexperienced in enforcing corporate and commercial law, leading to a higher than usual degree of uncertainty as to the outcome of any litigation. The inability to enforce or obtain a remedy under any of our future agreements could result in a significant loss of business, business opportunities or capital.

The ability of our Chinese operating subsidiaries to pay certain foreign currency obligations, including dividends, is subject to restrictions.