UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

PROXY STATEMENT PURSUANT TO SECTION 14(a) OF THE

SECURITIES EXCHANGE ACT OF 1934

|

Filed by the Registrant x |

Filed by a Party other than the Registrant o |

|

Check the appropriate box:

|

o |

Preliminary Proxy Statement |

|

o |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

|

x |

Definitive Proxy Statement |

|

o |

Definitive Additional Materials |

|

o |

Soliciting Material Pursuant to §240.14a-11(c) or §240.14a-2 |

TUBEMOGUL, INC.

(Name of Registrant as Specified In Its Charter)

Payment of Filing Fee (Check the appropriate box):

|

x |

No fee required. |

|

o |

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

|

(1) |

Title of each class of securities to which transaction applies: |

|

(2) |

Aggregate number of securities to which transaction applies: |

|

(3) |

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

|

(4) |

Proposed maximum aggregate value of transaction: |

|

(5) |

Total fee paid: |

|

o |

Fee paid previously with preliminary materials. |

|

o |

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

(1) |

Amount Previously Paid: |

|

(2) |

Form, Schedule or Registration Statement No.: |

|

(3) |

Filing Party: |

April 30, 2015

Dear Stockholder:

You are cordially invited to attend the 2015 Annual Meeting of Stockholders (Annual Meeting) of TubeMogul, Inc. (TubeMogul, the Company, we or our) to be held at our principal executive offices, located at 1250 53rd Street, Suite 2, Emeryville, California 94608, on June 18, 2015 at 11:00 a.m. Pacific Time.

We are pleased to take advantage of Securities and Exchange Commission rules that allow companies to furnish proxy materials to stockholders primarily over the Internet. On or about April 30, 2015, you were provided with a Notice of Internet Availability of Proxy Materials (Internet Notice) containing instructions on how to access our proxy materials, including our proxy statement and Annual Report on Form 10-K for the fiscal year ended December 31, 2014 (Annual Report), over the Internet. The Internet Notice also provides instructions on how to vote online or by telephone and includes instructions on how to receive a paper copy of the proxy materials by mail.

If you receive your Annual Meeting materials by mail, the Notice of Annual Meeting of Stockholders, proxy statement, Annual Report and proxy card will be enclosed. If you receive your proxy materials via email, the email will contain voting instructions and links to the Annual Report and proxy statement on the Internet, both of which are available at www.viewproxy.com/tubemogul/2015.

Details regarding the business to be conducted at the Annual Meeting are described in the Notice of Annual Meeting of Stockholders and proxy statement. Following the formal business of the Annual Meeting, certain senior executives of TubeMogul will be in attendance to answer questions. However, there will be no formal presentation concerning the business of TubeMogul.

Your vote is important. Whether or not you plan to attend the meeting, we encourage you to vote promptly. You may vote by proxy over the Internet or by telephone, or, if you received paper copies of the proxy materials by mail, you can also vote by mail by following the instructions on the proxy card or voting instruction card. If you attend the meeting you will, of course, have the right to revoke the proxy and vote your shares in person. If you hold your shares through an account with a brokerage firm, bank or other nominee, please follow the instructions you receive from your brokerage firm, bank or other nominee to vote your shares.

We look forward to seeing you at the Annual Meeting.

Sincerely yours,

/s/ Brett Wilson

Brett Wilson

President and Chief Executive Officer

NOTICE OF 2015 ANNUAL MEETING OF STOCKHOLDERS

To Be Held at 11:00 A.M. Pacific Time on Thursday June 18, 2015

NOTICE IS HEREBY GIVEN that the 2015 Annual Meeting of Stockholders of TubeMogul, Inc., a Delaware corporation (TubeMogul, the Company, we or our), will be held on June 18, 2015 at 11:00 a.m., Pacific Time, at our principal executive offices, located at 1250 53rd Street, Suite 2, Emeryville, California 94608, for the following purposes:

|

1. |

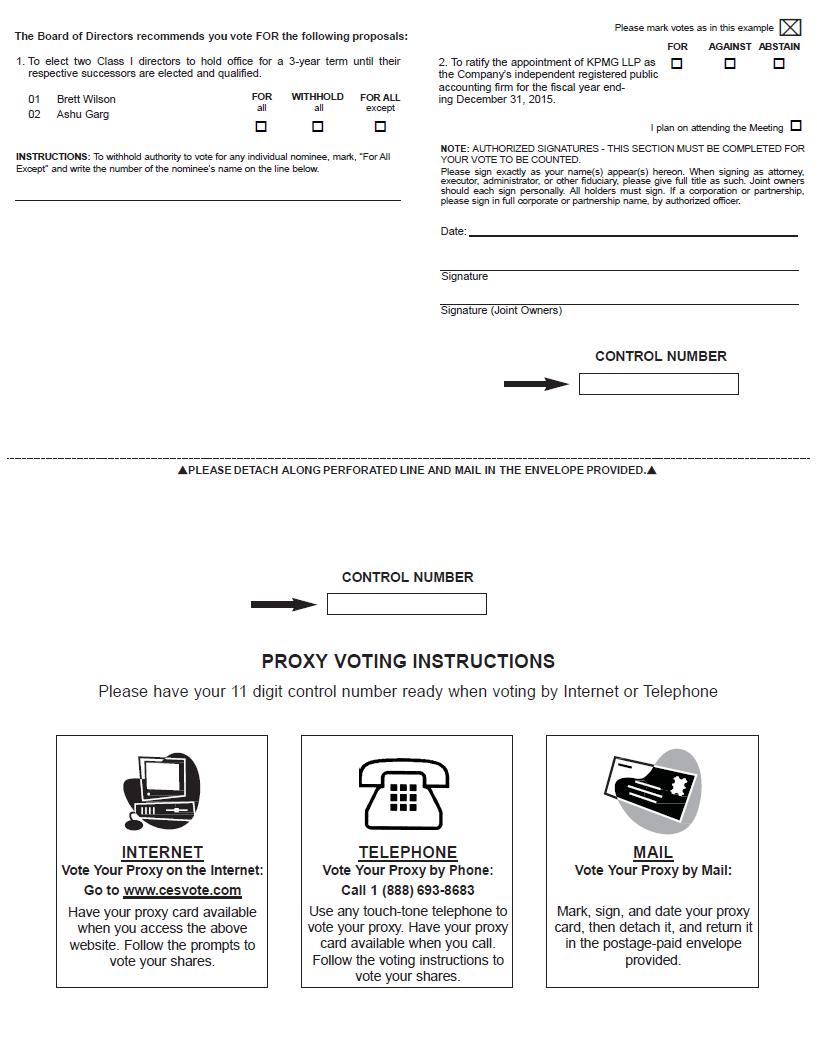

To elect two Class I directors to hold office for a 3-year term and until their respective successors are elected and qualified. |

|

2. |

To ratify the appointment of KPMG LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2015. |

|

3. |

To transact such other business as may properly come before the meeting or any adjournment or postponement of the meeting. |

Stockholders of record at the close of business on April 22, 2015 are entitled to notice of, and to vote at, the meeting and any adjournment or postponement thereof. For ten days prior to the meeting, a complete list of stockholders entitled to vote at the meeting will be available for examination by any stockholder, for any purpose relating to the meeting, during ordinary business hours at our principal offices located at 1250 53rd Street, Suite 2, Emeryville, California 94608.

Please note that space limitations may make it necessary to limit attendance only to stockholders. Registration will begin at 10:30 a.m., and seating will be available at approximately 10:45 a.m. Each stockholder may be asked to present valid government issued picture identification, such as a driver’s license or passport. Stockholders holding stock in brokerage accounts (street name holders) will need to bring a copy of a brokerage statement reflecting stock ownership as of the record date.

|

|

|

By order of the Board of Directors, |

|

|

|

|

|

|

|

/s/ Eric Deeds |

|

|

|

|

|

|

|

Eric Deeds |

|

|

|

General Counsel and Secretary |

|

|

|

|

|

Emeryville, California |

|

|

|

April 30, 2015 |

|

|

IMPORTANT: Your vote is important. Whether or not you plan to attend the Annual Meeting, please vote your shares via telephone or the Internet, as described in the accompanying materials, to assure that your shares are represented at the meeting, or, if you received a paper copy of the proxy card by mail, you may mark, sign and date the proxy card and return it in the enclosed postage-paid envelope. If you attend the meeting, you may choose to vote in person even if you have previously voted your shares.

TABLE OF CONTENTS

|

|

|

Page |

|

QUESTIONS AND ANSWERS ABOUT THE PROXY MATERIALS AND THE ANNUAL MEETING |

|

1 |

|

|

1 |

|

|

|

2 |

|

|

|

4 |

|

|

Stockholder Proposals, Director Nominations, and Related Bylaw Provisions |

|

5 |

|

|

7 |

|

|

|

7 |

|

|

|

7 |

|

|

|

8 |

|

|

|

8 |

|

|

|

8 |

|

|

|

9 |

|

|

|

9 |

|

|

|

11 |

|

|

|

11 |

|

|

|

11 |

|

|

|

11 |

|

|

|

12 |

|

|

Corporate Governance Guidelines and Code of Business Conduct and Ethics |

|

12 |

|

|

12 |

|

|

|

13 |

|

|

|

14 |

|

|

|

14 |

|

|

|

14 |

|

|

|

16 |

|

|

|

16 |

|

|

|

17 |

|

|

|

17 |

|

|

Post-Employment Compensation and Change in Control Payments and Benefits |

|

17 |

|

|

18 |

|

|

|

20 |

|

|

|

21 |

|

|

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT |

|

22 |

|

|

24 |

|

|

|

25 |

|

|

|

25 |

|

|

|

26 |

|

|

PROPOSAL NO. 2 RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM |

|

27 |

|

|

28 |

i

TUBEMOGUL, INC.

1250 53RD STREET, SUITE 2

EMERYVILLE, CALIFORNIA 94608

PROXY STATEMENT FOR ANNUAL MEETING

OF STOCKHOLDERS

TO BE HELD JUNE 18, 2015

QUESTIONS AND ANSWERS ABOUT THE PROXY MATERIALS AND THE ANNUAL MEETING

|

1. |

Why am I receiving these materials? |

Our Board of Directors have made these proxy materials available to you on the Internet, or, upon your request, has delivered printed versions of these materials to you by mail, in connection with the solicitation of proxies for use at TubeMogul’s Annual Meeting, which will take place on June 18, 2015 at 11:00 a.m., Pacific Time, at our principal executive offices. As a stockholder, you are invited to attend the Annual Meeting and are requested to vote on the proposals described in this proxy statement. This proxy statement includes information that we are required to provide to you under Securities and Exchange Commission (SEC) rules and that is designed to assist you in voting your shares.

|

2. |

What is included in these materials? |

The proxy materials include:

|

· |

Our proxy statement for the Annual Meeting; |

|

· |

Our Annual Report; and |

|

· |

The proxy card or a voting instruction card for the Annual Meeting. |

|

3. |

What information is contained in this proxy statement? |

The information in this proxy statement relates to the proposals to be voted on at the Annual Meeting, the voting process, the compensation of our directors and certain of our executive officers, corporate governance, and certain other required information.

|

4. |

Why did I receive a notice in the mail regarding the Internet availability of the proxy materials instead of a paper copy of the proxy materials? |

Most stockholders will not receive printed copies of the proxy materials unless they request them. Instead, the Internet Notice, which was mailed to most of our stockholders, will instruct you as to how you may access and review all of the proxy materials on the Internet. The Internet Notice also instructs you as to how you may submit your proxy on the Internet. If you would like to receive a paper or email copy of our proxy materials, you should follow the instructions for requesting such materials in the Internet Notice.

|

5. |

How can I access the proxy materials over the Internet? |

The Internet Notice, proxy card or voting instructions card will contain instructions on how to:

|

· |

Access and view our proxy materials for the Annual Meeting over the Internet and vote your shares; and |

|

· |

Instruct us to send our future proxy materials to you electronically by email. |

Our proxy materials are also available on our website at http://investor.tubemogul.com/annuals-proxies.cfm.

Choosing to receive your future proxy materials by email will save us the cost of printing and mailing documents to you, and will reduce the impact of printing and mailing these materials on the environment. If you choose to receive future proxy materials by email, you will receive an email next year with instructions containing a link to those materials and a link to the proxy voting site. Your election to receive proxy materials by email will remain in effect until you revoke it.

1

|

6. |

I share an address with another stockholder, and we received only one paper copy of the proxy materials. How may I obtain an additional copy of the proxy materials? |

Certain stockholders who share an address are being delivered only one copy of the proxy materials. You may receive additional copies of this proxy statement without charge by sending a written request to our Secretary at 1250 53rd Street, Suite 2, Emeryville, California 94608, and we will promptly send you what you have requested.

|

7. |

What items of business will be voted on at the Annual Meeting? |

You will be voting on:

|

· |

The election of two Class I directors to hold office for a three-year term and until their respective successors are elected and qualified. |

|

· |

A proposal to ratify the appointment of KPMG LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2015. |

|

· |

Any other business as may properly come before the Annual Meeting or any adjournment or postponement of the meeting. |

|

8. |

How does the Board of Directors recommend that I vote? |

Our Board of Directors recommends that you vote your shares:

|

· |

FOR the election of each of the two directors nominated by our Board of Directors and named in this proxy statement as Class I directors to serve for a three-year term. |

|

· |

FOR the ratification of the appointment of KPMG LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2015. |

|

9. |

Who is entitled to vote at the Annual Meeting? |

Holders of our common stock at the close of business on April 22, 2015 (Record Date) will be entitled to vote at the Annual Meeting. As of the Record Date, 30,348,848 shares of common stock were outstanding and entitled to vote. Stockholders do not have the right to cumulate their votes in the election of directors.

|

10. |

What is the difference between holding shares as a stockholder of record and as a beneficial owner? |

Stockholder of Record: Shares Registered in Your Name. If, at the close of business on the Record Date, your shares were registered directly in your name with American Stock Transfer & Trust Company, LLC, our transfer agent, then you are considered the stockholder of record with respect to those shares. As the stockholder of record, you have the right to grant your voting proxy directly to the individuals listed on the proxy card or to vote in person at the Annual Meeting.

Beneficial Owners: Shares Registered in the Name of a Broker, Bank or Other Nominee. If, at the close of business on the Record Date, your shares were held, not in your name, but rather in a stock brokerage account or by a bank or other nominee on your behalf, then you are considered the beneficial owner of shares held in “street name.” As the beneficial owner, you have the right to direct your broker, bank or other nominee how to vote your shares by following the voting instructions your broker, bank or other nominee provides. If you do not provide your broker, bank or other nominee with instructions on how to vote your shares, your broker, bank or other nominee may, in its discretion, vote your shares with respect to routine matters (e.g., the ratification of the appointment of our independent registered public accounting firm) but may not vote your shares with respect to any non-routine matters (e.g., the election of directors). Please see “What if I do not specify how my shares are to be voted?” for additional information.

2

|

11. |

How do I vote and what are the voting deadlines? |

Stockholders of Record. If you are a stockholder of record, then you can vote in one of the following ways:

|

· |

You may vote via the Internet or by telephone. To vote via the Internet or by telephone, follow the instructions provided in the Internet Notice. If you vote via the Internet or by telephone, you do not need to return a proxy card by mail. Internet and telephone voting are available 24 hours a day. Votes submitted through the Internet or by telephone must be received by 11:59 p.m. Pacific Time on June 17, 2015. Alternatively, you may request a printed proxy card by telephone at (877) 777 2857, over the Internet at www/viewproxy.com/tubemogul/2015, or by email at requests@viewproxy.com, and follow the instructions under the heading “You may vote by mail” immediately below. |

|

· |

You may vote by mail. If you have received printed proxy materials by mail and would like to vote by mail, you need to complete, date and sign the proxy card that accompanies this proxy statement and promptly mail it in the enclosed postage-paid envelope so that it is received no later than June 17, 2015. You do not need to put a stamp on the enclosed envelope if you mail it from within the United States. The persons named on the proxy card will vote the shares you own in accordance with your instructions on the proxy card you mail. If you return the proxy card, but do not give any instructions on a particular matter to be voted on at the Annual Meeting, the persons named on the proxy card will vote the shares you own in accordance with the recommendations of our Board of Directors. Our Board of Directors recommends that you vote FOR each of Proposals No. 1 and 2. |

|

· |

You may vote in person. If you plan to attend the Annual Meeting, you may vote by delivering your completed proxy card in person or by completing and submitting a ballot, which will be provided at the Annual Meeting. |

Beneficial Owners. If you are the beneficial owner of shares held of record by a broker or other nominee, you will receive voting instructions from your broker or other nominee. You must follow the voting instructions provided by your broker or other nominee in order to instruct your broker or other nominee how to vote your shares. The availability of telephone and Internet voting options will depend on the voting process of your broker or other nominee. As discussed below, if you are a beneficial owner, you may not vote your shares in person at the Annual Meeting unless you obtain a legal proxy from your broker or other nominee.

|

12. |

What is a quorum? |

A quorum is the minimum number of shares required to be present at the Annual Meeting for the Annual Meeting to be properly held under our bylaws and Delaware law. The holders of a majority of the shares of our capital stock entitled to vote at the meeting, present in person or represented by proxy, shall constitute a quorum for the transaction of business.

|

13. |

How many votes are needed for approval of each proposal? |

The following table sets forth the voting requirement with respect to each of the proposals:

|

PROPOSAL |

|

VOTE REQUIRED |

|

BROKER DISCRETIONARY VOTE ALLOWED |

|

Proposal 1: Election of two Class I directors |

|

Plurality of the votes cast by the stockholders entitled to vote at the election. This means the two nominees who receive the highest number of affirmative votes will be elected. |

|

NO |

|

|

|

|

||

|

Proposal 2: The ratification of KPMG LLP as our independent registered public accounting firm |

|

Majority of shares entitled to vote and present in person or represented by proxy. |

|

YES |

|

14. |

What are the effects of abstentions and broker non-votes? |

Shares not present at the meeting and shares voted “Withhold” will have no effect on Proposal No. 1 regarding the election of directors. For Proposal No. 2, abstentions will have the same effect as negative votes. If your shares are held in an account at a bank or brokerage firm, that bank or brokerage firm may vote your shares on Proposal No. 2 regarding ratification of our independent registered public accounting firm, but will not be permitted to vote your shares of common stock with respect to Proposal No. 1 regarding election of directors unless you provide instructions as to how your shares should be voted.

3

If an executed proxy card is returned by a bank or broker holding shares which indicates that the bank or broker has not received voting instructions and does not have discretionary authority to vote on the proposals, the shares will not be considered to have been voted in favor of the proposals. Your bank or broker will vote your shares of common stock on Proposal No. 1 only if you provide instructions on how to vote by following the instructions they provide to you. Accordingly, we encourage you to vote promptly, even if you plan to attend the Annual Meeting. In tabulating the voting results for any particular proposal, shares that constitute broker non-votes are not considered entitled to vote on that proposal.

|

15. |

What if I do not specify how my shares are to be voted? |

Stockholders of Record. If you are a stockholder of record and you submit a proxy but you do not provide voting instructions, your shares will be voted as recommended by our Board of Directors. Please see “How does the Board of Directors recommend that I vote?” for more information.

Beneficial Owners. If you are a beneficial owner and you do not provide your broker or other nominee that holds your shares with voting instructions, your broker or other nominee will determine if it has discretion to vote on each matter. In general, brokers and other nominees do not have discretion to vote on non-routine matters. Proposal No. 1 is a non-routine matter, while Proposal No. 2 is a routine matter. As a result, if you do not provide voting instructions to your broker or other nominee, your broker or other nominee cannot vote your shares with respect to Proposal No. 1, which would result in a “broker non-vote,” but may, in its discretion, vote your shares with respect to Proposal No. 2. For additional information regarding broker non-votes, see “What are the effects of abstentions and broker non-votes?” above.

|

16. |

Can I change my vote or revoke my proxy? |

Yes. If you are a stockholder of record, you can change your vote or revoke your proxy any time before the Annual Meeting by:

|

· |

entering a new vote by Internet or by telephone; |

|

· |

returning a later-dated proxy card; |

|

· |

notifying the Secretary of TubeMogul, Inc., in writing, at 1250 53rd Street, Suite 2, Emeryville, California 94608; or |

|

· |

completing a written ballot at the Annual Meeting. |

If you are a street name stockholder, your broker, bank or other nominee can provide you with instructions on how to change your vote.

|

17. |

Is my vote confidential? |

Proxy instructions, ballots, and voting tabulations that identify individual stockholders are handled in a manner that protects your voting privacy. Your vote will not be disclosed either within TubeMogul or to third parties, except: (1) as necessary to meet applicable legal requirements, (2) to allow for the tabulation of votes and certification of the vote, and (3) to facilitate a successful proxy solicitation. If stockholders provide written comments on their proxy cards, the comments will be forwarded to TubeMogul.

|

18. |

Where can I find the voting results of the Annual Meeting? |

We intend to announce preliminary voting results at the Annual Meeting and publish final results in a Form 8-K report to be filed with the SEC within four business days of the Annual Meeting.

|

19. |

Do I have to do anything in advance if I plan to attend the Annual Meeting and vote in person? |

Stockholders of Record. If you are a stockholder of record, you do not need to do anything in advance to attend and/or vote your shares in person at the Annual Meeting, but you may be asked to present government-issued photo identification for entrance into the Annual Meeting.

4

Beneficial Owners. If you are a beneficial owner, you may not vote your shares in person at the Annual Meeting unless you obtain a “legal proxy” from your broker or other nominee, who is the stockholder of record with respect to your shares. You may still attend the Annual Meeting even if you do not have a legal proxy. You may be asked to present government-issued photo identification for entrance into the Annual Meeting. You will also be asked to provide proof of beneficial ownership as of the Record Date, such as the voting instructions you received from your broker or other nominee, or your brokerage statement reflecting ownership of shares as of the Record Date.

|

20. |

What happens if additional matters are presented at the Annual Meeting? |

If any other matters are properly presented for consideration at the Annual Meeting, including, among other things, consideration of a motion to adjourn the Annual Meeting to another time or place (including, without limitation, for the purpose of soliciting additional proxies), the persons named in the proxy card and acting thereunder will have discretion to vote on those matters in accordance with their best judgment. TubeMogul does not currently anticipate that any other matters will be raised at the Annual Meeting.

|

21. |

Who will bear the cost of soliciting votes for the Annual Meeting? |

TubeMogul will pay the entire cost of preparing, assembling, printing, mailing, and distributing these proxy materials and soliciting votes. If you choose to access the proxy materials and/or vote over the Internet, you are responsible for Internet access charges you may incur. If you choose to vote by telephone, you are responsible for telephone charges you may incur. In addition to the mailing of these proxy materials, the solicitation of proxies or votes may be made in person, by telephone, or by electronic communication by our directors, officers, and employees, who will not receive any additional compensation for such solicitation activities.

Stockholder Proposals, Director Nominations, and Related Bylaw Provisions

|

22. |

What is the deadline to propose actions for consideration at next year’s annual meeting of stockholders or to nominate individuals to serve as directors? |

Stockholder proposals. Stockholders may present proper proposals for inclusion in TubeMogul’s proxy statement and for consideration at the next annual meeting of stockholders by submitting their proposals in writing to TubeMogul’s Secretary in a timely manner. For a stockholder proposal to be considered for inclusion in our proxy statement for our 2016 annual meeting of stockholders, the Secretary of TubeMogul must receive the written proposal at our principal executive offices no later than January 1, 2016. In addition, proposals must also comply with SEC regulations under Rule 14a-8 regarding the inclusion of stockholder proposals in company-sponsored proxy materials. Proposals should be addressed to:

TubeMogul, Inc.

Attn: Secretary

1250 53rd Street, Suite 2

Emeryville, California 94608

Our bylaws also establish an advance notice procedure for stockholders who wish to present a proposal before an annual meeting of stockholders but do not intend for the proposal to be included in our proxy statement. Our bylaws provide that the only business that may be conducted at an annual meeting is business that is (1) specified in the notice of a meeting given by or at the direction of our Board of Directors, (2) otherwise properly brought before the meeting by or at the direction of our Board of Directors, or (3) properly brought before the meeting by a stockholder entitled to vote at the annual meeting who has delivered timely written notice to our Secretary, which notice must contain the information specified in our bylaws. To be timely for our 2016 annual meeting of stockholders, our Secretary must receive the written notice at our principal executive offices:

|

· |

not earlier than the close of business on February 19, 2016; and |

|

· |

not later than the close of business on March 20, 2016; |

In the event that we hold our 2016 annual meeting of stockholders more than thirty (30) days before or after the one-year anniversary date of the Annual Meeting, then notice of a stockholder proposal that is not intended to be included in our proxy statement must be received not later than the close of business on the earlier of the following two dates:

|

· |

the 90th day prior to such annual meeting, or |

|

· |

the 10th day following the date on which public announcement of the date of such meeting is first made. |

5

Nomination of Director Candidates. You may propose director candidates for consideration by our Nominating and Corporate Governance Committee. Any such recommendations should include the nominee’s name and qualifications for membership on our Board of Directors, and should be directed to the Secretary of TubeMogul at the address set forth above. For additional information regarding stockholder recommendations for director candidates, see “Stockholder Recommendations and Nominees” on page 12 of this proxy statement.

In addition, our bylaws permit stockholders to nominate directors for election at an annual meeting of stockholders. To nominate a director, the stockholder must provide the information required by our bylaws. In addition, the stockholder must give timely notice to our Secretary in accordance with our bylaws, which, in general, require that the notice be received by our Secretary within the time period described above under “Stockholder proposals” for stockholder proposals that are not intended to be included in our proxy statement.

|

23. |

How can I obtain a copy of the bylaw provisions regarding stockholder proposals and director nominations? |

You may obtain a copy of the relevant bylaw provisions regarding the requirements for making stockholder proposals and director nominations by writing to the Secretary of TubeMogul.

6

BOARD OF DIRECTORS AND CORPORATE GOVERNANCE

Our business affairs are managed under the direction of our Board of Directors, which is currently composed of six members, with one vacancy. We have a classified Board of Directors consisting of two Class I directors, one Class II director and three Class III directors. At each annual meeting of stockholders, directors are elected for a term of three years to succeed those directors whose terms expire at the annual meeting dates.

Thomas Vardell resigned from our Board of Directors effective December 8, 2014. The Company and the Board of Directors would like to acknowledge and to thank Mr. Vardell for his commitment, dedication and thoughtful service to the Company during his tenure as director.

The term of the Class I directors will expire on the date of the upcoming Annual Meeting. Accordingly, two persons are to be elected to serve as Class I directors of the Board of Directors at the meeting.

The following table sets forth the names, ages and certain other information for each of the directors with terms expiring at the Annual Meeting (who are also nominees for election as a director at the Annual Meeting) and for each of the continuing members of our Board of Directors as of April 30, 2015:

|

|

|

Class |

|

Age |

|

Position |

|

Director Since |

|

Current Term Expires |

|

Expiration of Term For Which Nominated |

|

Directors with Terms expiring at the Annual Meeting/Nominees |

|

|

|

|

|

|

|

|

|

|

|

|

|

Brett Wilson |

|

I |

|

41 |

|

Chief Executive Officer, President and Director |

|

2007 |

|

2015 |

|

2018 |

|

Ashu Garg |

|

I |

|

45 |

|

Director |

|

2010 |

|

2015 |

|

2018 |

|

Continuing Directors |

|

|

|

|

|

|

|

|

|

|

|

|

|

David Toth |

|

II |

|

58 |

|

Director |

|

2008 |

|

2016 |

|

__ |

|

Ajay Chopra |

|

III |

|

58 |

|

Director |

|

2009 |

|

2017 |

|

__ |

|

Russell Fradin |

|

III |

|

38 |

|

Director |

|

2012 |

|

2017 |

|

__ |

|

Jack Lazar |

|

III |

|

49 |

|

Director |

|

2013 |

|

2017 |

|

__ |

Brett Wilson co-founded TubeMogul and has served as our President and Chief Executive Officer since our inception in March 2007. Prior to founding TubeMogul, he founded YouCanSave.com, an e-commerce company, in August 1999 and served as its President until August 2004. Mr. Wilson also worked as a technology consultant at Accenture from 1996 to 1999 leading large financial system implementations. Mr. Wilson holds a B.S. in Business Administration from California State University, Chico and an M.B.A. from the Haas School of Business at the University of California, Berkeley. We have determined that Mr. Wilson’s perspective, operational and historical expertise gained from his experience as our co-founder, President, Chief Executive Officer and one of our largest stockholders, make him a critical member of our Board of Directors.

Ashu Garg has served on our Board of Directors since September 2010. Mr. Garg is currently a General Partner at Foundation Capital, LLC, an early stage venture firm, which he joined in 2008. Mr. Garg currently serves on the boards of directors of several private technology companies. From 2003 to 2008, Mr. Garg served as General Manager of various groups at Microsoft Corporation. In addition, Mr. Garg also worked with McKinsey & Company serving technology clients across Asia and North America. Mr. Garg holds a B.S. in Technology Engineering from the Indian Institute of Technology at New Delhi and an M.B.A. from the Indian Institute of Management at Bangalore. We have determined that Mr. Garg is qualified to serve as a member of our Board of Directors because of his extensive experience in the venture capital industry and his knowledge of technology companies, especially in the digital media and online video sectors.

David Toth has served on our Board of Directors since 2008. He co-founded NetRatings, a leading provider of Internet audience information and analysis, in 1997 and served as its President and Chief Executive Officer until 2003. Prior to forming NetRatings, Mr. Toth was a Vice President at Hitachi Computer Products where he led the Network Products Group and was responsible for the development, sales and marketing of numerous hardware and software products. Mr. Toth is a member of the boards of directors of several private companies. Mr. Toth holds a B.S. in Electrical Engineering from the University of Pittsburgh. We have determined that Mr. Toth is qualified to serve as a member of our Board of Directors because of his experience as a technology company executive in the digital media sector.

7

Ajay Chopra has served on our Board of Directors since April 2009. Mr. Chopra is currently a General Partner at Trinity Ventures, an early stage venture firm, which he joined in 2006. Prior to joining Trinity Ventures, Mr. Chopra co-founded Pinnacle Systems Inc., a media technology company, in 1986, and served in a variety of roles at various times while at Pinnacle, including as President and Chief Executive Officer, Chairman of the Board, and Chief Operations Officer, until it was acquired by Avid Technology Inc. in August 2005. Mr. Chopra holds a B.S. in Electrical Engineering from Birla Institute of Technology and Science in India and an M.S. in Electrical Engineering from Stony Brook University. As an active venture capital investor, Mr. Chopra is a member of the boards of directors of several private technology companies and serves as a member of the audit committee or compensation committee on some of these boards. We have determined that Mr. Chopra is qualified to serve as a member of our Board of Directors because of his experience in both managing and evaluating companies as an executive officer, board member and investor.

Russell Fradin has served on our Board of Directors since July 2012. Mr. Fradin is the co-founder and has served as Chief Executive Officer of Dynamic Signal Inc., a marketing company, since November 2010. From October 2005 to April 2010, Mr. Fradin co-founded and served as Chief Executive Officer of Adify Corporation, an on-line advertising company sold to Cox Enterprises. Prior to founding Adify, Mr. Fradin held executive positions with Wine.com, comScore and FlyCast Communications. Mr. Fradin is an active angel investor and serves on a number of boards of directors. Mr. Fradin holds a B.S. in Economics from the Wharton School at the University of Pennsylvania. We have determined that Mr. Fradin is qualified to serve as a member of our Board of Directors because of the breadth of his operational background and experience as an executive and director at a diverse range of digital media and online marketing companies.

Jack Lazar has served on our Board of Directors since October 2013. Mr. Lazar is currently the Chief Financial Officer at GoPro, a provider of wearable and mountable capture devices. In addition, Mr. Lazar has served on the board of directors and on the audit committee of Silicon Labs, a semiconductor company since April 2013. From May 2011 to January 2013, Mr. Lazar was Senior Vice President, Corporate Development and General Manager of Qualcomm Atheros, Inc. From September 2003 until the acquisition of Atheros Communications, Inc., a publicly traded provider of communications semiconductor solutions, by Qualcomm in May 2011, Mr. Lazar served in various positions at Atheros, most recently as Senior Vice President of Corporate Development, Chief Financial Officer and Secretary. Mr. Lazar is a certified public accountant and holds a B.S. in Commerce with an emphasis in Accounting from Santa Clara University. We have determined that Mr. Lazar is qualified to serve as a member of our Board of Directors because of his strong financial and operational expertise gained from his experience as a technology company executive and consultant.

Our Board of Directors has undertaken a review of the independence of each director. Based on information provided by each director concerning his or her background, employment and affiliations, our Board of Directors has determined that, other than Brett Wilson, our President and Chief Executive Officer, each of the current members of the Board of Directors is an “independent director” for purposes of the NASDAQ Listing Rules and Rule 10A-3(b)(1) under the Securities Exchange Act of 1934, as amended, as the term relates to membership on the board of directors and the various committees of the board of directors. The Board of Directors has also determined that Thomas Vardell, who served as a director until December 2014, was independent during the time he served as a director.

Our Board of Directors has adopted Corporate Governance Guidelines to promote the functioning of the board and its committees. These guidelines address the role of the board composition, board functions and responsibilities, qualifications, leadership structure, committees and meetings.

To date, the Board of Directors has not appointed a Chairman of the Board. If a Chairman of the Board were to be appointed, our Corporate Governance Guidelines do not contain a policy mandating the separation of the offices of the Chairman of the Board and the Chief Executive Officer, and the Board of Directors is given the flexibility to select its Chairman and our Chief Executive Officer in the manner that it believes is in the best interests of our stockholders. Accordingly, the Chairman and the Chief Executive Officer may be filled by one individual or two.

Risk is inherent with every business, and we face a number of risks, including general economic risks, operational risks, financial risks, competitive risks and reputational risks. Management is responsible for the day-to-day management of those risks, while our Board of Directors, as a whole and through its committees, has responsibility for the oversight of risk management. While the full Board of Directors is charged with ultimate oversight responsibility for risk management, committees of the Board of Directors have responsibilities with respect to various aspects of risk oversight. In particular, the Audit Committee plays a significant role in monitoring and assessing the Company’s financial and operational risks. The Audit Committee reviews and discusses with management areas of financial risk exposure and steps management has taken to monitor and control such exposure. The Audit

8

Committee is also responsible for establishing and administering the Company’s Code of Business Conduct and Ethics and reviewing and approving transactions between the Company and any related parties. The Compensation Committee monitors and assesses risks associated with the Company’s compensation policies, and oversees the development of incentives that encourage a level of risk-taking consistent with the Company’s overall strategy. The Nominating and Corporate Governance Committee has oversight responsibility for corporate governance risks, including risks associated with director independence.

It is the policy of our Board of Directors that our independent directors will meet periodically in executive sessions. In normal circumstances, executive sessions shall be scheduled as a part of all regular Board of Directors meetings, and, in any event, such sessions shall be held not less than twice during each calendar year.

Meetings of the Board of Directors and Committees

The Board of Directors held seven meetings during the fiscal year ended December 31, 2014. The Board of Directors has three standing committees: an Audit Committee, a Compensation Committee and a Nominating and Corporate Governance Committee. During the last fiscal year, with the exception of Mr. Fradin, each of our directors attended at least 75% of the total number of meetings of the Board of Directors and all of the committees of the Board of Directors on which such director served during that period.

The following table sets forth the standing committees of the Board of Directors and the members of each committee as of the date that this proxy statement was first made available to our stockholders:

|

Name of Director |

|

Audit |

|

Compensation |

|

Nominating and |

|

Ajay Chopra |

|

X |

|

X |

|

|

|

Russell Fradin |

|

|

|

|

|

Chair |

|

Ashu Garg |

|

|

|

|

|

X |

|

Jack Lazar |

|

Chair |

|

|

|

|

|

David Toth |

|

X |

|

Chair |

|

|

Audit Committee

Our Audit Committee is currently comprised of Messrs. Chopra, Lazar and Toth. Mr. Lazar serves as our Audit Committee chairperson. Our Audit Committee met six times during 2014. Our Board of Directors has determined that all of the members of the Audit Committee possess the level of financial literacy and sophistication required under the listing standards of NASDAQ, and that Mr. Lazar is an audit committee financial expert as defined by SEC rules. Our Board of Directors has also determined that Messrs. Chopra, Lazar and Toth satisfy the independence requirements of audit committee members under the applicable rules and regulations of the SEC and the listing standards of NASDAQ.

Our Audit Committee is responsible for, among other things:

|

· |

appointing, compensating, retaining and overseeing our independent registered public accounting firm; |

|

· |

approving the audit and non-audit services to be performed by our independent registered public accounting firm; |

|

· |

ensuring the independence and performance of our independent registered public accounting firm; |

|

· |

reviewing, with our independent registered public accounting firm, all critical accounting policies and procedures; |

|

· |

reviewing with management the adequacy and effectiveness of our internal control structure and procedures for financial reports; |

|

· |

reviewing and discussing with management and our independent registered public accounting firm our annual audited financial statements and any certification, report, opinion or review rendered by our independent registered public accounting firm; |

|

· |

reviewing and investigating conduct alleged to be in violation of our code of conduct; |

|

· |

reviewing and approving related party transactions; |

|

· |

preparing the Audit Committee report required in our annual proxy statement; and |

|

· |

reviewing and evaluating, at least annually, its own performance and the adequacy of the committee charter. |

9

Compensation Committee

Our Compensation Committee is currently comprised of Messrs. Chopra and Toth, each of whom satisfies the independence requirements under the applicable rules and regulations of the SEC and the listing standards of NASDAQ. Mr. Toth serves as our Compensation Committee chairperson. Our Compensation Committee met three times during 2014. In addition, each member of our Compensation Committee qualifies as a “non-employee director” as defined pursuant to Rule 16b-3 promulgated under the Exchange Act and an “outside director” for purposes of Section 162(m) of the Internal Revenue Code.

Our Compensation Committee is responsible for, among other things:

|

· |

reviewing and approving corporate goals and objectives relevant to compensation of our Chief Executive Officer and other executive officers; |

|

· |

reviewing and approving the following compensation for our Chief Executive Officer and our other executive officers: salaries, bonuses, incentive compensation, equity awards, benefits and perquisites; |

|

· |

recommending the establishment and terms of our incentive compensation plans and equity compensation plans, and administering such plans; |

|

· |

recommending compensation programs for directors; |

|

· |

preparing disclosures regarding executive compensation and any related reports required by the rules of the SEC; |

|

· |

making and approving grants of options and other equity awards to all executive officers, directors and all other eligible individuals; and |

|

· |

reviewing and evaluating, at least annually, its own performance and the adequacy of the committee charter. |

In carrying out these responsibilities, the Compensation Committee reviews all components of executive compensation for consistency with our compensation philosophy and with the interests of our stockholders.

The Compensation Committee is authorized to obtain advice of one or more compensation advisors, as it sees fit, in connection with performance of its duties. In October 2014, the Compensation Committee selected Compensia, a national compensation consultant, to serve as an independent advisor to the Compensation Committee regarding executive compensation matters on an ongoing basis. The Compensation Committee engaged Compensia to conduct an executive compensation assessment and to assist with other compensation governance items as requested, with a goal of ensuring that the compensation we offer to our executive officers is competitive and fair. The engagement of any compensation consultant rests exclusively with the Compensation Committee, which has sole authority to retain and terminate any compensation consultant or other advisor that it uses.

In October 2014, the Compensation Committee assessed the independence of Compensia and concluded that no conflicts of interest exist that would prevent Compensia from providing independent and objective advice to the Compensation Committee under applicable SEC or NASDAQ rules.

Nominating and Corporate Governance Committee

Our Nominating and Corporate Governance Committee is comprised of Messrs. Fradin and Garg, each of whom satisfies the independence requirements under applicable rules and regulations of the SEC and the listing standards of NASDAQ. Mr. Fradin serves as our Nominating and Corporate Governance Committee chairperson. Our Nominating and Corporate Governance Committee did not formally hold a meeting during 2014, but did act by written consent.

Our Nominating and Corporate Governance Committee is responsible for, among other things:

|

· |

assisting our Board of Directors in identifying qualified director nominees and recommending nominees for each annual meeting of stockholders; |

|

· |

developing, recommending and reviewing corporate governance principles and a code of conduct applicable to us; |

|

· |

assisting our Board of Directors in its evaluation of the performance of our Board of Directors and each committee thereof; and |

|

· |

reviewing and evaluating, at least annually, its own performance and the adequacy of the committee charter. |

10

Compensation Committee Interlocks and Insider Participation

None of the members of our Compensation Committee is currently or has been at any time one of our officers or employees. None of our executive officers currently serves, or in the past year has served, as a member of the board of directors or compensation committee of any entity that has one or more executive officers serving on our Board of Directors or Compensation Committee.

On July 23, 2014, in connection with the closing of our initial public offering, entities affiliated with Trinity TVL X, LLC, of which Mr. Chopra is a management member, purchased an aggregate of approximately 700,000 shares. For more information, please see “Certain Relationships and Related Party Transactions.”

Our Board of Directors has also adopted a written charter for each of the Audit Committee, the Compensation Committee and the Nominating and Corporate Governance Committee. Each charter is available on the investor relations portion of our website at http://investor.tubemogul.com.

Considerations in Evaluating Director Nominees

The Nominating and Corporate Governance Committee’s goal is to assemble a Board of Directors that brings to the Company a diversity of experience relevant to the Company’s activities and that complies with the NASDAQ Listing Rules and applicable SEC rules and regulations. Our Nominating and Corporate Governance Committee uses a variety of methods for identifying and evaluating director nominees. In its evaluation of director candidates, the Nominating and Corporate Governance Committee reviews the needs of the Board of Directors for various skills, background, experience and expected contributions and the qualification standards established from time to time by the Nominating and Corporate Governance Committee and considers the perceived needs of the Board of Directors as a whole, the candidate’s relevant background, experience and skills and expected contributions to the Board of Directors. Our Nominating and Corporate Governance Committee requires the following minimum qualifications to be satisfied by any nominee for a position on our Board of Directors: (i) the highest personal and professional ethics, integrity and values and commitment to representing the long-term interests of the stockholders, (ii) an inquisitive and objective outlook and mature judgment, (iii) experience in positions with a high degree of responsibility and leadership roles in the companies and institutions with which they are, or have been, affiliated.

While the Company does not have a specific policy regarding diversity, when considering the nomination of directors, the Nominating and Corporate Governance Committee does consider the diversity of its directors and nominees in terms of knowledge, experience, background, skills, expertise and other demographic factors.

In addition, director candidates must have sufficient time available in the judgment of the Nominating and Corporate Governance Committee to perform all responsibilities that will be expected of them by the Board of Directors and committees. Members of the Board of Directors are expected to rigorously prepare for, attend and participate in all meetings of the Board of Directors and applicable committees. The Company will annually solicit information from directors in order to monitor potential conflicts of interest and directors are expected to be mindful of their fiduciary obligations to the Company.

If the Nominating and Corporate Governance Committee believes at any time that it is desirable that the Board of Directors consider additional candidates for nomination, the Nominating and Corporate Governance Committee may poll directors and management for suggestions or conduct research to identify possible candidates and may engage, if the Nominating and Corporate Governance Committee believes it is appropriate, a third party search firm to assist in identifying qualified candidates.

The Nominating and Corporate Committee annually evaluates the current members of the Board of Directors whose terms are expiring and who are willing to continue in service against the criteria set forth above in determining whether to recommend these directors for election. The Nominating and Corporate Governance Committee regularly assesses the optimum size of the Board of Directors and its committees and the needs of the Board of Directors for various skills, background and business experience in determining if the Board of Directors requires additional candidates for nomination.

Stockholder Recommendations and Nominees

The Nominating and Corporate Governance Committee considers properly submitted recommendations for candidates to the Board of Directors from stockholders. These candidates may be considered at meetings of the Nominating and Corporate Governance Committee at any point during the year. Such candidates are evaluated against the criteria set forth above.

11

Any stockholder recommendations for consideration by the Nominating and Corporate Governance Committee should include the candidate’s name, age, contact information, principal occupation or employment and a description of the candidate’s qualifications, skills, background, and business experience during, at a minimum, the last five years, including his/her principal occupation and employment and the name and principal business of any corporation or other organization in which the candidate was employed or served as a director, as well as any additional information required to be provided under securities laws and regulations. In order to be evaluated in connection with the Nominating and Corporate Governance Committee’s established procedures for evaluating potential director nominees, any recommendation for director nominee submitted by a stockholder must be sent in writing to the Secretary, TubeMogul, Inc., at 1250 53rd Street, Suite 2, Emeryville, CA 94608, by January 1, 2016, 120 days prior to the anniversary of the date proxy statements were mailed to stockholders in connection with the prior year’s annual meeting.

In addition, our bylaws permit stockholders to nominate directors for consideration at an annual meeting. For a description of the process for nominating directors in accordance with our bylaws, see “What is the deadline to propose actions for consideration at next year’s Annual Meeting of Stockholders or to nominate individuals to serve as directors?”

Director Attendance at Annual Meetings

We attempt to schedule our annual meeting of stockholders at a time and date to accommodate attendance by members of our Board of Directors taking into account the directors’ schedules. Although we do not have a formal policy regarding attendance by members of our Board of Directors at annual meetings of stockholders, we encourage, but do not require, our directors to attend.

Corporate Governance Guidelines and Code of Business Conduct and Ethics

We have adopted written Corporate Governance Guidelines that address the composition of the Board of Directors, criteria for board membership and other board governance matters. We have adopted a written Code of Business Conduct and Ethics, applicable to all of our directors, officers and employees, which outlines the principles of legal and ethical business conduct under which we do business. We intend to disclose any amendments to our Code of Business Conduct and Ethics, or waivers of its requirements, on our website or in filings under the Exchange Act to the extent required by applicable rules and exchange requirements. The full text of our Code of Business Conduct and Ethics and our Corporate Governance Guidelines is posted on the Investor Relations portion of our website at http://investor.tubemogul.com. Printed copies may also be obtained by any stockholder free of charge upon request to the Secretary, TubeMogul, Inc., in writing, at 1250 53rd Street, Suite 2, Emeryville, California 94608.

Non-Employee Director Compensation

Our non-employee directors, or Outside Directors, do not currently receive, and did not receive in 2014, any cash compensation or any fee reimbursement for their service on our Board of Directors and committees of our Board of Directors. The following table provides information regarding total compensation that was granted to our Outside Directors during the year ended December 31, 2014.

|

Director Name |

|

Stock |

|

|

Total |

|

||

|

Ajay Chopra |

|

$ |

— |

|

|

$ |

— |

|

|

Russell Fradin(2) |

|

|

— |

|

|

|

— |

|

|

Ashu Garg |

|

|

— |

|

|

|

— |

|

|

Jack Lazar(3) |

|

|

— |

|

|

|

— |

|

|

David Toth(4) |

|

|

44,375 |

|

|

|

44,375 |

|

|

Thomas Vardell(5) |

|

|

— |

|

|

|

— |

|

|

(1) |

The amounts reported represent the aggregate grant-date fair value of the stock options and restricted stock units (RSUs) awarded during 2014, as computed in accordance with Financial Accounting Standards Board Accounting Standards Codification Topic 718, or ASC Topic 718. The assumptions used in calculating the grant date fair value of the stock option reported in this column are set forth in Note 7 to our audited consolidated financial statements included in our Annual Report. As required by SEC rules, the amounts shown exclude the impact of estimated forfeitures related to service-based vesting conditions. |

|

(2) |

As of December 31, 2014, Mr. Fradin had one option to purchase a total of 32,292 shares. The shares subject to the stock option have an exercise price of $0.70 per share and vest over a four-year period as follows: 1/4 of the shares underlying the option vested on the first anniversary of the vesting commencement date and 1/48th of the shares vest each month thereafter, subject to continued service with us through each vesting date. |

|

(3) |

As of December 31, 2014, Mr. Lazar had one option to purchase a total of 112,500 shares. The shares subject to the stock option have an exercise price of $2.76 per share and vest over a four-year period as follows: 1/48th of the shares underlying the option vested one month after the vesting commencement date and 1/48th of the shares vest each month thereafter, subject to continued service with us through each vesting date. |

12

|

(4) |

As of December 31, 2014, Mr. Toth had one option to purchase a total of 50,000 shares and 6,250 RSUs. The shares subject to the stock option have an exercise price of $0.70 per share and vest over a four-year period as follows: 1/48th of the shares underlying the option vest one month after the vesting commencement date and 1/48th of the shares underlying the option vest each month thereafter, subject to continued service with us through each vesting date. The RSUs are subject to both an event condition as well as a three-year vesting period. The event condition, the earlier of six months after the Company’s IPO or March 15, 2015, was satisfied in January 2015. Upon satisfaction of the event condition, 1/12th of the shares underlying the RSUs were vested as of April 21, 2014 and 1/12th of the shares underlying the RSUs vest every three months thereafter, subject to continued service with us through each vesting date. |

|

(5) |

Mr. Vardell resigned as a member of our Board of Directors in December 2014. |

As of December 31, 2014, Messrs. Fradin, Lazar and Toth were the only Outside Directors who held equity awards that would have been subject to accelerated vesting in connection with a change in control.

Directors who are also our employees receive no additional compensation for their service as a director. During the year ended December 31, 2014, one of our directors, Mr. Wilson, our President and Chief Executive Officer, was an employee and did not receive any additional compensation for his services as director.

Outside Director Compensation Policy

In April 2014, our Board of Directors adopted a policy for the compensation for our Outside Directors. Outside Directors receive compensation in the form of equity granted under the terms of our 2014 Equity Incentive Plan (2014 Plan), as described below:

Initial award. Each person who first becomes an Outside Director following our initial public offering in July 2014 will be granted (i) an option to purchase shares having a grant date fair value equal to $100,000 (Initial Option), and (ii) RSUs with a grant date fair value equal to $100,000 (Initial RSU Award). The shares underlying the Initial Option and Initial RSU Award will vest and become exercisable, as to one-third of the shares subject to such award on each anniversary of the commencement of the individual’s service as an Outside Director, subject to continued service as a director through the applicable vesting date.

Annual award. On the date of each annual meeting of our stockholders, each Outside Director who has served on our Board of Directors for at least the preceding six months will be granted (i) an option to purchase shares having a grant date fair value equal to $50,000, or the Annual Option, and (ii) RSUs with a grant date fair value equal to $50,000, or the Annual RSU Award. All of the shares underlying the Annual Option and Annual RSU Award will vest and become exercisable upon the earlier of (i) the day prior to the next year’s annual meeting of stockholders or (ii) one year from grant, subject to continued service as a director through the applicable vesting date.

13

EXECUTIVE OFFICERS AND KEY EMPLOYEES

The following table identifies certain information about our executive officers and key employees as of April 30, 2015. Officers are elected annually by our Board of Directors to hold office until their successors are elected and qualified. Effective March 2015, certain key employees who previously were designated as executive officers in fiscal year 2014 are no longer designated as executive officers. There are no family relationships among any of our directors, executive officers or key employees.

|

Name |

|

Age |

|

Position |

|

Executive Officers |

|

|

|

|

|

Brett Wilson |

|

41 |

|

Chief Executive Officer, President and Director |

|

Paul Joachim |

|

49 |

|

Chief Financial Officer |

|

Chip Scovic |

|

44 |

|

Chief Revenue Officer |

|

Eric Deeds |

|

44 |

|

General Counsel and Secretary |

|

Key Employees |

|

|

|

|

|

Keith Eadie |

|

37 |

|

Chief Marketing Officer |

|

Daniel Schotland |

|

39 |

|

Vice President of Client Services |

|

John Hughes |

|

37 |

|

President of Products |

|

Jason Lopatecki |

|

39 |

|

Chief Strategy Officer |

|

Adam Rose |

|

41 |

|

Chief Technology Officer |

|

Patricia Money |

|

58 |

|

Chief People Officer |

Brett Wilson’s biography can be found on page 7 of this proxy statement with the biographies of the other members of the Board of Directors. Biographies for our other executive officers are below.

Paul Joachim has served as our Chief Financial Officer since April 2013. He served as our Chief Revenue Officer from February 2012 to March 2013. Prior to joining us, from February 2006 to January 2012, Mr. Joachim was employed by Vibrant Media, Inc., a digital advertising company, most recently as Senior Vice President and Managing Director, Americas. Previously, he was a Managing Director with investment banking firm Jefferies Broadview where he worked from 1995 to 2006. Mr. Joachim was with IBM in sales from 1988 to 1993. Mr. Joachim holds a B.S. in Mechanical Engineering from the University of California, Berkeley and an M.B.A. from the Haas School of Business at the University of California, Berkeley.

Chip Scovic has served as our Chief Revenue Officer since April 2013. From December 2009 to March 2013, Mr. Scovic ran Google’s media platforms business for brands and independent agencies, as well as Google’s programmatic buying strategy for brand advertisers. Prior to that, Mr. Scovic served as Vice President of Sales at Teracent, Inc., an online advertising company, from February 2009 until Teracent was acquired by Google in December 2009. From September 2005 to February 2009 Chip worked at Yahoo!, an Internet media company, where he ran Yahoo! video ad sales. Mr. Scovic holds a B.A. in Political Science from Miami University and a J.D. from Ohio Northern University.

Eric Deeds has served as our General Counsel and Secretary since April 2013. From October 1999 to March 2013, Mr. Deeds served as an attorney in the Corporate and Securities practice group at DLA Piper LLP (US). Mr. Deeds holds a B.A. in Economics from the University of Michigan and a J.D. from the Georgetown University Law Center.

Keith Eadie has served as our Chief Marketing Officer since February 2014. He also served as our Vice President of Marketing from January 2012 to January 2014 and our Director of Marketing from June 2010 to December 2011. Prior to joining us, from September 2008 to May 2010, Mr. Eadie served as a technology and digital media consultant for the Boston Consulting Group, a management consulting firm. Mr. Eadie holds a B.Com. from the University of British Columbia and an M.B.A. from the Haas School of Business at the University of California, Berkeley.

Daniel Schotland has served as our Vice President of Client Services since April 2013. In this capacity, Mr. Schotland oversees our global operations team. From 2003 to 2013, Mr. Schotland served as Vice President of Client Services and Vice President of Business Development for Experian Marketing Services, a global provider of integrated consumer data. Mr. Schotland started his career as a technology consultant for Deloitte Consulting leading large enterprise resource planning implementations. Mr. Schotland holds a B.S. from the Haas School of Business at the University of California, Berkeley.

14

John Hughes co-founded TubeMogul and has led Product Development since our inception in March 2007. He also served as the Chief Technology Officer of TubeMogul from March 2007 to October 2009. He originally conceived of TubeMogul while attending business school with Brett Wilson. Prior to TubeMogul Mr. Hughes was a Product Manager at Gateway, Inc. from February 2003 to June 2005. Mr. Hughes holds a B.S. in Pre-Medicine from Pennsylvania State University and an M.B.A from the Haas School of Business at the University of California, Berkeley.

Jason Lopatecki has served as our Chief Strategy Officer since October 2008. Previously, Mr. Lopatecki co-founded and served as Chief Executive Officer of Illumenix, a video analytics software company, from 2008 until it was acquired by TubeMogul in October 2008. Mr. Lopatecki worked at Calix Networks, a communication equipment supplier, from 2000 to 2007, serving as the Product Architect for the E-series product line. Mr. Lopatecki started at Calix in the ASIC (chip-design) team. Mr. Lopatecki holds a B.S. in Electrical Engineering and Computer Science from the University of California, Berkeley.

Adam Rose has served as our Chief Technology Officer since October 2008. Previously, Mr. Rose co-founded and served as Chief Technology Officer of Illumenix, a video analytics software company, from 2008 until it was acquired by TubeMogul in October 2008. From March 2001 to April 2008, Mr. Rose held positions as a Software Engineer, Engineering Manager and Systems Architect at Calix Networks, a communication equipment supplier. From 1999 to 2001, Mr. Rose served as a Software Engineer at Cyras Systems, an optical networking platform developer, which was acquired by Ciena Systems. From 1997 to 1998, Mr. Rose worked as a Software Integration Engineer at Spar Aerospace. Mr. Rose holds a B.Eng. in Computer Engineering from the Royal Military College of Canada.

Patricia Money has served as our Chief People Officer since April 2015. From May 2013 to April 2015, Ms. Money served as Senior Vice President, Human Resources at Mercury Payment Systems, LLC. From March 2000 to April 2013, she served as Vice President, Human Resources at Monotype Imaging Incorporated. Ms. Money holds a B.B.A. from the University of Memphis and an M.S., Human Resource Development from the Villanova University.

15

This section describes the material elements of compensation awarded to, earned by, or paid to our Chief Executive Officer and two other mostly highly compensated individuals who served as our executive officers during the year ended December 31, 2014. Throughout this proxy statement, these three officers are referred to as our named executive officers:

|

· |

Brett Wilson, our President and Chief Executive Officer; |

|

· |

Keith Eadie, our Chief Marketing Officer; and |

|

· |

Daniel Schotland, our Vice President of Client Services. |

2014 Summary Compensation Table

The following table presents summary information regarding the total compensation earned during 2014 and 2013 by our named executive officers.

|

Name and Principal Position |

|

Year |

|

Salary ($) |

|

|

Bonus ($) |

|

|

Stock Awards ($)(1) |

|

|

Option Awards ($)(1) |

|

|

Non-Equity Incentive Plan Compensation ($) |

|

|

Change in Pension Value and Nonqualified Deferred Compensation Earnings ($) |

|

|

All Other Compensation ($) |

|

|

Total ($) |

|

||||||||

|

Brett Wilson |

|

2014 |

|

|

325,000 |

|

|

50,000 |

|

(2) |

|

— |

|

|

7,898,633 |

|

(3) |

125,000 |

|

(4) |

|

— |

|

|

|

— |

|

|

|

8,398,633 |

|

|||

|

President and Chief Executive Officer |

|

2013 |

|

|

325,000 |

|

|

|

— |

|

|

|

|

|

|

|

1,013,471 |

|

|

117,500 |

|

(4) |

|

— |

|

|

|

— |

|

|

|

1,455,971 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Keith Eadie(5) |

|

2014 |

|

|

220,000 |

|

|

|

— |

|

|

|

— |

|

|

|

1,411,895 |

|

|

48,000 |

|

(4) |

|

— |

|

|

|

— |

|

|

|

1,679,895 |

|

|

|

Chief Marketing Officer |

|

2013 |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Daniel Schotland(5) |

|

2014 |

|

216,042 |

|

(6) |

|

— |

|

|

|

566,050 |

|

|

|

780,617 |

|

|

75,000 |

|

(4) |

|

— |

|

|

|

— |

|

|

|

1,637,709 |

|

||

|

Vice President of Client Services |

|

2013 |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

(1) |

The amounts reported reflect the aggregate grant date fair value of RSU awards and option awards granted during the year as computed in accordance with ASC Topic 718. The assumptions used to calculate these amounts are discussed in Note 7 to our notes to consolidated financial statements included in our Annual Report. As required by SEC rules, the amounts shown exclude the impact of estimated forfeitures related to service-based vesting conditions. |

|

(2) |

Based on the Company’s financial performance in 2014, the Board of Directors approved a discretionary bonus for Brett Wilson of $50,000. |

|

(3) |

In November 2014, Mr. Wilson was granted options for 308,028 shares subject to standard vesting terms under the 2014 Plan and options for 385,035 shares under the 2014 Plan subject to both market-based performance conditions as well as time-based vesting conditions. Performance options for 154,014 shares will begin vesting if the Company achieves a market capitalization of $700 million, maintained for 90 consecutive trading days, and will then vest in equal monthly increments over the subsequent 24 months. Performance options for 231,021 shares will begin vesting if the Company achieves a market capitalization of $1 billion, maintained for 90 consecutive trading days, and will then vest in equal monthly increments over the subsequent 24 months. If the Company does not achieve either of these market capitalization conditions during the period of Mr. Wilson’s service to the Company, the performance options will not vest and will not be a source of compensation value for Mr. Wilson. We have calculated the grant date fair value of these market-based performance options in accordance with ASC Topic 718 as $4.6 million, which is included in the figure set forth in the table above and will be recognized over a requisite service period. The vesting conditions and assumptions used to calculate the grant date fair value of these market-based performance options are discussed in further detail in Note 7 to our notes to consolidated financial statements included in our Annual Report. |

|

(4) |

These amounts consist of payments earned for achievement of mutually agreed-upon performance objectives. See “2014 Executive Bonus Arrangements” below for further information on awards made pursuant to these arrangements. Amounts earned are payable annually, with such payments made in January of the following fiscal year. |

|

(5) |

Mr. Eadie and Mr. Schotland became named executive officers in fiscal year 2014 and therefore fiscal 2013 compensation information is not provided. |

|

(6) |

Mr. Schotland received a 17.5% merit-based increase in base salary and an increase to his non-equity incentive plan compensation target in July 2014. |

16

2014 Executive Bonus Arrangements

Brett Wilson, our President and Chief Executive Officer, Keith Eadie, our Chief Marketing Officer and Daniel Schotland, our Vice President of Client Services, were eligible to receive bonuses during fiscal year 2014 which provided for cash payments based upon achievement of specified performance objectives as set forth in their executive employment arrangements.