UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

For the fiscal year ended December 31 , 2020

For the transition period from to

Commission file number 001-36157

(Exact name of registrant as specified in its charter)

| Not Applicable | ||||||||

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification Number) | |||||||

(Address of principal executive offices and zip code)

(441 ) 297-9901

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||||||

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232-405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files.) Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of "large accelerated filer," "accelerated filer," "smaller reporting company" and "emerging growth company" in Rule 12b-2 of the Exchange Act.

| ☒ | Accelerated filer | ☐ | ||||||||||||

| Non-accelerated filer | ☐ | Smaller reporting company | ||||||||||||

| Emerging growth company | ||||||||||||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of

the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C.

7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

As of June 30, 2020, the last business day of the registrant's most recently completed second fiscal quarter, the aggregate market value of common shares held by non-affiliates of the registrant was approximately $3,976,558,799 (based upon the last reported sales price on The New York Stock Exchange on such date).

The number of the registrant's common shares outstanding as of February 19, 2021 was 112,840,615 .

DOCUMENTS INCORPORATED BY REFERENCE

TABLE OF CONTENTS

| Page | ||||||||

i

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K, or Annual Report, includes forward-looking statements pursuant to the "safe harbor" provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements relate to expectations, beliefs, projections, future plans and strategies, anticipated events or trends and similar expressions concerning matters that are not historical facts or present facts or conditions, such as statements regarding our future financial condition or results of operations, our prospects and strategies for future growth, the introduction of new products and services, and the implementation of our marketing and branding strategies. In many cases, you can identify forward-looking statements by terms such as "may," "will," "should," "expects," "plans," "anticipates," "believes," "estimates," "predicts," "potential" or the negative of these terms or other comparable terminology.

The forward-looking statements contained in this Annual Report reflect our views as of the date of this Annual Report about future events and are subject to risks, uncertainties, assumptions and changes in circumstances that may cause events or our actual activities or results to differ significantly from those expressed in any forward-looking statement. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future events, results, actions, levels of activity, performance or achievements. A number of important factors could cause actual results to differ materially from those indicated by the forward-looking statements, including, but not limited to, those factors described in Part I, Item 1A "Risk Factors" and in Part II, Item 7 "Management's Discussion and Analysis of Financial Condition and Results of Operations."

Readers are urged to consider these factors carefully in evaluating the forward-looking statements and are cautioned not to place undue reliance on these forward-looking statements. All of the forward-looking statements we have included in this Annual Report are based on information available to us on the date of this Annual Report. We undertake no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future events or otherwise, except as otherwise required by law.

ii

RISK FACTOR SUMMARY

Investing in our securities involves a high degree of risk and uncertainties. Below is a summary of the material risk factors associated with an investment in our securities. You should read this summary together with the more detailed description of each risk factor that immediately follows this summary. However, the risk factors described herein are not all of the risks we may face. Other risks not presently known to us or that we currently believe are immaterial may materially affect our business if they occur. Moreover, new risks emerge from time to time. Further, our business may also be affected by additional factors that apply to all companies operating in the U.S. and globally, which have not been included. In addition to this summary and the more detailed description of the risk factors, you should carefully consider other sections of this annual report on Form 10-K, which may include additional factors that could adversely affect our business, prior to investing in our securities.

Risks Related to the COVID-19 Pandemic

•The extent to which the COVID-19 pandemic continues to materially adversely affect our business, results of operations, financial condition and liquidity will depend on numerous evolving factors and future developments that we are not able to predict.

Risks Related to the Operation of Our Business

•Competition. Intense competition among private mortgage insurers could result in competitors reducing pricing, loosening their underwriting guidelines or relaxing their risk management practices, which could, in turn, improve their competitive position in the industry and negatively impact our level of NIW.

•Importance of Significant Customers. Maintaining our business relationships and business volumes with our largest lending customers remains critical to the success of our business.

•Alternatives to Private Mortgage Insurance. The use of alternatives to private mortgage insurance, including government-supported mortgage insurance programs as well as home purchase or refinancing alternatives that do not use any form of mortgage insurance, could reduce or eliminate the demand for our product.

•Reduction in Volume of Low Down Payment Mortgage Originations. Changes in interest rates, alternatives to private mortgage insurance, and changes in tax laws relating to the deductibility of mortgage interest, among other factors, could negatively impact the origination volume of low down payment mortgages requiring private mortgage insurance.

•Claims and Loss Reserve Estimates. An increase in the number or size of claims, compared to what we anticipate, could adversely affect our results of operations or financial conditions. We establish reserves using estimated claim rates and claim amounts in estimating the ultimate loss. Because our reserving method does not account for the impact of future losses that could occur from loans that are not yet delinquent, our obligation for ultimate losses that we expect to occur under our policies in force at any period end is generally not reflected in our financial statements.

•Deteriorating Economic Conditions. A deterioration in macroeconomic conditions generally increases the likelihood that borrowers will lack sufficient income to pay their mortgages and otherwise likely negatively affects the value of homes, increasing the risk to us of a claim from a mortgage default.

•Inadequate Premium Levels. Our mortgage insurance premium rates may not be adequate to cover future losses.

•Investment Portfolio. Changing market conditions could materially impact the future valuation of securities in our investment portfolio.

•Financial Strength Ratings. A downgrade in our financial strength ratings could adversely affect us in many ways, including requiring us to reduce our premiums in order to remain competitive, impacting our ability to obtain reinsurance, and limiting our access to the capital markets.

•IT and Cybersecurity. If our information technology systems were to fail or become outmoded, we may experience a significant disruption in our operations. Breaches in our information technology security could result in the loss or misuse of this information, which could, in turn, result in potential regulatory actions or litigation,

iii

•Reinsurance. Due to market conditions or otherwise, reinsurance may not be available to us in amounts that we consider to be sufficient or at rates that we consider to be acceptable.

Risks Related to Regulation and Litigation

•GSE Reform. Legislative or regulatory actions or decisions to change the role of the GSEs in the U.S. housing market generally, or changes to the charters of the GSEs with regard to the use of credit enhancements generally and private mortgage insurance specifically, could reduce our revenues or adversely affect our profitability and returns.

•GSE Eligibility. Changes in the business practices of the GSEs, including actions or decisions to decrease or discontinue the use of mortgage insurance or changes in the GSEs' eligibility requirements for mortgage insurers, could reduce our revenues or adversely affect our profitability and returns.

•QM and QRM Rules. Changes in the definitions of "Qualified Mortgage" or "Qualified Residential Mortgage" could reduce the size of the mortgage origination market or create incentives to use government mortgage insurance programs over, or other alternatives to, private mortgage insurance.

•Basel III. Implementation of the Basel III Capital Accord may discourage the use of private mortgage insurance.

•Regulation. Our insurance and reinsurance subsidiaries are subject to broad government regulation in each of the jurisdictions in which they are licensed or authorized to do business, including regarding trade and claim practices, accounting methods, premium rates, marketing practices, advertising, policy forms, and capital adequacy.

•Litigation. The mortgage insurance industry faces litigation risk in the ordinary course of operations, including the risk of class action lawsuits and administrative enforcement by Federal and state agencies.

Risks Related to Taxes and Our Corporate Structure

•Foreign Operations. We and our non-U.S. subsidiaries may become subject to U.S. Federal income and branch profits taxation.

•Tax-Related Matters. Holders of 10% or more of our common shares may be subject to U.S. income taxation under the "controlled foreign corporation" rules. U.S. Persons who hold our shares may be subject to U.S. income taxation at ordinary income rates on their proportionate share of our "related party insurance income". U.S. Persons who dispose of our shares may be subject to U.S. Federal income taxation at the rates applicable to dividends on a portion of such disposition. U.S. Persons who hold our shares will be subject to adverse tax consequences if we are considered to be a "passive foreign investment company" ("PFIC"). U.S. tax-exempt organizations who own our shares may recognize unrelated business taxable income. Proposed U.S. tax legislation could have an adverse impact on us or holders of our common shares.

•Bermuda Holding Company. As a Bermuda exempted company, the rights of holders of our common shares are governed by our memorandum of association and bye-laws and Bermuda law, which may differ from the rights of shareholders of companies incorporated in other jurisdictions. We have the option, but not the obligation, under our bye-laws and subject to Bermuda law to require a shareholder to sell to us at fair market value the minimum number of common shares which is necessary to avoid or cure any adverse tax consequences or materially adverse legal or regulatory treatment to us as reasonably determined by our board. There are regulatory limitations on the ownership and transfer of our common shares imposed by the Bermuda Monetary Authority and the Pennsylvania Insurance Department. U.S. persons who own our shares may have more difficulty in protecting their interests than U.S. persons who are shareholders of a U.S. corporation.

•Dividend Restrictions. Dividend income to Essent Group Ltd. from its insurance subsidiaries may be restricted by applicable state and Bermuda insurance laws.

iv

Unless the context otherwise indicates or requires, the terms "we," "our," "us," "Essent," and the "Company," as used in this Annual Report, refer to Essent Group Ltd. and its directly and indirectly owned subsidiaries, including our primary operating subsidiaries, Essent Guaranty, Inc. and Essent Reinsurance Ltd., as a combined entity, except where otherwise stated or where it is clear that the terms mean only Essent Group Ltd. exclusive of its subsidiaries.

PART I

ITEM 1. BUSINESS

Overview

We are an established and growing private mortgage insurance company. Private mortgage insurance plays a critical role in the U.S. housing finance system. Essent and other private mortgage insurers provide credit protection to lenders and mortgage investors by covering a portion of the unpaid principal balance of a mortgage and certain related expenses in the event of a default. In doing so, we provide private capital to mitigate mortgage credit risk, allowing lenders to make additional mortgage financing available to prospective homeowners.

Private mortgage insurance helps extend affordable home ownership by facilitating the sale of low down payment loans into the secondary market. The GSEs, which are U.S. Federal government-sponsored enterprises, purchase residential mortgages from banks and other lenders and guaranty mortgage-backed securities that are offered to investors in the secondary mortgage market. The GSEs are restricted by their charters from purchasing or guaranteeing low down payment loans, defined as loans with less than a 20% down payment, that are not covered by certain credit protections. Private mortgage insurance satisfies the GSEs' credit protection requirements for low down payment loans, supporting a robust secondary mortgage market in the United States.

Our primary U.S. mortgage insurance subsidiary, Essent Guaranty, Inc., which we refer to as "Essent Guaranty," received its certificate of authority from the Pennsylvania Insurance Department in July 2009. We subsequently acquired our mortgage insurance platform from a former private mortgage insurance industry participant and, in 2010, became the first private mortgage insurer to be approved since 1995 by Fannie Mae and Freddie Mac, which we refer to collectively as the GSEs. We are licensed to write coverage in all 50 states and the District of Columbia.

For the years ended December 31, 2020, 2019 and 2018, we generated new insurance written, or NIW, of approximately $107.9 billion, $63.6 billion and $47.5 billion, respectively. As of December 31, 2020, we had approximately $198.9 billion of insurance in force. Our top ten customers represented approximately 35.8%, 42.8% and 43.5% of our NIW on a flow basis for the years ended December 31, 2020, 2019 and 2018, respectively. The financial strength ratings of Essent Guaranty are A3 with a stable outlook by Moody's Investors Service ("Moody's"), BBB+ with a negative outlook by S&P Global Ratings ("S&P") and A (Excellent) with a stable outlook by A.M. Best.

We also offer mortgage-related insurance and reinsurance through our wholly-owned Bermuda-based subsidiary, Essent Reinsurance Ltd., which we refer to as "Essent Re." As of December 31, 2020, Essent Re provided insurance or reinsurance relating to GSE risk share and other reinsurance transactions covering approximately $1.4 billion of risk. Essent Re also reinsures 25% of Essent Guaranty, Inc.'s NIW under a quota share reinsurance agreement. The financial strength ratings of Essent Re are BBB+ with a negative outlook by S&P and A (Excellent) with a stable outlook by A.M. Best.

Our holding company is domiciled in Bermuda and our U.S. insurance business is headquartered in Radnor, Pennsylvania. We operate additional underwriting and service centers in Winston-Salem, North Carolina and Irvine, California. We have a highly experienced, talented team of 381 employees as of December 31, 2020.

The COVID-19 pandemic had a material impact on our 2020 financial results. While uncertain, the future impact of the COVID-19 pandemic on our business, results of operations, financial condition and liquidity may also be material. Under forbearance plans announced by the GSEs and implemented by their servicers, eligible homeowners who are adversely impacted by COVID-19 are permitted to temporarily reduce or suspend their mortgage payments for up to 12 months. Over 90% of mortgage loans insured by us are federally backed by the GSEs. Because a mortgage loan in forbearance is considered delinquent, we will provide loss reserves as loans in forbearance are reported to us as delinquent once the borrower has missed two consecutive payments. However, we believe providing borrowers time to recover from the adverse financial impact of the COVID-19 event may allow some families to be able to remain in their homes and avoid foreclosure. For borrowers that have the ability to begin to pay their mortgage at the end of the forbearance period, we expect that mortgage servicers will work with them to modify their loans at which time the mortgage will be removed from delinquency status.

1

The COVID-19 pandemic also had a significant impact on our human capital management in 2020. A majority of our workforce worked remotely beginning in the first quarter. We reopened several of our office locations in September 2020 on a fully volunteer basis to provide our employees an in office option. We support a healthy work environment by implementing new Health Safety policies and practices including temperature scanning, face masks requirements, staggered shifts, upgraded cleaning practices, social distancing requirements and contact tracing. We did not furlough or conduct any employee layoffs due to the pandemic during the year.

For more information on how COVID-19 has, and may continue to, impact us, our employees and our results of operations, see "—Human Capital Management", "Risk Factors—Risks Related to the COVID-19 Pandemic", and "Management's Discussion and Analysis of Financial Condition and Results of Operations—Overview—COVID-19".

Our Industry

U.S. Mortgage Market

The U.S. residential mortgage market is one of the largest in the world, with over $11.5 trillion of debt outstanding as of September 30, 2020, and includes a range of private and government-sponsored participants. Private industry participants include mortgage banks, mortgage brokers, commercial, regional and investment banks, savings institutions, credit unions, REITs, mortgage insurers and other financial institutions. Public participants include government agencies such as the Federal Housing Administration, or FHA, the Veterans Administration, or VA, the U.S. Department of Agriculture Rural Development program and the Government National Mortgage Association, or Ginnie Mae, as well as government-sponsored enterprises such as Fannie Mae and Freddie Mac. The overall U.S. residential mortgage market encompasses both primary and secondary markets. The primary market consists of lenders originating home loans to borrowers, and includes loans made to support home purchases, which are referred to as purchase originations, and loans made to refinance existing mortgages, which are referred to as refinancing originations. The secondary market includes institutions buying and selling mortgages in the form of whole loans or securitized assets, such as mortgage-backed securities.

GSEs

The GSEs are the largest participants in the secondary mortgage market, buying residential mortgages from banks and other primary lenders as part of their government mandate to provide liquidity and stability in the U.S. housing finance system. According to the Federal Reserve, the GSEs held or guaranteed approximately $5.3 trillion, or 45.8%, of total U.S. residential mortgage debt outstanding as of September 30, 2020. Their charters generally prohibit the GSEs from purchasing a low down payment loan unless that loan is insured by a GSE-approved mortgage insurer, the mortgage seller retains at least a 10% participation in the loan or the seller agrees to repurchase or replace the loan in the event of a default. Historically, private mortgage insurance has been the preferred method utilized to meet this GSE charter requirement. As a result, the private mortgage insurance industry in the United States is driven in large part by the business practices and mortgage insurance requirements of the GSEs.

Mortgage Insurance

Mortgage insurance plays a critical role in the U.S. residential mortgage market by facilitating secondary market sales and by providing lenders and investors a means to diversify their exposures and mitigate mortgage credit risk. Mortgage insurance is provided by both private companies, such as Essent, and government agencies, such as the FHA and the VA. From 2001 through 2020, an average of 25.5% of total annual mortgage origination volume utilized mortgage insurance.

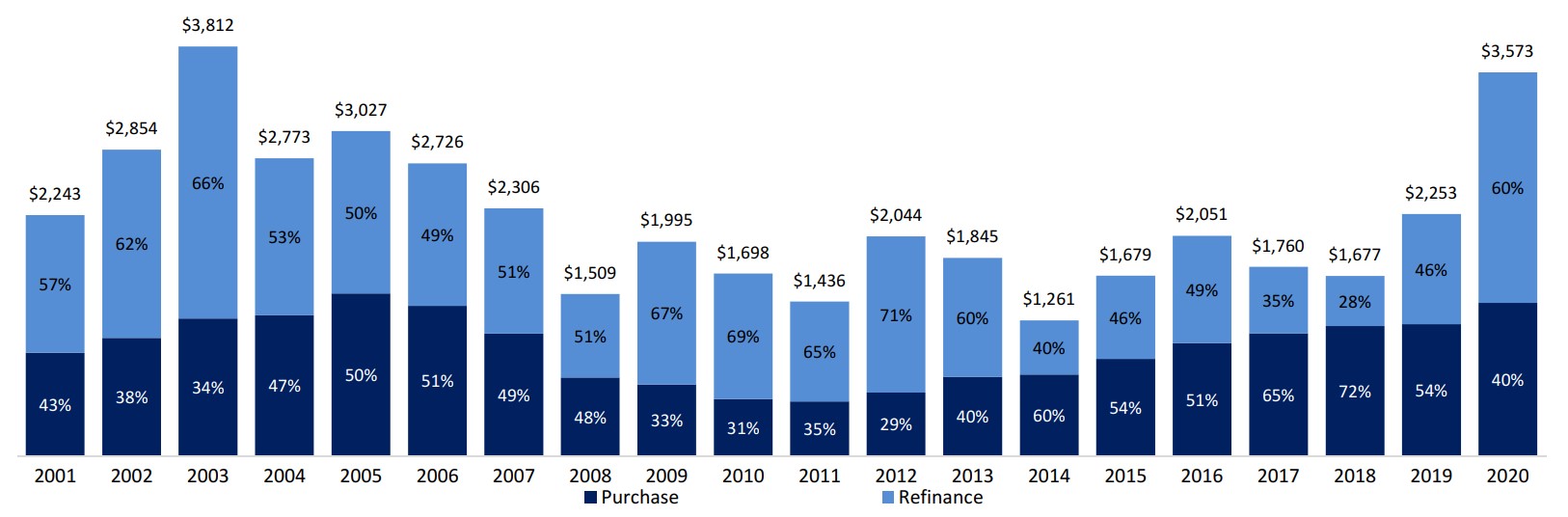

Mortgage insurance industry volumes are influenced by total mortgage originations, and the mix between purchase and refinancing originations. Historically, mortgage insurance utilization has been meaningfully higher in purchase originations compared to refinancing originations. In 2020, total U.S. residential mortgage origination volume was estimated at $3.57 trillion, comprised of $1.42 trillion of purchase originations and $2.15 trillion of refinancing originations. The significant increase in the mortgage market in 2020 over the prior year was driven in large part by historically low interest rates resulting from the COVID-19 pandemic and related economic conditions.

The following graph provides detail on trends in total residential mortgage originations and the breakdown of the market between purchase and refinancing volume.

2

Residential Purchase vs. Refinancing Mortgage Originations ($ in billions)

_______________________________________________________________________________

Source: Mortgage Bankers Association

The charts below detail the relative share of the insured mortgage market covered by public and private participants, and historical NIW trends in the mortgage insurance market and private mortgage insurance penetration rates, which represents private mortgage insurance NIW to total U.S. residential mortgage origination volume. As depicted below, the severe economic and housing market dislocation experienced as a result of the 2007-2008 financial crisis had a profound impact on our industry. Incumbent insurers experienced record high claims activity and sustained significant financial losses, resulting in depleted capital positions. The private mortgage insurance industry, however, has more than doubled its share of the total insured market since 2009, leading to higher private mortgage insurance penetration of the total mortgage origination market. In 2020, private mortgage insurance increased to an estimated 46% of the total insured market and covered 17% of the total mortgage origination volume.

Relative Share of Private and Public Mortgage Insurance

_______________________________________________________________________________

Source: Inside Mortgage Finance

3

Private mortgage insurance NIW ($ in billions)

_______________________________________________________________________________

Source: Inside Mortgage Finance, except for total originations for the purpose of calculating private mortgage insurance penetration, which is based on Mortgage Bankers Association. For 2011 through 2020, private mortgage insurance penetration includes private mortgage insurance NIW originated under the Home Affordable Refinancing Program, or "HARP".

Competition

The private mortgage insurance industry is highly competitive. Private mortgage insurers generally compete on the basis of pricing, customer relationships, underwriting guidelines, terms and conditions, financial strength, reputation, the strength of management and field organizations, the effective use of technology, and innovation in the delivery and servicing of insurance products. The private mortgage insurance industry currently consists of six active private mortgage insurers: Essent Guaranty, Arch Mortgage Insurance Company, Genworth Financial, Inc., Mortgage Guaranty Insurance Corporation, National Mortgage Insurance Corporation and Radian Guaranty Inc.

We and other private mortgage insurers compete directly with Federal and state governmental and quasi-governmental agencies that provide mortgage insurance, principally, the FHA and, to a lesser degree, the VA. We and other private mortgage insurers also face limited competition from state-sponsored mortgage insurance funds in several states, including California and New York. From time to time, other state legislatures and agencies consider expanding the authority of their state governments to insure residential mortgages.

Our industry also competes with products designed to eliminate the need for private mortgage insurance, such as "piggyback loans," which combine a first lien loan with a second lien in order to meet the 80% loan-to-value threshold required for sale to the GSEs without certain credit protections. In addition, we compete with investors willing to hold credit risk on their own balance sheets without credit enhancement and, in some markets, with alternative forms of credit enhancement such as structured finance products and derivatives.

Our Products and Services

Mortgage Insurance

In general, there are two principal types of private mortgage insurance, primary and pool.

Primary Mortgage Insurance

Primary mortgage insurance provides protection on individual loans at specified coverage percentages. Primary mortgage insurance is typically offered to customers on individual loans at the time of origination on a flow (i.e., loan-by-loan) basis, but can also be written in bulk transactions (in which each loan in a portfolio of loans is insured in a single transaction). A substantial majority of our policies are primary mortgage insurance.

Customers that purchase our primary mortgage insurance select a specific coverage level for each insured loan. To be eligible for purchase by a GSE, a low down payment loan must comply with the coverage percentages established by that GSE. For loans not sold to the GSEs, the customer determines its desired coverage percentage. Generally, our risk across all policies written is approximately 25% of the underlying primary insurance in force, but may vary from policy to policy between 6% and 35% coverage.

We file our premium rates with the insurance departments of the 50 states and the District of Columbia as required. Premium rates cannot be changed after the issuance of coverage and premiums applicable to an individual loan are based on a

4

broad spectrum of risk variables including coverage percentages, loan-to-value, or LTV, loan and property attributes, and borrower risk characteristics. See "Management's Discussion and Analysis of Financial Condition and Results of Operations—Factors Affecting Our Results of Operations—Net Premiums Written and Earned" and "—Key Performance Indicators—Average Net Premium Rate."

Premium payments for primary mortgage insurance coverage are typically made by the borrower. Mortgage insurance paid directly by the borrower is referred to as borrower-paid mortgage insurance, or "BPMI." If the borrower is not required to pay the premium, then the premium is paid by the lender, who may recover the premium through an increase in the note rate on the mortgage or higher origination fees. Loans for which premiums are paid by the lender are referred to as lender-paid mortgage insurance, or "LPMI." In either case, the payment of premium to us generally is the legal responsibility of the insured.

Premiums are generally calculated as a percentage of the original principal balance and may be paid as follows:

•monthly, where premiums are collected on a monthly basis over the life of the policy;

•in a single payment, where the entire premium is paid upfront at the time the mortgage loan is originated;

•annually, where premiums are paid in advance for the subsequent 12 months; or

•on a "split" basis, where an initial premium is paid upfront along with subsequent monthly payments.

As of December 31, 2020, substantially all of our policies are monthly or single premium policies.

In general, we may not terminate mortgage insurance coverage except in the event there is non-payment of premiums or certain material violations of our mortgage insurance policies. The insured may cancel mortgage insurance coverage at any time at their option or upon mortgage repayment. GSE guidelines generally provide that a borrower meeting certain conditions may require the mortgage servicer to cancel mortgage insurance coverage upon the borrower's request when the principal balance of the loan is 80% or less of the property's current value. The Homeowners Protection Act of 1998, or HOPA, also requires the automatic termination of BPMI on most loans when the LTV ratio, based upon the original property value and amortized loan balance, reaches 78%, and provides for cancellation of BPMI upon a borrower's request when the LTV ratio, based on the current value of the property, reaches 80%, upon satisfaction of the conditions set forth in HOPA. See "—Regulation—Federal Mortgage—Related Laws and Regulations—Homeowners Protection Act of 1988" below. In addition, some states impose their own mortgage insurance notice and cancellation requirements on mortgage loan servicers.

The GSEs have implemented certain guidelines that may provide more flexibility to certain borrowers to cancel mortgage insurance than is required for such loans under HOPA. For example, borrowers may request termination of mortgage insurance based on the current value of the property if certain loan-to-value and seasoning requirements are met and the borrower has an acceptable payment history. For loans seasoned between two and five years, the loan-to-value ratio must be 75% or less, and for loans seasoned more than five years, the loan-to-value ratio must be 80% or less. If the borrower has made substantial improvements to the property, the GSEs allow for cancellation once the loan-to-value ratio reaches 80% or less with no minimum seasoning requirement. In addition, GSE servicing guidelines currently require servicers to cancel BPMI on second homes with a 78% loan-to-value ratio, whereas HOPA applies to principal residences and excludes second homes.

Pool Insurance

Pool insurance is typically used to provide additional credit enhancement for certain secondary market and other mortgage transactions. Pool insurance generally covers the excess of the loss on a defaulted mortgage loan that exceeds the claim payment under the primary coverage, if such loan has primary coverage, as well as the total loss on a defaulted mortgage loan that did not have primary coverage. Pool insurance may have a stated aggregate loss limit for a pool of loans and may also have a deductible under which no losses are paid by the insurer until losses on the pool of loans exceed the deductible. In another variation, generally referred to as modified pool insurance, policies are structured to include an exposure limit for each individual loan as well as an aggregate loss limit or a deductible for the entire pool.

Master Policy

We issue a master policy to each customer approved as a counterparty by our risk department before accepting their applications for insurance. The master policy, along with its related endorsements and certificates, sets forth the general terms and conditions of our mortgage insurance coverage, including loan eligibility requirements, coverage terms, policy administration, premium payment obligations, exclusions or reductions in coverage, conditions precedent to payment of a claim, claim payment requirements, subrogation and other matters attendant to our coverage.

5

Mortgage insurance master policies generally protect mortgage insurers from the risk of material misrepresentations and fraud in the origination of an insured loan by establishing the right to rescind coverage in such event. Pursuant to the current minimum standards for mortgage insurer master policies enacted by the GSEs and the Federal Housing Finance Agency, or FHFA, which we refer to as the "Rescission Relief Principles," we implemented a new master policy effective March 1, 2020. Consistent with the Rescission Relief Principles, our current master policy provides rescission relief for loans that (i) remain current up to 36 months after origination, have not experienced more than two late payments of 30 days or more, and have never been 60 days late, or (ii) are current after 60 payments, and otherwise permits the provision of rescission relief concurrent with independent validation of representations, including validation by use of duly approved automated tools. Our current master policy also reserves rescission rights with respect to fraud committed by any party in connection with the origination or closing of a loan or application for mortgage insurance (provided, however, that the exclusion for fraud by borrowers may be sunset after the borrower has made 12 timely payments) and certain patterns of fraud or data inaccuracies and permits us to offer certain alternatives to rescission. See "Risk Factors—Risks Relating to the Operation of Our Business—Changes in the business practices of the GSEs, including actions or decisions to decrease or discontinue the use of mortgage insurance or changes in the GSEs' eligibility requirements for mortgage insurers, could reduce our revenues or adversely affect our profitability and returns" elsewhere in this Annual Report and "—Regulation—Direct U.S. Regulation—GSE Qualified Mortgage Insurer Requirements" below.

Contract Underwriting

In addition to offering mortgage insurance, we provide contract underwriting services on a limited basis. As a part of these services, we assess whether data provided by the customer relating to a mortgage application complies with the customer's loan underwriting guidelines. These services are provided for loans that require private mortgage insurance, as well as for loans that do not require private mortgage insurance. Under the terms of our contract underwriting agreements with customers and subject to contractual limitations on liability, we agree to indemnify the customer against losses incurred in the event that we make an underwriting error which materially restricts or impairs the saleability of a loan, results in a material reduction in the value of a loan or results in the customer being required to repurchase a loan. The indemnification may be in the form of monetary or other remedies, subject to per loan and annual limitations. See "Risk Factors—Risks Relating to the Operation of Our Business—We face risks associated with our contract underwriting business."

Bermuda-Based Insurance and Reinsurance

We offer mortgage-related insurance and reinsurance through Essent Re, a Class 3A insurance company licensed pursuant to Section 4 of the Bermuda Insurance Act 1978. Essent Re provides insurance or reinsurance relating to the GSE risk share and other reinsurance transactions. Essent Re also reinsures 25% of Essent Guaranty's NIW under a quota share reinsurance agreement. Essent Re also provides underwriting consulting services to third-party reinsurers through its wholly-owned subsidiary, Essent Agency (Bermuda) Ltd.

Our Mortgage Insurance Portfolio

All of our policies in force were written since May 2010. The following data presents information on our primary mortgage insurance portfolio for policies written by Essent Guaranty.

Insurance in Force by Policy Year

The following table sets forth our insurance in force, or IIF, as of December 31, 2020, by year of policy origination. IIF refers to the unpaid principal balance of mortgage loans that we insure.

| ($ in thousands) | $ | % | ||||||||||||

| 2020 | $ | 102,123,354 | 51.3 | % | ||||||||||

| 2019 | 38,688,532 | 19.5 | ||||||||||||

| 2018 | 18,677,363 | 9.4 | ||||||||||||

| 2017 | 16,268,294 | 8.2 | ||||||||||||

| 2016 | 11,314,546 | 5.7 | ||||||||||||

| 2015 and prior | 11,810,263 | 5.9 | ||||||||||||

| $ | 198,882,352 | 100.0 | % | |||||||||||

6

Portfolio Characteristics

The following tables reflect our IIF and risk in force, or RIF, amounts by borrower credit scores at origination, LTV at origination, and IIF by loan type and amortization, each as of December 31, 2020 and 2019. RIF refers to the product of the coverage percentage applied to the unpaid principal balance of mortgage loans that we insure.

Portfolio by Credit Score

| December 31, | ||||||||||||||||||||||||||

| IIF by FICO score ($ in thousands) | 2020 | 2019 | ||||||||||||||||||||||||

| >=760 | $ | 82,452,139 | 41.5 | % | $ | 68,123,523 | 41.5 | % | ||||||||||||||||||

| 740-759 | 34,538,761 | 17.3 | 27,886,603 | 17.0 | ||||||||||||||||||||||

| 720-739 | 29,599,646 | 14.9 | 24,069,139 | 14.7 | ||||||||||||||||||||||

| 700-719 | 23,807,982 | 12.0 | 19,183,219 | 11.7 | ||||||||||||||||||||||

| 680-699 | 15,538,235 | 7.8 | 13,713,164 | 8.4 | ||||||||||||||||||||||

| <=679 | 12,945,589 | 6.5 | 11,030,205 | 6.7 | ||||||||||||||||||||||

| Total | $ | 198,882,352 | 100.0 | % | $ | 164,005,853 | 100.0 | % | ||||||||||||||||||

| December 31, | ||||||||||||||||||||||||||

| Gross RIF (1) by FICO score ($ in thousands) | 2020 | 2019 | ||||||||||||||||||||||||

| >=760 | $ | 20,336,799 | 41.0 | % | $ | 17,082,683 | 41.3 | % | ||||||||||||||||||

| 740-759 | 8,682,265 | 17.5 | 7,056,654 | 17.0 | ||||||||||||||||||||||

| 720-739 | 7,504,065 | 15.1 | 6,150,334 | 14.9 | ||||||||||||||||||||||

| 700-719 | 5,970,851 | 12.1 | 4,873,597 | 11.8 | ||||||||||||||||||||||

| 680-699 | 3,887,059 | 7.9 | 3,491,755 | 8.4 | ||||||||||||||||||||||

| <=679 | 3,184,111 | 6.4 | 2,747,927 | 6.6 | ||||||||||||||||||||||

| Total | $ | 49,565,150 | 100.0 | % | $ | 41,402,950 | 100.0 | % | ||||||||||||||||||

_______________________________________________________________________________

(1)Gross RIF includes risk ceded under third-party reinsurance.

Portfolio by LTV

| December 31, | ||||||||||||||||||||||||||

| IIF by LTV ($ in thousands) | 2020 | 2019 | ||||||||||||||||||||||||

| 85.00% and below | $ | 27,308,296 | 13.7 | % | $ | 17,128,008 | 10.5 | % | ||||||||||||||||||

| 85.01% to 90.00% | 58,606,394 | 29.5 | 46,771,386 | 28.5 | ||||||||||||||||||||||

| 90.01% to 95.00% | 86,169,485 | 43.3 | 76,611,494 | 46.7 | ||||||||||||||||||||||

| 95.01% and above | 26,798,177 | 13.5 | 23,494,965 | 14.3 | ||||||||||||||||||||||

| Total | $ | 198,882,352 | 100.0 | % | $ | 164,005,853 | 100.0 | % | ||||||||||||||||||

| December 31, | ||||||||||||||||||||||||||

| Gross RIF (1) by LTV ($ in thousands) | 2020 | 2019 | ||||||||||||||||||||||||

| 85.00% and below | $ | 3,142,034 | 6.3 | % | $ | 1,977,361 | 4.8 | % | ||||||||||||||||||

| 85.01% to 90.00% | 14,061,553 | 28.4 | 11,249,383 | 27.2 | ||||||||||||||||||||||

| 90.01% to 95.00% | 24,895,471 | 50.2 | 21,981,598 | 53.1 | ||||||||||||||||||||||

| 95.01% and above | 7,466,092 | 15.1 | 6,194,608 | 14.9 | ||||||||||||||||||||||

| Total | $ | 49,565,150 | 100.0 | % | $ | 41,402,950 | 100.0 | % | ||||||||||||||||||

_______________________________________________________________________________

(1)Gross RIF includes risk ceded under third-party reinsurance.

7

Portfolio by Loan Amortization Period

| December 31, | ||||||||||||||||||||||||||

| IIF by Loan Amortization Period ($ in thousands) | 2020 | 2019 | ||||||||||||||||||||||||

| FRM 30 years and higher | $ | 187,704,000 | 94.4 | % | $ | 154,905,519 | 94.5 | % | ||||||||||||||||||

| FRM 20-25 years | 4,365,585 | 2.2 | 2,854,560 | 1.7 | ||||||||||||||||||||||

| FRM 15 years | 4,776,068 | 2.4 | 3,300,715 | 2.0 | ||||||||||||||||||||||

| ARM 5 years and higher | 2,036,699 | 1.0 | 2,945,059 | 1.8 | ||||||||||||||||||||||

| Total | $ | 198,882,352 | 100.0 | % | $ | 164,005,853 | 100.0 | % | ||||||||||||||||||

Portfolio by Geography

Our in force portfolio is geographically diverse. As of December 31, 2020, only three states accounted for greater than 5% of our portfolio and no single metropolitan statistical area accounted for greater than 3% of our portfolio, as measured by either IIF or Gross RIF. The following tables provide detail of the IIF and Gross RIF in our top ten most concentrated states and our top ten most concentrated U.S. metropolitan statistical areas as of December 31, 2020 and 2019.

Top Ten States

| December 31, | ||||||||||||||

| 2020 | 2019 | |||||||||||||

| IIF by State | ||||||||||||||

| CA | 12.0 | % | 10.0 | % | ||||||||||

| TX | 9.7 | 8.6 | ||||||||||||

| FL | 8.7 | 7.9 | ||||||||||||

| CO | 4.1 | 3.7 | ||||||||||||

| WA | 3.8 | 4.4 | ||||||||||||

| AZ | 3.6 | 3.3 | ||||||||||||

| IL | 3.4 | 3.7 | ||||||||||||

| NJ | 3.3 | 3.6 | ||||||||||||

| VA | 3.1 | 3.2 | ||||||||||||

| MD | 3.0 | 2.8 | ||||||||||||

| All Others | 45.3 | 48.8 | ||||||||||||

| Total | 100.0 | % | 100.0 | % | ||||||||||

8

| December 31, | |||||||||||

| 2020 | 2019 | ||||||||||

| Gross RIF by State | |||||||||||

| CA | 11.8 | % | 9.8 | % | |||||||

| TX | 10.0 | 8.9 | |||||||||

| FL | 9.0 | 8.0 | |||||||||

| CO | 4.1 | 3.6 | |||||||||

| WA | 3.8 | 4.4 | |||||||||

| AZ | 3.5 | 3.2 | |||||||||

| IL | 3.3 | 3.5 | |||||||||

| NJ | 3.2 | 3.6 | |||||||||

| GA | 3.1 | 3.3 | |||||||||

| VA | 3.1 | 3.1 | |||||||||

| All Others | 45.1 | 48.6 | |||||||||

| Total | 100.0 | % | 100.0 | % | |||||||

Top Ten Metropolitan Statistical Areas

| December 31, | ||||||||||||||

| 2020 | 2019 | |||||||||||||

| IIF by Metropolitan Statistical Area | ||||||||||||||

| Phoenix-Mesa-Chandler, AZ | 3.0 | % | 2.7 | % | ||||||||||

| Houston-The Woodlands-Sugar Land, TX | 2.8 | 2.4 | ||||||||||||

| Denver-Aurora-Lakewood, CO | 2.6 | 2.3 | ||||||||||||

| Washington-Arlington-Alexandria, DC-VA-MD-WV | 2.6 | 2.5 | ||||||||||||

| Dallas-Plano-Irving, TX | 2.3 | 2.0 | ||||||||||||

| Los Angeles-Long Beach-Glendale, CA | 2.3 | 2.0 | ||||||||||||

| Chicago-Naperville-Evanston, IL | 2.3 | 2.5 | ||||||||||||

| Atlanta-Sandy Springs-Alpharetta, GA | 2.2 | 2.4 | ||||||||||||

| Riverside-San Bernardino-Ontario, CA | 2.1 | 1.6 | ||||||||||||

| Minneapolis-St. Paul-Bloomington, MN-WI | 2.0 | 2.3 | ||||||||||||

| All Others | 75.8 | 77.3 | ||||||||||||

| Total | 100.0 | % | 100.0 | % | ||||||||||

9

| December 31, | ||||||||||||||

| 2020 | 2019 | |||||||||||||

| Gross RIF by Metropolitan Statistical Area | ||||||||||||||

| Phoenix-Mesa-Chandler, AZ | 3.0 | % | 2.7 | % | ||||||||||

| Houston-The Woodlands-Sugar Land, TX | 2.9 | 2.5 | ||||||||||||

| Denver-Aurora-Lakewood, CO | 2.6 | 2.3 | ||||||||||||

| Washington-Arlington-Alexandria, DC-VA-MD-WV | 2.5 | 2.5 | ||||||||||||

| Dallas-Plano-Irving, TX | 2.4 | 2.0 | ||||||||||||

| Atlanta-Sandy Springs-Alpharetta, GA | 2.3 | 2.4 | ||||||||||||

| Los Angeles-Long Beach-Glendale, CA | 2.2 | 2.0 | ||||||||||||

| Chicago-Naperville-Evanston, IL | 2.2 | 2.3 | ||||||||||||

| Riverside-San Bernardino-Ontario, CA | 2.2 | 1.6 | ||||||||||||

| Minneapolis-St. Paul-Bloomington, MN-WI | 1.9 | 2.3 | ||||||||||||

| All Others | 75.8 | 77.4 | ||||||||||||

| Total | 100.0 | % | 100.0 | % | ||||||||||

Customers

Our customers consist of originators of residential mortgage loans, such as regulated depository institutions, mortgage banks, credit unions and other lenders. We classify our customers into two broad categories and target our marketing efforts based on the customer's operating model and whether decisions to select a mortgage insurance provider are made centrally, or at the field or customer branch level:

•Centralized—Centralized customers make decisions regarding the placement and allocation of mortgage insurance among their approved private mortgage insurers at the corporate level. Generally, these customers consist of the larger, national mortgage originators which originate loans across multiple states, but there are several regional and mid-size lenders which use this method as well.

•Decentralized—Decentralized customers make mortgage insurance purchasing decisions at the field or branch level. These customers generally are more prevalent with regional and mid-size lenders which originate mortgages in a smaller geographic footprint, but are also seen, on a limited basis, among some national lenders.

We seek to maintain strong institutional relationships with all our customers. We provide them with ongoing risk, sales, training, service and product development support. We maintain regular and ongoing dialogue with our customers to develop an in-depth understanding of their strategies and needs, to share market perspectives and industry best practices, and to offer tailored solutions and training where necessary on a local level.

Our top ten customers generated 35.8% of our NIW on a flow basis during the year ended December 31, 2020, compared to 42.8% and 43.5% for the years ended December 31, 2019 and 2018, respectively. For the year ended December 31, 2020, no customer exceeded 10% of our consolidated revenue. The loss of any of our larger customers could have a material adverse impact on us and our business. See "Risk Factors—Risks Relating to the Operation of Our Business—Our revenues, profitability and returns would decline if we lose a significant customer."

Sales and Marketing

Our sales and marketing efforts are designed to help us establish and maintain in-depth, quality customer relationships. We organize our sales and marketing efforts based on our centralized and decentralized customer segmentation, giving additional consideration to a customer's geographic location and whether its lending footprint is national or regional in nature.

We emphasize a collaborative approach with our customers that includes a number of educational offerings and joint product development and marketing initiatives:

•Regular Portfolio and Risk Management Reviews. We conduct periodic insured mortgage portfolio reviews with customers, including detailed loan performance metrics.

10

•Joint Product Development and Marketing Initiatives. We emphasize the development of specialized products and programs that provide increased opportunities for customers and address targeted segments of the market. We recognize the value in developing new products collaboratively with our customers. We also work closely with customers to understand their strategic priorities and business objectives while identifying opportunities that will enhance and complement the customers' marketing activities.

•Customer Service, Support and Trainings. We have an experienced and knowledgeable customer services team that strives to provide premier service to our customers. We dedicate service representatives to our customers so they can establish relationships with their customer peers and become thoroughly familiar with unique customer systems, processes and service needs. We have developed mortgage industry training courses that are offered to our customers as a value added service. We have an experienced team that maintains the course materials so that they are relevant and current and who facilitate training sessions for our customers.

We have an experienced team of national and regional account managers strategically deployed nationwide that markets our mortgage insurance products and support services.

We assign national account managers to each of the national lenders, providing a point of communication between us and the customer's senior management team. These professionals are responsible for the development and execution of sales and marketing strategies aimed at growing customer volumes and ensuring each customer's needs are understood and helping them to pursue their strategies. The national account managers also coordinate the direct communication of customers with our underwriting and risk management groups to provide a continual flow of information between the organizations.

We also have regional account managers and dedicated support staff operating in defined geographic regions. Our regional account managers play a similar role to our national account managers with respect to customer relationship management, education and customer training, serving as our primary point of contact for small and mid-sized regional lenders operating in a given territory. Regional account managers also support our national account team by assisting with our efforts to directly market and service the branch locations of certain national lenders.

We support our national and regional sales force, and improve their effectiveness in acquiring new customers, by raising our brand awareness through advertising and marketing campaigns, website enhancements, electronic communication strategies and sponsorship of industry and educational events.

We continue to build our sales force by hiring qualified mortgage professionals who generally have well-established relationships with industry-leading lenders and significant experience in both mortgage insurance and mortgage lending. Our approach is reflected in and supported by our compensation structure, pursuant to which we have successfully implemented a non-commission-based structure that includes an equity ownership program, which we believe aligns their efforts with our long-term corporate objectives, including providing better customer service and better risk selection.

Information Technology and Cybersecurity

We have a highly automated business that relies on information technology. We accept insurance applications through electronic submission and issue electronic insurance approvals. In order to facilitate this process, we establish direct connections to the origination and servicing systems of our customers and servicers, which may require a significant upfront investment. We also provide our customers secure access to our web-based mortgage insurance ordering and servicing systems to facilitate transactions.

We continue to upgrade and enhance our systems and technology, including:

•investing in new customer-facing technology that enables our customers to transact business faster and easier, whether over an internet browser or through direct system-to-system interfacing with our customers' loan origination and servicing systems;

•integrating our platform with third-party technology providers used by our customers in their loan origination process and for ordering mortgage insurance;

•supporting a business rules engine that automatically enforces our eligibility guidelines and pricing rules at the time the mortgage insurance application is submitted; and

11

•implementing advanced business process management software that focuses on improving our underwriting productivity and that may also be used to improve our quality assurance and loss management functions.

We believe that our technology, together with our information technology team, greatly enhances our operating efficiency and creates competitive advantages. Our team is experienced in large-scale project delivery, including mortgage insurance administration systems and the development of web-enabled servicing capabilities. Technology costs are managed by standardizing our technology infrastructure, consolidating application systems, managing project execution risks and using contract employees as needed.

As for all institutions involved in financial services, information security represents a significant operational risk. To mitigate this risk, Essent has developed and manages comprehensive information security program dedicated to protecting data entrusted to us by our clients as well as our own proprietary corporate information. Essent’s approach is a considered a defense-in-depth strategy, with multiple tiers of security controls and monitoring. Essent has developed our security program using National Institute of Standards and Technology Cybersecurity Framework (the “NIST”) as our benchmark to manage cybersecurity-related risks. Based on NIST, we have designed our security services, including but not limited to, Application Security, Vulnerability Management and Data Protection, Threat Detection and Incident Response. We test our programs effectiveness and readiness through table top exercises, regular external and internal penetration testing, “Red Team” testing and other means to ensure our program is effectively meeting our program goals as designed.

Our commitment to our information security program extends across the organization. We have an information security committee comprised of cross-departmental company executives and IT leaders to ensure that we maintain strong governance mechanisms and to ensure compliance with our security policies and procedures. Additionally, our board of directors, led by the board’s technology, innovation and operations committee, actively oversees our information security program, with Essent's management providing that committee with regular updates and reporting on our IT strategy, including information security strategies and initiatives, event preparedness and incremental improvement efforts. Although our information security program is designed to attempt to prevent, detect and respond to unauthorized use or disclosure of confidential information, including non-public personal information, there can be no assurance that such use or disclosure will not occur. See “Risk Factors—Risks Relating to the Operation of Our Business—The security of our information technology systems may be compromised and confidential information, including non-public personal information that we maintain, could be improperly disclosed."

Underwriting

We have established underwriting guidelines that we believe protect our balance sheet and result in the insurance of high quality business. Most applications for mortgage insurance are submitted to us electronically, and we rely upon the lender's representations and warranties that the data submitted is true and correct when making our insurance decision. Our underwriting guidelines incorporate credit eligibility requirements that, among other things, restrict our coverage to mortgages that meet our requirements with respect to borrower FICO scores, maximum debt-to-income levels, maximum LTV ratios and documentation requirements. Our underwriting guidelines also limit the coverage we provide for mortgages made with certain high risk features, including those for cash-out refinance, second homes or investment properties.

We regularly seek to enhance our underwriting guidelines through extensive data gathering, detailed loan level risk analysis, and assessments of trends in key macroeconomic factors such as housing prices, interest rates and employment. We utilize proprietary models that enable us to assess individual loan risks with a high degree of granularity and set pricing for our policies within a risk-adjusted return framework. See "—Risk Management" below. We have adopted a balanced underwriting approach, which considers our risk analysis, return objectives and market factors.

At present, our underwriting guidelines are broadly consistent with those of the GSEs. Many of our customers use the GSEs' automated loan underwriting systems, Desktop Underwriter® and Loan Prospector®, for making credit determinations. We accept the underwriting decisions made by the GSEs' underwriting systems, subject to certain additional limitations and requirements. We monitor the GSEs for updates to these systems, and may engage in a deeper review for the more substantive releases. Our reviews may result in the maintenance or implementation of additional eligibility requirements. In addition, the performance results of loans scored via automated underwriting systems are monitored within our portfolio management protocols.

12

Our primary mortgage insurance policies are issued through one of two programs:

•Delegated Underwriting. We delegate to eligible customers the ability to underwrite the loans based on agreed-upon underwriting guidelines. To perform delegated underwriting, customers must be approved by our risk management group. See "—Risk Management—Loan Life Cycle Risk Management" below. Some customers prefer to assume underwriting responsibilities because it is more efficient within their loan origination process. Because this delegated underwriting is performed by third parties, we regularly perform quality assurance reviews on a sample of delegated loans to assess compliance with our guidelines. As of December 31, 2020, approximately 66% of our insurance in force had been originated on a delegated basis, compared to 62% as of December 31, 2019. See "Risk Factors—Risks Relating to the Operation of Our Business—Our delegated underwriting program may subject our mortgage insurance business to unanticipated claims."

•Non-Delegated Underwriting. Customers who choose not to participate in, or do not qualify for, our delegated underwriting program submit loan files to us so that we may reach a decision as to whether we will insure the loan. In addition, customers participating in our delegated underwriting program may choose not to use their delegated authority, and instead may submit loans for our independent underwriting. Some customers prefer our non-delegated program because we assume underwriting responsibility and will not rescind coverage if we make an underwriting error, subject to the terms of our master policy. We seek to ensure that our employees properly underwrite our loans through quality assurance sampling, loan performance monitoring and training. As of December 31, 2020, approximately 34% of our insurance in force had been originated on a non-delegated basis, compared to 38% as of December 31, 2019.

We maintain primary underwriting centers in Radnor, Pennsylvania, Winston-Salem, North Carolina and Irvine, California. We believe that the geographical distribution of our underwriting staff allows us to make underwriting determinations across different time zones and to best serve customers across the United States. Although our employees conduct the substantial majority of our non-delegated underwriting, we engage underwriters on an outsourced basis from time to time in order to provide temporary underwriting capacity.

Risk Management

We have established risk management controls throughout our organization and have a risk management framework that we believe reduces the volatility of our financial results and capital position. The risk committee of our board of directors has formal oversight responsibility for the risks associated with our business and is supported by a management risk committee, chaired by our Chief Risk Officer, comprised of senior members of our executive management team.

We believe that our risk management framework encompasses all of the major risks we face, including our mortgage insurance portfolio, investment risk, liquidity risk and regulatory compliance risk, among others. The majority of our risk analysis is directed toward the risks embedded in our mortgage insurance portfolio. As such, we have established a risk management approach that analyzes the risk across the full life cycle of a mortgage, into what we term the "loan life cycle."

Loan Life Cycle Risk Management

We generally break down the loan life cycle risk management process into three components:

•Customer qualification—customer review and approval process;

•Policy acquisition—loan underwriting, valuation and risk approval; and

•Portfolio management—loan performance and lender monitoring with continuous oversight through the settlement of a claim.

Customer qualification involves a process in which we diligence a potential customer's financial resources, operational practices, management experience and track record of originating quality mortgages prior to formalizing a customer relationship. We leverage the experience of our management team to pre-screen lenders prior to formally engaging and performing a lender qualification review. Once engaged, our counterparty risk management team conducts a lender qualification review with oversight from the management risk committee. Approved lenders are subject to clear parameters regarding underwriting delegation status, credit guideline requirements and variances and collateral thresholds and volume mix expectations for loan diversification.

13

The policy acquisition process involves the establishment of underwriting guidelines, pricing schedules and aggregate risk limits. See "—Underwriting" above. These guidelines and schedules are coded in our credit risk rule engine which is utilized to screen each loan underwritten, and are constructed to ensure prudent risk acquisition with adequate return on capital. These guidelines and schedules are maintained and periodically reviewed by our risk management team and adjusted to reflect the most current risk assessment based on ongoing experience in the insurance portfolio as well as industry loan quality trends.

The portfolio management process involves two main functions, quality assurance, or QA, reviews, and a comprehensive surveillance protocol, in order to provide customers timely feedback that fosters high quality loan production. Through our QA process, we review a statistically significant sample of individual mortgages from our customers to ensure that the loans accepted through our underwriting process meet our pre-determined eligibility and underwriting criteria. The QA process allows us to identify trends in lender underwriting and origination practices, as well as to back-test underlying reasons for delinquencies, defaults and claims within our portfolio. The information gathered from the QA process is incorporated into our policy acquisition function and is intended to prevent continued aggregation of underperforming risks. Our surveillance protocol maintains oversight over customer and vendor activities, industry dynamics, production trends and portfolio performance. The portfolio management process also involves loss mitigation aimed to reduce both frequency and severity of non-performing risk. See "—Defaults and Claims" below.

Modeling and Analytics

Our risk management professionals are supported by substantial data analysis and sophisticated risk models. We have a dedicated modeling and analytics team which is responsible for delivering actionable models, tools, analysis and reporting to inform our credit underwriting and pricing decisions. The team analyzes mortgage, financial, economic and housing data to develop proprietary behavioral models that help us assess credit, prepayment and loss severity trends and collateral valuation models to help inform business decisions. Performance and profitability are evaluated across customers and products to identify the emergence of potential weaknesses and adverse risks. Geographic housing market analysis also is utilized in establishing market restrictions for certain products and segments. We utilize an economic capital framework to evaluate risk-adjusted returns. We also perform stress tests on our portfolio to analyze how our book of business may perform under adverse scenarios. We believe that our economic capital framework and stress testing analysis helps to inform our optimal capitalization targets, allowing us to prudently manage and protect our balance sheet.

Reinsurance

We proactively manage our risk exposure and capital in part through the use of third-party reinsurance arrangements. Since 2018, we have entered into several types of reinsurance arrangements:

•fully collateralized excess of loss reinsurance coverage on mortgage insurance policies that we have already issued with special purpose insurers funding such reinsurance obligations through the issuance of mortgage insurance-linked notes;

•excess of loss reinsurance arrangements with third party reinsurers on mortgage insurance policies that we have already issued; and

•quota share reinsurance arrangements in which third party reinsurers agree to prospectively reinsure a pro rata portion of the risk on policies that we write.

We believe that our reinsurance programs offer us a number of benefits, including:

•hedging against adverse losses in times of stress and mitigation of portfolio risk and volatility through the housing and economic cycle;

•providing capital relief under the various state insurance risk to capital framework, rating agency capital requirements and GSE PMIERs available asset requirements;

•providing a diversified source of capital to support and grow our business; and

•enhancing our counterparty strength and improving the sustainability of our franchise.

For additional information regarding our third-party reinsurance programs, see Note 5 to our consolidated financial statements entitled "Reinsurance" included elsewhere in this Annual Report.

14

Defaults and Claims

Defaults

The default and claim cycle for a mortgage insurance policy begins with receipt of a default notice from the servicer. We consider a loan to be in default when we are notified by the servicer that the borrower has missed at least two consecutive monthly payments. Defaults may occur for a variety of reasons including death or illness, divorce or other family problems, unemployment, changes in economic conditions, declines in property values that cause the outstanding mortgage amount to exceed the value of a home or other events.

We expect servicers to make timely collection efforts on borrowers who have defaulted, and to attempt to restore the defaulted mortgage, and our mortgage insurance coverage, to current status. If the servicer cannot restore a borrower to current status, the servicer may be able to offer the borrower a forbearance or loan modification alternatives. Where these alternatives cannot cure the default, the servicer is responsible for pursuing remedies for the default, including foreclosure or acceptable foreclosure alternatives, certain of which, such as short sales and deeds in lieu of foreclosure, require our prior approval under the terms of our master policy. We have delegated certain authority to the GSEs and their servicers to exercise some of these alternatives. Among other requirements, servicers operate under protocols established by the GSEs. See "Risk Factors—Risks Relating to the Operation of Our Business—If servicers fail to adhere to appropriate servicing standards or experience disruptions to their businesses, our losses could unexpectedly increase."

The following table shows the number of primary insured loans and the percentage of loans insured by us that are in default as of December 31, 2020 and 2019:

Number of Loans in Default and Default Rate

| December 31, | ||||||||||||||

| 2020 | 2019 | |||||||||||||

| Number of policies in force | 799,893 | 702,925 | ||||||||||||

| Loans in default | 31,469 | 5,947 | ||||||||||||

| Percentage of loans in default | 3.93 | % | 0.85 | % | ||||||||||

Loan Defaults by Originating Year

| December 31, 2020 | December 31, 2019 | |||||||||||||||||||||||||||||||||||||

| Originating Year | Loans in Default | Percentage of policies written in period | Defaulted RIF (in thousands) | Loans in Default | Percentage of policies written in period | Defaulted RIF (in thousands) | ||||||||||||||||||||||||||||||||

| 2010 - 2014 | 1,985 | 0.7 | % | 106,380 | 888 | 0.3 | % | 46,989 | ||||||||||||||||||||||||||||||

| 2015 | 1,615 | 1.4 | 91,288 | 669 | 0.6 | 36,362 | ||||||||||||||||||||||||||||||||

| 2016 | 3,154 | 2.2 | 188,240 | 948 | 0.7 | 51,304 | ||||||||||||||||||||||||||||||||

| 2017 | 5,614 | 3.0 | 307,133 | 1,623 | 0.9 | 81,398 | ||||||||||||||||||||||||||||||||

| 2018 | 6,903 | 3.6 | 414,691 | 1,398 | 0.7 | 76,955 | ||||||||||||||||||||||||||||||||

| 2019 | 9,230 | 4.0 | 666,756 | 421 | 0.2 | 26,902 | ||||||||||||||||||||||||||||||||

| 2020 | 2,968 | 0.8 | 234,117 | N/A | N/A | N/A | ||||||||||||||||||||||||||||||||

| Total | 31,469 | $ | 2,008,605 | 5,947 | $ | 319,910 | ||||||||||||||||||||||||||||||||

We have experienced a relatively low level of defaults to date. This is due, in part, to the weighted average life of our mortgage insurance portfolio being 19.0 months as of December 31, 2020, whereas the peak default period for insured mortgage loans has historically been three to six years after loan origination. As a result, we do expect default levels to increase as our portfolio seasons. We believe that in recent years the underwriting practices in the industry have improved substantially and that the quality of mortgage loans originated has been high. Consequently, we expect that the default rate and losses on the business we have underwritten to date will be favorable in comparison to the default rate and losses historically experienced by mortgage insurers. Due to business restrictions, stay-at-home orders and travel restrictions initially implemented in March 2020 as a result of COVID-19, unemployment in the United States increased significantly in the second quarter of 2020 and remained elevated at December 31, 2020. As unemployment is one of the most common reasons for borrowers to default on their

15

mortgage, the increase in unemployment has increased the number of delinquencies on the mortgages we insure, and has the potential to increase claim frequencies on defaults. As of December 31, 2020, insured loans in default totaled 31,469 and included 28,922 defaults classified as COVID-19 defaults. For borrowers that have the ability to begin to pay their mortgage at the end of the forbearance period, we expect that mortgage servicers will work with them to modify their loans at which time the mortgage will be removed from delinquency status. We believe that the forbearance process could have a favorable effect on the frequency of claims that we ultimately pay. Based on the forbearance programs in place and the credit characteristics of the COVID-19 defaulted loans, we expect the ultimate number of COVID-19-related defaults that result in claims will be less than our historical default-to-claim experience.

Claims

Defaulted mortgages that are not cured turn into claims. The insured customer must acquire title to the property before submitting a claim. The time in which a customer may acquire title to a property through foreclosure varies, depending on the state in which the property is located. Historically, on average, mortgage insurers do not receive a request for claim payment until approximately 18 months following a default on a first-lien mortgage. This time lag has increased in recent years as the industry has experienced a slowdown in foreclosures (and, consequently, a slowdown in claims submitted to mortgage insurers) largely due to foreclosure moratoriums imposed by various government entities and lenders and increased scrutiny within the mortgage servicing industry on the foreclosure process.

Upon review and determination that a claim is valid, we generally have the following three settlement options:

•Percentage option—determined by multiplying the claim amount by the applicable coverage percentage, with the customer retaining title to the property. The claim amount is defined in the master policy as consisting of the unpaid loan principal, plus past due interest, subject to a defined maximum, and certain expenses associated with the default;

•Third-party sale option—pay the amount of the claim required to make the customer whole, commonly referred to as the "actual loss amount" (not to exceed our maximum liability as outlined under the percentage option), following an approved sale; or

•Acquisition option—pay the full claim amount and acquire title to the property.

We believe there are opportunities to mitigate losses between the time a loan defaults and the ultimate loss we may experience. Because of the small number of defaults and filed claims in our insurance portfolio to date, our opportunities to pursue these activities have been limited. However, we expect both defaulted loan counts and claim filings to increase as our portfolio grows and matures, expanding the potential benefit from these loss mitigation activities. Our loss mitigation and claims area is led by seasoned personnel supported by default tracking and claims processing capabilities within our integrated platform. Our loss mitigation staff is also actively engaged with our servicers and the GSEs with regard to appropriate servicing and loss mitigation practices.

Investment Portfolio

Our investment portfolio, including cash, comprises the largest single component of our balance sheet, representing 91.4% of our total assets at December 31, 2020. Our primary objectives with respect to our investment portfolio are to preserve capital, generate investment income and maintain sufficient liquidity to cover operating expenses and pay future insurance claims. As of December 31, 2020, predominantly all of our investment securities were rated investment-grade.

We have adopted and our board of directors has approved an investment policy that defines specific limits for asset sectors, single issuer, credit rating, asset duration, industry and geographic concentration and eligible and ineligible investments. Our senior management is responsible for the execution of our investment strategy and compliance with the adopted investment policy, and review of investment performance and strategy with the investment committee of the board of directors on a quarterly basis.

Our current strategy for the investment portfolio is focused primarily on the following: selecting fixed income securities; maintaining sufficient liquidity to meet expected and unexpected financial obligations; mitigating interest rate risk through management of asset durations; continuously monitoring investment quality; and limiting investments in assets that are highly correlated to the residential mortgage market.

We engage external asset managers to assist with the trading, investment research, investment due diligence and portfolio allocation within the guidelines that we have set. Approximately 86.2% of our investments available for sale were managed by

16

external managers as of December 31, 2020. Assets not managed by external managers include securities on deposit with state regulatory agencies in connection with the insurance licenses and bonds issued by the U.S. Treasury and U.S. government agencies. To date, we have not used any derivatives to hedge any investment or business risks that we are currently assuming. We measure investment performance against market benchmarks on both total return and return volatility dimensions.

See "Management's Discussion and Analysis of Financial Condition and Results of Operations—Financial Condition—Investments" for information regarding the performance of our investment portfolio.

Regulation

Direct U.S. Regulation

We are subject to comprehensive, detailed regulation by Federal regulators and state insurance departments. State regulations are principally designed for the protection of the public and our insured policyholders, rather than for the benefit of investors. Although their scope varies, state insurance laws generally grant broad supervisory powers to agencies or to officials to examine insurance companies and to enforce rules or to exercise discretion affecting almost every significant aspect of the insurance business.

GSE Qualified Mortgage Insurer Requirements

Pursuant to their charters, Fannie Mae and Freddie Mac purchase or guaranty low down payment loans insured by entities that they determine to be qualified mortgage insurance companies. Our primary insurance subsidiary, Essent Guaranty, Inc., is currently approved by both Fannie Mae and Freddie Mac as a mortgage insurer.