Source: Kitimat LNG.

As described in the table below, numerous different natural gas liquefaction facilities have been proposed to export LNG from British Columbia in Western Canada, and from Oregon in the United States, to markets in Asia.

|

Project Name

|

|

Companies

|

|

Location

|

|

Capacity

mtpa

|

|

|

Capacity

Bcf/d

|

|

|

Export

Status

|

|

Kitimat LNG

|

|

Chevron Canada Limited-Apache Corporation

|

|

Kitimat, BC

|

|

|

10.0 |

|

|

|

1.3 |

|

|

Approved

|

|

BC LNG

|

|

Alta Gas/ Idemitsu / Haisla Nation

|

|

Kitimat, BC

|

|

|

1.8 |

|

|

|

0.2 |

|

|

Approved

|

|

LNG Canada

|

|

Shell / Kogas / Mitsubishi/ Petrochina

|

|

Kitimat, BC

|

|

|

24.0 |

|

|

|

3.2 |

|

|

Approved

|

|

Pacific Northwest LNG

|

|

Petronas / Progress Energy / Sinopec /JAPEX/ Indian Oil / Ptroleum Brunei

|

|

Prince Rupert, BC

|

|

|

20.3 |

|

|

|

2.7 |

|

|

Approved

|

|

Prince Rupert LNG

|

|

BG Group / CNOOC

|

|

Prince Rupert, BC

|

|

|

21.0 |

|

|

|

2.9 |

|

|

Approved

|

|

Kitimat Floating LNG

|

|

Teekay / BAML

|

|

Kitimat, BC

|

|

|

0.6 |

|

|

|

0.1 |

|

|

Proposed

|

|

WCC LNG Ltd. (WCC)

|

|

Exxon/Imperial

|

|

Kitimat/Prince Rupert

|

|

|

30.0 |

|

|

|

4.0 |

|

|

Approved

|

|

Aurora LNG

|

|

CNOOC / Ipex, JGC

|

|

Grassy Point, BC

|

|

|

24.0 |

|

|

|

3.0 |

|

|

Approved

|

|

Kitsault Energy Ltd.

|

|

Kitsault Energy

|

|

Prince Rupert, BC

|

|

|

20.0 |

|

|

|

2.6 |

|

|

Proposed

|

|

Oregon LNG

|

|

Leucadia National

|

|

Warrenton, Oregon

|

|

|

9.0 |

|

|

|

1.3 |

|

|

Approved

|

|

Jordan Cove LNG LP

|

|

Veresen

|

|

Coos Bay, Oregon

|

|

|

9.0 |

|

|

|

1.6 |

|

|

Approved

|

|

Triton LNG LP

|

|

AltaGas/Idemitsu/Haisla Nation

|

|

TBD

|

|

|

2.3 |

|

|

|

0.32 |

|

|

Approved

|

|

Canada Stewart

|

|

Canada Stewart Energy

|

|

Stewart, BC

|

|

|

30.0 |

|

|

|

4.0 |

|

|

Proposed

|

|

Woodfiber LNG

|

|

Woodfiber LNG, Singapore

|

|

Squamish, BC

|

|

|

2.1 |

|

|

|

0.33 |

|

|

Approved

|

The planned Kitimat LNG project received an injection of capital and management expertise with Chevron Canada Limited's (Chevron) acquisition of a 50% interest in the plant and pipeline in December 2012. Chevron will be the operator for the LNG facility and planned Pacific Trail Pipeline. The Pacific Trail Pipeline will provide a direct connection between the Spectra Energy Transmission pipeline system and the Kitimat LNG terminal for the transportation of natural gas from Western Canada. The proposed 463 km 42-inch pipeline would have approximately 1.3 Bcf/d through-put capacity from Summit Lake to Kitimat. This project received the first LNG export license from the National Energy Board (NEB) in 2011.

BC LNG, initially a joint project between LNG Partners and the Haisla First Nations, has experienced financial distress recently and is insolvent. AltaGas and partner Idemitsu Kosan Co. Ltd have announced that they have presented a proposal to the courts and creditors. Phase 1 would take 90 MMcf/d of existing capacity on the Pacific Northern Gas pipeline (owned by AltaGas) providing the ability to start delivering LNG exports by 2016-17 timeframe. The Haisla First Nations, a joint partner in the Douglas channel scheme, would develop a separate project with Golar LNG.

LNG Canada has partnered with TransCanada Corporation (TransCanada) to design, build, and operate the proposed Coastal GasLink Project, a pipeline that would transport natural gas from the Montney gas-producing regions near Dawson Creek, British Columbia to the LNG Canada liquefied natural gas facility near Kitimat. The proposed 700 km large diameter pipeline would have a capacity in excess of 1.7 Bcf/d.

Petronas and Progress Energy Canada Ltd. have partnered with TransCanada to build a pipeline from northeast British Columbia to the proposed Pacific Northwest LNG facility in Prince Rupert. The proposed pipeline would have a capacity of 1.2 to 2.0 Bcf/d. Sinopec has agreed to partner for a 15% interest and has agreed to offtake 1.8 million tonnes per annum (mtpa) which represents a prorata 15% of the LNG facilities production, for a minimum of 20 years. Pacific Northwest LNG has also signed a binding agreement with Petronas for purchase of an additional 3.0 mtpa for 20 years sourced primarily from Petronas. Prior thereto additional interests were sold to Japex Montney Ltd. (10%); PetroleumBrunei (3%) and Indian Oil Corporation (10%) and each of these partners will offtake a volume of LNG prorate to their upstream and downstream interests in the project.

BG Group in partnership with Spectra Energy proposes to build a pipeline to service BG Group's potential LNG export facility in Prince Rupert. A CNOOC subsidiary recently entered into a partnership agreement with the BG Group, however, no terms have been disclosed. The proposed pipeline will be approximately 850 km in length and will have a 36 to 48-inch pipe diameter. The system will be capable of transporting 4.2 Bcf/d from Cyprus in northeast British Columbia to Ridley Island near Prince Rupert.

WCC has made an application for a license to export up to 30 mtpa of LNG having a natural gas equivalent of 1.5 Bcf/d for a term of 25 years. The LNG terminal will be located on the west coast of British Columbia and prospective sites are currently being evaluated in the vicinity of Kitimat and Prince Rupert.

Aurora LNG is seeking permission from the NEB to export up to 24 million tonnes of LNG per annum or 3 Bcf/d over 25 years. It plans for an initial two train facility with total capacity of 12 mtpa with potential to expand to four processing units.

Canada Stewart Energy Corp. is proposing a project at Stewart, BC. Initial capacity of 5 mtpa would be handled from a floating LNG facility and the balance of 25 mpta would be handled from a land based facility. The project would require a strategic relationship with a third party pipeline company.

Woodfibre LNG, which is based in Singapore, has received approval to export 2.1 mtpa requiring gas supply of 330 MMcf/d. It has acquired the Squamish, BC site from Western Forest Products which operated as a pulp mill until 2006. There is an existing pipeline connection with FortisBC which needs to be expanded, existing hydro connection with BC Hydro and existing deep water port.

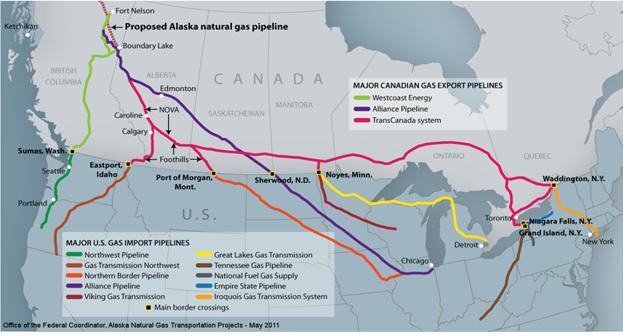

Kitimat has access to the preexisting Pacific Northwest Gas pipeline network, but its 0.1 Bcf/d capacity is insufficient to meet the required amount proposed by all the new terminals. Therefore, the development and construction of natural gas pipelines with sufficient capacity to service anticipated natural gas supply to proposed Kitimat LNG facilities is a key risk in the development of the LNG export market for Liard Basin natural gas.

Oregon Pipeline, a company affiliated with Oregon LNG, is proposing an 85 mile pipeline connecting their LNG terminal with the Williams Northwest pipeline in Woodland, Washington. On January 13, 2014 Oregon LNG filed an application with the National Energy Board to export gas from Canada to the United States to provide feed gas for their facility. The application is for up to 1.3 Bcf/d for a period of 25 years and was recently approved. It has also received approval to export LNG from the United States.

The Jordan Cove project proposes the Pacific Connector Gas Pipeline which would transport up to 1Bcf/d of gas 230 miles from an interconnect in Main, Oregon to its terminal in Coos Bay, Oregon. In September of 2013 Veresen filed an application with the NEB requesting an export volume of 1.55 Bcf/d for 25 years to supply feedstock and approval was granted by the NEB in December 2013. The project has also received approval to export LNG from the United States.

Enbridge Western Access has acquired a parcel of land at Grassy Point near Prince Rupert. This land is adjacent to parcels that have been acquired from the Province of British Columbia by CNOOC/Nexen and Woodside based in Australia.

Northern Gateway Pipelines plans to build a 1,177 km pipeline from Alberta to Kitimat to access new oil markets in the Pacific Rim. The Kitimat marine terminal will have two ship births and 19 storage tanks for oil and condensate and would expect 220 ship calls per annum. The west line would be 36-inch diameter and have capacity of 525,000 bbls/d and the east flowing line would be 20-inch diameter with capacity for 193,000 bbls/d of condensate.

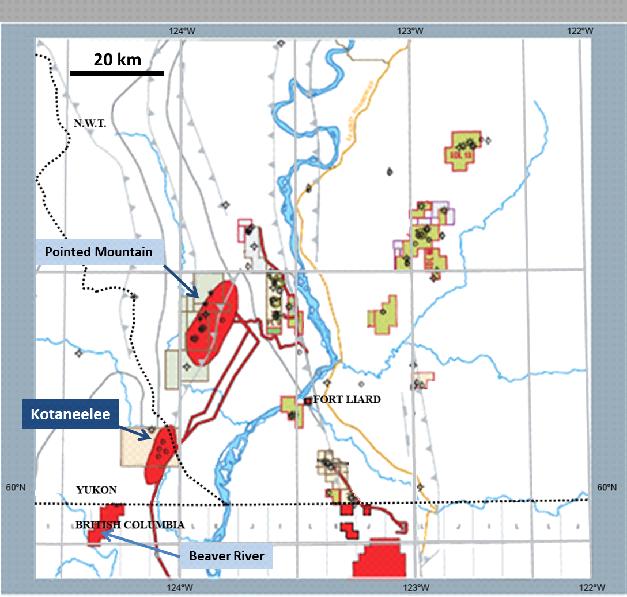

The Kotaneelee Gas Project

Working Interest Acquisitions

The KGP covers 30,542 gross acres in the Yukon Territory in Canada, and includes; a gas dehydration plant (capacity: 70 MMcf/d), one shut in gas well, one water disposal well (capacity: 6,000 bbl/d), and two suspended gas wells. The KGP has a fully developed gas gathering, sales and delivery infrastructure, airstrip, roads, flarestack, storage tanks, barge dock and a 24 person permanent camp facility. The KGP gas dehydration plant has a processing capacity of 70 MMcf/d, outlet gas compression of 1,200 psig and is tied-in to a 24-inch gas sales line to a gas processing plant in Fort Nelson, British Columbia. The Fort Nelson plant is owned and operated by Spectra Energy and connected to the North American gas grid with a delivery capacity of approximately 1 Bcf/d.

On July 18, 2012, we completed the acquisition of Devon Canada's (Devon) entire right and interest (generally a working interest of 22.989%, with a working interest of 69.337% in one shut in gas well) in the KGP. As consideration for Devon's working interest in the KGP (the Devon Assets), we paid approximately US$23,298,000. The consideration was comprised of US$290,000 in cash, 7,250,000 shares of our common stock valued at US$15,950,000, and the absorption of approximately US$7,058,000 in asset retirement obligations.

On October 17, 2012, we completed the acquisition of the entire right and interest of Nahanni Energy Inc. (Nahanni) (generally a working interest of 30.664%) in the KGP (the Nahanni Assets) which, in addition to the 69.337% working interest acquired from Devon on July 18, 2012, provided us with a 100% interest in one shut in gas well in the KGP. The acquisition of the Nahanni Assets was completed through our acquisition of 1700665 Alberta Ltd., a wholly-owned indirect subsidiary of Nahanni formed solely to hold the Nahanni Assets and complete the transaction. Other than acquiring the Nahanni Assets, immediately prior to closing, 1700665 Alberta Ltd. had no assets or operating history.

As consideration for the Nahanni Assets, we paid Nahanni approximately $13,761,000. The consideration was comprised of approximately $133,000 in cash ($398,550 offset by $265,950 paid in connection with the acquisition of the Devon Assets in settlement of certain Nahanni indebtedness), 1,614,767 shares of our subsidiary, 1693730 Alberta Ltd., which are exchangeable, under certain terms and circumstances, for 1,614,767 shares of our common stock valued at approximately $4,191,000, and the absorption of approximately $9,437,000 in asset retirement obligations. The number of shares issued by our subsidiary was calculated by dividing the fair value of the exchangeable shares by the volume weighted average trading price of our stock for the ten trading days prior to closing.

Operating statements for each of the Devon Assets and the Nahanni Assets are attached to Appendix "A" of this prospectus.

As a result of our purchase of the Devon Assets and Nahanni Assets, we now generally own a 53.65% working interest in the KGP, including a 100% working interest in one gas well which has been shut-in while economic viability is being evaluated.

After giving effect to these acquisitions, the current voting interest allocations in the KGP are described in the table below:

|

Voting Interest Holder

|

|

Working Interest

|

|

| |

|

|

|

|

EFLO Energy, Inc. and affiliates

|

|

|

53.65 |

% |

|

Apache Canada Ltd.

|

|

|

31.95 |

% |

|

Imperial Oil Resources

|

|

|

10.4 |

% |

|

Exxon Mobil Properties Canada

|

|

|

1.3 |

% |

|

Talisman Energy Canada

|

|

|

2.7 |

% |

We intend to pursue the acquisition of additional interests in the KGP.

During the tenure of Nahanni's prior ownership of the Nahanni Assets, Nahanni entered into an agreement with a third party in consideration of certain funding obligations (which were in part never performed by the third party) to earn potential net profits interests in a portion of the Nahanni Assets. We are of the view that the foregoing agreement potentially resulted in a 20% net profit interest applicable to a maximum of 250 Mcf/d of production in certain of the Nahanni Assets payable to the third party. In addition, the third party has previously alleged that the agreement between the third party and Nahanni resulted in a further 20% net profits interest, convertible into a working interest, in certain of the Nahanni Assets. We have disputed this assertion on several bases, including that any potential arrangement between the third party and Nahanni, even if valid, (a) did not necessarily attach to the relevant properties and is personal between Nahanni and the third party; (b) pertains at most to Nahanni's former working interest in six potential wells included in the Nahanni Assets; and (c) even if valid, the third party is responsible for accrued and unpaid operating costs to date. See "Risk Factors" – Our business will suffer if we cannot obtain or maintain necessary licenses or if there is a defect in the chain of title.

We record assets acquired and liabilities assumed at their estimated acquisition date fair values, while transaction and integration costs associated with the acquisitions are expensed as incurred. We use relevant market assumptions to determine fair value and allocate purchase price, such as future commodity pricing for purchased hydrocarbons, market multiples for similar transactions and replacement value for certain equipment. Many of the assumptions are unobservable. Our preliminary assessment of the fair value of the Nahanni Assets and the Devon Assets resulted in a valuation of $25,526,554 and $22,103,530, respectively. As a result of our purchase price allocation, we recognized a gain on bargain purchase of $11,766,787 on the Nahanni Assets. The gain on bargain purchase was primarily attributable to the strategic nature of the divestiture by the motivated seller, coupled with a confluence of certain favorable economic trends in the industry and the geographic region in which the Nahanni Assets are located. The excess of the consideration paid over the estimated fair value of the Devon Assets was $1,194,365. We have recorded this amount as goodwill.

| |

|

Fair Value of Assets Acquired

|

|

| |

|

|

|

|

|

|

|

|

|

|

Asset Description

|

|

|

|

|

|

|

|

|

|

|

Unproven Properties

|

|

|

|

|

|

|

|

|

|

|

Unproved leasehold costs

|

|

|

14,548,787 |

|

|

|

13,827,001 |

|

|

|

28,375,788 |

|

|

Plant and equipment

|

|

|

8,594,362 |

|

|

|

6,484,001 |

|

|

|

15,078,363 |

|

|

Gathering systems

|

|

|

2,383,405 |

|

|

|

1,788,001 |

|

|

|

4,171,406 |

|

|

Vehicles

|

|

|

- |

|

|

|

4,527 |

|

|

|

4,527 |

|

| |

|

|

25,526,554 |

|

|

|

22,103,530 |

|

|

|

47,630,084 |

|

|

Goodwill

|

|

|

- |

|

|

|

1,194,365 |

|

|

|

1,194,365 |

|

|

Total Assets acquired - KGP

|

|

|

25,526,554 |

|

|

|

23,297,895 |

|

|

|

48,824,449 |

|

KGP Governing Agreements

Joint Operating Agreement

We or our affiliates are party to a Joint Operating Agreement originally dated as of May 28, 1959, as amended, originally among Canada Southern Petroleum Ltd., Magellan Petroleum Corporation, Oil Investments, Inc., Home Oil Company Limited, Kern County Land Company, Alminex Limited, United Oils Limited and Signal Oil and Gas Company (the "JOA"), which governs the operating and joint venture accounting procedures relating to the KGP.

We have been appointed to act as the interim manager operator (the "Manager Operator") for the other joint operators under the JOA. Pursuant to the terms of the JOA, the Manager Operator has sole and exclusive management and control of the exploration, development and operation of the KGP in addition to its rights, duties and obligations as a joint operator, including the right to vote on the removal or appointment of the Manager Operator. We may cease to be Manager Operator if we make a general delegation of our powers of management and control, if we cease to hold at least a 10% participating equity in the KGP, or if we become bankrupt or insolvent, make any general assignment for the benefit of creditors, any execution or attachment issue is made against us whereby all or part of our participating equity shall be taken by any custodian, receiver, trustee or other legal authority, or an effective resolution shall have been passed for the winding up or liquidation of our business and affairs.

We may be liable to the joint operators in damages for any acts undertaken or our failure to do anything under the JOA where such act or failure was done pursuant to acts of fraud, dishonesty or gross neglect on the part of any of our officers in carrying out our duties as Manager Operator or our failure to remedy any default as soon as reasonably possible after the receipt of written notice of a joint operator in respect of such default.

In the event that we cease to be, or resign from the position of, the Manager Operator, the joint operators will appoint a successor Manager Operator, however we will not be released from our obligations under the JOA for a period of three months after our discharge unless the successor Manager Operator shall have taken over the options under the JOA.

Meetings of the joint operators may be called at any time by providing not less than seven days written notice of the time and place of such meetings to each of the other joint operators. Any decision to carry the matter forward at a meeting of the joint operators requires the approval of more than two-thirds of the participating equities in the KGP with such decision being binding upon all of the joint operators. Decisions which are approved at meetings of the joint operators shall be carried out by the Manager Operator.

In the event that a joint operator fails to pay its share of any costs or expenses as required under the JOA (and such default shall continue for thirty days after the Manager Operator has provided notice specifying such default and requiring it to be remedied), the Manager Operator may place a lien on the participating equity of such joint operator's share to secure payment of its share of the specified costs and expenses. The Manager Operator may enforce the lien by taking possession of all or any part of the participating equity of a defaulting joint operator and may sell and dispose of all or any part of such participating equity either in whole or in separate parcels at public auction or by private tender. The proceeds of any such sale shall be first applied by the Manager Operator in payment of any outstanding costs or expenses owed by the defaulting joint operator, and any such remaining balance shall be paid to the defaulting joint operator.

No joint operator shall be required to participate in the cost of drilling, deepening, or reworking of any well under the JOA. If no well is being drilled or deepened in the KGP for the joint account, and provided no drilling or deepening operations have been approved in any budget, then any joint operator who wishes to deepen or re-work any well which is incapable of producing petroleum substances in paying quantities or to drill a new well, is to provide written notice to the other joint operators, including the location, depth and estimated cost of the operations, of its intention to proceed with the operation at its own cost and risk. Each joint operator will be deemed to be a participant in such operation unless it has given written notice to the other joint operators within thirty days of receiving the written notice of its intention not to participate. The joint operator providing the written notice in addition to the participating joint operators will be entitled to require the Manager Operator to commence work on the operations within sixty days of receipt by the joint operators of the written notice.

More specifically, decisions at a meeting requires an affirmative vote of 66 2/3% of the joint venture partners. Any budget approved by 66 2/3% shall be binding on all joint venture partners.

With respect to independent operations for an exploratory well, if a joint venture partner elects to not participate in the well it is required to immediately assign all of its participating interest in all formations as follows:

|

1.

|

Assign six sections of land (640 acres per section) if well depth is greater than 6,000 feet unless production is established at less than 6,000 feet.

|

|

2.

|

Assign four sections of land if well depth less than 6,000 feet or an exploratory well of greater than 6,000 feet establishes production at less than 6,000 feet.

|

Sections can be selected laterally or diagonally adjoining the section in which the well was drilled.

With respect to an independent operation that is a deepening, reworking operation or drilling of a development well a non-participating party has 30 days following the completion of the operation to elect to participate by paying three times the cost of the operation relating to the non-participant’s working interest. If the non-participant fails to pay it will immediately assign its interest in the section(s) on which well was drilled to the participating working interest.

A joint operator may not dispose of its interest under the JOA unless the proposed transferee of its interest agrees to be bound by the terms of the JOA.

Construction, Ownership and Operating Agreement

We or our affiliates are party to the Kotaneelee Production Facilities Construction Ownership and Operating Agreement made effective as of December 1, 1980, as amended, originally among Amoco Canada Petroleum Company Ltd., Canadian Superior Oil Ltd., Columbia Gas Development of Canada Ltd., Amoco Canada Resources Ltd., and Esso Resources Canada Limited (the "CO&O Agreement"). The CO&O Agreement governs the ownership, operation and maintenance of: the gas plant and all related facilities utilized to process natural gas (the "Plant"); the facilities utilized for gathering and transporting natural gas from the downstream flange of the wing valve of each well to the upstream flange of the inlet facilities of the Plant for processing (the "Gathering System"); and all support facilities, other than the Plant and Gathering System, utilized for operations (collectively with the Plant and Gathering System, the Production Facilities) in the Kotaneelee area.

The supervision and control of operations under the CO&O Agreement is governed by an operating committee (the Operating Committee) comprised of representatives of each of the owners having an ownership interest in the Production Facilities (the Owners). The matters to be governed by the Operating Committee under the CO&O Agreement include, but are not limited to: the approval of the design, modification and alterations of the Production Facilities; the approval of expenditures; the sale or disposition of surplus material or equipment; the appointment of auditors; the appointment or designation of committees or subcommittees to study any problems in connection with the Production Facilities or operations thereunder; the removal of the Operator or designation of a successor; the determination of capacity from time to time; and any fees charged for utilization of the Production Facilities.

Each Owner has a voting interest equal to its ownership interest in the Production Facilities. Decisions of the Operating Committee with respect to general matters under the CO&O Agreement require the approval of two or more Owners having voting interests greater than 60%, however, if only one Owner votes against a matter before the Operating Committee, and such Owner has a voting interest between 40% and 50%, the matter may be approved despite the failure to obtain the approval of voting interests greater than 60%. Decisions of the Operating Committee with respect to special matters, such as the removal of the operator, the alteration of the Plant or Gathering System or the termination of the CO&O Agreement, require a higher threshold of voting interests in order to carry the matter.

We have been appointed as the Interim Operator by the Operating Committee under the CO&O Agreement. Our duties in the capacity of Operator pursuant to the terms of the CO&O Agreement include, but are not limited to: preparing and submitting all reports relating to the operations of the Production Facilities to the appropriate governmental agency; furnishing a monthly report to each Owner for the preceding month of the amount and ownership of natural gas received at the Plant, the amount of such natural gas handled in the Plant, the amount and ownership of processed gas and plant products, and the amount of processed gas shipped or delivered from the Plant for the account of each Owner; consulting with the Owners and keeping them advised of all matters arising in connection with the operations of the Production Facilities; conducting all operations in connection with the Production Facilities in accordance with all applicable laws; and paying and discharging all costs, expenses and taxes incurred in connection with the operations associated with the Production Facilities. In our capacity as Operator we are not permitted to make any expenditure in connection with the Production Facilities without the approval of the Owners other than in certain limited exceptions. We may be liable to the Owners for any loss or damage suffered by the Owners resulting or arising from the operations associated with the Production Facilities where such loss or damage results from our gross negligence or willful or wanton misconduct.

If an Owner wishes to sell all or any portion of its interest in the Plant or receives a bona fide offer for the purchase of all or any portion of its interest in the Production Facilities (the "Sale Interest"), the Owner must provide written notice to each of the other Owners, including the purchaser if it is an Owner, of the offer containing full and complete details of the purchase price and terms and conditions of the offer (the "Sales Notice"), and each of the Owners shall have the right to purchase a share of the Sales Interest ratably in accordance with their respective interests in the Production Facilities. If the Owners do not elect to purchase all of the Sales Interest then the Selling Owner shall be at liberty to sell the entire Sale Interest to the Purchaser on the same terms and conditions specified in the Sales Notice. The person acquiring the Sales Interest (if not already an Owner) is required to execute and deliver to the operator a counterpart of the CO&O Agreement in order for the sale of the Sale Interest to be effective.

Owners are permitted to dispose of their interest in the Production Facilities without providing written notice to the other Owners if it is in conjunction with the disposal of the Owner's working interest in the lands in the Kotaneelee Area; through a merger, amalgamation, reorganization, consolidation or sale of all of its oil and gas producing properties in the Yukon Territories; or by way of mortgage, pledge or hypothecation provided that the mortgagee, pledgee or hypothecatee shall hold the Owner's interest in the Production Facilities subject to the terms and conditions of the CO&O Agreement.

The CO&O Agreement may be terminated when the Operating Committee determines to cease operations at the Production Facilities.

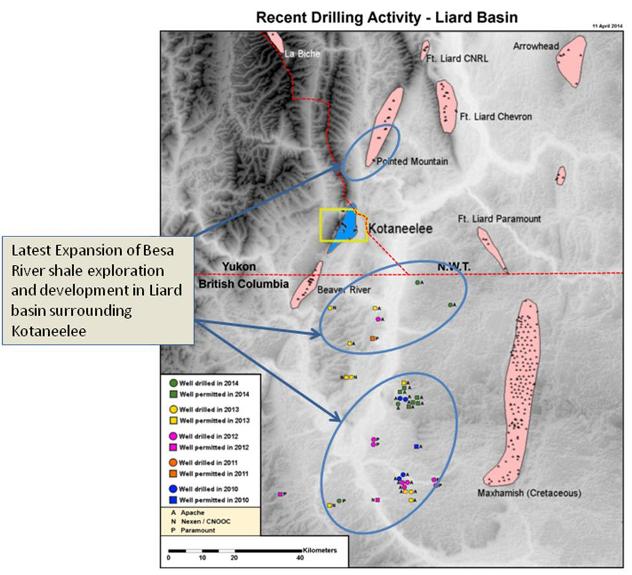

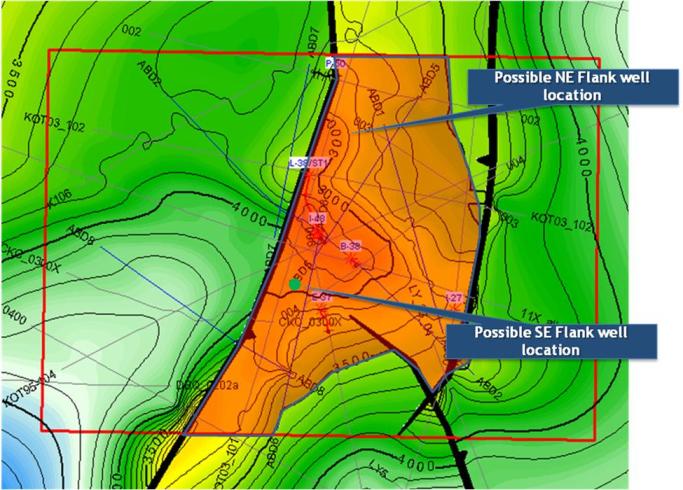

Future Development and Exploration

Our long term exploration plan for the KGP involves the exploitation of both conventional and unconventional (shale) gas resources. Phase one of that plan includes the rework or recompletion of up to three wells, and the drilling, completion and equipping of two new wells. These efforts will focus on previously identified or tested conventional gas zones. During phase one, we intend to target lower cost development and exploration targets with the potential to create positive cash flows and long term sustainability for the KGP. During this period we also plan to carry out feasibility studies to investigate the potential of developing a modular LNG project to supply LNG to the Yukon and other areas of north western Canada. Early estimates indicate the cost of phase one may range from US$20,000,000 to US$25,000,000 on a gross basis. We expect that approximately US$10,000,000 to US$15,000,000 in costs associated with phase one exploration to be incurred during the next twelve months. See "Use of Proceeds".

Phases two and three of our exploration plan anticipate further development of conventional reservoirs and testing and development of shale resources.

The San Miguel Lease - Zavala County, Texas

We are party to a farmout and participation agreement (the "Eagleford Agreement"), which provides for our acquisition of a 21.25% net working in a 2,629 acre oil and gas lease known as the San Miguel Lease, insofar as that lease covers from the surface to the base of the San Miguel formation. The San Miguel Lease is located in Zavala County, Texas and has no current reserves or production.

Under the Eagleford Agreement, to earn our initial 21.25% working interest with Dyami Energy LLC and Eagleford Energy Inc. (net revenue interest 15.94%), we were obligated to drill and complete a vertical test well (the Test Well) in the San Miguel shale formation. We were also obligated to perform an injection operation on the Test Well. If the Test Well was prospective for production in commercial quantities, we were required to equip the Test Well and place it on production. If we determine that the Test Well is not prospective for production in commercial quantities, we are responsible for the abandonment of the Test Well.

During April and May 2011, we drilled and completed the Test Well, performed injection operations and earned our initial interest. The Test Well was drilled into the San Miguel heavy oil zone to a depth of 3,168 feet. The well encountered oil but after completion, it was determined that the oil was subject to significant viscosity changes related to temperature reductions from formation to recovery at surface. The Test Well was stimulated with nitrified hydrochloric acid and placed on production. Oil viscosity, however, has prohibited economic operation of the Test Well. As a result, during August 2011, and November 2011, we recognized losses on the impairment of oil and gas assets of $835,659 and $44,335, respectively. The carrying value of oil and gas properties was likewise reduced to reflect the impairment of the San Miguel Lease.

We continue to consider methods to improve production from the Test Well. In the event we are unable to substantially improve production, we intend to abandon the Test Well, or actively pursue the sale of our interest in the San Miguel Lease. We have made no additional expenditures on the San Miguel Lease since November 30, 2011. The entire asset retirement obligation relating to the San Miguel Lease has been classified as a current liability in our May 31, 2014 financial statements.

Company History

We were incorporated under Chapter 78 of the Nevada Revised Statutes on July 22, 2008 as "EFL Overseas, Inc". On March 1, 2013, our shareholders approved amendments to our Articles of Incorporation to: (a) change our name to "EFLO Energy, Inc."; and (b) change our authorized capital to 150,000,000 shares of common stock and 10,000,000 shares of preferred stock.

2014 Convertible Note Offering

In August 2014, we sold convertible notes having an aggregate principal amount of $1,400,000 (the "2014 Convertible Notes"), to three investors under the following general terms (the "2014 Convertible Note Offering"):

|

●

|

the maturity date of the 2014 Convertible Notes is December 31, 2014;

|

|

●

|

at the option of the note holder, upon completion of this offering, the principal amount of the 2014 Convertible Notes may be convertible into shares of our common stock at a price of $● per share, being the price per share of this Offering, less a 10% discount (the “2014 Conversion Right”);

|

|

●

|

a 6% financing fee on the principal sum of the 2014 Convertible Notes, is payable:

|

|

a.

|

in the event the note holder exercises its 2014 Conversion Right, in 69,422 shares of our common stock; or

|

|

b.

|

in the event the note holder does not exercise its 2014 Conversion Right, at the option of the note holder in cash, or 69,422 shares of our common stock;

|

|

●

|

the 2014 Convertible Notes are be non-interest bearing so long as they are paid or converted prior to December 31, 2014. In the event of default, or if a 2014 Convertible Note is not paid, or converted on or before December 31, 2014:

|

|

a.

|

the interest rate will increase to 10% per annum, payable monthly; and

|

|

b.

|

an additional 4% financing fee (the "Default Financing Fee") on the then outstanding principal balance of the 2014 Convertible Notes shall become due and payable. The Default Financing Fee will be paid in common shares at a conversion price equal to the closing market price of the common shares on the date of the event of default, or December 31, 2014, whichever is earliest.

|

In aggregate, we have reserved ● shares of our common stock, or such greater number of shares as may be issuable upon our election to pay interest in shares of our common stock under the terms of the 2014 Convertible Notes, for issuance upon conversion of the 2014 Convertible Notes in accordance with their terms. See "Consolidated Capitalization".

2013 Convertible Note Offering

On October 30, 2013, we sold convertible notes having an aggregate principal amount of $2,255,000 (the "2013 Convertible Notes"), to 22 accredited investors, under the following general terms (the "2013 Convertible Note Offering"):

|

●

|

the maturity date of the 2013 Convertible Notes is April 30, 2015;

|

|

●

|

the principal amount of the 2013 Convertible Notes is convertible into shares of the our common stock at a price of US$1.00 per share;

|

|

●

|

the 2013 Convertible Notes bear interest at 10% per annum payable, at our election, in cash or shares of our common stock at a rate of US$1.25 per share;

|

|

●

|

the interest rate payable on the 2013 Convertible Notes is subject to escalation to 12.5% or 15.0% per annum for the entire period during which the 2013 Convertible Notes are outstanding, in the event we do not complete a listing of our common stock or the migration of trading of our common stock to a senior stock exchange (which includes the TSX Venture Exchange) by July 30, 2014 or October 31, 2014 , respectively, from date of issuance; and

|

|

●

|

we also issued stock purchase warrants in connection with the 2013 Convertible Note Offering providing for the purchase of up to 1,127,500 shares of our common stock (one full share for each US$2.00 invested in the 2013 Convertible Notes) at an exercise price of US$1.25 per share for a period of three years (the Warrants).

|

If we complete our migration to a senior stock exchange by July 30, 2014, the interest we will pay on the convertible notes from the date of the issuance until maturity, assuming none of the notes are converted into shares of our common stock, will be $338,250.

If we complete our migration to a senior stock exchange after July 30, 2014 but before October 31, 2014, the interest we will pay on the convertible notes from the date of the issuance until maturity, assuming none of the notes are converted into shares of our common stock, will be $422,812.

In the event we do not complete our migration to a senior stock exchange by October 31, 2014, the interest we will pay on the convertible notes from the date of the issuance until maturity, assuming none of the notes are converted into shares of our common stock, will be $507,375.

In aggregate, we have reserved 3,382,500 shares of our common stock (comprised of 2,255,000 shares issuable on conversion of the principal of the 2013 Convertible Notes and 1,127,500 shares issuable on exercise of the Warrants), or such greater number of shares as may be issuable upon our election to pay interest in shares of our common stock under the terms of the 2013 Convertible Notes, for issuance upon conversion of the 2013 Convertible Notes or exercise of the Warrants in accordance with their terms. See "Consolidated Capitalization".

We paid US$176,400 in finders' fees with respect to the 2013 Convertible Note Offering. Entities controlled by our Chief Executive Officer and President acquired $50,000 and $150,000 of 2013 Convertible Notes, and were issued 25,000 and 75,000 Warrants, respectively, in the 2013 Convertible Note Offering under these terms.

Acquisition of Kotaneelee Interests

During the period from July 18, 2012 through October 17, 2012, we acquired working interests totaling 53.65% (including a 100% working interest in one shut in gas well) in the KGP located in the Yukon Territory in Canada. We believe the KGP has significant conventional and shale gas potential and is supported by an environment of growing investment in gas processing and export in the Pacific Northwest.

Our acquisition of an initial working interest of 22.989% (including a 69.337% working interest in one shut in gas well) in the KGP was completed on July 18, 2012, with an effective date of July 1, 2012. Since that date, we have been responsible for the operations of the KGP, and have recognized our portion of its related net revenues and costs as an increase to the unamortized cost pool related to our unproven interests while economic viability is being evaluated.

Pre-Kotaneelee Events

Prior to our initial working interest acquisition in the KGP, we had generated no revenues and had no proven reserves. Following our acquisition of the KGP, we have generated limited revenue which reduced the unamortized cost pool related to our unproven interests while economic viability is being evaluated.

During March 2011, we initiated oil and gas operations by entry into the Eagleford Agreement which provided for our acquisition of a net working interest, ranging from 21.25% to 42.5%, in the San Miguel Lease. The San Miguel Lease is located in Zavala County, Texas, and has no current production or commercial reserves.

On April 28, 2010, shareholders owning a majority of our outstanding shares approved a 20 for 1 forward split of our common stock. The stock split was based on market conditions and upon a determination by the board of directors that the stock split was in our best interests and in the best interests of our shareholders. We filed the amendment to our Articles of Incorporation pertaining to the forward stock split with the Nevada Secretary of State on May 3, 2010. The forward stock split became effective on the OTC Bulletin Board on June 30, 2010. Prior to the forward stock split, we had 330,000 shares of common stock outstanding. Subsequent to the forward stock split we had 6,600,000 shares of common stock outstanding.

OTHER OIL AND GAS INFORMATION

Oil and Gas Properties

The following is a description of assets in which we have an interest and that are material to our operations and exploration activities.

Kotaneelee

The KGP, our only material oil and gas property, is comprised of 30,542 acres located onshore in the Nahanni region of the Yukon Territory. Title to our initial 22.989% working interest in the KGP, acquired on July 18, 2012, is held by our wholly-owned Canadian subsidiary, EFLO Energy Yukon Ltd. ("EFLO Yukon"). Title to the additional 30.664% working interest in the KGP, acquired on October 17, 2012, is held by our wholly-owned Canadian subsidiary 1700665 Alberta Ltd. EFLO Yukon acts as managing operator of the KGP.

We currently hold a 100% working interest in one shut-in proved undeveloped gas well targeting the Nahanni zone and a before payout working interest of 53.65% (after payout working interest of 52.77%) in three probable locations (two of which target the Flett zone and one of which targets the Arnica zone) and one proved undeveloped location targeting the Nahanni zone.

See "Description of the Business – The Kotaneelee Gas Project".

Oil and Gas Wells

During the years ended August 31, 2013 and 2012, we did not drill or participate in the drilling of any wells. During the year ended August 31, 2011, we drilled one exploratory well which, as April 30, 2014, was not productive. As of April 30, 2014, we were not drilling or completing any wells.

The following table shows, as at August 31, 2013, 2012 and 2011, the number and status of our wells:

| |

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2013

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

1.00 |

|

|

|

0.22 |

|

|

|

3.00 |

|

|

|

2.07 |

|

|

2012

|

|

|

- |

|

|

|

- |

|

|

|

1.00 |

(1) |

|

|

0.69 |

|

|

|

1.00 |

|

|

|

0.22 |

|

|

|

2.00 |

|

|

|

0.46 |

|

|

2011

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

1.00 |

|

|

|

0.22 |

|

|

|

- |

|

|

|

- |

|

Notes:

|

(1)

|

All of the above natural gas wells are located in the Yukon Territory and the above oil well is located in Texas, USA. "Non-Producing" wells means wells which have encountered and are capable of producing crude oil or natural gas but which are not producing due to lack of available transportation facilities, available markets or other reasons.

|

|

(2)

|

"Gross" wells are the total number of wells in which we have an interest.

|

|

(3)

|

"Net" wells are the aggregate of the numbers obtained by multiplying each gross well by our percentage working interest therein.

|

At August 31, 2014, we had a 100% working interest in one conventional natural gas well in the KGP. This well was shut in during September 2012 and remained shut in as of August 31, 2014.

Production, Pricing and Lease Operating Cost Data

The following table describes, for the years ended August 31, 2013 and 2012, crude oil and natural gas production, average lease operating expenses per mcf (including severance and other taxes and transportation costs) and our average sales prices. All of this information relates to our working interest in the KGP:

| |

|

|

|

|

Average

|

|

|

Average

|

|

| |

|

Natural Gas

|

|

|

Lease Operating

|

|

|

Average Sales

|

|

| |

|

Production

|

|

|

Expense

|

|

|

Price

|

|

| |

|

(mcf)

|

|

|

(per mcf)

|

|

|

(per mcf)

|

|

| Year ended: |

|

|

|

|

|

|

|

|

|

| August 31, 2013 |

|

|

24,927 |

|

|

$ |

1.51 |

|

|

$ |

2.02 |

|

| August 31, 2012 |

|

|

111,425 |

|

|

$ |

2.43 |

|

|

$ |

2.30 |

|

Well and Lease Data

The following table shows, by state/territory, our producing wells, developed acreage, and undeveloped acreage, excluding service (injection and disposal) wells as of July 30, 2014:

| |

|

Productive Wells

|

|

|

Developed Acreage

|

|

|

Undeveloped Acreage

|

|

|

State/Territory

|

|

Gross (1)

|

|

|

Net (2)

|

|

|

Gross

|

|

|

Net

|

|

|

Gross

|

|

|

Net

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Yukon

|

|

|

––

|

|

|

|

––

|

|

|

|

––

|

|

|

|

––

|

|

|

|

28,124

|

|

|

|

15,088

|

|

|

Texas

|

|

|

––

|

|

|

|

––

|

|

|

|

––

|

|

|

|

––

|

|

|

|

40

|

|

|

|

8.6

|

|

|

(1)

|

"Gross" refers to the total acres in which we have an interest, directly or indirectly.

|

|

(2)

|

"Net" refers to the total acres in which we have an interest, directly or indirectly, multiplied by the percentage working interest owned by us therein.

|

Undeveloped acreage includes leasehold interests on which wells have not been drilled, or completed, to the point that would permit the production of commercial quantities of natural gas and oil, regardless of whether the leasehold interest is classified as containing proved undeveloped reserves.

The following table shows, as of July 30, 2014, the status of our gross acreage:

|

State/Territory

|

Held by

Production

|

|

Not Held by

Production

|

| |

|

|

|

|

|

Yukon

|

|

--

|

|

28,124

|

|

Texas

|

|

40

|

|

--

|

Acres that are Held by Production remain in force so long as oil or gas is produced from the well on the particular lease. Leased acres, which are not Held by Production, often require annual rental payments to maintain the lease until the first to occur of the following: the expiration of the lease or the time oil or gas is produced from one or more wells drilled on the leased acreage. At the time oil or gas is produced from wells drilled on the leased acreage, the lease is considered to be Held by Production.

The following table shows the years our leases, which are not Held by Production, will expire, unless a productive oil or gas well is drilled on the lease.

|

Leased Acres (Gross)

|

|

Expiration of Lease

|

|

28,124

|

|

2020

|

Costs Incurred

Oil and gas revenues and lease operating expenses related to unproved oil and gas properties that are being evaluated for economic viability are offset against the full cost pool until proved reserves are established, or determination is made that the unproved properties are impaired. During the nine months ended May 31, 2014, and for the years ended August 31, 2013 and 2012, we capitalized $935,064, $1,264,037 and $3,851, respectively, of lease operating expense, net of oil and gas revenue, into the KGP full cost pool.

Other than the capitalization of net lease operating expense, our capital expenditures on the KGP for the years ended August 31, 2013 and 2012, consisted of the acquisition of the Nahanni Assets which were recorded at $25.5 million during the year ended August 31, 2013, and the acquisition of the Devon Assets which were recorded at $23.3 million during the year ended August 31, 2012.

During the years ended August 31, 2012 and 2011, we capitalized $44,335 and $835,659, respectively, in exploration expenditures relating to the San Miguel Lease. During August 2011, and November 2011, we recognized losses on the impairment of the San Miguel lease to the full extent of its carrying value.

Exploration and Development Activities

Our exploration plan for the KGP involves the exploitation of both conventional and unconventional (shale) gas resources. Phase one of that plan includes the rework or recompletion of up to three wells, and the drilling, completion and equipping of up to two new wells. These efforts will focus on previously identified or tested conventional gas zones. See "Use of Proceeds".

During phase one, we intend to target lower cost development and exploration targets with the potential to create positive cash flows and long term sustainability for the KGP. In addition, we plan to evaluate the share prospectively by performing analysis on the shale reservoirs within the wells that we drill to the lower conventional Devonian targets.

Additional Information Concerning Abandonment and Reclamation Costs

In connection with our acquisition of the KGP, we absorbed asset retirement obligations totaling $16,687,000. In addition, we have recognized $80,000 in abandonment liabilities related to the San Miguel Lease. Other than these liabilities, we have no other retirement obligations or abandonment and reclamation costs.

Forward Contracts

Although we have no set policy, our management may use financial instruments to reduce corporate risk in certain situations. Risk management policies will be developed over time as we build a production base to support sustainable growth. Currently, we have no hedging commitments due to the nature of our current asset portfolio.

Tax Horizon

Presently we do not expect to pay current income tax for the predictable future. This estimate is based on existing tax pools, planned capital activities and current forecasts of taxable income, however, several factors can affect this prediction including commodity prices, future production, corporate expenses and both the type and amount of capital expenditures incurred in future reporting periods.

Production

We did not produce any oil or gas during the fiscal year ended August 31, 2014

Production History

There has been no production from the Kotaneelee properties since September 2012. We acquired the Devon Assets effective July 18, 2012. Following the acquisition during the 2012 calendar year, Kotaneelee produced an average of 1,913 Mcf/d or 319 boe/d for a total of 26,788 Mcf or 4,465 boe prior to being shut in September 2012. The average price received net of all third party transportation and processing fees was Cdn$0.257/Mcf. There were no crown royalties owed or paid during this period.

OTHER BUSINESS INFORMATION

Competition

The petroleum and natural gas industry is highly competitive. Numerous independent oil and gas companies and major oil and gas companies actively seek out and bid for oil and gas properties as well as for the services of third party providers, such as drilling companies, upon which we rely. From time to time, seismic vendors, drilling contractors, rigs and supplies may be in short supply. Their availability may be controlled by other larger explorers in the area. Native title holders or certain of our competitors may control pipeline capacity, roads, bridges and other infrastructure we require to access or fully exploit our properties. Our reliance upon their resources may create a competitive disadvantage for us. A substantial number of our competitors have longer operating histories and substantially greater financial and personnel resources than we do, and have demonstrated the ability to operate through industry cycles.

Some of our competitors not only explore for, produce and market petroleum and natural gas, but also carry out refining operations and market the resultant products on a worldwide basis which may provide them with additional sources of capital. Larger and better capitalized competitors may be in a position to outbid us for particular prospect rights. These competitors may also be better able to withstand sustained periods of unsuccessful drilling. Larger competitors may be able to absorb the burden of any changes in laws and regulations more easily than we can, which would adversely affect our competitive position.

Petroleum and natural gas producers also compete with other suppliers of energy and fuel to industrial, commercial and individual customers. Competitive conditions may be substantially affected by various forms of energy legislation and/or regulation considered from time to time by the governments and/or their agencies and other factors which are out of our control including, international political conditions, terrorism, overall levels of supply and demand for oil and gas, and the markets for synthetic fuels and alternative energy sources.

See "Risk Factors – Risks Associated with Our Business".

Regulation

The exploration, production and sale of oil and gas are extensively regulated by governmental authorities. Applicable legislation is under constant review for amendment or expansion. These efforts frequently result in an increase in the regulatory burden on companies in our industry and consequently an increase in the cost of doing business and decrease in profitability. Numerous governmental departments and agencies are authorized to, and have, issued rules and regulations imposing additional burdens on the oil and gas industry that often are costly to comply with and carry substantial penalties for non-compliance. Production operations are affected by changing tax and other laws relating to the petroleum industry, constantly changing administrative regulations and possible delays, interruptions or termination by government authorities.

Oil and gas mineral rights may be held by individuals, corporations or governments having jurisdiction over the area in which such mineral rights are located. As a general rule, parties holding such mineral rights grant licenses or leases to third parties to facilitate the exploration and development of these mineral rights. The terms of the leases and licenses are generally established to require timely development. Notwithstanding the ownership of mineral rights, the government of the jurisdiction in which mineral rights are located generally retains authority over the drilling and operation of oil and gas wells.

See "Industry Conditions – Government Regulation".

Environmental Matters

Our operations are also subject to a variety of constantly changing laws and regulations governing the discharge of materials into the environment or otherwise relating to environmental protection. Failure to comply with environmental laws and regulations can result in the imposition of substantial fines and penalties as well as potential orders suspending or terminating our rights to operate. Some environmental laws to which we are subject provide for strict liability for pollution damage, rendering a company liable for environmental damage without regard to negligence or fault on the part of such company. In addition, we may be subject to claims alleging personal injury or property damage as a result of alleged exposure to hazardous substances, such as oil and gas related products or for other reasons.

Some environmental protection laws and regulations may expose us to liability arising out of the conduct of operations or conditions caused by others, or for acts which were in compliance with all applicable laws at the time the acts were performed. Changes in environmental laws and regulations, or claims for damages to persons, property, natural resources or the environment, could result in substantial costs and liabilities to us. These laws and regulations may substantially increase the cost of exploring, developing, producing or processing oil and gas and may prevent or delay the commencement or continuation of a given project and thus generally could have a material adverse effect upon our capital expenditures, earnings, or competitive position. We believe that we are in substantial compliance with current applicable environmental laws and regulations. Nevertheless, changes in existing environmental laws and regulations or in the interpretations thereof could have a significant impact on us and the oil and gas industry in general.

See "Risk Factors — Risks Associated with Our Business".

Research and Development

Other than engineering, geochemical, geophysical and exploration programs capitalized in connection with our oil and gas concessions, we have devoted no substantial efforts to research and development within the last two fiscal years.

Employees

We currently have no full or part-time employees. We use consultants and contractors to provide us with, among other things, executive management, accounting services, field operating support and technical engineering. See "Directors and Officers" and "Executive Compensation".

Reorganizations

Since incorporation, we have not completed any material reorganization. No material reorganization is currently proposed for the current financial year.

INDUSTRY CONDITIONS

Government Regulation

The oil and natural gas industry is subject to extensive controls and regulations governing its operations (including land tenure, exploration, development, production, refining, transportation and marketing) imposed by legislation enacted by various levels of government.

More particularly, matters subject to current governmental regulation and/or pending legislative or regulatory changes include the licensing for drilling of wells, the method and ability to produce wells, surface usage, conservation matters, bonds or other financial responsibility requirements, the spacing of wells, unitization and pooling of properties, and royalties and taxation. Failure to comply with the laws and regulations in effect from time to time may result in the assessment of administrative, civil, and criminal penalties, the imposition of remedial obligations, and the issuance of injunctions that could delay, limit, or prohibit operations.

We do not expect that any of these controls or regulations will affect our operations in a manner materially different than they would affect other oil and gas companies of similar size, however these controls and regulations should be considered carefully by those investing in the oil and gas industry. All current legislation is a matter of public record, and we are unable to predict what additional legislation or amendments may be enacted. Outlined below are some of the principal aspects of legislation, regulations and agreements governing the oil and gas industry in Canada and, in particular, in the Yukon.

Land Tenure and Production Rights Processes

Federal Crown Lands

Crude oil and natural gas located in the Yukon is owned predominantly by the Crown and governed by the Government of the Yukon.

The Government of the Yukon, through the Minister of Economic Development (Minister), grants rights to explore for and produce oil and natural gas pursuant to dispositions (oil and gas permits, oil and gas leases, and other instruments or contracts). Dispositions may be issued by the Minister pursuant to a call for bids, on application, or pursuant to any other procedure determined by the Minister.

Permits allow the permit-holder to explore, drill and test for oil and gas. Permits may be renewed under certain conditions and, subject to the regulations and legislations, convey to the permit-holder the right to apply for a lease. The lease grants, in accordance with the terms and conditions of the lease, the right to oil and gas. An oil and gas lease's term is ten years and renewable for further terms of five years under certain conditions. In addition, the foregoing dispositions are subject to the legislations, regulations and any terms and conditions prescribed by the Minister of Economic Development.

The above tenure regime applies to dispositions made after November 19, 1998. Federal dispositions relating to oil and gas interests in the Yukon Territory prior to such date remain in effect until such dispositions expire, are cancelled, or are surrendered by the holder thereof. Properties in the KGB are all federal dispositions made before November 19, 1998.

Freehold Lands

Oil and natural gas located in the Yukon Territory can also be owned privately and rights to explore for and produce such oil and natural gas are granted through leases on such terms and conditions as may be negotiated between the parties. Further, pursuant to agreements made between First Nations and the Government of Canada, First Nations have been granted title to certain lands in the Yukon Territory, in fee simple, including mines and minerals within, upon or under such lands.

In order to obtain the right to explore and produce minerals within these lands, corporations enter into an oil and gas lease with the owner (or its designated organization) of the lands. Generally, such a lease functions similar to crown oil and gas leases, whereby the lessor as the legal owner grants the lessee certain rights to explore for and produce oil and gas, subject to the specific terms of the lease. Typically, upon entering into the lease, the lessee is granted the right to explore and produce oil and gas from the land, for an initial term, followed by potential renewable terms. The lease generally includes, among other terms, various drilling and payment obligations, which if not satisfied by the lessee, may result in the termination of certain rights, the surrendering of specific portions of the leased land, payment penalties and/or termination of the lease. The grant to the lessee is also generally subject to the payment of royalties to the lessor based on production from the leased lands or revenues from production from the leased lands.

In addition, in First Nation leases, the lessee is often obligated to consult with the lessor and to commit to community support incentives and benefit agreements such as consideration for employment, training and business opportunities; support and utilization of local business; development of employment opportunity procedures; and development training plans.

Pricing and Marketing

Natural Gas

In Canada, the price of natural gas sold is determined by negotiations between buyers and sellers. Such price depends, in part, on natural gas quality, prices of competing natural gas and other fuels, distance to market, access to downstream transportation, weather conditions, the supply/demand balance, pipeline capacity and contractual terms. Natural gas exported from Canada is subject to regulation by the Canadian National Energy Board (“NEB”) and the Government of Canada. Exporters are free to negotiate prices and other terms with purchasers, provided that the export contracts continue to meet certain criteria prescribed by the NEB and the government of Canada. Natural gas exports for a term of less than two years or for a term of two to 20 years (in quantities not exceeding 30,000 m3/day) are subject to an NEB order. Any natural gas exported under a contract of longer duration (to a maximum of 25 years) or in larger quantities requires the exporter to obtain an export license from the NEB and the issuance of such license requires the approval of the NEB and its Governor in Council.

Crude Oil

Producers of crude oil negotiate sales contracts directly with oil purchasers, with the result that the market determines the price of oil. Such price depends, in part, on crude oil quality, prices of competing fuels, distance to market, the value of refined products, the supply/demand balance, contractual terms, pipeline capacity and the world price of oil. Oil may be exported from Canada pursuant to export contracts with terms not exceeding one year in the case of light crude, and not exceeding two years in the case of heavy crude, provided that an order approving such export has been obtained from the National Energy Board (the NEB). Any oil exported under a contract of longer duration (to a maximum of 25 years) requires the exporter to obtain an export licence from the NEB and the issuance of such licence requires the approval of the Governor in Council.

The North American Free Trade Agreement

Under the North American Free Trade Agreement (NAFTA), the Canadian government is free to determine whether exports of energy resources to the United States or Mexico should be allowed, provided that export restrictions do not: (1) reduce the proportion of energy resources exported relative to energy resources consumed domestically; (2) impose a higher export price than domestic price (subject to an exception relating to certain voluntary measures that restrict the volume of exports); and (3) disrupt normal channels of supply.

NAFTA prohibits discriminatory border restrictions and export taxes and also prohibits the imposition of minimum or maximum export or import price requirements except with respect to the enforcement of countervailing and anti-dumping orders and undertakings. Discipline on regulators is addressed as the signatories to NAFTA agree to ensure that their regulatory bodies provide equitable implementation of regulatory measures and minimize the disruption of contractual arrangements.

Royalties and Incentives

Royalties payable on production from privately owned lands are determined by negotiations between the lessor and lessee.

For crude oil, natural gas and related production from Crown lands, the royalty regime is a significant factor in the profitability of a corporation's production. Crown royalties payable in respect of Crown lands are determined by governmental regulation and are typically calculated as a percentage of the value of gross production. The Oil and Gas Royalty Regulations (Yukon) were passed in February 2008 and authorized the Government of Yukon to collect oil and gas royalties on Crown lands.

The lessees are considered the royalty client and are responsible for the payment of royalties in proportion to the lessee's interest in the disposition of production. Royalty clients are required to submit a Yukon Royalty Return for every month in which there is production detailing the quantity of oil, gas, and field condensate extracted from a well in a production month and summarizing royalty payable for a production month, along with allowances, and prescribed prices.

The Yukon Territory royalty system is based on an ad valorem structure. The rate of the royalty is based on a royalty rate, select price and par price (reference price) which vary between crude oil and gas. These rates along with the royalty allowances are prescribed by the Oil and Gas Resources Division Head. Par prices and select prices are generally set for each month in which there is production and select prices will vary from time to time. The royalty allowances function as proxies in lieu of transportation and processing costs.

The royalty rate for federal leases that have been grandfathered under the Oil and Gas Act (Yukon), which includes our leases under the KGP, is 10%.

For any new leases acquired in the Yukon, the basic formula for calculating royalties for crude oil and gas is similar and is described in the respective sections of the regulations:

R% = 10 x SP + 30(PP-SP)

PP

Where:

R = Royalty rate

SP = Select Price

PP = Par Price (Reference Price)

The royalty rate calculated by the foregoing formula is subject to a minimum royalty rate of 10% and a maximum royalty rate of 25%. There is also an initial period during which the royalty rate for crude oil and gas production is reduced to 2.5% for each well, subject to production thresholds. The current Select Price for gas is Cdn$4.00 per gigajoule and the current Reference Price is Cdn$2.65 per gigajoule.

From time to time, governments have established incentive programs for exploration and development through the royalty regime. Such programs often provide for royalty reductions, credits and holidays, and are generally introduced when commodity prices are low. The programs are designed to encourage exploration and development activity by improving earnings and cash flow within the industry.

Environmental Regulation

Climate Change Regulation

Internationally, Canada is a signatory to the United Nations Framework Convention on Climate Change and previously ratified the Kyoto Protocol established thereunder, which set legally binding targets to reduce nation-wide emissions of carbon dioxide, methane, nitrous oxide, and other greenhouse gases (“GHG”). In December 2011, the Canadian federal government announced that it would not agree to another commitment period under the Kyoto Protocol after 2012. The federal government instead endorsed the Durban Platform, a broad agreement reached among the 194 countries that are party to the United Nations Framework Convention on Climate Change. The Durban Platform sets forth a process for negotiating a new climate change treaty that would create binding commitments for all major GHG emitters. The Canadian government expressed cautious optimism that agreement on a new treaty could be reached by 2015. The Durban Platform followed the Copenhagen Accord reached in December 2009 which represents a broad political consensus and reinforces commitments to reducing GHG emissions but is not a binding international treaty. Although Canada had committed under the Copenhagen Accord to reduce its GHG emissions by 17% from 2005 levels by 2020, the target is not legally binding. The impact of Canada's withdrawal from the Kyoto Protocol on prior GHG emission reduction initiatives is uncertain.

Domestically, the Canadian federal government released in 2007 its Regulatory Framework for Air Emissions, which was updated in March 2008 in a document entitled Turning the Corner: Regulatory Framework for Industrial Greenhouse Gas Emissions. On January 30, 2010 the Canadian federal government announced a GHG emission reduction target consistent with its commitment under the Copenhagen Accord to reduce GHG emissions to 17% below 2005 levels by 2020. Canada's framework proposes mandatory emissions intensity reduction obligations on a sector-by-sector basis. To date, regulations for Canada's transportation and coal-fired electricity sectors have been developed, but none have been developed for the oil and gas sector and regulations for the electricity sector aren't expected to take effect until 2015. In 2009, the Canadian federal government announced its commitment to work with the provincial governments to implement a North America-wide cap and trade system for GHG emissions, in cooperation with the United States, under which Canada would have its own cap-and-trade market for Canadian-specific industrial sectors that could be integrated into a North American market for carbon permits. The Government of Canada currently proposes to enter into equivalency agreements with provinces to establish a consistent regulatory regime for GHGs, but the success of any such plan is uncertain, possibly leaving overlapping levels of regulation. It is uncertain whether or when either Canadian federal GHG regulations for the oil and gas industry or an integrated North American cap-and-trade system will be implemented, or what obligations might be imposed under any such systems.

General Environmental Regulation

The oil and natural gas industry is currently subject to environmental regulation pursuant to provincial, territorial and federal legislation. Environmental legislation provides for restrictions and prohibitions on releases or emissions of various substances produced or utilized in association with certain oil and natural gas industry operations. In addition, legislation requires that well, pipeline and facility sites be abandoned and reclaimed to the satisfaction of the applicable regulatory authority. A breach of such legislation may result in the imposition of fines and penalties, the revocation of necessary licenses and authorizations and civil liability for pollution damage.

USE OF PROCEEDS

Funds Available and Principal Purposes

The gross proceeds from this offering will be Cdn.$10,000,000 under the Minimum Offering and Cdn.$20,000,000 under the Maximum Offering (assuming that the over-allotment option is not exercised). After deducting the agent's commission of 7.0% of the gross proceeds realized from this offering and the estimated offering expenses of Cnd.$500,000 payable by us, we expect to receive total net proceeds of approximately Cdn$8,800,000 under the Minimum Offering and Cdn$18,100,000 under the Maximum Offering (assuming that the over-allotment option is not exercised).

We anticipate there will be working capital of approximately Cdn.$10,400,000 following completion of the Minimum Offering and approximately Cdn.$19,700,000 following completion of the Maximum Offering.

The following table sets forth the principal purposes to which we propose to apply the available funds

|

|

|

Minimum Offering

(Cdn$million)

|

|

|

Maximum Offering (1)

(Cdn$million)

|

|

| |

|

|

|

|

|

|

|

Existing Working Capital (as at June 30, 2014)

|

|

|

1.60 |

|

|

|

1.60 |

|

|

Gross Offering Proceeds

|

|

|

10.00 |

|

|

|

20.00 |

|

|

Less: Fees and Commissions

|

|

|

(0.70 |

) |

|

|

(1.40 |

) |

|

Less: Offering Expenses

|

|

|

(0.50 |

) |

|

|

(0.50 |

) |

|

Total Available Funds

|

|

|

10.40 |

|

|

|

19.70 |

|

|

|

|

Minimum Offering (1)

(Cdn$million)

|

|

|

Maximum Offering (1)

(Cdn$million)

|

|

|

Potential Acquisition of Additional Interests in KGP

|

|

|

0.40 |

|

|

|

0.40 |

|

|

Project Planning and Permitting (Technical)

|

|

|

0.25 |

|

|

|

0.25 |

|

|

L-38 Well Workover

|

|

|

0.60 |

|

|

|

0.60 |

|

|

B-38 Well Recompletion to the Flett Formation

|

|

|

1.30 |

|

|

|

1.30 |

|

|

I-48 Well Recompletion

|

|

|

1.30 |

|

|

|

1.30 |

|

|

Drill Development Well

|

|

|

- |

|

|

|

9.72 |

|

Plant (OPEX, Maintenance and Refurbishment)

|

|

|

2.20 |

|

|

|

2.20 |

|

|

|

|

|

1.50 |

|

|

|

1.50 |

|

|