UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

[X] Quarterly Report Pursuant To Section 13 or 15(d) of the Securities Exchange Act Of 1934

For the quarterly period ended June 30, 2019

[ ] Transition Report Under Section 13 or 15(d) of the Securities Exchange Act Of 1934

For the transition period from ______________ to ______________

Commission File Number: 333-154799

SYLIOS CORP

(Exact name of registrant as specified in its charter)

| Florida | 26-2317506 | |

| (State

or other jurisdiction of incorporation or organization) |

(I.R.S.

Employer Identification No.) |

501 1st Ave N., Suite 901

St. Petersburg, FL 33701

(Address of principal executive offices, including Zip Code)

(727)-482-1505

(Issuer’s telephone number, including area code)

NOT APPLICABLE

(Former name or former address if changed since last report)

Check whether the issuer (1) has filed all reports required to be filed by section 13 or 15(d) of the Exchange Act during the past 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes [X] No [ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes [X] No [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a small reporting company. See the definitions of “large accelerated filer,” “accelerated filer,” “non-accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer [ ] | Accelerated filer [ ] |

| Non-accelerated filer [ ] | Smaller reporting company [X] |

| Emerging growth company [ ] |

If an emerging growth company, indicate by checkmark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. [ ]

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes [ ] No [X]

State the number of shares outstanding of each of the issuer’s classes of common equity, as of the latest practicable date: 11,694,595 shares of common stock as of August 16, 2019.

TABLE OF CONTENTS

| Page | ||

| PART I | FINANCIAL INFORMATION | |

| Item 1 | Financial Statements | F-1 |

| Item 2 | Management’s Discussion and Analysis of Financial Condition and Results of Operation | 4 |

| Item 3 | Quantitative and Qualitative Disclosures About Market Risk | 15 |

| Item 4 | Controls and Procedures | 15 |

| PART II | OTHER INFORMATION | |

| Item 1 | Legal Proceedings | 16 |

| Item 1A | Risk Factors | 16 |

| Item 2 | Unregistered Sales of equity Securities and Use of Proceeds | 17 |

| Item 3 | Defaults Upon Senior Securities | 17 |

| Item 4 | Mine Safety Disclosures | 17 |

| Item 5 | Other Information | 17 |

| Item 6 | Exhibits | 18 |

| Item 7 | Signatures | 20 |

| 2 |

Cautionary Note Regarding Forward Looking Statements

This quarterly report contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. The words “believe,” “expect,” “anticipate,” “intend,” “estimate,” “may,” “should,” “could,” “will,” “plan,” “future,” “continue, “and other expressions that are predictions of or indicate future events and trends and that do not relate to historical matters identify forward-looking statements. These forward-looking statements are based largely on our expectations or forecasts of future events, can be affected by inaccurate assumptions, and are subject to various business risks and known and unknown uncertainties, a number of which are beyond our control. Therefore, actual results could differ materially from the forward-looking statements contained in this document, and readers are cautioned not to place undue reliance on such forward-looking statements. We undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. A wide variety of factors could cause or contribute to such differences and could adversely impact revenues, profitability, cash flows and capital needs. There can be no assurance that the forward-looking statements contained in this document will, in fact, transpire or prove to be accurate. These statements are only predictions and involve known and unknown risks, uncertainties and other factors, including the risks in the section entitled “Risk Factors” that may cause our or our industry’s actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by any forward-looking statements.

Important factors that may cause the actual results to differ from the forward-looking statements, projections or other expectations include, but are not limited to, the following:

| ● | risk that we will not be able to remediate identified material weaknesses in our internal control over financial reporting and disclosure controls and procedures; | |

| ● | risk that we fail to meet the requirements of the agreements under which we acquired our business interests, including any cash payments to the business operations, which could result in the loss of our right to continue to operate or develop the specific businesses described in the agreements; | |

| ● | risk that we will be unable to secure additional financing in the near future in order to commence and sustain our planned development and growth plans; | |

| ● | risk that we cannot attract, retain and motivate qualified personnel, particularly employees, consultants and contractors for our operations; | |

| ● | risks and uncertainties relating to the various industries and operations we are currently engaged in; | |

| ● | results of initial feasibility, pre-feasibility and feasibility studies, and the possibility that future growth, development or expansion will not be consistent with our expectations; | |

| ● | risks related to the inherent uncertainty of business operations including profit, cost of goods, production costs and cost estimates and the potential for unexpected costs and expenses; | |

| ● | risks related to commodity price fluctuations; | |

| ● | the uncertainty of profitability based upon our history of losses; | |

| ● | risks related to failure to obtain adequate financing on a timely basis and on acceptable terms for our planned development projects; | |

| ● | risks related to environmental regulation and liability; | |

| ● | risks related to tax assessments; | |

| ● | other risks and uncertainties related to our prospects, properties and business strategy. |

Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements. You should not place undue reliance on these forward-looking statements, which speak only as of the date of this report. Except as required by law, we do not undertake to update or revise any of the forward-looking statements to conform these statements to actual results, whether as a result of new information, future events or otherwise.

As used in this quarterly report, “Sylios,” the “Company,” “we,” “us,” or “our” refer to Sylios Corp unless otherwise indicated.

| 3 |

SYLIOS CORP

JUNE 30, 2019

FORM 10-Q

| F-1 |

(Formerly US Natural Gas Corp)

CONSOLIDATED BALANCE SHEETS

| June 30, 2019 | December 31, 2018 | |||||||

| (Unaudited) | ||||||||

| ASSETS | ||||||||

| CURRENT ASSETS | ||||||||

| Cash | $ | 118 | $ | 28,005 | ||||

| Total current assets | 118 | 28,005 | ||||||

| PROPERTY AND EQUIPMENT, net | 76,330 | 76,814 | ||||||

| OTHER ASSETS | ||||||||

| Oil and gas royalty interests | - | - | ||||||

| Oil and gas operating bonds | 24,500 | 24,500 | ||||||

| Investments in and advances to spun-off former subsidiaries: | ||||||||

| The Greater Cannabis Company, Inc. | - | - | ||||||

| AMDAQ Corp | - | - | ||||||

| TOTAL ASSETS | $ | 100,948 | $ | 129,319 | ||||

| LIABILITIES AND STOCKHOLDERS’ (DEFICIT) | ||||||||

| CURRENT LIABILITIES | ||||||||

| Accounts payable | $ | 61,358 | $ | 29,585 | ||||

| Accrued officer and director compensation | 401,964 | 804,335 | ||||||

| Accrued interest on notes payable | 463,991 | 439,414 | ||||||

| Notes payable, third parties | 1,396,855 | 1,440,242 | ||||||

| Notes payable, related parties | 148,000 | 148,000 | ||||||

| Loans, related parties | 3,840 | 3,762 | ||||||

| Derivative liability | 1,174,261 | 8,683,257 | ||||||

| Total current liabilities | 3,650,269 | 11,548,595 | ||||||

| Asset Retirement Obligations (ARO’s) | 64,500 | 64,500 | ||||||

| TOTAL LIABILITIES | 3,714,769 | 11,613,095 | ||||||

| STOCKHOLDERS’ DEFICIT | ||||||||

| Preferred stock: 5,000,000 shares authorized, par value $.001, as of June 30, 2019 and December 31, 2018, there are the following shares outstanding: | ||||||||

| Series A: 1,000,000 and 1,000,000, respectively | 1,000 | 1,000 | ||||||

| Series B: 0 and 0, respectively | - | - | ||||||

| Series C: 0 and 0, respectively | - | - | ||||||

| Series D: 100 and 100, respectively | - | - | ||||||

| Common stock: 750,000,000 shares authorized, par value $.001, as of June 30, 2019 and December 31, 2018, there are 11,694,595 and 5,909,113 shares outstanding, respectively. | 11,695 | 5,909 | ||||||

| Additional paid in capital | 10,562,345 | 8,981,912 | ||||||

| Accumulated Deficit | (14,188,861 | ) | (20,472,597 | ) | ||||

| Total stockholders’ (deficit) | (3,613,821 | ) | (11,483,776 | ) | ||||

| TOTAL LIABILITIES AND STOCKHOLDERS’ DEFICIT | $ | 100,948 | $ | 129,319 | ||||

The accompanying notes are an integral part of these consolidated financial statements.

| F-2 |

(Formerly US Natural Gas Corp)

CONSOLIDATED STATEMENTS OF OPERATIONS

For the six months ended June 30, 2019 and 2018 (Unaudited)

(Unaudited) June 30, 2019 | (Unaudited) June 30, 2018 | |||||||

| Revenue earned | ||||||||

| Consulting fees | $ | 2,500 | $ | - | ||||

| Total revenue earned | 2,500 | - | ||||||

| Operating Expenses | ||||||||

| Officer and director compensation, including stock-based compensation of $296,000 and $10,000, respectively | 471,000 | 162,942 | ||||||

| Professional

fees (including stock-based compensation of $491,400 and $0, respectively) | 564,900 | 2,694 | ||||||

| Other operating expenses | 85,282 | 7,999 | ||||||

| Total operating expenses | 1,121,182 | 173,635 | ||||||

| Loss from operations | (1,118,682 | ) | (173,635 | ) | ||||

| Other income (expenses) | ||||||||

| Income from modification of convertible notes payable | - | 343,540 | ||||||

| Loss on conversions of notes payable | (111,977 | ) | - | |||||

| Derivative liability income (expense) | 7,610,646 | (98,938 | ) | |||||

| Amortization of debt discounts | (63,214 | ) | (5,877 | ) | ||||

| Gain from marketable securities | 7,283 | - | ||||||

| Interest expense | (40,320 | ) | (104,020 | ) | ||||

| Total other income (expenses) | 7,402,418 | 134,705 | ||||||

| Net income (loss) before provision for income taxes | 6,283,736 | (38,930 | ) | |||||

| Provision for income taxes | - | - | ||||||

| Net income (loss) | $ | 6,283,736 | $ | (38,930 | ) | |||

| Basic and diluted income (loss) per common share | $ | .62 | $ | (0.01 | ) | |||

| Weighted average common shares outstanding – basic and diluted | 10,191,467 | 2,737,471 | ||||||

The accompanying notes are an integral part of these consolidated financial statements.

| F-3 |

(Formerly US Natural Gas Corp)

CONSOLIDATED STATEMENTS OF OPERATIONS

For the three months ended June 30, 2019 and 2018 (unaudited)

(Unaudited) June 30, 2019 | (Unaudited) June 30, 2018 | |||||||

| Revenue earned | ||||||||

| Consulting fees | $ | 2,500 | $ | - | ||||

| Total revenue earned | 2,500 | - | ||||||

| Operating Expenses | ||||||||

| Officer and director compensation, including stock-based compensation of $0 and $10,000, respectively | 87,500 | 87,500 | ||||||

| Professional fees | 3,500 | - | ||||||

| Other operating expenses | 14,709 | 2,834 | ||||||

| Total operating expenses | 105,709 | 90,334 | ||||||

| Loss from operations | (103,209 | ) | (90,334 | ) | ||||

| Other income (expenses) | ||||||||

| Income from modification of convertible note payable | - | 343,540 | ||||||

| Derivative liability income (expense) | (28,503 | ) | - | |||||

| Amortization of debt discounts | (38,364 | ) | - | |||||

| Gain (loss) from marketable securities | (657 | ) | - | |||||

| Interest expense | (18,945 | ) | (48,656 | ) | ||||

| Total other income (expenses) | (86,469 | ) | 294,884 | |||||

| Net income (loss) before provision for income taxes | (189,678 | ) | 204,550 | |||||

| Provision for income taxes | - | - | ||||||

| Net income (loss) | $ | (189,678 | ) | $ | 204,550 | |||

| Basic and diluted income (loss) per common share | $ | (.02 | ) | $ | 0.07 | |||

| Weighted average common shares outstanding – basic and diluted | 11,672,771 | 2,737,471 | ||||||

The accompanying notes are an integral part of these consolidated financial statements.

| F-4 |

(Formerly US Natural Gas Corp)

CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ (DEFICIENCY)

For the three and six months ended June 30, 2019 and 2018 (unaudited)

For the six months ended June 30, 2019:

| Series A Preferred | Series D Preferred | Additional | ||||||||||||||||||||||||||||||||||

| stock | stock | Common Stock | Paid in | Accumulated | ||||||||||||||||||||||||||||||||

| Shares | Amount | Shares | Amount | Shares | Amount | Capital | Deficit | Total | ||||||||||||||||||||||||||||

| Balances at December 31, 2018 | 1,000,000 | $ | 1,000 | 100 | $ | - | 5,909,113 | $ | 5,909 | $ | 8,981,912 | $ | (20,472,597 | ) | $ | (11,483,776 | ) | |||||||||||||||||||

| Unaudited: | ||||||||||||||||||||||||||||||||||||

| Issuance of common stock in satisfaction of convertible debt and accrued interest | 1,130,651 | 1,131 | 112,588 | 113,719 | ||||||||||||||||||||||||||||||||

| Issuance of common stock to consultant in satisfaction of account payable to consultant | - | - | - | - | 37,500 | 37 | 14,963 | - | 15,000 | |||||||||||||||||||||||||||

| Issuance of common stock chargeable as professional fees to Valvasone Trust and affiliate for services of independent financial advisor (7% stockholder of Company) | - | - | - | - | 4,500,000 | 4,500 | 445,500 | - | 450,000 | |||||||||||||||||||||||||||

Transfer of 750,000 shares of The Greater Cannabis Company, Inc. common stock ($157,500 fair value) to Valvasone Trust in satisfaction of $107,000 notes payable and $9,100 accrued interest | - | - | - | - | - | - | 157,500 | - | 157,500 | |||||||||||||||||||||||||||

| Transfer of 4,000,000 shares of The Greater Cannabis Company, Inc. common stock ($840,000 fair value) in satisfaction of $544,000 accrued officer’s compensation | - | - | - | - | - | - | 840,000 | - | 840,000 | |||||||||||||||||||||||||||

| Round up shares after reverse split | 509 | 1 | (1 | ) | - | |||||||||||||||||||||||||||||||

| Net income for the three months ended March 31, 2019 | - | - | - | - | - | - | - | 6,473,414 | 6,473,414 | |||||||||||||||||||||||||||

| Balances at March 31, 2019 | 1,000,000 | $ | 1,000 | 100 | $ | - | 11,577,773 | $ | 11,578 | $ | 10,552,462 | $ | (13,999,183 | ) | $ | (3,434,143 | ) | |||||||||||||||||||

| Issuance of restricted common stock to Company chief executive officer for director compensation for 1st quarter 2019 | 116,822 | 117 | 9,883 | 10,000 | ||||||||||||||||||||||||||||||||

| Net loss for the three months ended June 30, 2019 | (189,678 | ) | (189,678 | ) | ||||||||||||||||||||||||||||||||

| Balances at June 30, 2019 | 1,000,000 | $ | 1,000 | 100 | $ | - | 11,694,595 | $ | 11,695 | $ | 10,562,345 | $ | (14,188,861 | ) | $ | (3,613,821 | ) | |||||||||||||||||||

For the six months ended June 30, 2018:

| Series A Preferred | Series D Preferred | Additional | ||||||||||||||||||||||||||||||||||

| stock | stock | Common Stock | Paid in | Accumulated | ||||||||||||||||||||||||||||||||

| Shares | Amount | Shares | Amount | Shares | Amount | Capital | Deficit | Total | ||||||||||||||||||||||||||||

| Balances at December 31, 2017 | 1,000,000 | $ | 1,000 | 100 | $ | - | 2,737,471 | $ | 2,737 | $ | 8,875,084 | $ | (12,761,607 | ) | $ | (3,882,786 | ) | |||||||||||||||||||

| Net loss for the three months ended March 31, 2018 (as restated-see Note Q) | - | - | - | - | - | - | - | (243,480 | ) | (243,480 | ) | |||||||||||||||||||||||||

| Balances at March 31, 2018 | 1,000,000 | $ | 1,000 | 100 | $ | - | 2,737,471 | $ | 2,737 | $ | 8,875,084 | $ | (13,005,087 | ) | $ | (4,126,266 | ) | |||||||||||||||||||

| Net income for the three months ended June 30, 2018 | - | - | - | - | - | - | - | 204,550 | 204,550 | |||||||||||||||||||||||||||

| Balances at June 30, 2018 | 1,000,000 | $ | 1,000 | 100 | $ | - | 2,737,471 | $ | 2,737 | $ | 8,875,084 | $ | (12,800,537 | ) | $ | (3,921,716 | ) | |||||||||||||||||||

The accompanying notes are an integral part of these consolidated financial statements.

| F-5 |

(Formerly US Natural Gas Corp)

CONSOLIDATED STATEMENTS OF CASH FLOWS

For the six months ended June 30, 2019 and 2018 (Unaudited)

(Unaudited) June 30, 2019 |

(Unaudited) June 30, 2018 |

|||||||

| OPERATING ACTIVITIES: | ||||||||

| Net income (loss) | $ | 6,283,736 | $ | (38,930 | ) | |||

| Adjustments to reconcile net income (loss) to net cash used from operating activities: | ||||||||

| Depreciation | 484 | 484 | ||||||

| Stock-based professional fees relating to Valvasone Trust and affiliate | 450,000 | - | ||||||

| Excess of fair value of The Greater Cannabis Company, Inc. common stock transferred to the Company CEO over accrued officer compensation settled charged to officer and director compensation | 296,000 | - | ||||||

| Excess of fair value of The Greater Cannabis Company, Inc. common stock transferred to Valvasone Trust over notes payable and accrued interest settled charged to professional fees | 41,400 | - | ||||||

| Issuance of notes payable to Valvasone Trust for professional fees | 20,000 | - | ||||||

| Income from modification of non-convertible notes payable | - | (343,540 | ) | |||||

| Loss on conversion of notes payable | 111,977 | - | ||||||

| Derivative liability expense (income) | (7,610,646 | ) | 98,938 | |||||

| Amortization of debt discounts | 63,214 | 5,877 | ||||||

| Changes in operating assets and liabilities: | ||||||||

| Accounts payable | 46,773 | - | ||||||

| Accrued officer and director compensation | 151,629 | 162,942 | ||||||

| Accrued interest on notes payable | 40,318 | 104,020 | ||||||

| Net cash provided (used) from operating activities | (105,115 | ) | (10,209 | ) | ||||

| INVESTING ACTIVITIES: | ||||||||

| Advances to spun-off former subsidiary, The Greater Cannabis Company, Inc. | - | (3,389 | ) | |||||

| Net cash used by investing activities | - | (3,389 | ) | |||||

| FINANCING ACTIVITIES: | ||||||||

| Loans, related parties, net | 78 | (5,993 | ) | |||||

| Proceeds from notes payable | 80,150 | 20,000 | ||||||

| Repayment of note payable | (3,000 | ) | - | |||||

| Net cash provided from financing activities | 77,228 | 14,007 | ||||||

| NET INCREASE (DECREASE) IN CASH | (27,887 | ) | 409 | |||||

| CASH, BEGINNING OF PERIOD | 28,005 | 2 | ||||||

| CASH, END OF PERIOD | $ | 118 | $ | 411 | ||||

| Supplemental Disclosures of Cash Flow Information: | ||||||||

| Taxes paid | $ | - | $ | - | ||||

| Interest paid | $ | - | $ | - | ||||

| Non-cash investing and financing activities: | ||||||||

| Issuance of notes payable to Valvasone Trust for professional services | $ | 20,000 | $ | - | ||||

| Initial derivative liability charged to debt discounts | $ | 107,150 | $ | - | ||||

| Transfer of 750,000 shares of The Greater Cannabis Company, Inc. common stock ($157,500 fair value) to Valvasone Trust in satisfaction of $107,000 notes payable and $9,100 accrued interest | $ | 157,500 | $ | - | ||||

| Transfer of 4,000,000 shares of The Greater Cannabis Company, Inc. common stock ($840,000 fair value) in satisfaction of $544,000 accrued officer’s compensation | $ | 840,000 | $ | - | ||||

| Issuance of common stock (total fair value of $113,917 in 2019) to convertible noteholders in satisfaction of: | ||||||||

| Notes payable | $ | 1,100 | $ | - | ||||

| Accrued interest | 642 | - | ||||||

| Subtotal | 1,742 | - | ||||||

| Loss on conversion of notes payable | 111,977 | - | ||||||

| Total fair value of common stock issued | $ | 113,719 | $ | |||||

| Issuance of common stock to consultant in settlement of account payable to consultant | $ | 15,000 | $ | - | ||||

| Issuance of common stock in satisfaction of accrued director’s compensation | $ | 10,000 | $ | - | ||||

The accompanying notes are an integral part of these consolidated financial statements.

| F-6 |

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

For the three and six months ended June 30, 2019 and 2018 (Unaudited)

NOTE A – ORGANIZATION

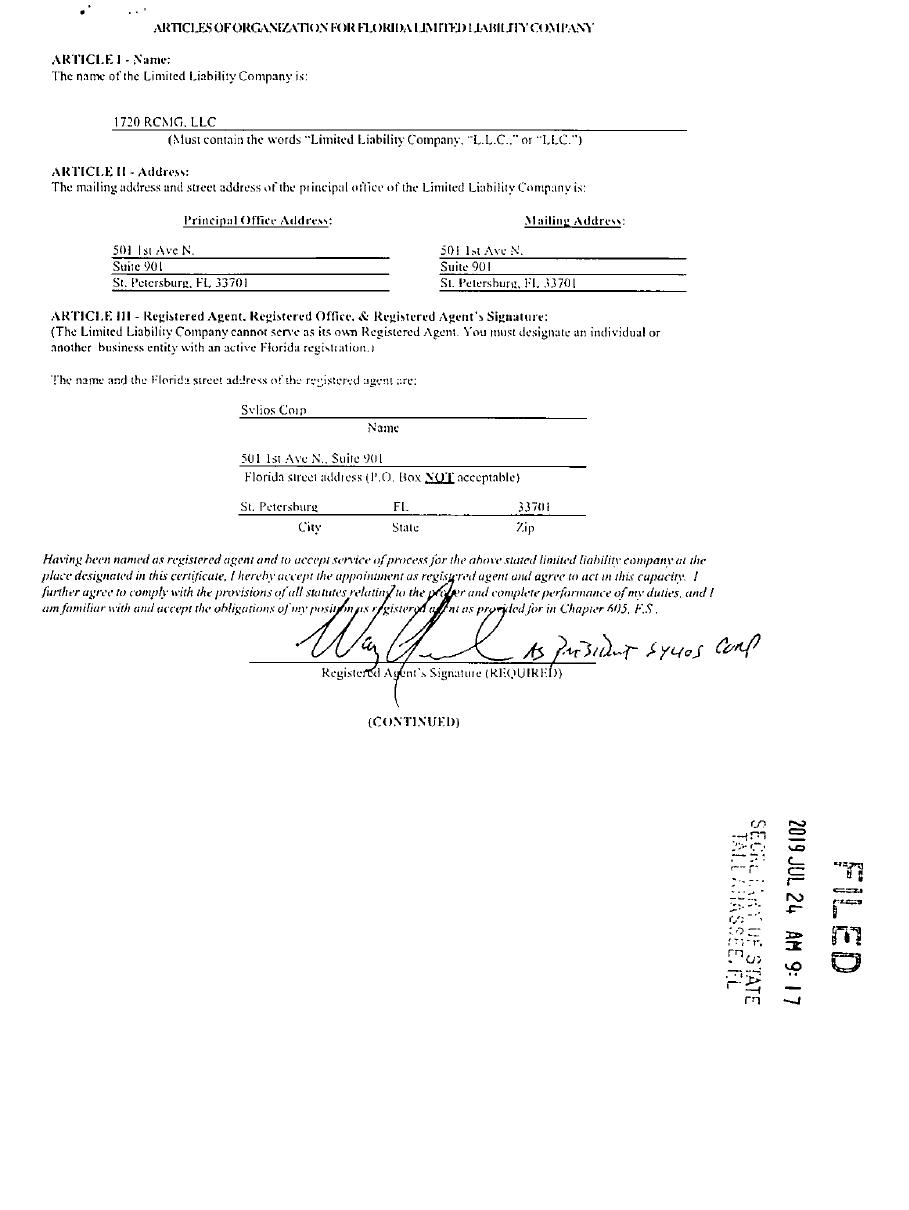

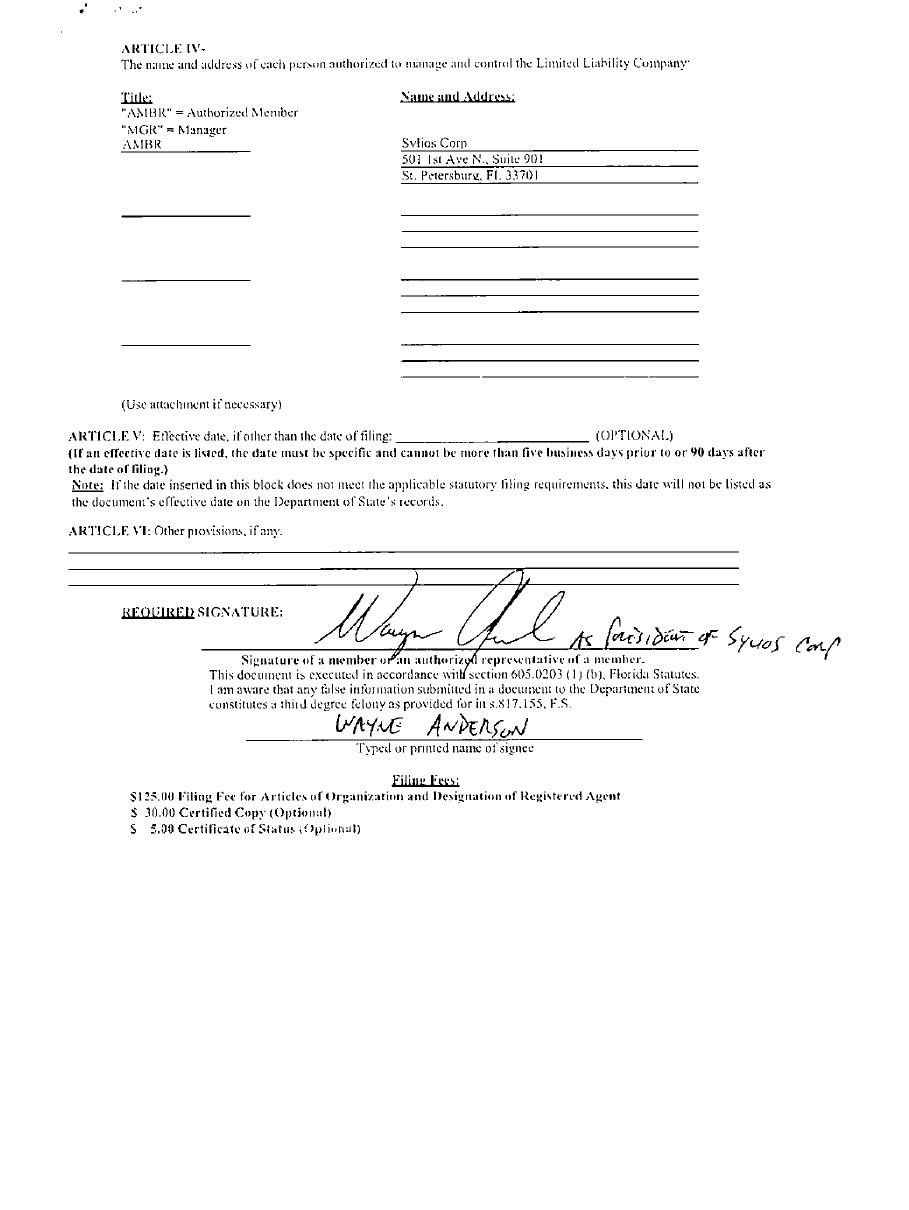

Sylios Corp (f/k/a US Natural Gas Corp) (“Sylios”, the “Company”, “we”, “us”, or “our”) was organized as a Florida Corporation on March 28, 2008 under the name of Adventure Energy, Inc. Sylios has four wholly owned subsidiaries: (i) US Natural Gas Corp KY (“USNG KY”), a corporation incorporated in Florida on February 1, 2010; (ii) US Natural Gas Corp WV (“USNG WV”) a corporation incorporated in Tennessee on August 25, 2009 and redomiciled in Florida on April 26, 2010; (iii) E 3 Petroleum Corp (“E 3”) a corporation incorporated in Florida on February 2, 2010; and (iv) 1720 RCMG, LLC (“RCMG”) a limited liability company formed in the State of Florida on July 24, 2019.

Effective March 10, 2017, Sylios distributed approximately 80.01% of the common stock of The Greater Cannabis Company, Inc. (“GCAN”), a former wholly owned subsidiary of Sylios organized in Florida on March 13, 2014. Please see NOTE F - INVESTMENTS IN AND ADVANCES TO SPUN-OFF FORMER SUBSIDIARIES for further information.

Effective October 2, 2017, Sylios distributed approximately 41.05% of the common stock of AMDAQ Corp (formerly E 2 Investments, LLC) (“AMDAQ”), a former wholly owned subsidiary of Sylios organized in Florida on July 20, 2009. Please see NOTE F - INVESTMENTS IN AND ADVANCES TO SPUN-OFF FORMER SUBSIDIARIES and NOTE P- SUBSEQUENT EVENTS for further information.

Effective December 28, 2018, Sylios effected a 1 share for 4,000 shares reverse stock split of its common stock reducing the number of issued and outstanding shares of its common stock from 10,949,884,000 to 2,737,471 shares. The accompanying financial statements retroactively reflect the reverse stock split.

Sylios owns vacant land in Macon, GA, which subject to receipt of adequate financing, it plans upon developing a storage facility for customer rentals. Please see NOTE C - PROPERTY AND EQUIPMENT for further information. USNG KY was granted royalty interests in 13 oil and gas wells in Kentucky (that had been shut-in since 2014) that it had acquired several years prior to the year ended December 31, 2017, which were sold to a third party in 2018. Please see NOTE D - OIL AND GAS ROYALTY INTERESTS for further information.

NOTE B - SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Principles of Consolidation

Summary of Significant Accounting Policies

This summary of significant accounting policies of the Company is presented to assist in understanding the Company’s financial statements. The financial statements and notes are representations of the Company’s management, which is responsible for their integrity and objectivity. These accounting policies conform to accounting principles generally accepted in the United States and have been consistently applied in the preparation of the financial statements.

Interim Financial Statements

The unaudited condensed financial statements of the Company for the three and six month periods ended June 30, 2019 and 2018 have been prepared in accordance with accounting principles generally accepted in the United States of America for interim financial information and pursuant to the requirements for reporting on Form 10-Q and Regulation S-K. Accordingly, they do not include all the information and footnotes required by accounting principles generally accepted in the United States of America for complete financial statements. However, such information reflects all adjustments (consisting solely of normal recurring adjustments), which are, in the opinion of management, necessary for the fair presentation of the financial position and the results of operations. Results shown for interim periods are not necessarily indicative of the results to be obtained for a full fiscal year. The balance sheet information as of December 31, 2018 was derived from the audited financial statements included in the Company’s financial statements as of and for the year ended December 31, 2018 included in the Company’s Amendment No. 2 to Form S-1 filed with the Securities and Exchange Commission (the “SEC”). These financial statements should be read in conjunction with that report.

Principles of Consolidation

The consolidated financial statements include the accounts of Sylios Corp and its wholly owned subsidiaries, US Natural Gas Corp KY, US Natural Gas Corp WV, E 3 Petroleum Corp and 1720 RCMG, LLC. All inter-company balances and transactions have been eliminated in consolidation.

| F-7 |

SYLIOS CORP

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

For the three and six months ended June 30, 2019 and 2018 (Unaudited)

NOTE B - SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (continued)

Cash Equivalents

Investments having an original maturity of 90 days or less that are readily convertible into cash are considered to be cash equivalents. For the periods presented, the Company had no cash equivalents.

Income Taxes

In accordance with Accounting Standards Codification (ASC) 740 - Income Taxes, the provision for income taxes is computed using the asset and liability method. The asset and liability method measures deferred income taxes by applying enacted statutory rates in effect at the balance sheet date to the differences between the tax basis of assets and liabilities and their reported amounts on the financial statements. The resulting deferred tax assets or liabilities are adjusted to reflect changes in tax laws as they occur. A valuation allowance is provided when it is not more likely than not that a deferred tax asset will be realized.

We expect to recognize the financial statement benefit of an uncertain tax position only after considering the probability that a tax authority would sustain the position in an examination. For tax positions meeting a “more-likely-than-not” threshold, the amount to be recognized in the financial statements will be the benefit expected to be realized upon settlement with the tax authority. For tax positions not meeting the threshold, no financial statement benefit is recognized. As of December 31, 2018, we had no uncertain tax positions. We recognize interest and penalties, if any, related to uncertain tax positions as general and administrative expenses. We currently have no federal or state tax examinations nor have we had any federal or state examinations since our inception. To date, we have not incurred any interest or tax penalties.

Financial Instruments and Fair Value of Financial Instruments

We adopted ASC Topic 820, Fair Value Measurements and Disclosures, for assets and liabilities measured at fair value on a recurring basis. ASC Topic 820 establishes a common definition for fair value to be applied to existing US GAAP that requires the use of fair value measurements that establishes a framework for measuring fair value and expands disclosure about such fair value measurements.

ASC 820 defines fair value as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. Additionally, ASC Topic 820 requires the use of valuation techniques that maximize the use of observable inputs and minimize the use of unobservable inputs. These inputs are prioritized below:

| Level 1: | Observable inputs such as quoted market prices in active markets for identical assets or liabilities | |

| Level 2: | Observable market-based inputs or unobservable inputs that are corroborated by market data | |

| Level 3: | Unobservable inputs for which there is little or no market data, which require the use of the reporting entity’s own assumptions. |

The carrying value of financial assets and liabilities recorded at fair value is measured on a recurring or nonrecurring basis. Financial assets and liabilities measured on a recurring basis are those that are adjusted to fair value each time a financial statement is prepared. Financial assets and liabilities measured on a non-recurring basis are those that are adjusted to fair value when a significant event occurs. Except for the derivative liability, we had no financial assets or liabilities carried and measured at fair value on a recurring or nonrecurring basis during the periods presented.

Oil and Gas Properties

The Company has adopted the successful efforts method of accounting for oil and gas producing activities. Under the successful efforts method, costs to acquire mineral interests in oil and gas properties, to drill and equip exploratory wells that find proved reserves, and to drill and equip developmental wells are capitalized. Costs to drill exploratory wells that do not find proved reserves, costs of developmental wells on properties the Company has no further interest in, geological and geophysical costs, and costs of carrying and retaining unproved properties are expensed.

| F-8 |

SYLIOS CORP

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

For the three and six months ended June 30, 2019 and 2018 (Unaudited)

NOTE B - SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (continued)

When a property is determined to contain proved reserves, the capitalized costs of such properties are transferred from unproved properties to proved properties and are amortized by the unit-of-production method based upon estimated proved developed reserves. To the extent that capitalized costs of groups of proved properties having similar characteristics exceed the estimated future net cash flows, the excess, if any, of capitalized costs are written down to the present value of such amounts. Estimated future net cash flows are determined based primarily upon the estimated future proved reserves related to the Company’s current proved properties and, to a lesser extent, certain future net cash flows related to operating and related fees. The Company follows U.S. GAAP in Accounting for Impairments.

On sale or abandonment of an entire interest in a proved property, gain or loss is recognized, taking into consideration the amount of any recorded impairment. If a partial interest in a proved property is sold, the amount received is treated as a reduction of the cost of the interest retained. (Please see NOTE D - OIL AND GAS ROYALTY INTERESTS for further information.).

Derivative Liabilities

We evaluate convertible notes payable, stock options, stock warrants and other contracts to determine if those contracts or embedded components of those contracts qualify as derivatives to be separately accounted for under the relevant sections of ASC Topic 815-40, Derivative Instruments and Hedging: Contracts in Entity’s Own Equity.

The result of this accounting treatment could be that the fair value of a financial instrument is classified as a derivative instrument and is marked-to-market at each balance sheet date and recorded as a liability. In the event that the fair value is recorded as a liability, the change in fair value is recorded in the statement of operations as other income or other expense. Upon conversion or exercise of a derivative instrument, the instrument is marked to fair value at the conversion date and then that fair value is reclassified to equity. Financial instruments that are initially classified as equity that become subject to reclassification under ASC Topic 815-40 are reclassified to a liability account at the fair value of the instrument on the reclassification date.

Long-lived Assets

Long-lived assets such as property and equipment and intangible assets are periodically reviewed for impairment. We test for impairment losses on long-lived assets used in operations whenever events or changes in circumstances indicate that the carrying amount of the asset may not be recoverable. Recoverability of an asset to be held and used is measured by a comparison of the carrying amount of an asset to the future undiscounted cash flows expected to be generated by the asset. If such asset is considered to be impaired, the impairment to be recognized is measured by the amount by which the carrying amount of the asset exceeds its fair value. Impairment evaluations involve management’s estimates on asset useful lives and future cash flows. Actual useful lives and cash flows could be different from those estimated by management which could have a material effect on our reporting results and financial positions. Fair value is determined through various valuation techniques including discounted cash flow models, quoted market values and third-party independent appraisals, as considered necessary.

Marketable Equity Securities

Marketable equity securities are stated at market value with unrealized gains and losses included in operations. The Company has classified its marketable equity securities as trading securities.

Deferred Financing Costs

Deferred financing costs represent costs incurred in the connection with obtaining debt financing. These costs are amortized ratably and charged to financing expenses over the term of the related debt.

| F-9 |

SYLIOS CORP

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

For the three and six months ended June 30, 2019 and 2018 (Unaudited)

NOTE B - SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (continued)

Equity Instruments Issued to Non-Employees for Acquiring Goods or Services

Issuances of our common stock or warrants for acquiring goods or services are measured at the fair value of the consideration received or the fair value of the equity instruments issued, whichever is more reliably measurable. The measurement date for the fair value of the equity instruments issued to consultants or vendors is determined at the earlier of (i) the date at which a commitment for performance to earn the equity instruments is reached (a “performance commitment” which would include a penalty considered to be of a magnitude that is a sufficiently large disincentive for nonperformance) or (ii) the date at which performance is complete.

Although situations may arise in which counter performance may be required over a period of time, the equity award granted to the party performing the service is fully vested and non-forfeitable on the date of the agreement. As a result, in this situation in which vesting periods do not exist if the instruments are fully vested on the date of agreement, we determine such date to be the measurement date and will record the estimated fair market value of the instruments granted as a prepaid expense and amortize such amount to expense over the contract period. When it is appropriate for us to recognize the cost of a transaction during financial reporting periods prior to the measurement date, for purposes of recognition of costs during those periods, the equity instrument is measured at the then-current fair values.

Stock-Based Compensation

We account for share-based awards to employees in accordance with ASC 718 “Stock Compensation”. Under this guidance, stock compensation expense is measured at the grant date, based on the fair value of the award, and is recognized as an expense over the estimated service period (generally the vesting period) on the straight-line attribute method. Share-based awards to non-employees are accounted for in accordance with ASC 505-50 “Equity”, wherein such awards are expensed over the period in which the related services are rendered.

Related Parties

A party is considered to be related to us if the party directly or indirectly or through one or more intermediaries, controls, is controlled by, or is under common control with us. Related parties also include our principal owners, our management, members of the immediate families of our principal owners and our management and other parties with which we may deal if one party controls or can significantly influence the management or operating policies of the other to an extent that one of the transacting parties might be prevented from fully pursuing its own separate interests. A party which can significantly influence the management or operating policies of the transacting parties, or if it has an ownership interest in one of the transacting parties and can significantly influence the other to an extent that one or more of the transacting parties might be prevented from fully pursuing its own separate interests, is also a related party.

Revenue Recognition

Revenue is recognized when all of the following criteria are met: (1) persuasive evidence of an arrangement exists, (2) the price is fixed or determinable, (3) collectability is reasonably assured, and (4) delivery has occurred.

Advertising Costs

Advertising costs are expensed as incurred. For the periods presented, we had no advertising costs.

Loss per Share

We compute net loss per share in accordance with FASB ASC 260. The ASC specifies the computation, presentation and disclosure requirements for loss per share for entities with publicly held common stock.

Basic loss per share amounts are computed by dividing the net loss by the weighted average number of common shares outstanding. Diluted net loss per common share is computed on the basis of the weighted average number of common shares and dilutive securities (such as stock options, warrants and convertible securities) outstanding. Dilutive securities having an anti-dilutive effect on diluted net loss per share are excluded from the calculation. For the six months ended June 30, 2019 and 2018, the Company excluded 58,713,064 and 2,628,416 shares, respectively relating to convertible notes payable to third parties (Please see NOTE H - NOTES PAYABLE, THIRD PARTIES for further information), 7,800,000 and 7,800,000 shares, respectively, relating to the Series A Preferred stock and 31,250,000 and 1,562,500 shares, respectively, relating to the Series D Preferred stock from the calculation of diluted shares outstanding as the effect of their inclusion would be anti-dilutive.

| F-10 |

SYLIOS CORP

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

For the three and six months ended June 30, 2019 and 2018 (Unaudited)

NOTE B - SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (continued)

Recently Enacted Accounting Standards

In May 2014, the Financial Accounting Standards Board (FASB) issued Accounting Standards Update (ASU) No. 2014-09, Revenue from Contracts with Customers, which will supersede nearly all existing revenue recognition guidance under U.S. GAAP. The core principle of ASU 2014-09 is to recognize revenues when promised goods or services are transferred to customers in an amount that reflects the consideration to which an entity expects to be entitled for those goods or services. ASU 2014-09 defines a five-step process to achieve this core principle and, in doing so, more judgment and estimates may be required within the revenue recognition process than are required under existing U.S. GAAP. As amended by the FASB in July 2015, the standard is effective for annual periods beginning after December 15, 2017, and interim periods therein, using either of the following transition methods: (i) a full retrospective approach reflecting the application of the standard in each prior reporting period with the option to elect certain practical expedients, or (ii) a retrospective approach with the cumulative effect of initially adopting ASU 2014-09 recognized at the date of adoption (which includes additional footnote disclosures). ASU 2014-09 has not had any significant effect on our Financial statements for the periods presented.

In February 2016, the FASB issued ASU No. 2016-02, Leases (Topic 842), to provide guidance on recognizing lease assets and lease liabilities on the balance sheet and disclosing key information about leasing arrangements, specifically differentiating between different types of leases. The core principle of Topic 842 is that a lessee should recognize the assets and liabilities that arise from all leases. The recognition, measurement, and presentation of expenses and cash flows arising from a lease by a lessee have not significantly changed from previous GAAP. There continues to be a differentiation between finance leases and operating leases. However, the principal difference from previous guidance is that the lease assets and lease liabilities arising from operating leases should be recognized in the balance sheet. The accounting applied by a lessor is largely unchanged from that applied under previous GAAP. The amendments will be effective for fiscal years beginning after December 15, 2018, including interim periods within those fiscal years, and early adoption is permitted. In transition, lessees and lessors are required to recognize and measure leases at the beginning of the earliest period presented using a modified retrospective approach. The modified retrospective approach includes a number of optional practical expedients that entities may elect to apply. These practical expedients relate to the identification and classification of leases that commenced before the effective date, initial direct costs for leases that commenced before the effective date, and the ability to use hindsight in evaluating lessee options to extend or terminate a lease or to purchase the underlying asset. An entity that elects to apply the practical expedients will, in effect, continue to account for leases that commence before the effective date in accordance with previous GAAP unless the lease is modified, except that lessees are required to recognize a right-of-use asset and a lease liability for all operating leases at each reporting date based on the present value of the remaining minimum rental payments that were tracked and disclosed under previous GAAP. ASU No. 2016-02 has not had any significant effect on our Financial statements for the periods presented.

On July 13, 2017, the Financial Accounting Standards Board (FASB) issued Accounting Standards Update (“ASU”) 2017-11. Among other things, ASU 2017-11 provides guidance that eliminates the requirement to consider “down round” features when determining whether certain financial instruments or embedded features are indexed to an entity’s stock and need to be classified as liabilities. ASU 2017-11 provides for entities to recognize the effect of a down round feature only when it is triggered and then as a dividend and a reduction to income available to common stockholders in basic earnings per share. The guidance is effective for annual periods beginning after December 15, 2018; early adoption is permitted.

The Company has early adopted ASU 2017-11. As a result, we have not recognized the fair value of the warrants containing down round features as liabilities. Please see NOTE L - CAPITAL STOCK for further information.

Use of Estimates

The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and reported amounts of revenue and expenses during the reporting periods. Actual results could differ from those estimates.

| F-11 |

SYLIOS CORP

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

For the three and six months ended June 30, 2019 and 2018 (Unaudited)

NOTE B - SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (continued)

Fair Value of Financial Instruments

The Company defines the fair value of a financial instrument as the amount at which the instrument could be exchanged in a current transaction between willing parties. Financial instruments included in the Company’s financial statements include cash, accounts payable and accrued expenses, accrued interest payable, loans payable to related parties, notes payable to third parties, notes payable to related parties and derivative liability. Unless otherwise disclosed in the notes to the financial statements, the carrying value of financial instruments is considered to approximate fair value due to the short maturity and characteristics of those instruments. The carrying value of debt approximates fair value as terms approximate those currently available for similar debt instruments.

NOTE C - PROPERTY AND EQUIPMENT

Property and equipment consist of the following at:

| June 30, 2019 | December 31, 2018 | |||||||

| (Unaudited) | ||||||||

| Land and storage facility costs development plans (pledged as security for promissory note of $75,000. Please see NOTE – I for further information) | 75,000 | 75,000 | ||||||

| Computer Software | 20,000 | 20,000 | ||||||

| Furniture, Fixtures and Equipment | 10,828 | 10,828 | ||||||

| Total | 105,828 | 105,828 | ||||||

| Accumulated depreciation and depletion | (29,498 | ) | (29,014 | ) | ||||

| Net property and equipment | $ | 76,330 | $ | 76,814 | ||||

On October 6, 2018, the Company entered into a Commercial Real Estate Purchase and Sale Agreement with the Company’s President for the purchase of a .92 acre of land located in Bibb County, GA. The purchase price for the land was $40,000.

On this same date, the Company entered into an Asset Purchase Agreement with its President for the purchase of all architectural and engineering plans for the development of a storage facility to be constructed on the .92 acre of land. The purchase price for these assets was $35,000.

The Company issued its President a Note in the amount of $75,000 on this same date. The Note has a term of one year and bears interest at 3%. The Company’s first payment in the amount of $15,000 was due within 90 days of an effective reverse stock split. As of the date of issuance of these Financial statements, except for a $5,000 payment made by the Company to the Company’s president on November 12, 2018, the Company has not made any payment against the Note.

The Company uses the straight-line method of depreciation for computer software and furniture, fixtures and equipment over the estimated useful lives of the respective assets. For the six months ended June 30, 2019 and 2018, depreciation expense relating to property and equipment was $484 and $484, respectively.

| F-12 |

SYLIOS CORP

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

For the three and six months ended June 30, 2019 and 2018 (Unaudited)

NOTE D - OIL AND GAS ROYALTY INTERESTS

Oil and gas royalty interests consist of:

| June 30, 2019 | December 31, 2018 | |||||||

| (Unaudited) | ||||||||

| Royalty interests in 13 wells located in Kentucky, acquired in 2009, shut-in since 2014, and sold to Soligen Technologies, Inc. on May 10, 2018 (1) | $ | - | $ | - | ||||

| Royalty interest in oil well located in Fentress County, Tennessee, acquired in September 2015 and shut-in since September 2015. (2) | - | - | ||||||

| Royalty interest in oil well located in Cumberland County, Kentucky, acquired in September 2015 and shut-in since September 2015. (3) | - | - | ||||||

| Totals | $ | - | $ | - | ||||

| (1) | Pursuant to an Asset Purchase Agreement dated May 10, 2018, USNG KY was granted a royalty interest resulting from the sale of these wells equal to 30% of the gross proceeds of production from the 13 wells and 10% of the gross proceeds of production from any new drilled wells on the sold leases up to a maximum of $140,000. From 2014 to the date of issuance of these financial statements, there has been no production from these wells. |

No gain or loss has been recognized from the sale of these wells. No guaranteed royalty revenue was granted to the Company in the sale, only a royalty interest dependent on future production. There was no remaining carrying value for these wells at the time of the sale as the wells were fully impaired prior to the year ended December 31, 2017.

| (2) | Represents a 79.5% royalty interest up to $11,500 and a 15% royalty interest thereafter. From September 2015 to the date of issuance of these financial statements, there has been no production from this well. Effective December 31, 2018, the Company recognized an impairment loss of $7,500 and reduced the carrying cost of this asset from $7,500 to $0. |

| (3) | Represents a 5% royalty interest. From September 2015 to the date of issuance of these financial statements, there has been no production from this well. Effective December 31, 2018, the Company recognized an impairment loss of $2,500 and reduced the carrying cost of this asset from $2,500 to $0. |

NOTE E – OIL AND GAS OPERATING BONDS

The Company is required to put up for bond either cash or a Surety bond for each well it elects to act as operator. The amount of the bond is calculated based on the total depth of the well. In the event the Company were to abandon the wells, the Kentucky Department of Natural Resources would claim the cash bond and use the funds for reclamation.

The Company hopes to reclaim the cash bonds totaling $24,500 for the 13 wells sold in the Asset Purchase Agreement with Soligen Technologies, Inc. when Soligen replaces the Company’s cash bonds by funding with its own bond, which has not yet occurred at the date of issuance of these financial statements. Please see NOTE D - OIL AND GAS ROYALTY INTERESTS for further information.

NOTE F - INVESTMENTS IN AND ADVANCES TO SPUN-OFF FORMER SUBSIDIARIES

The Greater Cannabis Company, Inc.

Effective March 10, 2017, in connection with a partial spin-off of The Greater Cannabis Company, Inc. (“GCAN”) from the Company, the Company issued a total of 26,905,969 shares of GCAN common stock. 5,378,476 shares were issued to itself (representing 19.9% of the issued and outstanding shares of GCAN common stock after the spin-off) and 21,527,493 shares were issued to the stockholders of record of the Company on February 3, 2017 on the basis of one share of GCAN common stock for each 500 shares of the Company’s common stock held (representing 80.1% of the issued and outstanding shares of GCAN common stock after the spin-off). The related Registration Statement on Form S-1 was declared effective by the Securities and Exchange Commission on August 31, 2017. The Financial Industry Regulatory Authority (“FINRA”) cleared the quotation of GCAN common stock on July 10, 2018 under the symbol “GCAN.”

| F-13 |

SYLIOS CORP

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

For the three and six months ended June 30, 2019 and 2018 (Unaudited)

NOTE F - INVESTMENTS IN AND ADVANCES TO SPUN-OFF SUBSIDIARIES (continued)

Generally accepted accounting principles in the United States require that an entity’s distribution of shares of a wholly owned or consolidated subsidiary to be recorded based on the carrying value of the subsidiary. The partial spin-off was recorded at the carrying value of GCAN’s net assets which was a deficit of $113,922 as of March 10, 2017, as follows:

| ASSETS | $ | - | ||

| LIABILITIES | ||||

| Notes payable to Sylios | $ | 104,557 | ||

| Accrued interest on notes payable to Sylios | 7,604 | |||

| Loans payable to related parties: | ||||

| Due to Chief Executive Officer of Sylios | 1,477 | |||

| Due to two subsidiaries of Sylios | 284 | |||

| Total liabilities | 113,922 | |||

| Net Assets | $ | (113,922 | ) |

Operations of GCAN for the period January 1, 2017 to March 10, 2017 (while GCAN was a wholly owned subsidiary of the Company) have been included in the accompanying Consolidated Statement of Operations for the year ended December 31, 2017, as follows:

| Revenues | $ | - | ||

| Expenses: | ||||

| Selling, general and administrative | $ | 4,557 | ||

| Interest | 577 | |||

| Total expenses | 5,134 | |||

| Net loss | $ | (5,134 | ) |

Since GCAN had negative assets at the March 10, 2017 effective date of the spin-off, the Company recorded its 19.9% investment in GCAN at $0.

At June 30, 2019 and December 31, 2018, the Company held 628,476 (1.81% of the issued and outstanding common shares) and 5,378,476 (16.87% of the issued and outstanding common shares) shares of common stock of GCAN, respectively. On January 9, 2019, the Company transferred 4,000,000 shares of GCAN common stock (fair value of $840,000) to Wayne Anderson to satisfy liabilities of $544,000. Also, on January 9, 2019 the Company transferred 750,000 shares of GCAN common stock (fair value of $157,500) to Valvasone Trust to satisfy liabilities of $116,100.

AMDAQ Corp

On September 1, 2017, AMDAQ Corp (“AMDAQ”) acquired AMDAQ, Ltd. (“Limited”), a corporation formed under the Registrar of Companies for England and Wales in March 2016, in exchange for 15,000,000 shares of AMDAQ common stock (representing approximately 46% of the 32,552,818 issued and outstanding shares of AMDAQ common stock after the transaction). As of the September 1, 2017 acquisition date. Limited had no assets and no liabilities. For the period from January 1, 2017 to September 1, 2017, Limited had no revenues and expenses of $12,327. From September 1, 2017 to October 2, 2017, Limited had no revenues and no expenses.

Effective October 2, 2017, in connection with a partial spin-off of AMDAQ from the Company, the Company issued a total of 17,552,626 shares of AMDAQ common stock. 2,956,650 shares were issued to itself (representing 9.1% of the issued and outstanding shares of AMDAQ common stock after the spin-off) and 14,595,976 shares were issued to the stockholders of record of the Company on September 15, 2017 on the basis of one share of AMDAQ common stock for each 750 shares of the Company’s common stock held (representing 44.8% of the issued and outstanding shares of AMDAQ common stock after the spin-off). AMDAQ plans to file a Registration Statement on Form S-1 during the fourth quarter of 2019.

Generally accepted accounting principles in the United States require that an entity’s distribution of shares of a wholly owned or consolidated subsidiary to be recorded based on the carrying value of the subsidiary. The partial spin-off was recorded at the carrying value of AMDAQ’s net assets which was a deficit of $21,319 as of October 2, 2017, as follows:

| ASSETS | ||||

| Loans receivable from USNG KY | $ | 41,714 | ||

| Total assets | 41,714 | |||

| LIABILITIES | ||||

| Loans payable to Sylios: | $ | 63,033 | ||

| Total liabilities | 63,033 | |||

| Net Assets | $ | (21,319 | ) | |

| F-14 |

SYLIOS CORP

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

For the three and six months ended June 30, 2019 and 2018 (Unaudited)

NOTE F - INVESTMENTS IN AND ADVANCES TO SPUN-OFF FORMER SUBSIDIARIES (continued)

AMDAQ had no revenues or expenses for the period January 1, 2017 to October 2, 2017 (while AMDAQ was a subsidiary of the Company).

Since AMDAQ had negative assets at the October 2, 2017 effective date of the spin-off, the Company recorded its 9.1% investment in AMDAQ at $0.

On October 16, 2017, AMDAQ acquired 1,000,000 Ethereum compliant tokens from two business associates in exchange for 3,000,000 shares of AMDAQ common stock.

At June 30, 2019 and December 31, 2018, the Company held 2,956,650 (13.47% of the issued and outstanding common shares) and 2,956,650 (7.69% of the issued and outstanding common shares) shares of common stock of AMDAQ, respectively. On January 7, 2019, the prior owner of AMDAQ, Ltd and the prior owners of the AMDAQ tokens agreed to a reduction in the number of common shares of AMDAQ Corp that they would retain. Of the 15,000,000 shares of AMDAQ Corp common stock issued to the prior owner of AMDAQ, Ltd, 7,500,000 were returned to AMDAQ Corp to be retired. Of the 3,000,000 shares of AMDAQ Corp common stock issued for the purchase of the AMDAQ tokens, 1,500,000 were returned to AMDAQ Corp to be retired.

NOTE G – ACCRUED OFFICER AND DIRECTOR COMPENSATION

Accrued officer and director compensation is due to Wayne Anderson, the sole officer and director of the Company, and consists of:

| June 30, 2019 | December 31, 2018 | |||||||

(Unaudited) | ||||||||

| Pursuant to April 1, 2015 Employment Agreement | $ | 6,964 | $ | 561,835 | ||||

| Pursuant to April 1, 2018 Employment Agreement | 337,500 | 202,500 | ||||||

| Pursuant to January 5, 2011 Board of Directors Service Agreement | - | - | ||||||

| Pursuant to January 2, 2018 Board of Directors Service Agreement | 57,500 | 40,000 | ||||||

| Total | $ | 401,964 | $ | 804,335 | ||||

For the year ended December 31, 2018 and the three and six months ended June 30, 2019, the balance of accrued officer and director compensation changed as follows:

| Pursuant

to Employment Agreements | Pursuant

to Board of Directors Services Agreements | Total | ||||||||||

| Balance, December 31, 2017 | 506,393 | 70,000 | 576,393 | |||||||||

| Officer’s/director’s compensation for year ended December 31, 2018 | 257,942 | 80,000 | 337,942 | |||||||||

| Issuance of 2,176,617 restricted shares of common stock (with a fair value of $87,500 at a $70,000 agreed reduction of the liability) on December 31, 2018 | - | (70,000 | ) | (70,000 | ) | |||||||

| Issuance of 995,025 restricted shares of common stock (with a fair value of $40,000) on December 31, 2018 | - | (40,000 | ) | (40,000 | ) | |||||||

| Balance, December 31, 2018 | 764,335 | 40,000 | 804,335 | |||||||||

| Officer’s/director’s compensation for three months ended March 31, 2019 | 67,500 | 20,000 | 87,500 | |||||||||

| Transfer of 4,000,000 shares of The Greater Cannabis Company, Inc. (“GCAN”) common stock from the Company to the Company’s sole officer and director | (544,000 | ) | - | (544,000 | ) | |||||||

| Balance March 31, 2019 (unaudited) | 287,835 | 60,000 | 347,835 | |||||||||

| Officer’s/director’s compensation for three months ended June 30, 2019 | 67,500 | 20,000 | 87,500 | |||||||||

| Cash payments to Officer/Director during the three months ended June 30, 2019 | (10,871 | ) | (12,500 | ) | (23,371 | ) | ||||||

| Issuance of 116,822 restricted shares of common stock (with a fair value of $10,000) on April 10, 2019 | - | (10,000 | ) | (10,000 | ) | |||||||

| Balance June 30, 2019 (unaudited) | $ | 344,464 | $ | 57,500 | $ | 401,964 | ||||||

| F-15 |

SYLIOS CORP

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

For the three and six months ended June 30, 2019 and 2018 (Unaudited)

NOTE H - NOTES PAYABLE, THIRD PARTIES

Notes payable to third parties consist of:

| June 30, 2019 | December 31, 2018 | |||||||

| (Unaudited) | ||||||||

| Unsecured Convertible Promissory Note payable to Armada Investment Fund, LLC (“Armada”), with interest at 8% payable at maturity with principal (default interest rates ranging from 18% to 24%); convertible into shares of common stock at a variable conversion price equal to 50% of the Market Price which is defined as the lowest Trading Price for the common stock during the 20 trading day period prior to the Conversion Date: | ||||||||

| Issue date October 9, 2018, maturity date of October 9, 2019- net of unamortized debt discount of $8,302 and $23,178 at June 30, 2019 and December 31, 2018, respectively | 21,698 | 6,822 | ||||||

| Issue date December 31, 2018, maturity date of December 31, 2019- net of unamortized debt discount of $16,636 and $33,000 at June 30, 2019 and December 31, 2018, respectively | 16,364 | - | ||||||

| Amended and Restated Replacement Convertible Promissory Note, Issue date February 12, 2019, maturity date of February 12, 2019- net of amounts converted into Sylios common stock and net of unamortized debt discount of $13,763 and $0 at June 30, 2019 and December 31, 2018, respectively | 6,637 | - | ||||||

| Issue date February 18, 2019, maturity date of February 18, 2020- net of unamortized debt discount of $7,373 and $0 at June 30, 2019 and December 31, 2018 respectively | 4,177 | - | ||||||

| Issue date June 5, 2019, maturity date of June 5, 2020- net of unamortized debt discount of $15,370 and $0 at June 30, 2019, December 31, 2018, respectively | 1,130 | - | ||||||

| Subtotal Armada | 50,006 | 6,822 | ||||||

| Unsecured Convertible Promissory Notes payable to Darling Capital, LLC and its affiliate Darling Investments, LLC (“Darling”), all in technical default, with interest at 12% payable at maturity with principal (default interest rates ranging from 18% to 22%); convertible into shares of common stock at a variable conversion price equal to 40% of the Market Price (20% for the note due March 7, 2018), which is defined as the lowest Trading Price for the common stock during the 20 trading day period prior to the Conversion Date. | ||||||||

| Issue date January 28, 2017, maturity date September 28, 2017, net of amounts converted into Sylios common stock | 3,984 | 3,984 | ||||||

| Issue date February 1, 2017, maturity date November 30, 2017, net of amounts converted into Sylios common stock | 4,742 | 4,742 | ||||||

| Issue date February 13, 2017, maturity date November 30, 2017 | 10,000 | 10,000 | ||||||

| Issue date March 7, 2017, maturity date March 7, 2018, - net of amounts converted into Sylios common stock | 10,000 | 10,000 | ||||||

| Issue date January 9, 2019, maturity date January 9, 2020, -net of unamortized debt discount of $6,610 and $0 at June 30, 2019 and December 31, 2018, respectively | 5,890 | - | ||||||

| Subtotal Darling | 34,616 | 28,726 | ||||||

| Unsecured Convertible Promissory Notes payable to Tangiers Investment Group, LLC (“Tangiers”), all in technical default, with interest ranging from 0% to 15% payable at maturity with principal (default interest rates ranging from 0% to 20%); except for the March 16, 2016 Promissory Note, convertible into shares of common stock at a variable conversion price equal to 50% of the Market Price (40% for the note due April 25, 2014), which is defined as the lowest Trading Price for the common stock during the 20 trading day period prior to the Conversion Date. | ||||||||

| Issue date April 2, 2014, maturity date April 2, 2015, net of amounts converted into Sylios common stock | 5,500 | 3,086 | ||||||

| Issue date April 28, 2014, maturity date April 28, 2015, net of amounts converted into Sylios common stock | 521 | 521 | ||||||

| Issue date June 2, 2014, maturity date June 2, 2015, net of amounts converted into Sylios common stock | 26,086 | 26,086 | ||||||

| F-16 |

SYLIOS CORP

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

For the three and six months ended June 30, 2019 and 2018 (Unaudited)

NOTE H - NOTES PAYABLE, THIRD PARTIES (continued)

| Issue date August 12, 2014, maturity date August 12, 2015 | 112,500 | 112,500 | ||||||

| Issue date July 3, 2014, maturity date July 3, 2015 | 50,000 | 50,000 | ||||||

| Issue date June 3, 2015, maturity date June 3, 2016 | 17,250 | 17,250 | ||||||

| Issue date March 16, 2016, maturity date June 14, 2016 | 17,500 | 17,500 | ||||||

| Issue date January 27, 2017, maturity date January 27, 2018 | 55,000 | 55,000 | ||||||

| Subtotal Tangiers | 284,357 | 281,943 | ||||||

| Unsecured Convertible Promissory Notes payable to Bullfly Trading Company, Inc. (“Bullfly”), all in technical default until assigned to Armada on February 12, 2019, with interest at 15% payable at maturity with principal, convertible into shares of common stock at a conversion price equal to a 50% discount to the 5-day moving bid average: | ||||||||

| Issue date June 1, 2016, maturity date December 1, 2016 | - | 4,000 | ||||||

| Issue date July 11, 2016, maturity date January 11, 2017 | - | 4,000 | ||||||

| Subtotal Bullfly | - | 8,000 | ||||||

| Unsecured Convertible Promissory Notes payable to Mountain Properties, Inc. (“Mountain”), all in technical default until assigned to Armada on February 12, 2019, with interest at 15% payable at maturity with principal, convertible into shares of common stock at a conversion price equal to a 50% discount to the 5-day moving bid average: | ||||||||

| Issue date February 24, 2016, maturity date August 24, 2016 | - | 7,500 | ||||||

| Subtotal Mountain | - | 7,500 | ||||||

| Secured Renewal Notes payable to SLMI Energy Holdings, LLC (“SLMI”), with interest at 3% payable on demand with principal, secured by substantially all assets of the Company per UCC filing dated June 30, 2015: | ||||||||

| Issue date June 6, 2018 (renewing note dated September 4, 2009) | 790,000 | 790,000 | ||||||

| Issue date June 6, 2018 (renewing note dated November 12, 2009) | 120,000 | 120,000 | ||||||

| Subtotal SLMI | 910,000 | 910,000 | ||||||

| Secured Note payable to MTEL Investment and Management (“MTEL”) in technical default, with interest of $50,000 payable at maturity with principal: | ||||||||

| Issue date January 11, 2010, maturity date July 10, 2010 | 100,000 | 100,000 | ||||||

| Subtotal MTEL | 100,000 | 100,000 | ||||||

| Unsecured Notes payable to Valvasone Trust (“Valvasone”), all in technical default until satisfied on January 9, 2019, with interest at 3% payable at maturity with principal: | ||||||||

| Issue date October 7, 2013, maturity date January 31, 2014 | - | 10,000 | ||||||

| Issue date March 30, 2014, maturity date June 30, 2014 | - | 15,000 | ||||||

| Issue date January 11, 2016, maturity date March 31, 2016 | - | 22,000 | ||||||

| Issue date July 1, 2017, maturity date September 30, 2017 | - | 40,000 | ||||||

| Subtotal Valvasone | - | 87,000 | ||||||

| Unsecured Note payable to Mt. Atlas Consulting (“Atlas”) in technical default, with interest at 20% payable at maturity with principal: | ||||||||

| Issue date November 17, 2017, maturity date April 17, 2018 | 4,000 | 4,000 | ||||||

| Subtotal Atlas | 4,000 | 4,000 | ||||||

| Unsecured Promissory Note payable to Jefferson Street Capital (“Jefferson”), with interest at 8% payable at maturity with principal: | ||||||||

| Issue date February 18, 2019, maturity date February 18, 2020- net of unamortized debt discount of $7,373 and $0 at June 30, 2019 and December 31, 2018, respectively | 4,177 | - | ||||||

| Issue date May 2, 2019, maturity date February 3, 2020- net of unamortized debt discount of $8,657 and $0 at June 30, 2019 and December 31, 2018, respectively | 2,343 | - | ||||||

| Subtotal Jefferson | 6,520 | |||||||

| Unsecured Promissory Note payable to BHP Capital NY, Inc. (“BHP”), with interest at 8% payable at maturity with principal: | ||||||||

| Issue date February 18, 2019, maturity date February 18, 2020- net of unamortized debt discount of $7,373 and $0 at June 30, 2019 and December 31, 2018, respectively | 4,177 | - | ||||||

| Issue date May 2, 2019, maturity date February 3, 2020- net of unamortized debt discount of $8,657 and $0 at June 30, 2019 and December 31, 2018, respectively | 2,343 | - | ||||||

| Subtotal BHP | 6,520 | |||||||

| Unsecured Promissory Note payable to Pacific Stock Transfer Company (“Pacific”) in technical default, with interest at 5% payable at maturity with principal: | ||||||||

| Issue date August 11, 2017, maturity date November 11, 2017 | 3,250 | 6,250 | ||||||

| Subtotal Pacific | 3,250 | 6,250 | ||||||

| Total | $ | 1,396,855 | $ | 1,440,242 |

| F-17 |

SYLIOS CORP

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

For the three and six months ended June 30, 2019 and 2018 (Unaudited)

NOTE H - NOTES PAYABLE, THIRD PARTIES (continued)

Concentration of Debt Due Lenders:

| SLMI | Tangiers | Other | Total | |||||||||||||

| June 30, 2019 | ||||||||||||||||

| Promissory notes payable, net of discount | $ | 910,000 | $ | 284,357 | $ | 204,912 | $ | 1,396,855 | ||||||||

| Accrued interest: | ||||||||||||||||

| Stated interest | 292,934 | 91,111 | 79,946 | 463,991 | ||||||||||||

| Additional default interest | - | - | - | - | ||||||||||||

| Total accrued interest | 292,934 | 91,111 | 79,946 | 463,991 | ||||||||||||

| Total debt (Unaudited) | $ | 1,202,934 | $ | 375,468 | $ | 284,858 | $ | 1,860,846 | ||||||||

| December 31, 2018 | ||||||||||||||||

| Promissory notes payable, net of discount | $ | 910,000 | $ | 281,943 | $ | 248,299 | $ | 1,440,242 | ||||||||

| Accrued interest: | - | |||||||||||||||

| Stated interest | 279,284 | 79,145 | 80,985 | 439,414 | ||||||||||||

| Additional default interest | - | - | - | - | ||||||||||||

| Total accrued interest | 279,284 | 79,145 | 80,985 | 439,414 | ||||||||||||

| Total debt | $ | 1,189,284 | $ | 361,088 | $ | 329,284 | $ | 1,879,656 | ||||||||

Interest expense consists of:

| Three Months Ended | Six Months Ended | |||||||||||||||

| June 30, 2019 | June 30, 2018 | June 30, 2019 | June 30, 2018 | |||||||||||||

| (Unaudited) | (Unaudited) | (Unaudited) | (Unaudited) | |||||||||||||

| Stated interest | $ | 18,945 | $ | 19,856 | $ | 40,320 | $ | 39,693 | ||||||||

| Additional default interest | - | 28,820 | - | 64,347 | ||||||||||||

| Totals | $ | 18,945 | $ | 48,676 | $ | 40,320 | $ | 104,040 | ||||||||

The stated interest and additional default interest expense relates to the following lenders:

| Three Months Ended | Six Months Ended | |||||||||||||||

| June 30, 2019 | June 30, 2018 | June 30, 2019 | June 30, 2018 | |||||||||||||

| (Unaudited) | (Unaudited) | (Unaudited) | (Unaudited) | |||||||||||||

| SLMI | $ | $ | $ | $ | ||||||||||||

| Stated Interest | 6,825 | 7,140 | 13,650 | 13,650 | ||||||||||||

| Additional default interest | - | 12,267 | - | 30,667 | ||||||||||||

| Total SLMI | 6,825 | 19,407 | 13,650 | 44,317 | ||||||||||||

| Tangiers: | ||||||||||||||||

| Stated Interest | 5,983 | 5,920 |

11,966 | 11,820 | ||||||||||||

| Additional default interest | - | 12,656 | - | 25,689 | ||||||||||||

| Total Tangiers | 5,983 | 18,576 | 11,966 | 37,509 | ||||||||||||

| Other lenders | ||||||||||||||||

| Stated Interest | 6,029 | 6,796 | 14,704 | 14,223 | ||||||||||||

| Additional default interest | - | 3,897 | - | 7,991 | ||||||||||||

| Total others | 6,029 | 10,693 | 14,704 | 22,214 | ||||||||||||

| Totals | ||||||||||||||||

| Stated Interest | 18,945 | 19,856 | 40,320 | 39,693 | ||||||||||||

| Additional default interest | - | 28,820 | - | 64,347 | ||||||||||||

| Total all Lenders | $ | 18,945 | $ | 48,676 | $ | 40,320 | $ | 104,040 | ||||||||

| F-18 |

SYLIOS CORP

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

For the three and six months ended June 30, 2019 and 2018 (Unaudited)

NOTE H - NOTES PAYABLE, THIRD PARTIES (continued)

Income from modification of convertible and non-convertible notes payable consists of:

| Three Months Ended | Six Months Ended | |||||||||||||||

June 30, 2019 |

June 30, 2018 | June 30, 2019 | June 30, 2018 | |||||||||||||

| (Unaudited) | (Unaudited) | (Unaudited) | (Unaudited) | |||||||||||||

| Waiver of prior and future additional default interest pursuant to debt modifications with SLMI Energy Holdings, LLC on June 8, 2018 (1) | $ | - | $ | 343,540 | $ | - | $ | 343,540 | ||||||||

| Waiver of prior and future additional default interest pursuant to debt modifications with Darling Capital, LLC on December 6, 2018 (2) | - | - | - | - | ||||||||||||

| Waiver of prior and future additional default interest pursuant to debt modifications with Tangiers Investment Group, LLC on December 18, 2018 (2) | - | - | - | - | ||||||||||||

| Total | $ | - | $ | 343,540 | $ | - | $ | 343,540 | ||||||||

(1) The debt modifications with SLMI Energy Holdings, LLC (“SLMI”) provide that in the event that the Company does not make a payment to SMLI within 30 days written notice of demand by SLMI, all unpaid interest accruing since September 4, 2009 (in the case of the original September 4, 2009 Note) and accruing since November 12, 2009 (in the case of the original November 12, 2009 Note) shall accrue at a 18% default interest rate rather than the 3% stated interest rate in the Renewal Notes. If that had occurred on December 31, 2018, the additional default interest accruable would have been approximately $1,200,000. As of the date of the issuance of these financial statements, SLMI has not provided the Company any notice of demand for payment and accordingly, the Company is not in default of these obligations.

(2) As of the date of the issuance of these financial statements, waivers of the additional default interest for both Darling and Tangiers obligations remain in effect. However, the Company is still in technical default for the principal and stated interest of these significantly past-due convertible promissory notes.

Gain on settlement of convertible notes payable consists of:

| Three Months Ended | Three Months Ended | Six Months Ended | ||||||||||||||

| June 30, 2019 | June 30, 2018 | June 30, 2019 | June 30, 2018 | |||||||||||||

| (Unaudited) | (Unaudited) | (Unaudited) | (Unaudited) | |||||||||||||

| Company payment of $15,000 on October 5, 2018 in full and final settlement of $130,298 debt and $83,100 accrued interest due Beaufort Capital Partners, LLC | $ | - | $ | - | $ | - | $ | - | ||||||||

| Total | $ | - | $ | - | $ | - | $ | - | ||||||||

Convertible Note Conversions:

During the six months ended June 30, 2019, the Company issued the following shares of common stock upon the conversions of portions of the Convertible Notes:

| Principal | Interest | Total | Conversion | Shares | ||||||||||||||||||

| Date | Conversion | Conversion | Conversion | Price | Issued | Issued to | ||||||||||||||||

| 2/7/2019 | $ | — | $ | 642 | $ | 642 | $ | 0.00108 | 594,066 | Darling | ||||||||||||

| 2/20/2019 | 1,100 | — | 1,100 | 0.00205 | 536,585 | Armada | ||||||||||||||||

| $ | 1,100 | $ | 642 | $ | 1,742 | 1,130,651 | ||||||||||||||||

Loss on conversions of notes payable consists of:

| Three Months Ended | Six Months | |||||||||||||||

| June 30, 2019 | June 30, 2018 | June 30, 2019 | June 30, 2018 | |||||||||||||

| (Unaudited) | (Unaudited) | (Unaudited) | (Unaudited) | |||||||||||||

| Armada convertible notes | $ | - | $ | - | $ | (52,599 | ) | $ | - | |||||||

| Beaufort convertible notes | - | - | - | - | ||||||||||||

| Darling convertible notes | - | - | (59,418 | ) | - | |||||||||||

| Tangiers convertible notes | - | - | - | - | ||||||||||||

| Other convertible notes | - | - | - | - | ||||||||||||

| Total | $ | - | $ | - | $ | (111,977 | ) | $ | - | |||||||

| F-19 |

SYLIOS CORP

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

For the three and six months ended June 30, 2019 and 2018 (Unaudited)

NOTE I - NOTES PAYABLE, RELATED PARTIES

Notes payable to related parties consist of:

| June 30, 2019 | December 31, 2018 | |||||||

| (Unaudited) | ||||||||

| Secured Promissory Note dated October 6, 2018 payable to Wayne Anderson, CEO of the Company, interest at 3%, due October 6, 2019 | $ | 70,000 | $ | 70,000 | ||||

| Unsecured Promissory Note dated September 15, 2017, payable to Around the Clock Partners, LP (entity controlled by Wayne Anderson), interest at 3%, due September 15, 2018 | 78,000 | 78,000 | ||||||

| Total | $ | 148,000 |

$ | 148,000 | ||||

The Secured Promissory Note dated October 6, 2018 payable to Wayne Anderson (originally in the amount of $75,000) is secured by a Deed to Secure Debt, Assignment of Rents and Security Agreement relating to the property located in Macon, Georgia (Please see NOTE C – PROPERTY AND EQUIPMENT for further information). The Note provides for the Company to make a first payment of $15,000 within 90 days of an effective reverse stock split. As of the date of issuance of these Financial statements, except for a $5,000 payment made by the Company to Mr. Anderson on November 12, 2018, the Company has not made any payment against the Note.

| F-20 |

SYLIOS CORP

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

For the three and six months ended June 30, 2019 and 2018 (Unaudited)

NOTE J - DERIVATIVE LIABILITY