Unassociated Document

As

filed with the Securities and Exchange Commission on January 24, 2012

Registration No. 333-178362

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

Amendment No. 2 to

Form F-1

REGISTRATION STATEMENT UNDER

THE SECURITIES ACT OF 1933

China Dredging Group Co., Ltd.

(Exact name of Registrant as specified in its charter)

Not Applicable

(Translation of Registrant’s name into English)

|

British Virgin Islands

|

|

1600

|

|

Not Applicable

|

|

(State or other jurisdiction of

incorporation or organization)

|

|

(Primary Standard Industrial

Classification Code Number)

|

|

(I.R.S. Employer

Identification Number)

|

Floor 18, Tower A

Zhongshan Building No. 154

Hudong Road, Gulou District

Fuzhou City, Fujian Province 350001, PRC

+86-591-8727-1266

(Address, including zip code, and telephone number, including area code, of Registrant’s principal executive offices)

C T Corporation System

111 Eighth Avenue

New York, NY 10011

(212) 894-8940

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

|

Jonathan Klein, Esq.

|

|

Steven Liu, Esq.

|

|

Andrew D. Ledbetter, Esq.

|

|

DLA Piper UK LLP

|

|

DLA Piper LLP (US)

|

|

20th Floor, South Tower

|

|

1251 Avenue of the Americas

|

|

Beijing Kerry Center

|

|

New York, New York 10020-1104

|

|

1 Guanghua Road, Chaoyang District

|

|

Tel: (212) 335-4500

|

|

Beijing 100020, PRC

|

|

Fax: (212) 335-4501

|

|

Tel: +86 10 6561 1788

|

| |

|

Fax: +86 10 6561 5158

|

Approximate date of commencement of proposed sale to the public: as soon as practicable after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to such Section 8(a), may determine.

The information in this preliminary prospectus is not complete and may be changed. The selling shareholders may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where such offer or sale is not permitted.

|

SUBJECT TO COMPLETION

|

|

PRELIMINARY PROSPECTUS

DATED

JANUARY 24, 2012

|

American Depositary Shares

China Dredging Group Co., Ltd.

Representing 62,690,310 Ordinary Shares

This prospectus relates to the offering of 62,690,310 American depositary shares, or ADSs, each representing one ordinary share, no par value per share, by the shareholders identified in this prospectus. We will not receive any proceeds from the ADSs sold by the selling shareholders, if at all, all of which will be received by the selling shareholders. We are paying the cost of registering the ADSs covered by this prospectus as well as various related expenses.

The selling shareholders and any broker-dealers or agents that are involved in selling the shares may be deemed to be “underwriters” within the meaning of the Securities Act of 1933, as amended, in connection with such sales. In the event such persons may be deemed to be “underwriters,” any commissions received by such broker-dealers or agents and any profit on the resale of the shares purchased by them may be deemed to be underwriting commissions or discounts under the Securities Act of 1933, as amended.

No public market currently exists for our shares or ADSs. We may in the future pursue a trading market for our shares or ADSs, although we may not do so, we may be unable to maintain any such a trading market, and any such trading market may never be active. The selling shareholders and any of their pledgees, assignees and successors-in-interest may, from time to time, sell any or all of their ADSs included in this prospectus on any stock exchange, market or trading facility on which the ADSs are traded or in private transactions. These sales may be at fixed or negotiated prices. However, selling shareholders must sell at a fixed price of $5.00 per share until there is a public market for the ADSs.

Investing in our ADSs involves a high degree of risk. See “Risk Factors” beginning on page 5.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is _______, 2012.

CHINA DREDGING GROUP CO., LTD.

TABLE OF CONTENTS

|

PROSPECTUS SUMMARY

|

|

1

|

|

FORWARD-LOOKING STATEMENTS

|

|

4

|

|

RISK FACTORS

|

|

5

|

|

MARKET DATA AND FORECASTS

|

|

20

|

|

USE OF PROCEEDS

|

|

20

|

|

DIVIDEND POLICY

|

|

20

|

| CAPITALIZATION |

|

20 |

|

EXCHANGE RATE INFORMATION

|

|

21

|

|

ENFORCEABILITY OF CIVIL LIABILITIES

|

|

22

|

|

SELECTED HISTORICAL FINANCIAL DATA

|

|

23

|

|

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

|

|

25

|

|

OUR CORPORATE HISTORY AND STRUCTURE

|

|

54

|

|

BUSINESS

|

|

58

|

|

PRC GOVERNMENT REGULATIONS

|

|

66

|

|

MANAGEMENT

|

|

73

|

|

PRINCIPAL SHAREHOLDERS

|

|

76

|

|

SELLING SHAREHOLDERS

|

|

78

|

|

RELATED PARTY TRANSACTIONS

|

|

85

|

|

DESCRIPTION OF SHARES

|

|

86

|

|

DESCRIPTION OF AMERICAN DEPOSITARY SHARES

|

|

91

|

|

TAXATION

|

|

97

|

|

PLAN OF DISTRIBUTION

|

|

105

|

|

LEGAL MATTERS

|

|

107

|

|

EXPERTS

|

|

107

|

|

WHERE YOU CAN FIND ADDITIONAL INFORMATION

|

|

108

|

You should rely only on the information contained in this prospectus. We have not authorized anyone to provide you with information that is different from that contained in this prospectus. We have not taken any action to permit a public offering of the ADSs outside the United States. Persons outside the United States who come into possession of this prospectus must inform themselves about and observe any restrictions relating to the offering of the ADSs and the distribution of this prospectus outside the United States.

Conventions That Apply to This Prospectus

Unless we indicate otherwise or the context otherwise requires, and for purposes of this prospectus only:

| |

•

|

All share and per share data have been presented to give retrospective effect to our reorganization as described in the section entitled “Our Corporate History and Structure.”

|

| |

•

|

“We,” “us,” “our company,” “our” and “China Dredging” refer to China Dredging Group Co., Ltd., a BVI company, and its subsidiaries and variable interest entities.

|

| |

•

|

“China Dredging HK” refers to China Dredging (HK) Company Limited, a company organized under the laws of Hong Kong, a wholly owned subsidiary of China Dredging.

|

| |

•

|

“Fujian Service” refers to Fujian Xing Gang Port Service Co., Ltd., our operating business in the PRC.

|

| |

•

|

“Fujian WangGang” refers to Fujian WangGang Dredging Construction Co., Ltd., a PRC company, a wholly owned subsidiary of China Dredging HK and a wholly foreign-owned enterprise under PRC law. Fujian WangGang holds 50% of the equity interest in Fujian Service.

|

| |

•

|

“Wonder Dredging” refers to Wonder Dredging Engineering LLC, a PRC company, which holds a 50% equity interest in Fujian Service. The shareholders of Wonder Dredging have transferred 100% of the economic benefit of Fujian Service and full voting and management control to Fujian WangGang.

|

| |

•

|

“CAC” refers to Chardan Acquisition Corp., a BVI company.

|

| |

•

|

The “Merger” refers to the merger of CAC with and into China Dredging, which was consummated on October 27, 2010.

|

| |

•

|

“2010 Private Placement” refers to our private placement, between October 2010 to December 21, 2010, in multiple closings, of an aggregate of 10,012,987 preferred shares, at a purchase price of $5.00 per share with gross proceeds of approximately $50.1 million.

|

| |

•

|

“ADSs” refers to American depositary shares, each of which represents one of our ordinary shares, and “ADRs” refers to American depositary receipts, which, if issued, evidence ADSs.

|

| |

•

|

“Shares” or “ordinary shares” refers to our ordinary shares, no par value per share, and “preferred shares” refers to our Class A preferred shares, no par value per share.

|

| |

•

|

“China” or the “PRC” refers to the People’s Republic of China, excluding Hong Kong, Macau and Taiwan.

|

| |

•

|

“BVI” refers to the British Virgin Islands.

|

| |

•

|

The “U.S.” and the “United States” refers to the United States of America.

|

| |

•

|

“RMB” or “Renminbi” refers to the legal currency of China and “$,” “dollar,” “US$” or “U.S. dollar” refers to the legal currency of the United States.

|

This registration statement contains translations of Renminbi amounts into U.S. dollars at specified rates solely for the convenience of the reader. Unless otherwise noted, including in the notes to our financial statements, all translations from Renminbi to U.S. dollars were made at the rate of US$1 = RMB6.83. We make no representation that the Renminbi or U.S. dollar amounts referred to herein could have been or could be converted into U.S. dollars or Renminbi, as the case may be, at any particular rate or at all.

PROSPECTUS SUMMARY

You should read the following summary together with the entire prospectus, including the more detailed information regarding us, the ADSs being sold in this offering, and our consolidated financial statements and related notes appearing elsewhere in this prospectus. You should consider carefully, among other things, the matters discussed in the section entitled “Risk Factors.”

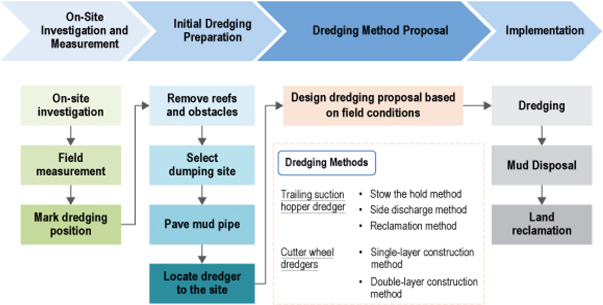

Our Company

We provide specialized dredging services exclusively to the Chinese marine infrastructure market and, based on the number and capacity of the dredging vessels we operate, we believe we are one of the leading independent (not state-owned) providers of such services in the PRC. Our services, which require significant engineering and project management expertise, include on-site investigation and measurement, cost estimation, sediment and obstruction removal and transport and disposal of dredged material in an environmentally responsible manner. We conduct our dredging operations through Fujian Service, in which we hold a 50% equity interest, with the remaining 50% interest controlled by us pursuant to variable interest entity agreements.

Dredging involves preserving or enhancing the navigability of waterways by removing soil, sand or rock or the transfer of marine bottom materials to other locations for environmental purposes or for land creation. We engage in three primary types of dredging work:

|

|

·

|

Capital dredging, which represented 35.2% of our revenues for the six months ended June 30, 2011, consists of sediment removal or transfer for the initial construction or deepening of ports and navigation channels;

|

|

|

·

|

Maintenance dredging, which represented 5.8% of our revenues for the six months ended June 30, 2011, entails ongoing dredging that is required to ensure that ports and navigation channels maintain sufficient water depth to serve their intended purpose; and

|

|

|

·

|

Reclamation dredging, which represented 59.0% of our revenues for the six months ended June 30, 2011, involves transferring material removed from sea or river-beds to another location to raise the surface above the water level and thereby increase land availability or utility.

|

Our modern fleet of thirteen dredging vessels has broad capabilities with which we are able to address diverse types of projects, and we intend to build our fleet by continuing to acquire additional vessels. As of June 30, 2011, we had successfully completed over 76 dredging projects in fifteen districts of eight provinces in the PRC. Our fleet has been substantially fully committed to projects since our inception in 2008. Fujian Service operated five dredgers in 2008 that it owned or leased. Currently, we own four dredgers and lease nine dredgers.

Our primary customers are large, state-owned enterprises that act as general contractors and perform a significant majority of the port infrastructure and dredging activity in the PRC. These companies sub-contract a portion of the required dredging services to specialty contractors, such as us, as a means of increasing their margins and more efficiently allocating their own resources.

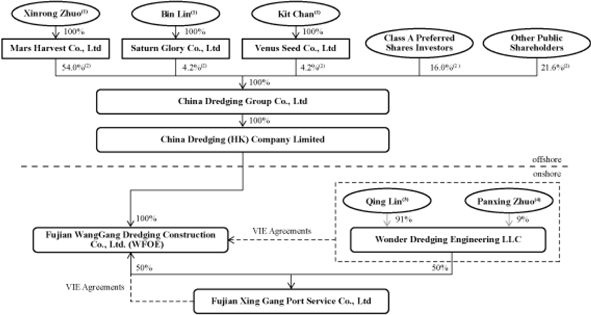

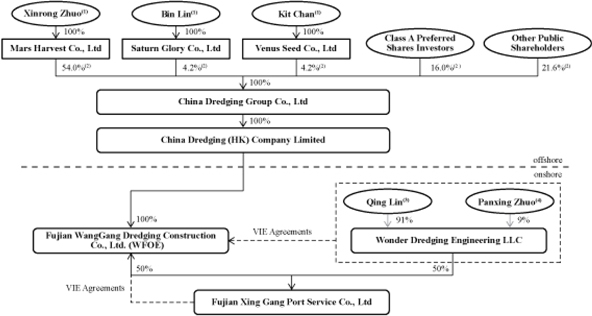

Our Corporate Structure

We are a BVI holding company and conduct our dredging operations through our PRC subsidiary, Fujian Service. Our wholly owned subsidiary, China Dredging HK, was organized under the laws of Hong Kong in April 2010 to serve as a holding company for Fujian WangGang, a PRC company and wholly foreign-owned enterprise, or WFOE, under PRC law. Fujian WangGang holds a 50% direct equity interest in Fujian Service and consolidates the remaining 50% interest as a result of certain variable interest entity agreements described in the section entitled “Our Corporate History and Structure — Variable Interest Entity Agreements.”

In October 2010, we merged with CAC, a public reporting, non-trading shell company domiciled in the BVI. The terms of the Merger were set forth in a merger agreement, or the Merger Agreement, which provided that China Dredging would continue as the surviving company following the Merger. We have accounted for the Merger as a recapitalization, with China Dredging being treated as the accounting acquirer. Immediately prior to, and in contemplation of, the consummation of the Merger, we redesignated our shares to retroactively adjust our legal capital. At the time of the Merger, all of the issued and outstanding shares of CAC were exchanged for 500,000, or 0.95%, of our issued and then outstanding ordinary shares, while our shareholders immediately prior to the Merger retained 52,177,323, or 99.05%, of our issued and then outstanding ordinary shares. As a result of the Merger, we became a public reporting company. CAC, being the non-surviving company, ceased its corporate existence. Concurrently with the closing of the Merger, we conducted a private placement, which is described in more detail below in the section entitled “Our Corporate History and Structure — 2010 Private Placement.”

Under applicable PRC law, foreign ownership in certain industries is restricted and may not exceed a government specified level. WFOEs may only undertake certain types of construction projects, and foreign ownership in a Chinese-foreign joint venture construction enterprise is restricted to no more than 75% according to the PRC Regulations on Administration of Foreign-Invested Construction Enterprises, or the RAFCE. Additionally, as a marine contractor working on restricted projects within the PRC, Fujian Service is required to register its vessels under the flag of the PRC, and foreign ownership of the enterprises which own the PRC-registered vessels is limited to no more than 50%. Therefore, Fujian Service’s business operations will be adversely affected if its foreign ownership is increased to more than 50%. While Wonder Dredging qualifies as a PRC entity under PRC law and owns 50% equity of Fujian Service, Fujian WangGang’s direct ownership of 50% of Fujian Service and beneficial ownership and control of the remaining 50% of Fujian Service through the variable interest entity agreements allows it to meet both the requirements for foreign ownership under its qualifications as a marine construction company and as an operator of dredging vessels within PRC waters.

The following diagram illustrates our current corporate structure:

|

(1)

|

Xinrong Zhuo is our Chairman of the Board of Directors and Chief Executive Officer, Bin Lin is our Senior Vice President, and Kit Chan is one of our independent directors.

|

|

(2)

|

Assumes the conversion of all of our preferred shares into ordinary shares.

|

|

(3)

|

Qing Lin is the brother-in-law of Xinrong Zhuo, our Chairman of the Board of Directors and Chief Executive Officer, and holds the 91% interest as the representative of the family.

|

|

(4)

|

Panxing Zhuo is the father of Xinrong Zhuo, our Chairman of the Board of Directors and Chief Executive Officer, and holds the 9% interest as the representative of the family.

|

For more information regarding our corporate structure, including a “Make-Good Escrow” our controlling shareholder entered into in connection with our 2010 Private Placement, please see “Our Corporate History and Structure.”

Our Corporate Information

Our principal executive offices are located at Floor 18, Tower A, Zhongshan Building No. 154, Hudong Road, Gulou District, Fuzhou City, Fujian Province 350001, PRC. Our telephone number at this address is +86-591-8727-1266. Our registered office in the BVI is located at Kingston Chambers, PO Box 173, Road Town, Tortola, BVI.

Investors should submit any inquiries to the address and telephone number of our principal executive offices. Our main website is www.chinadredgingco.com. The information contained on our website is not a part of this prospectus. Our agent for service of process in the United States is C T Corporation System.

The Offering

|

ADSs offered by the selling shareholders

|

|

ADSs

|

| |

|

|

|

Ordinary shares outstanding immediately before this offering

|

|

52,677,323

ordinary shares as of January 24, 2012

|

| |

|

|

|

Trading

|

|

No public market currently exists for our shares or ADSs. We may in the future pursue a trading market for our shares or ADSs, although we may not do so, we may be unable to maintain any such a trading market, and any such trading market may never be active.

|

| |

|

|

|

Use of proceeds

|

|

We will not receive any proceeds from the ADSs sold by the selling shareholders, if at all, all of which will be received by the selling shareholders.

|

| |

|

|

|

Risk factors

|

|

See “Risk Factors” and other information included in this prospectus for a discussion of risks you should carefully consider before investing in the ADSs.

|

| |

|

|

|

Terms of the offering by selling shareholders

|

|

The selling shareholders will determine when and how they will sell the ADSs, if at all. However, selling shareholders must sell at a fixed price of $5.00 per share until there is a public market for the ADSs.

|

FORWARD-LOOKING STATEMENTS

This prospectus contains forward-looking statements that reflect our current expectations and views of future events. The forward looking statements are contained principally in the sections entitled “Prospectus Summary,” “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Business.” All statements other than statements of historical fact are “forward-looking statements,” including any statements of the plans, strategies, goals, intentions and objectives of management for future operations, any statements concerning proposed new projects or other developments, any statements regarding future economic or industry conditions or performance, any statements of management’s beliefs, expectations and estimations, and any assumptions underlying any of the foregoing. You can identify some of these forward-looking statements by words or phrases such as “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “future,” “intend,” “likely to,” “may,” “plan,” “potential,” “predict,” “project,” “scheduled to,” “should,” “target,” “will,” “would,” and similar expressions, as well as statements in the future tense. We have based these forward-looking statements largely on our current expectations and projections about future events that we believe may affect our financial position, results of operations, business strategy and financial needs. These forward-looking statements include statements relating to:

|

|

·

|

our future development, financial positions and results of operations;

|

|

|

·

|

the expected growth of the dredging industry in China and globally;

|

|

|

·

|

market acceptance of our services;

|

|

|

·

|

our expectations regarding demand for our services;

|

|

|

·

|

our ability to stay abreast of market trends and technological advances;

|

|

|

·

|

competition in our industry;

|

|

|

·

|

PRC governmental policies and regulations relating to our industry;

|

|

|

·

|

litigation and government proceedings involving our company and industry; and

|

|

|

·

|

general economic and business conditions, particularly in China.

|

These forward-looking statements involve various known and unknown risks, uncertainties and other factors. Although we believe that our expectations expressed in these forward-looking statements are reasonable, our expectations may later be found to be incorrect. Our actual results, performance or achievements could be materially different from our expectations. Important risks, uncertainties and other factors that could cause such material differences are generally set forth in “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” “Business,” “PRC Government Regulations” and other sections in this prospectus. You should read this prospectus and the documents that we refer to in this prospectus and have filed as exhibits to the registration statement, of which this prospectus is a part, completely and with the understanding that actual future results, performance or achievements may be materially different from what we expect. We qualify all of our forward-looking statements by these cautionary statements.

The forward-looking statements made in this prospectus relate only to events or information as of the date on which the statements are made in this prospectus. Except as required by law, we undertake no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise, after the date on which the statements are made or to reflect the occurrence of unanticipated events.

Investing in our ADSs involves a high degree of risk. You should consider carefully all of the information in this prospectus, including the risks and uncertainties described below, before making an investment in our ADSs. Any of the following risks could have a material adverse effect on our business, financial position and results of operations. In any such case, the market price of our ADSs could decline, and you may lose all or part of your investment.

Risks Relating to Our Business and Industry

Our performance depends upon public spending on marine transportation infrastructure, which may significantly decline.

Our ability to generate revenues significantly depends upon the PRC government’s public spending on marine transportation infrastructure, primarily for the construction and improvement of ports and waterways. Our major customers include PRC government agencies at the national, provincial and local levels, and state-owned enterprises. We are therefore affected by changes in public works’ budgets. The future growth of the dredging industry in the PRC depends significantly upon the continued availability of major marine transportation infrastructure projects. The nature, extent and timing of these projects will, however, be determined by the interplay of a variety of factors, including the PRC government’s spending in the marine transportation infrastructure industry in the PRC and the general conditions and prospects of the PRC economy. The PRC government’s spending in the marine transportation infrastructure industry has historically been, and we expect to continue to be, affected by general PRC economic trends and subject to fluctuation. Should there be a significant reduction in public spending on marine transportation infrastructure projects in the PRC and we fail to open up new markets in or outside the PRC, our operations and profits could be materially and adversely affected.

Our profitability is subject to inherent risks because of the fixed-price nature of most of our contracts.

Our revenues are derived from our role as a subcontractor for general contractors of dredging projects. Substantially all of the contracts between us and the general contractors are fixed-price contracts or fixed unit price in nature. Under a fixed-price contract, the customer agrees to pay a specified price for its performance of the entire contract. Fixed-price contracts carry inherent risks, including risks of losses from underestimating costs of materials, operational difficulties and other changes that may occur during the contract period. As a result, we will only realize profits on these contracts if we successfully estimate project costs and avoid cost overruns.

One of the most significant factors affecting the profitability of a dredging project is the weather at the project site. Inclement or hazardous weather conditions can result in substantial delays in dredging and additional contract expenses. Due to these factors, it is possible that we will not be able to perform obligations under fixed-price contracts without incurring additional expenses. Should we significantly underestimate the costs on one or more significant contracts, the resulting losses could have a material adverse effect on us.

In the past several years we have derived a significant portion of our revenues from a small group of customers and we expect this to continue to be the case. The loss of any one of these customers could have a material adverse effect on our business, operating results and financial condition.

Our customer base has been, and we expect it to remain, highly concentrated. For each of the years ended December 31, 2010 and 2009, four customers accounted for 78.1% and 100%, respectively, of our total revenues. For the six months ended June 30, 2011 and the years ended December 31, 2010 and 2009, two subsidiaries of our largest customer, China Communications, accounted for 59.8%, 67.5% and 48.8%, respectively, of our total revenues. We expect our total revenues to remain heavily concentrated with a small group of customers. We may lose customers from time to time, and if our customer base remains highly concentrated, the loss of, or reduction of our sales to, any such major customers could have a material adverse effect on our business, operating results and financial condition.

Our general contractor customers may continue to expand internal capacity and modernize their fleets which may reduce their reliance on subcontracting and limit our business growth.

Our largest general contractor customers have subcontracted a substantial amount of dredging work in the past, reflecting a large shortfall in internal capacity. If these customers continue to invest in a modern fleet for larger capacity and better efficiency, they may reduce reliance on subcontracting. Since our prospects for growth are primarily driven by increases in subcontracting by our major customers, a reduced subcontracting demand from those customers would adversely impact our growth prospects.

Our operations may cause substantial harm to persons, property and the environment, which could hurt our reputation and, to the extent they are not covered contractually or by insurance could cause us to incur substantial costs.

Our operations are subject to hazards inherent in providing dredging and related support services, such as the risk of equipment failure, vessel collision or other transit related accidents, industrial accidents, fire and explosion. These hazards can cause personal injuries and losses of lives, business interruptions, property and equipment damage, pollution and environmental damage. We may be subject to claims as a result of incidents relating to these and other hazards. For example, Fujian Service was sued in four related lawsuits brought by several individuals in Wenzhou, China, in May 2010. The lawsuits related to a traffic accident that allegedly caused the deaths of two people and injuries to two other people. The plaintiffs alleged that a truck was hired for the Wenzhou Lingkun working area multiple function port construction project, or the Lingkun Construction Project, and that the owner, the general contractor and Fujian Service as the subcontractor of the Lingkun Construction Project, all of whom were named as co-defendants in these lawsuits, were responsible for the damages. The plaintiffs claimed total damages of approximately $0.6 million. Although Fujian Service was held not responsible for any of the plaintiffs’ claims, similar unpredictable events could occur in the future and adversely affect our operations.

We normally seek to limit our exposure to these claims and liabilities through contractual limitations of liability and insurance. These measures, however, may not always be effective because of various reasons outside of our control, including, among other things:

|

|

·

|

In some of the jurisdictions in which we operate, environmental and workers’ compensation liabilities may be assigned to us as a matter of law and may not be limited through contracts;

|

|

|

·

|

Insurance coverage may not be sufficient because it may not be possible to obtain adequate insurance against some risks on commercially reasonable terms, or at all. Insurance products, in particular, have become increasingly expensive and sometimes very difficult to obtain. In this regard, consistent with what we believe is customary practice in the PRC, we do not carry any business interruption insurance. While we do have Ship Pollution Liability coverage for certain environmental damage and third-party losses that arise from fuel or chemical leaks from the three vessels that we own, there may be circumstances in which we would not be fully covered or compensated for losses and liabilities arising from interruptions to our operations, construction accidents, defects in our work or other risks by insurance that we have maintained. Our Ship Pollution Liability coverage is for up to approximately $732,000 annually for Xinggangjun #66, $366,000 annually for Xinggangjun #3, $309,000 annually for Xinggangjun #6 and $309,000 annually for Xinggangjun #9.

|

Failure to effectively cover these risks for any of the above reasons could expose us to substantial costs and potentially lead to material losses. Additionally, the occurrence of any of these risks may harm our reputation, which may materially inhibit our ability to win more projects.

Customers pay us by way of progress payments, and delay in progress payments may affect working capital and cash flow.

Most of our contracts provide for progress payments from our general contractor customers based upon the value of work completed upon reaching certain milestones. Generally a site engineer issues a progress certificate certifying the work progress in the preceding contract stage. The customers then effect payments with reference to these certificates. As a result, we are often required to commit resources to projects prior to receiving payment from customers in amounts sufficient to cover expenditures on the projects as they are incurred. These progress payments may not be remitted by customers to us on a timely basis and we may not be able to efficiently manage the level of bad debt arising from such payment practice.

Delays in progress payments from customers would increase our working capital needs. If a customer defaults in making its payments on a project to which we have devoted significant resources, it would also affect our liquidity and decrease the capital resources that are otherwise available for other uses. In such cases, we may file a claim for compensation of the loss of a payment default, but settlement of disputes of this nature generally takes substantial time in the PRC and expenditure of financial and other resources, and the outcome is often uncertain.

We require substantial capital and any failure to obtain the capital needed on acceptable terms, or at all, may adversely affect our expansion plans and growth prospects.

The transportation infrastructure industry in which we operate is generally capital intensive. It requires significant capital to acquire, maintain and operate our vessels and facilities, resulting in high fixed costs. It also requires significant capital to purchase dredging equipment, develop new services and implement new technologies. Our capital expenditures may increase as a result of the further upgrade of our dredging fleet and expansion of our scope of operations.

Under most of our contracts, we are required to finance dredging equipment, and performance of engineering, construction and other work on projects for periods averaging approximately one month before receiving progress payments from customers in amounts sufficient to cover expenditures. We may therefore have significant working capital requirements. Our working capital requirements would materially increase if our general contractor customers impose extended payment terms in line with their corporate averages, which approach three months. To the extent that our working capital funding requirements exceed our financial resources, we will be required to seek additional debt or equity financing or to defer planned expenditures. In the past, we have financed our working capital and capital expenditures through a combination of sources, including cash flow from our operations and bank and other borrowings. If we are unable to obtain financing in a timely manner and at a reasonable cost, our expansion plans may be delayed, project progress may be constrained, and our growth, competitive position and future profitability may be adversely affected.

Our backlog is subject to unexpected adjustments and cancellations and is, therefore, an uncertain indicator of our future earnings.

Backlog represents our estimate of the contract value of work that remains to be completed on firm contracts that have not yet commenced and on contracts in progress as at a certain date. The contract value of a project represents the revenue that is expected to be received under the terms of the contract if the contract is performed in accordance with its terms. As of June 30, 2011, we had a backlog of approximately $97.4 million. The revenues anticipated by our backlog may not be realized and, if realized, may not result in profits. Projects may remain in backlog for an extended period of time. In addition, project cancellations or scope adjustments may occur from time to time, which could reduce the dollar amount of the backlog and the revenue and profits that are ultimately earned from the contracts. For instance, in October 2010 we formally deferred three contracts totaling approximately $44.6 million which were reported in our backlog as of June 30, 2010. We believe these deferral agreements created enough uncertainty about when the contracts would be performed that they should no longer be included in our backlog. By mutual agreement, these three contracts were, subsequent to December 31, 2010, replaced by three other one-year contracts for which work has commenced with an aggregate contract value of approximately $61.0 million. Accordingly, investors should not unduly rely on the backlog information presented in this prospectus as an indicator of our future earnings. In addition, since our backlog represents less than six months of potential revenue, our longer-term results depend significantly on our ability to convert our bid- and negotiation-stage project pipeline into backlog, which we may be unable to do.

Failure to meet schedule requirements of contracts could require us to pay liquidated damages.

Substantially all of our contracts with general contractors are subject to specific completion schedule requirements with liquidated damages charged to us if we do not achieve the schedules. Liquidated damages are typically levied at an agreed rate for each day of delay that is deemed to be our responsibility. Any failure to meet the schedule requirements of the contracts could cause us to pay significant liquidated damages, which would reduce or eliminate profit on the relevant contracts and could adversely affect liquidity and cash flows and have a material adverse effect on our business, financial condition, results of operations and prospects.

We are subject to extensive environmental, safety and health regulations in the PRC, the compliance with which may be difficult or expensive.

The PRC government has published extensive environmental, safety and health regulations with which we need to comply. Failure to comply with these regulations may result in penalties, fines, suspension or revocation of our licenses or permits to conduct business, and litigation. Given the magnitude and complexity of these regulations, compliance with them may be difficult or involve the expenditure of significant financial and other resources to establish effective compliance and monitoring systems. In addition, these regulations are constantly evolving. The PRC government may impose additional or stricter laws or regulations, compliance with which may cause us to incur significant costs that we may not be able to pass on to our customers. Furthermore, some of the new overseas markets that we are seeking to enter may have more onerous environmental, safety and health regulations than China, compliance with which may be very costly and could hinder our endeavors to enter these new overseas markets. In addition, we face numerous PRC regulatory risks associated with our operations in China. Please see “ — Risks Relating to Doing Business in the PRC” and “PRC Government Regulations.”

Our operations depend heavily on the timely availability of an adequate supply of supplies and consumable parts at acceptable prices and quality.

To operate successfully, we must obtain from our suppliers sufficient quantities of supplies and consumable parts, such as mud pipe and dredge pumps at acceptable prices and quality and in a timely manner. In 2009 and 2010, the cost of supplies and consumable parts accounted for approximately 76.8% and 73.1%, respectively, of our total cost of contract revenue. During times of short supply, we may have to pay significantly higher prices to obtain the supplies and consumable parts required for our operations. Most of our dredging contracts specify a fixed unit price and we are responsible for procuring supplies and consumable parts needed for the projects. As a result, when prices of such supplies and consumable parts increase, we are unlikely to be able to pass the price increases on to our customers. In addition, we have entered into fixed price supply contracts with some of our suppliers, under which we are obligated to procure a fixed amount of supplies and consumable parts annually. Although we negotiate these agreements on an annual basis, in the event when prices of such supplies and consumable parts drop, we are unlikely to be able to procure the supplies and consumable parts of similar quality from a cheaper source. The profitable performance of our contracts also requires components and supplies of high quality. If quality supplies and consumable parts are not available, it could directly and adversely affect the quality, timeliness or efficiency of our work, undermine our reputation and increase the chances of potential disputes and liabilities, all or any of which may negatively affect future profits and projected growth.

We face significant competition in the markets in which we operate, which could adversely affect our financial results and business prospects.

We face significant competition in the PRC markets in which we operate. Our competition comes from various sources, including the internal operations of our general contractor customers and numerous private companies providing dredging services as general contractors or subcontractors. Some of our competitors may have advantages over us in terms of capacity, access to capital pricing and management expertise. Our market position and growth prospects depend on our ability to anticipate and respond to various competitive factors, including pricing strategies adopted by competitors, changes in customer preferences or work priorities, availability of capital and financing resources and the introduction of new or improved equipment, technology and services.

Our current or potential competitors may offer services or products comparable or superior to those that we offer at the same or lower prices or adapt more quickly than we do to evolving industry trends or changing market conditions. We may lose our customers to our competitors if, among other things, we fail to keep our prices at competitive levels or to sustain and upgrade our capacity and technology. Increased competition may result in price reductions, reduced profit margins and loss of market share.

Our operations require permits or licenses and the loss of these permits or licenses could significantly hinder our business and reduce our expected revenue and profits.

We require operating permits and licenses to conduct our business in PRC waters and we must comply with the restrictions and conditions imposed by various levels of government to maintain our permits and licenses. Such restrictions include limitations on foreign ownership of the enterprises which own the PRC-registered vessels and the licensed entity performing dredging works, maintenance of sufficient number of qualified personnel, maintenance of sufficient project track records and compliance with safety regulations and environment protection regulations and maintenance of various licenses of the dredging vessels. If we fail to comply with any of the regulations required for the maintenance of our licenses, our licenses could be temporarily suspended or even revoked, or the renewal of our licenses upon expiration of their original terms may be delayed, which would directly impact our ability to undertake dredging work and reduce our revenue and profit. For a detailed discussion of the effects of restrictions on foreign ownership of the enterprise which owns the PRC-registered vessels, the licensed entity performing dredging works and other conditions, please see “ — Risks Relating to Doing Business in the PRC” and “PRC Government Regulations.”

Our controlling shareholder has contractual obligations that may create potential conflicts of interest.

In October 2010, our controlling shareholder, a company controlled by Mr. Xinrong Zhuo, our Chairman of the Board of Directors and Chief Executive Officer, placed into escrow 15,000,000 of our ordinary shares, or the Make-Good Escrow, pursuant to a securities escrow agreement, for the purpose of providing protection to the investors in our 2010 Private Placement in the event we do not achieve certain net income thresholds for the years ended 2010 and 2011. If we were not to achieve the thresholds set forth below, holders of our preferred shares will receive additional shares from the Make-Good Escrow, up to the full number of shares held in the Make-Good Escrow. Although we already achieved the applicable threshold for 2010 and believe we are likely to achieve the applicable threshold for 2011, our belief may be mistaken. If we do not achieve the applicable threshold for 2011, Mr. Zhou would face a loss of significant value associated with the escrow shares, which represent approximately 28.5% of our outstanding ordinary shares and could cause him to cease to be our controlling shareholder. A conflict of interest could develop between us and Fujian Service if Mr. Zhuo loses his interest in the escrow shares but, through his membership in the common control group that controls Fujian Service, retains ownership of Fujian Service. Any such conflict of interest may materially and adversely affect our financial condition or results or operation.

We may encounter unexpected difficulties in expanding into new markets.

As we broaden the scope of our geographical operations within the PRC it places additional demands on our management resources. Such expansion also increases the requirements for spare parts and consumable inventories because our business model contemplates maintaining minimum quantities of key items close enough to each vessel to be delivered quickly. Further, it requires us to become familiar with and manage our operations in keeping with local requirements with which we may not be familiar. Any of these factors could adversely affect the cost and efficiency of our dredging operations and our financial performance.

Although we have no plans to do so, we may expand the geographical coverage of our operations outside the PRC to meet the evolving needs of our key customers who are expanding internationally to places such as Vietnam, Taiwan and other Asian countries. Expansion into overseas markets carries with it many associated risks, including risks relating to being relatively new in such markets and unfamiliar with and unable to manage the requirements of operating there. Expansion into overseas markets could also stretch our capital, personnel and management resources to a greater extent than further geographical expansion within the PRC. In addition, there may be many established incumbent players in these markets, who already enjoy a significant presence, and it may be difficult for us to win market share from them. Some of the overseas markets that we could potentially enter may have high barriers of entry to foreign competitors and any such expansion outside of the PRC may not be successful.

Our continued success requires hiring and retaining qualified personnel.

Our future success is dependent upon our ability to attract and retain personnel, including executive officers and key qualified personnel, who have the necessary and required experience and expertise. Particularly, our success is largely attributable to the highly qualified and experienced personnel that we have been able to attract and retain in the past such as captains and chief engineers for dredgers or construction-related geology analysts. Competition for qualified personnel is intense and we have periodically experienced difficulties in recruiting suitable personnel. We may lose these persons to those competitors who are able to offer more competitive packages, or we may have to significantly increase our related staff costs.

We significantly depend on our Chief Executive Officer.

We are dependent on the principal members of our management staff, and in particular Xinrong Zhuo, our Chief Executive Officer. While we have entered into a three-year employment agreement with Mr. Zhuo, there are circumstances under the agreement in which Mr. Zhuo may elect to terminate his employment pursuant to the agreement. Even if Mr. Zhuo were to terminate employment with us in breach of his agreement, we would have little or no practical recourse against Mr. Zhuo under PRC law. Mr. Zhuo may not continue to be employed by us for as long as we require his services. In addition, we rely on members of our senior management team with dredging industry experience for important aspects of our operations, and we believe that losing the services of these executive officers could be detrimental to our operations because they would be difficult to replace. We do not have key-man life insurance for any of our executive officers or other employees.

Risks Relating to Doing Business in the PRC

The political and economic policies of the PRC government could affect our businesses and results of operations.

The economy of the PRC differs from the economies of most developed countries in a number of respects, including the degree of government involvement, control of capital investment, and the overall level of development. Before its adoption of reform and open up policies in 1978, China was primarily a planned economy. In recent years the PRC government has been reforming the PRC economic system and the government structure. These reforms have resulted in significant economic growth and social progress. Economic reform measures, however, may be adjusted, modified or applied inconsistently from industry to industry or across different regions of the country. As a result, we may not continue to benefit from all, or any, of these measures. In addition, it cannot be predicted whether changes in the PRC’s political, economic and social conditions, laws, regulations and policies will have any adverse effect on our current or future business, financial condition and results of operations.

The PRC legal system is evolving and has inherent uncertainties regarding interpretation and enforcement of PRC laws and regulations that could limit the legal protections available to you.

Fujian Service, our operating company, is organized under the laws of the PRC. The PRC legal system is based on written statutes. Prior court decisions may be cited for reference but have limited weight as precedents. Since 1979, the PRC government has been developing a comprehensive system of commercial laws and considerable progress has been made in introducing laws and regulations dealing with economic matters such as foreign investment, corporate organization and governance, commerce, taxation and trade. However, because these laws and regulations are relatively new, and because of the limited number and non-binding nature of published cases, the interpretation and enforcement of these laws and regulations involve uncertainties.

Our operations and assets in the PRC are subject to significant political and economic uncertainties.

Changes in PRC laws and regulations, or their interpretation, or the imposition of confiscatory taxation, restrictions on currency conversion, imports and sources of supply, devaluations of currency or the nationalization or other expropriation of private enterprises could have a material adverse effect on our business, results of operations and financial condition. The PRC government has been pursuing economic reform policies that encourage private economic activity and greater economic decentralization. The PRC government may continue to pursue these policies, and it may significantly alter these policies from time to time without notice.

We may be required to obtain prior approval from Ministry of Commerce and the China Securities Regulatory Commission for the Merger and the listing and trading of our ADSs on any U.S. stock exchange

In August 2006, six PRC regulatory authorities, including the Ministry of Commerce, or MOFCOM, the State Assets Supervision and Administration Commission, the State Administration for Taxation, the State Administration for Industry and Commerce, the China Securities Regulatory Commission, or the CSRC, and the State Administration of Foreign Exchange, or SAFE, promulgated a regulation entitled Provisions Regarding Mergers and Acquisitions of Domestic Enterprises by Foreign Investors, which became effective in September 2006 and was amended in June 2009 by the MOFCOM, or the M&A Regulations. The M&A Regulations, among other things, purports to require that the approval from MOFCOM be obtained for acquisitions of affiliated domestic entities by foreign entities established or controlled by domestic natural persons or enterprises, and also that an offshore special purpose vehicle, or SPV, formed for purposes of overseas listing of equity interests in PRC companies and controlled directly or indirectly by PRC companies or individuals, obtain the approval of the CSRC prior to the listing and trading of such SPV’s securities on an overseas stock exchange. On September 21, 2006, the CSRC published on its official website procedures regarding its approval of overseas listings by SPVs. The CSRC approval procedures require the filing of a number of documents with the CSRC.

As at the date of this prospectus, the application of the M&A Regulations remains unclear, with no consensus among leading PRC law firms regarding the scope and applicability of the CSRC approval requirement. Our PRC legal counsel, Dacheng Law Offices LLP (Fuzhou), based on its understanding of current PRC laws, regulations and rules, has advised us that the M&A Regulations are not applicable to us or the Merger we already consummated and that any potential quotation of our ADSs on the OTCBB or any listing and trading of our ADSs on a U.S. stock exchange would not require CSRC’s approval because our founder and controlling shareholder, Mr. Xinrong Zhuo, is not a mainland PRC natural person. However, the relevant PRC government authorities, including MOFCOM and the CSRC, may reach a different conclusion than our PRC counsel. If prior approval from MOFCOM or the CSRC is required but not obtained, we may face sanctions by MOFCOM, the CSRC or other PRC regulatory agencies. Consequently, MOFCOM, the CSRC or other PRC regulatory agencies may impose fines and penalties on our operations in the PRC, limit our operations in the PRC, or take other actions that could have a material adverse effect on our business, financial condition, results of operations, reputation and prospects, as well as the trading price of our ADSs. MOFCOM, the CSRC or other PRC regulatory agencies may also take actions requiring us, or making it advisable for us, not to commence a public offering.

The Circular of the General Office of the State Council on the Establishment of Security Review System Regarding the Merger & Acquisition of Domestic Enterprises by Foreign Investors promulgated on February 3, 2011, or the Circular of Security Review, and the Regulations of Implementing the Security Review System Regarding Merger & Acquisition of Domestic Enterprises by Foreign Investors promulgated by MOFCOM on August 25, 2011, or the Regulations of Security Review collectively, provide that as of March 5, 2011, any foreign investor should file an application with MOFCOM for the merger and acquisition of domestic enterprises in sensitive sectors or industries. Furthermore, the aforementioned security review shall not be substantially evaded by VIE control or any other methods. The Circular of Security Review was put into effect on March 5, 2011. As our current ownership structure or contractual arrangements were established before 2011, our PRC counsel, Dacheng Law Offices LLP (Fuzhou), has advised us that the Regulations of Security Review do not apply to us. However, the relevant PRC regulatory authorities may have a different view or interpretation in this regard when implementing the Regulations of Security Review. As a result, our future mergers and acquisitions of PRC domestic enterprises may be subject to PRC security review, which could be time-consuming and complex, and in turn affect our ability to expand our business or maintain our market share.

Due to various restrictions under PRC laws on the distribution of dividends by our PRC operating companies, we may not be able to pay dividends to our shareholders.

The Wholly-Foreign Owned Enterprise Law (1986), as amended, The Wholly-Foreign Owned Enterprise Law Implementing Rules (1990), as amended, and the Company Law of the PRC (2006) contain the principal regulations governing dividend distributions by WFOEs. Under these regulations, WFOEs may pay dividends only out of their accumulated profits, if any, determined in accordance with PRC accounting standards and regulations. Additionally, they are required to set aside each year 10% of its net profits (if any), based on PRC accounting standards, to fund a statutory surplus reserve until the accumulated amount of such reserve reaches 50% of their respective registered capital. These reserves are not distributable as cash dividends except in the event of liquidation and cannot be used for working capital purposes. The PRC government also imposes controls on the conversion of RMB into foreign currencies and the remittance of currencies out of the PRC. We may experience difficulties in completing the administrative procedures necessary to obtain and remit foreign currency for the payment of dividends from the profits of Fujian WangGang.

Furthermore, if our subsidiaries in the PRC incur debt on their own in the future, the instruments governing the debt may restrict its ability to pay dividends or make other payments. If we or our subsidiaries are unable to receive all of the revenues from our operations through these contractual or dividend arrangements, we may be unable to pay dividends on our ordinary shares.

Because our principal assets are located outside of the United States and our directors and officers reside outside of the United States, it may be difficult for our investors to enforce their rights based on the United States federal securities laws against us and our officers and directors in the United States or to enforce foreign judgments or bring original actions in the PRC against us or our management named in this prospectus.

All of our officers and directors reside outside of the United States. In addition, our operating subsidiaries are located in the PRC and all of their assets are located outside of the United States. The PRC does not have a treaty with United States providing for the reciprocal recognition and enforcement of judgments of courts. It may therefore be difficult for investors in the United States to enforce their legal rights based on the civil liability provisions of the United States Federal securities laws against us in the courts of either the United States or the PRC and, even if civil judgments are obtained in courts of the United States, to enforce such judgments in PRC courts.

In addition, since we are incorporated under the laws of the BVI and our corporation affairs are governed by the laws of the BVI, it may not be possible for our investors to originate actions against us or against our directors or officers based upon PRC laws, and it may be difficult, if possible at all, to bring actions based upon BVI laws in the PRC in the event that you believe that your rights as a shareholder have been infringed.

If the PRC government determines that our contractual arrangements that establish the structure for our business operations do not comply with applicable PRC laws, rules and regulations, we could be subject to severe penalties or be forced to restructure our ownership structure.

Foreign ownership in ships which are authorized to operate within the waters in the PRC is subject to significant restrictions under current PRC laws, rules and regulations. According to the Regulation of Ship Registration of the PRC and other related regulations, a ship with more than 50% foreign ownership may not be registered with China nationality. In addition, a ship without a China nationality is not allowed to operate within the waters in the PRC. According to the requirements of the Rules of PRC Governing Vessels of Foreign Nationality, effective as of September 18, 1979, and other applicable rules and regulations, foreign vessels are required to obtain applicable permissions from the PRC administrative authorities for port entries into, navigations in, and exits from the PRC inland waterways and territorial seas. Furthermore, the RAFCE, provides that wholly foreign-owned construction enterprises may only undertake certain types of construction projects prescribed by the RAFCE within the scope of their qualifications. According to such stipulations, the business operations of our operating company, Fujian Service, will be adversely affected if its foreign-owned equity is increased to more than 50%.

To comply with applicable PRC laws, rules and regulations, we directly own 50% equity interests of Fujian Service, our operating company, and entered into the VIE Agreements with Wonder Dredging, which is a PRC domestic company and legal owner of the other 50% equity interests of Fujian Service, and the shareholders of Wonder Dredging. We believe these contractual arrangements give us total control and 100% beneficial interest in the 50% of Fujian Service and 100% of Wonder Dredging that we do not directly own. Our PRC legal counsel, Dacheng Law Offices LLP (Fuzhou), has advised us that (a) our contractual arrangements are in compliance with the requirements of applicable PRC laws and regulations and are in full force and effect; (b) the execution, delivery, effectiveness, enforceability and performance of the such contractual arrangements by any of the our subsidiaries do not (i) result in any violation of the provisions of the articles of association, business licenses or other constitutive documents of such parties, (ii) conflict with or constitute a breach of any contracts, agreements, or other instruments to which any such parties is a party or by which any of them may be bound, or to which any of the property or assets of such parties is subject, or (iii) result in any violation of any judgment, award, order, writ or decree of any domestic PRC government body, court, arbitration panel, domestic or foreign, having jurisdiction over any such party. However, the relevant PRC regulatory authorities have broad discretion in determining whether a particular corporate structure or contractual arrangement violates applicable PRC laws, rules and regulations, and may take a different view from that of our PRC legal counsel. If the current ownership structure or contractual arrangements is found to be in violation of any existing or future PRC laws, rules or regulations, the relevant PRC regulatory authorities would have broad discretion in dealing with such violations, including imposition of fines, revocation of the business and operating licenses of Fujian Service, whose business and operating licenses are essential to the operation of our business, confiscation of our income or the income of Fujian Service, or requiring us, our PRC subsidiary and Fujian Service to restructure the relevant ownership structure, operations or contractual arrangements and taking other regulatory or enforcement actions that could be harmful to our business.

In addition, new PRC laws, rules and regulations may be introduced to impose additional requirements that may be applicable to our corporate structure and contractual arrangements. The imposition of any of these penalties and the effect of any new PRC laws, rules and regulations applicable to our corporate structure and contractual arrangements could have a material adverse effect on our financial condition and results of operations.

Contractual or other arrangements among our affiliates may be subject to scrutiny by PRC tax authorities, and a finding that we or our affiliates owe additional taxes could substantially reduce our profitability and the value of your investment.

As a result of our contractual arrangements, we are entitled to substantially all of the economic benefits of ownership of Fujian Service and Wonder Dredging and also bear substantially all of their economic risks. If the PRC tax authorities determine that the economic terms, including pricing, of our arrangements in respect of Fujian Service were not determined on an arm’s length basis, we could be subject to significant additional tax liabilities and other penalties, which may materially adversely affect our operation results.

Contractual arrangements, including voting proxies, with our affiliated entities for our dredging businesses may not be as effective in providing operational control as direct or indirect ownership.

Since applicable PRC laws, rules and regulations restrict foreign ownership in the enterprises which own the ships allowed to operate within PRC waters, we only directly own 50% equity interests of Fujian Service, our operating company, and entered into a series of contractual arrangements with Wonder Dredging, which is a PRC domestic company and legal owner of the other 50% equity interests of Fujian Service, and all the shareholders of Wonder Dredging. Fujian Service holds the licenses and approvals pertaining to the operation of our dredging business. We conduct our dredging business and derive related revenues through the direct ownership and contractual arrangements. As we do not have a controlling ownership interest in Fujian Service, these contractual arrangements, including the voting proxies granted to us, may not be as effective in providing us with control over these companies as 100% direct or indirect ownership. If we were the controlling shareholder of Fujian Service with direct or indirect ownership, we would be able to exercise our rights as shareholder to effect changes in the board of directors more effectively, which in turn could effect changes, subject to any applicable fiduciary obligations, at the management level.

However, pursuant to our contractual arrangements, if Fujian Service, Wonder Dredging or the shareholders of Wonder Dredging fail to perform their obligations under these contractual arrangements, we may be forced to (i) incur substantial costs and resources to enforce such arrangements, including the voting proxies, and (ii) rely on legal remedies available under PRC law, including exercising our call option right over the equity interests in Fujian Service, seeking specific performance or injunctive relief, and claiming monetary damages. In the event that we are unable to enforce these contractual arrangements, or if we suffer significant time delays or other obstacles in the process of enforcing these contractual arrangements, our business, financial condition and results of operations could be materially and adversely affected.

If SAFE determines that its foreign exchange regulations concerning “round-trip” investment apply to us and our shareholding structure, a failure by our shareholders or beneficial owners to comply with these regulations may restrict our ability to distribute profits, restrict our overseas and cross-border investment activities or subject us to liability under PRC laws, which may materially and adversely affect our business and prospects.

In October 2005, SAFE issued the Notice on Issues Relating to the Administration of Foreign Exchange in Fundraising and Roundtrip Investment Activities of Domestic Residents Conducted via Offshore Special Purpose Companies, which became effective as of November 1, 2005 and which was supplemented by several notices and regulations thereafter. We refer to them collectively as SAFE Circular No. 75. Under SAFE Circular No. 75, PRC citizens, residents and entities who make, or have previously made prior to the implementation of SAFE Circular No. 75, direct or indirect investments in offshore SPVs will be required to register those investments with the local branch of SAFE. In addition, any PRC citizen, resident, or entity which is a direct or indirect shareholder of an SPV is required to update the previously filed registration with the local branch of SAFE, with respect to that SPV, to reflect any material change. Moreover, the PRC subsidiary of the SPV is required to urge its shareholders who are PRC citizens, residents, or entities to update their registration with the local branch of SAFE. The registration and filing procedures under SAFE Circular No. 75 are prerequisites for other approval and registration procedures necessary for capital inflow from the offshore entity, such as inbound investments or shareholders’ loans, or capital outflow to the offshore entity, such as the payment of profits or dividends, liquidating distributions, equity sale proceeds or the return of funds upon a capital reduction.

Because our founder and controlling shareholder, Mr. Xinrong Zhuo, obtained his Hong Kong identity card in 2005 and surrendered his PRC identity subsequently thereto but still resides in mainland China, there is a risk that he may be determined as the PRC resident defined in SAFE Circular No. 75. Due to the uncertainty over how SAFE Circular No. 75 will be interpreted and implemented, we cannot predict how it will affect our business operations or future strategies. If SAFE Circular No. 75 were determined to apply to us or any of our PRC resident shareholders, none of whom has made registrations or filings according to SAFE Circular No. 75, a failure by any of our shareholders or beneficial owners to comply with SAFE Circular No. 75 may subject the relevant shareholders or beneficiaries to penalties under PRC foreign exchange administrative regulations, and may subject us to fines or legal sanctions, restrict our overseas or cross-border investment activities, limit our subsidiaries’ ability to make distributions or pay dividends or affect our ownership structure and capital inflow from the offshore entity, which would have a material adverse effect on our business, financial condition, results of operations and liquidity as well as our ability to pay dividends or make other distributions to our shareholders. In addition, we may not be informed of the identities of the beneficial owners of our company and our Chinese resident beneficial owners, if any, may not comply with SAFE Circular No. 75. The failure or inability of our beneficial owners who are PRC citizens, residents or entities to make or amend any required registrations may subject these PRC residents or our PRC subsidiary to fines and legal sanctions, and may also limit our ability to contribute additional capital into our PRC subsidiaries and limit our PRC subsidiaries’ ability to make distributions or pay dividends to us, as a result of which our business operations and our ability to distribute profits to you may be materially and adversely affected.

The dividends we receive from our Chinese subsidiaries and our global income may be subject to Chinese enterprise income tax, which would have a material adverse effect on our results of operations; our foreign ADS holders will be subject to a Chinese withholding tax upon the dividends payable by us and subject to the income tax on the gains on the sale of ADSs, if we are classified as a Chinese “resident enterprise.”

Under the PRC’s Enterprise Income Tax Law, or the EIT Law, dividends, interests, rent, royalties and gains on transfers of property payable by a foreign-invested enterprise in China to its foreign investor who is a non-resident enterprise will be subject to a 10% withholding tax, unless such non-resident enterprise’s jurisdiction of incorporation has a tax treaty with China that provides for a reduced rate of withholding tax. Under the arrangement for avoidance of double taxation between mainland China and Hong Kong, the effective withholding tax applicable to a Hong Kong non-resident company is 5% if it directly owns no less than a 25% stake in the Chinese foreign-invested enterprise.

Under the EIT Law, an enterprise established outside China with its “de facto management body” within China is considered a “resident enterprise” in China and is subject to the Chinese enterprise income tax at the rate of 25% on its worldwide income. China Dredging, our BVI holding company, may be deemed to be a PRC resident enterprise under the EIT Law and be subject to the PRC enterprise income tax at the rate of 25% on our worldwide income. It is also unclear whether the dividends we receive from Fujian WangGang will constitute dividends between resident enterprises and therefore will be exempted from income tax, even if we are deemed to be a “resident enterprise” for PRC enterprise income tax purposes. If the Chinese tax authorities subsequently determine that we should be classified as a resident enterprise, foreign ADS holders will be subject to a 10% withholding tax upon dividends payable by us and subject to income tax upon gains on the sale of ADSs under the EIT Law. Any such tax may reduce the returns on your investment in our ADSs.

Fujian Service has operated its construction business without the appropriate qualification certificate and therefore may be subject to various penalties.

PRC laws and regulations concerning construction or construction enterprises require that a construction enterprise must hold a qualification certificate for the purpose of undertaking construction projects. Furthermore, there are three levels of qualifications for enterprises undertaking waterway engineering projects and a license holder may only carry out projects permitted by its level of qualification. A construction enterprise is prohibited from undertaking projects without the requisite qualification certificate or exceeding the scope permitted by its level of qualification, otherwise it may be subject to penalties, fines, confiscation of the gains derived from the business activities or the suspension of operations. In addition, if a construction enterprise without the requisite qualification certificate is involved in any dispute in relation with the construction, the relevant court may rule the construction contract to be void. However, despite the void construction contract, if the construction has been completed and accepted after inspection, the construction enterprise is entitled to claim for the project payment.

Where a construction enterprise, which has acquired the construction qualification, applies for a higher level of qualification or to add new items to its qualification, the approval authorities may not approve its application if the construction enterprise, within a year before the day of application, has undertaken a project beyond the scope permitted by its level of qualification.

Our operating company, Fujian Service, commenced its business operation since January 2008 but obtained Level-III qualification only in August 2010. In addition, all major business contracts executed and performed by Fujian Service exceed the permitted scope for Level-III qualification. Although Fujian Service has received all project payments in accordance with the related construction contracts so far, and has not received any notice from the PRC authority for its previous and existing non-compliance, PRC authorities may impose any of the above penalties upon Fujian Service.

To be eligible for the Level-II qualification, a construction company is required to meet certain criteria as set forth in the PRC Criterion for Qualifications of Construction Enterprises, or Qualification Regulations. Fujian Service meets all of the criteria for the Level-II qualification except the following: (i) it does not have a dredger with 2 cubic meter volume; (ii) it does not have 150 or more engineers and financial managers; and (iii) the project manager does not have 10 years or more experience in construction management with a minimum of mid-level class qualification. Fujian Service plans to recruit the personnel with the requisite experiences and qualifications and to purchase a dredger with 2 cubic meter volume so as to be eligible for the Level-II qualification. However, it may take significant time for Fujian Service to meet such criteria. As Fujian Service has not complied with the relevant laws and regulations, such application may not be approved. If Fujian Service fails to upgrade its qualification in a timely manner and meanwhile continues to undertake projects exceeding the scope of Level-III qualification, it may be subject to fines, confiscation of the gains derived from the business activities or the suspension of operations, and the contracts may be ruled unenforceable or void if any dispute arises, which could materially and adversely affect our business and results of operations.