Exhibit 99.1

OCEAN RIG UDW INC. ANNOUNCES OFFERING OF COMMON SHARES BY ITS SUBSIDIARY

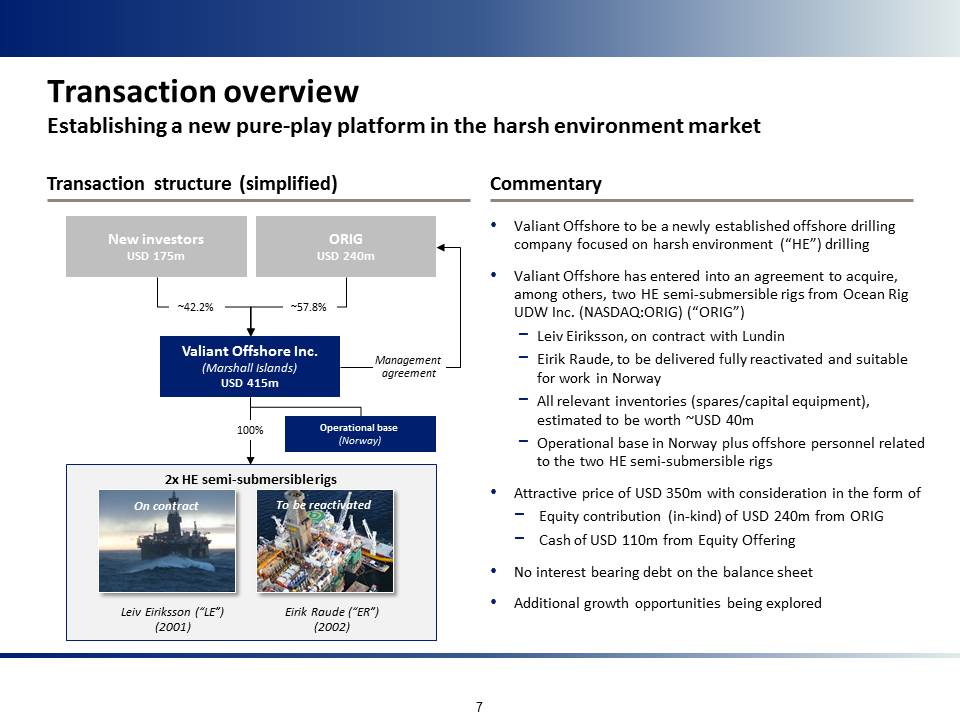

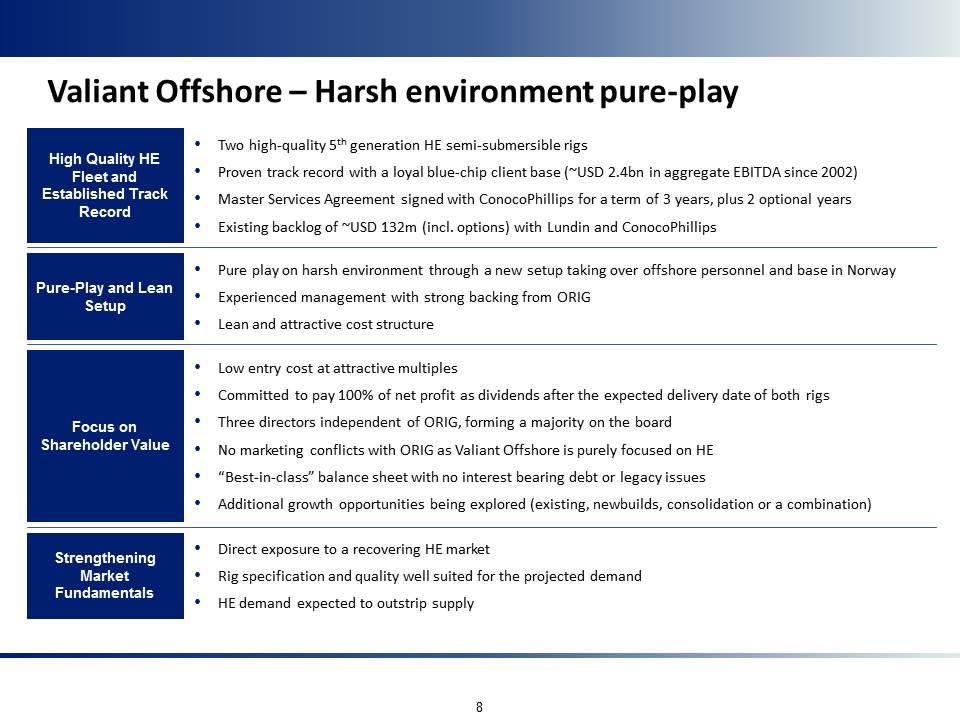

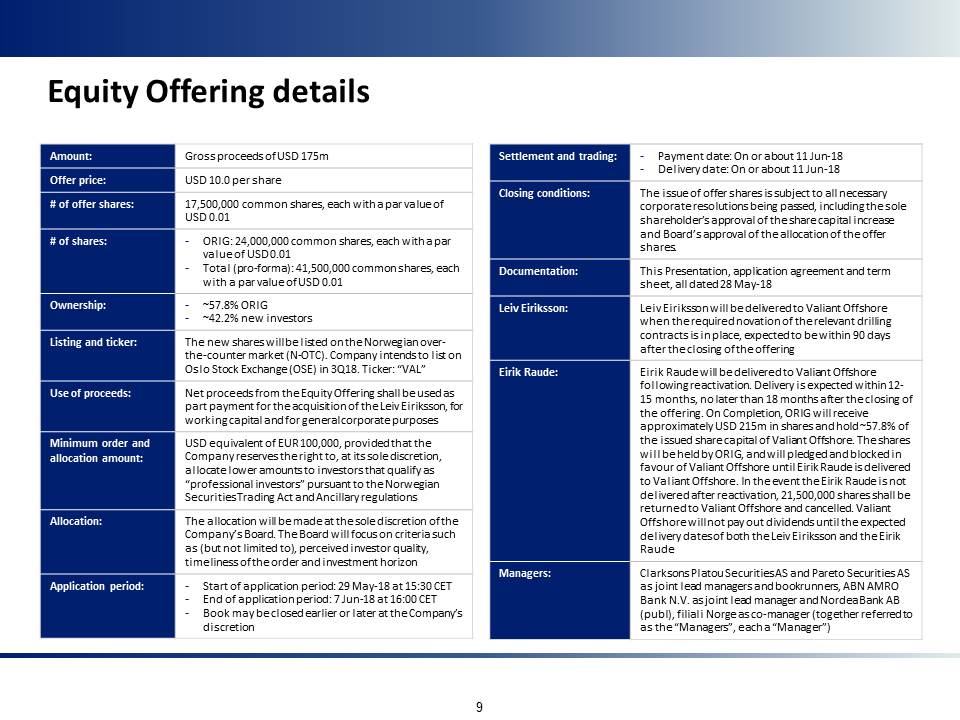

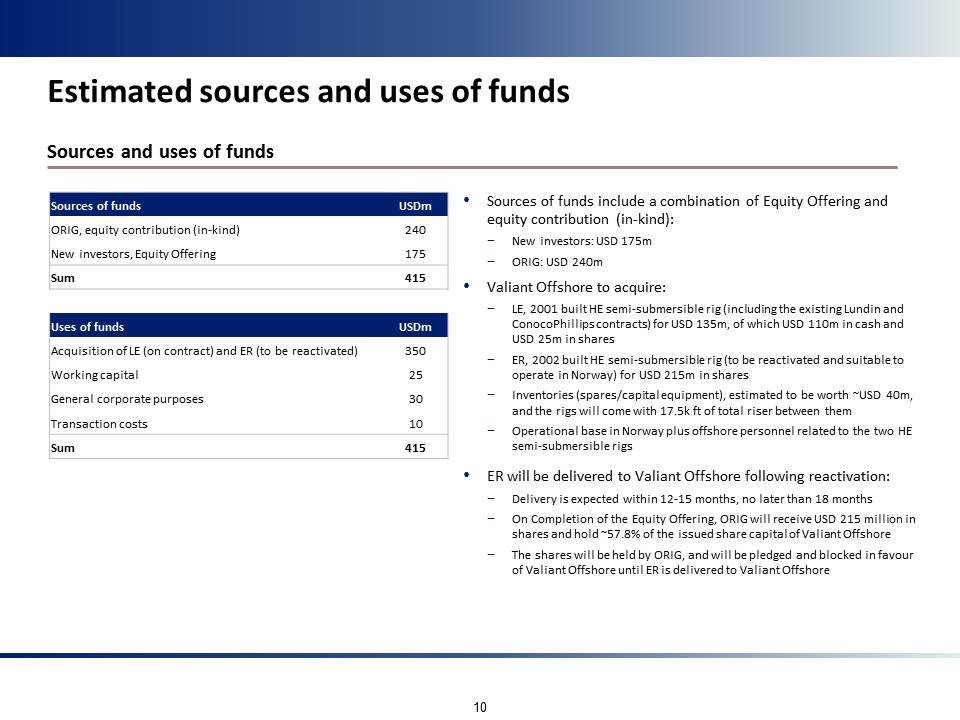

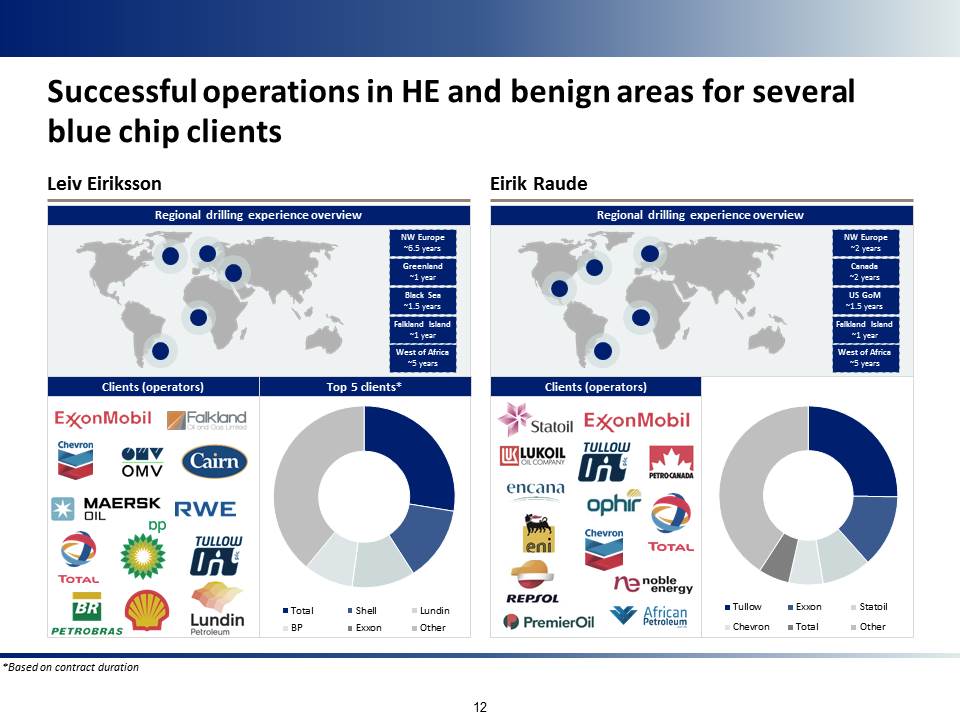

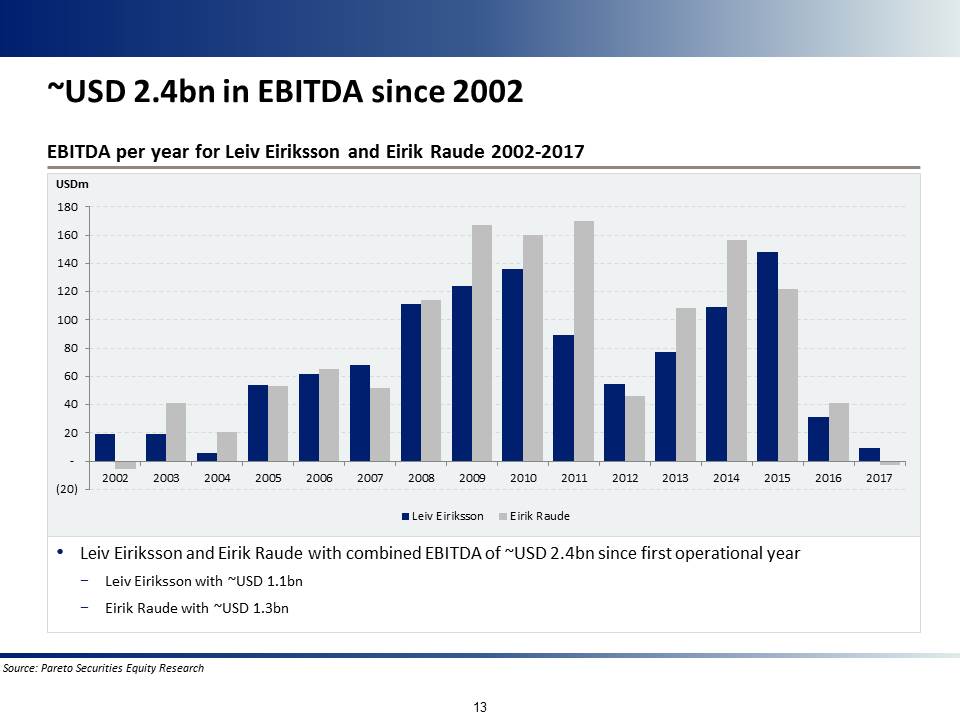

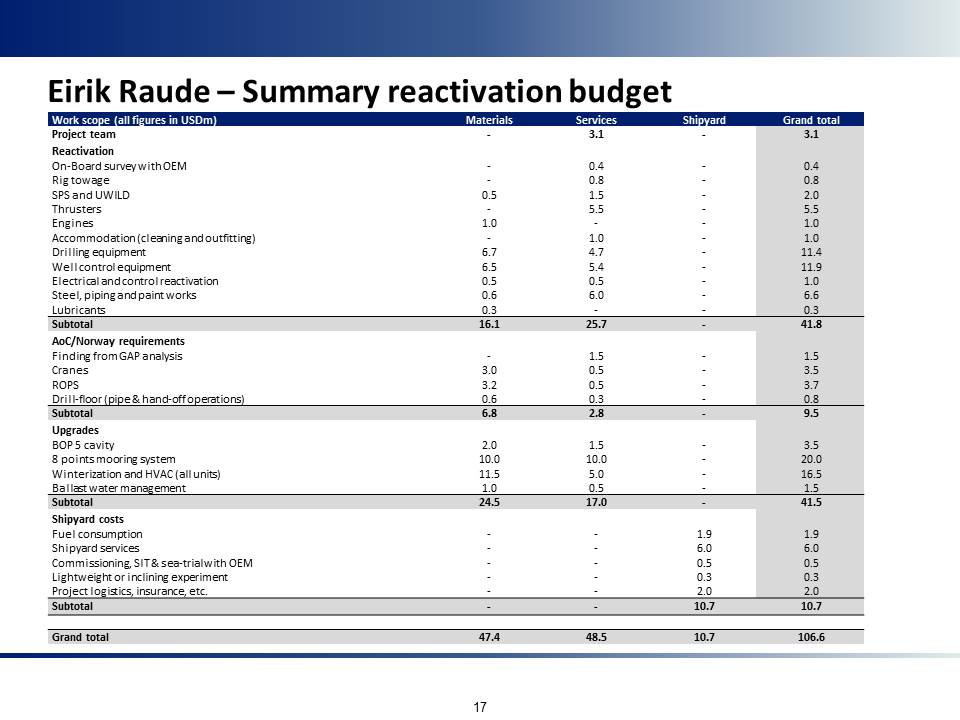

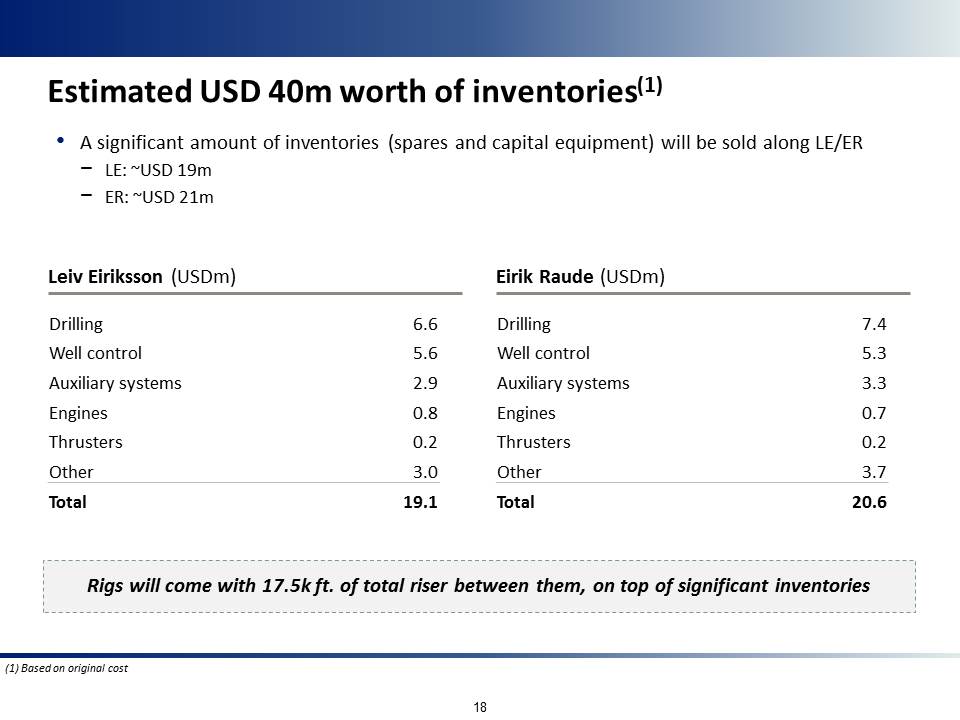

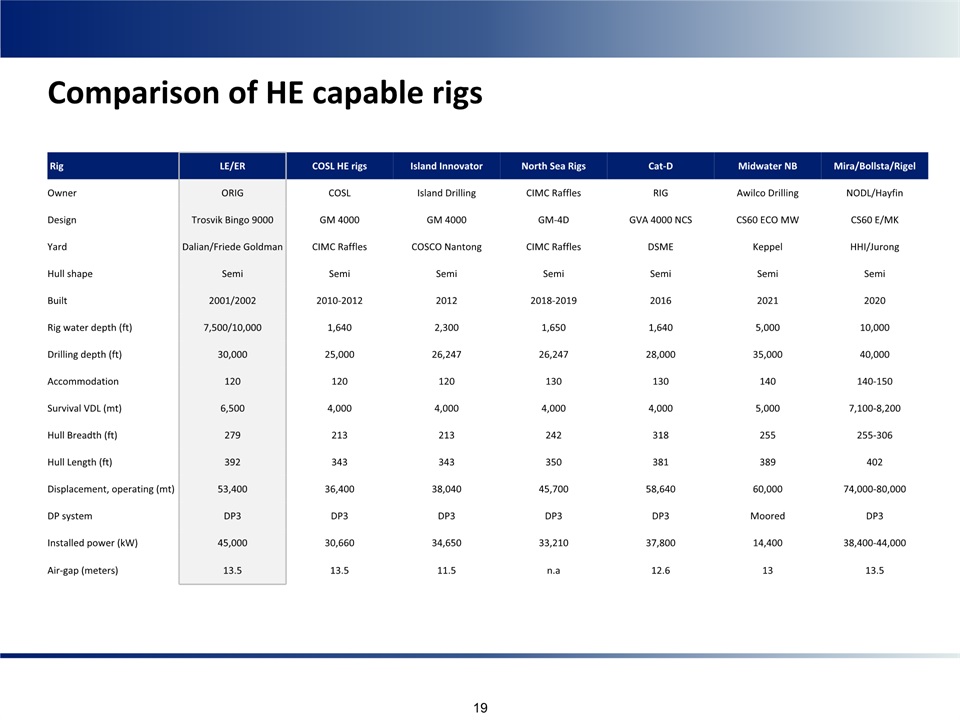

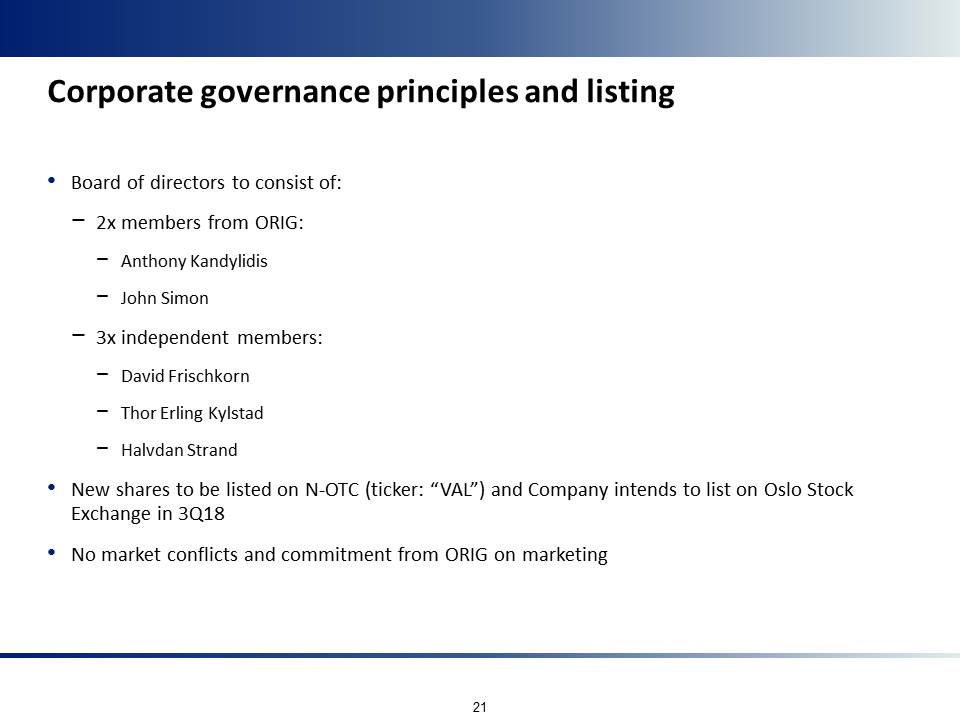

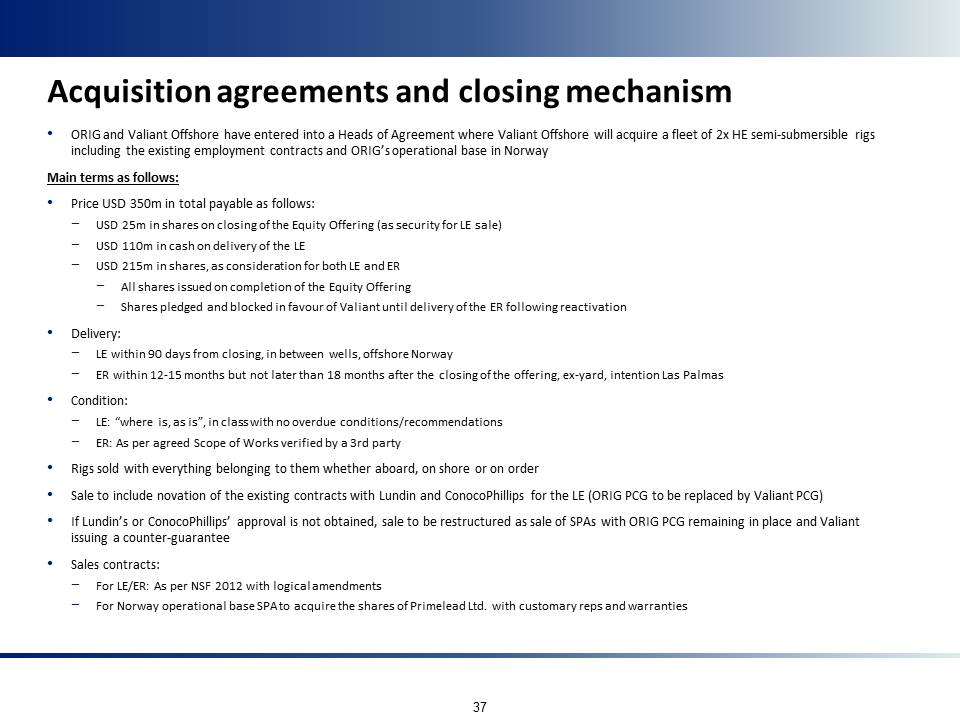

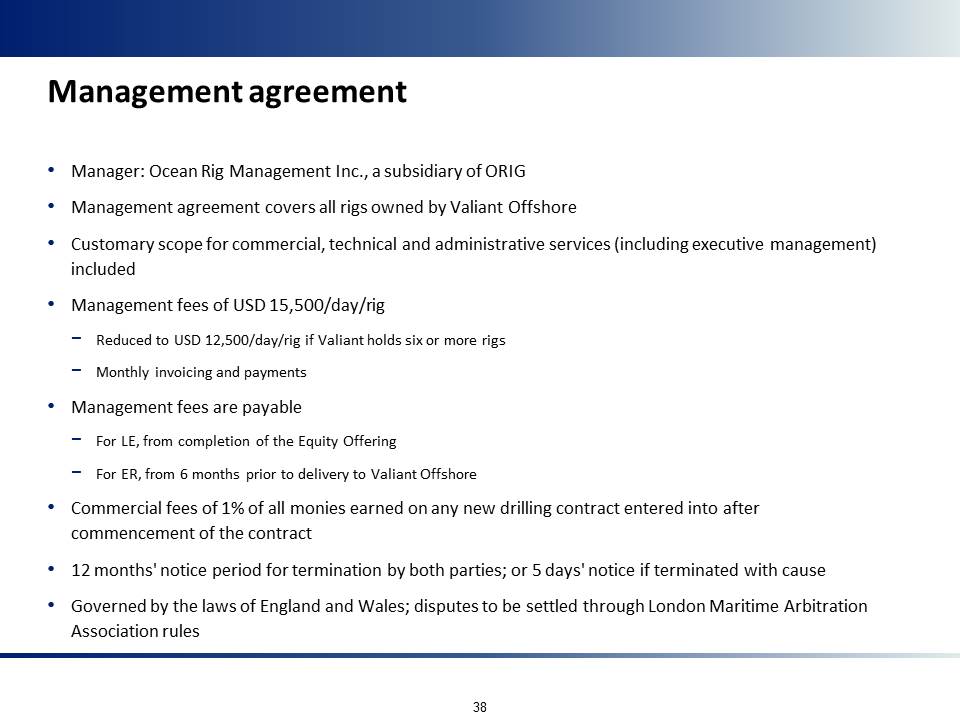

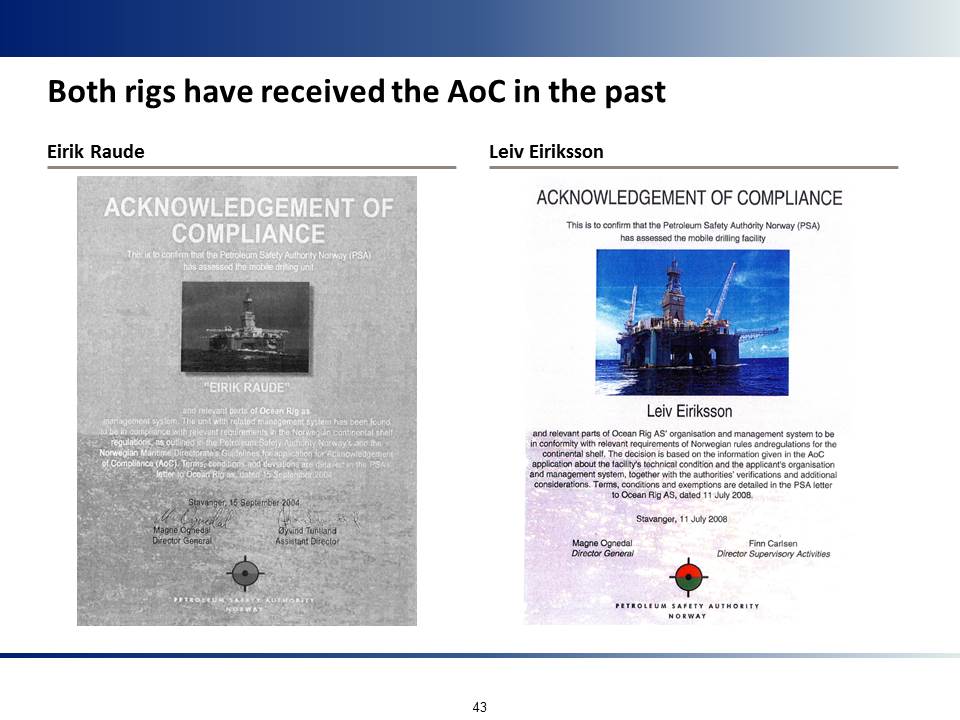

May 28, 2018, Grand Cayman, Cayman Islands - Ocean Rig UDW Inc. (NASDAQ:ORIG), ("Ocean Rig" or the "Company"), an international contractor of offshore deepwater drilling services, today announced the launch of an offering of common shares by its wholly-owned Marshall Islands subsidiary, Valiant Offshore Inc., ("Valiant"), which upon the completion of the offering will acquire the Leiv Eiriksson and the Eirik Raude, two fifth generation harsh environment semi-submersible rigs that are currently indirectly owned by the Company in exchange for 24,000,000 shares of Valiant (representing approximately 57.8% of the issued share capital of Valiant) and cash in the amount of $110,000,000, expected to be used towards reactivating the Eirik Raude. An additional 17,500,000 shares of Valiant (representing approximately 42.2% of the share capital of Valiant) are expected to be sold in the offering. Valiant intends to use the net proceeds from the offering as partial payment for the acquisition of the Leiv Eiriksson, for working capital and for general corporate purposes.

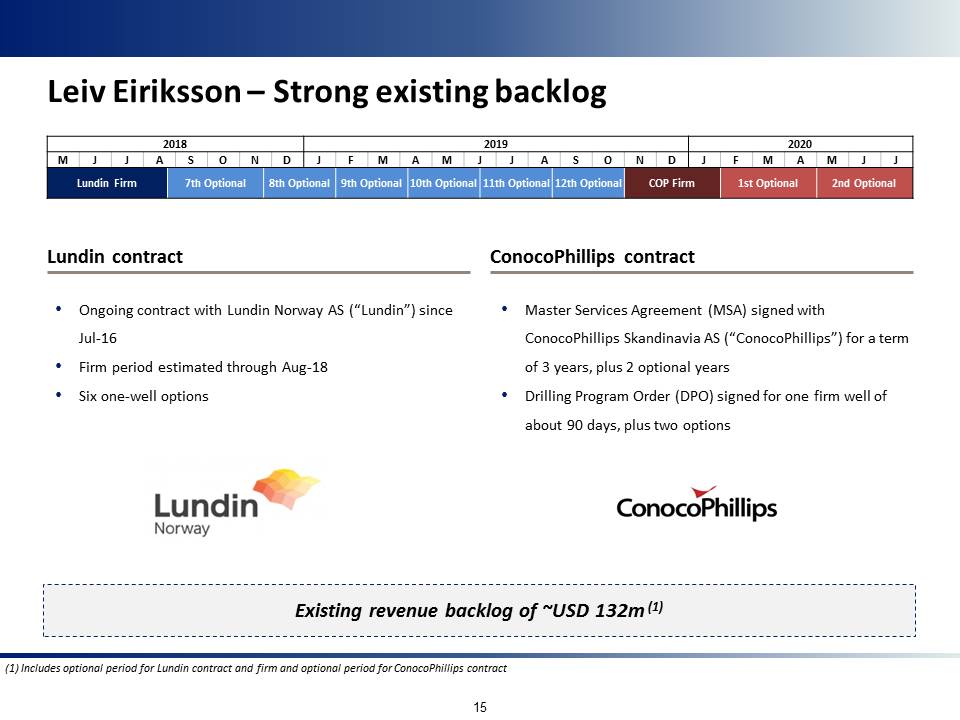

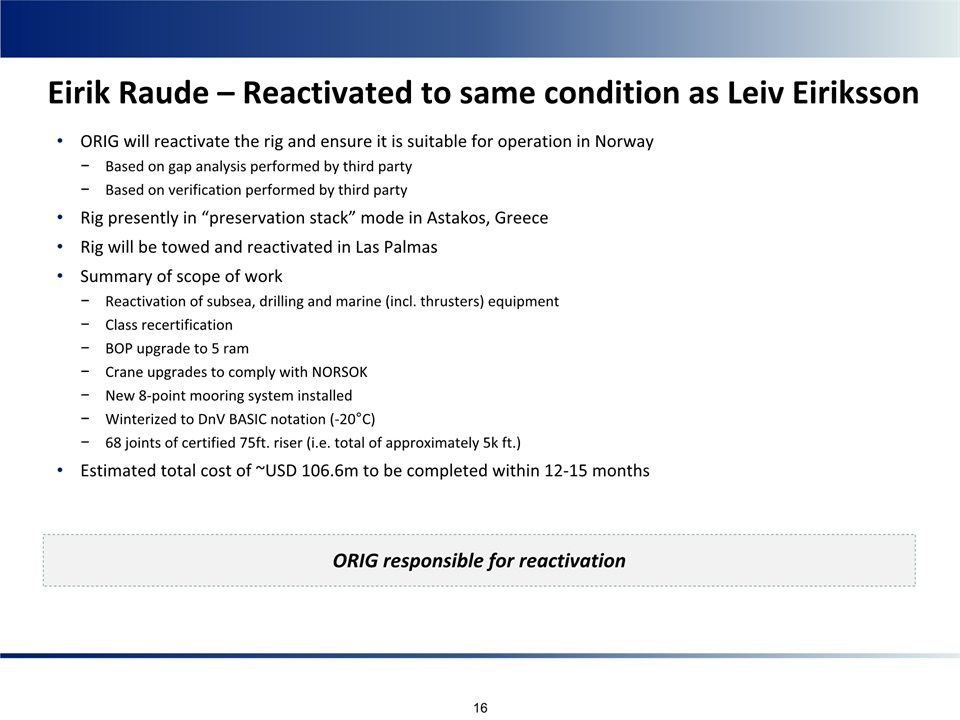

It is expected that the Leiv Eiriksson will be delivered to Valiant with its current drilling contracts in place, which is scheduled to take place within ninety days after the closing of this offering. It is expected that the Eirik Raude will be delivered to Valiant following its reactivation, which is expected to take place within twelve to fifteen months and no later than eighteen months from the closing of the offering.

The shares of Valiant will be offered and sold in the United States to qualified institutional buyers pursuant to applicable exemptions from the registration requirements under the U.S. Securities Act of 1933 (the "Securities Act of 1933") and outside the United States pursuant to Regulation S under the Securities Act of 1933.

The shares of Valiant have not been registered under the Securities Act of 1933 or any state securities laws and may not be offered or sold in the United States absent registration or an applicable exemption from the registration requirements of the Securities Act of 1933 and applicable state laws.

This press release shall not constitute an offer to sell or a solicitation of an offer to purchase shares of Valiant or any other securities, and shall not constitute an offer, solicitation or sale in any state or jurisdiction in which such an offer, solicitation or sale would be unlawful.

About Ocean Rig UDW Inc.

Ocean Rig is an international offshore drilling contractor providing oilfield services for offshore oil and gas exploration, development and production drilling, and specializing in the ultra-deepwater and harsh-environment segment of the offshore drilling industry.

Ocean Rig's common stock is listed on the NASDAQ Global Select Market where it trades under the symbol "ORIG."

Visit the Company's website at www.ocean-rig.com

Forward-Looking Statement

Matters discussed in this release may constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. The Private Securities Litigation Reform Act of 1995 provides safe

harbor protections for forward-looking statements in order to encourage companies to provide prospective information about their business. The Company desires to take advantage of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995 and is including this cautionary statement in connection with such safe harbor legislation.

Forward-looking statements relate to Ocean Rig's expectations, beliefs, intentions or strategies regarding the future. These statements may be identified by the use of words like "anticipate," "believe," "estimate," "expect," "intend," "may," "plan," "project," "should," "seek," and similar expressions. Forward-looking statements reflect Ocean Rig's current views and assumptions with respect to future events and are subject to risks and uncertainties.

The forward-looking statements in this release are based upon various assumptions, many of which are based, in turn, upon further assumptions, including without limitation, management's examination of historical operating trends, data contained in Ocean Rig's records and other data available from third parties. Although Ocean Rig believes that these assumptions were reasonable when made, because these assumptions are inherently subject to significant uncertainties and contingencies which are difficult or impossible to predict and are beyond Ocean Rig's control, Ocean Rig cannot assure you that it will achieve or accomplish these expectations, beliefs or projections described in the forward- looking statements contained herein. Actual and future results and trends could differ materially from those set forth in such statements.

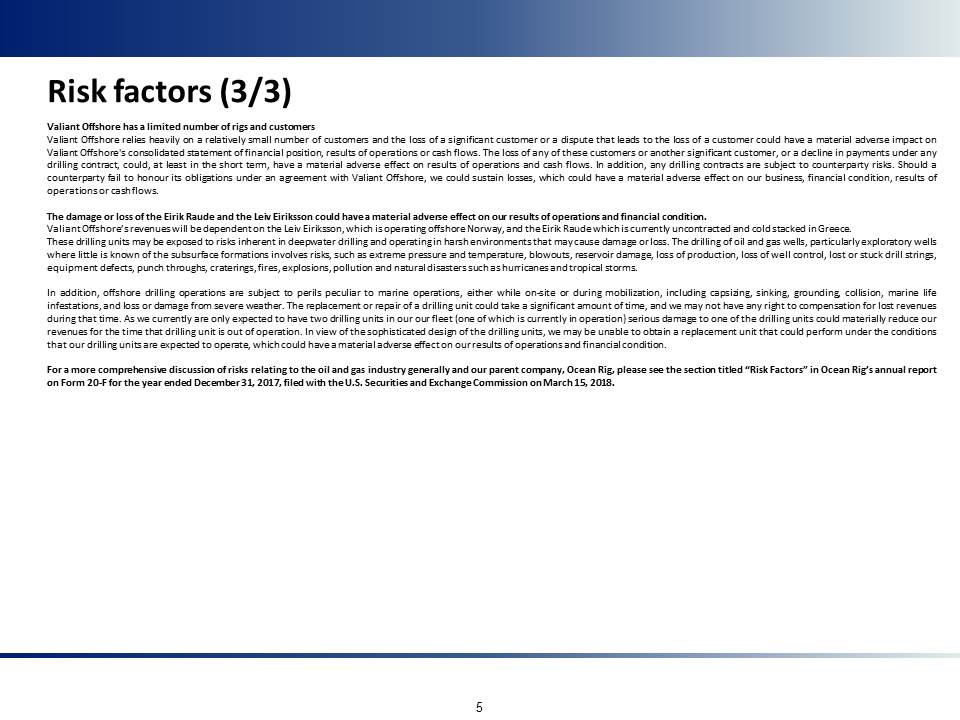

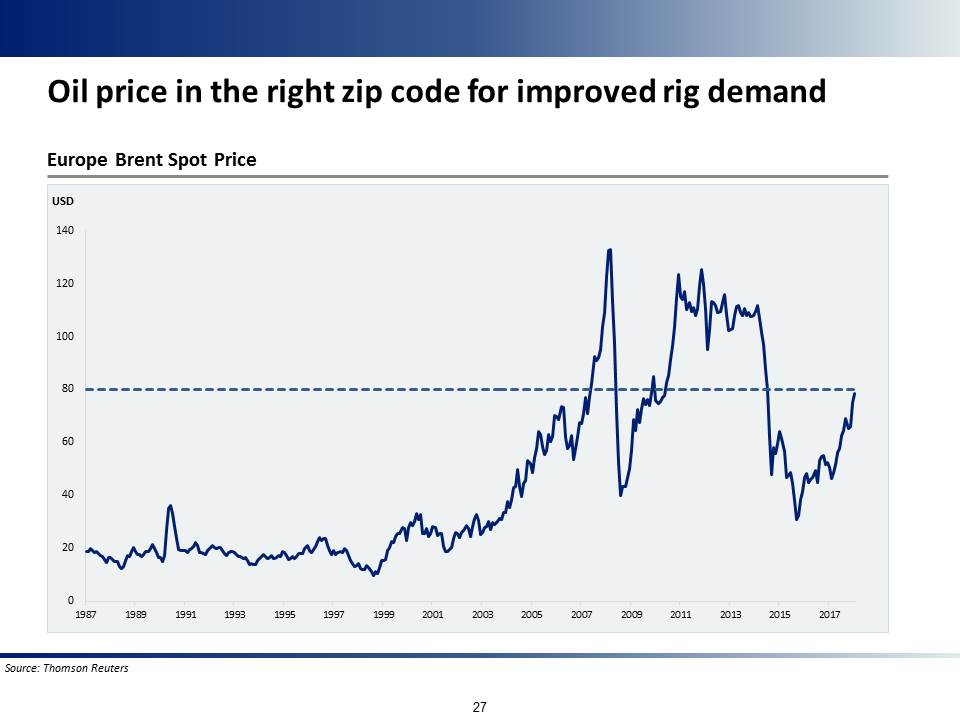

Important factors that, in Ocean Rig's view, could cause actual results to differ materially from those discussed in the forward-looking statements include factors related to (i) the offshore drilling market, including supply and demand, utilization, day rates and customer drilling programs, commodity prices, effects of new rigs and drillships on the market and effects of declines in commodity process and downturns in the global economy on the market outlook for our various geographical operating sectors and classes of rigs and drillships; (ii) hazards inherent in the drilling industry and marine operations causing personal injury or loss of life, severe damage to or destruction of property and equipment, pollution or environmental damage, claims by third parties or customers and suspension of operations; (iii) newbuildings, upgrades, and shipyard and other capital projects; (iv) changes in laws and governmental regulations, particularly with respect to environmental matters; (v) the availability of competing offshore drilling vessels; (vi) political and other uncertainties, including risks of terrorist acts, war and civil disturbances; piracy; significant governmental influence over many aspects of local economies, seizure; nationalization or expropriation of property or equipment; repudiation, nullification, modification or renegotiation of contracts; limitations on insurance coverage, such as war risk coverage, in certain areas; political unrest; foreign and U.S. monetary policy and foreign currency fluctuations and devaluations; the inability to repatriate income or capital; complications associated with repairing and replacing equipment in remote locations; import-export quotas, wage and price controls imposition of trade barriers; regulatory or financial requirements to comply with foreign bureaucratic actions; changing taxation policies; and other forms of government regulation and economic conditions that are beyond our control; (vii) the performance of our rigs; (viii) our new capital structure; (ix) our ability to procure or have access to financing and our ability comply with covenants in documents governing our debt; (x) our substantial leverage, including our ability to generate sufficient cash flow to service our existing debt and the incurrence of substantial indebtedness in the future; (xi) our ability to successfully employ our drilling units our customer contracts, including contract backlog, contract commencements and contract terminations; (xii) our capital expenditures, including the timing and cost of completion of capital projects; (xiii) our revenues and expenses; (xiv) complications associated with repairing and replacing equipment in remote locations; and (xv) regulatory or financial requirements to comply with foreign bureaucratic actions, including potential limitations on drilling activities; (xvi) any litigation or adverse actions that may arise from our recently completed financial restructuring. Due to such uncertainties and risks, investors are cautioned not to place undue reliance upon such forward-looking statements.

Risks and uncertainties are further described in reports of Ocean Rig filed with or submitted to the U.S. Securities and Exchange Commission, including the Company's most recently filed Annual Report on Form 20-F.

Investor Relations / Media:

Nicolas Bornozis

Capital Link, Inc. (New York) Tel. 212-661 7566

E-mail: oceanrig@capitallink.com