UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the Fiscal Year Ended December 31, 2015

OR

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the Transition Period from to

Commission File Number: [001-34949]

Arbutus Biopharma Corporation

(Exact Name of Registrant as Specified in Its Charter)

British Columbia, Canada | 980,597,776 | |

(State or Other Jurisdiction of Incorporation or Organization) | (I.R.S. Employer Identification No.) | |

100-8900 Glenlyon Parkway, Burnaby, BC V5J 5J8 (Address of Principal Executive Offices) | ||

604-419-3200 (Registrant’s Telephone Number, Including Area Code): | ||

Securities registered pursuant to Section 12(b) of the Act: | ||

Title of Each Class | Name of Each Exchange on Which Registered | |

Common shares, without par value | The NASDAQ Stock Market LLC | |

Securities registered pursuant to Section 12(g) of the Act: | ||

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer o | Accelerated filer x | Non-accelerated filer o | Smaller reporting company o |

(Do not check if a smaller reporting company) | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No x

The registrant is an accelerated filer as the aggregate market capitalization of voting and non-voting equity held by non-affiliates as at June 30, 2015 was $644,038,348. As of February 29, 2016, the registrant had 54,625,703 Common Shares, no par value, outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s definitive proxy statement for its 2016 annual meeting of stockholders, which the registrant intends to file pursuant to Regulation 14A with the Securities and Exchange Commission not later than 120 days after the registrant’s fiscal year end of December 31, 2015, are incorporated by reference into Part III of this Form 10-K.

ARBUTUS BIOPHARMA CORPORATION

TABLE OF CONTENTS

Page | ||

3

This annual report on Form 10-K contains forward-looking statements within the meaning of the Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934, and forward looking information within the meaning of Canadian securities laws (collectively, “forward-looking statements”).

Forward-looking statements in this annual report include statements about Arbutus’ strategy, future operations, clinical trials, prospects and the plans of management; the composition and roles of the management team; Arbutus’ continued listing on NASDAQ; the effects of Arbutus’ products on the treatment of cancer, chronic Hepatitis B infection, infectious disease, alcohol use disorder, and other diseases; using a combination of HBV drug candidates to effect patient benefit and develop a potential cure; intervening at different points in the viral life cycle; evaluating combinations of two or more drug candidates in cohorts of patients with chronic HBV infection, and using the results to adaptively design additional treatment regimens for the next cohorts; evaluating different treatment durations to determine the optimal finite duration of therapy, and continuing this iterative process until we select combination therapy regimens and treatment durations to conduct Phase III clinical trials intended to ultimately support regulatory filings for marketing approval; continuing to expand our HBV pipeline through internal development, acquisitions and in-licenses; the format and timing of the ARB-1467 Phase II multi-dosing study, including the expectation of single dose and multi-dose HBsAg reduction data in the second half of 2016; incorporating technological and product design advancements that may result in an improvement in safety and/or efficacy; the potential of ARB-1740 to be effective at lower clinical doses than ARB-1467; filing an IND (or equivalent filing) for ARB-1740 in the second half of 2016; the expectation for inhibition of cccDNA formation to reduce the amount of cccDNA in the infected liver by blocking the formation of new cccDNA, with faster declines in cccDNA levels in patients than is seen with nucleot(s)ide analogs alone; filing an IND (or equivalent filing) for our lead cccDNA formation inhibitor in the second half of 2016; blocking viral replication with core protein inhibitors as oral therapeutics for the treatment of chronic HBV infection; filing an IND (or equivalent filing) for our lead core protein inhibitor candidate in the second half of 2016; using immune stimulation by toll-like receptor (TLR) agonists to overcome the immunologic blocks that allow chronic HBV persistence; initiating clinical development of ARB-1598 in chronically infected HBV patients in 2016; the development of multiple small molecule orally bioavailable inhibitors of HBV surface antigen production and secretion, with the immune response of patients treated with this therapy able to reengage and thereby mount a more credible response to a hepatitis B virus infection; developing cccDNA epigenetic modifiers to inhibit the formation of new virus and sub viral particles from cccDNA; developing STING agonists so the body can produce additional interferon alpha and beta, with the plan to identify potent, orally active small molecule human STING agonists that possess the desired characteristics to progress into human clinical studies; continuing to explore opportunities to generate value from our LNP platform technology; partnering or external funding opportunities to maximize the value of our oncology related assets; an assessment of efficacy of TKM-PLK1 in terms of tumor response in approximately 20 subjects upon completion of the expansion cohort of the Phase I/II clinical, with results expected in 2016; partnering or external funding to maximize the value of RNAi product assets; partnering or external funding to maximize the value of TKM-HTG; TKM-ALDH inducing prolonged ethanol sensitivity that will enable it to overcome the compliance limitations associated with daily dosing; partnering or external funding to maximize the value of TKM-ALDH; receiving low single digit royalties as Alnylam’s LNP-enabled products are commercialized; New Drug Application (NDA) filing for this patisiran in 2017; initiate the Phase I clinical trial of DCR-PH1 in patients with PH1 in 2016; arbitration proceedings with the University of British Columbia in connection with alleged unpaid royalties; the expected return from strategic alliances, licensing agreements, and research collaborations; receiving payments for the Alnylam license agreement; the result of negotiations with Monsanto regarding the close out terms, which could involve termination or exercise of the option to acquire rights to our proprietary LNP technology for use in agriculture; the terms of a potential licensing agreement with Cytos; royalty and milestone payments to Blumberg and Drexel under the license agreement; royalty and milestone payments to Enantigen’s stockholders; a potential exclusive, royalty bearing, worldwide license with Blumberg; expanding our exclusive license agreement with NeuroVive; the expectation for revenue to continue to fluctuate due to the irregular nature of licensing and milestone receipts under our collaboration and licensing contracts; the expectation to see future changes in the fair value of our warrant liability; not recording significant revenue from the DoD contract beyond 2015; the length of the Monsanto option period being approximately four years; the expectation to complete services to Dicerna in March 2017; the plan to use March 2015 public offering proceeds to develop and advance product candidates through clinical trials, as well as for working capital and general corporate purposes; having sufficient cash resources for at least the next 12 months; milestone payments and royalties to Arcturus under their license agreement; when we will to adopt recent accounting updates; continuing to incur substantial expenses and hold cash and investment balances in Canadian dollars; Arbutus’ intent to retain earnings, if any, to finance the growth and development of their business and not to pay dividends or to make any other distributions in the near future; anticipated royalty receipts; statements with respect to revenue and expense fluctuation and guidance; predicted tax treatment; not expecting the enrollment of first patient in Phase 1b clinical trial in HBV patients to occur in the next twelve-month period; discontinuing the OCB-030 development program; and the quantum and timing of potential funding.

With respect to the forward-looking statements contained in this annual report, Arbutus has made numerous assumptions. While Arbutus considers these assumptions to be reasonable, these assumptions are inherently subject to significant business, economic, competitive, market and social uncertainties and contingencies.

4

Our actual results could differ materially from those discussed in the forward-looking statements as a result of a number of important factors, including the factors discussed in this annual report on Form 10-K, including those discussed in Item 1A of this report under the heading “Risk Factors,” and the risks discussed in our other filings with the Securities and Exchange Commission and Canadian Securities Regulators. Readers are cautioned not to place undue reliance on these forward-looking statements, which reflect management’s analysis, judgment, belief or expectation only as of the date hereof. We explicitly disclaim any obligation to update these forward-looking statements to reflect events or circumstances that arise after the date hereof, except as required by law.

5

PART I

1. Business

Overview

Arbutus Biopharma Corporation (“Arbutus”, “we”, “us”, and “our”) is a publicly traded industry-leading therapeutic solutions company focused on discovering, developing and commercializing a cure for patients suffering from chronic hepatitis B (HBV) infection, which leads to serious liver disease. Effective July 31, 2015, our corporate name changed from Tekmira Pharmaceuticals Corporation to Arbutus Biopharma Corporation. Our pipeline is focused on finding a cure for chronic HBV infection. This HBV pipeline consists of multiple drug candidates, with complementary mechanisms of action, which we expect to use in combination to effect patient benefit.

HBV represents a significant unmet medical need and is the cause of the most common serious liver infection in the world. The World Health Organization estimates that 350 million people worldwide are chronically infected, and other estimates suggest this could include approximately 2 million people in the United States (Kowdley et al., 2012). Individuals chronically infected with HBV are at an increased risk of developing significant liver disease, including cirrhosis, or permanent scarring of the liver, as well as liver failure and hepatocellular carcinoma (HCC) or liver cancer. According to the Hepatitis B Foundation, HBV is the cause of up to 80% of liver cancers. Individuals with liver cancer typically have a five-year survival rate of only 15%. The WHO estimates that more than 780,000 people die every year due to the consequences of hepatitis B virus disease.

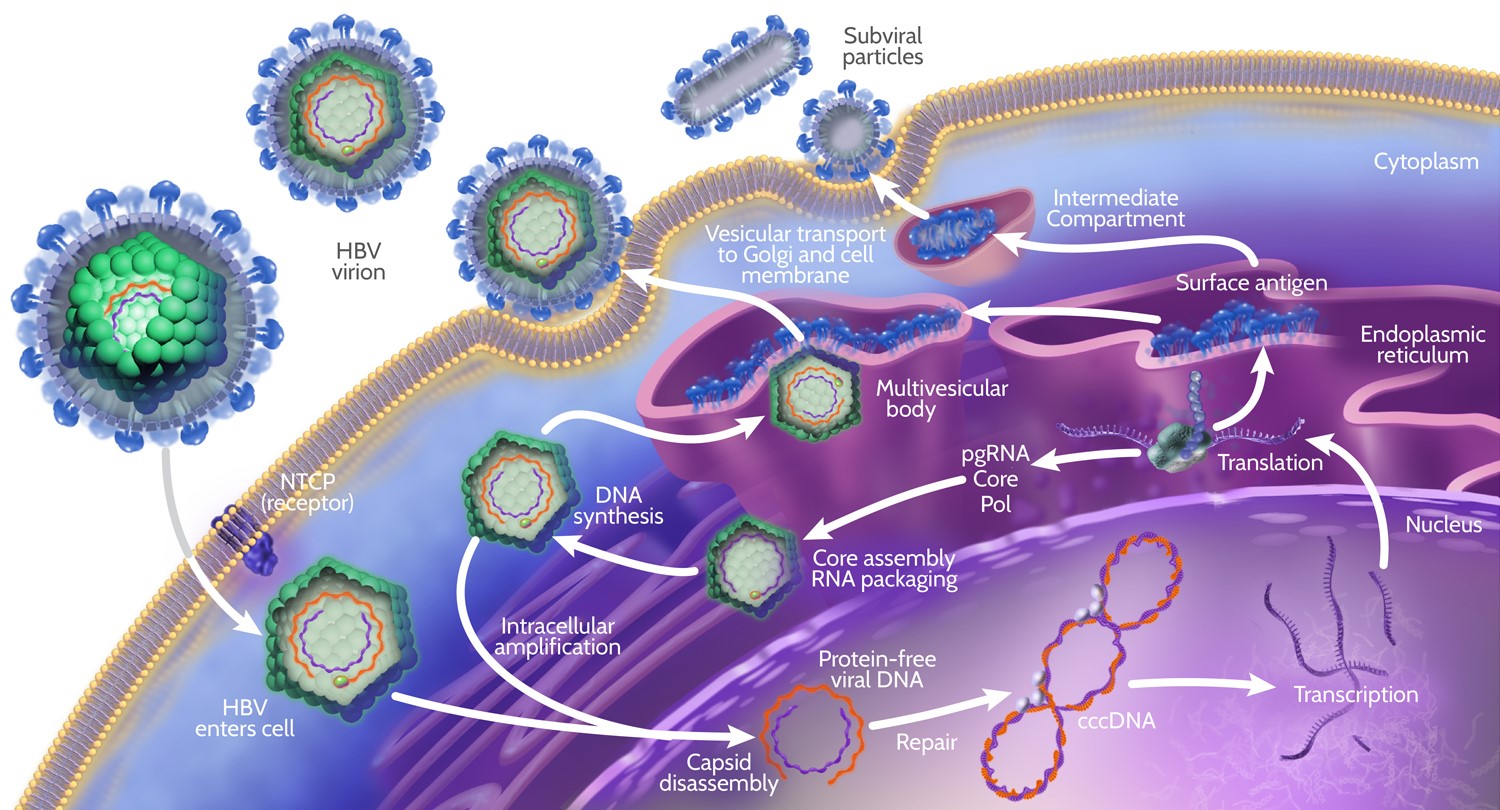

Given the complex biology of HBV (as shown in the graphic below), we believe combination therapies are the key to HBV treatment and a potential cure, and development can be accelerated when multiple components of a combination therapy regimen are controlled by the same company.

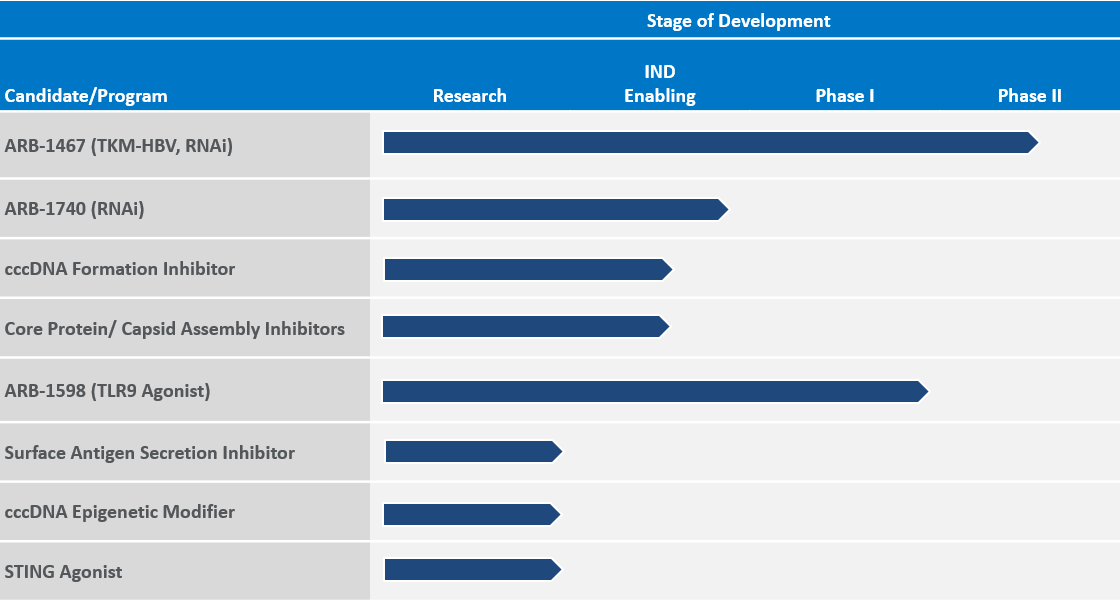

HBV Focused Product Pipeline

We have a pipeline focused on finding a cure for chronic HBV infection, with the objective of developing a combination of products that intervene at different points in the viral life cycle. Given our strong scientific and research capabilities in-house, we are able to conduct preclinical combination studies to evaluate combinations of our proprietary pipeline candidates. Once compounds within the portfolio with sufficient activity have been identified, we intend, subject to discussions with regulatory authorities, to evaluate combinations of two or more drug candidates in cohorts of patients with chronic HBV infection. We expect to use these results to adaptively design additional treatment regimens for the next cohorts. We also plan to evaluate different treatment durations to determine the optimal finite duration of therapy. We plan to continue this iterative process until we select combination therapy regimens and treatment durations to conduct Phase III clinical trials intended to ultimately support regulatory filings for marketing approval. Our pipeline of HBV product candidates includes:

We intend to continue to expand our HBV pipeline through internal development, acquisitions and in-licenses. We also have a research collaboration agreement with The Baruch S. Blumberg Institute, a non-profit research institute established by the Hepatitis B Foundation, that provides exclusive rights to in-license any intellectual property generated through the collaboration. For more information about this agreement please refer to the “Strategic Alliances, Licensing Agreements, and Research Collaborations” section of this annual report on Form 10-K below.

RNAi (ARB-1467 & ARB-1740)

The development of RNA Interference (RNAi) drugs allows for a completely novel approach to treating disease, which is why RNAi is considered one of the most promising and rapidly advancing frontiers in drug discovery. While there are no RNAi therapeutics approved for commercial use, there are a number of RNAi products currently in human clinical trials. RNAi products are broadly applicable as they can eliminate the production of disease-causing proteins from cells, creating opportunities for therapeutic intervention that have not been achievable with conventional drugs. Our extensive experience in antiviral drug development has been applied to our RNAi program to develop therapeutics for chronic hepatitis B infection. Small molecule nucleotide therapy has been the standard of care for chronic HBV infected patients. However, many of these patients continue to express a viral protein called HBV surface antigen (HBsAg). This protein causes inflammation in the liver leading to cirrhosis and, in some cases, HCC and death.

7

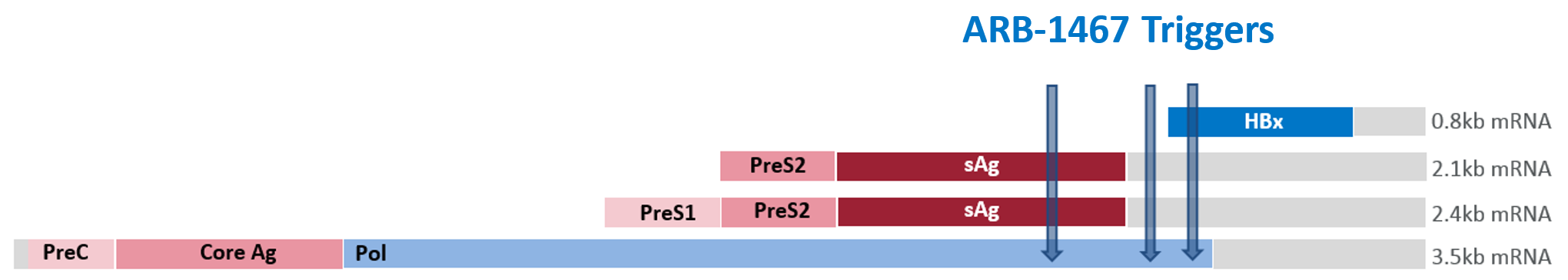

Our lead RNAi HBV candidate, ARB-1467 (formerly TKM-HBV), is designed to eliminate HBsAg expression in patients chronically infected with HBV. Reducing HBsAg is thought to be a key prerequisite to enable a patient’s immune system to raise an adequate immune response against the virus. The ability of ARB-1467 to inhibit numerous viral elements in addition to HBsAg increases the likelihood of affecting the viral infection. ARB-1467 is being developed as a multi-component (3-trigger) RNAi therapeutic that simultaneously targets three sites on the HBV genome, including the HBsAg coding region. Targeting three distinct and highly conserved sites on the HBV genome is intended to facilitate potent knockdown of all viral mRNA transcripts and viral antigens across a broad range of HBV genotypes and reduce the risk of developing antiviral resistance.

ARB-1467 results in potent and rapid reduction in HBsAg in several preclinical models. In these models, ARB-1467 treatment resulted in reductions in both intrahepatic and serum HBsAg, as well as reductions in HBV DNA, cccDNA, Hepatitis B e antigen (HBeAg) and HBcAg (Hepatitis B c antigen). A rapid 1 log reduction in serum HBsAg was achieved with a single 1 mg/kg dose of ARB-1467 in the humanized mouse model. 1-2 log viral reductions from similar single-dose LNP treatments in two other true-infection animal models were also demonstrated. Preclinical studies conducted on infected primary human hepatocytes showed that ARB-1467 had robust and consistent activity against different viral strains representing the major clinical genotypes A, B, C and D. Our data shows that inclusion of three RNAi triggers results in a more broadly effective knockdown of hepatitis B viral elements than a single trigger alone. The mode of action of ARB-1467 complements standard of care nucleoside/nucleotide (NUC) therapy, and lack of drug antagonism has been demonstrated with entecavir, lamivudine and tenofovir on infected primary human hepatocytes, making combination therapy a viable option. This data was presented at the DIA/FDA Oligonucleotide-Based Therapeutics Conference in Washington, DC, in September 2015. We presented additional data at the 2015 International Meeting on Molecular Biology of Hepatitis B Viruses in Dolce Bad Nauheim, Germany, in October 2015, and at the 2015 AASLD Liver Meeting in San Francisco in November 2015.

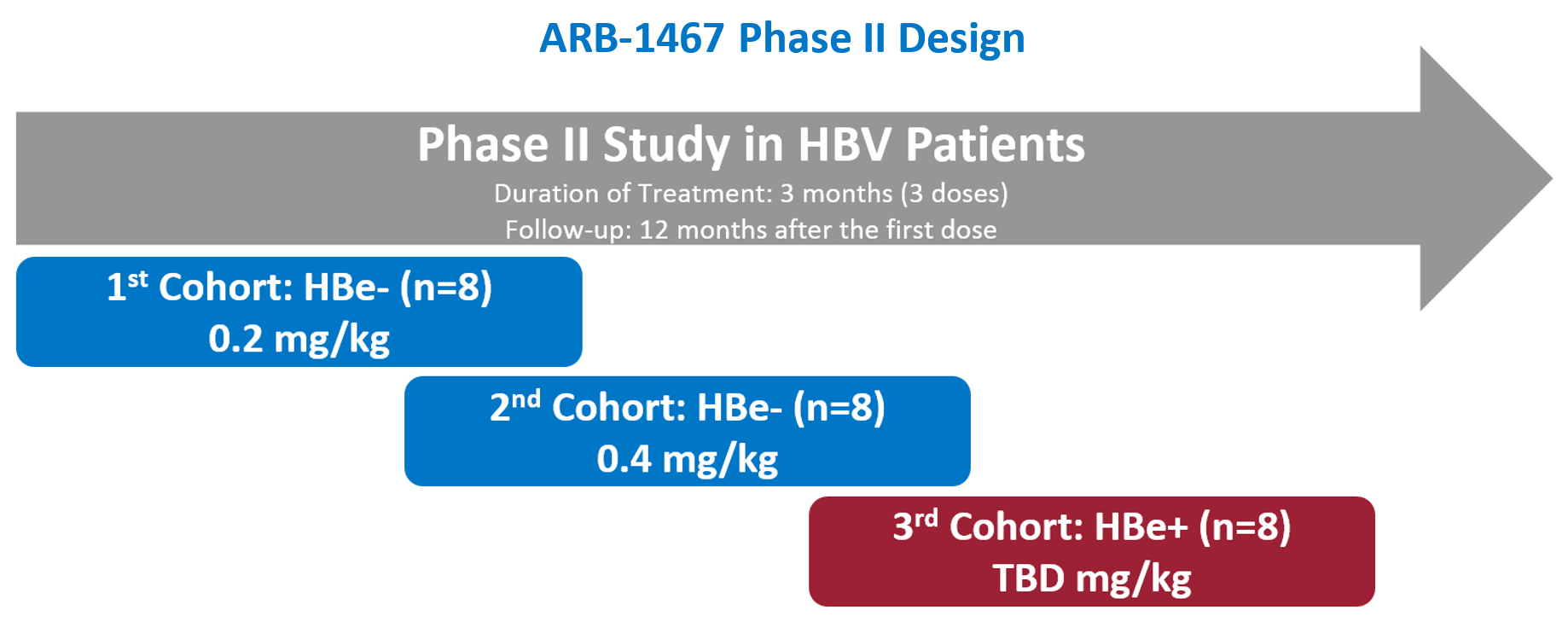

In early 2015, we advanced two RNAi product candidates (ARB-1467 and ARB-1468) into a Phase I Single Ascending Dose (SAD) trial. Both product candidates employ the same unique combination of three RNAi trigger molecules; however, they differ in their LNP composition. ARB-1467 employs a third generation LNP, and ARB-1468 employs a new, fourth generation LNP, which incorporates novel lipid chemistry and demonstrates improved potency in preclinical studies. The Phase I clinical trial is a randomized, single-blind, placebo-controlled study, involving single ascending doses of ARB-1467 and ARB-1468. The study is assessing the safety, tolerability and pharmacokinetics of intravenous administration of two LNP formulations (third and fourth generation) of the product in healthy adult subjects. In order to enable maximum dose escalation, steroid premedication was added to the Phase I protocol. No dose limiting toxicities were seen with either formulation through 0.4mg/kg, the highest dose tested in Phase I. At this time, a maximum tolerated dose has not been reached and the protocol has been amended to allow evaluation of higher doses. ARB-1467 was selected to progress to a Phase II multi-dosing study in HBV infected patients.

8

The Phase II study evaluates two dose levels of ARB-1467 administered as three monthly doses in chronic HBV infected patients who are on stable background nucleot(s)ide analog therapy. Eight subjects will be enrolled in each of the two dose cohorts with six subjects receiving ARB-1467, and two receiving placebo. The ARB-1467 Phase II multi-dosing study has been initiated and single dose and multi-dose HBsAg reduction data are expected in the second half of 2016.

While we are focused on development of our lead HBV product candidates, we believe in continuous innovation and will incorporate technological and product design advancements that may result in an improvement in safety and/or efficacy. An example of this is our follow-on RNAi HBV candidate, ARB-1740. ARB-1740 is more potent than ARB-1467 in preclinical studies and has the potential to be effective at lower clinical doses than ARB-1467. ARB-1740 employs the same LNP formulation as ARB-1467 (with a different set of three RNAi triggers). We plan to file an IND (or equivalent filing) for ARB-1740 in the second half of 2016.

cccDNA Formation Inhibitors

We are developing small molecule cccDNA formation inhibitors. The inhibition of cccDNA formation is expected to reduce the amount of cccDNA in the infected liver by blocking the formation of new cccDNA. We acquired the exclusive, worldwide rights to this program through an in-license from the Blumberg Institute. We have made significant progress with the discovery of potent and small molecule cccDNA formation inhibitors. As presented at the 2015 International Meeting on Molecular Biology of Hepatitis B Viruses in October 2015, our cccDNA formation inhibitors demonstrate synergy with approved nucleot(s)ide analogs in preclinical models, which could lead to faster declines in cccDNA levels in patients than is seen with nucleot(s)ide analogs alone. We plan to file an IND (or equivalent filing) for our lead cccDNA formation inhibitor in the second half of 2016.

Core Protein/ Capsid Assembly Inhibitors

HBV core protein, or capsid, is required for viral replication and core protein may have additional roles in cccDNA function. Current nucleot(s)side analog therapy significantly reduces serum HBV DNA levels in the serum but significant HBV replication continues in the liver, thereby enabling HBV infection to persist. Effective therapy for patients requires new agents which will effectively block viral replication. We are developing core protein inhibitors (also known as capsid assembly inhibitors) as oral therapeutics for the treatment of chronic HBV infection. By inhibiting assembly of the viral capsid, the ability of hepatitis B virus to replicate is impaired, resulting in reduced cccDNA. We acquired exclusive, worldwide rights to these drug candidates through an in-license from Blumberg and Drexel University, or (“Drexel”), and through Arbutus Inc.’s acquisition of Enantigen Therapeutics, Inc. (“Enantigen”). We plan to file an IND (or equivalent filing) for our lead candidate in the second half of 2016.

9

TLR9 Agonist (ARB-1598)

Immune stimulation by toll-like receptor (TLR) agonists may overcome the immunologic blocks that allow chronic HBV persistence, including direct activation of the host’s innate antiviral response. Licensed from Cytos Biotechnology Ltd., (“Cytos”), ARB-1598 (formerly CYT003) is a biological carrier which is filled with the immunostimulatory oligonucleotide called G10, a TLR-9 agonist. ARB-1598 has been shown to directly activate B cells and stimulates human plasmacytoid dendritic cells to secrete Interferon alpha, and has previously been utilized in human trials in other indications. ARB-1598 also activates other antigen presenting cells indirectly and promotes the development of TH1 type cytokine response, which is thought to be potentially beneficial in promoting anti-HBV T cell immunity. ARB-1598 is undergoing preclinical evaluation to establish its utility for HBV, and if there is a clear support for this application, we plan to initiate clinical development of ARB-1598 in chronically infected HBV patients in 2016.

Other Research Programs

Surface Antigen Secretion Inhibitors

We are developing multiple small molecule orally bioavailable inhibitors of HBV surface antigen production and secretion. By inhibiting the production and secretion of HBV surface antigen from infected cells, we expect that the immune response of patients treated with this therapy can reengage and thereby mount a more credible response to a hepatitis B virus infection.

cccDNA Epigenetic Modifiers

In addition to cccDNA formation inhibitors, we are developing cccDNA epigenetic modifiers. By controlling cccDNA transcription, we anticipate that we may be able to inhibit the formation of new virus and sub viral particles from cccDNA. This development program, which is currently in the discovery research stage, is based on proof of concept data generated by Blumberg using known inhibitors of enzymes involved in DNA information processing.

STING Agonists

We are developing stimulator of interferon genes (STING) agonists. By activating interferon genes, we anticipate that the body can produce additional interferon alpha and beta, which have antiviral properties. Our development program, which is currently in the discovery research stage, is based on proof of concept data in mice generated by Blumberg which showed that STING agonists can elicit an antiviral response and inhibit HBV replication in mouse liver cells. In collaboration with Blumberg, our plan is to identify potent, orally active small molecule human STING agonists that possess the desired characteristics to progress into human clinical studies.

Cyclophilin Inhibitor (OCB-030)

We licensed from NeuroVive Pharmaceutical AB, or (NeuroVive), the exclusive rights to develop and commercialize cyclophilin inhibitor drug candidates, including OCB-030, for the treatment of hepatitis B. After extensive preclinical evaluation of OCB-030 and other competitive cyclophilin inhibitors against HBV, we have concluded that cellular cyclophillins do not play a role in HBV chronic infection and further development of OCB-030 is unwarranted. As a result, we made the decision in October 2015 to discontinue the development of OCB-030 and have suspended our interest in the cyclophilin inhibitor class.

Our Proprietary Delivery Technology

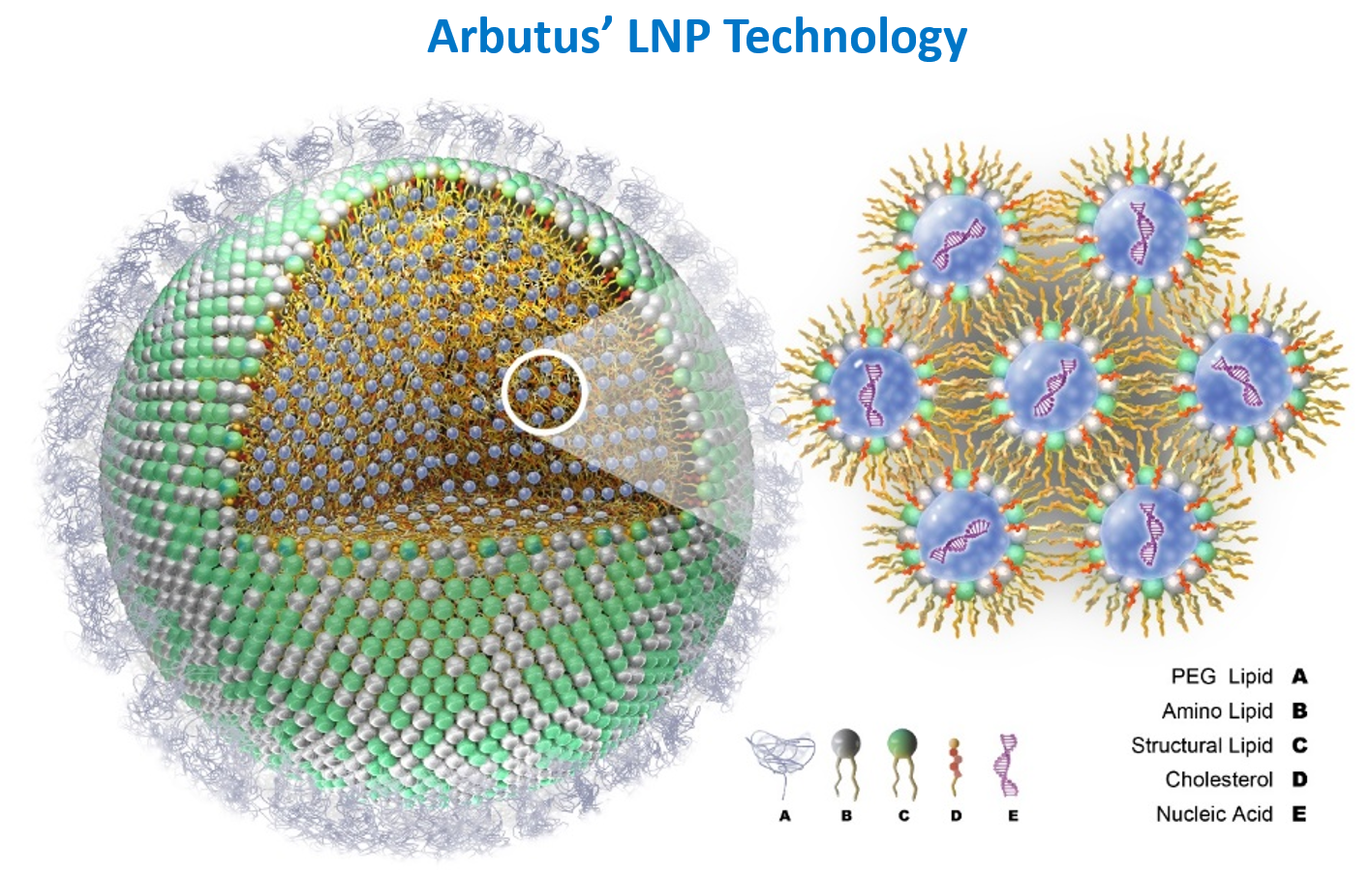

Development of RNAi therapeutic products is currently limited by the instability of the RNAi trigger molecules in the bloodstream and the inability of these molecules to access target cells or tissues following administration. Delivery technology is necessary to protect these drugs in the bloodstream to allow efficient delivery and cellular uptake by the target cells. Arbutus has developed a proprietary delivery platform called Lipid Nanoparticle, or LNP. The broad applicability of this platform to RNAi development has established Arbutus as a leader in this new area of innovative medicine.

Our proprietary LNP delivery technology allows for the successful encapsulation of RNAi trigger molecules in LNP administered intravenously, which travel through the bloodstream to target tissues or disease sites. LNPs are designed to protect the triggers, and stay in the circulation long enough to accumulate at disease sites, such as the liver or cancerous tumors. LNPs are then taken up into the target cells by a process called endocytosis. Subsequent activation by the changing environment inside the cell causes the LNP to release the trigger molecules, which can then successfully mediate RNAi.

10

Ongoing Advancements in LNP Technology

Our LNP technology represents the most widely adopted delivery technology in RNAi, which has enabled several clinical trials and has been administered to hundreds of human subjects. Because LNP can enable a wide variety of nucleic acid triggers, including mRNA, we continue to see new product development and partnering opportunities based on our industry-leading delivery expertise and intellectual property. We presented preclinical data in October 2013 at the International mRNA Health Conference in Tubingen, Germany, and in February 2014 at the AsiaTIDES Conference in Toyko, Japan. This data demonstrated that mRNA encapsulated and delivered using our proprietary LNP technology can be effectively delivered and expressed in the liver in tumors and other specific tissues of therapeutic interest.

Arbutus continues to explore opportunities to generate value from its LNP platform technology, which is well suited to deliver therapies based on RNAi, mRNA, gene editing, as well as other technologies.

Suspended Non-HBV RNAi Assets

Our intent is to focus our efforts on discovering, developing and commercializing a cure for patients suffering from chronic HBV infection. As such, pending completion of ongoing studies associated with TKM-PLK1, we have suspended further development of our non-HBV assets and are exploring different strategic options to maximize the value of these assets. Our non-HBV assets include our LNP-based product candidates TKM-PLK for oncology, TKM-Ebola and TKM-Marburg for hemorrhagic fever viruses, TKM-HTG for metabolic disorders, and TKM-ADLH for severe alcohol use disorder.

Oncology (TKM-PLK1)

Our oncology product platform, TKM-PLK1, targets PLK1, a protein involved in tumor cell proliferation and a validated oncology target. Inhibition of PLK1 expression prevents the tumor cell from completing cell division, resulting in cell cycle arrest and death of the cancer cell. Evidence that patients with elevated levels of PLK1 in their tumors exhibit poorer prognosis and survival rates has been documented in the medical literature. TKM-PLK1 is being evaluated in the following oncology indications where there are limited or ineffective therapies available: Gastrointestinal Neuroendocrine Tumors (GI-NET), Adrenocortical Carcinoma (ACC) and Hepatocellular Carcinoma (HCC). We are exploring partnering or external funding opportunities to maximize the value of our oncology related assets.

11

TKM-PLK1: GI-NET and ACC

GI-NET is the gastrointestinal subset of neuroendocrine tumors with an estimated U.S. prevalence of 55,000 individuals. Prognosis for advanced or metastatic GI-NET, the target population for TKM-PLK1, is poor with 25-54% of patients surviving less than one year. ACC is an extremely rare form of cancer that develops in the adrenal gland. Data from the U.S. National Cancer Institute indicates there are approximately 500 patients in the U.S. with ACC. Survival prognosis for patients with ACC is poor. A large percentage of patients are not good surgical candidates and there is a lack of effective systemic therapies.

We presented Phase I TKM-PLK1 data at the 6th and 8th Annual NET Conferences hosted by the North American Neuroendocrine Tumor Society (NANETS) in October 2013 and October 2015. Based on encouraging results from the dose escalation portion and expansion cohort from our Phase I TKM-PLK1 clinical trial, we expanded into a Phase I/II clinical trial with TKM-PLK1, which enrolled patients within the two therapeutic indications: advanced GI-NET or ACC. This multi-center, single arm, open label study was designed to measure efficacy using RECIST criteria for GI-NET patients and ACC patients as well as evaluate the safety, tolerability and pharmacokinetics of TKM-PLK1 in a population of 63 subjects with advanced solid tumors, including 15 subjects with GI-NET. TKM-PLK1 was administered weekly with each four-week cycle consisting of three once-weekly doses followed by a rest week. We provided an update on the Phase I/II GI-NET clinical study in October 2015 at the NANETS conference.

In the GI-NET population, one subject, a "remarkable responder" had a maximal 61.1% decrease in target tumor at cycle 2. This subject remained on-study for 10 cycles and the partial tumor response (PR) was stable throughout this period. Twelve of 13 evaluable subjects had a best response of stable disease (SD) or PR. Duration of SD/PR ranged from two to 14 cycles. In the ACC population one subject, a "remarkable responder" had a maximal 48.7% decrease in target tumor at cycle 14. After 18 cycles, the residual tumor was resected and histopathology showed near-complete necrosis, at which time the subject discontinued the study. Five of eight evaluable subjects had a best response of SD or PR. Duration of SD/PR ranged from two to 18 cycles. Therapy with TKM-PLK1 was received for up to 18 months and was generally well tolerated by the majority of subjects. The TKM-PLK1 GI-NET/ACC trial has concluded.

TKM-PLK1: HCC

HCC is one of the most common cancers, one of the most deadly and a common outcome of chronic HBV infection, with over 650,000 deaths each year worldwide according to the Globocan 2012 database. US incidence is estimated at 27,000 individuals with annual growth rates greater than 2%. HCC is an aggressive, hard-to-treat disease with one-year survival rates of less than 50% and five-year rates as low as 4% (National Cancer Institute). To date, Nexavar (sorafenib) is the only agent approved to treat HCC with an improvement in overall survival of just two to three months.

In June 2014, we initiated another Phase I/II clinical trial with TKM-PLK1, enrolling patients with advanced HCC. Patient dosing has commenced and we have completed the dose escalation portion of this trial. This Phase I/II clinical trial is a multi-center, single arm, open label dose escalation study designed to evaluate the safety, tolerability and pharmacokinetics of TKM-PLK1 as well as determine the maximum tolerated dose in patients with advanced inoperable HCC. It will also include a preliminary assessment of the anti-tumor activity of TKM-PLK1 in this patient population. In August 2015 we announced initiation of patient dosing in the expansion cohort of the clinical trial at multiple sites in Canada, the United States and Asia, and have since completed enrollment. An assessment of efficacy in terms of tumor response in approximately 20 subjects will take place upon trial completion and results are expected in 2016.

Other Infectious Diseases (TKM-Ebola and TKM-Marburg)

We have suspended further development of our RNAi product candidates targeting filoviruses Ebola and Marburg. In December 2014, the U.S. Congress amended the FDA Priority Review Voucher (PRV) Program Act to add filoviruses as a candidate for a PRV. We are exploring partnering or external funding opportunities to maximize the value of these assets.

12

TKM-Ebola-Kikwit has been developed under a $140 million contract with the U.S. Department of Defense (DoD) awarded in July 2010. Given the unclear development path for TKM-Ebola, development activities have been suspended and the contract with the DoD has been terminated. TKM-Ebola-Kikwit completed the single ascending dose portion of the Phase I clinical trial in healthy human volunteers. Results demonstrated that administration of the TKM-Ebola-Kikwit therapeutic, in the absence of any steroid containing pre-medication, was well-tolerated at a dose level of 0.3 mg/kg, determined to be the maximum tolerated dose. Under the FDA’s expanded access program, several patients with a confirmed or suspected Ebola virus infection were treated with TKM-Ebola-Kikwit during the ebola outbreak in 2014. In March 2015, a TKM-Ebola-Guinea Phase II single arm trial called Rapid Assessment of Potential Interventions & Drugs for Ebola (RAPIDE) was initiated in Sierra Leone, led by the International Severe Acute Respiratory and Emerging Infection Consortium (ISARIC) at the University of Oxford, UK, with funding from the Wellcome Trust. In June 2015 we announced closing of the enrollment for the trial as it reached a futility boundary, which was a predefined statistical endpoint. The results of the study have been submitted for publication and the manuscript is under review.

We have several publications related to our Ebola and Marburg RNAi therapeutic candidates. In April 2015, we, along with our collaborators at the University of Texas Medical Branch (UTMB) at Galveston, USA, published positive Ebola treatment data in the journal Nature (Thi EP., et al.; Nature, April 2015). Data demonstrated 100% survival of nonhuman primates previously infected with the West African Makona strain of Ebola virus even when treatment did not begin until three days after viral exposure a time point at which animals were five to six days away from death. These efficacy results are comparable to those obtained with TKM-Ebola-Kikwit, which also demonstrated up to 100% protection from an otherwise lethal dose of the virus. We have published data demonstrating complete protection of non-human primates against lethal Marburg-Angola strain, (Thi EP., et al.; Science Translational Medicine, Aug 2014). Selected data from these programs was presented at the Chemical and Biological Defense Science and Technology Conference in May 2015.

Metabolic Disorders (TKM-HTG)

TKM-HTG is a multi-component RNAi therapeutic that simultaneously targets a combination of genes expressed in the liver, which are known to play a significant role in triglyceride metabolism. High triglyceride levels are medically linked to increased risk of cardiovascular disease, fatty liver disease, insulin resistance and pancreatitis. Approximately one million adults in the US and 18 million worldwide suffer from severe HTG. (NHANES 2003-2004 data). Another patient group affected by HTG are those with Familial Chylomicronemia Syndrome (FCS), which is a very rare hereditary condition affecting an estimated 1:1,000,000 people (www.fcs.raredr.com). Additionally, 35% of patients with Type 2 Diabetes (T2D) suffer from mixed hyperlipidemia which is a combination of elevated cholesterol and high triglycerides. With underlying T2D, these patients are at considerable risk from cardiovascular disease. We are exploring partnering or external funding opportunities to maximize the value of this asset.

Alcohol Use Disorder (TKM-ALDH)

TKM-ALDH is designed to knockdown or silence aldehyde dehydrogenase (ALDH) to induce long term acute sensitivity to ethanol, for use in severe alcohol use disorder. Aldehyde dehydrogenase is a key enzyme in ethanol metabolism. Inhibition of ALDH activity, through the silencing of ALDH, results in the build-up of acetaldehyde leading to adverse physiological effects. Human proof of concept for ALDH inhibition already exists in the form of the approved drug disulfiram. However, disulfiram’s efficacy is compromised by poor compliance because it has to be taken daily. We believe TKM-ALDH will induce prolonged ethanol sensitivity that will enable it to overcome the compliance limitations associated with daily dosing. We are exploring partnering or external funding opportunities to maximize the value of this asset.

Partner Programs

Patisiran (ALN-TTR02)

Alnylam Pharmaceuticals, Inc., or Alnylam, has a license to use our intellectual property (IP) to develop and commercialize products and may only grant access to our LNP technology to its partners if it is part of a product sublicense. Alnylam’s license rights are limited to patents that we have filed, or that claim priority to a patent that was filed, before April 15, 2010. Alnylam does not have rights to our patents filed after April 15, 2010 unless they claim priority to a patent filed before that date. Alnylam will pay us low single digit royalties as Alnylam’s LNP-enabled products are commercialized. More information about our licensing agreement with Alnylam can be found under the “Strategic Alliances, Licensing Agreements, and Research Collaborations” section of this report.

13

In April 2014, Alnylam presented positive new data from its Phase II clinical trial with patisiran, an RNAi therapeutic targeting transthyretin (TTR) for the treatment of TTR-mediated amyloidosis (ATTR). These results provide additional support for Alnylam's Phase III APOLLO trial. In October 2014, Alnylam reported positive clinical data for the ongoing patisiran Phase II Open Label Extension (OLE) study in patients with Familial Amyloidotic Polyneuropathy (FAP). The results demonstrated sustained knockdown of serum TTR of up to 90% and a favorable tolerability profile out to one year of treatment. In April 2015, Alnylam announced positive data from the ongoing open-label study with patisiran which demonstrated continued evidence for possible halting of neuropathy progression after the first 12 months of treatment. In addition, patisiran treatment showed robust mean knockdown of serum TTR of up to 88%. Alnylam's ongoing OLE study is an open-label, multi-center trial designed to evaluate the long-term safety and tolerability of patisiran administration in FAP patients that were previously enrolled in a Phase II study. In July 2015, Alnylam announced initiation of a Phase III open label OLE study with patisiran (APOLLO-OLE) to evaluate the long-term safety and tolerability of patisiran in ATTR amyloidosis patients with FAP who were previously enrolled in the APOLLO Phase III study. In September 2015, Alnylam reported evidence of reduced pathogenic, misfolded TTR monomers and oligomers in TTR-mediated amyloidosis patients with FAP, and in November 2015 it reported that patisiran demonstrates continued evidence for potential halting of neuropathy progression and improvement in nerve fiber density in patients with FAP. New Drug Application (NDA) filing for this program is expected in 2017.

The patisiran program represents the most clinically advanced application of our LNP delivery technology. Furthermore, Alnylam’s results demonstrate that multi-dosing with our LNP has been well-tolerated with treatments out to 21 months.

Marqibo®

Marqibo®, originally developed by Arbutus, is a novel, sphingomyelin/cholesterol liposome-encapsulated formulation of the FDA-approved anticancer drug vincristine. Marqibo’s approved indication is for the treatment of adult patients with Philadelphia chromosome-negative acute lymphoblastic leukemia (Ph-ALL) in second or greater relapse or whose disease has progressed following two or more lines of anti-leukemia therapy. Our licensee, Spectrum Pharmaceuticals, Inc. (Spectrum), launched Marqibo through its existing hematology sales force in the United States. We are entitled to mid-single digit royalty payments based on Marqibo’s commercial sales. Spectrum has ongoing trials evaluating Marqibo in three additional indications, which are: first line use in patients with Philadelphia Negative Acute Lymphoblastic Leukemia (Ph-ALL), Pediatric ALL and Non-Hodgkin’s lymphoma. More information about our licensing agreement with Spectrum can be found under the “Strategic Alliances, Licensing Agreements, and Research Collaborations” section of this report.

DCR-PH1

In November 2014, we signed a licensing and collaboration agreement with Dicerna Pharmaceuticals, Inc. to utilize our LNP delivery technology exclusively in Dicerna's primary hyperoxaluria type 1 (PH1) development program. Dicerna will use our third generation LNP technology for delivery of DCR-PH1, Dicerna's product incorporating its Dicer substrate RNA (DsiRNA) molecule, for the treatment of PH1, a rare, inherited liver disorder that often results in kidney failure and for which there are no approved therapies. In December 2015, Dicerna announced initiation of dosing in healthy volunteers with plans to initiate the Phase I clinical trial in patients with PH1 in 2016. More information about our licensing agreement with Dicerna can be found under the “Strategic Alliances, Licensing Agreements, and Research Collaborations” section of this report.

Strategic Alliances, Licensing Agreements, and Research Collaborations

Alnylam Pharmaceuticals, Inc.

Alnylam has a license to use our IP to develop and commercialize products and may only grant access to our LNP technology to its partners if it is part of a product sublicense. Alnylam’s license rights are limited to patents that we have filed, or that claim priority to a patent that was filed, before April 15, 2010. Alnylam does not have rights to our patents filed after April 15, 2010 unless they claim priority to a patent filed before that date. Alnylam will pay low single digit royalties as Alnylam’s LNP-enabled products are commercialized. Alnylam currently has three LNP-based products in clinical development: ALN-TTR02 (patisiran), ALN-VSP, and ALN-PCS02.

Our licensing agreement with Alnylam grants us IP rights for the development and commercialization of RNAi therapeutics for specified targets. In consideration for these three exclusive and 10 non-exclusive licenses, we have agreed to pay single-digit royalties to Alnylam on product sales, with milestone obligations of up to $8.5 million on the non-exclusive licenses and no milestone obligations on the three exclusive licenses.Alnylam has also pursued two other LNP-based products through clinical development: ALN-VSP (liver cancer), and ALN-PCS02 (hypercholesterolemia). Alnylam will pay Arbutus low single digit royalties based on commercial sales of Alnylam’s LNP-enabled products.

14

We entered an arbitration proceeding with Alnylam, as provided for under our licensing agreement, to resolve a matter related to a disputed $5 million milestone payment to Arbutus from Alnylam related to its ALN-VSP product. The arbitration proceeding with Alnylam has concluded resulting in no milestone payment to Arbutus.

Acuitas Therapeutics Inc.

Consistent with the terms of the settlement agreement signed in November 2012, we finalized and entered a cross-license agreement with Acuitas Therapeutics Inc., or Acuitas in December 2013. The terms of the cross-license agreement provide Acuitas with access to certain of our earlier IP generated prior to April 2010. At the same time, the terms provide us with certain access to Acuitas’ technology and licenses in the RNAi field, along with a percentage of each milestone and royalty payment with respect to certain products. Acuitas has agreed that it will not compete in the RNAi field for a period of five years, ending in November 2017.

Merck & Co., Inc. and Alnylam License Agreement

As a result of the settlement between Protiva Biotherapeutics, Inc. (Protiva), and Merck & Co., Inc. in 2008, we acquired a non-exclusive royalty-bearing world-wide license agreement with Merck. Under the license, Merck will pay up to $17 million in milestones for each product they develop covered by our IP, except for the first product for which Merck will pay up to $15 million in milestones, and will pay royalties on product sales. Merck’s license rights are limited to patents that Protiva filed, or that claim priority to one of Protiva’s patents that was filed, before October 9, 2008. Merck does not have rights to Protiva patents filed after October 9, 2008 unless they claim priority to a patent filed before that date. On March 6, 2014, Alnylam announced that they acquired all assets and licenses from Merck, which included our license agreement.

Dicerna Pharmaceuticals, Inc.

In November 2014, we signed a licensing agreement and a development and supply agreement with Dicerna to license our LNP delivery technology for exclusive use in Dicerna's PH1 development program. Dicerna will use Arbutus’ third generation LNP technology for delivery of DCR-PH1, Dicerna's product incorporates its DsiRNA molecule, for the treatment of PH1, a rare, inherited liver disorder that often results in kidney failure and for which there are no approved therapies. Under the agreements, Dicerna paid Arbutus $2.5 million upfront and will potentially make payments of $22 million in aggregate development milestones, plus a mid-single-digit royalty on future PH1 sales. This partnership also includes a supply agreement under which we will provide clinical drug supply and regulatory support for the rapid advancement of this product candidate.

Monsanto Company

In January 2014, we signed an Option Agreement and a Service Agreement with Monsanto Company, or Monsanto, and granted Monsanto an option to obtain a license to use our proprietary LNP delivery technology. The transaction supports the application of LNP technology and related IP for use in agriculture. The potential value of the transaction could reach $86.2 million following the successful completion of milestones. In January 2014, we received $14.5 million of the $17.5 million in near term payments. We received additional payments of $1.5 million each in June 2014 and October 2014 following the achievement of specific program objectives. In May 2015, the arrangement was amended to extend the option period by approximately five months, with payments up to $2.0 million for the extension period. As of December 31, 2015, we have received $19.3 million. Following the completion of the Phase A extension period in October 2015, no further research activities were conducted under the arrangement, as Monsanto did not elect to proceed to Phase B of the research plan.

On March 4, 2016, Monsanto exercised its option to acquire 100% of the outstanding shares of Protiva Agricultural Development Company Inc., or PADCo, and will pay Arbutus an exercise fee of $1 million. As a result, PADCo is no longer an indirect wholly owned subsidiary of us. In connection with Monsanto’s exercise of its option, on March 4, 2016, we entered into an amended Option Agreement. We also entered into an amended Service Agreement on March 4, 2016 to give effect to the grant back to Protiva of new intellectual property created by Monsanto in connection with the exercise of its option. In addition, we entered into an amended License and Services Agreement to recognize Monsanto’s early exercise of option before Protiva’a completion of Phases B and C, and introduce a new Technology Transfer Completion Criteria through the amended Option Agreement. Each of the amended Option Agreement, amended License and Services Agreement and amendment to the Service Agreement have been filed as Exhibits to this annual report on Form 10-K.

Spectrum Pharmaceuticals, Inc.

In September 2013, we announced that our licensee, Spectrum, had launched Marqibo® through its existing hematology sales force in the United States. Since then commercial sales have occurred. Arbutus is entitled to mid-single digit royalty

15

payments based on Marqibo®’s commercial sales. Marqibo®, which is a novel sphingomyelin/cholesterol liposome-encapsulated formulation of the FDA-approved anticancer drug vincristine, was originally developed by Arbutus. We out-licensed the product to Talon Therapeutics in 2006, and in July 2013, Talon was acquired by Spectrum. Marqibo®’s approved indication is for the treatment of adult patients with Philadelphia chromosome-negative acute lymphoblastic leukemia (Ph-ALL) in second or greater relapse or whose disease has progressed following two or more lines of anti-leukemia therapy. Spectrum has ongoing trials evaluating Marqibo® in three additional indications, which are: first line use in patients with Ph-ALL, Pediatric ALL and Non-Hodgkin’s lymphoma.

Marina Biotech, Inc. /Arcturus Therapeutics, Inc.

In November 2012, we disclosed that we had obtained a worldwide, non-exclusive license to a novel RNAi trigger technology called Unlocked Nucleobase Analog (UNA) from Marina Biotech Inc., or Marina, for the development of RNAi therapeutics. UNAs can be incorporated into RNAi drugs and have the potential to improve them by increasing their stability and reducing off-target effects. In August 2013, Marina assigned its UNA technology to Arcturus Therapeutics, Inc., or Arcturus, and the UNA license agreement between us and Marina was assigned to Arcturus. The terms of the license are otherwise unchanged.

To date, we have paid Marina $0.5 million in license fees and there are milestones of up to $3.2 million plus royalties for each product that we develop using UNA technology licensed from Marina. We announced on January 21, 2015, that we had initiated a Phase I clinical trial with TKM-HBV (RNAi). As TKM-HBV utilizes UNA technology in-licensed from Arcturus, the initiation of the trial triggered a single milestone payment of $250,000 payable by us to Arcturus.

U.S. National Institutes of Health

On October 13, 2010 we announced that together with collaborators at the University of Texas Medical Branch (UTMB), we were awarded a new NIH grant, worth $2.4 million, to support research to develop RNAi therapeutics to treat Ebola and Marburg hemorrhagic fever viral infections using our LNP delivery technology. In February 2014, we along with UTMB and other collaborators were awarded additional funding of $3.4 million over five years from the NIH in support of this research.

Bristol-Myers Squibb Company

In May 2010, we announced a research collaboration with Bristol-Myers Squibb Company, BMS. Under this agreement, BMS conducted preclinical work to validate the function of certain genes and shared the data with us to potentially develop RNAi therapeutic drugs against therapeutic targets of interest. We formulated the required RNAi trigger molecules enabled by our LNP technology to silence target genes of interest. BMS paid us $3.0 million concurrent with the signing of the agreement. We provided a predetermined number of LNP batches over the four-year agreement. In May 2011, we announced a further expansion of the collaboration to include broader applications of our LNP technology and additional target validation work. In May 2014, the collaboration expired and all parties’ obligations ended.

Halo-Bio RNAi Therapeutics, Inc.

In August 2011, we entered into a license and collaboration agreement with Halo-Bio RNAi Therapeutics, Inc., or Halo-Bio. Under the agreement, Halo-Bio granted to us an exclusive license to its multivalent ribonucleic acid MV-RNA technology. The agreement was amended on August 8, 2012, to adjust future license fees and other contingent payments. To date, we have recorded $0.5 million in fees under our license from Halo-Bio. We terminated the agreement with Halo-Bio on July 31, 2013. There are no further payments due or contingently payable to Halo-Bio.

Aradigm Corporation

In December 2004, we entered into a licensing agreement with Aradigm Corporation, or Aradigm, under which Aradigm exclusively licensed certain of our liposomal intellectual property for the pulmonary delivery of Ciprofloxacin. As amended, this agreement calls for milestone payments totalling $4.5 and $4.75 million, respectively, for the first two disease indications pursued by Aradigm using our technology, and for low- to mid-single-digit royalties on sales revenue from products using our technology. We terminated the Aradigm license agreement in May 2013.

University of British Columbia

Certain early work on lipid nanoparticle delivery systems and related inventions was undertaken at the University of British Columbia, or UBC. These inventions are licensed to us by UBC under a license agreement, initially entered in 1998 as

16

amended in 2001, 2006 and 2007. We have granted sublicenses under the UBC license to Alnylam as well as to Spectrum (Talon Therapeutics Inc., acquisition). Alnylam has in turn sublicensed back to us under the licensed UBC patents for discovery, development and commercialization of RNAi products. In mid-2009, we and our subsidiary Protiva entered into a supplemental agreement with UBC, Alnylam and Acuitas Technologies, Inc., in relation to a separate research collaboration to be conducted among UBC, Alnylam and Acuitas to which we have license rights. The settlement agreement signed in late 2012 to resolve the litigation among Alnylam, Acuitas, Arbutus and Protiva provided for the effective termination of all obligations under such supplemental agreement as between and among all litigants.

On November 10, 2014, the University of British Columbia filed a demand for arbitration against Arbutus Biopharma Corp., BCICAC File No.: DCA-1623. We received UBC’s Statement of Claims on January 16, 2015. In its Statement of Claims, UBC alleges that it is entitled to $3.5 million in allegedly unpaid royalties based on publicly available information, and an unspecified amount based on non-public information. UBC also seeks interest and costs, including legal fees. We dispute UBC’s allegation. No dates have been scheduled for this arbitration.

Cytos Biotechnology Ltd

On December 30, 2014, Arbutus Inc., our wholly owned subsidiary, entered into an exclusive, worldwide, sub-licensable (subject to certain restrictions with respect to licensed viral infections other than hepatitis) license to six different series of compounds from Cytos Biotechnology Ltd., or Cytos. The licensed compounds are Qbeta-derived virus-like particles that encapsulate TLR9, TLR7 or RIG-I agonists and may or may not be conjugated with antigens from the hepatitis virus or other licensed viruses. We have an option to expand this license to include additional viral infections other than influenza and Cytos will retain all rights for influenza, all non-viral infections, and all viral infections (other than hepatitis) for which we have not exercised an option.

In partial consideration for this license, we will be obligated to pay Cytos up to a total of $67 million for each of the six licensed compound series upon the achievement of specified development and regulatory milestones; for hepatitis and each additional licensed viral infection, up to a total of $110 million upon the achievement of specified sales performance milestones; and tiered royalty payments in the high-single to low-double digits, based upon the proportionate net sales of licensed products in any commercialized combination.

The Baruch S. Blumberg Institute and Drexel University

In February 2014, Arbutus Inc., our wholly owned subsidiary, entered into a license agreement with The Blumberg S. Blumberg Institute, or Blumberg, and Drexel University, or Drexel, that granted an exclusive (except as to certain know-how and subject to retained non-commercial research rights), worldwide, sub-licensable license to three different compound series: cccDNA inhibitors, capsid assembly inhibitors and HCC inhibitors.

In partial consideration for this license, Arbutus Inc. paid a license initiation fee of $150,000 and issued warrants to Blumberg and Drexel. No warrants were outstanding as at the date Arbutus merged with Arbutus Inc. Under this license agreement, Arbutus Inc. also agreed to pay up to $3.5 million in development and regulatory milestones per licensed compound series, up to $92.5 million in sales performance milestones per licensed product, and royalties in the mid-single digits based upon the proportionate net sales of licensed products in any commercialized combination. We are obligated to pay Blumberg and Drexel a double digit percentage of all amounts received from the sub-licensees, subject to customary exclusions.

In November 2014, Arbutus Inc. entered into an additional license agreement with Blumberg and Drexel pursuant to which it received an exclusive (subject to retained non-commercial research rights), worldwide, sub-licensable license under specified patents and know-how controlled by Blumberg and Drexel covering epigenetic modifiers of cccDNA and STING agonists. In consideration for these exclusive licenses, Arbutus Inc. made an upfront payment of $50,000. Under this agreement, we will be required to pay up to $1.0 million for each licensed product upon the achievement of a specified regulatory milestone and a low single digit royalty, based upon the proportionate net sales of compounds covered by this intellectual property in any commercialized combination. We are also obligated to pay Blumberg and Drexel a double digit percentage of all amounts received from its sub-licensees, subject to exclusions.

License Agreements between Enantigen and Blumberg and Drexel

In October 2014, Arbutus Inc., our wholly owned subsidiary, acquired all of the outstanding shares of Enantigen Therapeutics, Inc., or Enantigen, pursuant to a stock purchase agreement. Through this transaction, Arbutus Inc. acquired a HBV surface antigen secretion inhibitor program and a capsid assembly inhibitor program, each of which are now assets of Arbutus, following our merger with Arbutus Inc.

17

Under the stock purchase agreement, we agreed to pay up to a total of $21.0 million to Enantigen’s selling stockholders upon the achievement of specified development and regulatory milestones, for the first two products that contain either a capsid compound, or a HBV surface antigen compound that is covered by a patent acquired under this agreement; or a capsid compound from an agreed upon list of compounds. The amount paid could be up to a total of $102.5 million in sales performance milestones in connection with the sale of the first commercialized product by us for the treatment of HBV, regardless of whether such product is based upon assets acquired under this agreement; and low single digit royalty on net sales of such first commercialized HBV product, up to a maximum royalty payment of $1.0 million that, if paid, would be offset against our milestone payment obligations.

Under the stock purchase agreement, we also agreed that Enantigen would fulfill its obligations as they relate to the three patent license agreements with Blumberg and Drexel. Pursuant to each patent license agreement, Enantigen is obligated to pay Blumberg and Drexel up to approximately $500,000 in development and regulatory milestones per licensed product, royalties in the low single digits, and a percentage of revenue it receives from its sub-licensees.

Research Collaboration and Funding Agreement with Blumberg

In October 2014, Arbutus Inc., our wholly owned subsidiary, entered into a research collaboration and funding agreement with Blumberg under which we will provide $1.0 million per year of research funding for three years, renewable at our option for an additional three years, for Blumberg to conduct research projects in HBV and liver cancer pursuant to a research plan to be agreed upon by the parties. Blumberg has exclusivity obligations to Arbutus with respect to HBV research funded under the agreement. In addition, we have the right to match any third party offer to fund HBV research that falls outside the scope of the research being funded under the agreement. Blumberg has granted us the right to obtain an exclusive, royalty bearing, worldwide license to any intellectual property generated by any funded research project. If we elect to exercise our right to obtain such a license, we will have a specified period of time to negotiate and enter into a mutually agreeable license agreement with Blumberg. This license agreement will include the following pre negotiated upfront, milestone and royalty payments: an upfront payment in the amount of $100,000; up to $8.1 million upon the achievement of specified development and regulatory milestones; up to $92.5 million upon the achievement of specified commercialization milestones; and royalties at a low single to mid-single digit rates based upon the proportionate net sales of licensed products from any commercialized combination.

NeuroVive Pharmaceutical AB

In September 2014, Arbutus Inc., our wholly owned subsidiary, entered into a license agreement with NeuroVive that granted us an exclusive, worldwide, sub-licensable license to develop, manufacture and commercialize, for the treatment of HBV, oral dosage form sanglifehrin based cyclophilin inhibitors (including OCB-030). Arbutus Inc. became our wholly owned subsidiary by way of a Merger Agreement, which does not trigger any milestone payments. Under this license agreement we have been granted a non-exclusive, royalty free right and license and right of reference to NeuroVive’s relevant regulatory approvals and filings for the sole purpose of developing, manufacturing and commercializing licensed products for the treatment of HBV. Under this license agreement, we have (1) an option to expand our exclusive license to include treatment of viral diseases other than HBV and (2) an option, exercisable upon specified conditions, to expand our exclusive license to include development, manufacture and commercialization of non-oral variations of licensed products for treatment of viral diseases other than HBV. NeuroVive retains all rights with respect to development, manufacture and commercialization of licensed products and non-oral variations of licensed products for all indications (other than HBV) for which we have not exercised our option.

In partial consideration for this license, Arbutus Inc. paid NeuroVive a license fee of $1 million. We have conducted significant research and analysis on the NeuroVive Product, OCB-030. Based on this research and analysis, we have decided to discontinue the OCB-030 development program. Otherwise, the license agreement and ongoing relationship with NeuroVive remains in full effect at this time.

Patents and Proprietary Rights

Our commercial success depends in part on our ability to obtain and maintain proprietary protection for our drug candidates, novel discoveries, product development technologies and other know-how, to operate without infringing on the proprietary rights of others and to prevent others from infringing our proprietary rights. Our policy is to seek to protect our proprietary position by, among other methods, filing or in licensing U.S. and foreign patents and patent applications related to our proprietary technology, inventions and improvements that are important to the development and implementation of our business. We also rely on trademarks, trade secrets, know how, continuing technological innovation and potential in licensing opportunities to develop and maintain our proprietary position.

18

In addition to our proprietary expertise, we own a portfolio of patents and patent applications directed to HBV cccDNA formation inhibitors, HBV core/capsid protein assembly inhibitors, TLR-9 agonists, HBV surface antigens secretion inhibitors, HBV cccDNA epigenetic modifiers, STING agonists, cyclophilin inhibitors, LNP inventions, LNP compositions for delivering nucleic acids such as mRNA and siRNA, the formulation and manufacture of LNP-based pharmaceuticals, chemical modification of RNAi molecules, and RNAi drugs and processes directed at particular disease indications. We have filed many patent applications with the US and European Patent Offices that have been granted. In the US our patents might be challenged by interference or opposition proceedings. In Europe, upon grant, a period of nine months is allowed for notification of opposition to such granted patents. If our patents are subjected to interference or opposition proceedings, we would incur significant costs to defend them. Further, our failure to prevail in any such proceedings could limit the patent protection available to our therapeutic HBV programs or RNAi platform, including our product candidates.

We have a portfolio of approximately 121 patent families, in the U.S. and abroad, that are directed to our therapeutic HBV product candidates and various aspects of LNPs and LNP formulations. The portfolio includes approximately 83 issued U.S. patents, approximately 100 issued non-U.S. patents, and approximately 350 pending patent applications, including the following patents and applications in the United States and Europe (1) :

Subject Matter | Status | Expiration Date* |

LNP Compositions and Methods of Use (siRNA) | U.S. Pat. No. 7,982,027; applications pending in other jurisdictions | 2024 |

LNP Compositions (interferingRNA) | U.S. Pat. No. 7,799,565; patents issued in other jurisdictions | 2025 |

LNP Compositions (Nucleic Acid) | U.S. Pat. Nos. 8,058,069; 8,492,359 and 8,822,668; applications pending in other jurisdictions | 2029 |

LNP Compositions and Methods of Use (PLK-1) | U.S. Pat. No.8,283,333; applications pending in other jurisdictions | 2030 |

LNP Compositions (Nucleic Acid) | U.S. Pat. No. 9,006,417 | 2031 |

LNP Manufacturing Process | U.S. Pat. Nos. 7,901,708 and 8,329,070; European Pat. Nos. 1519714 and 2338478; application pending in the U.S. | 2023 |

LNP Manufacturing Process | U.S. Pat. No. 9,005,654; application pending in Europe | 2026 |

Lipid Compositions | U.S. Pat. No. 7,745,651; European Pat. No. 1781593; application pending in the U.S. | 2025 |

Lipid Compositions | U.S. Pat. Nos. 7,803,397 and 8,936,942; European Pat. No. 1664316 | 2024 |

Modified siRNA Compositions | U.S. Pat. Nos. 8,101,741, 8,188,263 and 9,074,208; applications pending in other jurisdictions | 2026 |

Modified siRNA Compositions | U.S. Pat. No. 7,915,399 | 2027 |

siRNA and LNP Compositions (Ebola Virus) | U.S. Pat. No. 7,838,658 | 2026 |

siRNA and LNP Compositions and Methods of Treatment (Ebola Virus) | U.S. Pat. No. 8,716,464 | 2030 |

siRNA and LNP Compositions (PLK1) | U.S. Pat. No. 9,006,191; European Pat. No. 2238251 | 2028 |

Immunostimulatory Compositions, Methods of Use and Production | U.S. Pat. No. 8,691,209; European Pat. No. 1450856 | 2022 |

siRNA and LNP Compositions (HBV) | Patent applications pending in U.S. and other jurisdictions | 2035 |

HBV Capsid Assembly Inhibitor Compositions and Methods of Treatment | Patent applications pending in U.S. and other jurisdictions | 2032 |

(1) | Patent information current as of February 15, 2016. |

* Once issued, the term of a US patent first filed after mid-1995 generally extends until the 20th anniversary of the filing date of the first non-provisional application to which such patent claims priority. It is important to note, however, that the United States Patent & Trademark Office, or USPTO, sometimes requires the filing of a Terminal Disclaimer during prosecution, which may shorten the term of the patent. On the other hand, certain patent term adjustments may be available based on USPTO delays during prosecution. Similarly, in the pharmaceutical area, certain patent term extensions may be available based on the history of the drug in clinical trials. We cannot predict whether or not any such adjustments or extensions will be available or the length of any such adjustments or extensions.

19

Scientific Advisers

We seek advice from our scientific advisory board, which consists of a number of leading scientists and physicians, on scientific and medical matters. The current members of our scientific advisory board are:

Name | Position(s)/Institutional Affiliation(S) | |

Adrian Di Bisceglie, MD | Professor of Internal Medicine and Chairman of the Department of Medicine at St Louis University , St Louis University School of Medicine, Chief of Hepatology | |

Charlie Rice, Ph.D. | Maurice and Corinne Greenberg Professor in Virology, Rockefeller University | |

Scott Biller, Ph.D. | Chief Scientific Officer at Agios Pharmaceuticals | |

Ulrike Protzer, Ph.D. | Director, Institute of Virology, Technische Universität München / Helmholtz Zentrum München - German Center for Environmental Health | |

Fabien Zoulim, MD, Ph.D. | Professor of Medicine, Lyon University, Head of Hepatology Department, Hospices Civils de Lyon | |

Employees

At December 31, 2015, Arbutus had 134 employees, 105 of whom were engaged in research and development. None of our employees are represented by a labor union or covered by a collective bargaining agreement, nor have we experienced any work stoppages. We believe that relations with our employees are good.

Corporate information

Arbutus Biopharma Corporation (“Arbutus”, “we”, “us”, and “our”) is a publicly traded industry-leading therapeutic solutions company focused on discovering, developing and commercializing a cure for patients suffering from chronic hepatitis HBV infection. Effective July 31, 2015, our corporate name changed from Tekmira Pharmaceuticals Corporation to Arbutus Biopharma Corporation. Also effective July 31, 2015, the corporate name of our wholly owned subsidiary, OnCore Biopharma, Inc. changed to Arbutus Biopharma, Inc. (“Arbutus Inc.”). We have two wholly owned subsidiaries:Arbutus Inc., and Protiva Biotherapeutics Inc. (“Protiva”). Unless stated otherwise or the context otherwise requires, references herein to “Arbutus”, “we”, “us” and “our” refer to Arbutus Biopharma Corporation, and, unless the context requires otherwise, one or more subsidiaries through which we conduct business.

Arbutus was incorporated pursuant to the British Columbia Business Corporations Act, or BCBCA, on October 6, 2005, and commenced active business on April 30, 2007, when Arbutus and its parent company, Inex Pharmaceuticals Corporation, or Inex, Inex, were reorganized under a statutory plan of arrangement (the Reorganization) completed under the provisions of the BCBCA. The Reorganization saw Inex’s entire business transferred to and continued by Arbutus.

On March 4, 2015, we completed a business combination pursuant to which OnCore Biopharma, Inc., or OnCore, became our wholly-owned subsidiary. This combined company intends to focus on developing a curative regimen for HBV patients by combining multiple therapeutic approaches.

Arbutus’ head office and principal place of business is located at 100-8900 Glenlyon Parkway, Burnaby, British Columbia, Canada, V5J 5J8 (telephone: (604) 419-3200). The Company’s registered and records office is located at 700 West Georgia St, 25th Floor, Vancouver, British Columbia, Canada, V7Y 1B3. Arbutus also has a US office located at 3805 Old Easton Road, Doylestown, PA 18902.

Investor information

We are a reporting issuer in Canada under the securities laws of each of the Provinces of Canada. On March 3, 2015, Arbutus’ common shares were voluntarily delisted from the Toronto Stock Exchange.

20

Arbutus’ common shares trade on the NASDAQ Global Market under the symbol “ABUS”. We maintain a website at http://www.arbutusbio.com. The information on our website is not incorporated by reference into this annual report on Form 10-K and should not be considered to be a part of this annual report on Form 10-K. Our website address is included in this annual report on Form 10-K as an inactive technical reference only. Our reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended, including our annual reports on Form 10-K (annual reports on Form 20-F up to year-ended December 31, 2012), our quarterly reports on Form 10-Q (quarterly reports on Form 6-K up to quarter-ended September 30, 2013) and our current reports on Form 8-K, and amendments to those reports, are accessible through our website, free of charge, as soon as reasonably practicable after these reports are filed electronically with, or otherwise furnished to, the SEC. We also make available on our website the charters of our audit committee, executive compensation and human resources committee and corporate governance and nominating committee, whistleblower policy, insider trading policy, and majority voting policy, as well as our code of business conduct and ethics for directors, officers and employees. In addition, we intend to disclose on our web site any amendments to, or waivers from, our code of business conduct and ethics that are required to be disclosed pursuant to the SEC rules.

You may read and copy any materials we file with the SEC at the SEC’s Public Reference Room at 100 F Street, NE, Washington, DC 20549. You may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. The SEC also maintains a website that contains reports, proxy and information statements, and other information regarding Arbutus and other issuers that file electronically with the SEC. The SEC’s website address is http://www.sec.gov.

Executive Officers of the Registrant

Set forth below is information about our executive officers, as of March 8, 2016.

Name | Age | Position(s) | ||

Mark Murray | 67 | President and Chief Executive Officer, and Director | ||

Bruce Cousins | 55 | Executive Vice President and Chief Financial Officer | ||

Mark Kowalski | 61 | Chief Medical Officer | ||

Peter Lutwyche | 50 | Chief Technology Officer | ||

Patrick Higgins | 58 | Chief Business Officer | ||

Michael Sofia | 57 | Chief Scientific Officer | ||

William Symonds | 48 | Chief Development Officer and Director | ||

Elizabeth Howard | 62 | Executive Vice President and General Counsel | ||

Michael Abrams | 59 | Managing Director | ||

Dr. Mark Murray serves as our President, Chief Executive Officer and a Director since May 2008 when Arbutus and Protiva Biotherapeutics, Inc. merged. Previously, he was the President and CEO and founder of Protiva since its inception in the summer of 2000. Dr. Murray has over 20 years of experience in both the R&D and business development and management facets of the biotechnology industry. Dr. Murray has held senior management positions at ZymoGenetics and Xcyte Therapies prior to joining Protiva. Since entering the biotechnology industry Dr. Murray has successfully completed numerous and varied partnering deals, directed successful research and product development programs, been responsible for strategic planning programs, raised millions of dollars in capital and executed extensive business development initiatives in the U.S., Europe and Asia. During his R&D career, Dr. Murray worked extensively on three programs that resulted in FDA approved drugs, including the first growth factor protein approved for human use, a program he led for several years following his discovery. Dr. Murray obtained his Ph.D. in Biochemistry from the University of Oregon Health Sciences University and was a Damon Runyon-Walter Winchell post-doctoral research fellow for three years at the Massachusetts Institute of Technology.

Mr. Bruce Cousins serves as our Executive Vice President and Chief Financial Officer. Mr. Cousins brings to Arbutus extensive global financial and pharmaceutical industry experience both working for multi-million dollar companies and leading start-ups through to successful completion of their strategic growth plans. In 2004, Mr. Cousins joined Aspreva Pharmaceuticals and led its highly successful IPO. In 2008, he played a key leadership role in the eventual sale of Aspreva in a $915 million all-cash transaction. Prior to joining Aspreva, Mr. Cousins spent 14 years with Johnson & Johnson (J&J) working in operations and finance, both domestically and internationally. Prior to the pharmaceutical industry, Mr. Cousins was a chartered accountant with Deloitte & Touche. More recently, Mr. Cousins has spent the past few years in the renewable energy sector, and from 2011 to 2013 he was Chief Executive Officer of Carmanah Technologies Corporation, a TSX-listed company. Prior to Carmanah, he held Chief Financial Officer positions at Xantrex Technology Inc. and Ballard Power Systems. Mr. Cousins completed a Bachelor of Commerce degree from McMaster University in 1987 and received a Chartered Accountant designation in 1989.

21