Use these links to rapidly review the document

TABLE OF CONTENTS

Index to Consolidated Financial Statements of Ironwood Pharmaceuticals, Inc.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| (Mark One) | ||

ý |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

For the fiscal year ended December 31, 2015 |

||

OR |

||

o |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

For the transition period from to |

||

Commission File Number 001-34620

IRONWOOD PHARMACEUTICALS, INC.

(Exact name of registrant as specified in its charter)

| Delaware (State or other jurisdiction of incorporation or organization) |

04-3404176 (I.R.S. Employer Identification Number) |

|

301 Binney Street Cambridge, Massachusetts (Address of Principal Executive Offices) |

02142 (Zip Code) |

Registrant's telephone number, including area code: (617) 621-7722

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Name of each exchange on which registered | |

|---|---|---|

| Class A common stock, $0.001 par value | The NASDAQ Stock Market LLC | |

| (NASDAQ Global Select Market) |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ý No o

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Exchange Act. Yes o No ý

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days. Yes ý No o

Indicate by check mark whether the Registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the Registrant was required to submit and post such files). Yes ý No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ý | Accelerated filer o | Non-accelerated filer o (Do not check if a smaller reporting company) |

Smaller reporting company o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No ý

Aggregate market value of voting stock held by non-affiliates of the Registrant as of June 30, 2015: $1,647,058,706

As of February 12, 2016, there were 127,453,930 shares of Class A common stock outstanding and 15,934,458 shares of Class B common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE:

Portions of the definitive proxy statement for our 2016 Annual Meeting of Stockholders are incorporated by reference into Part III of this report.

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K, including the sections titled "Business," "Risk Factors" and "Management's Discussion and Analysis of Financial Condition and Results of Operations" contains forward-looking statements. All statements contained in this Annual Report on Form 10-K other than statements of historical fact are forward-looking statements. Forward-looking statements include statements regarding our future financial position, business strategy, budgets, projected costs, plans and objectives of management for future operations. The words "may," "continue," "estimate," "intend," "plan," "will," "believe," "project," "expect," "seek," "anticipate," "goal" and similar expressions may identify forward-looking statements, but the absence of these words does not necessarily mean that a statement is not forward-looking. These forward-looking statements include, among other things, statements about:

- •

- the demand and market potential for linaclotide in the United States, or the U.S. (LINZESS®), in the European Union, or

the E.U. (CONSTELLA®), and in other countries where it is approved for marketing, as well as the revenues therefrom;

- •

- the timing, investment and associated activities involved in commercializing LINZESS by us and Allergan plc in the U.S.;

- •

- the timing and execution of the launches and commercialization of CONSTELLA in the E.U.;

- •

- the timing, investment and associated activities involved in developing, launching, and commercializing linaclotide by us and our

partners worldwide;

- •

- our ability and the ability of our partners to secure and maintain adequate reimbursement for linaclotide;

- •

- the ability of our partners and third-party manufacturers to manufacture and distribute sufficient amounts of linaclotide active

pharmaceutical ingredient, or API, drug product and finished goods on a commercial scale;

- •

- our expectations regarding U.S. and foreign regulatory requirements for linaclotide and our product candidates, including our

post-approval, nonclinical and clinical post-marketing plan with the Food and Drug Administration, or the FDA;

- •

- our partners' ability to obtain foreign regulatory approval of linaclotide and the ability of all of our product candidates to meet

existing or future regulatory standards;

- •

- the safety profile and related adverse events of linaclotide and our product candidates;

- •

- the therapeutic benefits and effectiveness of linaclotide and our product candidates and the potential indications and market

opportunities therefor;

- •

- our ability to obtain and maintain intellectual property protection for linaclotide and our product candidates and the strength

thereof;

- •

- the ability of our partners to perform their obligations under our collaboration, license and other agreements with them, and our

ability to achieve milestone and other payments under such agreements;

- •

- our plans with respect to the development, manufacture or sale of our product candidates and the associated timing thereof, including

the design and results of pre-clinical and clinical studies;

- •

- the in-licensing or acquisition of externally discovered businesses, products or technologies;

- •

- our expectations as to future financial performance, revenues, expense levels, payments, cash flows, profitability, tax obligations, capital raising and liquidity sources, and real estate needs, as well as the timing and drivers thereof;

2

- •

- our ability to repay our outstanding indebtedness when due, or redeem or repurchase all or a portion of such debt, as well as the

potential benefits of the note hedge transactions described herein;

- •

- inventory levels and write downs and the drivers thereof, and inventory purchase commitments;

- •

- our ability to compete with other companies that are or may be developing or selling products that are competitive with our products

and product candidates;

- •

- the status of government regulation in the life sciences industry, particularly with respect to healthcare reform;

- •

- trends and challenges in our potential markets;

- •

- our ability to attract and motivate key personnel; and

- •

- other factors discussed elsewhere in this Annual Report on Form 10-K.

Any or all of our forward-looking statements in this Annual Report on Form 10-K may turn out to be inaccurate. These forward-looking statements may be affected by inaccurate assumptions or by known or unknown risks and uncertainties, including the risks, uncertainties and assumptions identified under the heading "Risk Factors" in this Annual Report on Form 10-K. In light of these risks, uncertainties and assumptions, the forward-looking events and circumstances discussed in this Annual Report on Form 10-K may not occur as contemplated, and actual results could differ materially from those anticipated or implied by the forward-looking statements.

You should not unduly rely on these forward-looking statements, which speak only as of the date of this Annual Report on Form 10-K. Unless required by law, we undertake no obligation to publicly update or revise any forward-looking statements to reflect new information or future events or otherwise. You should, however, review the factors and risks we describe in the reports we will file from time to time with the U.S. Securities and Exchange Commission, or the SEC, after the date of this Annual Report on Form 10-K.

LINZESS® and CONSTELLA® are trademarks of Ironwood Pharmaceuticals, Inc. Any other trademarks referred to in this Annual Report Form 10-K are the property of their respective owners. All rights reserved.

3

4

Our Company

We are a commercial biotechnology company leveraging our proven development and commercial capabilities as we seek to bring multiple medicines to patients. We are advancing two therapeutic platforms, which include product opportunities in areas of large unmet need, including irritable bowel syndrome with constipation, or IBS-C, and chronic idiopathic constipation, or CIC, vascular and fibrotic diseases, and refractory gastroesophageal reflux disease, or GERD.

Our first and to-date only commercial product, linaclotide, is available to adult men and women suffering from IBS-C or CIC in the United States, or the U.S., under the trademarked name LINZESS®, and is available to adult men and women suffering from IBS-C in certain European countries under the trademarked name CONSTELLA®. We and our U.S. partner Allergan plc (together with its affiliates), or Allergan (formerly Actavis plc), are also advancing linaclotide colonic release, a second-generation product candidate with the potential to improve abdominal pain relief in adult IBS-C patients, as well as in patients with additional gastrointestinal, or GI, disorders where lower abdominal pain is a predominant symptom such as IBS-mixed, or IBS-M. Further, we and Allergan are exploring ways to enhance the clinical profile of LINZESS by seeking to expand its utility within IBS-C and CIC, as well as studying linaclotide in additional indications and populations to assess its potential to treat various GI conditions. Linaclotide is also being developed and commercialized in other parts of the world by certain of our partners. In addition, we are advancing other GI development programs for indications such as refractory GERD and diabetic gastroparesis.

Within our vascular/fibrotic platform, we are leveraging our pharmacological expertise in guanylate cyclase, or GC, pathways gained through the discovery and development of linaclotide to advance development programs targeting soluble guanylate cyclase, or sGC. sGC is a validated mechanism with the potential for broad therapeutic utility and multiple opportunities for product development in vascular and fibrotic diseases, as well as other therapeutic areas.

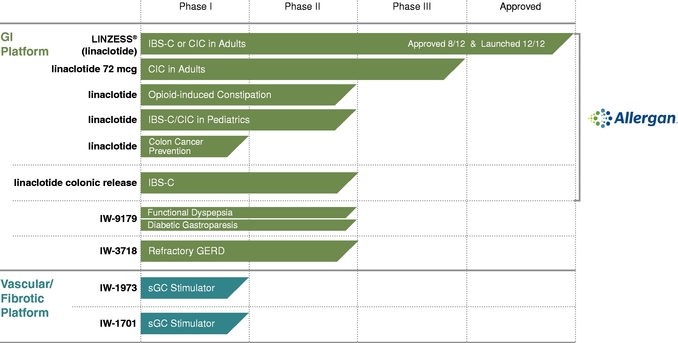

Our GI and vascular/fibrotic platforms include the following:

5

The status of our development programs in the table above represents the ongoing phase of development, and does not correspond to the initiation or completion of a particular phase. Drug development involves a high degree of risk and investment, and the status, timing and scope of our development programs are subject to change. Important factors that could adversely affect our drug development efforts are discussed in the "Risk Factors" section of this Annual Report on Form 10-K. As part of the linaclotide colonic release Phase IIb clinical trial in IBS-C patients, we and Allergan are also evaluating a second colonic release formulation that is expected to inform a path forward in additional GI disorders, such as IBS-M. In its current target product profile, IW-9179 is a wholly owned asset.

LINZESS and our current product candidates have all been discovered internally. We believe our discovery team has created a number of promising candidates over the past few years and has developed an extensive intellectual property estate in each of these areas. We have committed significant resources into the research and development of our product candidates and intend to continue to do so for the foreseeable future. For the years ended December 31, 2015, 2014 and 2013, research and development expenses were approximately $108.7 million, $101.9 million and $102.4 million, respectively. In addition, we intend to access externally -discovered drug candidates that fit within our core strategy. In evaluating these potential assets, we apply the same investment criteria as those used for investments in internally discovered assets.

We were incorporated in Delaware on January 5, 1998 as Microbia, Inc. On April 7, 2008, we changed our name to Ironwood Pharmaceuticals, Inc. To date, we have dedicated substantially all of our activities to the research, development and commercialization of linaclotide, as well as to the research and development of our other product candidates.

GI Platform

IBS-C / CIC

IBS-C and CIC are chronic, functional GI disorders that afflict millions of sufferers worldwide. As many as 13 million adults suffer from IBS-C and as many as 35 million adults suffer from CIC in the U.S. alone, according to our analysis of studies including NJ Talley, et al. (published in 1995 in the American Journal of Epidemiology), P Pare, et al. (published in 2001 in the American Journal of Gastroenterology) and J.F. Johanson, et al. (published in 2007 in Alimentary Pharmacology and Therapeutics). Symptoms of IBS-C include abdominal pain, discomfort or bloating and constipation symptoms (e.g., incomplete evacuation, infrequent bowel movements, hard/lumpy stools), while CIC is primarily characterized by constipation symptoms.

Linaclotide—U.S. In August 2012, the FDA approved LINZESS as a once-daily treatment for adult men and women suffering from IBS-C or CIC. We and Allergan began commercializing LINZESS in the U.S. in December 2012. Linaclotide is the first, and to date, only product approved by the U.S. Food and Drug Administration, or FDA, in a new class of GI medicines called guanylate cyclase type-C, or GC-C, agonists. We and Allergan are also exploring development opportunities to enhance the clinical profile of LINZESS by seeking to expand its utility within IBS-C and CIC, as well as studying linaclotide in additional indications and populations to assess its potential to treat various GI conditions. For example, in November 2015, the FDA approved the inclusion of labeling instructions in the full LINZESS Prescribing Information allowing adult IBS-C and CIC patients with swallowing difficulties the option to administer the contents of LINZESS capsules in applesauce or water.

72 mcg for CIC in Adults. In October 2015, we reported positive top-line data from a Phase III clinical trial in the U.S. with Allergan evaluating a 72 mcg dose of linaclotide in adult patients with CIC. We believe these data support the submission of a supplemental new drug application, or sNDA, to the FDA for approval to market the 72 mcg dose of linaclotide in the U.S. If approved, the

6

72 mcg dose would provide a broader range of treatment options to physicians and adult CIC patients in the U.S.

Pediatrics. We and Allergan have established a nonclinical and clinical post-marketing plan with the FDA to understand the safety and efficacy of LINZESS in pediatric patients. The first step in this plan was to undertake certain additional nonclinical studies. We and Allergan have completed these nonclinical studies and have initiated two Phase II clinical pediatric studies in IBS-C patients age seven to 17 and functional constipation patients age six to 17.

Upon FDA-approval of LINZESS in the U.S., we received five years of exclusivity under the Drug Price Competition and Patent Term Restoration Act of 1984, or the Hatch-Waxman Act. In addition, LINZESS is covered by a U.S. composition of matter patent that expires in 2026, including patent term extension, as well as three additional patents covering the commercial formulation of LINZESS and methods of using this formulation to treat patients with IBS-C or CIC, all of which expire in 2031.

Linaclotide—Global. In November 2012, the European Commission granted marketing authorization to CONSTELLA for the symptomatic treatment of moderate to severe IBS-C in adults. CONSTELLA is the first, and to date, only drug approved in the European Union, or E.U., for IBS-C. Our former European partner, Almirall, S.A., or Almirall, began commercializing CONSTELLA in Europe in the second quarter of 2013. In October 2015, Almirall transferred its exclusive license to develop and commercialize linaclotide in Europe to Allergan. Currently, CONSTELLA is commercially available in certain European countries, including the United Kingdom, Italy and Spain.

In December 2013 and February 2014, linaclotide was approved in Canada and Mexico, respectively, as a treatment for adult women and men suffering from IBS-C or CIC. Allergan has exclusive rights to commercialize linaclotide in Canada as CONSTELLA and, through a sublicense from Allergan, Almirall had exclusive rights to commercialize linaclotide in Mexico as LINZESS. In May 2014, Allergan began commercializing CONSTELLA in Canada and in June 2014, Almirall began commercializing LINZESS in Mexico. In October 2015, Almirall and Allergan terminated the sublicense arrangement with respect to Mexico, returning the exclusive rights to commercialize CONSTELLA in Mexico to Allergan. CONSTELLA continues to be available to adult IBS-C patients in Mexico.

Astellas Pharma Inc., or Astellas, our partner in Japan, is developing linaclotide for the treatment of patients with IBS-C and chronic constipation in its territory. In November 2015, we and Astellas reported positive top-line data from Astellas' Phase III clinical trial of linaclotide in adult patients with IBS-C for Japan. We believe these data support the submission of a new drug application, or NDA, to the Ministry of Health, Labor and Welfare for approval to market linaclotide in Japan. We and AstraZeneca AB, or AstraZeneca, are co-developing linaclotide in China, Hong Kong and Macau, with AstraZeneca having primary responsibility for the local operational execution. In December 2015, we and AstraZeneca filed for approval with the China Food and Drug Administration to market linaclotide in China. We continue to assess alternatives to bring linaclotide to IBS-C and CIC sufferers in the parts of the world outside of our partnered territories.

Linaclotide is covered by European and Japanese composition of matter patents, all of which expire in 2024, subject to possible patent term extension, as well as Chinese composition of matter patents and commercial formulation patents which expire in 2024 and 2029, respectively.

Linaclotide Colonic Release. Abdominal pain is one of the predominant symptoms associated with IBS, with greater than 75% of IBS-C patients reporting continuous or frequent abdominal pain, according to information published in 2007 by the International Foundation for Functional Gastrointestinal Disorders. In Phase III clinical trials supporting its U.S. approval, linaclotide was demonstrated to reduce the abdominal pain associated with IBS-C.

7

We and Allergan are developing linaclotide colonic release, a targeted oral delivery formulation of linaclotide designed to potentially improve abdominal pain relief in adult IBS-C patients. In November 2015, we and Allergan initiated a Phase IIb clinical trial evaluating linaclotide colonic release in adult patients with IBS-C.

Refractory GERD

IW-3718. According to a study published in 2010 by H. El-Sarag in Alimentary Pharmacology & Therapeutics and 2015 U.S. census data, there are an estimated 10 million Americans who suffer regularly from symptoms of gastroesophageal reflux disease, or GERD, such as heartburn and regurgitation, despite receiving the current standard of care of treatment with a proton pump inhibitor, or PPI, to suppress stomach acid. Research suggests some refractory GERD patients may experience reflux of bile from the intestine into the stomach and esophagus.

We are investigating IW-3718, a gastric retentive formulation of a bile acid sequestrant designed to bind over an extended period of time to bile that refluxes into the stomach and upper small intestine, potentially providing symptomatic relief in patients with refractory GERD. In February 2015, we reported top-line data from an exploratory Phase IIa clinical study of IW-3718 in patients with refractory GERD. Data from this study demonstrated encouraging improvements in relief of heartburn and certain other upper GI symptoms often associated with refractory GERD.

Other GI Disorders

IW-9179. We are investigating IW-9179, a GC-C agonist designed to target upper GI conditions, for the treatment of gastroparesis and functional dyspepsia.

Gastroparesis is an upper GI disorder in which the muscles and/or nerves of the stomach do not function properly, which disrupts the functional activities of the stomach. Diabetic gastroparesis, which is the focus of our Phase IIa study discussed below, is a condition in which symptoms of gastroparesis occur in patients with type 1 or type 2 diabetes, and has additional harmful effects on glycemic control, as well as secondary effects on organs, which may lead to increased mortality. Information published in 2009 by H.P. Parkman, et al. in Neuro & Mot provides that gastroparesis symptoms are reported by approximately five to 12 percent of diabetic patients. In December 2014, we initiated a randomized, placebo-controlled, multi-site Phase IIa clinical study evaluating whether IW-9179 can provide symptomatic relief to adult patients with diabetic gastroparesis.

Functional dyspepsia, or FD, is an upper GI disorder characterized by key symptoms of epigastric pain, epigastric bloating, postprandial fullness, epigastric burning, nausea, belching and early satiety. Based upon a study published in 2005 by G.R. Locke in Neuro & Mot, it is estimated that approximately 35 million people suffer from FD in the U.S. In October 2014, we presented data from a Phase IIa clinical study evaluating IW-9179 for the treatment of functional dyspepsia. Patients treated with IW-9179 reported a numerically greater improvement from baseline, compared with placebo-treated patients, on six out of seven FD symptoms evaluated. The most common adverse event in IW-9179-treated patients was diarrhea. Enrollment in this study was limited by stringent enrollment criteria that sought to identify patients suffering only from GI symptoms of FD. These data inform our continued work with GI experts and regulatory authorities to define the path to bring forward new therapies in FD.

Linaclotide Colonic Release. In addition to IBS-C, we are also exploring linaclotide colonic release for use in additional GI disorders where lower abdominal pain is a predominant symptom, including IBS-M, ulcerative colitis and diverticulitis, among others. As part of the linaclotide colonic release Phase IIb clinical trial in IBS-C patients, we and Allergan are also evaluating a second colonic release formulation that is expected to inform a path forward in these additional GI disorders.

8

Linaclotide. We and Allergan are evaluating linaclotide in additional indications to assess its potential to treat various GI conditions.

We and Allergan are exploring the potential of linaclotide to provide relief of the GI dysfunction associated with opioid induced constipation, or OIC. In November 2015, we reported positive top-line data from a Phase II clinical study evaluating linaclotide in adult patients with OIC in which linaclotide-treated patients showed a statistically significant improvement in bowel movement frequency compared to placebo-treated patients. In addition, the National Cancer Institute, or NCI, is exploring linaclotide in a Phase I biomarker study, in partnership with us and Allergan, designed to assess the colorectal bioactivity of linaclotide in healthy volunteers, and to inform the feasibility and design of a study to evaluate the potential for linaclotide to prevent colorectal cancer. The NCI is funding and managing the clinical study.

Vascular/Fibrotic Platform

We are advancing development programs targeting sGC, and exploring its utility in vascular and fibrotic diseases. The stimulation of sGC is a clinically validated approach with broad therapeutic potential. Found throughout the body, sGC is an enzyme that is activated by the key regulator nitric oxide to increase levels of the second messenger cyclic guanosine monophosphate, or cGMP, which ultimately regulates processes such as blood flow, inflammation and fibrosis. As modulators of these core physiological processes, sGC stimulators may be relevant in the treatment of a broad range of diseases including cardiovascular diseases such as pulmonary arterial hypertension and congestive heart failure, as well as muscular dystrophy, diabetic nephropathy and other disorders. To date, we have identified two sGC development candidates, IW-1973 and IW-1701, which have distinct pharmacologic profiles that we believe may be differentiating and enable opportunities in multiple indications.

IW-1973. In November 2015, we initiated a Phase Ib clinical study of IW-1973. The study includes two stages: an open-label, single dose, crossover stage and a randomized, double-blind, placebo-controlled, multiple-ascending-dose stage. The Phase Ib clinical study is designed to assess the safety, tolerability, pharmacokinetic profile and pharmacodynamics effects of IW-1973 in healthy subjects.

IW-1701. In November 2015, we initiated a randomized, double-blind, placebo-controlled, single-ascending-dose Phase Ia clinical study of IW-1701 to assess the safety, tolerability, pharmacokinetic profile and pharmacodynamics effects of IW-1701 in healthy subjects.

Collaborations and Partnerships

As part of our strategy, we have established development and commercial capabilities that we plan to leverage as we seek to bring multiple medicines to patients. We intend to play an active role in the development and commercialization of our internally developed products in the U.S., and to establish a strong global brand by out-licensing commercialization rights in other territories to high-performing partners. We believe in the long-term value of our drug candidates, so we seek collaborations that provide meaningful economics and incentives for us and any potential partner. Furthermore, we seek partners who share our values, culture, processes and vision for our products, which we believe will enable us to work with those partners successfully for the entire potential patent life of our drugs. In addition to our internally developed products, we also intend to access innovative products through strategic transactions and leverage our existing capabilities to develop and commercialize these products in the U.S.

The following chart shows our revenue for the U.S. and territories outside of the U.S. as a percentage of our total revenue for each of the years ended December 31, 2015, 2014 and 2013. Revenue attributable to our linaclotide partnerships comprised substantially all of our revenue for each of the years indicated; none of our other product candidates generated revenue during these periods. Further, we currently derive substantially all of our revenue from our LINZESS collaboration with

9

Allergan for the U.S. and believe that the revenues from this collaboration will continue to constitute a significant portion of our total revenue for the foreseeable future. In addition, our collaborative arrangements revenue outside of the U.S. has fluctuated for the years ended December 31, 2015, 2014 and 2013, and may continue to fluctuate as a result of the timing and amount of license fees and clinical and commercial milestones received and recognized under our current and future strategic partnerships outside of the U.S., as well as the timing and amount of royalties from the sales of linaclotide in the European, Canadian or Mexican markets or any other markets where linaclotide receives approval.

| |

2015 | 2014 | 2013 | |||||||

|---|---|---|---|---|---|---|---|---|---|---|

U.S. |

92.3 | % | 62.3 | % | 12.9 | % | ||||

Rest of world |

7.7 | % | 37.7 | % | 87.1 | % | ||||

| | | | | | | | | | | |

|

100.0 | % | 100.0 | % | 100.0 | % | ||||

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

We have pursued a partnering strategy for commercializing linaclotide that has enabled us to retain significant oversight over linaclotide's development and commercialization worldwide, share the costs with collaborators whose capabilities complement ours, and retain a significant portion of linaclotide's future long-term value. As of December 31, 2015, licensing fees, milestones, royalties and related equity investments from our linaclotide partners totaled approximately $378.1 million. In addition, we and Allergan jointly fund the development and commercialization of LINZESS in the U.S., sharing equally in any net profits or losses, and we and AstraZeneca jointly fund the development and commercialization of linaclotide in China, Hong Kong and Macau, with AstraZeneca receiving 55% of the net profits or incurring 55% of the net losses until a certain specified commercial milestone is achieved, at which time profits or losses will be shared equally thereafter. Such reimbursements for our development and commercialization costs received from Allergan in the U.S. or AstraZeneca are excluded from the amount above. We continue to assess alternatives to bring linaclotide to IBS-C and CIC sufferers in the parts of the world outside of our partnered territories.

Allergan plc. In September 2007, we entered into a collaboration agreement with Allergan to develop and commercialize linaclotide for the treatment of IBS-C, CIC and other GI conditions in North America. Under the terms of the collaboration agreement, we and Allergan are jointly and equally funding the development and commercialization of LINZESS in the U.S., with equal share of any profits or losses. Additionally, we granted Allergan exclusive rights to develop and commercialize linaclotide in Canada and Mexico in which we receive royalties in the mid-teens percent on net sales in those countries. Allergan is solely responsible for the further development, regulatory approval and commercialization of linaclotide in those countries and funding any costs. Total licensing, milestone payments and related equity investments to us under the Allergan collaboration agreement for North America could total up to $330.0 million, including the $205.0 million that Allergan has already paid to us in license fees and development-related milestones and the $25.0 million of our capital stock that Allergan has already purchased.

In April 2009, we entered into a license agreement with Almirall to develop and commercialize linaclotide in Europe (including the Commonwealth of Independent States and Turkey) for the treatment of IBS-C, CIC and other GI conditions. Under the terms of this agreement, we were eligible to receive licensing, milestone payments and related equity investments that could have totaled up to $118.0 million, including the $61.0 million in milestones, net of foreign withholding taxes, that Almirall already paid to us, and the $15.0 million of our capital stock that Almirall already purchased. We were also eligible to receive royalties based on sales volume in the Almirall territory, beginning in the low-twenties percent and escalating to the mid-forties percent through April 2017, and thereafter beginning in the mid-twenties percent and escalating to the mid-forties percent at lower sales thresholds. These royalty payments were reduced by the transfer price paid for the active

10

pharmaceutical ingredient, or API, included in the product actually sold in the Almirall territory and other contractual deductions. In October 2015, Almirall transferred its exclusive license to develop and commercialize linaclotide in Europe to Allergan, and we separately entered into an amendment to the license agreement with Allergan relating to the development and commercialization of linaclotide in Europe. Pursuant to the terms of the amendment, (i) the remaining sales-based milestones payable to us under the license agreement were modified such that, when aggregated with the remaining commercial launch milestones, they could total up to $42.5 million, (ii) the royalties payable to us during the term of the license agreement were modified such that the royalties based on sales volume in Europe begin in the mid-single digit percent and escalate to the upper-teens percent by calendar year 2019, and (iii) Allergan assumed responsibility for the manufacturing of linaclotide API for Europe from us, as well as the associated costs. Furthermore, as we are no longer responsible for the manufacturing of linaclotide API for Europe, the royalties under the license agreement will no longer be reduced by the transfer price paid for the API included in the product actually sold by Allergan in Europe in any given period.

In August 2015, we and Allergan entered into an agreement for the co-promotion of VIBERZI™ (eluxadoline) in the U.S., Allergan's treatment for adults suffering from IBS with diarrhea, or IBS-D. Under the terms of the agreement, our clinical sales specialists are detailing VIBERZI to the approximately 25,000 health care practitioners to whom they detail LINZESS. Allergan is responsible for all costs and activities relating to the commercialization of VIBERZI outside of the co-promotion. Our promotional efforts are compensated based on the volume of calls delivered by our sales force, with the terms of the agreement reducing or eliminating certain of the unfavorable adjustments to our share of net profits stipulated by the linaclotide collaboration agreement with Allergan for North America, provided that we deliver a minimum number of VIBERZI calls on physicians. We have the potential to achieve milestone payments of up to $10.0 million based on the net sales of VIBERZI in each of 2017 and 2018, and are also compensated via reimbursements for medical education initiatives. Our promotional efforts under the agreement began when VIBERZI became commercially available in December 2015, and will continue until December 31, 2017, unless earlier terminated by either party pursuant to the provisions of the agreement.

In November 2015, Allergan and Pfizer Inc. entered into a definitive agreement providing for the combination of the two companies. Our collaboration for the development and commercialization of linaclotide, as well as our agreement to co-promote VIBERZI, remains in effect.

Astellas Pharma Inc. In November 2009, we entered into a license agreement with Astellas to develop and commercialize linaclotide for the treatment of IBS-C, CIC and other GI conditions in Japan, South Korea, Taiwan, Thailand, the Philippines and Indonesia. As a result of an amendment to the license agreement executed in March 2013, we regained rights to linaclotide in South Korea, Taiwan, Thailand, the Philippines and Indonesia. If linaclotide is successfully developed and commercialized in the Astellas territory, licensing and milestone payments to us could total up to $75.0 million, including the $30.0 million up-front licensing fee and the $15.0 million development milestone that have already been paid to us. If Astellas receives approval to market and sell linaclotide, Astellas will pay us gross royalties which escalate based on sales volume in the Astellas territory, beginning in the low-twenties percent, less the transfer price paid for the API included in the product actually sold in the Astellas territory and other contractual deductions.

AstraZeneca AB. In October 2012, we entered into a collaboration with AstraZeneca to co-develop and co-commercialize linaclotide in China, Hong Kong and Macau. Under the terms of the agreement, we and AstraZeneca are jointly funding the development and commercialization of linaclotide in the AstraZeneca territory, with AstraZeneca receiving 55% of the net profits or incurring 55% of the net losses until a certain specified commercial milestone is achieved, at which time profits or losses will be shared equally thereafter. If linaclotide is successfully developed and commercialized in China, total licensing and milestone payments to us under the collaboration agreement could total up

11

to $150.0 million, including the $25.0 million that AstraZeneca has already paid to us. As part of the collaboration, Ironwood's sales force promoted AstraZeneca's NEXIUM® (esomeprazole magnesium), one of AstraZeneca's products, in the U.S. through May 2014.

Exact Sciences Corp. In March 2015, we and Exact Sciences Corp, or Exact Sciences, entered into an agreement to co-promote Cologuard®, the first and only FDA-approved noninvasive stool DNA screening test for colorectal cancer. Under the terms of the agreement, our sales team is promoting and educating health care practitioners regarding Cologuard. We are also collaborating on medical education initiatives to support more in-depth understanding of Cologuard and the importance of colorectal cancer screening. Exact Sciences maintains responsibility for all other aspects of the commercialization of Cologuard outside of the co-promotion. We are compensated via reimbursements for sales detailing, promotional support services and medical education initiatives. During the initial one-year term of the agreement, we could receive up to a maximum reimbursement of approximately $4.8 million. We also earn royalties on the net sales of Cologuard generated from the healthcare practitioners on whom we call less the sales promotion reimbursement to us, such royalties being payable during the term and for one year following the termination of our co-promotion efforts.

Owner-related Business Principles

We encourage all current and potential stockholders to read the owner-related business principles below that guide our overall strategy and decision making.

1. Ironwood's stockholders own the business; all of our employees work for them.

Each of our employees also has equity in the business, aligning their interests with those of their fellow stockholders. As employees and co-owners of Ironwood, our management and employee team seek to effectively allocate scarce stockholder capital to maximize the average annual growth of per share value.

Through our policies and communication, we seek to attract like-minded owner-oriented stockholders. We strive to effectively communicate our views of the business opportunities and risks over time so that entering and exiting stockholders are doing so at a price that approximately reflects our intrinsic value.

2. We believe we can best maximize long-term stockholder value by building a great pharmaceutical franchise.

We believe that Ironwood has the potential to deliver outstanding long-term returns to stockholders who are sober to the risks inherent in the pharmaceutical product lifecycle and to the potential dramatic highs and lows along the way, and who focus on superior long-term, per share cash flows.

Since the pharmaceutical product lifecycle is lengthy and unpredictable, we believe it is critical to have a long-term strategic horizon. We work hard to embed our long-term focus into our policies and practices, which may give us a competitive advantage in attracting like-minded stockholders and the highest caliber employees. Our current and future employees may perceive both financial and qualitative advantages in having their inventions or hard work result in marketed drugs that they and their fellow stockholders continue to own. Some of our key policies and practices that are aligned with this imperative include:

a. Our dual class equity voting structure (which provides for super-voting rights of our pre-IPO stockholders only in the event of a change of control vote) is designed to concentrate change of control decisions in the hands of long-term focused owners who have a history of experience with us.

12

b. We grant each of our employees stock-based awards, and long-term equity is a significant component of their total compensation. We believe our emphasis on equity plays an important role in attracting and motivating the owner-oriented employees we seek and aligning their interests with those of their fellow stockholders.

c. We have adopted a change of control severance plan for all of our employees that is intended to encourage them to bring forward their best ideas by providing them with the comfort that if a change of control occurs and their employment is terminated, they will still have an opportunity to share in the economic value that they have helped create for stockholders.

d. All of the members of our board of directors are investors in the company. Furthermore, each director is required to hold all shares of stock acquired as payment for his or her service as a director throughout his or her term on the board.

e. Our partnerships with Allergan, Astellas and AstraZeneca all include standstill agreements, which serve to protect us from an unwelcome acquisition attempt by one of our partners. In addition, we have change of control provisions in our partnership agreements in order to protect the economic value of linaclotide should the acquirer of one of our partners be unable or unwilling to devote the time and resources required to maximize linaclotide's benefit to patients in their respective territory.

3. We are and will remain careful stewards of our stockholders' capital.

We work intensely to allocate capital carefully and prudently, continually reinforcing a lean, cost-conscious culture.

While we are mindful of the declining productivity and inherent challenges of pharmaceutical research and development, we intend to invest in discovery and development research for many years to come. Our singular passion is to create, develop and commercialize novel drug candidates, seeking to integrate the most successful drugmaking and marketing practices of the past and the best of today's cutting-edge technologies and basic research, development and commercialization advances.

While we hope to improve the productivity and efficiency of our drug creation efforts over time, our discovery process revolves around small, highly interactive, cross-functional teams. We believe that this is one area where our relatively small size is a competitive advantage, so for the foreseeable future, we do not expect our drug discovery team to grow beyond 100-150 scientists. We will continue to prioritize constrained resources and maintain organizational discipline. Once internally or externally derived candidates advance into development, compounds follow careful stage-gated plans, with further advancement depending on clear data points. Since most pharmaceutical research and development projects fail, it is critical that our teams are rigorous in making early go/no go decisions, following the data, terminating unsuccessful programs, and allocating scarce dollars and talent to the most promising efforts, thus enhancing the likelihood of late phase development success.

Our global operations and commercial teams take a similar approach to capital allocation and decision-making. By working with our partners to establish redundancy at each critical node of the linaclotide global supply chain, we are mitigating against a fundamental risk inherent with pharmaceuticals—unanticipated shortages of commercial product. Likewise, we have established a commercial organization dedicated to bringing innovative, highly-valued healthcare solutions to all of our customers. Our commercial organization works closely and methodically with our global commercialization partners, striving to maximize linaclotide's commercial potential through focused efforts aimed at educating patients, payers and healthcare providers.

13

4. Our financial goal is to maximize long-term per share cash flows.

Our goal is to maximize long-term cash flows per share, and we will prioritize this even if it leads to uneven short-term financial results. If and when we become profitable, we expect and accept uneven earnings growth. Our underlying product development model is risky and unpredictable, and we have no intention to advance marginal development candidates or consummate suboptimal in-license transactions in an attempt to fill anticipated gaps in revenue growth. Successful drugs can be enormously beneficial to patients and highly profitable and rewarding to stockholders, and we believe strongly in our ability to occasionally (but not in regular or predictable fashion) create and commercialize great medicines that make a meaningful difference in patients' lives.

If and when we reach profitability, we do not intend to issue quarterly or annual earnings guidance; however we plan to continue to be transparent about the key elements of our performance, including near-term operating plans and longer-term strategic goals.

Our Strategy

Our mission is to create medicines that make a difference for patients, build value for our fellow stockholders, and empower our passionate team. Our core strategy to achieve this mission is to leverage our development and commercial capabilities in addressing GI disorders as well as our pharmacologic expertise in GC pathways to bring multiple medicines to patients. Key elements of our strategy include:

- •

- attracting and incentivizing a team with a singular passion for creating, developing and commercializing medicines that can make a

significant difference in patients' lives;

- •

- successfully and profitably commercializing LINZESS in collaboration with Allergan in the U.S.;

- •

- exploring development opportunities to enhance the clinical profile of LINZESS by seeking to expand its utility in its indicated

populations, as well as studying linaclotide in additional indications, populations and formulations to assess its potential to treat various GI conditions;

- •

- investing in our pipeline of novel GI product candidates and advancing our sGC stimulators targeting vascular/fibrotic diseases;

- •

- solidifying and expanding our position as the leader in the field of GC-C agonists and cGMP pharmacology;

- •

- leveraging our U.S.-focused commercial capabilities in marketing, reimbursement, patient engagement and sales;

- •

- evaluating candidates outside of the company for in-licensing or acquisition opportunities;

- •

- maximizing the commercial potential of our drugs and playing an active role in their commercialization or find partners who share our

vision, values, culture and processes;

- •

- supporting global partners to commercialize linaclotide outside of the U.S.;

- •

- harvesting the maximum value of linaclotide outside of our currently partnered territories; and,

- •

- executing our strategy with our stockholders' long-term interests in mind by seeking to maximize long-term per share cash flows.

Competition

Linaclotide, our only marketed product to date, competes globally with certain prescription therapies and over-the-counter, or OTC, products for the treatment of IBS-C and CIC, or their associated symptoms.

14

Polyethylene glycol, or PEG (such as MiraLAX®), and lactulose account for the majority of prescription laxative treatments. Both agents demonstrate an improvement in stool frequency and consistency but do not improve bloating, abdominal discomfort or the recurrence of symptoms. Clinical trials and product labels document several adverse effects with PEG and lactulose, including exacerbation of bloating, cramping and, according to a study published in 2005 by L.E. Brandt, et al. in the American Journal of Gastroenterology, up to a 40% incidence of diarrhea. Overall, up to 75% of patients taking prescription laxatives report not being completely satisfied with the predictability of when they will experience a bowel movement on treatment, and 50% were not completely satisfied with relief of the multiple symptoms associated with constipation, according to the J.F. Johanson study published in 2007 in Alimentary Pharmacology & Therapeutics.

OTC laxatives make up the majority of the IBS-C and CIC treatment market, according to a GI patient landscape survey performed in 2010 by Lieberman et al. Given the low barriers to access, many IBS-C and CIC sufferers try OTC fiber and laxatives, but according to this same patient landscape survey, less than half of them are very satisfied with the ability of these OTC products to manage their symptoms. Two of the largest selling OTC laxatives in the U.S., based on 2013 U.S. sales volume data from Euromonitor International, are MiraLAX and Dulcolax®.

Until the launch of LINZESS, the only available prescription therapy for IBS-C and CIC in the U.S. was Amitiza® (lubiprostone), which was approved for the treatment of CIC in 2006, for the treatment of IBS-C in 2008, and for the treatment of opioid-induced constipation in 2013. Amitiza is also approved for the treatment of CIC in the United Kingdom and Switzerland, and for the treatment of chronic constipation in Japan. There are additional compounds in late-stage development by other companies for the treatment of patients with IBS-C and CIC.

Manufacturing and Supply

We currently manage our global supply and distribution of linaclotide through a combination of contract manufacturers and collaboration partners. It is our objective to produce safe and effective medicine on a worldwide basis, with redundancy built into critical steps of the supply chain. We believe that we have sufficient in-house expertise to manage our manufacturing and supply chain network to meet worldwide demand.

Linaclotide production consists of three phases—manufacture of the API (sometimes referred to as drug substance), manufacture of drug product and manufacture of finished goods. We have entered into agreements with multiple third party manufacturers for the production of linaclotide API. We believe our commercial suppliers have the capabilities to produce linaclotide API in accordance with current good manufacturing practices, or GMP, on a sufficient scale to meet our development and commercial needs. Our commercial suppliers are subject to routine inspections by regulatory agencies worldwide and also undergo periodic audit and certification by our quality department. In connection with the transfer of Almirall's exclusive license to develop and commercialize linaclotide in Europe to Allergan, Allergan assumed responsibility for the manufacturing of linaclotide API for Europe.

Each of Allergan and Astellas is responsible for drug product and finished goods manufacturing (including bottling and packaging) for its respective territories, and distributing the finished goods to wholesalers. We have an agreement with an independent third party to serve as an additional source of drug product manufacturing of linaclotide for our partnered territories and we have worked with our partners to achieve sufficient redundancy in this component of the linaclotide supply chain. Under our collaboration with AstraZeneca, we are accountable for drug product and finished goods manufacturing for China, Hong Kong and Macau.

Prior to linaclotide, there was no precedent for long-term room temperature shelf storage formulation for an orally dosed peptide to be produced in millions of capsules per year. Our efforts to date have led to a formulation that is both cost effective and able to meet the stability requirements for

15

commercial pharmaceutical products. Our work in this area has created an opportunity to seek additional intellectual property protection around the linaclotide program. In conjunction with Allergan and Astellas, we have filed patent applications in the U.S. and foreign jurisdictions and have been issued three U.S. patents to protect the current commercial formulation of linaclotide as well as related formulations. The three issued U.S. patents expire in 2031. If issued, the pending patent applications would expire in 2029 or later in the U.S. and foreign jurisdictions and would be eligible for potential patent term adjustments or patent term extensions in countries where such extensions may be available.

Sales and Marketing

For the foreseeable future, we intend to develop and commercialize our drugs in the U.S. alone or with partners, and expect to rely on partners to commercialize our drugs in territories outside the U.S. In executing our strategy, our goal is to retain significant worldwide oversight over the development process and commercialization of our products, by playing an active role in their commercialization or finding partners who share our vision, values, culture and processes.

We have built our commercial capabilities, including marketing, reimbursement, patient engagement and sales, around linaclotide, with the intent to leverage these capabilities for future internally and externally developed products. To date, we have established a high-quality commercial organization dedicated to bringing innovative, highly-valued healthcare solutions to our customers, including patients, payers, and healthcare providers. As part of our strategy, we and Allergan have been investing in a direct-to-consumer patient awareness campaign for LINZESS designed to help adults in the U.S. suffering from IBS-C or CIC recognize the symptoms of their disorder, describe their symptoms to their doctor, and ask their doctor whether LINZESS can help proactively manage their disease.

We are coordinating efforts with all of our partners to ensure that we launch and maintain an integrated, global linaclotide brand. By leveraging the knowledge base and expertise of our experienced commercial team and the insights of each of our linaclotide commercialization partners, we continually improve our collective marketing strategies.

Patents and Proprietary Rights

We actively seek to protect the proprietary technology that we consider important to our business, including pursuing patents that cover our products and compositions, their methods of use and the processes for their manufacture, as well as any other relevant inventions and improvements that are commercially important to the development of our business. We also rely on trade secrets that may be important to the development of our business.

Our success will depend significantly on our ability to obtain and maintain patent and other proprietary protection for the technology, inventions and improvements we consider important to our business; defend our patents; preserve the confidentiality of our trade secrets; and operate without infringing the patents and proprietary rights of third parties.

Linaclotide Patent Portfolio

Our linaclotide patent portfolio is currently composed of nine U.S. patents listed in the FDA publication, "Approved Drug Products with Therapeutic Equivalence Evaluations" (also known as the "Orange Book"), three granted European patents (each of which has been validated in 31 European countries), five granted Japanese patents, four granted Chinese patents, 33 issued patents in other foreign jurisdictions, and numerous pending provisional, U.S. non-provisional, foreign and PCT patent applications. We own or jointly own all of the issued patents and pending applications.

16

The issued U.S. patents, which will expire between 2024 and 2031, contain claims directed to the linaclotide molecule, pharmaceutical compositions thereof, methods of using linaclotide to treat GI disorders, processes for making the molecule, and room temperature stable formulations of linaclotide and methods of use thereof. The granted European patents, which will expire in 2024, subject to potential patent term extension, contain claims directed to the linaclotide molecule, pharmaceutical compositions thereof and uses of linaclotide to prepare medicaments for treating GI disorders. The granted Chinese patents, which will expire between 2024 and 2031, and the granted Japanese patents, which will expire between 2024 and 2029 subject to potential patent term extension, contain claims directed to the linaclotide molecule, pharmaceutical compositions of linaclotide for use in treating GI disorders, and room temperature stable formulations of linaclotide.

We have pending patent applications worldwide covering the current commercial formulation of linaclotide that, if issued, will expire in 2029 or later.

We have pending applications directed to linaclotide products under development that will extend patent protection, if issued, until 2035 or later. We also have pending provisional, U.S. non-provisional, foreign and PCT applications directed to linaclotide and related molecules, pharmaceutical formulations thereof, methods of using linaclotide to treat various diseases and disorders and processes for making the molecule. These additional patent applications, if issued, will expire between 2024 and 2036.

The patent term of a patent that covers an FDA-approved drug is also eligible for patent term extension, which permits patent term restoration as compensation for some of the patent term lost during the FDA regulatory review process. The Hatch-Waxman Act permits a patent term extension of a single patent applicable to an approved drug for up to five years beyond the expiration of the patent but the extension cannot extend the remaining term of a patent beyond a total of 14 years from the date of product approval by the FDA. The United States Patent and Trademark Office has issued a Certificate of Patent Term Extension for U.S. Patent 7,304,036, which covers linaclotide and methods of use thereof. As a result, the patent term of this patent was extended to August 30, 2026, 14 years from the date of linaclotide's approval by the FDA. Similar provisions are available in Europe and certain other foreign jurisdictions to extend the term of a patent that covers an approved drug.

Pipeline Patent Portfolio

Our pipeline patent portfolio relating to our development programs outside of linaclotide is currently composed of eight issued U.S. patents; 11 issued patents in foreign jurisdictions; and numerous pending provisional, U.S. non-provisional, foreign and PCT patent applications. We own all of the issued patents and pending applications. The issued U.S. patents expire between 2028 and 2032. The foreign issued patents expire between 2027 and 2036. The pending patent applications, if issued, will expire between 2027 and 2035.

Additional Intellectual Property

In addition to the patents and patent applications related to linaclotide and our GI and sGC pipeline, we currently have five issued U.S. patents; six patents granted in foreign jurisdictions; and a number of pending provisional, U.S. non-provisional, foreign and PCT applications directed to other GC-C agonist molecules and uses thereof. We also have other issued patents and pending patent applications relating to our other research and development programs, and we are the licensee of a number of issued patents and pending patent applications.

The term of individual patents depends upon the legal term of the patents in the countries in which they are obtained. In most countries in which we file, the patent term is 20 years from the date of filing the non-provisional application. In the U.S., a patent's term may be lengthened by patent term adjustment, which compensates a patentee for administrative delays by the U.S. Patent and Trademark

17

Office in granting a patent, or may be shortened if a patent is terminally disclaimed over an earlier-filed patent. We also expect to apply for patent term extensions for some of our patents once issued, depending upon the length of clinical trials and other factors involved in the submission of a NDA.

Government Regulation

In the U.S., pharmaceutical products are subject to extensive regulation by the FDA. The Federal Food, Drug, and Cosmetic Act and other federal and state statutes and regulations, govern, among other things, the research, development, testing, manufacture, storage, recordkeeping, approval, labeling, promotion and marketing, distribution, FDA post marketing requirements and assessments, post-approval monitoring and reporting, sampling, and import and export of pharmaceutical products. The FDA has very broad enforcement authority and failure to abide by applicable regulatory requirements can result in administrative or judicial sanctions being imposed on us, including warning letters, refusals of government contracts, clinical holds, civil penalties, injunctions, restitution, disgorgement of profits, recall or seizure of products, total or partial suspension of production or distribution, withdrawal of approval, refusal to approve pending applications, and civil or criminal prosecution.

FDA Approval Process

We believe that our product candidates will be regulated by the FDA as drugs. No company may market a new drug until it has submitted an NDA to the FDA, and the FDA has approved it. The steps required before the FDA may approve an NDA generally include:

- •

- conducting nonclinical laboratory tests and animal tests in compliance with FDA's good laboratory practice requirements;

- •

- development, manufacture and testing of active pharmaceutical product and dosage forms suitable for human use in compliance with

current GMP;

- •

- conducting adequate and well-controlled human clinical trials that establish the safety and efficacy of the product for its specific

intended use(s);

- •

- In order to evaluate a drug in humans in the U.S., an investigational new drug application, or IND, must be submitted and

come into effect before human clinical trials may begin.

- •

- the submission to the FDA of an NDA;

- •

- satisfactory completion of one or more FDA inspections of the manufacturing facility or facilities at which the product, or components

thereof, are produced to assess compliance with current GMP requirements and to assure that the facilities, methods and controls are adequate to preserve the product's identity, strength, quality and

purity; and

- •

- Inspections of other sources of data in the NDA, such as inspection of clinical trial sites to assess compliance with

good clinical practice, or GCP, requirements are also generally required.

- •

- FDA review and approval of the NDA.

Nonclinical tests include laboratory evaluation of the product candidate, as well as animal studies to assess the potential safety and efficacy of the product candidate. The conduct of the nonclinical tests must comply with federal regulations and requirements including good laboratory practices. We must submit the results of the nonclinical tests, together with manufacturing information, analytical data and a proposed clinical trial protocol to the FDA as part of an IND, which must become effective before we may commence human clinical trials in the U.S. The IND will automatically become effective 30 days after its receipt by the FDA, unless the FDA raises concerns or questions before that time

18

about the conduct of the proposed trial. In such a case, we must work with the FDA to resolve any outstanding concerns before the clinical trial can proceed. We cannot be sure that submission of an IND will result in the FDA allowing clinical trials to begin, or that, once begun, issues will not arise that will cause us or the FDA to modify, suspend or terminate such trials. The study protocol and informed consent information for patients in clinical trials must also be submitted to an institutional review board for approval. An institutional review board may also require the clinical trial at the site to be halted, either temporarily or permanently, for failure to comply with the institutional review board's requirements or if the trial has been associated with unexpected serious harm to subjects. An institutional review board may also impose other conditions on the trial.

Clinical trials involve the administration of the product candidate to humans under the supervision of qualified investigators, generally physicians not employed by or under the trial sponsor's control. Clinical trials are typically conducted in three sequential phases, though the phases may overlap or be combined. In Phase I, the initial introduction of the drug into healthy human subjects, the drug is usually tested for safety (adverse effects), dosage tolerance and pharmacologic action, as well as to understand how the drug is taken up by and distributed within the body. Phase II usually involves studies in a limited patient population (individuals with the disease under study) to:

- •

- evaluate preliminarily the efficacy of the drug for specific, targeted conditions;

- •

- determine dosage tolerance and appropriate dosage as well as other important information about how to design larger Phase III

trials; and

- •

- identify possible adverse effects and safety risks.

Phase III trials generally further evaluate clinical efficacy and test for safety within an expanded patient population. The conduct of clinical trials is subject to extensive regulation, including compliance with GCP regulations and guidance, and regulations designed to protect the rights and safety of subjects involved in investigations.

The FDA may order the temporary or permanent discontinuation of a clinical trial at any time or impose other sanctions if it believes that the clinical trial is not being conducted in accordance with FDA requirements or presents an unacceptable risk to the clinical trial patients. We may also suspend clinical trials at any time on various grounds.

The results of the nonclinical and clinical studies, together with other detailed information, including the manufacture and composition of the product candidate, are submitted to the FDA in the form of an NDA requesting approval to market the drug. FDA approval of the NDA is required before marketing of the product may begin in the U.S. If the NDA contains all pertinent information and data, the FDA will "file" the application and begin review. The review process, however, may be extended by FDA requests for additional information, nonclinical or clinical studies, clarification regarding information already provided in the submission, or submission of a risk evaluation and mitigation strategy. The FDA may refer an application to an advisory committee for review, evaluation and recommendation as to whether the application should be approved. The FDA is not bound by the recommendations of an advisory committee, but it considers such recommendations carefully when making decisions. Before approving an NDA, the FDA will typically inspect the facilities at which the product candidate is manufactured and will not approve the product candidate unless current GMP compliance is satisfactory. FDA also typically inspects facilities responsible for performing animal testing, as well as clinical investigators who participate in clinical trials. The FDA may refuse to approve an NDA if applicable regulatory criteria are not satisfied, or may require additional testing or information. The FDA may also limit the indications for use and/or require post-marketing testing and surveillance to monitor the safety or efficacy of a product. Once granted, product approvals may be withdrawn if compliance with regulatory standards is not maintained or problems are identified following initial marketing.

19

The testing and approval process requires substantial time, effort and financial resources, and our product candidates may not be approved on a timely basis, if at all. The time and expense required to perform the clinical testing necessary to obtain FDA approval for regulated products can frequently exceed the time and expense of the research and development initially required to create the product. The results of nonclinical studies and initial clinical trials of our product candidates are not necessarily predictive of the results from large-scale clinical trials, and clinical trials may be subject to additional costs, delays or modifications due to a number of factors, including difficulty in obtaining enough patients, investigators or product candidate supply. Failure by us or our collaborators, licensors or licensees, including Allergan, Astellas and AstraZeneca, to obtain, or any delay in obtaining, regulatory approvals or in complying with requirements could adversely affect commercialization and our ability to receive product or royalty revenues.

Hatch-Waxman Act

The Hatch-Waxman Act established abbreviated approval procedures for generic drugs. Approval to market and distribute these drugs is obtained by submitting an abbreviated new drug application, or ANDA, with the FDA. The application for a generic drug is "abbreviated" because it need not include nonclinical or clinical data to demonstrate safety and effectiveness and may instead rely on the FDA's previous finding that the brand drug, or reference drug, is safe and effective. In order to obtain approval of an ANDA, an applicant must, among other things, establish that its product is bioequivalent to an existing approved drug and that it has the same active ingredient(s), strength, dosage form, and the same route of administration. A generic drug is considered bioequivalent to its reference drug if testing demonstrates that the rate and extent of absorption of the generic drug is not significantly different from the rate and extent of absorption of the reference drug when administered under similar experimental conditions.

The Hatch-Waxman Act also provides incentives by awarding, in certain circumstances, certain legal protections from generic competition. This protection comes in the form of a non-patent exclusivity period, during which the FDA may not accept, or approve, an application for a generic drug, whether the application for such drug is submitted through an ANDA or a through another form of application, known as a 505(b)(2) application.

The Hatch-Waxman Act grants five years of exclusivity when a company develops and gains NDA approval of a new chemical entity that has not been previously approved by the FDA. This exclusivity provides that the FDA may not accept an ANDA or 505(b)(2) application for five years after the date of approval of previously approved drug, or four years in the case of an ANDA or 505(b)(2) application that challenges a patent claiming the reference drug (see discussion below regarding Paragraph IV Certifications). The Hatch-Waxman Act also provides three years of exclusivity for approved applications for drugs that are not new chemical entities, if the application contains the results of new clinical investigations (other than bioavailability studies) that were essential to approval of the application. Examples of such applications include applications for new indications, dosage forms (including new drug delivery systems), strengths, or conditions of use for an already approved product. This three-year exclusivity period only protects against FDA approval of ANDAs and 505(b)(2) applications for generic drugs that include the innovation that required new clinical investigations that were essential to approval; it does not prohibit the FDA from accepting or approving ANDAs or 505(b)(2) NDAs for generic drugs that do not include such an innovation.

Paragraph IV Certifications. Under the Hatch-Waxman Act, NDA applicants and NDA holders must provide information about certain patents claiming their drugs for listing in the FDA publication, "Approved Drug Products with Therapeutic Equivalence Evaluations," also known as the "Orange Book." When an ANDA or 505(b)(2) application is submitted, it must contain one of several possible certifications regarding each of the patents listed in the Orange Book for the reference drug. A

20

certification that a listed patent is invalid or will not be infringed by the sale of the proposed product is called a "Paragraph IV" certification.

Within 20 days of the acceptance by the FDA of an ANDA or 505(b)(2) application containing a Paragraph IV certification, the applicant must notify the NDA holder and patent owner that the application has been submitted, and provide the factual and legal basis for the applicant's opinion that the patent is invalid or not infringed. The NDA holder or patent holder may then initiate a patent infringement suit in response to the Paragraph IV notice. If this is done within 45 days of receiving notice of the Paragraph IV certification, a 30-month stay of the FDA's ability to approve the ANDA or 505(b)(2) application is triggered. The FDA may approve the proposed product before the expiration of the 30-month stay only if a court finds the patent invalid or not infringed, or if the court shortens the period because the parties have failed to cooperate in expediting the litigation.

Patent Term Restoration. Under the Hatch-Waxman Act, a portion of the patent term lost during product development and FDA review of an NDA or 505(b)(2) application is restored if approval of the application is the first permitted commercial marketing of a drug containing the active ingredient. The patent term restoration period is generally one-half the time between the effective date of the IND and the date of submission of the NDA, plus the time between the date of submission of the NDA and the date of FDA approval of the product. The maximum period of patent term extension is five years, and the patent cannot be extended to more than 14 years from the date of FDA approval of the product. Only one patent claiming each approved product is eligible for restoration and the patent holder must apply for restoration within 60 days of approval. The U.S. Patent and Trademark Office, in consultation with the FDA, reviews and approves the application for patent term restoration.

Other Regulatory Requirements

After approval, drug products are subject to extensive continuing regulation by the FDA, which include company obligations to manufacture products in accordance with current GMP, maintain and provide to the FDA updated safety and efficacy information, report adverse experiences with the product, keep certain records and submit periodic reports, obtain FDA approval of certain manufacturing or labeling changes, and comply with FDA promotion and advertising requirements and restrictions. Failure to meet these obligations can result in various adverse consequences, both voluntary and FDA-imposed, including product recalls, withdrawal of approval, restrictions on marketing, and the imposition of civil fines and criminal penalties against the NDA holder. In addition, later discovery of previously unknown safety or efficacy issues may result in restrictions on the product, manufacturer or NDA holder.

We and any manufacturers of our products are required to comply with applicable FDA manufacturing requirements contained in the FDA's current GMP regulations. Current GMP regulations require, among other things, quality control and quality assurance as well as the corresponding maintenance of records and documentation. The manufacturing facilities for our products must meet current GMP requirements to the satisfaction of the FDA pursuant to a pre-approval inspection before we can use them to manufacture our products. We and any third-party manufacturers are also subject to periodic inspections of facilities by the FDA and other authorities, including procedures and operations used in the testing and manufacture of our products to assess our compliance with applicable regulations.

With respect to post-market product advertising and promotion, the FDA imposes a number of complex regulations on entities that advertise and promote pharmaceuticals, which include, among others, standards for direct-to-consumer advertising, prohibitions on promoting drugs for uses or in patient populations that are not described in the drug's approved labeling (known as "off-label use"), and principles governing industry-sponsored scientific and educational activities. Failure to comply with FDA requirements can have negative consequences, including adverse publicity, enforcement letters

21

from the FDA, mandated corrective advertising or communications with doctors or patients, and civil or criminal penalties. Although physicians may prescribe legally available drugs for off-label uses, manufacturers may not market or promote such off-label uses.

Changes to some of the conditions established in an approved application, including changes in indications, labeling, or manufacturing processes or facilities, require submission and FDA approval of a new NDA or NDA supplement before the change can be implemented. An NDA supplement for a new indication typically requires clinical data similar in type and quality to the clinical data supporting the original application for the original indication, and the FDA uses similar procedures and actions in reviewing such NDA supplements as it does in reviewing NDAs.

Adverse event reporting and submission of periodic reports is required following FDA approval of an NDA. The FDA also may require post-marketing testing, known as Phase IV testing, risk minimization action plans, and surveillance to monitor the effects of an approved product or to place conditions on an approval that restrict the distribution or use of the product.