UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended March 31, 2020

or

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number: 001-35776

ACASTI PHARMA INC.

(Exact name of registrant as specified in its charter)

| Québec, Canada | 98-1359336 | |

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification Number) |

545, Promenade du Centropolis, Suite 100, Laval, Québec H7T 0A3

(Address of principal executive offices, including zip code)

Registrant’s telephone number, including area code: 450-687-2262

Securities registered pursuant to Section 12(b) of the Act:

Title of each class |

Name of each exchange on which registered | |

| Common Shares, no par value per share | NASDAQ Stock Market |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☒

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ | |||

| Non-accelerated filer | ☒ | Smaller reporting company | ☒ | |||

| Emerging growth company | ☐ | |||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Securities Exchange Act of 1934). Yes ☐ No ☒

The aggregate market value of the voting and non-voting common shares held by non-affiliates of the registrant, based on the closing sale price of the registrant’s common shares on the last business day of its most recently completed second fiscal quarter, as reported on the NASDAQ Stock Market, was approximately $161,005,499.55.

The number of outstanding common shares of the registrant, no par value per share, as of June 26, 2020 was 92,488,385.

ACASTI PHARMA INC.

FORM 10-K

For the Fiscal Year Ended March 31, 2020

Table of Contents

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This annual report contains information that may be forward-looking information within the meaning of Canadian securities laws and forward-looking statements within the meaning of U.S. federal securities laws, both of which we refer to in this annual report as forward-looking information. Forward-looking information can be identified by the use of terms such as “may”, “will”, “should”, “expect”, “plan”, “anticipate”, “believe”, “intend”, “estimate”, “predict”, “potential”, “continue” or other similar expressions concerning matters that are not statements about the present or historical facts. Forward-looking information in this annual report includes, among other things, information or statements about:

| · | our ability to conduct all required clinical and nonclinical trials for our drug candidate, CaPre, including the timing and results of those trials; | |

| · | the outcome of our ongoing dialogue with the U.S. Food and Drug Administration, or FDA, regarding the unusually large placebo effect observed in the triglyceride, or TG, topline results of our TRILOGY 1 Phase 3 clinical trial and the implications for our TRILOGY 2 Phase 3 clinical trial and its outcome; | |

| · | our ability to file a New Drug Application, or NDA, based on the results of our TRILOGY Phase 3 program; | |

| · | whether the FDA may require additional clinical development work or study to support an NDA filing for CaPre; |

| · | our strategy, future operations, prospects and the plans of our management; |

| · | the regulatory plan, timeline, costs and results of our clinical and nonclinical trials for CaPre; |

| · | the timing and outcome of our meetings and discussions with the FDA; |

| · | our planned regulatory filings for CaPre, and their timing; | |

| · | our expectation that our Bridging Study (as defined below) results will support our plan to get authorization from the FDA to use the 505(b)(2) pathway with new chemical entity, or NCE, status towards an NDA approval in the United States; |

| · | the potential benefits and risks of CaPre as compared to other products in the pharmaceutical, medical food, natural health and dietary supplement products markets; |

| · | our estimates of the size and growth rate of the potential market for CaPre, unmet medical needs in that market, the potential for future market expansion, the rate and degree of market acceptance of CaPre if it reaches commercialization, and our ability to serve that market; |

| · | our anticipated marketing advantages and product differentiation of CaPre and its potential to become a best-in-class omega-3, or OM3, compound for the treatment of severe hypertriglyceridemia, or sHTG; |

| · | the potential to expand CaPre’s indication for the treatment of high TGs (200-499 mg/dL), assuming at least one additional study; |

| · | the degree to which physicians would switch their patients to a product with CaPre’s target product profile based on the outcome of our TRILOGY Phase 3 trials; |

| · | our strategy and ability to develop, commercialize and distribute CaPre in the United States and elsewhere; |

| · | our ability to strengthen our patent portfolio and other means of protecting our intellectual property rights, including our ability to obtain additional patent protection for CaPre; |

| 1 |

| · | the availability and consistency of our raw materials, including raw krill oil, or RKO, from existing and future alternative suppliers; |

| · | our expectation that following expiration of our license agreement with Neptune Wellness Solutions Inc., or Neptune, we will not require any licenses from third parties to support the commercialization of CaPre; |

| · | our expectation to be able to rely on third parties to manufacture CaPre whose manufacturing processes and facilities are in compliance with current good manufacturing practices, or cGMP; |

| · | the potential for CaPre in other cardiometabolic medicine indications; |

| · | our intention and ability to build a U.S. commercial organization, and to successfully launch CaPre and compete in the U.S. market; |

| · | our intention and ability to complete development and/or distribution partnerships to support the commercialization of CaPre outside of the United States, and to pursue strategic opportunities to provide supplemental capital and market access; |

| · | the potential adverse effects that the recent COVID-19 pandemic may have on our business and operations; |

| · | our need for additional financing, and our estimates regarding our future financing and capital requirements; |

| · | our expectation regarding our financial performance, including our revenues, cost-of-goods, profitability, research and development, costs and expenses, gross margins, liquidity, capital resources, and capital expenditures; and |

| · | our projected capital requirements to fund our anticipated expenses, including our research and development, marketing and sales, general and administrative expenses, and capital equipment expenditures. |

Although the forward-looking information in this annual report is based upon what we believe are reasonable assumptions, you should not place undue reliance on that forward-looking information since actual results may vary materially from it. Important assumptions made by us when making forward-looking statements include, among other things, assumptions by us that:

| · | we are able to obtain the additional capital and financing we require when we need it; |

| · | the FDA will not require an additional study for us to file an NDA for CaPre, and that we successfully and timely complete all required clinical and nonclinical trials necessary for regulatory approval of CaPre; |

| · | the timeline and costs for our TRILOGY Phase 3 program are not materially underestimated or affected by the COVID-19 pandemic or other unforeseen circumstances; |

| · | CaPre is safe and effective; |

| · | we obtain and maintain regulatory approval for CaPre on a timely basis; |

| · | we are able to attract, hire and retain key management and skilled scientific and commercial personnel; | |

| · | third parties provide their services to us on a timely and effective basis; |

| · | we are able to maintain our required supply of raw materials at a reasonable price, including RKO; | |

| · | we are able to scale-up production of CaPre with third-party manufacturers to support commercial demand; |

| 2 |

| · | we are able to successfully build a commercial organization, launch CaPre in the United States, and compete in the U.S. market; |

| · | we are able to secure distribution arrangements for CaPre outside of the United States, if it reaches commercialization; |

| · | we are able to manage and fund our future growth effectively; |

| · | we are able to gain acceptance of CaPre in its targeted markets, and we are able to serve those markets; |

| · | our patent and trademark portfolio is sufficient and valid; |

| · | we are able to secure and defend our intellectual property rights, and to avoid infringing upon the intellectual property rights of third parties; |

| · | we are able to take advantage of new business opportunities in the pharmaceutical industry; | |

| · | we are able to execute on strategic partnerships according to our business plan; |

| · | we are able to continue as a going concern; |

| · | there is no significant increase in competition for CaPre from other companies in the pharmaceutical, medical food, dietary supplement and natural health product industries; |

| · | CaPre would be viewed favorably by payers at launch, and receive appropriate healthcare reimbursement; |

| · | market data and reports reviewed by us are accurate; |

| · | there are no material adverse changes in relevant laws or regulations; and |

| · | we face no product liability lawsuits or other proceedings or any such matters, if they arise, are satisfactorily resolved. |

In addition, the forward-looking information in this annual report is subject to a number of known and unknown risks, uncertainties and other factors, including those described in this annual report under the heading “Item 1A. Risk Factors”, many of which are beyond our control, that could cause our actual results and developments to differ materially from those that are disclosed in or implied by the forward-looking information, including, among others:

| · | risks related to timing and possible difficulties, delays or failures in our ongoing TRILOGY Phase 3 program for CaPre; |

| · | nonclinical and clinical trials may be more costly or take longer to complete than anticipated and may never be completed, or they may generate results that warrant future clinical trials, additional clinical development and/or delay commercialization of CaPre; | |

| · | our TRILOGY Phase 3 trials may not achieve all or any of its primary and secondary endpoints; | |

| · | assuming our TRILOGY 2 trial meets its primary endpoint, the results of pooling that data with our TRILOGY 1 trial results may not achieve statistical significance or, may not be supported by the FDA; | |

| · | based on the final TRILOGY 1 and TRILOGY 2 clinical trial data, the FDA may require that we conduct additional clinical work or studies to support an NDA for CaPre; |

| · | our anticipated studies and submissions to the FDA may not occur as currently anticipated, or at all; | |

| · | the FDA could reject our 505(b)(2) regulatory pathway and/or our NDA; |

| 3 |

| · | while the REDUCE-IT results (a cardiovascular outcome study conducted by Amarin Corporation plc, or Amarin, with their OM3 drug VASCEPA) were positive, on January 13, 2020, AstraZeneca plc announced that its cardiovascular Phase 3 STRENGTH trial for its OM3 drug EPANOVA had been discontinued due to its low likelihood of demonstrating a benefit to patients with mixed dyslipidemia. The potential impacts of the discontinuance of the STRENGTH trial on our business and the OM3 drug market in general are not yet known; |

| · | if Amarin loses its appeal of the U.S. District Court for the District of Nevada’s March 30, 2020 decision invalidating its patent on the basis of obviousness, then additional generic versions of VASCEPA could potentially enter the market within the next year and this could result in downward pressure on pricing for CaPre; |

| · | we may encounter difficulties, delays or failures in obtaining regulatory approvals for the initiation of clinical trials or to market CaPre, or the FDA may refuse to approve CaPre or place restrictions on our ability to commercialize and promote CaPre; |

| · | the FDA may require, or for competitive reasons we may need to, conduct additional future clinical trials for CaPre, the occurrence and success of which cannot be assured; |

| · | CaPre may have unknown side effects, or may not prove to be as safe and effective or as potent as we currently believe; |

| · | CaPre could be subject to extensive post-market obligations and continued regulatory review, which may result in significant additional expense and affect sales, marketing and profitability; |

| · | we may fail to achieve our publicly announced milestones on time; |

| · | we may encounter difficulties in completing or funding additional development or commercialization of CaPre; | |

| · | third parties we are relying upon to conduct our TRILOGY Phase 3 program and support the data analysis and filing of an NDA for CaPre may not effectively fulfill their obligations to us, including complying with FDA requirements; |

| · | there may be difficulties, delays, or failures in obtaining health care reimbursements for CaPre; |

| · | recently enacted and future laws may increase the difficulty and cost for us to obtain marketing approval and commercialization of CaPre, and may affect the prices we can charge; |

| · | new laws, regulatory requirements, and the continuing efforts of governmental and third-party payors to contain or reduce the costs of healthcare through various means could adversely affect our business; |

| · | the market opportunity for, and demand and market acceptance of, CaPre may not be as strong as we anticipate; |

| · | third parties that we will rely upon to manufacture, supply and distribute CaPre may not effectively fulfill their obligations to us, including complying with FDA requirements; |

| · | there may not be an adequate supply of raw materials, including RKO, in sufficient quantities and quality to produce CaPre under cGMP standards and that meet our target specifications; |

| · | we may not be able to meet applicable regulatory standards for the manufacture of CaPre or scale-up our manufacturing successfully; |

| · | as a development stage company, we currently have limited sales, marketing and distribution personnel and resources; |

| 4 |

| · | our patent applications may not result in issued patents, our issued patents may be circumvented or challenged and ultimately struck down, and we may not be able to successfully protect our trade secrets or other confidential proprietary information; |

| · | we may not be able to build name recognition in our markets of interest if we do not protect our trademark for CaPre or any new trademark that is developed for CaPre; |

| · | we may face claims of infringement of third party intellectual property and other proprietary rights; |

| · | we may face product liability claims and product recalls; |

| · | we may face intense competition from other companies in the pharmaceutical, medical food and natural health product industries; |

| · | we have a history of negative operating cash flow, and may never become profitable or be able to sustain profitability; |

| · | we have significant additional future capital needs, and may not be able to raise additional financing required to fund further research and development, clinical studies, obtain regulatory approvals, build a commercial organization in the United States, and meet ongoing capital requirements to continue our current operations on commercially acceptable terms or at all; |

| · | we face additional costs related to the change in our status from a foreign private issuer to a U.S. domestic issuer; |

| · | we may not be able to successfully compete in the U.S. market with competitors who are larger and have more resources than we do; |

| · | we may acquire businesses or products or form strategic partnerships in the future that may not be successful; |

| · | we may be unable to secure development and/or distribution partnerships to support the development and commercialization of CaPre, provide development capital, or provide market access in any key market; |

| · | we rely on the retention of key management and skilled scientific, manufacturing, regulatory and commercial personnel; and |

| · | general changes in economic and capital market conditions could adversely affect us. |

All of the forward-looking information in this annual report is qualified by this cautionary statement. There can be no guarantee that the results or developments that we anticipate will be realized or, even if substantially realized, that they will have the consequences or effects on our business, financial condition or results of operations that we anticipate. As a result, you should not place undue reliance on the forward-looking information. Except as required by applicable law, we do not undertake to update or amend any forward-looking information, whether as a result of new information, future events or otherwise. All forward-looking information is made as of the date of this annual report.

We express all amounts in this annual report in U.S. dollars, except where otherwise indicated. References to “$” and “US$” are to U.S. dollars and references to “C$” or “CAD$” are to Canadian dollars.

Except as otherwise indicated, references in this annual report to “Acasti,” “the Company,” “we,” “us” and “our” refer to Acasti Pharma Inc. and its consolidated subsidiaries.

| 5 |

| Item 1. | Business |

Overview

We are a biopharmaceutical innovator focused on the research, development and commercialization of prescription drugs using OM3 fatty acids delivered both as free fatty acids and bound-to-phospholipid esters, derived from krill oil. OM3 fatty acids have extensive clinical evidence of safety and efficacy in lowering triglycerides, or TGs, in patients with hypertriglyceridemia, or HTG. Our lead product candidate is CaPre, an OM3 phospholipid therapeutic, which we are developing initially for the treatment of sHTG, a condition characterized by very high or severe levels of TGs in the bloodstream (≥ 500 mg/dL). In accordance with a study published in 2009 in the Archives of Internal Medicine by Ford et al., it is estimated that three to four million people in the United States have sHTG. In primary qualitative market research studies commissioned by Acasti in August 2016 and November 2017 by DP Analytics, a division of Destum Partners, and in April 2019 by a well-respected third party provider, key opinion leaders, or KOLs, high volume prescribers, or HVPs, and pharmacy benefit managers, or PBMs, who were interviewed indicated a significant unmet medical need exists for an effective, safe and well-absorbing OM3 therapeutic that can also demonstrate a positive impact on the major blood lipids associated with cardiovascular disease risk. We believe that CaPre may address this unmet medical need if our TRILOGY Phase 3 clinical program is successful in reproducing what we observed in our Phase 2 clinical data. See “—Our Clinical Data” and “—Our TRILOGY Phase 3 Program”.

We also believe the potential exists to expand CaPre’s initial indication to the roughly 44.4 million patients in the United States with elevated TGs in the mild to moderate range (e.g., blood levels between 200 - 499 mg/dL), although at least one additional clinical trial would likely be required to support FDA approval of a supplemental NDA to expand CaPre’s indication to this segment. Data from our Phase 2 studies indicated that CaPre may have a positive effect in diabetes and other inflammatory and cardiometabolic diseases; consequently, we may also seek to identify new potential indications for CaPre that may be appropriate for future studies and pipeline expansion. In addition, we may also seek to in-license other cardiometabolic or other primary care-focused drug candidates for drug development and commercialization.

In four clinical trials conducted to date, we saw the following consistent results with CaPre, and we are seeking to demonstrate similar safety and efficacy in our TRILOGY Phase 3 program:

| · | significant reduction of TGs and non-high density lipoprotein cholesterol (non-HDL-C) levels in the blood of patients with mild to sHTG; |

| · | no deleterious effect on low-density lipoprotein cholesterol (LDL-C), or “bad” cholesterol, with the potential to reduce LDL-C; |

| · | potential to increase high-density lipoprotein cholesterol (HDL-C), or “good” cholesterol; |

| · | potential to benefit diabetes patients by decreasing hemoglobin A1c (HbA1c), a marker of glucose control; |

| · | good bioavailability (absorption by the body), even under fasting conditions; |

| · | no significant food effect when taken with either low-fat or high-fat meals; and |

| · | an overall safety profile similar to that demonstrated by currently marketed OM3s. |

We believe that if we are able to reproduce these results in our TRILOGY Phase 3 program, that this could potentially set CaPre apart from current FDA-approved fish oil-derived OM3 treatment options, and it could give us a significant clinical and marketing advantage.

| 6 |

Recent Developments

As we have previously disclosed, we filed a Type C meeting request at the end of March 2020 with the FDA. We subsequently submitted our briefing package on April 29, 2020 to the FDA. The briefing package was intended to provide the FDA with a review of the relevant TRILOGY 1 clinical data and audit findings, with the objective of gaining alignment on the interpretation of the TRILOGY 1 results and implications for TRILOGY 2. We also sought the FDA’s input on our proposed revisions to the pre-specified TRILOGY 2 Statistical Analysis Plan, or SAP, and their input on a plan for pooling the data from TRILOGY 1 and TRILOGY 2 to support an NDA filing.

On June 19, 2020, we announced that the FDA had provided us with a written response to our meeting request and briefing package. The FDA confirmed that it will require pivotal efficacy analyses to be performed on the full Intent to Treat, or ITT, population as contemplated in the original SAP, and it supported the conduct of post-hoc analyses in TRILOGY 1 for exploratory purposes. Consistent with our prior disclosures and depending on the outcome of TRILOGY 2, an additional clinical study may still be needed prior to an NDA submission. We and our expert advisors are carefully considering the FDA’s comments on the TRILOGY 1 data and will conduct further post-hoc analysis based on the FDA’s feedback.

Based on the written feedback received from the FDA, we intend to now finalize the SAP for TRILOGY 2, which we plan to submit to the FDA by the end of July 2020. We continue to remain blinded to the TRILOGY 2 clinical data and we continue to expect to report topline data from TRILOGY 2 by the end of August 2020. The key secondary and exploratory endpoints from both TRILOGY 1 and TRILOGY 2 trials would still be expected as soon as possible after the unblinding of TRILOGY 2 results.

Additional details on our post-hoc data analyses of TRILOGY 1 results and clinical site and laboratory audit findings are summarized below, along with our planned next steps for unblinding TRILOGY 2 results. See “— TRILOGY 1 Findings based on Post-Hoc Analyses and Audits.”

On April 30, 2020, we announced that we had received notice of issuance of a composition of matter patent awarded by the Intellectual Property Office in Hong Kong. This new patent expands our intellectual property portfolio by granting claims for any composition containing eicosapentaenoic acid, or EPA, and docosahexaenoic acid, or DHA, where at least 50% of the composition consists of phospholipids.

About Hypertriglyceridemia (HTG)

According to the American Heart Association Scientific Statement on Triglycerides and Cardiovascular Disease from 2011, TG levels provide important information as a marker associated with the risk for heart disease and stroke, especially when an individual also has low levels of HDL-C and elevated levels of LDL-C. HTG can be caused by both genetic and environmental factors, including obesity, sedentary lifestyle and high-fat diets. HTG is also associated with comorbid conditions such as chronic renal failure, pancreatitis, nephrotic syndrome, and diabetes. Multiple epidemiological, clinical, genetic studies suggest that patients with elevated TG levels (≥ 200 mg/dL) are at a greater risk of coronary artery disease, or CAD, and pancreatitis, a life-threatening condition, as compared to those with normal TG levels. The genes regulating TGs and LDL-C are equally strong predictors of CAD. Other studies suggest that lowering and managing TG levels may reduce these risks. In addition, the Japan EPA Lipid Intervention Study, or JELIS, demonstrated the long-term benefit of an OM3 EPA in preventing major coronary events in hypercholesterolemic patients receiving statin treatment. JELIS found a 19% relative risk reduction in major coronary events in patients with relatively normal TGs but a more pronounced 53% reduction in the subgroup of patients with TGs > 150mg/dL and HDL-C < 40mg/dL. Meta-analyses published by Alexander et al. (Mayo Clinic Proceedings, 2017) and Maki et al. (Journal of Clinical Lipidology, 2016) suggest that EPA and DHA may be associated with reducing coronary heart disease risk to a greater extent in populations with elevated TG levels, and that drugs lowering TG and TG-rich lipoproteins may reduce cardiovascular event risk in patients with elevated TG levels, particularly if associated with low HDL-C. In November 2018, Amarin published the results of its REDUCE-IT cardiovascular outcome trial, or CVOT, which showed that a therapeutic dose of VASCEPA at 4 grams per day, taken on top of a statin, reduced residual cardiovascular risk by 25%. Based on this data, in December 2019, the FDA granted Amarin an expanded label for VASCEPA that allows its use in patients with mild to moderate HTG (200 – 500mg/dL). The table below lists several CVOT studies done over approximately the last 13 years, and supports the hypothesis that the right dose of any drug (e.g. OM3, fibrate or niacin) that reduces TG levels in at risk patients (e.g. those with elevated TGs and low HDL-C), can significantly reduce their cardiovascular risk.

| 7 |

About CaPre

CaPre is a highly purified, proprietary krill oil-derived mixture containing polyunsaturated fatty acids, or PUFAs, primarily composed of OM3 fatty acids, principally EPA and DHA, present as a combination of phospholipid esters and free fatty acids. EPA and DHA are well known to be complementary and beneficial for human health, and according to numerous recent clinical studies, may promote healthy heart, brain and visual function (Kwantes and Grundmann, Journal of Dietary Supplements, 2014), and may also contribute to reducing inflammation and blood levels of TGs (Ulven and Holven, Vascular Health and Risk Management, 2015). Krill is a rich natural source of phospholipids and OM3 fatty acids. The EPA and DHA contained in CaPre are delivered as a combination of OM3s as free fatty acids and OM3s bound to phospholipid esters. Both forms allow these PUFAs to reach the small intestine where they undergo rapid absorption and transformation into complex fat molecules that are required for lipid transport into the bloodstream. We believe that EPA and DHA are more efficiently transported by phospholipids sourced from krill oil than the EPA and DHA contained in fish oil, which are transported either by TGs (as in dietary supplements) or as ethyl esters as in other prescription OM3 drugs (such as LOVAZA and VASCEPA). These OM3 ethyl ester prescription products must undergo additional digestion before they are ready for transport into the bloodstream. The digestion and absorption of OM3 ethyl ester drugs requires a particular enzymatic process that is highly dependent on the fat content of a meal – the higher the fat content, the better the OM3 ethyl ester absorption. High fat content meals are not recommended in patients with HTG. We believe that CaPre’s superior absorption profile could represent a significant clinical advantage, since taking it with a low-fat meal represents a healthier and more realistic regimen for patients with HTG who must follow a restricted low-fat diet. CaPre is intended to be used as a therapy combined with positive lifestyle changes, such as a healthy diet and exercise, and can be administered either alone or with other drug treatment regimens such as fibrates and/or statins (a class of drug used to reduce LDL-C). CaPre is intended to be taken orally once or twice per day in capsule form.

Potential Market for CaPre

We believe a significant opportunity exists for OM3 market expansion because, among other things:

| · | Cardiovascular diseases, or CVD, and stroke are the leading causes of morbidity and mortality in the United States. The burden of CVD and stroke in terms of life-years lost, diminished quality of life, and direct and indirect medical costs also remains enormous. According to the American Heart Association, in 2016, CVD cost the American healthcare system $555.0 billion. By 2035, this cost is estimated by the American Heart Association to increase to $1.1 trillion; |

| 8 |

| · | Evidence suggests potential for OM3s in other cardiometabolic indications, such as diabetes and high blood pressure; |

| · | Subgroup analyses from outcome studies conducted since 2007 such as JELIS, ACCORD-Lipid and AIM-HIGH, have all shown that patients who entered these studies with high TGs (above 150 mg/dL) and low HDL (below 40 mg/dL) and received a TG-lowering medication (either an OM3, fibrate or niacin) saw a relative cardiovascular risk reduction of 31 – 53% by the end of the study when compared to placebo or standard of care; and |

| · | In February 2019, following the release of Amarin’s REDUCE-IT results in September 2018, Cantor Fitzgerald projected that based on their market research survey with 100 physicians, prescriptions for OM3s were expected to grow significantly in 2019. Audited prescription data from Symphony Health Analytics showed that by August 2019, the U.S. market for OM3 therapeutics had reached an annualized run rate of more than $1.65 billion, up from $1.4 billion for the full year of 2018. |

According to the American Heart Association, the prevalence of HTG in the United States and globally correlates to the aging of the population and the increasing incidence of obesity and diabetes. Market participants, including the American Heart Association, have estimated that one-third of adults (approximately 70 million people) in the United States have elevated levels of TGs (TGs >150 mg/dL) (Ford, Archives of Internal Medicine, 2009; 169(6):572-578), including approximately 3 to 4 million people diagnosed with sHTG (Miller et al. Circulation, 2011 and Maki et al. J. Clan. Lipid, 2012). Moreover, according to Ford, Archives of Internal Medicine in a study conducted between 1999 and 2004, 18% of adults in the United States, corresponding to approximately 40 million people, had elevated TG levels equal to or greater than 200 mg/dL, of which only 3.6% were treated specifically with TG-lowering medication (Ford, Archives of Internal Medicine, 2009; 169(6):572-578; Kapoor and Miller, ACC, 2016, Christian et al. Am. J. Cardiology, 2011). We believe this data indicates there is a large underserved market opportunity for CaPre.

CaPre’s target market in the United States for treatment of HTG was estimated by Symphony Health Analytics Audit data to be approximately $1.4 billion in 2018, with approximately 4.5 million prescriptions written annually. The total global market for treatment of HTG was estimated by GOED Proprietary Research in 2015 to be approximately $2.3 billion annually. Until late 2019, all marketed OM3 products had been approved by the FDA only for patients with sHTG. On December 13, 2019, the FDA granted Amarin an expanded label for patients with TG levels above 150mg/dL, who also have established CVD or diabetes, and two or more additional risk factors for CVD, based upon the results of their REDUCE-IT outcome study. Given this expanded labeling for VASCEPA, we believe there is the potential to greatly expand the treatable market for OM3s in the United States to the approximately 70 million people with TGs above 150 mg/dL. It is not yet known whether the discontinuance by AstraZeneca of its Phase 3 STRENGTH CVOT for its OM3 drug EPANOVA (announced on January 13, 2020) will have an adverse effect on the size or growth rate of this potential treatable market. The REDUCE-IT and STRENGTH CVOT studies were designed to evaluate the long-term benefit of lowering TGs on CVD risk with prescription drugs containing OM3 fatty acids in patients with mild to moderately elevated TGs, low HDL-C, and concurrently taking a statin. Additional clinical trials would likely be required for CaPre to also expand its label claims to this segment.

CaPre currently has two FDA-approved and marketed branded competitors, LOVAZA and VASCEPA. Generic LOVAZA became available on the U.S. market in 2013. In spite of generic LOVAZA options, 2017 audited prescription data from IMS NSP indicates that approximately 70% of OM3 prescriptions were written for branded products (predominantly VASCEPA). According to Symphony Health Analytics Audit data from August 2019, the U.S. OM3 market for HTG is valued at more than $1.65 billion. However, the number of prescriptions written for branded OM3s is now increasing significantly since Amarin announced its REDUCE-IT results in late 2018 and has recently received expanded label claims. Normalized prescription growth for Amarin’s VASCEPA grew by 78% in 2019 compared to 2018. According to Amarin, they have forecasted net revenue in 2020 of $650 million to $700 million, mostly from sales of VASCEPA in the United States. However, if Amarin loses its appeal of the U.S. District Court for the District of Nevada’s March 30, 2020 decision invalidating its patent on the basis of obviousness, then additional generic versions of VASCEPA could enter the market in the next few years.

We conduct market research at least annually with physicians and payers to monitor market developments, reimbursement and clinical practice. Except as otherwise indicated, all of the information that follows under this section has been derived from secondary sources, including audited U.S. prescribing data, and from qualitative U.S. primary market research with physicians and payers conducted for us by Destum, and more recently by a well-respected third party survey provider.

| 9 |

Destum utilized secondary market data and reports to develop market projections for us, and they also conducted primary qualitative market research with physicians and third-party payers, such as pharmacy benefit managers, or PBMs. One-on-one in-depth phone interviews conducted in November 2017 lasting on average 30-60 minutes were conducted with 22 physicians and 5 PBMs. Key insights and data were collected by Destum on current clinical practice for treating patients with HTG, and physician and payer perceptions of the current unmet medical and key economic needs in this space. All interviews were conducted by the same individual at Destum to ensure consistency in the collection of key information. Destum utilized OM3 prescription data from 2009 to 2017 to estimate the size of CaPre’s potential market. Based on discussions with the PBMs, Destum also assumed CaPre would be viewed favorably by payers at launch (e.g., Tier 2 or 3, depending on payer plan, which is comparable to LOVAZA and VASCEPA) provided CaPre is similarly priced. Upon completing the screening questionnaire and being approved for inclusion in Destum’s study, key opinion leaders, or KOLs, and high volume prescribers, or HVPs, were provided with a study questionnaire and were asked to comment on a target profile for a potential new OM3 “Product X” delivering a “trifecta” of cardio-metabolic benefits similar to the potential efficacy and safety benefits demonstrated by CaPre in our two Phase 1 pharmacokinetic studies and two Phase 2 clinical trials, which we refer to as the “Target Product Profile.” Respondents were told that the unidentified product was being prepared for a Phase 3 program designed to confirm with statistical significance the product’s safety and efficacy in patients with sHTG. The Target Product Profile was used by Destum strictly for market research analysis purposes and should not be construed as an indication of future performance of CaPre and should not be read as an expectation or guarantee of future performance or results of CaPre, and will not necessarily be an accurate indication of whether or not such results will be achieved by CaPre in our TRILOGY Phase 3 program.

In the market research conducted for us, KOLs and HVPs interviewed by Destum were asked to assess the level of unmet medical need associated with treating patients with sHTG based on currently available treatment options. 91% of physicians interviewed by Destum in 2016 indicated that they believe that the current unmet medical need for treating HTG was moderate to high. That number increased to 100% in the subsequent December 2017 research. The reasons identified by these physicians for their dissatisfaction with the currently available OM3s included insufficient lowering of TGs (a complaint principally related to VASCEPA), negative LDL-C effects (a complaint principally related to LOVAZA), the “food effect” or reduced absorption of both LOVAZA and VASCEPA when taken with a low-fat meal (or the corollary to this concern, which is that their patients had to take either drug with a fatty meal to get full efficacy benefit), gastrointestinal side effects, and the fishy taste from these fish oil-derived OM3s. Physicians reported that their patients have difficulty swallowing the large 1 gram softgel capsules of VASCEPA and LOVAZA, and they worried about these issues contributing to patient non-compliance. Despite the availability of other drug classes to treat sHTG, interviewed physicians indicated that they would welcome the introduction of new and improved OM3 products, particularly if they can address these perceived deficiencies.

Interviewed physicians responded favorably to the blinded Target Product Profile of CaPre in the Destum Market Research studies. In the study conducted in December 2017, they indicated that they would prescribe a new OM3 drug with the Target Product Profile to approximately 82% of their patients in the sHTG patient population and 68% of their patients in the high HTG segment within two years of the new OM3 drug’s approval. Approximately 60% of the interviewed physicians indicated that they would switch to a drug with the Target Product Profile primarily due to the “trifecta effect” of reducing TGs and LDL-C while elevating HDL-C, and the remaining 40% indicated they would switch primarily due to a drug with the Target Product Profile due to the effective reduction of TGs alone. In connection with their responses, the interviewed physicians were instructed to assume the drug with the Target Product Profile and all currently available OM3 products were priced similarly and not subject to any reimbursement or coverage hurdles (e.g., all products were on an equal health care coverage playing field). This assumption was subsequently supported by our interviews with leading PBMs in the United States.

This market research was updated again in March 2019 to reflect the more current views of physicians and third party payers following the publication of the REDUCE-IT study results. This updated primary qualitative market research project was conducted by a well-respected third party survey provider, and the design of the study was similar to the Destum project, with one-on-one interviews lasting approximately 60 minutes in duration. These interviews were conducted with 10 physicians and 20 pharmacy directors, covering 179,913,005 commercial lives across the United States, consistent with the current payer mix for the OM3 market. CaPre was evaluated positively by physicians with particular value placed on its potential to lower TGs, LDL-C and HbA1c (this was seen as unique, and especially valued), and to increase HDL-C, as well as its potentially superior tolerability features (e.g., easier to swallow when compared to the ethyl ester fish oils, and no fishy taste or “burpiness”). On average, physicians indicated that they would begin prescribing CaPre 3 months after launch, and would evaluate its performance in their initial patients after 3 to 6 months of use. Depending on favorable experience in initial use, some physicians indicated peak use could begin as quickly as 12 to 18 months after launch. Physicians expect CaPre to be priced similar to VASCEPA, and to have an out-of-pocket cost after insurance reimbursement of approximately $10-$50. Payers also viewed CaPre favorably, and did not anticipate any major reimbursement restrictions, with likely coverage at Tier 2 or 3 depending on the payer plan.

| 10 |

The Redbook published by Thomson Reuters is widely used by healthcare professionals to assess the latest drug product pricing and packaging information on prescription and over-the-counter drug products. Based on recent Redbook pricing data from May 5, 2020, the average wholesale pricing for branded VASCEPA is currently approximately US$397 per month. Amarin has raised prices for VASCEPA annually since its launch in late 2013. PBMs typically offer “Preferred Brand” status (Tier 2 or Tier 3) for VASCEPA. By the end of 2018, VASCEPA had reached about 45% market share in the United States, in spite of generic competition from LOVAZA. Amarin continues to gain market share in the United States and, as of August 2019 based on Symphony Health Analytics prescription audit date, Amarin had reached about 64% of market share based on dollars, and had about 53% of market share based on units. This growth is principally coming from market expansion along with some erosion of generic sales.

We plan to continue to regularly conduct additional market research with KOLs, HVPs, primary care physicians and payers to further develop and refine our understanding of the potential market for CaPre ahead of potential commercial launch in the United States.

Our Nonclinical Research

In addition to our Phase 2 and 3 clinical trials, we carried out an extensive nonclinical program to demonstrate the safety of CaPre in a defined set of studies required by the FDA. These studies were carried out by contract research organizations in compliance with the FDA’s Good Laboratory Practices, or GLP, and conducted on various species of animals recommended by the FDA to investigate the long-term effects of CaPre at doses of up to 65 grams of human equivalent dose over 39 weeks. In these studies, hematological, biochemical, coagulation and overall health parameters of CaPre were evaluated and no toxic effects were observed in any of the segments of the studies. Other studies focused on the potential toxic effects of CaPre on vital systems, such as the cardiovascular, respiratory and central nervous system, as evaluated by behavioral studies of the various species. These studies showed that CaPre did not have any adverse or toxic effects on any of the vital systems investigated, again up to doses well above the equivalent recommended clinical dose of CaPre. To rule out short term toxic effects of CaPre on genes, genomic toxicity studies were undertaken on accepted cellular and animal models. These studies showed no toxic effects of CaPre on any of the genetic markers indicative of potential gene altering toxic effects.

We believe the studies conducted to date indicate that CaPre is well-tolerated and shows no toxic effects on any of the physiological and vital systems of the tested animals or their genes at doses well above CaPre’s anticipated clinical therapeutic dose of 4 grams daily.

In parallel to our TRILOGY Phase 3 program, we also conducted additional nonclinical studies, including a pre- and postnatal development study in rodents and a 26-week oral carcinogenicity study in transgenic homozygous rasH2 mice. Both study protocols were designed to support an NDA filing for CaPre and were pre-approved by the FDA by means of a special protocol assessment through the FDA’s Executive Carcinogenicity Assessment Committee. Both studies have now been completed and there was no evidence of a carcinogenic potential of NKPL66, which is CaPre’s active pharmaceutical ingredient, or API, in the transgenic Hemizygous rasH2 mice following daily oral gavage at doses up to 2000 mg/kg/day. In addition, administration of NKPL66, once daily oral gavage, was well tolerated in F0 female rats with no evidence of maternal toxicity and no effects on maternal performance. In addition, there were no effects on the development of F1 generation.

In addition to the non-clinical studies described above, which are required to support NDA filing, we also conducted an additional non-clinical study in mice to gain additional insights into CaPre’s potentially unique mechanism of action in diabetes. In our Phase 2 studies in humans, a statistically significant reduction of hemoglobin A1c (HbA1c) was seen in the 4 gram treatment arm of our COLT Phase 2 clinical trial. This is the same dose that is currently being tested in our TRILOGY Phase 3 program in humans. This positive HbA1c result in our COLT phase 2 clinical trial was unexpected at the time, and potentially unique to CaPre, as other therapeutic OM3s had previously shown a range of outcomes, from no effect to a potentially deleterious effect, on glucose metabolism in diabetic or pre-diabetic patients. The main objective for this mechanistic diabetes mouse study was to assess if CaPre acts on glucose and/or insulin in some unique manner, and to compare results head-to-head with icosapent ethyl (VASCEPA) and metformin, a widely-prescribed diabetic medication. We collaborated with Dr. André Marette, who is the Director of the Pfizer Chair to study the pathogenesis of insulin resistance and cardiometabolic diseases at the University Laval, Quebec, and conducted the study in widely used and well accepted animal models in diet-induced obese C57BL6 and dyslipidemic LDLrKO mice to compare the mechanisms of action of CaPre versus icosapent ethyl and metformin on insulin resistance and type 2 diabetes. Dr. Marette is a widely-published researcher of cardiometabolic disease.

| 11 |

The preliminary findings obtained for the diabetes mouse study showed that CaPre may promote insulin secretion as seen by statistically significant results produced in a standard glucose challenge test, thus suggesting a mechanism of action different and unique when compared to metformin, which does not promote insulin secretion. Furthermore, icosapent ethyl showed no effect on insulin or any improvement in glucose metabolism or management. Key additional findings from this diabetic mouse study are:

| · | CaPre increased insulin production in association with increased c-peptide levels, suggesting that this effect is linked to greater insulin secretion by ß cells. This effect was also associated with a tendency for lower glucose responses during a glucose challenge test. CaPre exhibited a dose response, where the higher the dose the more insulin was secreted. |

| · | Both CaPre and icosapent ethyl significantly increased plasma 18RS-HEPE, (a metabolite of EPA and a precursor of Resolvin E1) as compared to the untreated control and metformin groups. Despite the lower levels of EPA in CaPre’s composition, the actual levels of 18RS-HEPE reached in the blood were higher for CaPre than levels produced by icosapent ethyl. Again, a dose response effect was seen with CaPre. 18RS-HEPE and Resolvin E1 are both resolving mediators of OM3s, and particularly EPA, and they are involved in the resolution of inflammation that is triggered in many chronic diseases, including obesity and diabetes. |

| · | Both high-dose (human equivalent dose of 4 grams/day), and low-dose (human equivalent dose of 2 grams/day) of CaPre significantly increased plasma levels of 17S-HDHA and PDX (two metabolites of DHA) as compared to the untreated control group. The effects of high-dose CaPre on PDX was very robust and significant, and much greater than those of icosapent ethyl, which showed virtually no response. Research has shown that increased levels of PDX improves insulin sensitivity in various models of insulin resistance and diabetes by several mechanisms, including by limiting inflammation in metabolic tissues, as well as by enhancing skeletal muscle IL-6 secretion, AMP activated protein kinase activation and glucose uptake, and by enhancing insulin's ability to suppress hepatic glucose production, which is also elevated in diabetic patients. |

Data from the diabetic mouse study are still being compiled and finalized. A second study is underway in a fatty liver/NASH disease model to further confirm the findings of the diabetes study, and may potentially provide more insight into the mechanism of action of CaPre on the plasma lipid profile, and in fatty liver disease by further comparing the impact of CaPre on plasma TGs, LDL-C and HDL-C, as well as on hepatic lipid accumulation versus that of icosapent ethyl and metformin. We have also filed additional patents covering unique aspects and new potential therapeutic applications of this expanded understanding of CaPre’s mechanism of action.

Our Clinical Data

CaPre is being developed for the treatment of patients with sHTG. In two Phase 2 clinical trials conducted by us in Canada (our COLT and TRIFECTA trials), CaPre was well-tolerated at all doses tested, with no serious adverse events that were considered treatment-related. Among the reported adverse events with an occurrence of greater than 2% of subjects and greater than placebo, only diarrhea had an incidence of 2.2%.

In both Phase 2 clinical trials, CaPre significantly lowered TGs in patients with mild to sHTG. Importantly, in these studies, CaPre also demonstrated no deleterious effect on LDL-C (unlike LOVAZA and EPANOVA, which had been shown to significantly increase LDL-C in patients with sHTG). Further, our Phase 2 data indicated that unlike LOVAZA, CaPre may actually reduce LDL-C with a 4 gram per day dose (a dose equivalent to VASCEPA and LOVAZA). LDL-C is undesirable because it accumulates in the walls of blood vessels, where it can cause blockages (atherosclerosis). Clinically, the phospholipids may potentially not only improve the absorption, distribution, and metabolism of OM3s, but they may also decrease the synthesis of LDL cholesterol in the liver, impede or block cholesterol absorption, and stimulate lipid secretion from bile. In the Phase 2 trials, CaPre also significantly reduced non-HDL-C (all cholesterol contained in the bloodstream except HDL-C), which is also considered to be a marker of cardiovascular disease. The COLT trial data showed a mean increase of 7.7% in HDL-C with CaPre at 4 grams per day (p=0.07). Further analysis of the data from our TRILOGY Phase 3 program will be required to demonstrate CaPre’s statistical significance with respect to lowering LDL-C and increasing HDL-C. Finally, we saw a statistically significant reduction of HbA1c in the CaPre 4g treatment group in the COLT study after only 8 weeks on drug in a diabetic population of patients with HbA1c levels at or below 7.0% at baseline. This interesting and potentially differentiating effect is being investigated more thoroughly in our TRILOGY Phase 3 program, where a larger proportion of the patients are diabetic, with HbA1c levels up to 9.5%, and they will be followed for 6 months.

| 12 |

We believe that these multiple potential cardiometabolic benefits, if confirmed in our TRILOGY Phase 3 program, could be significant differentiators for CaPre in the marketplace, as no currently approved OM3 drug has shown an ability to positively modulate all four of these important blood lipids (TGs, non-HDL-C, LDL-C and HDL-C) in the treatment of patients with dyslipidemia. We also believe that if supported by additional clinical trials, CaPre has the potential to become the best-in-class OM3 compound for the treatment of mild to moderate HTG.

On September 14, 2016, we announced positive data from our completed comparative bioavailability study, or the “Bridging Study”. The Bridging Study was an open-label, randomized, four-way, cross-over, bioavailability study comparing CaPre, given as a single dose of 4 grams in fasting and fed (high-fat) states, as compared to the FDA-approved HTG drug LOVAZA (OM3-acid ethyl esters) in 56 healthy volunteers. The protocol was reviewed and approved by the FDA. The primary objective of the Bridging Study was to compare the bioavailability of CaPre to LOVAZA, each administered as a single 4-gram dose with a high-fat meal, which is the condition under which administration of OM3 drugs will yield the highest levels of EPA and DHA in the blood, and therefore has the highest potential for toxicity. For us to rely on the long-term safety data of LOVAZA to support a 505(b)(2) NDA for CaPre, our results had to show that the blood levels of EPA and DHA resulting from a single 4-gram dose of CaPre, are not significantly higher than those from a single 4-gram dose of LOVAZA under fed (high-fat meal) conditions. The Bridging Study met all of its objectives and demonstrated that the levels of EPA and DHA following administration of CaPre did not exceed corresponding levels following administration of LOVAZA in subjects who were fed a high-fat meal. We expect that these results will support a claim by us that CaPre and LOVAZA have a comparable safety profile. Also, among subjects in a fasting state, CaPre demonstrated better bioavailability than LOVAZA, as measured by significantly higher blood levels of EPA and DHA. Since most HTG patients must follow a restricted low-fat diet, we believe that CaPre’s strong bioavailability profile could provide a more effective clinical solution for these patients.

We summarized and submitted data from our Bridging Study to the FDA for review and discussed it with the FDA at an End of Phase 2 meeting during the first quarter of 2017. We also presented our Bridging Study data at the National Lipid Association Conference in May 2017, and this data was subsequently published in the peer-reviewed Journal of Clinical Therapeutics in 2019. The graph below illustrates that the Bridging Study achieved all of its objectives:

| 13 |

Absorption of EPA and DHA as ethyl ester formulations in the currently available prescription OM3 drugs derived from fish oil (such as LOVAZA and VASCEPA) requires the breakdown of the ethyl esters by pancreatic enzymes (lipases) to be released into the blood. These particular enzymes are produced in response to the consumption of high-fat content meals, leading to optimal absorption of DHA and/or EPA. As a result, these OM3 ethyl ester formulations have demonstrated lower absorption and bioavailability when taken with a low-fat meal or on an empty stomach. As shown in our CAP13-101 study described further below, absorption of CaPre, which is formulated as a combination of OM3 phospholipids and free fatty acids, is not meaningfully affected by the fat content of a meal consumed prior to drug administration. Since a low-fat diet is typically a critical component for treatment of patients with sHTG, we believe that being able to effectively combine CaPre with a low-fat diet could give CaPre a significant clinical and marketing advantage over the ethyl ester-based OM3s, such as LOVAZA and VASCEPA, that must be taken with a high-fat meal to achieve optimal absorption.

Our CAP13-101 study was an open-label, randomized, multiple-dose, single-center, parallel-design study in healthy volunteers. 42 subjects were enrolled into 3 groups of 14 subjects who took 1 gram, 2 grams or 4 grams of CaPre, administered once a day, 30 minutes after breakfast. The objectives of the study were to determine the pharmacokinetic, or PK, profile and safety on Day 1 following a single oral dose and Day 14 following multiple oral doses of CaPre in individuals pursuing a low-fat diet (therapeutic lifestyle change diet). The effect of a high-fat meal on the bioavailability of CaPre was also evaluated at Day 15. Blood samples were collected for assessment of EPA and DHA total lipids in plasma to derive the PK parameters.

The PK profile of CaPre following multiple 4-gram doses obtained in the CAP13-101 study at Day 14 was compared to the results obtained in a similar PK study (Offman 2013 - ECLIPSE 2) where LOVAZA was also administered at 4 grams a day for 14 days with a low-fat diet. Although CaPre contains approximately 2.5 times less EPA and DHA compared to LOVAZA (approximately 310 mg/1g capsule for CaPre versus 770 mg/1g capsule for LOVAZA), when administered with a low-fat meal, CaPre plasma levels of EPA and DHA are very similar to those of LOVAZA. This is indicated by the area under the plasma drug concentration against time curve, or AUC, and the maximal plasma drug concentration. This study gives us confidence in the dosing and design of our TRILOGY Phase 3 program, as we believe blood levels of EPA and DHA should translate into efficacy of TG reduction. Our CAP 13-101 study gives us confidence that 4 grams/day of CaPre could be as effective in lowering TGs as LOVAZA. We anticipate that our TRILOGY Phase 3 clinical program will confirm if this hypothesis is correct.

As illustrated by the two graphs below, CaPre reached similar blood and therapeutic levels to LOVAZA after 14 daily doses of CaPre at 4 grams/day, despite CaPre containing 2.5 times less EPA and DHA compared to LOVAZA:

| 14 |

The graph below illustrates that the bioavailability of CaPre (total EPA+DHA levels in the blood) does not appear to be meaningfully affected by the fat content of a meal after multiple daily doses of CaPre at 4 grams/day (< 20% difference in AUC). We believe that CaPre’s strong bioavailability could represent a significant clinical advantage since taking it with a low-fat meal represents a more realistic and attractive regimen for patients with HTG who must follow a restricted low-fat diet.

Our CAP13-101 Study for CaPre Pharmacokinetics Shows No Significant Food Effect

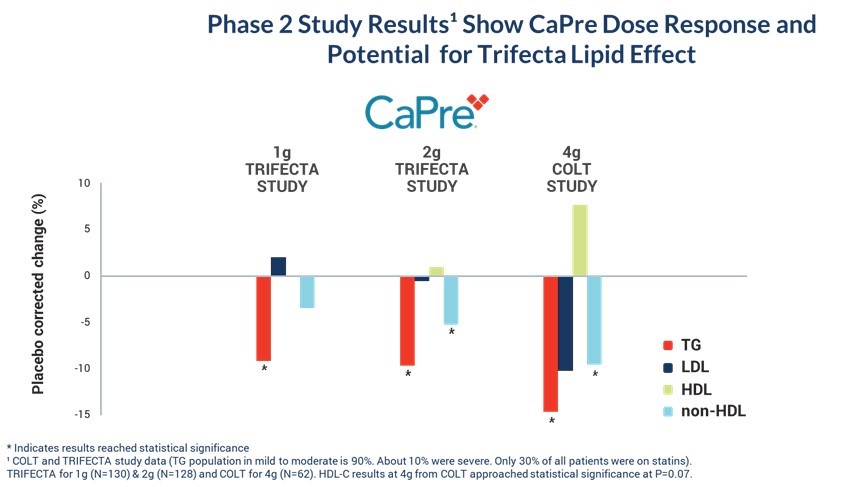

The graph below presents a summary of the effects of CaPre on patient lipid profiles as obtained in our completed TRIFECTA and COLT Phase 2 clinical trials. 90% of the patients in these clinical trials had mild to moderate HTG (levels between 200 - 499 mg/dL) and only 10% of patients had sHTG (levels between 500 and 877 mg/dL), which was the maximum level of TGs permitted by Health Canada’s study protocol. Only 30% of the participating patients were taking statins, which we believe is important because statins appear to enhance the TG-lowering effect of OM3s. In contrast, in our competitors’ summary data that follows, 100% of the patients in those studies with mild to moderate HTG were taking statins with their OM3s.

The summary data from our COLT and TRIFECTA clinical trials shows that CaPre significantly reduces TGs, but unlike some other prescription EPA/DHA-based OM3s, it has no deleterious effect on LDL-C and may potentially increase HDL-C (p=0.07), which we refer to as the “trifecta effect”. Also, a dose response was seen for all of the major lipid markers; the greater the dose of CaPre, the greater the beneficial effect of CaPre.

Our Phase 2 Study Results Show CaPre Dose Response and Potential for “Trifecta” Lipid Effect

* Indicates results reached statistical significance

TRIFECTA for 1g (N=130) & 2g (N=128) and COLT for 4g (N=62). HDL-C results at 4g from COLT approached statistical significance at P=0.07.

| 15 |

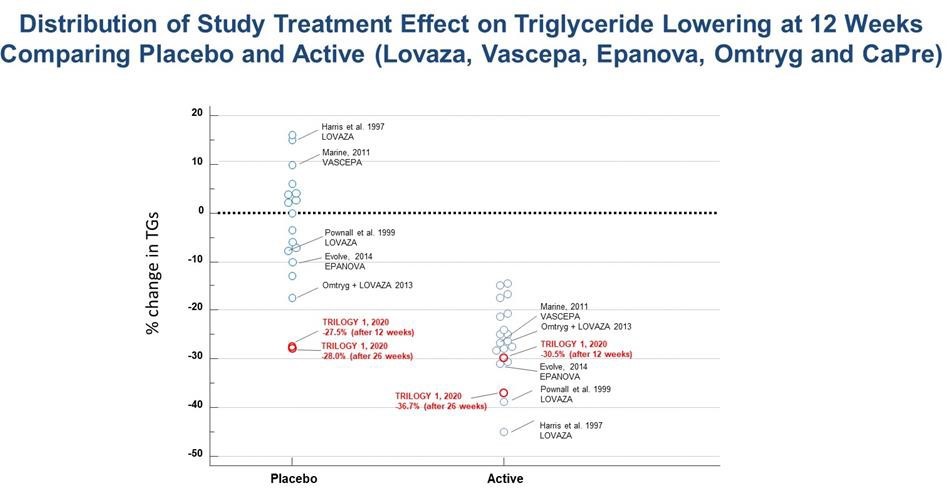

We conducted a subgroup analysis including only patients with sHTG, consisting of approximately 10% of the patients from our TRIFECTA study, to compare the effects of CaPre versus other OM3 drugs in the initial target population of patients with sHTG. Despite being given at a lower dose (only 1 gram and 2 grams), CaPre’s results compared very well with data from independent studies for the other prescription OM3 drugs that are FDA-approved for the treatment of sHTG at higher doses of 2 grams and 4 grams. While the results of this subgroup analysis were not statistically significant for CaPre (potentially due to the small sample size), numerically, the results compared well with the other OM3 drugs, even though CaPre was given at a much lower dose. The results for LDL-C, HDL-C and non-HDL-C levels in the subgroup shown in the table below are based on descriptive statistics only and are solely directional, meaning that no statistical testing was conducted, and so no “p” values were generated. Note also that VASCEPA’s TG-lowering results from Amarin’s MARINE study were inflated due to a significant placebo effect that increased TGs in the placebo group as compared to baseline levels. This resulted in VASCEPA’s placebo-corrected TG reduction being overstated by about 10%.

Since statins appear to enhance the TG-lowering property of OM3 drugs, we conducted a subgroup analysis that only included patients who were taking a statin at baseline in the COLT and TRIFECTA studies (approximately 30% of the population of both trials, combined). The graph below compares the TG-lowering effects of CaPre to other OM3s, all on a background of a statin drug, and shows that CaPre’s TG-lowering effects compare well with other FDA-approved OM3 drugs. We believe it is noteworthy that only 39 patients on 2 grams of CaPre in our TRIFECTA study (out of a total of 128) and only 22 patients on 4 grams of CaPre in our COLT study (out of 62) were taking statins.

The CaPre 2-gram bar graph in the table below shows the results from patients in our TRIFECTA trial who were taking statins. A statistically significant reduction in TGs (-25.7% placebo-corrected) was seen in that statin subgroup. The CaPre 4-gram bar graph in the table below shows patient results only from our COLT trial (as there was no 4-gram component for our TRIFECTA trial). None of the results were statistically significant at 4 grams of CaPre, potentially due to the small number of patients (22) in the statin subgroup.

As seen in the larger full study analyses in the tables above, CaPre does not show any deleterious effect on LDL, and shows the potential to decrease LDL and increase HDL (p=0.07). These observations will need to be confirmed in our TRILOGY Phase 3 program.

| 16 |

VASCEPA’s TG-lowering results from Amarin’s ANCHOR study were also inflated due to the use of mineral oil in their placebo group, which resulted in an increase of TG over baseline. This resulted in VASCEPA’s placebo-corrected TG reduction being overstated by about 6% in this study.

In summary, in addition to effectively reducing TG levels in patients with mild to sHTG, clinical data collected by us to date indicates that CaPre may also have:

| · | beneficial clinical effects on other blood lipids, such as HDL-C (good cholesterol) and non-HDL-C; |

| · | no deleterious effect on, and may potentially reduce, LDL-C (bad cholesterol) levels; |

| · | potential to benefit diabetes patients by reducing HbA1c, an important marker of diabetes; and |

| · | absorption capability that, unlike VASCEPA and LOVAZA, is not meaningfully affected by the fat content of a meal consumed prior to drug administration, providing patients with the reassurance that following their physician-recommended low-fat diet will still result in high absorption. |

We believe that these features could set CaPre apart from currently available FDA-approved OM3 treatment options in the marketplace and could give us a significant clinical and marketing advantage.

| 17 |

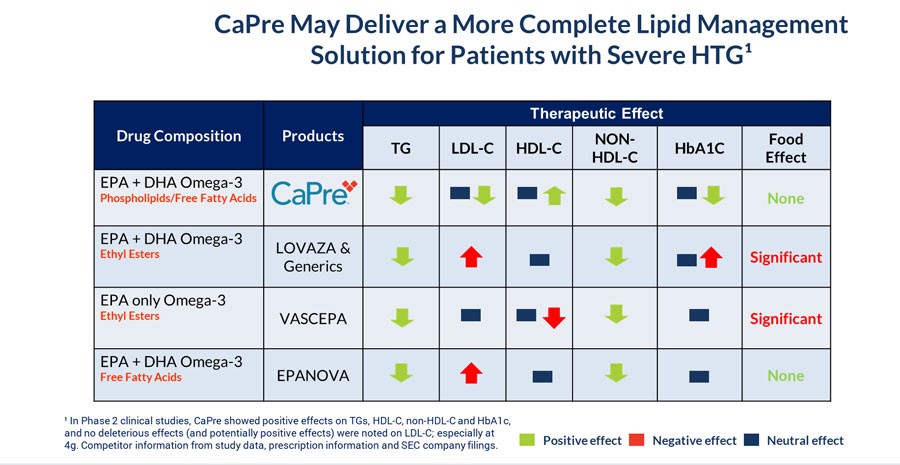

CaPre’s potential clinical benefits as compared to currently available FDA-approved OM3 treatment options are summarized in the table below and indicate that CaPre may deliver a more complete lipid management solution for patients with sHTG:

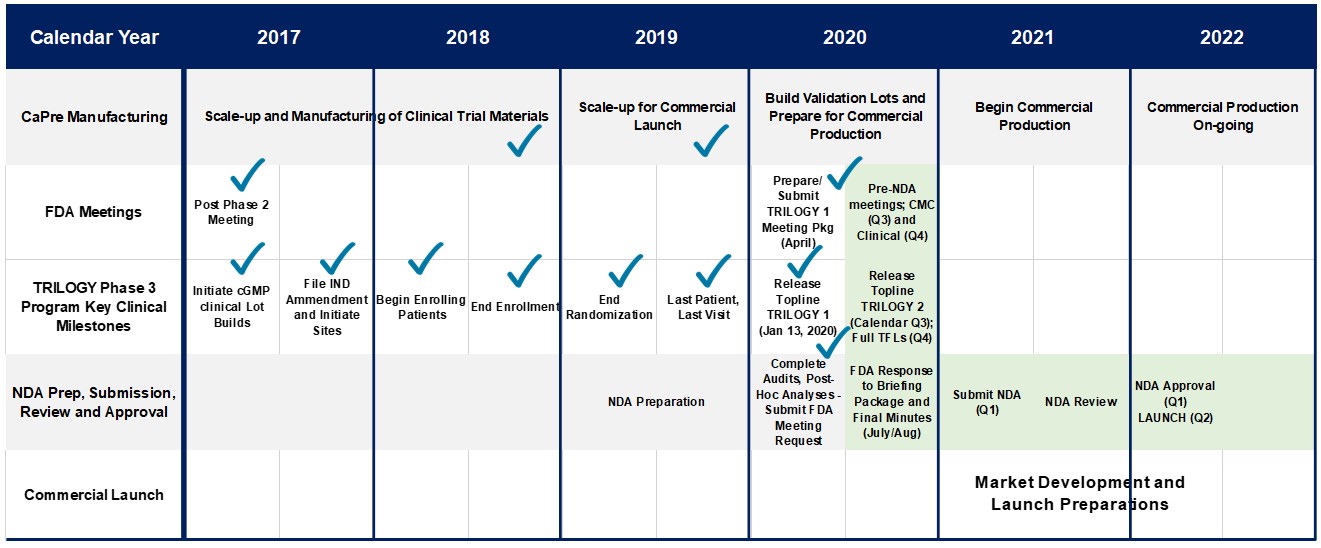

Our TRILOGY Phase 3 Program

In March 2017, we announced our plans to proceed with our TRILOGY Phase 3 program following our End-of-Phase 2 meeting with the FDA in February 2017. Based on the guidance we received from the FDA, we implemented two pivotal, randomized, placebo-controlled, double-blinded Phase 3 studies to evaluate the safety and efficacy of CaPre in patients with sHTG. These 26-week studies are evaluating CaPre’s ability to lower TGs from baseline in approximately 500 patients (approximately 250 per study) randomized to either 4 grams daily or placebo. The FDA’s feedback supported our plan to conduct two studies in parallel, potentially reducing the cost and shortening the time to an NDA submission. These studies were conducted in approximately 125 sites across North America.

The primary endpoint of these studies is to determine the efficacy of CaPre at 4 grams/day compared to placebo in lowering TGs after 12 weeks in sHTG patients, and to confirm safety and persistence of TG-lowering effect by following these patients for the full 26 weeks. The study was designed to provide at least 90% statistical power to detect a difference of at least a 20% decrease from baseline in TGs between CaPre and placebo. In addition, the TRILOGY Phase 3 studies included numerous secondary and exploratory endpoints, which are designed to assess the effect of CaPre on the broader lipid profile and certain metabolic, inflammatory and CVD risk markers.

In November 2017, we announced that Dariush Mozaffarian, M.D., Dr.P.H., agreed to serve as the principal investigator of our TRILOGY Phase 3 clinical program. Dr. Mozaffarian is a cardiologist and epidemiologist serving as the Jean Mayer Professor of Nutrition & Medicine, and the Dean of the Friedman School of Nutrition Science & Policy at Tuft’s University. His widely-published research focuses on how diets, such as those rich in OM3s, and lifestyle influence cardiometabolic health and how effective policies can improve health and wellness.

Late in 2017, based on feedback from the FDA, we finalized our Chemistry, Manufacturing, and Controls plans that support our TRILOGY Phase 3 program. The protocol for the TRILOGY 1 and 2 trials had input from and was approved by the FDA, and was essentially of the same standard design as has been used by all other companies having run previous trials in sHTG. In parallel with our Phase 3 clinical trial planning, additional cGMP production lots of our NKPL66 API and CaPre were manufactured, enabling us to build the CaPre and placebo inventory required to support the activated clinical trial sites and complete patient randomization. In the first calendar quarter of 2018, additional RKO was purchased and additional lots of CaPre were manufactured with this material for use in our TRILOGY Phase 3 program. With manufacturing of clinical trial material completed in 2019, our technical resources have been allocated to other activities related to the scale-up of manufacturing for a potential commercial launch of CaPre in early 2022.

| 18 |

Working with a major clinical research organization, we initiated our TRILOGY Phase 3 program and began site activation and patient enrollment at the end of 2017. The TRILOGY studies continued to progress on schedule throughout 2018 and 2019, and by the end of September 2019, both Phase 3 TRILOGY trials had reached 100% patient randomization at clinical sites across the United States, Canada and Mexico. The last visit for the last patient randomized in TRILOGY 1 occurred at the end of November 2019, and the last visit for the last patient randomized in TRILOGY 2 occurred in early January 2020.

The following chart illustrates the design and dosing of our TRILOGY Phase 3 program for CaPre.

Our first Phase 3 clinical trial, designated as TRILOGY 1, was conducted exclusively in the United States and was fully randomized with a final total of 242 patients. On January 13, 2020, we released topline results for TRILOGY 1, which, despite meaningful TG-lowering in the CaPre arm of the study, did not reach statistical significance due to an unusually large placebo effect described in more detail below. Our second Phase 3 clinical trial, designated TRILOGY 2, which is also fully randomized with a total of 278 patients, is being conducted in the United States, Canada and Mexico, and remains blinded pending proposed modifications to the SAP based on feedback from the FDA. We expect to report TRILOGY 2 topline results by the end of August 2020.

TRILOGY 1 Topline Results

On January 13, 2020, we announced preliminary topline results for the primary endpoint (TG reduction at 12 and 26 weeks) from our Phase 3 TRILOGY 1 trial for CaPre.

We reported a 30.5% median reduction in TG levels among all patients receiving CaPre, compared to a 27.5% median reduction in TG levels among patients receiving placebo at 12 weeks. We also reported a 42.2% median reduction in TGs among patients receiving CaPre while on background statin therapy at 12 weeks, compared to a 31.5% median reduction in TG levels among patients receiving placebo and on background statin therapy. In addition, we reported a 36.7% median reduction in TG levels among patients receiving CaPre at 26 weeks (end of the study), compared to a 28.0% median reduction in TG levels among patients receiving placebo. Both the placebo and CaPre study groups experienced significant reductions in TGs within the first four weeks from baseline, and even though the difference at 12 and 26 weeks was in favor of CaPre, due to the unexpectedly large placebo response, TRILOGY 1 did not reach statistical significance. The safety profile of CaPre in TRILOGY 1 was similar to placebo, as there was no significant difference in treatment-related serious adverse events in the trial. Results for all of the secondary and exploratory endpoints as well as topline results for TRILOGY 2 have subsequently been delayed, pending our investigation into the unusually large placebo effect observed in TRILOGY 1.

| 19 |

The observed reductions in TG levels in the TRILOGY 1 placebo group were far greater than that seen in any previous TG-lowering trial with a prescription OM3. The placebo used in the TRILOGY trials is simple cornstarch, which is a complex carbohydrate with a low glycemic index, and consequently would be expected to have a neutral effect on key biomarkers of patients in the placebo group. In similar previously conducted TG-lowering trials involving prescription OM3 preparations, the placebo responses (using corn oil, olive oil, or vegetable oil) ranged from a change of +16% to -17% across 18 interventions arms, with 14 of 18 arms ranging between +10% to -10%. Note that a low fat diet contains approximately 55% of energy as carbohydrates, and represents approximately 180-220g of carbohydrates per day. Consequently, an additional 4 grams/day of cornstarch (representing roughly 2% of daily intake) would not significantly add to this expected daily intake. In addition, cornstarch is generally regarded as safe (GRAS) and is a commonly used placebo in the pharma industry (the so-called “sugar pill”) that is well known to be an inert and inactive excipient, with low nutritive value. This justification was also noted by FDA.

A table summarizing the placebo and active TG-lowering results from all of these previous HTG trials is presented below:

With more investigation, we noted that 5 sites out of the total 54 enrolling sites disproportionately contributed to this placebo response and accounted for approximately 36% of the 242 patients enrolled in the TRILOGY 1 trial. By comparison, the TRILOGY 2 trial was conducted at 71 sites in Canada, Mexico and the United States that enrolled a total of 278 patients. The 5 sites also participated in the TRILOGY 2 trial; however, these sites accounted for only 12% of the total patients, with the majority of these patients coming from only two sites.

Despite monitoring activities conducted throughout the TRILOGY 1 trial to ensure adherence to the protocol and to identify protocol violations, we subsequently identified some unexpected and inconsistent findings that we believed may have negatively contributed to the overall topline results. These findings were explored via a comprehensive and rigorous review of the data and patient medical records, and on site audits of the five sites conducted by an independent team of auditors. To support this effort, we, our independent contract research organization, or CRO, that conducted the TRILOGY trials, our principal investigator Dr. Mozaffarian, and other clinical and regulatory advisors, conducted a thorough review of all data from patients taking both CaPre and placebo. These site audits and the post-hoc investigations of the data were completed in March 2020, and a Type C meeting request was filed with the FDA on April 1, 2020 with the intent to discuss the TRILOGY 1 data and gain alignment with the FDA on the interpretation of the results. We sought the FDA’s input on our proposed revisions to the pre-specified TRILOGY 2 SAP, and a proposal for pooling the data from the TRILOGY 1 and TRILOGY 2 clinical trials in support of an NDA filing. All of the findings and data were summarized and compiled into a briefing package that was filed with the FDA on April 29, 2020.

| 20 |

Given the need to complete the audits and extensive post-hoc review of the TRILOGY 1 data and to obtain FDA feedback, we decided to postpone the unblinding of the topline results for TRILOGY 2 until the third calendar quarter of 2020. Accordingly, key secondary and exploratory endpoints from both TRILOGY 1 and TRILOGY 2 trials are expected as soon as possible after the unblinding of TRILOGY 2 results. We continue to remain blinded to the TRILOGY 2 data, and now that we have feedback from the FDA, we intend to finalize the SAP and submit it to the FDA by the end of July 2020 and expect to report topline results by the end of August 2020.

TRILOGY 1 Findings based on Post-Hoc Analyses and Audits