UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

________________

FORM

| (Mark One) |

|

|

|

|

| | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

| For the fiscal year ended |

or

|

|

|

| | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

| For the transition period from to |

Commission File Number:

Proto Labs, Inc.

(Exact name of Registrant as specified in its charter)

| | |

| (State or other jurisdiction of | (I.R.S. Employer |

| incorporation or organization) | Identification No.) |

|

|

|

| |

|

| | |

| (Address of principal executive offices) | (Zip Code) |

(

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| | | |

Securities registered pursuant to Section 12(g) of the Act: None

____________________________________________

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the Registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the Registrant was required to submit such files).

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | Accelerated filer ☐ |

|

|

|

| Non-accelerated filer ☐ | Smaller reporting company |

|

| Emerging growth company |

If an emerging growth company, indicate by check mark if the Registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the Registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report.

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant's executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

As of June 30, 2022 (the last business day of the Registrant’s most recently completed second fiscal quarter), the aggregate market value of voting stock held by non-affiliates of the Registrant was approximately $

As of February 6, 2023, there were

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Registrant’s definitive proxy statement relating to its 2023 annual meeting of shareholders are incorporated by reference into Part III of this Annual Report on Form 10-K where indicated. Such proxy statement will be filed with the U.S. Securities and Exchange Commission within 120 days after the end of the fiscal year to which this report relates.

| Page |

||

| Item 1. |

||

| Item 1A. |

||

| Item 1B. |

||

| Item 2. |

||

| Item 3. |

||

| Item 4. |

||

| Item 5. |

||

| Item 6. |

||

| Item 7. |

Management's Discussion and Analysis of Financial Condition and Results of Operations |

|

| Item 7A. |

||

| Item 8. |

||

| Item 9. |

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

|

| Item 9A. |

||

| Item 9B. |

||

| Item 9C. | Disclosure Regarding Foreign Jurisdictions that Prevent Inspections | 82 |

| Item 10. |

||

| Item 11. |

||

| Item 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Shareholder Matters |

|

| Item 13. |

Certain Relationships and Related Transactions, and Director Independence |

|

| Item 14. |

||

| Item 15. |

||

Special Note Regarding Forward Looking Statements

Statements contained in this Annual Report on Form 10-K regarding matters that are not historical or current facts are “forward-looking statements” within the meaning of The Private Securities Litigation Reform Act of 1995. In some cases, you can identify forward-looking statements by the following words: “may,” “will,” “could,” “would,” “should,” “expect,” “intend,” “plan,” “anticipate,” “believe,” “estimate,” “predict,” “project,” “potential,” “continue,” “ongoing” or the negative of these terms or other comparable terminology, although not all forward-looking statements contain these words. These statements involve known and unknown risks, uncertainties and other factors which may cause our results to be materially different than those expressed or implied in such statements. In particular, some of the risks associated with our business include:

| • |

the level of competition in our industry and our ability to compete; |

|

|

|

|

|

| • |

our ability to respond to changes in our industry; |

|

|

|

|

|

| • |

our ability to effectively grow our business and manage our growth; |

|

|

|

|

|

| • |

our ability to continue to sell to existing and new customers; |

|

|

|

|

|

| • |

our ability to meet product developers’ and engineers’ needs and expectations regarding quick turnaround time, breadth of manufacturing processes, price and specifications for quality; |

|

|

|

|

|

| • |

the adoption rate of e-commerce and 3D CAD software by product developers and engineers; |

|

|

|

|

|

| • |

our ability to process a large volume of designs and identify significant opportunities in our business; |

|

|

|

|

|

| • |

our ability to maintain and enhance our brand; |

|

|

|

|

|

| • |

our ability to successfully identify, complete and integrate acquisitions or other strategic transactions; |

|

| • | our ability to complete and successfully launch updates to our systems; | |

|

|

|

|

| • |

the loss of key personnel or failure to attract and retain additional personnel; |

|

|

|

|

|

| • |

system interruptions at our operating facilities; |

|

|

|

|

|

| • |

possible unauthorized access to customers’ confidential information stored in our systems; and |

|

|

|

|

|

| • |

our ability to protect our intellectual property and not infringe on others’ intellectual property. |

Certain of these factors and others are described in the discussion on risk factors that appear in Part I, Item 1A. “Risk Factors” of this Annual Report on Form 10-K and uncertainties are detailed in this and other reports and filings with the Securities and Exchange Commission ("SEC"). Other unknown or unpredictable factors also could have material adverse effects on our future results. We cannot guarantee future results, levels of activity, performance or achievements. Accordingly, you should not place undue reliance on these forward-looking statements. Finally, except as required by law, we expressly disclaim any intent or obligation to update any forward-looking statements to reflect subsequent events or circumstances.

Overview

Proto Labs, Inc. was incorporated in Minnesota in 1999. The terms “Proto Labs,” the “Company,” “we,” “us,” and “our” as used herein refer to the business and operations of Proto Labs, Inc. and its subsidiaries. We are one of the world’s largest and fastest digital manufacturers of custom prototypes and on-demand production parts. Our mission is to empower companies to bring new ideas to market by offering the fastest and most comprehensive digital manufacturing service in the world. Our automated quoting and manufacturing systems allow us to produce commercial-grade plastic, metal, and liquid silicone rubber parts in as fast as one day. We manufacture prototype and low volume production parts for companies worldwide, who are under increasing pressure to bring their finished products to market faster than their competition. We utilize injection molding, computer numerical control (CNC) machining, 3D printing and sheet metal fabrication to manufacture custom parts for our customers. We have manufactured over 450 million parts for customers. For most of our offerings, our proprietary technology eliminates most of the time-consuming and expensive skilled labor conventionally required to quote and manufacture parts. Using our technology, we have analyzed over 13.0 million unique part designs. Our customers conduct nearly all of their business with us over the Internet. We target our products to the millions of product developers and engineers who use three-dimensional computer-aided design (3D CAD) software to design products across a diverse range of end-markets. In addition, we serve procurement and supply chain professionals seeking to manufacture custom parts on-demand. We have established our operations in the United States, Europe and Japan. We believe the United States and Europe are two of the largest geographic markets where product developers and engineers are located. On May 27, 2022, the Company's board of directors approved a plan for the closure of the Company's manufacturing facility in Japan and announced an intention to cease operations in the region. Through the acquisition of Hubs (formerly 3D Hubs, Inc.) (Hubs) in 2021, we are able to provide our customers access to a global network of premium manufacturing partners who reside across North America, Europe and Asia, complementing our in-house manufacturing. We believe our use of advanced technology enables us to offer significant advantages at competitive prices to many customers and is the primary reason we have become a leading supplier of custom parts.

We believe prototype and low volume custom parts manufacturing has historically been an underserved market due to the inefficiencies inherent in the quotation, equipment set-up and non-recurring engineering processes required to produce custom parts. Our customers typically order short run custom parts for a variety of reasons, including:

| ● |

they need a prototype to confirm the form, fit and function of one or more components of a product under development; |

|

| ● |

they need an initial supply of parts to support pilot production for testing of a product; |

|

| ● |

they need an initial supply of parts to support production while their tools for a high-volume production mold are prepared; |

|

| ● |

they need to meet their customers' variable demand for parts in a competitive timeframe; |

|

| ● |

their product will only be produced in a limited quantity and/or is highly customized; |

|

| ● |

they need to support end-of-life production in a cost-effective manner; |

|

| ● |

they want to avoid minimum order quantities or costs related to storing excess inventory; |

|

| ● |

they need access to diverse, cost competitive manufacturing capabilities and value the convenience of working with a single supplier to match parts to the best producer; or |

|

| ● |

they need low- to mid-volumes of parts on an irregular schedule and prefer to order on-demand. |

In each of these instances, we believe our solution provides product developers, engineers, and production buyers with an exceptional combination of speed, quality, competitive pricing, ease of use and reliability that they typically cannot find among conventional custom parts manufacturers. Our technology enables us to ship parts as soon as the same day after receipt of a customer’s design submission.

Our primary manufacturing product lines currently include Injection Molding, CNC Machining, 3D Printing and Sheet Metal. We continually seek to expand the range of size and geometric complexity of the parts we can make with these processes, to extend the variety of materials we are able to support and to identify additional manufacturing processes to which we can apply our technology in order to better serve the evolving preferences and needs of product developers and production buyers. Through the acquisition of Hubs, and as we complete the integration of our offerings, we will be providing our customers access to a global network of premium manufacturing partners which significantly expands the breadth and depth of our manufacturing capabilities. The acquisition of Hubs also allows us to offer customers a wider variety of lead times and pricing options, and an expanded envelope of parts (complexity, size, etc.).

Our increases in revenue can be attributed to expanding our customer base, broadening our parts envelope, and launching new manufacturing technologies. We were founded in 1999 with plastic injection molding, and have expanded our product lines over the years by the introduction of:

| ● |

CNC machining in 2007; |

| ● |

liquid silicon rubber (LSR) and lathe manufacturing processes that expanded the breadth and scope of our injection molding and CNC machining product lines in 2014; |

| ● |

3D printing, including stereolithography (SL), selective laser sintering (SLS), and direct metal laser sintering (DMLS), through our acquisition of FineLine Prototyping, Inc. (FineLine) in 2014 and expanded through our acquisition of certain assets of Alphaform AG (Alphaform) in 2015; |

| ● |

rapid overmolding technology in 2016 and insert molding technology in 2017, both of which expanded the breadth of our manufacturing capabilities in our Injection Molding product line; |

| ● |

PolyJet and Multi Jet Fusion (MJF) in 2017, which expanded the processes with which we produce 3D printed parts; |

| ● |

injection molding commercial offerings tailored to on-demand manufacturing customers in 2017; |

| ● |

sheet metal fabrication capability through our acquisition of RAPID Manufacturing Group, LLC (RAPID) in 2017; |

| ● |

expanded CNC machining capabilities for larger and more complex parts through our acquisition of RAPID in 2017; |

| ● |

Carbon Digital Light Synthesis(TM) (DLS) in 2019, which further expanded the processes with which we produce 3D printed parts; |

| ● |

enhancements to our e-commerce customer interface and back-end operations software in Europe in the fourth quarter of 2020 and in the United States in the first quarter of 2021 designed to add value for our customers and support the growth of the business in the future; |

| ● |

Hubs in 2021 to provide the platform to expand our offering for our customers by providing access to a global network of premium manufacturing partners; and |

| ● |

Critical-to-Quality First Article Inspection technology for Injection Molded prototypes and low-volume production parts in 2021. |

Industry Overview

We serve product developers and engineers worldwide who bring new ideas to market in the form of products containing one or more custom parts. Many of these product developers and engineers use 3D CAD software to create digital models representing their custom part designs that are then used to create physical parts for concept modeling, prototyping, functional testing, market evaluation or production. Custom prototype parts play a critical role in the product development process, as they provide product developers and engineers with the ability to test and confirm their intended performance requirements and explore design alternatives.

Our digital model supports the transition from prototyping to production and enables us to serve product developers and engineers through prototyping and product development. Our digital model also enables us to serve production buyers that are focused on bringing their end product to market in a scalable, cost-effective manner. Our internal manufacturing operations, augmented by external manufacturing partners through our acquisition of Hubs in 2021, allow us to provide solutions for the many customer use cases from prototyping to low-volume production in a broad range of lead time and pricing options.

We believe there are three significant trends disrupting the manufacturing industry today:

| ● |

SKU Proliferation – The increase in the number of products launched has been dramatic across many sectors. |

| ● |

Shorter Product Life Cycles – New products are launching faster and more frequently than ever before, partially driven by the internet of things and other connected device trends, resulting in shorter lives in the market. |

| ● |

Shift to E-commerce Sourcing – The first two trends, SKU proliferation and shorter product life cycles, put pressure on traditional supply chains causing many to adopt digital solutions and begin to invest in digital supply ecosystems. |

The impacts of these trends include increased volatility, reduced development time, increased variety to manage, higher pressure on development costs, shorter payback period in the market and reduced capital investment per product. Our digital thread makes us ideally suited to solve these challenges for many manufacturing companies by offering world-class speed, low upfront investment, no minimum order quantities, broad manufacturing capabilities, and flexibility to adapt to demand volatility.

Our Process

Our digital thread, which is the combination of our proprietary software and the physical manufacturing process, has enabled us to reinvent manufacturing. Our digital thread ties together each aspect of the online ordering and manufacturing processes, including 3D CAD modeling and visualization tools, proprietary design for manufacturability analysis (DFM), computer aided manufacturing, the manufacturing equipment, and the shop floor data collection systems. Digital manufacturing, and the addition of the digital thread, results in automation that reduces manufacturing and labor costs and increases throughput, enabling us to differentiate ourselves as one of the world’s fastest and most effective solutions for prototype and low volume production use cases.

Our technology allows us to manufacture a broad range of parts and products, across multiple industries and processes and enables us to serve a diverse set of customers. We currently serve all manufacturing industry verticals, with our top industries being medical and healthcare, computer electronics, industrial machinery and equipment, aerospace and automotive.

One example of our broad ability to serve our customers’ use cases is a prominent medical company that turned to Protolabs and its advanced capabilities to accelerate the development of its new product. The medical team needed 12 injection molding tools for multiple components—all from a single manufacturing supplier. To address their needs, we paired our digital factory capabilities and global supply network together for accelerated manufacturing, advanced mold production capabilities, and quality parts. In the end, we produced nine quick-turn tools through our molding factory and three high-requirement tools via our supply network. Supply chain complexity was ultimately simplified by being a one-stop digital manufacturing resource.

Customer Order

The customer order process begins when the customer uploads one or more 3D CAD models representing the desired part geometry through our web-based customer interfaces. Our websites provide a straightforward means for our customers to submit 3D CAD part designs, including managing projects with multi-part orders, across multiple services and capabilities. Our proprietary software uses complex algorithms to analyze the 3D CAD geometry, analyze its DFM and support the creation of an interactive, web-based quotation containing pricing and manufacturability information. Using this technology, we have analyzed over 13.0 million unique part designs. The artificial intelligence and machine learning provided by each analysis allows us to continually improve our DFM technology. When the analysis is complete, a link to the quotation is then e-mailed to the customer, who can access the quotation, change a variety of order parameters and instantly see the effect on price before finalizing the order.

Digital Manufacturing Process

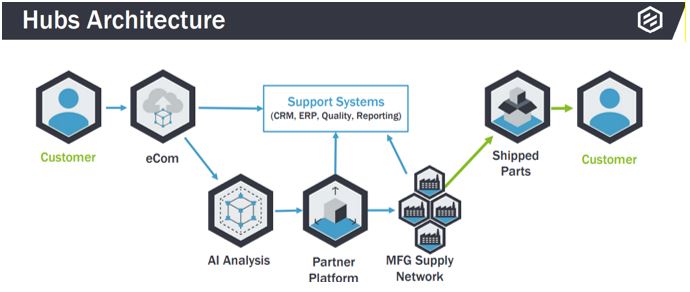

Our internal manufacturing operations produce parts in-house, while our outsourced manufacturing operations automatically route the parts for production by a global network of premium manufacturing partners.

Internal Manufacturing Operations

For our internal manufacturing operations, once the design is ready and the customer places the order, digital instructions are sent to the production floor where manufacturing can begin immediately. Our proprietary software and business process automates the non-recurring manufacturing engineering in many of our services, removing time and cost from the manufacture of the custom part. With the integrated digital thread, data is shared through the continuum of the manufacturing process, from product conception and design upload to manufacturing, inspection and delivery. This ensures consistency, quality and a high degree of automation. As a result of this automation, we are able to ship parts to customers with industry leading speed at scale.

Outsourced Manufacturing Operations to Network of Manufacturing Partners

Once a customer order is confirmed, Hubs’ proprietary software automatically routes the parts to the right manufacturing partner within minutes using a smart order routing system. Selected highlights of Hubs’ proprietary software platform are:

| ● |

Majority of ordered parts are instantly quoted |

| ● |

98% of orders are manufacturable and the design for manufacturability software developed in-house |

| ● |

Majority of sourced orders are paired automatically using smart order routing system |

|

| ● | Machine learning on data of over 12.0 million parts produced |

Shipping Parts to Customers

Once parts are produced through our digital manufacturing process, either in-house or by one of our manufacturing partners, the parts are shipped to our customer. Parts are shipped in as little as one business day from design submission. We ship our parts via small parcel common carriers on standard terms and conditions.

Our Product Lines

Our suite of services falls under our four main product offerings — Injection Molding, CNC Machining, 3D Printing and Sheet Metal. These product lines offer many engineers and buyers the ability to quickly and efficiently outsource their quick-turn custom parts manufacturing. See Item 7. “Management’s Discussion and Analysis of Financial Condition and Results of Operations” for the historical revenue generated by each of Injection Molding, CNC Machining, 3D Printing and Sheet Metal. In 2021, we augmented our internal manufacturing operations through our acquisition of Hubs to expand the envelope of custom parts we can provide to our customers through a network of premium manufacturing partners in each of our product lines.

Injection Molding

Our Injection Molding product line uses our 3D CAD-to-CNC machining technology for the automated design and manufacture of molds, which are then used to produce custom plastic and liquid silicone rubber injection-molded parts and over-molded and insert-molded injection-molded parts on commercially available equipment. Our Injection Molding product line works best for on-demand production, bridge tooling, pilot runs and functional prototyping. Our affordable molds and quick turnaround times help reduce design risk and limit overall production costs for product developers and engineers. Because we retain possession of the molds, customers who need short-run production often come back to Proto Labs’ Injection Molding product line for additional quantities. They do so to support pilot production for product testing, while their tooling for high-volume production is being prepared, because they need on-demand manufacturing due to disruptions in their manufacturing process, because their product requires limited annual quantity or because they need end-of-life production support. In 2017, we launched an on-demand manufacturing injection molding service. This service utilizes our existing processes, but is designed to fulfill the needs of customers with on-going production needs.

CNC Machining

Our CNC Machining product line uses commercially available CNC machines to offer milling and turning. CNC milling is a manufacturing process that cuts plastic and metal blocks into one or more custom parts based on the 3D CAD model uploaded by the customer. CNC turning is a subtractive manufacturing process that rotates a metal rod while a cutting tool is used to remove material and create final parts. Quick-turn CNC machining works best for prototyping, form and fit testing, jigs and fixtures and functional components for end-use applications.

Industrial 3D Printing

Our Industrial 3D Printing product line includes SL, SLS, DMLS, MJF, PolyJet, Carbon DLS and fused deposition modeling (FDM) processes, which offers customers a wide-variety of high-quality, precision rapid prototyping and low volume production. These processes create parts with a high level of accuracy, detail, strength and durability. Industrial 3D Printing is best suited for functional prototypes, complex designs and end-use applications.

Sheet Metal

Our Sheet Metal product line includes quick-turn and e-commerce-enabled custom sheet metal parts, providing customers with prototype and low-volume production parts. The rapid prototype sheet metal process is most often used when form, fit and function are all a priority. Our manufacturing process uses customer 3D CAD models uploaded by the customer to fabricate rapid prototyping sheet metal or end-use production parts and assemblies.

Our Growth Strategy

We currently operate in a global custom contract manufacturing market which is a form of outsourcing where companies enter into an arrangement or formal agreement with another company or individual for the manufacture of complete parts, products, or components. Since our inception, we have focused on areas where we could automate the manufacturing process via our digital model. Our initial focus was on prototypes and simple parts and have added complexity over time. We have added product lines and expanded those product lines to meet the needs of our customers, which has ultimately driven our growth. Historically, we focused on speed, reliability and quality as key components of our differentiation, and customers used us for production where there was a good fit. We have positioned ourselves to avoid routine, low margin, high-volume commoditized manufacturing. We have evolved from serving primarily fast response prototypes to broader customer use cases including higher requirements, such as a tighter tolerance, broader ranges of lead times and price points and quality and process documentation to support production needs. We have further expanded our offering through the acquisition of Hubs to be able to serve our customers more holistically, augmenting our in-house manufacturing capabilities with a network of premium manufacturing partners to serve our customer needs that currently reside outside of our internal manufacturing capabilities. As we integrate with Hubs, our goal is to go from being one of the fastest and most reliable providers of custom parts to one of the most comprehensive in our four services. Combining our unprecedented in-house manufacturing with Hubs broad services offer and wide variety of price and lead time options expands our ability to provide value to our customers and differentiates us from competitors.

The principal elements of our growth strategy are to:

Establish Platform (2022-2023)

We serve nearly all of our customers over the internet using our e-commerce, digital model. The majority of customers upload CAD files through our secure e-commerce platform to receive a quote, and ultimately, place an order. The order is then processed through our digital model that is connected by our systems.

In the fourth quarter of 2020 in Europe and in the first quarter of 2021 in the United States, we launched Protolabs 2.0 (PL 2.0), a project designed to enhance the functionality and ease of use of our platform and expanded the capabilities of our customer-facing and back-end systems in order to further increase automation and meet the evolving needs of product developers and engineers worldwide. In 2022, we launched the first iteration of our integrated offer in Europe, which allows us to offer CNC manufacturing for eligible parts through the combination of our internal digital manufacturing and our digital network of manufacturing partners.

In 2021, our e-commerce platform was recognized by the World Economic Forum’s Global Lighthouse Network, recognizing our industry leading efforts to implement Fourth Industrial Revolution (4IR) technologies at our Plymouth, MN injection molding facility. The Lighthouse Network serves as a platform for manufacturers showing leadership in using 4IR technologies to share and learn best practices, support new partnerships and help other manufacturers deploy technology, adopt sustainable solutions, and transform their workforces. By implementing manufacturing automation and industrial internet of things technologies like this, we are able to unlock new levels of sustainability and efficiency for ourselves and our customers.

We believe product developers and engineers have come to expect advanced web-based tools and a fully integrated Internet platform from their vendors. In the near term, PL 2.0 provides our customers a more simplified quoting and more intuitive user experience. It requires fewer clicks and provides a better overall buying experience. Further, it allows expanded production capabilities for our customers. In the long-term, we expect PL 2.0 will allow us to launch new services and capabilities faster, help integrate acquisitions more efficiently, and continue to improve the buying experience by monitoring customer feedback and how customers use the system.

Our integration of the Hubs platform will position us to be able to expand our offer to provide our customers with the broadest solution for custom parts and we will continue to deliver innovation through historic and future R&D investment. With the integration of the Protolabs and Hubs architectures into a united platform, we can provide customers a complete offer with a single e-commerce storefront. This combined architecture will connect customers to the right manufacturing solution based on their needs. We will provide a range of price and lead time options providing customers with the most comprehensive custom parts solution in the world.

Accelerate Growth (2022-2026)

Our launch of PL 2.0 and acquisition of Hubs in 2021 provides the foundation for us to accelerate growth. The enhanced customer experience and expanded offering portfolio is expected to drive higher customer satisfaction, higher annual revenue per customer and improved customer retention. In addition, the new platform will allow us to continue to expand our parts offerings and serve a broader set of customer use cases. We serve a diverse set of customers from over a dozen industries. Accordingly, unlike most traditional manufacturers, we are not reliant on a single industry for growth. Our customers range from small start-ups to multi-national corporations. We continue to capitalize on the e-commerce revolution, as product developers and engineers move from sourcing parts traditionally to the e-commerce experience for sourcing custom parts.

We primarily focus on two types of customers: design engineers and production buyers. Our original customer, and still our largest type of customer, is the design engineer. Design engineers typically value, in order of importance, reliability, speed, quality, breadth of manufacturing capabilities, ease of use and price. Our first growth opportunity is to capture more wallet share by being a single provider for all their needs. The breadth and depth of our offering expanded with our acquisition of Hubs, allowing us to better serve our design engineers. Our enhanced offering is expected to lead to higher customer retention, greater customer satisfaction and increased revenue per customer as we serve more of their product needs.

Our second type of customer is the production buyer. Our ability to move quickly from prototyping to production enables us to serve the low volume, on-demand production needs of our customers. Shorter product life cycles, unpredictable demand, and the need to get products to market more quickly have increased the demand for our production offering. Production buyers typically value, in order of importance, quality, total cost of ownership, reliability, breadth of manufacturing capabilities, ease of use and speed. Transitioning with our customers to production has been a newer growth strategy for us and we historically captured only a portion of production business. Through our internal R&D road map and our acquisition of Hubs, we continue to expand our production capabilities to be able to serve more of our customers’ needs, including offering a variety of price points and lead times, quality documentation and 3D printing production for certain use cases.

Finally, we anticipate our new complete and comprehensive offering will be attractive to new customers. We expect to continue to acquire new customers from traditional shops by communicating the advantages of digital manufacturing. The breadth of our offer will allow us to be a single supplier, or one-stop-shop, for all of our customer's needs.

Expand Profitability (2025 and beyond)

The market in which we play, the tremendous value we deliver to our customers and our ability to expand our capabilities to serve our customers, has allowed us to grow from revenue of $126.0 million in 2012, the year of our IPO, to revenue of $488.4 million in 2022. As we establish our platform and accelerate growth, we are positioned to serve customers more holistically, which we expect will drive continued, long-term sustainable revenue growth, and ultimately, expanded profitability.

In recent years, we have focused on expanding our capabilities and investing in building our base infrastructure to support our long-term growth. Our integrated offer and service expansion will provide the platform for accelerating our growth. Going forward, we aim to leverage scale and innovation to expand profitability and capture enhanced operational efficiencies.

Marketing

As a customer-centric organization, we continue to evolve our go-to-market strategy. We believe we have three marketing opportunities to capitalize on: 1) expanding business with existing customers, including engineers and buyers, 2) engaging buyers who are new to us and are increasing e-commerce spend as manufacturing digitalizes, and 3) capturing engineers who are new to us and are turning to digital manufacturing solutions. Our global marketing effort generates leads for our sales teams and seeks to strengthen our reputation as an industry leader in digital manufacturing services for custom prototyping and low-volume manufacturing. Since we are an agile, technology-based company, much of our marketing activities occur online. We use marketing automation software to enhance the productivity of our marketing and sales teams and continuously track the results of our campaigns to ensure our return on investment.

We maintain top-of-mind brand awareness with product developers and engineers through regular publication of technical information including design guidelines and helpful tips, engineering white papers, educational webinars, quick videos, and a quarterly journal focused on important industry topics. We also provide complimentary physical design aids to designers and engineers — as well as teachers and students — that highlight technical aspects of injection molding to help create efficient, well-designed parts. We believe these educational materials are key aspects of our lead generation efforts.

Marketing represents the face of Proto Labs, so it is our goal to actively and intelligently engage buyers and engineers across multiple mediums — whether print, online, social media or in person. By doing this, we gain new customers, drive sales and build brand equity.

Sales and Customer Service

We maintain an internal sales team trained in the basics of part design and the capabilities of our manufacturing product lines, as well as the key advantages of our processes over alternate methods of custom parts manufacturing. We organize our sales team into complementary roles: business development, account management and strategic account management, with the former focused on selling to new customer companies within targeted market segments and the latter two focused on expanding sales within existing customer companies.

We believe our sales staff is adept at researching customer companies and networking to find additional customers who may have a need for our products. We also have a team of customer service engineers who can support highly technical engineering discussions with product developers and engineers as required during the sales process. Our revenue is generated from a diverse customer base, with no single customer company representing more than 5% of our total revenue in 2022. In our history, we have served over 85% of the 2022 Fortune 500 companies in our target industries.

Competition

The market for custom parts manufacturing is fragmented, highly competitive and subject to rapid and significant technological change. Our potential competitors include:

| ● |

Other custom parts manufacturers. There are thousands of alternative manufacturing machine shops, injection molding suppliers, sheet metal fabricators, and 3D printing service bureaus and vendors worldwide. The size and scale of these businesses range from very small specialty shops to large, high-volume production manufacturers. |

| ● |

Brokers. There are an increasing number of digital brokers that provide product developers with a network of manufacturers, generally a subset of the other custom parts manufacturers described above, that can offer a diverse range of capabilities, capacity, competitive pricing and desired lead times to meet customer demand. |

| ● |

Captive in-house product manufacturing. Many larger companies undertaking product development have established additive rapid prototyping (3D printing), CNC machining, injection molding or sheet metal capabilities internally to support prototyping or manufacturing requirements of their product developers and engineers. |

We believe that the key competitive factors in our industry include:

| ● |

Quality: dimensional accuracy, surface finish, color and cleanliness; |

|

|

|

||

| ● |

Speed: turnaround time for quotations and parts; |

|

|

|

||

| ● |

Reliability: highly reliable delivery with predictable lead times; |

|

|

|

||

| ● |

Service: overall customer experience, from web interface to post-sales support; |

|

|

|

||

| ● |

Capability: range of part sizes and dimensional complexities supported, variety of manufacturing processes offered, materials supported and post-processing provided; |

|

|

|

||

| ● |

Scale: ability to support thousands of part designs in parallel; |

| ● |

Capacity: ability to manage peaks in demand with very short lead times and no minimum order quantities; and |

| ● |

Price: competitive mold and part pricing, including total cost of ownership. |

We believe that our digital end-to-end manufacturing capability positions us favorably and has enabled us to become a leader in our markets. We also believe that substantially all of our current direct competitors are smaller than us in terms of size of operations, revenue, number of customers and volume of parts sold, and generally lack our technological capabilities, or where developed at scale, have yet to operate profitably. However, our industry is evolving rapidly and other companies, including potentially larger and more established companies with developed technological capabilities, may begin to focus on low volume, high mix custom parts manufacturing. These companies could more directly compete with us, along with our existing competitors, and could also launch new products and product lines that we do not offer that may quickly gain market acceptance. Any of the foregoing could adversely affect our ability to attract customers.

Corporate Responsibility and Sustainability

Our corporate responsibility and sustainability practices are built on a foundation of shared fundamental values of teamwork, trust and achievement, and help us to deliver strong financial results that create value for our Company and our shareholders in a way that respects our communities and the environments in which we operate. The Company's three core values are embodied in everything we do.

| • |

Teamwork – We are dedicated to the idea that a diversity of minds is better than one. Through open communication, we strive to collaborate with and include all of our colleagues to maximize our creativity and to make our good ideas great. We respect each other’s opinions. We help colleagues who are struggling to improve, so our success is everyone’s success. |

| • |

Trust – Our integrity is built on honest answers to our customers and colleagues. It is okay to make mistakes if we use them to learn. We navigate difficult situations with compassion. The success of our Company depends on the success of our people. |

| • |

Achievement – Speed and innovation are the cornerstones of our success. We are committed to being a solution for getting things done quickly and sustainably and a catalyst for great ideas for our shareholders, customers, the environment and each other. We are responsible for our performance, our results and our future. |

2022 Environmental, Social and Governance Strategy and Risk Assessment Process

In 2021, our board of directors, executives and leaders throughout the organization focused to identify our top environmental, social and governance (ESG) priorities for 2022 and beyond. In 2022, for each of our top priorities, we focused to: (1) identify data, measures and metrics, (2) assess our current performance, (3) set both short- and long-term goals for each of our top priorities, and (4) begin to execute on our plans for each of these areas. The figure below shows the results of our ESG priority setting initiative in terms of both importance to shareholders and our Company’s success.

Our environmental key priorities include:

| • |

Environmental compliance |

| • |

Energy use reduction |

| • |

Waste management/recycling |

In 2022, our environmental initiative was to define our key priorities and focus areas. Once our key priorities were defined, we implemented cross functional teams to begin collecting base data related to energy use and waste management/recycling. Data is being monitored and tracked, with the intent to review 12 months of baseline data in 2023 to ensure action plans now and in the future are resulting in measurable results. For areas where data was not currently available, we are implementing action plans and processes to enable us to track baseline data in the future.

Our social key priorities include:

| • |

Ethics and integrity |

| • |

Employee health and well being |

| • | Diversity, equity and inclusion |

In 2022, we strived to define our key priorities and focus areas. We established goals and initiatives specific to each key area, determined whether goals were global or regional in nature and established action plans to drive improvement.

Our governance key priorities include:

| • |

Ethics, compliance and transparency |

| • | Regulatory management |

| • | Risk and crisis management |

In 2022, we developed a formal enterprise risk management program, which included input from our board of directors and various levels of company leadership. Our program includes formal enterprise and fraud risk assessments. The results of the enterprise risk management program will be used to drive governance key priorities and company strategy in 2023 and beyond. In addition, we set regulatory management goals around International Traffic in Arms Regulation and global export compliance and established enhanced decision authority and signatory matrices to drive governance oversight and compliance.

Environmental

| ● |

Digital Manufacturing Drives Sustainability |

As a digital manufacturer, we are able to assist our customers as they focus on materials management, operational productivity and on-demand solutions. Digital manufacturing is a solution our customers can deploy to reduce product waste by iterating part designs virtually, on a digital twin model before any actual production begins. With on-demand production of parts, there is also reduced reliance on storage facilities since inventory is virtual – the parts you need, when you need them. Our on-demand manufacturing model also helps customers with end-of-life planning for products, reducing the need for ordering excess parts with shifting market demand.

When paired with a robust e-commerce platform, digital manufacturing can also increase efficiencies in material selection and usage, the procurement process, and accelerating innovation. Furthermore, reducing scrap rate requires monitoring systems that enable automated process cycle sheet generation, ensuring run-to-run repeatability and reducing operator error. This kind of monitoring system can improve consistency in part production and reduce scrap costs, especially in injection molding and parts nonconformance. We believe sustainability in product development, and in manufacturing, is the future and we will continue to support our customers in their own sustainability journeys.

| ● |

Environmental Initiatives |

We are committed to having a positive impact on the environment. In 2022, we hosted InspirON in Europe, an online knowledge sharing event to focus on what design engineers need to consider when developing sustainable products for manufacturing. The event was designed to provide insight into designing more sustainable products and to explore how design can help make the manufacturing process greener and more efficient. The event covered topics ranging from: sustainable material selection, to the role that digital manufacturing and industry 4.0 will play, to how to develop and optimize a sustainable supply chain.

In 2021, we were awarded a Manufacturing Leadership Award from the National Association of Manufacturers (NAM) in the Sustainability Leadership category. This category recognizes companies embracing manufacturing processes that are non-polluting, conserve energy and natural resources, and are economically sound and safe for employees, communities, and consumers. In 2020, we installed nearly 1,900 solar panels on the roof of our facility in Plymouth, MN, one of our larger manufacturing facilities. The solar array covers nearly 20 percent of our energy use in Plymouth, MN and offsets the equivalent of 1.3 million pounds of CO2 and preserves 775 acres of forest annually.

We strive to maximize recycling in both our manufacturing and office facilities. In our manufacturing facilities, we recycle metal, plastic and water used throughout the manufacturing processes. Finally, the Green Team, an employee-led organization, educates our employees on how they can positively impact the environment, both at work and at home. The Green Team also provides opportunities for employees to positively impact the environment, including activities like roadside cleanup and tree planting.

Social

| ● |

Diversity, Equity and Inclusion |

At Protolabs, diversity, equity and inclusion matters. We are committed to nurturing a culture where we celebrate diversity, equity and inclusivity as a way of life. Our diversity and inclusion efforts start at the top with our board regularly reviewing initiatives. Our Diversity, Equity and Inclusion (DEI) Leadership Council was established to promote honest conversations, influence best practices and educate our employees. Our DEI Leadership Council members are employee representatives chosen from various functions and locations to work directly with our leadership team to drive change in our work environment. We also require certain employees to participate in annual unconscious bias training to further foster a work environment of fairness and sensitivity. As we continue to grow, we will continue to emphasize employee safety and having an inclusive work environment as top priorities. Our goal is to build diverse teams throughout the global organization and be a role model for the communities where we work and live. Uniqueness defines us as a company, from our custom products to our employees. Our pledge is to promote a global culture that invites, recognizes and embraces each individuals contributions to make a stronger “US”.

| ● |

Workforce Demographics |

As of December 31, 2022, we had 2,568 full-time employees, including 1,787 full-time employees in the United States, 777 full-time employees in Europe and 4 full-time employees in Japan. We also regularly use independent contractors and other temporary employees across the organization to augment our regular staff. We believe that our future success will depend in part on our continued ability to attract, hire and retain qualified, diverse and inclusive personnel.

We are an equal opportunity employer, and we believe that a diverse workforce made up of people with different ideas, strengths, interests and cultural backgrounds drives employee and business success. Our workforce is composed of a diverse group of engineers, technicians and business professionals from around the world and every walk of life.

We believe our employees are critical to our success and continually seek employee feedback to enhance employee engagement. In 2022, our attrition rates were higher than normal. Our attrition rates were 21.8% and 23.1% in the United States and Europe, respectively.

| ● |

Compensation and Benefits |

We believe our success depends in large measure on our ability to attract, retain and motivate a broad range of employees to be successful in a dynamic and changing business environment, and that a competitive compensation program is essential. In determining employee compensation, our executive leadership team reviews and considers several factors, including individual and corporate performance, input from managers, competitor market data from third party compensation surveys, our compensation philosophy and key principles, and the leadership’s collective experience and knowledge. Annually, our executive leadership team reviews input from managers throughout our organization, including recommendations as to compensation levels that the managers believe are commensurate with an individual’s job performance, skills, experience, qualifications, criticality to our company and development/career opportunities. We also award long-term equity-based compensation to high performing employees and managers who have the greatest impact on the creation of shareholder value to further align the interests of our employees and shareholders.

We provide employee benefits that meet or exceed the requirements of local law. We are committed to providing comprehensive benefits plans including, but not limited to, paid leave, retirement savings, health benefits, dental benefits, maternity leave, parental leave, family care leave, and childcare benefits. All overtime is performed and compensated in accordance with the law and the individual’s employment contract or other applicable contract or collective agreement.

| ● |

Education |

We firmly believe that investing in the education of our employees is critical to our success. Our employees are provided access to a robust learning management system that offers hundreds of courses on various topics ranging from compliance to leadership and for job-specific skills. In 2022 and 2021, employees spent an average of 36 and 14 hours, respectively, per employee in training sessions. We provide an Educational Assistance Program for employees, which offers financial assistance for both professional and personal development to inspire employees to continuously enhance their skills and knowledge. We have a customized leadership development program designed for current and aspiring managers in search of developing their leadership skills. The program provides training on topics that are aligned with our Leadership Principles and our Core Values. In 2022, we launched a pilot mentorship program to provide opportunity for mentors and mentees to accelerate their personal and professional development through a one-on-one guided relationship.

In order to ensure our industry remains robust, we are committed to supporting Science, Technology, Engineering and Mathematics (STEM) programs in the cities where we have facilities. Through the Protolabs Foundation, we provide STEM education grants to eligible organizations. In addition, we partner with schools, colleges and universities to provide various outreach opportunities and sponsorships.

| ● |

Health, Safety and Wellness |

We are committed to providing a safe and healthy working environment that minimizes health and safety risks. Our processes support accident prevention and prioritizes the health and safety of all of our employees and all others affected by their activities. We provide and require our employees to use personal protective equipment at all times. To ensure our employees understand the importance of safety, we provide regular, mandatory training.

We strive to continuously improve our employees’ health, safety and wellness. Our “I Am” safety program teaches that safety is the responsibility of every individual in our organization. We believe this program is the basis for our excellent safety compliance record. We believe that our employees are our most valuable asset, and their safety and health is among our top priorities.

In addition to concentrating on employee safety in the workplace, we also focus on the overall wellbeing of our employees. We continue to invest in a variety of employee health and wellness programs, including gym membership discounts, on-site yoga classes at certain facilities, wellness newsletters and learning sessions, and providing various Employee Assistance Programs.

| ● |

Charitable Giving |

We pride ourselves in being a responsible corporate citizen through our Protolabs Foundation. We support several charitable causes with our Employee Matching, Cool Ideas, and Major Gifts Programs. The Foundation’s efforts serve as a sustaining investment in the future of the communities where our employees live and work, and also a commitment to build talent to support the future employment needs of the manufacturing industry. ProtoGivers, our employee led community involvement team, organizes a wide variety of charitable activities, including blood drives, working for Habitat for Humanity projects, volunteering for Feed My Starving Children, and making financial contributions to charitable causes, many of which are matched through the Protolabs Foundation Employee Giving Program. Our financial support and our community outreach programs are intended to improve the quality of life in the communities where we have facilities.

| ● |

Human Rights |

We recognize our responsibility to protect human rights and we are committed to fostering an organizational culture which promotes support for internationally recognized human rights and labor standards. We strive to respect and promote human rights in accordance with the UN Guiding Principles on Business and Human Rights in our relationship with our employees, customers and suppliers. We have established a Human Rights Policy which is available on the Investor Relations section of our website.

| ● |

Supply Chain |

We are committed to conducting our business in accordance with the highest ethical standards and in compliance with all applicable laws, rules and regulations. We expect our suppliers to share our principles and uphold our standards and for each to develop policies and programs as appropriate to ensure that all workers understand and adhere to these standards. We have established a Vendor Code of Conduct Policy, including guidance on anti-bribery, privacy and data protection; responsible sourcing of materials; environmental standards; labor and human rights and anti-tax evasion. Our full policy is available on the Investor Relations section of our website.

Intellectual Property

We regard our patents, trademarks, service marks, trade dress, trade secrets, copyrights, domain names and other intellectual property as valuable to our business and rely on patent, trademark and copyright law, trade secret protection and confidentiality and/or license agreements with our employees, customers, vendors and others to protect our proprietary rights. We register our patents, trademarks and service marks in the United States and other jurisdictions as we deem appropriate. As of December 31, 2022, we owned and had applications pending for patents relating to various aspects of our quoting and manufacturing processes as follows:

| Jurisdiction |

Issued Patents | Applications Pending | ||||

| United States |

34 | 12 | ||||

| United Kingdom |

3 | 0 | ||||

| Netherlands |

1 | 0 |

Our patents have expiration dates ranging from 2023 to 2042. We also owned approximately 29 registered United States trademarks or service marks as of December 31, 2022, with corresponding registered protection in Europe and Japan for the most important of these marks such as PROTO LABS, HUBS, PROTOMOLD, FIRSTCUT, PROTOQUOTE, FIRSTQUOTE, PROTOFLOW and FINELINE, corresponding approved protection in Canada for PROTO LABS, FIRSTCUT and FINELINE, and corresponding registered protection in Australia, Canada and Mexico for PROTOMOLD. There can be no assurance that the steps we take to protect our proprietary rights will be adequate or that third parties will not infringe or misappropriate such rights. We have been subject to claims and expect to be subject to legal proceedings and claims from time to time in the ordinary course of our business. In particular, we may face claims from third parties that we have infringed their patents, trademarks or other intellectual property rights. Such claims, even if not meritorious, could result in the expenditure of significant financial and managerial resources. Any unauthorized disclosure or use of our intellectual property could make it more expensive to do business and harm our operating results.

Available Information

Our principal executive offices are located at 5540 Pioneer Creek Drive, Maple Plain, Minnesota 55359 and our telephone number is (763) 479-3680. Our website address is www.protolabs.com. Information on our website does not constitute part of this Annual Report on Form 10-K or any other report we file or furnish with the Securities and Exchange Commission (SEC). We provide free access to various reports that we file with or furnish to the SEC through our website as soon as reasonably practicable after they have been filed or furnished. These reports include, but are not limited to, our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and any amendments to these reports. Our SEC reports can be accessed through the investor relations section of our website.

The SEC maintains a website that contains reports, proxy and information statements, and other information regarding issuers that file information electronically with the SEC. The SEC’s website is www.sec.gov.

Executive Officers of the Registrant

Set forth below are the names of our current executive officers, their ages, titles, the year first appointed as an executive officer, and employment for the past five years:

| Robert Bodor |

50 |

President, Chief Executive Officer and Director |

| Daniel Schumacher | 48 | Chief Financial Officer |

| Oleg Ryaboy | 47 | Chief Technology Officer |

| Michael R. Kenison |

51 |

Vice President/General Manager – Americas |

| Bjoern Klaas |

53 |

Vice President/General Manager and Managing Director – Europe, Middle East and Africa |

Executive officers of the Company are elected at the discretion of the board of directors with no fixed terms. There are no family relationships between or among any of the executive officers or directors of the Company. There are no arrangements or understandings between any of the executive officers and any other persons pursuant to which they were selected as an officer.

Robert Bodor. Dr. Bodor has served as our President and Chief Executive Officer since March 2021. Prior to his current position, Dr. Bodor served as Vice President/General Manager - Americas since 2015. From July 2013 to January 2015, Dr. Bodor served as our Chief Technology Officer. From December 2012 to June 2013, Dr. Bodor served as our Director of Business Development. Prior to joining Proto Labs, from January 2011 to December 2012, Dr. Bodor held several roles at Honeywell, most recently leading SaaS business offerings for Honeywell’s Life Safety Division.

Daniel Schumacher. Mr. Schumacher has served as our Chief Financial Officer and principal financial and accounting officer since June 2022. Prior to his current role, Mr. Schumacher served as our Interim Chief Financial Officer since December 2021. Mr. Schumacher also led investor communication, forecasting and planning, and business intelligence for the Company as Vice President of Investor Relations and FP&A from April 2017 to December 2021. From 2015 to 2017, Mr. Schumacher served as finance director in the Americas Finance & Operations organization of Stratasys, Inc, a 3D Printing OEM. From 2001 to 2015, Mr. Schumacher was in finance leadership roles of increasing responsibility for Rockwell Automation, an industrial automation company.

Oleg Ryaboy. Mr. Ryaboy has served as our Chief Technology Officer since September 2022. Prior to joining Proto Labs, Mr. Ryaboy served from 2010 to 2022 as Chief Technology Officer and Senior Vice President at Digital River, a global e-commerce platform and software-as-a-service company providing online storefronts.

Michael Kenison. Mr. Kenison has served as our Vice President/General Manager - Americas since June 2021. Prior to his current position, Mr. Kenison led various teams at the Company, including as Vice President of Manufacturing, a role he held since 2013. Before his tenure at Protolabs, Mr. Kenison served in several leadership roles within the industry, including as Vice President of Manufacturing at Cardiac Science, Inc. - a medical device provider of defibrillator technology.

Bjoern Klaas. Mr. Klaas has led our Company’s business in Europe, Middle East and Africa as the Vice President and Managing Director since December 2017. Prior to joining Proto Labs, Mr. Klaas held key positions with global polymer supplier PolyOne from 2012 to 2017, most recently as its Vice President and General Manager for its ColorMatrix Group headquartered in the United States. From 2008 to 2012, Mr. Klaas worked at Colorant-Chromatics, a global leader for high temperature polymer formulations, as the General Manager for the global business.

The following are the significant factors that could materially adversely affect our business, financial condition, or operating results, as well as adversely affect the value of an investment in our common stock. The risks described below are not the only risks facing our Company. Risks and uncertainties not currently known to us or that we currently deem to be immaterial also may materially adversely affect our business, financial condition and operating results.

Risks Relating to Our Business

We face significant competition and expect to face increasing competition in many aspects of our business, which could cause our operating results to suffer.

The market for custom parts manufacturing is fragmented and highly competitive. We compete for customers with a wide variety of custom parts manufacturers and methods. Some of our current and potential competitors include captive in-house product lines, other custom parts manufacturers, brokers of custom parts and alternative manufacturing vendors such as those utilizing 3D printing processes. Moreover, some of our existing and potential competitors are researching, designing, developing and marketing other types of products and product lines. We also expect that future competition may arise from the development of allied or related techniques for custom parts manufacturing that are not encompassed by our patents, from the issuance of patents to other companies that may inhibit our ability to develop certain products and from improvements to existing technologies. Furthermore, our competitors may attempt to adopt and improve upon key aspects of our business model, such as development of technology that automates much of the manual labor conventionally required to quote and manufacture custom parts, implementation of interactive web-based and automated user interface and quoting systems and/or building scalable operating models specifically designed for efficient custom production. Third-party CAD software companies may develop software that mold-makers, injection molders and CNC machine shops could use to compete with our business model. Additive manufacturers may develop stronger, higher temperature resins or introduce other improvements that could more effectively compete with us on part quality. We may also, from time to time, establish alliances or relationships with other competitors or potential competitors. To the extent companies terminate such relationships and establish alliances and relationships with our competitors, our business could be harmed.

Existing and potential competitors may have substantially greater financial, technical, marketing and sales, manufacturing, distribution and other resources and name recognition than us, as well as experience and expertise in intellectual property rights and operating within certain international locations, any of which may enable them to compete effectively against us.

Though we plan to continue to expend resources to develop new technologies, processes and product lines, we cannot assure you that we will be able to maintain our current position or continue to compete successfully against current and future sources of competition. Our challenge to develop new products manufactured internally is finding product lines for which our automated quotation and manufacturing processes offer an attractive value proposition, and we may not be able to find any new product lines with potential economies of scale similar to our existing product lines. We mitigate this risk through products offered by our manufacturing partner network via our acquisition of Hubs in 2021. If we do not keep pace with technological change and introduce new technologies, processes and product lines, the demand for our products and product lines may decline and our operating results may suffer.

We may not timely and effectively scale and adapt our existing technology, processes and infrastructure to meet the needs of our business.

A key element to our continued growth is the ability to quickly and efficiently quote an increasing number of product developer and engineer submissions across geographic regions and to manufacture the related parts. This will require us to timely and effectively scale and adapt our existing technology, processes and infrastructure to meet the needs of our business. With respect to our websites and quoting technology, it may become increasingly difficult to maintain and improve their performance, especially during periods of heavy usage and as our solutions become more complex and our user traffic increases across geographic regions. Similarly, our manufacturing automation technology may not enable us to process the large numbers of unique designs and efficiently manufacture the related parts in a timely fashion to meet the needs of product developers and engineers as our business continues to grow. Any failure in our ability to timely and effectively scale and adapt our existing technology, processes and infrastructure could negatively impact our ability to retain existing customers and attract new customers, damage our reputation and brand, result in lost revenue, and otherwise substantially harm our business and results of operations.

Economic uncertainty arising from the recent COVID-19 pandemic has adversely affected our business and results of operations and could continue to do so in the future.

On March 11, 2020, the World Health Organization declared the outbreak of the novel coronavirus (COVID-19) a pandemic. The COVID-19 pandemic and associated counter-acting measures implemented by governments around the world, as well as increased business uncertainty, has adversely affected our business and results of operations and could continue to do so in the future. The Company is monitoring the global COVID-19 pandemic and has taken steps to mitigate the risks to our employees, customers, suppliers and other stakeholders. The current business environment and quickly evolving market conditions require significant management judgment to interpret and quantify the actual and potential impact on our assumptions about future financial performance and operating cash flows. To the extent that changes in the current business environment continue to impact our ability to achieve levels of forecasted operating results and cash flows, if our stock price were to trade below book value per share for an extended period of time and/or should other events occur indicating the carrying value of our assets might be impaired, we may be required to recognize impairment losses on goodwill, intangible and tangible assets.

Numerous factors may cause us not to maintain the revenue growth that we have historically experienced.

We believe that our continued revenue growth will depend on many factors, a number of which are out of our control, including among others, our ability to:

| • |

retain and further penetrate existing customer companies, as well as attract new customer companies; |

|

|

|

|

|

| • |

consistently execute on custom part orders in a manner that satisfies product developers’ and engineers’ needs and provides them with a superior experience; |

|

|

|

|

|

| • |

develop new technologies or manufacturing processes and broaden the range of parts we offer; |

|

|

|

|

|

| • |

successfully execute on our international strategy and expand into new geographic markets; |

|

|

|

|

|

| • |

capitalize on product developer and engineer expectations for access to comprehensive, user-friendly e-commerce capabilities 24 hours per day, 7 days per week; |

|

|

|

|

|

| • |

increase the strength and awareness of our brand across geographic regions; |

|

|

|

|

|

| • |

respond to changes in product developer and engineer needs, technology and our industry; |

|

| • |

successfully integrate operations and offerings of acquisitions; | |

|

|

|

|

| • |

react to challenges from existing and new competitors; |

|

|

|

|

|

| • |

continue to attract and retain R&D professionals who will continue to expand our technologies; and | |

| • |

respond to an economic recession which negatively impacts manufacturers' ability to innovate and bring new products to market. |

We cannot assure you that we will be successful in addressing the factors above and continuing to grow our business and revenue.

Interruptions to, or other problems with, our website and interactive user interface, information technology systems, manufacturing processes or other operations could damage our reputation and brand and substantially harm our business and results of operations.

The satisfactory performance, reliability, consistency, security and availability of our websites and interactive user interface, information technology systems, manufacturing processes and other operations are critical to our reputation and brand, and to our ability to effectively service product developers and engineers. Any interruptions or other problems that cause any of our websites, interactive user interface or information technology systems to malfunction or be unavailable, or negatively impact our manufacturing processes or other operations, may damage our reputation and brand, result in lost revenue, cause us to incur significant costs seeking to remedy the problem and otherwise substantially harm our business and results of operations.

A number of factors or events could cause such interruptions or problems, including among others: human and software errors, design faults, challenges associated with upgrades, changes or new facets of our business, power loss, telecommunication failures, fire, flood, extreme weather, political instability, acts of terrorism, war, break-ins and security breaches, contract disputes, labor strikes and other workforce-related issues, capacity constraints due to an unusually large number of product developers and engineers accessing our websites or ordering parts at the same time, and other similar events. These risks are augmented by the fact that our customers come to us largely for our quick-turn manufacturing capabilities and that accessibility and turnaround speed are often of critical importance to these product developers and engineers. We are dependent upon our facilities through which we satisfy all of our production demands, as well as managerial, customer service, sales, marketing and other similar functions, and we have not identified alternatives to these facilities or established fully redundant systems in multiple locations. However, we have redundant computing systems for each of our United States and European operations. In addition, we are dependent in part on third parties for the implementation and maintenance of certain aspects of our communications and production systems, and therefore preventing, identifying and rectifying problems with these aspects of our systems is to a large extent outside of our control.

Moreover, the business interruption insurance that we carry may not be sufficient to compensate us for the potentially significant losses, including the potential harm to the future growth of our business that may result from interruptions in our product lines as a result of system failures.

We store confidential customer information in our systems that, if breached or otherwise subjected to unauthorized access, may harm our reputation or brand or expose us to liability.

Our system stores, processes and transmits our customers’ confidential information, including the intellectual property in their part designs and other sensitive data. We rely on encryption, authentication and other technologies licensed from third parties, as well as administrative and physical safeguards, to secure such confidential information. Any compromise of our information security could damage our reputation and brand and expose us to a risk of loss, costly litigation and liability that would substantially harm our business and operating results. We may not have adequately assessed the internal and external risks posed to the security of our company’s systems and information and may not have implemented adequate preventative safeguards or take adequate reactionary measures in the event of a security incident. In addition, most states have enacted laws requiring companies to notify individuals and often state authorities of data security breaches involving their personal data. These mandatory disclosures regarding a security breach often lead to widespread negative publicity, which may cause our existing and prospective customers to lose confidence in the effectiveness of our data security measures. Any security breach, whether successful or not, would harm our reputation and brand and could cause the loss of customers.

Aspects of our business are subject to privacy, data use and data security regulations, which may impact the way we use data to target customers.