U. S. SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 10-Q

| x | Quarterly report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the quarterly period ended September 30, 2016

| ¨ | Transition report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the transition period from to .

Commission File Number 001-34409

RECON TECHNOLOGY, LTD

(Exact name of registrant as specified in its charter)

| Cayman Islands | Not Applicable | |

|

(State or other jurisdiction of incorporation or organization) |

(I.R.S. employer identification number) |

1902 Building C, King Long International Mansion

9 Fulin Road, Beijing 100107

People’s Republic of China

(Address of principal executive offices and zip code)

+86 (10) 8494-5799

(Registrant’s telephone number, including area code)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company.

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |||

| Non-accelerated filer | ¨ | (Do not check if a smaller reporting company) | Smaller reporting company | x |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

Indicate the number of shares outstanding of each of the issuer’s classes of ordinary shares, as of the latest practicable date. The Company is authorized to issue 100,000,000 ordinary shares. As of October 31, 2016 , the Company has issued and outstanding 6,230,792 shares.

RECON TECHNOLOGY, LTD

FORM 10-Q

INDEX

| Special Note Regarding Forward-Looking Statements | ii | ||

| Part I Financial Information | 1 | ||

| Item 1. | Financial Statements (Unaudited). | 1 | |

| Item 2. | Management’s Discussion and Analysis of Financial Condition and Results of Operations. | 1 | |

| Item 3. | Quantitative and Qualitative Disclosures about Market Risk. | 13 | |

| Item 4. | Controls and Procedures. | 14 | |

| Part II Other Information | 15 | ||

| Item 1. | Legal Proceedings. | 15 | |

| Item 1A. | Risk Factors. | 15 | |

| Item 2. | Unregistered Sales of Equity Securities and Use of Proceeds. | 15 | |

| Item 3. | Defaults upon Senior Securities. | 15 | |

| Item 4. | Mine Safety Disclosures. | 15 | |

| Item 5. | Other Information. | 15 | |

| Item 6. | Exhibits. | 16 | |

Special Note Regarding Forward-Looking Statements

This document contains certain statements of a forward-looking nature. Such forward-looking statements, including but not limited to projected growth, trends and strategies, future operating and financial results, financial expectations and current business indicators are based upon current information and expectations and are subject to change based on factors beyond the control of the Company. Forward-looking statements typically are identified by the use of terms such as “look,” “may,” “should,” “might,” “believe,” “plan,” “expect,” “anticipate,” “estimate” and similar words, although some forward-looking statements are expressed differently. The accuracy of such statements may be influenced by a number of business risks and uncertainties that could cause actual results to differ materially from those projected or anticipated, including but not limited to the following:

| • | the timing of the development of future products; |

| • | projections of revenue, earnings, capital structure and other financial items; |

| • | statements of our plans and objectives; |

| • | statements regarding the capabilities of our business operations; |

| • | statements of expected future economic performance; |

| • | statements regarding competition in our market; and |

| • | assumptions underlying statements regarding us or our business. |

Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof. The Company undertakes no obligation to update this forward-looking information. Nonetheless, the Company reserves the right to make such updates from time to time by press release, periodic report or other method of public disclosure without the need for specific reference to this report. No such update shall be deemed to indicate that other statements not addressed by such update remain correct or create an obligation to provide any other updates.

ii

| Item 1. | Financial Statements. |

See the unaudited condensed consolidated financial statements following the signature page of this report, which are incorporated herein by reference.

| Item 2. | Management’s Discussion and Analysis of Financial Condition and Results of Operations. |

The following discussion and analysis of our company’s financial condition and results of operations should be read in conjunction with our unaudited condensed consolidated financial statements and the related notes included elsewhere in this report. This discussion contains forward-looking statements that involve risks and uncertainties. Actual results and the timing of selected events could differ materially from those anticipated in these forward-looking statements as a result of various factors.

Overview

We are a company with limited liability incorporated in 2007 under the laws of the Cayman Islands. Headquartered in Beijing, we provide products and services to oil and gas companies and their affiliates through Nanjing Recon Technology Co. Ltd (“Nanjing Recon”) and Beijing BHD Petroleum Technology Co, Ltd (“BHD”), hereafter referred to as our domestic companies (the “Domestic Companies”), which are established under the laws of the People’s Republic of China (“PRC”). As the Company contractually controls the Domestic Companies, we serve as the center of strategic management, financial control and human resources allocation. Due to this contractual control and our obligation to bear the losses of the Domestic Companies, we consider them to be variable interest entities (“VIEs”) for accounting purposes and consolidate their results in our financial statements.

Through Nanjing Recon and BHD, our business is mainly focused on the upstream sectors of the oil and gas industry. We derive our revenues from the sales and provision of (1) oilfield automation products, (2) equipment for oil and gas production and transportation, (3) waste water treatment products, and (4) engineering services. Our products and services involve most of the key procedures of the extraction and production of oil and gas, and include automation systems, equipment, tools and on-site technical services.

| • | Nanjing Recon: Nanjing Recon is a high-tech company that specializes in automation services for oilfield companies. It mainly focuses on providing automation solutions to the oil exploration industry, including monitoring wells, automatic metering to the joint station production, process monitor, and a variety of oilfield equipment and control systems. |

| • | BHD: BHD is a high-tech company that specializes in transportation equipment and stimulation productions and services. Possessing proprietary patents and substantial industry experience, BHD has built up stable and strong working relationships with the major oilfields in China. |

Recent Developments

As of the first quarter of fiscal year 2017, the Company has achieved remarkable achievement in oilfield waste water treatment segment. In January 2016, the Company announced its cooperation with Qinghai Oilfield Company, signing an agreement to sell the oilfield RMB3.98 million of related products and services. For the three months period as of September 30, 2016, the Company has completed this agreement and continues to expand markets in environmental protection industry, including oilfield water treatment and other industrial and sewage disposal projects.

The Company has also developed new clients in China’s top producing Changqing Oilfield, which is located in China’s Xi’an Province. The Company has signed sales contracts for furnaces as of the report day. Management expects further improvement in the coming year.

| 1 |

Products and Services

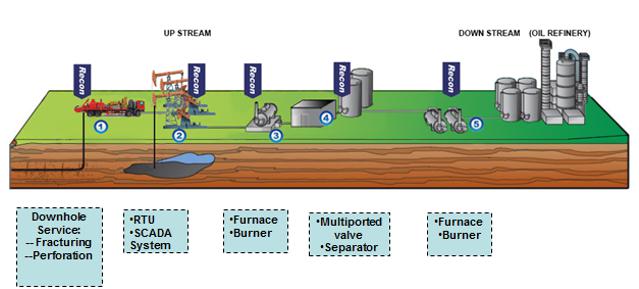

We currently provide products and services to oil and gas field companies focused on the development and production of oil and natural gas. Our products and services described below correlate to the numbered stages of the oilfield production system graphical expression shown below.

Our products and services include:

Equipment for Oil and Gas Production and Transportation

High-Efficiency Heating Furnaces (as shown above). Crude petroleum contains certain impurities that must be removed before it can be sold, including water and natural gas. To remove the impurities and to prevent solidification and blockage in transport pipes, companies employ heating furnaces. BHD researched, developed and implemented a new oilfield furnace that is advanced, highly automated, reliable, easy to operate, safe and highly heat-efficient (90% efficiency).

Burner (as shown above). We serve as an agent for the Unigas Burner, which is designed and manufactured by UNIGAS, a European burning equipment production company. The burner we provide has the following characteristics: high degree of automation, energy conservation, high turn-down ratio, high security and environmental safety.

Oil and Gas Production Improvement Techniques

Packers of Fracturing. This utility model is used in concert with the security joint, hydraulic anchor, and slide brushing of sand spray in the well. It is used for easy seat sealing and sand uptake prevention. The utility model reduces desilting volume and prevents sand-up, which makes the deblocking processes easier to realize. The back flushing is sand-stick proof.

Production Packer. At varying withdrawal points, the production packer separates different oil layers and protects the oil pipe from sand and permeation, promoting the recovery ratio.

Sand Prevention in Oil and Water Well. This technique processes additives that are resistant to elevated temperatures into “resin sand” which is transported to the bottom of the well via carrying fluid. The resin sand goes through the borehole, piling up and compacting at the borehole and oil vacancy layer. An artificial borehole wall is then formed, functioning as a means of sand prevention. This sand prevention technique has been adapted to more than 100 wells, including heavy oil wells, light oil wells, water wells and gas wells, with a 100% success rate and a 98% effective rate.

| 2 |

Water Locating and Plugging Technique. High water cut affects the normal production of oilfields. Previously, there was no sophisticated method for water locating and tubular column plugging in China. The mechanical water locating and tubular column plugging technique we have developed resolves the problem of high water cut wells. This technique conducts a self-sealing test during multi-stage usage and is reliable to separate different production sets effectively. The water location switch forms a complete set by which the water locating and plugging can be finished in one trip. The tubular column is adaptable to several oil drilling methods and is available for water locating and plugging in second and third class layers.

Fissure Shaper. This is our proprietary product that is used along with a perforating gun to effectively increase perforation depth by between 46% and 80%, shape stratum fissures, improve stratum diversion capability and, as a result, improve our ability to locate oilfields and increase the output of oil wells.

Fracture Acidizing. We inject acid to layers under pressure, which can form or expand fissures. The treatment process of the acid is defined as fracture acidizing. The technique is mainly adapted to oil and gas wells that are blocked up relatively deeply, or oil and gas wells in low permeability zones.

Electronic Break-Down Service. This service resolves block-up and freezing problems by generating heat from the electric resistivity of the drive pipe and utilizing a loop tank composed of an oil pipe and a drive pipe. This technique saves energy and is environmentally friendly. It can increase the production of oilfields that are in the middle and later periods.

Automation System and Services

Pumping Unit Controller. This controller functions as a monitor to the pumping unit and also collects data for load, pressure, voltage, and startup and shutdown control.

RTU Monitor. This monitor collects gas well pressure data.

Wireless Dynamometer and Wireless Pressure Gauge. These products replace wired technology with cordless displacement sensor technology. They are easy to install and significantly reduce the work load associated with cable laying.

Electric Multi-way Valve for Oilfield Metering Station Flow Control. This multi-way valve is used before the test separator to replace the existing three valve manifolds. It facilitates the electronic control of the connection of the oil lead pipeline with the separator.

Natural Gas Flow Computer System. The flow computer system is used in natural gas stations and gas distribution stations to measure flow.

Recon Supervisory Control and Data Acquisition System (“SCADA”). Recon SCADA is a system which applies to the oil well, measurement station and the union station for supervision and data collection.

EPC Service of Pipeline SCADA System. This service technique is used for pipeline monitoring and data acquisition after crude oil transmission.

EPC Service of Oil and Gas Wells SCADA System. This service technique is used for monitoring and data acquisition of oil wells and natural gas wells.

EPC Service of Oilfield Video Surveillance and Control System. This video surveillance technique is used for controlling the oil and gas wellhead area and the measurement station area.

Technique Service for “Digital oilfield” Transformation. This service includes engineering technique services such as oil and gas SCADA systems, video surveillance and control systems and communication systems.

| 3 |

Factors Affecting Our Business

Business Outlook

The oilfield engineering and technical service industry is generally divided into five sectors: (1) exploration, (2) drilling and completion, (3) testing and logging, (4) production and (5) oilfield construction. Thus far our businesses have been involved in the completion, production and construction processes. Our management still believes we need to expand our core business, move into new markets and develop new businesses quickly for the coming years. Management anticipates there will be opportunities in new markets and our existing markets. We also believe that many existing wells and oilfields need to improve or renew their equipment and service to maintain production and techniques and services like ours will be needed as new oil and gas fields are developed. In the next three years, we plan to focus on the following:

Measuring Equipment and Service. Digital oil field technology and the management of oil companies are highly regarded in the industry. We believe our oilfield SCADA system and assorted products, production managing expert software, and related technical support services will address the needs of the oil well automation system market, for which we believe there will be increasing demand over the short term and strong needs in the long term.

Gathering and Transferring Equipment. With more new wells developed, our management anticipates that demand for our furnaces and burners will grow as compared to last year, especially in the Qinghai Oilfield and Zhongyuan Oilfield.

New business. We have been developing new products for oilfield wastewater treatment and achieved preliminary business on this segment. Our management anticipates expanding the new business more rapidly in the coming year.

Growth Strategy

As a smaller China-focused company, our basic strategy focuses on developing our onshore oilfield business in the upstream sector of the industry.

Large domestic oil companies have historically focused on their exploration and development businesses to earn higher margins and maintain their competitive advantage. With regard to private oilfield service companies, we estimate that approximately 90% specialize in the manufacture of drilling and production equipment. Thus, the market for technical support and project service is still in its early stage. Our management is focused on providing high quality products and services in oilfields in which we have a geographical advantage. This helps us to avoid conflicts of interest with bigger suppliers of drilling equipment while protecting our position within this market segment. Our mission is to increase the automation and safety levels of industrial petroleum production in China and improve the underdeveloped working process and management mode used by many companies by providing advanced technologies. At the same time, we are always looking to improve our business and to increase our earning capability.

Recent Industry Developments

Affected by the worldwide decrease in oil prices, CNPC and Sinopec, parent companies of our direct clients, reduced their capital expenditure and production activities, resulting in a declining market and intensive competition. Management will closely monitor the situation and will seek to extend our business on the industrial chain, such as through providing more integrated services and advanced products and through growing our business from a predominantly above-ground business to include some downhole services as well.

On January 1, 2015, China formally began implementing an updated Environmental Protection Law (the China EPL). The EPL is perceived as the most progressive and stringent law in the history of environmental protection in China. It details harsher penalties for environmental offences and imposes additional requirements for oil and gas production companies. As a result, although they reduced capital expenditures and production activities, China’s oil companies have strengthened their investment and resources in oil field environment protection and this market is estimated to be billions of RMB. The Company also focused on this segment and started to develop its own products and service from year 2015.

| 4 |

Factors Affecting Our Results of Operations

Our operating results in any period are subject to general conditions typically affecting the Chinese oilfield service industry and included but are not limited to:

| • | oil and gas prices; |

| • | the amount of spending by our customers, primarily those in the oil and gas industry; |

| • | growing demand from large corporations for improved management and software designed to achieve such corporate performance; |

| • | the procurement processes of our customers, especially those in the oil and gas industry; |

| • | competition and related pricing pressure from other oilfield service solution providers, especially those targeting the Chinese oil and gas industry; |

| • | the ongoing development of the oilfield service market in China; and |

| • | inflation and other macroeconomic factors. |

Unfavorable changes in any of these general conditions could negatively affect the number and size of the projects we undertake, the number of products we sell, the amount of services we provide, the price of our products and services, and otherwise affect our results of operations.

Our operating results in any period are more directly affected by company-specific factors including:

| • | our revenue growth, in terms of the proportion of our business dedicated to large companies and our ability to successfully develop, introduce and market new solutions and services; |

| • | our ability to increase our revenues from both old and new customers in the oil and gas industry in China; |

| • | our ability to effectively manage our operating costs and expenses; and |

| • | our ability to effectively implement any targeted acquisitions and/or strategic alliances so as to provide efficient access to markets and industries in the oil and gas industry in China. |

Critical Accounting Policies and Estimates

Estimates and Assumptions

We prepare our unaudited condensed consolidated financial statements in conformity with accounting principles generally accepted in the United States of America (“US GAAP”), which require us to make judgments, estimates and assumptions. We continually evaluate these estimates and assumptions based on the most recently available information, our own historical experience and various other assumptions that we believe to be reasonable under the circumstances. Since the use of estimates is an integral component of the financial reporting process, actual results could differ from those estimates. An accounting policy is considered critical if it requires an accounting estimate to be made based on assumptions about matters that are highly uncertain at the time such estimate is made, and if different accounting estimates that reasonably could have been used, or changes in the accounting estimates that are reasonably likely to occur periodically, could materially impact the unaudited condensed consolidated financial statements. We believe that the following policies involve a higher degree of judgment and complexity in their application and require us to make significant accounting estimates. The following descriptions of critical accounting policies, judgments and estimates should be read in conjunction with our unaudited condensed consolidated financial statements and other disclosures included in this quarterly report. Significant accounting estimates reflected in our Company’s unaudited condensed consolidated financial statements include revenue recognition, allowance for doubtful accounts, inventory valuation, fair value of share based payments, and useful lives of property and equipment.

| 5 |

Consolidation of VIEs

We recognize an entity as a VIE if it either (i) has insufficient equity to permit the entity to finance its activities without additional subordinated financial support or (ii) has equity investors who lack the characteristics of a controlling financial interest. We consolidate a VIE as our primary beneficiary when we have both the power to direct the activities that most significantly impact the entity’s economic performance and the obligation to absorb losses or the right to receive benefits from the entity that could potentially be significant to the VIE. We perform ongoing assessments to determine whether an entity should be considered a VIE and whether an entity previously identified as a VIE continues to be a VIE and whether we continue to be the primary beneficiary.

Assets recognized as a result of consolidating VIEs do not represent additional assets that could be used to satisfy claims against our general assets. Conversely, liabilities recognized as a result of consolidating these VIEs do not represent additional claims on our general assets; rather, they represent claims against the specific assets of the consolidated VIEs.

Revenue Recognition

We recognize revenue when the following four criteria are met: (1) persuasive evidence of an arrangement exists, (2) delivery has occurred or services have been provided, (3) the sales price is fixed or determinable, and (4) collectability is reasonably assured. Delivery does not occur until products have been shipped or services have been provided to the customers and the customers have signed a completion and acceptance report, risk of loss has transferred to the customer, customer acceptance provisions have lapsed, or the Company has objective evidence that the criteria specified in a customer’s acceptance provisions have been satisfied. The sales price is not considered to be fixed or determinable until all contingencies related to the sale have been resolved.

Hardware and software

Revenue from hardware and software sales is generally recognized when the product with the embedded software system is shipped to the customer and when there are no unfulfilled company obligations that affect the customer’s final acceptance of the arrangement. Revenue from software is recognized according to project contracts. Usually this is short term. Revenue is not recognized until completion of the contracts and receipt of acceptance.

Services

The Company provides services to improve software functions and system requirements on separated fixed-price contracts. Revenue is recognized when services are completed and acceptance is determined by a completion report signed by the customer.

Deferred income represents unearned amounts billed to customers related to sales contracts.

Cost of Revenues

When the criteria for revenue recognition have been met, costs incurred are recognized as cost of revenue. Cost of revenues includes wages, materials, handling charges, the cost of purchased equipment and pipes, other expenses associated with manufactured products and services provided to customers, and inventory reserve. We expect cost of revenues to grow as our revenues grow. It is possible that we could incur development costs with little revenue recognition, but based upon our past history, we expect our revenues to grow.

Fair Values of Financial Instruments

The US GAAP accounting standards regarding fair value of financial instruments and related fair value measurements define fair value, establish a three-level valuation hierarchy that requires an entity to maximize the use of observable inputs and minimize the use of unobservable inputs when measuring fair value.

| 6 |

The three levels of inputs are defined as follows:

Level 1 inputs to the valuation methodology are quoted prices (unadjusted) for identical assets or liabilities in active markets.

Level 2 inputs to the valuation methodology include quoted prices for similar assets and liabilities in active markets, and inputs that are observable for the asset or liability, either directly or indirectly, for substantially the full term of the financial instrument.

Level 3 inputs to the valuation methodology are unobservable.

The carrying amounts reported in the unaudited condensed consolidated balance sheets for trade accounts receivable, other receivables, advances to suppliers, trade accounts payable, accrued liabilities, advances from customers and notes payable approximate fair value because of the immediate or short-term maturity of these financial instruments. Long-term receivables and borrowings approximate fair value because their interest rates charged approximate the market rates for financial instruments with similar terms.

Receivables

Trade receivables are carried at the original invoiced amount less a provision for any potential uncollectible amounts. Provisions are applied to trade receivables where events or changes in circumstances indicate that the balance may not be collectible. The identification of doubtful accounts requires the use of judgment and estimates of management. Our management must make estimates of the collectability of our accounts receivable. Management specifically analyzes accounts receivable, historical bad debts, customer creditworthiness, current economic trends and changes in our customer payment terms when evaluating the adequacy of the allowance for doubtful accounts. Increases in our allowance for doubtful accounts would lower our net income and earnings per share.

Valuation of Long-Lived Assets

We review the carrying values of our long-lived assets for impairment whenever events or changes in circumstances indicate that they may not be recoverable. When such an event occurs, we project undiscounted cash flows to be generated from the use of the asset and its eventual disposition over the remaining life of the asset. If projections indicate that the carrying value of the long-lived asset will not be recovered, we reduce the carrying value of the long-lived asset by the estimated excess of the carrying value over the projected discounted cash flows. In the past, we have not had to make significant adjustments to the carrying values of our long-lived assets, and we do not anticipate a need to do so in the future. However, circumstances could cause us to have to reduce the value of our capitalized assets more rapidly than we have in the past if our revenues were to significantly decline. Estimated cash flows from the use of the long-lived assets are highly uncertain and therefore the estimation of the need to impair these assets is reasonably likely to change in the future. Should the economy or acceptance of our assets change in the future, it is likely that our estimate of the future cash flows from the use of these assets will change by a material amount. There were no impairments at June 30, 2016 and September 30, 2016. However, if impairments were required, our net income and earnings per share would decrease accordingly.

Share-Based Compensation

The Company accounts for share-based compensation in accordance with Accounting Standards Codification (ASC) Topic 718, Share-Based Payment. Under the fair value recognition provisions of this topic, share-based compensation cost is measured at the grant date based on the fair value of the award and is recognized as expense with graded vesting on a straight–line basis over the requisite service period for the entire award. The Company has elected to mainly utilize the Black-Scholes valuation model to estimate an award’s fair value.

Recently enacted accounting pronouncements

In October 2016, the FASB has issued Accounting Standards Update (ASU) No. 2016-17, Consolidation (Topic 810): Interest Held through Related Parties That Are under Common Control, to provide guidance on the evaluation of whether a reporting entity is the primary beneficiary of a VIE by amending how a reporting entity, that is a single decision maker of a VIE, treats indirect interests in that entity held through related parties that are under common control. The amendments are effective for public business entities for fiscal years beginning after December 15, 2016, including interim periods within those fiscal years. For all other entities, the amendments are effective for fiscal years beginning after December 15, 2016, and interim periods within fiscal years beginning after December 15, 2017. Early adoption is permitted, including adoption in an interim period. The Company is currently evaluating the impact of this new standard on its unaudited condensed consolidated financial statements and related disclosures.

| 7 |

Results of Operations

The following consolidated results of operations include the results of operations of the Company and its variable interest entities (“VIEs”), BHD and Nanjing Recon.

Our historical reporting results are not necessarily indicative of the results to be expected for any future period.

Three Months Ended September 30, 2015 Compared to Three Months Ended September 30, 2016

Revenue

| For the Three Months Ended | ||||||||||||||||

| September 30, | ||||||||||||||||

| Increase / | Percentage | |||||||||||||||

| 2015 | 2016 | (Decrease) | Change | |||||||||||||

| Hardware and software- non-related parties | ¥ | 3,480,752 | ¥ | 7,802,103 | ¥ | 4,321,351 | 124.1 | % | ||||||||

| Service | 113,208 | - | (113,208 | ) | (100.0 | )% | ||||||||||

| Total revenues | ¥ | 3,593,960 | ¥ | 7,802,103 | ¥ | 4,208,143 | 117.1 | % | ||||||||

Our total revenues for the three months ended September 30, 2016 were approximately ¥7.8 million ($1.2 million), an increase of approximately ¥4.2 million or 117.1% from ¥3.6 million for the three months ended September 30, 2015. The overall increase in revenue was mainly caused by our increased hardware and software revenue, which includes revenue from automation products and embedded software, equipment and accessories. The increase in hardware and software revenue was mainly caused by increased demand for our waste water treatment products, and equipment and furnaces for the first quarter of fiscal year 2017.

Revenue – Hardware and software- non-related parties

| For the Three Months Ended | ||||||||||||||||

| September 30 | ||||||||||||||||

| Increase / | Percentage | |||||||||||||||

| 2015 | 2016 | (Decrease) | Change | |||||||||||||

| Automation product and software | ¥ | 2,020,646 | ¥ | 2,076,736 | ¥ | 56,090 | 2.8 | % | ||||||||

| Equipment and accessories | 1,460,106 | 3,803,918 | 2,343,812 | 160.5 | % | |||||||||||

| Waste water treatment products | - | 1,921,449 | 1,921,449 | 100.0 | % | |||||||||||

| Total revenue - Hardware and software- non-related parties | ¥ | 3,480,752 | ¥ | 7,802,103 | ¥ | 4,321,351 | 124.1 | % | ||||||||

| (1) | Revenue from automation products and embedded software increased slightly by ¥56.1 thousand ($8.4 thousand). |

| (2) | As shown above, the overall increase in revenue was significantly affected by equipment sales increases due to more furnaces provided to our new client, Changqing Oilfield, a major subsidiary of PetroChina. |

| (3) | During fiscal year 2016, the Company expanded the new market of oilfield waste water treatment products. As of first quarter of fiscal year 2017, this segment continued to contribute revenue and margin to our operation. Management expects to obtain more business in the coming months due to the quality of our products and long-term cooperation with oilfield companies. |

| 8 |

Cost and Margin

| For the Three Months Ended | ||||||||||||||||

| September 30, | ||||||||||||||||

| Increase / | Percentage | |||||||||||||||

| 2015 | 2016 | (Decrease) | Change | |||||||||||||

| Total revenues | ¥ | 3,593,960 | ¥ | 7,802,103 | ¥ | 4,208,143 | 117.1 | % | ||||||||

| Cost of revenues | 3,192,295 | 6,709,778 | 3,517,483 | 110.2 | % | |||||||||||

| Gross profit | ¥ | 401,665 | ¥ | 1,092,325 | ¥ | 690,660 | 171.9 | % | ||||||||

| Margin % | 11.2 | % | 14.0 | % | 2.8 | % | - | |||||||||

Cost of Revenues. Our cost of revenues includes raw materials and costs related to design, implementation, delivery and maintenance of products and services. All materials and components we need can be purchased or manufactured by subcontractors. Usually the prices of electronic components do not fluctuate dramatically due to market competition and will not significantly affect our cost of revenues. However, specialized equipment and incentive chemical products may be directly influenced by metal and oil price fluctuations. Additionally, the prices of some imported accessories mandated by our customers can also affect our costs. Inventory reserve for changes in price level, impairment of inventory, slow moving inventory or other similar causes will also affect our cost.

Our cost of revenues increased from approximately ¥3.2 million in the three months ended September 30, 2015 to approximately ¥6.7 million ($1.0 million) for the same period in 2016, an increase of approximately ¥3.5 million ($0.5 million), or 110.2% . This increase was mainly caused by higher revenue during the three months ended September 30, 2016 compared to the same period of 2015.

Gross Profit. Our gross profit increased to approximately ¥1.1 million ($0.2 million) for the three months ended September 30, 2016 from approximately ¥0.4 million for the same period in 2015. Our gross profit as a percentage of revenue increased to 14.0% for the three months ended September 30, 2016 from 11.2% for the same period in 2015. This was mainly due to the increase of higher margin hardware sales during this period.

In 2015, there was a slow-down in the oilfield industry, thus customers negotiated a lower selling price which caused the margin percentage to be depressed. In 2016, the gross margin percentage increased to a normal amount.

In more detail:

| For the Three Months Ended | ||||||||||||||||

| September 30, | ||||||||||||||||

| Increase / | Percentage | |||||||||||||||

| 2015 | 2016 | (Decrease) | Change | |||||||||||||

| Total revenues-hardware and software- non related parties | ¥ | 3,480,752 | ¥ | 7,802,103 | ¥ | 4,321,351 | 124.1 | % | ||||||||

| Cost of revenues -hardware and software- non related parties | 3,192,295 | 6,709,778 | 3,517,483 | 110.2 | % | |||||||||||

| Gross profit | ¥ | 288,457 | ¥ | 1,092,325 | ¥ | 803,868 | 278.7 | % | ||||||||

| Margin % | 8.3 | % | 14.0 | % | 5.7 | % | - | |||||||||

| 9 |

Revenue from hardware and software to non-related parties increased by approximately ¥4.3 million mainly due to the increased orders of waste water treatment products and furnaces. The gross profit from hardware and software sales to non-related parties increased ¥0.8 million ($0.1 million) compared to the same period of last year.

| For the Three Months Ended | ||||||||||||||||

| September 30, | ||||||||||||||||

| Increase / | Percentage | |||||||||||||||

| 2015 | 2016 | (Decrease) | Change | |||||||||||||

| Total revenues-service | ¥ | 113,208 | ¥ | - | ¥ | (113,208 | ) | (100.0 | )% | |||||||

| Cost of revenues -service | - | - | - | - | % | |||||||||||

| Gross profit | ¥ | 113,208 | ¥ | - | ¥ | (113,208 | ) | (100.0 | )% | |||||||

| Margin % | 100.0 | % | - | (100.0 | )% | - | ||||||||||

Service revenue for the three months ended September 30, 2015 and 2016 consisted mainly of maintenance services, which were provided upon request by customers.

Operating Expenses

| For the Three Months Ended | ||||||||||||||||

| September 30, | ||||||||||||||||

| Increase / | Percentage | |||||||||||||||

| 2015 | 2016 | (Decrease) | Change | |||||||||||||

| Selling and distribution expenses | ¥ | 1,112,670 | ¥ | 1,050,141 | ¥ | (62,529 | ) | (5.6 | )% | |||||||

| % of revenue | 31.0 | % | 13.5 | % | (17.5 | )% | - | |||||||||

| General and administrative expenses | 4,067,219 | 4,899,328 | 832,109 | 20.5 | % | |||||||||||

| % of revenue | 113.2 | % | 62.8 | % | (50.4 | )% | - | |||||||||

| Provision for doubtful accounts | 2,109,926 | 8,026 | (2,101,900 | ) | (99.6 | )% | ||||||||||

| % of revenue | 58.7 | % | 0.1 | % | (58.6 | )% | - | |||||||||

| Research and development expenses | 1,792,997 | 618,674 | (1,174,323 | ) | (65.5 | )% | ||||||||||

| % of revenue | 49.9 | % | 7.9 | % | (42.0 | )% | - | |||||||||

| Operating expenses | ¥ | 9,082,812 | ¥ | 6,576,169 | ¥ | (2,506,643 | ) | (27.6 | )% | |||||||

| 10 |

Selling and Distribution Expenses. Selling and distribution expenses consist primarily of salaries and related expenditures of our sales and marketing organization, sales commissions, costs of our marketing programs including traveling charges, advertising and trade shows, and an allocation of our facilities, depreciation expenses and rental expense, as well as shipping charges. Selling expenses decreased approximately ¥62.5 thousand ($9.4 thousand) for the three months ended September 30, 2016 compared to the same period in 2015. This decrease was primarily due to a decrease in service fees and shipping charges, as we began working with qualified vendors located closer to our customers. Selling expenses were 31.0% of total revenues in the three months ended September 30, 2015 and 13.5% of total revenues in the same period of 2016.

General and Administrative Expenses. General and administrative expenses consist primarily of costs in human resources, facilities costs, depreciation expenses, professional advisor fees, audit fees, stock based compensation expense and other miscellaneous expenses incurred in connection with general operations. General and administrative expenses increased by 20.5% or ¥0.8 million ($0.1 million), from approximately ¥4.1 million in the three months ended September 30, 2015 to approximately ¥4.9 million ($0.7 million) in the same period of 2016. The increase in general and administrative expenses was mainly due to an increase in share-based compensation. General and administrative expenses were 62.8% of total revenues in the three months ended September 30, 2016 and 113.2% of total revenues in the same period of 2015, due to the increase in our total revenue.

Provision for doubtful accounts . Provision for doubtful accounts is the estimated amount of bad debt that will arise from accounts receivables, other receivables and purchase advances. We recorded a provision for doubtful accounts of ¥2.1 million for the three months ended September 30, 2015 and ¥8.0 thousand ($1.2 thousand) for the same period in 2016. The decrease in provision of doubtful accounts was mainly caused by provision for purchase advances of ¥2.0 million in the three months ended September 30, 2015. During the last few years, we made various down payments for some customized products with a non-refundable requirement. As those projects were canceled or postponed due to unfavorable industry conditions, management recorded a provision for these down payments while still trying to minimize the potential losses in the fiscal year of 2016.

Research and development (“R&D”) expenses. Research and development expenses consist primarily of salaries and related expenditures for our research and development projects. Research and development expenses decreased from approximately ¥1.8 million for three months ended September 30, 2015 to approximately ¥0.6 million ($0.1 million) for the same period of 2016. This decrease was primarily due to less research and development expense spent on design of chemical products used for waste water treatment.

Net Income

| For the Three Months Ended | ||||||||||||||||

| September 30, | ||||||||||||||||

| Increase / | Percentage | |||||||||||||||

| 2015 | 2016 | (Decrease) | Change | |||||||||||||

| Loss from operations | ¥ | (8,681,147 | ) | ¥ | (5,483,844 | ) | ¥ | 3,197,303 | (36.8 | )% | ||||||

| Interest and other income (expense) | (183,916 | ) | 3,117 | 187,033 | (101.7 | )% | ||||||||||

| Loss before income taxes | (8,865,063 | ) | (5,480,727 | ) | 3,384,336 | (38.2 | )% | |||||||||

| Benefit for income taxes | (16,457 | ) | (20,143 | ) | (3,686 | ) | 22.4 | % | ||||||||

| Net loss | (8,848,606 | ) | (5,460,584 | ) | 3,388,022 | (38.3 | )% | |||||||||

| Less: Net income attributable to non-controlling interest | - | - | - | - | % | |||||||||||

| Net loss attributable to Recon Technology, Ltd | ¥ | (8,848,606 | ) | ¥ | (5,460,584 | ) | ¥ | 3,388,022 | (38.3 | )% | ||||||

| 11 |

Loss from operations. Loss from operations was approximately ¥5.5 million ($0.8 million) for the three months ended September 30, 2016, compared to a loss of ¥8.7 million for the same period of 2015. This decrease in loss from operations was primary due to an increase in gross profit, and a decrease in provision for doubtful accounts and research and development expenses.

Interest and other income (expense). Interest and other income was approximately ¥3.1 thousand ($0.5 thousand) for the three months ended September 30, 2016, compared to interest and other expense of ¥0.2 million for the same period of 2015. The ¥0.2 million ($0.03 million) increase in interest and other income was primarily due to the increased other income and the decreased interest expense.

Benefit for income tax. Benefit for income tax was approximately ¥20.1 thousand ($3.0 thousand) for the three months ended September 30, 2016, compared to ¥16.5 thousand for the three months ended September 30, 2015. This increase in benefit for income tax was mainly due to an increase in income tax benefit of Nanjing Recon as a result of increased tax rebate for the three months ended September 30, 2016 compared to the same period of 2015.

Net loss. As a result of the factors described above, net loss was approximately ¥5.5 million ($0.8 million) for the three months ended September 30, 2016, a decrease of approximately ¥3.3 million ($0.5 million) from net loss of ¥8.8 million for the same period of 2015.

Liquidity and Capital Resources

As of September 30, 2016, we had cash in the amount of approximately ¥554.6 thousand ($83.2 thousand). As of June 30, 2016, we had cash in the amount of approximately ¥1.8 million.

Indebtedness. As of September 30, 2016, except for approximately ¥12.5 million ($1.9 million) of short-term borrowings from related parties, we did not have any finance leases or purchase commitments, guarantees or other material contingent liabilities.

Holding Company Structure. We are a holding company with no operations of our own. All of our operations are conducted through our Domestic Companies. As a result, our ability to pay dividends and to finance any debt that we may incur is dependent upon the receipt of dividends and other distributions from the Domestic Companies. In addition, Chinese legal restrictions permit payment of dividends to us by our Domestic Companies only out of their respective accumulated net profits, if any, determined in accordance with Chinese accounting standards and regulations. Under Chinese law, our Domestic Companies are required to set aside a portion (at least 10%) of their after-tax net income (after discharging all cumulated loss), if any, each year for compulsory statutory reserve until the amount of the reserve reaches 50% of our Domestic Companies’ registered capital. These funds may be distributed to shareholders at the time of each Domestic Company’s wind up.

Off-Balance Sheet Arrangements. We have not entered into any financial guarantees or other commitments to guarantee the payment obligations of any third parties. In addition, we have not entered into any derivative contracts that are indexed to our own shares and classified as shareholders’ equity, or that are not reflected in our financial statements. Furthermore, we do not have any retained or contingent interest in assets transferred to an unconsolidated entity that serves as credit, liquidity or market risk support to such entity. Moreover, we do not have any variable interest in an unconsolidated entity that provides financing, liquidity, market risk or credit support to us or engages in leasing, hedging or research and development services with us.

Capital Resources. To date we have financed our operations primarily through cash flows from operations and financing activities. As of September 30, 2016, we had total assets of approximately ¥76.4 million ($11.4 million), which includes cash of approximately ¥0.6 million ($0.08 million), net accounts receivable due from third parties of approximately ¥37.3 million ($5.6 million), working capital of approximately ¥41.2 million ($6.2 million). Shareholders’ equity amounted to approximately ¥37.9 million ($5.7 million).

| 12 |

Cash from Operating Activities. Net cash used in operating activities was approximately ¥0.3 million ($0.05 million) for the three months ended September 30, 2016. This was a decrease of approximately ¥0.7 million ($0.1 million) compared to net cash used in operating activities of approximately ¥1.0 million for the three months ended September 30, 2015. The decrease in net cash used in operating activities for the three months ended September 30, 2016 was primarily attributable to collections of notes receivable of ¥1.6 million ($0.2 million), collections from trade accounts receivable due from third parties of ¥1.0 million ($0.2 million), collections of other receivable due from third parties of ¥1.9 million ($0.3 million) and an increase in trade accounts payable due from third parties of ¥1.7 million ($0.3 million), partly offset by payments for advances due from third parties of ¥2.9 million ($0.4 million).

Cash from Investing Activities. Net cash provided by investing activities was approximately ¥22.3 thousand ($3.3 thousand) for the three months ended September 30, 2016, which was an increase in cash provided by investing activities of approximately ¥0.5 million compared to the same period in 2015, which increase is due to a decrease in the Company’s purchase of additional property and equipment and an increase in proceeds from disposal of equipment.

Cash from Financing Activities. Net cash used in financing activities amounted to ¥1.0 million ($0.1 million) for the three months ended September 30, 2016, as compared to net cash used in financing activities of $7.1 million for the same period in 2015. During the three months ended September 30, 2016, we repaid ¥5.3 million ($0.8 million) in short-term borrowings to two related parties and repaid ¥0.5 million ($0.08 million) in short-term borrowings to one third-party, and we received ¥4.8 million ($0.7 million) from two related parties.

Working Capital. Total working capital as of September 30, 2016 amounted to approximately ¥41.2 million ($6.2 million), compared to approximately ¥44.5 million as of June 30, 2016. Total current assets as of September 30, 2016 amounted to approximately ¥71.4 million ($10.7 million), a decrease of approximately ¥2.9 million ($0.4 million) compared to approximately ¥74.3 million at June 30, 2016. The decrease in total current assets at September 30, 2016 compared to June 30, 2016 was mainly due to decreases in cash, notes receivable and other receivables, partially offset by an increase in purchase advance.

Current liabilities amounted to approximately ¥30.3 million ($4.5 million) at September 30, 2016, in comparison to approximately ¥29.9 million at June 30, 2016. This increase of liabilities was attributable mainly to an increase in trade accounts payable, partially offset by a decrease in short-term borrowings-third parties and short-term borrowings-related parties.

The decrease in working capital of approximately ¥3.3 million helped to support the loss from operation of approximately ¥5.4 million.

Capital Needs. With the uncertainty of the current market, our management believes it is necessary to enhance collection of outstanding accounts receivable and other receivables, and to be cautious on operational decisions and project selection. Our management believes that our current operations can satisfy our daily working capital needs. We may also raise capital through public offerings or private placements of our securities to finance our development of our business and to consummate any merger and acquisition, if necessary.

| Item 3. | Quantitative and Qualitative Disclosures about Market Risk. |

Not applicable.

| 13 |

| Item 4. | Controls and Procedures. |

Disclosure Controls and Procedures

As of September 30, 2016, the company carried out an evaluation, under the supervision of and with the participation of management, including our Company’s chief executive officer and chief financial officer, of the effectiveness of the design and operation of our Company’s disclosure controls and procedures under the 2013 COSO framework. Because we do not currently have enough full-time employees with experience with U.S. generally accepted accounting principles, the chief executive officer and chief financial officer concluded that our Company’s disclosure controls and procedures (as defined in Rules 13a-15(e) and 15d-15(e) under the Securities Exchange Act of 1934) were ineffective in timely alerting them to information required to be included in the Company’s periodic Securities and Exchange Commission filings.

Changes in Internal Control over Financial Reporting

Management continues to focus on internal control over financial reporting. As of September 30, 2016, the Company intends to further implement the following remedial initiatives

| ● | Improve the design and documentation related to multiple levels of review over financial statements included in our SEC filings; |

| ● | Expand the design and assessment test work over the monitoring function of entity level controls; |

| ● | Enhance documentation retention policies over test work related to continuous management assessments of internal control effectiveness; and |

| ● | Expand documentation practices and policies related to various key controls to provide support and audit trails for both internal management assessment as well as external auditor testing. |

There were no changes in the Company’s internal control over financial reporting (as defined in Rule 13a-15(f) of the Securities Exchange Act of 1934) during the three months ended September 30, 2016 that have materially affected, or are reasonably likely to materially affect, the Company’s internal control over financial reporting, except as disclosed above.

| 14 |

| Item 1. | Legal Proceedings. |

None.

| Item 1A. | Risk Factors. |

Not applicable.

| Item 2. | Unregistered Sales of Equity Securities and Use of Proceeds. |

| (a) | None |

| (b) | None |

| (c) | None |

| Item 3. | Defaults upon Senior Securities. |

None.

| Item 4. | Mine Safety Disclosures. |

Not applicable.

| Item 5. | Other Information. |

None.

| 15 |

| Item 6. | Exhibits. |

The following exhibits are filed herewith:

|

Exhibit Number |

Document | |

| 3.1 | Amended and Restated Articles of Association of the Registrant (1) | |

| 3.2 | Amended and Restated Memorandum of Association of the Registrant (1) | |

| 4.1 | Specimen Share Certificate (1) | |

| 10.1 | Translation of Exclusive Technical Consulting Service Agreement between Recon Technology (Jining) Co., Ltd. and Beijing BHD Petroleum Technology Co., Ltd. (1) | |

| 10.2 | Translation of Power of Attorney for rights of Chen Guangqiang in Beijing BHD Petroleum Technology Co., Ltd. (1) | |

| 10.3 | Translation of Power of Attorney for rights of Yin Shenping in Beijing BHD Petroleum Technology Co., Ltd. (1) | |

| 10.4 | Translation of Power of Attorney for rights of Li Hongqi in Beijing BHD Petroleum Technology Co., Ltd. (1) | |

| 10.5 | Translation of Exclusive Equity Interest Purchase Agreement between Recon Technology (Jining) Co. Ltd., Chen Guangqiang and Beijing BHD Petroleum Technology Co., Ltd. (1) | |

| 10.6 | Translation of Exclusive Equity Interest Purchase Agreement between Recon Technology (Jining) Co. Ltd., Yin Shenping and Beijing BHD Petroleum Technology Co., Ltd. (1) | |

| 10.7 | Translation of Exclusive Equity Interest Purchase Agreement between Recon Technology (Jining) Co. Ltd., Li Hongqi and Beijing BHD Petroleum Technology Co., Ltd. (1) | |

| 10.8 | Translation of Equity Interest Pledge Agreement between Recon Technology (Jining) Co., Ltd., Chen Guangqiang and Beijing BHD Petroleum Technology Co., Ltd. (1) | |

| 10.9 | Translation of Equity Interest Pledge Agreement between Recon Technology (Jining) Co., Ltd., Yin Shenping and Beijing BHD Petroleum Technology Co., Ltd. (1) | |

| 10.10 | Translation of Equity Interest Pledge Agreement between Recon Technology (Jining) Co., Ltd., Li Hongqi and Beijing BHD Petroleum Technology Co., Ltd. (1) | |

| 10.11 | Translation of Exclusive Technical Consulting Service Agreement between Recon Technology (Jining) Co., Ltd. and Jining ENI Energy Technology Co., Ltd. (1) | |

| 10.12 | Translation of Power of Attorney for rights of Chen Guangqiang in Jining ENI Energy Technology Co., Ltd. (1) | |

| 10.13 | Translation of Power of Attorney for rights of Yin Shenping in Jining ENI Energy Technology Co., Ltd. (1) | |

| 16 |

| 10.14 | Translation of Power of Attorney for rights of Li Hongqi in Jining ENI Energy Technology Co., Ltd. (1) | |

| 10.15 | Translation of Exclusive Equity Interest Purchase Agreement between Recon Technology (Jining) Co. Ltd., Chen Guangqiang and Jining ENI Energy Technology Co., Ltd. (1) | |

| 10.16 | Translation of Exclusive Equity Interest Purchase Agreement between Recon Technology (Jining) Co. Ltd., Yin Shenping and Jining ENI Energy Technology Co., Ltd. (1) | |

| 10.17 | Translation of Exclusive Equity Interest Purchase Agreement between Recon Technology (Jining) Co. Ltd., Li Hongqi and Jining ENI Energy Technology Co., Ltd. (1) | |

| 10.18 | Translation of Equity Interest Pledge Agreement between Recon Technology (Jining) Co., Ltd., Chen Guangqiang and Jining ENI Energy Technology Co., Ltd. (1) | |

| 10.19 | Translation of Equity Interest Pledge Agreement between Recon Technology (Jining) Co., Ltd., Yin Shenping and Jining ENI Energy Technology Co., Ltd. (1) | |

| 10.20 | Translation of Equity Interest Pledge Agreement between Recon Technology (Jining) Co., Ltd., Li Hongqi and Jining ENI Energy Technology Co., Ltd. (1) | |

| 10.21 | Translation of Exclusive Technical Consulting Service Agreement between Recon Technology (Jining) Co., Ltd. and Nanjing Recon Technology Co., Ltd. (1) | |

| 10.22 | Translation of Power of Attorney for rights of Chen Guangqiang in Nanjing Recon Technology Co., Ltd. (1) | |

| 10.23 | Translation of Power of Attorney for rights of Yin Shenping in Nanjing Recon Technology Co., Ltd. (1) | |

| 10.24 | Translation of Power of Attorney for rights of Li Hongqi in Nanjing Recon Technology Co., Ltd. (1) | |

| 10.25 | Translation of Exclusive Equity Interest Purchase Agreement between Recon Technology (Jining) Co. Ltd., Chen Guangqiang and Nanjing Recon Technology Co., Ltd. (1) | |

| 10.26 | Translation of Exclusive Equity Interest Purchase Agreement between Recon Technology (Jining) Co. Ltd., Yin Shenping and Nanjing Recon Technology Co., Ltd. (1) | |

| 10.27 | Translation of Exclusive Equity Interest Purchase Agreement between Recon Technology (Jining) Co. Ltd., Li Hongqi and Nanjing Recon Technology Co., Ltd. (1) | |

| 10.28 | Translation of Equity Interest Pledge Agreement between Recon Technology (Jining) Co., Ltd., Chen Guangqiang and Nanjing Recon Technology Co., Ltd. (1) | |

| 10.29 | Translation of Equity Interest Pledge Agreement between Recon Technology (Jining) Co., Ltd., Yin Shenping and Nanjing Recon Technology Co., Ltd. (1) | |

| 10.30 | Translation of Equity Interest Pledge Agreement between Recon Technology (Jining) Co., Ltd., Li Hongqi and Nanjing Recon Technology Co., Ltd. (1) | |

| 10.33 | Employment Agreement between Recon Technology (Jining) Co., Ltd. and Mr. Yin Shenping (1) | |

| 10.34 | Employment Agreement between Recon Technology (Jining) Co., Ltd. and Mr. Chen Guangqiang (1) | |

| 17 |

| 10.35 | Employment Agreement between Recon Technology (Jining) Co., Ltd. and Mr. Li Hongqi (1) | |

| 10.36 | Operating Agreement among Recon Technology (Jining) Co. Ltd., Nanjing Recon Technology Co., Ltd. and Mr. Yin Shenping, Mr. Chen Guangqiang and Mr. Li Hongqi (1) | |

| 10.37 | Operating Agreement among Recon Technology (Jining) Co. Ltd., Jining ENI Energy Technology Co., Ltd., and Mr. Yin Shenping, Mr. Chen Guangqiang and Mr. Li Hongqi (1) | |

| 10.38 | Operating Agreement among Recon Technology (Jining) Co. Ltd., Beijing BHD and Mr. Yin Shenping, Mr. Chen Guangqiang and Mr. Li Hongqi (1) | |

| 21.1 | Subsidiaries of the Registrant (2) | |

| 31.1 | Certifications pursuant to Rule 13a-14(a) or 15d-14(a) under the Securities Exchange Act of 1934, as amended, as adopted pursuant to Section 302 of the Sarbanes-Oxley Act of 2002. (3) | |

| 31.2 | Certifications pursuant to Rule 13a-14(a) or 15d-14(a) under the Securities Exchange Act of 1934, as amended, as adopted pursuant to Section 302 of the Sarbanes-Oxley Act of 2002. (3) | |

| 32.1 | Certifications pursuant to 18 U.S.C. Section 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002. (4) | |

| 32.2 | Certifications pursuant to 18 U.S.C. Section 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002. (4) | |

| 99.1 | Stock Option Plan (1) | |

| 99.2 | Code of Business Conduct and Ethics (1) | |

| 99.3 | Press Release (3) | |

| 101.INS | XBRL Instance Document (3) | |

| 101.SCH | XBRL Taxonomy Extension Schema Document (3) | |

| 101.CAL | XBRL Taxonomy Extension Calculation Linkbase Document (3) | |

| 101.LAB | XBRL Taxonomy Extension Label Linkbase Document (3) | |

| 101.PRE | XBRL Taxonomy Extension Presentation Linkbase Document (3) | |

| 101.DEF | XBRL Taxonomy Extension Definition Linkbase Document (3) |

| (1) | Incorporated by reference to the Company’s Registration Statement on Form S-1, Registration No. 333-152964. |

| (2) | Incorporated by reference to the Company’s Quarterly Report on Form 10-Q/A, filed on January 31, 2012. |

| (3) | Filed herewith. |

| (4) | Furnished herewith. |

| 18 |

In accordance with the requirements of the Exchange Act, the Company caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| RECON TECHNOLOGY, LTD | |||

| November 14, 2016 | By: | /s/ Liu Jia | |

| Liu Jia | |||

| Chief Financial Officer | |||

| (Principal Financial and Accounting Officer) | |||

| 19 |

SIGNATURES

In accordance with the requirements of the Exchange Act, the Company caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| RECON TECHNOLOGY, LTD | |||

| November 14, 2016 | By: | /s/ Yin Shenping | |

| Yin Shen ping | |||

| Chief Executive Officer | |||

| 20 |

RECON TECHNOLOGY, LTD

| F-1 |

Condensed Consolidated Balance Sheets

(unAUDITED)

| As of June 30, | As of September 30, | As of September 30, | ||||||||||

| 2016 | 2016 | 2016 | ||||||||||

| ASSETS | RMB | RMB | U.S. Dollars | |||||||||

| Current assets | ||||||||||||

| Cash | ¥ | 1,817,620 | ¥ | 554,630 | $ | 83,150 | ||||||

| Notes receivable | 4,660,177 | 3,105,770 | 465,617 | |||||||||

| Trade accounts receivable, net | 38,097,626 | 37,267,708 | 5,587,178 | |||||||||

| Inventories, net | 6,313,070 | 6,339,234 | 950,379 | |||||||||

| Other receivables, net | 22,000,112 | 20,101,962 | 3,013,688 | |||||||||

| Purchase advances, net | 1,323,305 | 4,000,124 | 599,699 | |||||||||

| Prepaid expenses | 110,310 | 55,260 | 8,285 | |||||||||

| Total current assets | 74,322,220 | 71,424,688 | 10,707,996 | |||||||||

| Property and equipment, net | 2,907,762 | 2,723,363 | 408,287 | |||||||||

| Long-term trade accounts receivable, net | 2,220,332 | 2,220,332 | 332,872 | |||||||||

| Total Assets | ¥ | 79,450,314 | ¥ | 76,368,383 | $ | 11,449,155 | ||||||

| Current liabilities | ||||||||||||

| Trade accounts payable | ¥ | 7,540,430 | ¥ | 9,267,662 | $ | 1,389,409 | ||||||

| Other payables | 2,972,192 | 2,787,443 | 417,894 | |||||||||

| Other payable- related parties | 3,680,244 | 3,712,698 | 556,608 | |||||||||

| Deferred revenue | 406,681 | 231,187 | 34,660 | |||||||||

| Advances from customers | 200,600 | 200,100 | 29,999 | |||||||||

| Accrued payroll and employees' welfare | 381,109 | 499,155 | 74,833 | |||||||||

| Accrued expenses | 261,348 | 193,274 | 28,974 | |||||||||

| Taxes payable | 755,880 | 683,148 | 102,418 | |||||||||

| Short-term borrowings | 530,000 | - | - | |||||||||

| Short-term borrowings - related parties | 12,941,848 | 12,515,253 | 1,876,288 | |||||||||

| Deferred tax liability | 180,186 | 180,186 | 27,014 | |||||||||

| Total current liabilities | 29,850,518 | 30,270,106 | 4,538,097 | |||||||||

| Equity | ||||||||||||

| Common stock, ($ 0.0185 U.S. dollar par value, 100,000,000 shares authorized; 5,804,005 and 5,980,792 shares issued and outstanding as of June 30, 2016 and September 30, 2016, respectively) | 741,467 | 763,340 | 114,440 | |||||||||

| Additional paid-in capital | 100,612,455 | 102,557,249 | 15,375,392 | |||||||||

| Statutory reserve | 4,148,929 | 4,148,929 | 622,008 | |||||||||

| Accumulated deficits | (63,907,512 | ) | (69,368,096 | ) | (10,399,671 | ) | ||||||

| Accumulated other comprehensive loss | (219,040 | ) | (226,642 | ) | (33,978 | ) | ||||||

| Total shareholders’ equity | 41,376,299 | 37,874,780 | 5,678,191 | |||||||||

| Non-controlling interest | 8,223,497 | 8,223,497 | 1,232,867 | |||||||||

| Total equity | 49,599,796 | 46,098,277 | 6,911,058 | |||||||||

| Total Liabilities and Equity | ¥ | 79,450,314 | ¥ | 76,368,383 | $ | 11,449,155 | ||||||

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements

| F-2 |

CONDENSED Consolidated Statements of operations and Comprehensive LOSS

(UNAUDITED)

| For the three months ended | ||||||||||||

| September 30, | ||||||||||||

| 2015 | 2016 | 2016 | ||||||||||

| RMB | RMB | USD | ||||||||||

| Revenues | ||||||||||||

| Hardware and software | ¥ | 3,480,752 | ¥ | 7,802,103 | $ | 1,169,692 | ||||||

| Service | 113,208 | - | - | |||||||||

| Total revenues | 3,593,960 | 7,802,103 | 1,169,692 | |||||||||

| - | - | - | ||||||||||

| Cost of revenues | ||||||||||||

| Hardware and software | 3,315,627 | 6,447,643 | 966,632 | |||||||||

| Provision for (reversal of) slow moving inventories | (123,332 | ) | 262,135 | 39,299 | ||||||||

| Total cost of revenues | 3,192,295 | 6,709,778 | 1,005,931 | |||||||||

| Gross profit | 401,665 | 1,092,325 | 163,761 | |||||||||

| Selling and distribution expenses | 1,112,670 | 1,050,141 | 157,437 | |||||||||

| General and administrative expenses | 4,067,219 | 4,899,328 | 734,508 | |||||||||

| Provision for doubtful accounts | 2,109,926 | 8,026 | 1,203 | |||||||||

| Research and development expenses | 1,792,997 | 618,674 | 92,752 | |||||||||

| Operating expenses | 9,082,812 | 6,576,169 | 985,900 | |||||||||

| Loss from operations | (8,681,147 | ) | (5,483,844 | ) | (822,139 | ) | ||||||

| Other income (expenses) | ||||||||||||

| Subsidy income | 49,000 | 7,807 | 1,170 | |||||||||

| Interest income | 55,510 | 27,894 | 4,182 | |||||||||

| Interest expense | (277,824 | ) | (132,490 | ) | (19,863 | ) | ||||||

| Income (loss) from foreign currency exchange | (938 | ) | 388 | 58 | ||||||||

| Other income (expense) | (9,664 | ) | 99,518 | 14,920 | ||||||||

| Other income (expense) | (183,916 | ) | 3,117 | 467 | ||||||||

| Loss before income tax | (8,865,063 | ) | (5,480,727 | ) | (821,672 | ) | ||||||

| Benefit for income tax | (16,457 | ) | (20,143 | ) | (3,020 | ) | ||||||

| Net loss | (8,848,606 | ) | (5,460,584 | ) | (818,652 | ) | ||||||

| Comprehensive loss | ||||||||||||

| Net loss | (8,848,606 | ) | (5,460,584 | ) | (818,652 | ) | ||||||

| Foreign currency translation adjustment | 124,218 | (7,602 | ) | (1,140 | ) | |||||||

| Comprehensive loss | (8,724,388 | ) | (5,468,186 | ) | (819,792 | ) | ||||||

| Less: Comprehensive loss attributable to non-controlling interest | 16,620 | - | - | |||||||||

| Comprehensive loss attributable to Recon Technology, Ltd | ¥ | (8,741,008 | ) | ¥ | (5,468,186 | ) | $ | (819,792 | ) | |||

| Loss per common share - basic and diluted | ¥ | (1.63 | ) | ¥ | (0.92 | ) | $ | (0.14 | ) | |||

| Weighted - average shares -basic and diluted | 5,438,763 | 5,957,733 | 5,957,733 | |||||||||

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements

| F-3 |

CONDENSED Consolidated Statements of Cash flows

(UNAUDITED)

| For the three months ended September 30, | ||||||||||||

| 2015 | 2016 | 2016 | ||||||||||

| RMB | RMB | U.S. Dollars | ||||||||||

| Cash flows from operating activities: | ||||||||||||

| Net loss | ¥ | (8,848,606 | ) | ¥ | (5,460,584 | ) | $ | (818,652 | ) | |||

| Adjustments to reconcile net loss to net cash used in operating activities: | ||||||||||||

| Depreciation | 259,768 | 205,580 | 30,821 | |||||||||

| Gain from disposal of equipment | - | (35,919 | ) | (5,385 | ) | |||||||

| Provision for doubtful accounts | 2,109,926 | 8,026 | 1,203 | |||||||||

| Provision for (reversal of) slow moving inventories | (123,332 | ) | 262,135 | 39,299 | ||||||||

| Share based compensation | 1,126,552 | 1,966,670 | 294,843 | |||||||||

| Deferred tax benefit | (16,458 | ) | - | - | ||||||||

| Restricted shares issued for services | 202,475 | - | - | |||||||||

| Changes in operating assets and liabilities: | ||||||||||||

| Notes receivable | 977,950 | 1,554,407 | 233,037 | |||||||||

| Trade accounts receivable | 1,685,745 | 1,035,863 | 155,297 | |||||||||

| Trade accounts receivable-related parties | 4,569,800 | - | - | |||||||||

| Inventories | (908,544 | ) | (288,299 | ) | (43,222 | ) | ||||||

| Other receivable, net | (419,821 | ) | 1,866,616 | 279,843 | ||||||||

| Other receivables-related parties, net | 91,021 | - | - | |||||||||

| Purchase advance, net | (847,071 | ) | (2,873,141 | ) | (430,742 | ) | ||||||

| Purchase advance-related parties, net | 394,034 | - | - | |||||||||

| Prepaid expense | 216,619 | 55,050 | 8,253 | |||||||||

| Prepaid expense - related parties, net | 210,000 | - | - | |||||||||

| Trade accounts payable | (217,263 | ) | 1,727,232 | 258,947 | ||||||||

| Trade accounts payable-related parties | (254,826 | ) | - | - | ||||||||

| Other payables | (308,852 | ) | (184,749 | ) | (27,698 | ) | ||||||

| Other payables-related parties | (2,465,074 | ) | 32,454 | 4,866 | ||||||||

| Deferred revenue | 166,982 | (175,494 | ) | (26,310 | ) | |||||||

| Advances from customers | (158,716 | ) | (500 | ) | (75 | ) | ||||||

| Accrued payroll and employees' welfare | 83,268 | 118,046 | 17,697 | |||||||||

| Accrued expenses | (7,505 | ) | (56,539 | ) | (8,476 | ) | ||||||

| Taxes payable | 1,507,434 | (80,273 | ) | (12,035 | ) | |||||||

| Net cash used in operating activities | (974,494 | ) | (323,419 | ) | (48,489 | ) | ||||||

| Cash flows from investing activities: | ||||||||||||

| Purchase of property and equipment | (470,265 | ) | (29,621 | ) | (4,441 | ) | ||||||

| Proceeds from disposal of equipment | - | 51,900 | 7,781 | |||||||||

| Net cash provided by (used in) investing activities | (470,265 | ) | 22,279 | 3,340 | ||||||||

| Cash flows from financing activities: | ||||||||||||

| Repayment of short-term borrowings | - | (530,000 | ) | (79,458 | ) | |||||||

| Proceeds from short-term borrowings-related parties | 1,800,000 | 4,838,318 | 725,361 | |||||||||

| Repayment of short-term borrowings-related parties | (9,100,000 | ) | (5,276,448 | ) | (791,046 | ) | ||||||

| Proceeds from sale of common stock, net of issuance costs | 165,823 | - | - | |||||||||

| Net cash used in financing activities | (7,134,177 | ) | (968,130 | ) | (145,143 | ) | ||||||

| Effect of exchange rate fluctuation on cash and cash equivalents | 111,279 | 6,280 | 943 | |||||||||

| Net decrease in cash | (8,467,657 | ) | (1,262,990 | ) | (189,349 | ) | ||||||

| Cash at beginning of period | 12,344,929 | 1,817,620 | 272,498 | |||||||||

| Cas at end of period | ¥ | 3,877,272 | ¥ | 554,630 | $ | 83,149 | ||||||

| Supplemental cash flow information | ||||||||||||

| Cash paid during the period for interest | ¥ | 277,824 | ¥ | 167,403 | $ | 25,097 | ||||||

| Cash paid during the period for taxes | ¥ | 72,217 | ¥ | - | $ | - | ||||||

| Non-cash investing and financing activities | ||||||||||||

| AR and short-term borrowings-related parties offset | ¥ | 200,000 | ¥ | - | $ | - | ||||||

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements

| F-4 |

RECON TECHNOLOGY, LTD

Notes to the unaudited condensed consolidated financial statements

NOTE 1. ORGANIZATION AND NATURE OF OPERATIONS

Organization – Recon Technology, Ltd (the “Company”) was incorporated under the laws of the Cayman Islands on August 21, 2007 by Messrs. Yin Shenping, Chen Guangqiang and Li Hongqi (the “Founders”) as a limited liability company. The Company provides specialized oilfield equipment, automation systems, tools, chemicals and field services to petroleum companies mainly in the People’s Republic of China (the “PRC”).

The Company, along with its wholly-owned subsidiaries, Recon Technology Co., Limited (“Recon HK”), Jining Recon Technology Ltd. (“Recon JN”), Recon Investment Ltd. (“Recon IN”) and Recon Hengda Technology (Beijing) Co., Ltd. (“Recon BJ”), conducts its business through the following PRC legal entities (“Domestic Companies”) that are consolidated as variable interest entities (“VIEs”) and operate in the Chinese oilfield equipment & service industry:

| 1. | Beijing BHD Petroleum Technology Co., Ltd. (“BHD”), |

| 2. | Nanjing Recon Technology Co., Ltd. (“Nanjing Recon”). |

The Company has signed Exclusive Technical Consulting Service Agreements with each of the Domestic Companies, which are our VIEs and Equity Interest Pledge Agreements and Exclusive Equity Interest Purchase Agreements with their shareholders. Through these contractual arrangements, the Company has the ability to substantially influence each of the Domestic Companies’ daily operations and financial affairs, appoint their senior executives and approve all matters requiring shareholder approval. As a result of these contractual arrangements, which enable the Company to control the Domestic Companies, the Company is considered as the primary beneficiary of each Domestic Company. Thus, the Company is able to absorb 90% of net interest or 100% of net loss of those VIEs.

On December 17, 2015, Huang Hua BHD Petroleum Equipment Manufacturing Co. LTD, a fully owned subsidiary established by BHD was organized under the laws of the PRC.

Nature of Operations – The Company engaged in (1) providing equipment, tools and other hardware related to oilfield production and management, including simple installations in connection with some projects; (2) service to improve production and efficiency of exploited oil wells, and (3) developing and selling its own specialized industrial automation control and information solutions. The products and services provided by the Company include:

NOTE 2. LIQUIDITY

As reflected in the Company’s unaudited condensed consolidated financial statements, the Company had recurring net losses for the three months ended September 30, 2015 and 2016. In assessing its liquidity, management monitors and analyzes the Company’s cash on-hand and its ability to generate sufficient revenue sources in the future to support its operating and capital expenditure commitments. The Company plans to fund its continuing operations through identifying new prospective joint venture and strategic alliance opportunities for new revenue sources, financial supports by major shareholders and reducing costs to improve profitability and replenish working capital. Management believes that the foregoing measures collectively will provide sufficient liquidity for the Company to meet its future liquidity and capital obligations.

NOTE 3. SIGNIFICANT ACCOUNTING POLICIES

Basis of presentation - The accompanying unaudited condensed consolidated financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America for interim financial information pursuant to the rules of the SEC and have been consistently applied. In the opinion of management, all adjustments (consisting of normal recurring accruals) considered necessary for a fair presentation have been included. These financial statements should be read in conjunction with the audited financial statements and notes thereto included in the Company’s Form 10-K for the fiscal year ended June 30, 2016. The results of operations for the interim periods presented may not be indicative of the operating results to be expected for the Company’s fiscal year ending June 30, 2017.

| F-5 |

RECON TECHNOLOGY, LTD

Notes to the unaudited condensed consolidated financial statements

Principles of Consolidation - The unaudited condensed consolidated financial statements include the accounts of the Company, all the subsidiaries and VIEs of the Company. All transactions and balances between the Company and its subsidiaries and VIEs have been eliminated upon consolidation.

Variable Interest Entities - A VIE is an entity that either (i) has insufficient equity to permit the entity to finance its activities without additional subordinated financial support or (ii) has equity investors who lack the characteristics of a controlling financial interest. A VIE is consolidated by its primary beneficiary. The primary beneficiary has both the power to direct the activities that most significantly impact the entity’s economic performance and the obligation to absorb losses or the right to receive benefits from the entity that could potentially be significant to the VIE. The Company performs ongoing assessments to determine whether an entity should be considered a VIE and whether an entity previously identified as a VIE continues to be a VIE and whether the Company continues to be the primary beneficiary.

Assets recognized as a result of consolidating VIEs do not represent additional assets that could be used to satisfy claims against the Company’s general assets. Conversely, liabilities recognized as a result of consolidating these VIEs do not represent additional claims on the Company’s general assets; rather, they represent claims against the specific assets of the consolidated VIEs.