Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

| x | Annual report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the fiscal year ended December 31, 2014

or

| ¨ | Transition report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the transition period from to

Commission File Number: 001-36030

Marrone Bio Innovations, Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 20-5137161 | |

| (State or other jurisdiction of Incorporation or organization) |

(I.R.S. Employer Identification No.) |

1540 Drew Avenue, Davis, CA 95618

(Address of principal executive offices and zip code)

(530) 750-2800

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Class |

Exchange on which registered | |

| Common Stock, $0.00001 par value | NASDAQ Global Market |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ¨ No x

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ¨ No x

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 or Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act:

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |||

| Non-accelerated filer | ¨ (Do not check if a smaller reporting company) | Smaller reporting company | x | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

As of June 30, 2015, the last day of the registrant’s most recently completed second quarter, the aggregate market value of the registrant’s voting and non-voting common stock held by non-affiliates was $20,508,703, based upon the closing price of the common stock as reported on the NASDAQ Global Market. This calculation excludes the shares of common stock held by each officer, director and holder of 5% or more of the outstanding common stock as of June 30, 2015. This calculation does not reflect a determination that such persons are affiliates for any other purposes.

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date.

| Class |

Shares Outstanding at October 31, 2015 | |

| Common Stock, $0.00001 par value |

24,464,582 |

Table of Contents

EXPLANATORY NOTE

In this Annual Report on Form 10-K, or this Form 10-K, Marrone Bio Innovations, Inc., or the Company, is restating its consolidated financial statements, selected financial data (as applicable) and certain financial data in management’s discussion and analysis and other information for the following periods: (i) the fiscal year ended December 31, 2013, including related quarterly periods; and (ii) the quarterly periods ended March 31 and June 30, 2014 (the Restatement). This is our first periodic report since our Quarterly Report on Form 10-Q for the period ended June 30, 2014. This report covers the fiscal years ended December 31, 2014, 2013 (as restated) and 2012 and includes unaudited condensed consolidated financial statements and supplemental information as applicable for quarterly periods ended March 31, 2014 (as restated), June 30, 2014 (as restated), September 30, 2014, December 31, 2014, March 31, 2013 (as restated), June 30, 2013 (as restated), September 30, 2013 (as restated) and December 31, 2013 (as restated).

The Company has not amended, and does not intend to amend, its Annual Report on Form 10-K for the year ended December 31, 2013 or any of its Quarterly Reports on Form 10-Q for periods prior to December 31, 2014. The Company also does not intend to file a Quarterly Report on Form 10-Q for the quarter ended September 30, 2014. The financial statements and related financial information for the restated periods contained in any of the Company’s filings prior to this Annual Report on Form 10-K for the year ended December 31, 2014 should no longer be relied upon.

Summary of the Restatement

On September 3, 2014, the Company announced that the Audit Committee of the Company’s board of directors had commenced an independent investigation after learning of documents calling into question the recognition of revenue in the fourth quarter of 2013 for an $870,000 transaction. The Audit Committee concluded, after consultation with management, that the Company’s previously reported financial statements as of and for the fiscal year ended December 31, 2013, the related report of the independent auditors on those 2013 financial statements dated March 25, 2014, and the unaudited interim financial statements as of and for the three months, the three and six months and the three and nine months ended March 31, June 30 and September 30, 2013, respectively, and as of and for the three months and the three and six months ended March 31 and June 30, 2014, respectively, should no longer be relied upon.

In February 2015, the Company announced the conclusion and findings of the Audit Committee’s independent investigation. As discussed further below, the Audit Committee principally determined that as a result of the failure of certain employees to share with the Company’s finance department or the external auditors important transaction terms with distributors, including “inventory protection” arrangements that would permit the distributors to return to the Company certain unsold products, the Company inappropriately recognized revenue for certain historical sales transactions with these distributors prior to satisfying the criteria for revenue recognition required under U.S. Generally Accepted Accounting Principles (GAAP).

In light of the foregoing, the Company’s management evaluated the necessity, nature and scope of any restatements of its previously filed financial statements, as discussed further below. Based on such evaluation, the Company, among other things, determined to change its revenue recognition methodology from “sell-in” to “sell-through” for sales to certain distributors. The Company has now recognized, in the aggregate, approximately $6.7 million less in product revenues than previously reported for 2013 and the first six months of 2014, as discussed further below. Of this amount, an aggregate of approximately $2.0 million in product was returned by certain distributors subsequent to June 30, 2014 pursuant to “inventory protection” rights and will not result in recognition of revenue in future periods.

Audit Committee Investigation

In late August 2014, a written agreement executed on behalf of the Company with one its distributors was identified by management that had not previously been disclosed by certain sales personnel to the Company’s

i

Table of Contents

finance department. This arrangement was promptly communicated to the Audit Committee, which decided to conduct an independent investigation of the issues identified by management. The Audit Committee promptly retained independent legal counsel to assist in the investigation.

The Audit Committee and its advisors investigated certain sales to distributors to determine whether undisclosed commitments were made that could have an impact on the timing and treatment of revenue recognition and whether the Company’s internal controls over financial reporting and disclosure controls and procedures were sufficient. The Audit Committee and its advisors also considered risk areas other than revenue recognition.

The investigation focused on revenue recorded in 2013 and the first two quarters of 2014. During the course of the investigation, the Audit Committee and its advisors collected and reviewed hard copy documents from individual custodians, electronically stored information, and various Company files. The Audit Committee also conducted 44 interviews with both current and former employees.

Audit Committee Findings

In February 2015, the Audit Committee completed its internal investigation. The principal findings of the Audit Committee were as follows:

| • | certain employees did not share with the Company’s finance department or the external auditors certain important transactional terms related to historical sales transactions; |

| • | certain sales personnel executed inaccurate “sales representation” letters, which are intended to inform the Company’s finance department and the external auditors of any commitments not included on a customer purchase order provided to the finance department; and |

| • | certain employees mischaracterized expenses related to agreements to pay for the storage and freight fees associated with certain transactions. |

As a result the Audit Committee concluded that the Company recognized revenue for certain transactions prior to satisfying the criteria for revenue recognition required under GAAP. In addition, the Audit Committee found that supply chain personnel were directed to ship the wrong product to a customer because the Company did not have the ordered product readily available.

The employees primarily responsible for the foregoing conduct are no longer with the Company. The Audit Committee concluded that the Company can rely on current management to accurately prepare the Company’s financial statements.

Restatement Process and Impact

Based on the results of the investigation, the Company’s management carried out a further evaluation to determine whether and by what amounts to restate any of the Company’s previously filed financial statements. This evaluation included collection and review of additional electronically stored information, transactional records from certain customers and correspondence with certain customers. Specifically, the Company’s management evaluated all distributor sales transactions during 2013 and the first two quarters of 2014 on a customer-by-customer and transaction-by-transaction basis. With respect to each individual transaction, the Company’s management evaluated relevant facts and circumstances that came to light in their review in order to apply the Company’s revenue recognition policy to such transactions.

Historically, the Company had determined that with limited exceptions, the criteria for revenue recognition were met at the point at which title was transferred to the distributor. However, based on the review, the following circumstances were identified for certain transactions that would result in the criteria for revenue recognition not being met with respect to such transactions until the Company’s products were sold through by the distributor, including:

| • | promises to certain distributors to accept returns of unsold inventory where the amount of future returns could not be reasonably estimated and/or we had significant obligations for future performance to bring about resale of the product by the distributor; and |

ii

Table of Contents

| • | arrangements with certain distributors that did not require payment of amounts due until product was resold by the distributor. |

Accordingly, in the restated periods, and for the foreseeable future, the Company is now using a “sell-through” method for sales to certain distributors rather than the “sell-in” method previously used by the Company. In general, under the “sell-in” method, sales by the Company to distributors are recognized at the point at which title was transferred to the distributors, in contrast to the “sell-through” method, whereby sales by the Company to distributors are not recognized as product revenues until the distributors sell the product through to end-users. The principal impact of switching from a “sell-in” to a “sell-through” method is that product revenues with respect to the applicable distributors are deferred to later periods.

Primarily as a result of the change in methodology from “sell-in” to “sell-through” for certain sales to certain distributors, the Company recognized approximately $6.1 million and $0.6 million less revenue for the year ended December 31, 2013 and the six months ended June 30, 2014, respectively, than had been previously reported. Of these amounts, an aggregate of approximately $2.0 million in product was returned by certain distributors subsequent to June 30, 2014 pursuant to “inventory protection” rights and will not result in recognition of revenue in future periods. The restatement of previously issued financial statements reduced the Company’s gross profit for the year ended December 31, 2013 and the six months ended June 30, 2014 by $2.6 million and $0.6 million, respectively. Net loss, basic loss per share and diluted loss per share for the year ended December 31, 2013 was increased by approximately $2.8 million, $0.32 per share and $0.31 per share, respectively, and the six months ended June 30, 2014 was increased by approximately $0.4 million, $0.02 per share and $0.02 per share, respectively.

For additional discussion of the accounting errors identified and the restatement adjustments, see Note 2, Restatement of Previously Issued Consolidated Financial Statements, and Note 21, Quarterly Financial Information (Unaudited), to the consolidated financial statements included in Part II–Item 8–“Financial Statements and Supplementary Data” in this Annual Report on Form 10-K.

Controls and Procedures

Management has assessed the adequacy of its internal control over financial reporting, and based on the Audit Committee’s recommendations, Company management has concluded that the following deficiencies related to the Audit Committee’s investigation constituted, individually or in the aggregate, material weaknesses in our internal control over financial reporting as of December 31, 2014:

| • | Control Environment - The control environment, which includes the Company’s Code of Conduct, is the responsibility of senior management, sets the tone of our organization, influences the control consciousness of employees, and is the foundation for the other components of internal control over financial reporting. The Audit Committee determined, based on the results of its independent investigation, that relevant information related to historical sales transactions, to which certain sales personnel were aware of, was consistently not shared with the finance department or the Company’s external auditors, certain sales personnel executed inaccurate representation letters, and certain sales personnel mischaracterized expense reports to pay for storage or freight charges associated with certain sales transactions. As a result of these findings, we determined that certain former sales personnel did not project an attitude of integrity and control consciousness, leading to insufficient attention to their responsibilities and internal controls. Further, effective mitigating controls were not in place to discourage, prevent or detect management override of internal control by certain sales personnel related to the Company’s process for recognizing revenue. |

| • | Revenue Recognition – The Company’s internal controls were not effectively designed to identify instances when sales personnel made unauthorized commitments with certain distributors, including “inventory protection” arrangements that would permit the distributors to return to the Company certain unsold products. In addition, controls were not in place to identify instances of management |

iii

Table of Contents

| override of internal controls by sales personnel related to the recognition of sales to the Company’s distributors. Consequently, revenue for certain transactions was recognized prior to satisfaction of all required revenue recognition criteria. |

While the Company has implemented the plan for remediation of these material weaknesses, the Company is still in the process of testing and evaluating the effectiveness of the remediation measures we have taken to date. In addition, many of these remediation efforts focus on continued training and communication of the Company’s enhanced policies and procedures. More specifically, the Company’s plan includes, among other things, improvement of the Company’s Code of Conduct and whistleblower policies; enhancement of training for all employees on the Company’s Code of Conduct and for sales personnel on the Company’s revenue recognition policy and the need for timely communication with the finance department; and expansion of the Company’s formal internal certification process to additional individuals within the Company. Additionally, as part of the Company’s remediation process the Company has taken steps to ensure that sales personnel primarily responsible for accounting improprieties are no longer employed by the Company.

The Company intends to continue to identify and implement actions to improve the effectiveness of its internal control over financial reporting. For more information on the status of the Company’s remediation efforts, please see Part II-Item 9A-“Controls and Procedures” in this Annual Report on Form 10-K.

iv

Table of Contents

Special Note Regarding Forward-Looking Statements and Trade Names

This Annual Report on Form 10-K includes a number of forward-looking statements that involve many risks and uncertainties. Forward-looking statements may be identified by the use of the words “would,” “could,” “will,” “may,” “expect,” “believe,” “should,” “anticipate,” “outlook,” “if,” “future,” “intend,” “plan,” “estimate,” “predict,” “potential,” “targets,” “seek” or “continue” and similar words and phrases, including the negatives of these terms, or other variations of these terms, that denote future events. These forward-looking statements include: our plans to target our existing products or product variations for new markets and for new uses and applications; our plans and expectations with respect to growth in sales of our product lines; our ability and plans to develop, register and commercialize additional new product candidates and bring new products to market across multiple categories faster and at a lower cost than other developers of pest management products; our expectations regarding registering new products and new formulations and expanded use labels for existing products, including submitting new products to the EPA; our belief that challenges facing the use of conventional chemical pesticides will continue to grow; our beliefs regarding the growth of markets for, and unmet demand for, bio-based products; our beliefs regarding market adoption for our products and our ability to compete in our target markets; our intention to maintain existing, and develop new, supply, sales and distribution channels and extend market access; expectations regarding potential future payments under strategic collaboration and development agreements; our plans to grow our business while improving efficiency, including by focusing on a limited number of product candidates, taking measures to reduce expenses and expanding our sales and marketing team; our plans with respect to manufacturing; our plans to seek third-party collaborations to develop and commercialize more early stage product candidates; our intention to continue to devote significant resources toward our proprietary technology and research and development; our expectations that sales will be seasonal and the impact of continued drought and other weather-related conditions; our ability to protect our intellectual property in the United States and abroad; our beliefs regarding the effects of the outcome of certain legal matters; our expectations regarding incurring additional costs related to the Audit Committee investigation, restatement of financial statements and director and officer liability insurance; our plans regarding remediation activities related to weakness in our internal control over financial reporting; our anticipated impact of certain accounting pronouncements; our ability to use carryforwards; our expectations regarding market risk, including interest rate changes, foreign currency fluctuations and commodity price changes; and our future financial and operating results. These statements reflect our current views with respect to future events and our potential financial performance and are subject to risks and uncertainties that could cause our actual results and financial position to differ materially and adversely from what is projected or implied in any forward-looking statements included in this Annual Report on Form 10-K. These factors include, but are not limited to, the risks described under Part I–Item 1A—“Risk Factors,” Part II–Item 7—“Management’s Discussion and Analysis of Financial Condition and Results of Operations,” elsewhere in this Annual Report on Form 10-K and those discussed in other documents we file with the U.S. Securities and Exchange Commission (“SEC”). We make these forward-looking statements based upon information available on the date of this Annual Report on Form 10-K, and we have no obligation (and expressly disclaim any such obligation) to update or alter any forward-looking statements, whether as a result of new information or otherwise except as otherwise required by securities regulations.

As used herein, “MBI,” the “Company,” “we,” “our” and similar terms refer to Marrone Bio Innovations, Inc., unless the context indicates otherwise.

Except as context otherwise requires, references in this Annual Report on Form 10-K to our product lines, such as Regalia, refer collectively to all formulations of the respective product line, such as Regalia Maxx, Regalia Rx or Regalia SC, and all trade names under which our distributors sell such product lines internationally, such as Sakalia, Sentry R or Milsana. Our logos, Grandevo®, Regalia®, Venerate®, Zequanox®, HavenTM, MajesteneTM and other trade names, trademarks or service marks of Marrone Bio Innovations, Inc. appearing herein are the property of Marrone Bio Innovations, Inc. This Annual Report on Form 10-K contains additional trade names, trademarks and service marks of other companies. We do not intend our use or display of other companies’ trade names, trademarks or service marks to imply relationships with, or endorsement or sponsorship of us by, these other companies.

v

Table of Contents

| Page | ||||||

| Item 1. |

1 | |||||

| Item 1A. |

27 | |||||

| Item 1B. |

48 | |||||

| Item 2. |

48 | |||||

| Item 3. |

48 | |||||

| Item 4. |

49 | |||||

| Item 5. |

50 | |||||

| Item 6. |

51 | |||||

| Item 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

54 | ||||

| Item 7A. |

90 | |||||

| Item 8. |

91 | |||||

| Item 9. |

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

163 | ||||

| Item 9A. |

163 | |||||

| Item 9B. |

166 | |||||

| Item 10. |

167 | |||||

| Item 11. |

175 | |||||

| Item 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

185 | ||||

| Item 13. |

Certain Relationships and Related Transactions, and Director Independence |

188 | ||||

| Item 14. |

190 | |||||

| Item 15. |

191 | |||||

| 192 | ||||||

vi

Table of Contents

We make bio-based pest management and plant health products. Bio-based products are comprised of naturally occurring microorganisms, such as bacteria and fungi, and plant extracts. Our current products target the major markets that use conventional chemical pesticides, including certain agricultural and water markets, where our bio-based products are used as alternatives for, or mixed with, conventional chemical products. We also target new markets for which there are no available conventional chemical pesticides, the use of conventional chemical products may not be desirable or permissible because of health and environmental concerns (including for organically certified crops) or because the development of pest resistance has reduced the efficacy of conventional chemical pesticides. All of our current products are EPA-approved and registered as “biopesticides.” We expect our future products will include plant health products qualified as “biostimulants,” which may require state registrations but do not require EPA registration. We believe our current portfolio of products and our pipeline address the growing global demand for effective, efficient and environmentally responsible products to control pests, increase crop yields and reduce crop stress.

We currently primarily sell to the crop protection market. Our three commercially available crop protection product lines, are Regalia, for plant disease control and plant health, and Grandevo and Venerate, for insect and mite control. These products can be used in both conventional and organic crop production, and are sold to growers of specialty crops such as grapes, citrus, tomatoes, vegetables, nuts, leafy greens and ornamental plants. We have also had some sales of Regalia for large-acre row crops such as corn and soybeans. We have also developed a commercially available product line that we sell to the water treatment market. Zequanox selectively controls invasive mussels that cause significant infrastructure and ecological damage across a broad range of in-pipe and open-water applications, including hydroelectric and thermoelectric power generation, industrial applications and recreation. We believe that our existing crop protection products, or variations thereof, can also be specifically targeted for industrial and institutional, turf and ornamental, home and garden and animal health uses such as controlling grubs, ants, flies and mosquitoes in and around schools, parks, golf courses and other public-use areas.

Since the second half of 2014, we have been implementing a prioritization plan to focus our resources on continuing to improve and promote our commercially available products, advancing product candidates that are expected to have the greatest impact on near-term growth potential and expanding international presence and commercialization. Our goal has been to reduce expenses, conserve cash and improve operating efficiencies, to extract greater value from our products and product pipeline and to improve our communication to and connection with the global sustainability movement that is core to our cultural values.

In connection with this new strategy, we have significantly reduced overall headcount, while building a new sales organization with increased training and ability to educate and support customers, as well as providing our product development staff with greater responsibility for technical sales support, field-trials and demonstrations to promote sales growth. In addition, while we believe that we have developed a robust pipeline of novel product candidates, we are currently limiting our internal efforts to five product candidates, Majestene (MBI-305), a biopesticide for parasitic roundworm control, or “bionematicide,” based on the microbe used in Venerate, for which we have initiated a targeted placement to select customers, MBI-010, a bioherbicide that is also based on the microorganism in Venerate and Majestene, and MBI-110, a biofungicide, both of which we plan to submit to the EPA in 2016, Haven (MBI-505), a plant health product that does not require EPA registration, and MBI-601, a biopesticide that produces gaseous natural compounds, or “biofumigant,” which we submitted to the EPA in April 2014. Simultaneously, we are seeking collaborations with third parties to develop and commercialize more early stage candidates on which we have elected not to expend significant resources given our reduced budget.

We believe that collectively, these measures will best position us to respond to the business challenges reflected in our financial results for recent periods, but our long-term, global vision for our business and our commitment to that vision remains fundamentally unchanged.

1

Table of Contents

Industry Overview

Pest management is an important global industry. Phillips McDougall, an independent advisory firm, estimates the 2014 agrichemical market (crop protection) at $56.6 billion, with Brazil ranking first at $11.6 billion in sales, followed by the United States at $9.2 billion. Most of the markets we currently target or plan to target primarily rely on conventional chemical pesticides, supplemented in certain agricultural markets by the use of genetically modified crops. Conventional chemical pesticides are generally synthetic materials that directly kill or inactivate pests. However, demand for effective and environmentally responsible bio-based products continues to increase. The global market for biopesticides, which control pests by non-toxic mechanisms such as attracting pests to traps or interfering with their ability to digest food, was valued at $3.6 billion for 2014 and projected to grow to $6.9 billion in 2019, reflecting a 13.9% compound annual growth rate of over the period, according to BCC Research, an independent market research firm. In comparison, global synthetic pesticides sales were projected at 5.7% compound annual growth for the same period. We believe these trends will continue as the benefits of using bio-based pest management and plant health products become more widely known.

Crop Protection

Conventional Production. Growers are constantly challenged to supply the escalating global demand for food, while reducing the negative impact of crop protection practices on consumers, farm workers and the environment. The dominant technologies for crop protection are conventional chemical pesticides and genetically modified crops. Major agrichemical companies have invested billions of dollars to develop genetically modified crops that resist pests or have high tolerance to conventional chemical pesticides. The market for genetically modified crops was estimated at $21 billion in 2014, according to Phillips McDougall. In addition, according to the International Service for the Acquisition of Agri-biotech Applications, a third-party not-for-profit organization, in 2014, 182 million hectares (484 million acres) were planted with genetically modified crops in 28 countries, with the United States, Brazil, Argentina, India and Canada planting the most (in that order). Soybean, corn, cotton and canola plantings have made the greatest inroads, accounting for 50%, 30%, 14% and 9%, respectively, of genetically modified seeds planted globally.

Conventional chemical pesticides and genetically modified crops have historically been effective in controlling pests. However, there are increasing challenges facing the use of conventional chemical pesticides such as pest resistance and environmental, consumer and worker safety concerns. Governmental agencies are further pressuring growers, distributors and manufacturers by restricting or banning certain forms of conventional chemical pesticide usage, particularly in the European Union, as some conventional chemical pesticide products are being phased out, as well as at local levels, where many city and county governments have prohibited the sale of certain conventional chemical pesticide products, magnifying the complexity of agrichemical companies’ distribution and regulatory compliance. At the same time, a number of supermarket chains and food processors, key purchasers of specialty fruits, nuts and vegetables, are imposing synthetic chemical residue restrictions, limiting options available to growers close to harvest. Consumers, scientists and environmental groups have also voiced concerns about the unintended effects of genetically modified crops, including pest resistance and contamination of non-genetically modified crops. In response to consumer and environmental group concerns and restrictions by importing countries, several large-scale food purchasers have demanded that their contracted growers supply them only non-genetically modified crops.

These factors are significant market drivers for conventional producers, and their impact is continuing to grow. An increasing number of growers are implementing integrated pest management (IPM) programs that, among other things, combine bio-based pest management products and crop cultivating practices and techniques such as crop rotation, with conventional chemical pesticides and genetically modified crops. Bio-based pest management products are becoming a larger component of IPM programs due in part to the challenges associated with conventional chemical pesticides and genetically modified crops.

Organic Production. Certified organic crops such as food, cotton and ornamental plants, are produced without the use of synthetic chemicals, genetic modification or any other bioengineering or adulteration. As such, organic

2

Table of Contents

growers are limited in the number of alternatives for pest management. The U.S. Department of Agriculture, or the USDA, approved national production and labeling standards for organic food marketed in the United States in late 2000. These standards have contributed to the growth of organic food consumption in the United States, and other countries have implemented similar programs. According to the Organic Trade Association, a business association, consumer demand for organic food has outpaced the available acreage in the United States, with $1.4 billion of organic food imported in 2013 and $49 billion of domestic organic food sales in 2014, or 5% of all food sales, up 11% over 2013. In addition, U.S. sales of non-GMO-labeled foods were estimated at $8.5 billion across 2,100 brands and 22,000 verified items in 2014, according to SPINS, a third party consulting firm. We believe this growing demand is primarily driven by concerns about food safety and the adverse environmental effects of conventional chemical pesticides and genetically modified crops.

Water Treatment

Global demand for water treatment products was estimated to be $48 billion in 2012, according to The Freedonia Group, an independent market research firm, and the global market for specialty biocide chemicals for water treatment was projected to be $5.2 billion in 2013, according to BCC Research. Invasive and native pest species are increasingly a concern in diverse applications such as hydroelectric and thermoelectric power generation, industrial applications, drinking water, aquaculture, irrigation and recreation. However, discharge of water treatment chemicals to target these pests is highly regulated, and in many cases, such as with management of open waters and sensitive environmental habitats, use of conventional chemicals is prohibited.

One particular area of concern has been the damage caused by invasive zebra and quagga mussels, which clog pipes, disrupt ecosystems, encrust infrastructure and blanket beaches with razor-sharp shells. These species initially infested the Great Lakes region and have spread across the United States. Industry reports estimate that these mussels cause approximately $1.0 billion in damage and associated control costs annually in parts of the United States alone. There are limited treatment options available, many of which are toxic to aquatic flora and fauna. To date, most treatment options have been focused either on manual removal of the mussels, which is time consuming and costly, or conventional chemical treatments, which potentially jeopardize the environment and are thus controlled tightly by regulatory agencies.

The water treatment market also includes products to control algae, aquatic weeds and unwanted microorganisms. For example, one of the most effective and popular methods for controlling algae and unwanted microorganisms is chlorination. One of the major concerns in using chlorination in surface water supplies is that chlorine combines with various organic compounds to form by-products, some of which are considered possible carcinogens.

Other Target Markets

We are also taking steps through strategic collaborations to commercialize our existing crop protection products, or variations thereof, for other markets. Although conventional chemical pesticides have traditionally serviced the industrial and institutional, professional turf and ornamental, home and garden and animal health markets, governmental regulations are restricting their use, and reports indicate that end users increasingly value environmentally friendly products, with some households willing to forego pest control treatments entirely if alternatives to conventional chemical pesticides are not available.

Benefits of Bio-Based Pest Management and Plant Health Products

While conventional chemical pesticides are often effective in controlling pests, some of these chemicals are acutely toxic, some are suspected carcinogens and some can have other harmful effects on the environment and other animals. Health and environmental concerns have prompted stricter legislation around the use of conventional chemical pesticides, particularly in Europe, where the use of some highly toxic or endocrine-disrupting chemical pesticides is banned or severely limited and the importation of produce is subject to strict regulatory standards on

3

Table of Contents

pesticide residues. In addition, the European Union has passed the Sustainable Use Directive, which requires EU-member countries to reduce the use of conventional chemical pesticides and to use alternative pest management methods, including bio-based pest management products. Over the past two decades, U.S. regulatory agencies have also developed stricter standards and regulations. Furthermore, a growing shift in consumer preference towards organic and sustainable food production has led many large, global food retailers to require their supply chains to implement these practices, including the use of bio-based pest management and fertilizer solutions, water and energy efficiency practices, and localized food product sourcing.

Aside from the health and environmental concerns, conventional chemical pesticide users face additional challenges such as pest resistance and reduced worker productivity, as workers may not return to the fields for a certain period of time after treatment. Similar risks and hazards are also prevalent in the water treatment market, as chlorine and other chemicals used to control invasive water pests contaminate and endanger natural waterways. Costs of using conventional chemical pesticides are also increasing due to a number of factors, including raw materials costs such as rising costs of petroleum, stringent regulatory requirements and pest resistance to conventional chemical pesticides, which requires increasing application rates or the use of more expensive alternative products.

As the cost of conventional chemical pesticides increases and the use of conventional chemical pesticides and genetically modified crops meets increased opposition from government agencies and consumers, and the efficacy of bio-based pest management and plant health products becomes more widely recognized among growers, bio-based pest management products are gaining popularity and represent a strong growth sector within the market for pest management technologies. Growers are increasingly incorporating bio-based pest management products into IPM programs, and bio-based pest management products help create the type of sustainable agriculture programs that growers and food companies increasingly emphasize.

Bio-based pest management products include biopesticides, as well as minerals such as copper and sulfur. The EPA registers biopesticides in two major categories: (i) microbial pesticides, which contain a microorganism such as a bacterium or fungus as the active ingredient and (ii) biochemical pesticides, which are naturally occurring substances such as insect sex pheromones, certain plant extracts and fatty acids. Biostimulasts, which are not registered by the EPA absent additional pest control usages, are microorganisms or natural substances derived from microorganisms or plants that growers use to reduce plant stress, stimulate plant physiology to increase yield, manage pest resistance and reduce chemical residues.

We believe many bio-based pest management products perform as well as or better than conventional chemical pesticides. When used in rotation or in spray tank mixtures with conventional chemical pesticides, bio-based pest management products can increase crop yields and quality over chemical-only programs. Agricultural industry reports, as well as our own research, indicate that bio-based pest management products can affect plant physiology and morphology in ways that may improve crop yield and can increase the efficacy of conventional chemical pesticides. In addition, pests rarely develop resistance to bio-based pest management products due to their complex modes of action. Likewise, bio-based pest management products have been shown to extend the product life of conventional chemical pesticides and limit the development of pest resistance, a key issue facing users of conventional chemical pesticides, by eliminating pests that survive conventional chemical pesticide treatments. Most bio-based pest management products are listed for use in organic farming, providing those growers with compelling pest control options to protect yields and quality. Given their generally lower toxicity compared with many conventional chemical pesticides, bio-based pest management products can add flexibility to harvest timing and worker re-entry times and can improve worker safety. Many bio-based pest management products are also exempt from conventional chemical residue tolerances, which are permissible levels of chemical residue at the time of harvest set by governmental agencies. Bio-based pest management products may not be subject to restrictions by food retailers and governmental agencies limiting chemical residues on produce, which enables growers to export to wider markets.

In addition to performance attributes, bio-based pest management products registered with the EPA as biopesticides can offer other advantages over conventional chemical pesticides. From an environmental

4

Table of Contents

perspective, biopesticides have low toxicity, posing low risk to most non-target organisms, including humans, other mammals, birds, fish and beneficial insects. Biopesticides are biodegradable, resulting in less risk to surface water and groundwater and generally have low air-polluting volatile organic compound content. Because biopesticides tend to pose fewer risks than conventional pesticides, the EPA offers a more streamlined registration process for these products, which generally requires significantly less toxicological and environmental data and a lower registration fee. As a result, both the time and money required to bring a new product to market are reduced.

Our Solution

We produce bio-based pest management and plant health products that are effective and generally designed to be compatible with existing pest control equipment and infrastructure. This allows them to be used as alternatives for, or mixed with, conventional chemical pesticides, as well as in markets for which there are no available conventional chemical pesticides or the use of conventional chemical products may not be desirable or permissible because of health and environmental concerns. We believe that compared with conventional chemical pesticides, our products:

| • | can be competitive in both price and efficacy; |

| • | provide viable alternatives where conventional chemical pesticides and genetically modified crops are subject to regulatory restrictions; |

| • | comply with market-imposed requirements for pest management programs by food processors and retailers; |

| • | are environmentally friendly; |

| • | meet stringent organic farming requirements; |

| • | improve worker productivity by shortening field re-entry times after spraying and allowing spraying up to the time of harvest; |

| • | are exempt from residue restrictions applicable to conventional chemical pesticides in both the agriculture and water markets; and |

| • | are less likely to result in the development of pest resistance. |

In addition, our experience has shown that when our products are mixed with conventional chemical pesticides, they can:

| • | increase the effectiveness of conventional chemical pesticides while reducing their required application levels; |

| • | increase levels of pest control and consistency of control; |

| • | increase crop yields; |

| • | increase crop quality, including producing crops with higher levels of protein, better taste and color and more attractive flowers; and |

| • | delay the development of pest resistance to conventional chemical pesticides. |

We believe that the benefits of our products will encourage sustained adoption by end users. For example, we have seen that growers that have used our products on a trial basis in one year have generally continued to use our products in higher levels in subsequent years.

5

Table of Contents

Our Competitive Strengths

Focus on Bio-Based Products

Our belief in and commitment to our vision is our greatest strength. We believe that the world needs more organic and sustainable products and practices, and our goal is to champion that cause. Our experience has shown that by using bio-based pest management and plant health products, growers can benefit the environment and produce more healthy food while improving yields. However, bio-based products have application methods and modes of action that differ fundamentally from conventional chemical products. While major agrichemical companies sell bio-based products, we do not believe that those companies have sufficiently prioritized bio-based products or invested in the internal and external education that is essential to successfully promote these products, and those companies are often conflicted when marketing both conventional chemical products and bio-based products. In contrast, we believe MBI has long been recognized as a thought leader in the bio-based product industry, and we have consistently sought to educate growers in the use and benefits of these products, both alone and mixed with conventional chemical products. We believe our drive to convert acres to these sustainable practices will make us disruptive.

Commercially Available Products

We have four commercially available product lines: Regalia, Grandevo, Venerate and Zequanox. All four of these product lines are EPA approved, and Regalia is also approved in Canada, nine Latin American countries (including Brazil), South Africa and parts of Europe. Zequanox is approved in Canada, and is the only product EPA-approved for open water application other than copper, which is rarely used due to its negative environmental effects. All four of these commercialized lines are subject to patents and trade secrets related to the work we have done to characterize, formulate, develop and manufacture marketable products. We believe these product lines, along with our other EPA-approved and EPA-submitted products and other pipeline product candidates, provide us the foundation for continuing to build the leading portfolio of bio-based pest management products.

Robust Pipeline of Novel Product Candidates

Our pipeline of early-stage discoveries and new product candidates extends across a variety of product types for different end markets, including herbicides, fungicides, nematicides, insecticides, algaecides (for algae control), molluscicides (for mussel and snail control) and plant growth and plant stress regulators. Our product candidates are developed both internally and sourced from third parties. Our research and development process enables us to discover, source and develop multiple products in parallel, which keeps our pipeline robust. In August 2014, we received EPA approval of MBI-011, a weed-controlling biochemical, sarmentine, discovered and isolated from a pepper plant species, and we are currently pursuing third-party manufacturers to synthesize the natural compound at a cost that allows us to introduce the product to the market. We are currently developing the active ingredient in Venerate, a Burkholderia rinojensis microbe we isolated using our discovery process, for commercial release as Majestene bionematicide (MBI-305). We also have additional product candidates at various other stages of development, including MBI-601, a fungus that produces volatile compounds and works as a soil biofumigant, which was submitted to the EPA in April 2014, and a new Bacillus-based fungicide, MBI-110 that has demonstrated activity against downy mildew, Sclerotinia and other crop diseases, which we expect to submit to the EPA by early 2016.

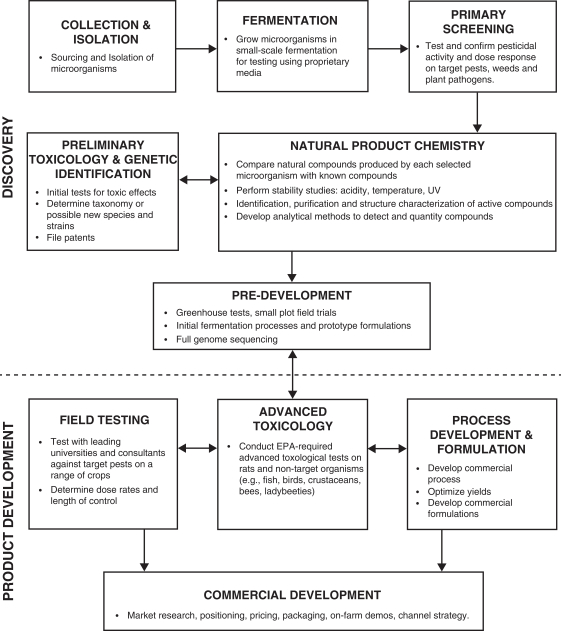

Rapid and Efficient Development Process

We believe we can develop and commercialize novel and effective products faster and at a lower cost than many other developers of pest management products. For example, we have moved each of Regalia, Grandevo, Venerate and Zequanox through development, EPA approval and first U.S. launch in approximately four years or less at a cost of $3 million to $6 million. Thereafter, we have continued to develop and refine these products producing new formulations, applying for expanded use labels, and seeking new markets, in each case at a cost of less than $10 million per product line. In comparison, a report from Phillips McDougall shows that the average

6

Table of Contents

cost for major agrichemical companies to bring a new crop protection product to market has been over $250 million, and these products have historically taken an average of nearly ten years to move through development, regulatory approval and market launch.

Proprietary Discovery Process

Our discovery process allows us to efficiently discover microorganisms and plant extracts that produce or contain compounds that display a high level of pesticidal activity against various pests. After we identify pesticidal activity, we subject the microorganisms and plant extracts to tests to determine effects on plant growth, nutrient uptake and drought and salt stress. We then use various analytical chemistry techniques to identify and characterize the natural product chemistry of the compounds, which we optimize and patent. Four of our product candidates, one of which is EPA-approved, are what we believe to be newly identified microorganism species. We believe that four of our product candidates produce novel compounds that we identified, and four of our product candidates have been found to have, or produce compounds with, a novel mode of action. Our proprietary discovery process is protected by patents on the microorganisms, their natural product compounds and their uses for pest management, as well as a patent application we have filed on a screening process to identify enzyme-inhibiting herbicides. We also maintain trade secrets related to the discovery, formulation, process development and manufacturing capabilities. By conducting our own discovery as well as working with outside collaborators, we are able to access the broadest range of products for commercialization, giving us an advantage over other natural bio-based pest management companies.

Management Team with Significant Industry Experience

Our management team has deep experience in bio-based pest management products and the broader agriculture industry. Our chief executive officer and other key employees average over 25 years of experience and include individuals who have led agrichemical sales and marketing organizations, top scientists and industry experts, some of whom have served in leadership roles at large multinational corporations and governmental agencies, commercialized multiple products, brought multiple products through EPA, state and foreign regulatory processes, filed patent applications and received patents, led groundbreaking research studies and published numerous scientific articles. In addition, our chief financial officer brings over 30 years of financial management experience spanning a variety of industries, including over 13 years of service as several public companies’ chief financial officer. Our general counsel has over 30 years of experience (25 years with public companies) in senior legal, sales and operating roles, including general counsel, vice president of sales and chief operating officer.

Our Growth Strategy

Accelerate Adoption of New Products, Product Applications and Product Lines

Our goal is to provide growers with complete and effective solutions to a broad range of pest management and plant health needs. Due to the competitive nature of the industry and the seasonality of crop growing, speed is essential to ensure widespread adoption. Accordingly, we have launched targeted placements of our products with early adopters in the United States relatively early in the product commercialization stage and for a limited number of indications. These growers, many of whom have unmet market needs, help us to troubleshoot and refine our products and to maximize their value proposition, enabling us to efficiently develop new formulations and expand uses and market penetration with minimal up-front capital investment per product line. We also believe we will be able to leverage growers’ positive experiences using our Regalia, Grandevo and Venerate product lines to accelerate adoption of new products, product applications and product lines. We believe product diversity allows us to compete with larger companies, to strengthen relationships with growers and distributors and not to be dependent on any one product or product category. Further, by offering and developing multiple products simultaneously, we believe we are perceived as a technology leader and can gain the benefits of increased momentum with distributors and end users. We will continue to target early adopters of new pest management and plant health technologies with controlled product launches and to educate growers and water resource managers about the benefits of bio-based pest management products through demonstrations to accelerate commercial adoption of our products.

7

Table of Contents

Deliberately Expand Applications of Our Product Lines

We want growers to know and trust that our products work. Although our initial EPA-approved master labels cover our products’ anticipated crop-pest use combinations, we launch early formulations of our pest management and plant health products to targeted customers under commercial labels that list a limited number of crops and applications that our initial efficacy data can best support. We then gather new data from experiments, field trials and demonstrations, gain product knowledge and get feedback to our research and development team from customers, researchers and agricultural agencies. Based on this information, we enhance our products, refine our recommendations for their use in optimal integrated pest management programs, expand our commercial labels, and submit new product formulations to the EPA and other regulatory agencies. For example, we began sales of Regalia SC, an earlier formulation of Regalia, in the Florida fresh tomatoes market in 2008, while a more effective formulation of Regalia with an expanded master label, including listing for use in organic farming, was under review by the EPA. When approved, we launched this new formulation into the Southeast United States in 2009 and nationally in 2010. In 2011, we received EPA approval of a newly expanded Regalia master label covering hundreds of crops and various new uses for applications to soil and through irrigation systems, and we recently expanded sales of Regalia in large-acre row crops as a plant stimulus product, in addition to its beneficial uses as a fungicide. Similarly, ongoing field development research on the microbe used in our insecticide product Venerate led to our October 2015 registration of Majestene (MBI-305) as a nematicide. We believe we have opportunities to broaden the commercial applications and expand the use of our existing products lines into several key end markets, including large-acre row crop applications, seed treatment, forestry, and public health to help drive significant growth for our company.

Focus on Proven Technology Families

We discover and develop more than one product line based on the same technology. For example, the Burkholderia microbe on which Venerate is based is also active against a broad range of nematodes, enabling development as our bionematicide product candidate, Majestene (MBI-305), and produces several herbicidal compounds, enabling development as our bioherbicide product candidate, MBI-010. In addition, our product candidates MBI-110 and MBI-507 are based on microbial fermentations of a newly identified Bacillus strain we isolated using our proprietary screening platform, and the Chromobacterium species on which Grandevo is based may also yield a promising bionematicide product, which we have begun development as MBI-304. Developing multiple products based on the same microbe allows for a more efficient use of research, development and manufacturing resources and enables us to leverage capital invested in existing technologies.

Continue to Develop and Commercialize New Products in Both Existing and New Markets

Our goal is to rapidly and efficiently develop, register and commercialize new products each year, with the goal of developing a full suite of pest management and plant health products. For example, while our current crop protection products address plant diseases and insects, we are developing products that can also control nematodes and weeds as well as products for improving fertilizer efficiency and reducing drought and salt stress. Our bioassay screening has identified at least four microbes that display activity against blue-green algae associated with toxic algal blooms, which have resulted in seasonal closures of some drinking water supplies in the Great Lakes region, and we are seeking partners to move these early-stage discoveries forward.

Target International Markets

Expanding international sales is an important component of our growth strategy, but the global markets for pest management products are intensely competitive. Our plan is to focus on key countries and regions with the largest and fastest growing biopesticide and plant health product markets for specialty crops and selected row crops. We intend to work with regional and country distributors who have brand recognition and established customer bases and who can conduct field trials and grower demonstrations and lead or assist in regulatory processes and market development.

8

Table of Contents

Leverage Manufacturing Capabilities

We initially used third-party manufacturers to produce all of our products on a commercial scale. In 2014, we completed the repurpose of a manufacturing facility that we purchased in July 2012 by installing three 20,000 liter fermentation tanks and constructing a dedicated building to house them, which has enabled us to manufacture in-house the majority of our products. We believe that greater control of our own manufacturing capacity allows us to scale-up processes and institute process changes more quickly and efficiently while ultimately lowering manufacturing costs over time to achieve the desired margins and protecting the proprietary position of our products. We continue to use third party manufacturers for Venerate and for spray-dried powder formulations of Grandevo and Zequanox.

Our Products

Commercially Available Products

The table below summarizes our current portfolio of commercially available biopesticide products, which have been able to move through development, EPA approval and first U.S. market launch in four years or less and at a cost of $3.0 million to $6.0 million. We have continued to develop and refine these products after initial launch, producing new formulations, applying for expanded use labels, and seeking new markets.

| NAME |

MARKET |

TARGET |

USE |

STATUS | ||||

| Regalia | Crop Protection, Home and Garden, Turf | Plant Disease/ Plant Health |

Protects against fungal and bacterial diseases and enhances yields | Commercially Available Domestically and Internationally | ||||

| Grandevo | Crop Protection, Home and Garden, Turf | Insects and Mites | Controls a broad range of sucking and chewing insects through feeding | Commercially Available Domestically | ||||

| Zequanox | Water Treatment | Invasive Mussels (In-Pipe and Open Water Habitat Restoration) | Controls invasive mussels that restrict water flow in industrial and power facilities and harm recreational waters | Commercially Available Domestically and in Canada | ||||

| Venerate | Crop Protection, Home and Garden, Turf, Animal Health | Insects and Mites | Controls sucking and chewing insects on contact | Commercially Available Domestically | ||||

Regalia

| • | Biofungicide |

| • | Crop Protection, Home and Garden, Turf: Targets Plant Disease, Improves Plant Health, Increases Yields |

| • | Commercially Available Internationally |

Regalia, a plant extract-based fungicidal biopesticide, or “biofungicide,” is EPA-registered for crop and non-crop uses and approved for use on foliage and roots in all states in the United States, including California and Florida, where the majority of the specialty crops are grown. It is also approved for sale in Brazil (tomatoes, potatoes, dried beans), Ecuador (flowers), Mexico (citrus and tree fruit, berries, tomatoes, peppers, potatoes, cucurbits, flowers, potatoes and grapes), Turkey (covered vegetables), Canada (tomatoes, grapes, strawberries, cucurbits, apples, turf, blueberries, hops (emergency use), ornamental plants and wheat), Peru (grapes and quinoa), South

9

Table of Contents

Africa (grapes), and Panama, Dominican Republic, El Salvador, Guatemala and Honduras (potatoes, tomatoes, peppers, tobacco, cucurbits, beans, avocados, citrus, peanuts, papayas and strawberries). Registration efforts are currently underway in China, with Regalia demonstrating efficacy in government-conducted trials on tomatoes, cucurbits, strawberries and grapes. University researchers have extensively tested the product against several important plant diseases, especially against mildews. We, and our commercial partners, have also conducted hundreds of trials in the United States and abroad, including five years of crop trials in Europe. The data show that Regalia is an effective addition to a disease management program against a broad range of diseases and can increase yields in crops such as strawberries, tomatoes, potatoes, soybeans, rice, wheat, alfalfa, sugarcane and corn.

Regalia is made from an extract of the giant knotweed plant and acts by turning on a plant’s “immune system,” a process called induced systemic resistance. Regalia also enhances the efficacy of major conventional chemical fungicides, and we have received a patent application on this synergism. Regalia also is effective for seed treatment of soybean, corn and cotton, for which we have filed a patent application, and we have received a patent on the effects on root growth and yield when Regalia is applied to the seed or as a root stimulant. For example, in field tests and in actual grower use, Regalia has shown significant yield increases on strawberries, tomatoes, potatoes, soybeans, rice, wheat, alfalfa, sugarcane and corn, with less irrigation required for strawberries treated with Regalia.

We obtained an exclusive license relating to the technology used in our Regalia product line while Regalia was in the process development and formulation stage of product development. In addition to developing the supply chain to commercially market the product, using our natural product chemistry expertise, we developed an analytical method to measure and characterize the major compounds in the plant extract, and we enhanced these compounds several times in new formulations, providing Regalia with a broader spectrum of activity and better efficacy than the original licensed product. In addition, we improved the physical properties of our Regalia formulations and developed four formulations that meet organic farming standards. We have filed several patent applications with respect to these innovations. In addition, we have received a U.S. patent for modulating plant growth by treating roots of plants with Regalia (or other compounds or extracts of knotweed), and transplanting the plants into soil. We have also received a patent on the synergistic combination of Regalia or knotweed extract and some important chemical fungicides.

We launched Regalia SC, an earlier formulation of Regalia, into the Florida fresh tomatoes market in December 2008. This formulation had a limited label with a few crops and uses on the label and it was not compliant for organic listing. In 2009, we began sales of Regalia based plant health products in the United Kingdom (under the name Sentry R by Plant Health Care) and Ecuador (under the name Milsana), and we later received a revised, broader label with hundreds of crops for a new organic formulation, which we subsequently launched into the Florida vegetables and Arizona leafy greens markets. In January 2010, we received state approval in California and immediately launched Regalia into the leafy greens and walnuts markets. Key markets include vegetables in the southeast, citrus in Florida, leafy greens and vegetables in California and Arizona, walnuts and stone fruit in California and pome fruit and grapes in California and the Pacific Northwest. In December 2011 and August 2012, we received EPA approval and California regulatory approval, respectively, for an expanded Regalia label that includes new soil applications, instructions for yield improvement in corn and soybeans and additional crops and target pathogens. Our product for row crops is sold separately as Regalia Rx and for international markets, where the Regalia trademark is allowed, as Regalia Maxx. We submitted Regalia for registration in the European Union, which is one of the largest fungicide markets in the world. We received regulatory approval for Regalia in South Africa in June 2013, in El Salvador, Guatemala and Honduras in December 2013, in Peru in March 2014, in Colombia in June 2014, in Tunisia and Morocco in late 2014 and in Brazil, for tomato, potato and dry beans, in December 2014. We have recently received EPA approval for three new formulations (12%, 16% and a solvent-free 5%), which will be used for market segmentation and replacement of existing formulations.

Regalia, Regalia Maxx and Regalia Rx are USDA National Organic Program compliant and OMRI-USA/OMRI-Canada certified.

10

Table of Contents

Grandevo

| • | Bioinsecticide |

| • | Crop Protection, Home and Garden, Turf: Targets Insects and Mites |

| • | Commercially Available Domestically, International Expansion Efforts Underway |

Grandevo is based on a new species of microorganism, Chromobacterium subtsugae, which was discovered by a scientist at the USDA in Beltsville, Maryland, and which we have licensed and commercialized. Grandevo is a powerful feeding inhibitor: insects and mites become agitated when encountering it and will not feed and starve, or, if they do ingest it, die from disruption to their digestive system. Grandevo also has repellent effects on and reduces egg hatching and reproduction of target insects and mites. Grandevo is particularly effective against chewing insects (such as caterpillars and beetles) and sucking insects (such as stinkbugs and mealybugs, as well as thrips and psyllids, which are respectively known as “corn lice” and “plant lice”). Trials to date and reports from grower use have shown instances of commercial levels of efficacy as good as the leading conventional chemical pesticides on a range of chewing and sucking insect and mite pests, including two invasive species of psyllid affecting citrus and potato crops. Grandevo has also shown significant control of other pests such as plant-feeding fly larvae, mosquitoes, and white grubs in turf grass, “leafmining” caterpillar larvae and other leaf-eating caterpillars. Grandevo has also shown efficacy against corn rootworm, a major pest of corn, which has reportedly been resistant to corn engineered for rootworm control. Grandevo has shown efficacy against other soil pests, including white grubs, wireworms, and root maggots. Field trials are ongoing to further characterize Grandevo’s efficacy.

We obtained a co-exclusive license for the bacterial strain used in our Grandevo product line while Grandevo was undergoing primary screening as a potential product candidate. Since licensing the microorganism, we completed the testing and development necessary to produce and commercialize an EPA-approved product and have filed our own patent applications with respect to the microorganism, including its genome, synergistic combinations with conventional chemical pesticides, product formulations containing the bacterial strain as well as the chemistry produced by the microorganism upon which Grandevo is based. We have an issued U.S. patent on one of these novel compounds produced by the bacteria and novel insecticidal and nematicidal uses.

We placed a prototype liquid formulation of Grandevo on a targeted basis under a limited label into the Florida citrus crop market in 2011. Commencing in the summer of 2012, we launched a dry formulation of Grandevo in markets across the United States where state registrations have been approved, targeting key markets, including citrus, tomatoes, peppers, strawberries, potatoes, leafy greens and other fruits and vegetables. This dry formulation was approved by the EPA in May 2012 and has been registered in 49 of 50 states (Hawaii pending) as well as Puerto Rico. In May 2013, we received EPA approval for a revised label reflecting Grandevo’s safety for bees. In addition, we submitted the registration dossier for Grandevo to Mexico and Canada and for emergency use in Brazil in October 2014. Grandevo has received completeness determination from the European Commission and is now cleared to begin the evaluation for Annex 1 listing and commercialization in the European Union. A June 2015 policy decision by the European Commission, the European Food Safety Authority and a Working Group of EU Member States has allowed Grandevo, which contains only non-viable Chromobacterium subtsugae cells, to be evaluated as a microbial pesticide. Until this recent EU decision, only pesticides containing live microbes could be evaluated under EU regulation. Grandevo is being assessed under the Netherlands Government’s “Green Deal” Initiative, which has been created with an aim to “speed up the sustainability of PPPs (plant protection products) in agriculture and horticulture by facilitating the authorization of green PPPs with a low risk for humans, animals and the environment.” Efficacy trials recently completed in Europe will be used to support uses of Grandevo for the control of whitefly and thrips in Solanaceae (tomato, pepper and aubergine) and Cucurbitaceae (melon, cucumber and squash) crops.

Grandevo is USDA National Organic Program compliant and OMRI-USA/OMRI-Canada certified.

11

Table of Contents

Zequanox

| • | Biomolluscicide |

| • | Water Treatment: Targets Invasive Mussels (In-Pipe and Open Water Habitat Restoration) |

| • | Commercially Available in United States and Canada |

| • | USDA “BioPreferred” Program Certified Product |

Zequanox addresses the problem of invasive zebra and quagga mussels, which clog pipes, disrupt ecosystems, encrust infrastructure and blanket beaches with razor-sharp shells. These mussels cause approximately $1.0 billion in damage and associated control costs annually in parts of the United States alone. There are limited treatment options available, many of which are time-consuming and costly, or harm aquatic flora and fauna. Zequanox is a biomolluscicide derived from a common microbe found in soil and water bodies, Pseudomonas fluorescens. Zequanox is an environmentally friendly, bio-based pest management product that is designed to kill over 75% of invasive mussels in treated pipe systems without causing collateral ecological damage. In July 2012, we conducted an open water trial in Deep Quarry Lake, Illinois, where the Zequanox treatment killed more than 90% of the tested mussels on the lake bed. This level of control in open water treatments was repeated in 2013. We generated revenues for treating an Oklahoma Gas & Electric facility 2012 and 2013 and a First Light & Power facility along the Housatonic River in Connecticut in 2014. In addition, Zequanox was used by the Minnesota Department of Natural Resources and the Minnehaha Creek Watershed District’s Aquatic Invasive Species Program to treat a recent infestation of these invasive mussels in Christmas Lake, resulting in 100% control of the mussels in the tested area. Zequanox is approved in Canada and is the only product EPA-approved for open water application in the United States other than copper, which is rarely used due to its negative environmental effects.

At recommended application rates, Zequanox is not toxic to other aquatic life, including ducks, fish, crustaceans and other bivalve species such as native clams or mussels. Zequanox is safe to workers, less labor intensive and requires shorter treatment times compared with conventional chemical pesticides. Zequanox can be used by power plants and raw water treatment facilities as an alternative to conventional chemical treatments such as chlorine, or as a complement to those products.

We entered into a license agreement with The University of the State of New York pursuant to which we were granted an exclusive license under the University’s rights relating to the bacterial strain used in our Zequanox product line while the product’s natural product chemistry was still under investigation. Since then, we have developed dry powder formulations, significantly improved the fermentation process for higher cell yield, allowing us to increase manufacturing scale, and we have filed patent applications relating to natural product compounds in the Zequanox cells we have identified and product formulations we have developed. In addition, we have received $1.1 million in grants from the National Science Foundation for work needed to commercialize the bacterial strain in Zequanox, which is currently being marketed and sold directly to U.S. power and industrial companies.

Due to prioritization constraints, we have not committed resources to Zequanox sufficient to market it full-scale and substantially improve margins. However, we are currently in discussions with large water treatment companies to further develop Zequanox and expand it commercially. In addition, we continue to work with state, federal and bi-national partners via the Great Lakes Commission’s Invasive Mussel Collaborative and the EPA’s Great Lakes Restoration Initiative to further develop Zequanox in the Great Lakes/Upper Mississippi River Basin as a habitat restoration tool and potential harmful algal bloom management tool (as zebra and quagga mussels selectively feed on beneficial algae while rejecting toxic blue-green algae).

12

Table of Contents

Venerate

| • | Bioinsecticide |

| • | Crop Protection, Home and Garden, Turf and Ornamentals, Animal Health: Targets Insects and Mites |

| • | Commercially Available Domestically |

Venerate is based on a microbial fermentation of a new bacterial species we isolated using our proprietary discovery process. We have identified compounds produced by the microorganism in Venerate that control a broad range of chewing and sucking insects and mites, as well as flies and plant parasitic nematodes, on contact, which is complementary to the anti-feeding effects of Grandevo. In addition, because we currently sell Venerate in a liquid formulation and Grandevo in a powder formulation, we are seeking to exploit opportunities for market segmentation, including for combinations with liquid fertilizer and for low-volume aerial applications. Venerate was approved by the EPA in February 2014 and we began to sell in May 2014. We submitted Venerate for the Canadian Pest Management Regulatory Agency registration in April 2014 and submitted the registration dossier for Venerate to Mexico in April 2014. We have conducted field trials on several crops and insects and mites, many of which show efficacy as good as leading conventional chemical pesticides. Venerate has shown positive results in field trials against soil insects of corn, wheat and soybeans, applied both in-furrow and as seed treatments, and has shown broad spectrum activity across a wide range of pests, including Asian citrus psyllid, corn rootworm, stinkbugs, caterpillars and weevils. Additional trials are in progress in 2015.