SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K/A

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 of the

Securities Exchange Act of 1934

For the month of April, 2024

Commission File Number 1-34129

CENTRAIS ELÉTRICAS BRASILEIRAS S.A. - ELETROBRÁS

(Exact name of registrant as specified in its charter)

BRAZILIAN ELECTRIC POWER COMPANY

(Translation of Registrant's name into English)

Rua da Quitanda, 196 – 24th floor,

Centro, CEP 20091-005,

Rio de Janeiro, RJ, Brazil

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F ___X___ Form 40-F _______

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes _______ No___X____

|

Table of Contents

| Message from the Chairman of the Board of Directors | 6 |

| Manual for Participation | 8 |

| 1.1. Entirely digital OEGM | 8 |

| 1.2. Voting Ballot | 10 |

| 1.3. Required documents | 11 |

| 1.4. Registration and accreditation | 12 |

| 1.5. Declaration of Membership in a Group of Shareholders | 14 |

| 1.6. Installation of the Fiscal Council | 15 |

| 2. Management Proposal | 17 |

| 2.1. Matters to be approved at the OEGM | 17 |

| 2.1.1.1. To take the management accounts, examine, discuss and vote on the Management Report and the Complete Annual Financial Statements of the Company for the fiscal year ending December 31, 2023 | 19 |

| 2.1.1.2. To approve the proposal of the Company's management for the allocation of net income for the fiscal year ending December 31, 2023 and the distribution of dividends | 23 |

| 2.1.1.3. To set the annual maximum compensation of the managers, the external members of the advisory committees to the Board of Directors and the members of the Fiscal Council (if installed) for the fiscal year 2024 | 25 |

| 2.1.2.1. To approve the proposed amendment to the Stock Plan approved at the Company's Extraordinary General Meeting held on December 22, 2022 | 32 |

| 2.1.2.2. To approve the proposed amendment to the Restricted Stock Option Plan approved at the Company's Extraordinary General Meeting held on December 22, 2022; | 35 |

| 2.1.2.3. Pursuant to article 53 of the Company's Bylaws and as approved by the shareholders at the Company's Extraordinary General Meeting held on April 17th, 2023, to elect the member of the Board of Directors who will replace Mr. Carlos Eduardo Rodrigues Pereira, whose term of office ends at the Ordinary and Extraordinary General Meeting of 2024, and the new member elected to the position in question will remain in the position until the ordinary general meeting to be held in 2025. | 38 |

| Conclusion | 41 |

| List of Schedules | 42 |

| SCHEDULE A | 44 |

| Section 2 of the Company's Reference Form (information on the executive officers' comments on the financial and equity conditions and results of operations) | 44 |

|

| SCHEDULE B | 107 |

| Information required by Schedule A of CVM Resolution 81 (Allocation of the Company's Net Income) | 107 |

| SCHEDULE C | 115 |

| Section 8 of the Company's Reference Form (detailed information on the compensation of managers and members of advisory committees) | 115 |

| SCHEDULE D | 176 |

| Historical information on Management compensation effectively paid compared to approved maximum aggregate compensation at the OGM | 176 |

| SCHEDULE E | 181 |

| Information required under Schedule B of Resolution CVM 81/2022 (proposal for amending the "Eletrobras Compensation Plan Based on Stock Options" approved at the Company's Extraordinary Shareholders' Meeting held on December 22, 2022) | 181 |

| SCHEDULE F | 188 |

| "From/To" table of the proposed changes to the Compensation Plan Based on Stock Purchase Options | 188 |

| SCHEDULE G | 193 |

| Stock Option Plan with consolidated proposed changes | 193 |

| SCHEDULE H | 203 |

| Information required by Annex B of CVM Resolution 81/2022 (proposal for amending the "Eletrobras Restricted Share-Based Compensation Plan" approved at the Company's Extraordinary General Meeting held on December 22, 2022) | 203 |

| SCHEDULE I | 210 |

| "From/To" table of the proposed changes to the Compensation Plan Based on the Restricted Shares | 210 |

| SCHEDULE J | 214 |

| Restricted Shares Plan with the proposed consolidated amendments | 214 |

| SCHEDULE K | 221 |

| Sections 7.3 to 7.6 of the Company's Reference Form (information on Ms. Ana Silvia Matte, candidate for member of the Company's Board of Directors) | 221 |

|

Message from the Chairman of the Board of Directors

|

Dear Shareholders, It is with great pleasure and a sense of responsibility that, on behalf of the Board of Directors, I invite you to attend in the Ordinary and Extraordinary General Meetings of Centrais Elétricas Brasileiras S/A (“Eletrobras” ou “Company”), to be held on April 26, 2024, at 2 p.m. (Brasilia time), entirely remotely (“Meetings” or “OEGM”). And in this brief and indispensable introduction, I feel compelled to share with you some considerations. Since its historic privatization on June 17, 2022, with the implementation of the "true corporation" model, Eletrobras has set itself a pace of constant and orderly transformation. The destination is clear: to become the global leader in generating sustainable value based on innovative clean and renewable energy solutions. The mission, however, is not elementary. The journey is hard. It is precisely this destiny, rooted in every fiber of every employee, that makes our work both challenging and rewarding . When we are faced with major challenges, in a world surrounded by volatility and uncertainty, where looking to the future goes beyond the mere work routine and becomes a survival instinct, it is not uncommon for us to forget to look back. From time to time, we need to do this exercise and remember the hard-won achievements and lessons learned, because they are the foundation of tomorrow's victories and the compass that points us in the right direction. |

First of all, I would like to highlight the effort made to restructure our companies, which has allowed us to plant solid roots towards an effective and innovative management model, capable of seeing the business, assets, people, processes, risks and opportunities holistically and synergistically. We can finally say that we have taken the first steps towards the vision of a single Eletrobras.

In addition, I am pleased to point out that we have managed to structure an effective compensation model for the Company, providing it with tools to attract and retain talent and to ensure alignment of interests among stakeholders, always prioritizing the Company's continuity and the generation of sustainable long-term value. It was based on this remuneration model that we were able to build a team of executives of the highest excellence, integrity, training and experience, who are key members of this transformational process at Eletrobras.

|

Which brings us to a third important point: people. Our most important asset, people are fundamental to this journey. Our challenge is to ensure that our employees have the right tools, incentives and direction to search for, produce and transmit knowledge, always based on ethical, innovative and high-performance practices.

With this in mind, we structured a vice-presidency and teams focused on people. We also gave deserved prominence to the aspects of communication and sustainability with the creation of dedicated departments and teams. We promoted meetings with Eletrobras' leaders, where our executives and board members were interviewed and taught by the eager and curious minds of the future. We initiated several recruitment and selection processes, such as the launch of the first Eletrobras Trainee Program, under the direct sponsorship of the Board of Directors. We are also working on the strategic process to ensure that every employee, from the company's CEO to the line or substation operator, knows (and tells us too, as this is a joint effort) exactly what their role and relevance is in this incredible journey. Because the pursuit of knowledge and exceeding targets will only come if everyone is effectively involved in building our future.

Naturally, all of these initiatives, and countless others highlighted throughout our corporate documents, required adjustments and corrections throughout 2023. And when difficult decisions had to be made, the Board of Directors showed integrity, assertiveness and firmness.

And it couldn't be any different. After all, the mission of this Board of Directors is to pave the road to Eletrobras' future. Results will always be a consequence of our long-term vision. And the continuity and governance of this corporation, combined with the well-being of its people, are our most precious assets.

We wish you a good meeting !

Vicente Falconi Campos

CHAIRMAN OF THE BOARD OF DIRECTORS

|

|

– that the recordings and their information will be used and processed by the Company for a period of five years, and may be used for the Company's defense or due to a mandatory obligation. | |

The Admitted Shareholder declares that he/she is aware of the following: |

– the carrying out of various types information processing due to legal or regulatory obligations to which the respective data controller is subject, which is in the interest of the Admitted Shareholder, in accordance with their legitimate expectations, based on the support and promotion of the Company's activity. |

– that the rights over their personal data may be exercised as permitted by applicable laws and regulations, after formal communication to the Company. |

By accessing the Digital Platform and participating in the OEGM, the Admitted Shareholder is aware and authorizes the Company, as well as third parties authorized by the Company, to record and make use of the information, provided that the applicable legislation and regulations are complied. The purpose of the authorized use is:

| § | registration of the possibility of manifestation and visualization of the documents presented during the OEGM; |

| § | record of the authenticity and security of communications during the OEGM; |

| § | register of attendance of Admitted Shareholders at the OEGM ; |

| § | register of votes cast by Admitted Shareholders at the OEGM ; |

| § | compliance with judicial, arbitration, legal, administrative, regulatory or self-regulatory orders; |

| § | if necessary, to defend the rights of the Company and its managers in judicial, arbitration, administrative, regulatory or self-regulatory spheres. |

|

If the Admitted Shareholder wishes to speak on a matter on the Agenda, they must use the Digital Platform to register their request. The secretary of the OEGM will then activate the audio, according to the queue of requests. The time allowed to speak may be limited. If the request is not related to any matter on the Agenda, the Admitted Shareholder should use the usual contact channels, through the Investor Relations area. |

The statements of Admitted Shareholders sent to the board of the OEGM before the end of the meeting, via e-mail to assembleiavirtual@eletrobras.com,, will only be attached to the minutes if expressly requested.

|

The Company is not responsible for any situations that are not under the Company's control, such as instability in the internet connection or incompatibility between the Digital Platform and the equipment used by the OEGM participant. |

|

It is recommended that Admitted Shareholders access the Digital Platform at least 30 minutes before the start of the OEGM, in order to avoid any unwanted situations when using the platform. The Company will provide to Admitted Shareholders remote technical support and a guide with basic instructions for accessing the OEGM.

Any questions or explanations can be given by the Vice-President for Finance and Investor Relations by sending an e-mail to assembleiavirtual@eletrobras.com.

1.2. Voting Ballot

|

The Shareholders may attend the OEGM through the Remote Voting Ballot. Guidance on the documentation required for remote voting can be found in the Voting Ballot, available on the websites: https://ri.eletrobras.com/, https://sistemas.cvm.gov.br/ e https://www.b3.com.br/pt_br/. |

To attend the OEGM through the Voting Ballot, the Company's Shareholders must fill in the appropriate fields, sign the Voting Ballot and send it no later than 7 days before the date of the OEGM to the following recipients:

| bookkeeping agent | The Shareholders with a shareholding position in the book-entry book may vote remotely through Itaú Corretora de Valores S.A. ("Bookkeeping Agent"). In this case, the Voting Ballot must be sent via the Itaú Assembleia Digital website. To this purpose, it is necessary to register and have a digital certification. Information on registration and the step-by-step process for issuing the digital certificate is available at https://assembleiadigital.certificadodigital.com/itausecuritiesservices/artigo/home/assembleia-digital |

| custody agent | The Shareholders must check with the custody agent whether it will provide a service for receiving Voting Ballots ("Custody Agent"). If so, the Shareholders may, at their sole discretion, forward the Voting Ballot to the Custody Agent, adopting the appropriate procedures, and may incur in possible costs. |

| company | The Shareholders may forward the Voting Ballot directly to the Company, provided that the Voting Ballot: § It will only be received if it is sent solely and exclusively via the website https://qicentral.com.br/m/agoe-eletrobras-2024. To access the system (i) Shareholders who have already registered on the platform must use the same access credentials, entering their e-mail address and password; and (ii) Shareholders who have not yet accessed the platform must click on "Sign up now" and enter their e-mail address. The system will then send a verification code to the e-mail address provided, so that the shareholder can complete their registration. § It must include the place, date and signature of the signatory Shareholder. If the Shareholder is considered a legal entity under Brazilian law, the signature must be that of its legal representatives or attorneys-in-fact with powers to perform this act. § It must be provided with documentation proving the signatory Shareholder's status as a Shareholder or legal representative, in accordance with the requirements and formalities indicated in this Management Proposal. |

|

The Voting Ballot will be considered invalid and will not be processed by the Company if it is not supported with the documents required to prove Shareholder or attorney status and/or if it is delivered after the expiration of the deadline of 7 days before the OEGM.

Until the end of the submission period, the Voting Ballot may be corrected and resubmitted by the Shareholder to the Company, in compliance with the procedures and other deadlines set out in CVM Res 81/2022, it being understood that no Voting Ballot will be accepted after the end of such deadline.

If there are items not completed after the expiration of the 7-day period prior to the OEGM, the Company will consider them as instructions equivalent to abstaining from voting .

Admitted Shareholders who have already sent in their Voting Ballot may register to attend the OEGM via the Digital Platform, provided that they do so in the manner and within the timeframe provided. In this case, the Admitted Shareholder may:

§ simply attend the OEGM, whether or not you have sent the Voting Ballot; or

§ attend and vote at the OEGM, noting that all voting instructions received by means of a Voting Ballot will be rejected, if the Shareholder wishes to vote at the OEGM but has already sent the Voting Ballot.

1.3. Required documents

|

These are the documents required to qualify and attend or vote in the OEGM via the Digital Platform, in compliance with article 126, paragraph 1, of the Brazilian Corporate Law and the decision of the CVM Board in case CVM RJ-2014/3578: |

i. if an individual:

§ copy of the identification document legally recognized as such, with a recent photo and national validity, as well as within the validity period (if applicable); or

§ in the event of being represented by an attorney-in-fact, a copy of the power of attorney signed less than one year ago, together with the attorney-in-fact's official identity document with photo, such attorney-in-fact to be another Shareholder, a director of the Company or a lawyer duly registered with the Brazilian Bar Association (OAB).

ii. if legal entity:

§ up-to-date articles of incorporation of the Shareholder and of the corporate document that elects the representative(s) with sufficient powers to represent it at the OEGM, duly registered with the competent authorities, together with the official identity document with photo of the said representative(s); and

|

§ if applicable, an instrument (as a power of attorney) duly granted in accordance with the law and/or the Shareholder's articles of association, together with an official identity document with photo of the attorney-in-fact .

iii. if an investment fund:

§ a copy of the current and consolidated fund regulations, bylaws or articles of incorporation of the administrator or the fund manager, as the case may be, in compliance with the investment fund voting policy;

§ documents that provides representative powers (corporate documents of election, term(s) of investiture and/or power of attorney);

§ identification document of the legal representative(s) with a recent photo and national validity;

§ if applicable, a copy of the , instrument (as a power of attorney) granted under the terms of its articles of association and in accordance with the rules of the Brazilian Civil Law, together with the attorney's official identity document with photo.

It is not necessary to send the hard copies of the Shareholder representation documents to the Company's office, nor is it necessary to notarize the signature of the grantor of the power of attorney to represent the Shareholder, registration before the embassy, apostille or sworn translation of all the foreign Shareholder representation documents.

Only simple copies of the original version of the required documents should be sent via the website https://qicentral.com.br/m/agoe-eletrobras-2024.

Powers of attorney granted by Shareholders by electronic means will only be admitted if they contain digital certification within the standards of the Brazilian Public Key Infrastructure (ICP-Brasil) system or by another means of proving the source and integrity of the document in electronic form.

1.4. Registration and accreditation

– Shareholder

The Shareholder who wishes to attend the OEGM via the Digital Platform must fill in all the registration details on the website https://qicentral.com.br/m/agoe-eletrobras-2024 and attach all the supporting documents at least 2 days before the date set for the OEGM, that is, by 11:59 p.m. on April 24, 2024.

To access the system, the Shareholder that :

§ already registered on the platform must access the link and use the same access credentials, entering their e-mail and password; and

|

§ who have not yet registered on the platform should access the link and click on "Register now" and then enter their e-mail address. The system will then send the verification code to the e-mail address provided so that the shareholder can complete their registration.

– Attorney-in-fact

The attorney-in-fact must register with their details on the website https://qicentral.com.br/m/agoe-eletrobras-2024 and, through this platform, inform each Shareholder they will represent and attach the respective documents proving their status of the shareholder and representation, in accordance with the guidelines set out in this Management Proposal.

After this personal registry, the attorney-in-fact is automatically directed to the register of his or her grantor, but if he or she leaves this page and wants to add more grantors, the attorney-in-fact will need to access the website https://qicentral.com.br/m/agoe-eletrobras-2024 and log in with the password created at the time of registration to continue registering them. The attorney in fact will receive individual confirmation of the qualification status of each shareholder registered in their register and will arrange, if necessary, for documents to be completed.

If the attorney-in-fact represents more than one Shareholder, the attorney-in-fact:

§ will only be able to vote at the OEGM by Shareholders whose qualification has been confirmed by the Company; and

§ should beware of §2 of Article 8 of the Bylaws, which establishes that any Shareholder represented by the same agent, administrator or representative in any capacity, with the exception of holders of securities issued under the Company's Depositary Receipts program, when represented by the respective depositary bank, will be considered to be a member of the same group of Shareholders, for the purposes of the voting limitation pursuant to Articles 6 and 7 of the Bylaws, provided that they do not fall within any of the other hypotheses set out in the caput or §1 of Article 8 of the Bylaws.

The Company will check the documents and, if there are no pending issues, the Shareholder or his/her attorney-in-fact, as the case may be, will be accredited ("Admitted Shareholder") and will receive, via the Digital Platform, confirmation of his/her admission to attend the OEGM.

|

In the event of insufficient documentation, the Shareholder must complete it on the same website https://qicentral.com.br/m/agoe-eletrobras-2024, by 11:59 p.m. on April 24, 2024. |

If an Admitted Shareholder does not receive confirmation of virtual access to the OEGM up to 8 hours before the beginning of the OEGM, they must contact the Company's Investor Relations area by e-mail at assembleiavirtual@eletrobras.com up to 4 hours before the beginning of the OEGM.

|

Access to the OEGM via the Digital Platform will be restricted to Admitted Shareholders (shareholders or their attorneys-in-fact, as the case may be). The Company warns that shareholders who do not submit the request and the necessary participation documents within the deadline will not be able to attend the OEGM.

Admitted Shareholders (shareholders or their attorneys-in-fact, as the case may be) undertake to:

§ use the individual register solely and exclusively for remote participation in the OEGM;

§ not to transfer or disclose, in whole or in part, the individual registration to any third party, Shareholder or not, the registration being non-transferable; and

§ not to record or reproduce, in whole or in part, or transfer, to any third party, Shareholder or not, the content or any information transmitted by virtual means during the OEGM.

1.5. Declaration of Membership in a Group of Shareholders

Due to the limitation on the exercise of voting rights pursuant to articles 6 and 7 of the Company's Bylaws, the Company requests, for the purposes of the timely examination of the matter, that the Shareholders included in the legal situations contemplated in article 8 of the Bylaws inform, up to 2 days prior to the date designated for the holding of the OGM, that is, up to 11:59 p.m. on April 24, 2024, which are the members of a potential group of Shareholders.

In the case of investment funds with the same administrator or manager, only those whose investment and voting policies at shareholders’ meetings, under the terms of the respective regulations, are the responsibility of the administrator or manager will be considered members of a Shareholder group.

The information must be provided by sending the Declaration of Membership in a Group of Shareholders, exclusively to the following website address https://qicentral.com.br/m/agoe-eletrobras-2024, mentioning whether:

§ are part of a voting agreement and whether there are other members of the agreement and their respective corporate interests;

§ are part of an economic group of companies or group of entities with common administration or management or under the same authority; and

§ are represented by the same agent, administrator or representative in any capacity whatsoever.

The form of the Declaration of Membership in a Group of Shareholders is available on the website https://ri.eletrobras.com/informacoes/convocacoes-e-atas/.

The Shareholders who do not fall within the legal situations contemplated in Article 8 of the Company's Bylaws do not need to send the aforementioned statement and the Company will consider that such Shareholders affirm that they are not a member in any "group of shareholders" and that they are responsible for such affirmation, given the informational duty provided for in the Company's Bylaws.

|

Pursuant to article 8, paragraph 5, of the Company's Bylaws, the chairman and secretary of the Shareholder meeting may, if they deem necessary, request documents and information from shareholders in order to verify whether a shareholder is a member of a "shareholder group" that may hold 10% or more of the Company's voting capital.

1.6. Installation of the Fiscal Council

Eletrobras does not have a permanent Fiscal Council. For this reason, under the terms of article 43 of the Company's Bylaws, article 161, paragraph 2, of the Brazilian Corporation Law, and article 4 of CVM Resolution No. 70, of March 22, 2022 (CVM Res 70/2022), Eletrobras' Fiscal Council will be installed at the request of Shareholders representing at least 2% of the shares with voting rights (common shares issued by the Company), or 1% of the shares without voting rights (class "A" and class "B" preferred shares issued by the Company), which can be made via Voting Ballot or directly to the Company, by e-mail to assembleiavirtual@eletrobras.com.

The Fiscal Council may be composed by 3 to 5 effective members and an equal number of alternates, whether shareholder or not, who will be elected at the OEGM. Before deciding on the election of the members of the Fiscal Council, the meeting will set the number of vacancies to be filled by candidates.

The rules that must be complied when nominating candidates for the Fiscal Council are set out below in item "1.7.1 Nomination of Candidates for the Board of Directors and the Fiscal Council".

1.7. Election of a Member to the Board of Directors - Transitional Provision of the Bylaws

The term of office of Mr. Carlos Eduardo Rodrigues Pereira, elected at the Extraordinary General Meeting held on February 22, 2022, as representative of the Company's employees, will end at the OEGM, due to the extinction of this seat on the Board of Directors, as approved at the Extraordinary General Meeting held on April 17, 2022 and reflected in article 53 of the Bylaws ("Transitional Provision").

Under the terms of the Transitional Provision, the OEGM must elect a member to the Board of Directors who will remain in the position until the end of the term of office of the current members of the Board of Directors (i.e. until the Ordinary General Meeting is held in 2025).

The relevant election will take place solely to comply with the Transitional Provision, by electing 1 member to the Board of Directors. Further information on the subject, including the candidate nominated by the Company's management, can be found in item 2.1.2.3 of this Management Proposal. If shareholders are interested in nominating a candidate for member of the Board of Directors, guidelines on the subject can be found in item 1.8 below.

|

1.8. Nomination of candidates

Pursuant to article 37 et seq. of CVM Res 81/2022, shareholders representing at least 0.5% of the Company's shares of a certain type, by means of a request sent to the Financial and Investor Relations Vice-Presidency at the e-mail address assembleiavirtual@eletrobras.com, may submit a request for inclusion in the Voting Ballot of (i) candidates for permanent members and respective alternates of the Fiscal Council; and (ii) candidates for members of the Board of Directors, under the terms of the Transitional Provision and item 1.7 above ("Inclusion Request").

The Inclusion Request may be sent up to 25 days before the date of the meeting, i.e. up to 11:59 p.m. on April 1, 2024.

The Shareholder who sends a Request for Inclusion must comply with the requirements applicable to the drafting and instruction of the Voting Ballot as provided for in articles 32 and 38, II, of CVM Res 81/2022, which includes, without limitation, the information indicated in items 7.3 to 7.6 of the Company's Reference Form, in accordance with the provisions of article 11, I, of CVM Res 81/2022.

Also, when nominating candidates for members of the Board of Directors and/or for full and alternate members of the Fiscal Council, Shareholders must, in addition to submitting all relevant supporting documentation, be aware of the terms of articles 147, §§1 to 3 of the Brazilian Corporation Law.

The Company reserves the right, after receiving the Request for Inclusion and the initial analysis of the information sent by the Shareholders, in accordance with the deadline established by CVM Res 81/2022, to request additional information.

The Company points out that the nomination of candidates by Shareholders can be made at any time up to the conclusion of the meeting. However, in order to provide adequate publicity to its Shareholders about any candidates nominated, the Company encourages Shareholders to make their nominations as far in advance as possible.

1.8.1. Additional rules for nominating candidates to the Fiscal Council

In addition to the requirements set out in item "1.8.1. Nomination of candidates" above, Shareholders must comply with the additional requirements applicable to candidates for the Fiscal Council set out in article 162, caput and §2 of the Brazilian Corporation Law.

The election of candidates for members of the Fiscal Council will comply with the provisions of the Company's Bylaws and the terms of article 161, paragraph 4 of the Brazilian Corporation Law.

Shareholders holding non-voting shares (class "A" and class "B" preferred shares issued by the Company) will have the right to request the separate election of a sitting member and respective alternate member to the Fiscal Council.

|

2. Management Proposal

The Management of Eletrobras submits to its Shareholders the following proposals, to be deliberated at the Ordinary and Extraordinary General Meetings ("OEGM"), which will be held exclusively digitally, on April 26, 2024, at 2 p.m.

2.1. Matters to be approved at the OEGM

|

2.1.1. AGENDA - OGM : 2.1.1.1. To take the accounts of the management, examine, discuss and vote on the Management Report and the Complete Annual Financial Statements of the Company for the fiscal year ending December 31, 2023; 2.1.1.2. To approve the proposal of the Company's management for the allocation of net income for the fiscal year ending December 31, 2023 and the distribution of dividends; and 2.1.1.3. To set the maximum annual compensation of the management, the external members of the advisory committees to the Board of Directors and the members of the Fiscal Council (if installed) for the 2024 fiscal year. |

2.1.2. AGENDA – EGM: 2.1.2.1. To approve the proposed amendment to the Stock Option Plan approved at the Company's Extraordinary General Meeting of December 22, 2022; 2.1.2.2. To approve the proposed amendment to the Restricted Share Plan approved at the Company's Extraordinary General Meeting of December 22, 2022; and 2.1.2.3. Pursuant to article 53 of the Company's Bylaws and as approved by the shareholders at the Company's Extraordinary General Meeting held on April 17, 2023, to elect the member of the Board of Directors who will replace Mr. Carlos Eduardo Rodrigues Pereira, whose term of office ends at the 2024 Ordinary and Extraordinary General Meeting, and the new member elected to the position in question will remain in the position until the ordinary general meeting to be held in 2025. |

|

Voting Rights § Shareholders holding ordinary shares shall have the right to vote on all items on the Agenda of the OEGM, subject to the Restriction provided for in Articles 6 and 7 of the Bylaws . § Shareholders of preferred shares will not have the right to vote on any of the items on the Agenda of the OEGM, unless there is a valid request for the installation of the Fiscal Council. In this case, the holders of class "A" and class "B" preferred shares may request the separate election of an effective member and alternate member of the Fiscal Council, pursuant to article 161, paragraph 4, 'a', of the Brazilian Corporation Law, and article 43 of the Company's Bylaws.

|

2.1.1. AGENDA - OGM

2.1.1.1. To take the management accounts, examine, discuss and vote on the Management Report and the Complete Annual Financial Statements of the Company for the fiscal year ending December 31, 2023

Management proposes to the Shareholders the approval of the management accounts, the management report on the business and main administrative facts ("Management Report") and the Company's complete annual financial statements ("Financial Statements"), accompanied by the report issued by PriceWaterhouseCoopers Auditores Independentes ("Independent Auditor's Report" and "PWC"), all referring to the fiscal year ended December 31, 2023 and approved by the Board of Directors, at a meeting held on March 13, 2024.

To support the deliberations to be taken at the Meeting, management asks Shareholders to analyze all the documentation and considerations described below:

Sustainability highlights in the Management Report, ESG approach and main milestones achieved in 2023.

The year 2023 was marked by significant changes, continuing the company's transformational process that began after its privatization in 2022.

The creation of the Sustainability Department, directly linked to the Vice-Presidency of Governance, Risks, Compliance and Sustainability, and the organizational restructuring of the main wholly-owned subsidiaries, with the establishment of integrated teams, processes and practices, allowed the Company to develop tools to build a sustainable, holistic and interconnected vision of the business, and apply it organically and diversified in the daily routine of employees.

The commitment to sustainability was strengthened, with the directive to be a "Reference in ESG" and the Net Zero target by 2030 in the Company's Strategic Plan. In the middle of changes and new challenges, some highlights were:

| § | Implementation of the Innovation Grid, a platform for connecting with the innovation ecosystem; |

| § | Sale of UTE Candiota on January, 2024; |

| § | Brazil's first green hydrogen certification; |

| § | Participation in COP 28; |

| § | Acting as Ambassador of the Amazon Impact Movement (Movimento Impacto Amazônia); |

| § | Creation of the first Trainee program; |

| § | Launch of the "Commitments for Life" Program; |

| § | Launch of the new Compliance Program. |

This was also a year of defining new Eletrobras' Materiality (Materialidade da Eletrobras), as part of the process of preparing the 2023 Annual Sustainability Report and other management and corporate governance documents, and with the aim of continuously strengthening and improving our processes, practices and businesses.

We developed dual materiality, in line with European standards, considering both impact and financial materiality. Using a comprehensive methodology, the process included inputs from market and competitor analysis, feedback from stakeholders and executives, dynamic materiality, a consultation workshop with the Sustainability Committee and the guidelines and objectives of the Strategic Plan.

The new Materiality proposed by the Executive Board was approved by the Board of Directors in November 2023.

Lastly, the company received important recognition, such as:

| § | Maintained in the ISE B3 2024 Portfolio for the 17th time; |

| § | Inclusion in the first IDIVERSA B3 portfolio: B3's diversity index, with a focus on gender and race; |

| § | Pro-Ethics Company Seal 2022-2023, from the Office of the Comptroller General (CGU – Controladoria Geral da União); |

| § | Good Practices Award 100% Transparency Movement, from the Global Pact, for the practice of raising awareness among critical suppliers; |

| § | Listed on the Bloomberg Gender-Equality Index 2023; |

| § | International Project Management Award from PMOGA World Unconference. Eletrobras' PMO was among the two best PMOs in the Americas and among the seven best in the world; |

| § | Anefac Transparency Trophy 2023, from the National Association of Executives, in recognition of transparency practices in accounting information; |

| § | Permanence in The Sustainability Yearbook 2024, a Standard&Poors Global ranking, for the fourth consecutive year ; |

| § | Advancement to the A- (leadership) classification in the Climate Change and Water Security 2023 dimensions of the CDP - Disclosure Insight Action. |

Financial Statements, accompanied by the Management Report, the Independent Auditor's Report, the Fiscal Council's opinions on the Capital Budget and on the Financial Statements, as well as the Summary Annual Report of Eletrobras' Statutory Audit and Risk Committee, for the fiscal year ending December 31, 2023

The Financial Statements, accompanied by the Management Report, the Independent Auditor's Report, the opinion of the Fiscal Council on the capital budget, the proposal for allocation of net income and on the Financial Statements ("Opinion of the Fiscal Council"), as well as the annual summary report on the activities of the Eletrobras Audit and Risk Committee ("Annual Summary Report"), for the fiscal year ended December 31, 2023, are available on the Company's website (https://ri.eletrobras.com/), CVM (https://sistemas.cvm.gov.br/) and B3 (https://www.b3.com.br/pt_br/).

In more detail:

(a) the Financial Statements (i) express the economic and financial situation of the Company, as well as the changes in its assets in the financial year just ended, enabling shareholders to assess the Company's assets and profitability; (ii) comprise the Balance Sheet, the Statement of Income for the Year, the Statement of Changes in Shareholders' Equity, the Cash Flow Statement (DFC), the Statement of Comprehensive Income and the Statement of Value Added, together with the notes to the financial statements, the purpose of which is to assist shareholders in analyzing and understanding this information;

(b) the Management Report, which accompanies the Complete Annual Financial Statements, presents information on the Company of a financial and non-financial, statistical and operational nature, which should be read together and as part of this Management Proposal;

(c) the Independent Auditor's Report on the Financial Statements was issued by PWC, which examined all relevant documentation and concluded that the Financial Statements present fairly, in all material respects, the financial position of the Company and its subsidiaries as of December 31, 2023;

(d) the Opinion of the Fiscal Council was issued after a meeting held on March 13, 2024 and is the result of an examination of the Management Report, the proposals for the capital budget and the allocation of net income for the fiscal year ended December 31, 2023, the Financial Statements and respective explanatory notes, the clarifications received during the fiscal year in meetings with management, PWC and the Audit and Risk Committee, as well as an examination of the Independent Auditor's Report, on which the Fiscal Council expressed the opinion that they were in a position to be considered by the Meeting; and

(e) the Annual Summary Report contains a description of the activities carried out by the Company's Audit and Risks Committee, its results and conclusions reached, as well as the recommendations made.

The Financial Statements are expected to be published in the newspaper Valor Econômico (National Edition) by April 12, 2024.

Management comments on the Company's financial situation

The management's comments on the Company's financial situation for the fiscal year ending December 31, 2023, pursuant to Section 2 of the Reference Form, can be found in SCHEDULE A of this Management Proposal.

Standardized Financial Statements Form

In addition, the Standardized Financial Statements Form - DFP is also available for consultation by Shareholders on the Company's website (https://ri.eletrobras.com/), CVM’s (https://sistemas.cvm.gov.br/) and B3's (https://www.b3.com.br/pt_br/).

2.1.1.2. To approve the proposal of the Company's management for the allocation of net income for the fiscal year ending December 31, 2023, and the distribution of dividends

Eletrobras reported a consolidated net profit of R$4,395 billion for the fiscal year ended December 31, 2023, 21% higher than the R$3,638 billion in 2022. The Management Report and SCHEDULE A of this Proposal detail the variation in the main accounts that make up the result for the year 2023, presenting the highlights and events that occurred during the year and which shed light on this result.

In this context, having noted the favorable opinions of the Fiscal Council and the Audit and Risks Committee, as well as the Independent Auditor's Report, the Company's Management proposes that the determination of the parent company's net profit in the amount of R$4,550 million, as per the Financial Statements, be recorded.

Allocation of Profits and Distribution of Dividends

The Company's Management proposes the following allocation of net income for the fiscal year ending December 31, 2023 (without prejudice to the proposed Capital Budget and Retention, detailed below):

| § | As provided for in the main section of article 193 of the Brazilian Corporation Law, 5% of the net profit for the year, corresponding to R$227 million, must be allocated to the Legal Reserve; |

| § | Pursuant to article 49, paragraph 1 of the Bylaws, the portion corresponding to 25% of the adjusted net profit for the fiscal year ending December 31, 2023, corresponding to R$1,081 million, will be distributed to the company's shareholders as mandatory dividends. In addition, management proposes the distribution of an additional 5% of adjusted net income as an additional dividend, corresponding to R$216 million. Thus, the total distribution of dividends proposed corresponds to 30% of the adjusted net profit for the fiscal year ending December 31, 2023, totaling R$1,297 million, including the portion to be attributed to holders of class "A", class "B" and special class preferred shares (golden share). If approved, the dividends will be paid within a time limit of 60 days from the date of approval, to be announced in due course, in accordance with the provisions of article 205, paragraph 3 of the Brazilian Corporate Law. |

| § | Pursuant to article 50, II, of the Company's current Bylaws, up to 75% of the net profit for the year may be allocated to the Statutory Investment Reserve. Management therefore proposes that the amount of R$3,026 million, corresponding to 66.50% of the net profit for the year, be allocated to the Statutory Investment Reserve. |

Pursuant to article 10, II, and Schedule A of CVM Res 81/2022, detailed information regarding management's proposal for the allocation of net income for the fiscal year ending December 31, 2023, can be found in SCHEDULE B to this Management Proposal.

| § | Capital Budget and Retention (article 196 of the Brazilian Corporation Law) |

In addition to the above, with regard to the proposal to retain profits for capital budget purposes, as authorized by article 196 of the Brazilian Corporation Law ("Capital Budget"), management clarifies that, for the current fiscal year (2024), it has reviewed its Capital Budget and considered the proposal to retain accumulated profits of R$373 million to be appropriate. Information on the proposed Capital Budget and on the retention of profits, under the terms of article 196 of the Brazilian Corporation Law, can be found in SCHEDULE B to this Management Proposal.

2.1.1.3. To set the annual maximum compensation of the managers, the external members of the advisory committees to the Board of Directors and the members of the Fiscal Council (if installed) for the fiscal year 2024

· Brief Background

Until June 17, 2022, the date on which the privatization of the Company materialized through an operation to increase the capital stock with dilution of the controlling public entity (capitalization or follow-on), the compensation strategy of the managers of Eletrobras and its subsidiaries was defined exclusively by the Secretariat for the Coordination and Governance of State-Owned Companies (SEST), whose guidelines were to be applied to all state-owned enterprises. This is because, until that date, the Company was a federal state-owned company, under the control of the Federal Government, and was subject to a series of limitations for the determination of the compensation of its managers.

After the follow-on, the Company the company no longer had a defined controlling shareholder (corporation), which imposed new challenges on the management associated with its transformational process, aiming at unlocking the numerous value levers associated with the new nature of private company.

In view of this situation, it was found that the management compensation model in force at the time of privatization was outdated with market practices and inadequate to the Company's objectives of attracting and retaining talent and generating sustainable value in the long term.

At the EGM held on December 22, 2022, the Company presented the new compensation model for its managers ("Compensation Model" or "Model"), which was based on a study prepared by the specialized consulting firm Korn Ferry. At that moment, the shareholders became aware of the main characteristics of the new short-term incentive mechanism for executives, approved the prospective review of the overall compensation within the period in effect at the time, and also approved the components of the new long-term incentives, more specifically: (i) the Compensation Plan Based on Stock Options ("Stock Option Plan"); and (ii) Restricted Stock Based Compensation Plan ("Restricted Stock Plan"), both available for consultation on the Company's investor relations website (https://ri.eletrobras.com) and on the CVM website (www.cvm.gov.br), which the Company's management proposes to amend, pursuant to SCHEDULE E to SCHEDULE J of this Proposal.

At the OGM held on April 27, 2023, the shareholders approved the proposal for the overall compensation of the managers for the period from April 1, 2023, to March 31, 2024, and the guidelines and assumptions of the Compensation Model approved at the December 2022 meeting were preserved.

Contemplating compensation levels aligned with companies of similar size and sector, the Compensation Model is composed of fixed compensation, benefits and short and long-term incentive mechanisms, with the distribution of weights focused primarily on the long-term vision, with the objective of solidifying a high-performance, ethical and sustainable culture. In this sense, the Compensation Model:

| (i) | enables the Company to retain current key professionals and attract new talent, in addition to fostering a high-performance culture, through the granting of long-term incentives conditioned to the fulfillment of previously established conditions, goals and triggers, which serves as a driving force for unlocking the value levers of capitalization; |

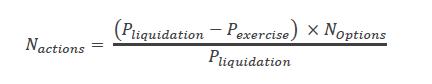

| (ii) | allows managers (and other beneficiaries) to benefit a direct association between their performance and the capture of a portion of the value related to the appreciation of the Company's shares compared to the exercise price defined in the Option Plan, whose pricing is based on the premise that the exercise price cannot be less than BRL42.00 per share, monetarily adjusted by the variation of the IPCA since October 10, 2022 (date of the capital increase operation that resulted in the privatization of the Company) until the effective exercise of the right of call options, and may also be increased by additional spread by decision of the Board of Directors. In addition, management proposes to the Meeting to amend the Stock Option Plan to provide that, in addition to the foregoing, the exercise price of the options, set forth in the respective grant agreement, is not lower than the average price per share of the Company, to be determined by the Company based on the average closing price of its common shares traded on B3 S.A. – Brasil, Stock Exchange, Over-the-Counter (ticker: ELET3), in the 90 trading sessions prior to the date of granting of the Options to each Beneficiary (as defined in the Options Plan), weighted by the trading volume of such common shares; |

| (iii) | It fosters an ethical culture of high performance, focused on exceeding targets, maximizing the ability to generate long-term value and sharing this value with long-term investors. |

Along these lines, the approval of the Compensation Model enabled the Company to carry out its initial personnel restructuring, with emphasis on building a team of excellence of twelve executives who now occupy the Presidency and eleven Executive Vice-Presidencies, according to the reformulation of the organizational structure of the Company's Executive Officers ("Executive Officers") in 2023.

It is the vision of this management that the achievement of the desired levels of the management of assets and business presupposes, above all, the search for excellence in people management. And the composition of a highly qualified, collaborative, honest and high-performance executive team is an inescapable prerequisite for the Company to build a high-performance culture.

· Annual Maximum Compensation Proposal

This annual maximum compensation proposal ("Compensation Proposal"), approved unanimously by the Company's Board of Directors, covers the period from January 1, 2024 to December 31, 2024. The purpose of the Compensation Proposal is to continue the implementation of the Compensation Model, which represents an essential element in unlocking the levers associated with privatization.

The Compensation Proposal considers the following general assumptions and guidelines:

§ the Compensation Model approved by shareholders in December 2022 enabled Eletrobras to start its transformational journey by strengthening its people management strategy, through the inclusion of tools to capture and retain talent and qualified executives, as well as to encourage an ethical and high-performance culture and alignment of interests among management, the Company and its shareholders;

§ the best market practices and the recommendations made by the consulting firm Korn Ferry gave rise to the development of a Model whose general premise is that the highest percentage of the total compensation for the members of the Board of Executive Officers should be concentrated in short-term (STI) and long-term (LTI) incentives: 20% to 30% for fixed compensation; 25% to 30% for STI; and 40% to 50% for LTI.

§ the fixed compensation levels of the Executive Officers are positioned in the P50 (50% percentile) of the market, and, with the adoption of short- and long-term incentives based on goals, triggers and challenges of an economic-financial, social, environmental and governance nature of the Company, the total compensation package will be framed between P75 and P90 (between the 75% percentile and the 90% percentile). Therefore, the executive's maximum compensation package will only be achieved if the performance is proportional and targeted to the achievement of its goals.

§ the Executive Officers play a key role in the rationalization and optimization of the governance and management structure of the Company's subsidiaries, as well as in the consolidation of Eletrobras' role as a driver of a unified business strategy, through initiatives such as: (i) definition and implementation of its optimal capital structures; (ii) exploration of synergistic gains with the standardization of processes, routines, practices and structures, economies of scale and elimination of redundancies; (iii) unification and continuous improvement of safety standards in the management of people, assets and care for the environment; (iv) greater speed and security in decision-making; (v) improvement of integrated risk management; (vi) efficiency gains in the management of people, in the operation of assets and in the structuring and execution of investment projects; (vii) structuring a holistic and integrated view of the innovation, research and development process, aiming at identifying and capturing new technologies, risks and opportunities in the face of the constant evolution and development of the energy sector.

§ the Executive Officers played an important role in leading several fronts that led to relevant achievements in the 2023 fiscal year, always guided by the Company's Strategic Plan, whose objective is to position Eletrobras as a global leader in value creation with renewable and low-emission infrastructure and solutions. In this sense, the following initiatives are highlighted in the Strategic Plan: (i) the simplification and optimization of the corporate structures of Eletrobras and its subsidiaries; (ii) the structuring of the teams of managers responsible for the leadership and structuring of key strategic areas; (iii) the reduction of its operating costs (PMSO); (iv) the evolution of the rationalization process of Special Purpose Companies (SPEs)/Clusters; (v) the negotiation of debts associated with compulsory loans; and (vi) the disposal of assets and reduction of liabilities;

§ the Strategic Plan also defined four guidelines that guide Eletrobras' long-term vision of consolidating itself as a global green major, which guide the goals, triggers and indicators of the Compensation Model, namely: (i) transformation and operational resilience; (ii) reference in ESG (environmental, social and governance) practices; (iii) innovation and technology; and (iv) sustainable growth.

§ the Compensation Model is a necessary lever for the execution of the Company's Strategic Plan, as it allows the management to channel its efforts in favor of the intended short, medium and long-term directions, including indicators and targets of different dimensions, such as: economic-financial, governance, environmental and social – as described in SCHEDULE C to this Management Proposal;

§ the Bonus Program ("Short-Term Incentive" or "STI") and the Stock Option Program ("Long-Term Incentive" or "LTI") are based on goals considered together or separately, such as, for example, profitability, sustainability, excellence and/or long-term value creation, as well as the Company's triggers and challenges, so that, if fulfilled, and depending on the degree attained, there is a corresponding remuneration. Therefore, the short- and long-term incentives adopted by the Company reflect, while supporting the Strategic Plan;

§ in the case of the Stock Option Plan, there is no possibility of the exercise price per option granted being set at a level lower than BRL42.00 (adjusted annually by the variation of the IPCA and also subject to the addition of a specific spread at the discretion of the Board of Directors). In addition, management proposes that the Plan be amended to include a rule that the exercise price may not be set at an amount lower than the market value of the common shares issued by the Company (calculated based on the average of the closing price of the 90 trading sessions prior to the respective date of grant, weighted by the trading volume of such common shares). given that the basic premise of the Stock Option Plan is the generation of long-term sustainable value, to be shared between its beneficiaries and the Company's shareholders, who supported the privatization and approved the Stock Option Plan. In addition, it is it was pointed out that at the time of the follow on, approximately 55% of the shareholders acquired shares at the previously mentioned price of BRL 42.00, which reinforces the Company's zeal, when constructing the Compensation Model, to align the long-term interests of shareholders and managers;

§ the Restricted Stock Plan was developed as a specific long-term incentive mechanism for the Executive Officers and the members of the Board of Directors and with the objective of attracting and retaining key talents and qualified executives, strictly in the context of privatization. Thus, the possibility of granting grants under this plan ended in March 2023.

§ in line with good corporate governance practices and principles and applicable legislation, the Company's Board of Directors approved, in 2023, the following policies: (i) Management Compensation Policy, which consolidates rules and assumptions associated with the Compensation Model and also establishes rules aimed at the possible retention and compensation of amounts due to managers (malus) and reimbursement to the Company of any compensation incentives erroneously granted to managers due to a subsequent accounting rectification (clawback), including compliance with the provisions of Section 10D of the Securities Exchange Act of 1934, as amended (Exchange Act), Rule 10D-1 enacted under the Exchange Act (Rule 10D-1). 10D-1) and Section 303.14 of the New York Stock Exchange Listed Company Manual; (ii) Indemnity Policy, which establishes clear guidelines and limits for the exercise of the right of indemnity by its beneficiaries, whether through the activation of the D&O Insurance or the Indemnity Agreement entered into, such as the establishment of a limit on the Company's financial exposure, the establishment of rules for the treatment of potential situations of conflict of interest and the establishment of causes excluding the right to indemnity, among which the hypothesis of compensation based on Rule 10D-1 stands out, which overrides any indemnity; (iii) Nomination Policy, which establishes objectives, assumptions and general rules associated with the process of nomination and investiture of managers of Eletrobras and its subsidiaries.

Finally, in accordance with market practices and aiming at a better understanding of the information by shareholders, the Company now presents to investors the proposal for the remuneration of managers for the fiscal year (coinciding with the calendar of the current year) and no longer for the period between April of the current year and March of the following year.

That said, Management proposes to the Shareholders' Meeting that the amount of up to BRL83,174,264.33 be approved for the fiscal year 2024, as maximum aggregate compensation for the members of the Executive Officers, members of the Board of Directors and external members of the Advisory Committees to the Board of Directors, as well as the Fiscal Council (if installed). This amount does not include the charges related to the national institute of social security (INSS), and is composed of:

· BRL67,097,036.21 for the Executive Officers;

· BRL13,219,728.12 for members of the Board of Directors;

· BRL2,100,000.00 for the external members of the Advisory Committees to the Board of Directors; and

· BRL757,500.00 for the Fiscal Councilors (if installed, considering as premise the election of five full members).

The adjustments and amounts set forth above are aimed at achieving the Company's objectives of retaining key talent and attracting qualified executives, as well as aligning the compensation of Eletrobras' management with the Company's performance and growth after its privatization and with other companies in the market and similar size.

On this occasion, Management informs that the maximum aggregate compensation of the Company's management approved at the OGM held on April 27, 2023 was BRL106,516,417.95, of which BRL94,029,167.54 was effectively paid to the management during the period from April 1, 2023 to March 31, 2024.

For a better understanding by the Shareholders of the proposed remuneration of the Company's directors for the financial year 2024, and in line with the guidelines contained in the Circular/Annual-2024-CVM/SEP Letter, of March 7, 2024, SCHEDULE D presents historical information on the remuneration actually paid compared against the global remuneration approved at the Meetings for the periods from April 2023 to March 2024, as well as April 2022 to March 2023.

Pursuant to Article 13 of CVM Resolution 81/2022, all information and details regarding Management's proposal to set the overall compensation of the members of the Board of Directors, the Executive Officers, the Fiscal Council (if installed) and the external members of the advisory committees to the Board of Directors, as provided for in Section 8 of the Reference Form, are set out in SCHEDULE C of this Management Proposal.

2.1.2. AGENDA – EGM

2.1.2.1. To approve the proposed amendment to the Stock Plan approved at the Company's Extraordinary General Meeting held on December 22, 2022

At the EGM held on December 22, 2022, the Eletrobras Stock Option Plan ("Stock Option Plan") was approved with the objective of enabling the incorporation of long-term incentives, associated with the achievement of previously defined goals, in the remuneration package of the Beneficiaries, transforming them into potential shareholders of the Company, thus fostering a long-term vision of value creation.

In the course of the implementation of the Stock Option Plan and the definition of the terms and conditions for the respective grants, the Board of Directors identified the need to make specific adjustments to the rules of the plan, in order to:

| § | address the particularities faced by the Company in 2023, during the period of adaptation of its team of executive officers to its new phase after privatization; and |

| § | provide greater transparency to shareholders about the practices already adopted by the Company in setting the exercise price of call options, by establishing that the exercise price provided for in the grant agreement must always be at a level not lower than the market value of the shares on the date of the grant, to be calculated based on the average closing price of the Company's common shares traded in the 90 trading sessions prior to the respective date weighted by the trading volume of such shares. |

In this sense, Management proposes to make adjustments to the Stock Option Plan, which are summarized below, together with their respective justification. Additional information on the proposed amendment to the Stock Option Plan can be found in (i) SCHEDULE E, referring to the information required by Schedule B of CVM Resolution 81/2022; (ii) in SCHEDULE F, corresponding to the "from/to" table highlighting the proposed changes to the Stock Option Plan; and (iii) in SCHEDULE G, in which the consolidated version of the Stock Option Plan is presented, as proposed for amendment.

| # | Summary Description of Adjustment | Justification |

| 1. | To enable that, exclusively for the beneficiaries to whom the Company approved the granting of Call Options during the fiscal year of 2023, the Board of Directors may set the initial milestone for calculating the Maturity Period of the respective Options granted, on a date prior to the date of the respective Option Agreement, but in no case prior to June 1, 2023, and always after the possession or admission of the respective beneficiary. |

In order to ensure that the implementation of the Company's Stock Option Plan is carried out in a manner consistent with the long-term interests of the Company and its shareholders, the discussions on the terms and conditions for granting the Options to the executives required significant time and effort from the Company. Even after the approval by the Board of Directors of the Option Program and the selection of some of the Company's employees as beneficiaries of the Plan, a significant amount of time elapsed until the effective drafting of the respective Option Agreements, implying that the granting of the Options, through the execution of the respective instruments, was postponed to the 2024 fiscal year. As a result, as a way of not harming the executives selected by the Board of Directors in 2023 as beneficiaries of the Plan, the Company proposes that the Board of Directors may, in an extraordinary manner, set an initial milestone for calculating the Maturity Period of their respective Options on a date prior to the date of the respective Option Agreement, provided that this date: (a) is in no case prior to June 1, 2023, and (b) is always subsequent to the possession or admission of the beneficiary. The proposed adjustment, therefore, is restricted to options already approved by the Board of Directors in 2023. It should also be noted that the change relates exclusively to the beginning of the calculation date of the maturity period, and therefore there is no change in other conditions provided for in the Stock Option Plan (exercise price, indicators and performance goals, vesting conditions etc.). |

| 2. | To provide that, in addition to the current rule of the Plan for setting the exercise price of Call Options – according to which the price per share may not be lower than BRL 42.00 updated by the variation of the IPCA since June 6, 2022 – the exercise price may also not be lower than the average price per share of the Company, to be determined by the Company based on the average closing price of its common shares traded on B3 S.A. – Brasil, Bolsa, Balcão (ticker: ELET3), in the 90 trading sessions prior to the date of grant, weighted by the trading volume of such common shares. |

The Company has already adopted the rule of not setting the exercise price at a level lower than the market value of the shares. Thus, the proposed adjustment only seeks to increase the degree of transparency in relation to a conduct that is already practiced by the Company. |

2.1.2.2. To approve the proposed amendment to the Restricted Stock Option Plan approved at the Company's Extraordinary General Meeting held on December 22, 2022;

As mentioned above, at the EGM held on December 22, 2022, Eletrobras' Restricted Shares Plan ("Restricted Share Plan") was also approved, the objective of which is to (i) retain the Company's talents who have demonstrated solid high-performance performance and have qualifications and professional profiles aligned with the Company's new stage; (ii) assist in attracting new talent to key positions within the scope of Eletrobras' ongoing restructuring process; and (iii) encourage the Company's development and sustainable growth and the maximization of long-term value, in alignment with the capitalization value levers, by incorporating this Restricted Stock Plan into the compensation package of the current composition of the Board of Directors, whose term of office extends until the 2025 Annual General Meeting.

As in the case of the Stock Option Plan, when implementing the Restricted Stock Plan, the Board of Directors identified the need to make specific adjustments to the plan's rules, in order to ensure greater adherence to market practices.

In the view of management, the share-based compensation model adopted by Eletrobras requires constant improvement to maintain its objectives, competitiveness, effectiveness and alignment of the interests of the Company, its shareholders and beneficiaries.

The Company presents below a summary of the adjustments and the respective justification for the amendment of the Restricted Stock Plan. Additional information on the proposed amendment to the Restricted Action Plan can be found in (i) SCHEDULE H, referring to the information required by Exhibit B of CVM Resolution 81/2022; (ii) in SCHEDULE I, corresponding to the "from/to" table highlighting the proposed changes to the Restricted Action Plan; and (iii) in SCHEDULE J, in which the consolidated version of the Restricted Action Plan is presented, as proposed for amendment.

| # | Summary Description of Adjustment | Justification |

| 1. |

To make it possible that, exceptionally, in the event of death or permanent disability of a Beneficiary who is a member of the Board of Directors, the Beneficiary (or his/her heir(s), in the event of death) has the right to receive a number of Restricted Shares calculated in a proportional manner (pro rata) to the period served by the Beneficiary during his/her term of office on the Board of Directors. In addition, include the specific treatment of the case of the Beneficiary who is deceased or incapacitated by a permanent cause who holds a position as Executive Officer and on the Board of Directors, so that the shares received as Executive Officer are deducted from the number of pro rata shares to which the Beneficiary (or his/her heir, as the case may be) will be entitled, in the event of death or disability. |

Adjustment in line with market practices, as well as to address the exceptional scenario experienced by the Company, where certain beneficiaries hold positions on the Board of Directors and the Executive Officers, and, therefore, demand differentiated treatment in the event of death or permanent disability, given that they may have received lots of the restricted shares granted to them, prior to the respective vacancy event. We emphasize that the manager who holds a position on the Board of Directors and as Executive Officer is not entitled to cumulative compensation, that is, there is no duplicate payment. |

| 2. | To enable that, in addition to the adjustments in the number of restricted shares granted in the event that the number of shares issued by the Company is increased, decreased, there is a split or reverse split of shares, or dividends paid in shares, the Board of Directors may also make adjustments in order to reflect the economic impact of any dividend distributions; Interest on equity or proceeds in the period between the date of grant and transfer of ownership of the shares. | Adjustment in line with market practices. |

2.1.2.3. Pursuant to article 53 of the Company's Bylaws and as approved by the shareholders at the Company's Extraordinary General Meeting held on April 17th, 2023, to elect the member of the Board of Directors who will replace Mr. Carlos Eduardo Rodrigues Pereira, whose term of office ends at the Ordinary and Extraordinary General Meeting of 2024, and the new member elected to the position in question will remain in the position until the ordinary general meeting to be held in 2025.

§ Background

At the Company's Extraordinary General Meeting, held on April 17th, 2023, the exclusion of the statutory provision for the position of member of the Board of Directors representing employees was approved.

In this context, a Transitional Provision was included in article 53 of the Company's Bylaws, stating that, despite the approval of the extinction of the seat on the Board of Directors held by an employee representative, Mr. Carlos Eduardo Rodrigues Pereira, who had been elected to the position in question, should remain in the position until the OEGM of 2024, when the shareholders with common shares would elect his successor for the conclusion of the unified mandate of the Board of Directors at the OGM of 2025.

In addition, current formation of Eletrobras' Board of Directors concluded its first performance assessment cycle in February 2024, with the support of the external consultancy Spencer Stuart. This evaluation covered the individual and collegiate performance of the Board of Directors, as well as the performance of its advisory committees.

The work in question considered numerous aspects of the performance of the Board of Directors and its committees, including its structure, organization and attributions, its culture, and the individual and effective contribution of its members.

In this sense, the board identified opportunities for improvement that became part of its Development Plan, which reflects the company's commitment to diversity, not just as an intrinsic value, but as a strategic driver of innovation. The Company's management therefore prioritizes a composition of the Board of Directors that encompasses a wide range of perspectives - including gender, race, ethnicity, and representation of historically under-represented communities. In addition, we emphasize the importance of complementary and multidisciplinary functional expertise, with special attention to critical areas for the Company, such as human capital management, organizational structure, development, and succession planning.

§ Appointment of Ms. Ana Silvia Matte

In this context, based on the provisions of Eletrobras' Appointments Policy, and taking into account the inputs provided by the Board of Directors' performance evaluation process, the Company's People Committee referred to the Board of Directors the appointment of Ms. Ana Silvia Matte to assume the vacant seat, for the purpose of concluding the unified term of office until the OGM of 2025.

Ms. Ana Silvia Matte's appointment was approved by the Board of Directors at the meeting held on March 25th, 2024, based on the recommendation from the People´s Committee, without the involvement of the aforementioned, and the Committee also analyzed her investiture requirements. The candidate's qualifications and experience are detailed below and in SCHEDULE K to this Management Proposal, in accordance with items 7.3 to 7.6 of the Reference Form. The candidate in question meets the independence requirements set out in Annex K of Res CVM 80/2022 and in the Rules of the New Market special governance segment of B3 S.A. - Brasil, Bolsa, Balcão ("B3").

Ms. Ana Silvia Matte is a professional with solid experience in executive positions with a focus on people and human resources, C-Level in large companies and with strong relationships with stakeholders and shareholders. Throughout her career, she has had various experiences as a board member and as a member of thematic committees of publicly traded companies, having already been a member of the Company's Board of Directors at the time of its privatization and having worked in the management bodies of companies such as Petrobras, Vale, Copel, Cemig and Renova Energia. Ms. Ana Silvia Matte is currently an independent external member of the Company's People Committee.

In addition, Ms. Ana Silvia Matte has a career marked by the promotion of gender equality and equity in executive positions and is co-author of the book "Women on the Board - The Power of a Story", published in November 2022 by Editora Leader.

The Board of Directors and the People Committee believe that the appointment of Ms. Ana Silvia Matte is in line with Eletrobras' purpose and with the best national and international corporate governance practices, considering, in

addition to regulatory requirements, diversity criteria and a professional profile suited to the needs of the Board and the Company which, taken together, represent the attributes considered critical for the Board of Directors to act in line with the Company's long-term strategic vision.

Conclusion

In view of the above, the Company's Board of Directors has approved the convening of Eletrobras’ Ordinary and Extraordinary General Shareholders’ Meeting, to be held on April 26, 2024, under the terms of this Management Proposal and its annexes and recommends that Shareholders carefully read all the documentation made available to them in relation to the proposed resolutions, as well as approve them at the Meeting.

All the documents relating to the matter to be resolved by the OEGM, in particular the Financial Statements, accompanied by the Management Report, the Independent Auditor's Report, the opinions of the Fiscal Council on the Capital Budget and on the Financial Statements, as well as the Summary Annual Report of the Eletrobras Statutory Audit and Risk Committee and the Standardized Financial Statements Form - DFP, all relating to the fiscal year ending December 31, 2023 are available to Shareholders on the website: https://ri.eletrobras.com/, https://sistemas.cvm.gov.br/ e https://www.b3.com.br/pt_br/, as well as the Schedules listed below.

List of Schedules

| Schedule A | Section 2 of the Company's Reference Form (information on the directors' comments on the financial and equity conditions and results of operations) |

| Schedule B | Information required by Schedule A of CVM Resolution 81 (Allocation of the Company's Net Income) |

| Schedule C | Section 8 of the Company's Reference Form (detailed information on the remuneration of managers and members of advisory committees) |

| Schedule D | Historical information on Management compensation effectively paid compared to approved maximum aggregate compensation at the OGM |

| Schedule E | Information required under Schedule B of Resolution CVM 81/2022 (proposal for amending the "Eletrobras Compensation Plan Based on Stock Options" approved at the Company's Extraordinary Shareholders' Meeting held on December 22, 2022) |

| Schedule F | "From/To" table of the proposed changes to the Compensation Plan Based on Stock Purchase Options |

| Schedule G | Stock Option Plan with consolidated proposed changes |

| Schedule H | Information required by Annex B of CVM Resolution 81/2022 (proposal for amending the "Eletrobras Restricted Share-Based Compensation Plan" approved at the Company's Extraordinary General Meeting held on December 22, 2022) |

| Schedule I | "From/To" table of the proposed changes to the Compensation Plan Based on the Restricted Shares |

| Schedule J | Restricted Shares Plan with the proposed consolidated amendments |

| Schedule K | Sections 7.3 to 7.6 of the Company's Reference Form (information on Ms. Ana Silvia Matte, candidate for member of the Company's Board of Directors) |

SCHEDULE A