☐ |

Preliminary Proxy Statement | |

☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

☒ |

Definitive Proxy Statement | |

☐ |

Definitive Additional Materials | |

☐ |

Soliciting Material Pursuant to §240.14a-12 | |

| Payment of Filing Fee (Check all boxes that apply): | ||||

☒ |

No fee required. | |||

☐ |

Fee paid previously with preliminary materials. | |||

☐ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

April 3, 2024

Dear Fellow Stockholders:

As chairman of MRC Global’s Board of Directors, I am proud of the Company’s strong commitment to its investors, customers, employees and sound governance. On behalf of the MRC Global Board of Directors, I thank you for your investment in our Company and your continued support.

We are pleased to invite you to the 2024 Annual Meeting of Stockholders that will be conducted virtually on Tuesday, May 7, 2024, starting at 10:00 a.m. Houston, Texas time. Stockholders will be able to listen, vote and submit questions from any remote location with internet connectivity. A notice of the meeting and a Proxy Statement containing information about the matters to be acted upon are attached to this letter. Information on how to participate in this year’s virtual meeting can be found on page 1.

In March of this year, we added David A. Hager to the Board as a new independent director. During his tenure as CEO and Executive Chairman of Devon Energy, Dave led the execution of a strategy that drove impressive returns for Devon’s shareholders. His breadth and depth of board and business experience, particularly in energy, will bring valuable perspectives to our board as MRC Global continues to invest in our growth drivers, serve our customers and drive to generate significant value for our shareholders. On April 1, 2024, we entered into a cooperation agreement with Engine Capital L.P. and added Daniel B. Silvers to the Board as a new director. Daniel has served as the managing member of Matthews Lane Capital Partners LLC, an investment firm, since 2015 and as Executive Chairman of Winventory, Inc., a tech-enabled event ticketing management partner. His executive-level experience, along with his corporate finance, capital allocation and capital markets expertise will make him a valuable addition to the Board. Additionally, in March 2024 our Board determined to not re-nominate Barbara J. Duganier for re-election at the 2024 Annual Meeting of Stockholders as she had notified the Board of her desire to not stand for re-election. We want to thank Barbara for her many years of contribution to the Company and wish her the best in all of her future endeavors.

Thank you for being a stockholder and for the trust and continued interest you have in MRC Global Inc.

Best regards,

/s/ Robert L. Wood

Robert L. Wood

Chairman of the Board

| Notice of 2024 Virtual Annual Meeting of Stockholders

Date and Time Tuesday, May 7, 2024 10:00 am Houston, Texas time

Virtual Only Meeting No physical meeting location; See Voting Instructions for Stockholders on page 1.

Items to be Voted On | ||

| 1. |

Election of 9 Company director nominees: Deborah G. Adams, Leonard M. Anthony, George J. Damiris, David A. Hager, Ronald L. Jadin, Dr. Anne McEntee, Robert J. Saltiel, Jr., Daniel B. Silvers and Robert L. Wood | |

| 2. |

Consider and act upon an advisory approval of a non-binding resolution approving the Company’s named executive officer compensation. | |

| 3. |

Consider and act upon the ratification of the appointment of Ernst & Young LLP as the independent registered public accounting firm for the Company for 2024. | |

| 4. |

Approve an amendment to the Company’s Amended and Restated Certificate of Incorporation to reflect new Delaware law provisions regarding officer exculpation. | |

| 5. |

Act on any other business that may properly come before the Annual Meeting or any reconvened meeting after adjournment. | |

|

How to Vote in Advance

Your vote is very important. Even if you intend to be present virtually at the Annual Meeting, please promptly vote in one of the following ways so that your shares may be represented and voted at the Annual Meeting:

Advance Voting Methods

| ||

|

|

Internet – Follow online instructions on your Proxy Card and vote at www.cesvote.com | |

|

|

Mail - Complete, sign, date and return your proxy card or voting instruction form.

| |

|

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting to be Held on May 7, 2024.

MRC Global’s proxy materials including the Proxy Statement and 2023 Annual Report for the fiscal year ended December 31, 2023, are available and all future soliciting materials will be available, at www.viewourmaterial.com/mrc.

|

Who Can Vote?

You can vote at the virtual Annual Meeting if you were a holder of record of the Company’s common or preferred stock at the close of business on March 25, 2024.

Changes to Board Composition

In March 2024, the Company added David A. Hager to the Board. In April 2024, the Company added Daniel B. Silvers to the Board pursuant to the cooperation agreement with Engine Capital L.P. described under the caption “Engine Capital Cooperation Agreement” below. Additionally, the Board determined to not re-nominate Barbara J. Duganier for re-election at the 2024 Annual Meeting of Stockholders as she had notified the Board of her desire to not stand for re-election at the 2024 Annual Meeting of Stockholders. Effective as of the end of Ms. Duganier’s term of office, the Board has decreased the size of the Board from eleven to ten directors.

Voting Instructions

If you plan to participate in the virtual 2024 Annual Meeting of Stockholders, please see the instructions on page 1 of the Proxy Statement.

Voting by internet or by returning your proxy card or voting instruction form in advance of the 2024 Annual Meeting of Stockholders does not deprive you of your right to attend the virtual meeting.

By Order of the Board of Directors,

/s/ Daniel J. Churay

Daniel J. Churay

Executive Vice President – Corporate Affairs,

General Counsel and Corporate Secretary

April 3, 2024

MRC Global Inc.

1301 McKinney Street, Suite 2300

Houston, Texas 77010

TABLE OF CONTENTS

| Page |

| 1 | ||||

| 2 | ||||

| 5 | ||||

| 14 | ||||

| 20 | ||||

| 20 | ||||

| 21 | ||||

| 22 | ||||

| 26 | ||||

| Knowledge, Skills and Experience of Nominees Plus our Designated Director |

27 | |||

| 28 | ||||

| Director Designated by the Holder of the Company’s Preferred Stock |

36 | |||

| 37 | ||||

| 38 | ||||

| 38 | ||||

| 38 | ||||

| 38 | ||||

| 39 | ||||

| 39 | ||||

| 40 | ||||

| 40 | ||||

| 41 | ||||

| 41 | ||||

| 41 | ||||

| 42 | ||||

| Director Attendance at Meetings of the Board, Committees and Annual Meeting of Stockholders |

42 | |||

| 42 | ||||

| Board Oversight of Cybersecurity and Information Security Risk |

44 | |||

| 45 | ||||

| 45 | ||||

| 47 | ||||

| 47 | ||||

| 49 | ||||

| 49 | ||||

| 50 | ||||

| 52 | ||||

| 54 | ||||

| 58 | ||||

|

|

i | 2024 Proxy Statement |

|

|

ii | 2024 Proxy Statement |

INSTRUCTIONS FOR THE VIRTUAL ANNUAL MEETING

Our 2024 Annual Meeting of Stockholders, or the Annual Meeting, will be a completely virtual meeting. There will be no physical meeting location.

How Can I Participate in the Virtual Annual Meeting?

The Annual Meeting will be held online via a live webcast at www.cesonlineservices.com/mrc24_vm. You are entitled to participate in the Annual Meeting only if you were a holder of Common or Preferred Stock as of the close of business on the Record Date, or your authorized representative or you hold a valid proxy for the Annual Meeting. Stockholders must pre-register to attend or vote by ballot at the Annual Meeting.

You may only participate in the virtual meeting by registering in advance at www.cesonlineservices.com/mrc24_vm prior to the deadline of 10:00 a.m. Houston, Texas time on May 6, 2024. Please have your voting instruction form, proxy card or other communication containing your control number available and follow the instructions to complete your registration request.

If you are a beneficial holder, you must obtain a “legal proxy” from your broker, bank or other nominee to vote at the Annual Meeting. Upon completing registration, participants will receive further instructions via e-mail, including unique links that will allow them to access the meeting. Beneficial holders do not require a “legal proxy” to attend the meeting (but not vote at the meeting) and can do so by following the instructions above.

If you have any difficulty following the registration process, please email Morrow Sodali at MRC@info.morrowsodali.com.

Even if you plan to attend the virtual Annual Meeting, we recommend you also vote by proxy in advance of the Annual Meeting so that your vote will be counted if you later are unable or decide not to attend the virtual Annual Meeting.

|

|

1 | 2024 Proxy Statement |

RECONCILIATION OF NON-GAAP FINANCIAL MEASURES FROM GAAP

In this Proxy Statement, we present certain financial measures that deviate from measures calculated in accordance with U.S. generally accepted accounting principles (“GAAP”). These non-GAAP measures are not necessarily better than the nearest GAAP measure but provide additional information as described below. For more complete information on the 2023 financial and operating performance of MRC Global Inc. (“MRC Global”, the “Company”, “we”, “us” or “our”), please review the Company’s Annual Report on Form 10-K for the year ended December 31, 2023 (the “Form 10-K”) that was filed with the U.S. Securities and Exchange Commission (the “SEC”) and can be found on the internet at www.viewourmaterial.com/mrc. This annual report provides a complete reconciliation of certain of the non-GAAP measures as described below.

Adjusted EBITDA. Adjusted EBITDA is a non-GAAP financial measure, and we define adjusted EBITDA as net income plus interest, income taxes, depreciation and amortization, amortization of intangibles and certain other expenses, including non-cash expenses (such as equity-based compensation, severance and restructuring, changes in the fair value of derivative instruments, long-lived asset impairments, including goodwill and intangible assets), inventory-related charges incremental to normal operations and plus or minus the impact of our last-in, first-out (“LIFO”) inventory costing methodology. We believe adjusted EBITDA provides investors a helpful measure for comparing our operating performance with the performance of other companies that may have different financing and capital structures or tax rates. We believe it is a useful indicator of our operating performance without regard to items, such as amortization of intangibles, which can vary substantially from company to company depending upon the nature and extent of acquisitions. Similarly, the impact of the LIFO inventory costing method can cause results to vary substantially from company to company depending upon whether they elect to utilize LIFO and depending upon which method they may elect. We believe that net income is the financial measure calculated and presented in accordance with GAAP that is most directly comparable to adjusted EBITDA. See the following table for a detailed reconciliation of net income to adjusted EBITDA.

| ($ in millions) | ||||||||||||

| Year Ended December 31, | ||||||||||||

| 2021 | 2022 | 2023 | ||||||||||

| Net Income (loss) |

$ | (14 | ) | $ | 75 | $ | 114 | |||||

| Income tax expense |

— | 35 | 39 | |||||||||

| Interest expense |

23 | 24 | 32 | |||||||||

| Depreciation and amortization |

19 | 18 | 19 | |||||||||

| Amortization of intangibles |

24 | 21 | 21 | |||||||||

| Facility closures |

1 | — | — | |||||||||

| Severance and restructuring |

1 | 1 | — | |||||||||

| Employee separation |

1 | — | — | |||||||||

| Non-recurring IT related professional fees |

— | — | 1 | |||||||||

| Increase in LIFO reserve |

77 | 66 | 2 | |||||||||

| Equity-based compensation expense |

12 | 13 | 14 | |||||||||

| Customer settlement |

— | — | 3 | |||||||||

| Activism response legal and consulting costs |

— | — | 1 | |||||||||

| Asset disposal |

— | — | 1 | |||||||||

| Foreign currency losses |

2 | 8 | 3 | |||||||||

|

|

|

|

|

|

|

|||||||

| Adjusted EBITDA |

$ | 146 | $ | 261 | $ | 250 | ||||||

|

|

|

|

|

|

|

|||||||

|

|

2 | 2024 Proxy Statement |

Adjusted Gross Profit. Adjusted gross profit is a non-GAAP financial measure. We define adjusted gross profit as sales, less cost of sales, plus depreciation and amortization, plus amortization of intangibles plus inventory-related charges incremental to normal operations, and plus or minus the impact of our LIFO inventory costing methodology. We present adjusted gross profit because we believe it is a useful indicator of our operating performance without regard to items, such as amortization of intangibles, which can vary substantially from company to company depending upon the nature and extent of acquisitions. Similarly, the impact of the LIFO inventory costing method can cause results to vary substantially from company to company depending upon whether they elect to utilize LIFO and depending upon which method they may elect. We use adjusted gross profit as a key performance indicator in managing our business. We believe that gross profit is the financial measure calculated and presented in accordance with GAAP that is most directly comparable to adjusted gross profit. See the following table for a detailed reconciliation of gross profit to adjusted gross profit.

| ($ in millions) | ||||||||||||||||||||||||

| Year Ended December 31, | ||||||||||||||||||||||||

| % of | % of | % of | ||||||||||||||||||||||

| 2021 | Revenue | 2022 | Revenue* | 2023 | Revenue* | |||||||||||||||||||

| Gross profit, as reported |

$ | 417 | 15.6 | % | $ | 610 | 18.1 | % | $ | 690 | 20.2 | % | ||||||||||||

| Depreciation and amortization |

19 | 0.7 | % | 18 | 0.5 | % | 19 | 0.6 | % | |||||||||||||||

| Amortization of intangibles |

24 | 0.9 | % | 21 | 0.6 | % | 21 | 0.6 | % | |||||||||||||||

| Increase in LIFO reserve |

77 | 2.9 | % | 66 | 2.0 | % | 2 | 0.1 | % | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Adjusted Gross Profit |

$ | 537 | 20.1 | % | $ | 715 | 21.3 | % | $ | 732 | 21.5 | % | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| * | Does not foot due to rounding |

Net Debt. Net debt and related leverage metrics may be considered non-GAAP measures. We define net debt as total long-term debt, including the current portion, minus cash. We define our leverage ratio as net debt divided by adjusted EBITDA (as defined above). We believe net debt is an indicator of the extent to which the Company’s outstanding debt obligations could be satisfied by cash on hand and a useful metric for investors to evaluate the Company’s leverage position. We believe the leverage ratio is a commonly used metric that management and investors use to assess the borrowing capacity of the Company. We believe total long-term debt (including the current portion) is the financial measure calculated and presented in accordance with GAAP that is most directly comparable to net debt.

The following table reconciles total long-term debt (including the current portion), as derived from our consolidated financial statements, with net debt (in millions) and shows the calculation of our leverage ratio:

| ($ in millions) | ||||||||||||

| Year Ended December 31, | ||||||||||||

| 2021 | 2022 | 2023 | ||||||||||

| Long-term debt, net |

$ | 295 | $ | 337 | $ | 9 | ||||||

| Plus: current portion of debt |

2 | 3 | 292 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total debt |

297 | 340 | 301 | |||||||||

| Less: Cash |

48 | 32 | 131 | |||||||||

|

|

|

|

|

|

|

|||||||

| Net Debt |

$ | 249 | $ | 308 | $ | 170 | ||||||

|

|

|

|

|

|

|

|||||||

| Adjusted EBITDA |

$ | 146 | $ | 261 | $ | 250 | ||||||

| Leverage ratio (net debt : adjusted EBITDA) |

1.7x | 1.2x | 0.7x | |||||||||

|

|

|

|

|

|

|

|||||||

RANCE Adjusted for LIFO. Return on average net capital employed (“RANCE”) adjusted for LIFO is a non-GAAP measure. We define RANCE adjusted for LIFO as RANCE, plus or minus the impact of the

|

|

3 | 2024 Proxy Statement |

benefit or expense of our LIFO accounting. We believe that RANCE, calculated in accordance with GAAP without the adjustment, is the financial measure calculated and presented in accordance with GAAP that is most directly comparable to RANCE adjusted for LIFO. RANCE adjusted for LIFO is not necessarily a better measure of return. However, we believe that it provides a good measure of our return without the impact of our LIFO accounting for inventory. Inflationary and deflationary conditions, which are beyond management’s control, create swings in LIFO expense or benefit. The following table reconciles RANCE to RANCE adjusted for LIFO.

| ($ in thousands) | ||||||||||||||||

| 2021 | 2022 | 2023 | 2020–23 | |||||||||||||

| Net Income (Loss) before Preferred |

$ | (14,100 | ) | $ | 74,853 | $ | 113,587 | $ | 174,340 | |||||||

| Interest |

23,205 | 23,982 | 32,565 | $ | 79,752 | |||||||||||

| Interest, net tax |

18,332 | 18,946 | 25,727 | $ | 63,005 | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| NOPAT before Preferred |

$ | 4,232 | $ | 93,799 | $ | 139,314 | $ | 237,345 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Debt |

$ | 297,347 | $ | 339,974 | $ | 300,965 | $ | 330,409 | ||||||||

| Equity |

678,407 | 741,477 | 843,077 | 742,013 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net Capital |

$ | 975,754 | $ | 1,081,451 | $ | 1,144,042 | $ | 1,072,422 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Annual RANCE % |

0.4 | % | 9.1 | % | 12.5 | % | 7.4 | % | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| LIFO |

$ | 76,893 | $ | 66,335 | $ | 2,193 | $ | 145,423 | ||||||||

| LIFO, net tax |

60,745 | 52,405 | 1,732 | 114,884 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| NOPAT before Preferred adj. for LIFO |

$ | 64,977 | $ | 146,204 | $ | 141,046 | $ | 352,229 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| RANCE % adj. for LIFO |

6.2 | % | 13.5 | % | 12.4 | % | 10.7 | % | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

|

|

4 | 2024 Proxy Statement |

PROXY SUMMARY

This summary highlights information contained elsewhere in this Proxy Statement. This summary does not contain all of the information that you should consider, and you should read the entire Proxy Statement before voting. For more complete information on the 2023 financial and operating performance of MRC Global Inc. (“MRC Global”, the “Company”, “we”, “us” or “our”), please review the Company’s Annual Report on Form 10-K for the year ended December 31, 2023 (the “Form 10-K”) that was filed with the SEC and can be found on the internet at www.viewourmaterial.com/mrc.

Time of Virtual Annual Meeting

Tuesday, May 7, 2024

10:00 a.m. Houston, Texas time

We will hold a virtual meeting of stockholders. Stockholders may participate virtually by typing www.cesonlineservices.com/mrc24_vm into your computer’s browser window. Please see Instructions for the virtual Annual Meeting on page 1.

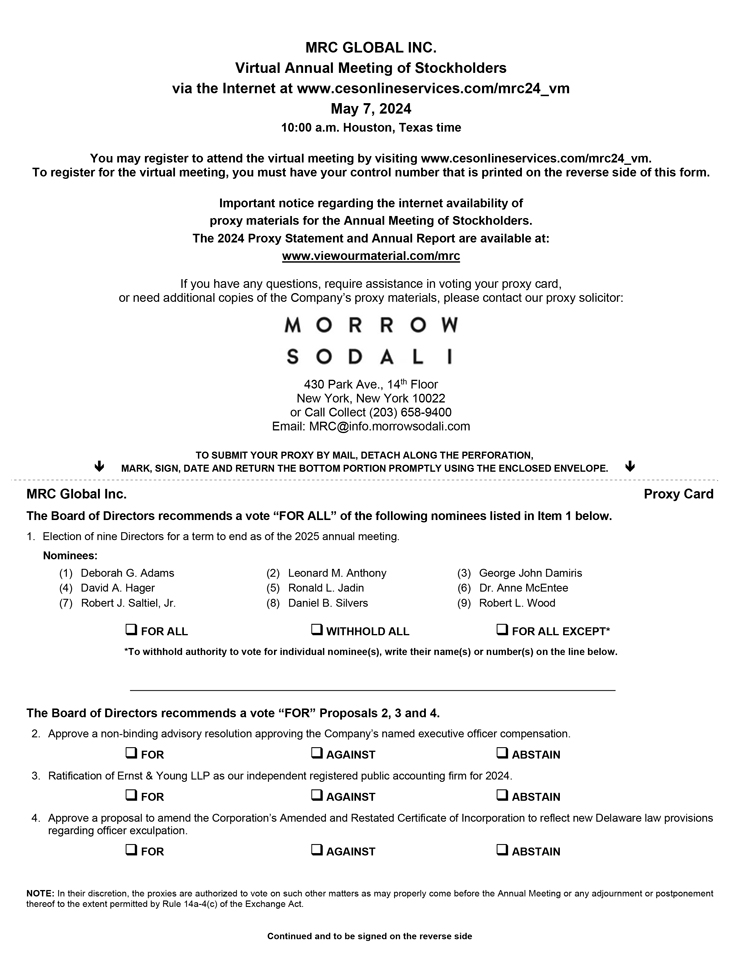

Voting Matters

Stockholders are being asked to vote on the following matters at the 2024 Annual Meeting of Stockholders:

|

Item I

|

The election of 9 Company director nominees:

|

Page 26

| ||

| Board Recommendation: FOR each of the Company’s nominees

|

||||

| Item II | Approval, on an advisory basis, of the Company’s Named Executive Officer Compensation

|

Page 71 | ||

| Board Recommendation: FOR | ||||

| Item III | Ratification of the appointment of Ernst & Young LLP as independent auditors for 2024

|

Page 90 | ||

| Board Recommendation: FOR | ||||

| Item IV | Amendment of the Company’s Amended and Restated Certificate of Incorporation to reflect new Delaware law provisions regarding officer exculpation

|

Page 91 | ||

| Board Recommendation: FOR

|

||||

|

|

5 | 2024 Proxy Statement |

Company Director Nominees

| Name | Age at Annual Meeting |

Director Since |

Professional Background |

Independent | Committee Membership & Positions | |||||

| Robert L. Wood |

70 | 2015 | Former Chairman, President & CEO of Chemtura Corporation

|

✓ | Chairman of the Board | |||||

| Deborah G. Adams |

63 | 2017 | Former Senior Vice President of Phillips 66

|

✓ | Compensation (Chair) Governance | |||||

| Leonard M. Anthony |

69 | 2008 | Former CEO of WCI Steel, Inc. & former CFO of Dresser-Rand Group, Inc.

|

✓ | Audit Compensation | |||||

| George J. Damiris |

64 | 2021 | Former CEO of HollyFrontier Corporation and Holly Energy Partners

|

✓ | Compensation Governance (Chair) | |||||

| David A. Hager |

67 | 2024 | Former CEO & Executive Chairman of Devon Energy Corporation

|

✓ | Audit Governance | |||||

| Ronald L. Jadin |

63 | 2021 | Former CFO of W.W. Grainger, Inc.

|

✓ | Audit (Chair) Governance | |||||

| Dr. Anne McEntee |

53 | 2022 | Managing Director - Asset Management with Wren House Infrastructure Management Ltd., Former CEO of General Electric Company’s Digital Services unit of GE Renewable Energy

|

✓ | Audit Compensation | |||||

| Robert J. Saltiel, Jr. |

61 | 2021 | President & CEO of MRC Global, Former CEO of Key Energy Services, Inc. and Atwood Oceanics, Inc.

|

CEO | ||||||

| Daniel B. Silvers |

47 | 2024 | Managing Member of Matthews Lane Capital Partners LLC

|

✓ | Compensation Governance |

In the chart above, “Compensation” refers to the Board’s Compensation & Human Capital Committee, and “Governance” refers to the Board’s Environmental, Social, Governance & Enterprise Risk Committee

Preferred Stock Designated Director

| Henry Cornell |

68 | 2018 | Founder & Senior Partner of Cornell Capital LLC and former Vice Chairman of the Merchant Banking Division of Goldman Sachs Co.

|

Independent Director |

|

|

6 | 2024 Proxy Statement |

Key Statistics about our Director Nominees

| Independence |

CEO Experience | Board Refreshment | ||

| 89% |

67% |

6 | ||

| 8 of 9 Director Nominees are |

6 of 9 Director Nominees are Current or Former CEOs |

New Directors have been added since 2021 | ||

| Gender Diversity |

Overall Diversity | Average Tenure | ||

| 22% |

33% | 4.1 Years | ||

| 2 of 9 Director Nominees |

3 of 9 Director Nominees are Women or from a Minority Group |

|||

| 50% | ||||

|

|

2 of 4 Board Leadership Positions (including the Chairman of the Board) are Women or from a Minority Group |

| ||

|

|

7 | 2024 Proxy Statement |

Governance Highlights

Our Board of Directors (the “Board”) oversees the development and execution of MRC Global’s strategy. Some examples of the robust corporate governance practices and procedures that the Board and MRC Global through its Executive Leadership Team have adopted are listed below.

| Board Structure & Governance |

✓ |

|

|

Ten of our directors and eight of our nine director nominees are independent.

| ||||||

|

✓ |

|

|

Each of the Audit, Compensation & Human Capital and Environmental, Social, Governance & Enterprise Risk (“ESG & Enterprise Risk”) Committees is comprised entirely of independent directors.

| |||||||

| ✓ | The directors regularly hold executive sessions at each Board and committee meeting.

| |||||||||

| ✓ | We have a mandatory retirement policy for directors.

| |||||||||

| ✓ | Annually, we review our committee charters and Corporate Governance Guidelines.

| |||||||||

| ✓ | Our non-executive Chairman is independent and separate from our CEO.

| |||||||||

| ✓ | All directors are elected annually based on a plurality of the votes cast in uncontested elections, with a director resignation policy requiring a letter of resignation from a director if a director receives a greater number of “withhold” votes than “for” votes in the director’s election other than the one director designated by the holder of the Company’s preferred stock as described below in “Security Ownership—Preferred Stock Issuance—Board Representation Rights.”

| |||||||||

| ✓ | The Board and each committee annually conduct a thorough self-assessment process focused on Board or committee performance, respectively.

| |||||||||

| ✓ | We are committed to Board refreshment. Since 2021, we have added six new independent directors.

| |||||||||

| ✓ | Our Board is committed to diversity of backgrounds, experience and perspectives. As Ms. Duganier leaves the Board, the Board expects to consider additional female candidates for the Board.

| |||||||||

| ✓ | Our Board and committees actively review risks and oversee risk management, including enterprise, environmental, social and governance (“ESG”) and cyber security risks.

| |||||||||

| ✓ | Our Board is actively engaged in overseeing talent and long-term succession planning for senior leadership and directors.

| |||||||||

| Corporate Responsibility |

✓ | We have a comprehensive ethics program with standards of business conduct that help guide and promote good governance, responsible business practices and the highest standards of integrity.

| ||||||||

| ✓ | Our Board and our ESG & Enterprise Risk Committee oversee management’s implementation of our ESG policies, programs and standards and there is a dedicated Sustainability Leader on the Executive Leadership Team.

| |||||||||

| Stock Ownership | ✓ | We have stock ownership guidelines of 5x the annual cash retainer for our nonemployee directors.

| ||||||||

| ✓ | We have stock ownership guidelines of 5x base salary for the CEO and 3x base salary for other named executive officers (“NEOs”).

| |||||||||

| ✓ | We prohibit hedging and pledging of our Company securities by directors and executive officers.

|

|

|

8 | 2024 Proxy Statement |

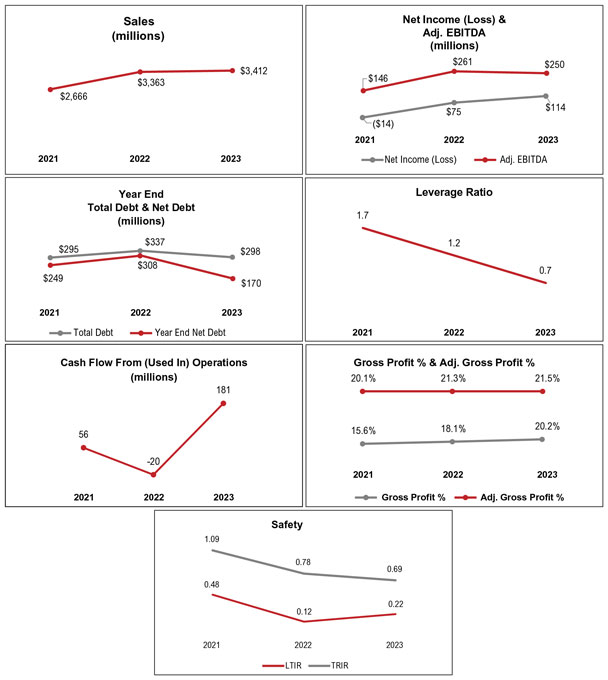

2023 Financial and Operational Highlights

MRC Global is the leading global distributor of pipe, valves, fittings (“PVF”) and other infrastructure products and services to diversified energy, industrial and gas utility end-markets. We provide innovative supply chain solutions, technical product expertise and a robust digital platform to customers globally through our leading position across each of our diversified end-markets including the following sectors:

| ● | Gas Utilities: gas utilities (storage and distribution of natural gas) |

| ● | DIET: downstream, industrial and energy transition (crude oil refining, petrochemical and chemical processing, general industrials and energy transition projects) |

| ● | PTI: production and transmission infrastructure (exploration, production and extraction, gathering, processing and transmission of oil and gas) |

Financial and operational highlights from fiscal year 2023 include:

| Sales of $3.41 billion, compared to $3.36 billion in 2022 |

Cash flow provided by operations of $181 million | |||||

| Net income attributable to common stockholders of $90 million, a 76% increase over $51 million in 2022

Adjusted EBITDA of $250 million, 7.3% of sales |

Gross profit percentage of 20.2% of sales

Adjusted gross profit percentage of 21.5% of sales - two consecutive years above 21% | |||||

| Total debt of $301 million, and net debt of $170 million (both as of December 31, 2023)

— the lowest net debt since the Company’s initial public offering (“IPO”) in 2012 |

Ended the year with a leverage ratio of 0.7x

— the lowest since the Company’s IPO in 2012 | |||||

| Generated 44% of the Company’s revenue through MRCGO™ digital platform/e- commerce |

96% of 2023 valve sales were “Low-E” valves, dramatically reducing fugitive emissions of methane and other greenhouse gases. | |||||

| * | See “Reconciliation of Non-GAAP Financial Measures From GAAP” above for information about the non-GAAP measures: adjusted gross profit percentage, adjusted EBITDA, net debt and leverage ratio. |

|

|

9 | 2024 Proxy Statement |

2023 Executive Compensation Highlights

“Pay for Performance” Executive Compensation Strategy

MRC Global’s executive compensation program is designed to attract, motivate and retain our executives, including our named executive officers (“NEOs”), who are critical to the Company’s long-term success. Our executive compensation strategy is “pay for performance” and is focused on:

| ● | motivating executive officers to increase the economic value of the Company by strengthening our position as a leading global distributor of infrastructure products and value-added services provider and by aggressively pursuing profitable growth; and |

| ● | aligning our executive officers’ interests and actions with the interests of our stockholders and key stakeholders. |

We provide our executive officers with a compensation package that consists primarily of:

| ● | a base salary, |

| ● | short-term incentive (“STI”) in the form of annual cash payments based upon achievement of certain performance metrics, and |

| ● | long-term incentive (“LTI”) in the form of time-vested restricted stock units (“RSUs”) and performance share units (“PSUs”), which pay out based upon achievement of certain performance metrics over a three-year performance period. |

Our Compensation & Human Capital Committee, which is composed solely of independent directors, believes in a pay for performance philosophy. While our Compensation & Human Capital Committee sets target compensation for the executive officers each year based on market practices and internal considerations, the executive officers’ realized compensation is strongly dependent on the Company’s performance relative to pre-determined and measurable financial and safety metrics and stock price performance.

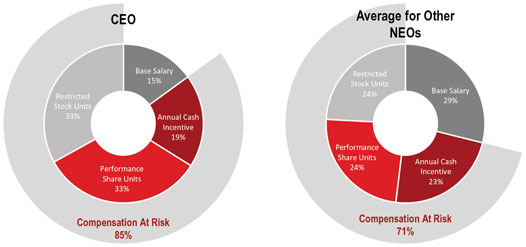

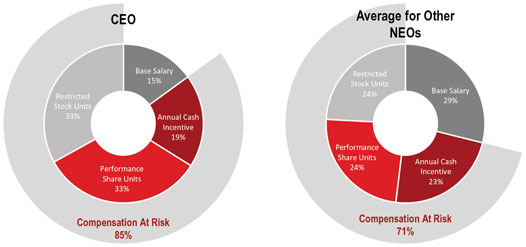

| ● | As illustrated in the following graphic, a substantial portion of our target compensation for executive officers is at risk. |

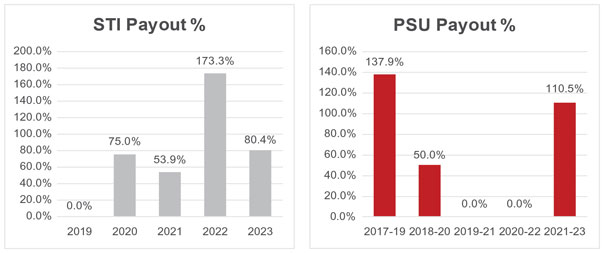

| ● | The 2023 STI payments for our NEOs were based on the achievement of the following performance metrics: |

| ● | 87.5% on the Company’s adjusted earnings before interest, taxes, depreciation and amortization (“adjusted EBITDA”) and |

| ● | 12.5% on two safety targets. |

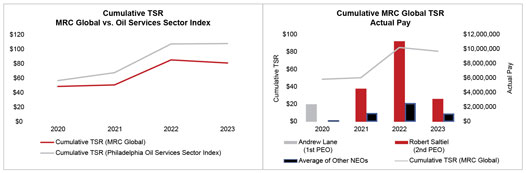

| ● | The 2023 LTI equity grant consisted of time vested RSUs and PSUs for NEOs. Vesting of the PSUs depends on performance based upon the Company’s total shareholder return (“TSR”) relative to companies in the OIH1 index plus DNOW Inc. plus the Russell 2000 (IWM – iShares Russell 2000 ETF) for each year in the three-year period ended December 31, 2025 as well as the full three-year period. The time vested RSUs provide retention value, and the value of the units is also tied to performance because it increases or decreases depending on our stock price at vesting. See “Pay Versus Performance Disclosure”. The time vested RSUs vest ratably on each anniversary of the grant date over a three-year period. |

| 1 | The OIH Index is the Van Eck Oil Services ETF. |

|

|

10 | 2024 Proxy Statement |

Target Compensation

The following illustration represents the elements of our 2023 compensation package at target to reflect the CEO’s compensation and an average for the other active NEOs.

The CEO’s Compensation at Risk has increased from 84% in 2022 to 85% in 2023, and the average Compensation at Risk for the other NEOs has increased from 66% to 71% from 2022 to 2023.

|

|

11 | 2024 Proxy Statement |

Key Features of Our Executive Compensation Program

|

What We Do | ||

|

✓ |

We pay for performance – 85% of CEO ongoing pay and an average of 71% of other active NEOs’ 2023 target compensation is at risk, and target total direct compensation is achieved only when performance objectives are achieved.

| |

|

✓ |

We benchmark pay relative to the market and review the peer group used for market benchmarking on an annual basis.

| |

|

✓ |

We set objectives for our annual STI plan that are measurable, determined in advance and aligned with stockholder interests. Our 2023 STI targets were stretch targets; our 2023 adjusted EBITDA target was $300 million compared to 2022 actual results of $261 million, a 15% increase, and the 2023 safety targets were more stringent than our 2022 targets.

| |

|

✓ |

Our LTI equity compensation plan is designed to be strongly tied to Company performance. We award PSUs to tie payouts to our relative TSR versus other comparator companies. We award RSUs to tie realized value to stock price and to provide retention value.

| |

|

✓ |

We have a 100% cap on PSU payouts based on relative TSR if the Company’s TSR is negative.

| |

|

✓ |

Beginning in 2022, we added a Russell 2000 ETF to the companies used in the relative TSR calculation for PSUs to better reflect our performance against the broader market and acknowledge the broader competition for investor capital. In 2023, we replaced the OSX with the OIH in our comparator group that is used to calculate relative TSR for our PSUs to better reflect our markets for investor capital.

| |

|

✓ |

Beginning in 2024, our RSUs and PSUs will no longer vest solely upon a Change in Control. Our agreements for the awards have been modified to reflect “double-trigger” vesting.

| |

|

✓ |

We have equity ownership guidelines that provide for significant executive officer equity ownership.

| |

|

✓ |

We have adopted a new Compensation Clawback Policy to align with new New York Stock Exchange and SEC rules, which replaces our prior longstanding policy.

| |

|

✓ |

We have a fully independent Compensation & Human Capital Committee.

| |

|

✓ |

Our Compensation & Human Capital Committee engages a compensation consultant that is independent of management and the Company.

| |

|

✓ |

We have an annual Say-on-Pay vote.

| |

| What We Don’t Do | ||

|

|

No guaranteed minimum incentives

| |

|

|

No excise tax gross ups

| |

|

|

No re-pricing of stock options or stock appreciation rights permitted without approval from stockholders

| |

|

|

No hedging or derivative transactions with respect to our shares by executive officers or directors permitted

| |

|

|

No pledging of MRC Global securities by executive officers or directors permitted

| |

SAY-ON-PAY

| 81% APPROVAL |

Stockholders showed support of our executive compensation programs, with 81% of the votes cast for the approval of the “say-on-pay” proposal at our 2023 annual meeting of stockholders. |

|

|

12 | 2024 Proxy Statement |

Deadlines for Submitting Stockholder Proposals for 2025 Annual Meeting of Stockholders

The Corporate Secretary of the Company must receive proposals for inclusion in our Proxy Statement for our 2025 annual meeting of stockholders in accordance with Rule 14a-8 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), no later than December 4, 2024.

The Corporate Secretary of the Company must receive notice of a stockholder nomination for candidates for the Board or any other business to be considered at our 2025 annual meeting of stockholders no earlier than the close of business on January 7, 2025, and no later than the close of business on February 6, 2025. Changes to the date of our annual meeting and the date of the first announcement of such meeting may change these dates, as set forth in our bylaws and further discussed below. Copies of our bylaws are available on our website at https://www.mrcglobal.com, by clicking on “Investors” in the menu, then “Corporate Governance”, then “Documents and Charters”.

|

|

13 | 2024 Proxy Statement |

QUESTIONS AND ANSWERS ABOUT THE ANNUAL MEETING AND VOTING

Why am I receiving these materials?

We are furnishing this Proxy Statement to you as part of a solicitation by the Board of Directors of MRC Global Inc., a Delaware corporation, for use at our 2024 virtual Annual Meeting of Stockholders (the “Annual Meeting”) and at any reconvened meeting after an adjournment or postponement of the Annual Meeting. We will hold the Annual Meeting online only. There will be no physical meeting location. The Annual Meeting will be held on Tuesday, May 7, 2024, at 10:00 a.m. Houston, Texas time. Please see Instructions for the virtual Annual Meeting on page 1.

We have two classes of stock: common stock, $.01 par value per share (“common stock”), and 6.5% Series A Convertible Perpetual Preferred Stock (“preferred stock”, and together with the common stock, “stock”). You are receiving these materials because, at the close of business on March 25, 2024 (the “Record Date”), you owned shares of stock. All stockholders of record on the Record Date are entitled to attend and vote at the Annual Meeting. Each common stockholder will have one vote on each matter for every share of common stock owned on the Record Date. On the Record Date, we had a total of 105,508,677 shares of common stock, of which 24,216,330 shares are held in treasury, resulting in 85,206,668 shares of common stock entitled to vote at the meeting. Any shares held in our treasury on the Record Date are not considered outstanding and will not be voted or considered present at the meeting. On the Record Date, we had a total of 363,000 shares of preferred stock outstanding entitled to 20,302,009 votes at the Annual Meeting, which number is equal to the number of shares of common stock into which the shares of preferred stock could be converted on the Record Date, rounded to the nearest share. Holders of the common stock and the preferred stock vote (on an as-converted basis) together on all matters as a single class.

How is MRC Global distributing proxy materials? Is MRC Global using the SEC’s “Notice and Access” rule?

We expect our proxy materials including this Proxy Statement, our proxy card and our 2023 Annual Report (the “Annual Report”) (which includes the Form 10-K), to first be mailed on or about April 3, 2024 and to first be made available to stockholders at that time. Copies of the Form 10-K, as well as other periodic filings by the Company with the SEC, are also available on our website at

https://www.mrcglobal.com by clicking on “INVESTOR” and “SEC Filings”. The information included in our website is not incorporated herein by reference.

MRC Global is not using the SEC’s “Notice and Access” rule with respect to this year’s Annual Meeting.

What information is contained in this Proxy Statement?

This Proxy Statement includes information about the nominees for director and other matters to be voted on at the Annual Meeting. It also:

| (i) | explains the voting process and requirements; |

| (ii) | describes the Company’s nominees and the compensation of our directors; |

| (iii) | describes the compensation of our principal executive officer, our principal financial officer and at least our three other most highly compensated officers (collectively referred to as our “named executive officers” or “NEOs”); |

| (iv) | provides information regarding our independent registered accounting firm, and |

| (v) | provides certain other information that SEC rules require. |

|

|

14 | 2024 Proxy Statement |

What matters am I voting on, how may I vote on each matter and how does the Board recommend that I vote on each matter?

The following table sets forth each of the proposals you are being asked to vote on, how you may vote on each proposal and how the Board recommends that you vote on each proposal:

|

Company Proposals |

How may I vote?

|

How does the Board

| ||||

| I. Election of 9 Company director nominees |

You may: (i) vote FOR the election of each nominee; or (ii) WITHHOLD authority to vote for each nominee. |

FOR each of the Company’s 9 director nominees | ||||

| II. Approve on an advisory basis the Company’s named executive officer compensation |

You may: (i) vote FOR or AGAINST the non-binding, advisory resolution approving named executive officer compensation; or (ii) indicate that you wish to ABSTAIN from voting on the matter. |

FOR the approval of a non-binding, advisory resolution approving the Company’s named executive officer compensation | ||||

|

|

III. Ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for 2024 |

You may: (i) vote FOR or AGAINST the ratification of the appointment of Ernst & Young LLP as our Independent registered accounting firm for 2024; or (ii) you may indicate that you wish to ABSTAIN from voting on the matter.

|

FOR the ratification of Ernst & Young LLP as our registered public accounting firm for 2024 | |||

| IV. Approve an amendment to the Company’s Amended and Restated Certificate of Incorporation to reflect new Delaware law provisions regarding officer exculpation |

You may: (i) vote FOR or AGAINST the approval of an amendment to the Company’s Amended and Restated Certificate of Incorporation to reflect new Delaware law provisions regarding officer exculpation; or (ii) you may indicate that you wish to ABSTAIN from voting on this matter. |

FOR the approval of an Amendment to the Company’s Amended and Restated Certificate of Incorporation to reflect new Delaware law provisions regarding officer exculpation | ||||

We are not aware of any matter to be presented at the Annual Meeting that is not included in this Proxy Statement. However, your proxy authorizes the person named on the proxy card to take action on additional matters that may properly arise. These individuals will exercise their best judgment to vote on any other matter, including a question of adjourning the Annual Meeting.

What is the difference between a stockholder of record and a stockholder who holds stock in street name?

If your shares are registered in your name with our transfer agent, Computershare Trust Company, N.A. (“Computershare”), you are a stockholder of record.

If you hold your shares with a broker or in an account at a bank, then you are a beneficial owner of shares held in “street name”. Your broker or bank is considered the stockholder of record for purposes of voting at the Annual Meeting. Your broker or bank should provide you with instructions for directing the broker or bank how to vote your shares.

|

|

15 | 2024 Proxy Statement |

How do I vote if I am a stockholder of record?

As a stockholder of record, you may vote your shares in any one of the following ways:

|

Vote online at the Virtual Annual Meeting |

|

Vote online at www.cesvote.com | |||

|

If you receive a paper copy of the proxy materials, complete, sign, date and return the proxy card or voting instruction form | |||||

Unless you or your representative attend and vote online at the virtual Annual Meeting, for your vote to count the Company must receive your vote, either by internet, proxy card or voting instruction form by 11:59 p.m., Eastern Daylight Time on May 6, 2024. Internet voting will close at 11:59 p.m., Eastern Daylight Time on May 6, 2024.

If I hold shares in street name, does my broker need instructions to vote my shares?

Under rules of the New York Stock Exchange (the “NYSE”), if you hold shares of stock in street name and do not submit specific voting instructions to your brokers, banks or other nominees, they generally will have discretion to vote your shares on routine matters such as Proposal III but will not have the discretion to vote your shares on non-routine matters, such as Proposals I, II and IV. When the broker, bank or other nominee is unable to vote on a proposal because the proposal is not routine, and you do not provide any voting instructions, a broker non-vote occurs and, as a result, your shares will not be voted on these proposals.

Therefore:

| ● | on the non-routine proposals of election of directors (Proposal I), approval, on an advisory basis, of a non-binding advisory resolution approving our executive compensation (Proposal II), and approval of an amendment to the Company’s Amended and Restated Certificate of Incorporation to reflect new Delaware law provisions regarding officer exculpation (Proposal IV), your broker, bank or nominee will not be able to vote without instruction from you; and |

| ● | on the routine proposal of ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for 2024 (Proposal III), your broker, bank or nominee may vote in their discretion without instruction from you. |

How do I vote my shares?

If you are a stockholder of record, you may vote your shares by proxy without attending the Annual Meeting. We encourage stockholders to submit their proxies in advance of the Annual Meeting. You can ensure that your shares are voted by completing, signing and returning the proxy card or voting your shares over the Internet pursuant to the instructions provided on the proxy card. If you are voting over the Internet, you will need to provide the control number that is printed on the proxy card that you receive. Voting your shares by proxy by any of these methods will not affect your right to attend and vote at the Annual Meeting or by executing a proxy designating a representative to vote for you at the Annual Meeting.

You are urged to follow the instructions on your proxy card or voting instruction form to indicate how your vote is to be cast. Please see the Instructions for the virtual Annual Meeting on page 1 if you wish to attend the virtual meeting.

Pursuant to Section 212(c) of Delaware Law, stockholders may validly grant proxies over the internet. Your internet vote authorizes the proxies designated by the Company to vote your shares in the same

|

|

16 | 2024 Proxy Statement |

manner as if you had returned a proxy card or voting instruction form. To vote over the internet, follow the instructions provided on your Notice. If you hold shares in street name, you are encouraged to contact your bank or broker to obtain and return the appropriate voting instruction form.

What if I return my proxy card or vote by internet but do not specify how I want to vote?

If you are a stockholder of record and correctly sign, date and return your proxy card or complete the internet voting procedures, but do not specify how you want to vote your shares, we will vote them as follows:

| I. | FOR the election of the 9 Company director nominees: Deborah G. Adams, Leonard M. Anthony, George J. Damiris, David A. Hager, Ronald L. Jadin, Dr. Anne McEntee, Robert J. Saltiel, Jr., Daniel B. Silvers and Robert L. Wood |

| II. | FOR the approval, on an advisory basis, of a non-binding advisory resolution approving the Company’s named executive officer compensation |

| III. | FOR the ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for 2024 |

| IV. | FOR the approval of an amendment to the Company’s Amended and Restated Certificate of Incorporation to reflect new Delaware law provisions regarding officer exculpation. |

What can I do if I change my mind after I vote my shares?

Attendance virtually in the virtual Annual Meeting will not in and of itself constitute revocation of a proxy. Any stockholder of record who authorizes his or her vote or by internet or executes and returns a proxy card may revoke the proxy before it is voted by:

| ● | notifying in writing the Corporate Secretary of MRC Global Inc. at 1301 McKinney Street, Suite 2300, Houston, Texas 77010, Attention: Corporate Secretary; |

| ● | executing and returning a subsequent proxy; or |

| ● | appearing online and voting at the Annual Meeting. |

For shares you hold in street name, you may change your vote by submitting new voting instructions to your broker, bank or other nominee or by obtaining a legal proxy from your broker, bank or other nominee giving you the right to vote your shares at the Annual Meeting.

What shares are included on my proxy card?

You will receive one proxy card for all the shares of MRC Global that you hold as a stockholder of record (in certificate form or in book-entry form). If you hold your shares of MRC Global in street name, you will receive voting instructions for each account you have with a broker or bank.

How may I obtain instructions on how to attend the Annual Meeting online?

Please see Instructions for the virtual Annual Meeting on page 1. If you need assistance with these directions, please call us at 713-655-1005 or 877-294-7574 or write us at MRC Global Inc., 1301 McKinney Street, Suite 2300, Houston, Texas 77010, Attn: Corporate Secretary.

What is the quorum requirement for the Annual Meeting?

There must be a quorum to take action at the Annual Meeting (other than action to adjourn or postpone the Annual Meeting for lack of a quorum). A quorum will exist at the Annual Meeting if stockholders holding a majority of the voting powers of all of the shares entitled to vote at the Annual Meeting are present virtually or by proxy. Stockholders of record who return a proxy or vote virtually at the Annual Meeting will be considered part of the quorum. Abstentions and “broker non-votes” are counted as present and entitled to vote for purposes of determining a quorum.

|

|

17 | 2024 Proxy Statement |

What is the voting requirement to approve each of the proposals?

The following table sets forth the voting requirement with respect to each of the proposals:

|

Proposal

|

Voting Requirement

| |

| I.Election of the 9 Company director nominees |

Each director must be elected by a plurality of the votes cast. Any director who receives a greater number of “WITHHOLD” votes than “FOR” votes is expected to tender to the Board the director’s resignation promptly following the certification of election results pursuant to the Company’s Corporate Governance Guidelines. Pursuant to these guidelines, the Board must accept or reject the resignation within 90 days following the certification of election results and publicly disclose its decision.

| |

| II.Approve, on an advisory basis, a non-binding advisory resolution approving the Company’s executive officer compensation |

To be approved, this proposal must be approved by a majority of the votes cast by the stockholders present in person or represented by proxy, meaning that the votes cast by the stockholders “FOR” the approval of the proposal must exceed the number of votes cast “AGAINST” the approval of the proposal.

| |

| III.Ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for 2024 |

To be approved, this proposal must be approved by a majority of the votes cast by the stockholders present in person or represented by proxy, meaning that the votes cast by the stockholders “FOR” the approval of the proposal must exceed the number of votes cast “AGAINST” the approval of the proposal.

| |

| IV.Approve an amendment to the Company’s Amended and Restated Certificate of Incorporation to reflect new Delaware law provisions regarding officer exculpation. |

To be approved, this proposal must be approved by the affirmative vote of the holders of at least 75% of the voting power of the Company’s issued and outstanding stock entitled to vote thereon, voting together as a single class.

| |

Other matters that may properly come before the Annual Meeting may or may not require more than a majority vote under our bylaws, our Amended and Restated Certificate of Incorporation, the laws of Delaware or other applicable laws, depending on the nature of the matter.

Who will count the votes?

A representative of First Coast Results, Inc. will act as the inspector of elections and count the votes.

Where can I find the voting results of the Annual Meeting?

We will disclose the final voting results in a Form 8-K filed with the SEC within four business days after the Annual Meeting.

May I propose actions for consideration at the 2025 Annual Meeting of stockholders?

Yes. For your proposal to be considered for inclusion in our Proxy Statement for the 2025 annual meeting of stockholders, we must receive your written proposal no later than December 4, 2024. If we change the date of the 2025 annual meeting of stockholders by more than 30 days from the anniversary of the date of this year’s Annual Meeting, then the deadline to submit proposals will be a reasonable time before we begin to print and mail our proxy materials. Your proposal, including the manner in which you submit it, must comply with SEC regulations regarding stockholder proposals.

|

|

18 | 2024 Proxy Statement |

If you wish to raise a proposal (including a director nomination) from the floor during our 2025 annual meeting of stockholders, we must receive a written notice of the proposal no earlier than the close of business on January 7, 2025 and no later than the close of business on February 6, 2025. If our first announcement of the date of the 2025 annual meeting of stockholders is less than 100 days prior to the meeting, then in accordance with the Bylaws, the Corporate Secretary of the Company must receive the notice by the 10th day following the announcement. If the date of the 2025 annual meeting is more than 30 days before or more than 30 days after the anniversary of the date of this year’s Annual Meeting, you must deliver the notice not earlier than the close of business on the 120th day prior to the date of the 2025 annual meeting and not later than the close of business on the later of the 90th day prior to the date of the 2025 annual meeting. Your submission must contain the additional information that our bylaws require. Proposals should be addressed to our Corporate Secretary at 1301 McKinney Street, Suite 2300, Houston, Texas 77010.

Who is paying for this proxy solicitation?

Our Board is soliciting your proxy. We expect to solicit proxies in person, by telephone or by other electronic means. We have retained Morrow Sodali LLC, 430 Park Ave., 14th Floor, New York, NY 10022 to assist in this solicitation. We expect to pay Morrow Sodali LLC an estimated $150,000, plus expenses and disbursements.

We will pay the expenses of this proxy solicitation, including the cost of preparing, printing and mailing the Notice, this Proxy Statement and related proxy materials. These expenses may include the charges and expenses of banks, brokerage firms and other custodians, nominees or fiduciaries for forwarding proxy materials to beneficial owners of MRC Global shares.

Are you “householding” for stockholders sharing the same address?

The SEC has adopted rules that allow a company to deliver a single set of proxy materials to an address shared by two or more of its stockholders. This method of delivery, known as “householding”, permits us to realize cost savings and reduces the amount of duplicate information stockholders receive. In accordance with notices sent to stockholders sharing a single address, we are sending only one set of proxy materials to that address unless we have received contrary instructions from a stockholder at that address. Any stockholders who object to or wish to begin householding may notify the Corporate Secretary of the Company orally or in writing at the telephone number or address, as applicable, set forth above. We will deliver promptly an individual copy of the proxy materials to any stockholder who revokes its consent to householding upon our receipt of such revocation.

If you would like to receive a copy of this Proxy Statement and our 2023 Annual Report, we will promptly send you a copy upon request directed to our transfer agent, Computershare. You can call Computershare toll free at 1-800-962-4284. You can call the same phone number to notify us that you wish to receive a separate 2023 Annual Report or Proxy Statement in the future or to request delivery of a single copy of any materials if you are receiving multiple copies now.

|

|

19 | 2024 Proxy Statement |

SECURITY OWNERSHIP

Directors and Executive Officers

The following table shows, as of March 15, 2024, the number of shares of our common stock that each of our directors, each of our named executive officers (NEOs) and all of our executive officers and directors as a group beneficially own.

The rules of the SEC generally determine beneficial ownership, which generally includes voting or investment power with respect to securities. Unless indicated below, to our knowledge, the persons and entities that the table names have sole voting and sole investment power with respect to all shares beneficially owned, subject to community property laws where applicable. Shares of common stock subject to options that are currently exercisable or exercisable within 60 days of March 15, 2024, are deemed to be outstanding and to be beneficially owned by the person holding the options for the purpose of computing the percentage ownership of that person but are not treated as outstanding for the purpose of computing the percentage ownership of any other person. Unvested restricted stock units (RSUs) and performance share units (PSUs) are not included to the extent they will not definitively vest within 60 days of March 15, 2024. Except as otherwise indicated, the business address for each of our beneficial owners is c/o MRC Global Inc., 1301 McKinney Street, Suite 2300, Houston, Texas 77010.

| Name | Total Shares of Common Stock Beneficially Owned |

Percent of Common Stock Outstanding |

Shares of Unvested Restricted Stock or RSUs included in Total |

Options Exercisable Included in Total | ||||

| Robert J Saltiel, Jr. |

397,160 | * | — | — | ||||

| Kelly Youngblood |

237,545 | * | 9,017 | — | ||||

| Daniel J. Churay(1) |

171,054 | * | 7,665 | 25,109 | ||||

| Grant R. Bates(2) |

116,094 | * | 6,313 | 4,046 | ||||

| Rance C. Long |

70,366 | * | — | 2,636 | ||||

| Deborah G. Adams |

85,608 | * | 15,295 | — | ||||

| Leonard M. Anthony |

128,924 | * | 15,295 | 0 | ||||

| Henry Cornell(3) |

20,386,193 | 19.3% | 15,295 | 9,415 | ||||

| George J. Damiris |

33,221 | * | 15,295 | — | ||||

| Barbara Duganier |

93,233 | * | 15,295 | — | ||||

| David A. Hager |

12,414 | * | — | — | ||||

| Ronald L. Jadin |

33,221 | * | 15,295 | — | ||||

| Anne McEntee |

22,310 | * | 15,295 | — | ||||

| Daniel B. Silvers(4) |

— | — | — | — | ||||

| Robert L. Wood(5) |

119,229 | * | 27,954 | — | ||||

| All directors and executive officers, as a group (19 persons) |

22,033,708 | 20.9% | ||||||

| *Less than 1% |

| (1) | Mr. Churay owns 550 shares of our common stock through an Individual Retirement Account. |

| (2) | Mr. Bates indirectly owns 5,004 shares of our common stock through ownership by his spouse. |

|

|

20 | 2024 Proxy Statement |

| (3) | Mr. Cornell directly owns 84,174 shares of our common stock and indirectly owns 10 shares of our common stock held by his minor son. In addition, Mr. Cornell together with Mario Investments LLC, Cornell Capital Special Situations Partners II LP, Cornell Capital GP II LP and Cornell Investment Partners LLC has beneficial ownership of the outstanding Series A Convertible Perpetual Preferred Stock convertible into 20,302,009 shares of common stock. Mr. Cornell is the sole member of Cornell Investment Partners LLC, which is the general partner of Cornell Capital GP II LP, which is the general partner of Cornell Capital Special Situations Partners II LP, which is the sole member of Mario Investments LLC. Refer to “Certain Beneficial Owners” and “Preferred Stock Issuance” for additional details. |

| (4) | Mr. Silvers joined the Board on April 1, 2024 after the date of this table. |

| (5) | Mr. Wood owns 3,000 shares of our common stock indirectly through Robert Wood TTE. |

As of March 15, 2024, the Company’s directors and executive officers beneficially owned 20.9% of our outstanding common stock (assuming conversion of all preferred stock to common stock). The percentage beneficially owned was calculated based on 85,135,649 shares of common stock and preferred stock convertible into 20,302,009 shares of common stock for a total of 105,437,658 shares outstanding on March 15, 2024.

Certain Beneficial Owners

The following table sets forth information regarding persons or groups known to the Company to be beneficial owners of more than 5% of our outstanding preferred stock or common stock as of March 15, 2024, including the business address of each.

| Names and Address of Beneficial Owner | Number of Shares of Common Stock

|

Percent of Common Stock Outstanding | ||

| Mario Investments LLC(1) c/o Cornell Capital GP II LP 499 Park Avenue, 21st Floor New York, NY 10022

|

20,302,009 | 19.3% | ||

| The Vanguard Group(2) 100 Vanguard Blvd. Malvern, PA 19355

|

9,003,975 | 8.5% | ||

| Pzena Investment Management, LLC(3) 320 Park Avenue, 8th Floor New York, NY 10022

|

7,001,859 | 6.6% | ||

| BlackRock, Inc.(4) 50 Hudson Yards New York, NY 10001

|

6,560,977 | 6.2% | ||

| Frontier Capital Management Co., LLC(5) 99 Summer Street Boston, MA 02110

|

6,005,201 | 5.7% | ||

| (1) | On April 26, 2023, Mario Investments LLC, Cornell Capital Special Situations Partners II LP, Cornell Capital GP II LP, Cornell Investment Partners LLC, and Henry Cornell filed a Schedule 13D/A reporting shared beneficial ownership of 363,000 shares of preferred stock convertible into 20,302,009 shares of common stock on an as-converted basis with shared voting and dispositive power. |

| (2) | Based on the Schedule 13G/A filed with the SEC on February 13, 2024, The Vanguard Group has sole dispositive power with respect to 8,836,179 shares of common stock, shared dispositive power with respect to 167,796 shares of common stock and shared voting power with respect to 88,600 shares of common stock. |

|

|

21 | 2024 Proxy Statement |

| (3) | Based on the Schedule 13G/A filed with the SEC on February 8, 2024, Pzena Investment Management, LLC has sole dispositive power with respect to 7,001,859 shares of common stock and sole voting power with respect to 5,382,512 shares of common stock. |

| (4) | Based on the Schedule 13G/A filed with the SEC on January 26, 2024, BlackRock, Inc. has sole dispositive power with respect to 6,560,977 shares of common stock and sole voting power with respect to 6,405,529 shares of common stock. |

| (5) | Based on the Schedule 13G filed with the SEC on February 14, 2024, Frontier Capital Management Co., LLC has sole dispositive power with respect to 6,005,201 shares of common stock and sole voting power with respect to 4,380,058 shares of common stock. |

Preferred Stock Issuance

In June 2015, we filed with the Secretary of State of the State of Delaware a Certificate of Designations, Preferences, Rights and Limitations of Series A Convertible Perpetual Preferred Stock (the “Certificate of Designations”) creating the Series A Convertible Perpetual Preferred Stock, par value $0.01 per share (the “preferred stock”), and establishing the designations, preferences, and other rights of the preferred stock. On June 10, 2015, we issued 363,000 shares of preferred stock and received gross proceeds of $363 million. In connection with the issuance, we entered into a shareholders’ agreement (the “Shareholders’ Agreement”) with Mario Investments LLC, the initial holder of the preferred stock (the “Initial Holder”). The following description is qualified in its entirety by reference to the full text of the Certificate of Designations and the Shareholders’ Agreement, each of which were filed as exhibits to our Current Report on Form 8-K, which was filed with the SEC on June 11, 2015. Capitalized terms used in this “Preferred Stock Issuance” description that are not defined in this Proxy Statement shall have the terms that the Certificate of Designations assigns to those terms.

Voting and Other Rights

The preferred stock ranks senior to our common stock with respect to dividend rights and rights on liquidation, winding-up and dissolution. The preferred stock has a stated value of $1,000 per share, and holders of the preferred stock are entitled to cumulative dividends payable quarterly in cash at a rate of 6.50% per annum.

The preferred stock does not create a dual class voting structure as it is does not constitute a second class of common stock with special voting rights. Holders of the preferred stock are entitled to vote together with the holders of the common stock as a single class, in each case, on an as-converted basis, except in rare instances when the law requires a separate class vote of the common stockholders. The preferred stockholders also have certain rights regarding the issuance of stock that is Parity Stock or Senior Stock (as each of those terms are defined in the Certificate of Designations). A vote of two-thirds of the preferred stock is required to:

| ● | amend or alter the Company’s certificate of incorporation to create or increase any class or series of Parity Stock or Senior Stock or adversely affect the rights of the preferred stock; |

| ● | amend, alter or repeal any provision of the Company’s certificate of incorporation so as to adversely affect the rights, preferences, privileges or voting powers of the preferred stock; or |

| ● | to consummate a share exchange, reclassification, merger or consolidation where: |

| ● | the shares of the preferred stock do not remain outstanding, and the terms of the preferred stock are not amended or |

| ● | the preferred stockholders do not receive preference securities in a transaction with the same or better terms than those in the preferred stock, |

or, in either case, certain additional requirements are not met.

Pursuant to the Shareholders’ Agreement, the Initial Holder and certain related parties if the preferred stock is transferred to those parties (collectively, the “Original Holder’s Group”) are entitled to vote their shares in their discretion. Holders of the preferred stock have certain limited special approval rights, including with respect to the issuance of pari passu or senior equity securities of the Company.

|

|

22 | 2024 Proxy Statement |

Lapse of Certain Voting Requirements

Prior to June 10, 2020, the Original Holder’s Group agreed to vote their shares in favor of director nominees that the Board nominates. This provision has lapsed, and the Original Holder’s Group is no longer required to vote their shares in favor of director nominees that the Board nominates.

Sunset Provisions

The preferred stock is convertible at the option of the holders into shares of common stock at an initial conversion rate of 55.9284 shares of common stock for each share of preferred stock, which represents an initial conversion price of $17.88 per share of common stock, subject to adjustment. The Company currently has the option to redeem, in whole but not in part, all of the outstanding shares of preferred stock at par value, subject to certain redemption price adjustments. We may elect to convert the preferred stock, in whole but not in part, into the relevant number of shares of common stock if the last reported sale price of the common stock has been at least 150% of the conversion price then in effect for a specified period. The conversion rate is subject to customary anti-dilution and other adjustments.

Fundamental Change

If a Fundamental Change occurs, each holder of the preferred stock has the right, at the holder’s option, to require the Company to repurchase all or part of the holder’s shares of preferred stock for cash. Among other things, as described as follows, an all-cash acquisition of the Company would constitute a Fundamental Change, but a stock-for-stock merger of the Company would not so long as the shares received in exchange for Company common stock were quoted or listed on a major U.S. stock market. A “Fundamental Change” occurs when:

| (i) | (except as described in clause (ii) below) the acquisition by a “person” or “group” within the meaning of Section 13(d) of the Exchange Act (other than the current holder of the preferred stock, the Company, the Company’s Wholly Owned Subsidiaries and the employee benefit plans of the Company and its Wholly Owned Subsidiaries) of the “beneficial ownership,” as defined in Rule 13d-3 under the Exchange Act, of more than 50% of the voting power in the aggregate of all classes of the Company’s Common Equity (i.e. the Company’s common stock); |

| (ii) | the consummation of: |

| (A) | any recapitalization, reclassification or change of the Company’s common stock (other than changes resulting from a subdivision or combination) as a result of which the common stock is converted into, or exchanged for, stock, other securities, other property or assets; |

| (B) | any share exchange, consolidation or merger of the Company pursuant to which the Company’s common stock is converted into cash, securities or other property or assets; or |

| (C) | any sale, lease or other transfer of all or substantially all of the consolidated assets of the Company and its Subsidiaries, taken as a whole, to any person or entity other than one of the Company’s Wholly Owned Subsidiaries; |

provided, that any transaction described in clause (B) above in which the holders of all classes of the Company’s Common Equity immediately prior to such transaction(s) own, directly or indirectly, more than 50% of all classes of Common Equity of the continuing or surviving corporation or transferee or the parent thereof immediately after such transaction(s) in substantially the same proportions as such ownership immediately prior to such transaction(s) will not be a Fundamental Change;

| (iii) | the stockholders of the Company approve any plan or proposal for the liquidation or dissolution of the Company; or |

| (iv) | the Company’s common stock (or other common stock underlying the Preferred Stock, such as after a stock-for-stock merger) ceases to be listed or quoted on a major U.S. stock market; |

provided, that:

| (x) | transaction(s) described in clause (ii) above will not be a Fundamental Change, if at least 90% of the consideration received by the common stockholders of the Company (excluding cash payments for fractional shares) in connection with the transaction(s) |

|

|

23 | 2024 Proxy Statement |

| consist of shares of common stock that are listed or quoted on a major U.S. stock market and as a result of the transaction(s) the preferred stock becomes convertible into that consideration; and |

| (y) | transactions described in clause (i) above will not constitute a Fundamental Change, if the holders of the preferred stock transfer to any transferee shares of preferred stock that would cause a Fundamental Change to occur described in clause (i) above and the holders of the preferred stock know or have good reason to know that the consummation of the transfer to the transferee would cause a Fundamental Change to occur. |

Board Representation Rights

Pursuant to the Shareholders’ Agreement, for so long as the Original Holder’s Group maintains at least 33% of their original investment (whether in preferred stock or shares of common stock issued upon conversion of the preferred stock), the Original Holder’s Group has the right to appoint a single representative, in a non-voting observer capacity, to attend all meetings of the Board, subject to certain exceptions.

Pursuant to the Certificate of Designations and the Shareholders’ Agreement, on June 10, 2018, the Original Holder’s Group had the right to designate one person to serve as a director on the Board if the Original Holder’s Group maintained at least 33% of their original investment and shares of the preferred stock remained outstanding. The Original Holder’s Group met such requirement, and the Company was required to increase the size of the Board to accommodate the appointment of Henry Cornell, as a director designated by the Original Holder’s Group on June 10, 2018. The holders of the preferred stock also have certain Board representation rights if dividends payable on the preferred stock are in arrears for six or more quarterly periods, but in no event may the holders of the preferred stock appoint more than two directors. Also, pursuant to the Shareholders’ Agreement, if no shares of the preferred stock remain outstanding but the Original Holder’s Group maintains at least 33% of their original investment through their shares of common stock received upon conversion of the preferred stock, the Original Holder’s Group may designate one nominee to serve as a director on the Board (the “Investor Designee”), subject to the Investor Designee’s satisfaction of all applicable requirements regarding service as a director of the Company under applicable law, regulation or stock exchange rules and such other criteria and qualifications the Company maintained that is applicable to all directors as of the date of the issuance of the preferred stock. The Company is required to increase the size of the Board by one director and fill the vacancy with the Investor Designee. Thereafter, the Company is required to nominate the Investor Designee for election by the Company’s stockholders and recommend that the Company’s stockholders vote in favor of the election of the Investor Designee.

If for any reason the director that the Original Holder’s Group appointed or designated is no longer serving as a director, the Original Holder’s Group may appoint or designate a new person to fill the vacancy. At such time as the Original Holder’s Group owns less than 33% of their original investment, pursuant to the Shareholders’ Agreement, the rights of the Original Holder’s Group terminate, and the Investor Designee must resign.

Certain Other Provisions

Pursuant to the Shareholders’ Agreement, the Original Holder’s Group has certain registration rights, including customary demand and piggyback registration rights in respect of the shares of preferred stock and any shares of common stock issued upon conversion of the preferred stock.

Pursuant to the Shareholders’ Agreement, for so long as the Original Holder’s Group maintains at least 33% of their original investment (whether in preferred stock or shares of common stock issued upon conversion of the preferred stock), the Company is required to, prior to the issuance of equity securities to a third party (subject to certain exceptions), offer the Original Holder’s Group the right to acquire its pro rata portion of such equity securities.

MRC Global Inc. may not enter into any new, or amend, or modify any existing agreement or arrangement that by its terms restricts, limits, prohibits or prevents MRC Global Inc. from paying dividends on the Preferred Stock, redeeming or repurchasing the Preferred Stock or effecting the conversion of the Preferred Stock. Any such agreement, amendment or modification would require the consent of the holder of the Preferred Stock.

|

|

24 | 2024 Proxy Statement |

Engine Capital Cooperation Agreement

On April 1, 2024, the Company entered into a Cooperation Agreement (the “Cooperation Agreement”) with Engine Capital L.P. and certain of its affiliates (collectively, “Engine Capital”).