UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| þ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Fiscal Year Ended December 31, 2014

| ¨ | Transition Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

Commission File Number: 000-53293

RETROPHIN, INC.

(Exact Name of Registrant as specified in its Charter)

| Delaware | 27-4842691 |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

| 12255 El Camino Real, San Diego, CA | 92130 |

| (Address of Principal Executive Offices) | (Zip code) |

760-260-8600

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Name of exchange on which registered |

| Common Stock, par value $0.0001 per share | The NASDAQ Global Market |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. ¨ Yes þ No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. ¨ Yes þ No

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. þ Yes ¨ No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). þ Yes ¨ No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. þ

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act):

| Large Accelerated Filer ¨ | Accelerated Filer þ | |

| Non-Accelerated Filer ¨ | Smaller Reporting Company ¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). ¨ Yes þ No

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant's most recently completed second fiscal quarter. $120,825,955.

The number of shares of outstanding common stock, par value $0.0001 per share, of the Registrant as of March 3, 2015 was 26,486,570.

| 2 |

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

Certain information contained in this Annual Report on Form 10-K of Retrophin, Inc., a Delaware corporation (the “Company”) include forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. The statements herein which are not historical reflect our current expectations and projections about the Company’s future results, performance, liquidity, financial condition, prospects and opportunities and are based upon information currently available to the Company and management and its subject to its interpretation of what is believed to be significant factors affecting the businesses, including many assumptions regarding future events. Such forward-looking statements include statements regarding, among other things:

| · | our ability to produce, sustain and expand sales of our products; |

| · | our ability to develop, acquire and/or introduce new products; |

| · | our projected future sales, profitability and other financial metrics; |

| · | our future financing plans; |

| · | our anticipated needs for working capital; |

| · | the anticipated trends in our industry; |

| · | acquisitions of other companies or assets that we might undertake in the future; |

| · | our operations in the United States and abroad, and the domestic and foreign regulatory, economic and political conditions; and |

| · | competition existing today or that will likely arise in the future. |

Forward-looking statements, which involve assumptions and describe our future plans, strategies and expectations, are generally identifiable by use of the words “may,” “should,” “expect,” “anticipate,” “estimate,” “believe,” “intend,” “seek,” or “project” or the negative of these words or other variations on these words or comparable terminology. Actual results, performance, liquidity, financial condition and results of operations, prospects and opportunities could differ materially from those expressed in, or implied by, these forward-looking statements as a result of various risks, uncertainties and other factors, including the ability to raise sufficient capital to continue the Company’s operations. Actual events or results may differ materially from those discussed in forward-looking statements as a result of various factors, including, without limitation, the risks outlined under “Risk Factors” and matters described in this Annual Report generally. In light of these risks and uncertainties, there can be no assurance that the forward-looking statements contained in this Annual Report will in fact occur. Potential investors should not place undue reliance on any forward-looking statements. Except as expressly required by the federal securities laws, there is no undertaking to publicly update or revise any forward-looking statements, whether as a result of new information, future events, changed circumstances or any other reason.

The specific discussions in this Annual Report about the Company include financial projections and future estimates and expectations about the Company’s business. The projections, estimates and expectations are presented in this Annual Report only as a guide about future possibilities and do not represent actual amounts or assured events. All the projections and estimates are based exclusively on the Company management’s own assessment of the business, the industry in which it works and the economy at large and other operational factors, including capital resources and liquidity, financial condition, fulfillment of contracts and opportunities. The actual results may differ significantly from the projections.

Potential investors should not make an investment decision based solely on the Company’s projections, estimates or expectations.

| 3 |

In this Annual Report on Form 10-K, unless the context requires otherwise, the terms “we”, “our”, “us”, “Retrophin” and the “Company” refer to Retrophin, Inc., a Delaware corporation, as well as our direct and indirect subsidiaries.

Those statements in the following discussion that are not historical in nature should be considered to be forward looking statements that are inherently uncertain. Actual results and the timing of the events may differ materially from those contained in these forward looking statements due to a number of factors, including those discussed in the “Cautionary Note on Forward Looking Statements” and “Risk Factors” set forth elsewhere in this Annual Report.

Overview

We are a fully integrated biopharmaceutical company with approximately 110 employees headquartered in San Diego, California focused on the development, acquisition and commercialization of therapies for the treatment of serious, catastrophic or rare diseases. We regularly evaluate and, where appropriate, act on opportunities to expand our product pipeline through licenses and acquisitions of products in areas that will serve patients with serious, catastrophic or rare diseases and that we believe offer attractive growth characteristics. During the first quarter of 2014, we completed the acquisition of all of the membership interests of Manchester Pharmaceuticals LLC (“Manchester”), a privately-held specialty pharmaceutical company that focuses on treatments for rare diseases. This acquisition expanded our ability to address the special needs of patients with rare diseases. We generated our first sales in March 2014 and our planned principal operations commenced. On May 29, 2014, we entered into a license agreement with Mission Pharmacal Company (“Mission”), a privately-held healthcare medications and treatments provider, for the U.S. marketing rights to Thiola® (tiopronin). As a result of this license we added Thiola® to our product line. In July 2014, we amended the license agreement to secure the Canadian marketing rights to Thiola®. During 2014, the Company built a specialty commercial team to launch and commercialize these products.

We currently sell the following two products:

| · | Chenodal® (chenodial) is approved in the United States for the treatment of patients suffering from gallstones in whom surgery poses an unacceptable health risk due to disease or advanced age. Chenodal® has been the standard of care for CTX patients for more than three decades and the Company is currently pursuing adding this indication to the label. |

| · | Thiola® (tiopronin) is approved in the United States for the prevention of cysteine (kidney) stone formation in patients with severe homozygous cystinuria. |

Acquisition of Exclusive Right to Purchase Cholic Acid

On January 12, 2015, the Company announced the signing of a definitive agreement under which Retrophin has acquired the exclusive right to purchase from Asklepion Pharmaceutical LLC (“Asklepion”), all worldwide rights, titles, and ownership of cholic acid for the treatment of bile acid synthesis defects, if approved by the U.S. Food and Drug Administration (“FDA”). Under the terms of the agreement, Retrophin paid Asklepion an upfront payment of $5 million and will pay up to $73 million in milestones based on approval and net product sales, plus tiered royalties on future net sales of cholic acid. Retrophin has secured a line of credit from current lenders to cover necessary payments.

Sale of Assets

On January 9, 2015, the Company entered into an asset purchase agreement with Turing Pharmaceuticals A.G. (“Turing Pharmaceuticals”) pursuant to which the Company sold Turing Pharmaceuticals its ketamine licenses and assets (the “Assets”) for a purchase price of $1 million. Turing Pharmaceuticals will also assume all future liabilities related to the ketamine Assets. The Company’s former Chief Executive Officer is the Chief Executive Officer of Turing Pharmaceuticals.

On February 13, 2015, Retrophin, Inc., its wholly-owned subsidiary Manchester and its other wholly-owned subsidiary Retrophin Therapeutics International, LLC (collectively, the “Sellers”), entered into a purchase agreement with Waldun Pharmaceuticals, LLC (“Waldun”), a holding company of Turing Pharmaceuticals, pursuant to which the Sellers sold Waldun their product rights to mecamylamine hydrochloride (also referred to as Vecamyl) (the “Vecamyl Product Rights”) for a purchase price of $0.7 million. Waldun in turn sold the Vecamyl Product Rights to Turing Pharmaceuticals. In connection therewith, on February 13, 2015, the Company and Manchester entered into an Asset Purchase Agreement with Turing Pharmaceuticals, pursuant to which the Company and Manchester sold Turing Pharmaceuticals their mecamylamine hydrochloride inventory (the “Inventory”) for a purchase price of $0.3 million. Turing Pharmaceuticals will also assume certain liabilities related to the Vecamyl Product Rights and the Inventory.

Additionally, on February 13, 2015, the Company entered into an asset purchase agreement with Turing Pharmaceuticals pursuant to which the Company sold Turing Pharmaceuticals its Syntocinon (also referred to as oxytocin) licenses and assets (the “Oxytocin Assets ”), including related inventory, for a purchase price of $1.1 million. Turing Pharmaceuticals will also assume certain liabilities related to the Oxytocin Assets.

| 4 |

Our Strategy

Our goal is to become a leading biopharmaceutical company specializing in the development and commercialization of therapies that deliver significant value for patients with serious, catastrophic or rare diseases. In order to achieve our goal, we intend to:

| · | Expand our product pipeline. We intend to expand our product pipeline by pursuing additional acquisitions of pharmaceutical products that have the potential to have a profound impact on patients’ lives. We believe that there are multiple drugs for treating life-threatening diseases that may be neglected by other pharmaceutical companies. We believe that we can acquire certain of these products to achieve increased sales. |

| · | Focus on developing products to treat rare diseases characterized by severe unmet medical needs. We focus on potentially transformational orphan drug candidates in order to leverage our development and commercialization capabilities in rare disease. We believe that drug development for orphan drug markets is particularly attractive because relatively small clinical trials can demonstrate the large clinical effects expected with transformational therapies. Furthermore, the regulatory and commercial models for orphan drugs are well established. Finally, we believe that our research, development, and commercialization capabilities are well suited to the orphan drug market and represent distinct competitive advantages. |

| · | Develop a sustainable pipeline by employing disciplined decision criteria in the evaluation of potential in-licensing candidates. We seek to build a sustainable product pipeline by employing multiple therapeutic approaches and by developing or acquiring orphan drug candidates. We will augment our internally developed pipeline projects by selectively and strategically acquiring pipeline assets that will add value to the portfolio. We intend to mitigate risk by employing rigorous decision criteria, favoring drug candidates that have undergone at least some clinical study. Our decision to license a drug candidate also depends on the scientific merits of the available clinical data; the identifiable orphan patient population; the economic terms of any proposed license; the amount of capital required to develop the asset; and the economic potential of the drug candidate, should it be commercialized. We believe this strategy minimizes our clinical development risk and allows us to accelerate the development and potential commercialization of current and future drug candidates. |

| · | Evaluate the commercialization strategies on a product-by-product basis to maximize the value of each. As we move our drug candidates through development toward regulatory approval, we will evaluate several options for each drug candidate’s commercialization strategy. These options include building our own internal sales force; entering into joint marketing partnerships with other pharmaceutical or biotechnology companies, whereby we jointly sell and market the product; and out-licensing our products, whereby other pharmaceutical or biotechnology companies sell and market our product and pay us a royalty on sales. Our decision will be made separately for each product and will be based on a number of factors including capital necessary to execute on each option, size of the market and terms of potential offers from other pharmaceutical and biotechnology companies. |

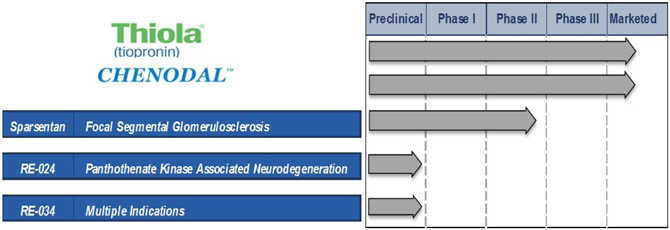

The following summarizes the status of our product candidates and preclinical programs, each of which will be described and discussed in further detail below under “—Our Product Candidates and Preclinical Programs.”

| · | Sparsentan. Sparsentan, also known as RE-021, is an investigational therapeutic agent which acts as both a potent angiotensin receptor blocker (“ARB”), as well as a selective endothelin receptor antagonist (“ERA”), with selectivity toward endothelin receptor type A. We have secured a license to sparsentan from Ligand and Bristol-Myers Squibb (who referred to it as DARA). We are developing sparsentan as a treatment for FSGS, which is a leading cause of end-stage renal disease. We are currently enrolling patients for the DUET Phase 2 clinical study of sparsentan for the treatment of FSGS and we expect approximately 100 patients to be enrolled. Based on the robustness of the data obtained in the DUET study, we may be able to support an application for accelerated approval for sparsentan on the basis of proteinuria as a surrogate endpoint. |

| · | RE-024. We are developing RE-024, a novel small molecule, as a potential treatment for pantothenate kinase-associated neurodegeneration (“PKAN”). PKAN is a genetic neurodegenerative disorder that is typically diagnosed in the first decade of life. Consequences of PKAN include dystonia, dysarthria, rigidity, retinal degeneration, and severe digestive problems. PKAN is estimated to affect 1 to 3 persons per million. There are currently no viable treatment options for patients with PKAN. RE-024 is a phosphopantothenate prodrug therapy that aims to restore levels of this key substrate in PKAN patients. Certain ex-US health regulators have approved the initiation of dosing RE-024 in PKAN under physician-initiated studies in accordance with local regulations in their respective countries. The Company intends to file a U.S. IND in 2015 to support the initiation of company-sponsored studies. |

| · | RE-034 is a synthetic hormone analog of the first 24 amino acids of the 39 amino acids contained in ACTH formulated using a novel process by Retrophin. RE-034 exhibits the same physiological actions as endogenous ACTH by binding to all five melanocortin receptors (pan-MCR), resulting in its anti-inflammatory and immunomodulatory effects. Retrophin has successfully formulated and manufactured RE-034 at proof-of-concept scale using a novel formulation process that allows modulation of the release of the active ingredient from the site of administration. Retrophin continues preclinical development of RE-034 to enable multiple strategic options, which may include the initiation of IND-enabling studies in 2015. |

| 5 |

| · | Carbetocin. Carbetocin, similar to Oxytocin, has potential utility for the treatment of milk let-down in post pregnant women, inducing contractions during labor, ostpartum hemorrhage, as well as for autism and schizophrenia. We are currently exploring options relating to the future development of RE-034. |

Our Product Candidates and Marketed Products

The following table summarizes the status of our marketed products, product candidates and preclinical programs, each of which are described in further detail below.

Marketed Products:

Thiola® (Tiopronin)

Thiola® is approved by the FDA for the treatment of cystinuria, a rare autosomal recessive disorder of di-basic amino acid transport. Mutations in the genes encoding for transporters found in the proximal tubule prevent necessary reabsorption of the dibasic amino acids, including cystine. This defect causes high cystine levels in the urine which leads to the formation of recurring kidney stones. Cystine stone formers tend to form stones that are larger and more frequent than non-cystine stone formers. As a result, cystinuric patients undergo many invasive procedures for stone removal and are at greater risk for loss of renal function and suffer lower quality of life. The prevalence of cystinuria in the United States is estimated to be 1 per 15,000, indicating that there may be as many as 20,000 affected individuals with cystinuria in the United States.

Chenodal® (chenodiol tablets)

Chenodal® is a synthetic oral form of chenodeoxycholic acid, a naturally occurring primary bile acid synthesized from cholesterol in the liver, indicated for the treatment of radiolucent stones in well-opacifying gallbladders in whom selective surgery would be undertaken except for the presence of increased surgical risk due to systemic disease or age.

Chenodiol administration is known to reduce biliary cholesterol and the dissolution of radiolucent gallstones through suppression of hepatic synthesis of cholesterol, cholic acid and deoxycholic acid in the bile pool. Chenodiol was first approved by FDA in 1983 for the management of gallstones and discontinued due to lack of commercial success. In 2009 an Abbreviated New Drug Application, or ANDA, for chenodiol submitted by Nexgen Pharma was approved by the FDA for the treatment of gallstones; Chenodal® is private label manufactured for Manchester under this ANDA. Manchester subsequently obtained Orphan Drug Designation for chenodiol for the treatment of cerebrotendinous xanthomatosis (CTX) in 2010.

On March 26, 2014, we completed the acquisition of Manchester including the U.S. rights for Chenodal® and the intellectual property to develop, manufacture, and sell the product in the United States. We will continue to supply Chenodal® to the U.S. market.

Chenodal® in Cerebrotendinous Xanthomatosis

We intend to obtain FDA approval of Chenodal® for the treatment of CTX, a rare autosomal recessive lipid storage disease for which there are no FDA approved treatments. The prevalence of CTX is estimated in the literature to be as high as 1 in 50,000 in the overall population. Pathogenesis of CTX involves deficiency of the enzyme 27-hydroxylase (encoded by the gene CYP27A1), a rate-limiting enzyme in the synthesis of primary bile acids, including chenodeoxycholic acid, from cholesterol. The disruption of primary

| 6 |

bile acid synthesis in CTX leads to toxic accumulation of cholesterol and cholestanol in most tissues. Most patients present with intractable diarrhea, premature cataracts, tendon xanthomas, atherosclerosis, and cardiovascular disease in childhood and adolescence. Neurological manifestations of the disease, including dementia and cognitive and cerebellar deficiencies, emerge during late adolescence and adulthood. Oral administration of chenodeoxycholic acid has been shown to normalize primary bile acid synthesis in patients with CTX. Chenodeoxycholic acid has been used as the standard of care for CTX for well over three decades.

Sparsentan

Sparsentan, also known as RE-021, is an investigational therapeutic agent which acts as both a potent angiotensin receptor blocker (“ARB”), as well as a selective endothelin receptor antagonist (“ERA”), with selectivity toward endothelin receptor type A. We are developing sparsentan as a treatment for Focal Segmental Glomerulosclerosis (“FSGS”), which is a leading cause of end-stage renal disease and Nephrotic Syndrome (“NS”). There are no FDA approved treatments for FSGS and the off-label armamentarium is limited to ACE/ARBs, steroids, and immunosuppressant agents, which are effective in only a subset of patients. We estimate that there are at least 40,000 FSGS patients in the United States. Retrophin is currently enrolling patients for the Phase 2 DUET study to evaluate the effects of sparsentan in 100 FSGS patients. The primary endpoint of the study is the decrease in proteinuria, which is well recognized as a marker of disease progression for FSGS. Retrophin believes that a decrease in proteinuria could serve as the basis for an accelerated approval if the data prove to be robust. On January 5, 2015, the Office of Orphan Products Development of the U.S. Food and Drug Administration (“FDA”) granted orphan drug designation for sparsentan for the treatment of FSGS.

RE-034 (Tetracosactide Zinc)

RE-034 is a synthetic hormone analog of the first 24 amino acids of the 39 amino acids contained in ACTH formulated using a novel process by Retrophin. RE-034 exhibits the same physiological actions as endogenous ACTH by binding to all five melanocortin receptors (pan-MCR), resulting in its anti-inflammatory and immunomodulatory effects. Retrophin has successfully formulated and manufactured RE-034 at proof-of-concept scale using a novel formulation process that allows modulation of the release of the active ingredient from the site of administration. Retrophin continues preclinical development of RE-034 to enable multiple strategic options, which may include the initiation of IND-enabling studies in 2015.

Competition

Clinical studies of Cholic Acid as a potential treatment for inborn errors of bile acid synthesis, sponsored by Asklepion Pharmaceuticals, have been reported. Intercept Pharmaceuticals is currently conducting clinical trials of its FXR agonist, obeticholic acid, in primary biliary cirrhosis, portal hypertension, NASH, and bile acid diarrhea. Additionally, we believe that Intercept Pharmaceuticals is working on a possible treatment of inborn errors of bile acid synthesis using FXR agonists.

The pharmaceutical and biotechnology industries are intensely competitive and subject to rapid and significant technological change. Most of our competitors are larger than us and have substantially greater financial, marketing and technical resources than we have.

The development and commercialization of new products to treat orphan diseases is highly competitive, and we expect considerable competition from major pharmaceutical, biotechnology and specialty pharmaceutical companies. As a result, there are, and will likely continue to be, extensive research and substantial financial resources invested in the discovery and development of new orphan drug products. Our potential competitors include, but are not limited to: GlaxoSmithKline, Roche, Novartis, Pfizer, Sanofi/Genzyme, Shire, Abbvie, and BioMarin.

We are an early stage company with a limited history of operations. Many of our competitors have substantially more resources than we do, including both financial and technical. In addition, many of our competitors have more experience than we do in pre-clinical and clinical development, manufacturing, regulatory and global commercialization. We are also competing with academic institutions, governmental agencies and private organizations that are conducting research in the field of orphan diseases.

Our competition will be determined in part by the potential indications for which drugs are developed and ultimately approved by regulatory authorities. Additionally, the timing of market introduction of some of our potential products or our competitors’ products may be an important competitive factor. Accordingly, the speed with which we can develop products, complete pre-clinical testing, clinical trials, approval processes, and supply commercial quantities to market are expected to be important competitive factors. We expect that competition among products approved for sale will be based on various factors, including product efficacy, safety, reliability, availability, price, reimbursement, and patent position.

Licenses and Royalties

Ligand License

We have a worldwide license from Ligand for the development, manufacture and commercialization of sparsentan, an ARB and

| 7 |

ERA which we are initially using in connection with the treatment of FSGS. Under the license agreement, Ligand granted us a sublicense under certain of its patents and other intellectual property in connection with the development and commercialization of sparsentan. Under the license agreement, Ligand is obligated to transfer to us certain information, records, regulatory filings, materials and inventory controlled by Ligand and relating to or useful for developing sparsentan. We must use commercially reasonable efforts to develop and commercialize sparsentan in specified major market countries and other countries in which we believe it is commercially reasonable to develop and commercialize such products.

As consideration for the license, we are required to make payments payable upon the achievement of certain milestones totaling up to $105.5 million. Should we commercialize sparsentan or any products containing any of these compounds, we will be obligated to pay to Ligand an escalating annual royalty between 15% and 17% of net sales of all such products. Through December 31, 2014, we made payments to Ligand of $2.5 million under the license agreement.

In the event that we desire to enter into a license arrangement with respect to any licensed compound under the license agreement, Bristol-Myers Squibb will have a right of first negotiation and Ligand will have a right of second negotiation with respect to any such license arrangement for a licensed compound.

The license agreement contains other customary clauses and terms as are common in similar agreements in the industry.

The license agreement will continue until neither party has any further payment obligations under the agreement and is expected to continue for approximately 10 to 20 years. Ligand may also terminate the license agreement due to (i) our insolvency, (ii) our material uncured breach of the agreement, (iii) our failure to use commercially reasonable efforts to develop and commercialize sparsentan as described above or (iv) certain other conditions. We may terminate the license agreement due to a material uncured breach of the agreement by Ligand.

Thiola® License Agreement

Thiola® (Tiopronin)

On May 29, 2014, the Company entered into a license agreement with Mission, pursuant to which Mission agreed to grant the Company an exclusive, royalty-bearing license to market, sell and commercialize Thiola® in the United States and a non-exclusive license to use know-how relating to Thiola® to the extent necessary to market Thiola®. In July 2014, the Company amended the license agreement with Mission to secure the Canadian marketing rights to the product for no additional consideration.

Upon execution of the agreement, the Company paid Mission an up-front license fee of $3 million. In addition, the Company shall pay guaranteed minimum royalties during each calendar year the greater of $2 million or twenty percent (20%) of the Company’s net sales of Thiola® through June 30, 2024. As of December 31, 2014, the present value of guaranteed minimum royalties payable is $11.6 million using a discount rate of approximately 11% based on the Company’s current borrowing rate. As of December 31, 2014, the guaranteed minimum royalties’ current and long term liability is approximately $0.7 million and $10.9 million, respectively, and is recorded as other liability in the consolidated balance sheet. The Company capitalized $15.0 million related to the Thiola® asset which consists of the up-front license fee, professional fees, present value of the guaranteed minimum royalties and any additional payments in 2014 in excess of minimum royalties.

Thiola® is approved by the FDA for the treatment of cystinuria, a rare autosomal recessive disorder of di-basic amino acid transport. Mutations in the genes encoding for transporters found in the proximal tubule prevent necessary reabsorption of the dibasic amino acids, including cystine. This defect causes high cystine levels in the urine which leads to the formation of recurring kidney stones. Cystine stone formers tend to form stones that are larger and more frequent than non-cystine stone formers. As a result, cystinuric patients undergo many invasive procedures for stone removal and are at greater risk for loss of renal function and suffer lower quality of life. The prevalence of cystinuria in the US is estimated to be 1 per 15,000, indicating that there may be as many as 20,000 affected individuals with cystinuria in the US.

Intellectual Property

The proprietary nature of, and protection for, our product candidates and our discovery programs, processes and know-how are important to our business. We have sought patent protection in the United States and certain other jurisdictions for sparsentan, RE-024, and certain other inventions to which we have rights, where available and when appropriate. Our policy is to pursue, maintain and defend patent rights, whether developed internally or licensed from third parties, and to protect the technology, inventions and improvements that are commercially important to the development of our business. We also rely on trade secrets relating to our proprietary technology that may be important to the development of our business.

Our commercial success will depend in part on obtaining and maintaining patent protection and trade secret protection for our current and future product candidates and the methods used to develop and manufacture them, as well as successfully defending these patents against third-party challenges. Our ability to stop third parties from making, using, selling, offering to sell, or importing our products depends on the extent to which we have rights under valid and enforceable patents or trade secrets that cover these activities. We cannot be sure that patents will be granted with respect to any of our pending patent applications or with respect to any patent applications filed by us in the future, nor can we be sure that any of our existing patents or any patents that may be granted to us in the future will be commercially useful in protecting our product candidates, discovery programs and processes.

| 8 |

Sparsentan (RE-021)

Our patent portfolio for sparsentan is comprised of two distinct patent families, both of which are exclusively licensed from Ligand. One of these patent families is owned by Bristol-Myers Squibb Company (“BMS”), which exclusively licensed it to Ligand (the “BMS patent family”), and the other is owned by Ligand (the “Ligand patent family”).

The BMS patent family is directed to sparsentan and structural analogs thereof, and to pharmaceutical compositions containing sparsentan or a structural analog thereof. As of January 31, 2015, this patent family included three U.S. patents (U.S. Patent Nos. 6,638,937, which we refer to herein as the ‘937 patent; 6,835,741; and 6,852,745), of which one (U.S. Patent No. 6,638,937) claims sparsentan and pharmaceutical compositions that contain sparsentan. In addition, as of January 31, 2014, this patent family included a granted European patent and a granted Chinese patent. With the exception of the ‘937 patent, which the USPTO has determined is entitled to 175 days of patent term adjustment, we expect all U.S. and foreign patents in this patent family to expire in July 2019. In view of the USPTO determination that the ‘937 patent is entitled to 175 days of patent term adjustment, we expect the ‘937 patent to expire in December 2019.

The Ligand patent family patent family is directed to methods of using sparsentan in the treatment of endothelin-dependent or angiotensin II-dependent disorders. As of January 31, 2015, this patent family included applications pending in the United States (Application Serial No. 13/720,452, filed December 19, 2012), China, Europe, Hong Kong and Japan. We expect any U.S. and foreign patents granted in this patent family to expire in March 2030.

It is possible, assuming that sparsentan achieves regulatory approval and depending upon the date of any such approval, that the term of the ‘937 patent may be extended up to a maximum of five additional years under the provisions of the Drug Price Competition and Patent Term Restoration Act of 1984, also referred to as the Hatch-Waxman Act. Patent term extension also may be available in certain foreign jurisdictions upon regulatory approval.

PKAN (RE-024)

Our patent portfolio covering compounds for the treatment of PKAN is comprised of two Retrophin-owned patent families. One of these two patent families includes patents and patent applications directed to RE-024 and structural analogs thereof, pharmaceutical compositions containing RE-024 or analogs thereof, and methods of using RE-024 or analogs thereof in the treatment of PKAN. As of January 31, 2015, this patent family included one U.S. patent (U.S. Patent No. 8,673,883, issued March 18, 2014, which we refer to herein as the ‘883 patent), one pending U.S. patent application (Application Serial No. 14/157,173, filed January 16, 2014) and corresponding foreign patent applications pending in Brazil, Canada, China, Europe, India, Japan, Korea, Mexico, and Russia. We expect all U.S. and foreign patents in this patent family to expire in April 2033.

Our other PKAN patent family is directed to a chemical genus that encompasses structural analogs of RE-024, but not RE-024 itself. As of January 31, 2015, this patent family was comprised of International Patent Application PCT/US2014/062451, filed October 27, 2014. We expect any U.S. or foreign patent family granted in this patent family to expire in October 2034.

It is possible, assuming that RE-024 achieves regulatory approval and depending upon the date of any such approval, that the term of the ‘883’ patent may be extended up to a maximum of five additional years under the provisions of the Hatch-Waxman Act. Patent term extension also may be available in certain foreign jurisdictions upon regulatory approval. Should we commercialize RE-024, we may be obligated to pay royalties of up to 5% of net sales of all such products.

Carbetocin

Our patent portfolio for Carbetocin is comprised of three distinct patent families, two of which we acquired upon our acquisition Kyalin Biosciences, Inc. (“Kyalin”) and the third to which we have an option for an exclusive license under an agreement with Neuropharmacology Services, Inc. (“Neuropharmacology”).

One of the two patent families we acquired from our acquisition of Kyalin is directed to intranasal Carbetocin formulations and treatment of methods for the treatment of autism therewith. As of January 31, 2015, this patent family included an allowed U.S. application (U.S. Application Serial No. 13/204,485) and nine corresponding foreign patents and patent applications. As of January 31, 2015, we had corresponding patents granted in Australia, Canada, and New Zealand. In addition, as of January 31, 2015, we had corresponding patent applications pending in Australia, China (2), Europe, Hong Kong, and India.

The other patent family we acquired from our acquisition of Kyalin is directed to long-acting oxytocin analogs, including Carbetocin, for the treatment and prevention of breast cancer and psychiatric disorders. As of January 31, 2015, this patent family included a pending U.S. patent application (U.S. Application Serial No. 11/537,468.

Finally, under an agreement with Neuropharmacology, we have an option to an exclusive license to pending U.S. Application Serial No.

| 9 |

10/530,246 (“the ‘246 application”). The ‘246 application is directed to the use of oxytocin and analogs thereof, including Carbetocin, for the treatment of autism.

Regulatory Exclusivity

If we obtain marketing approval for RE-024, sparsentan or other drug candidates in the United States or in certain jurisdictions outside of the United States, we may be eligible for regulatory protection. For example, in the U.S. an FDA approved product may be eligible to receive five years of new chemical entity exclusivity or, for drugs granted an orphan designation by the FDA, seven years of orphan drug exclusivity. In Europe a new drug product approved by the European Medicines Agency (EMA) may receive eight years of data exclusivity and up to 11 years of marketing exclusivity or, in the case of orphan drugs, ten years of data exclusivity. There can be no assurance that we will qualify for any such regulatory exclusivity, or that any such exclusivity will prevent competitors from seeking approval solely on the basis of their own studies. See “Government Regulation” below.

Trademarks

Our trademark portfolio is comprised of two U.S. trademark applications for the mark “RETROPHIN”, one U.S. trademark application directed to the Retrophin logo, one registered U.S. trademark and one registered Canadian trademark for the mark “CHENODAL®”, one registered U.S. trademark directed to the Chenodal® logo, one registered U.S. trademark for the mark “MANCHESTER PHARMACEUTICALS”, and one U.S. trademark application for the mark “KEEP IT BELOW THE LINE”. In addition, under our license agreement with Mission Pharmacal we have an exclusive license to use Mission Pharmacal’s three registered U.S. trademarks and one registered Canadian trademark for the mark “THIOLA®”.

Trade Secrets

In addition to patents, we rely on trade secrets and know-how to develop and maintain our competitive position. We seek to protect our proprietary data and processes, in part, by confidentiality agreements and invention assignment agreements with our employees, consultants, scientific advisors, contractors, and partners. These agreements are designed to protect our proprietary information. We also seek to preserve the integrity and confidentiality of our data, trade secrets and know-how by maintaining physical security of our premises and physical and electronic security of our information technology systems. Trade secrets and know-how can be difficult to protect. Consequently, we anticipate that trade secrets and know-how will, over time, be disseminated within the industry through independent development, the publication of journal articles, and the movement of personnel skilled in the art from academic to industry scientific positions.

Manufacturing and Distribution

Nexgen Pharma manufactures Chenodal® and Mission manufactures Thiola®. Dohmen Life Sciences Services (“Dohmen”) is our distributor.

We intend to continue to use our financial resources to accelerate development of our drug candidates rather than diverting resources to establish our own manufacturing facilities. We intend to meet our pre-clinical and clinical trial manufacturing requirements by establishing relationships with third-party manufacturers and other service providers to perform these services for us.

Should any of our drug candidates obtain marketing approval, we anticipate establishing relationships with third-party manufacturers and other service providers in connection with the commercial production of our products. We have some flexibility in securing other manufacturers to produce our drug candidates; however, our alternatives may be limited due to proprietary technologies or methods used in the manufacture of some of our drug candidates.

Sales and Marketing

During fiscal 2014, we built a specialty sales force to market our products. In order to commercialize our clinical drug candidates if and when they are approved for sale in the United States or elsewhere, we will need to build marketing, sales and distribution capabilities.

Pricing and Reimbursement

A portion of our end-user demand for our drugs comes from patients covered under Medicaid, Medicare and other government-related programs such as TRICARE and the Department of Veterans Affairs, or the VA. As required by Federal regulations, we will provide rebates and discounts in connection with these programs. As a result of Medicaid rebates, we may not generate any net revenues with respect to Medicaid sales, but we may generate net revenues with respect to Medicare sales, TRICARE sales and sales made to the VA.

Our commercial success depends in significant part on the extent to which coverage and adequate reimbursement for these products will be available from third-party payers, including government health administration authorities, private health insurers and other organizations. Third-party payers determine which medications they will cover and establish reimbursement levels. Even if a third-party

| 10 |

payer covers a particular product, the resulting reimbursement payment rates may not be adequate or may require co-payments that patients find unacceptably high. Patients who are prescribed medications for the treatment of their conditions, and their prescribing physicians, generally rely on third-party payers to reimburse all or part of the costs associated with their prescription drugs. Patients are unlikely to use our products unless coverage is provided and reimbursement is adequate to cover all or a significant portion of the cost of our products. Therefore, coverage and adequate reimbursement is critical to product acceptance.

Government authorities and other third-party payers are developing increasingly sophisticated methods of controlling healthcare costs, such as by limiting coverage and the amount of reimbursement for particular medications. Increasingly, third-party payers are requiring that drug companies provide them with predetermined discounts from list prices as a condition of coverage, are using restrictive formularies and preferred drug lists to leverage greater discounts in competitive classes, and are challenging the prices charged for medical products. Further, no uniform policy requirement for coverage and reimbursement for drug products exists among third-party payers in the United States. Therefore, coverage and reimbursement for drug products can differ significantly from payer to payer. As a result, the coverage determination process is often a time-consuming and costly process that will require us to provide scientific and clinical support for the use of our products to each payer separately, with no assurance that coverage and adequate reimbursement will be applied consistently or obtained in the first instance.

In addition, it is possible that future legislation in the United States and other jurisdictions could be enacted which could potentially impact the coverage and reimbursement rates for our products and also could further impact the levels of discounts and rebates paid to federal and state government entities. Any legislation that impacts these areas could impact, in a significant way, our ability to generate revenues from sales of products that, if successfully developed, we bring to market.

There have been a number of enacted or proposed legislative and regulatory changes affecting the healthcare system and pharmaceutical industry that could affect our commercial success. For example, in March 2010, President Obama signed into law the Patient Protection and Affordable Care Act, as amended by the Health Care and Education Reconciliation Act of 2010, (collectively, the “Health Care Reform Law”) a law intended to, among other things, broaden access to health insurance, reduce or constrain the growth of healthcare spending, enhance remedies against healthcare fraud and abuse, add new transparency requirements for healthcare and health insurance industries, impose new taxes and fees on pharmaceutical and medical device manufacturers and impose additional health policy reforms. Among other things, the Health Care Reform Law expanded manufacturers’ rebate liability under the Medicaid Drug Rebate Program, which could increase the amount of Medicaid drug rebates manufacturers are required to pay to states. The Health Care Reform Law also expanded the types of entities eligible to receive discounted 340B pricing, although, with the exception of children’s hospitals, these newly eligible entities will not be eligible to receive discounted 340B pricing on orphan drugs used in orphan indications. The Health Care Reform Law also imposed a significant annual fee on companies that manufacture or import certain branded prescription drug products. Furthermore, the Health Care Reform Law changed the Medicare Part D coverage gap discount program by requiring manufacturers to provide a 50% point-of-sale-discount off the negotiated price of applicable brand drugs to certain eligible beneficiaries during their coverage gap period as a condition for the manufacturers’ outpatient drugs to be covered under Medicare Part D.

In addition, other legislative changes have been proposed and adopted since the Health Care Reform Law was enacted. For example, in August 2011, the President signed into law the Budget Control Act of 2011, which, among other things, created the Joint Select Committee on Deficit Reduction to recommend to Congress proposals in spending reductions. The Joint Select Committee on Deficit Reduction did not achieve a targeted deficit reduction of at least $1.2 trillion for fiscal years 2012 through 2021, triggering the legislation’s automatic reduction to several government programs. This includes aggregate reductions to Medicare payments to providers of up to 2% per fiscal year, which went into effect beginning on April 1, 2013 and will stay in effect through 2024 unless additional Congressional action is taken. Additionally, in January 2013, the American Taxpayer Relief Act of 2012 was signed into law, which, among other things, reduced Medicare payments to several providers, including hospitals and imaging centers.

Moreover, the Drug Supply Chain Security Act imposes new obligations on manufacturers of pharmaceutical products related to product tracking and tracing. Legislative and regulatory proposals have been made to expand post-approval requirements and restrict sales and promotional activities for pharmaceutical products. We are not sure whether additional legislative changes will be enacted, or whether the current regulations, guidance or interpretations will be changed, or what the impact of such changes on our business, if any, may be.

We expect that the Health Care Reform Law, as well as other federal and state healthcare reform measures that have been and may be adopted in the future, may result in more rigorous coverage criteria and in additional downward pressure on the price that we receive for any of our products, and could seriously harm our future revenues.

In addition, it is possible that future legislation in the United States and other jurisdictions could be enacted which could potentially impact the reimbursement rates for the products we are developing and may develop in the future and also could further impact the levels of discounts and rebates paid to federal and state government entities. Any legislation that impacts these areas could impact, in a significant way, our ability to generate revenues from sales of products that, if successfully developed, we bring to market.

| 11 |

Chenodal® (chenodiol tablets)

Chenodal® is a synthetic oral form of chenodeoxycholic acid, a naturally occurring primary bile acid synthesized from cholesterol in the liver, indicated for the treatment of radiolucent stones in well-opacifying gallbladders in whom selective surgery would be undertaken except for the presence of increased surgical risk due to systemic disease or age.

Chenodiol administration is known to reduce biliary cholesterol and the dissolution of radiolucent gallstones through suppression of hepatic synthesis of cholesterol, cholic acid and deoxycholic acid in the bile pool. Chenodiol was approved in 1983 for the management of gallstones and discontinued due to lack of commercial success. In 2009 Manchester Pharmaceuticals was granted approval of Chenodal® for the treatment of gallstones and subsequently obtained Orphan Drug Designation for the treatment of cerebrotendinous xanthomatosis (CTX) in 2010.

On March 26, 2014, we completed the acquisition of Manchester Pharmaceuticals including the U.S. rights for Chenodal® and the intellectual property to develop, manufacture, and sell the product in the United States. We will continue to supply Chenodal® to the U.S. market.

There are currently no FDA approved products for Cerebrotendinous Xanthomatosis (“CTX”). Cholic Acid is approved in Europe for CTX and is currently under FDA review in the US for Inborn Errors of Bile Acid Synthesis including CTX.

Statins lower cholesterol and have been studied as a treatment for CTX. However, statins deplete CoQ10 and thereby alter mitochondrial function, which is a theoretical concern because abnormal mitochondrial metabolism has been reported in CTX. Although data are sparse, statin monotherapy appears to have little or no benefit for CTX. However, statins may be useful for lowering cholestanol levels when combined with CDCA, and there is limited evidence that they provide additional clinical benefit over CDCA treatment alone.

Thiola® (Tiopronin)

Thiola® is approved by the FDA for the treatment of cystinuria, a rare genetic cystine transport disorder that causes high cystine levels in the urine and the formation of recurring kidney stones. The resulting long-term damage can cause loss of kidney function in addition to substantial pain and loss of productivity associated with renal colic and stone passage. The worldwide prevalence of the disease is believed to be one in 7,000. We have begun to build a salesforce to promote Thiola® to targeted physicians.

On May 29, 2014, the Company entered into a license agreement with Mission, pursuant to which Mission agreed to grant the Company an exclusive, royalty-bearing license to market, sell and commercialize Thiola® in the United States and a non-exclusive license to use know-how relating to Thiola® to the extent necessary to market Thiola®. In July 2014, the Company amended the license agreement with Mission to secure the Canadian marketing rights to the product for no additional consideration.

Upon execution of the agreement, the Company paid Mission an up-front license fee of $3 million. In addition, the Company shall pay guaranteed minimum royalties during each calendar year the greater of $2 million or twenty percent (20%) of the Company’s net sales of Thiola® through June 30, 2024. As of December 31, 2014, the present value of guaranteed minimum royalties payable is $11.6 million using a discount rate of approximately 11% based on the Company’s current borrowing rate. As of December 31, 2014, the guaranteed minimum royalties’ current and long term liability is approximately $0.7 million and $10.9 million, respectively, and is recorded as other liability in the consolidated balance sheet. The Company capitalized $15.0 million related to the Thiola® asset which consists of the up-front license fee, professional fees, present value of the guaranteed minimum royalties and any additional payments in 2014 in excess of minimum royalties.

D-penicillamine is the only other prescription medication FDA approved for the treatment of cystinuria. D-penicillamine forms a penicillamine-cysteine disulfide that is 50 times more soluble than cystine. In uncontrolled trials and observational studies, penicillamine decreases stone size or dissolves stones in up to 75 percent of patients.

The use of D-penicillamine is often limited by a relatively high incidence of side effects, such as fever, rash, abnormal taste, arthritis, leukopenia, aplastic anemia, hepatotoxicity, and pyridoxine (vitamin B6) deficiency. In addition, patients treated with penicillamine may develop proteinuria (usually due to membranous nephropathy), typically within the first 6 to 12 months of therapy, or, less commonly, crescentic glomerulonephritis.

Given the high incidence of side effects, drug therapy may be discontinued once preexisting stones have dissolved. Additional courses can be given if stones recur. If penicillamine is to be used long term, pyridoxine supplementation (50 mg/day) is required.

Captopril is not FDA approved for the treatment of cystinuria but has been prescribed for patients with cystinuria. The proportion of orally administered captopril that appears in the urine is low. Thus, the doses of captopril required to reduce cystine excretion (more than 150 mg/day) may not be tolerated because of hypotension. In addition, the efficacy of captopril as a treatment for cystinuria remains unproven. Thus, its use is typically limited to patients who cannot tolerate other cystine-binding agents.

RE-034 (Tetracosactide Zinc)

RE-034 is a synthetic hormone analog of the first 24 amino acids of the 39 amino acids contained in ACTH formulated using a novel process by

| 12 |

Retrophin. RE-034 exhibits the same physiological actions as endogenous ACTH by binding to all five melanocortin receptors (pan-MCR), resulting in its anti-inflammatory and immunomodulatory effects. Retrophin has successfully formulated and manufactured RE-034 at proof-of-concept scale using a novel formulation process that allows modulation of the release of the active ingredient from the site of administration. Retrophin continues preclinical development of RE-034 to enable multiple strategic options, which may include the initiation of IND-enabling studies in 2015.

RE-034 in Infantile Spasms

IS, also known as West syndrome, is a form of epileptic encephalopathy that begins in infancy. Infantile Spasms is considered a catastrophic form of epilepsy due to the difficulty in controlling seizures and normalization of electroencephalography in addition to strong association with sequelae of developmental delay and mental retardation. Commercially available ACTH formulations that are substantially similar to RE-034 have been shown to be an effective treatment of IS. We are currently evaluating development options for RE-024 in several indications.

RE-034 in Nephrotic Syndrome

We intend to initiate studies of RE-034 for the treatment of NS. NS is a kidney disorder that leads to proteinuria, a condition in which an excess of proteins are contained in a patient’s urine. Long-term conventional immunosuppression therapies have been used effectively to induce remission of proteinuria; however, many patients with NS will relapse after remission or are resistant to primary and secondary treatments. Commercially available ACTH formulations that are substantially similar to RE-034 have been shown to successfully induce remission of proteinuria in patients with NS. We are currently exploring strategic options for development of RE-034 which could be enabled for U.S. IND in 2015.

Questcor’s H.P. Acthar Gel (repository corticotropin injection) is a highly purified sterile preparation of the adrenocorticotropic hormone in 16% gelatin. Acthar is the only approved long-lasting ACTH medication in the US.

H.P. Acthar Gel is indicated for the following diseases:

| · | Collagen diseases: Treatment of exacerbations or as maintenance therapy of systemic lupus erythematosus, or systemic dermatomyositis (polymyositis). |

| · | Dermatologic diseases: Treatment of severe erythema multiforme or Stevens-Johnson syndrome. |

| · | Diuresis in nephrotic syndrome: To induce a diuresis or remission of proteinuria in patients with nephrotic syndrome without idiopathic uremia or due to lupus erythematosus. |

| · | Infantile spasms: Treatment of infantile spasms in infants and children younger than 2 years. |

| · | Multiple sclerosis: Treatment of acute exacerbations of multiple sclerosis in adults. |

| · | Ophthalmic diseases: Treatment of severe acute and chronic allergic and inflammatory processes involving the eye and its adnexa (eg, keratitis, iritis, iridocyclitis, diffuse posterior uveitis, choroiditis, optic neuritis, chorioretinitis, anterior segment inflammation). |

| · | Rheumatic disorders: As adjunctive therapy for acute episodes/exacerbations of psoriatic arthritis, rheumatoid arthritis, including juvenile rheumatoid arthritis (select cases may require low-dose maintenance therapy) and/or ankylosing spondylitis. |

| · | Serum sickness: Treatment of serum sickness. |

| · | Symptomatic sarcoidosis: Treatment of symptomatic sarcoidosis. |

Amphastar’s Cortrosyn® (cosyntropin) for injection use is a sterile Iyophilized powder in vials containing 0.25 mg of Cortrosyn® and 10 mg of mannitol. Cortrosyn® is indicated for the ACTH Stimulation Test which measures the ability of the adrenal cortex to respond to ACTH by producing cortisol appropriately. Administration is by intravenous or intramuscular injection. Currently, Cortrosyn is only approved as a diagnostic, not as a drug. Further, Cortrosyn is a short acting formulation of ACTH in contrast to Synacthen Depot and Acthar.

Sparsentan

We are developing sparsentan as a treatment for focal segmental glomerulosclerosis (“FSGS”) and other nephropathies. Sparsentan is an investigational therapeutic agent which acts as both a potent angiotensin receptor blocker (“ARB”), which is a type of drug that modulates the renin-angiotensin-aldosterone system and is typically used to treat hypertension, diabetic nephropathy and congestive heart failure, as well as a selective endothelin receptor antagonist (ERA), which is a type of drug that blocks endothelin receptors, preferential for endothelin receptor type A.

Sparsentan in FSGS

We intend to develop sparsentan as a treatment for FSGS. FSGS is a leading cause of end-stage renal disease (“ESRD”) and NS. There are no FDA- approved treatments for FSGS and the off-label armamentarium is limited to ARBs, steroids, and immunosuppressant agents, which we believe are only effective for some patients. We estimate that there are at least 40,000 FSGS patients in the United States.

We believe that FSGS as an indication would be eligible to receive orphan drug status from both the FDA and the EMA. FSGS is

| 13 |

similar to over a dozen other rare, but severe, nephropathies and glomerulopathies for which sparsentan could serve a critical role. Retrophin believes that a drop in proteinuria could serve as a primary endpoint in a pivotal clinical study and that FDA approval could be received on the basis of a single, small pivotal trial. On January 9, 2015, the Company announced the Office of Orphan Products Development of the U.S. Food and Drug Administration (“FDA”) has granted orphan drug designation for sparsentan (RE-021) for the treatment of Focal Segmental Glomerulosclerosis.

There are currently no products approved for FSGS in Europe or the United States. Generally, patients with primary FSGS are treated using glucorticoids such as predinisone as initial therapy when proteinuria is >3.5 g/day and accompanied by hypoalbuminemia <3.5 g/dL (<35 g/L). Depending upon the response to and the toxicity from this therapy, the duration of prednisone therapy can vary from as short as 8 to 12 weeks to as long as one year. Some patients treated with glucocorticoids have only a transient remission or no remission whatsoever.

Calcineurin inhibitors as alternative initial therapy — in patients at increased risk for glucocorticoid-associated toxicity (eg, obese patients, diabetic patients, patients with severe osteoporosis, patients >70 years of age), we use cyclosporine or tacrolimus with or without low-dose prednisone as initial therapy, although data evaluating this strategy are limited.

Treatment of steroid-dependent or steroid-resistant FSGS can consist of use a calcineurin inhibitor with or without low-dose glucocorticoids in patients with steroid-dependent or steroid-resistant FSGS. Most existing data support the use of cyclosporine; however, many authorities believe that cyclosporine and tacrolimus are interchangeable, and preferably use tacrolimus in women because this drug is associated with fewer cosmetic side effects.

Mycophenolate mofetil (“MMF”) is an alternative for steroid-dependent or steroid-resistant FSGS. Observational studies and one randomized trial suggest that MMF given with or without glucocorticoids may be beneficial in patients with FSGS. Based upon these limited data, some physicians use MMF (750 to 1000 mg twice daily for six months) in combination with low-dose glucocorticoids be used in patients with steroid-dependent or steroid-resistant primary FSGS who have either not responded to or should not be exposed to calcineurin inhibitors, or who have had a partial response to prednisone and/or calcineurin inhibitors but developed signs of toxicity to these drugs.

ACE inhibitor or an ARB is often used to treat patients with primary FSGS, even as specific immunosuppressive treatment is undertaken, or as primary therapy for patients with non-nephrotic proteinuria and patients who have other reasons for not receiving immunosuppression.

Other therapies — Data are relatively poor for other disease-modifying therapies in patients with primary FSGS. These products include cytotoxic drugs such as chlorampucil and cyclosporine, rituximab, adrenocorticotropic hormone (ACTH), plasmapheresis and related modalities, LDL apheresis, abatacept.

Revive Therapeutics is developing Bucillamine for cystinuria. Bucillamine has shown the potential to be an effective agent in both non-clinical and clinical studies in the treatment of cystinuria and may be a new therapeutic agent for cystinuria in place of monothiol compounds such as tiopronin (Thiola®) and D-penicillamine which currently treat cystinuria.

Clinical Testing of Our Products in Development

Each of our products in development, and likely all future drug candidates we develop, will require extensive pre-clinical and clinical testing to determine the safety and efficacy of the product applications prior to seeking and obtaining regulatory approval. This process is expensive and time consuming. In completing these trials, we are dependent upon third-party consultants, consisting mainly of investigators and collaborators, who will conduct such trials.

We and our third-party consultants conduct pre-clinical testing in accordance with Good-Laboratory Practices (“GLP”), and clinical testing in accordance with Good Clinical Practice standards (“GCP”), which are international ethical and scientific quality standards utilized for pre- clinical and clinical testing, respectively. GCP is the standard for the design, conduct, performance, monitoring, auditing, recording, analysis and reporting of clinical trials, and is required by the FDA to be followed in conducting clinical trials.

Government Regulation

Regulation by government authorities in the United States and foreign countries is a significant factor in the development, manufacture and marketing of our proposed products and in our ongoing research and product development activities. All of our products will require regulatory approval by government agencies prior to commercialization. In particular, human therapeutic products are subject to rigorous preclinical studies and clinical trials and other approval procedures of the FDA and similar regulatory authorities in foreign countries. Various federal and state statutes and regulations also govern or influence testing, manufacturing, safety, labeling, storage and record-keeping related to such products and their marketing. The process of obtaining these approvals and the subsequent compliance with appropriate federal and state statutes and regulations require the expenditure of substantial time and financial resources.

The Hatch-Waxman Amendments

Orange Book Listing

| 14 |

In seeking approval for a drug through an NDA, applicants are required to list with the FDA each patent whose claims cover the applicant’s product. Upon approval of a drug, each of the patents listed in the application for the drug is then published in the FDA’s Approved Drug Products with Therapeutic Equivalence Evaluations, commonly known as the Orange Book. Drugs listed in the Orange Book can, in turn, be cited by potential generic competitors in support of approval of an abbreviated new drug application, or ANDA. An ANDA provides for marketing of a drug product that has the same active ingredients in the same strengths and dosage form as the listed drug and has been shown through bioequivalence testing to be therapeutically equivalent to the listed drug. Other than the requirement for bioequivalence testing, ANDA applicants are not required to conduct, or submit results of, pre-clinical or clinical tests to prove the safety or effectiveness of their drug product. Drugs approved in this way are commonly referred to as “generic equivalents” to the listed drug, and can often be substituted by pharmacists under prescriptions written for the original listed drug.

The ANDA applicant is required to certify to the FDA concerning any patents listed for the approved product in the FDA’s Orange Book. Specifically, the applicant must certify that: (i) the required patent information has not been filed; (ii) the listed patent has expired; (iii) the listed patent has not expired, but will expire on a particular date and approval is sought after patent expiration; or (iv) the listed patent is invalid or will not be infringed by the new product. The ANDA applicant may also elect to submit a section viii statement certifying that its proposed ANDA label does not contain (or carves out) any language regarding the patented method-of-use rather than certify to a listed method-of-use patent. If the applicant does not challenge the listed patents, the ANDA application will not be approved until all the listed patents claiming the referenced product have expired.

A certification that the new product will not infringe the already approved product’s listed patents, or that such patents are invalid, is called a Paragraph IV certification. If the ANDA applicant has provided a Paragraph IV certification to the FDA, the applicant must also send notice of the Paragraph IV certification to the NDA and patent holders once the ANDA has been accepted for filing by the FDA. The NDA and patent holders may then initiate a patent infringement lawsuit in response to the notice of the Paragraph IV certification. The filing of a patent infringement lawsuit within 45 days of the receipt of a Paragraph IV certification automatically prevents the FDA from approving the ANDA until the earlier of 30 months, expiration of the patent, settlement of the lawsuit, or a decision in the infringement case that is favorable to the ANDA applicant.

The ANDA application also will not be approved until any applicable non-patent exclusivity listed in the Orange Book for the referenced product has expired.

FDA Drug Approval Process

In the United States, pharmaceutical products are subject to extensive regulation by the FDA. The Federal Food, Drug, and Cosmetic Act, and other federal and state statutes and regulations, govern, among other things, the research, development, testing, manufacture, storage, recordkeeping, approval, labeling, promotion and marketing, distribution, post-approval monitoring and reporting, sampling and import and export of pharmaceutical products. Failure to comply with applicable U.S. requirements may subject a company to a variety of administrative or judicial sanctions, such as FDA refusal to approve pending new drug applications, or NDAs, warning or untitled letters, product recalls, product seizures, total or partial suspension of production or distribution, injunctions, fines, civil penalties and criminal prosecution.

We cannot market a drug product candidate in the United States until the drug has received FDA approval. The steps required before a drug may be marketed in the United States generally include the following:

| · | completion of extensive pre-clinical laboratory tests, animal studies, and formulation studies in accordance with the FDA’s GLP regulations; |

| · | submission to the FDA of an IND for human clinical testing, which must become effective before human clinical trials may begin; |

| · | performance of adequate and well-controlled human clinical trials in accordance with GCP requirements to establish the safety and efficacy of the drug for each proposed indication; |

| · | submission to the FDA of an NDA after completion of all pivotal clinical trials; |

| · | satisfactory completion of an FDA pre-approval inspection of the manufacturing facility or facilities at which the active pharmaceutical ingredient, or API, and finished drug product are produced and tested to assess compliance with cGMPs; and |

| · | FDA review and approval of the NDA prior to any commercial marketing or sale of the drug in the United States. |

Satisfaction of FDA pre-market approval requirements typically takes many years and the actual time required may vary substantially based upon the type, complexity and novelty of the product or disease.

| 15 |

Preclinical tests include laboratory evaluation of product chemistry, formulation and toxicity, as well as animal trials to assess the characteristics and potential safety and efficacy of the product. The conduct of the preclinical tests must comply with federal regulations and requirements, including good laboratory practices. The results of preclinical testing are submitted to the FDA as part of an IND along with other information, including information about product chemistry, manufacturing and controls and a proposed clinical trial protocol. Long term preclinical tests, such as animal tests of reproductive toxicity and carcinogenicity, may continue after the IND is submitted.

A 30-day waiting period after the submission of each IND is required prior to the commencement of clinical testing in humans. If the FDA has neither commented on nor questioned the IND within this 30-day period, the clinical trial proposed in the IND may begin. If the FDA raises concerns or questions about the conduct of the trial, such as whether human research subjects will be exposed to an unreasonable health risk, the IND sponsor and the FDA must resolve any outstanding FDA concerns or questions before clinical trials can proceed.

Clinical trials involve the administration of the investigational new drug to healthy volunteers or patients under the supervision of a qualified investigator. Clinical trials must be conducted in compliance with federal regulations, including GCP requirements, as well as under protocols detailing the objectives of the trial, the parameters to be used in monitoring safety and the effectiveness criteria to be evaluated. Each protocol and subsequent protocol amendments must be submitted to the FDA as part of the IND.

The FDA may order the temporary, or permanent, discontinuation of a clinical trial at any time, or impose other sanctions, if it believes that the clinical trial either is not being conducted in accordance with FDA requirements or presents an unacceptable risk to the clinical trial patients. The study protocol and informed consent information for patients in clinical trials must also be submitted to an institutional review board, or IRB, for approval at each site at which the clinical trial will be conducted. An IRB may also require the clinical trial at the site to be halted, either temporarily or permanently, for failure to comply with the IRB’s requirements, or may impose other conditions.

Clinical trials to support NDAs for marketing approval are typically conducted in three sequential phases, but the phases may overlap. In Phase 1, the initial introduction of the drug into healthy human subjects or patients, the drug is tested to assess pharmacological actions, side effects associated with increasing doses and, if possible, early evidence on effectiveness. Phase 2 usually involves trials in a limited patient population to determine metabolism, pharmacokinetics, the effectiveness of the drug for a particular indication, dosage tolerance and optimum dosage, and to identify common adverse effects and safety risks. If a compound demonstrates evidence of effectiveness and an acceptable safety profile in Phase 2 evaluations, Phase 3 clinical trials, also called pivotal trials, are undertaken to obtain the additional information about clinical efficacy and safety in a larger number of patients, typically at geographically dispersed clinical trial sites, to permit the FDA to evaluate the overall benefit-risk relationship of the drug and to provide adequate information for the labeling of the drug. In most cases the FDA requires two adequate and well controlled Phase 3 clinical trials to demonstrate the efficacy of the drug. A single Phase 3 clinical trial with other confirmatory evidence may be sufficient in rare instances where the study is a large multicenter trial demonstrating internal consistency and a statistically very persuasive finding of a clinically meaningful effect on mortality, irreversible morbidity or prevention of a disease with a potentially serious outcome and confirmation of the result in a second trial would be practically or ethically impossible.

After completion of the required clinical testing, an NDA is prepared and submitted to the FDA. FDA approval of the NDA is required before marketing of the product may begin in the United States. The NDA must include the results of all preclinical, clinical and other testing and a compilation of data relating to the product’s pharmacology, chemistry, manufacture and controls. The cost of preparing and submitting an NDA is substantial. The submission of most NDAs is additionally subject to a substantial application user fee, and the manufacturer and/or sponsor under an approved NDA are also subject to annual product and establishment user fees. These fees are typically increased annually.

The FDA has 60 days from its receipt of an NDA to determine whether the application will be accepted for filing based on the agency’s threshold determination that it is sufficiently complete to permit substantive review. Once the submission is accepted for filing, the FDA begins an in-depth review. The FDA has agreed to certain performance goals in the review of NDAs. Most such applications for standard review drug products are reviewed within 10 to 12 months; most applications for priority review drugs are reviewed in six to eight months. Priority review can be applied to drugs to treat serious conditions that the FDA determines offer significant improvement in safety or effectiveness. The review process for both standard and priority review may be extended by the FDA for three additional months to consider certain late-submitted information, or information intended to clarify information already provided in the submission.