RETROPHIN, INC. AND SUBSIDIARIES

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

Organization and Description of Business

Retrophin, Inc. and its subsidiaries (the “Company”) is a fully integrated biopharmaceutical company focused on the development, acquisition and commercialization of therapies for the treatment of serious, catastrophic or rare diseases.

Acquisition of Manchester Pharmaceuticals LLC

On March 26, 2014, the Company completed its acquisition of all of the membership interests of Manchester Pharmaceuticals LLC, a privately-held specialty pharmaceutical company that focuses on treatments for rare diseases. The acquisition expands the Company’s ability to address the special needs of patients with rare diseases.

Thiola® License

On May 29, 2014, the Company entered into a license agreement with Mission Pharmacal Company (“Mission”), a privately-held healthcare medications and treatments provider, for the U.S. marketing rights to Thiola. The license adds Thiola to the Company’s product line. In July 2014, the Company amended the license agreement with Mission to secure the Canadian marketing rights to the product.

The Company currently sells the three following products:

|

·

|

Chenodal®, which is available in the United States for the treatment of patients suffering from gallstones in whom surgery poses an unacceptable health risk due to disease or advanced age.

|

|

·

|

Vecamyl®, which is available in the United States for the treatment of moderately severe to severe essential hypertension and uncomplicated cases of malignant hypertension.

|

|

·

|

Thiola, which is available in the United States for the prevention of cysteine (kidney) stone formation in patients with severe homozygous cystinuria.

|

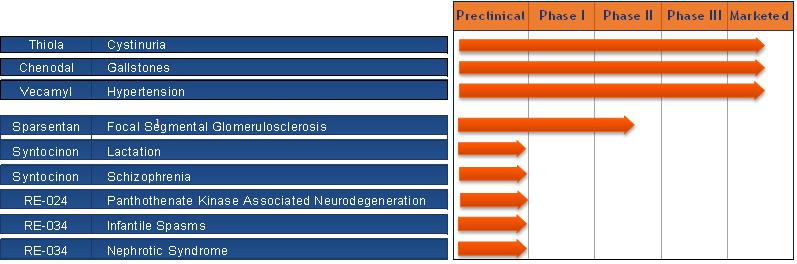

The Company is developing RE-024, a novel small molecule, as a potential treatment for pantothenate kinase-associated neurodegeneration, or PKAN. Also, the Company is developing sparsentan, formerly known as RE-021, a dual acting receptor antagonist of angiotensin and endothelin receptors, for the treatment of focal segmental glomerulosclerosis, or FSGS. The Company is developing SyntocinonTM Nasal Spray in the United States to assist initial postpartum milk ejection, and for the treatment of Schizophrenia. Syntocinon Nasal Spray is currently marketed by Novartis and Sigma-Tau in Europe and other countries for aiding milk let-down. In addition, the Company is developing RE-034, a synthetic hormone analogue that is composed of the first 24 amino acids of the 39 amino acids contained in ACTH for the treatment of Infantile Spasms, or IS, and Nephrotic Syndrome, or NS. The Company also has several additional programs in preclinical development, including RE-001, a therapy for the treatment of Duchenne muscular dystrophy, or DMD.

NOTE 2. BASIS OF PRESENTATION

The accompanying unaudited condensed consolidated financial statements of the Company should be read in conjunction with the audited consolidated financial statements and notes thereto included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2013 (the “2013 10-K”) filed with the Securities and Exchange Commission (the “SEC”) on March 28, 2014. The accompanying condensed consolidated financial statements have been prepared in accordance with accounting principles generally accepted in the United States (“GAAP”) for interim financial information, the instructions to Form 10-Q and the rules and regulations of the SEC. Accordingly, since they are interim statements, the accompanying condensed consolidated financial statements do not include all of the information and notes required by GAAP for annual financial statements, but reflect all adjustments consisting of normal, recurring adjustments, that are necessary for a fair presentation of the financial position, results of operations and cash flows for the interim periods presented. Interim results are not necessarily indicative of results for a full year. The December 31, 2013 balance sheet information was derived from the audited financial statements as of that date.

NOTE 3. LIQUIDITY AND FINANCIAL CONDITION AND MANAGEMENT’S PLANS

The Company incurred a net loss of approximately $62.1 million, which includes a charge for the change in fair value of derivative instruments in the amount of $20.6 million, for the six months ended June 30, 2014. At June 30, 2014, the Company had a cash balance of approximately $39.9 million and working capital of approximately $5.4 million. The Company’s accumulated deficit amounted to approximately $129.6 million as of June 30, 2014.

The Company has principally financed its operations from inception using proceeds from sales of its equity securities in a series of private placement transactions and the issuance of debt. On January 9, 2014, the Company completed a public offering of 4,705,882 shares of common stock at a price of $8.50 per share. The Company received net proceeds from the offering of approximately $36.8 million, after deducting the underwriting fees and other offering costs.

On May 29, 2014, the Company entered into a Note Purchase Agreement (the “Note Purchase Agreement”) relating to the private placement of $46 million aggregate principal senior convertible notes with an interest rate of 4.50% due 2019 (the “Notes”). The Company received net funds from the Note Purchase Agreement of approximately $41.9 million. As of June 30, 2014, the Company has recorded $1 million as other receivable related to the Note Purchase Agreement due to a principal amount an investor agreed to purchase. As of the date of this filing, the $1 million has not been received, but the Company expects to receive such payment in the third quarter.

On June 30, 2014, the Company entered into a $45 million Credit Agreement (the “Credit Agreement”) which matures on June 30, 2018 and bears interest at an annual rate of (i) the Adjusted LIBOR Rate plus 10% or (ii) in certain circumstances, the Base Rate (as such term defined in the Credit Agreement) plus 9.00%. The Company received net funds from the Credit Agreement of approximately $38.8 million. As of June 30, 2014, the Company recorded approximately $5 million as other receivable related to the Credit Agreement due to funding received in July 2014.

On June 30, 2014, the Company made the final payment of $33 million to the sellers of Manchester Pharmaceuticals LLC (“Manchester”) in full satisfaction of the outstanding amount owed (see Note 5).

Management believes the Company’s ability to continue its operations depends on its ability to raise capital. The Company’s future depends on the costs, timing, and outcome of regulatory reviews of its product candidates, ongoing research and development, the funding of planned or potential acquisitions, other planned operating activities, and the costs of commercialization activities, including ongoing, product marketing, sales and distribution. The Company expects to continue to finance its cash needs through additional private and public equity offerings and debt financings, corporate collaboration and licensing arrangements and grants from patient advocacy groups, foundations and government agencies. Although management believes that the Company has access to capital resources, there are no commitments for financing in place at this time, nor can management provide any assurance that such financing will be available on commercially acceptable terms, if at all.

These conditions raise substantial doubt about the Company’s ability to continue as a going concern. These unaudited condensed consolidated financial statements do not include any adjustments relating to the recovery of assets or the classification of liabilities that might be necessary should the Company be unable to continue as a going concern.

NOTE 4. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

A summary of the significant accounting policies applied in the preparation of the accompanying condensed consolidated financial statements follows:

Principles of Consolidation

The unaudited condensed consolidated financial statements represent the consolidation of the accounts of the Company and its subsidiaries in conformity with GAAP. All intercompany accounts and transactions have been eliminated in consolidation.

Accounts Receivable – Trade

The Company's trade accounts receivable represents amounts due from customers. The Company monitors the financial performance and credit worthiness of its customers so that it can properly assess and respond to changes in their credit profile. The Company provides reserves against trade receivables for estimated losses that may result from a customer's inability to pay. Amounts determined to be uncollectible are written-off against the reserve.

Inventory

Inventories are stated at the lower of cost or estimated realizable value. The Company determines the cost of inventory using the first-in, first-out, or FIFO, method. The Company periodically analyzes its inventory levels to identify inventory that may expire prior to expected sale or has a cost basis in excess of its estimated realizable value, and write down such inventories as appropriate. In addition, the Company's products are subject to strict quality control and monitoring which the Company’s manufacturers perform throughout their manufacturing process.

Inventory consists of the following at June 30, 2014:

| |

|

June 30, 2014

|

|

|

Raw material

|

|

$ |

375,875 |

|

|

Finished goods

|

|

|

120,810 |

|

|

Total inventory

|

|

$ |

496,685 |

|

Income Taxes

The Company follows FASB ASC 740, Income Taxes, which requires recognition of deferred tax assets and liabilities for the expected future tax consequences of events that have been included in the financial statements or tax returns. Under this method, deferred tax assets and liabilities are based on the differences between the financial statement and tax bases of assets and liabilities using enacted tax rates in effect for the year in which the differences are expected to reverse. Deferred tax assets are reduced by a valuation allowance to the extent management concludes it is more likely than not that the asset will not be realized. Deferred tax assets and liabilities are measured using enacted tax rates expected to apply to taxable income in the years in which those temporary differences are expected to be recovered or settled.

The standard addresses the determination of whether tax benefits claimed or expected to be claimed on a tax return should be recorded in the financial statements. Under FASB ASC 740, the Company may recognize the tax benefit from an uncertain tax position only if it is more likely than not that the tax position will be sustained on examination by the tax authorities, based on the technical merits of the position. The tax benefits recognized in the financial statements from such a position should be measured based on the largest benefit that has a greater than fifty percent likelihood of being realized upon ultimate settlement. FASB ASC 740 also provides guidance on de-recognition, classification, interest and penalties on income taxes, accounting in interim periods and requires increased disclosures. As of June 30, 2014 and December 31, 2013, the Company has $1,522,063, and $0, respectively, recorded as a liability for unrecognized tax uncertainties, included in other liability-long term in the condensed consolidated balance sheet.

Revenue Recognition

Product sales consist of U.S. sales of Chenodal, Vecamyl, and Thiola. Revenue from product sales is recognized when persuasive evidence of an arrangement exists, title to product and associated risk of loss have passed to the customer, the price is fixed or determinable, collection from the customer is reasonably assured, the Company has no further performance obligations, and returns can be reasonably estimated. The Company records revenue from product sales upon delivery to its customers. The Company sells Chenodal and Vecamyl in the United States to a specialty pharmacy. Under this distribution model, the specialty pharmacy takes title of the inventory FOB shipping point and sells directly to patients. The Company sells Thiola in the United States and Canada through a specialty distributor. Under this model, the Company will record revenues once the distributor ships products to customers and such customers take title of the inventory FOB shipping point.

Government Rebates and Chargebacks: The Company estimates reductions to product sales for Medicaid programs, and for certain other qualifying federal and state government programs. Based upon the Company's contracts with government agencies, statutorily-defined discounts applicable to government-funded programs, historical experience, and estimated payer mix, the Company estimates and records an allowance for rebates and chargebacks as a reduction in sales. The Company's liability for Medicaid rebates consists of estimates for claims that a state will make for a current quarter, claims for prior quarters that have been estimated for which an invoice has not been received, and invoices received for claims from prior quarters that have not been paid. The Company's customers charge the Company for the difference between what they pay for the products and the ultimate selling price.

Distribution-Related Fees: The Company has written contracts with its customer that include terms for distribution-related fees. The Company estimates and records distribution and related fees due to its customer based on gross sales. Distribution-related fees amounted to $56,912 and $57,191 for the three and six months ended June 30, 2014, respectively, and are recorded as general and administrative expense in our condensed consolidated financial statements. Distribution-related fees were not incurred in 2013.

Prompt Pay Discounts: The Company offers discounts to its customers for prompt payments. The Company estimates these discounts based on customer terms and historical experience, and expect that its customer will always take advantage of this discount. Therefore, the Company accrues 100% of the prompt pay discount that is based on the gross amount of each invoice, at the time of sale.

Product Returns: Consistent with industry practice, the Company offers its customers a limited right to return product purchased directly from the Company, which is principally based upon the product's expiration date. Product returned is generally not resalable given the nature of the Company's products and method of administration. The Company develops estimates for product returns based upon historical experience, inventory levels in the distribution channel, shelf life of the product, and other relevant factors. The Company monitors product supply levels in the distribution channel, as well as sales by its customers to patients using product-specific data provided by its customers. If necessary, the Company's estimates of product returns may be adjusted in the future based on actual returns experience, known or expected changes in the marketplace, or other factors.

During the three and six months ended June 30, 2014, one customer accounted for 99% of the Company’s revenues. As of June 30, 2014 one customer accounted for 98% of accounts receivable.

Earnings (Loss) per Share

The Company adopted ASC 260, "Earnings Per Share" ("EPS"), which requires presentation of basic and diluted EPS on the face of the income statement for all entities with complex capital structures, and requires a reconciliation of the numerator and denominator of the basic EPS computation to the numerator and denominator of the diluted EPS computation. In the accompanying financial statements, basic earnings (loss) per share is computed by dividing net income (loss) by the weighted average number of shares of common stock outstanding during the period. Diluted EPS excluded all dilutive potential shares if their effect is anti-dilutive.

The following sets forth the computation of diluted EPS for the three months ended June 30, 2014:

| |

|

Three months ended June 30, 2014

|

|

| |

|

Net income (loss) (Numerator)

|

|

|

Shares (Denominator)

|

|

|

Per Share Amount

|

|

|

Basic EPS

|

|

$ |

8,482,947 |

|

|

|

25,635,277 |

|

|

$ |

0.33 |

|

|

Change in fair value of derivative instruments

|

|

|

(32,978,586 |

) |

|

|

- |

|

|

|

|

|

Dilutive shares related to warrants

|

|

|

- |

|

|

|

1,691,165 |

|

|

|

|

|

|

Dilutive EPS

|

|

$ |

(24,495,639 |

) |

|

|

27,326,442 |

|

|

$ |

(0.90 |

) |

Basic net income (loss) per share is based on the weighted average number of common and common equivalent shares outstanding. Potential common shares includable in the computation of fully diluted per share results are not presented for the six month ended June 30, 2014 and the periods ended June 30, 2013 in the condensed consolidated financial statements as their effect would be anti-dilutive. The total number of shares issuable upon exercise of options that were not included in dilutive earnings per share for the three and six months ended June 30, 2014 were 2,852,500. The total number of shares issuable upon conversion of debt that were not included in dilutive earnings per share for the three and six months ended June 30, 2014 were 2,642,160. The total number of shares issuable upon exercise of options that were not included in dilutive earnings per share for the three and six months ended June 30, 2013 were 120,000. The total number of shares issuable upon exercise of warrants that were not included in dilutive earnings per share for the three and six months ended June 30, 2013 were 1,917,792.

Financial Instruments and Fair Value

The Company accounts for financial instruments in accordance with ASC 820, “Fair Value Measurements and Disclosures” (“ASC 820”). ASC 820 establishes a fair value hierarchy that prioritizes the inputs to valuation techniques used to measure fair value. The hierarchy gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities (Level 1 measurements) and the lowest priority to unobservable inputs (Level 3 measurements). The three levels of the fair value hierarchy under ASC 820 are described below:

Level 1 – Unadjusted quoted prices in active markets that are accessible at the measurement date for identical, unrestricted assets or liabilities;

Level 2 – Quoted prices in markets that are not active or financial instruments for which all significant inputs are observable, either directly or indirectly; and

Level 3 – Prices or valuations that require inputs that are both significant to the fair value measurement and unobservable.

In estimating the fair value of the Company’s marketable securities available-for-sale and securities sold, not yet purchased, the Company used quoted prices in active markets (see Note 6 and Note 8).

In estimating the fair value of the Company’s derivative liabilities, the Company used the Binomial Lattice options pricing model at inception and on each subsequent valuation date (see Note 7 and Note 8).

In estimating the fair value of the Company’s contingent consideration, the Company used the comparable uncontrolled transaction (“CUT”) method for royalty payments based on projected revenues. Based on the fair value hierarchy, the Company classified contingent consideration within Level 3 because valuation inputs are based on projected revenues discounted to a present value (see Note 8).

Financial instruments with carrying values approximating fair value include cash as well as accounts receivable, deposits on license agreements, and accounts payable.

New Accounting Standards

In May 2014, the Financial Accounting Standards Board (“FASB”) issued ASU 2014-09, "Revenue from Contracts with Customers (Topic 606)," which is the new comprehensive revenue recognition standard that will supersede all existing revenue recognition guidance under GAAP. The standard's core principle is that a company will recognize revenue when it transfers promised goods or services to a customer in an amount that reflects the consideration to which the company expects to be entitled in exchange for those goods or services. This ASU is effective for annual and interim periods beginning on or after December 15, 2016, and early adoption is not permitted. Companies will have the option of using either a full retrospective approach or a modified approach to adopt the guidance in the ASU. We are currently evaluating the impact of adopting this guidance.

Note 5. BUSINESS COMBINATION

Manchester Pharmaceuticals LLC

On March 26, 2014 (the “Manchester Closing Date”), the Company acquired 100% of the outstanding membership interests of Manchester. Under the terms of the agreement, the Company paid $29.5 million upon consummation of the transaction, of which $3.2 million was paid by Retrophin Therapeutics International LLC, a newly formed indirect wholly owned subsidiary, for rights of product sales outside of the United States. Acquisition costs amounted to approximately $0.3 million and have been recorded as selling, general, and administrative expense in the accompanying condensed consolidated financial statements. The Company entered into a promissory note with Manchester principals for $33 million which was discounted to $31.3 million to be paid in three equal installments of $11 million within three, six, and nine months after the Manchester Closing Date. On June 30, 2014, the Company paid the sellers of Manchester $33 million in full satisfaction of the outstanding amount owed.

In addition, the Company agreed to make contractual payments based on 10% of net sales of the products Chenodal and Vecamyl to the former members of Manchester. Additional contingent payments will be made based on 5% of net sales from new products derived from the existing products. Contingent consideration will be revalued at each reporting period and any change in valuation will be recorded in the Company’s statement of operations.

The acquisition was accounted for under the purchase method of accounting in accordance with ASC 805, with the excess purchase price over the fair market value of the assets acquired and liabilities assumed allocated to goodwill. Based on the preliminary purchase price allocation, the purchase price of $73.23 million has resulted in goodwill of $0.9 million and is primarily attributed to the synergies expected to arise after the acquisition. The $0.9 million of goodwill resulting from the acquisition is deductible for income tax purposes.

The fair value of assets acquired and liabilities assumed was based upon a preliminary valuation and the Company’s estimates and assumptions are subject to change within the measurement period. Critical estimates in valuing certain intangible assets include but are not limited to future expected cash flows from customer relationships and developed technology, present value and discount rates. Management’s estimates of fair value are based upon assumptions believed to be reasonable, but which are inherently uncertain and unpredictable and, as a result, actual results may differ from estimates.

The purchase included $72 million of intangible assets with definite lives related to product rights, trade names, and customer relationships with values of $71.4 million, $0.2 million, and $0.4 million, respectively. The useful lives related to the acquired product rights, trade names, and customer relationships are expected to be approximately 16, 1 and 10 years, respectively. Under the terms of the agreement, the sellers agreed to indemnify the Company for uncertain tax liabilities, any breach of any representation or warranty the sellers made to the purchaser, failure of the sellers to perform any covenants or obligations made to the purchaser, and third party claims relating to the operation of the Company and events occurring prior to the Manchester Closing Date. As of June 30, 2014, the Company has recorded an indemnification asset with a corresponding liability in the amount of $1.5 million related to uncertain tax liabilities.

The purchase price allocation of $73.23 million was as follows:

| |

|

Amount (in thousands)

|

|

|

Cash paid upon consummation, net

|

|

$ |

29,150 |

|

|

Secured promissory note

|

|

|

31,283 |

|

|

Fair value of contingent consideration

|

|

|

12,800 |

|

|

Total purchase price

|

|

$ |

73,233 |

|

| |

|

|

|

|

|

Prepaid expenses

|

|

|

116 |

|

|

Inventory

|

|

|

517 |

|

|

Product rights

|

|

|

71,372 |

|

|

Trade names

|

|

|

175 |

|

|

Customer relationship

|

|

|

403 |

|

|

Goodwill

|

|

|

936 |

|

|

Other asset

|

|

|

1,522 |

|

|

Accounts payable and accrued expenses

|

|

|

(286 |

) |

|

Other liability

|

|

|

(1,522 |

) |

|

Total allocation of purchase price consideration

|

|

$ |

73,233 |

|

Pro Forma Operating Results

The following table provides unaudited pro forma results of operations for the three and six months ended June 30, 2014 and 2013, as if the March 26, 2014 acquisition had occurred on January 1, 2013. The pro forma results of operations were prepared for comparative purposes only and do not purport to be indicative of what would have occurred had the acquisitions been made as of January 1, 2013 or of results that may occur in the future.

| |

|

Pro Forma (Unaudited)

|

|

| |

|

Three months ended June 30,

(in thousands, except per share data)

|

|

|

Six months ended June 30,

(in thousands, except per share data)

|

|

| |

|

2014

|

|

|

2013

|

|

|

2014

|

|

|

2013

|

|

|

Net Sales

|

|

$ |

5,742 |

|

|

$ |

1,098 |

|

|

$ |

6,988 |

|

|

$ |

2,197 |

|

|

Net income (loss)

|

|

$ |

8,483 |

|

|

$ |

(4,184 |

) |

|

$ |

(61,524 |

) |

|

$ |

(8,063 |

) |

|

Net income (loss) per common share, basic

|

|

$ |

0.33 |

|

|

$ |

(0.34 |

) |

|

$ |

(2.51 |

) |

|

$ |

(0.70 |

) |

|

Net loss per common share, diluted

|

|

$ |

(0.90 |

) |

|

$ |

(0.34 |

) |

|

$ |

(2.51 |

) |

|

$ |

(0.70 |

) |

NOTE 6. MARKETABLE SECURITIES AND SECURITIES SOLD, NOT YET PURCHASED

The Company measures marketable securities and securities sold, not yet purchased on a recurring basis. Generally, the types of securities the Company invests in are traded on a market such as the NASDAQ Global Market, which the Company considers to be Level 1 measurements.

Marketable securities and securities sold, not yet purchased at June 30, 2014 consisted of the following:

| |

|

Cost

|

|

|

Unrealized Gains

|

|

|

Unrealized Losses

|

|

|

Estimated Fair Value

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Marketable securities

available-for-sale:

|

|

$ |

3,157,355 |

|

|

$ |

406,826 |

|

|

$ |

267 |

|

|

$ |

3,563,914 |

|

|

Securities sold, not yet purchased

|

|

$ |

147,190 |

|

|

$ |

2,340 |

|

|

$ |

- |

|

|

$ |

144,850 |

|

Marketable securities and securities sold, not yet purchased at December 31, 2013 consisted of the following:

| |

|

Cost

|

|

|

Unrealized Gains

|

|

|

Unrealized Losses

|

|

|

Estimated Fair Value

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Marketable securities

available-for-sale:

|

|

$ |

129,702 |

|

|

$ |

3,292 |

|

|

$ |

- |

|

|

$ |

132,994 |

|

|

Securities sold, not yet purchased

|

|

$ |

1,344,622 |

|

|

$ |

13,256 |

|

|

$ |

126,535 |

|

|

$ |

1,457,901 |

|

NOTE 7. DERIVATIVE FINANCIAL INSTRUMENTS

The Company accounts for derivative financial instruments in accordance with ASC 815-40, “Derivative and Hedging – Contracts in Entity’s Own Equity” (“ASC 815-40”), instruments which do not have fixed settlement provisions are deemed to be derivative instruments. The Company’s warrants are classified as liability instruments due to an anti-dilution provision that provides for a reduction to the exercise price of the warrants if the Company issues additional equity or equity linked instruments in the future at an effective price per share less than the exercise price then in effect.

The warrants are re-measured at each balance sheet date based on estimated fair value. Changes in estimated fair value are recorded as non-cash valuation adjustments within other income (expense) in the Company’s accompanying condensed consolidated statements of operations. The Company recorded a gain on a change in the estimated fair value of warrants of $33 million and $0.06 million during the three months ended June 30, 2014 and 2013, respectively. The Company recorded a loss on a change in the estimated fair value of warrants of $20.6 million and $2.4 million during the six months ended June 30, 2014 and 2013, respectively.

The Company calculated the fair value of the warrants using the Binomial Lattice options pricing model at inception and on each subsequent valuation date. The assumptions used at June 30, 2014 and December 31, 2013 are as follows:

| |

As of

|

|

| |

December 31, 2013

|

|

|

June 30, 2014

|

|

|

Fair market price of common stock

|

$7.00 |

|

|

|

$11.74 |

|

|

Expected life (in years), represents the weighted average period until next liquidity event

|

4.12-4.62 years

|

|

|

.36 – 3.63 years

|

|

|

Risk-free interest rate

|

1.39% |

|

|

|

1.11% - 1.62% |

|

|

Expected volatility

|

93-97% |

|

|

|

85% |

|

|

Dividend yield

|

0.00% |

|

|

|

0.00% |

|

Expected volatility is based on analysis of the Company’s volatility, as well as the volatilities of guideline companies. The risk free interest rate is based on the U.S. Treasury security rates for the remaining term of the warrants at the measurement date.

NOTE 8. FAIR VALUE MEASUREMENTS

The following table presents the Company’s asset and liabilities that are measured and recognized at fair value on a recurring basis classified under the appropriate level of the fair value hierarchy as of June 30, 2014:

| |

|

As of June 30, 2014

|

|

|

Fair Value Hierarchy at June 30, 2014

|

|

| |

|

Total carrying and estimated fair value

|

|

|

Quoted prices in active markets (Level 1)

|

|

|

Significant other observable inputs (Level 2)

|

|

|

Significant unobservable inputs (Level 3)

|

|

|

Asset:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Marketable securities, available-for-sale

|

|

$ |

3,563,914 |

|

|

$ |

3,563,914 |

|

|

$ |

- |

|

|

|

|

|

Liabilities:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Derivative liability related to

warrants

|

|

$ |

24,839,144 |

|

|

$ |

- |

|

|

$ |

- |

|

|

$ |

24,839,144 |

|

|

Securities sold, not yet purchased

|

|

$ |

144,850 |

|

|

$ |

144,850 |

|

|

$ |

- |

|

|

$ |

- |

|

|

Contingent consideration

|

|

$ |

12,800,000 |

|

|

$ |

- |

|

|

$ |

- |

|

|

$ |

12,800,000 |

|

The following table presents the Company’s asset and liabilities that are measured and recognized at fair value on a recurring basis classified under the appropriate level of the fair value hierarchy as of December 31, 2013:

| |

|

As of December 31, 2013

|

|

|

Fair Value Hierarchy at December 31, 2013

|

|

| |

|

Total carrying and estimated fair value

|

|

|

Quoted prices in active markets (Level 1)

|

|

|

Significant other observable inputs (Level 2)

|

|

|

Significant unobservable inputs (Level 3)

|

|

|

Asset:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Marketable securities, available-for-sale

|

|

$ |

132,994 |

|

|

$ |

132,994 |

|

|

$ |

- |

|

|

$ |

- |

|

|

Liability:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Derivative liability related to warrants

|

|

$ |

25,037,346 |

|

|

$ |

- |

|

|

$ |

- |

|

|

$ |

25,037,346 |

|

|

Securities sold, not yet purchased

|

|

$ |

1,457,901 |

|

|

$ |

1,457,901 |

|

|

$ |

- |

|

|

$ |

- |

|

The following table sets forth a summary of changes in the estimated fair value of the Company’s derivative financial instruments, warrants liability for the period from January 1, 2014 through June 30, 2014:

| |

|

Fair Value Measurements of Common Stock Warrants Using Significant Unobservable Inputs (Level 3)

|

|

|

Balance at January 1, 2013

|

|

$ |

- |

|

|

Issuance of common stock warrants:

|

|

|

|

|

|

February 14, 2013

|

|

|

5,407,372 |

|

|

August 14, 2013

|

|

|

328,561 |

|

|

August 15, 2013

|

|

|

9,201,487 |

|

|

Total value upon issuance

|

|

|

14,937,420 |

|

|

Change in fair value of common stock warrant liability

|

|

|

10,099,926 |

|

|

Balance at December 31, 2013

|

|

|

25,037,346 |

|

|

Issuance of common stock warrants, June 30, 2014 (Note 12)

|

|

|

2,531,250 |

|

|

Reclassification of derivative liability to equity upon exercise of warrants

|

|

|

(23,364,668 |

) |

|

Change in estimated fair value of liability classified warrants

|

|

|

20,635,216 |

|

|

Balance at June 30, 2014

|

|

$ |

24,839,144 |

|

A financial instrument’s level within the fair value hierarchy is based on the lowest level of any input that is significant to the fair value measurement. At each reporting period, the Company performs a detailed analysis of the assets and liabilities that are subject to ASC 820.

The following table sets forth a summary of changes in the estimated contingent consideration for the period from January 1, 2014 through June 30, 2014:

| |

|

Fair Value Measurements of

Contingent Consideration

|

|

|

Balance at January 1, 2014

|

|

$ |

- |

|

Present value of contractual payments, contingent consideration upon acquisition

|

|

|

12,800,000 |

|

|

Balance at June 30, 2014

|

|

$ |

12,800,000 |

|

NOTE 9. INTANGIBLE ASSETS

Amortizable intangible assets

Ligand License Agreement

On February 16, 2012, the Company entered into an agreement for a worldwide sublicense for $2.5 million to develop, manufacture and commercialize a drug technology which is referred to as DARA (the “Ligand License Agreement”). The cost of the Ligand License Agreement, which is presented net of amortization in the accompanying condensed consolidated balance sheet as other amortizable intangible asset, is being amortized to research and development on a straight-line basis through September 30, 2023.

Syntocinon License Agreement

On December 12, 2013, the Company entered into an agreement with Novartis Pharma AG and Novartis AG pursuant to which Novartis Pharma AG and Novartis AG agreed to grant the Company an exclusive, perpetual, and royalty-bearing license for the manufacture, development and commercialization of Syntocinon and related intranasal products in the United States (the “Syntocinon License Agreement”). Under the Syntocinon License Agreement, Novartis Pharma AG and Novartis AG are obligated to transfer to the Company certain information that is necessary for or related to the development or commercialization of Syntocinon. As consideration for the Syntocinon License Agreement, the Company paid to Novartis Pharma AG and Novartis AG, and capitalized, a $5 million upfront fee. The intellectual property underlying the Syntocinon License Agreement is held in perpetuity. The Company has examined the Syntocinon License Agreement and has capitalized the license fee in accordance with ASC 350 due to future alternative uses such as re-licensing of the technology to other third parties, the sale of the licensed technology to other life science companies, and the potential development of various ingestible drug products using the licensed technologies.

During the quarter ended June 30, 2014, certain key underlying assumptions regarding the estimated useful life of the Syntocinon License Agreement changed resulting in the Company changing the estimated useful life from indefinite-lived to definite lived, starting in the second quarter of 2014. Such changes relate to the regulatory requirements needed to re-introduce the product for the treatment of lactation deficiency. Management determined the development program approximates seven to eight years and the use patent exclusivity and/or commercial viability period upon approval will be eleven to twelve years. Management assigned a life of twenty (20) years to the asset and is being amortized to research and development on a straight-line basis through December 2033.

Kyalin - Carbetocin Technology Purchase

On December 23, 2013, the Company entered into a stock purchase agreement with Kyalin to acquire substantially all of Kyalin’s assets which include patents, patent applications, contracts and data related to the intranasal formulation of the compound Carbetocin (collectively, the “Carbetocin Assets”). Carbetocin, similar to Oxytocin, has potential utility for the treatment of milk let-down in post pregnant women, inducing contractions during labor, postpartum hemorrhage, as well as for schizophrenia.

The Company capitalized $3 million of fixed minimum payments and closing costs. For tax purposes, intangible assets are subject to different amortization allowances than for book purposes. FASB ASC 740-10-55 (“ASC 740”) addresses the accounting treatment when an asset is acquired outside of a business combination, and the tax basis of that asset differs from the amount paid. For the year ended December 31, 2013, pursuant to the guidance in ASC 740, the Company has stepped-up the basis of its intangible assets by $2.5 million and has recorded a deferred tax liability in the same amount, to account for the book/tax basis difference resulting from the Kyalin acquisition.

During the quarter ended June 30, 2014, certain underlying assumptions regarding the estimated useful life of the Carbetocin Assets changed resulting in the Company changing the estimated useful life from indefinite-lived to definite lived, starting in the second quarter of 2014. Such changes relate to the regulatory requirements needed to develop the Carbetocin Assets, as well as the departure of key personnel responsible for the development of the Carbetocin Assets. Management determined the development program approximates five to seven years and commercial viability will be five to seven years. Management assigned a life of ten (10) years to the assets and is being amortized to research and development on a straight-line basis through December 2023.

The change in estimated useful life in the current quarter also resulted in reversal of the deferred tax liability and recording a tax benefit of $2.5 million, as it was no longer necessary to account for the book/tax difference of Kyalin.

Manchester Pharmaceuticals LLC

Upon the completion of the Company’s acquisition of Manchester on March 26, 2014, it acquired intangible assets with definite lives related to product rights, trade names, and customer relationships with the values of $71.4 million, $0.2 million, and $0.4 million, respectively. The useful lives related to the acquired product rights, trade names, and customer relationships are expected to be approximately 16, 1 and, 10 years, respectively. Amortization of product rights is being recorded as cost of goods sold and amortization of trade names and customer relationships is being recorded as general and administrative expense over their respective lives.

Thiola License Agreement

On May 29, 2014, the Company entered into a license agreement with Mission Pharmacal Company (“Mission”), pursuant to which Mission agreed to grant the Company an exclusive, royalty-bearing license to market, sell and commercialize Thiola in the United States and a non-exclusive license to use know-how relating to Thiola to the extent necessary to market Thiola. In July 2014, the Company amended the license agreement with Mission to secure the Canadian marketing rights to the product for no additional consideration.

Upon execution of the agreement, the Company paid Mission an up-front license fee of $3 million. In addition, the Company shall pay guaranteed minimum royalties during each calendar year the greater of $2 million or twenty percent (20%) of the Company’s net sales of Thiola through June 30, 2024. As of June 30, 2014, the present value of guaranteed minimum royalties payable is $11.8 million using a discount rate of approximately 11% based on the Company’s current borrowing rate. As of June 30, 2014, the guaranteed minimum royalties’ current and long term liability is approximately $.6 million and $11.2 million, respectively, and is recorded as other liability in the condensed consolidated balance sheet. The Company capitalized $15 million related to the Thiola asset which consists of the up-front license fee, professional fees, and the present value of the guaranteed minimum royalties.

As of June 30, 2014, amortizable intangible assets were approximately $98 million. Amortization expense recorded as research and development amounted to $255,430 and $305,386 for the three and six months ended June 30, 2014, respectively. Amortization expense recorded as research and development amounted to $0 for the three and six months ended June 30, 2013. Amortization expense recorded as general and administrative amounted to $172,203 and $175,151 for the three and six months ended June 30, 2014, and $50,511 and $100,466 for the three and six months ended June 30, 2013, respectively. Amortization expense recorded as cost of goods sold amounted to $1,111,371 and $1,172,435 for the three and six months ended June 30, 2014, respectively. Amortization expense recorded as cost of goods sold amounted to $0 for each of the three and six months ended June 30, 2013.

Amortizable intangible assets as of June 30, 2014 and December 31, 2013 consist of the following:

| |

|

June 30, 2014 |

|

| |

|

Gross Carrying Amount

|

|

|

Accumulated Amortization

|

|

|

Net Book Value

|

|

|

Product Rights

|

|

$ |

71,372,000 |

|

|

$ |

(1,172,435 |

) |

|

$ |

70,199,565 |

|

|

Thiola License

|

|

|

15,049,647 |

|

|

|

(118,533 |

) |

|

|

14,931,114 |

|

|

Carbetocin Assets*

|

|

|

5,567,736 |

|

|

|

(141,074 |

) |

|

|

5,426,662 |

|

|

Syntocinon License*

|

|

|

5,000,000 |

|

|

|

(62,552 |

) |

|

|

4,937,448 |

|

|

Ligand License

|

|

|

2,300,000 |

|

|

|

(424,447 |

) |

|

|

1,875,553 |

|

|

Customer Relationships

|

|

|

403,000 |

|

|

|

(10,591 |

) |

|

|

392,409 |

|

|

Trade Name

|

|

|

175,000 |

|

|

|

(46,027 |

) |

|

|

128,973 |

|

|

Patent Costs

|

|

|

143,928 |

|

|

|

(1,289 |

) |

|

|

142,639 |

|

|

Total

|

|

$ |

100,011,311 |

|

|

$ |

(1,976,948 |

) |

|

$ |

98,034,363 |

|

* The Company commenced amortization in the current quarter due to change in estimate.

| |

|

December 31, 2013 |

|

| |

|

Gross Carrying

Amount

|

|

|

Accumulated Amortization

|

|

|

Net Book Value

|

|

|

Ligand License

|

|

$ |

2,300,000 |

|

|

$ |

(323,980 |

) |

|

$ |

1,976,020 |

|

|

Patent Costs

|

|

|

49,775 |

|

|

|

- |

|

|

|

49,775 |

|

|

Total

|

|

$ |

2,349,775 |

|

|

$ |

(323,980 |

) |

|

$ |

2,025,795 |

|

Amortization expense for the years ended December 31, 2014, 2015, 2016, 2017, and 2018 is expected to be $5,281,810, $7,064,263, $7,042,752, $7,023,509, and $7,023,509 respectively.

NOTE 10. RESEARCH AND DEVELOPMENT

Research and development expenses consist of the following for the three and six months ended June 30, 2014 and 2013:

| |

|

Three Months Ended June 30

|

|

|

Six Months Ended June 30

|

|

| |

|

2014

|

|

|

2013

|

|

|

2014

|

|

|

2013

|

|

|

External service provider costs:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sparsentan

|

|

$ |

2,647,735 |

|

|

$ |

356,238 |

|

|

$ |

3,577,175 |

|

|

$ |

464,973 |

|

|

RE-024

|

|

|

3,745,059 |

|

|

|

- |

|

|

|

6,110,068 |

|

|

|

- |

|

|

Syntocinon

|

|

|

517,899 |

|

|

|

- |

|

|

|

642,765 |

|

|

|

- |

|

|

RE-034

|

|

|

602,129 |

|

|

|

- |

|

|

|

1,177,815 |

|

|

|

- |

|

|

General

|

|

|

2,036,756 |

|

|

|

- |

|

|

|

3,118,476 |

|

|

|

- |

|

|

Other product candidates

|

|

|

312,275 |

|

|

|

- |

|

|

|

610,677 |

|

|

|

- |

|

|

Amortization

|

|

|

255,430 |

|

|

|

- |

|

|

|

305,386 |

|

|

|

- |

|

|

Total external service provider costs:

|

|

|

10,117,283 |

|

|

|

356,238 |

|

|

|

15,542,362 |

|

|

|

464,973 |

|

|

Internal personnel costs:

|

|

|

3,580,708 |

|

|

|

248,965 |

|

|

|

5,042,355 |

|

|

|

248,964 |

|

|

Total research and development

|

|

$ |

13,697,991 |

|

|

$ |

605,203 |

|

|

$ |

20,584,717 |

|

|

$ |

713,937 |

|

NOTE 11. SELLING, GENERAL, AND ADMINISTRATIVE

Selling, general, and administrative expenses consist of the following for the three and six months ended June 30, 2014 and 2013, respectively:

| |

|

Three Months Ended June 30

|

|

|

Six Months Ended June 30

|

|

| |

|

2014

|

|

|

2013

|

|

|

2014

|

|

|

2013

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Professional fees

|

|

$ |

4,913,393 |

|

|

$ |

1,595,026 |

|

|

$ |

11,068,778 |

|

|

$ |

1,928,868 |

|

|

Compensation and related costs

|

|

|

3,847,879 |

|

|

|

358,167 |

|

|

|

5,931,468 |

|

|

|

1,288,454 |

|

|

Depreciation and amortization

|

|

|

198,619 |

|

|

|

53,139 |

|

|

|

214,785 |

|

|

|

105,307 |

|

|

Other

|

|

|

2,380,180 |

|

|

|

2,488,367 |

|

|

|

4,217,062 |

|

|

|

3,313,820 |

|

|

Total selling, general, and administrative expenses

|

|

$ |

11,340,071 |

|

|

$ |

4,494,699 |

|

|

$ |

21,432,093 |

|

|

$ |

6,636,449 |

|

NOTE 12. NOTES PAYABLE

Total interest expense recognized for the three and six months ended June 30, 2014 aggregated to $2,178,937 and $2,178,401, respectively. Total interest income (expense) recognized for the three and six months ended June 30, 2013 aggregated to $5 and ($41,558), respectively.

Note Payable – Manchester Pharmaceuticals, LLC

On March 26, 2014 upon the acquisition of Manchester, the Company entered into a note payable in the amount of $33 million. The note is non-interest bearing and therefore the Company recorded the loan at present value of $31.2 million using the effective interest rate of approximately 11%, which is the Company’s current borrowing rate. The note was due and payable in three consecutive payments, each in the amount of $11 million payable on June 26, 2014, September 26, 2014, and December 12, 2014 (the maturity date). On June 30, 2014, the Company paid off the note in its entirety. The Company accelerated interest expense in the amount of $1.7 million for the difference between the present value of the loan and the loan balance paid.

Convertible Notes Payable

On May 29, 2014, the Company entered into a Note Purchase Agreement with the investors thereunder (the “Investors”) relating to a private placement by the Company of $46 million aggregate principal senior convertible notes due 2019 (the “Notes”), which are convertible into shares of the Company’s common stock at an initial conversion price of $17.41 per share. The conversion price is subject to customary anti-dilution protection. The Notes bear interest at a rate of 4.5% per annum, payable semiannually in arrears on May 15 and November 15 of each year, beginning on November 15. The Notes mature on May 30, 2019 unless earlier converted or repurchased in accordance with the terms. The aggregate carrying value of the Notes on their issuance was $43 million, which was net of the $3 million debt discount. The debt discount is being amortized to interest expense over the term of the Notes under the effective interest method. As of June 30, 2014, accrued interest amounted to $0.2 million related to the convertible notes payable.

On June 30, 2014, the Company issued 401,047 shares of Common Stock to the Investors and such Investors granted the Company a release of certain claims they may have had in connection with the Company's sale of the Notes or certain statements made by the Company in connection with such sale. The Company recorded finance expense as other expense in the amount of $4,708,280 in relation to the shares issued based on the fair market value of the stock on the date of issuance.

Note Payable with Detachable Warrants

On June 30, 2014, the Company entered into a $45 million Credit Agreement which matures on June 30, 2018 and bears interest at an annual rate of (i) the Adjusted LIBOR Rate (as such term is defined in the Credit Agreement) plus 10.00% or (ii) in certain circumstances, the Base Rate (as such term is defined in the Credit Agreement) plus 9.00%. The Credit Agreement contains certain covenants, including those limiting the Company's and its subsidiaries' abilities to incur indebtedness, incur liens, sell or acquire assets or businesses, change the nature of their businesses, engage in transactions with related parties, make certain investments or pay dividends. In addition, the Credit Agreement requires the Company and its subsidiaries to meet certain financial quarterly requirements commencing in September 2014. Failure by the Company or its subsidiaries to comply with any of these covenants or financial tests could result in the acceleration of the loans under the Credit Agreement. The aggregate carrying value of the convertible notes on their issuance was $39.8 million, which was net of the $5.2 million debt discount. The debt discount is being amortized to interest expense over the term of the notes under the effective interest method. No interest expense was incurred during the quarter ended June 30, 2014 related to the Note Payable.

In connection with the execution of the Credit Agreement, the Company issued warrants (the "Warrants") to the Lenders under the Credit Agreement, initially exercisable to purchase up to an aggregate of 337,500 shares of common stock of the Company. The Warrants will be exercisable in whole or in part, at an initial exercise price per share of $12.76 per share, which is subject to weighted-average anti-dilution protections. The Warrants may be exercised at any time upon the election of the holder, beginning on the date of issuance and ending on the fifth anniversary of the date of issuance. The issuance of the Warrants was not registered under the Securities Act of 1933, as amended (the "Securities Act") as such issuance was exempt from registration under Section 4(2) of the Securities Act.

The total grant date fair value of the Warrants is $2.5 million and was recorded as a derivative liability and is included in the debt discount to the Note Payable. The Company calculates the fair value of the warrants using the Binomial Lattice pricing model using the following assumptions:

|

Risk free rate

|

|

1.62%

|

|

Expected volatility

|

|

85%

|

|

Expected life (in years), represents the weighted average period until next liquidity event

|

|

0.36

|

|

Expected dividend yield

|

|

-

|

|

Exercise Price

|

|

$12.76

|

Debt Maturities

The stated maturities of the Company’s long-term debt at December 31 are as follows (in millions):

|

2014

|

|

$ |

- |

|

|

2015

|

|

|

- |

|

|

2016

|

|

|

- |

|

|

2017

|

|

|

- |

|

|

2018

|

|

|

45 |

|

|

Thereafter

|

|

|

46 |

|

|

|

|

$ |

91 |

|

NOTE 13. COMMITMENTS AND CONTINGENCIES

Leases and Sublease

On February 28, 2014, the Company amended its lease agreement for its offices located in Carlsbad, California. The Company increased its Carlsbad office space for approximately $110,000 of additional annual base rent plus rent escalations, common area maintenance, insurance, and real estate taxes under a lease agreement expiring in June 2017.

On April 10, 2014, the Company entered into an amended lease agreement at its principal offices in New York, New York and is responsible for additional rent of approximately $537,264 annually plus rent escalations through April 2015.

Research Collaboration and Licensing Agreements

As part of the Company's research and development efforts, the Company enters into research collaboration and licensing agreements with unrelated companies, scientific collaborators, universities, and consultants. These agreements contain varying terms and provisions which include fees and milestones to be paid by the Company, services to be provided, and ownership rights to certain proprietary technology developed under the agreements. Some of these agreements contain provisions which require the Company to pay royalties in the event the Company sells or licenses any proprietary products developed under the respective agreements.

Contract Commitments

The following table summarizes our principal contractual commitments, excluding open orders that support normal operations, as of June 30, 2014:

|

Year Ending December 31,

|

|

Research and Development and

other Charitable Donations

|

|

|

Consultants

|

|

|

Operating Leases

|

|

|

2014

|

|

$ |

5,332,827 |

|

|

$ |

220,830 |

|

|

$ |

1,133,034 |

|

|

2015

|

|

|

4,941,144 |

|

|

|

- |

|

|

|

1,054,961 |

|

|

2016

|

|

|

- |

|

|

|

- |

|

|

|

836,978 |

|

|

2017

|

|

|

- |

|

|

|

- |

|

|

|

70,504 |

|

|

Total

|

|

$ |

10,273,971 |

|

|

$ |

220,830 |

|

|

$ |

3,095,477 |

|

Legal Proceedings

In Charles Schwab & Co., Inc. v. Retrophin, Inc., et. al., Case No. 14 CV 4294 (S.D.N.Y.), the plaintiff, Charles Schwab & Co., Inc. (“Schwab”), asserts that it was misled by two of its customers, Jackson Su (“Su”), and Chun Yi “George” Huang (“Huang”), who are former employees of the Company, and who induced Schwab to wrongfully execute sales of their restricted shares of the Company’s common stock (the “Shares”). Schwab has also alleged that certain agents of the Company provided incorrect information to Schwab in connection with the sale of the Shares. Schwab has alleged that as a result of its detrimental reliance on the incorrect information provided to it by the Company’s agents, it has incurred in excess of $2 million in damages. Su and Huang have asserted “cross-claims” against the Company for alleged fraud and negligent misrepresentation premised upon the Company’s alleged failure to inform them of restrictions on the sale of their Shares. The Company believes that it has valid defenses against all claims and that it is not responsible for any losses incurred by the other parties. The Company cannot predict the timing or outcome of this litigation.

From time to time the Company is involved in legal proceedings arising in the ordinary course of business. The Company believes there is no other litigation pending that could have, individually or in the aggregate, a material adverse effect on its results of operations or financial condition.

NOTE 14. STOCKHOLDERS’ DEFICIT

Common Stock

The Company is currently authorized to issue up to 100,000,000 shares of $0.0001 par value common stock. All issued shares of common stock are entitled to vote on a 1 share/1 vote basis.

Preferred Stock

The Company is currently authorized to issue up to 20,000,000 shares of $0.001 preferred stock, of which 1,000 shares are designated Class "A" Preferred shares, $0.001 par value. Class A Preferred Shares are not entitled to interest, have certain liquidation preferences, special voting rights and other provisions. No Preferred Shares have been issued to date.

Public Offering - 2014

On January 9, 2014, the Company completed a public offering of 4,705,882 shares of common stock at a price of $8.50 per share. The Company received net proceeds from the offering of $36,835,007, after deducting the underwriting fees and other offering costs of $3,164,990, which were recorded against additional paid in capital.

As of June 30, 2014 and December 31, 2013, there was approximately $10,549,613 and $1,105,967, respectively, of unrecognized compensation cost related to restricted shares granted. As of June 30, 2014 and December 31, 2013, these amounts are expected to be recognized over a weighted average period of 2.73 and 2.19 years, respectively. Unvested restricted shares consist of the following as of June 30, 2014 and December 31, 2013.

| |

|

Employee - number of shares

|

|

|

Non Employee - number of shares

|

|

|

Total number of shares

|

|

|

Weighted Average Grant Date Fair Value

|

|

|

Unvested December 31, 2013

|

|

|

130,215 |

|

|

|

38,427 |

|

|

|

168,642 |

|

|

|

6.44 |

|

|

Granted

|

|

|

630,000 |

|

|

|

- |

|

|

|

630,000 |

|

|

|

17.08 |

|

|

Vested

|

|

|

(61,393 |

) |

|

|

(28,437 |

) |

|

|

(89,830 |

) |

|

|

13.85 |

|

|

Forfeited/cancelled

|

|

|

(4,155 |

) |

|

|

- |

|

|

|

(4,155 |

) |

|

|

3.00 |

|

|

Unvested June 30, 2014

|

|

|

694,667 |

|

|

|

9,990 |

|

|

|

704,657 |

|

|

|

15.40 |

|

The Company uses the Black-Scholes option pricing model to value options granted to employees and directors. Compensation expense is recognized over the period of service, generally the vesting period. Stock-based compensation related to stock options totaled $2,299,505 and $3,501,298 for the three and six months ended June 30, 214, respectively. The Company did not record stock based compensation in 2013 related to options.

The unamortized amount of stock options expense totaled $31,649,853 as of June 30, 2014 which will be recognized over a weighted-average period of 2.66 years.

During the six months ended June 30, 2014, 2,686,500 stock options were granted by the Company. The fair values of stock option grants during the six months ended June 30, 2014 were calculated on the date of grant using the Black-Scholes option pricing model, except for options granted for market and revenue performance criteria. The following assumptions were used in the Black-Scholes options pricing model:

| |

|

Six months ended June 30, 2014

|

|

Risk free rate

|

|

1.55% - 1.57%

|

|

Expected volatility

|

|

85%

|

|

Expected life (in years)

|

|

5.81

|

|

Expected dividend yield

|

|

-

|

The risk-free interest rate was based on rates established by the Federal Reserve. The Company’s expected volatility was based on analysis of the Company’s volatility, as well as the volatilities of guideline companies. The expected life of the Company’s options was determined using the simplified method as a result of limited historical data regarding the Company’s activity. The dividend yield is based upon the fact that the Company has not historically paid dividends, and does not expect to pay dividends in the foreseeable future.

The fair value of 100,000 stock options granted for achievement of market performance of the Company’s stock price during the six months ended June 30, 2014 was calculated using the Binomial Lattice options pricing model. These options vest upon such time as the trailing twenty day average of the closing price of the Company’s common stock equals or exceeds $25 per share (but no earlier than February 24, 2015). The Company will record stock compensation expense for 100,000 options that vest based on revenue performance conditions when achievement is considered probable. The revenue performance options vest upon such time as the Company’s revenues meet or exceed $50 million in the aggregate over any consecutive four fiscal quarter period (but no earlier than February 24, 2015). No compensation has been recorded for the revenue performance options.

Options granted during the six months ended June 30, 2014 were as follows:

| |

|

|

|

|

Weighted Average

|

|

|

|

| |

|

Shares Underlying Options

|

|

|

Exercise Price

|

|

|

Remaining Contractual Term (in years)

|

|

|

Aggregate Intrinsic Value

|

|

|

Outstanding at December 31, 2013

|

|

|

1,721,000 |

|

|

$ |

7.66 |

|

|

|

9.89 |

|

|

$ |

172,000 |

|

|

Granted during 2014

|

|

|

2,686,500 |

|

|

|

14.57 |

|

|

|

10 |

|

|

|

- |

|

|

Exercised

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

Forfeited/cancelled

|

|

|

(12,500 |

) |

|

|

6.20 |

|

|

|

0.08 |

|

|

|

- |

|

|

Outstanding at June 30, 2014

|

|

|

4,395,000 |

|

|

$ |

11.89 |

|

|

|

9.65 |

|

|

$ |

7,297,560 |

|

|

Exercisable as of June 30, 2014

|

|

|

521,417 |

|

|

$ |

9.27 |

|

|

|

9.42 |

|

|

$ |

1,810,115 |

|

The intrinsic value is calculated as the difference between the closing price of the Company’s common stock as of June 30, 2014, which was $11.74 per share, and the exercise price of the options.

Share Based Compensation

Share based compensation expenses consist of the following for the three months and six months ended June 30, 2014 and 2013, respectively:

| |

|

Three Months Ended

|

|

|

Six Months Ended

|

|

| |

|

June 30,

2014

|

|

|

June 30,

2013

|

|

|

June 30,

2014

|

|

|

June 30,

2013

|

|

|

Restricted Shares

|

|

$ |

2,857,681 |

|

|

$ |

91,705 |

|

|

$ |

6,513,331 |

|

|

$ |

250,909 |

|

|

Stock Options

|

|

|

2,150,591 |

|

|

|

36,683 |

|

|

|

3,501,295 |

|

|

|

36,683 |

|

|

Total

|

|

$ |

5,008,272 |

|

|

$ |

128,388 |

|

|

$ |

10,014,626 |

|

|

$ |

287,592 |

|

Exercise of Warrants

During the six months ended June 30, 2014, the Company issued 1,962,377 shares of common stock upon the exercise of warrants for cash received by the Company in the amount of $8,337,380. The Company reclassified $23,364,668 derivative liability as equity for the value of these warrants on the date of exercise. The warrants were revalued immediately prior to exercise and the change in the fair value of the warrants was recorded as other expense in the condensed consolidated financial statements of the Company.

During the six months ended June 30, 2014, the Company repurchased 248,801 shares of its common stock for an aggregate purchase price of $2,257,336. The Company currently recognizes such repurchased common stock as treasury stock.

NOTE 15. SUBSEQUENT EVENTS

In July 2014, the Company amended the license agreement with Mission to secure the Canadian marketing rights to the product.

Stock Option Grants

Subsequent to year end, the Company granted 311,000 options to employees and consultants.

Sublease Agreement

Subsequent to quarter end, the Company entered into a sublease agreement for new office space located in Cambridge, MA. The Company increased its office space for approximately $800,000 of additional rent per annum. The sublease expires on December 31, 2016.

Clinuvel

On July 17, 2014, the Company made a proposal to the board of directors of Clinuvel Pharmaceuticals Limited (“Clinuvel”) to acquire all of the outstanding shares of Clinuvel for either 0.175 shares of common stock of the Company or $2.03 in cash per share for an aggregate purchase price of approximately $89 million. As of July 30, 2014, the Company has invested approximately $4.5 million and acquired approximately 6.7% of the outstanding shares of Clinuvel as part of the proposal process. If Clinuvel accepts the Company’s proposal to acquire all of its outstanding shares of common stock, the Company will need to obtain additional equity or debt financing to consummate the acquisition and consolidation (see Note 3).

The following discussion and analysis is intended as a review of significant factors affecting our financial condition and results of operations for the periods indicated. The discussion should be read in conjunction with our consolidated financial statements and the notes presented herein. In addition to historical information, the following Management's Discussion and Analysis of Financial Condition and Results of Operations contains forward-looking statements that involve risks and uncertainties. Our actual results could differ significantly from those anticipated in these forward-looking statements as a result of certain factors discussed in this Form 10-Q.

Cautionary Note Regarding Forward-Looking Statements

Certain information contained in this Quarterly Report on Form 10-Q of Retrophin, Inc., a Delaware corporation (“we”, “us”, the “Company” or “Retrophin”) include forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. The statements herein which are not historical reflect our current expectations and projections about the Company’s future results, performance, liquidity, financial condition, prospects and opportunities and are based upon information currently available to the Company and our management and their interpretation of what is believed to be significant factors affecting the businesses, including many assumptions regarding future events. Such forward-looking statements include statements regarding, among other things:

| |

·

|

our ability to produce, market and generate sales of our products;

|

| |

·

|

our ability to develop, acquire and/or introduce new products;

|

| |

·

|

our projected future sales, profitability and other financial metrics;

|

| |

·

|

our future financing plans;

|

| |

·

|

our plans for expansion of our facilities;

|

| |

·

|

our anticipated needs for working capital;

|

| |

·

|

the anticipated trends in our industry;

|

| |

·

|

our ability to expand our sales and marketing capability;

|

| |

·

|

acquisitions of other companies or assets that we might undertake in the future;

|

| |

·

|

our operations in the United States and abroad, and the domestic and foreign regulatory, economic and political conditions; and

|

| |

·

|

competition existing today or that will likely arise in the future.

|

Forward-looking statements, which involve assumptions and describe our future plans, strategies and expectations, are generally identifiable by use of the words “may,” “should,” “expect,” “anticipate,” “estimate,” “believe,” “intend,” “seek,” or “project” or the negative of these words or other variations on these words or comparable terminology. Actual results, performance, liquidity, financial condition and results of operations, prospects and opportunities could differ materially from those expressed in, or implied by, these forward-looking statements as a result of various risks, uncertainties and other factors, including the ability to raise sufficient capital to continue the Company’s operations. Actual events or results may differ materially from those discussed in forward-looking statements as a result of various factors, including, without limitation, the risks outlined under “Risk Factors” on our Form 10-K filed with the Securities and Exchange Commission (the “SEC”) on March 28, 2014. In light of these risks and uncertainties, there can be no assurance that the forward-looking statements contained in this Form 10-Q will in fact occur. Potential investors should not place undue reliance on any forward-looking statements. Except as expressly required by the federal securities laws, there is no undertaking to publicly update or revise any forward-looking statements, whether as a result of new information, future events, changed circumstances or any other reason.