UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-22212

CALVERT SAGE FUND

(Exact name of registrant as specified in charter)

4550 Montgomery Avenue

Suite 1000N

Bethesda, Maryland 20814

(Address of Principal Executive Offices)

William M. Tartikoff, Esq.

4550 Montgomery Avenue

Suite 1000N

Bethesda, Maryland 20814

(Name and Address of Agent for Service)

Registrant's telephone number, including area code: (301) 951-4800

Date of fiscal year end: September 30

Date of reporting period: Twelve months ended September 30, 2012

Item 1. Report to Stockholders.

[Calvert Large Cap Value Fund Annual Report to Shareholders]

[Calvert Equity Income Fund Annual Report to Shareholders]

Choose Planet-friendly E-delivery!

Sign up now for on-line statements, prospectuses, and fund reports. In less than five minutes you can help reduce paper mail and lower fund costs.

Just go to www.calvert.com. If you already have an online account at Calvert, click on My Account, and select the documents you would like to receive via e-mail.

If you’re new to online account access, click on Login/Register to open an online account. Once you’re in, click on the E-delivery sign-up at the bottom of the Account Portfolio page and follow the quick, easy steps. Note: if your shares are not held directly at Calvert but through a brokerage firm, you must contact your broker for electronic delivery options available through their firm.

Dear Shareholder:

Stock markets ended the 2012 annual reporting period sharply higher as the Standard & Poor’s (S&P) 500 Index returned 30.20% versus 1.14% for the 12 months through September 30, 2011. While the two periods shared many commonalities--such as a softening of economic indicators, mounting concerns about sovereign debt in the eurozone, and relatively strong corporate profits--there were some key differences.

Financial markets around the world breathed a sigh of relief after the European Central Bank committed to saving the euro this summer and offered to support the debt markets for any euro member government seeking a new financial bailout. And while the disasters in Japan and strife in the Middle East and North Africa weighed heavily on investor confidence last year, uncertainty closer to home rattled investors this year, primarily as a result of the presidential election and looming “fiscal cliff” in January 2013 that could raise taxes for many Americans. The good news is both situations should see some resolution by the end of 2012.

The U.S. economy’s relative strength was also more evident in this annual reporting period. The divergence with foreign stock market returns widened as the S&P 500 Index more than doubled the 14.33% return of the MSCI EAFE Index for the 12-month period ending September 30, 2012. In the 12 months ending September 30, 2011, the S&P 500 barely eked out a positive return compared with -8.94% for the MSCI EAFE for the same period.

A Truly Uneven Recovery

Within the United States, the economic recovery was also uneven, with some consumers and businesses feeling left behind in the midst of an “improving” economy. For example, growth in northeastern metropolitan areas lagged, while metro areas out west, particularly those in natural gas or high-tech centers, rebounded strongly.1 Also, the housing market finally turned the corner, as national home prices rose 3.6% year-over-year for the past 12 months. However, they surged 9.4% in the western U.S. while notching up only 0.9% in the northeast.2 In employment, more than 70% of jobs lost in service industries during the recession have returned, but only 15% of jobs lost in manufacturing, construction, and other goods-producing industries have come back. The differences are stark even within industries, where retail general merchandisers such as Costco recouped 92% while department stores regained just 41% of lost jobs.3 Overall, we remain cautiously optimistic about the economic recovery ahead. As both citizens and investors, we hope that government legislators return to the negotiating table after the election and give us all the gift of more certainty before the holidays.

www.calvert.com CALVERT LARGE CAP VALUE FUND ANNUAL REPORT 4

Making Strides in Board Diversity

Calvert continued its advocacy efforts in many areas, including board diversity. The United Nations Gender Equality for Sustainable Business Event in March marked the two-year anniversary of the U.N.’s Women’s Empowerment Principles (WEP), which were adapted from the Calvert’s Women Principles®, and emphasized the business case for promoting gender equality and women’s empowerment in the workplace. Calvert also joined the newly formed WEP Leadership Group to expand implementation of the Principles.

On March 21, we testified before the Senate Democratic Steering and Outreach Committee about the importance of gender equity in economic empowerment and job creation, highlighting research showing the inclusion of women in corporate management correlates with higher shareholder value and better operating results.

Creating “The Future We Want” in Rio

Finally, I had the pleasure of representing Calvert by speaking at several events at the Rio + 20 Summit about board oversight of sustainability, social enterprise and impact investing, the role of business in promoting gender equality, the business case for the green economy, and establishing value for natural capital.

The first Earth Summit in Rio de Janeiro 20 years ago created climate and biodiversity conventions and set the stage for frameworks to address global environmental degradation, climate change, and poverty. However, global economic uncertainty weighed heavily on the Rio + 20 Summit. While negotiations continued to advance toward 2015, we’re disappointed by the lack of concrete commitments needed for substantial progress on critical sustainability issues.

However, side events sponsored by private-sector and non-governmental organizations sparked many innovative initiatives and positive outcomes. A number of major companies made significant commitments on water, energy, renewable materials, and deforestation. Corporate and investor disclosure of environmental, social, and governance (ESG) impacts took a real step forward as well. In fact, NASDAQ will now encourage companies on its exchange to report on ESG issues, or explain why they do not.

While these efforts can’t substitute for binding governmental commitments, we are happy to see so many companies and investors stepping up to the plate and believe the private sector will remain a key driver of progress on sustainability issues over the next few years.

Stay Informed in the Months Ahead

Maintaining a well-diversified mix of stocks, bonds, and cash appropriate for your goals and risk tolerance is one of the best ways to mitigate the effects of an uneven economic recovery. We also recommend discussing any changes in your financial situation with your investment advisor.

www.calvert.com CALVERT LARGE CAP VALUE FUND ANNUAL REPORT 5

A financial services consulting firm recently named Calvert as one of the Top Social Media Leaders in 2012 for using Facebook to share valuable content with investors and advisors.4 Join the dialogue at www.facebook.com/calvert.

We also invite you to visit our website, www.calvert.com, for fund information, portfolio updates, and commentary from Calvert professionals. You can now get the same information on the go with our new iPhone® app, available free at iTunes.

As always, we thank you for investing with Calvert.

Barbara Krumsiek

President and CEO of Calvert Investments, Inc.

October 2012

1. Brookings Institution, Metro Monitor - September 2012, www.brookings.edu/research/ interactives/metromonitor#overall

2. Clear Capital, “June Home Prices Provide Further Evidence of Budding Recovery. Forecast Indicates Further Increases Through 2012,” July 2012 Market Report, http://clearcapital.com/ company/MarketReport.cfm?month=July&year=2012

3. Paul Davison and Barbara Hansen, “Service Businesses Lead Uneven Jobs Recovery,” USA Today, July 15, 2012, www. usatoday.com/money/economy/story/2012-07-15/jobs-recovered/56242656/1

4. kasina ranked Calvert fifth of 53 asset management and insurance companies for using Facebook to tell a compelling brand story and share valuable content with investors and advisors. The ranking was based on kasina’s three-tier methodology that ranked firms based on content, branding, interactivity, and usability on each social platform. For more information, visit www.kasina.com.

www.calvert.com CALVERT LARGE CAP VALUE FUND ANNUAL REPORT 6

As always, Calvert continues to work hard to ensure you have a say in the responsible management of environmental, social, and governance (ESG) factors for the companies in which we invest. Below are highlights of our accomplishments during the reporting period.

Landmark Rules on Conflict Minerals & Extractive Revenue Payments

In August, the Securities and Exchange Commission (SEC) released landmark rules on conflict minerals and extractive revenue payments. Calvert played a leading role among investors in the complicated and controversial two year-long rule-making process for both rules, which require companies registered on U.S. exchanges to make unprecedented disclosures of these potentially material risks to investors.

Dodd-Frank Wall Street Reform and Consumer Protection Act (Dodd-Frank) Section 1502 requires companies to file Conflict Mineral Reports on their efforts to identify and eliminate the use of tin, tantalum, tungsten, and gold from the Eastern Democratic Republic of the Congo (DRC), where these “conflict minerals” have fueled a 14-year violent conflict, claiming over five million lives.

Supply chain due diligence that conforms to a nationally or internationally recognized framework and independent third party audits of due diligence are also required. We were also pleased that these reports must also be published on the internet for public consumption.

This far-reaching rule means investors will finally be able to assess one of the most critical human right-related risks they face in the world. However, we were disappointed in the two- to four-year phase-in (depending on size) for compliance, as well as the exclusion of mining companies from reporting requirements. Therefore, Calvert will continue to press all companies involved with conflict minerals to step up their efforts to address these issues.

As the lead investor supporting Dodd-Frank Section 1504, Calvert commends the SEC for its careful treatment of the complex and sensitive issues presented by the rulemaking to require oil, gas, and mining companies to disclose revenue payments they make to governments around the world. As the SEC acknowledged, these disclosures are essential to investors’ consideration of the growing social, regulatory, and taxation risks faced by oil, gas, and mining companies as they venture further into countries with poor governance, weak rule of law, and high levels of corruption.

As a result, about 1,100 companies will now have to file Section 1504 disclosures as part of their annual SEC submission. Despite lobbying from involved industries, no companies were exempt from the requirements. Finally, we were pleased to see that many of Calvert’s comments and suggestions to the SEC were included in the text of the final rules for Section 1504.

www.calvert.com CALVERT LARGE CAP VALUE FUND ANNUAL REPORT 7

Exercising Our Say on Pay

Calvert fought for the new “say on pay” rule, which requires publicly traded U.S. companies to allow shareholders to vote on the compensation awarded to senior management the previous year. We built on that success this year by creating a strict set of voting guidelines on executive compensation for the proxy season. We also shared our reasons for voting against the proposals to management at key companies.

Overall, Calvert votes against compensation packages that do not align management and shareholder interests and do not incentivize the company’s long-term performance. Even before the May announcement of a massive trading loss, we rejected the $23 million pay package for JPMorgan Chase Chairman and CEO Jamie Dimon due to its discretionary nature and inherent lack of accountability to long-term financial goals. The weaknesses in risk oversight evident exhibited by the company’s failed hedging strategy only reinforced our decision.

Promoting Privacy on the Internet

In 2006, Calvert joined other investors, human rights advocacy organizations, academic experts, and companies to develop the multi-stakeholder Global Network Initiative (GNI) to help information and communication technology (ICT) companies address freedom of expression and privacy issues. In early 2012, GNI’s path to becoming a fully global standard leapt forward as the first three GNI companies—Yahoo, Google, and Microsoft— completed the second phase of the assessment process.

In addition, Facebook became a GNI observer in May, opening the door to its participation in GNI policy and advocacy discussions for one year as it evaluates the potential commitment of implementing the GNI principles. We welcome the opportunity to work with Facebook, particularly in protecting against privacy violations that can endanger members using it as an instrument of freedom of expression and political dissent across the world.

New Standards Will Nearly Double Fuel Efficiency by 2025

Newly finalized corporate average fuel economy (CAFE) standards require car and light-duty truck efficiency to reach the equivalent of 54.5 mpg by 2025. This historic progress will benefit the environment and energy security by reducing oil consumption by an estimated 12 billion barrels while saving consumers about $1.7 trillion. The major automakers supported the new standards and have already begun work to provide more innovative, fuel-efficient, and cleaner vehicles.

Fuel economy rules are critical for the environment and investors. In the U.S., transportation alone represents nearly 30% of greenhouse gas emissions (GHGs), with about two-thirds coming from passenger cars and light-duty trucks.1 Furthermore, transportation emissions have grown faster than any other economic sector since 1990.2 Yet before 2010, the standards had not been changed for decades.

Calvert has long advocated for higher standards that we believe will help American automakers become more competitive. Higher standards will also boost U.S. policy efforts to mitigate climate change, as more than 90% of a vehicle’s contribution to climate change through GHGs is related to fuel consumption.3

www.calvert.com CALVERT LARGE CAP VALUE FUND ANNUAL REPORT 8

Helping Companies Combat Climate Change Risks

Economic and insured losses from natural catastrophes set new records last year, driving home the very real physical climate risks for investors. Extreme weather events accounted for 90% of the disasters and eight of the 10 most costly events, causing overall losses of more than $148 billion. To that end, Calvert co-authored two reports to help companies evaluate their exposure to climate risks and protect shareholder value.

Oxfam America and Ceres joined us to create Physical Risks from Climate Change: A guide for companies and investors on disclosure and management of climate impacts. The guide focuses on companies in the agriculture, food and beverage, apparel, electric power, insurance, mining, oil and gas, and tourism sectors—all of which are considered highly vulnerable to climate impacts.

We also developed Value Chain Climate Resilience: A guide to managing climate impacts in companies and communities, a first-of-its-kind guide to help businesses assess and prepare for the risks and opportunities posed by climate change, with other leading companies from the Partnership for Resilience and Environmental Preparedness (PREP). While written for all companies, it provides additional material for managers and executives in three highly vulnerable business sectors: food, beverage, and agriculture; water and energy utilities; and general manufacturing.

The Future We Want

In addition to the highlights from the June Rio + 20 Summit in Rio de Janeiro mentioned in the letter from CEO and President Barbara Krumsiek, other specific accomplishments included: The Natural Capital Declaration (NCD) was launched in Rio. It seeks to engage investors, governments, and insurers to develop tools for valuing “natural capital,” or goods and services derived from the environment, such as food, clean water, and biodiversity. Calvert is a signatory to the NCD and spoke at the launch, stressing the need for companies to disclose their use of natural resources and clarify potential impacts on local communities and Indigenous Peoples.

Avoided Deforestation Partners, a coalition of more than 400 companies of the Consumer Goods Forum, announced a new partnership with USAID to achieve their pledge to reach zero net deforestation within their supply chains by 2020. The kickoff event was held in Rio, featuring Jane Goodall as the keynote speaker. Member companies include Coca-Cola, Unilever, Procter & Gamble, 3M, Hewlett-Packard, General Mills, and Kellogg.

www.calvert.com CALVERT LARGE CAP VALUE FUND ANNUAL REPORT 9

1 ACEEE, Automobiles and the Environment, www.greenercars.org/guide_environment.htm

2 NHTSA, EPA/NHTSA Fact Sheet on Rulemaking, www.nhtsa.gov/staticfiles/rulemaking/ pdf/cafe/CAFE_2014-18_Trucks_FactSheet-v1.pdf

3 Environmental Protection Agency, Greenhouse Gas Emissions from the U.S. Transportation Sector, www.epa.gov/otaq/climate/420r06003.pdf

As of September 30, 2012, the following companies represent the following percentages of Fund net assets: JPMorgan Chase 2.28% of Calvert Large Cap Value and 2.11% of Calvert Equity Income, Google 1.16% of Calvert Large Cap Value, Microsoft 2.38% of Calvert Large Cap Value and 1.96% of Calvert Equity Income, Unilever 1.33% of Calvert Large Cap Value and 1.36% of Calvert Equity Income, Procter & Gamble 2.26% of Calvert Large Cap Value and 1.96% of Calvert Equity Income, 3M 0.99% of Calvert Large Cap Value and 1.20% of Calvert Equity Income. Yahoo, Coca-Cola, Hewlett-Packard, General Mills, and Kellogg weren’t held by either Fund. Holdings are subject to change.

www.calvert.com CALVERT LARGE CAP VALUE FUND ANNUAL REPORT 10

Investment Performance

For the 12-month period ended September 30, 2012, Calvert Large Cap Value posted a 27.92% return versus the 30.92% return of the Russell 1000 Value Index. Adverse sector selection, including the effects of carrying a modest cash balance in strongly advancing markets, hurt the Fund’s relative performance for the period.

Investment Climate

An obvious sign that the economy has failed to gain traction is that unemployment is only now beginning to edge down from 9% to around 8%. Economic growth, once at a high of near 3%, stalled at its current 1.5% pace. However, the economy typically maintains growth rates well in excess of 3% during an economic rebound, especially after such a prolonged slowdown. The White House scrambled to reduce unemployment and to boost economic growth with the reelection campaign in full swing. The Federal Reserve went on record that monetary policy will be loose until unemployment is reduced to 7% or less.

| CALVERT LARGE CAP | ||||

| VALUE FUND | ||||

| September 30, 2012 | ||||

| INVESTMENT PERFORMANCE | ||||

| (total return at NAV*) | ||||

| 6 months | 12 months | |||

| ended | ended | |||

| 9/30/12 | 9/30/12 | |||

| Class A | 3.19 | % | 27.92 | % |

| Class C | 2.61 | % | 26.49 | % |

| Class Y | 3.31 | % | 28.23 | % |

| Russell 1000 Value Index | 4.16 | % | 30.92 | % |

| Lipper Large-Cap Value | ||||

| Funds Average | 2.09 | % | 27.74 | % |

| % of Total | |||

| ECONOMIC SECTORS | Investments | ||

| Consumer Discretionary | 12.4 | % | |

| Consumer Staples | 7.7 | % | |

| Energy | 15.3 | % | |

| Financials | 22.9 | % | |

| Health Care | 10.5 | % | |

| Industrials | 8.2 | % | |

| Information Technology | 9.0 | % | |

| Materials | 5.7 | % | |

| Short-Term Investments | 2.2 | % | |

| Telecommunication Services | 3.2 | % | |

| Utilities | 2.9 | % | |

| Total | 100 | % | |

| TEN LARGEST | % of Net | ||

| STOCK HOLDINGS | Assets | ||

| Lowe’s Co.’s, Inc. | 2.6 | % | |

| Pfizer, Inc. | 2.5 | % | |

| Exxon Mobil Corp. | 2.4 | % | |

| MetLife, Inc. | 2.4 | % | |

| Microsoft Corp. | 2.4 | % | |

| Goldman Sachs Group, Inc. | 2.4 | % | |

| Royal Dutch Shell plc (ADR) | 2.4 | % | |

| Tyco International Ltd. | 2.4 | % | |

| Bank of America Corp. | 2.3 | % | |

| PNC Financial Services Group, Inc. | 2.3 | % | |

| Total | 24.1 | % | |

*Investment performance/return at NAV does not reflect the deduction of the Fund’s maximum 4.75% front-end sales charge or any deferred sales charge.

www.calvert.com CALVERT LARGE CAP VALUE FUND ANNUAL REPORT 11

There were some positive signs of growth underlying the economy, however. Automobile sales continued to climb all year due, in part, to looser credit and consumer optimism. Housing, which detracted from economic growth for five years, appears to have bottomed and actually began contributing to growth. This is very important for multiple reasons. When the homeowner’s largest asset--the home--is increasing in value, it creates consumer confidence.

The building of new homes and repairing of older ones also creates jobs and reduces unemployment, which has been intractable. This should also bolster retail sales as consumers have more money to spend. The combination of automobile sales and housing construction/sales might be the answer to lowering the unemployment rate.

Despite signs of slowdown throughout Europe and China, it’s encouraging that monetary authorities worldwide were on the same page with wanting to promote economic growth. The European Central Bank essentially said it will do “whatever it takes” to protect the euro and provide liquidity to the financially stressed nations in the European Union.

Portfolio Strategy

Despite anemic economic growth, the underpinnings of an economic recovery finally seem to be set in place. New stocks added to take advantage of the consumer-led recovery include Lowe’s, Target, DirecTV, and DuPont. Occidental Petroleum was added since energy prices may rise as the Federal Reserve continues its inflationary policy. New holding Norfolk Southern should benefit from a lift in coal prices.

Two more defensive holdings were initiated with a common theme of corporate restructuring. Abbot will be spinning off a division to realize greater value for it on a stand-alone basis and PepsiCo management has been put on notice to focus more on shareholder value.

To fund these new holdings, many names were eliminated. Some were sold as they approached full value, including Spectra Energy, News Corp, Walgreens, Diamond Offshore, Walmart, and Travelers. Others were sold due to weakened fundamentals or other holdings were deemed more attractive.

Performance Detractors

The Fund’s top three detractors were the Telecommunication Services, Materials, and Financials sectors. An overweight to the Telecommunications sector, along with holdings in Frontier and Verizon Communications, detracted from performance, although Frontier Communications was the primary reason for the sector’s underperformance. We exited it as revenue and earnings continued to disappoint. The Fund also lacked exposure to the outperforming wireless telecommunications sub-sector.

Poor stock selection hurt performance in the Materials sector. The fund was overweight Newmont Mining, which was a bottom 10 contributor to returns as management announced lower production guidance for 2012 and higher capital spending to fund its growth. Continued volatility in gold prices also had an impact. Poor stock selection in Chemicals also hurt, as we didn’t own the outperforming LyondellBasell. This was par-

www.calvert.com CALVERT LARGE CAP VALUE FUND ANNUAL REPORT 12

tially offset by a holding in Dow Chemical, which was a top 10 contributor to returns.

An underweight to the outperforming Financials sector with poor stock selection hurt relative performance as well. Bottom 10 contributors included Legg Mason and AllianceBernstein. We also did not have exposure to the outperforming consumer finance sub-sector.

Performance Contributors

The top three contributors to performance were the Energy, Technology, and Consumer Discretionary sectors. Superior stock selection drove outperformance in the Energy sector. The Fund was overweight Marathon Petroleum, Marathon Oil, and Phillips 66 as these refiners benefited from discounted West Texas Intermediate crude prices relative to Brent crude prices, rising exports, and potential for master limited partnerships.

We also benefited from strong sub-sector allocation in the Technology sector due to an overweight to the internet software & services industry with holdings in eBay and Google. We had no exposure to underperforming semiconductors and were underweight computers & peripherals.

Finally, an overweight to the outperforming Consumer Discretionary sector added to returns. Media holdings in CBS, Time Warner, and Gannett outperformed as management continued to find new ways to monetize their content. Among retailers, Target and Lowe’s also outperformed during the time period.

Outlook

The 8.1% unemployment rate and lack of robust consumer spending are keeping the Federal Reserve in stimulus mode. Previously, the Federal Reserve was weighing inflation fears from rising commodity prices versus excess housing and unemployment. Currently, there are positive signs in automobile sales, housing, and consumer confidence to give hope that the much-delayed economic recovery might be beginning to take hold. Additionally, the political calculus is such that if there were ever a time to reduce unemployment and promote economic growth, it would be now.

For that reason, equities are in a much more favorable position than fixed-income securities. The revival of the equity markets and the economy and the rise of interest rates may attract investors back to the stock market, which would finally provide additional and much-needed demand. As equity investors, we plan to remain diversified among sectors, investing with the expectations of returning cost inflation and rising interest rates and remaining fully invested to benefit from a recovery in the domestic economy.

October 2012

www.calvert.com CALVERT LARGE CAP VALUE FUND ANNUAL REPORT 13

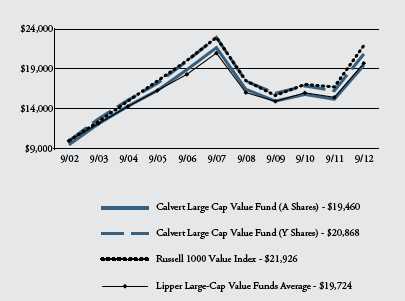

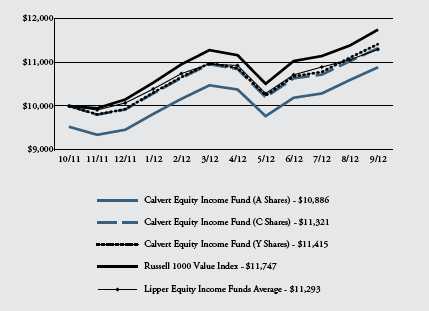

Growth of $10,000

The graph below shows the value of a hypothetical $10,000 investment in the Fund over the past 10 fiscal year periods. The results shown are for Class A and Y shares and reflect the deduction of the maximum front-end Class A sales charge of 4.75%, and assume the reinvestment of dividends. The result is compared with benchmarks that include a broad based market index and a Lipper peer group average. Market indexes are unmanaged and their results do not reflect the effect of expenses or sales charges. The Lipper average reflects the deduction of the category’s average front-end sales charge. The value of an investment in a different share class would be different.

All performance data shown, including the graph above and the adjacent table, represents past performance, does not guarantee future results, assumes reinvestment of dividends and distributions and does not reflect the deduction of taxes that a shareholder would pay on the Fund’s distributions or the redemption of the Fund shares. All performance data reflects fee waivers and/or expense limitations, if any are in effect; in their absence performance would be lower. See Note B in Notes to Financial Statements. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted; for current performance data visit www.calvert.com. The gross expense ratio from the current prospectus for Class A shares is 1.84%. This number may differ from the expense ratio shown elsewhere in this report because it is based on a different time period and, if applicable, does not include fee or expense waivers. Performance data quoted already reflects the deduction of the Fund’s operating expenses.

www.calvert.com CALVERT LARGE CAP VALUE FUND ANNUAL REPORT 14

| CALVERT LARGE CAP | ||

| VALUE FUND | ||

| September 30, 2012 | ||

| AVERAGE ANNUAL TOTAL RETURNS | ||

| Class A Shares* | (with max. load) | |

| One year | 21.85 | % |

| Five year | -3.07 | % |

| Ten year | 6.88 | % |

| Class C Shares | (with max. load) | |

| One year | 25.49 | % |

| Since inception (12/12/2008) | 12.23 | % |

| Class Y Shares* | ||

| One year | 28.23 | % |

| Five year | -1.89 | % |

| Ten year | 7.63 | % |

* Pursuant to an Agreement and Plan of Reorganization, Class A shares and Class I shares of the Everest Fund of Summit Mutual Funds, Inc. were reorganized into the Class A shares and Class Y shares, respectively, of Calvert Large Cap Value Fund, which commenced operations on 12/12/08. Class A shares and Class Y shares of Calvert Large Cap Value Fund each have an inception date of 12/29/99, and Class C shares have an inception date of 12/12/08. The performance results prior to 12/12/08 for Class A shares of Calvert Large Cap Value Fund reflect the performance of Class A of the Everest Fund since its inception on 12/29/99. The performance results prior to 12/12/08 for Class Y shares of Calvert Large Cap Value Fund reflect the performance of Class I of the Everest Fund since its inception on 12/29/99.

As of September 30, 2012, the following companies represented the following percentages of Fund net assets: Lowe’s 2.62%, Target 2.22%, DirecTV 2.28%, DuPont 2.18%, Occidental Petroleum 1.46%, Norfolk Southern 0.90%, Abbott 1.26%, PepsiCo 1.93%, Spectra Energy 0%, News Corp 0%, Walgreens 0%, Diamond Offshore 0%, Walmart 0%, Travelers 0%, Frontier Communications 0%, Verizon Communications 1.02%, Newmont Mining 1.55%, Lyondell Basell 0%, Dow Chemical 2.0%, Legg Mason 0%, AllianceBernstein 0%, Marathon Petroleum 1.85%, Marathon Oil 1.76%, and Phillips 66 1.67%, eBay 1.69%, Google 1.16%, CBS 1.51%, Time Warner 2.21%, and Gannett 0%. Holdings are subject to change.www. calvert.com CALVERT LARGE CAP VALUE FUND ANNUAL REPORT 15

SHAREHOLDER EXPENSE EXAMPLE

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges and redemption fees; and (2) ongoing costs, including management fees; distribution (12b-1) fees; and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

This Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (April 1, 2012 to September 30, 2012).

Actual Expenses

The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare the 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), or redemption fees. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

www.calvert.com CALVERT LARGE CAP VALUE FUND ANNUAL REPORT 16

| BEGINNING | ENDING ACCOUNT | EXPENSES PAID | |

| ACCOUNT VALUE | VALUE | DURING PERIOD* | |

| 4/1/12 | 9/30/12 | 4/1/12 - 9/30/12 | |

| CLASS A | |||

| Actual | $1,000.00 | $1,031.90 | $6.25 |

| Hypothetical | $1,000.00 | $1,018.85 | $6.21 |

| (5% return per | |||

| year before expenses) | |||

| CLASS C | |||

| Actual | $1,000.00 | $1,026.10 | $11.90 |

| Hypothetical | $1,000.00 | $1,013.25 | $11.83 |

| (5% return per | |||

| year before expenses) | |||

| CLASS Y | |||

| Actual | $1,000.00 | $1,033.10 | $4.98 |

| Hypothetical | $1,000.00 | $1,020.10 | $4.95 |

| (5% return per | |||

| year before expenses) | |||

*Expenses are equal to the Fund’s annualized expense ratio of 1.23%, 2.35%, and 0.98% for Class A, Class C, and Class Y, respectively, multiplied by the average account value over the period, multiplied by 183/366 (to reflect the one-half year period).

www.calvert.com CALVERT LARGE CAP VALUE FUND ANNUAL REPORT 17

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Board of Trustees of Calvert SAGE Fund

and Shareholders of Calvert Large Cap Value Fund:

We have audited the accompanying statement of net assets of the Calvert Large Cap Value Fund (the Fund), a series of Calvert SAGE Fund, as of September 30, 2012, and the related statement of operations for the year then ended, the statements of changes in net assets for each of the years in the two-year period then ended, and the financial highlights for each of the years or periods in the four-year period then ended. These financial statements and financial highlights are the responsibility of the Fund’s management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits. The accompanying financial highlights for the period presented through September 30, 2008 were audited by other auditors whose report thereon, dated November 26, 2008, expressed an unqualified opinion on those financial highlights.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of September 30, 2012, by correspondence with the custodian and brokers or by performing other appropriate auditing procedures. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of the Calvert Large Cap Value Fund as of September 30, 2012, the results of its operations for the year then ended, the changes in its net assets for each of the years in the two-year period then ended, and the financial highlights for each of the years or periods in the four-year period then ended, in conformity with U.S. generally accepted accounting principles.

Philadelphia, Pennsylvania

November 29, 2012

www.calvert.com CALVERT LARGE CAP VALUE FUND ANNUAL REPORT 18

| STATEMENT OF NET ASSETS | |||

| SEPTEMBER 30, 2012 | |||

| EQUITY SECURITIES - 97.7% | SHARES | VALUE | |

| Beverages - 1.9% | |||

| PepsiCo, Inc | 23,100 | $ | 1,634,787 |

| Capital Markets - 4.6% | |||

| Goldman Sachs Group, Inc | 17,713 | 2,013,614 | |

| Morgan Stanley | 113,400 | 1,898,316 | |

| 3,911,930 | |||

| Chemicals - 4.2% | |||

| Dow Chemical Co. | 58,700 | 1,699,952 | |

| E.I. du Pont de Nemours & Co | 36,700 | 1,844,909 | |

| 3,544,861 | |||

| Commercial Banks - 5.9% | |||

| PNC Financial Services Group, Inc. | 31,100 | 1,962,410 | |

| US Bancorp | 37,500 | 1,286,250 | |

| Wells Fargo & Co | 51,823 | 1,789,448 | |

| 5,038,108 | |||

| Commercial Services & Supplies - 2.4% | |||

| Tyco International Ltd | 35,725 | 2,009,888 | |

| Communications Equipment - 0.8% | |||

| Cisco Systems, Inc. | 34,960 | 667,386 | |

| Diversified Financial Services - 5.6% | |||

| Bank of America Corp. | 225,192 | 1,988,445 | |

| CME Group, Inc. | 14,500 | 830,850 | |

| JPMorgan Chase & Co. | 47,864 | 1,937,535 | |

| 4,756,830 | |||

| Diversified Telecommunication Services - 3.2% | |||

| AT&T, Inc. | 49,090 | 1,850,693 | |

| Verizon Communications, Inc. | 19,000 | 865,830 | |

| 2,716,523 | |||

| Electric Utilities - 2.9% | |||

| Duke Energy Corp | 25,549 | 1,655,575 | |

| The Southern Co. | 18,200 | 838,838 | |

| 2,494,413 | |||

| Electrical Equipment - 2.0% | |||

| Emerson Electric Co. | 35,228 | 1,700,456 | |

| Electronic Equipment & Instruments - 1.4% | |||

| TE Connectivity Ltd | 35,425 | 1,204,804 | |

| Food & Staples Retailing - 2.1% | |||

| CVS Caremark Corp. | 37,400 | 1,810,908 | |

www.calvert.com CALVERT LARGE CAP VALUE FUND ANNUAL REPORT 19

| EQUITY SECURITIES - cont’d | SHARES | VALUE | |

| Food Products - 1.3% | |||

| Unilever NV, NY Shares | 31,800 | $ | 1,128,264 |

| Health Care Equipment & Supplies - 0.5% | |||

| Covidien plc | 7,225 | 429,309 | |

| Health Care Providers & Services - 1.9% | |||

| WellPoint, Inc | 28,300 | 1,641,683 | |

| Household Durables - 0.7% | |||

| Sony Corp. (ADR) | 47,300 | 553,410 | |

| Household Products - 2.3% | |||

| Procter & Gamble Co | 27,600 | 1,914,336 | |

| Industrial Conglomerates - 2.9% | |||

| 3M Co. | 9,045 | 835,939 | |

| General Electric Co | 71,600 | 1,626,036 | |

| 2,461,975 | |||

| Insurance - 6.8% | |||

| Berkshire Hathaway, Inc., Class B* | 20,700 | 1,825,740 | |

| Hartford Financial Services Group, Inc | 96,000 | 1,866,240 | |

| MetLife, Inc. | 59,400 | 2,046,924 | |

| 5,738,904 | |||

| Internet Software & Services - 2.9% | |||

| eBay, Inc.* | 29,600 | 1,432,936 | |

| Google, Inc.* | 1,300 | 980,850 | |

| 2,413,786 | |||

| IT Services - 1.5% | |||

| International Business Machines Corp. | 6,200 | 1,286,190 | |

| Media - 6.9% | |||

| CBS Corp., Class B | 35,174 | 1,277,872 | |

| Comcast Corp | 21,000 | 751,170 | |

| DIRECTV* | 36,900 | 1,935,774 | |

| Time Warner, Inc. | 41,307 | 1,872,446 | |

| 5,837,262 | |||

| Metals & Mining - 1.5% | |||

| Newmont Mining Corp | 23,400 | 1,310,634 | |

| Multiline Retail - 2.2% | |||

| Target Corp. | 29,600 | 1,878,712 | |

| Oil, Gas & Consumable Fuels - 15.3% | |||

| ConocoPhillips | 26,254 | 1,501,204 | |

| Devon Energy Corp. | 28,300 | 1,712,150 | |

| Exxon Mobil Corp | 22,500 | 2,057,625 | |

| Marathon Oil Corp | 50,400 | 1,490,328 | |

| Marathon Petroleum Corp | 28,800 | 1,572,192 | |

| Occidental Petroleum Corp. | 14,400 | 1,239,264 | |

www.calvert.com CALVERT LARGE CAP VALUE FUND ANNUAL REPORT 20

| EQUITY SECURITIES - cont’d | SHARES | VALUE | ||

| Oil, Gas & Consumable Fuels - Cont’d | ||||

| Phillips 66 Co. | 30,527 | $ | 1,415,537 | |

| Royal Dutch Shell plc (ADR) | 29,000 | 2,012,890 | ||

| 13,001,190 | ||||

| Pharmaceuticals - 8.1% | ||||

| Abbott Laboratories | 15,600 | 1,069,536 | ||

| GlaxoSmithKline plc (ADR) | 25,307 | 1,170,196 | ||

| Johnson & Johnson | 18,165 | 1,251,750 | ||

| Merck & Co., Inc. | 28,000 | 1,262,800 | ||

| Pfizer, Inc. | 84,400 | 2,097,340 | ||

| 6,851,622 | ||||

| Road & Rail - 0.9% | ||||

| Norfolk Southern Corp | 12,000 | 763,560 | ||

| Software - 2.4% | ||||

| Microsoft Corp. | 67,801 | 2,019,114 | ||

| Specialty Retail - 2.6% | ||||

| Lowe’s Co.’s, Inc | 73,400 | 2,219,616 | ||

| Total Equity Securities (Cost $75,958,616) | 82,940,461 | |||

| PRINCIPAL | ||||

| TIME DEPOSIT - 2.2% | AMOUNT | |||

| State Street Bank Time Deposit, 0.113%, 10/1/12 | $ | 1,859,637 | 1,859,637 | |

| Total Time Deposit (Cost $1,859,637) | 1,859,637 | |||

| TOTAL INVESTMENTS (Cost $77,818,253) - 99.9% | 84,800,098 | |||

| Other assets and liabilities, net - 0.1% | 50,298 | |||

| NET ASSETS - 100% | $ | 84,850,396 | ||

See notes to financial statements.

www.calvert.com CALVERT LARGE CAP VALUE FUND ANNUAL REPORT 21

| NET ASSETS CONSIST OF: | |||

| Paid-in capital applicable to the following shares of beneficial interest, | |||

| unlimited number of no par value shares authorized: | |||

| Class A: 388,227 shares outstanding | $ | 19,070,853 | |

| Class C: 35,445 shares outstanding | 1,592,450 | ||

| Class Y: 1,204,952 shares outstanding | 70,367,582 | ||

| Undistributed net investment income | 1,001,753 | ||

| Accumulated net realized gain (loss) | (14,164,087 | ) | |

| Net unrealized appreciation (depreciation) | 6,981,845 | ||

| NET ASSETS | $ | 84,850,396 | |

| NET ASSET VALUE PER SHARE | |||

| Class A (based on net assets of $20,241,857) | $ | 52.14 | |

| Class C (based on net assets of $1,842,634) | $ | 51.99 | |

| Class Y (based on net assets of $62,765,905) | $ | 52.09 | |

* Non-income producing security.

Abbreviations:

ADR: American Depositary Receipt

plc: Public Limited Company

See notes to financial statements.

www.calvert.com CALVERT LARGE CAP VALUE FUND ANNUAL REPORT 22

| STATEMENT OF OPERATIONS | |||

| YEAR ENDED SEPTEMBER 30, 2012 | |||

| NET INVESTMENT INCOME | |||

| Investment Income: | |||

| Dividend income (net of foreign taxes withheld of $22,243) | $ | 2,319,828 | |

| Interest income | 2,345 | ||

| Total investment income | 2,322,173 | ||

| Expenses: | |||

| Investment advisory fee | 544,279 | ||

| Transfer agency fees and expenses | 63,071 | ||

| Distribution Plan expenses: | |||

| Class A | 44,864 | ||

| Class C | 14,180 | ||

| Trustees’ fees and expenses | 170,526 | ||

| Administrative fees | 167,470 | ||

| Accounting fees | 13,336 | ||

| Custodian fees | 21,076 | ||

| Registration fees | 41,429 | ||

| Reports to shareholders | 25,207 | ||

| Professional fees | 73,551 | ||

| Miscellaneous | 10,189 | ||

| Total expenses | 1,189,178 | ||

| Reimbursement from Advisor: | |||

| Class A | (111,543 | ) | |

| Class C | (12,366 | ) | |

| Class Y | (180,335 | ) | |

| Fees paid indirectly | (39 | ) | |

| Net expenses | 884,895 | ||

| NET INVESTMENT INCOME | 1,437,278 | ||

| REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS | |||

| Net realized gain (loss) | (3,015,292 | ) | |

| Change in unrealized appreciation (depreciation) | 21,967,792 | ||

| NET REALIZED AND UNREALIZED GAIN (LOSS) | 18,952,500 | ||

| INCREASE (DECREASE) IN NET ASSETS | |||

| RESULTING FROM OPERATIONS | $ | 20,389,778 | |

See notes to financial statements.

www.calvert.com CALVERT LARGE CAP VALUE FUND ANNUAL REPORT 23

|

STATEMENTS OF CHANGES IN NET ASSETS | |||||

| Year ended | Year ended | ||||

| INCREASE (DECREASE) IN NET ASSETS | September 30, 2012 | September 30, 2011 | |||

| Operations: | |||||

| Net investment income | $ | 1,437,278 | $1,307,645 | ||

| Net realized gain (loss) | (3,015,292 | ) | 2,875,367 | ||

| Change in unrealized appreciation (depreciation) | 21,967,792 | (6,469,880 | ) | ||

| INCREASE (DECREASE) IN NET ASSETS | |||||

| RESULTINGFROM OPERATIONS | 20,389,778 | (2,286,868 | ) | ||

| Distributions to shareholders from: | |||||

| Net investment income: | |||||

| Class A shares | (230,506 | ) | (113,849 | ) | |

| Class C shares | (4,147 | ) | (560 | ) | |

| Class Y shares | (1,194,196 | ) | (1,047,317 | ) | |

| Total distributions | (1,428,849 | ) | (1,161,726 | ) | |

| Capital share transactions: | |||||

| Shares sold: | |||||

| Class A shares | 5,024,123 | 8,965,234 | |||

| Class C shares | 572,018 | 748,656 | |||

| Class Y shares | 3,318,957 | 8,261,748 | |||

| Reinvestment of distributions: | |||||

| Class A shares | 214,744 | 106,009 | |||

| Class C shares | 3,996 | 555 | |||

| Class Y shares | 1,186,496 | 1,045,236 | |||

| Redemption fees: | |||||

| Class A shares | 197 | 549 | |||

| Class Y shares | 965 | — | |||

| Shares redeemed: | |||||

| Class A shares | (4,206,605 | ) | (3,073,014 | ) | |

| Class C shares | (199,578 | ) | (145,679 | ) | |

| Class Y shares | (16,671,682 | ) | (20,230,918 | ) | |

| Total capital share transactions | (10,756,369 | ) | (4,321,624 | ) | |

| TOTAL INCREASE (DECREASE) IN NET ASSETS | 8,204,560 | (7,770,218 | ) | ||

| NET ASSETS | |||||

| Beginning of year | 76,645,836 | 84,416,054 | |||

| End of year (including undistributed net investment | |||||

| income of $1,001,753 and $1,005,353, respectively) | $ | 84,850,396 | $76,645,836 | ||

See notes to financial statements.

www.calvert.com CALVERT LARGE CAP VALUE FUND ANNUAL REPORT 24

|

STATEMENTS OF CHANGES IN NET ASSETS | ||||

| Year ended | Year ended | |||

| CAPITAL SHARE ACTIVITY | September 30, 2012 | September 30, 2011 | ||

| Shares sold: | ||||

| Class A shares | 104,981 | 188,356 | ||

| Class C shares | 11,700 | 16,006 | ||

| Class Y shares | 69,170 | 174,485 | ||

| Reinvestment of distributions: | ||||

| Class A shares | 4,742 | 2,252 | ||

| Class C shares | 88 | 12 | ||

| Class Y shares | 26,273 | 22,229 | ||

| Shares redeemed: | ||||

| Class A shares | (89,320 | ) | (64,884 | ) |

| Class C shares | (4,248 | ) | (3,110 | ) |

| Class Y shares | (347,064 | ) | (424,546 | ) |

| Total capital share activity | (223,678 | ) | (89,200 | ) |

See notes to financial statements.

www.calvert.com CALVERT LARGE CAP VALUE FUND ANNUAL REPORT 25

NOTES TO FINANCIAL STATEMENTS

NOTE A — SIGNIFICANT ACCOUNTING POLICIES

General: The Calvert Large Cap Value Fund (the “Fund”), a series of the Calvert SAGE Fund, is registered under the Investment Company Act of 1940 as a diversified, open-end management investment company. The Calvert SAGE Fund is comprised of two series. The operations of each series are accounted for separately. The Fund offers three separate classes of shares - Classes A, C, and Y. Class A shares are sold with a maximum front-end sales charge of 4.75%. Class C shares are sold without a front-end sales charge and, with certain exceptions, will be charged a deferred sales charge on shares sold within one year of purchase. Class C shares have higher levels of expenses than Class A shares. Class Y shares are generally only available to wrap or similar fee-based programs offered by financial intermediaries that have entered into an agreement with the Fund’s Distributor to offer Class Y shares. Class Y shares have no front-end or deferred sales charge and have lower levels of expenses than Class A shares. Each class has different: (a) dividend rates, due to differences in Distribution Plan expenses and other class specific expenses, (b) exchange privileges and (c) class specific voting rights.

Security Valuation: Net asset value per share is determined every business day as of the close of the regular session of the New York Stock Exchange (generally 4:00 p.m. Eastern time). The Fund uses independent pricing services approved by the Board of Trustees (“the Board”) to value its investments wherever possible. Investments for which market quotations are not available or deemed not reliable are fair valued in good faith under the direction of the Board.

The Board has adopted Valuation Procedures (the “Procedures”) to determine the fair value of securities and other financial instruments for which market prices are not readily available or which may not be reliably priced. The Board has delegated the day-to-day responsibility for determining the fair value of assets of the Fund to Calvert Investment Management, Inc. (the “Advisor” or “Calvert”) and has provided these Procedures to govern Calvert in its valuation duties.

Calvert has chartered an internal Valuation Committee to oversee the implementation of these Procedures and to assist it in carrying out the valuation responsibilities that the Board has delegated.

The Valuation Committee meets on a regular basis to review illiquid securities and other investments which may not have readily available market prices. The Valuation Committee’s fair valuation determinations are subject to review, approval and ratification by the Board at its next regularly scheduled meeting covering the calendar quarter in which the fair valuation was determined.

The Valuation Committee utilizes various methods to measure the fair value of the Fund’s investments. Generally Accepted Accounting Principles (GAAP) establishes a disclosure hierarchy that categorizes the inputs to valuation techniques used to value assets and liabilities at measurement date. These inputs are summarized in the three broad lev-

www.calvert.com CALVERT LARGE CAP VALUE FUND ANNUAL REPORT 26

els listed below:

Level 1 – quoted prices in active markets for identical securities

Level 2 – other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.)

Level 3 – significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments)

The inputs or methodologies used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

Changes in valuation techniques may result in transfers in or out of an investment’s assigned level within the hierarchy during the period. Valuation techniques used to value the Fund’s investments by major category are as follows: Equity securities, including restricted securities, for which market quotations are readily available, are valued at the last reported sale price or official closing price as reported by an independent pricing service on the primary market or exchange on which they are traded and are categorized as Level 1 in the hierarchy. In the event that there were no sales during the day or closing prices are not available, securities are valued at the last quoted bid price or using the last available price and are categorized as Level 2 in the hierarchy. Foreign securities are valued based on quotations from the principal market in which such securities are normally traded. If events occur after the close of the principal market in which foreign securities are traded, and before the close of business of the Fund, that are expected to materially affect the value of those securities, then they are valued at their fair value taking these events into account. For restricted securities and private placements where observable inputs are limited, assumptions about market activity and risk are used and such securities are categorized as Level 3 in the hierarchy.

Short-term securities of sufficient credit quality with remaining maturities of sixty days or less for which quotations are not readily available are valued at amortized cost, which approximates fair value, and are categorized as Level 2 in the hierarchy.

If a market value cannot be determined for a security using the methodologies described above, or if, in the good faith opinion of the Advisor, the market value does not constitute a readily available market quotation, or if a significant event has occurred that would materially affect the value of the security, the security will be fair valued as determined in good faith by the Valuation Committee.

The Valuation Committee considers a number of factors, including significant unobservable valuation inputs when arriving at fair value. It considers all significant facts that are reasonably available and relevant to the determination of fair value.

The Valuation Committee primarily employs a market-based approach which may use related or comparable assets or liabilities, recent transactions, market multiples, book values, and other relevant information for the investment to determine the fair value of the investment. When more appropriate, the fund may employ an income-based or cost approach. An income-based valuation approach discounts anticipated future cash flows of the investment to calculate a present amount (discounted). The measurement is

www.calvert.com CALVERT LARGE CAP VALUE FUND ANNUAL REPORT 27

based on the value indicated by current market expectations about those future amounts. Discounts may also be applied due to the nature or duration of any restrictions on the disposition of the investments. A cost based approach is based on the amount that currently would be required to replace the service capacity of an asset (current replacement cost). From the seller’s perspective, the price that would be received for the asset is determined based on the cost to a buyer to acquire or construct a substitute asset of comparable utility, adjusted for obsolescence.

The values assigned to fair value investments are based on available information and do not necessarily represent amounts that might ultimately be realized. Further, due to the inherent uncertainty of valuations of such investments, the fair values may differ significantly from the values that would have been used had an active market existed, and the differences could be material. The Valuation Committee employs various methods for calibrating these valuation approaches including a regular review of key inputs and assumptions, transactional back-testing or disposition analysis and reviews of any related market activity.

At September 30, 2012, no securities were fair valued in good faith under the direction of the Board.

The following is a summary of the inputs used to value the Fund’s net assets as of September 30, 2012:

| VALUATION INPUTS | ||||

| INVESTMENTS IN SECURITIES | Level 1 | Level 2 | Level 3 | Total |

| Equity securities* | $82,940,461 | - | - | $82,940,461 |

| Other debt obligations | - | $1,859,637 | - | 1,859,637 |

| TOTAL | $82,940,461 | $1,859,637 | - | $84,800,098 |

* For further breakdown of equity securities by industry type, please refer to the Statement of Net Assets.

Security Transactions and Net Investment Income: Security transactions are accounted for on trade date. Realized gains and losses are recorded on an identified cost basis and may include proceeds from litigation. Dividend income is recorded on the ex-dividend date, or in the case of dividends on certain foreign securities, as soon as the Fund is informed of the ex-dividend date. Withholding taxes on foreign dividends have been provided for in accordance with the Fund’s understanding of the applicable country’s tax rules and rates. Distributions received on securities that represent a return of capital or capital gain are recorded as a reduction of cost of investments and/or as a realized gain. Interest income, which includes amortization of premium and accretion of discount on debt securities, is accrued as earned. Investment income and realized and unrealized gains and losses are allocated to separate classes of shares based upon the relative net assets of each class. Expenses arising in connection with a specific class are charged directly to that class. Expenses common to the classes are allocated to each class in proportion to their relative net assets.

Foreign Currency Transactions: The Fund’s accounting records are maintained in U.S. dollars. For valuation of assets and liabilities on each date of net asset value determina-

www.calvert.com CALVERT LARGE CAP VALUE FUND ANNUAL REPORT 28

tion, foreign denominations are converted into U.S. dollars using the current exchange rate. Security transactions, income and expenses are translated at the prevailing rate of exchange on the date of the event. The effect of changes in foreign exchange rates on securities and foreign currencies is included in the net realized and unrealized gain or loss on investments.

Distributions to Shareholders: Distributions to shareholders are recorded by the Fund on ex-dividend date. Dividends from net investment income and distributions from net realized capital gains, if any, are paid at least annually. Distributions are determined in accordance with income tax regulations which may differ from generally accepted accounting principles; accordingly, periodic reclassifications are made within the Fund’s capital accounts to reflect income and gains available for distribution under income tax regulations.

Estimates: The preparation of the financial statements in conformity with accounting principles generally accepted in the United States requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of income and expenses during the reported period. Actual results could differ from those estimates.

Redemption Fees: The Fund charges a 2% redemption fee on redemptions, including exchanges, made within 30 days of purchase in the same Fund. The redemption fee is accounted for as an addition to paid-in capital and is intended to discourage market-timers by ensuring that short-term trading costs are borne by the investors making the transactions and not the shareholders already in the Fund.

Expense Offset Arrangements: The Fund has an arrangement with its custodian bank whereby the custodian’s fees may be paid indirectly by credits earned on the Fund’s cash on deposit with the bank. These credits are used to reduce the Fund’s expenses. Such a deposit arrangement may be an alternative to overnight investments.

Federal Income Taxes: No provision for federal income or excise tax is required since the Fund intends to continue to qualify as a regulated investment company under the Internal Revenue Code and to distribute substantially all of its taxable earnings.

Management has analyzed the Fund’s tax positions taken for all open federal income tax years and has concluded that no provision for federal income tax is required in the Fund’s financial statements. A Fund’s federal tax return is subject to examination by the Internal Revenue Service for a period of three years.

NOTE B — RELATED PARTY TRANSACTIONS

Calvert Investment Management, Inc. (the “Advisor”) is wholly-owned by Calvert Investments, Inc., which is indirectly wholly-owned by Ameritas Mutual Holding Company (formerly known as UNIFI Mutual Holding Company). The Advisor provides investment advisory services and pays the salaries and fees of officers and Trustees of the Fund who are employees of the Advisor or its affiliates. For its services, the Advisor receives an annual fee, payable monthly of .65% of the Fund’s average daily net assets. Under the terms of the agreement, $45,234 was payable at year end. In addition,

www.calvert.com CALVERT LARGE CAP VALUE FUND ANNUAL REPORT 29

$36,520 was payable at year end for operating expenses paid by the Advisor during September 2012.

The Advisor has contractually agreed to limit net annual fund operating expenses through January 31, 2013. The contractual expense cap is 1.23%, 2.35%, and .98% for Class A, C, and Y, respectively. For the purpose of this expense limit, operating expenses do not include interest expense, brokerage commissions, taxes, and extraordinary expenses. To the extent any expense offset credits are earned, the Advisor’s obligation under the contractual limitation may be reduced and the Advisor may benefit from the expense offset arrangement.

Calvert Investment Administrative Services, Inc., an affiliate of the Advisor, provides administrative services to the Fund for an annual fee, payable monthly, of .20% for Class A, C, and Y based on their average daily net assets. Under the terms of the agreement, $13,918 was payable at year end.

Calvert Investment Distributors, Inc. (“CID”), an affiliate of the Advisor, is the distributor and principal underwriter for the Fund. Pursuant to Rule 12b-1 under the Investment Company Act of 1940, the Fund has adopted Distribution Plans that permit the Fund to pay certain expenses associated with the distribution and servicing of its shares. The expenses paid may not exceed .50% and 1.00% annually of average daily net assets of Class A and C, respectively. The amount actually paid by the Fund is an annualized fee, payable monthly of .25% and 1.00% of the Fund’s average daily net assets of Class A and C, respectively. Class Y shares do not have Distribution Plan expenses. Under the terms of the agreement, $5,614 was payable at year end.

CID received $24,496 as its portion of commissions charged on sales of the Fund’s Class A shares for the year ended September 30, 2012.

Calvert Investment Services, Inc. (“CIS”), is the shareholder servicing agent for the Fund. For its services, CIS received a fee of $12,297 for the year ended September 30, 2012. Under the terms of the agreement, $915 was payable at year end. Boston Financial Data Services, Inc. is the transfer and dividend disbursing agent.

Each Trustee of the Fund who is not an employee of the Advisor or its affiliates receives a fee of $1,500 for each Board and Committee meeting attended plus an annual fee of $14,000. Committee chairs each receive an additional $2,500 annual retainer.

NOTE C — INVESTMENT ACTIVITY AND TAX INFORMATION

During the year, the cost of purchases and proceeds from sales of investments, other than short-term securities, were $30,111,308 and $40,362,411, respectively.

| CAPITAL LOSS CARRYFORWARDS | |

| EXPIRATION DATE | |

| 30-Sep-18 | ($10,275,871) |

www.calvert.com CALVERT LARGE CAP VALUE FUND ANNUAL REPORT 30

Under the Regulated Investment Company Modernization Act of 2010, capital losses incurred in taxable years beginning after December 22, 2010 can be carried forward for an unlimited period. These losses are required to be utilized prior to the losses incurred in pre-enactment taxable years. Losses incurred in pre-enactment taxable years can be utilized until expiration.

The Fund intends to elect to defer net capital losses of $3,647,102 incurred from November 1, 2011 through September 30, 2012 and treat them as arising in the fiscal year ending September 30, 2013.

The tax character of dividends and distributions paid during the years ended September 30, 2012 and September 30, 2011 was as follows:

| Distributions paid from: | 2012 | 2011 |

| Ordinary income | $1,428,849 | $1,161,726 |

| Total | $1,428,849 | $1,161,726 |

As of September 30, 2012, the tax basis components of distributable earnings/(accumulated losses) and the federal tax cost were as follows:

| Unrealized appreciation | $12,509,100 | |

| Unrealized (depreciation) | (5,768,369 | ) |

| Net unrealized appreciation/(depreciation) | $6,740,731 | |

| Undistributed ordinary income | $1,001,753 | |

| Capital loss carryforward | ($10,275,871 | ) |

| Federal income tax cost of investments | $78,059,367 | |

The differences between the components of distributable earnings on a tax basis and the amounts reflected in the statement of net assets are primarily due to temporary book-tax differences that will reverse in a subsequent period. These differences are due to wash sales and deferral of post October losses.

Reclassifications, as shown in the table below, have been made to the Fund’s components of net assets to reflect income and gains available for distribution (or available capital loss carryovers, as applicable) under income tax law and regulations. These reclassifications are due to permanent book-tax differences and have no impact on net assets. The primary permanent differences causing such reclassifications for the Fund are due to investments in partnerships.

www.calvert.com CALVERT LARGE CAP VALUE FUND ANNUAL REPORT 31

| Undistributed net investment income | ($12,029 | ) |

| Accumulated net realized gain (loss) | 28,291 | |

| Paid-in capital | (16,262 | ) |

NOTE D — LINE OF CREDIT

A financing agreement is in place with the Calvert Funds and State Street Corporation (“SSC”). Under the agreement, SSC provides an unsecured line of credit facility, in the aggregate amount of $50 million ($25 million committed and $25 million uncommitted), accessible by the Funds for temporary or emergency purposes only. Borrowings under this committed facility bear interest at the higher of the London Interbank Offered Rate (LIBOR) or the overnight Federal Funds Rate plus 1.25% per annum. A commitment fee of .11% per annum is incurred on the unused portion of the committed facility, which is allocated to all participating funds. The Fund had no borrowings under the agreement during the year ended September 30, 2012.

NOTE E – SUBSEQUENT EVENTS

In preparing the financial statements as of September 30, 2012, no subsequent events or transactions occurred that would have required recognition or disclosure in these financial statements.

www.calvert.com CALVERT LARGE CAP VALUE FUND ANNUAL REPORT 32

| FINANCIAL HIGHLIGHTS | ||||||

| YEARS ENDED | ||||||

| September 30, | September 30, | September 30, | ||||

| CLASS A SHARES | 2012 | 2011 | (z) | 2010 | (z) | |

| Net asset value, beginning | $41.36 | $43.38 | $41.51 | |||

| Income from investment operations: | ||||||

| Net investment income | .76 | .61 | .53 | |||

| Net realized and unrealized gain (loss) | 10.69 | (2.20 | ) | 1.75 | ||

| Total from investment operations | 11.45 | (1.59 | ) | 2.28 | ||

| Distributions from: | ||||||

| Net investment income | (.67 | ) | (.43 | ) | (.41 | ) |

| Total distributions | (.67 | ) | (.43 | ) | (.41 | ) |

| Total increase (decrease) in net asset value | 10.78 | (2.02 | ) | 1.87 | ||

| Net asset value, ending | $52.14 | $41.36 | $43.38 | |||

| Total return* | 27.92 | % | (3.78 | %) | 5.50 | % |

| Ratios to average net assets: A | ||||||

| Net investment income | 1.53 | % | 1.30 | % | 1.23 | % |

| Total expenses | 1.85 | % | 1.84 | % | 1.99 | % |

| Expenses before offsets | 1.23 | % | 1.23 | % | 1.23 | % |

| Net expenses | 1.23 | % | 1.23 | % | 1.23 | % |

| Portfolio turnover | 37 | % | 25 | % | 30 | % |

| Net assets, ending (in thousands) | $20,242 | $15,213 | $10,502 | |||

| YEARS ENDED | ||||||

| September 30, | September30, | |||||

| CLASS A SHARES | 2009 | (z) | 2008 | |||

| Net asset value, beginning | $46.85 | $67.86 | ||||

| Income from investment operations: | ||||||

| Net investment income | .68 | 1.03 | ||||

| Net realized and unrealized gain (loss) | (5.08 | ) | (16.17 | ) | ||

| Total from investment operations | (4.40 | ) | (15.14 | ) | ||

| Distributions from: | ||||||

| Net investment income | (.93 | ) | (.84 | ) | ||

| Net realized gain | (.01 | ) | (5.03 | ) | ||

| Total distributions | (.94 | ) | (5.87 | ) | ||

| Total increase (decrease) in net asset value | (5.34 | ) | (21.01 | ) | ||

| Net asset value, ending | $41.51 | $46.85 | ||||

| Total return* | (8.91 | %) | (24.05 | %) | ||

| Ratios to average net assets: A | ||||||

| Net investment income | 1.97 | % | 1.55 | % | ||

| Total expenses | 2.18 | % | 1.15 | % | ||

| Expenses before offsets | 1.23 | % | 1.15 | % | ||

| Net expenses | 1.23 | % | 1.15 | % | ||

| Portfolio turnover | 31 | % | 37 | % | ||

| Net assets, ending (in thousands) | $5,701 | $4,554 | ||||

See notes to financial highlights.

www.calvert.com CALVERT LARGE CAP VALUE FUND ANNUAL REPORT 33

| FINANCIAL HIGHLIGHTS | ||||

| YEARS ENDED | ||||

| September 30, | September 30, | |||

| CLASS C SHARES | 2012 | 2011 | (z) | |

| Net asset value, beginning | $41.24 | $43.37 | ||

| Income from investment operations: | ||||

| Net investment income | .18 | .08 | ||

| Net realized and unrealized gain (loss) | 10.72 | (2.18 | ) | |

| Total from investment operations | 10.90 | (2.10 | ) | |

| Distributions from: | ||||

| Net investment income | (.15 | ) | (.03 | ) |

| Total distributions | (.15 | ) | (.03 | ) |

| Total increase (decrease) in net asset value | 10.75 | (2.13 | ) | |

| Net asset value, ending | $51.99 | $41.24 | ||

| Total return* | 26.49 | % | (4.85 | %) |

| Ratios to average net assets: A | ||||

| Net investment income | .39 | % | .18 | % |

| Total expenses | 3.22 | % | 3.52 | % |

| Expenses before offsets | 2.35 | % | 2.35 | % |

| Net expenses | 2.35 | % | 2.35 | % |

| Portfolio turnover | 37 | % | 25 | % |

| Net assets, ending (in thousands) | $1,843 | $1,151 | ||

| PERIODS ENDED | ||||

| September 30, | September 30, | |||

| CLASS C SHARES | 2010 | (z) | 2009 | (z)# |

| Net asset value, beginning | $41.61 | $33.72 | ||

| Income from investment operations: | ||||

| Net investment income | .06 | .15 | ||

| Net realized and unrealized gain (loss) | 1.78 | 7.74 | ||

| Total from investment operations | 1.84 | 7.89 | ||

| Distributions from: | ||||

| Net investment income | (.08 | ) | ** | |

| Total distributions | (.08 | ) | ** | |

| Total increase (decrease) in net asset value | 1.76 | 7.89 | ||

| Net asset value, ending | $43.37 | $41.61 | ||

| Total return* | 4.41 | % | 23.41 | % |

| Ratios to average net assets: A | ||||

| Net investment income | .14 | % | .58 | % (a) |

| Total expenses | 5.09 | % | 19.77 | % (a) |

| Expenses before offsets | 2.35 | % | 2.35 | % (a) |

| Net expenses | 2.35 | % | 2.35 | % (a) |

| Portfolio turnover | 30 | % | 20 | % |

| Net assets, ending (in thousands) | $650 | $182 | ||

See notes to financial highlights.

www.calvert.com CALVERT LARGE CAP VALUE FUND ANNUAL REPORT 34

| FINANCIAL HIGHLIGHTS | ||||||

| YEARS ENDED | ||||||

| September 30, | September 30, | September 30, | ||||

| CLASS Y SHARES | 2012 | 2011 | (z) | 2010 | (z) | |

| Net asset value, beginning | $41.39 | $43.50 | $41.85 | |||

| Income from investment operations: | ||||||

| Net investment income | .94 | .71 | .65 | |||

| Net realized and unrealized gain (loss) | 10.61 | (2.18 | ) | 1.76 | ||

| Total from investment operations | 11.55 | (1.47 | ) | 2.41 | ||

| Distributions from: | ||||||

| Net investment income | (.85 | ) | (.64 | ) | (.76 | ) |

| Total distributions | (.85 | ) | (.64 | ) | (.76 | ) |

| Total increase (decrease) in net asset value | 10.70 | (2.11 | ) | 1.65 | ||

| Net asset value, ending | $52.09 | $41.39 | $43.50 | |||

| Total return* | 28.23 | % | (3.55 | %) | 5.77 | % |

| Ratios to average net assets: A | ||||||

| Net investment income | 1.80 | % | 1.52 | % | 1.52 | % |

| Total expenses | 1.26 | % | 1.20 | % | 1.17 | % |

| Expenses before offsets | .98 | % | .98 | % | .98 | % |

| Net expenses | .98 | % | .98 | % | .98 | % |

| Portfolio turnover | 37 | % | 25 | % | 30 | % |

| Net assets, ending (in thousands) | $62,766 | $60,282 | $73,263 | |||

| YEARS ENDED | ||||||

| September 30, | September 30, | |||||

| CLASS Y SHARES | 2009 | (z) | 2008 | |||

| Net asset value, beginning | $47.32 | $68.56 | ||||

| Income from investment operations: | ||||||

| Net investment income | .81 | 1.05 | ||||

| Net realized and unrealized gain (loss) | (5.18 | ) | (16.22 | ) | ||

| Total from investment operations | (4.37 | ) | (15.17 | ) | ||

| Distributions from: | ||||||

| Net investment income | (1.09 | ) | (1.04 | ) | ||

| Net realized gain | (.01 | ) | (5.03 | ) | ||

| Total distributions | (1.10 | ) | (6.07 | ) | ||

| Total increase (decrease) in net asset value | (5.47 | ) | 21.24 | |||

| Net asset value, ending | $41.85 | $47.32 | ||||

| Total return* | (8.70 | %) | (23.89 | %) | ||

| Ratios to average net assets: A | ||||||

| Net investment income | 2.32 | % | 1.80 | % | ||

| Total expenses | 1.27 | % | .90 | % | ||

| Expenses before offsets | .98 | % | .90 | % | ||

| Net expenses | .98 | % | .90 | % | ||

| Portfolio turnover | 31 | % | 37 | % | ||

| Net assets, ending (in thousands) | $73,369 | $82,922 | ||||

See notes to financial highlights.

www.calvert.com CALVERT LARGE CAP VALUE FUND ANNUAL REPORT 35

A Total expenses do not reflect amounts reimbursed and/or waived by the Advisor or reductions from expense offset arrangements. Expenses before offsets reflect expenses after reimbursement and/or waiver by the Advisor but prior to reductions from expense offset arrangements. Net expenses are net of all reductions and represent the net expenses paid by the Fund.

# From December 12, 2008 inception.

* Total return is not annualized for periods less than one year and does not reflect deduction of any front-end or deferred sales charge.

** Distribution was less than $.01 per share.

(a) Annualized.

(z) Per share figures are calculated using the Average Shares Method.

See notes to financial statements.

www.calvert.com CALVERT LARGE CAP VALUE FUND ANNUAL REPORT 36

EXPLANATION OF FINANCIAL TABLES

SCHEDULE OF INVESTMENTS

The Schedule of Investments is a snapshot of all securities held in the fund at their market value, on the last day of the reporting period. Securities are listed by asset type (e.g., common stock, corporate bonds, U.S. government obligations) and may be further broken down into sub-groups and by industry classification.

STATEMENT OF ASSETS AND LIABILITIES

The Statement of Assets and Liabilities is often referred to as the fund’s balance sheet. It lists the value of what the fund owns, is due and owes on the last day of the reporting period. The fund’s assets include the market value of securities owned, cash, receivables for securities sold and shareholder subscriptions, and receivables for dividends and interest payments that have been earned, but not yet received. The fund’s liabilities include payables for securities purchased and shareholder redemptions, and expenses owed but not yet paid. The statement also reports the fund’s net asset value (NAV) per share on the last day of the reporting period. The NAV is calculated by dividing the fund’s net assets (assets minus liabilities) by the number of shares outstanding. This statement is accompanied by a Schedule of Investments. Alternatively, if certain conditions are met, a Statement of Net Assets may be presented in lieu of this statement and the Schedule of Investments.

STATEMENT OF NET ASSETS

The Statement of Net Assets provides a detailed list of the fund’s holdings, including each security’s market value on the last day of the reporting period. The Statement of Net Assets includes a Schedule of Investments. Other assets are added and other liabilities subtracted from the investments total to calculate the fund’s net assets. Finally, net assets are divided by the outstanding shares of the fund to arrive at its share price, or Net Asset Value (NAV) per share.

At the end of the Statement of Net Assets is a table displaying the composition of the fund’s net assets. Paid in Capital is the money invested by shareholders and represents the bulk of net assets. Undistributed Net Investment Income and Accumulated Net Realized Gains usually approximate the amounts the fund had available to distribute to shareholders as of the statement date. Accumulated Realized Losses will appear as negative balances. Unrealized Appreciation (Depreciation) is the difference between the market value of the fund’s investments and their cost, and reflects the gains (losses) that would be realized if the fund were to sell all of its investments at their statement-date values.

STATEMENT OF OPERATIONS

The Statement of Operations summarizes the fund’s investment income earned and expenses incurred in operating the fund. Investment income includes dividends earned from stocks and interest earned from interest-bearing securities in the fund. Expenses

www.calvert.com CALVERT LARGE CAP VALUE FUND ANNUAL REPORT (UNAUDITED) 37