Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

| x | Annual Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the fiscal year ended December 31, 2012

OR

| ¨ | Transition Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the transition period from to

Commission File Number 001-34108

DIGIMARC CORPORATION

(Exact name of registrant as specified in its charter)

| Oregon | 26-2828185 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

9405 SW Gemini Drive, Beaverton, Oregon 97008

(Address of principal executive offices) (Zip Code)

(503) 469-4800

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class |

Name of Each Exchange on Which Registered | |

| Common Stock, $0.001 Par Value Per Share | The NASDAQ Stock Market LLC |

Securities registered pursuant to Section 12(g) of the Act: NONE

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer |

¨ | Accelerated filer | x | |||||

| Non-accelerated filer |

¨ | (Do not check if a smaller reporting company) | Smaller reporting company | ¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

The aggregate market value of common stock, par value $0.001 per share, held by non-affiliates of the registrant, based on the closing price of our common stock on The Nasdaq Global Market on the last business day of the registrant’s most recently completed fiscal second quarter (June 29, 2012), was approximately $174 million. Shares of common stock beneficially held by each officer and director have been excluded from this computation because these persons may be deemed to be affiliates. This determination of affiliate status is not necessarily a conclusive determination for any other purposes.

As of February 15, 2013, 7,281,983 shares of the registrant’s common stock were outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s proxy statement pursuant to Regulation 14A (the “Proxy Statement”) for its 2013 annual meeting of shareholders are incorporated by reference into Items 10, 11, 12, 13 and 14 of Part III of this Annual Report on Form 10-K. The registrant intends to file the Proxy Statement not later than 120 days after the end of the fiscal year covered by this Annual Report on Form 10-K.

Table of Contents

| Item 1. |

1 | |||||

| Item 1A. |

7 | |||||

| Item 1B. |

18 | |||||

| Item 2. |

18 | |||||

| Item 3. |

18 | |||||

| Item 4. |

18 | |||||

| Item 5. |

19 | |||||

| Item 6. |

22 | |||||

| Item 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

25 | ||||

| Item 7A. |

47 | |||||

| Item 8. |

47 | |||||

| Item 9. |

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

47 | ||||

| Item 9A. |

48 | |||||

| Item 9B. |

50 | |||||

| Item 10. |

51 | |||||

| Item 11. |

51 | |||||

| Item 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

51 | ||||

| Item 13. |

Certain Relationships and Related Transactions, and Director Independence |

51 | ||||

| Item 14. |

51 | |||||

| Item 15. |

52 | |||||

| 53 | ||||||

| E-1 | ||||||

Table of Contents

Unless the context otherwise requires, references in this Annual Report on Form 10-K to (i) “Digimarc,” “we,” “our” and “us” refer to Digimarc Corporation and (ii) “Old Digimarc” refers to the former Digimarc Corporation, which merged with and into a wholly owned subsidiary of L-1 Identity Solutions, Inc. (“L-1”) on August 13, 2008, and its consolidated subsidiaries (other than us).

All dollar amounts are in thousands, unless otherwise noted.

Digimarc Discover is a registered trademark of Digimarc Corporation. This Annual Report on Form 10-K also includes trademarks and trade names owned by other parties, and all other such trademarks and trade names mentioned in this Annual Report on Form 10-K are the property of their respective owners.

| ITEM 1: BUSINESS |

The following discussion of Digimarc’s business contains forward-looking statements relating to future events or the future financial performance of Digimarc. Our actual results could differ materially from those anticipated in these forward-looking statements. Please see the discussion regarding forward-looking statements included in this Annual Report on Form 10-K in Item 7, Management’s Discussion and Analysis of Financial Condition and Results of Operations, under the caption “Forward-Looking Statements.”

The following discussion of our business should be read in conjunction with our consolidated financial statements and the related notes and other financial information appearing elsewhere in this Annual Report on Form 10-K.

Overview

Until August 1, 2008, we were a wholly owned subsidiary of DMRC LLC, a wholly owned subsidiary of Old Digimarc to which Old Digimarc contributed all of the assets and liabilities related to its digital watermarking business (the “Digital Watermarking Business”), together with all of Old Digimarc’s cash, including cash received upon the exercise of stock options. On August 1, 2008 Old Digimarc spun off DMRC LLC. Following the spin-off, DMRC LLC merged with and into DMRC Corporation, and each limited liability company interest of DMRC LLC was converted into one share of common stock of DMRC Corporation. After completion of the acquisition of Old Digimarc by L-1, DMRC Corporation changed its name to Digimarc Corporation. On October 16, 2008, each Old Digimarc record holder received one share of Digimarc common stock for every three and one-half shares of Old Digimarc common stock held by the shareholder as of the spin-off record date, and we became an independent, publicly-traded company owning and operating the Digital Watermarking Business. On April 30, 2010, following our Annual Meeting and approval by our shareholders, we changed our state of incorporation from Delaware to Oregon by means of a merger into a newly formed, wholly owned Oregon subsidiary.

Digimarc Corporation enables governments and enterprises around the world to give digital identities to media and objects that computers can sense and recognize and to which they can react. Our technology provides the means to infuse persistent digital information, perceptible only to computers and digital devices, into all forms of media content. The unique digital identifier placed in media generally persists with it regardless of the distribution path and whether it is copied, manipulated or converted to a different format, and does not affect the quality of the content or the enjoyment or other traditional uses of it. Our technology permits computers and digital devices to quickly identify relevant data from vast amounts of media content.

Our technologies, and those of our licensees, span a range of media content, enabling our customers and those of our partners to:

| • | Quickly and reliably identify and effectively manage music, movies, television programming, digital images, e-books, documents and other printed materials, especially in light of new non-linear distribution over the internet; |

1

Table of Contents

| • | Deter counterfeiting of money, media and goods, and piracy of e-books, movies and music; |

| • | Support new digital media distribution models and methods to monetize media content; |

| • | Leverage the power of ubiquitous computing to instantly link consumers to a wealth of information and/or interactive experiences related to the media and objects they encounter each day; |

| • | Provide consumers with more choice and access to media content when, where and how they want it; |

| • | Enhance imagery and video by associating metadata or authenticating media content for government and commercial uses; and |

| • | Better secure identity documents to enhance national security and combat identity theft and fraud. |

At the core of our intellectual property is a signal processing innovation known as “digital watermarking,” which allows imperceptible digital information to be embedded in all forms of digitally designed, produced or distributed media content and some physical objects, including photographs, movies, music, television, personal identification documents, financial instruments, industrial parts and product packages. The digital information can be detected and read by a wide range of computers, mobile phones and other digital devices.

Digital watermarking allows our customers to embed digital data into any media content that is digitally processed at some point during its lifecycle. The technology can be applied to printed materials, video, audio, and images. The inclusion of these digital signals enables a wide range of improvements in security and media management, and new business models for distribution and consumption of media content. Over the years our technology and intellectual property portfolios have grown to encompass many related technologies.

We provide solutions directly and through our licensees. Our proprietary technology has proven to be a powerful element of document security, giving rise to our long-term relationship with a consortium of central banks, which we refer to as the Central Banks, and many leading companies in the information technology industry. We and our licensees have successfully propagated digital watermarking in music, movies, television broadcasts, images and printed materials. Digital watermarks have been used in these applications to improve media rights and asset management, reduce piracy and counterfeiting losses, improve marketing programs, permit more efficient and effective distribution of valuable media content and enhance consumer entertainment and commercial experiences. Banknote counterfeit deterrence was the first commercially successful use of our technologies in a large scale system. More recently, innovations based on our existing digital watermarking technology and experience have been leveraged to create new products to deter counterfeiting and tampering of driver licenses and other government-issued secure credentials. In parallel, our business partners, under patent or technology licenses from us, are delivering digital watermarking solutions to track and monitor the distribution of music, images, television and movies to consumers. In November of 2007, we announced a relationship with The Nielsen Company (US) LLC, or Nielsen, to license our patents in support of Nielsen’s industry leading television audience measurement.

On July 1, 2009, we commenced operation of two joint ventures with Nielsen. In connection with these joint ventures, we terminated our 2007 agreement with Nielsen, and entered into the joint venture agreements and a new patent license agreement. In March 2012, Digimarc and Nielsen decided to reduce the investments in their two joint ventures to minimal levels while assessing alternative approaches to achieving each of their goals in the emerging market opportunity of synchronized second screen television.

On October 5, 2010, we entered into a patent licensing arrangement with IV Digital Multimedia Inventions, LLC, a Delaware limited liability company affiliated with Intellectual Ventures (“IV”), pursuant to which we granted an exclusive license to sublicense, subject to pre-existing encumbrances and a grant-back license, an aggregate of approximately 900 of the 1,200 patents and applications held by us noted below in the section titled “Technology and Intellectual Property.”

2

Table of Contents

Our business has further expanded in e-commerce with our recent acquisition of Attributor Corporation (“Attributor”) the global leader in protecting e-books from online piracy. On December 3, 2012, we acquired Attributor, for a purchase price of $5,600 in cash, subject to certain adjustments, and an additional $900 if certain performance objectives are met. Attributor’s Guardian software and services protect book revenue and authors’ rights by finding, reporting on, and assisting in removing pirated content found on the Internet. Online book piracy is a growing and global problem, and with emerging e-book standards and the growing popularity of iPads, Kindles and other e-readers, book piracy is expected to grow dramatically. Attributor is building a promising business in this high growth market, and possesses technical skills and market knowledge that will complement our existing organization. We expect the acquisition to provide many strategic and financial benefits.

On December 6, 2012, we entered into a renewal and extension of the Counterfeit Deterrence System Development and License Agreement with the Central Banks through 2024, with a 5 year extension option.

Financial information about geographic areas is included in Note 6 of our Notes to Consolidated Financial Statements.

Customers and Business Partners

Our revenue is generated through commercial and government applications of our technology. We generate a majority of our revenue from service and license fees paid to us under long-term contracts with IV, Verance Corporation (“Verance”), the Central Banks, Nielsen, and Civolution. The remainder of our revenue is generated primarily from patent and technology license fees and royalties paid by commercial business partners providing media identification and management solutions to movie studios and music labels, television broadcasters, creative professionals and other customers around the world. Patent and technology licensing is expected to continue to contribute most of the revenue from our non-government customers for the foreseeable future.

In 2012, revenue from government contracts accounted for approximately 24% of our total revenue, and revenue generated under our contract with the Central Banks accounted for substantially all of the revenue generated under our government contracts. Our government contracts typically span one or more base years and multiple option years. Government customers generally have the right to not exercise option periods. As part of our work with government customers, we must comply with and are affected by laws and regulations relating to the award, administration and performance of government contracts. Government contract laws and regulations affect how we do business with our government customers and, in some instances, impose added costs to on our business.

Information about customers that accounted for 10% or more of revenue in the last three years is included in Note 6 of our Notes to Consolidated Financial Statements.

Products and Services

We provide media identification and management solutions to commercial entities and government customers and license our technology and patent inventions to other solution providers. Our largest government customer is the Central Banks, with whom we have for the last 14 years been developing, deploying, supporting and continuing to enhance a system to deter digital counterfeiting of currency using personal computers and digital reprographics.

We license primarily to commercial entities who use our technology and patented inventions in the media and entertainment industry. Commercial customers use a range of solutions from our business partners and us to identify, track, manage and protect content as it is distributed and consumed—either digitally or physically—and to enable new consumer applications to access networks and information from personal computers and mobile

3

Table of Contents

devices. Many movie studios, record labels, broadcasters, creative professionals and other customers rely on digital watermarking as a cost-effective means to:

| • | deter piracy and illegal use of movies, music and images; |

| • | protect entertainment content from copyright infringement; |

| • | track and monitor entertainment content for rights usage and licensing compliance; |

| • | monitor advertisements to verify ad placement and measure return on investment; |

| • | enhance information access, search and marketing capabilities related to media content; and |

| • | enable fair and legitimate use of content by consumers. |

Digital watermarks are easily embedded into all forms of media and are imperceptible to human senses, but quickly detected by computers, networks or other digital devices like smartphones. Unlike barcodes and tags, a watermarking solution does not require publishers to give up valuable space in magazines and newspapers; nor does it impact the overall layout or aesthetics of the publication. One of our more recent product offerings is the Digimarc Discover™ platform, which delivers a range of rich media experiences to its readers on their smartphones. Unique to the Digimarc Discover platform is its ability to use various content identification technologies as needed, including our patented digital watermarking technology.

The Attributor acquisition gives us more depth and breadth in our product and service offerings, expands our business relations with publishers, giving us participation in the digital, as well as print aspects of the market, increases our customer base and reduces revenue concentration. We expect to expand our offerings to Attributor’s book publisher customers to include Digimarc Discover and the use of digital watermarking for copyright protection. The digital editions of magazines continue to take greater share of readership and we intend to explore expanding the Attributor customer base to magazine publishers. We see the potential for this new area of our business to provide significant growth for many years.

As part of our intellectual property marketing and patent monetization efforts, our key objectives in building relationships with potential customers and partners are to:

| • | make progress toward the realization of our vision and mission; |

| • | expand the scope of our license program; |

| • | more effectively monetize our patent assets; |

| • | encourage large scale adoption of our technologies by industry leaders; |

| • | improve our financial performance; |

| • | increase the scale and rate of growth of our products and services business; and |

| • | lay a foundation for continuing innovation. |

Current licensees include, but are not limited to, AlpVision SA, AquaMobile, Arbitron Inc., Civolution, Digital Space, IV, Monic, The Nielsen Company, Signum Technologies, Verance and Verimatrix, Inc.

Technology and Intellectual Property

We develop intellectual property to differentiate our products and technology, mitigate infringement risks, and develop opportunities for licensing. Our broad patent portfolio covers a wide range of methods, applications, system architectures and business processes.

Most of our patents relate to various methods for embedding and decoding digital information in video, audio and images, whether the content is rendered in analog or digital formats. The digital information is generally embedded by making subtle modifications to the fundamental elements of the content itself, generally at a signal processing level. The changes necessary to embed this information are so subtle that they are generally

4

Table of Contents

not noticeable by people during normal use. Because the message is carried by the content itself, it is file-format independent. The embedded digital information generally survives most normal content transformations, including compression, edits, rotation, scaling, re-sampling, file-format transformations, copying, scanning and printing.

Our patent portfolio contains a number of innovations in digital watermarking, pattern recognition (sometimes referred to as “fingerprinting”), digital rights management and related fields. To protect our significant efforts in creating our technology, we have implemented an extensive intellectual property protection program that relies on a combination of patent, copyright, trademark and trade secret laws, and nondisclosure agreements and other contracts. As a result, we believe we have one of the world’s most extensive patent portfolios in digital watermarking and related fields, with greater than 1,200 U.S. and foreign patents and pending patent applications as of December 31, 2012. We continue to develop and broaden our portfolio of patented inventions in the fields of media identification and management technology and related applications and systems. We devote significant resources to developing and protecting our inventions and continuously seek to identify and evaluate potential licensees for our patents. The patents in our portfolio have a life of approximately 20 years from invention date, and up to 17 years after the patent has been granted.

For a discussion of activities and costs related to our research and development in the last three years, please read “Research, development and engineering” under Part II, Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

Markets

Our patented inventions are used in various media identification and management products and solutions supporting a variety of media objects, from movies and music to banknotes and secure credentials. Each media object enabled by our inventions creates the potential for several applications, such as:

| • | counterfeiting and piracy deterrence; |

| • | content identification and media management; |

| • | authentication and monitoring; |

| • | linking to networks and providing access to information; and |

| • | enhanced services in support of mobile commerce. |

We believe the market for most of these applications is in the early stages of development and that existing solutions represent only a small portion of the potential market for our products, services and technology.

Book publishing is a nearly $80 billion industry. E-books share of book publishing has grown exponentially in the last few years and now accounts for approximately 10% of the book publishing market. Attributor has been growing rapidly as the market expanded, and the compound annual growth rate for the last three years for revenues is over 50%. We are projecting another high-growth year in 2013.

Competition

No single competitor or small number of competitors dominate our market. Our competitors vary depending on the application of our products and services. Our business partners and we generally compete with non-digital watermarking technologies for the security or marketing budgets of the producers and distributors of media objects, documents, products and advertising. These alternatives include, among other things, encryption-based security systems and technologies and solutions based on fingerprinting and pattern recognition. Our competitive position in digital watermarking applications is strong because of our large, high quality, sophisticated patent portfolio and our substantial and growing amount of intellectual property in related media security and

5

Table of Contents

management innovations that span basic technologies, applications, system designs and business processes. Our intellectual property portfolio allows us to use proprietary technologies that are well regarded by our customers and partners and not available to our competitors. We compete based on the variety of features we offer and a traditional cost/benefit analysis against alternative technologies and solutions. We anticipate that our competitive position within some markets may be affected by factors such as reluctance to adopt new technologies and by changes in government regulations.

Backlog

Based on projected commitments we have for the periods under contract with our respective customers, we anticipate our current contracts as of December 31, 2012 will generate a minimum of $44 million in revenue through early 2015, the remaining term of these contracts. We expect approximately $27 million of this amount to be recognized as revenue during 2013.

Some factors that lead to increased backlog include:

| • | contracts with new customers; |

| • | renewals with current customers; |

| • | add-on orders to current customers; and |

| • | contracts with longer contractual periods replacing contracts with shorter contractual periods. |

Some factors that lead to decreased backlog include:

| • | recognition of revenue associated with backlog currently in place; |

| • | contracts with shorter contractual periods replacing contracts with longer contractual periods; |

| • | modifications to existing contracts; |

| • | contract minimum payments ending; and |

| • | contracts ending with existing customers. |

The mix of these factors, among others, dictates whether our backlog increases or decreases for any given period. Our backlog may not result in actual revenue in any particular period, because the orders, awards and contracts included in our backlog may be subject to modification, cancellation or suspension. We may not realize revenue on certain contracts, orders or awards included in our backlog or the timing of any realization may change.

Employees

At December 31, 2012, we had 124 full-time employees, including 26 in sales, marketing, technical support and customer support; 73 in research, development and engineering, including intellectual property; and 25 in finance, administration, information technology and legal. The total includes 18 full-time employees from our recent acquisition of Attributor. Attributor also contracts with approximately 60 independent contractors.

Our employees are not covered by any collective bargaining agreement, and we have never experienced a work stoppage. We believe that our relations with our employees are good.

Available Information

We make available free of charge through our website at www.digimarc.com our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and amendments to these and other reports filed or furnished by us pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934 as soon as reasonably practicable after we file these materials with the Securities and Exchange Commission.

6

Table of Contents

| ITEM 1A: | RISK FACTORS |

The following risk factors are those risks of which we are aware and that we consider to be material to our business. If any of the following risks and uncertainties develops into actual events, our business, financial condition or results of operations and cash flows could be materially adversely affected. In that case, the trading price of our common stock could decline. Additionally, we cannot be certain or give any assurance that any actions taken to reduce known risks and uncertainties will be effective.

RISKS RELATED TO OUR BUSINESS

(1) A small number of customers account for a substantial portion of our revenue, and the loss of any large contract could materially disrupt our business.

Historically, we have derived a significant portion of our revenue from a limited number of customers. Five customers, IV, Verance, the Bank for International Settlements (acting on behalf of the Central Banks), Nielsen, and Civolution represented approximately 95% of our revenue for the year ended December 31, 2012. Most of our revenue come from long-term contracts generally having terms of at least three to five years, with some licenses for the life of the associated patents, which could be up to 20 years. The agreements with some of these customers provide minimum or fixed payment obligations that expire within the next few years. Some contracts we enter into contain termination for convenience provisions. If we were to lose such a contract for any reason, or if revenue from variable payment obligations do not replace revenue under the existing fixed payment obligations, our financial results could be adversely affected. For example, in connection with our arrangement with IV, after the second quarter of 2013, the quarterly installments on the license issue fee end. We are not able to reasonably estimate the future cash flow impact of any profit sharing we may earn from IV.

We expect to continue to depend upon a small number of customers for a significant portion of our revenue for the foreseeable future. The loss of, or decline in, orders or backlog from one or more major customers could reduce our revenue and have a material adverse effect on our financial results.

(2) Although we achieved profitability in the last three years, we may not be able to sustain profitability in the future, particularly if we were to lose large contracts.

For the year ended December 31, 2012, we generated net income of $8.3 million. Our profit was primarily due to a licensing arrangement with IV that we entered into in the fourth quarter of 2010, which the quarterly payments will end in May 2013, and a lump sum legal settlement for past due royalties from Verance we received in the first quarter of 2012. On a quarterly basis, our operating results have been inconsistent.

Maintaining profitability in the future will depend upon a variety of factors, including our ability to maintain and obtain more significant partnerships like those we have with the Central Banks, Nielsen, IV, Verance and Civolution. Profitability will also depend on growth in revenue of our licensees and our efficiency in executing our business strategy and capitalizing on new opportunities. Various adverse developments, including the loss of large contracts, the expiration of fixed payment obligations on our contracts or cost overruns on our existing contracts, could have a negative effect on our revenue, margins and profitability.

(3) We may be adversely affected by variability of contracted arrangements.

We have frequently agreed to modify the terms of contractual arrangements with our customers, partners and licensees in response to changes in circumstances underlying the original contractual arrangements, and it is likely that we will do so in the future. As a result of this practice, the terms of our contractual arrangements with our customers, partners and licensees may vary over time and, depending on the particular modification, could have a material adverse effect on our financial position, results of operations or cash flows.

Some of our customers report royalties to us based on their revenue and their interpretation and allocation of contracted royalty rates. For example, IV reports profit sharing to us based on income earned, which is subject to

7

Table of Contents

IV’s interpretation and allocation of revenue and expenses. It is possible that the originally reported royalties and profit sharing could differ materially from those determined by an audit performed by us or a third party, or self-corrected by the customer.

(4) A significant portion of our current and potential future revenue is subject to commercial and government contracts and development of new markets that may involve unpredictable delays and other unexpected changes. Such volatility and uncertainty might limit our actual revenue in any given quarter or year.

We derive substantial portions of our revenue from commercial contracts tied to development schedules or development of new markets, which could shift for months, quarters or years as the needs of our customers and the markets in which they participate change. Government agencies and commercial customers also face budget pressures that introduce added uncertainty. Any shift in development schedules, the markets in which we or our licensees participate, or customer procurement processes, which are outside our control and may not be predictable, could result in delays in bookings forecasted for any particular period, could affect the predictability of our quarterly and annual results, and might limit our actual revenue in any given quarter or year, resulting in reduced and less predictable revenue and adversely affecting profitability.

We are also expanding into new markets, which involve inherent risk and unpredictability. Until recent years, our business was focused primarily on digital watermarking and related signal processing technology. Our work in that field dated back to the early 1990s, so that by the time of the 1999 public offering of our predecessor company, we were an established competitor or participant in that area, and had a historical perspective that provided certain advantages. Those advantages continued to grow and serve us as our tenure in the field lengthened.

In recent years, particularly with the proliferation of smartphones and increased demands in the public sector for enhanced covert security options, we have investigated other technologies that may provide attractive future opportunities, for example in the packaging and publishing markets. These generally include technologies that leverage our strength in signal processing and support our vision for intuitive, pervasive computing. As we seek to expand outside our areas of historical expertise, we lack the history and insight that benefited us in the watermarking field. We also lack the size and scale typical of contractors providing products and services to the federal government. While we were in the vanguard of commercial application of digital watermarking, we are not so uniquely poised in these other disciplines. Accordingly, it may be difficult for us to replicate our watermarking success in other technologies we might pursue.

(5) The market for our products is highly competitive, and alternative technologies or larger companies that compete with us may undermine, limit or eliminate the market for our products’ technologies, which would decrease our revenue and profits.

The markets in which we compete for business are intensely competitive and rapidly evolving. We expect competition to continue from both existing competitors and new market entrants. We face competition from other companies and from alternative technologies, including some of our customers and licensees. Because the market solutions based on our technologies are still in an early stage of development, we also may face competition from unexpected sources.

Alternative technologies that may directly or indirectly compete with particular applications of our watermarking technologies include:

| • | Encryption—securing data during distribution using a secret code so it cannot be accessed except by authorized users; |

| • | Containers—inserting a media object in an encrypted wrapper, which prevents the media object from being duplicated, used for content distribution and transaction management; |

8

Table of Contents

| • | Traditional anti-counterfeiting technologies—a number of solutions used by many government agencies (that compete for budgetary outlays) designed to deter counterfeiting, including optically sensitive ink, magnetic threads and other materials used in the printing of currencies; |

| • | Image recognition—one or several pre-specified or learned objects or object classes that can be recognized, usually together with their two-dimensional positions in the image or three-dimensional poses in the scene, such as Google Goggles, which provides a stand-alone program illustration of this function; |

| • | Radio frequency tags—embedding a chip that emits a signal when in close proximity with a receiver, used in some photo identification credentials, labels and tags; |

| • | Internet technologies—numerous existing and potential Internet access and search methods are competitive with Digimarc Mobile systems and the searching capabilities of Digimarc for Images; |

| • | Digital fingerprints and signatures—a metric, or metrics, computed solely from a source image or audio or video track, that can be used to identify an image or track, or authenticate the image or track; |

| • | Smart cards—badges and cards including a semiconductor memory and /or processor, used for authentication and related purposes; and |

| • | Bar codes or QR codes—data-carrying codes, typically visible in nature (but may be invisible if printed in ultraviolet- or infrared-responsive inks). |

In the competitive environments in which we operate, product generation, development and marketing processes relating to technology are uncertain and complex, and require accurate prediction of demand as well as successful management of various risks inherent in technology development. In light of these uncertainties, it is possible that our failure to successfully accommodate future changes in technologies related to our technology could have a long-term negative effect on our growth and results of operations.

New developments are expected to continue, and discoveries by others, including current and potential competitors, possibly could render our services and products noncompetitive. Moreover, because of rapid technological changes, we may be required to expend greater amounts of time and money than anticipated to develop new products and services, which in turn may require greater revenue streams from those products and services to cover developmental costs. Many of the companies that compete with us for some of our business, as well as other companies with whom we may compete in the future, are larger and may have greater technical, financial, marketing and political resources than we do. These resources could enable these companies to initiate severe price cuts or take other measures in an effort to gain market share or otherwise impede our progress. We may be unable to compete successfully against current or future participants in our market or against alternative technologies, and the competitive pressures we face could decrease our revenue and profits in the future.

(6) We may not realize all the expected benefits of our patent licensing arrangement with Intellectual Ventures.

In connection with our patent licensing arrangement with IV, we granted an exclusive license to sublicense a substantial portion of our patent assets to IV in exchange for various strategic and financial benefits. We may not realize all the expected benefits of our patent licensing arrangement with IV, including the expected full payment of the license issue fee, profit participation revenue, reduction of patent prosecution and maintenance costs, and full payment for the assistance we provide to IV with respect to the licensed patents. Any failure to realize these expected benefits could have a material adverse effect on our financial position, results of operations or cash flows. We have given IV control over both prosecution and enforcement of these assets. While IV can seek our assistance and has committed to pay for it, we cannot guarantee that IV will seek our assistance in prosecution, nor enforce the patents to the extent we would.

9

Table of Contents

As provided in the arrangement with IV, we have initiated an audit of the profit participation reports provided by IV to better understand the revenue and expenses IV has included in their calculation of whether we are entitled to any profit participation revenue for 2011, as well as determining whether the expenses included in the calculations are within the terms of the contract. We are currently working through the identified issues through the dispute resolution process provided for in the arrangement.

(7) We recently completed an acquisition and may acquire or invest in other companies or technologies in the future, which could divert management’s attention, result in additional dilution to our stockholders, increase expenses, disrupt our operations and harm our operating results.

We recently completed the acquisition of Attributor Corporation, and we may in the future acquire or invest in businesses, products or technologies that we believe could complement or expand our current product and service offerings, enhance our technical capabilities, expand our operations into new markets or otherwise offer growth opportunities. We cannot assure you that we will realize the anticipated benefits of our recent or any future acquisition. The pursuit of potential acquisitions may divert the attention of management and cause us to incur various expenses related to identifying, investigating and pursuing suitable acquisitions, whether or not they are consummated.

There are inherent risks in integrating and managing acquisitions. We may not be able to assimilate or integrate the acquired personnel, operations and technologies successfully or effectively manage the combined business following an acquisition. We also may not achieve the anticipated benefits from an acquired business due to a number of factors, including:

| • | unanticipated costs or liabilities associated with the acquisition; |

| • | incurrence of acquisition-related costs, which would be recognized as a current period expense; |

| • | inability to generate sufficient revenue to offset acquisition or investment costs; |

| • | the inability to maintain relationships with customers and partners of the acquired business; |

| • | the need to implement additional controls, procedures and policies; |

| • | entry into geographic markets in which we have little or no prior experience, and challenges caused by distance, language and cultural differences; |

| • | differences in foreign labor and employment laws, including classification of employees and contractors; |

| • | disruption of our ongoing business; |

| • | the potential loss of key employees; and |

| • | use of substantial portions of our available cash or the incurrence of debt to consummate the acquisition. |

Acquisitions could also result in dilutive issuances of equity securities or the incurrence of debt, which could adversely affect our operating results. In addition, if an acquired business fails to meet our expectations, our operating results, business and financial condition may suffer.

(8) An increase in our operations outside of the U.S. subjects us to risks additional to those to which we are exposed in our domestic operations.

We believe that revenue from sales of products and services to commercial, governmental and other customers outside the U.S. could represent a growing percentage of our total revenue in the future. In addition, as a result of our recent acquisition of Attributor Corporation, we may perform certain functions in various jurisdictions outside of the U.S. International operations are subject to a number of risks that can adversely affect

10

Table of Contents

our sales of products and services to customers outside of the U.S., or expose us to additional expense or liabilities, including the following:

| • | difficulties and costs of staffing, developing and managing foreign operations as a result of distance, language and cultural differences; |

| • | the effect of laws governing employee and contractor relationships, and the existence of workers’ councils and labor unions in some jurisdictions; |

| • | changes in foreign government regulations and security requirements; |

| • | export license requirements, tariffs and taxes; |

| • | trade barriers; |

| • | difficulty in protecting intellectual property; |

| • | difficulty in collecting accounts receivable; |

| • | currency fluctuations; |

| • | longer payment cycles than those for customers in the U.S; and |

| • | political and economic instability |

We do not have an extensive operational infrastructure for international business. We generally depend on local or international business partners and subcontractors for performance of substantial portions of our business. These factors may result in greater risk of performance problems or of reduced profitability with respect to our international programs in these markets. In addition, if foreign customers, in particular foreign government authorities, terminate or delay the implementation of our products and services, it may be difficult for us, or we may not be able, to recover our potential losses.

(9) Our future growth will depend to some extent on our successful implementation of our technology in solutions provided by third parties.

Our business and strategy rely substantially on deployment of our technology by our licensees and other third-party software developers and original equipment manufacturers. For example, one form of our technology is commonly deployed in image editing applications to permit users of these products to read data embedded in imagery, and thereby identify ownership and discern the identities of image owners. Another form of our technology is used in our anti-counterfeiting products. Our patented inventions are also being deployed as part of Digital Cinema systems to theatres around the world by companies that integrate technologies and subsystems. In addition, we rely on the ability of IV to license our patented inventions to third party licensees pursuant to the patent licensing arrangement we entered into with IV in October 2010. If third parties who include our technology in their products or otherwise license our intellectual property for use in their products cease to do so, or we fail to obtain other partners who will incorporate, embed, integrate or bundle our technology, or these partners are unsuccessful in their efforts, our efforts to expand deployment of our technology and increase licensing revenue would be adversely affected. Consequently, our ability to increase revenue would be adversely affected and we may suffer other adverse effects to our business. In addition, if our technology does not perform according to market expectations, our future sales would suffer as customers seek other alternatives.

(10) We depend on our management and key employees for our future success. If we are not able to retain, hire or integrate these employees, we may not be able to meet our commitments.

Our success depends to a significant extent on the performance and continued service of our management and our intellectual property team. The loss of the services of any of these employees could limit our growth or undermine customer relationships.

11

Table of Contents

Due to the high level of technical expertise that our industry requires, our ability to successfully develop, market, sell, license and support our products, services, and intellectual property depends to a significant degree upon the continued contributions of our key personnel in engineering, sales, marketing, operations, legal and licensing, many of whom would be difficult to replace. We believe our future success will depend in large part upon our ability to retain our current key employees and our ability to attract, integrate and retain new personnel in the future. It may not be practical for us to match the compensation some of our employees could garner at other employment. In addition, we may encounter difficulties in hiring and retaining employees because of concerns related to our financial performance or operating results. These circumstances may have a negative effect on the market price of our common stock, and employees and prospective employees may factor in the uncertainties relating to our stability and the value of any equity-based incentives in their decisions regarding employment opportunities and decide to leave our employ. Moreover, our business is based in large part on patented technology, which is a unique and sophisticated signal processing technology. New employees require substantial training, involving significant resources and management attention. Competition for experienced personnel in our business can be intense. If we do not succeed in attracting new, qualified personnel or in integrating, retaining and motivating our current personnel, our growth and ability to deliver products and services that our customers require may be hampered. Although our employees generally have executed agreements containing non-competition clauses, we do not assure you that a court would enforce all of the terms of these clauses or the agreements generally. If these clauses were not fully enforced, our employees could be able to freely join our competitors. Although we generally attempt to control access to and distribution of our proprietary information by our employees, we do not assure you that the confidential nature of our proprietary information will be maintained in the course of such future employment. Any of these events could have a material adverse effect on our financial and business prospects.

(11) If leading companies in our industry or standard-setting bodies or institutions downplay, minimize or reject the use of our technology, deployment may be slowed and we may be unable to achieve revenue growth, particularly in the media and entertainment sectors.

Many of our business endeavors, such as our licensing of intellectual property in support of audio and video copy-control applications, can be impeded or frustrated by larger, more influential companies or by standard-setting bodies or institutions downplaying, minimizing or rejecting the value or use of our technology. A negative position by these companies, bodies or institutions, if taken, may result in obstacles for us that we would be incapable of overcoming and may block or impede the adoption of digital watermarking, particularly in the media and entertainment market. In addition, potential customers in the media and entertainment industry may delay or reject initiatives that relate to deployment of our technology. Such a development would make the achievement of our business objectives in this market difficult or impossible.

(12) We are subject to risks encountered by companies developing and relying upon new technologies, products and services for substantial amounts of their growth or revenue.

Our business and prospects must be considered in light of the risks and uncertainties to which companies with new and rapidly evolving technology, products and services are exposed. These risks include the following:

| • | we may be unable to develop sources of new revenue or sustainable growth in revenue because our current and anticipated technologies, products and services may be inadequate or may be unable to attract or retain customers; |

| • | the intense competition and rapid technological change in our industry could adversely affect the market’s acceptance of our existing and new products and services; |

| • | we may be unable to develop and maintain new technologies upon which our existing and new products and services are dependent in order for our products and services to be sustainable and competitive and in order for us to expand our revenue and business; and |

| • | our licensees may not be able to successfully enter new markets or grow their businesses, limiting the royalties payable to us and our associated revenue and profits. |

12

Table of Contents

Some of our key technology and solutions from our patent or technology licensees are in the development stage. Consequently, products incorporating our technology and solutions are undergoing technological change and are in the early stages of introduction in the marketplace. Delays in the adoption of these products or adverse competitive developments may result in delays in the development of new revenue sources or the growth in our revenue. In addition, we may be required to incur unanticipated expenditures if product changes or improvements are required. Moreover, new industry standards might redefine the products that we or our licensees are able to sell, especially if these products are only in the prototype stage of development. If product changes or improvements are required, success in marketing these products by us or our licensees and achieving profitability from these products could be delayed or halted. We also may be required to fund any changes or improvements out of operating income, which could adversely affect our profitability.

(13) We may not be able to adequately protect or enforce our intellectual property, and we may be subject to infringement claims and other litigation, which could adversely affect our business.

Our success depends in part on licensing our proprietary technology. To protect our intellectual property portfolio, we rely on a combination of patent, copyright, trademark and trade secret rights, confidentiality procedures and licensing arrangements. Unlicensed copying and use of our intellectual property or infringement of our intellectual property rights may result in the loss of revenue to us. Although we devote significant resources to developing and protecting our technologies, and evaluating potential competitors of our technologies for infringement of our intellectual property rights, these infringements may nonetheless go undetected or may arise in the future.

We face risks associated with our patent position, including the potential need from time to time to engage in significant legal proceedings to enforce our patents, the possibility that the validity or enforceability of our patents may be challenged, and the possibility that third parties will be able to compete against us without infringing our patents. Our recently resolved litigation with Verance, which brought a declaratory judgment action alleging that certain of our patents are invalid or not infringed, is an example. Budgetary concerns may cause us not to file or continue litigation against known infringers of our patent rights, or may cause us not to file for, or pursue, patent protection for all of our inventive technology, in jurisdictions where they may have value. Some governmental entities that might infringe our intellectual property rights may enjoy sovereign immunity from such claims. Failure to reliably enforce our patent rights against infringers may make licensing more difficult. If we fail to protect our intellectual property rights and proprietary technology adequately, if there are changes in applicable laws that are adverse to our interests, or if we become involved in litigation relating to our intellectual property rights and proprietary technology or relating to the intellectual property rights of others, our business could be seriously harmed because the value ascribed to our intellectual property could diminish and result in a lower stock price, or we may incur significant costs in bringing legal proceedings against third parties who are infringing our patents.

Effective protection of intellectual property rights may be unavailable or limited. Patent protection throughout the world is generally established on a country-by-country basis. We have applied for patent protection in the U.S. and in various other countries. We do not assure you, however, that pending patents will be issued or that issued patents will be valid or enforceable. Failure to obtain these patents or failure to enforce those patents that are obtained may result in a loss of revenue to us. We do not assure you that the protection of our proprietary rights will be adequate or that our competitors will not independently develop similar technologies, duplicate our services or design around any of our patents or other intellectual property rights.

In the ordinary course of building strategic business relationships with potential partners we may encounter companies that we believe are infringing on our patent portfolio. When we encounter these companies we believe are infringing, we try to negotiate a license to our patents. If we are unable to negotiate a license and continue to believe they are infringing on our patents, we may file a lawsuit and incur legal fees in the process.

Patents have finite lives, and our ability to continue to commercially exploit our patents is limited to the term of the patents. Our earliest patents began expiring in July 2012. The size and strength of our portfolio

13

Table of Contents

depends on the number of patents that have been granted, offset by the number of patents that expire, in any given year. We continue to grow our patent portfolio, but we do not assure you that we will be able to exploit newer patents to the extent that we have our earlier patents.

We are the exclusive licensee under some third-party patents, and may need the assistance of these parties if we choose to enforce any of these patent rights. The cooperation of these third parties cannot be assured. Although we rely on some of these technologies for our products or for our licenses to third parties to date, the licensed patents have not been material to our operations.

As more companies engage in business activities relating to digital watermarking, and develop corresponding intellectual property rights, it is increasingly likely that claims may arise which assert that some of our products or services infringe upon other parties’ intellectual property rights. These claims could subject us to costly litigation and divert management resources. These claims may require us to pay significant damages, cease production of infringing products, terminate our use of infringing technology or develop non-infringing technologies. In these circumstances, continued use of our technology may require that we acquire licenses to the intellectual property that is the subject of the alleged infringement, and we might not be able to obtain these licenses on commercially reasonable terms or at all. Our use of protected technology may result in liability that threatens our continuing operation.

Some of our contracts include indemnity and similar provisions regarding our non-infringement of third-party intellectual property rights. As deployment of our technology increases, and more companies enter our markets, the likelihood of a third party lawsuit resulting from these provisions increases. If an infringement arose in a context governed by such a contract, we may have to refund to our customer amounts already paid to us or pay significant damages, or we may be sued by the party whose intellectual property has allegedly been infringed upon.

As part of our confidentiality procedures, we generally enter into non-disclosure agreements with our employees, directors, consultants and corporate partners, and attempt to control access to and distribution of our technology, solutions, documentation and other proprietary information. Despite these procedures, third parties could copy or otherwise obtain and make unauthorized use of our technology, solutions or other proprietary information or independently develop similar technologies, solutions or information. The steps that we have taken to prevent misappropriation of our solutions, technology or other proprietary information may not succeed.

(14) If our revenue models and pricing structures relating to products and services that are under development do not gain market acceptance, the products and services may fail to attract or retain customers and we may not be able to generate new revenue or sustain existing revenue.

Some of our business involves embedding digital watermarks in traditional and digital media, including secure documents, audio, video and imagery, and licensing our intellectual property. Our revenue stream is based primarily on a combination of development, consulting, subscription and license fees from a variety of media identification and management applications. We also launched our Digimarc Discover initiative during 2011, which incorporates new business and pricing models for licensing access to our online services portal and value added service providers. We have not fully developed revenue models for some of these future digital watermarking applications and licensing endeavors. Because some of our products and services are not yet well-established in the marketplace, and because some of these products and services will not directly displace existing solutions, we cannot be certain that the pricing structure for these products and services will gain market acceptance or be sustainable over time or that the marketing for these products and services will be effective.

(15) If we are unable to respond to regulatory or industry standards effectively, or if we are unable to develop and integrate new technologies effectively, our growth and the development of our products and services could be delayed or limited.

Our future success will depend in part on our ability to enhance and improve the responsiveness, functionality and features of our products and services, and those of our business partners, in accordance with

14

Table of Contents

regulatory or industry standards. Our ability to remain competitive will depend in part on our ability to influence and respond to emerging industry and governmental standards in a timely and cost-effective manner. If we are unable to influence these or other standards or respond to these standards effectively, our growth and the development of various products and services could be delayed or limited.

Our market is characterized by new and evolving technologies. The success of our business will depend on our ability to develop and integrate new technologies effectively and address the increasingly sophisticated technological needs of our customers in a timely and cost-effective manner. Our ability to remain competitive will depend in part on our ability to:

| • | enhance and improve the responsiveness, functionality and other features of the products and services we offer or plan to offer; |

| • | continue to develop our technical expertise; and |

| • | develop and introduce new services, applications and technologies to meet changing customer needs and preferences and to integrate new technologies. |

We do not assure you that we will be successful in responding to these technological and industry challenges in a timely and cost-effective manner. If we are unable to develop or integrate new technologies effectively or respond to these changing needs, our margins could decrease, and our release of new products and services and the deployment of our watermarking technology could be adversely affected.

(16) We may need to retain additional employees or contract labor in the future in order to take advantage of new business opportunities arising from increased demand, which could increase costs and impede our ability to achieve or sustain profitability in the short term.

We have staffed our company with the intent of achieving and sustaining profitability. Our current staffing levels could affect our ability to respond to increased demand for our services. In addition, to meet any increased demand and take advantage of new business opportunities in the future, we may need to increase our workforce through additional employees or contract labor. Although we believe that increasing our workforce would potentially support anticipated growth and profitability, it would increase our costs. If we experience such an increase in costs, we may not succeed in achieving or sustaining profitability in the short term.

(17) The terms and conditions of our contracts could subject us to damages, losses and other expenses if we fail to meet delivery and other performance requirements.

Our service contracts typically include provisions imposing:

| • | development, delivery and installation schedules and milestones; |

| • | customer acceptance and testing requirements; and |

| • | other performance requirements. |

To the extent these provisions involve performance over extended periods of time, risks of noncompliance may increase. From time to time we have experienced delays in system implementation, timely acceptance of programs, concerns regarding program performance and other contractual disputes. If we fail to meet contractual milestones or other performance requirements as promised, or to successfully resolve customer disputes, we could incur liability for damages, as well as increased costs, lower margins, or compensatory obligations in addition to other losses, such as harm to our reputation. Any unexpected increases in costs to meet our contractual obligations or any other requirements necessary to address claims and damages with regard to our customer contracts could have a material adverse effect on our business and financial results.

15

Table of Contents

(18) Products deploying our technology could have unknown defects or errors, which may give rise to claims against us, divert application of our resources from other purposes or increase our project implementation and support costs.

Products and services as complex as those we offer or develop may contain undetected defects or errors. Furthermore, we often provide complex implementation, integration, customization, consulting and other technical services in connection with the implementation and ongoing maintenance of our products. Despite testing, defects or errors in our products and services may occur, which could result in delays in the development and implementation of products and systems, inability to meet customer requirements or expectations in a timely manner, loss of revenue or market share, increased implementation and support costs, failure to achieve market acceptance, diversion of development resources, injury to our reputation, increased insurance costs, increased service and warranty costs and warranty or breach of contract claims. Although we attempt to reduce the risk of losses resulting from warranty or breach of contract claims through warranty disclaimers and liability limitation clauses in our sales agreements when we can, these contractual provisions are sometimes not included and may not be enforceable in every instance. If a court refuses to enforce the liability limiting provisions of our contracts for any reason, or if liabilities arise that were not contractually limited or adequately covered by insurance, the expense associated with defending these actions or paying the resultant claims could be significant.

(19) The security systems used in our product and service offerings may be circumvented or sabotaged by third parties, which could result in the disclosure of sensitive information or private personal information or cause other business interruptions that could damage our reputation and disrupt our business.

Our business relies on computers and other information technologies, both internal and at customer locations. The protective measures that we use may not prevent security breaches, and failure to prevent security breaches may disrupt our business, damage our reputation, and expose us to litigation and liability. A party who is able to circumvent security measures could misappropriate sensitive or proprietary information or materials or cause interruptions or otherwise damage our products, services and reputation, and the property of our customers. If unintended parties obtain sensitive data and information, or create bugs or viruses or otherwise sabotage the functionality of our systems, we may receive negative publicity, incur liability to our customers or lose the confidence of our customers, any of which may cause the termination or modification of our contracts. Further, our insurance coverage may be insufficient to cover losses and liabilities that may result from these events.

In addition, we may be required to expend significant capital and other resources to protect ourselves against the threat of security breaches or to alleviate problems caused by these breaches. Any protection or remedial measures may not be available at a reasonable price or at all, or may not be entirely effective if commenced.

(20) We are periodically involved in the ordinary course of business in litigation, and an adverse resolution of such litigation may adversely affect our business, financial condition, results of operations, and cash flows.

From time to time, in our normal course of business, we are a party to various legal claims, actions and complaints. As part of our patent licensing program, we bring claims or counterclaims of patent infringement to enforce our patent rights. Given the uncertain nature of litigation, we are not able to estimate the amount or range of gain or loss that could result from an outcome of litigation. Litigation can be expensive, lengthy, and disruptive to normal business operations. The results of complex legal proceedings are often uncertain and difficult to predict. We could incur costs in excess of any currently established accruals and, to the extent available, excess liability insurance. An unfavorable outcome in any legal proceedings could have a material adverse effect on our business, financial condition, results of operations, and cash flows.

16

Table of Contents

RISKS RELATED TO OUR CAPITAL STOCK

(21) Our common stock price may be volatile, and you could lose all or part of your investment in shares of our common stock.

The price of shares of our common stock may fluctuate as a result of changes in our operating performance or prospects and other factors. Some specific factors that may have a significant effect on the price of shares of our common stock include:

| • | the public’s reaction to our public disclosures; |

| • | actual or anticipated changes in our operating results or future prospects; |

| • | potential changes from originally reported royalties by customers resulting from an audit performed by us or a third party, or self-corrected by the customer; |

| • | strategic actions by us or our competitors, such as acquisitions or restructurings; |

| • | impact of acquisitions on our liquidity and financial performance; |

| • | new laws or regulations or new interpretations of existing laws or regulations applicable to our business; |

| • | changes in accounting standards, policies, guidance, interpretations or principles applicable to us; |

| • | conditions of the industry as a result of changes in financial markets or general economic or political conditions; |

| • | the failure of securities analysts to cover our common stock in the future, or changes in financial estimates by analysts; |

| • | changes in analyst recommendations or earnings estimates regarding us, other comparable companies or the industry generally, and our ability to meet those estimates; |

| • | future issuances of our common stock or the perception that future sales could occur; and |

| • | volatility in the equity securities market. |

(22) Our common stock price may increase or decrease on material news or developments.

As a thinly-traded microcap company, volatility in the equity securities market may disproportionately affect swings in our stock price, upward and downward, on positive and negative developments. Over the past year, we have had significant fluctuations, primarily downward push on our stock price and market capitalization despite positive developments, including the $8.0 million past due royalties payment from Verance received in the first quarter of 2012 in connection with the resolution of our litigation. In contrast, in connection with our arrangement with IV, after the second quarter of 2013, the quarterly installments on the license issue fee end, and we are not able to reasonably estimate the future cash flow impact of any profit sharing we may earn from IV, which may or may not have an effect on our stock price. We suspect that the effects of computerized trading also exacerbate fluctuations in our stock price.

(23) Our corporate governance documents, our rights agreement and Oregon law may delay or prevent an acquisition of us that shareholders may consider favorable, which could decrease the value of your shares.

Our articles of incorporation and bylaws and Oregon law contain provisions that could make it more difficult for a third party to acquire us without the consent of our board of directors. These provisions include supermajority voting requirements for shareholders to amend our organizational documents and limitations on actions by our shareholders by written consent. In addition, our board of directors has the right to issue preferred stock without shareholder approval, which could be used to dilute the stock ownership of a potential hostile acquirer. On July 31, 2008, our Board of Directors adopted a rights agreement pursuant to which one one-

17

Table of Contents

hundredth (1/100) of a preferred stock purchase right will be issued for each outstanding share of our common stock. In general terms, our rights agreement works by imposing a significant penalty upon any person or group that acquires 15% or more of our outstanding common stock without the approval of our Board of Directors. Oregon law also restricts the ability to vote shares of stock acquired in a transaction that causes the acquiring person to control at least one-fifth, one-third or one-half of the votes entitled to be cast in the election of directors. Shares acquired in a control share acquisition have no voting rights except as authorized by a vote of the shareholders. Although we believe these provisions protect our shareholders from coercive or otherwise unfair takeover tactics and thereby provide for an opportunity to receive a higher bid by requiring potential acquirers to negotiate with our board of directors, these provisions apply even if the offer may be considered beneficial by some shareholders.

| ITEM 1B: | UNRESOLVED STAFF COMMENTS |

None.

| ITEM 2: PROPERTIES |

We lease our principal administrative, marketing, research, and intellectual property development facility, which is approximately 46,000 square feet in size and located in Beaverton, Oregon. In May 2010 we entered into an amendment with the landlord to extend the length of our facilities lease through August 2016.

We assumed the existing facilities lease agreement for Attributor in San Mateo, California which is approximately 3,500 square feet in size. The original lease term has been extended through April 2013 and we are currently in negotiations to establish a new agreement with the landlord.

See Note 10 of our Notes to Consolidated Financial Statements for further lease related disclosures.

| ITEM 3: LEGAL | PROCEEDINGS |

We are subject from time to time to legal proceedings and claims arising in the ordinary course of business

Our newly acquired subsidiary, Attributor, is a defendant in a patent infringement lawsuit brought by Blue Spike, LLC (E.D. Texas, Civil Action No: 6:12-cv-540). The case was brought against Attributor in August 2012, and was consolidated with other lawsuits brought by Blue Spike into Civil Action No. 6:12-cv-00499.

Blue Spike asserted infringement by Attributor of four patents. Attributor filed an answer denying that it has infringed any valid claim of the patents in suit, and asserting specified defenses, including non-infringement and invalidity.

The court is consolidating cases that Blue Spike brought against over sixty defendants into one case. After that process is complete, a schedule should be set.

Blue Spike has not alleged a specific amount of monetary damages in its Complaint.

| ITEM 4: MINE | SAFETY DISCLOSURES |

Not applicable.

18

Table of Contents

| ITEM 5: | MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURTIES |

Our common stock began trading on the Nasdaq Stock Market LLC in October 2008 under the symbol “DMRC.” The closing price of our common stock on the Nasdaq Global Market was $22.94 on February 15, 2013. The following table lists the high and low sales prices of our common stock for the periods indicated, as reported by The Nasdaq Global Market.

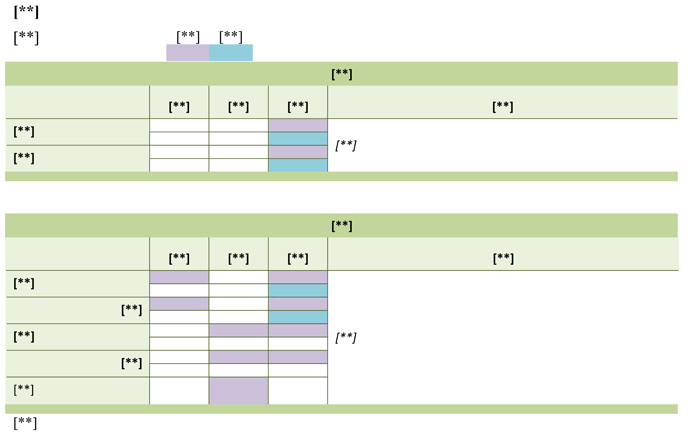

| Year Ended December 31, | ||||||||||||||||

| 2012 | 2011 | |||||||||||||||

| High | Low | High | Low | |||||||||||||

| First quarter |

$ | 32.10 | $ | 24.34 | $ | 31.55 | $ | 24.03 | ||||||||

| Second quarter |

$ | 30.25 | $ | 23.55 | $ | 35.47 | $ | 24.58 | ||||||||

| Third quarter |

$ | 28.05 | $ | 21.06 | $ | 43.82 | $ | 25.38 | ||||||||

| Fourth quarter |

$ | 22.80 | $ | 17.68 | $ | 29.31 | $ | 21.00 | ||||||||

At February 15, 2013, we had 210 shareholders of record of our common stock, as shown in the records of our transfer agent. Since many holders hold shares in “street name,” we believe that there is a significantly larger number of beneficial owners of our common stock than the number of record holders.