Table of Contents

As filed with the Securities and Exchange Commission on June 19, 2018

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Coastal Financial Corporation

(Exact name of registrant as specified in its charter)

| Washington | 6022 | 56-2392007 | ||

| State or other jurisdiction of incorporation or organization |

(Primary Standard Industrial Classification Code Number) |

(IRS Employer Identification No.) |

5415 Evergreen Way

Everett, Washington 98203

(425) 257-9000

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Eric M. Sprink

President and Chief Executive Officer

Coastal Financial Corporation

5415 Evergreen Way

Everett, Washington 98203

(425) 257-9000

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

| Frank M. Conner III, Esq. | ||

| Michael P. Reed, Esq. | ||

| Aaron M. Kaslow, Esq. | Christopher J. DeCresce, Esq. | |

| Stephen F. Donahoe, Esq. | Covington & Burling LLP | |

| Kilpatrick Townsend & Stockton LLP | One CityCenter | |

| 607 14th Street, NW, Suite 900 | 850 Tenth Street, NW | |

| Washington, DC 20005 | Washington, DC 20001 | |

| Telephone: (202) 508-5800 | Telephone: (202) 662-6000 | |

| Facsimile (202) 204-5600 | Facsimile: (202) 662-6291 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after this Registration Statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ☐

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ | |||

| Non-accelerated filer | ☒ (Do not check if a smaller reporting company) | Smaller reporting company | ☐ | |||

| Emerging growth company | ☒ | |||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☒

Calculation of Registration Fee

|

| ||||

| Title of each class of securities to be registered |

Proposed maximum aggregate offering price(1)(2) |

Amount of registration fee | ||

| Common Stock, no par value |

$30,000,000.00 | $3,735 | ||

|

| ||||

|

| ||||

| (1) | Includes the aggregate offering price of additional shares of common stock that the underwriters have the option to purchase from the Registrant. |

| (2) | Estimated solely for the purpose of calculating the registration fee in accordance with Regulation 457(o) under the Securities Act of 1933, as amended. |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to Section 8(a), may determine.

Table of Contents

The information in this preliminary prospectus is not complete and may be changed. We may not sell these securities or accept any offer to buy these securities until the registration statement filed with the Securities and Exchange Commission is declared effective. This preliminary prospectus is not an offer to sell these securities and we are not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED JUNE 19, 2018

PRELIMINARY PROSPECTUS

Shares

Common Stock

This is the initial public offering of shares of common stock of Coastal Financial Corporation, the bank holding company for Coastal Community Bank, a Washington state chartered bank. We are offering shares of our common stock and the selling shareholders identified in this prospectus are offering shares of our common stock. We will not receive any proceeds from the sale of shares of our common stock by the selling shareholders.

Prior to this offering, there has been no established public trading market for our common stock. We currently estimate that the initial public offering price of our common stock will be between $ and $ per share. We have applied to list our common stock on the Nasdaq Global Select Market under the symbol “CCB.”

Investing in our common stock involves risks. See “Risk Factors” beginning on page 18.

We are an “emerging growth company” as defined in the Jumpstart Our Business Startups Act of 2012 and will be subject to reduced public company reporting requirements. See “Implications of Being an Emerging Growth Company.”

| Per Share | Total | |||||||

| Initial public offering price |

$ | $ | ||||||

| Underwriting discounts (1) |

$ | $ | ||||||

| Proceeds, before expenses, to us |

$ | $ | ||||||

| Proceeds, before expenses, to the selling shareholders |

$ | $ | ||||||

| (1) | See “Underwriting (Conflicts of Interest)” for additional information regarding underwriting compensation. |

We have granted the underwriters an option to purchase up to additional shares of our common stock at the initial public offering price, less the underwriting discounts, within 30 days after the date of this prospectus.

Neither the Securities and Exchange Commission nor any state securities commission or other regulatory body has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

Our common stock is not a deposit or savings account of our bank subsidiary and is not insured by the Federal Deposit Insurance Corporation or any other governmental agency or instrumentality.

The underwriters expect to deliver the shares of our common stock to purchasers on or about , 2018, subject to customary closing conditions.

Joint Book-Running Managers

| Keefe, Bruyette & Woods A Stifel Company |

Hovde Group, LLC |

The date of this prospectus is , 2018

Table of Contents

Dedicated to community banking 2017 & 2016 Recipient of the prestigious “5-Star Rating” from BauerFinancial, Inc. Everett Herald — 2014, 2015, 2016 and 2017 Readers Choice — “Best Bank” Plus... “2016 Best Financial Provider, Best Mortgage Lender and Best Place to Work” Stanwood & Camano News “Best Bank” (5 years in a row) 2013 * 2014 * 2015 * 2016 * 2017 “2017 & 2016 SBA Community Lender of the Year Award” in some of Washington’s most attractive markets

Table of Contents

| Page | ||||

| 1 | ||||

| 14 | ||||

| GAAP RECONCILIATION AND MANAGEMENT EXPLANATION OF NON-GAAP FINANCIAL MEASURES |

17 | |||

| 18 | ||||

| 42 | ||||

| 44 | ||||

| 45 | ||||

| 46 | ||||

| 48 | ||||

| 50 | ||||

| MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

51 | |||

| 85 | ||||

| 98 | ||||

| 111 | ||||

| 119 | ||||

| 130 | ||||

| 133 | ||||

| 136 | ||||

| 142 | ||||

| MATERIAL U.S. FEDERAL TAX CONSIDERATIONS FOR NON-U.S. HOLDERS OF OUR COMMON STOCK |

144 | |||

| 148 | ||||

| 154 | ||||

| 154 | ||||

| 154 | ||||

| F-1 | ||||

About This Prospectus

You should rely only on the information contained in this prospectus or in any free writing prospectus that we authorize to be delivered to you. We, the selling shareholders and the underwriters have not authorized anyone to provide you with different or additional information. If anyone provides you with different or additional information, you should not rely on it. This prospectus relates to an offer to sell only the securities offered hereby, and only under circumstances and in jurisdictions where it is lawful to do so. We, the selling shareholders and the underwriters are not making an offer of these securities in any jurisdiction where the offer is not permitted. You should not assume that the information contained in this prospectus or any free writing prospectus is accurate as of any date other than the date of the applicable document, regardless of its time of delivery or the time of any sales of our common stock. Our business, financial condition, results of operations and prospects may have changed since that date.

Unless we state otherwise or the context otherwise requires, references in this prospectus to “we,” “our,” “us” or “the Company” refer to Coastal Financial Corporation, a Washington corporation, and our consolidated subsidiary, and references to “Coastal Community Bank” or “the Bank” refer to our banking subsidiary, Coastal Community Bank, a Washington state chartered bank.

Unless otherwise indicated, references in this prospectus to “common stock” refer to our voting common stock, no par value per share, and references to “nonvoting common stock” include our Class B Nonvoting

i

Table of Contents

Common Stock, no par value per share, and our Class C Nonvoting Common Stock, no par value per share. References to our “common shares” include our common stock and nonvoting common stock. Per share amounts presented in this prospectus are based on total common shares outstanding. No shares of our nonvoting common stock are offered hereby.

References in this prospectus to the “Seattle MSA” refer to the Seattle-Tacoma-Bellevue, Washington metropolitan statistical area. References to the “Puget Sound region” refer to the Seattle MSA along with the adjacent metropolitan areas of Olympia, Bremerton and Mount Vernon, as well as Island County.

Unless otherwise stated, all information in this prospectus assumes that the underwriters do not exercise their option to purchase additional shares of our common stock and gives effect to a one-for-five reverse stock split of both our common stock and nonvoting common stock completed effective May 4, 2018. The effect of the reverse stock split on outstanding shares and per share figures has been retroactively applied to all periods presented in this prospectus.

Any discrepancies included in this prospectus between totals and the sums of the percentages and dollar amounts presented are due to rounding.

You should not interpret the contents of this prospectus or any free writing prospectus that we authorize to be delivered to you to be legal, business, investment or tax advice. You should consult with your own advisors for that type of advice and consult with them about the legal, tax, business, financial and other issues that you should consider before investing in our common stock.

Market and Industry Data

Within this prospectus, we reference certain industry and sector information and statistics. We have obtained this information and statistics from various independent, third-party sources. Nothing in the data used or derived from third-party sources should be construed as advice. Some data and other information are also based on our good faith estimates, which are derived from our review of internal surveys and third-party sources. We believe that these third-party sources and estimates are reliable, but have not independently verified them. Statements as to our market position are based on market data currently available to us. Although we are not aware of any misstatements regarding the demographic, economic, employment, industry and market data presented herein, these estimates involve inherent risks and uncertainties and are based on assumptions that are subject to change. See “Risk Factors.”

Trademarks referred to in this prospectus are the property of their respective owners, although for presentational convenience we may not use the ® or the ™ symbols to identify such trademarks.

Implications of Being an Emerging Growth Company

We are an “emerging growth company” under the Jumpstart Our Business Startups Act of 2012, or the JOBS Act. An emerging growth company may take advantage of reduced reporting requirements and is relieved of certain other significant requirements that are otherwise generally applicable to public companies. As an emerging growth company:

| • | we may present as few as two years of audited financial statements and as few as two years of related management’s discussion and analysis of financial condition and results of operations; |

| • | we are exempt from the requirement to obtain an attestation report from our auditors on management’s assessment of the effectiveness of our internal control over financial reporting under the Sarbanes-Oxley Act of 2002, or the Sarbanes-Oxley Act; |

ii

Table of Contents

| • | we may choose not to comply with any new requirements adopted by the Public Company Accounting Oversight Board requiring mandatory audit firm rotation or a supplement to the auditor’s report providing additional information about the audit and our financial statements; |

| • | we are permitted to provide reduced disclosure regarding our executive compensation arrangements pursuant to the rules applicable to smaller reporting companies, which means we do not have to include a compensation discussion and analysis and certain other disclosures regarding our executive compensation; and |

| • | we are not required to give our shareholders non-binding advisory votes on executive compensation or golden parachute arrangements. |

We will cease to be an “emerging growth company” upon the earliest of:

| • | the last day of the fiscal year in which we have total annual gross revenues of $1.07 billion or more; |

| • | the date on which we become a “large accelerated filer” (the fiscal year end on which the total market value of our common equity securities held by non-affiliates is $700 million or more as of June 30); |

| • | the date on which we have, during the previous three-year period, issued more than $1.0 billion in non-convertible debt; and |

| • | the last day of the fiscal year following the fifth anniversary of the completion of this offering. |

We have elected to adopt the reduced disclosure requirements above for purposes of the registration statement of which this prospectus forms a part. In addition, we expect to take advantage of certain of the reduced reporting and other requirements of the JOBS Act with respect to the periodic reports we will file with the Securities and Exchange Commission, or the SEC, and proxy statements that we use to solicit proxies from our shareholders.

In addition, Section 107 of the JOBS Act permits us to take advantage of an extended transition period for complying with new or revised accounting standards affecting public companies. However, we have irrevocably opted out of the extended transition period and, as a result, we will adopt new or revised accounting standards on the relevant dates on which adoption of such standards is required for other public companies.

iii

Table of Contents

This summary highlights selected information contained elsewhere in this prospectus and may not contain all the information you should consider before investing in our common stock. Before making a decision to purchase our common stock, you should read the entire prospectus carefully, including the sections entitled “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Cautionary Note Regarding Forward-Looking Statements,” together with our consolidated financial statements and the related notes to those financial statements that are included elsewhere in this prospectus. Except as otherwise noted, all information in this prospectus assumes that the underwriters do not exercise their option to purchase additional shares of our common stock and gives effect to a one-for-five reverse stock split of our common shares completed effective May 4, 2018. The effect of the reverse stock split on outstanding shares and per share figures has been retroactively applied to all periods presented in this prospectus.

Our Company

We are a bank holding company that operates through our wholly owned subsidiary, Coastal Community Bank. We are headquartered in Everett, Washington, which by population is the largest city in, and the county seat of, Snohomish County. We focus on providing a wide range of banking products and services to consumers and small to medium sized businesses in the broader Puget Sound region in the state of Washington. We believe that the size, growth and economic strength of the Puget Sound region provide us with significant opportunities for long-term growth and profitability. We currently operate 13 full-service banking locations, 10 of which are located in Snohomish County, where we are the largest community bank by deposit market share, and three of which are located in neighboring counties (one in King County and two in Island County). As of March 31, 2018, we had total assets of $831.0 million, total loans of $678.5 million, total deposits of $727.3 million and total shareholders’ equity of $66.9 million.

Our History and Growth

We are a Washington corporation that was formed on July 9, 2003, to become the holding company for Coastal Community Bank, which commenced operations in 1997 and to which we refer in this prospectus as the Bank. The Bank was formed by local business leaders who recognized the opportunity to create a bank that could meet the financial needs of the community, make decisions locally and support the communities it serves.

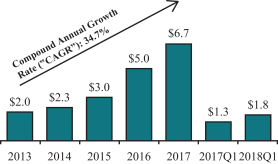

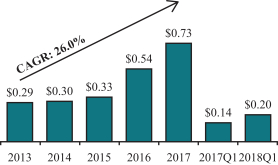

We have focused on achieving our growth organically, without engaging in mergers or branch acquisitions. Our net income and earnings per share for the three months ended March 31, 2018, were $1.8 million and $0.20, respectively. Including the negative impact of P.L. 115-97, commonly known as the Tax Cuts and Jobs Act, on our earnings in 2017, our net income and earnings per share for fiscal year 2017 were $5.4 million and $0.59, respectively. The following tables illustrate our income and balance sheet growth as of or for the quarter ended March 31, 2018, and the quarter ended March 31, 2017 (with respect to adjusted net income and adjusted earnings per share), and the years ended December 31, 2017, 2016, 2015, 2014 and 2013. (Dollars in millions except per share amounts.)

1

Table of Contents

| Adjusted Net Income (1) | Adjusted Earnings Per Share (1) | |

|

|

|

| Total Assets | Total Loans | |

|

|

|

| Total Deposits | Core Deposits (2) | |

|

|

|

| (1) | Adjusted net income and adjusted earnings per share for the year ended December 31, 2017, exclude the impact of the revaluation of our deferred tax assets as a result of the reduction in the corporate income tax rate as a result of the Tax Cuts and Jobs Act. See our reconciliation of non-GAAP financial measures to our most directly comparable GAAP financial measures in the section entitled “GAAP Reconciliation and Management Explanation of Non-GAAP Financial Measures.” See also “Selected Historical Consolidated Financial Data.” |

| (2) | We define core deposits more narrowly than many other banks and institutional data services. For us, core deposits consist of total deposits less all time deposits. |

2

Table of Contents

Competitive Strengths

We believe the following strengths differentiate us from our competitors and position us to execute our business strategy successfully:

Premier local bank in the Puget Sound region. We are the largest locally headquartered bank in Snohomish County, measured by deposit market share. Our success has made us attractive to lenders who prefer to work in a community bank setting and customers who seek the personal attention of a community bank. As further described in “Our Markets” below, we believe that our primary market, the Puget Sound region, which is located in northwest Washington, provides us with an advantage over other community banks in Washington in terms of growing our loans and deposits, as well as increasing profitability and building shareholder value. The net proceeds of this offering to us will enable us to serve larger customers through higher legal lending limits. Additionally, having publicly traded common stock will further enhance our ability to attract and retain talented bankers. We intend to continue expanding our physical presence in Snohomish and neighboring counties and believe we can continue to increase our market share in the Puget Sound region and surrounding counties.

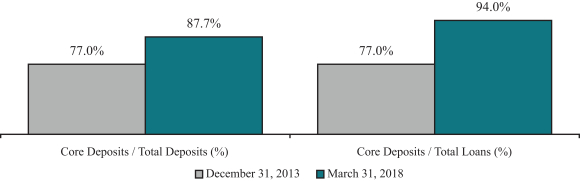

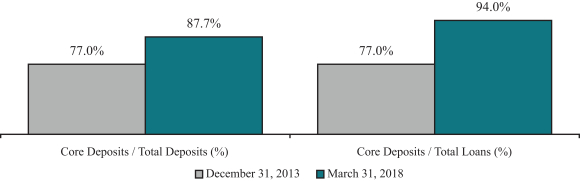

Attractive core deposit franchise. We have a valuable deposit franchise supported by a substantial level of core deposits, which we define as total deposits less all time deposits, and a high level of noninterest bearing accounts. As of March 31, 2018, core deposits comprised 87.7% of total deposits and 94.0% of total loans, while noninterest bearing core deposits comprised 34.9% of total deposits, up from 30.6% at December 31, 2013. None of our deposits were brokered or internet-sourced deposits at March 31, 2018. Our core deposit base results from our emphasis on banking relationships over transactional banking. We believe that our robust core deposit generation is powered by our strong personal service, visibility in our communities, broad commercial banking and treasury management product offerings, and convenient services such as remote deposit capture and commercial internet banking. We also employ deposit-focused business development officers to generate deposit relationships.

The following table illustrates the improvement of our core deposit base as a percent of total deposits and as a percent of total loans:

Balance Sheet Funded by Core Deposits (Total Deposits Less Time Deposits)

3

Table of Contents

Scalable operating model. We have invested in employees and infrastructure to enhance and expand our capabilities and support the growth of our franchise. In particular, we strive to adopt the latest technology to better serve our customer base and improve our operational efficiency. These investments include increasing staffing of our credit administration, finance and information technology departments and developing a full range of commercial and consumer banking services. We offer our retail customers internet and mobile banking with peer-to-peer payments. We offer our commercial customers internet banking, remote deposit capture and online treasury management tools. In addition, we use online tools to streamline the origination of small commercial loans. We believe these investments will support our future growth in a cost-effective manner. Our investments in technology and infrastructure have provided us with a scalable operating platform and organizational infrastructure that will allow us to continue to improve our operating leverage and continue our growth without significant investments in the near term.

Experienced senior management team. Our leadership team consists of experienced banking executives with strong ties to our markets, many of whom have experience working at larger financial institutions.

| • | Eric M. Sprink, our President and Chief Executive Officer, has over 27 years of experience in the financial services industry, including 12 years in the Puget Sound region. Prior to joining the Company in 2006, Mr. Sprink held leadership positions with several financial institutions in corporate finance, retail banking, commercial lending, private banking and trust management. |

| • | Joel G. Edwards, our Chief Financial Officer, has over 32 years of experience in the financial services industry, including 23 years in the Puget Sound region. He has served as chief financial officer for both privately held and publicly traded Washington banking institutions. Mr. Edwards joined the Company as Chief Financial Officer in 2012. |

| • | Russ A. Keithley, our Chief Lending Officer, has over 28 years of experience in the financial services industry, all in the Puget Sound region. Prior to joining the Company in 2012, Mr. Keithley served as chief lending officer and chief credit officer at other financial institutions. |

Diversified loan portfolio. We have an attractive loan mix, with 12.8% commercial and industrial, or C&I, loans, 24.9% owner-occupied commercial real estate, or CRE, loans, 32.8% non-owner-occupied CRE loans and 13.4% one- to four-family residential loans at March 31, 2018. Approximately 37.7% of our loan portfolio is comprised of owner-operated business loans, which includes C&I and owner-occupied CRE loans on a combined basis, and 48.6% of our portfolio consists of loans for investor-owned properties and projects, which includes non-owner-occupied CRE loans, multi-family loans and construction and land development loans on a combined basis. We believe that our knowledgeable and prudent approach to real estate lending results in relatively lower losses caused by defaults, as compared to other types of commercial lending.

4

Table of Contents

Well positioned for a rising rate environment. In anticipation of a rising rate environment, we have focused our business to emphasize the origination of floating-rate loans in our real estate loan portfolio and limited the number of long-term, fixed-rate loans. As of March 31, 2018, approximately 56.0% of our total loan portfolio had floating or adjustable interest rates. Additionally, we currently fund the majority of our loan portfolio with core deposits, which represented 94.0% of loans as of March 31, 2018, and which we believe will re-price more slowly than our assets. As of March 31, 2018, our one-year cumulative re-pricing gap to total assets of 25% was in the 78th percentile of banks nationwide, according to data obtained through S&P Global Market Intelligence, or S&P Global.

Disciplined underwriting and credit administration. Our management and credit administration team fosters a strong risk management culture supported by comprehensive policies and procedures for credit underwriting, funding, and loan administration and monitoring that we believe has enabled us to establish excellent credit quality. We monitor categories of lending activity within our portfolio and establish sub-limits that we review regularly and adjust in response to changes in our lending strategy and market conditions.

5

Table of Contents

The positive impact of our disciplined underwriting and credit administration is demonstrated in the graph below, which shows the decrease in our nonperforming assets and our charge-off history as of and for the three months ended March 31, 2018, and the twelve months ended December 31, 2017, 2016, 2015, 2014 and 2013.

Our Business Strategy

We position ourselves as an attractive local community bank alternative to larger, more impersonal financial services companies. We believe that banking industry consolidation and branch rationalizations have led to an underserved base of small and medium sized businesses, many of which prefer to bank with a local financial institution with agile, highly responsive decision-making capabilities. Our management team’s experience and established presence in our market area gives us valuable insight into the local market, allowing us to recruit talented lenders and attract high-quality customer relationships. We seek to develop long-term relationships by offering a wide array of deposit and treasury products and services to complement our loan products and by delivering high-quality customer service.

The following is a more detailed description of our business strategy:

Strategically expand. We aim to continuously enhance our customer base, increase loans and deposits and expand our overall market share, and we believe that the Puget Sound region specifically has significant organic growth opportunities. We have pursued measured growth through strategic de novo branch expansion. In the last five years, we have added five branches: two in 2013, two in 2015 and one in 2017. As we identify attractive communities for expansion, we seek branch managers, lenders and business development officers prior to establishing a physical presence in any area. We intend to continue expanding our physical presence in Snohomish and neighboring counties when good opportunities that meet our requirements become available.

While acquisitions have not been a driver of our historic growth, we periodically evaluate opportunities to expand through strategic acquisitions. We believe there are several community banks that could be a natural fit for our franchise and could meaningfully enhance our value, and we follow a disciplined approach when evaluating any acquisition opportunities.

Organically grow our loan portfolio and lending staff. We have successfully expanded our loan portfolio by training and encouraging the growth of our junior lenders and by recruiting additional lenders in our existing and target markets. We believe we will benefit from our commitment to developing the next generation of talented lenders. We have created a culture in which our more seasoned lenders train their junior counterparts, enabling them to generate additional loan relationships as they mature in the business. Additionally, by actively involving junior lenders, our senior lenders gain additional flexibility to expand their own relationships. In addition to

6

Table of Contents

developing our junior lenders, we seek to hire additional seasoned lending teams. We believe we are an attractive destination for top talent because we offer a platform of sophisticated product and service capabilities as well as the freedom and flexibility to follow customers in our market area without imposing strict territorial limitations on our lenders. Additionally, we believe that having a marketable common stock as the result of this offering will assist us in recruiting talented personnel through our having the ability to offer the possibility of stock-based incentive compensation. We believe that our commitment to the development of our lenders will lead to long-term continuity in personnel and the recruitment and retention of high-quality lenders in our markets.

Fund growth through core deposits. We fund our loan growth primarily through customer deposits, as reflected by our ratios of core deposits to total deposits and core deposits to total loans of 87.7% and 94.0%, respectively, as of March 31, 2018. The strength of our deposit franchise results from our development and maintenance of long-standing customer relationships. Our relationship managers and branch managers actively seek deposit relationships with our loan customers. We also employ business development officers to generate these relationships. We attract deposits from our commercial customers by providing them with personal service, a broad suite of commercial banking and treasury management products and convenient services such as remote deposit capture and commercial internet banking.

Dedication to community banking. We attribute our success to our adherence to the basic principles of community banking: we know our markets and our customers, and we are meaningfully contributing members of our communities. Our employees volunteer with, serve on the boards of and contribute to dozens of local organizations, and, in 2017, we contributed the most volunteer hours per employee of the 75 companies ranked by the Puget Sound Business Journal. We empower our employees of all levels to make appropriate decisions on customer products and services. By creating expectations of high-quality service and enabling our employees to deliver that service, we believe we have created an environment that attracts both employees and customers.

Increase utilization of technology. We actively explore opportunities to use technology to improve efficiency, deliver superior service and drive growth without compromising our underwriting standards. We have installed cash recyclers in every branch, deployed automatic teller machines, automated portions of the origination process for commercial loans and implemented instant issuance of debit and credit cards. We also provide commercial internet banking, remote deposit capture and online treasury management tools, as well as mobile and internet banking and peer-to-peer payment capabilities. We work diligently to make banking easier for small business owners, enabling them to focus on their businesses. Additionally, we actively recognize and monitor the potential impacts that emerging technologies may have on the banking landscape. We periodically evaluate strategic partnerships with technology-focused companies that we believe will benefit our employees, customers and shareholders, generate additional fee income, enhance our product offerings, monitor our enterprise risk, or otherwise enable us to identify process or cost efficiencies.

Our Markets

We define our market broadly as the Puget Sound region in the state of Washington, which encompasses the Seattle MSA, the metropolitan areas of Olympia, Bremerton and Mount Vernon, and Island County. The Seattle MSA includes Snohomish County (which contains the city of Everett), King County (which contains the cities of Seattle and Bellevue) and Pierce County (which contains the city of Tacoma). The Puget Sound region, which comprises over 60% of the population of the state of Washington as well as the number of businesses located therein, according to data obtained through S&P Global, is a growing market, currently with a population of approximately 4.7 million, over 178,000 businesses and $115 billion of deposits. We believe that the Puget Sound region specifically has significant organic growth opportunities.

7

Table of Contents

The following table shows certain demographic information regarding our market area:

| Market Area |

Number of Coastal Branches |

Total Deposits in Market ($ in millions) |

Population | Number of Businesses |

Median Household Income ($) |

April 2018 Unemployment Rate (% ) |

||||||||||||||||||||||||||

| 2018 Estimated |

Growth | |||||||||||||||||||||||||||||||

| 2013-2018 | 2018-2023 | |||||||||||||||||||||||||||||||

| Estimated | Projected | |||||||||||||||||||||||||||||||

| Puget Sound Region |

||||||||||||||||||||||||||||||||

| Seattle-Tacoma-Bellevue MSA |

11 | $ | 104,715 | 3,885,514 | 9.0 | % | 6.7 | % | 150,558 | $ | 82,186 | 3.6 | % | |||||||||||||||||||

| King County (Seattle & Bellevue) |

1 | 81,779 | 2,198,918 | 9.7 | % | 7.0 | % | 96,918 | 90,281 | 3.0 | % | |||||||||||||||||||||

| Snohomish County (Everett) |

10 | 11,640 | 807,101 | 10.0 | % | 6.8 | % | 23,864 | 83,174 | 3.3 | % | |||||||||||||||||||||

| Pierce County (Tacoma) |

0 | 11,296 | 879,495 | 6.6 | % | 6.0 | % | 29,776 | 65,896 | 5.4 | % | |||||||||||||||||||||

| Olympia-Tumwater MSA |

0 | 3,539 | 282,330 | 8.0 | % | 6.5 | % | 11,709 | 66,766 | 5.0 | % | |||||||||||||||||||||

| Bremerton-Silverdale MSA |

0 | 3,046 | 270,215 | 3.6 | % | 5.0 | % | 10,443 | 72,338 | 5.0 | % | |||||||||||||||||||||

| Mount Vernon-Anacortes MSA |

0 | 2,466 | 126,007 | 5.1 | % | 5.1 | % | 5,639 | 60,361 | 5.4 | % | |||||||||||||||||||||

| Island County |

2 | 1,134 | 84,841 | 6.0 | % | 5.2 | % | 3,354 | 64,150 | 5.6 | % | |||||||||||||||||||||

| Total Puget Sound Region |

13 | $ | 114,900 | 4,648,907 | 8.5 | % | 6.6 | % | 181,703 | - | - | |||||||||||||||||||||

Sources: S&P Global and the U.S. Bureau of Labor Statistics.

We are the largest locally headquartered bank by deposit market share in Snohomish County, according to data from the Federal Deposit Insurance Corporation, or FDIC, as of June 30, 2017, at which date we had a five percent deposit market share in Snohomish County. We aim to continuously enhance our customer base, increase loans and deposits and expand our overall market share in Snohomish County. In light of our market position and our business strategy, we do not regularly compete for commercial or retail deposits in the city of Seattle, and we believe this strategic decision has enabled us to generate low cost core deposits to fund our loan growth.

The following table shows our market position in Snohomish County:

| Institution (Headquarter State) |

Overall Rank |

In-Market HQ Rank |

Deposits in Market ($ in millions) |

Number of Branches |

Deposit Market Share (%) |

|||||||||||||||

| Bank of America Corp. (NC) |

1 | $ | 2,561 | 21 | 22.0 | % | ||||||||||||||

| JPMorgan Chase & Co. (NY) |

2 | 1,757 | 25 | 15.1 | % | |||||||||||||||

| Wells Fargo & Co. (CA) |

3 | 1,480 | 19 | 12.7 | % | |||||||||||||||

| U.S. Bancorp (MN) |

4 | 710 | 12 | 6.1 | % | |||||||||||||||

| KeyCorp (OH) |

5 | 583 | 18 | 5.0 | % | |||||||||||||||

| Coastal Financial Corp. (WA) |

6 | 1 | 578 | 10 | 5.0 | % | ||||||||||||||

| Union Bank of California (CA) |

7 | 545 | 8 | 4.7 | % | |||||||||||||||

| Opus Bank (CA) |

8 | 438 | 6 | 3.8 | % | |||||||||||||||

| Heritage Financial Corp. (WA) |

9 | 418 | 8 | 3.6 | % | |||||||||||||||

| Washington Federal Inc. (WA) |

10 | 416 | 9 | 3.6 | % | |||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total For Institutions In Market |

25 | 6 | $ | 11,640 | 180 | |||||||||||||||

Note: Deposits are as of June 30, 2017, the most recent deposit data available from the FDIC.

8

Table of Contents

Snohomish County. Our headquarters are located in Everett, Washington, which is the largest city in, and the county seat of, Snohomish County with a population of approximately 113,000 as of January 1, 2018. Snohomish is the third largest county by population in the state of Washington, with an estimated population of approximately 800,000 as of January 1, 2018, and the second largest county by total deposits, with $11.6 billion in total deposits as of June 30, 2017, according to data obtained through S&P Global.

The Snohomish County economy is one of the strongest in the United States, boasting a rapidly growing population with a median annual household income of $83,174, the second highest in Washington and significantly above the national average, as of January 1, 2018, and a low unemployment rate of 3.3% as of April 2018. Snohomish has seen consistent growth in service-providing jobs, which account for more than 72% of the jobs in the county. Jobs related to trade, transportation and utilities, retail, and education and health services are the largest sub-categories of service-providing jobs. The Boeing Company, which employed 34,500 people in 2017, is the largest employer in Snohomish County. The second and third largest employers in Snohomish County, Providence Regional Medical Center and the Tulalip Tribes employed 4,775 and 3,200 full-time employees in 2017, respectively, and the U.S. Navy has a meaningful presence in Everett and was the fourth largest employer in Snohomish County in 2017. In addition, Paine Field in Everett will open to commercial air traffic in 2018, and Southwest Airlines, Alaska Airlines, and United Airlines have announced plans to add routes to and from Paine Field, primarily to and from cities in the western United States. We believe this development will lead to further population growth and increase economic development in Snohomish County.

Snohomish County is a large, addressable market with a lower cost of doing business relative to neighboring King County, which includes the cities of Seattle and Bellevue. Based on available data, we believe that a significant portion of the Snohomish County population consists of a mobile commuter work force with relatively easy access to nearby technology and industrial centers. Our location in Snohomish County enables us to have a lower cost structure and lower cost deposits, compared to banks in King County, while also providing us ready access to its larger economy.

King County. King County borders Snohomish County to the south and is the largest county by population in the state of Washington. It is the 13th largest county in the United States with an estimated population of 2.2 million and total deposits of $82 billion as of June 30, 2017, according to the FDIC’s Summary of Deposits. Additionally, the population growth of King County was the second fastest in Washington from 2013 to 2018. While we do not have significant physical presence in King County, our locations in Snohomish County enable us to take advantage of the abundant lending and business opportunities there.

King County, which contains the city of Seattle, boasts headquarters to 10 Fortune 500 companies, including Amazon, Costco, Microsoft and Starbucks. Additionally, 31 Fortune 500 companies currently operate research and engineering hubs in Seattle, as compared to seven companies in 2010, according to The Atlantic. Seattle has become a favored location for technology companies and, according to CBRE Group, Inc., is currently one of the top two tech markets in the United States, ranking behind only the San Francisco Bay Area.

Recent Developments

Reverse Stock Split

On May 4, 2018, we effected a one-for-five reverse stock split, whereby every five shares of our common stock and nonvoting common stock were automatically combined into one share of common stock and nonvoting common stock, respectively. Fractional shares were rounded up to the nearest whole share. Except for adjustments that resulted from the treatment of fractional shares, each shareholder held the same percentage of common stock or nonvoting common stock, as the case may be, outstanding after the reverse stock split as that shareholder held immediately prior to the reverse stock split. The effect of the reverse stock split on outstanding shares and per share figures has been retroactively applied to all periods presented in this prospectus.

9

Table of Contents

Banking Services Agreement with Aspiration Financial, LLC

On May 17, 2018, we entered into an agreement with Aspiration Financial, LLC, or Aspiration, an online investment platform that offers socially-conscious and sustainable banking and investing, pursuant to which we will provide certain banking services for Aspiration’s new cash management account program that Aspiration intends to launch in the third quarter of 2018. As part of our services to Aspiration, we will serve as the issuing bank for debit cards issued to Aspiration’s customers and we will establish one or more settlement accounts for the purpose of settling customer transactions in the Aspiration cash management account program. Substantially all of the Aspiration customer cash balances will be distributed to accounts at other depository institutions through a sweep network. We will retain a small portion of Aspiration customer cash balances for the purpose of facilitating settlement of payments and transfers. The agreement with Aspiration has an initial term of three years from the later of July 1, 2018 or the date on which Aspiration begins enrolling customers, and is subject to two automatic renewals for successive 12-month terms. Pursuant to the agreement with Aspiration, we will receive a quarterly fee based on the total deposits in the Aspiration cash management account program (and we must pay interest to Aspiration on the deposits we retain) and Aspiration will reimburse us for certain expenses.

Corporate Information

Our principal executive offices are located at 5415 Evergreen Way, Everett, WA. Our telephone number is (425) 257-9000. Our website is www.coastalbank.com. The information contained on or accessible from our website does not constitute a part of this prospectus and is not incorporated by reference herein.

Summary Risk Factors

Our business is subject to a number of substantial risks and uncertainties of which you should be aware before making a decision to invest in our common stock. These risks are discussed more fully in the section entitled “Risk Factors” beginning on page 18. Some of these risks include the following:

| • | credit risks, including risks related to the significance of commercial real estate loans in our portfolio, our ability to effectively manage our credit risk and the potential deterioration of the business and economic conditions in our market areas; |

| • | liquidity and funding risks, including the risk that we will not be able to meet our obligations due to risks relating to our funding sources; |

| • | operational, strategic and reputational risks, including the risk that we may not be able to implement our growth strategy and risks related to cybersecurity, the possible loss of key members of our senior leadership team and maintaining our reputation; |

| • | legal, accounting and compliance risks, including risks related to the extensive state and federal regulation under which we operate and changes in such regulations; |

| • | market and interest rate risks, including risks related to interest rate fluctuations and the monetary policies and regulations of the Board of Governors of the Federal Reserve System, or the Federal Reserve; and |

| • | offering and investment risks, including illiquidity and volatility in the trading of our common stock, limitations on our ability to pay dividends and the dilution that investors in this offering will experience. |

10

Table of Contents

THE OFFERING

| Common stock offered by us |

shares | |

| Common stock offered by the selling shareholders |

shares | |

| Underwriters’ option to purchase additional |

We have granted the underwriters an option to purchase up to an additional shares of our common stock within 30 days after the date of this prospectus. | |

| Common shares to be outstanding after this |

shares, which includes common stock and nonvoting common stock (or shares if the underwriters exercise in full their option to purchase additional shares of common stock) | |

| Use of proceeds |

Assuming an initial public offering price of $ per share, which is the midpoint of the price range set forth on the cover page of this prospectus, we estimate that the net proceeds to us from this offering, after deducting estimated underwriting discounts but before payment of estimated offering expenses payable by us, will be approximately $ million (or approximately $ million if the underwriters exercise in full their option to purchase additional shares). We intend to use the net proceeds to us from this offering to support our growth, organically or through mergers and acquisitions, and for general corporate purposes, which may include the repayment or refinancing of debt and maintenance of our required regulatory capital levels. We will not receive any proceeds from the sale of shares of our common stock by the selling shareholders in this offering. See “Use of Proceeds.” | |

| Dividends |

We have not historically declared or paid dividends on our common stock and we do not intend to pay cash dividends on our common stock in the near term. Instead, we anticipate that all of our future earnings will be retained to support our operations and finance the growth and development of our business. Our determination to pay dividends in the future will be at the discretion of our board of directors and will depend upon a number of factors, including our earnings, financial condition, results of operations, capital requirements, regulatory restrictions, and other factors that our board of directors may deem relevant. See “Dividend Policy.” | |

| Investment Agreements |

Prior to this offering, we entered into Investment Agreements with certain of our shareholders that hold 4.9% or more of our outstanding common stock. Among other things, the Investment | |

11

Table of Contents

| Agreements provide such shareholders with certain board representation rights. For a detailed description of the Investment Agreements, see “Certain Relationships and Related Party Transactions—Certain Related Party Transactions—Investment Agreements.” | ||

| Proposed Nasdaq symbol |

We have applied to list our common stock on the Nasdaq Global Select Market under the symbol “CCB.” | |

| Conflicts of interest |

An affiliate of Hovde Group, LLC, or Hovde Group, an underwriter in this offering, beneficially owns more than 10% of our issued and outstanding common stock. As a result, Hovde Group is deemed to have a “conflict of interest” within the meaning of Rule 5121 of the Financial Industry Regulatory Authority, Inc., or FINRA. Accordingly, this offering will be conducted in compliance with the applicable requirements of Rule 5121, which include, among other things, that a “qualified independent underwriter” as defined in Rule 5121 participate in the preparation of, and exercise the usual standards of due diligence with respect to, this prospectus and the registration statement of which this prospectus forms a part. Keefe, Bruyette & Woods, Inc., or Keefe, Bruyette & Woods, has agreed to act as a qualified independent underwriter for this offering. Keefe, Bruyette & Woods will not receive any additional compensation for serving as qualified independent underwriter in connection with this offering. See “Underwriting (Conflicts of Interest)—Conflicts of Interest.” | |

| Directed share program |

At our request, the underwriters have reserved for sale, at the initial public offering price, up to 5% of the shares of our common stock offered in this offering for sale to certain of our directors, executive officers, employees and other related persons who have expressed an interest in purchasing our shares of common stock in this offering through a directed share program. We do not know if these persons will choose to purchase all or any portion of the reserved shares, but any purchases they do make will reduce the number of shares available to the general public. See “Underwriting (Conflicts of Interest)—Directed Share Program” for additional information. | |

| Risk factors |

Investing in our common stock involves certain risks. See “Risk Factors,” beginning on page 18, for a discussion of factors that you should carefully consider before investing in our common stock. | |

12

Table of Contents

Except as otherwise indicated, references in this prospectus to the number of our common shares outstanding after this offering are based on 8,891,859 of shares of common stock and 361,444 shares of nonvoting common stock outstanding as of March 31, 2018. Except as otherwise indicated, all information in this prospectus:

| • | gives effect to a one-for-five reverse stock split of our common shares completed effective May 4, 2018; |

| • | does not attribute to any director, executive officer or principal shareholder any purchase of shares of our common stock in this offering, including through the directed share program described in “Underwriting (Conflicts of Interest)—Directed Share Program;” |

| • | assumes no exercise by the underwriters of their option to purchase additional shares of our common stock; |

| • | assumes an initial public offering price of $ per share, which is the midpoint of the price range set forth on the cover page of this prospectus; |

| • | excludes 784,984 shares of our common stock issuable upon the exercise of stock options, with a weighted average exercise price of $6.27 per share, that were outstanding as of March 31, 2018; and |

| • | excludes 500,000 additional shares of our common stock that are reserved for future issuance under our 2018 Omnibus Incentive Plan. |

13

Table of Contents

SELECTED HISTORICAL CONSOLIDATED FINANCIAL DATA

The following table sets forth selected historical consolidated financial data as of and for the three months ended March 31, 2018, and as of and for the years ended December 31, 2017, 2016, 2015, 2014 and 2013. The selected balance sheet data as of March 31, 2018 and 2017, and the selected statement of income data for the three months ended March 31, 2018 and 2017, have been derived from our unaudited consolidated financial statements included elsewhere in this prospectus. The selected balance sheet data as of December 31, 2017 and 2016, and the selected statement of income data for the years ended December 31, 2017 and 2016, have been derived from our audited consolidated financial statements included elsewhere in this prospectus. The selected balance sheet data as of December 31, 2015, 2014 and 2013 and the selected statement of income data for the years ended December 31, 2015, 2014 and 2013 have been derived from our audited consolidated financial statements that are not included in this prospectus. Our historical results are not necessarily indicative of any future performance. The information presented in the following table has been adjusted to give effect to a one-for-five reverse stock split of our common shares completed effective May 4, 2018. The effect of the reverse stock split on outstanding shares and per share figures has been retroactively applied to all periods presented.

You should read the following financial data in conjunction with the other information contained in this prospectus, including in the sections entitled “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Capitalization,” as well as our consolidated financial statements and related notes to those financial statements included elsewhere in this prospectus. The selected historical consolidated financial data presented below contains financial measures that are not presented in accordance with accounting principles generally accepted in the United States and have not been audited. See “GAAP Reconciliation and Management Explanation of Non-GAAP Financial Measures.”

| As of or for the Three Months Ended March 31, |

As of or for the Year Ended December 31, |

|||||||||||||||||||||||||||

| (Dollars in thousands, except per share data) | 2018 | 2017 | 2017 | 2016 | 2015 | 2014 | 2013 | |||||||||||||||||||||

| Statement of Income Data: |

||||||||||||||||||||||||||||

| Total interest income |

$ | 8,607 | $ | 7,543 | $ | 32,113 | $ | 28,460 | $ | 24,829 | $ | 22,451 | $ | 18,794 | ||||||||||||||

| Total interest expense |

829 | 668 | 2,875 | 2,523 | 2,501 | 2,032 | 1,699 | |||||||||||||||||||||

| Provision for loan losses |

501 | 439 | 870 | 1,919 | 941 | 1,690 | 1,493 | |||||||||||||||||||||

| Net interest income after provision for loan losses |

7,277 | 6,436 | 28,368 | 24,018 | 21,387 | 18,729 | 15,602 | |||||||||||||||||||||

| Total noninterest income |

1,107 | 831 | 4,154 | 4,977 | 3,506 | 3,574 | 2,018 | |||||||||||||||||||||

| Total noninterest expense |

6,067 | 5,376 | 22,433 | 21,538 | 20,406 | 18,829 | 14,447 | |||||||||||||||||||||

| Provision for income taxes |

474 | 578 | 4,653 | 2,454 | 1,483 | 1,127 | 1,130 | |||||||||||||||||||||

| Net income |

1,843 | 1,313 | 5,436 | 5,003 | 3,004 | 2,347 | 2,043 | |||||||||||||||||||||

| Adjusted net income (1) |

1,843 | 1,313 | 6,731 | 5,003 | 3,004 | 2,347 | 2,043 | |||||||||||||||||||||

| Balance Sheet Data: |

||||||||||||||||||||||||||||

| Cash and cash equivalents |

94,569 | 104,606 | 89,751 | 86,975 | 84,674 | 80,167 | 38,625 | |||||||||||||||||||||

| Investment securities |

37,338 | 34,806 | 38,336 | 34,994 | 16,150 | 13,757 | 14,439 | |||||||||||||||||||||

| Loans |

678,515 | 596,219 | 656,788 | 596,128 | 499,186 | 431,119 | 359,317 | |||||||||||||||||||||

| Allowance for loan losses |

8,423 | 7,793 | 8,017 | 7,544 | 5,989 | 5,557 | 4,268 | |||||||||||||||||||||

| Total assets |

830,962 | 758,377 | 805,753 | 740,611 | 622,678 | 546,475 | 428,860 | |||||||||||||||||||||

| Interest-bearing deposits |

473,268 | 436,061 | 460,937 | 424,707 | 370,028 | 333,230 | 256,747 | |||||||||||||||||||||

| Noninterest-bearing deposits |

254,000 | 229,016 | 242,358 | 223,955 | 173,554 | 138,931 | 113,337 | |||||||||||||||||||||

| Total deposits |

727,268 | 665,077 | 703,295 | 648,662 | 543,582 | 472,161 | 370,084 | |||||||||||||||||||||

| Total borrowings |

33,534 | 28,681 | 33,529 | 28,513 | 20,376 | 19,374 | 18,372 | |||||||||||||||||||||

| Total shareholders’ equity |

66,927 | 61,303 | 65,711 | 59,897 | 55,753 | 52,521 | 38,487 | |||||||||||||||||||||

14

Table of Contents

| As of or for the Three Months Ended March 31, |

As of or for the Year Ended December 31, |

|||||||||||||||||||||||||||

| (Dollars in thousands, except per share data) | 2018 | 2017 | 2017 | 2016 | 2015 | 2014 | 2013 | |||||||||||||||||||||

| Share and Per Share Data: (2) |

||||||||||||||||||||||||||||

| Earnings per share—basic |

$ | 0.20 | $ | 0.14 | $ | 0.59 | $ | 0.54 | $ | 0.33 | $ | 0.30 | $ | 0.29 | ||||||||||||||

| Earnings per share—diluted |

$ | 0.20 | $ | 0.14 | $ | 0.59 | $ | 0.54 | $ | 0.33 | $ | 0.30 | $ | 0.29 | ||||||||||||||

| Adjusted earnings per share—diluted (3) |

$ | 0.20 | $ | 0.14 | $ | 0.73 | $ | 0.54 | $ | 0.33 | $ | 0.30 | $ | 0.29 | ||||||||||||||

| Dividends per share |

- | - | - | - | - | - | - | |||||||||||||||||||||

| Book value per share (4) |

$ | 7.23 | $ | 6.63 | $ | 7.11 | $ | 6.48 | $ | 6.04 | $ | 5.70 | $ | 5.28 | ||||||||||||||

| Tangible book value per share (5) |

$ | 7.23 | $ | 6.63 | $ | 7.11 | $ | 6.48 | $ | 6.04 | $ | 5.70 | $ | 5.28 | ||||||||||||||

| Weighted average common shares outstanding–basic |

9,242,839 | 9,232,398 | 9,232,398 | 9,226,204 | 9,218,418 | 7,859,830 | 7,148,165 | |||||||||||||||||||||

| Weighted average common shares outstanding–diluted |

9,248,428 | 9,235,475 | 9,237,629 | 9,227,216 | 9,220,836 | 7,859,830 | 7,148,165 | |||||||||||||||||||||

| Shares outstanding at end of period |

9,253,303 | 9,243,546 | 9,248,901 | 9,238,788 | 9,232,538 | 9,213,204 | 7,289,274 | |||||||||||||||||||||

| Performance Ratios: |

||||||||||||||||||||||||||||

| Return on average assets (6) |

0.94 | % | 0.73 | % | 0.73 | % | 0.76 | % | 0.52 | % | 0.49 | % | 0.51 | % | ||||||||||||||

| Adjusted return on average assets (6)(7) |

0.94 | % | 0.73 | % | 0.90 | % | 0.76 | % | 0.52 | % | 0.49 | % | 0.51 | % | ||||||||||||||

| Return on average shareholders’ equity (6) |

10.96 | % | 7.78 | % | 8.27 | % | 8.56 | % | 5.52 | % | 5.33 | % | 5.56 | % | ||||||||||||||

| Adjusted return on average shareholders’ equity (6)(8) |

10.96 | % | 7.78 | % | 10.24 | % | 8.56 | % | 5.52 | % | 5.33 | % | 5.56 | % | ||||||||||||||

| Yield on earnings assets (6) |

4.56 | % | 4.40 | % | 4.48 | % | 4.53 | % | 4.51 | % | 4.93 | % | 4.95 | % | ||||||||||||||

| Yield on loans (6) |

5.07 | % | 4.93 | % | 4.98 | % | 5.16 | % | 5.34 | % | 5.60 | % | 5.65 | % | ||||||||||||||

| Cost of funds (6) |

0.46 | % | 0.41 | % | 0.42 | % | 0.42 | % | 0.48 | % | 0.47 | % | 0.47 | % | ||||||||||||||

| Cost of deposits (6) |

0.37 | % | 0.31 | % | 0.32 | % | 0.36 | % | 0.46 | % | 0.44 | % | 0.43 | % | ||||||||||||||

| Net interest margin (6) |

4.12 | % | 4.01 | % | 4.08 | % | 4.13 | % | 4.06 | % | 4.49 | % | 4.50 | % | ||||||||||||||

| Noninterest expense to average assets (6) |

3.10 | % | 2.98 | % | 3.00 | % | 3.28 | % | 3.51 | % | 3.92 | % | 3.61 | % | ||||||||||||||

| Efficiency ratio (9) |

68.28 | % | 69.76 | % | 67.18 | % | 69.67 | % | 78.99 | % | 78.48 | % | 75.59 | % | ||||||||||||||

| Loans to deposits |

93.3 | % | 89.6 | % | 93.4 | % | 91.9 | % | 91.8 | % | 91.3 | % | 97.1 | % | ||||||||||||||

| Credit Quality Ratios: |

||||||||||||||||||||||||||||

| Nonperforming assets to total assets |

0.20 | % | 0.27 | % | 0.26 | % | 1.11 | % | 1.52 | % | 1.90 | % | 1.24 | % | ||||||||||||||

| Nonperforming assets to total loans and OREO |

0.25 | % | 0.34 | % | 0.32 | % | 1.38 | % | 1.89 | % | 2.39 | % | 1.46 | % | ||||||||||||||

| Nonperforming loans to total loans |

0.25 | % | 0.34 | % | 0.32 | % | 0.27 | % | 0.54 | % | 0.35 | % | 0.72 | % | ||||||||||||||

| Allowance for loan losses to nonperforming loans |

495.76 | % | 379.22 | % | 378.16 | % | 468.28 | % | 221.32 | % | 365.35 | % | 163.90 | % | ||||||||||||||

| Allowance for loan losses to total loans |

1.24 | % | 1.31 | % | 1.22 | % | 1.27 | % | 1.20 | % | 1.29 | % | 1.19 | % | ||||||||||||||

| Net charge-offs to average loans (6) |

0.06 | % | 0.13 | % | 0.06 | % | 0.07 | % | 0.11 | % | 0.10 | % | 0.33 | % | ||||||||||||||

| Capital Ratios: |

||||||||||||||||||||||||||||

| Total shareholders’ equity to total assets |

8.05 | % | 8.08 | % | 8.16 | % | 8.09 | % | 8.95 | % | 9.61 | % | 8.97 | % | ||||||||||||||

| Tangible equity to tangible assets (10) |

8.05 | % | 8.08 | % | 8.16 | % | 8.09 | % | 8.95 | % | 9.61 | % | 8.97 | % | ||||||||||||||

| Common equity tier 1 capital ratio (11) |

11.37 | % | 11.86 | % | 11.67 | % | 11.60 | % | 11.14 | % | N/A | N/A | ||||||||||||||||

| Tier 1 leverage ratio (11) |

10.09 | % | 10.07 | % | 9.94 | % | 10.11 | % | 9.58 | % | 10.10 | % | 9.58 | % | ||||||||||||||

| Tier 1 risk-based capital ratio (11) |

11.37 | % | 11.86 | % | 11.67 | % | 11.60 | % | 11.14 | % | 12.46 | % | 11.56 | % | ||||||||||||||

| Total risk-based capital ratio (11) |

12.60 | % | 13.11 | % | 12.90 | % | 12.85 | % | 12.31 | % | 13.71 | % | 12.78 | % | ||||||||||||||

| (1) | Adjusted net income is a non-GAAP financial measure that excludes the impact of the revaluation of our deferred tax assets as a result of the reduction in the corporate income tax rate under the Tax Cuts and Jobs Act in fiscal year 2017. The most directly comparable GAAP measure is net income. See our reconciliation of non-GAAP financial measures to their most directly comparable GAAP financial measures under the caption “GAAP Reconciliation and Management Explanation of Non-GAAP Financial Measures.” |

| (2) | Share and per share amounts are based on total common shares outstanding, which includes common stock and nonvoting common stock. |

| (3) | Adjusted earnings per share is a non-GAAP financial measure that excludes the impact of the revaluation of our deferred tax assets as a result of the reduction in the corporate income tax rate under the Tax Cuts and Jobs Act in fiscal year 2017. The most directly comparable GAAP measure is earnings per share. See our reconciliation of non-GAAP financial measures to their most directly comparable GAAP financial measures under the caption “GAAP Reconciliation and Management Explanation of Non-GAAP Financial Measures.” |

| (4) | We calculate book value per share as total shareholders’ equity at the end of the relevant period divided by the outstanding number of our common shares, which includes common stock and nonvoting common stock, at the end of each period. |

15

Table of Contents

| (5) | Tangible book value per share is a non-GAAP financial measure. We calculate tangible book value per share as total shareholders’ equity at the end of the relevant period, less goodwill and other intangible assets, divided by the outstanding number of our common shares, which includes common stock and nonvoting common stock, at the end of each period. The most directly comparable GAAP financial measure is book value per share. We had no goodwill or other intangible assets as of any of the dates indicated. As a result, tangible book value per share is the same as book value per share as of each of the dates indicated. |

| (6) | Ratios for the three months ended March 31, 2018 and 2017, are annualized. |

| (7) | Adjusted return on average assets is a non-GAAP financial measure that excludes the impact of the revaluation of our deferred tax assets as a result of the reduction in the corporate income tax rate under the Tax Cuts and Jobs Act in fiscal year 2017. The most directly comparable GAAP measure is return on average assets. See our reconciliation of non-GAAP financial measures to their most directly comparable GAAP financial measures under the caption “GAAP Reconciliation and Management Explanation of Non-GAAP Financial Measures.” |

| (8) | Adjusted return on average shareholder’s equity is a non-GAAP financial measure that excludes the impact of the revaluation of our deferred tax assets as a result of the reduction in the corporate income tax rate under the Tax Cuts and Jobs Act in fiscal year 2017. The most directly comparable GAAP measure is return on average shareholders’ equity. See our reconciliation of non-GAAP financial measures to their most directly comparable GAAP financial measures under the caption “GAAP Reconciliation and Management Explanation of Non-GAAP Financial Measures.” |

| (9) | Efficiency ratio represents noninterest expense divided by the sum of net interest income and noninterest income. |

| (10) | Tangible equity to tangible assets is a non-GAAP financial measure. We calculate tangible equity to tangible assets as total shareholders’ equity at the end of the relevant period, less goodwill and other intangible assets. The most directly comparable GAAP financial measures is total shareholders’ equity to total assets. We had no goodwill or other intangible assets as of the dates indicated. As a result, tangible equity to tangible assets is the same as total shareholders’ equity to total assets as of each of the dates indicated. |

| (11) | Capital ratios are for the Bank. |

16

Table of Contents

GAAP RECONCILIATION AND MANAGEMENT EXPLANATION OF

NON-GAAP FINANCIAL MEASURES

Some of the financial measures included in this prospectus are not measures of financial performance recognized by GAAP. Our management uses the non-GAAP financial measures set forth below in its analysis of our performance.

| • | “Adjusted net income” is a non-GAAP measure defined as net income increased by the additional income tax expense that resulted from the revaluation of deferred tax assets as a result of the reduction in the corporate income tax rate under the recently enacted Tax Cuts and Jobs Act. The most directly comparable GAAP measure is net income. |

| • | “Adjusted earnings per share” is a non-GAAP measure defined as net income, plus additional income tax expense, divided by weighted average outstanding shares (diluted). The most directly comparable GAAP measure is earnings per share. |

| • | “Adjusted return on average assets” is a non-GAAP measure defined as net income, plus additional income tax expense, divided by average assets. The most directly comparable GAAP measure is return on average assets. |

| • | “Adjusted return on average shareholders’ equity” is a non-GAAP measure defined as net income, plus additional income tax expense, divided by average shareholders’ equity. The most directly comparable GAAP measure is return on average shareholders’ equity. |

We believe that these non-GAAP financial measures provide information that is important to investors and that is useful in understanding our results of operations. However, these non-GAAP financial measures are supplemental and are not a substitute for an analysis based on GAAP measures. As other companies may use different calculations for these measures, this presentation may not be comparable to other similarly titled measures by other companies.

| (Dollars in thousands, except share and per share data) | As of and for the Year Ended December 31, 2017 |

|||

| Adjusted net income: |

||||

| Net income |

$ | 5,436 | ||

| Plus: additional income tax expense |

1,295 | |||

| Adjusted net income |

$ | 6,731 | ||

| Adjusted earnings per share—diluted |

||||

| Net income |

$ | 5,436 | ||

| Plus: additional income tax expense |

1,295 | |||

| Adjusted net income |

$ | 6,731 | ||

| Weighted average common shares outstanding—diluted (1) |

9,237,629 | |||

| Adjusted earnings per share—diluted (1) |

$ | 0.73 | ||

| Adjusted return on average assets |

||||

| Net income |

$ | 5,436 | ||

| Plus: additional income tax expense |

1,295 | |||

| Adjusted net income |

$ | 6,731 | ||

| Average assets |

$ | 748,940 | ||

| Adjusted return on average assets |

0.90 | % | ||

| Adjusted return on average shareholders’ equity |

||||

| Net income |

$ | 5,436 | ||

| Plus: additional income tax expense |

1,295 | |||

| Adjusted net income |

$ | 6,731 | ||

| Average shareholders’ equity |

$ | 65,720 | ||

| Adjusted return on average shareholders’ equity |

10.24 | % | ||

| (1) | Share and per share information has been adjusted to give effect to a one-for-five reverse stock split of our common shares completed effective May 4, 2018. |

17

Table of Contents

An investment in our common stock involves a number of risks. Before making a decision to purchase our common stock, you should carefully consider the following information about these risks, together with the other information contained in this prospectus. Additional risks and uncertainties not currently known to us or that we currently believe to be immaterial may also materially and adversely affect us. Many factors, including the risks described below, could result in a significant or material adverse effect on our business, financial condition, earnings and prospects. If this were to happen, the price of our common stock could decline significantly and you could lose all or part of your investment. Some statements in this prospectus, including statements in the following risk factors, constitute forward-looking statements. Please refer to “Cautionary Note Regarding Forward-Looking Statements.”

Risks Related to Our Business

Our commercial real estate lending activities expose us to increased lending risks and related loan losses.

At March 31, 2018, our commercial real estate loan portfolio totaled $453.9 million, or 66.9% of our total loan portfolio. Our current business strategy is to continue our originations of commercial real estate loans. Commercial real estate loans generally expose a lender to greater risk of non-payment and loss than one-to-four family residential mortgage loans because repayment of the loans often depends on the successful operation of the properties and the income stream of the borrowers. These loans involve larger loan balances to single borrowers or groups of related borrowers compared to one-to-four family residential mortgage loans. To the extent that borrowers have more than one commercial real estate loan outstanding, an adverse development with respect to one loan or one credit relationship could expose us to a significantly greater risk of loss compared to an adverse development with respect to a one-to-four family residential real estate loan. Moreover, if loans that are collateralized by commercial real estate become troubled and the value of the real estate has been significantly impaired, then we may not be able to recover the full contractual amount of principal and interest that we anticipated at the time we originated the loan, which could cause us to increase our provision for loan losses and would adversely affect our earnings and financial condition.

Imposition of limits by the bank regulators on commercial real estate lending activities could curtail our growth and adversely affect our earnings.

In 2006, the federal banking regulators issued joint guidance entitled “Concentrations in Commercial Real Estate Lending, Sound Risk Management Practices,” or the CRE Guidance. Although the CRE Guidance did not establish specific lending limits, it provides that a bank’s commercial real estate lending exposure could receive increased supervisory scrutiny where total non-owner-occupied commercial real estate loans, including loans secured by apartment buildings, investor commercial real estate, and construction and land loans, represent 300% or more of an institution’s total risk-based capital, and the outstanding balance of the commercial real estate loan portfolio has increased by 50% or more during the preceding 36 months. Our total non-owner-occupied commercial real estate loans, including loans secured by apartment buildings, investor commercial real estate, and construction and land loans represented 366.8% of the Bank’s total risk-based capital at March 31, 2018. However, the increase in the portfolio over the preceding 36 months was less than 50%.

In December 2015, the federal banking regulators released a new statement on prudent risk management for commercial real estate lending, referred to herein as the 2015 Statement. In the 2015 Statement, the federal banking regulators, among other things, indicate the intent to continue “to pay special attention” to commercial real estate lending activities and concentrations going forward. If the Federal Reserve, our primary federal regulator, were to impose restrictions on the amount of commercial real estate loans we can hold in our portfolio, for reasons noted above or otherwise, our earnings would be adversely affected.

18

Table of Contents

Our commercial business lending activities expose us to additional lending risks.

We make commercial business loans in our market area to a variety of professionals, sole proprietorships, partnerships and corporations. As compared to commercial real estate loans, which are secured by real property, the value of which tends to be more easily ascertainable, commercial business loans are of higher risk and typically are made on the basis of the borrower’s ability to make repayment from the cash flow of the borrower’s business. As a result, the availability of funds for the repayment of commercial business loans may depend substantially on the success of the business itself. Further, any collateral securing such loans may depreciate over time, may be difficult to appraise, may fluctuate in value and may depend on the borrower’s ability to collect receivables. We have increased our focus on commercial business lending in recent years and intend to continue to focus on this type of lending in the future.

Our concentration of residential mortgage loans exposes us to increased lending risks.

At March 31, 2018, $90.6 million, or 13.4%, of our loan portfolio was secured by one-to-four family real estate, a significant majority of which is located in the Puget Sound region. One-to-four family residential mortgage lending is generally sensitive to regional and local economic conditions that significantly impact the ability of borrowers to meet their loan payment obligations, making loss levels difficult to predict. A decline in residential real estate values as a result of a downturn in the Puget Sound housing market could reduce the value of the real estate collateral securing these types of loans. Declines in real estate values could cause some of our residential mortgages to be inadequately collateralized, which would expose us to a greater risk of loss if we seek to recover on defaulted loans by selling the real estate collateral.

Our origination of construction loans exposes us to increased lending risks.

We originate commercial construction loans primarily to professional builders for the construction of one-to-four family residences, apartment buildings, and commercial real estate properties. To a lesser degree, we also originate land acquisition loans for the purpose of facilitating the ultimate construction of a home or commercial building. Our construction loans present a greater level of risk than loans secured by improved, occupied real estate due to: (1) the increased difficulty at the time the loan is made of estimating the building costs and the selling price of the property to be built; (2) the increased difficulty and costs of monitoring the loan; (3) the higher degree of sensitivity to increases in market rates of interest; and (4) the increased difficulty of working out loan problems. In addition, construction costs may exceed original estimates as a result of increased materials, labor or other costs. Construction loans also often involve the disbursement of funds with repayment dependent, in part, on the success of the project and the ability of the borrower to sell or lease the property or refinance the indebtedness.

The small to medium-sized businesses that we lend to may have fewer resources to endure adverse business developments than larger firms, which may impair our borrowers’ ability to repay loans.