UNITED STATES

SECURITIES AND

EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 20-F/A

(Mark One)

| ☐ | REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2017

OR

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| ☐ | SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Date of event requiring this shell company report

Commission file number: 000-55135

POET TECHNOLOGIES INC.

(Exact name of Registrant as specified in its charter)

Ontario, Canada

(Jurisdiction of incorporation or organization)

1107 – 120 Eglinton Avenue East

Toronto, Ontario, M4P 1E2, Canada

(Address of principal executive offices)

Suresh Venkatesan, CEO

780 Montague

Expressway

Ste 107

San Jose, California 95131

Email: svv@poet-technologies.com

(Name, Telephone, Email and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act: None.

Securities registered or to be registered pursuant to Section 12(g) of the Act: Common Stock, no par value.

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: Not Required.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

☐ Yes ☒ No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

☒ Yes ☐ No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Not Applicable.

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or an emerging growth company. See definition of “large accelerated filer,” “accelerated filer,” and “emerging growth company” in the Exchange Act.

Large accelerated filer ☐ Accelerated filer ☒ Emerging Growth Company ☒ Non-accelerated filer ☐

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| U.S GAAP ☐ | International Financial Reporting Standards as issued by the International Accounting Standards Board ☒ |

Other ☐ |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow.

☐ Item 17 ☐ Item 18

EXPLANATORY NOTE

This Amendment No. 1 on Form 20-F/A (“Amendment No. 1”) to the Annual Report on Form 20-F of POET Technologies Inc. (the “Company”) for the fiscal year ended December 31, 2017, filed on April 30, 2018 (the “2017 Form 20-F”), amends the Company’s 2017 Form 20-F to correct the following:

| 1. | Submit its Interactive Data File (as defined in Rule 11 of Regulation S-T) with respect to the audited consolidated financial statements of the Company for that fiscal year as an exhibit to the Form 20-F pursuant to paragraph 101 under “Instructions as to Exhibits” of Form 20-F in accordance with Rule 405 of Regulation S-T; |

| 2. | Correct the date of the “REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM” from April 27, 2018 |

| 3. | Correct the “LOSS PER SHARE” note number from Note 13 |

| 4. | Correct 2016 numerical information in “NOTE 17 - SEGMENTED INFORMATION” |

The correction to the above noted statements are:

| 2. | Correct date should be April 30, 2018 |

| 3. | Note number should be Note 14 |

| 4. |

Cost of sales should be $946,001 in column 1 and $946,001 in column 4 Selling, marketing and administration should be $3,069,493 in column 1 and $11,421,604 in column 4 Research and development should be $1,042,842 in column 1 and $3,165,825 in column 4 |

Other than as set forth herein, the Company has not modified or updated any other disclosures and has made no changes to the items or sections in the Company’s 2017 Form 20-F. Other than as expressly set forth above, this Amendment No. 1 does not, and does not purport to, amend, update or restate the information in any part of the Company’s 2017 Form 20-F or reflect any events that have occurred after the 2017 Form 20-F was filed on April 30, 2018. The filing of this Amendment No. 1 should not be understood to mean that any other statements contained in the original filing are true and complete as of any date subsequent to April 30, 2018. Accordingly, this Amendment No. 1 should be read in conjunction with the 2017 Form 20-F and the documents filed with or furnished to the Securities and Exchange Commission by the Company subsequent to April 30, 2018, including any amendments to such documents.

POET TECHNOLOGIES INC.

FORM 20-F ANNUAL REPORT

TABLE OF CONTENTS

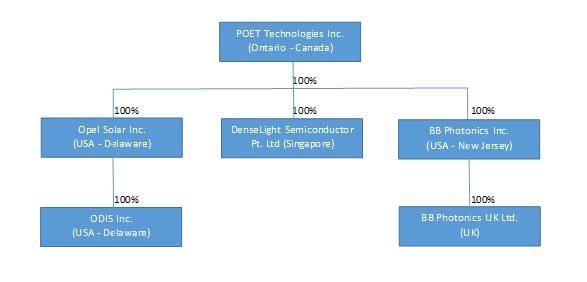

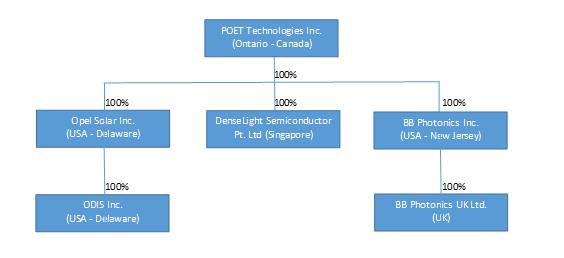

POET Technologies Inc. is organized under the Business Corporations Act (Ontario). In this Annual Report, the “Company”, “we”, “our”, “POET” and “us” refer to POET Technologies Inc. and its subsidiaries (unless the context otherwise requires). We refer you to the documents attached as exhibits hereto for more complete information than may be contained in this Annual Report. Our principal Canadian corporate offices are located at Suite 1107, 120 Eglinton Avenue East, Toronto, Ontario M4P 1E2, Canada. Our U.S office is located in the U.S. at Suite 107, 780 Montague Expressway, San Jose, CA, 95131. Our telephone number in Toronto is (416) 368-9411.

We file reports and other information with the Securities and Exchange Commission (“SEC”) located at 100 F Street NE, Washington, D.C. 20549. You may obtain copies of our filings with the SEC by accessing their website located at www.sec.gov. We also file reports under Canadian regulatory requirements on SEDAR; you may access our reports filed on SEDAR by accessing the website www.sedar.com.

This Annual Report (including the consolidated audited financial statements for the years ended December 31, 2017, 2016 and 2015 attached thereto, together with the auditors’ report thereon), and the exhibits thereto shall be deemed to be incorporated by reference as exhibits to the Registration Statement of the Company on Form F-10, as amended (File No. 333-213422), and to be a part thereof from the date on which this report was filed, to the extent not superseded by documents or reports subsequently filed or furnished.

| 1 |

Business of POET Technologies Inc.

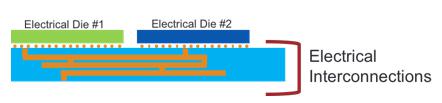

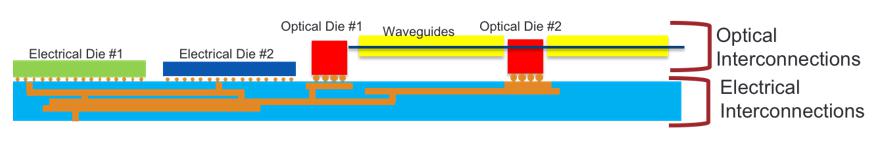

POET Technologies is a developer and manufacturer of optical light source products for the sensing and data communications markets. Integration of optics and electronics is fundamental to increasing functional scaling and lowering the cost of current photonic solutions. POET believes that its approach to both hybrid and monolithic integration of devices, utilizing a novel dielectric platform and proven advanced wafer-level packaging techniques enables substantial improvements in device cost, efficiency and performance. Optical engines based on this integrated approach have applications ranging from data centers to consumer products.

During the year ended December 31, 2017, the Company generated revenues of $2,794,044 and gross profit of $1,451,353. The Company currently operates at a loss. The loss for 2017 was $12,797,797. 100% of the Company’s revenue in 2017 was generated from the sale of sensing products through the Company’s subsidiary DenseLight Semiconductor Pte. Ltd. (“DenseLight”).

During 2017, the Company spent $5,442,873 on research and development activities directly related to the development and commercialization of the POET Optical Interposer Platform (POIP) and the development of photonic sensing products. $10,870,741 was spent on selling, marketing and administration expenses which included non-cash operating costs of $5,081,077, of which $2,275,160 related to depreciation and amortization, and $2,805,917 related to the fair value stock-based compensation. The 2017 loss included other income of $1,766,524 of which $1,695,383 related to the recovery of certain qualifying expenses from the Economic Development Board (EDB) in Singapore. The recovery includes both collected recoveries and an amount to be received in 2018. The Company also had deferred income tax recovery of $297,940.

As of December 31, 2017, we had over $7.9 million in current assets and approximately $800,000 of accounts payable and accrued liabilities. The Company is in a position to cover its liabilities as they come due, however, due to the continuation of losses, the Company will need to seek debt or equity financing to fund its operations. Consistent with its need for additional financing, on March 21, 2018, the Company completed a public offering of 25,090,700 units at a price of $0.425 (CAD$0.55) per unit for gross proceeds of $10,663,548 (CAD$13,799,885). Additionally, subsequent to December 31, 2017 through April 23, 2018 the Company raised $1,131,921 from the exercise of warrants and stock options. Refer to Subsequent Events for further details. The Company is well capitalized to support its activities beyond 2018 as we work toward the goal of monetizing the POIP and increasing the sales of the Company’s photonic products.

Financial and Other Information

In this Annual Report, unless otherwise specified, all dollar amounts are expressed in United States Dollars (“US$”, “USD” or “$”).

Cautionary Statements Regarding Forward-Looking Statements

This Annual Report on Form 20-F and other publicly available documents, including the documents incorporated herein and therein by reference contain forward-looking statements and information within the meaning of U.S. and Canadian securities laws. Forward-looking statements and information can generally be identified by the use of forward- looking terminology or words, such as, “continues”, “with a view to”, “is designed to”, “pending”, “predict”, “potential”, “plans”, “expects”, “anticipates”, “believes”, “intends”, “estimates”, “projects”, and similar expressions or variations thereon, or statements that events, conditions or results “can”, “might”, “will”, “shall”, “may”, “must”, “would”, “could”, or “should” occur or be achieved and similar expressions in connection with any discussion, expectation, or projection of future operating or financial performance, events or trends. Forward- looking statements and information are based on management’s current expectations and assumptions, which are inherently subject to uncertainties, risks and changes in circumstances that are difficult to predict.

The forward-looking statements and information in this Annual Report are subject to various risks and uncertainties, including those described in ITEM 3.D. “Risk Factors”, many of which are difficult to predict and generally beyond the control of the Company, including without limitation:

ö we have a limited operating history;

ö our need for additional financing, which may not be available on acceptable terms or at all;

ö the possibility that we will not be able to compete in the highly competitive semiconductor market;

ö the risk that our objectives will not be met within the time lines we expect or at all;

ö research and development risks;

ö the risks associated with successfully protecting patents and trademarks and other intellectual property;

ö the need to control costs and the possibility of unanticipated expenses;

ö manufacturing and development risks;

ö the risk that the price of our common stock will be volatile; and

ö the risk that shareholders’ interests will be diluted through future stock offerings, option and warrant exercises.

| 2 |

For all of the reasons set forth above, investors should not place undue reliance on forward-looking statements. Other than any obligation to disclose material information under applicable securities laws or otherwise as maybe required by law, we undertake no obligation to revise or update any forward-looking statements after the date hereof.

Data relevant to estimated market sizes for our technologies under development are presented in this Annual Report. These data have been obtained from a variety of published resources including published scientific literature, websites and information generally available through publicized means. The Company attempts to source reference data from multiple sources whenever possible for confirmatory purposes. However, the Company has not independently verified the accuracy and completeness of this data.

ITEM 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISORS

A. Not Required.

ITEM 2. OFFER STATISTICS AND EXPECTED TIMETABLE

Not Required.

A. Selected Financial Data

The selected financial data of the Company for the years ended December 31, 2017, 2016 and 2015 was derived from the audited annual consolidated financial statements of the Company, which have been audited by Marcum LLP, independent registered public accounting firm. Selected financial data of the Company for the years ended December 31, 2014 and 2013 was derived from the consolidated financial statements of the Company, which are not included in this Annual Report.

The information contained in the selected financial data for the 2017, 2016 and 2015 years is qualified in its entirety by reference to the Company’s audited consolidated financial statements and related notes included under the heading “ITEM 17”. Financial Statements” and should be read in conjunction with such financial statements and related notes and with the information appearing under the heading “ITEM 5”.

Operating and Financial Review and Prospects.” Except where otherwise indicated, all amounts are presented in accordance with International Financial Reporting Standards (“IFRS”) as issued by the International Accounting Standards Board (“IASB”).

Since its formation, the Company has financed its operations from public and private sales of equity securities, proceeds received upon the exercise of warrants and stock options, research and development contracts from U.S. government agencies, sales of the Company’s photonic products and, prior to 2012, by sales of solar energy equipment products. The Company has never been profitable, so its ability to finance operations has been dependent on equity financings. While the Company has been generating revenue from the sale of its photonic sensing products, we believe that it will also need to rely on the sale of our equity securities to provide funds for its activities. We believe the Company is well capitalized, nevertheless the Company may effect a future financing if an appropriate opportunity presents itself. See ITEM 3.D. “Risk Factors.”

The Company has not declared any dividends since incorporation and does not anticipate that it will do so in the foreseeable future.

| 3 |

The following consolidated financial information is separated between continuing and discontinued operations.

Consolidated Statements

of Operations

Under International Financial Reporting Standards

(US$)

| 2017 | 2016 | 2015 | 2014 | 2013 | ||||||||||||||||

| Revenue | $ | 2,794,044 | $ | 1,861,747 | $ | - | $ | - | $ | - | ||||||||||

| Cost of sales | 1,342,691 | 946,001 | - | - | - | |||||||||||||||

| Gross margin | 1,451,353 | 915,746 | - | - | - | |||||||||||||||

| Operating Expenses | ||||||||||||||||||||

| Selling, marketing and administration | 10,870,741 | 11,421,604 | 8,614,109 | 9,677,705 | 6,284,288 | |||||||||||||||

| Research and development | 5,442,873 | 3,165,825 | 3,532,492 | 2,277,927 | 1,925,974 | |||||||||||||||

| Impairment loss | - | 63,522 | - | - | - | |||||||||||||||

| Loss on disposal of property and equipment | - | 46,738 | - | - | - | |||||||||||||||

| Other income, including interest | (1,766,524 | ) | (66,872 | ) | (76,431 | ) | (169,832 | ) | (361,245 | ) | ||||||||||

| Operating expenses | 14,547,090 | 14,630,817 | 12,070,170 | 11,785,800 | 7,849,017 | |||||||||||||||

| Net loss from operations | (13,095,737 | ) | (13,715,071 | ) | (12,070,170 | ) | (11,785,800 | ) | (7,849,017 | ) | ||||||||||

| Change in fair value contingent consideration | - | (283,130 | ) | - | - | - | ||||||||||||||

| Net loss before income tax recovery | (13,095,737 | ) | (13,431,941 | ) | (12,070,170 | ) | (11,785,800 | ) | (7,849,017 | ) | ||||||||||

| Income tax recovery | (297,940 | ) | (207,257 | ) | - | - | - | |||||||||||||

| Net loss for the year | (12,797,797 | ) | (13,224,684 | ) | (12,070,170 | ) | (11,785,800 | ) | (7,849,017 | ) | ||||||||||

| Deficit, beginning of year | (104,075,356 | ) | (90,850,672 | ) | (78,780,502 | ) | (66,994,702 | ) | (59,145,685 | ) | ||||||||||

| Deficit, end of year | $ | (116,873,153 | ) | $ | (104,075,356 | ) | $ | (90,850,672 | ) | $ | (78,780,502 | ) | $ | (66,994,702 | ) | |||||

| Basic and diluted loss per share: | $ | (0.05 | ) | $ | (0.06 | ) | $ | (0.07 | ) | $ | (0.08 | ) | $ | (0.06 | ) | |||||

Certain prior period figures have been reclassified to conform with the current period’s presentation

| 4 |

Consolidated Statements of

Financial Position

Under International Financial Reporting Standards

(US$)

| December 31, | ||||||||||||||||||||

| Assets | 2017 | 2016 | 2015 | 2014 | 2013 | |||||||||||||||

| Cash | $ | 4,974,478 | $ | 14,376,282 | $ | 14,409,996 | $ | 11,287,864 | $ | 3,260,967 | ||||||||||

| Short-term investments | — | 589,275 | ||||||||||||||||||

| Accounts and other receivable | 493,925 | 292,849 | — | — | — | |||||||||||||||

| Prepaids and other current assets | 1,957,727 | 758,917 | 150,923 | 243,501 | 267,012 | |||||||||||||||

| Inventory | 524,582 | 1,116,880 | — | — | — | |||||||||||||||

| Marketable securities | — | — | — | — | 397 | |||||||||||||||

| Property and equipment | 8,278,170 | 9,364,210 | 947,107 | 1,058,860 | 903,792 | |||||||||||||||

| Patents and licenses | 456,250 | 449,676 | 426,813 | 260,721 | 125,676 | |||||||||||||||

| Intangible assets | 839,637 | 876,865 | — | — | — | |||||||||||||||

| Goodwill | 7,681,003 | 7,681,003 | — | — | — | |||||||||||||||

| Total Assets | $ | 25,205,772 | $ | 35,505,957 | $ | 15,934,839 | $ | 12,850,946 | $ | 4,557,844 | ||||||||||

| Liabilities | ||||||||||||||||||||

| Accounts payable and accrued liabilities | $ | 810,593 | $ | 1,624,344 | $ | 515,421 | $ | 451,724 | $ | 256,027 | ||||||||||

| Product warranty | — | — | — | — | — | |||||||||||||||

| Disposal group liabilities | — | — | — | — | — | |||||||||||||||

| Deferred tax liability | 1,298,367 | 1,596,307 | — | — | — | |||||||||||||||

| Deferred rent | 24,031 | 42,665 | — | — | — | |||||||||||||||

| Total Liabilities | 2,132,991 | 3,263,316 | 515,421 | 451,724 | 256,027 | |||||||||||||||

| Shareholders’ Equity | ||||||||||||||||||||

| Share capital | 103,616,221 | 103,357,862 | 81,027,171 | 61,688,953 | 42,911,455 | |||||||||||||||

| Special voting share | — | — | — | — | — | |||||||||||||||

| Warrants | 5,985,378 | 5,985,378 | 2,013,747 | 6,458,659 | 8,135,590 | |||||||||||||||

| Contributed surplus | 32,102,967 | 29,062,874 | 25,618,159 | 23,616,664 | 20,261,067 | |||||||||||||||

| Accumulated other comprehensive loss | (1,758,632 | ) | (2,088,117 | ) | (2,388,987 | ) | (584,552 | ) | (11,593 | ) | ||||||||||

| Deficit | (116,873,153 | ) | (104,075,356 | ) | (90,850,672 | ) | (78,780,502 | ) | (66,994,702 | ) | ||||||||||

| Total Shareholders’ Equity | 23,072,781 | 32,242,641 | 15,419,418 | 12,399,222 | 4,301,817 | |||||||||||||||

| Total Liabilities and Shareholders’ Equity | $ | 25,205,772 | $ | 35,505,957 | $ | 15,934,839 | $ | 12,850,946 | $ | 4,557,844 | ||||||||||

| 5 |

B. Capitalization and Indebtedness

Not Required.

C. Reasons for the Offer and Use of Proceeds

Not Required.

D. Risk Factors

We are subject to various risks, including those described below, which could materially adversely affect our business, financial condition and results of operations and, in turn, the value of our securities. In addition, other risks not presently known to us or that we currently believe to be immaterial may also adversely affect our business, financial condition and results of operations, perhaps materially. The risks discussed below also include forward-looking statements and information within the meaning of U.S. and Canadian securities laws that involve risks and uncertainties. The Company’s actual results may differ materially from the results discussed in the forward-looking statements and information Factors that might cause such differences include those discussed. Before making an investment decision with respect to any of our securities, you should carefully consider the following risks and uncertainties described below and elsewhere in this Annual Report. See also “Cautionary Statement Regarding Forward-Looking Statements.”

Risks Related to Our Business

The process of developing new, technologically advanced products in semiconductor manufacturing and photonics products is highly complex and uncertain, and we cannot guarantee a positive result.

The development of new, technologically advanced products is a complex and uncertain process requiring frequent innovation, highly-skilled engineering and development personnel and significant capital, as well as the accurate anticipation of technological and market trends. We cannot assure you that we will be able to identify, develop, manufacture, market or support new or enhanced products successfully or on a timely basis. Further, we cannot assure you that our new products will gain market acceptance or that we will be able to respond effectively to product introductions by competitors, technological changes or emerging industry standards. We also may not be able to develop the underlying core technologies necessary to create new products and enhancements, license these technologies from third parties, or remain competitive in our markets.

Customer demand is difficult to forecast accurately and, as a result, we may be unable to match production with customer demand.

We make planning and spending decisions, including determining the levels of business that we will seek and accept, production schedules, component procurement commitments, personnel needs and other resource requirements, based on our estimates of product demand and customer requirements. Our products are typically sold pursuant to individual purchase orders. While our customers may provide us with their demand forecasts, they are typically not contractually committed to buy any quantity of products beyond firm purchase orders. Furthermore, many of our customers may increase, decrease, cancel or delay purchase orders already in place without significant penalty. The short-term nature of commitments by our customers and the possibility of unexpected changes in demand for their products reduce our ability to accurately estimate future customer requirements. If any of our customers decrease, stop or delay purchasing our products for any reason, we will likely have excess manufacturing capacity or inventory and our business and results of operations would be harmed.

If our customers do not qualify our products for use on a timely basis, our results of operations may suffer.

Prior to the sale of new products, our customers typically require us to “qualify” our products for use in their applications. At the successful completion of this qualification process, we refer to the resulting sales opportunity as a “design win.” Additionally, new customers often audit our manufacturing facilities and perform other evaluations during this qualification process. The qualification process involves product sampling and reliability testing and collaboration with our product management and engineering teams in the design and manufacturing stages. If we are unable to accurately predict the amount of time required to qualify our products with customers, or are unable to qualify our products with certain customers at all, then our ability to generate revenue could be delayed or our revenue would be lower than expected and we may not be able to recover the costs associated with the qualification process or with our product development efforts, which would have an adverse effect on our results of operations.

The markets in which we operate are highly competitive, which could result in lost sales and lower revenues.

The market for optical components and modules is highly competitive and this competition could result in our existing customers moving their orders to our competitors. We are aware of a number of companies that have developed or are developing optical component products, including LEDs, lasers, pluggable components, modules and subsystems, among others, that compete directly with our current and proposed product offerings.

| 6 |

Some of our current competitors, as well as some of our potential competitors, have longer operating histories, greater name recognition, broader customer relationships and industry alliances and substantially greater financial, technical and marketing resources than we do. We may not be able to compete successfully with our competitors and aggressive competition in the market may result in lower prices for our products and/or decreased gross margins. Any such development could have a material adverse effect on our business, financial condition and results of operations.

Our products, including those sold by predecessor company, OPEL Solar, could contain defects that may cause us to incur significant costs or result in a loss of customers or subject us to claims for which we may not be fully insured.

Our predecessor company, Opel Solar, sold solar systems and products between 2007 and 2012, and some of those products may still be under warranty. We have not undertaken to quantify the size of that warranty obligation and it is not recorded on our balance sheet because it is not determinable. Although we carry product liability insurance, this insurance may not adequately cover our costs arising from defects or warranty claims related to those products.

Our current products sold by DenseLight are complex and undergo quality testing as well as formal qualification by our customers. Our customers’ testing procedures are limited to evaluating our products under likely and foreseeable failure scenarios and over varying amounts of time. For various reasons, such as the occurrence of performance problems that are unforeseeable in testing or that are detected only when products age or are operated under peak stress conditions, our products may fail to perform as expected long after customer acceptance. Failures could result from faulty components or design, problems in manufacturing or other unforeseen reasons. As a result, we could incur significant costs to repair or replace defective products under warranty, particularly when such failures occur in installed systems. Our products are typically embedded in, or deployed in conjunction with, our customers’ products, which incorporate a variety of components, modules and subsystems and may be expected to interoperate with modules produced by third parties. As a result, not all defects are immediately detectable and when problems occur, it may be difficult to identify the source of the problem. We will continue to face this risk going forward because our products are widely deployed in many demanding environments and applications worldwide. In addition, we may in certain circumstances honor warranty claims after the warranty has expired or for problems not covered by warranty to maintain customer relationships. Any significant product failure could result in litigation, damages, repair costs and lost future sales of the affected product and other products, divert the attention of our engineering personnel from our product development efforts and cause significant customer relations problems, all of which would harm our business. Although we carry product liability insurance, this insurance may not adequately cover our costs arising from defects in our products or otherwise.

The business that we acquired did not have a history of profitable operations. Our ability to successfully manage our manufacturing operations is essential to our overall success, and if we fail to do so, our financial results will suffer.

At the time of the acquisition of DenseLight Semiconductors, Pte. Ltd. in May of 2016, the company had been operating at a loss for several years and was at a minimum staffing level. Since the acquisition we have committed substantial capital and management attention to improving the operation, increasing sales and driving to profitability. Even though substantial changes in the management and personnel have been made, the results to date have been less than anticipated and more improvement will be required in order to make the DenseLight operation profitable. We cannot guarantee that our efforts to improve the DenseLight operation will be successful, and if they are not, the operation will continue to need capital and attention from the senior management of the Company and our financial results may suffer as a result.

If we encounter manufacturing problems or if manufacturing at our Singapore operation is discontinued for any reason, including an industrial or workplace accident, we may lose sales and damage our customer relationships, or be subject to claims for which we may not be fully insured.

We may experience delays, disruptions or quality control problems in our manufacturing operations. These and other factors may cause less than acceptable yields at our wafer fabrication facility. Manufacturing yields depend on a number of factors, including the quality of available raw materials, the degradation or change in equipment calibration and the rate and timing of the introduction of new products. Changes in manufacturing processes required as a result of changes in product specifications, changing customer needs and the introduction of new products may significantly reduce our manufacturing yields, resulting in low or negative margins on those products. In addition, because of our wafer size, we use equipment that is not readily available on the open market and for which spare parts and qualified service people may not be available. If any of our key equipment were to be damaged or destroyed for any reason, our manufacturing process would be severely disrupted. Any such manufacturing problems would likely delay product shipments to our customers, which would negatively affect our sales, competitive position and reputation.

Our operations in Singapore are subject to government regulations that protect the workplace safety of employees. We strive to maintain an accident-free workplace, but we cannot guarantee that industrial accidents will not take place, or that we will not be subject to liability for these and other workplace related claims. We have obtained insurance policies to protect the Company against claims for workplace related claims, but we cannot guarantee that these and other insurance policies carried by the Company will be sufficient to cover the full costs of such claims, which could have a material adverse effect on the Company.

| 7 |

We have limited operating history in the datacom market, and our business could be harmed if this market does not develop as we expect.

The initial target market for our Optical Interposer-based optical engine is the datacom market and we have no experience in selling products in this market. We may not be successful in developing a product for this market and even if we do, it may never gain widespread acceptance by large data center operators. If our expectations for the growth of the datacom market are not realized, our financial condition or results of operations may be adversely affected.

We depend on a limited number of suppliers and key contract manufacturers who could disrupt our business and technology development activities if they stopped, decreased, delayed or were unable to meet our demand for shipments of their products or manufacturing of our products.

We depend on a limited number of suppliers of epitaxial wafers and contract manufacturers for both our Indium Phosphide (“InP”) and Gallium Arsenide (“GaAs”) development and production activities. Some of these suppliers are sole source suppliers. We typically have not entered into long-term agreements with our suppliers. As a result, these suppliers generally may stop supplying us materials and other components at any time. Our reliance on a sole supplier or limited number of suppliers could result in delivery problems, reduced control over technology development, product development, pricing and quality, and an inability to identify and qualify another supplier in a timely manner. Some of our suppliers that may be small or under-capitalized may experience financial difficulties that could prevent them from supplying us materials and other components. In addition, our suppliers, including our sole source suppliers, may experience manufacturing delays or shut downs due to circumstances beyond their control such as earthquakes, floods, fires, labor unrest, political unrest or other natural disasters. A Change in supplier could require technology transfer that could require multiple iterations of test wafers. This could result in significant delays in resumption of production.

Any supply deficiencies relating to the quality or quantities of materials or equipment we use to manufacture our products could materially and adversely affect our ability to fulfill customer orders and our results of operations. Lead times for the purchase of certain materials and equipment from suppliers have increased and in some cases have limited our ability to rapidly respond to increased demand, and may continue to do so in the future. To the extent we introduce additional contract manufacturing partners, introduce new products with new partners and/or move existing internal or external production lines to new partners, we could experience supply disruptions during the transition process. In addition, due to our customers’ requirements relating to the qualification of our suppliers and contract manufacturing facilities and operations, we cannot quickly enter into alternative supplier relationships, which prevents us from being able to respond immediately to adverse events affecting our suppliers.

Our international business and operations expose us to additional risks.

Products shipped to customers located outside Canada and the United States account for a majority of our revenues. In addition, we have significant tangible assets located outside the United States. Our manufacturing facilities are located in Singapore. Conducting business outside Canada and the United States subjects us to a number of additional risks and challenges, including:

| • | periodic changes in a specific country's or region's economic conditions, such as recession; |

| • | licenses and other trade barriers; |

| • | the provision of services may require export licenses; |

| • | environmental regulations; |

| • | certification requirements; |

| • | fluctuations in foreign currency exchange rates; |

| • | inadequate protection of intellectual property rights in some countries; |

| • | preferences of certain customers for locally produced products; |

| • | potential political, legal and economic instability, foreign conflicts, and the impact of regional and global infectious illnesses in the countries in which we and our customers, suppliers and contract manufacturers are located; |

| • | Canadian and U. S. and foreign anticorruption laws; |

| • | seasonal reductions in business activities in certain countries or regions; and |

| • | fluctuations in freight rates and transportation disruptions. |

These factors, individually or in combination, could impair our ability to effectively operate one or more of our foreign facilities or deliver our products, result in unexpected and material expenses, or cause an unexpected decline in the demand for our products in certain countries or regions. Our failure to manage the risks and challenges associated with our international business and operations could have a material adverse effect on our business.

If we fail to attract and retain key personnel, our business could suffer.

Our future success depends, in part, on our ability to attract and retain key personnel, including executive management. Competition for highly skilled technical personnel is extremely intense and we may face difficulty identifying and hiring qualified engineers in many areas of our business. We may not be able to hire and retain such personnel at compensation levels consistent with our existing compensation and salary structure. Our future success also depends on the continued contributions of our executive management team and other key management and technical personnel, each of whom would be difficult to replace. The loss of services of these or other executive officers or key personnel or the inability to continue to attract qualified personnel could have a material adverse effect on our business.

| 8 |

Our prior acquisitions created a large amount of goodwill, which may be impaired in the future and as a result may adversely affect our financial results. In addition, past and any future acquisitions may adversely affect our financial condition and results of operations.

As part of our business strategy, we have in the past and may in the future pursue acquisitions of companies that we believe could enhance or complement our current product portfolio, augment our technology roadmap or diversify our revenue base. Acquisitions involve numerous risks, any of which could harm our business, including:

| • | difficulties integrating the acquired business; |

| • | unanticipated costs, capital expenditures, liabilities or changes to product development efforts; |

| • | difficulties integrating the business relationships with suppliers and customers of the acquired business with our existing operations; |

| • | acts or omissions by the acquired company prior to the acquisition that may subject us to unknown risks or liabilities; |

| • | risks associated with entering markets in which we have little or no prior experience; |

| • | potential loss of key employees, particularly those of the acquired organizations; and |

| • | diversion of financial and management resources from our existing business; |

Our prior acquisitions have resulted, and future acquisitions may result in the recording of goodwill and other intangible assets subject to potential impairment in the future, adversely affecting our operating results. We may not achieve the anticipated benefits of an acquisition if we fail to evaluate it properly, and we may incur costs in excess of what we anticipate. A failure to evaluate and execute an acquisition appropriately or otherwise adequately address these risks may adversely affect our financial condition and results of operations.

Our predecessor company received and our current companies receive and expect to receive in the future subsidies and other types of funding from government agencies in the locations in which we operate. The funding agreements stipulate that if we do not comply with various covenants, including eligibility requirements, and/or do not achieve certain pre-defined objectives, those government agencies may reclaim all or a portion of the funding provided. If this were to occur, we would either not be in a position to repay the claimed amounts or would have to borrow large sums in order to do so or refinance with dilutive financing, which could adversely affect our financial condition.

Our predecessor company, Opel Solar and its wholly-owned subsidiary ODIS, received research and development grants from the United States Air Force and from NASA; our recently acquired subsidiary company, DenseLight Semiconductor, Pte, Ltd. is expected to receive funding for new product development activities conducted in Singapore from the Economic Development Board; and we expect that our recently acquired subsidiary company BB Photonics U.K., may also apply for certain grants to defer the cost of development in the U.K. The rules for eligibility vary widely across government agencies, are complex and may be subject to different interpretations. Furthermore, some of the grants set pre-defined development or spending objectives, which we may not achieve. We cannot guarantee that one or more agencies will not seek repayment of all or a portion of the funds provided, and if this were to occur, we could have to borrow large sums or refinance with dilutive financing in order to make the repayments, which would adversely affect our financial condition.

We may be subject to disruptions or failures in information technology systems and network infrastructures that could have a material adverse effect on our business and financial condition.

We rely on the efficient and uninterrupted operation of complex information technology systems and network infrastructures to operate our business. A disruption, infiltration or failure of our information technology systems as a result of software or hardware malfunctions, system implementations or upgrades, computer viruses, third-party security breaches, employee error, theft or misuse, malfeasance, power disruptions, natural disasters or accidents could cause a breach of data security, loss of intellectual property and critical data and the release and misappropriation of sensitive competitive information and partner, customer, and employee personal data. Any of these events could harm our competitive position, result in a loss of customer confidence, cause us to incur significant costs to remedy any damages and ultimately materially adversely affect our business and financial condition.

We have a history of large operating losses. We may not be able to achieve profitability in the future and as a result we may not be able to maintain sufficient levels of liquidity.

We have historically incurred losses and negative cash flows from operations since our inception. As of December 31, 2017, we had an accumulated deficit of $116,873,153. For the years ended December 31, 2017 and December 31, 2016, we incurred net losses before income taxes of $13,095,737 and $13,431,941 respectively. We expect to continue to incur losses and operating cash outflows for the foreseeable future, and these losses and outflows could increase as we continue to work to develop our business. It is possible that we may never become profitable, and even if we achieve profitability in the future, we may not be able to sustain profitability in subsequent periods.] Should our losses continue, we may need to seek debt or equity financing to fund our operations.

| 9 |

As of December 31, 2017, we held $4,974,478 in cash, and we had working capital of $7,140,119.

The Company is currently in a position to cover its liabilities as they come due. However, we have sustained considerable operating losses in the past. Should such losses continue, the Company may need to seek debt or equity financing to fund its operations. Although the Company has been successful in obtaining such financings in the past, there is no assurance that it will be able do so in the future. If the Company is unable to obtain such financing, it may have an adverse effect on the Company’s ability to continue operations. Consistent with its needs for additional financing, on March 21, 2018, the Company completed a public offering of 25,090,700 units at a price of $0.425 (CAD$0.55) per unit for gross proceeds of $10,663,548 (CAD$13,799,885). Additionally, subsequent to December 31, 2017 the Company raised $1,131,921 from the exercise of warrants and stock options.

The optical communications industry is subject to significant operational fluctuations. In order to remain competitive we incur substantial costs associated with research and development, qualification, production capacity and sales and marketing activities in connection with products that may be purchased, if at all, long after we have incurred such costs. In addition, the rapidly changing industry in which we operate, the length of time between developing and introducing a product to market, frequent changing customer specifications for products, customer cancellations of products and general down cycles in the industry, among other things, make our prospects difficult to evaluate. As a result of these factors, it is possible that we may not (i) generate sufficient positive cash flow from operations; (ii) raise funds through the issuance of equity, equity-linked or convertible debt securities; or (iii) otherwise have sufficient capital resources to meet our future capital or liquidity needs. There are no guarantees we will be able to generate additional financial resources beyond our existing balances.

We may not be able to obtain additional capital when desired, on favorable terms or at all.

We operate in a market that makes our prospects difficult to evaluate and, to remain competitive, we will be required to make continued investments in capital equipment, facilities and technology. We expect that substantial capital will be required to continue technology and product development, to expand our manufacturing capacity if we need to do so and to fund working capital for anticipated growth. If we do not generate sufficient cash flow from operations or otherwise have the capital resources to meet our future capital needs, we may need additional financing to implement our business strategy.

If we raise additional funds through the issuance of our common stock or convertible securities, the ownership interests of our stockholders could be significantly diluted. These newly issued securities may have rights, preferences or privileges senior to those of existing stockholders. Additional financing may not, however, be available on terms favorable to us, or at all, if and when needed, and our ability to fund our operations, take advantage of unanticipated opportunities, develop or enhance our infrastructure or respond to competitive pressures could be significantly limited. If we cannot raise required capital when needed, including under our Short Form Prospectus filed with the Canadian Securities Exchange and the SEC in October 2016, we may be unable to continue technology and product development, meet the demands of existing and prospective customers, adversely affecting our sales and market opportunities and consequently our business, financial condition and results of operations.

Our business could be negatively impacted as a result of shareholder activism.

In recent years, shareholder activists have become involved in numerous public companies. Shareholder activists frequently propose to involve themselves in the governance, strategic direction, and operations of the company. We may in the future become subject to such shareholder activity and demands. Such demands may disrupt our business and divert the attention of our management and employees, and any perceived uncertainties as to our future direction resulting from such a situation could result in the loss of potential business opportunities, be exploited by our competitors, cause concern to our current or potential customers, and make it more difficult to attract and retain qualified personnel and business partners, all of which could adversely affect our business. In addition, actions of activist shareholders may cause significant fluctuations in our stock price based on temporary or speculative market perceptions or other factors that do not necessarily reflect the underlying fundamentals and prospects of our business.

If we fail to protect, or incur significant costs in defending, our intellectual property and other proprietary rights, our business and results of operations could be materially harmed.

Our success depends on our ability to protect our intellectual property and other proprietary rights. We rely on a combination of patent, trademark, copyright, trade secret and unfair competition laws, as well as license agreements and other contractual provisions, to establish and protect our intellectual property and other proprietary rights. We have applied for patent registrations in the U.S. and other foreign countries, some of which have been issued. We cannot guarantee that our pending applications will be approved by the applicable governmental authorities. Moreover, our existing and future patents and trademarks may not be sufficiently broad to protect our proprietary rights or may be held invalid or unenforceable in court. A failure to obtain patents or trademark registrations or a successful challenge to our registrations in the U.S. or foreign countries may limit our ability to protect the intellectual property rights that these applications and registrations intended to cover.

| 10 |

Policing unauthorized use of our technology is difficult and we cannot be certain that the steps we have taken will prevent the misappropriation, unauthorized use or other infringement of our intellectual property rights. Further, we may not be able to effectively protect our intellectual property rights from misappropriation or other infringement in foreign countries where we have not applied for patent protections, and where effective patent, trademark, trade secret and other intellectual property laws may be unavailable, or may not protect our proprietary rights as fully as Canadian or U.S. law. We may seek to secure comparable intellectual property protections in other countries. However, the level of protection afforded by patent and other laws in other countries may not be comparable to that afforded in Canada and the U.S.

We also attempt to protect our intellectual property, including our trade secrets and know-how, through the use of trade secret and other intellectual property laws, and contractual provisions. We enter into confidentiality and invention assignment agreements with our employees and independent consultants. We also use non-disclosure agreements with other third parties who may have access to our proprietary technologies and information. Such measures, however, provide only limited protection, and there can be no assurance that our confidentiality and non-disclosure agreements will not be breached, especially after our employees end their employment, and that our trade secrets will not otherwise become known by competitors or that we will have adequate remedies in the event of unauthorized use or disclosure of proprietary information. Unauthorized third parties may try to copy or reverse engineer our products or portions of our products, otherwise obtain and use our intellectual property, or may independently develop similar or equivalent trade secrets or know-how. If we fail to protect our intellectual property and other proprietary rights, or if such intellectual property and proprietary rights are infringed or misappropriated, our business, results of operations or financial condition could be materially harmed.

In the future, we may need to take legal actions to prevent third parties from infringing upon or misappropriating our intellectual property or from otherwise gaining access to our technology. Protecting and enforcing our intellectual property rights and determining their validity and scope could result in significant litigation costs and require significant time and attention from our technical and management personnel, which could significantly harm our business. We may not prevail in such proceedings, and an adverse outcome may adversely impact our competitive advantage or otherwise harm our financial condition and our business.

We may be involved in intellectual property disputes in the future, which could divert management’s attention, cause us to incur significant costs and prevent us from selling or using the challenged technology.

Participants in the markets in which we sell our products have experienced frequent litigation regarding patent and other intellectual property rights. There can be no assurance that third parties will not assert infringement claims against us and we cannot be certain that our products would not be found infringing on the intellectual property rights of others. Regardless of their merit, responding to such claims can be time consuming, divert management’s attention and resources and may cause us to incur significant expenses. Intellectual property claims against us could result in a requirement to license technology from others, discontinue manufacturing or selling the infringing products, or pay substantial monetary damages, each of could result in a substantial reduction in our revenue and could result in losses over an extended period of time.

If we fail to obtain the right to use the intellectual property rights of others that are necessary to operate our business, and to protect their intellectual property, our business and results of operations will be adversely affected.

From time to time we may choose to or be required to license technology or intellectual property from third parties in connection with the development of our products. We cannot assure you that third party licenses will be available to us on commercially reasonable terms, if at all. Generally, a license, if granted, would include payments of up-front fees, ongoing royalties or both. These payments or other terms could have a significant adverse impact on our results of operations. Our inability to obtain a necessary third party license required for our product offerings or to develop new products and product enhancements could require us to substitute technology of lower quality or performance standards, or of greater cost, either of which could adversely affect our business. If we are not able to obtain licenses from third parties, if necessary, then we may also be subject to litigation to defend against infringement claims from these third parties. Our competitors may be able to obtain licenses or cross-license their technology on better terms than we can, which could put us at a competitive disadvantage.

If we fail to maintain effective internal control over financial reporting in the future, the accuracy and timing of our financial reporting may be adversely affected.

Preparing our consolidated financial statements involves a number of complex manual and automated processes, which are dependent upon individual data input or review and require significant management judgment. One or more of these elements may result in errors that may not be detected and could result in a material misstatement of our consolidated financial statements. The Sarbanes-Oxley Act in the U.S. requires, among other things, that as a publicly traded company we disclose whether our internal control over financial reporting and disclosure controls and procedures are effective. As long as we qualify as an “emerging growth company” under the JOBS Act, which may be up to five years following the filing of our Form 20F Registration Statement, we will not have to provide an auditor’s attestation report on our internal controls. During the course of any evaluation, documentation or attestation, we or our independent registered public accounting firm may identify weaknesses and deficiencies that we may not otherwise identify in a timely manner or at all as a result of the deferred implementation of this additional level of review.

| 11 |

We have implemented internal controls that we believe provide reasonable assurance that we will be able to avoid accounting errors or material weaknesses in future periods. However, our internal controls cannot guarantee that no accounting errors exist or that all accounting errors, no matter how immaterial, will be detected because a control system, no matter how well designed and operated, can provide only reasonable, but not absolute assurance that the control system’s objectives will be met. If we are unable to implement and maintain effective internal control over financial reporting, our ability to accurately and timely report our financial results could be adversely impacted. This could result in late filings of our annual and quarterly reports under the Canadian Securities Act and the Securities Exchange Act of 1934, or the Exchange Act, restatements of our consolidated financial statements, a decline in our stock price, suspension or delisting of our common stock by the TSX Venture Exchange, or other material adverse effects on our business, reputation, results of operations or financial condition.

Our ability to use our net operating losses and certain other tax attributes may be limited.

As of December 31, 2017, we had accumulated net operating losses (NOLs), of approximately $124 million. Varying jurisdictional tax codes have restrictions on the use of NOLs, if a corporation undergoes an “ownership change,” the corporation’s ability to use its pre-change NOLs, R&D credits and other pre-change tax attributes to offset its post-change income may be limited. An ownership change is generally defined as a greater than 50% change in equity ownership. Based upon an analysis of our equity ownership, we do not believe that we have experienced such ownership changes and therefore our annual utilization of our NOLs is not limited. However, should we experience additional ownership changes, our NOL carry forwards may be limited.

We are subject to governmental export and import controls that could subject us to liability or impair our ability to compete in international markets.

We are subject to export and import control laws, trade regulations and other trade requirements that limit which raw materials and technology we can import or export and which products we sell and where and to whom we sell our products. Specifically, the Bureau of Industry and Security of the U.S. Department of Commerce is responsible for regulating the export of most commercial items that are so called dual-use goods that may have both commercial and military applications. A limited number of our products are exported by license under certain classifications. Export Control Classification requirements are dependent upon an item’s technical characteristics, the destination, the end-use, and the end-user, and other activities of the end-user. Should the regulations applicable to our products change, or the restrictions applicable to countries to which we ship our products change, then the export of our products to such countries could be restricted. As a result, our ability to export or sell our products to certain countries could be restricted, which could adversely affect our business, financial condition and results of operations. Changes in our products or any change in export or import regulations or related legislation, shift in approach to the enforcement or scope of existing regulations, or change in the countries, persons or technologies targeted by such regulations, could result in delayed or decreased sales of our products to existing or potential customers. In such event, our business and results of operations could be adversely affected.

Our manufacturing operations are subject to environmental regulation that could limit our growth or impose substantial costs, adversely affecting our financial condition and results of operations.

Our properties, operations and products are subject to the environmental laws and regulations of the jurisdictions in which we operate and sell products. These laws and regulations govern, among other things, air emissions, wastewater discharges, the management and disposal of hazardous materials, the contamination of soil and groundwater, employee health and safety and the content, performance, packaging and disposal of products. Our failure to comply with current and future environmental laws and regulations, or the identification of contamination for which we are liable, could subject us to substantial costs, including fines, clean-up costs, third-party property damages or personal injury claims, and make significant investments to upgrade our facilities or curtail our operations. Identification of presently unidentified environmental conditions, more vigorous enforcement by a governmental authority, enactment of more stringent legal requirements or other unanticipated events could give rise to adverse publicity, restrict our operations, affect the design or marketability of our products or otherwise cause us to incur material environmental costs, adversely affecting our financial condition and results of operations.

We are exposed to risks and increased expenses and business risk as a result of Restriction on Hazardous Substances, or RoHS directives.

Following the lead of the European Union, or EU, various governmental agencies have either already put into place or are planning to introduce regulations that regulate the permissible levels of hazardous substances in products sold in various regions of the world. For example, the RoHS directive for EU took effect on July 1, 2006. The labeling provisions of similar legislation in China went into effect on March 1, 2007. Consequently, many suppliers of products sold into the EU have required their suppliers to be compliant with the new directive. We anticipate that our customers may adopt this approach and will require our full compliance, which will require a significant amount of resources and effort in planning and executing our RoHS program, it is possible that some of our products might be incompatible with such regulations. In such events, we could experience the following consequences: loss of revenue, damages reputation, diversion of resources, monetary penalties, and legal action.

| 12 |

Failure to comply with the U.S. Foreign Corrupt Practices Act could subject us to penalties and other adverse consequences.

We are subject to the U.S. Foreign Corrupt Practices Act, which generally prohibits companies operating in the U.S. from engaging in bribery or other prohibited payments to foreign officials for the purpose of obtaining or retaining business. In addition, we are required to maintain records that accurately and fairly represent our transactions and have an adequate system of internal accounting controls. Non-U.S. companies, including some that may compete with us, may not be subject to these prohibitions, and therefore may have a competitive advantage over us. If we are not successful in implementing and maintaining adequate preventative measures, we may be responsible for acts of our employees or other agents engaging in such conduct. We could suffer severe penalties and other consequences that may have a material adverse effect on our financial condition and results of operations.

Natural disasters or other catastrophic events could harm our operations.

Our operations in the U.S., Canada and Singapore could be subject to significant risk of natural disasters, including earthquakes, hurricanes, typhoons, flooding and tornadoes, as well as other catastrophic events, such as epidemics, terrorist attacks or wars. For example, our wafer fabrication facility in Singapore is in an area that is susceptible to hurricanes. Any disruption in our manufacturing facilities arising from these and other natural disasters or other catastrophic events could cause significant delays in the production or shipment of our products until we are able to arrange for third parties to manufacture our products. We may not be able to obtain alternate capacity on favorable terms or at all. Our property insurance coverage with respect to natural disaster is limited and is subject to deductible and coverage limits. Such coverage may not be adequate or continue to be available at commercially reasonable rates and terms. The occurrence of any of these circumstances may adversely affect our financial condition and results of operation.

Goodwill Impairment Risk

POET’s Board and management is required to analyze on an annual basis whether any intangibles should be impaired, based on a calculation of the likely future cash flows from those assets. The annual impairment test was done by management in the fiscal fourth quarter. Both DenseLight and BB Photonics are regarded by POET’s Board and management as a single unit contributing to the Corporation’s development of an optical interposer platform. At the time of their acquisition in mid-2016, the combined purchase price exceeded their combined asset values, resulting in the creation of Goodwill, valued as of September 30, 2017 at $7,681,003. At the time of the initial valuation, no value was attributed to DenseLight’s Intellectual Property, which POET’s Board and management now expect to be a major contributor to the Corporation’s anticipated future cash flows. POET’s Board and management annually assesses the anticipated future cash flows of the Corporation related to this Goodwill and determines if an impairment is necessary.

Risks Related to Our Common Stock

Our stock price has been and may continue to be volatile.

The trading price for our common stock on the TSX Venture Exchange (“TSXV”) has been and is likely to continue to be highly volatile. Although we have registered our stock with the SEC, the U.S. market for our shares has been slow to develop, and if and as such a market develops, prices on that market are also likely to be highly volatile. The market prices for securities of early stage technology companies have historically been highly volatile.

Factors that could adversely affect our stock price include:

ö fluctuations in our operating results;

ö announcements of new products, partnerships or technological collaborations and announcements of the results or further actions in respect of any products, partnerships or collaborations, including termination of same;

ö innovations by us or our competitors;

ö governmental regulation;

ö developments in patent or other proprietary rights;

ö the results of technology and product development testing by us, our partners or our competitors;

ö litigation;

ö general stock market and economic conditions;

ö number of shares available for trading (float); and

ö inclusion in or dropping from stock indexes.

As of April 23, 2018, our 52-week high and low closing market prices for our common stock on the TSXV were CA$0.79 and CA$0.18 , respectively, based on the closing exchange rates on the respective dates.

| 13 |

We have historically obtained, and expect to continue to obtain, additional financing primarily by way of sales of equity, which may result in significant dilution to existing shareholders.

We have not earned profits, so the Company’s ability to finance operations is chiefly dependent on equity financings. Since 2012 we raised approximately US$50 million (net of share issue costs) in equity financing through private placements or the exercise of stock options and warrants in support of the POET initiative, which has resulted in significant dilution to existing shareholders. Further equity financings will also result in dilution to existing shareholders, and such dilution could be significant.

Future sales of common stock or warrants, or the prospect of future sales, may depress our stock price.

Sales of a substantial number of shares of common stock or warrants, or the perception that sales could occur, could adversely affect the market price of our common stock. Additionally, as of April 23, 2018, there were outstanding options to purchase up to 16,276,497 shares of our common stock that are currently exercisable and additional outstanding options to purchase up to 24,230,024 shares of common stock that are exercisable over the next several years. As of April 23, 2018, there were outstanding warrants to purchase 43,109,000 shares of our stock and broker compensation units to purchase 1,309,080 units. Each compensation unit is convertible into one common share and one half common share purchase warrant.. The holders of these options, warrants and compensation units have an opportunity to profit from a rise in the market price of our common stock with a resulting dilution in the interests of the other shareholders. The existence of these options, warrants and compensation units may adversely affect the terms on which we may be able to obtain additional financing. The weighted average exercise price of issued and outstanding options is CAD$0.77, the weighted average exercise price of warrants is CAD$0.58 and the weighted average exercise price of the compensation units is CAD$0.55, which compares to the CAD$0.42 market price at closing on April 23, 2018.

Dilution through exercise of share options could adversely affect the Company’s shareholders.

Because the success of the Company is highly dependent upon its employees, the Company has granted to some or all of its key employees, directors and consultants options to purchase common shares as non-cash incentives. To the extent that significant numbers of such options may be granted and exercised, the interests of the other stockholders of the Company may be diluted. As of April 23, 2018, there were 40,506,521 share purchase options outstanding with a weighted average exercise price of CAD$0.77, 43,109,000 share purchase warrants outstanding with a weighted average exercise price of CAD$0.58 and 1,309,000 compensation units outstanding with a weighted average price of CAD$0.55. If all of these securities were exercised, an additional 85,579,141 common shares would become issued and outstanding. This represents an increase of 29.7% in the number of shares issued and outstanding and would result in significant dilution to current shareholders.

The risks associated with penny stock classification could affect the marketability of the Company’s common shares and shareholders could find it difficult to sell their shares.

The Company’s common shares are subject to “penny stock” rules as defined in 1934 Securities and Exchange Act Rule 3a51-1. The SEC adopted rules that regulate broker-dealer practices in connection with transactions in penny stocks. Transaction costs associated with purchases and sales of penny stocks are likely to be higher than those for other securities. Penny stocks generally are equity securities with a price of less than $5.00 (other than securities listed on certain national securities exchanges, provided that current price and volume information with respect to transactions in such securities is provided by the exchange).

The penny stock rules require a broker-dealer, prior to a transaction in a penny stock not otherwise exempt from the rules, to deliver a standardized risk disclosure document that provides information about penny stocks and the nature and level of risks in the penny stock market. The broker-dealer also must provide the customer with current bid and offer quotations for the penny stock, the compensation of the broker-dealer and its salesperson in the transaction, and monthly account statements showing the market value of each penny stock held in the customer’s account. The bid and offer quotations, and the broker-dealer and salesperson compensation information, must be given to the customer orally or in writing prior to effecting the transaction and must be given to the customer in writing before or with the customer’s confirmation.

In addition, the penny stock rules require that prior to a transaction in a penny stock not otherwise exempt from such rules, the broker- dealer must make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser’s written agreement to the transaction. These disclosure requirements may have the effect of reducing the level of trading activity in the secondary market for the Company’s common shares in the United States and shareholders may find it more difficult to sell their shares.

| 14 |

The rights of our shareholders may differ from the rights typically afforded to shareholders of a U.S. corporation.

We are incorporated under the Business Corporations Act (Ontario) (the “OBCA”). The rights of holders of our common shares are governed by the laws of the Province of Ontario, including the OBCA, by the applicable laws of Canada, and by our Articles of Continuance and all amendments thereto (collectively, the “Articles”), and our by-laws (the “By-laws”). These rights differ in certain respects from the rights of shareholders in typical U.S. corporations. The principal differences include without limitation the following:

Under the OBCA, we have a lien on any common share registered in the name of a shareholder or the shareholder’s legal representative for any debt owed by the shareholder to us. Under U.S. state law, corporations generally are not entitled to any such statutory liens in respect of debts owed by shareholders.

With regard to certain matters, we must obtain approval of our shareholders by way of at least 66 2/3% of the votes cast at a meeting of shareholders duly called for such purpose being cast in favor of the proposed matter. Such matters include without limitation: (a) the sale, lease or exchange of all or substantially all of our assets out of the ordinary course of our business; and (b) any amendments to our Articles including, but not limited to, amendments affecting our capital structure such as the creation of new classes of shares, changing any rights, privileges, restrictions or conditions in respect of our shares, or changing the number of issued or authorized shares, as well as amendments changing the minimum or maximum number of directors set forth in the Articles. Under U.S. state law, the sale, lease, exchange or other disposition of all or substantially all of the assets of a corporation generally requires approval by a majority of the outstanding shares, although in some cases approval by a higher percentage of the outstanding shares may be required. In addition, under U.S. state law the vote of a majority of the shares is generally sufficient to amend a company’s certificate of incorporation, including amendments affecting capital structure or the number of directors.

Pursuant to our By-laws, two persons present in person or represented by proxy and each entitled to vote thereat shall constitute a quorum for the transaction of business at any meeting of shareholders. Under U.S. state law, a quorum generally requires the presence in person or by proxy of a specified percentage of the shares entitled to vote at a meeting, and such percentage is generally not less than one-third of the number of shares entitled to vote.

Under rules of the Ontario Securities Commission, a meeting of shareholders must be called for consideration and approval of certain transactions between a corporation and any “related party” (as defined in such rules). A “related party” is defined to include, among other parties, directors and senior officers of a corporation, holders of more than 10% of the voting securities of a corporation, persons owning a block of securities that is otherwise sufficient to affect materially the control of the corporation, and other persons that manage or direct, to a substantial degree, the affairs or operations of the corporation. At such shareholders’ meeting, votes cast by any related party who holds common shares and has an interest in the transaction may not be counted for the purposes of determining whether the minimum number of required votes have been cast in favor of the transaction. Under U.S. state law, a transaction between a corporation and one or more of its officers or directors can generally be approved either by the shareholders or a by majority of the directors who do not have an interest in the transaction.

Neither Canadian law nor our Articles or By-laws limit the right of a non-resident to hold or vote common shares of the Company, other than as provided in the Investment Canada Act (the “Investment Act”), as amended by the World Trade Organization Agreement Implementation Act (the “WTOA Act”). The Investment Act generally prohibits implementation of a direct reviewable investment by an individual, government or agency thereof, corporation, partnership, trust or joint venture that is not a “Canadian,” as defined in the Investment Act (a “non-Canadian”), unless, after review, the minister responsible for the Investment Act is satisfied that the investment is likely to be of net benefit to Canada. An investment in the common shares of the Company by a non-Canadian (other than a “WTO Investor,” as defined below) would be reviewable under the Investment Act if it were an investment to acquire direct control of the Company, and the value of the assets of the Company were CA$5.0 million or more (provided that immediately prior to the implementation of the investment the Company was not controlled by WTO Investors). An investment in common shares of the Company by a WTO Investor (or by a non- Canadian other than a WTO Investor if, immediately prior to the implementation of the investment the Company was controlled by WTO Investors) would be reviewable under the Investment Act if it were an investment to acquire direct control of the Company and the value of the assets of the Company equaled or exceeded certain threshold amounts determined on an annual basis.