UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

(Amendment No. 1)

(Mark One)

For the fiscal year ended

or

For the transition period from to

Commission file number:

(Exact name of registrant as specified in its charter)

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer |

|

|

(Address of principal executive offices) |

(Zip Code) |

Registrant’s telephone number, including area code: (

Securities registered pursuant to Section 12(b) of the Securities Act:

Title of each class |

|

Trading symbol(s) |

|

Name of each exchange on which registered |

|

|

The |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

☒ |

|

Accelerated filer |

|

☐ |

|

Non-accelerated filer |

|

☐ |

|

Smaller reporting company |

|

|

|

|

|

|

Emerging growth company |

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report.

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements.

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes

The aggregate market value of the voting and non-voting common equity held by non-affiliates of the registrant, based on the closing price of the registrant’s common stock on June 30, 2023 (the last business day of the registrant’s most recently completed second fiscal quarter), as reported on the Nasdaq Global Market on such date, was approximately $

The number of shares of registrant’s Common Stock outstanding as of April 26, 2024 was

DOCUMENTS INCORPORATED BY REFERENCE

None.

EXPLANATORY NOTE

This Amendment No. 1 to Form 10-K/A (the “Amendment”) amends the Annual Report on Form 10-K (the “Original 10-K”, and as amended by this Form 10-K/A, the “Form 10-K”) of the Company for the year ended December 31, 2023, which was originally filed with the Securities and Exchange Commission (the “SEC”) on February 27, 2024. This Amendment is being filed to amend Part III to include information required by Items 10 through 14.

The information required by Items 10 through 14 of Part III was previously omitted from the Original 10-K in reliance on General Instruction G(3) to Form 10-K, which permits the information in the above-referenced items to be incorporated in the Form 10-K by reference from our definitive proxy statement if such statement is filed no later than 120 days after our fiscal year end. We are filing this Amendment to include Part III information in our Form 10-K because a definitive proxy statement containing this information will not be filed by us within 120 days after the end of the fiscal year covered by the Form 10-K. The reference on the cover of the Original 10-K to the incorporation by reference to portions of a definitive proxy statement or amendment to our Form 10-K into Part III of the Original 10-K is hereby deleted.

In accordance with Rule 12b-15 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), Part III, Items 10 through 14 of the Original 10-K are hereby amended and restated in their entirety. Pursuant to Rule 12b-15 under the Exchange Act, this Amendment also contains new certifications pursuant to Section 302 of the Sarbanes-Oxley Act of 2002 from our principal executive officer and principal financial officer. As no financial statements are included in this Amendment and this Amendment does not contain or amend any disclosure with respect to Items 307 and 308 of Regulation S-K, paragraphs 3, 4 and 5 of the certifications have been omitted. Additionally, as no financial statements have been included in this Amendment, certifications pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 have been omitted.

Except as specifically set forth herein, this Amendment does not amend or otherwise update any other information in the Original 10-K. Accordingly, this Amendment should be read in conjunction with the Original 10-K and with our filings with the SEC subsequent to the Original 10-K.

2

EVERBRIDGE, INC. AND SUBSIDIARIES

FORM 10-K/A

TABLE OF CONTENTS

|

|

|

|

Page |

|

|

|

|

|

Item 10. |

|

|

4 |

|

Item 11. |

|

|

7 |

|

Item 12. |

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

|

32 |

Item 13. |

|

Certain Relationships and Related Transactions, and Director Independence |

|

34 |

Item 14. |

|

|

36 |

|

|

|

|

|

|

|

|

|

|

|

Item 15. |

|

|

37 |

|

|

|

|

38 |

Forward-Looking Statements

This Amendment contains forward-looking statements that involve risks and uncertainties, as well as assumptions that, if they never materialize or prove incorrect, could cause our results to differ materially from those expressed or implied by such forward-looking statements. Statements that are not purely historical are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements are often identified by the use of words such as, but not limited to, “anticipate,” “believe,” “can,” “continue,” “could,” “estimate,” “expect,” “goals,” “intend,” “may,” “plan,” “potential,” “predict,” “project,” “seek,” “should,” “target,” “will,” “would” or the negative or plural of these terms and similar expressions or variations intended to identify forward-looking statements. These forward-looking statements include, but are not limited to, statements concerning the following: our proposed acquisition by entities affiliated with Thoma Bravo, L.P. (“Thoma Bravo”); our expectation regarding the timing and completion of the proposed acquisition by entities affiliated with Thoma Bravo; the effect of recent changes in our senior management team on our business; our ability to maintain effective internal control over financial reporting and disclosure controls and procedures, including our ability to remediate the material weakness in internal control over financial reporting in the anticipated timeframe, if at all; our ability to continue to add new customers, maintain existing customers and sell new products and professional services to new and existing customers; the impact that global economic conditions may have on our business, strategy, operating results, financial condition and cash flows, as well as changes in overall level of software spending and volatility in the global economy; the potential impact of macroeconomic events such as the COVID-19 pandemic, the ongoing war in Ukraine or the evolving situation in the Middle East; the success of the 2022 Strategic Realignment; the effects of increased competition as well as innovations by new and existing competitors in our market; our ability to adapt to technological change and effectively enhance, innovate and scale our solutions; our ability to effectively manage or sustain our growth and to attain and sustain profitability; our ability to diversify our sources of revenue; our ability to integrate acquired companies, to complete potential acquisitions, and to integrate complementary businesses and technologies; our ability to maintain, or strengthen awareness of our brand; perceived or actual security, integrity, reliability, quality or compatibility problems with our solutions, including related to security breaches in our customers’ systems, unscheduled downtime or outages; statements regarding future revenue, hiring plans, expenses, capital expenditures, capital requirements and stock performance; our ability to attract and retain qualified employees and key personnel and further expand our overall headcount; our ability to grow, both domestically and internationally; our ability to stay abreast of new or modified laws and regulations that currently apply or become applicable to our business both in the United States and internationally, including laws and regulations related to export compliance and climate change; our ability to maintain, protect and enhance our intellectual property; costs associated with defending intellectual property infringement and other claims; and the future trading prices of our common stock and the impact of securities analysts’ reports on these prices. These statements represent the beliefs and assumptions of our management based on information currently available to us. Such forward-looking statements are subject to risks, uncertainties and other important factors that could cause actual results and the timing of certain events to differ materially from future results expressed or implied by such forward-looking statements. Factors that could cause or contribute to such differences include, but are not limited to, those identified above, and those discussed in the section titled “Risk Factors” included under Part I, Item 1A of our Annual Report on Form 10-K for the year ended December 31, 2023 filed with the SEC on February 27, 2024 and other subsequent filings with the SEC. Furthermore, such forward-looking statements speak only as of the date of this report. Except as required by law, we undertake no obligation to update any forward-looking statements to reflect events or circumstances that occur after the date of this report.

3

PART III

Item 10. Directors, Executive Officers and Corporate Governance.

Executive Officers and Directors

The following table sets forth information for our executive officers and directors, including their ages as of the date hereof.

Name |

|

Age |

|

Title |

Executive Officers |

||||

David Wagner |

|

59 |

|

Chief Executive Officer and President |

David Rockvam |

|

55 |

|

Executive Vice President and Chief Financial Officer |

Bryan Reed Barney |

|

61 |

|

Executive Vice President and Chief Product Officer |

John Di Leo |

|

62 |

|

Chief Revenue Officer |

Noah Webster |

|

50 |

|

Chief Legal & Compliance Officer, Corporate Secretary |

Shirley Devlin-Lebow |

|

50 |

|

Chief Accounting Officer |

|

|

|

|

|

Directors |

||||

David Benjamin (2) |

|

52 |

|

Director |

Richard D’Amore (1) |

|

70 |

|

Director |

Alison Dean (1) |

|

59 |

|

Director |

Rohit Ghai (1) (3) |

|

54 |

|

Director |

David Henshall (1) |

|

55 |

|

Chairman & Director |

Kent Mathy (2) (3) |

|

64 |

|

Director |

Simon Paris (2) |

|

54 |

|

Director |

Sharon Rowlands (3) |

|

65 |

|

Director |

(1) Member of the Audit Committee

(2) Member of the Nominating and Corporate Governance Committee

(3) Member of the Compensation Committee

Executive Officers

David Wagner has served as our Chief Executive Officer and President of Everbridge and a member of our board of directors since July 2022. Mr. Wagner previously served as President and Chief Executive Officer of Zix from January 2016 to December 2021. Mr. Wagner holds a B.S. in Accounting and an M.B.A. from Penn State University. Our Board believes Mr. Wagner's experience in the software-as-a-service and security industries qualifies him to serve on our Board.

David Rockvam has served as our Executive Vice President and Chief Financial Officer since February 2024. Mr. Rockvam previously served as Chief Financial Officer of Riskonnect from April 2022 until he joined the Company.

Before joining Riskonnect, Mr. Rockvam was the Chief Financial Officer at Zix from June 2016 to December 2021. Prior to joining Zix, Mr. Rockvam held various leadership positions at Entrust and Nortel Networks. Mr. Rockvam has a B.S. in International Trade, Business and Economics from Texas Tech University and M.B.A. from the University of Texas at Dallas.

Bryan Barney, has served as our Chief Product Officer since January 2023. Mr. Barney previously served as Chief Executive Officer at RedSeal from June 2020 to December 2022, and Senior Vice President and General Manager – Enterprise Security Group at Symantec from July 2017 to September 2019. Mr. Barney holds a B.S. in Electrical and Electronics Engineering and an M.B.A. from Brigham Young University.

4

John Di Leo has served as our Chief Revenue Officer since February 2023. Mr. Di Leo previously served as Senior Vice President at Opentext from December 2021 to February 2023, Chief Revenue Officer at Zix from December 2019 to December 2021 (when it was acquired by Opentext), and President of Broad Pointe Consulting from August 2016 to December 2019. Mr. Di Leo holds a B.B.A. in Marketing from Western CT State University, and an M.S. in Business from Johns Hopkins University.

Noah Webster has served as our Chief Legal and Compliance Officer and Corporate Secretary since December 2022. Mr. Webster has served as Chief Legal and Compliance Officer, Corporate Secretary at Integral Ad Science from May to December 2022; Chief Legal and Compliance Officer, Corporate Secretary at Zix from June 2018 to December 2021; and, in a number of roles, including General Counsel for Mobility Solutions at Blackberry from January 2010 to June 2018. Mr. Webster holds a B.S. in Mechanical Engineering from the United States Military Academy at West Point, and a J.D. from University of Illinois Urbana-Champaign.

Shirley Devlin-Lebow has served as our Chief Accounting Officer since March 2024. Ms. Devlin-Lebow joined the Company from Legends where she served as Chief Accounting Officer from April 2022 to March 2024. Prior to joining Legends, Ms. Devlin-Lebow served as Chief Accounting Officer of Zix Corporation from April 2021 to March 2022 and as the Vice President of Accounting at RealPage, Inc. from September 2018 through May 2021. Ms. Devlin-Lebow holds a Bachelor of Business Administration in Accounting and a Master of Science in Accounting from Texas A&M University. She is also a certified public accountant in the State of Texas.

Non-employee Directors

David Benjamin has served as a member of our Board since January 2023. Since July 2022, Mr. Benjamin has served as Executive Vice President and Chief Commercial Officer for Blackbaud, a leading cloud software company powering social good where he leads all global commercial efforts. Additionally, Mr. Benjamin served as Executive Vice President and President, International Markets, at Blackbaud from April 2018 to July 2022. Mr. Benjamin holds a B.A. in European Business from London Metropolitan University, and an MBA from the Manchester Metropolitan University. Our Board believes that Mr. Benjamin's go-to-market experience in the software as a service (SaaS) industry qualifies him to serve on our Board.

Richard D’Amore has served as a member of our Board since April 2015. Mr. D’Amore has been a General Partner of North Bridge Venture Partners, an early-stage venture capital and growth equity firm since its inception in 1994. Mr. D’Amore has served as a member of the board of directors of Veeco Instruments, Inc., a developer and manufacturer of electronics equipment, since 1990. Mr. D’Amore also serves as Chairman of the Board of Trustees at Northeastern University. Mr. D’Amore holds a B.S. in business from Northeastern University and an M.B.A. from Harvard Business School. Our Board believes that Mr. D’Amore’s broad entrepreneurial experience and his extensive service on public company boards qualifies him to serve on our Board.

Alison Dean has served as a member of our Board since July 2018. In addition, Ms. Dean has served as a board member of Salsify, a commerce management software company, since September 2021 and Yeti Holding, Inc. a global retailer of outdoor products, since October 2020. Ms. Dean formerly served as Executive Vice President, Chief Financial Officer, Treasurer and Principal Accounting Officer at iRobot, the leading global consumer robot company, from April 2013 to May 2020. Ms. Dean has more than 30 years of cumulative experience in corporate finance. Ms. Dean holds a B.A. in Business Economics from Brown University and an M.B.A. from Boston University. The Board believes Ms. Dean’s extensive background in finance and operations qualifies her to serve on our Board.

Rohit Ghai has served as a member of our Board since January 2023. Since January 2017, Mr. Ghai has served as Chief Executive Officer of RSA, a global leader in cybersecurity and risk management solutions. Mr. Ghai has extensive experience leading software and SaaS organizations in cybersecurity and information management and advises global organizations on their cyber resilience strategy. Mr Ghai also serves as a member of the board for RSA and for MHC Software. Mr. Rohit holds a B.E. in Computer Science from the Indian Institute of Technology, Roorkee, and an M.S. in Computer Science from the University of South Carolina. Our Board believes that Mr. Rohit's deep cyber security understanding and strong product management background in delivering technology to market at scale qualifies him to serve on our Board.

5

David Henshall was appointed to our Board in January 2022, and became Chairman of the Everbridge Board effective January 1, 2023. Prior to this, Mr. Henshall served as Vice Chair of the Board and, in addition to his Board responsibilities, assisted the Board and our senior management team on strategic and operational matters. Mr. Henshall previously served as President and Chief Executive Officer of Citrix Systems, Inc., a provider of workplace mobility solutions, from 2017 to 2021, and prior to that he was the Chief Operating Officer and Chief Financial Officer of Citrix from 2014 to 2017 and Chief Financial Officer of Citrix from 2003 to 2017. Mr. Henshall serves as a member of the board of directors Feedzai, a cloud-based risk management platform for financial management, and HashiCorp, a suite of multi-cloud infrastructure automation products. Mr. Henshall also served as a member of our Board from July 2015 to May 2018. Our Board believes that Mr. Henshall’s experience in chief leadership positions qualifies him to serve on our Board.

Kent Mathy has served as a member of our Board since August 2012. Mr. Mathy has also served as a board member of AVC Technologies, a provider of UCaaS, cybersecurity, and IT solutions, since July 2020, and Elea Institute (formerly known as JourneyCare Hospice), a provider of palliative and hospice care since October 2017. Mr. Mathy was the CEO of Sequential Technology International (STI), a business process outsourcer for wireline/wireless telecommunication, broadband, cable/multi-system operators, and satellite service providers, from January 2017 to May 2020. Prior to STI, Mr. Mathy held a variety of executive management positions at AT&T including having served as President, Southeast Region of AT&T Mobility; President, North Central Region for AT&T Mobility; and President, Small Business for AT&T Mobility. Mr. Mathy holds a B.A. in marketing from the University of Wisconsin-Oshkosh and attended the University of Michigan, Executive Program. Our Board believes Mr. Mathy’s experience in the telecommunications industry qualifies him to serve on our Board.

Simon Paris has served as a member of our Board since February 2020. Mr. Paris has served as Chief Executive Officer at Finastra, a global financial technology company since June 2018. He was Finastra’s President and Deputy Chief Executive Officer from June 2017 to June 2018, and joined Finastra as President in June 2015. Since November 2020, Mr. Paris has also served on the board of directors of Thomson Reuters, a provider of business information services. Mr. Paris holds a B.A. from the European Business School and an MBA from INSEAD. Our Board believes Mr. Paris’s experience in the software-as-a-service industry qualifies him to serve on our Board.

Sharon Rowlands has served as a member of our Board since January 2019. Since February 2021, Ms. Rowlands has served as Chief Executive Officer and President of Newfold Digital, a web hosting and domain registration company. Additionally, since January 2019, Ms. Rowlands has served as Chief Executive Officer and President of Web.com, a leading web technology company, which was renamed Newfold Digital in February 2021 after a merger with Endurance Web Presence. She served as President of USA Today Network Marketing Solutions at Gannett Co. from October 2017 to January 2019. Previously, Ms. Rowlands served as the Chief Executive Officer and member of the board of directors of ReachLocal, Inc., an Internet-based advertising and marketing company which specialized in search engine marketing, marketing analytics, and display advertising, from April 2014 to January 2019. Ms. Rowlands has served as a member of board of directors of The Glimpse Group, a virtual reality products provider, since October 2017, and Pegasystems Inc., a provider of software automation solutions, since April 2016. Our Board believes that Ms. Rowlands’ extensive business expertise and experience across the financial services, media and information and digital marketing sectors qualifies her to serve on our Board.

6

Certain Corporate Governance Matters

Process for Stockholder Nominations

There have been no material changes to the procedures by which stockholders may recommend nominees to our Board since we last provided disclosure of such procedures.

Audit Committee

The Audit Committee of the Board was established by the Board in accordance with Section 3(a)(58)(A) of the Exchange Act to oversee our corporate accounting and financial reporting processes and audits of its financial statements. The Audit Committee is currently composed of four directors: Ms. Dean and, Messrs. D’Amore, Ghai and Henshall.

Our Board has determined that each of Ms. Dean, Mr. D’Amore, Mr. Ghai and Mr. Henshall are independent directors under The Nasdaq Stock Market, LLC (“Nasdaq”) listing rules and under Rule 10A-3 under the Exchange Act.

The Board has also determined that Ms. Dean and Messrs. D’Amore and Henshall each qualify as an “audit committee financial expert,” as defined in applicable SEC rules. The Board made a qualitative assessment of Ms. Dean and Mr. D’Amore’s level of knowledge and experience based on a number of factors, including their formal education and experience. This designation does not impose on Ms. Dean or Mr. D’Amore any duties, obligations or liabilities that are greater than those generally imposed on members of our Audit Committee and our Board.

Code of Ethics

We have adopted the Everbridge, Inc. Code of Business Conduct that applies to all of our officers, directors, employees and independent contractors. The Code of Business Conduct is available in the investor relations section of our website at ir.everbridge.com. If we ever were to amend or waive any provision of the Code of Business Conduct that applies to our principal executive officer, principal financial officer, principal accounting officer or any person performing similar functions, we intend to satisfy our disclosure obligations, if any, with respect to any such waiver or amendment by posting such information on our website set forth above rather than by filing a Current Report on Form 8-K.

Delinquent Section 16(A) Reports

Section 16(a) of the Exchange Act requires our executive officers, directors and persons who own more than ten percent of a registered class of our equity securities, to file with the SEC initial reports of ownership and reports of changes in ownership of our common stock and other equity securities.

To our knowledge, based solely on a review of the copies of such reports furnished to us and written representations that no other reports were required, during the fiscal year that ended on December 31, 2023, all Section 16(a) filing requirements applicable to our officers, directors and greater than ten percent beneficial owners were complied with, except for one late filing from each of Phillip Huff, Patrick Brickley and Bryan Barney.

Item 11. Executive Compensation.

Compensation Discussion and Analysis

This Compensation Discussion and Analysis (“CD&A”) details Everbridge’s executive compensation philosophy, as well as how and why the Compensation Committee arrived at specific compensation decisions and policies. The Compensation Committee’s written charter is available on the Everbridge investor relations website at ir.everbridge.com.

7

In accordance with SEC rules and regulations, our Named Executive Officers (“NEOs”) for 2023 include the persons who held the role of Chief Executive Officer (“CEO”), Chief Financial Officer and the three remaining other most highly compensated executive officers for the year ended December 31, 2023.

Our Named Executive Officers for 2023 were:

Business Overview

Everbridge is a global software company that empowers resilience by leveraging intelligent automation technology to enable customers to anticipate, mitigate, respond to, and recover from critical events to keep people safe and organizations running. During public safety threats including severe weather conditions, active shooter situations, terrorist attacks or a pandemic, as well as critical business events such as Information Technology outages, cyber-attacks, product recalls or supply-chain interruptions, over 6,700 global customers rely on our Critical Event Management ("CEM") platform to empower their resilience and to quickly and reliably aggregate and assess threat data, locate people at risk and responders able to assist, automate the execution of pre-defined communications processes through the secure delivery to a comprehensive range of different communication channels and devices, and track progress on executing response plans. Everbridge digitizes organizational resilience by combining intelligent automation with the industry’s most comprehensive risk data to Keep People Safe and Organizations Running™.

2023 Financial Highlights include:

8

Non-GAAP Financial Measures

This Amendment contains the following non-GAAP financial measures: non-GAAP operating income, non-GAAP net income, non-GAAP net income per share, adjusted EBITDA and adjusted free cash flow.

Non-GAAP Financial Measures. Non-GAAP operating income, non-GAAP net income and non-GAAP net income per share exclude all or a combination of the following (as reflected in the following reconciliation tables): amortization of acquired intangible assets, stock-based compensation, costs related to the 2022 Strategic Realignment, Anvil legal dispute accrual, change in fair value of contingent consideration, accretion of interest on convertible senior notes, gain on extinguishment of debt, capped call modification and change in fair value and the tax impact of such adjustments. The tax impact of such adjustments was determined by recalculating current and deferred taxes utilizing non-GAAP pre-tax income for the year and analyzing changes in valuation allowance post purchase accounting. The presentation of the non-GAAP financial measures is not intended to be considered in isolation or as a substitute for, or superior to, the financial information prepared and presented in accordance with GAAP. We use these non-GAAP financial measures for financial and operational decision-making purposes and as a means to evaluate period-to-period comparisons. We believe that these non-GAAP financial measures provide useful information about our operating results, enhance the overall understanding of past financial performance and future prospects and allow for greater transparency with respect to metrics used by our management in its financial and operational decision making. While our non-GAAP financial measures are an important tool for financial and operational decision making and for evaluating our own operating results over different periods of time, you should consider our non-GAAP financial measures alongside our GAAP financial results.

We believe that excluding the impact of amortization of acquired intangibles allows for more meaningful comparisons between operating results from period to period as the intangibles are valued at the time of acquisition and are amortized over a period of several years after the acquisition. We exclude stock-based compensation expense which can vary based on plan design, share price, share price volatility, and the expected lives of equity instruments granted. We believe that providing non-GAAP financial measures that exclude stock-based compensation expense allow for more meaningful comparisons between our operating results from period to period because stock-based compensation expense does not represent a cash expenditure. We believe that excluding costs related to the 2022 Strategic Realignment allows for more meaningful comparisons between operating results from period to period as this is a discrete event based on a unique set of business objectives and is incremental to the core activities that arise in the ordinary course of our business. We believe that excluding the Anvil legal dispute accrual, which reflects an estimated potential liability in connection with a lawsuit filed in April 2022 by certain former shareholders of The Anvil Group (International) Limited, Anvil Worldwide Limited and The Anvil Group Limited (collectively, “Anvil”), allows for more meaningful comparisons between operating results from period to period as the litigation expense being excluded is not considered a normal, recurring expense, does not have a direct correlation to the operations of our business and is outside of the ordinary course of business due to the lack of frequency of similar cases that have been brought against us to date, the complexity of the case and the nature of the remedies sought. We believe that excluding the change in fair value of contingent consideration allows for more meaningful comparisons between operating results from period to period as it is non-operating in nature. We believe that excluding the impact of accretion of interest on convertible senior notes allows for more meaningful comparisons between operating results from period to period as accretion of interest on convertible senior notes relates to interest cost for the time value of money and are non-operating in nature. We believe that excluding gain on extinguishment of convertible notes, capped call modification and change in fair value allows for more meaningful comparisons between operating results from period to period as gains and losses on the extinguishment of convertible notes, capped call modifications and change in fair value are non-operating in nature. We do not engage in the repurchase of convertible notes on a regular basis or in the ordinary course of business. Accordingly, we believe that excluding these expenses provides investors and management with greater visibility of the underlying performance of our business operations, facilitates comparison of our results with other periods and may also facilitate comparison with the results of other companies in our industry.

9

There are limitations in using non-GAAP financial measures because the non-GAAP financial measures are not prepared in accordance with GAAP, may be different from non-GAAP financial measures used by other companies and exclude expenses that may have a material impact upon our reported financial results. Further, stock-based compensation expense has been and will continue to be for the foreseeable future a significant recurring expense in our business and an important part of the compensation provided to our employees.

The following table reconciles our GAAP operating loss to non-GAAP operating income (in thousands):

|

|

Twelve Months Ended |

|

|||||

|

|

December 31, |

|

|||||

|

|

2023 |

|

|

2022 |

|

||

Operating loss |

|

$ |

(61,399 |

) |

|

$ |

(84,183 |

) |

Amortization of acquired intangibles |

|

|

36,840 |

|

|

|

42,982 |

|

Stock-based compensation |

|

|

48,889 |

|

|

|

47,620 |

|

2022 Strategic Realignment |

|

|

13,751 |

|

|

|

17,357 |

|

Anvil legal dispute accrual |

|

|

24,000 |

|

|

|

1,000 |

|

Change in fair value of contingent consideration |

|

|

— |

|

|

|

(57 |

) |

Non-GAAP operating income |

|

$ |

62,081 |

|

|

$ |

24,719 |

|

The following table reconciles our GAAP net loss to non-GAAP net income (in thousands):

|

|

Twelve Months Ended |

|

|||||

|

|

December 31, |

|

|||||

|

|

2023 |

|

|

2022 |

|

||

Net loss |

|

$ |

(47,305 |

) |

|

$ |

(61,174 |

) |

Amortization of acquired intangibles |

|

|

36,840 |

|

|

|

42,982 |

|

Stock-based compensation |

|

|

48,889 |

|

|

|

47,620 |

|

2022 Strategic Realignment |

|

|

13,733 |

|

|

|

17,358 |

|

Anvil legal dispute accrual |

|

|

24,000 |

|

|

|

1,000 |

|

Change in fair value of contingent consideration |

|

|

— |

|

|

|

(57 |

) |

Accretion of interest on convertible senior notes |

|

|

2,640 |

|

|

|

4,561 |

|

Gain on extinguishment of convertible notes, capped call modification and change in fair value |

|

|

(12,658 |

) |

|

|

(19,243 |

) |

Income tax adjustments |

|

|

(1,427 |

) |

|

|

(1,151 |

) |

Non-GAAP net income |

|

$ |

64,712 |

|

|

$ |

31,896 |

|

10

The following table reconciles our GAAP net loss per diluted share to non-GAAP net income per diluted share(1):

|

|

Twelve Months Ended |

|

|||||

|

|

December 31, |

|

|||||

|

|

2023 |

|

|

2022 |

|

||

Net loss per diluted share⁽ᵃ⁾ |

|

$ |

(1.31 |

) |

|

$ |

(1.76 |

) |

|

|

|

|

|

|

|

||

Amortization of acquired intangibles per diluted share⁽ᵇ⁾ |

|

|

0.84 |

|

|

|

0.94 |

|

Stock-based compensation per diluted share⁽ᵇ⁾ |

|

|

1.12 |

|

|

|

1.04 |

|

2022 Strategic Realignment per diluted share⁽ᵇ⁾ |

|

|

0.31 |

|

|

|

0.38 |

|

Anvil legal dispute accrual per diluted share⁽ᵇ⁾ |

|

|

0.55 |

|

|

|

0.02 |

|

Change in fair value of contingent consideration per diluted share⁽ᵇ⁾ |

|

|

— |

|

|

|

— |

|

Accretion of interest on convertible senior notes per diluted share⁽ᵇ⁾ |

|

|

0.06 |

|

|

|

0.10 |

|

Gain on extinguishment of convertible notes, capped call modification and change in fair value per diluted share⁽ᵇ⁾ |

|

|

(0.29 |

) |

|

|

(0.42 |

) |

Income tax adjustments per diluted share⁽ᵇ⁾ |

|

|

(0.03 |

) |

|

|

(0.03 |

) |

Non-GAAP net income per diluted share⁽ᵇ⁾ |

|

$ |

1.48 |

|

|

$ |

0.70 |

|

|

|

|

|

|

|

|

||

(a) GAAP weighted-average common shares outstanding: |

|

|

|

|

|

|||

Diluted |

|

|

43,622,341 |

|

|

|

45,583,459 |

|

(b) Non-GAAP weighted-average common shares outstanding: |

|

|

|

|

|

|||

Diluted |

|

|

43,770,884 |

|

|

|

45,867,120 |

|

(1) Amounts may not add up due to differences in GAAP and non-GAAP net income (loss) and diluted shares.

Adjusted EBITDA. Adjusted EBITDA represents our net loss before interest and investment income, net, provision for (benefit from) income taxes, depreciation and amortization expense, stock-based compensation expense, costs related to the 2022 Strategic Realignment, Anvil legal dispute accrual, change in fair value of contingent consideration and gain on extinguishment of debt, capped call modification and change in fair value. We do not consider these items to be indicative of our core operating performance. The items that are non-cash include depreciation and amortization expense, stock-based compensation expense, change in fair value of contingent consideration and gain loss on extinguishment of debt, capped call modification and change in fair value. Adjusted EBITDA is a measure used by management to understand and evaluate our core operating performance and trends and to generate future operating plans, make strategic decisions regarding the allocation of capital and invest in initiatives that are focused on cultivating new markets for our solutions. In particular, the exclusion of certain expenses in calculating adjusted EBITDA facilitates comparisons of our operating performance on a period-to-period basis. Adjusted EBITDA is not a measure calculated in accordance with U.S. GAAP. We believe that adjusted EBITDA provides useful information to investors and others in understanding and evaluating our operating results in the same manner as our management and the Board. Nevertheless, the use of adjusted EBITDA has limitations as an analytical tool, and you should not consider it in isolation or as a substitute for analysis of our financial results as reported under GAAP. Some of these limitations are: (1) although depreciation and amortization are non-cash charges, the capitalized software that is amortized will need to be replaced in the future, and adjusted EBITDA does not reflect cash capital expenditure requirements for such replacements or for new capital expenditure requirements; (2) adjusted EBITDA does not reflect changes in, or cash requirements for, our working capital needs; (3) adjusted EBITDA does not reflect the potentially dilutive impact of equity-based compensation; (4) adjusted EBITDA does not reflect tax payments or receipts that may represent a reduction or increase in cash available to us; and (5) other companies, including companies in our industry, may calculate adjusted EBITDA or similarly titled measures differently, which reduces the usefulness of the metric as a comparative measure. Because of these and other limitations, you should consider adjusted EBITDA alongside our other GAAP-based financial performance measures, net loss and our other GAAP financial results.

11

The following table presents a reconciliation of adjusted EBITDA to net loss, the most directly comparable GAAP measure, for each of the periods indicated (in thousands):

|

|

Twelve Months Ended |

|

|||||

|

|

December 31, |

|

|||||

|

|

2023 |

|

|

2022 |

|

||

Net loss |

|

$ |

(47,305 |

) |

|

$ |

(61,174 |

) |

Interest and investment expense, net |

|

|

(4,324 |

) |

|

|

(591 |

) |

Provision for (benefit from) income taxes |

|

|

3,708 |

|

|

|

(2,398 |

) |

Depreciation and amortization |

|

|

58,815 |

|

|

|

60,600 |

|

Stock-based compensation |

|

|

48,889 |

|

|

|

47,620 |

|

2022 Strategic Realignment |

|

|

13,733 |

|

|

|

17,358 |

|

Anvil legal dispute accrual |

|

|

24,000 |

|

|

|

1,000 |

|

Change in fair value of contingent consideration |

|

|

— |

|

|

|

(57 |

) |

Gain on extinguishment of convertible notes, capped call modification and change in fair value |

|

|

(12,658 |

) |

|

|

(19,243 |

) |

Adjusted EBITDA |

|

$ |

84,858 |

|

|

$ |

43,115 |

|

Free Cash Flow and Adjusted Free Cash Flow. Free cash flow represents net cash provided by operating activities minus capital expenditures and capitalized software development costs. Adjusted free cash flow represents free cash flow as further adjusted for cash payments for the 2022 Strategic Realignment. Free cash flow and adjusted free cash flow are measures used by management to understand and evaluate our core operating performance and trends and to generate future operating plans. The exclusion of capital expenditures, amounts capitalized for internally-developed software and cash payments for the 2022 Strategic Realignment facilitates comparisons of our operating performance on a period-to-period basis and excludes items that we do not consider to be indicative of our core operating performance. Free cash flow and adjusted free cash flow are not measures calculated in accordance with GAAP. We believe that free cash flow and adjusted free cash flow provide useful information to investors and others in understanding and evaluating our operating results in the same manner as our management and the Board. Nevertheless, our use of free cash flow and adjusted free cash flow have limitations as an analytical tool, and you should not consider them in isolation or as a substitute for analysis of our financial results as reported under GAAP. You should consider free cash flow and adjusted free cash flow alongside our other GAAP-based financial performance measures, net cash provided by operating activities, and our other GAAP financial results.

The following table presents a reconciliation of free cash flow and adjusted free cash flow to net cash provided by operating activities, the most directly comparable GAAP measure, for each of the periods indicated (in thousands):

|

|

Twelve Months Ended |

|

|||||

|

|

December 31, |

|

|||||

|

|

2023 |

|

|

2022 |

|

||

Net cash provided by operating activities |

|

$ |

72,575 |

|

|

$ |

20,167 |

|

Capital expenditures |

|

|

(5,217 |

) |

|

|

(3,462 |

) |

Capitalized software development costs |

|

|

(16,540 |

) |

|

|

(15,065 |

) |

Free cash flow |

|

|

50,818 |

|

|

|

1,640 |

|

Cash payments for 2022 Strategic Realignment |

|

|

12,940 |

|

|

|

12,266 |

|

Adjusted free cash flow |

|

$ |

63,758 |

|

|

$ |

13,906 |

|

Annualized Recurring Revenue (“ARR”) is defined as the expected recurring revenue in the next twelve months from active customer contracts, assuming no increases or reductions in the subscriptions from that cohort of customers. Investors should not place undue reliance on ARR as an indicator of future or expected results. Our presentation of this metric may differ from similarly titled metrics presented by other companies and therefore comparability may be limited.

2023 Advisory Vote on Executive Compensation and Shareholder Engagement

We hold a say-on-pay advisory vote on executive compensation annually. At our 2023 annual meeting, we provided shareholders with the opportunity to cast a non-binding vote on a proposal regarding the compensation of our NEOs for the year ended December 31, 2022. Of the votes cast, approximately 96% voted in favor of the proposal. We

12

were pleased with these results and believe it reflects our continuous efforts to engage with shareholders and solicit their feedback on our executive compensation program.

The Compensation Committee reviewed the final vote results for the proposal and, given the significant level of shareholder support and positive feedback received on recent program and governance changes, concluded that our executive compensation program continues to provide a competitive pay-for-performance package that effectively incentivizes the NEOs and encourages long-term retention. The Compensation Committee and, with respect to our CEO’s compensation, our Board, determined not to make any significant changes to our 2023 executive compensation policies or decisions as a result of the vote.

Everbridge Executive Compensation Program

Pay-for-Performance Focus

We believe that our executive compensation program for 2023 continued to tie incentive-based compensation metrics with the business objectives and corporate strategies that drive stockholder value creation. Our compensation strategy is focused on targeted business priorities that guide and align our actions to the needs of our customers, stockholders, and employees. To achieve this, our compensation program is designed to (1) attract and retain top talent that can continue building on our trajectory for long-term growth and profitability (2) provide competitive compensation packages that create a significant and substantial link between our business results, stockholder interests, and the individual employee’s pay opportunity.

To ensure pay-for-performance alignment, the Compensation Committee annually reviews the designs of our short- and long-term incentive compensation programs to confirm that they continue to promote a culture of responsible performance. The majority of total compensation opportunity offered to our executives comes in the form of an annual incentive bonus and equity awards granted under our long-term incentive (“LTI”) program, both of which represent “at risk” pay. Payouts of our annual bonus are dependent on our short-term business objectives, and equity awards include restricted stock units (“RSUs”) and performance-based restricted stock units (“PSUs”).

Compensation Philosophy

Our executive compensation program is designed to attract, motivate, and retain our key executives who drive our success and enable long-term stockholder value. We achieve these objectives by:

Our NEOs are highly specialized talent, which makes their retention a key priority. The Compensation Committee believes NEO compensation should be set at competitive levels to retain a valuable team and attract talent, while placing a strong emphasis on successful attainment of Company performance goals.

Compensation Program and Governance

The Compensation Committee is appointed by the Board to oversee our compensation policies, plans and programs, administration of our equity plans, and its responsibilities related to the compensation of our executive officers, directors, and senior management, as appropriate. A significant part of this oversight is aligning management interests with our business strategies and goals, as well as stockholder interests, while also mitigating excessive risk-taking. We continually take steps to strengthen and improve our executive compensation policies and practices.

13

Highlights of our current policies and practices include:

What We Do |

What We Don’t Do |

||

✔ |

Balance short- and long-term incentives to discourage short-term risk-taking at the expense of long-term results |

✘ |

No guaranteed bonuses |

✔ |

Grant 50% of long-term incentives with performance-vesting conditions |

✘ |

No excise tax gross-ups |

✔ |

Cap incentive payouts below 200% of target |

✘ |

No hedging with respect to Everbridge shares |

✔ |

Seek annual stockholder advisory approval on executive compensation |

✘ |

No pledging of Everbridge shares |

✔ |

Engage an independent advisor reporting directly to the Compensation Committee |

✘ |

No short sales of Everbridge shares |

✔ |

Subject incentive compensation to a “clawback” recoupment policy |

✘ |

No transactions involving derivative securities instruments relating to Everbridge shares |

✔ |

Maintain share ownership guidelines for directors and executives |

✘ |

No excessive perquisites |

✔ |

Annual risk assessment of compensation policies and programs |

✘ |

No cash severance in excess of 2x target cash (annual base salary + target bonus) |

|

|

✘ |

No single trigger change in control payments |

14

Elements of Compensation Program

Our executive compensation program primarily consists of annual base salary, an “at-risk” annual incentive bonus, time-vesting RSUs and “at-risk” PSUs, each of which is tied to our business strategy in the following manner:

Compensation Element |

Link to Business Strategy |

2023 Compensation Actions |

Base Salary (See "Elements of Executive Compensation – Base Salary") |

• Recognition of the individual’s role and responsibilities. • Competitive base salaries help attract, maintain, and motivate executive talent. • Increases are not automatic or guaranteed, which promote a performance-first culture. |

• Increased cash salary of one NEO to better align compensation with market levels. • Recruited new executive team members. |

Bonus Plan (See "Elements of Executive Compensation – Annual Cash Incentives – 2023 Bonus Plan Structure") |

• Annual variable pay opportunities are designed to reward achievement of annual financial goals and individual achievement. • Metrics and targets are evaluated each year to ensure alignment with the overall Company business strategy. |

• Corporate bonus plan structure measured to reflect revenue and Adjusted EBITDA metrics. • NEOs were paid bonus amounts based on 96% funding of bonus plan. |

Long-Term Incentives (See "Elements of Executive Compensation – Long Term Incentives") |

• Promotes an ownership culture and aligns the interests of executives with those of stockholders, as multi-year vesting period provides meaningful incentives for management to execute on longer-term financial and strategic growth goals that drive stockholder value creation. • Award mix and performance metrics are reviewed annually for strategic alignment with long-term stockholder value and business strategy. • Differentiating target award values based on individual performance, as well as overlapping vesting periods, helps motivate and retain key talent. |

• LTI structure remained similar to 2022, with 50% granted as RSUs and 50% granted as PSUs. • PSU metrics were updated to include measures of Annual Recurring Revenue and Adjusted EBITDA. |

Elements of Executive Compensation

Target total direct compensation for NEOs is comprised of base salary, annual cash incentives, and long-term incentives (both time and performance-vesting). In addition, each NEO is eligible for benefits that are generally offered to Everbridge employees.

Base Salary

Base salaries for our NEOs are established based on the individual’s scope of responsibilities, experience, and market factors. The Compensation Committee reviews base salaries on an annual basis, referencing peer group and survey data to understand the marketplace for individuals in similar positions.

15

The table below summarizes 2022 and 2023 base salaries for our NEOs:

Executive |

|

2022 Base |

|

2023 Base |

|

% Increase |

David Wagner |

|

$425,000 |

|

$425,000 |

|

0.0% |

Patrick Brickley |

|

$375,000 |

|

$385,000 |

|

2.7% |

Noah Webster |

|

$360,000 |

|

$360,000 |

|

0.0% |

John Di Leo (1) |

|

— |

|

$385,000 |

|

— |

Bryan Barney |

|

$400,000 |

|

$400,000 |

|

0.0% |

(1) Mr. Di Leo joined the Company as Chief Revenue Officer on February 10, 2023.

Annual Cash Incentives – 2023 Bonus Plan Structure

Everbridge NEOs participate in an annual performance-based cash bonus plan as an incentive to achieve defined, quantitative corporate goals.

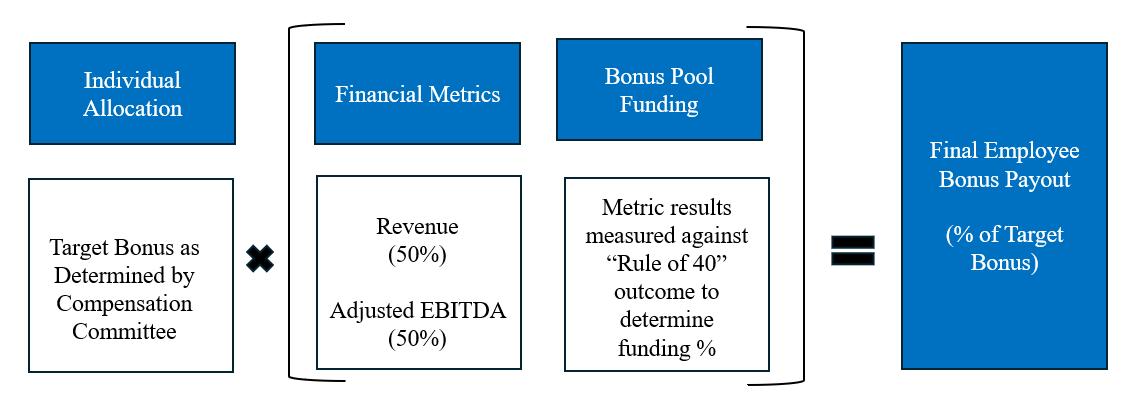

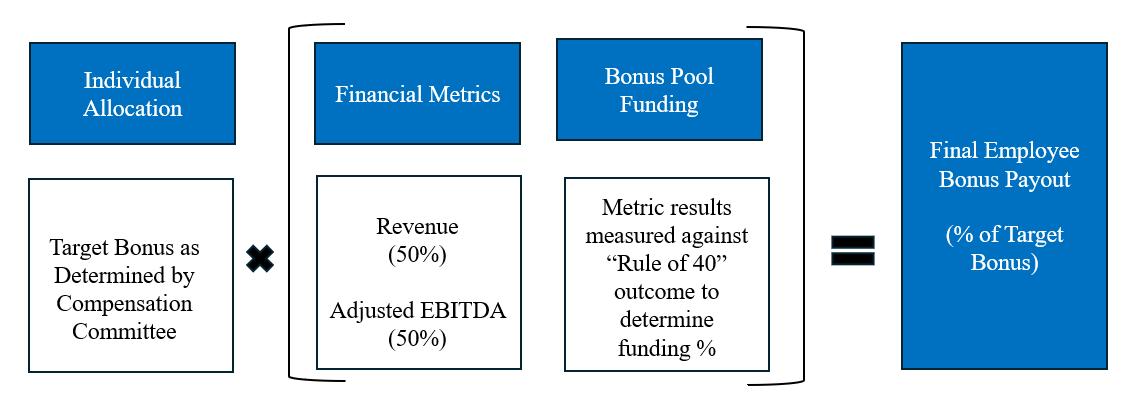

For 2023, the Compensation Committee established performance goals for the two bonus pool funding metrics – 50% Revenue and 50% Adjusted EBITDA . The results of these financial metrics are measured against the “Rule of 40” outcomes to determine the amount of funding for the bonus pool. The "Rule of 40" is a financial metric for software companies, and is measured by the sum of revenue growth percentage plus the adjusted EBITDA margin percentage. The qualification criteria for each of these performance goals were predetermined to align with our 2023 strategic priorities. In February 2024, the Compensation Committee approved a final bonus pool of 96% of target based on Revenue and Adjusted EBITDA performance, as displayed in the table below:

The Committee establishes an individual target for each NEO expressed as a dollar value (target bonus as a percentage of salary shown below for reference purposes), and the final bonus payout may range from 0% to 114% of the targeted payout level. When considering executives’ target bonus, the Committee evaluates market data as well as internal compensation parity among the executive team.

Financial Goals |

|

Weight |

Threshold |

Target |

Maximum |

Actual Results |

Actual Results |

Revenue |

|

50% |

$444,600,000 |

$468,000,000 |

$533,520,000 |

$448,788,000 |

96% Achievement |

Adjusted EBITDA |

|

50% |

$84,075,000 |

$88,500,000 |

$100,890,000 |

$84,858,000 |

96% Achievement |

Bonus Funding |

|

|

95.0% |

100% |

114.0% |

|

96% |

16

|

|

Target Bonus |

2023 Bonus Payout Range |

Actual Payout |

||

Executive |

|

(% of Salary) |

Threshold |

Target |

Maximum |

(96% of Target) |

|

|

|

(95%) |

(100%) |

(114%) |

|

David Wagner |

|

100% |

$403,750 |

$425,000 |

$484,500 |

$408,000 |

Patrick Brickley |

|

75% |

$274,313 |

$288,750 |

$329,175 |

$277,200 |

Noah Webster |

|

50% |

$171,000 |

$180,000 |

$205,200 |

$172,800 |

John Di Leo (1) |

|

100% |

$325,668 |

$342,808 |

$390,801 |

$329,096 |

Bryan Barney |

|

75% |

$285,000 |

$300,000 |

$342,000 |

$288,000 |

(1) Mr. Di Leo is eligible for a pro-rated bonus based on his February 10, 2023 hire date.

Long-Term Incentives

In 2022, the Compensation Committee adopted an annual LTI grant schedule for our existing executive officers. The Compensation Committee believes in a strong pay-for-performance program and culture that encourages management to align their long-term interests with those of Everbridge’s stockholders. To achieve this, the 2023 annual LTI grants to executives consisted of two equity vehicles:

LTI Award Type |

Purpose |

Vesting Terms |

RSUs (50% of Target LTI) |

Retain and motivate executives to drive long-term stockholder value while establishing personal ownership |

Time-vesting in equal installments over 12 calendar quarters |

PSUs (50% of Target LTI) |

Reward executives for the achievement of multi-year performance goals directly linked to the long-term success of the Company |

50% of the award eligible to vest (at 0% – 125% of target) at end of the fiscal quarter after the 2nd anniversary of grant based on (a) the preceding 8-quarter revenue compound annual growth rate (“CAGR”) of ARR achieved by the Company during the eight fiscal quarters preceding the then most recent fiscal quarter, weighted at 50% and (b) the Adjusted EBITDA weighted at 50%. 50% of the award eligible to vest (at 0% – 125% of target) at the end of the fiscal quarter after the 3rd anniversary of grant based on (a) preceding 12-quarter revenue CAGR of ARR achieved during the 12 fiscal quarters preceding the then most recent fiscal quarter weighted at 50% and (b) the Adjusted EBITDA weighted at 50%. |

We believe that the growth rate of our ARR and adjusted EBITDA is a critical bellwether of our current operating results and long-term business prospects, and that the 2023 PSUs demonstrate pay-for-performance by supporting our comprehensive approach to growing Everbridge’s top line. The structure of these awards is an integral part of ensuring that our leadership team is focused on our key objectives and operating principles of our long-term strategy, and PSUs appropriately reward executives for financial achievement.

17

In 2023, our NEOs received LTI grants for the following dollar amounts:

Executive |

|

2023 Annual |

|

2023 Annual |

|

Total 2023 |

|

|

|

|

|

|

|

David Wagner(1) |

$ |

— |

$ |

— |

$ |

— |

Patrick Brickley |

|

922,705 |

|

922,705 |

|

1,845,410 |

Noah Webster (2) |

|

— |

|

981,067 |

|

981,067 |

John Di Leo |

|

3,196,000 |

|

3,413,000 |

|

6,609,000 |

Bryan Barney(3) |

|

— |

|

3,413,000 |

|

3,413,000 |

(1) Mr. Wagner received a grant of 200,000 RSUs and 200,000 PSUs on December 31, 2021, and was ineligible for any LTI grants during 2023.

(2) Mr. Webster was granted 28,742 RSUs on December 30, 2023.

(3) Mr. Barney was granted 100,000 RSUs on December 30, 2023.

Treatment of RSUs and PSUs in Connection with the Proposed Merger.

In connection with the proposed Merger, all outstanding unvested RSUs will be converted into cash awards that will be subject to substantially the same vesting terms and conditions that applied to the unvested RSUs immediately prior to the effective time of the Merger. In addition, all outstanding PSUs will be converted into cash awards that will be subject to substantially the same vesting terms and conditions that applied to the unvested PSUs immediately prior to the effective time of the Merger, except that in lieu of vesting based on performance metrics, 50% of each converted PSU cash award will instead vest as target achievement at the end of the fiscal quarter which ends immediately after the second anniversary of the date of grant, and 50% of each converted PSU cash award will vest at target achievement at the end of the fiscal quarter which ends immediately after the third anniversary of the date of grant, subject in each case to continuous service through the applicable vesting date(s).

Vesting of PSUs

During 2023, Patrick Brickley vested 1,261 PSU shares. This vesting event occurred based on a previous PSU award with performance metrics based on our revenue CAGR for the 8-quarter and 12-quarter periods that ended during the 2023 fiscal year. At each vesting date, 50% of the award is eligible to vest (at 0% – 150% of target) based on preceding 8 or 12-quarter revenue CAGR. Each of the PSU awards that vested during 2023 represents one-half of the original PSU award vesting at an average of 20.6% of target. During 2023, no other NEOs had any PSU awards that were eligible for vesting.

Role of the Compensation Committee

The Compensation Committee seeks to ensure that our executive compensation program is properly rewarding and motivating our NEOs while aligning their goals with our business strategy and the interests of our stockholders. To do this, our Compensation Committee conducts an annual review of the aggregate level of our executive compensation and the mix of elements used to compensate our executive officers and historic compensation levels, including prior equity awards.

When setting executive compensation opportunities, the Compensation Committee considers several factors, including:

18

Role of the CEO in Compensation Decisions

Our CEO typically evaluates the performance of other executive officers and other employees, along with the performance of the Company as a whole, against previously determined objectives, on an annual basis and makes recommendations to the Compensation Committee with respect to annual base salary adjustments, bonuses, cash performance incentives and annual equity awards for the other executives. The Compensation Committee exercises its own independent discretion in approving compensation for all executive officers and assessing corporate performance against the pre-established objectives. The CEO is not present during deliberations or voting with respect to his own compensation.

Role of the Independent Compensation Consultant

The Compensation Committee retains the services of third-party, independent executive compensation consultants as it sees fit in connection with Everbridge’s compensation programs and related policies. For 2023, the Compensation Committee continued to engage Frederic W. Cook & Co., Inc. (“FW Cook”) as its independent consultant.

As the independent compensation consultant, FW Cook reports directly to the Compensation Committee. The scope of FW Cook’s assistance on Everbridge’s compensation program design and pay setting includes, but is not limited to, the following services:

The Compensation Committee has assessed the independence of FW Cook under applicable SEC and Nasdaq rules. After conducting this assessment and considering any potential conflicts of interest, the Compensation Committee concluded that FW Cook is independent and has no conflicts of interest.

Peer Group

The Compensation Committee believes that it is important to make decisions informed by the current practices of comparable public companies with which we compete for top talent.

In July 2022, the Compensation Committee reviewed a peer group of twenty companies. During that review, it was determined that four companies be removed (one due to an acquisition, and three others due to size alignment), resulting in the following 16 companies established as the recognized peer group.

2023 Compensation Peer Group |

|||

Appfolio |

Blackline |

Digital Turbine |

Fastly |

New Relic |

OneSpan |

PagerDuty |

Ping Identity |

PROS Holdings |

Q2 Holdings |

Rapid7 |

Smartsheet |

Sprout Social |

SPS Commerce |

Upland |

Workiva |

19

When making executive compensation decisions, the Compensation Committee does not rely on the peer group alone but also considers other data sources and other factors. To supplement market data gathered from publicly disclosed filings of our peer group, the Compensation Committee also considers market compensation data from the Radford Global Technology Survey, which is reflective of the broader market in which Everbridge competes for talent. The identity of the companies comprising the survey data is not disclosed to, or considered by, the Compensation Committee in its decision-making process, and the Compensation Committee does not consider the identity of the companies comprising the Radford Global Technology Survey to be material for its executive compensation responsibilities.

Other Features of the Our Executive Compensation Program

Employment Agreements

The initial terms and conditions of employment for each of our named executive officers are set forth in employment offer letters and employment agreements. The terms of these letters and agreements are described in greater detail in the section titled “Employment Arrangements” below. Each of our named executive officers is an at-will employee.

Severance and Change in Control Benefits

Adoption of Severance Plan

On August 5, 2022, upon the recommendation of the Compensation Committee, our Board of Directors adopted the Severance Plan. The Severance Plan provides severance benefits to our CEO, Executive Vice Presidents, Senior Vice Presidents, and certain specifically designated Vice Presidents, in the event such individual’s employment is terminated in either a Qualifying Termination or a CIC Qualifying Termination, in each case as described below. The Severance Plan supersedes any severance benefits that a participant would have been entitled to under any pre-existing employment agreement between the individual and the Company. To receive any of the severance benefits under these agreements, the participant would be required to execute a release of claims against the Company within 55 days of the qualifying termination. A description of the Severance Plan, and description of the termination and change of control provisions in our equity incentive plans and equity award agreements is provided below under “Potential Payments upon Termination” and “Potential Payments Upon Change in Control.”

401(k) Plan, Employee Stock Purchase Plan, Welfare and Health Benefits

We maintain a tax-qualified retirement plan that provides eligible U.S. employees, including our named executive officers, with an opportunity to save for retirement on a tax-advantaged basis. Eligible employees may make voluntary contributions from their eligible pay, up to certain applicable annual limits set by the Code. In 2023, we matched 50% of employee contributions, up to the first 4% of eligible employee deferrals per calendar year for each employee. Employee contributions are immediately and fully vested. Company matching contributions vest ratably over three years. The 401(k) plan is intended to be qualified under Section 401(a) of the Code with the 401(k) plan’s related trust intended to be tax exempt under Section 501(a) of the Code.

In 2023 we offered our employees, including our executive officers, the opportunity to purchase shares of our common stock at a discount under our 2016 Employee Stock Purchase Plan (“ESPP”). Pursuant to the ESPP, all eligible employees, including the eligible named executive officers, may allocate up to the lesser of $25,000 annually or 15% of the participant’s base compensation for that year to purchase our stock at a 15% discount to the market price, subject to specified limits. We terminated our ESPP program in 2024, in anticipation of the closing of the Merger with Thoma Bravo.

In addition, we provide other benefits to our executive officers, including the named executive officers, on the same basis as to all of our full-time employees. These benefits include, but are not limited to, medical, dental, vision, group life, disability and accidental death and dismemberment insurance plans.

We design our employee benefits programs to be affordable and competitive in relation to the market, as well as compliant with applicable laws and practices. We adjust our employee benefits programs as needed based upon regular monitoring of applicable laws and practices and the competitive market.

20

Perquisites and Other Personal Benefits

Currently, we do not view perquisites or other personal benefits as a significant component of our executive compensation program. Accordingly, we do not generally provide perquisites or other personal benefits to our executive officers, including our NEOs, except in situations where we believe it is appropriate to assist an individual in the performance of his or her duties, to make our executive officers more efficient and effective, and for recruitment and retention purposes. We do, however, pay the premiums for term life insurance and disability insurance, make matching contributions to our 401(k) plan, and allow participation in our ESPP, subject to certain limitations, for all of our employees, including our NEOs. None of our named executive officers individually received perquisites or other personal benefits in fiscal 2023 that were, in the aggregate, $10,000 or more.

In the future, we may provide perquisites or other personal benefits in limited circumstances. All future practices with respect to perquisites or other personal benefits will be approved and subject to periodic review by the Compensation Committee.

Tax and Accounting Implications

Accounting for Stock-Based Compensation

Under Financial Accounting Standard Board Accounting Standards Codification Topic 718 (“ASC 718”), Compensation—Stock Compensation, we are required to estimate and record an expense for each award of equity compensation over the vesting period of the award. We record share-based compensation expense on an ongoing basis according to ASC 718.

Under Section 162(m) of the Code (“Section 162(m)”), compensation paid to each of our “covered employees” that exceeds $1 million per taxable year is generally non-deductible.

Although the Compensation Committee will continue to consider tax implications as one factor in determining executive compensation, it also looks at other factors in making its decisions and retains the flexibility to provide compensation for our named executive officers in a manner consistent with the goals of our executive compensation program, which may include providing for compensation that is not deductible due to the deduction limit under Section 162(m).

Other Compensation Policies and Practices

Equity Awards Grant Delegation Policy

The Compensation Committee has delegated authority to our Chief Executive Officer to grant equity awards to our employees (other than our executive officers), subject to the terms and conditions of an equity awards grant delegation policy. Such awards may be granted on scheduled grant dates to newly-hired employees or to existing employees in connection with a promotion or in recognition of their contributions to the Company. In each instance, the policy provides for a limitation on the maximum size of any such awards.

Stock Ownership Guidelines

In May 2021, the Board adopted equity ownership guidelines to further align the interests of our senior management and directors with those of our stockholders. Under the guidelines, executives are expected to hold common stock in an amount ranging from five times base salary for our Chief Executive Officer, to two times base salary for our other executive officers. Our directors are also expected to hold common stock in an amount equal to three times their current cash retainer fee for Board service.

Position |

Guideline |

CEO or Executive Chair |

5x base salary |

Other Named Executive Officers |

2x base salary |

Non-Employee Directors |

3x annual cash retainer |

21

For purposes of these guidelines, stock ownership includes shares for which the executive or director has direct or indirect ownership or control and unvested restricted stock units, but does not include unvested performance-based stock units. As of December 31, 2023, our named executive officers met or exceeded these guidelines.

Compensation Recovery or Clawback Policy

In March 2020, the Board adopted a clawback policy that provides the Board discretion to reduce the amount of future compensation (both cash and equity) payable to an executive officer of the Company for excess proceeds from incentive compensation received by such executive officer due to a material restatement of financial statements. The clawback period is the three-year period following the filing of any such restated financial statements with the SEC. On November 7, 2023, the Board adopted an Incentive Compensation Recoupment Policy (the “2023 Clawback Policy”) designed to comply with Section 10D of the Exchange Act and the NYSE clawback listing standards. The 2023 Clawback Policy applies to all incentive compensation that is received by a covered officer on or after October 2, 2023, and replaces and supersedes our prior clawback policy with respect to all incentive compensation that is received by a covered officer on or after the October 2, 2023. The prior clawback policy continues to apply to any incentive compensation that is received by a covered officer prior to October 2, 2023. A copy of the 2023 Clawback Policy has been filed as an exhibit to our Annual Report on Form 10-K for the year ended December 31, 2023.

Policy Prohibiting Hedging and Pledging of Our Equity Securities

Our insider trading policy prohibits our employees, including our executive officers and directors, from engaging in short sales, hedging of stock ownership positions, and transactions involving derivative securities relating to our common stock. In addition, our directors and executive officers and any person required to comply with the blackout periods or pre-clearance requirements under our insider trading policy are prohibited from pledging Company securities as collateral for loans and may not hold Company securities in margin accounts.

Compensation Committee Report

The material in this report is not “soliciting material,” is furnished to, but not deemed “filed” with, the SEC and is not to be incorporated by reference in any of our filings under the Securities Act or Exchange Act whether made before or after the date hereof and irrespective of any general incorporation language in any such filing.

The Compensation Committee has reviewed and discussed the Compensation Discussion and Analysis contained in this Proxy Statement with the management of the Company. Based on this review and discussions, the Compensation Committee has recommended to the Board that the Compensation Discussion and Analysis be included in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2023.

This report has been furnished by the members of the Compensation Committee.

Sharon Rowlands, Chair

Rohit Ghai

Kent Mathy

22

Summary Compensation Table

The following table sets forth information in accordance with SEC rules regarding compensation of our NEOs as of December 31, 2023.

Name and Principal |

Year |

Base |

|

Bonus |

|

Stock |

|

Non-equity |

|

All Other |

|

Total |

|

|

|

|

|

|

|

|

|

|

|

|

|

David Wagner |

2023 |

$425,000 |

|

— |

|

— |

|

$408,000 |

|

$780 |

|

$833,780 |

Chief Executive Officer |

2022 |

186,301 |

(3) |

— |

|

10,656,000 |

|

173,260 |

|

325 |

|

11,015,886 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Patrick Brickley |

2023 |

385,000 |

|

— |

|

1,845,410 |

|

277,200 |

|

780 |

|

2,508,390 |