united

states

securities and exchange commission

washington, d.c. 20549

form n-csr

certified shareholder

report of registered management

investment companies

| Investment Company Act file number | 811-22208 |

| Valued Advisers Trust |

| (Exact name of registrant as specified in charter) |

| Ultimus Fund Solutions, LLC 225 Pictoria Drive, Suite 450 Cincinnati, OH | 45246 |

| (Address of principal executive offices) | (Zip code) |

Ultimus Fund Solutions, LLC

Attn: Gregory Knoth

225 Pictoria Drive, Suite 450

Cincinnati, OH 45246

(Name and address of agent for service)

| Registrant's telephone number, including area code: | 513-587-3400 |

| Date of fiscal year end: | 10/31 | |

| Date of reporting period: | 4/30/2019 |

Item 1. Reports to Stockholders.

DANA LARGE CAP EQUITY FUND

DANA SMALL CAP EQUITY FUND

DANA EPIPHANY ESG EQUITY FUND

Semi-Annual Report

April 30, 2019

Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Funds’ shareholder reports like this one will no longer be sent by mail, unless you specifically request paper copies of the reports from the Funds or from your financial intermediary such as a broker-dealer or bank. Instead, the reports will be made available on a website, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Funds electronically by contacting the Funds at (855) 280-9648 or, if you own these shares through a financial intermediary, you may contact your financial intermediary.

You may elect to receive all future reports in paper free of charge. You can inform the Funds that you wish to continue receiving paper copies of your shareholder reports by contacting the Funds at (855) 280-9648. If you own shares through a financial intermediary, you may contact your financial intermediary or follow instructions included with this document to elect to continue to receive paper copies of your shareholder reports. Your election to receive reports in paper will apply to all funds held with the fund complex or at your financial intermediary.

Dana Investment Advisors, Inc.

20700 Swenson Drive, Suite 400

Waukesha, WI 53186

(855) 280-9648

www.danafunds.com

Investment Results (Unaudited) |

|

Average Annual Total Returns(a) as of April 30, 2019

|

Six |

One |

Three |

Five |

Since |

Since |

Dana Large Cap Equity Fund |

||||||

Institutional Class |

8.11% |

7.56% |

13.95% |

9.61% |

N/A |

10.54% |

Investor Class |

8.01% |

7.32% |

13.68% |

9.32% |

13.09% |

N/A |

S&P 500® Index(b) |

9.76% |

13.49% |

14.87% |

11.63% |

13.51% |

11.96% |

Expense Ratios(c) |

||

|

Institutional |

Investor |

Gross |

0.83% |

1.08% |

With Applicable Waivers |

0.73% |

0.98% |

The performance quoted represents past performance, which does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect deduction of taxes that a shareholder would pay on Dana Large Cap Equity Fund (the “Large Cap Fund”) distributions or the redemption of Large Cap Fund shares. Current performance of the Large Cap Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 1-855-280-9648.

|

(a) |

Average annual total returns reflect any change in price per share and assume the reinvestment of all distributions. The Large Cap Fund’s returns reflect any fee reductions during the applicable period. If such reductions had not occurred, the quoted performance would have been lower. Total returns for periods less than one year are not annualized. |

|

(b) |

The S&P 500® Index (“S&P Index”) is a widely recognized unmanaged index of equity securities and is representative of a broader domestic equity market and range of securities than is found in the Large Cap Fund’s portfolio. Individuals cannot invest directly in the S&P Index; however, an individual can invest in exchange-traded funds (“ETFs”) or other investment vehicles that attempt to track the performance of a benchmark index. |

|

(c) |

The expense ratios are from the Large Cap Fund’s prospectus dated February 28, 2019. Expense ratios with applicable waivers reflect that Dana Investment Advisors, Inc. (the “Adviser”) has contractually agreed to waive or limit its fees and to assume other expenses of the Large Cap Fund until February 29, 2020, so that total annual fund operating expenses do not exceed 0.73% of the Large Cap Fund’s average daily net assets. This operating expense limitation does not apply to brokerage fees and commissions, borrowing costs (such as interest and dividend expenses on securities sold short), taxes, extraordinary expenses, fees and expenses paid under a distribution plan adopted pursuant to Rule 12b-1, fees and expenses paid under a shareholder services plan, and indirect expenses (such as “Acquired Funds Fees and Expenses”). Each waiver or reimbursement of an expense by the Adviser is subject to repayment by the Fund within three years following the date of such waiver or reimbursement, provided that the Large Cap Fund is able to make the repayment without exceeding the expense limitation in place at the time of waiver or reimbursement and the expense limitation in place at the time of the repayment. This agreement may only be terminated by mutual consent of the Adviser and the Board of Trustees. Additional information pertaining to the Large Cap Fund’s expense ratios as of April 30, 2019 can be found in the financial highlights. |

The Large Cap Fund’s investment objectives, strategies, risks, charges and expenses must be considered carefully before investing. The prospectus contains this and other important information about the Large Cap Fund and may be obtained by calling the same number as above. Please read it carefully before investing.

The Large Cap Fund is distributed by Unified Financial Securities, LLC, member FINRA/SIPC.

1

Investment Results (Unaudited) |

|

Average Annual Total Returns(a) as of April 30, 2019

|

Six |

One |

Three |

Since |

Dana Small Cap Equity Fund |

||||

Institutional Class |

3.39% |

1.83% |

8.12% |

4.09% |

Investor Class |

3.23% |

1.57% |

7.87% |

3.81% |

Russell 2000® Index(b) |

6.06% |

4.61% |

13.60% |

10.16% |

Expense Ratios(c) |

||

|

Institutional |

Investor |

Gross |

1.72% |

1.97% |

With Applicable Waivers |

0.95% |

1.20% |

The performance quoted represents past performance, which does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect deduction of taxes that a shareholder would pay on Dana Small Cap Equity Fund (the “Small Cap Fund”) distributions or the redemption of Small Cap Fund shares. Current performance of the Small Cap Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 1-855-280-9648.

|

(a) |

Average annual returns reflect any change in price per share and assume the reinvestment of all distributions. The Small Cap Fund’s returns reflect any fee reductions during the applicable period. If such reductions had not occurred, the quoted performance would have been lower. Total returns for periods less than one year are not annualized. |

|

(b) |

The Russell 2000® Index (“Russell Index”) is a widely recognized unmanaged index of equity securities and is representative of a broader domestic equity market and range of securities than are found in the Small Cap Fund’s portfolio. Individuals can not invest directly in the Russell Index; however, an individual can invest in ETFs or other investment vehicles that attempt to track the performance of a benchmark index. |

|

(c) |

The expense ratios are from the Small Cap Fund’s prospectus dated February 28, 2019. Expense ratios with applicable waivers reflect that the Adviser has contractually agreed to waive or limit its fees and to assume other expenses of the Small Cap Fund until February 29, 2020, so that total annual fund operating expenses do not exceed 0.95% of the Small Cap Fund’s average daily net assets. This operating expense limitation does not apply to brokerage fees and commissions, borrowing costs (such as interest and dividend expenses on securities sold short), taxes, extraordinary expenses, fees and expenses paid under a distribution plan adopted pursuant to Rule 12b-1, fees and expenses paid under a shareholder services plan, and indirect expenses (such as “Acquired Funds Fees and Expenses”). Each waiver or reimbursement of an expense by the Adviser is subject to repayment by the Small Cap Fund within three years following the date of such waiver or reimbursement, provided that the Small Cap Fund is able to make the repayment without exceeding the expense limitation in place at the time of waiver or reimbursement and the expense limitation in place at the time of the repayment. This agreement may only be terminated by mutual consent of the Adviser and the Board of Trustees. Additional information pertaining to the Small Cap Fund’s expense ratios as of April 30, 2019 can be found in the financial highlights. |

The Small Cap Fund’s investment objectives, strategies, risks, charges and expenses must be considered carefully before investing. The prospectus contains this and other important information about the Small Cap Fund and may be obtained by calling the same number as above. Please read it carefully before investing.

The Small Cap Fund is distributed by Unified Financial Securities, LLC, member FINRA/SIPC.

2

Investment Results (Unaudited) |

|

Average Annual Total Returns(a) as of April 30, 2019

|

Six |

One |

Three |

Five |

Ten |

Dana Epiphany ESG Equity Fund |

|||||

Institutional Class |

7.80% |

8.46% |

12.07% |

7.59% |

11.77% |

Investor Class |

7.58% |

8.09% |

12.15% |

8.07% |

12.46% |

S&P 500® Index(b) |

9.76% |

13.49% |

14.87% |

11.63% |

15.32% |

Expense Ratios(c) |

||

|

Institutional |

Investor |

Gross |

1.87% |

2.12% |

With Applicable Waivers |

0.85% |

1.10% |

The performance quoted represents past performance, which does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect deduction of taxes that a shareholder would pay on Dana Epiphany ESG Equity Fund (the “Epiphany ESG Fund”) distributions or the redemption of Epiphany ESG Fund shares. Current performance of the Epiphany ESG Fund may be lower or higher than the performance quoted. The Epiphany ESG Fund’s investment objectives, risks, charges and expenses must be considered carefully before investing. Performance data current to the most recent month end may be obtained by calling 1-855-280-9648.

|

(a) |

Average annual total returns reflect any change in price per share and assume the reinvestment of all distributions. The Epiphany ESG Fund’s returns reflect any fee reductions during the applicable period. If such reductions had not occurred, the quoted performance would have been lower. Investor Class returns shown for periods prior to December 19, 2018 are for Class A shares of the Epiphany FFV Fund, the Epiphany ESG Fund’s predecessor fund, and exclude the sales load. Institutional Class returns shown for periods prior to December 19, 2018 are for Class I shares of the Epiphany FFV Fund. Total returns for periods less than one year are not annualized. |

|

(b) |

The S&P 500® Index (“S&P Index”) is a widely recognized unmanaged index of equity securities and is representative of a broader domestic equity market and range of securities than is found in the Epiphany ESG Fund’s portfolio. Individuals cannot invest directly in the S&P Index; however, an individual can invest in ETFs or other investment vehicles that attempt to track the performance of a benchmark index. |

|

(c) |

The expense ratios are from the Epiphany ESG Fund’s prospectus dated February 28, 2019. Expense ratios with applicable waivers reflect that the Adviser has contractually agreed to waive or limit its fees and to assume other expenses of the Epiphany ESG Fund until February 28, 2021, so that total annual fund operating expenses does not exceed 0.85% of the Epiphany ESG Fund’s average net assets. This operating expense limitation does not apply to brokerage fees and commissions, borrowing costs (such as interest and dividend expenses on securities sold short), taxes, extraordinary expenses, fees and expenses paid under a distribution plan adopted pursuant to Rule 12b-1, fees and expenses paid under a shareholder services plan, and indirect expenses (such as “Acquired Funds Fees and Expenses”). Each waiver or reimbursement of an expense by the Adviser is subject to repayment by the Epiphany ESG Fund within three years following the date of such waiver or reimbursement, provided that the Epiphany ESG Fund is able to make the repayment without exceeding the expense limitation in place at the time of waiver or reimbursement and the expense limitation in place at the time of the repayment. This agreement may only be terminated by mutual consent of the Adviser and the Board of Trustees. Additional information pertaining to the Epiphany ESG Fund’s expense ratios as of April 30, 2019 can be found on the financial highlights. |

The Epiphany ESG Fund’s investment objectives, strategies, risks, charges and expenses must be considered carefully before investing. The prospectus contains this and other important information about the Epiphany ESG Fund and may be obtained by calling the same number as above. Please read it carefully before investing.

The Epiphany ESG Fund is distributed by Unified Financial Securities, LLC, member FINRA/SIPC.

3

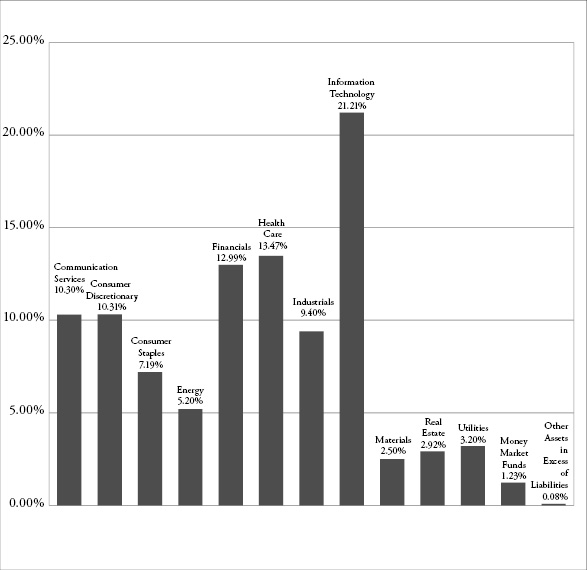

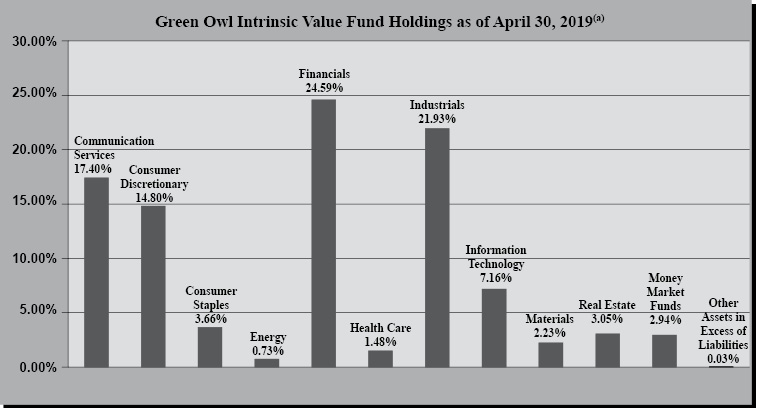

Portfolio Illustration (Unaudited)

April 30, 2019

The following chart gives a visual breakdown of the Large Cap Fund by sector weighting as a percentage of net assets as of April 30, 2019.

4

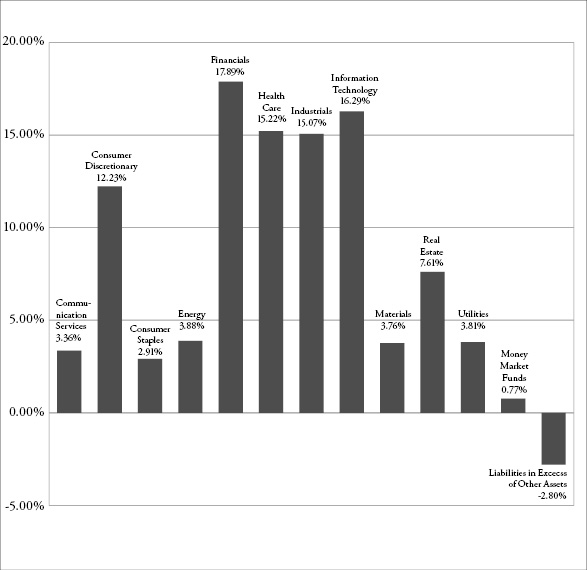

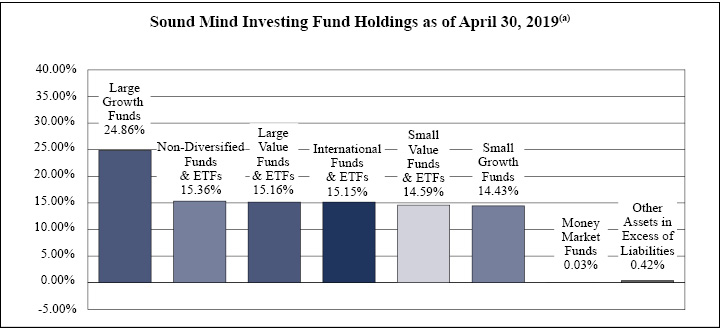

Portfolio Illustration (Unaudited)

April 30, 2019

The following chart gives a visual breakdown of the Small Cap Fund by sector weighting as a percentage of net assets as of April 30, 2019.

5

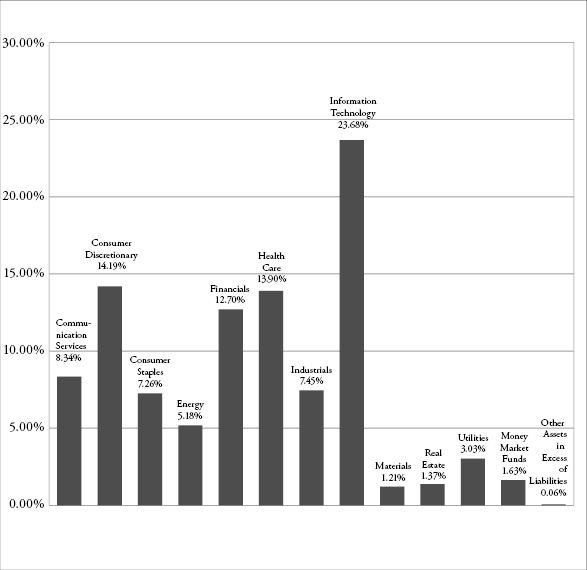

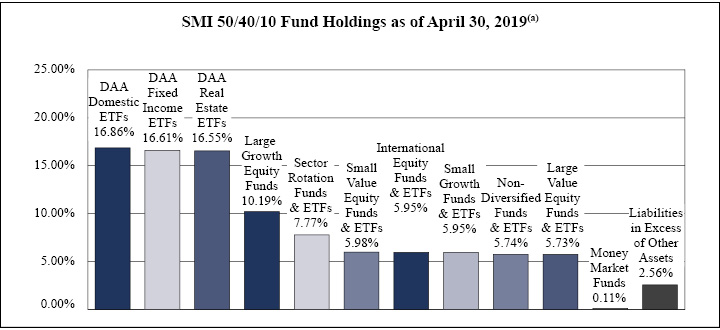

Portfolio Illustration (Unaudited)

April 30, 2019

The following chart gives a visual breakdown of the Epiphany ESG Fund by sector weighting as a percentage of net assets as of April 30, 2019.

Availability of Portfolio Schedules (Unaudited)

The Large Cap Fund, the Small Cap Fund, and the Epiphany ESG Fund (each a “Fund” and collectively the “Funds”) file their complete schedule of investments with the Securities and Exchange Commission (“SEC”) for the first and third quarters of each fiscal year on Form N-Q. The Funds’ Forms N-Q are available at the SEC’s website at www.sec.gov.

6

Dana Large Cap Equity Fund

Schedule of Investments

April 30, 2019 (Unaudited)

|

Shares |

Fair Value |

||||||

COMMON STOCKS — 98.69% |

||||||||

Communication Services — 10.30% |

||||||||

Alphabet, Inc., Class A(a) |

2,700 | $ | 3,237,192 | |||||

AT&T, Inc. |

85,000 | 2,631,600 | ||||||

Comcast Corporation, Class A |

70,000 | 3,047,100 | ||||||

Facebook, Inc., Class A(a) |

15,600 | 3,017,040 | ||||||

T-Mobile US, Inc.(a) |

40,000 | 2,919,600 | ||||||

| 14,852,532 | ||||||||

Consumer Discretionary — 10.31% |

||||||||

Amazon.com, Inc.(a) |

500 | 963,260 | ||||||

Best Buy Company, Inc. |

39,000 | 2,901,990 | ||||||

D.R. Horton, Inc. |

61,000 | 2,702,910 | ||||||

Home Depot, Inc. (The) |

13,400 | 2,729,580 | ||||||

lululemon athletica, Inc.(a) |

15,400 | 2,715,790 | ||||||

Royal Caribbean Cruises Ltd. |

23,600 | 2,854,184 | ||||||

| 14,867,714 | ||||||||

Consumer Staples — 7.19% |

||||||||

Constellation Brands, Inc., Class A |

12,400 | 2,624,708 | ||||||

Ingredion, Inc. |

300 | 28,425 | ||||||

Kimberly-Clark Corporation |

20,000 | 2,567,600 | ||||||

Sysco Corporation |

37,000 | 2,603,690 | ||||||

Walmart, Inc. |

24,800 | 2,550,432 | ||||||

| 10,374,855 | ||||||||

Energy — 5.20% |

||||||||

Chevron Corporation |

16,000 | 1,920,960 | ||||||

Exxon Mobil Corporation |

25,000 | 2,007,000 | ||||||

Marathon Petroleum Corporation |

32,000 | 1,947,840 | ||||||

ONEOK, Inc. |

24,000 | 1,630,320 | ||||||

| 7,506,120 | ||||||||

Financials — 12.99% |

||||||||

American Express Company |

23,000 | 2,696,290 | ||||||

Bank of America Corporation |

88,000 | 2,691,040 | ||||||

Citizens Financial Group, Inc. |

74,000 | 2,678,800 | ||||||

JPMorgan Chase & Company |

23,000 | 2,669,150 | ||||||

MetLife, Inc. |

59,000 | 2,721,670 | ||||||

Morgan Stanley |

55,000 | 2,653,750 | ||||||

Starwood Property Trust, Inc. |

114,000 | 2,627,700 | ||||||

| 18,738,400 | ||||||||

See accompanying notes which are an integral part of these financial statements. |

7 |

Dana Large Cap Equity Fund

Schedule of Investments (continued)

April 30, 2019 (Unaudited)

|

Shares |

Fair Value |

||||||

COMMON STOCKS — 98.69% — (continued) |

||||||||

Health Care — 13.47% |

||||||||

AbbVie, Inc. |

400 | $ | 31,756 | |||||

Amgen, Inc. |

14,600 | 2,618,072 | ||||||

Bristol-Myers Squibb Company |

54,000 | 2,507,220 | ||||||

CVS Health Corporation |

44,000 | 2,392,720 | ||||||

Merck & Company, Inc. |

35,000 | 2,754,850 | ||||||

Pfizer, Inc. |

40,000 | 1,624,400 | ||||||

Stryker Corporation |

14,400 | 2,720,304 | ||||||

UnitedHealth Group, Inc. |

11,000 | 2,563,770 | ||||||

WellCare Health Plans, Inc.(a) |

8,600 | 2,221,810 | ||||||

| 19,434,902 | ||||||||

Industrials — 9.40% |

||||||||

Boeing Company (The) |

200 | 75,538 | ||||||

Delta Air Lines, Inc. |

48,000 | 2,797,920 | ||||||

Eaton Corporation plc |

31,800 | 2,633,676 | ||||||

Norfolk Southern Corporation |

13,200 | 2,693,064 | ||||||

Raytheon Company |

14,800 | 2,628,332 | ||||||

Waste Management, Inc. |

25,400 | 2,726,436 | ||||||

| 13,554,966 | ||||||||

Information Technology — 21.21% |

||||||||

Accenture plc, Class A |

15,400 | 2,813,118 | ||||||

Adobe, Inc.(a) |

2,000 | 578,500 | ||||||

Apple, Inc. |

16,000 | 3,210,720 | ||||||

Broadcom, Inc. |

9,800 | 3,120,320 | ||||||

CDW Corporation |

29,000 | 3,062,400 | ||||||

Cisco Systems, Inc. |

55,000 | 3,077,250 | ||||||

Intel Corporation |

50,000 | 2,552,000 | ||||||

Mastercard, Inc., Class A |

11,200 | 2,847,488 | ||||||

Microsoft Corporation |

27,000 | 3,526,200 | ||||||

Visa, Inc., Class A |

18,800 | 3,091,284 | ||||||

Zebra Technologies Corporation, Class A(a) |

12,800 | 2,702,592 | ||||||

| 30,581,872 | ||||||||

Materials — 2.50% |

||||||||

Albemarle Corporation |

300 | 22,518 | ||||||

Packaging Corporation of America |

18,000 | 1,784,880 | ||||||

Steel Dynamics, Inc. |

57,000 | 1,805,760 | ||||||

| 3,613,158 | ||||||||

8 |

See accompanying notes which are an integral part of these financial statements. |

Dana Large Cap Equity Fund

Schedule of Investments (continued)

April 30, 2019 (Unaudited)

|

Shares |

Fair Value |

||||||

COMMON STOCKS — 98.69% — (continued) |

||||||||

Real Estate — 2.92% |

||||||||

American Tower Corporation, Class A |

11,000 | $ | 2,148,300 | |||||

Prologis, Inc. |

27,000 | 2,070,090 | ||||||

| 4,218,390 | ||||||||

Utilities — 3.20% |

||||||||

CenterPoint Energy, Inc. |

75,000 | 2,325,000 | ||||||

Exelon Corporation |

45,000 | 2,292,750 | ||||||

| 4,617,750 | ||||||||

Total Common Stocks (Cost $122,568,170) |

142,360,659 | |||||||

MONEY MARKET FUNDS — 1.23% |

||||||||

Federated Government Obligations Fund, Institutional Class, 2.31%(b) |

1,767,801 | 1,767,801 | ||||||

Total Money Market Funds (Cost $1,767,801) |

1,767,801 | |||||||

Total Investments — 99.92% (Cost $124,335,971) |

144,128,460 | |||||||

Other Assets in Excess of Liabilities — 0.08% |

116,375 | |||||||

NET ASSETS — 100.00% |

$ | 144,244,835 | ||||||

|

(a) |

Non-income producing security. |

|

(b) |

Rate disclosed is the seven day effective yield as of April 30, 2019. |

See accompanying notes which are an integral part of these financial statements. |

9 |

Dana Small Cap Equity Fund

Schedule of Investments

April 30, 2019 (Unaudited)

|

Shares |

Fair Value |

||||||

COMMON STOCKS — 102.03% |

||||||||

Communication Services — 3.36% |

||||||||

Marcus Corporation (The) |

6,737 | $ | 253,446 | |||||

QuinStreet, Inc.(a) |

21,663 | 309,131 | ||||||

| 562,577 | ||||||||

Consumer Discretionary — 12.23% |

||||||||

Boot Barn Holdings, Inc.(a) |

9,661 | 278,140 | ||||||

Boyd Gaming Corporation |

9,634 | 277,267 | ||||||

Fox Factory Holding Corporation(a) |

4,323 | 335,465 | ||||||

G-III Apparel Group Ltd.(a) |

7,158 | 308,868 | ||||||

Marriott Vacations Worldwide Corporation |

2,926 | 309,073 | ||||||

Ruth’s Hospitality Group, Inc. |

12,059 | 313,292 | ||||||

Urban Outfitters, Inc.(a) |

7,660 | 227,732 | ||||||

| 2,049,837 | ||||||||

Consumer Staples — 2.91% |

||||||||

Chefs’ Warehouse, Inc. (The)(a) |

6,950 | 227,126 | ||||||

Performance Food Group Company(a) |

6,384 | 261,425 | ||||||

| 488,551 | ||||||||

Energy — 3.88% |

||||||||

Delek US Holdings, Inc. |

4,161 | 154,207 | ||||||

Matador Resources Company(a) |

8,591 | 169,156 | ||||||

Oasis Petroleum, Inc.(a) |

25,355 | 154,666 | ||||||

ProPetro Holding Corporation(a) |

7,792 | 172,437 | ||||||

| 650,466 | ||||||||

Financials — 17.89% |

||||||||

Banner Corporation |

5,689 | 301,631 | ||||||

Blackstone Mortgage Trust, Inc., Class A |

7,927 | 282,122 | ||||||

CenterState Banks Corporation |

12,532 | 309,290 | ||||||

First Bancorp |

8,398 | 318,367 | ||||||

First Merchants Corporation |

7,983 | 292,737 | ||||||

Independent Bank Corporation |

3,410 | 273,584 | ||||||

Primerica, Inc. |

2,306 | 300,449 | ||||||

United Community Banks, Inc. |

11,162 | 313,428 | ||||||

Western Alliance Bancorporation(a) |

6,113 | 292,079 | ||||||

Wintrust Financial Corporation |

4,113 | 313,411 | ||||||

| 2,997,098 | ||||||||

Health Care — 15.22% |

||||||||

AMN Healthcare Services, Inc.(a) |

4,917 | 255,979 | ||||||

ANI Pharmaceuticals, Inc.(a) |

3,740 | 265,465 | ||||||

BioTelemetry, Inc.(a) |

4,105 | 223,312 | ||||||

10 |

See accompanying notes which are an integral part of these financial statements. |

Dana Small Cap Equity Fund

Schedule of Investments (continued)

April 30, 2019 (Unaudited)

|

Shares |

Fair Value |

||||||

COMMON STOCKS — 102.03% — (continued) |

||||||||

Health Care — (continued) |

||||||||

Emergent BioSolutions, Inc.(a) |

4,198 | $ | 216,953 | |||||

HMS Holdings Corporation(a) |

8,683 | 264,224 | ||||||

Horizon Pharma plc(a) |

9,536 | 243,454 | ||||||

Ligand Pharmaceuticals, Inc., Class B(a) |

2,283 | 287,315 | ||||||

Merit Medical Systems, Inc.(a) |

4,850 | 272,473 | ||||||

Repligen Corporation(a) |

3,946 | 265,881 | ||||||

Tabula Rasa HealthCare, Inc.(a) |

4,807 | 256,021 | ||||||

| 2,551,077 | ||||||||

Industrials — 15.07% |

||||||||

ASGN, Inc.(a) |

3,655 | 230,411 | ||||||

Comfort Systems USA, Inc. |

4,467 | 241,665 | ||||||

Curtiss-Wright Corporation |

2,221 | 253,061 | ||||||

Echo Global Logistics, Inc.(a) |

9,766 | 224,032 | ||||||

Harsco Corporation(a) |

11,427 | 258,707 | ||||||

MasTec, Inc.(a) |

5,641 | 285,716 | ||||||

Moog, Inc., Class A |

2,900 | 271,556 | ||||||

SkyWest, Inc. |

4,124 | 253,997 | ||||||

Timken Company (The) |

5,229 | 250,731 | ||||||

TriNet Group, Inc.(a) |

4,120 | 256,841 | ||||||

| 2,526,717 | ||||||||

Information Technology — 16.29% |

||||||||

Alarm.com Holdings, Inc.(a) |

4,267 | 302,445 | ||||||

Cabot Microelectronics Corporation |

2,418 | 305,273 | ||||||

Five9, Inc.(a) |

5,413 | 287,268 | ||||||

Quantenna Communications, Inc.(a) |

11,371 | 276,884 | ||||||

Rapid7, Inc.(a) |

6,014 | 326,800 | ||||||

RealPage, Inc.(a) |

4,820 | 314,312 | ||||||

Rudolph Technologies, Inc.(a) |

13,501 | 326,589 | ||||||

SYNNEX Corporation |

2,645 | 285,343 | ||||||

Upland Software, Inc.(a) |

6,573 | 305,579 | ||||||

| 2,730,493 | ||||||||

Materials — 3.76% |

||||||||

Ingevity Corporation(a) |

1,942 | 223,349 | ||||||

PolyOne Corporation |

6,504 | 179,771 | ||||||

W.R. Grace & Company |

3,004 | 227,042 | ||||||

| 630,162 | ||||||||

See accompanying notes which are an integral part of these financial statements. |

11 |

Dana Small Cap Equity Fund

Schedule of Investments (continued)

April 30, 2019 (Unaudited)

|

Shares |

Fair Value |

||||||

COMMON STOCKS — 102.03% — (continued) |

||||||||

Real Estate — 7.61% |

||||||||

CoreSite Realty Corporation |

3,121 | $ | 341,470 | |||||

EastGroup Properties, Inc. |

2,743 | 313,607 | ||||||

Preferred Apartment Communities, Inc., Class A |

19,371 | 302,962 | ||||||

STAG Industrial, Inc. |

11,039 | 317,702 | ||||||

| 1,275,741 | ||||||||

Utilities — 3.81% |

||||||||

Chesapeake Utilities Corporation |

3,377 | 312,845 | ||||||

Southwest Gas Holdings, Inc. |

3,912 | 325,440 | ||||||

| 638,285 | ||||||||

Total Common Stocks (Cost $15,398,792) |

17,101,004 | |||||||

MONEY MARKET FUNDS — 0.77% |

||||||||

Federated Government Obligations Fund, Institutional Class, 2.31%(b) |

129,807 | 129,807 | ||||||

Total Money Market Funds (Cost $129,807) |

129,807 | |||||||

Total Investments — 102.80% (Cost $15,490,045) |

17,230,811 | |||||||

Liabilities in Excess of Other Assets — (2.80)% |

(469,560 | ) | ||||||

NET ASSETS — 100.00% |

$ | 16,761,251 | ||||||

|

(a) |

Non-income producing security. |

|

(b) |

Rate disclosed is the seven day effective yield as of April 30, 2019. |

12 |

See accompanying notes which are an integral part of these financial statements. |

Dana Epiphany ESG Equity Fund

Schedule of Investments

April 30, 2019 (Unaudited)

|

Shares |

Fair Value |

||||||

COMMON STOCKS — 98.31% |

||||||||

Communication Services — 8.34% |

||||||||

Alphabet, Inc., Class C(a) |

250 | $ | 297,120 | |||||

AT&T, Inc. |

7,000 | 216,720 | ||||||

Facebook, Inc., Class A(a) |

2,500 | 483,500 | ||||||

T-Mobile US, Inc.(a) |

1,000 | 72,990 | ||||||

| 1,070,330 | ||||||||

Consumer Discretionary — 14.19% |

||||||||

Amazon.com, Inc.(a) |

270 | 520,160 | ||||||

Best Buy Company, Inc. |

1,600 | 119,056 | ||||||

Home Depot, Inc. (The) |

1,500 | 305,550 | ||||||

Lowe’s Companies, Inc. |

3,500 | 395,990 | ||||||

McDonald’s Corporation |

1,750 | 345,748 | ||||||

Tractor Supply Company |

1,300 | 134,550 | ||||||

| 1,821,054 | ||||||||

Consumer Staples — 7.26% |

||||||||

General Mills, Inc. |

4,200 | 216,174 | ||||||

Kimberly-Clark Corporation |

1,600 | 205,408 | ||||||

PepsiCo, Inc. |

2,500 | 320,125 | ||||||

Sysco Corporation |

2,700 | 189,999 | ||||||

| 931,706 | ||||||||

Energy — 5.18% |

||||||||

Marathon Petroleum Corporation |

2,900 | 176,523 | ||||||

Occidental Petroleum Corporation |

3,500 | 206,080 | ||||||

Phillips 66 |

3,000 | 282,810 | ||||||

| 665,413 | ||||||||

Financials — 12.70% |

||||||||

American Express Company |

3,000 | 351,690 | ||||||

Bank of America Corporation |

10,000 | 305,800 | ||||||

MetLife, Inc. |

4,300 | 198,359 | ||||||

PNC Financial Services Group, Inc. (The) |

2,000 | 273,860 | ||||||

Starwood Property Trust, Inc. |

9,000 | 207,450 | ||||||

U.S. Bancorp |

5,500 | 293,260 | ||||||

| 1,630,419 | ||||||||

See accompanying notes which are an integral part of these financial statements. |

13 |

Dana Epiphany ESG Equity Fund

Schedule of Investments (continued)

April 30, 2019 (Unaudited)

|

Shares |

Fair Value |

||||||

COMMON STOCKS — 98.31% — (continued) |

||||||||

Health Care — 13.90% |

||||||||

Becton, Dickinson and Company |

1,250 | $ | 300,925 | |||||

Bristol-Myers Squibb Company |

5,000 | 232,150 | ||||||

Cigna Corporation |

912 | 144,862 | ||||||

CVS Health Corporation |

2,700 | 146,826 | ||||||

Emergent BioSolutions, Inc.(a) |

2,800 | 144,704 | ||||||

Encompass Health Corporation |

2,700 | 174,015 | ||||||

Stryker Corporation |

2,000 | 377,820 | ||||||

WellCare Health Plans, Inc.(a) |

700 | 180,845 | ||||||

Zoetis, Inc. |

800 | 81,472 | ||||||

| 1,783,619 | ||||||||

Industrials — 7.45% |

||||||||

Allison Transmission Holdings, Inc. |

3,900 | 182,754 | ||||||

Delta Air Lines, Inc. |

3,700 | 215,673 | ||||||

Union Pacific Corporation |

2,000 | 354,080 | ||||||

Waste Management, Inc. |

1,900 | 203,946 | ||||||

| 956,453 | ||||||||

Information Technology — 23.68% |

||||||||

Accenture plc, Class A |

1,500 | 274,005 | ||||||

Apple, Inc. |

2,500 | 501,675 | ||||||

Automatic Data Processing, Inc. |

2,000 | 328,780 | ||||||

Cisco Systems, Inc. |

5,000 | 279,750 | ||||||

Intel Corporation |

7,500 | 382,800 | ||||||

Mastercard, Inc., Class A |

1,500 | 381,359 | ||||||

Microsoft Corporation |

4,000 | 522,400 | ||||||

Visa, Inc., Class A |

2,250 | 369,968 | ||||||

| 3,040,737 | ||||||||

Materials — 1.21% |

||||||||

Avery Dennison Corporation |

1,400 | 154,910 | ||||||

Real Estate — 1.37% |

||||||||

American Tower Corporation, Class A |

900 | 175,770 | ||||||

Utilities — 3.03% |

||||||||

NextEra Energy, Inc. |

2,000 | 388,880 | ||||||

Total Common Stocks (Cost $9,687,097) |

12,619,291 | |||||||

14 |

See accompanying notes which are an integral part of these financial statements. |

Dana Epiphany ESG Equity Fund

Schedule of Investments (continued)

April 30, 2019 (Unaudited)

|

Shares |

Fair Value |

||||||

MONEY MARKET FUNDS — 1.63% |

||||||||

Fidelity Investments Money Market Government Portfolio, Institutional Class, 2.35%(b) |

208,678 | $ | 208,678 | |||||

Total Money Market Funds (Cost $208,678) |

208,678 | |||||||

Total Investments — 99.94% (Cost $9,895,775) |

12,827,969 | |||||||

Other Assets in Excess of Liabilities — 0.06% |

7,780 | |||||||

NET ASSETS — 100.00% |

$ | 12,835,749 | ||||||

|

(a) |

Non-income producing security. |

|

(b) |

Rate disclosed is the seven day effective yield as of April 30, 2019. |

The sectors shown on the schedules of investments are based on the Global Industry Classification Standard, or GICS® (“GICS”). The GICS was developed by and/or is the exclusive property of MSCI, Inc. and Standard & Poor’s Financial Services LLC (“S&P”). GICS is a service mark of MSCI, Inc. and S&P and has been licensed for use by Ultimus Fund Solutions, LLC.

See accompanying notes which are an integral part of these financial statements. |

15 |

Dana Funds

Statements of Assets and Liabilities

April 30, 2019 (Unaudited)

Dana Large Cap |

Dana Small Cap |

Dana Epiphany |

||||||||||

Assets |

||||||||||||

Investments in securities at fair value (cost $124,335,971, $15,490,045 and $9,895,775) (Note 3) |

$ | 144,128,460 | $ | 17,230,811 | $ | 12,827,969 | ||||||

Receivable for fund shares sold |

52,780 | — | 1,000 | |||||||||

Dividends receivable |

208,799 | 1,534 | 17,026 | |||||||||

Receivable from Adviser (Note 4) |

— | 1,430 | 5,815 | |||||||||

Prepaid expenses |

25,525 | 21,733 | 26,424 | |||||||||

Total Assets |

144,415,564 | 17,255,508 | 12,878,234 | |||||||||

Liabilities |

||||||||||||

Payable for fund shares redeemed |

81,674 | 482,434 | 15 | |||||||||

Payable to Adviser (Note 4) |

69,689 | — | — | |||||||||

Accrued Distribution (12b-1) fees (Note 4) |

5,160 | 553 | 5,210 | |||||||||

Payable to Administrator (Note 4) |

12,706 | 7,583 | 6,660 | |||||||||

Other accrued expenses |

1,500 | 3,687 | 30,600 | |||||||||

Total Liabilities |

170,729 | 494,257 | 42,485 | |||||||||

Net Assets |

$ | 144,244,835 | $ | 16,761,251 | $ | 12,835,749 | ||||||

Net Assets consist of: |

||||||||||||

Paid-in capital |

117,511,547 | 15,243,713 | 9,259,703 | |||||||||

Accumulated earnings |

26,733,288 | 1,517,538 | 3,576,046 | |||||||||

Net Assets |

$ | 144,244,835 | $ | 16,761,251 | $ | 12,835,749 | ||||||

Institutional Class: |

||||||||||||

Net Assets |

$ | 118,894,046 | $ | 14,401,862 | $ | 5,020,214 | ||||||

Shares outstanding (unlimited number of shares authorized, no par value) |

5,556,337 | 1,371,236 | 450,798 | |||||||||

Net asset value, offering and redemption price per share (Note 2) |

$ | 21.40 | $ | 10.50 | $ | 11.14 | ||||||

Investor Class: |

||||||||||||

Net Assets |

$ | 25,350,789 | $ | 2,359,389 | $ | 7,815,535 | ||||||

Shares outstanding (unlimited number of shares authorized, no par value) |

1,184,870 | 226,609 | 682,330 | |||||||||

Net asset value, offering and redemption price per share (Note 2) |

$ | 21.40 | $ | 10.41 | $ | 11.45 | ||||||

16 |

See accompanying notes which are an integral part of these financial statements. |

Dana Funds

Statements of Operations

For the six months ended April 30, 2019 (Unaudited)

Dana Large Cap |

Dana Small Cap |

Dana Epiphany |

||||||||||

Investment Income |

||||||||||||

Dividend income |

$ | 2,151,235 | $ | 96,051 | $ | 142,726 | ||||||

Total investment income |

2,151,235 | 96,051 | 142,726 | |||||||||

Expenses |

||||||||||||

Investment Adviser fees (Note 4) |

532,222 | 66,323 | 44,174 | |||||||||

Administration fees (Note 4) |

42,707 | 18,975 | 12,982 | |||||||||

Distribution (12b-1) fees, Investor Class (Note 4) |

33,168 | 3,887 | 9,813 | |||||||||

Fund accounting fees (Note 4) |

23,412 | 14,973 | 8,678 | |||||||||

Registration expenses |

20,586 | 18,438 | 14,269 | |||||||||

Custodian fees |

11,196 | 2,052 | 3,057 | |||||||||

Transfer agent fees (Note 4) |

10,197 | 11,473 | 13,161 | |||||||||

Legal fees |

9,222 | 9,222 | 19,559 | |||||||||

Audit and tax preparation fees |

9,000 | 9,000 | 9,284 | |||||||||

Printing and postage expenses |

5,839 | 1,753 | 1,564 | |||||||||

Insurance expenses |

5,457 | 1,450 | 1,217 | |||||||||

Trustee fees (Note 4) |

998 | 2,024 | 5,982 | |||||||||

Interest expenses |

62 | — | 3 | |||||||||

Miscellaneous expenses |

516 | 554 | 8,697 | |||||||||

Total expenses |

704,582 | 160,124 | 152,440 | |||||||||

Fees contractually waived and expenses reimbursed by Adviser (Note 4) |

(73,814 | ) | (72,258 | ) | (78,281 | ) | ||||||

Net operating expenses |

630,768 | 87,866 | 74,159 | |||||||||

Net investment income |

1,520,467 | 8,185 | 68,567 | |||||||||

Net Realized and Change in Unrealized Gain (Loss) on Investments |

||||||||||||

Net realized gain (loss) on investment securities transactions |

6,687,938 | (142,044 | ) | 640,673 | ||||||||

Net change in unrealized appreciation on investment securities |

1,143,445 | 546,963 | 225,769 | |||||||||

Net realized and change in unrealized gain on investments |

7,831,383 | 404,919 | 866,442 | |||||||||

Net increase in net assets resulting from operations |

$ | 9,351,850 | $ | 413,104 | $ | 935,009 | ||||||

See accompanying notes which are an integral part of these financial statements. |

17 |

Dana Funds

Statements of Changes in Net Assets

Dana Large Cap Equity Fund |

Dana Small Cap Equity Fund |

|||||||||||||||

For the |

For the |

For the |

For the |

|||||||||||||

Increase (Decrease) in Net Assets due to: |

||||||||||||||||

Operations |

||||||||||||||||

Net investment income (loss) |

$ | 1,520,467 | $ | 2,899,378 | $ | 8,185 | $ | (61,414 | ) | |||||||

Net realized gain (loss) on investment securities transactions |

6,687,938 | 16,014,437 | (142,044 | ) | 1,549,728 | |||||||||||

Net change in unrealized appreciation (depreciation) of investment securities |

1,143,445 | (13,223,401 | ) | 546,963 | (2,109,601 | ) | ||||||||||

Net increase (decrease) in net assets resulting from operations |

9,351,850 | 5,690,414 | 413,104 | (621,287 | ) | |||||||||||

Distributions to Shareholders from Earnings (Note 2) |

||||||||||||||||

Institutional Class |

(14,597,614 | ) | (7,459,066 | ) | (1,098,363 | ) | (4,138 | ) | ||||||||

Investor Class |

(2,966,990 | ) | (1,701,334 | ) | (245,803 | ) | — | |||||||||

Total distributions |

(17,564,604 | ) | (9,160,400 | ) | (1,344,166 | ) | (4,138 | ) | ||||||||

Capital Transactions - Institutional Class |

||||||||||||||||

Proceeds from shares sold |

35,489,832 | 111,001,907 | 1,059,319 | 5,280,124 | ||||||||||||

Reinvestment of distributions |

11,446,426 | 5,913,368 | 1,065,847 | 3,493 | ||||||||||||

Amount paid for shares redeemed |

(97,893,113 | ) | (70,457,043 | ) | (3,159,881 | ) | (2,548,354 | ) | ||||||||

Total – Institutional Class |

(50,956,855 | ) | 46,458,232 | (1,034,715 | ) | 2,735,263 | ||||||||||

Capital Transactions – Investor Class |

||||||||||||||||

Proceeds from shares sold |

331,274 | 1,935,954 | 92,951 | 320,769 | ||||||||||||

Reinvestment of distributions |

2,963,842 | 1,700,677 | 245,803 | — | ||||||||||||

Amount paid for shares redeemed |

(5,704,344 | ) | (16,049,342 | ) | (1,280,585 | ) | (3,548,803 | ) | ||||||||

Total – Investor Class |

(2,409,228 | ) | (12,412,711 | ) | (941,831 | ) | (3,228,034 | ) | ||||||||

Net increase (decrease) in net assets resulting from capital transactions |

(53,366,083 | ) | 34,045,521 | (1,976,546 | ) | (492,771 | ) | |||||||||

Total Increase (Decrease) in Net Assets |

(61,578,837 | ) | 30,626,024 | (2,907,608 | ) | (1,079,892 | ) | |||||||||

Net Assets |

||||||||||||||||

Beginning of period |

205,823,672 | 175,248,137 | 19,668,859 | 20,787,055 | ||||||||||||

End of period |

$ | 144,244,835 | $ | 205,823,672 | $ | 16,761,251 | $ | 19,668,859 | ||||||||

18 |

See accompanying notes which are an integral part of these financial statements. |

Dana Funds

Statements of Changes in Net Assets (continued)

Dana Large Cap Equity Fund |

Dana Small Cap Equity Fund |

|||||||||||||||

For the |

For the |

For the |

For the |

|||||||||||||

Share Transactions - Institutional Class |

||||||||||||||||

Shares sold |

1,846,407 | 4,762,130 | 108,701 | 451,665 | ||||||||||||

Shares issued in reinvestment of distributions |

632,631 | 256,328 | 121,257 | 298 | ||||||||||||

Shares redeemed |

(4,838,690 | ) | (3,032,827 | ) | (318,915 | ) | (217,413 | ) | ||||||||

Total – Institutional Class |

(2,359,652 | ) | 1,985,631 | (88,957 | ) | 234,550 | ||||||||||

Share Transactions - Investor Class |

||||||||||||||||

Shares sold |

16,009 | 83,654 | 9,379 | 27,535 | ||||||||||||

Shares issued in reinvestment of distributions |

163,842 | 73,934 | 28,189 | — | ||||||||||||

Shares redeemed |

(286,531 | ) | (674,880 | ) | (126,197 | ) | (307,754 | ) | ||||||||

Total – Investor Class |

(106,680 | ) | (517,292 | ) | (88,629 | ) | (280,219 | ) | ||||||||

See accompanying notes which are an integral part of these financial statements. |

19 |

Dana Funds

Statements of Changes in Net Assets (continued)

Dana Epiphany ESG Equity Fund |

||||||||

For the |

For the |

|||||||

Increase (Decrease) in Net Assets due to: |

||||||||

Operations |

||||||||

Net investment income |

$ | 68,567 | $ | 88,672 | ||||

Net realized gain on investment securities transactions |

640,673 | 1,642,707 | ||||||

Net change in unrealized appreciation (depreciation) of investment securities |

225,769 | (375,549 | ) | |||||

Net increase in net assets resulting from operations |

935,009 | 1,355,830 | ||||||

Distributions to Shareholders from Earnings (Note 2) |

||||||||

Institutional Class |

(715,306 | ) | (1,192,255 | ) | ||||

Investor Class |

(976,870 | ) | (1,895,929 | ) | ||||

Total distributions |

(1,692,176 | ) | (3,088,184 | ) | ||||

Capital Transactions - Institutional Class |

||||||||

Proceeds from shares sold |

97,504 | 790,410 | ||||||

Reinvestment of distributions |

703,536 | 1,191,071 | ||||||

Amount paid for shares redeemed |

(1,924,007 | ) | (2,245,859 | ) | ||||

Total – Institutional Class |

(1,122,967 | ) | (264,378 | ) | ||||

Capital Transactions – Investor Class |

||||||||

Proceeds from shares sold |

245,678 | 594,407 | ||||||

Reinvestment of distributions |

957,190 | 1,843,847 | ||||||

Amount paid for shares redeemed |

(2,008,046 | ) | (5,958,253 | ) | ||||

Total – Investor Class |

(805,178 | ) | (3,519,999 | ) | ||||

Net decrease in net assets resulting from capital transactions |

(1,928,145 | ) | (3,784,377 | ) | ||||

Total Decrease in Net Assets |

(2,685,312 | ) | (5,516,731 | ) | ||||

Net Assets |

||||||||

Beginning of period |

15,521,061 | 21,037,792 | ||||||

End of period |

$ | 12,835,749 | $ | 15,521,061 | ||||

20 |

See accompanying notes which are an integral part of these financial statements. |

Dana Funds

Statements of Changes in Net Assets (continued)

Dana Epiphany ESG Equity Fund |

||||||||

For the |

For the |

|||||||

Share Transactions - Institutional Class |

||||||||

Shares sold |

9,237 | 64,220 | ||||||

Shares issued in reinvestment of distributions |

69,452 | 100,783 | ||||||

Shares redeemed |

(177,243 | ) | (183,044 | ) | ||||

Total – Institutional Class |

(98,554 | ) | (18,041 | ) | ||||

Share Transactions - Investor Class |

||||||||

Shares sold |

21,994 | 47,246 | ||||||

Shares issued in reinvestment of distributions |

91,870 | 152,260 | ||||||

Shares redeemed |

(178,182 | ) | (470,149 | ) | ||||

Total – Investor Class |

(64,318 | ) | (270,643 | ) | ||||

See accompanying notes which are an integral part of these financial statements. |

21 |

Dana Large Cap Equity Fund – Institutional Class

Financial Highlights

(For a share outstanding during each period)

Six Months |

Years Ended October 31, |

|||||||||||||||||||||||

(Unaudited) |

2018 |

2017 |

2016 |

2015 |

2014 |

|||||||||||||||||||

Selected Per Share Data: |

||||||||||||||||||||||||

Net asset value, beginning of period |

$ | 22.35 | $ | 22.64 | $ | 17.67 | $ | 18.22 | $ | 18.52 | $ | 17.19 | ||||||||||||

Investment operations: |

||||||||||||||||||||||||

Net investment income |

0.22 | 0.32 | 0.32 | 0.26 | (a) | 0.19 | 0.26 | |||||||||||||||||

Net realized and unrealized gain (loss) on investments |

1.16 | 0.45 | 4.96 | (0.56 | ) | 0.52 | (b) | 2.44 | ||||||||||||||||

Total from investment operations |

1.38 | 0.77 | 5.28 | (0.30 | ) | 0.71 | 2.70 | |||||||||||||||||

Less distributions to shareholders from: |

||||||||||||||||||||||||

Net investment income |

(0.19 | ) | (0.32 | ) | (0.31 | ) | (0.25 | ) | (0.19 | ) | (0.25 | ) | ||||||||||||

Net realized gains |

(2.14 | ) | (0.74 | ) | — | — | (0.83 | ) | (1.12 | ) | ||||||||||||||

Total distributions |

(2.33 | ) | (1.06 | ) | (0.31 | ) | (0.25 | ) | (1.02 | ) | (1.37 | ) | ||||||||||||

Redemption fees |

— | — | — | (c) | — | (c) | 0.01 | — | ||||||||||||||||

Net asset value, end of period |

$ | 21.40 | $ | 22.35 | $ | 22.64 | $ | 17.67 | $ | 18.22 | $ | 18.52 | ||||||||||||

Total Return(d) |

8.11 | %(e) | 3.27 | % | 30.11 | % | (1.66 | )% | 3.89 | % | 16.60 | % | ||||||||||||

Ratios and Supplemental Data: |

||||||||||||||||||||||||

Net assets, end of period (000 omitted) |

$ | 118,894 | $ | 176,954 | $ | 134,291 | $ | 138,540 | $ | 117,663 | $ | 6,919 | ||||||||||||

Before waiver |

||||||||||||||||||||||||

Ratio of expenses to average net assets |

0.82 | %(f) | 0.86 | % | 0.92 | % | 0.91 | % | 1.00 | % | 1.68 | % | ||||||||||||

After waiver |

||||||||||||||||||||||||

Ratio of expenses to average net assets |

0.73 | %(f) | 0.73 | % | 0.74 | %(g) | 0.73 | % | 0.73 | % | 0.73 | % | ||||||||||||

Ratio of net investment income to average net assets |

1.90 | %(f) | 1.41 | % | 1.48 | % | 1.45 | % | 1.25 | % | 1.34 | % | ||||||||||||

Portfolio turnover rate(h) |

28 | %(e) | 58 | % | 50 | % | 69 | % | 45 | % | 57 | % | ||||||||||||

|

(a) |

Per share net investment income has been determined on the basis of average shares outstanding during the year. |

|

(b) |

The amount shown for a share outstanding throughout the period does not accord with the change in aggregate gains and losses in the portfolio of securities during the period because of the timing of sales and purchases of fund shares in relation to fluctuating market values during the period. |

|

(c) |

Rounds to less than $0.005 per share. |

|

(d) |

Total return in the above table represents the rate that the investor would have earned or lost on an investment in the Fund, assuming reinvestment of distributions. |

|

(e) |

Not annualized |

|

(f) |

Annualized |

|

(g) |

This ratio includes the impact of overdraft fees. If this cost had been excluded, the ratio of expenses to average net assets would have been 0.73% for the fiscal year ended October 31, 2017. |

|

(h) |

Portfolio turnover is calculated on the basis of the Fund as a whole without distinguishing among the classes of shares. |

22 |

See accompanying notes which are an integral part of these financial statements. |

Dana Large Cap Equity Fund – Investor Class

Financial Highlights

(For a share outstanding during each period)

Six Months |

Years Ended October 31, |

|||||||||||||||||||||||

(Unaudited) |

2018 |

2017 |

2016 |

2015 |

2014 |

|||||||||||||||||||

Selected Per Share Data: |

||||||||||||||||||||||||

Net asset value, beginning of period |

$ | 22.35 | $ | 22.64 | $ | 17.68 | $ | 18.23 | $ | 18.54 | $ | 17.19 | ||||||||||||

Investment operations: |

||||||||||||||||||||||||

Net investment income |

0.17 | 0.28 | 0.24 | 0.22 | (a) | 0.18 | 0.19 | |||||||||||||||||

Net realized and unrealized gain (loss) on investments |

1.19 | 0.43 | 4.98 | (0.57 | ) | 0.49 | (b) | 2.46 | ||||||||||||||||

Total from investment operations |

1.36 | 0.71 | 5.22 | (0.35 | ) | 0.67 | 2.65 | |||||||||||||||||

Less distributions to shareholders from: |

||||||||||||||||||||||||

Net investment income |

(0.17 | ) | (0.26 | ) | (0.26 | ) | (0.20 | ) | (0.15 | ) | (0.18 | ) | ||||||||||||

Net realized gains |

(2.14 | ) | (0.74 | ) | — | — | (0.83 | ) | (1.12 | ) | ||||||||||||||

Total distributions |

(2.31 | ) | (1.00 | ) | (0.26 | ) | (0.20 | ) | (0.98 | ) | (1.30 | ) | ||||||||||||

Redemption fees |

— | — | — | — | (c) | — | (c) | — | (c) | |||||||||||||||

Net asset value, end of period |

$ | 21.40 | $ | 22.35 | $ | 22.64 | $ | 17.68 | $ | 18.23 | $ | 18.54 | ||||||||||||

Total Return(d) |

8.01 | %(e) | 3.01 | % | 29.72 | % | (1.91 | )% | 3.61 | % | 16.23 | % | ||||||||||||

Ratios and Supplemental Data: |

||||||||||||||||||||||||

Net assets, end of period (000 omitted) |

$ | 25,351 | $ | 28,870 | $ | 40,957 | $ | 32,514 | $ | 36,909 | $ | 29,197 | ||||||||||||

Before waiver |

||||||||||||||||||||||||

Ratio of expenses to average net assets |

1.07 | %(f) | 1.11 | % | 1.17 | % | 1.16 | % | 1.25 | % | 1.93 | % | ||||||||||||

After waiver |

||||||||||||||||||||||||

Ratio of expenses to average net assets |

0.98 | %(f) | 0.98 | % | 0.99 | %(g) | 0.98 | % | 0.98 | % | 0.98 | % | ||||||||||||

Ratio of net investment income to average net assets |

1.63 | %(f) | 1.17 | % | 1.20 | % | 1.22 | % | 1.00 | % | 1.09 | % | ||||||||||||

Portfolio turnover rate(h) |

28 | %(e) | 58 | % | 50 | % | 69 | % | 45 | % | 57 | % | ||||||||||||

|

(a) |

Per share net investment income has been determined on the basis of average shares outstanding during the year. |

|

(b) |

The amount shown for a share outstanding throughout the year does not accord with the change in aggregate gains and losses in the portfolio of securities during the year because of the timing of sales and purchases of fund shares in relation to fluctuating market values during the year. |

|

(c) |

Rounds to less than $0.005 per share. |

|

(d) |

Total return in the above table represents the rate that the investor would have earned or lost on an investment in the Fund, assuming reinvestment of distributions. |

|

(e) |

Not annualized |

|

(f) |

Annualized |

|

(g) |

This ratio includes the impact of overdraft fees. If this cost had been excluded, the ratio of expenses to average net assets would have been 0.98% for the fiscal year ended October 31, 2017. |

|

(h) |

Portfolio turnover is calculated on the basis of the Fund as a whole without distinguishing among the classes of shares. |

See accompanying notes which are an integral part of these financial statements. |

23 |

Dana Small Cap Equity Fund – Institutional Class

Financial Highlights

(For a share outstanding during each period)

Six Months |

Years Ended |

For the |

||||||||||||||

(Unaudited) |

2018 |

2017 |

2016(a) |

|||||||||||||

Selected Per Share Data: |

||||||||||||||||

Net asset value, beginning of period |

$ | 11.09 | $ | 11.43 | $ | 9.30 | $ | 10.00 | ||||||||

Investment operations: |

||||||||||||||||

Net investment income |

— | (b) | (0.03 | ) | — | (b) | 0.01 | |||||||||

Net realized and unrealized gain (loss) on investments |

0.22 | (0.31 | ) | 2.14 | (0.70 | )(c) | ||||||||||

Total from investment operations |

0.22 | (0.34 | ) | 2.14 | (0.69 | ) | ||||||||||

Less distributions to shareholders from: |

||||||||||||||||

Net investment income |

— | — | (b) | (0.01 | ) | (0.01 | ) | |||||||||

Net realized gains |

(0.81 | ) | — | — | — | |||||||||||

Total distributions |

(0.81 | ) | — | (b) | (0.01 | ) | (0.01 | ) | ||||||||

Redemption fees |

— | — | — | — | (b) | |||||||||||

Net asset value, end of period |

$ | 10.50 | $ | 11.09 | $ | 11.43 | $ | 9.30 | ||||||||

Total Return(d) |

3.39 | %(e) | (2.95 | )% | 23.08 | % | (6.87 | )%(e) | ||||||||

Ratios and Supplemental Data: |

||||||||||||||||

Net assets, end of period (000 omitted) |

$ | 14,402 | $ | 16,196 | $ | 14,011 | $ | 6,575 | ||||||||

Before waiver |

||||||||||||||||

Ratio of expenses to average net assets |

1.77 | %(f) | 1.75 | % | 2.02 | % | 4.11 | %(f) | ||||||||

After waiver |

||||||||||||||||

Ratio of expenses to average net assets |

0.95 | %(f) | 0.95 | % | 0.95 | % | 0.95 | %(f) | ||||||||

Ratio of net investment income (loss) to average net assets |

0.13 | %(f) | (0.24 | )% | — | % | 0.12 | %(f) | ||||||||

Portfolio turnover rate(g) |

31 | %(e) | 78 | % | 58 | % | 54 | %(e) | ||||||||

|

(a) |

For the period November 3, 2015 (commencement of operations) to October 31, 2016. |

|

(b) |

Rounds to less than $0.005 per share. |

|

(c) |

The amount shown for a share outstanding throughout the year does not accord with the change in aggregate gains and losses in the portfolio of securities during the year because of the timing of sales and purchases of fund shares in relation to fluctuating market values during the year. |

|

(d) |

Total return in the above table represents the rate that the investor would have earned or lost on an investment in the Fund, assuming reinvestment of distributions. |

|

(e) |

Not annualized |

|

(f) |

Annualized |

|

(g) |

Portfolio turnover is calculated on the basis of the Fund as a whole without distinguishing among the classes of shares. |

24 |

See accompanying notes which are an integral part of these financial statements. |

Dana Small Cap Equity Fund – Investor Class

Financial Highlights

(For a share outstanding during each period)

Six Months |

Years Ended |

For the |

||||||||||||||

(Unaudited) |

2018 |

2017 |

2016(a) |

|||||||||||||

Selected Per Share Data: |

||||||||||||||||

Net asset value, beginning of period |

$ | 11.02 | $ | 11.38 | $ | 9.28 | $ | 10.00 | ||||||||

Investment operations: |

||||||||||||||||

Net investment loss |

(0.02 | ) | (0.08 | ) | (0.02 | ) | — | (b)(c) | ||||||||

Net realized and unrealized gain (loss) on investments |

0.22 | (0.28 | ) | 2.13 | (0.71 | )(d) | ||||||||||

Total from investment operations |

0.20 | (0.36 | ) | 2.11 | (0.71 | ) | ||||||||||

Less distributions to shareholders from: |

||||||||||||||||

Net investment income |

— | — | (0.01 | ) | (0.01 | ) | ||||||||||

Net realized gains |

(0.81 | ) | — | — | — | |||||||||||

Total distributions |

(0.81 | ) | — | (0.01 | ) | (0.01 | ) | |||||||||

Redemption fees |

— | — | — | — | (c) | |||||||||||

Net asset value, end of period |

$ | 10.41 | $ | 11.02 | $ | 11.38 | $ | 9.28 | ||||||||

Total Return(e) |

3.23 | %(f) | (3.16 | )% | 22.73 | % | (7.13 | )%(f) | ||||||||

Ratios and Supplemental Data: |

||||||||||||||||

Net assets, end of period (000 omitted) |

$ | 2,359 | $ | 3,473 | $ | 6,776 | $ | 3,604 | ||||||||

Before waiver |

||||||||||||||||

Ratio of expenses to average net assets |

2.02 | %(g) | 2.00 | % | 2.27 | % | 4.53 | %(g) | ||||||||

After waiver |

||||||||||||||||

Ratio of expenses to average net assets |

1.20 | %(g) | 1.20 | % | 1.20 | % | 1.20 | %(g) | ||||||||

Ratio of net investment loss to average net assets |

(0.09 | )%(g) | (0.46 | )% | (0.25 | )% | (0.10 | )%(g) | ||||||||

Portfolio turnover rate(h) |

31 | %(f) | 78 | % | 58 | % | 54 | %(f) | ||||||||

|

(a) |

For the period November 3, 2015 (commencement of operations) to October 31, 2016. |

|

(b) |

Per share net investment income (loss) has been determined on the basis of average shares outstanding during the period. |

|

(c) |

Rounds to less than $0.005 per share. |

|

(d) |

The amount shown for a share outstanding throughout the year does not accord with the change in aggregate gains and losses in the portfolio of securities during the year because of the timing of sales and purchases of fund shares in relation to fluctuating market values during the year. |

|

(e) |

Total return in the above table represents the rate that the investor would have earned or lost on an investment in the Fund, assuming reinvestment of distributions. |

|

(f) |

Not annualized |

|

(g) |

Annualized |

|

(h) |

Portfolio turnover is calculated on the basis of the Fund as a whole without distinguishing among the classes of shares. |

See accompanying notes which are an integral part of these financial statements. |

25 |

Dana Epiphany ESG Equity Fund – Institutional Class

Financial Highlights

(For a share outstanding during each period)

Six Months |

Years Ended October 31, |

|||||||||||||||||||||||

(Unaudited) |

2018 |

2017(a) |

2016 |

2015 |

2014 |

|||||||||||||||||||

Selected Per Share Data: |

||||||||||||||||||||||||

Net asset value, beginning of period |

$ | 11.80 | $ | 13.09 | $ | 10.86 | $ | 11.64 | $ | 12.68 | $ | 12.71 | ||||||||||||

Investment operations: |

||||||||||||||||||||||||

Net investment income (loss) |

0.07 | 0.08 | (b) | 0.04 | (b) | (0.03 | )(b) | (0.05 | )(b) | (0.06 | )(b) | |||||||||||||

Net realized and unrealized gain (loss) on investments |

0.71 | 0.74 | 2.37 | (0.15 | ) | (0.03 | ) | 1.47 | ||||||||||||||||

Total from investment operations |

0.78 | 0.82 | 2.41 | (0.18 | ) | (0.08 | ) | 1.41 | ||||||||||||||||

Less distributions to shareholders from: |

||||||||||||||||||||||||

Net investment income |

(0.05 | ) | (0.08 | ) | (0.01 | ) | — | (c) | — | — | ||||||||||||||

Net realized gains |

(1.39 | ) | (2.03 | ) | (0.17 | ) | (0.60 | ) | (0.96 | ) | (1.44 | ) | ||||||||||||

Total distributions |

(1.44 | ) | (2.11 | ) | (0.18 | ) | (0.60 | ) | (0.96 | ) | (1.44 | ) | ||||||||||||

Redemption fees(c) |

— | — | — | — | — | — | ||||||||||||||||||

Net asset value, end of period |

$ | 11.14 | $ | 11.80 | $ | 13.09 | $ | 10.86 | $ | 11.64 | $ | 12.68 | ||||||||||||

Total Return(d) |

7.80 | %(e) | 6.32 | % | 22.46 | % | (1.46 | )% | (1.03 | )% | 12.16 | % | ||||||||||||

Ratios and Supplemental Data: |

||||||||||||||||||||||||

Net assets, end of period (000 omitted) |

$ | 5,020 | $ | 6,485 | $ | 7,429 | $ | 6,748 | $ | 7,175 | $ | 7,345 | ||||||||||||

Before waiver |

||||||||||||||||||||||||

Ratio of expenses to average net assets |

2.15 | %(f) | 1.63 | % | 2.15 | % | 2.43 | % | 2.42 | % | 2.35 | % | ||||||||||||

After waiver |

||||||||||||||||||||||||

Ratio of expenses to average net assets |

0.97 | %(f) | 1.25 | % | 1.82 | % | 2.25 | % | 2.25 | % | 2.25 | % | ||||||||||||

Ratio of net investment income (loss) to average net assets |

1.17 | %(f) | 0.62 | % | 0.36 | % | (0.27 | )% | (0.39 | )% | (0.47 | )% | ||||||||||||

Portfolio turnover rate(g) |

21 | %(e) | 23 | % | 97 | % | 63 | % | 81 | % | 70 | % | ||||||||||||

|

(a) |

Effective May 30, 2017, Class C shares were renamed Class I shares. Effective December 19, 2018, Class I shares were renamed Institutional Class shares. |

|

(b) |

Per share net investment income (loss) has been determined on the basis of average shares outstanding during the period. |

|

(c) |

Rounds to less than $0.005 per share. |

|

(d) |

Total return in the above table represents the rate that the investor would have earned or lost on an investment in the Fund, assuming reinvestment of distributions. |

|

(e) |

Not annualized |

|

(f) |

Annualized |

|

(g) |

Portfolio turnover is calculated on the basis of the Fund as a whole without distinguishing among the classes of shares. |

26 |

See accompanying notes which are an integral part of these financial statements. |

Dana Epiphany ESG Equity Fund – Investor Class

Financial Highlights

(For a share outstanding during each period)

Six Months |

Years Ended October 31, |

|||||||||||||||||||||||

(Unaudited) |

2018 |

2017 |

2016 |

2015(a) |

2014 |

|||||||||||||||||||

Selected Per Share Data: |

||||||||||||||||||||||||

Net asset value, beginning of period |

$ | 12.10 | $ | 13.38 | $ | 11.12 | $ | 11.88 | $ | 12.85 | $ | 12.82 | ||||||||||||

Investment operations: |

||||||||||||||||||||||||

Net investment income |

0.05 | 0.05 | (b) | 0.08 | (b) | 0.05 | (b) | 0.04 | (b) | 0.03 | (b) | |||||||||||||

Net realized and unrealized gain (loss) on investments |

0.73 | 0.75 | 2.43 | (0.15 | ) | 0.03 | 1.49 | |||||||||||||||||

Total from investment operations |

0.78 | 0.80 | 2.51 | (0.10 | ) | 0.07 | 1.52 | |||||||||||||||||

Less distributions to shareholders from: |

||||||||||||||||||||||||

Net investment income |

(0.04 | ) | (0.05 | ) | (0.08 | ) | (0.04 | ) | (0.08 | ) | (0.05 | ) | ||||||||||||

Net realized gains |

(1.39 | ) | (2.03 | ) | (0.17 | ) | (0.60 | ) | (0.96 | ) | (1.44 | ) | ||||||||||||

Return of capital |

— | — | — | (0.02 | ) | — | — | |||||||||||||||||

Total distributions |

(1.43 | ) | (2.08 | ) | (0.25 | ) | (0.66 | ) | (1.04 | ) | (1.49 | ) | ||||||||||||

Redemption fees(c) |

— | — | — | — | — | — | ||||||||||||||||||

Net asset value, end of period |

$ | 11.45 | $ | 12.10 | $ | 13.38 | $ | 11.12 | $ | 11.88 | $ | 12.85 | ||||||||||||

Total Return(d) |

7.58 | %(e) | 6.03 | % | 22.86 | % | (0.72 | )% | 0.25 | % | 12.96 | % | ||||||||||||

Ratios and Supplemental Data: |

||||||||||||||||||||||||

Net assets, end of period (000 omitted) |

$ | 7,816 | $ | 9,036 | $ | 13,609 | $ | 19,657 | $ | 22,619 | $ | 19,283 | ||||||||||||

Before waiver |

||||||||||||||||||||||||

Ratio of expenses to average net assets |

2.40 | %(f) | 1.87 | % | 1.82 | % | 1.68 | % | 1.68 | % | 1.60 | % | ||||||||||||

After waiver |

||||||||||||||||||||||||

Ratio of expenses to average net assets |

1.22 | %(f) | 1.50 | % | 1.50 | % | 1.50 | % | 1.50 | % | 1.50 | % | ||||||||||||

Ratio of net investment income to average net assets |

0.93 | %(f) | 0.38 | % | 0.69 | % | 0.48 | % | 0.36 | % | 0.26 | % | ||||||||||||

Portfolio turnover rate(g) |

21 | %(e) | 23 | % | 97 | % | 63 | % | 81 | % | 70 | % | ||||||||||||

|

(a) |

On June 1, 2015, Class N shares were renamed Class A Shares. Effective December 19, 2018, Class A shares were renamed Investor Class shares. |

|

(b) |

Per share net investment income (loss) has been determined on the basis of average shares outstanding during the period. |

|

(c) |

Rounds to less than $0.005 per share. |

|

(d) |

Total return in the above table represents the rate that the investor would have earned or lost on an investment in the Fund, assuming reinvestment of distributions. |

|

(e) |

Not annualized |

|

(f) |

Annualized |

|

(g) |

Portfolio turnover is calculated on the basis of the Fund as a whole without distinguishing among the classes of shares. |

See accompanying notes which are an integral part of these financial statements. |

27 |

Dana Funds

Notes to the Financial Statements

April 30, 2019 (Unaudited)

NOTE 1. ORGANIZATION

The Dana Large Cap Equity Fund (the “Large Cap Fund”), the Dana Small Cap Equity Fund (the “Small Cap Fund”), and Dana Epiphany ESG Equity Fund (the “Epiphany ESG Fund”) (each a “Fund” and collectively, the “Funds”) are each an open-end diversified series of Valued Advisers Trust (the “Trust”). The Trust is a management investment company established under the laws of Delaware by an Agreement and Declaration of Trust dated June 13, 2008 (the “Trust Agreement”). The Trust Agreement permits the Board of Trustees (“Board”) to issue an unlimited number of shares of beneficial interest of separate series without par value. Each Fund is one of a series of funds currently authorized by the Board. The investment adviser to the Funds is Dana Investment Advisors, Inc. (the “Adviser”). Each Fund seeks long-term growth of capital.

The Large Cap Fund, Small Cap Fund, and Epiphany ESG Fund currently offer Investor Class shares and Institutional Class shares. Effective on the close of business on October 13, 2017, Class A shares were consolidated into Class N shares of the Large Cap Fund which was subsequently re-designated Investor Class shares. Each share represents an equal proportionate interest in the assets and liabilities belonging to the Fund and is entitled to such dividends and distributions out of income belonging to the Fund as declared by the Board. Prior to February 28, 2017, all share classes of the Large Cap Fund and the Small Cap Fund imposed a 2.00% redemption fee on shares redeemed within 60 days of purchase.

On December 17, 2018, at a special meeting, the shareholders of the Epiphany FFV Fund, a series of the Epiphany Funds, approved the reorganization of the Epiphany FFV Fund with and into the Epiphany ESG Fund, a “shell” series of the Trust, and effective as of the close of business on December 19, 2018, the assets and liabilities of the Epiphany FFV Fund were transferred to the Trust in exchange for shares of the Epiphany ESG Fund. Shareholders of Class A shares of the Epiphany FFV Fund received Investor Class shares of the Epiphany ESG Fund and shareholders of Class I shares of the Epiphany FFV Fund received Institutional Class shares of the Epiphany ESG Fund. The Epiphany ESG Fund succeeded to the accounting and performance histories of the Epiphany FFV Fund. The Epiphany FFV Fund had the same investment objectives and substantially the same investment strategies and policies as the Epiphany ESG Fund. The Epiphany FFV Fund commenced operations in 2007.

NOTE 2. SIGNIFICANT ACCOUNTING POLICIES

The Funds are investment companies and follow accounting and reporting guidance under Financial Accounting Standards Board Accounting Standards Codification (“ASC”) Topic 946, “Financial Services-Investment Companies”. The following is a summary of significant accounting policies followed by the Funds in the preparation of their financial statements. These policies are in conformity with the generally accepted accounting principles in the United States of America (“GAAP”).

Estimates – The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates.

28

Dana Funds

Notes to the Financial Statements (continued)

April 30, 2019 (Unaudited)

Federal Income Taxes – The Funds make no provision for federal income or excise tax. Each Fund has qualified and intends to qualify each year as a regulated investment company (“RIC”) under subchapter M of the Internal Revenue Code of 1986, as amended, by complying with the requirements applicable to RICs and by distributing substantially all of its taxable income. Each Fund also intends to distribute sufficient net investment income and net capital gains, if any, so that it will not be subject to excise tax on undistributed income and gains. If the required amount of net investment income or gains is not distributed, the Fund could incur a tax expense.

As of and during the six months ended April 30, 2019, the Funds did not have any liabilities for any unrecognized tax benefits. The Funds recognize interest and penalties, if any, related to unrecognized tax benefits as income tax expense on the statements of operations when incurred. During the six months ended April 30, 2019, the Funds did not incur any interest or penalties. Management of the Funds has reviewed tax positions taken in tax years that remain subject to examination by all major tax jurisdictions, including federal (i.e., the last three tax year ends and the interim tax period since then, as applicable). Management believes that there is no tax liability resulting from unrecognized tax benefits related to uncertain tax positions taken.

Expenses – Expenses incurred by the Trust that do not relate to a specific fund of the Trust are allocated to the individual funds based on each fund’s relative net assets or other appropriate basis (as determined by the Board). Expenses specifically attributable to any class are borne by that class. Income, realized gains and losses, unrealized appreciation and depreciation, and expenses are allocated to each class based on the net assets in relation to the relative net assets of the Fund.

Security Transactions and Related Income – The Funds follow industry practice and record security transactions on the trade date for financial reporting purposes. The specific identification method is used for determining gains or losses for financial statement and income tax purposes. Dividend income is recorded on the ex-dividend date and interest income is recorded on an accrual basis. Discounts and premiums on securities purchased are accreted or amortized using the effective interest method, if applicable. Withholding taxes on foreign dividends have been provided for in accordance with the Funds’ understanding of the applicable country’s tax rules and rates.

Dividends and Distributions – Distributions to shareholders, which are determined in accordance with income tax regulations, are recorded on the ex-dividend date. The Funds intend to distribute substantially all of their net investment income quarterly. The Funds intend to distribute their net realized long-term and short-term capital gains, if any, annually. The treatment for financial reporting purposes of distributions made to shareholders during the year from net investment income or net realized capital gains may differ from their ultimate treatment for federal income tax purposes. These differences are caused primarily by differences in the timing of the recognition of certain components of income, expense or realized capital gain for federal income tax purposes. Where such differences are permanent in nature, they are reclassified in the components of the net assets based on their ultimate characterization for federal income tax purposes. Any such reclassifications will have no effect on net assets, results of operations or net asset value (“NAV”) per share of the Funds.

Share Valuation – The NAV per share of each class of the Fund is calculated each day the New York Stock Exchange is open by dividing the total value of the assets attributable to that class, less liabilities attributable to that class, by the number of shares outstanding of that class.

29

Dana Funds

Notes to the Financial Statements (continued)

April 30, 2019 (Unaudited)

NOTE 3. SECURITIES VALUATION AND FAIR VALUE MEASUREMENTS

All investments in securities are recorded at their estimated fair value. Fair value is defined as the price that a Fund would receive upon selling an investment in a timely transaction to an independent buyer in the principal or most advantageous market of the investment. GAAP establishes a three-tier hierarchy to maximize the use of observable market data and minimize the use of unobservable inputs and to establish classification of fair value measurements for disclosure purposes.

Inputs refer broadly to the assumptions that market participants would use in pricing the asset or liability, including assumptions about risk (the risk inherent in a particular valuation technique used to measure fair value including a pricing model and/or the risk inherent in the inputs to the valuation technique). Inputs may be observable or unobservable. Observable inputs are inputs that reflect the assumptions market participants would use in pricing the asset or liability developed based on market data obtained and available from sources independent of the reporting entity. Unobservable inputs are inputs that reflect the reporting entity’s own assumptions about the assumptions market participants would use in pricing the asset or liability developed based on the best information available in the circumstances.

Various inputs are used in determining the value of each Fund’s investments. These inputs are summarized in the three broad levels listed below.

● Level 1 – unadjusted quoted prices in active markets for identical investments and/or registered investment companies where the value per share is determined and published and is the basis for current transactions for identical assets or liabilities at the valuation date

● Level 2 – other significant observable inputs (including, but not limited to, quoted prices for an identical security in an inactive market, quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.)

● Level 3 – significant unobservable inputs (including the Funds’ own assumptions in determining fair value of investments based on the best information available)

The inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the level in the fair value hierarchy which is reported, is determined based on the lowest level input that is significant to the fair value measurement in its entirety.