As filed with the Securities and Exchange Commission on February 26, 2018

Securities Act File No. 333-______

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

Form N-14

REGISTRATION STATEMENT

UNDER

| THE SECURITIES ACT OF 1933 | ☒ | |

| Pre-Effective Amendment No. | ☐ | |

| Post-Effective Amendment No. | ☐ |

VALUED ADVISERS TRUST

(Exact Name of Registrant as Specified in Charter)

225 Pictoria Drive, Suite 450, Cincinnati, Ohio 45246

(Address of Principal Executive Offices) (Zip Code)

1-513-587-3400

(Registrant’s Area Code and Telephone Number)

Capitol Services, Inc.

1675 S. State St., Suite B, Dover, Delaware 19901

(Name and Address of Agent for Service)

With copies to:

John H. Lively, Esq.

The Law Offices of John H. Lively & Associate, Inc.

A member firm of The 1940 Act Law GroupTM

11300 Tomahawk Creek Parkway, Suite 310

Leawood, Kansas 66211

Approximate Date of Proposed Public Offering:

As soon as practicable after this Registration Statement becomes effective.

It is proposed that this filing will become effective on March 28, 2018, pursuant to Rule 488 under the Securities Act of 1933, as amended.

No filing fee is required because an indefinite number of shares have previously been registered pursuant to Rule 24f-2 under the Investment Company Act of 1940, as amended.

| Title of Securities Being Registered: | Shares of beneficial interest, no par value, of the SMI Conservative Allocation Fund |

SMI Funds

SMI 50/40/10 Fund

c/o Ultimus Fund Solutions, LLC

225 Pictoria Drive, Suite 450

Cincinnati, Ohio 45246

(877) 670-2227

March , 2018

Dear Shareholder:

On behalf of the Board of Trustees (the “Board”) of Valued Advisers Trust (the “Trust”), we are pleased to invite you to a special meeting of shareholders (the “Special Meeting”) of the SMI 50/40/10 Fund. The Special Meeting is scheduled for April 10, 2018 at 9:00 a.m. Eastern time, at 225 Pictoria Drive, Suite 450, Cincinnati, Ohio 45246.

At the Special Meeting, shareholders of the SMI 50/40/10 Fund will be asked to vote on the proposed reorganization (the “Reorganization”) of the SMI 50/40/10 Fund with and into the SMI Conservative Allocation Fund (collectively, the “Funds”). The Funds are each series of the Trust and share the same investment adviser.

If the Reorganization is approved by shareholders, the SMI 50/40/10 Fund will be combined into the SMI Conservative Allocation Fund and you will become a shareholder of SMI Conservative Allocation Fund, beginning on the date the Reorganization occurs. However, the SMI Conservative Allocation Fund’s name will then be changed to the SMI 50/40/10 Fund and it will adopt the investment strategies currently employed by the SMI 50/40/10 Fund. Essentially, the main change you will experience is a change in ticker symbol of the fund you own, from SMIRX to SMILX. Importantly, the fees you will be charged as a shareholder of the SMI 50/40/10 Fund will be those applicable to the SMI Conservative Allocation Fund (as it is the legal survivor following the Reorganization) and those fees are lower than those currently in place for the SMI 50/40/10 Fund.

Formal notice of the Special Meeting appears on the next page, followed by a combined proxy statement and prospectus (the “Proxy Statement/Prospectus”). The Reorganization is discussed in detail in the enclosed Proxy Statement/Prospectus, which you should read carefully. The Board recommends that you vote “FOR” the Reorganization.

Additionally, as detailed later in this enclosed Proxy Statement/Prospectus, the SMI Conservative Allocation Fund, in coordination with the Reorganization, is changing its name and investment strategies to align with those of the SMI 50/40/10 Fund. Accordingly, it is anticipated that the Reorganization would provide shareholders of the SMI 50/40/10 Fund with an opportunity to participate in a fund that invests in a substantially similar manner to the fund in which they are currently invested.

Your vote is important regardless of the number of shares you own. To avoid the added cost of follow-up solicitations and possible adjournments, please read the Proxy Statement/Prospectus and cast your vote. It is important that your vote be received no later than April 10, 2018.

We appreciate your participation and prompt response in this matter and thank you for your continued support.

Sincerely,

Carol J. Highsmith

Secretary

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS

OF

SMI 50/40/10 FUND

c/o Ultimus Fund Solutions, LLC

225 Pictoria Drive, Suite 450

Cincinnati, Ohio 45246

(877) 670-2227

Scheduled for April 10, 2018

To the Shareholders:

NOTICE IS HEREBY GIVEN that a special meeting of the shareholders (the “Special Meeting”) of the SMI 50/40/10 Fund is scheduled for 9:00 a.m., Eastern time, on April 10, 2018 at 225 Pictoria Drive, Suite 450, Cincinnati, Ohio 45246.

At the Special Meeting, the SMI 50/40/10 Fund’s shareholders will be asked to vote on the following proposal:

| 1. | To approve an Agreement and Plan of Reorganization by and between the SMI 50/40/10 Fund and the SMI Conservative Allocation Fund, providing for the reorganization of the SMI 50/40/10 Fund with and into the SMI Conservative Allocation Fund (the “Reorganization”); and |

| 2. | To transact such other business, not currently contemplated, that may properly come before the Special Meeting, or any adjournments or postponements thereof, in the discretion of the proxies or their substitutes. |

Please read the enclosed combined proxy statement and prospectus (the “Proxy Statement/Prospectus”) carefully for information concerning the Reorganization before the Special Meeting.

The Board of Trustees recommends that you vote “FOR” the Proposal.

Shareholders of record as of the close of business on February 15, 2018 are entitled to notice of, and to vote at, the Special Meeting and are also entitled to vote at any adjournments or postponements thereof. Your attention is called to the accompanying Proxy Statement/Prospectus. Regardless of whether you plan to attend the Special Meeting, please complete, sign, and return the enclosed Proxy Ballot by April 10, 2018 so that a quorum will be present and a maximum number of shares may be voted. Proxies may be revoked at any time before they are exercised by submitting a revised Proxy Ballot, by giving written notice of revocation to the SMI 50/40/10 Fund or by voting in person at the Special Meeting.

By Order of the Board of Trustees

Carol J. Highsmith

Secretary

PROXY STATEMENT/PROSPECTUS

March , 2018

Special Meeting of Shareholders

of the SMI 50/40/10 Fund

Scheduled for April 10, 2018

| Acquisition of the Assets of: | By and in Exchange for Shares of Beneficial Interest of: | |

| SMI 50/40/10 Fund (A series of Valued Advisers Trust) 225 Pictoria Drive, Suite 450 Cincinnati, Ohio 45246 (877) 764-3863 |

SMI Conservative Allocation Fund (A series of Valued Advisers Trust) 225 Pictoria Drive, Suite 450 Cincinnati, Ohio 45246 (877) 764-3863 | |

(each an open-end investment company)

Important Notice Regarding the Availability of Proxy Materials for

the Special Meeting to be held on April 10, 2018

The Proxy Statement/Prospectus explains concisely what you should know before voting on the matters described herein or investing in the SMI Conservative Allocation Fund. Please read it carefully and keep it for future reference.

THE U.S. SECURITIES AND EXCHANGE COMMISSION HAS NOT APPROVED OR DISAPPROVED THESE SECURITIES, OR DETERMIEND THAT THIS PROXY STATEMENT/PROSPECTUS IS TRUTHFUL OR COMPLETE. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

TO OBTAIN MORE INFORMATION

To obtain more information about the SMI 50/40/10 Fund and the SMI Conservative Allocation Fund (collectively, the “Funds”), please write or call for a free copy of the current prospectus, statement of additional information, annual/semi-annual shareholder reports, or other information. All of these documents are available for free online at www.smifund.com.

| By Phone: | (877) 764-3863 | |

| By Mail: | c/o Ultimus Fund Solutions, LLC 225 Pictoria Drive, Suite 450 Cincinnati, Ohio 45246 (877) 670-2227 | |

The following documents containing additional information about the Funds, each having been filed with the U.S. Securities and Exchange Commission (“SEC”), are incorporated by reference into this Proxy Statement/Prospectus:

| 1. | The Statement of Additional Information dated March __, 2018 relating to this Proxy Statement/Prospectus; |

| 2. | The Prospectus and Statement of Additional Information dated January 19, 2018 , each as supplemented from time to time, for the SMI 50/40/10 Fund and the SMI Conservative Allocation Fund; |

| 3. | The Annual Report dated October 31, 2017 for each of the Funds; and |

| 4. | The Semi-Annual Report dated April 30, 2017 for each of the Funds. |

The Funds are subject to the informational requirements of the Securities Exchange Act of 1934, as amended, and the Investment Company Act of 1940, as amended, and the rules, regulations, and exemptive orders thereunder, and in accordance therewith, file reports and other information including proxy materials with the SEC.

This Proxy Statement/Prospectus will be mailed on or about March , 2018 to shareholders of record of the SMI 50/40/10 Fund as of February 15, 2018 (the “Record Date”).

You also may view or obtain these documents from the SEC:

| In Person: | Public Reference Section 100 F Street, N.E. Washington, D.C. 20549 (202) 551-8090 | |

| By Mail: | U.S. Securities and Exchange Commission Public Reference Section 100 F Street, N.E. Washington, D.C. 20549 (Duplication Fee Required) | |

| By Email: | publicinfo@sec.gov (Duplication Fee Required) | |

| By Internet: | www.sec.gov | |

When contacting the SEC, you will want to refer to the Funds’ SEC file numbers. The file number for the document listed above as (1) is [File No. generated with N-14 filing]. The file number for the documents listed above as (2), (3) and (4) is 811-22208.

TABLE OF CONTENTS

QUESTIONS & ANSWERS

What is happening?

At a meeting held on December 12, 2017, the Board of Trustees (the “Board”) of Valued Advisers Trust approved an Agreement and Plan of Reorganization (the “Reorganization Agreement”) which provides for the reorganization of the SMI 50/40/10 Fund with and into the SMI Conservative Allocation Fund (the “Reorganization”). The Reorganization Agreement requires shareholder approval, and if approved, is expected to be effective on April 13, 2018 or such other date as the parties may agree (the “Closing Date”).

Why did you send me this information?

These materials include a combined proxy statement and prospectus (the “Proxy Statement/Prospectus”) and a Proxy Ballot for the SMI 50/40/10 Fund. The Proxy Statement/Prospectus provides you with information you should review before providing voting instructions on the proposal listed in the Notice of Special Meeting of Shareholders.

Because you, as a shareholder of the SMI 50/40/10 Fund, are being asked to approve a Reorganization Agreement that will result in a transaction in which you will ultimately hold shares of the SMI Conservative Allocation Fund, this Proxy Statement also serves as a prospectus for the SMI Conservative Allocation Fund. The SMI Conservative Allocation Fund is an open-end management investment company whose investment objective is described below.

Who is eligible to vote?

Shareholders holding an investment in shares of the SMI 50/40/10 Fund as of the close of business on February 15, 2018 (the “Record Date”) are eligible to vote at the Special Meeting or any adjournments or postponements thereof.

How do I vote?

You may submit your Proxy Ballot in one of four ways:

| • | By Internet. The web address and instructions for voting can be found on the enclosed Proxy Ballot. You will be required to provide your control number located on the Proxy Ballot. |

| • | By Telephone. The toll-free number for telephone voting can be found on the enclosed Proxy Ballot. You will be required to provide your control number located on the Proxy Ballot. |

| • | By Mail. Mark the enclosed Proxy Ballot, sign and date it, and return it in the postage-paid envelope we provided. Both joint owners must sign the Proxy Ballot. |

| • | In Person at the Special Meeting. You can vote your shares in person at the Special Meeting. If you expect to attend the Special Meeting in person, please call toll-free at (877) 764-3863. |

1

To be certain your vote will be counted, a properly executed Proxy Ballot must be received no later than 5:00 p.m., Eastern time, on April 9, 2018.

Should shareholders require additional information regarding the Special Meeting, they may call xxx-xxx-xxxx.

How does the Board recommend that I vote?

The Board recommends that shareholders vote “FOR” the Proposal.

Who is paying for the expenses associated with the Reorganization?

The expenses of the Reorganization will be paid by the Funds, and will be split evenly between the two Funds.

When and where will the Special Meeting be held?

The Special Meeting is scheduled to be held at 225 Pictoria Drive, Suite 450, Cincinnati, Ohio 45246, on April 10, 2018 at 9:00 a.m. Eastern time. If the Special Meeting is adjourned or postponed, any adjournments or postponements of the Special Meeting will also be held at the above location. If you expect to attend the Special Meeting in person, please call (877) 764-3863.

2

Proposal – The Reorganization

You should read this entire Proxy Statement/Prospectus and the Reorganization Agreement, which is included in Appendix A. For more information about the SMI Conservative Allocation Fund, please consult Appendix B.

On December 12, 2017, the Board approved the Reorganization. Subject to shareholder approval, the Reorganization Agreement provides for:

| • | the transfer of all of the assets of the SMI 50/40/10 Fund to the SMI Conservative Allocation Fund in exchange solely for shares of beneficial interest of the SMI Conservative Allocation Fund; |

| • | the assumption by the SMI Conservative Allocation Fund of all the liabilities of the SMI 50/40/10 Fund; |

| • | the distribution of shares of the SMI Conservative Allocation Fund to the shareholders of the SMI 50/40/10 Fund; and |

| • | the complete liquidation of the SMI 50/40/10 Fund. |

If shareholders approve the Reorganization, each owner of the SMI 50/40/10 Fund would become a shareholder of the SMI Conservative Allocation Fund. The Reorganization is expected to be effective on the Closing Date. Each shareholder of the SMI 50/40/10 Fund will hold, immediately after the Closing Date, shares of the SMI Conservative Allocation Fund having an aggregate value equal to the aggregate value of the shares of SMI 50/40/10 Fund held by that shareholder as of the close of business on the Closing Date.

In considering whether to approve the Reorganization, you should note that:

| • | Both Funds have the same investment objective – they both seek total return (total return is composed of both income and capital appreciation). |

| • | Upon completion of the Reorganization, the SMI Conservative Allocation Fund is changing its name to the SMI 50/40/10 Fund and will adopt the investment strategies currently employed by the SMI 50/40/10 Fund (see below for additional information on these changes). |

| • | SMI Advisory Services, LLC (“SMI” or the “Adviser”) serves as investment adviser to both Funds and the same team of portfolio managers serve both Funds as well. |

| • | Each Fund is serviced by the same service providers, including the distributor, administrator, transfer agent, and custodian. |

3

| • | The total annual operating expenses (before fee waivers and expense reimbursements) of the SMI 50/40/10 Fund are expected to decrease as a result of the Reorganization. Each Fund is currently operating under an expense limitation arrangement pursuant to which the Adviser has agreed to waive its advisory fees and limit certain other operating expenses. For the SMI 50/40/10 Fund, the agreement is in effect through February 28, 2019. For the SMI Conservative Allocation Fund, the agreement is in effect through February 29, 2020, 2019. The expense limitation agreement for the SMI Conservative Allocation Fund provides for a cap of 1.15% per annum while the fee arrangement with the SMI 50/40/10 Fund caps expenses at 1.45% per annum. There can be no assurance that these obligations will be continued. |

| • | The Reorganization will not affect a shareholder’s right to purchase, redeem, or exchange shares of the SMI Funds. |

| • | The Reorganization is intended to qualify for federal income tax purposes as a tax-free reorganization pursuant to Section 368(a) of the Internal Revenue Code of 1986, as amended (the “Code”); accordingly, pursuant to this treatment, neither the SMI 50/40/10 Fund nor its shareholders nor the SMI Conservative Allocation Fund nor its shareholders are expected to recognize any gain or loss for federal income tax purposes from the transactions contemplated by the Reorganization Agreement. |

Additional Information on Proposed Changes to the SMI Conservative Allocation Fund’s Name and Strategies

Additionally, on December 12, 2017, the Board approved proposals to change the name of the SMI Conservative Allocation Fund to the SMI 50/40/10 Fund and to adopt the investment strategies of the SMI 50/40/10 Fund. These revisions are intended to allow the SMI Conservative Allocation Fund (i.e., the SMI 50/40/10 Fund after the Reorganization) to focus on a broader range of asset classes. These changes do not require approval by the shareholders of the SMI Conservative Allocation Fund. Notice of the changes to the name and investment strategies of the SMI Conservative Allocation Fund were provided to shareholders of that Fund on January 2, 2018 and are expected to take effect on April 13, 2018 in conjunction with the anticipated closing of the Reorganization. More information on those changes are presented in this Proxy Statement/Prospectus.

4

PROPOSAL – APPROVAL OF THE REORGANIZATION

Shareholders of the SMI 50/40/10 Fund are being asked to approve a Reorganization Agreement, providing for the reorganization of the SMI 50/40/10 Fund with and into the SMI Conservative Allocation Fund. If the Reorganization is approved, shareholders in the SMI 50/40/10 Fund will become shareholders in the SMI Conservative Allocation Fund as of the close of business on the Closing Date.

At meetings held on November 22, 2017 and December 12, 2017, the Board considered a proposal by the Adviser to reorganize the SMI 50/40/10 Fund into the SMI Conservative Allocation Fund. The factors considered by the Board are discussed more fully under “Board Considerations” below and generally include representations by the Adviser that a combined Fund would provide investors with a reduced expense ratio, greater potential for economies of scale, more developed distribution network and expose investors to a broader range of asset classes. The Board also considered that the Reorganization is expected to be a tax-free transaction.

SPECIAL NOTE #1: At the December 12, 2017 meeting, the Board also approved a proposal by the Adviser to change the name of the SMI Conservative Allocation Fund to the SMI 50/40/10 Fund. In coordination with the name change, the Board also approved a proposal calling for the SMI Conservative Allocation Fund to adopt the investment strategies currently employed by the SMI 50/40/10 Fund. These changes will become effective in conjunction with the closing of the Reorganization.

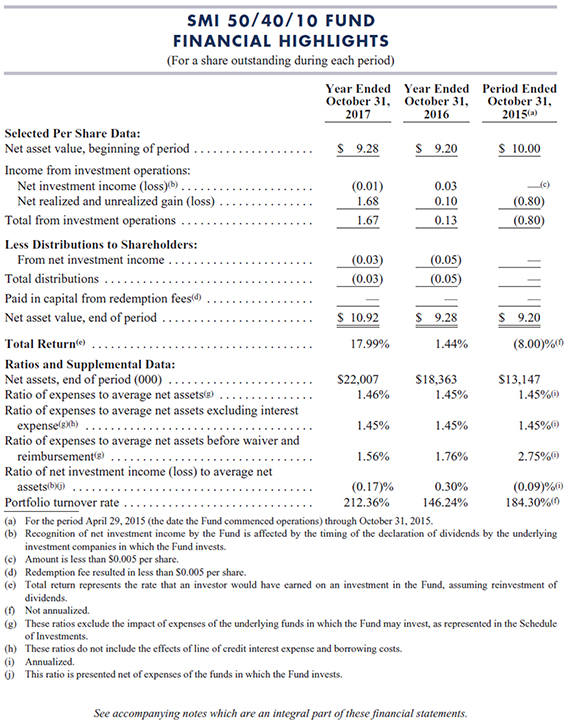

SPECIAL NOTE #2: As discussed in greater detail below, SMI 50/40/10 Fund shareholders are being solicited to approve the Reorganization Agreement. As a result of the Reorganization, the SMI Conservative Allocation Fund will be the legal survivor of the transaction. However, for purposes of performance reporting, the accounting survivor will be the SMI 50/40/10 Fund. This means that the fee structure of the SMI Conservative Allocation Fund will survive following the reorganization and that the performance and accounting records (such as the financial highlights) of the SMI 50/40/10 Fund will survive following the reorganization.

Comparison of the Funds’ Investment Objectives

The Funds have identical investment objectives – to seek total return. No changes are being proposed to the Funds’ investment objectives as part of the Reorganization.

Comparison of the Funds’ Fees and Expenses

The following tables describe the fees and expenses of the Funds. The Annual Fund Operating Expenses table and Example table shown below are based on actual expenses incurred in each Fund’s fiscal year ended October 31, 2017. The October 31, 2017 Pro forma numbers are estimated in good faith and are hypothetical.

5

Fees and Expenses

| Shareholder Fees (fees paid directly from your investment) |

SMI 50/40/10 Fund (before reorganization) |

SMI Conservative Allocation Fund |

Pro Forma Combined SMI Conservative Allocation Fund (i.e., the SMI 50/40/10 Fund after Reorganization) |

|||||||||

| Redemption Fee |

None | None | None | |||||||||

| Fee for Redemptions Paid by Wire |

$ | 15.00 | $ | 15.00 | $ | 15.00 | ||||||

| Annual Fund Operating Expenses (expenses that you pay each year as percentage of the value of your investment) |

SMI 50/40/10 Fund | SMI Conservative Allocation Fund |

Pro Forma Combined Forward SMI Conservative Allocation Fund (i.e., the SMI 50/40/10 Fund after Reorganization) |

|||||||||

| Management Fees |

1.00 | % | 0.90 | % | 0.90 | % | ||||||

| Distribution and/or (12b-1) Fees |

None | None | None | |||||||||

| Other Expenses |

0.56 | % | 0.63 | % | 0.63 | % | ||||||

| Acquired Fund Fees and Expenses |

0.66 | % | 0.21 | % | 0.31 | % | ||||||

| Total Annual Fund Operating Expenses |

2.22 | % | 1.74 | % | 1.84 | % | ||||||

| Fee Waiver/Expense Reimbursement |

(0.10 | %) | (0.37 | )% | (0.38 | )% | ||||||

| Total Annual Fund Operating Expenses After Fee Waiver/Expense Reimbursement |

2.12 | %1 | 1.37 | %2 | 1.46 | %3 | ||||||

| 1. | The Adviser contractually has agreed to waive its fee and/or reimburse expenses to the extent necessary to maintain Total Annual Fund Operating Expenses (excluding interest, taxes, brokerage commissions, other expenses which are capitalized in accordance with generally accepted accounting principles, extraordinary expenses, dividend expense on short sales, 12b-1 fees, and acquired fund fees and expenses) at 1.45% of the SMI 50/40/10 Fund’s average daily net assets through February 28, 2019. Each waiver or reimbursement of an expense by the Adviser is subject to repayment by the SMI 50/40/10 Fund within the three fiscal years following the fiscal year in which the expense was incurred, provided that the SMI 50/40/10 Fund is able to make the repayment without exceeding the expense limitation in place at the time of the waiver or reimbursement. This expense cap may not be terminated prior to this date except by the Board of Trustees. |

| 2. | The Adviser contractually has agreed to waive its fee and/or reimburse expenses to the extent necessary to maintain Total Annual Fund Operating Expenses (excluding interest, taxes, brokerage commissions, other expenses which are capitalized in accordance with generally accepted accounting principles, extraordinary expenses, dividend expense on short sales, 12b-1 fees, and acquired fund fees and expenses) at 1.15% of the SMI Conservative Allocation Fund’s average daily net assets through February 29, 2020. Each waiver or reimbursement of an expense by the Adviser is subject to repayment by the SMI Conservative Allocation Fund within the three fiscal years following the fiscal year in which the expense was incurred, provided that the Fund is able to make the repayment without exceeding the expense limitation in place at the time of the waiver or reimbursement. This expense cap may not be terminated prior to this date except by the Board of Trustees. |

6

| 3. | The Adviser contractually has agreed to waive its fee and/or reimburse expenses to the extent necessary to maintain Total Annual Fund Operating Expenses (excluding interest, taxes, brokerage commissions, other expenses which are capitalized in accordance with generally accepted accounting principles, extraordinary expenses, dividend expense on short sales, 12b-1 fees, and acquired fund fees and expenses) at 1.15% of the SMI 50/40/10 Fund’s average daily net assets through February 29, 2020. Each waiver or reimbursement of an expense by the Adviser is subject to repayment by the Fund within the three fiscal years following the fiscal year in which the expense was incurred, provided that the Fund is able to make the repayment without exceeding the expense limitation in place at the time of the waiver or reimbursement. This expense cap may not be terminated prior to this date except by the Board of Trustees. |

Portfolio Turnover

Each Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in annual operating expenses or in the Example, above, affect each Fund’s performance. During the most recent fiscal year, the SMI Conservative Allocation Fund’s portfolio turnover rate was 207.04% of the average value of its portfolio while the SMI 50/40/10 Fund’s portfolio turnover rate was 212.36% of the average value of its portfolio. Following the Reorganization, the SMI Conservative Allocation Fund will be implementing the SMI 50/40/10 Fund’s investment strategies so it is expected that your portfolio turnover rate will be consistent with your current investment.

Example

The following examples are intended to help you compare the costs of investing in each Fund and the combined Fund. The examples assume that you invest $10,000 in each Fund and in the combined Fund after the Reorganization for the time periods indicated and reflects what you would pay if you close your account at the end of each of the time periods shown. The examples also assume that your investment has a 5% return each year, that all distributions are reinvested and that each Fund’s operating expenses remain the same. Only the one year number shown below reflects the Adviser’s agreement to waive fees and/or reimburse Fund expenses. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

| Fund |

1 year | 3 years | 5 years | 10 years | ||||||||||||

| SMI 50/40/10 Fund |

$ | 215 | $ | 685 | $ | 1,181 | $ | 2,547 | ||||||||

| SMI Conservative Allocation Fund |

$ | 139 | $ | 512 | $ | 909 | $ | 2,021 | ||||||||

| Pro Forma Combined SMI Conservative Allocation Fund (i.e., to be renamed the SMI 50/40/10 Fund) |

$ | 149 | $ | 503 | $ | 923 | $ | 2,094 | ||||||||

Comparison of the Funds’ Principal Investment Strategies

The SMI Conservative Allocation Fund and the SMI 50/40/10 Fund will have identical investment strategies following the Reorganization as the SMI Conservative Allocation Fund will be adopting the strategies of the SMI 50/40/10 Fund.

7

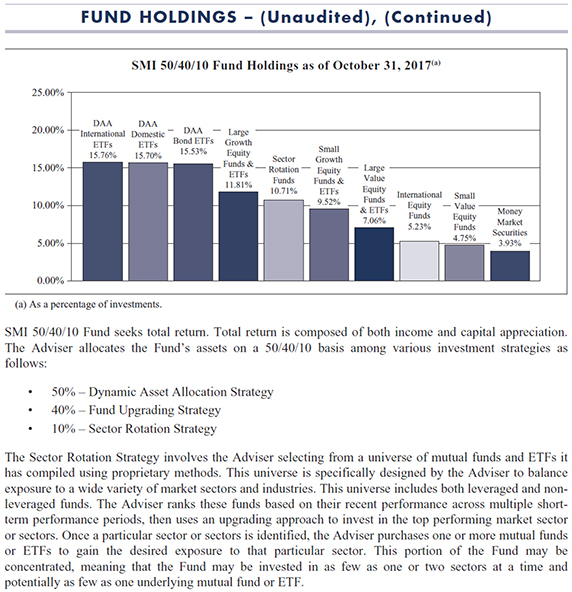

Those principal investment strategies are as follows:

SMI Advisory Services, LLC (the “Adviser”), the Fund’s adviser, allocates the Fund’s assets on a 50/40/10 basis among various investment strategies as follows:

50% - Dynamic Asset Allocation Strategy

40% - Fund Upgrading Strategy

10% - Sector Rotation Strategy

Dynamic Asset Allocation Strategy. This strategy involves investing in open-end mutual funds and exchange-traded funds (“ETFs”) (collectively “Underlying Funds”) that invest in securities from the following six asset classes – U.S. Equities, International Equities, Fixed Income Securities, Real Estate, Precious Metals, and Cash. Markets experience times of inflation, deflation, economic growth and recession. The Adviser believes great value can be added by adjusting portfolio exposure between the six asset classes as changes in market environments are identified. Generally, the Adviser will invest in each of the three “best” asset classes as determined by the Adviser. The factors considered in determining which asset classes are best at a particular point in time include, but are not limited to each class’s total returns for the most recent one, three, six, and twelve months, changes in those returns, asset flows, and historical volatility. The Adviser periodically rebalances the Fund’s asset allocation in response to market conditions as well as to balance the Fund’s exposure to the chosen asset classes. The Fund’s investment strategy involves active trading, which may result in a high portfolio turnover rate. The Fund obtains its exposure to the particular asset classes by investing in the instruments below:

U.S. Equities – The Fund may invest in Underlying Funds that invest primarily in the equity securities of companies located in the United States. The Underlying Funds may invest in companies of any market capitalization. The Fund may also invest directly in such companies. The Fund may also utilize derivatives, such as investing in futures contracts.

International Equities – The Fund may invest in Underlying Funds that invest primarily in the equity securities of companies located outside of the United States, including issuers located in emerging market countries. The Underlying Funds may invest in companies of any market capitalization. The Fund may also invest directly in such companies. The Fund may also utilize derivatives, such as investing in futures contracts.

Fixed Income Securities – The Fund may invest in Underlying Funds that invest primarily in fixed income securities of varying maturities and credit qualities including high-risk debt securities (or junk bonds). There are no limits on the level of investment in which the Fund may invest with respect to high-risk debt securities and there is no average weighted maturity of the securities in which the Fund must invest. The Underlying Funds may invest in fixed income securities denominated in foreign currencies. The Underlying Funds may also invest in derivative instruments, such as options, futures contracts, currency forwards or credit default swap agreements.

Real Estate – The Fund may invest in Underlying Funds that invest primarily in real estate securities. The Fund may also invest in real estate investment trusts (“REITs”).

Precious Metals – The Fund may invest in Underlying Funds that invest primarily in precious metals. The Fund may also invest in Underlying Funds that invest in mining and other precious metal related companies. The Fund may also invest in Publicly Traded Partnerships (PTPs) that invest in precious metals. PTPs are traded on stock exchanges or markets such as the New York Stock Exchange and NASDAQ. They are generally treated as “pass-through” entities for tax purposes, they do not ordinarily pay income taxes, but pass their earnings on to unit holders.

8

Cash (and cash equivalents) – The Fund may invest in short-term cash instruments including U.S. Treasury securities, repurchase agreements, short-term debt instruments, money market deposit accounts, and money market funds and other ETFs that focus on investing in the foregoing.

Fund Upgrading Strategy – This strategy is a systematic investment approach that is based on the belief of the Adviser that superior returns can be obtained by constantly monitoring the performance of a wide universe of other investment companies, and standing ready to move assets into funds deemed by the Adviser to be most attractive at the time of analysis. So long as the other investment companies have a track record of a minimum of 12 months, they may be monitored by the Adviser as a potential investment. This upgrading process strives to keep assets invested in funds that are demonstrating superior current performance relative to their peers as determined by a combination of size and investment style criteria.

The Fund primarily invests this portion of the portfolio in Underlying Funds using its Fund Upgrading strategy. Generally, the Underlying Funds with the highest momentum scores are chosen. These Underlying Funds may, in turn, invest in a broad range of equity securities, including foreign securities and securities of issuers located in emerging markets. Underlying Funds also may invest in securities other than equities, including but not limited to, fixed income securities of any maturity or credit quality, including high-yield, high-risk debt securities (junk bonds), and they may engage in derivative transactions. During any given year, if equities are performing extremely weakly, all or a portion of the Fund Upgrading assets may be shifted into Underlying Funds that focus on fixed income securities, or shifted into cash.

It should be noted that, even though the Adviser’s upgrading process ranks Underlying Funds primarily on the basis of performance, past performance is no guarantee of future performance.

Sector Rotation Strategy – This strategy involves the Adviser selecting from a universe of Underlying Funds it has compiled using proprietary methods. Generally, the Underlying Funds with a strong focus on a particular sector are chosen. This universe is specifically designed by the Adviser to balance exposure to a wide variety of market sectors and industries. This universe includes leveraged, non-leveraged and inverse Underlying Funds. The Adviser ranks these Underlying Funds based on their recent performance across multiple short-term performance periods, then uses an upgrading approach to invest in the top performing market sector or sectors. Once a particular sector or sectors is identified, the Adviser purchases one or more Underlying Funds to gain the desired exposure to that particular sector. This portion of the Underlying Fund may be concentrated, meaning that the Underlying Fund may be invested in as few as one or two sectors at a time and potentially as few as one Underlying Fund.

The Fund indirectly will bear its proportionate share of all management fees and other expenses of the Underlying Funds in which it invests. Therefore, the 50/40/10 Fund will incur higher expenses than other mutual funds that invest directly in securities. Actual expenses are expected to vary with changes in the allocation of the Fund’s assets among the various Underlying Funds in which it invests.

The Adviser is under common control with the publisher of the Sound Mind Investing Newsletter (the “Newsletter”), a monthly financial publication that recommends a Fund Upgrading Strategy similar to the strategy utilized by the Fund. Although mutual funds purchased by the Fund generally will be highly ranked in the Newsletter, the Fund may also invest in funds not included in the Newsletter, including funds not available to the general public but only to institutional investors.

9

Comparison of the Funds’ Principal Investment Risks

Because the SMI Conservative Allocation Fund will, following its name and strategy changes, have the same investment objective and strategy as the SMI 50/40/10 Fund, the Funds will be subject to identical principal risks. Those risk are as follows:

All investments involve risks, and the Fund cannot guarantee that it will achieve its investment objective. An investment in the Fund is not insured or guaranteed by any government agency. As with any mutual fund investment, the Fund’s returns and share price will fluctuate, and you may lose money by investing in the Fund. Below are some of the specific risks of investing in the Fund. Insofar as the Fund invests in Underlying Funds it may be directly subject to the risks described in this section of the prospectus.

Market Risk. The prices of securities held by the Fund may decline in response to certain events taking place around the world, including those directly involving the companies whose securities are owned by the Fund; conditions affecting the general economy; overall market changes; local, regional or global political, social or economic instability; and currency, interest rate and commodity price fluctuations.

Management Risk. The Fund is subject to management risk as an actively managed investment portfolio. The Adviser’s investment approach may fail to produce the intended results. If the Adviser’s perception of an Underlying Fund’s value is not realized in the expected time frame, the Fund’s overall performance may suffer.

Other Investment Company Securities Risks. When the Fund invests in another mutual fund or ETF (Underlying Funds), the Fund indirectly will bear its proportionate share of any fees and expenses payable directly by the Underlying Fund. Therefore, the Fund will incur higher expenses, many of which may be duplicative. In addition, the Fund may be affected by losses of the Underlying Funds and the level of risk arising from the investment practices of the Underlying Funds (such as the use of derivatives transactions by the Underlying Funds). The Fund has no control over the investments and related risks taken by the underlying funds in which it invests. In addition to risks generally associated with investments in investment company securities, ETFs are subject to the following risks that do not apply to traditional mutual funds: (i) an ETF’s shares may trade at a market price that is above or below their net asset value; (ii) an active trading market for an ETF’s shares may not develop or be maintained; (iii) the ETF may employ an investment strategy that utilizes high leverage ratios; or (iv) trading of an ETF’s shares may be halted if the listing exchange’s officials deem such action appropriate, the shares are delisted from the exchange, or the activation of market-wide “circuit breakers” (which are tied to large decreases in stock prices) halts stock trading generally.

Inverse and Leveraged ETF Risks. To the extent that the Fund invests in inverse or leveraged ETFs, the value of the Fund’s investment will decrease when the index underlying the ETF’s benchmark rises, a result that is the opposite from traditional equity or bond funds. The net asset value and market price of leveraged or inverse ETFs are usually more volatile than the value of the tracked index or of other ETFs that do not use leverage. Inverse and leveraged ETFs use investment techniques and financial instruments that may be considered aggressive, including the use of derivative transactions and short selling techniques. Most inverse and leveraged ETFs are designed to achieve their stated objectives on a daily basis. Their performance over long periods of time can differ significantly from the performance or inverse of the performance of the underlying index during the same period of time. This effect can be magnified in volatile markets.

10

Fixed Income Securities Risk. To the extent the Fund invests in Underlying Funds that invest in fixed income securities, the Fund will be subject to fixed income securities risks. While fixed income securities normally fluctuate less in price than stocks, there have been extended periods of increases in interest rates that have caused significant declines in fixed income securities prices. The values of fixed income securities may be affected by changes in the credit rating or financial condition of their issuers. Generally, the lower the credit rating of a security, the higher the degree of risk as to the payment of interest and return of principal.

Credit Risk. The issuer of a fixed income security may not be able to make interest and principal payments when due. Generally, the lower the credit rating of a security, the greater the risk that the issuer will default on its obligation.

Change in Rating Risk. If a rating agency gives a debt security a lower rating, the value of the debt security will decline because investors will demand a higher rate of return.

Interest Rate Risk. The value of the Fund may fluctuate based upon changes in interest rates and market conditions. As interest rates increase, the value of the Fund’s income-producing investments may go down. For example, bonds tend to decrease in value when interest rates rise. Debt obligations with longer maturities typically offer higher yields, but are subject to greater price movements as a result of interest rate changes than debt obligations with shorter maturities.

Duration Risk. Prices of fixed income securities with longer effective maturities are more sensitive to interest rate changes than those with shorter effective maturities.

Prepayment Risk. The Fund may invest in mortgage- and asset-backed securities, which are subject to fluctuations in yield due to prepayment rates that may be faster or slower than expected.

Income Risk. The Fund’s income could decline due to falling market interest rates. In a falling interest rate environment, the Fund may be required to invest its assets in lower-yielding securities. Because interest rates vary, it is impossible to predict the income or yield of the Fund for any particular period.

High-Yield Securities (“Junk Bond”) Risk. To the extent the Fund invests in Underlying Funds that invest in high-yield securities and unrated securities of similar credit quality (commonly known as “junk bonds”), the Fund may be subject to greater levels of interest rate and credit risk than funds that do not invest in such securities. Junk bonds are considered predominately speculative with respect to the issuer’s continuing ability to make principal and interest payments. An economic downturn or period of rising interest rates could adversely affect the market for these securities and reduce the Fund’s ability to sell these securities (liquidity risk). If the issuer of a security is in default with respect to interest or principal payments, the Fund or an Underlying Fund may lose its entire investment, which will affect the Fund’s return.

Portfolio Turnover Risk. The Fund’s investment strategy may involve active trading, which would result in a high portfolio turnover rate, which may negatively affect performance.

Foreign Securities Risk. To the extent the Fund invests in Underlying Funds that invest in foreign securities, it will be subject to risks not typically associated with domestic securities, such as currency risks, country risks (political, diplomatic, regional conflicts, terrorism, war, social and economic instability, currency devaluations and policies that have the effect of limiting or restricting foreign investment or the movement of assets), different trading practices, less government supervision, less publicly available information, limited trading markets and greater volatility. These risks may be heightened in connection with investments in emerging or developing countries.

11

Real Estate Risk. The Fund may invest in Underlying Funds that invest in real estate securities. Real estate securities are susceptible to the many risks associated with the direct ownership of real estate, including declines in property values, increases in property taxes, operating expenses, interest rates or competition, overbuilding, changes in zoning laws, or losses from casualty or condemnation. REITs are pooled investment vehicles which invest primarily in income producing real estate or real estate related loans or interests. Equity REITs invest the majority of their assets directly in real property and derive income primarily from the collection of rents. Equity REITs can also realize capital gains by selling property that has appreciated in value. Mortgage REITs invest the majority of their assets in real estate mortgages and derive income from the collection of interest payments. Similar to investment companies, REITs are not taxed on income distributed to shareholders provided they comply with certain requirements of the Internal Revenue Code of 1986, as amended (the “Code”). The Fund will indirectly bear its proportionate share of expenses incurred by REITs in which the Fund invests in addition to the expenses incurred directly by the Fund.

Credit Default Swaps Product Risk. To the extent that the Fund invests in Underlying Funds that invest in credit default swaps and related instruments, such as credit default swap index products, it may be subject to greater risks than if an investment was made directly in the reference obligation. These instruments are subject to general market risks, liquidity risks and credit risks, and may result in a loss of value to the Fund. The credit default swap market may be subject to additional regulations in the future.

Mortgage-Backed and Asset-Backed Securities Risk. To the extent that the Fund invests in Underlying Funds that invest in these securities, movements in interest rates may quickly and significantly reduce the value of certain types of mortgage- and asset-backed securities. Mortgage- and asset-backed securities can also be subject to the risk of default on the underlying mortgages and other assets and prepayment risk.

Market Timing Risk. Because the Fund does not consider Underlying Funds’ policies and procedures with respect to market timing, performance of the Underlying Funds may be diluted due to market timing and therefore may affect the performance of the Fund.

Small- and Mid-Cap Stocks Risk. To the extent the Fund invests in Underlying Funds that invest in small- and mid-cap company stocks, it will be subject to more volatility and less liquidity than large company stocks. Small- and mid-cap companies are less widely followed by stock analysts and less information about them is available to investors.

Commodity Risk. Some of the Underlying Funds and other instruments in the Fund’s portfolio may invest directly or indirectly in physical commodities, such as gold, silver, and other precious materials. Accordingly, the Fund may be affected by changes in commodity prices which can move significantly in short periods of time and be affected by new discoveries or changes in government regulation. Income derived from investments in Underlying Funds that invest in commodities may not be qualifying income for purposes of the “regulated investment company” (“RIC”) tax qualification tests. This could make it more difficult (or impossible) for the Fund to qualify as a RIC.

12

Furthermore, in August 2011, the Internal Revenue Service (“IRS”) announced that it would stop issuing private letter rulings authorizing favorable tax treatment for funds that invest indirectly in commodities or derivatives based upon commodities. The IRS has previously issued a number of private letter rulings to funds in this area, concluding that such investments generate “qualifying income” for RIC qualification purposes. It is unclear how long this suspension will last. The IRS has not indicated that any previously issued rulings in this area will be affected by this suspension. This suspension of guidance by the IRS means that the tax treatment of such investments is now subject to some uncertainty.

RIC Qualification Risk. To qualify for treatment as a “regulated investment company” (“RIC”) under the Internal Revenue Code (the “Code”), the Fund must meet certain income source, asset diversification and annual distribution requirements. Among other means of not satisfying the qualifications to be treated as a RIC, the Fund’s investments in certain ETFs or PTPs that invest in or hold physical commodities could cause the Fund to fail the income source component of the RIC requirements. If, in any year, the Fund fails to qualify as a RIC for any reason and does not use a “cure” provision, the Fund would be taxed as an ordinary corporation and would become (or remain) subject to corporate income tax. The resulting corporate taxes could substantially reduce the Fund’s net assets, the amount of income available for distribution and the amount of distributions.

Publicly Traded Partnership Risk. PTPs are partnerships that may be publicly traded on the New York Stock Exchange (“NYSE”) and NASDAQ. They often own businesses or properties relating to energy, natural resources or real estate. They are generally operated under the supervision of one or more managing partners or members. State law may offer fewer protections from enterprise liability to investors in a partnership compared to investors in a corporation. Distribution and management fees may be substantial. Losses are generally considered passive and cannot offset income other than income or gains relating to the same entity. These tax consequences may differ for different types of entities. Many PTPs may operate in certain limited sectors such as, without limitation, energy, natural resources, and real estate, which may be volatile or subject to periodic downturns. Growth may be limited because most cash is paid out to unit holders rather than retained to finance growth. The performance of PTPs may be partly tied to interest rates. Rising interest rates, a poor economy, or weak cash flows are among the factors that can pose significant risks for investments in PTPs. Investments in PTPs also may be relatively illiquid at times.

Derivatives Risk. To the extent the Fund invests in Underlying Funds that utilize derivatives, such as futures contracts and credit default swaps, the Fund is subject to the risk associated with such derivatives. Additionally, with respect to the equity investments of the Fund, underlying funds may use derivative instruments such as put and call options on stocks and stock indices, and index futures contracts and options thereon. There is no guarantee such strategies will work.

The value of derivatives may rise or fall more rapidly than other investments. For some derivatives, it is possible to lose more than the amount invested in the derivative. Other risks of investments in derivatives include imperfect correlation between the value of these instruments and the underlying assets; risks of default by the other party to the derivative transactions; risks that the transactions may result in losses that offset gains in portfolio positions; and risks that the derivative transactions may not be liquid.

While futures contracts are generally liquid instruments, under certain market conditions they may become illiquid. As a result, the Underlying Fund, may not be able to close out a position in a futures contract at a time that is advantageous. The price of futures can be highly volatile; using them could lower total return, and the potential loss from futures can exceed the Underlying Fund’s initial investment in such contracts. The Underlying Fund’s use of derivatives may magnify losses.

13

Underlying Funds may use derivatives such as put and call options and index futures contracts. There is no guarantee such strategies will work. If the Underlying Fund is not successful in employing such instruments in managing its portfolio, its performance will be worse than if it did not invest in such instruments. Successful use by an Underlying Fund of options on stock indices, index futures contracts (and options thereon) will be subject to its ability to correctly predict movements in the direction of the securities generally or of a particular market segment. In addition, Underlying Funds will pay commissions and other costs in connection with such investments, which may increase the Fund’s expenses and reduce the return. In utilizing certain derivatives, an Underlying Fund’s losses are potentially unlimited. Derivative instruments may also involve the risk that other parties to the derivative contract may fail to meet their obligations, which could cause losses.

Underlying Funds in which the Fund invests may use derivatives to seek to manage the risks described below.

Interest rate risk. This is the risk that the market value of bonds owned by the Underlying Funds will fluctuate as interest rates go up and down.

Yield curve risk. This is the risk that there is an adverse shift in market interest rates of fixed income investments held by the Underlying Funds. The risk is associated with either flattening or steepening of the yield curve, which is a result of changing yields among comparable bonds with different maturities. If the yield curve flattens, then the yield spread between long-and short-term interest rates narrows and the price of a bond will change. If the curve steepens, then the spread between the long- and short-term interest rates increases which means long-term bond prices decrease relative to short-term bond prices.

Prepayment risk. This is the risk that the issuers of bonds owned by the Underlying Funds will prepay them at a time when interest rates have declined any proceeds may have to be invested in bonds with lower interest rates, which can reduce the returns.

Liquidity risk. This is the risk that assets held by the Fund may not be liquid.

Credit risk. This is the risk that an issuer of a bond held by the Underlying Funds may default.

Market risk. This is the risk that the value of a security or portfolio of securities will change in value due to a change in general market sentiment or market expectations.

Inflation risk. This is the risk that the value of assets or income will decrease as inflation shrinks the purchasing power of a particular currency.

Industry or Sector Focus Risk. To the extent that Underlying Funds in which the Fund invests focus their investments in a particular industry or sector, the Fund’s shares may be more volatile and fluctuate more than shares of a fund investing in a broader range of securities.

Market Timing Risk. Because the Fund does not consider Underlying Funds’ policies and procedures with respect to market timing, performance of the Underlying Funds may be diluted due to market timing and therefore may affect the performance of the Fund.

14

Ratings Agencies Risk. Ratings agencies assign ratings to securities based on that agency’s opinion of the quality of debt securities. Ratings are not absolute standards of quality, do not reflect an evaluation of market risk, and do not necessarily correlate with yield.

Style Risk. The particular style or styles used primarily by the advisers of Underlying Funds in which the Fund invests may not produce the best results and may increase the volatility of the Fund’s share price.

Volatility Risk. The value of the Fund’s investment portfolio will change as the prices of its investments go up or down.

Liquidity Risk. In certain situations, it may be difficult or impossible to sell an investment in an orderly fashion at an acceptable price.

Cybersecurity Risk. The Fund and its service providers may be subject to operational and information security risks resulting from breaches in cybersecurity that may cause the Fund to lose or compromise confidential information, suffer data corruption or lose operational capacity. Similar types of cybersecurity risks are also present for issuers of securities in which the Fund may invest, which may cause the Fund’s investments in such companies to lose value. There is no guarantee the Fund will be successful in protecting against cybersecurity breaches.

Comparison of the Funds’ Investment Limitations

The fundamental investment limitations of the SMI Conservative Allocation Fund and the SMI 50/40/10 Fund are substantially identical. These limitations cannot be changed without the consent of the holders of a majority of each Fund’s outstanding shares. The term “majority of the outstanding shares” means the vote of (i) 67% or more of the Fund’s shares present at a meeting, if more than 50% of the outstanding shares of the Fund are present or represented by proxy; or (ii) more than 50% of the Fund’s outstanding shares, whichever is less.

As a matter of fundamental policy, the Funds:

1. Borrowing Money. The Funds will not borrow money, except (a) from a bank, provided that immediately after such borrowing there is an asset coverage of 300% for all borrowings of a Fund; or (b) from a bank or other persons for temporary purposes only, provided that such temporary borrowings are in an amount not exceeding 5% of a Fund’s total assets at the time when the borrowing is made. This limitation does not preclude a Fund from entering into reverse repurchase transactions, provided that the Fund has asset coverage of 300% for all borrowings and repurchase commitments of the Fund pursuant to reverse repurchase transactions.

2. Senior Securities. The Funds will not issue senior securities. This limitation is not applicable to activities that may be deemed to involve the issuance or sale of a senior security by a Fund, provided that the Fund’s engagement in such activities is consistent with or permitted by the 1940 Act, the rules and regulations promulgated thereunder or interpretations of the Securities and Exchange Commission (“SEC”) or its staff.

3. Underwriting. The Funds will not act as underwriter of securities issued by other persons. This limitation is not applicable to the extent that, in connection with the disposition of portfolio securities (including restricted securities), a Fund may be deemed an underwriter under certain federal securities laws.

15

4. Real Estate. The Funds 50/40/10 Fund will not purchase or sell real estate. This limitation is not applicable to investments in marketable securities which are secured by or represent interests in real estate. This limitation does not preclude a Fund from investing in mortgage-related securities or investing in companies engaged in the real estate business or that have a significant portion of their assets in real estate (including real estate investment trusts).

5. Commodities. The SMI Conservative Allocation Fund will not purchase or sell commodities unless acquired as a result of ownership of securities or other investments. This limitation does not preclude a Fund from purchasing or selling options or futures contracts, from investing in securities or other instruments backed by commodities or from investing in companies which are engaged in a commodities business or have a significant portion of their assets in commodities.

The SMI 50/40/10 Fund will not purchase or sell commodities unless acquired as a result of ownership of securities or other investments. This limitation does not preclude the Fund from purchasing or selling options or futures contracts, from investing in securities or other instruments backed by commodities, including interest in exchange traded grantor trusts, or from investing in companies which are engaged in a commodities business or have a significant portion of their assets in commodities.

6. Loans. The Funds will not make loans to other persons, except (a) by loaning portfolio securities, (b) by engaging in repurchase agreements, or (c) by purchasing nonpublicly offered debt securities. For purposes of this limitation, the term “loans” shall not include the purchase of a portion of an issue of publicly distributed bonds, debentures or other securities.

7. Concentration. The SMI Conservative Allocation Fund will not invest 25% or more of its total assets in a particular industry (other than investment companies). This limitation is not applicable to investments in obligations issued or guaranteed by the U.S. government, its agencies and instrumentalities or repurchase agreements with respect thereto.

The SMI 50/40/10 Fund will not invest 25% or more of its net assets in a particular industry (other than investment companies). This limitation is not applicable to investments in obligations issued or guaranteed by the U.S. government, its agencies and instrumentalities or repurchase agreements with respect thereto.

8. Diversification. With respect to 75% of its total assets, the SMI Conservative Allocation Fund will not purchase securities issued by any one issuer (other than cash, cash items, or securities issued or guaranteed by the government of the United States or its agencies or instrumentalities) if, as a result at the time of such purchase, more than 5% of the value of the Fund’s total assets would be invested in the securities of that issuer, or if it would own more than 10% of the outstanding voting securities of that issuer.

In regard to the SMI 50/40/10 Fund, with respect to 75% of its total assets, the Fund will not purchase securities issued by any one issuer (other than cash, cash items, securities of other investment companies, or securities issued by the government of the United States or its agencies or instrumentalities) if, as a result at the time of such purchase, more than 5% of the value of the Fund’s total assets would be invested in the securities of that issuer, or if it would own more than 10% of the outstanding voting securities of that issuer.

16

With respect to the percentages adopted by the Trust as maximum limitations on each Fund’s investment policies and limitations, an excess above the fixed percentage will not be a violation of the policy or limitation unless the excess results immediately and directly from the acquisition of any security or the action taken. This paragraph does not apply to the borrowing policy set forth in paragraph 1 above.

Notwithstanding any of the foregoing limitations, any investment company, whether organized as a trust, association or corporation, or a personal holding company, may be merged or consolidated with or acquired by the Trust, provided that if such merger, consolidation or acquisition results in an investment in the securities of any issuer prohibited by said paragraphs, the Trust shall, within ninety days after the consummation of such merger, consolidation or acquisition, dispose of all of the securities of such issuer so acquired or such portion thereof as shall bring the total investment therein within the limitations imposed by said paragraphs above as of the date of consummation.

The Funds also have identical non-fundamental investment limitations. Those are as follows:

1. Pledging. Each Fund will not mortgage, pledge, hypothecate or in any manner transfer, as security for indebtedness, any assets of the Fund except as may be necessary in connection with borrowings described in Fundamental limitation (1) above. Margin deposits, security interests, liens and collateral arrangements with respect to transactions involving options, futures contracts, short sales and other permitted investments and techniques are not deemed to be a mortgage, pledge or hypothecation of assets for purposes of this limitation.

2. Margin Purchases. Each Fund will not purchase securities or evidences of interest thereon on “margin.” This limitation is not applicable to short-term credit obtained by a Fund for the clearance of purchases and sales or redemption of securities, or to arrangements with respect to transactions involving options, futures contracts, short sales and other permitted investments and techniques.

3. Illiquid Securities. Each Fund will not invest more than 15% of its net assets in securities that are illiquid or restricted at the time of purchase.

4. Loans of Portfolio Securities. The Funds will not make loans of portfolio securities.

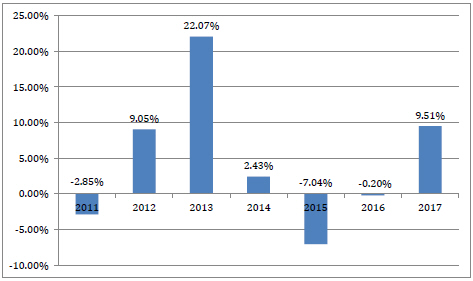

Comparison of the Funds’ Performance

The following information is intended to help you understand the risks of investing in the Funds. The following bar charts show the changes in each Fund’s performance from year to year over the life of the Fund. The table below shows how each Fund’s average annual total returns compare over time to those of broad-based securities market indices and a custom benchmark comprised of 60% of the Wilshire 5000 Total Market Index and 40% of the Bloomberg Barclays Capital U.S. Aggregate Bond Index. This information provides some indication of the risks of investing in the Funds. Past performance (before and after taxes) of the Funds is no guarantee of how they will perform in the future. As the SMI 50/40/10 Fund will be the accounting survivor as a result of the Reorganization, its performance record will be adopted by the SMI Conservative Allocation Fund.

17

SMI 50/40/10 Fund

Annual Total Return (years ended December 31st)

Highest/Lowest quarterly results during this time period were:

Best Quarter: 3rd Quarter, 2017, 5.26%

Worst Quarter: 4th Quarter, 2016, (1.31)%

| Average Annual Total Returns (For the Period Ended December 31, 2017) |

1 Year | Since Inception* |

||||||

| Before taxes |

18.62 | % | 4.44 | % | ||||

| After taxes on distributions |

18.21 | % | 4.21 | % | ||||

| After taxes on distributions and sale of shares |

10.63 | % | 3.34 | % | ||||

| Indices |

||||||||

| Wilshire 5000 Total Market Index |

21.00 | % | 11.47 | % | ||||

| Bloomberg Barclays Capital U.S. Aggregate Bond Index |

3.54 | % | 2.02 | % | ||||

| Weighted Index (60% of the Wilshire 5000 Total Market Index and 40% of the Bloomberg Barclays Capital U.S. Aggregate Bond Index) |

13.74 | % | 7.73 | % | ||||

| * | Inception date April 29, 2015 |

After-tax returns are calculated using the historical highest individual federal marginal income tax rates in effect and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor’s tax situation and may differ from those shown. After-tax returns shown are not relevant to investors who hold their Fund shares through tax-deferred arrangements, such as 401(k) plans or individual retirement accounts (“IRAs”).

18

Current performance of the Fund may be lower or higher than the performance quoted above. Performance data current to the most recent month end may be obtained by calling (877) 764-3863.

SMI Conservative Allocation Fund

Annual Total Return (years ended December 31st)

Highest/Lowest quarterly results during this time period were:

Best Quarter: 1st Quarter, 2013, 6.87%

Worst Quarter: 3rd Quarter, 2011, (11.21)%

| Average Annual Total Returns (For the Period Ended December 31, 2017) |

1 Year | 5 Years | Since Inception* |

|||||||||

| Before taxes |

9.51 | % | 4.90 | % | 4.33 | % | ||||||

| After taxes on distributions |

9.06 | % | 3.19 | % | 3.05 | % | ||||||

| After taxes on distributions and sale of shares |

5.49 | % | 3.43 | % | 3.12 | % | ||||||

| Indices |

||||||||||||

| Wilshire 5000 Total Market Index |

21.00 | % | 15.67 | % | 13.48 | % | ||||||

| Bloomberg Barclays Capital U.S. Aggregate Bond Index |

3.54 | % | 2.10 | % | 3.25 | % | ||||||

| Weighted Index (60% of the Wilshire 5000 Total Market Index and 40% of the Bloomberg Barclays Capital U.S. Aggregate Bond Index) |

13.74 | % | 10.19 | % | 9.46 | % | ||||||

| * | Inception Date December 30, 2010 |

19

After-tax returns are calculated using the historical highest individual federal marginal income tax rates in effect and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor’s tax situation and may differ from those shown. After-tax returns shown are not relevant to investors who hold their Fund shares through tax-deferred arrangements, such as 401(k) plans or IRAs.

Current performance of the Fund may be lower or higher than the performance quoted above. Performance data current to the most recent month end may be obtained by calling (877) 764-3863.

Comparison of Purchase, Redemption and Exchange Policies and Procedures

The purchase, redemption and exchange policies and procedures of each of the Funds, as they are each series of the Trust, are identical. Complete information on the purchase, redemption and exchange policies and procedures can be found in Appendix B to this Proxy Statement/Prospectus.

Comparison of the Management of the Funds

Each Fund is managed by SMI Advisory Services, LLC (“SMI” or “Adviser”). SMI is located at 411 6th Street, Columbus, Indiana 47201. SMI sets each Fund’s overall investment strategies, developing, constructing and monitoring the asset allocation, identifies securities for investment, determines when securities should be purchased or sold, selects brokers or dealers to execute transactions for each Fund’s portfolio and votes any proxies solicited by portfolio-held companies.

The Adviser is a joint venture between Omnium Investment Company, LLC, and Marathon Partners, LLC. Omnium was formed in 2005 by Anthony Ayers and Eric Collier, each a Portfolio Manager of the Funds, and other senior managers of Omnium. Marathon Partners was formed in 2005 by Mark Biller, Senior Portfolio Manager of the Funds, Austin Pryor and other managers of Sound Mind Investing, a Christian nondenominational financial newsletter. Mr. Pryor is the publisher, and Mr. Biller is the Executive Editor, of Sound Mind Investing.

The portfolio managers of the Funds are the same and are listed below.

Mark Biller, Senior Portfolio Manager – Mr. Biller has served as senior portfolio manager of the entire family of SMI Funds since their creation in 2005. He played a key role in the design and creation of the Sector Rotation, Dynamic Allocation, and Bond Upgrading strategies followed by the various SMI Funds.

As senior portfolio manager, Mr. Biller has ultimate decision-making authority regarding all portfolio decisions and trading practices of the Sound Mind Investing Funds. His duties involve researching and selecting the underlying funds in which the Funds’ invest, upgrading the Funds’ investments in underlying funds and determining the overall allocation among style categories. In addition to his duties at the Adviser, Mr. Biller has been the Executive Editor of the Sound Mind Investing newsletter and online business for over 15 years. Mr. Biller’s writings on a broad range of financial and investment topics have been featured in a variety of national print and electronic media, and he has also appeared as a financial commentator for various national and local radio programs. The Sound Mind Investing newsletter was first published in 1990 and currently has many thousands of subscribers. Since it was first published over 25 years ago, the newsletter has provided recommendations to tens of thousands of subscribers using a variety of investment strategies, including the Fund Upgrading, Dynamic Asset Allocation, Bond Upgrading and Sector Rotation strategies that are used by the Funds. Mr. Biller earned his B.S. in Finance from Oral Roberts University.

20

Eric Collier, CFA – Mr. Collier has served as a portfolio manager of the entire family of SMI Funds since their creation in 2005. He was integral in the design and testing of the Dynamic Allocation and Bond Upgrading strategies utilized by the various SMI Funds.

Mr. Collier is a co-Portfolio Manager responsible for researching and selecting each Fund’s investments, determining overall allocation among style categories, and trading, subject to the ultimate decision-making authority of the Senior Portfolio Manager. In addition to his duties at the Adviser, Mr. Collier is a co-founder of Omnium Investment Company, LLC. At Omnium, he conducts analytical and quantitative research, and risk management. Prior to co-founding Omnium, Mr. Collier worked at Oxford Group, Ltd, a fee-only financial services firm. At Oxford Group, Mr. Collier provided investment advice to several high net-worth individuals concentrating on investment and financial planning strategies. Prior to that Mr. Collier was an Investment Analyst and Registered Investment Adviser Representative for Webb Financial Advisers, an investment advisory firm, from 1997 to 2000, where he was responsible for due diligence and manager selection on large cap growth and value securities, small cap growth and value securities, international cap securities, and fixed income securities. Mr. Collier graduated from Indiana University with a B.S. in Finance in 1998. He also studied at the University of Maastricht in the Netherlands through the International Business Program at Indiana University. He has received the Chartered Financial Analyst (“CFA”) designation, and he is a member of the CFA Institute (formerly the Association for Investment Management and Research (“AIMR”)).

Anthony Ayers, CFA – Mr. Ayers has served as a portfolio manager of the entire family of SMI Funds since their creation in 2005. He was integral in the design and testing of the Dynamic Allocation and Bond Upgrading strategies utilized by the various SMI Funds.

Mr. Ayers is a co-Portfolio Manager responsible for researching and selecting each Fund’s investments, determining overall allocation among style categories, and trading, subject to the ultimate decision-making authority of the Senior Portfolio Manager. In addition to his duties at the Adviser, Mr. Ayers is a co-founder of Omnium Investment Company, LLC. At Omnium, he also conducts analytical and quantitative research, and risk management. Mr. Ayers helped develop the Adviser’s risk management procedures and a proprietary daily risk management reporting system. Prior to co-founding Omnium, Mr. Ayers was an Investment Analyst at Oxford Group, Ltd., where he was responsible for performing manager searches and due diligence on various mutual fund portfolio managers specializing in large capitalized growth and value securities, small capitalized growth and value securities, international capitalized securities, and fixed income securities. Prior to that Mr. Ayers was a Senior Investment Representative for Charles Schwab, where he assisted high net-worth clients with developing and trading complex option strategies, hedging concentrated portfolios, constructing diversified investment portfolios, risk management, and making individual stock and mutual fund recommendations. Mr. Ayers graduated from Indiana University with a B.S. in Finance in 1996, and he is a CFA charter holder.

The Funds’ Statement of Additional Information provides additional information about the portfolio managers, including a description of compensation, other accounts managed, and ownership of the Funds’ shares.

21

Comparison of Advisory Fees and Operating Expenses for the Funds

The advisory fee schedules for each of the Funds are set forth below. If the Reorganization is approved, shareholders of the SMI 50/4/10 Fund will be moving into the SMI Conservative Allocation Fund which has a lower overall advisory fee. In addition, the breakpoint schedule for the SMI Conservative Allocation Fund provides greater opportunities for economies of scale to be realized. The Board believes this structure will benefit SMI 50/40/10 shareholders.

The SMI Conservative Allocation Fund is authorized to pay the Adviser a fee based on the SMI Conservative Allocation Fund’s average daily net assets as follows:

| $1 - $100 million |

0.90 | % | ||

| $100 million to $250 million |

0.80 | % | ||

| $250 million to $500 million |

0.70 | % | ||

| Over $500 million |

0.60 | % |

During the fiscal year ended October 31, 2017, the SMI Conservative Allocation Fund paid advisory fees (after fee waivers and/or expense reimbursements) equal to 0.53% of its average daily net assets.

The SMI 50/40/10 Fund is authorized to pay the Adviser a fee based on the SMI 50/40/10 Fund’s average daily net assets as follows:

| Up to $250 million |

1.00 | % | ||

| $250,000,001 to $500,000,000 |

0.90 | % | ||

| Over $500 million |

0.80 | % |

During the fiscal year ended October 31, 2017, the SMI 50/40/10 Fund paid advisory fees (after fee waivers and/or expense reimbursements) equal to 0.89% of its average daily net assets.

Expense Limitation Agreement. The Adviser has contractually agreed to waive its management fee and/or reimburse certain operating expenses, but only to the extent necessary so that each Fund’s total annual operating expenses (excluding interest, taxes, brokerage commissions, other expenses which are capitalized in accordance with generally accepted accounting principles, extraordinary expenses, dividend expense on short sales, 12b-1 fees, and acquired fund fees and expenses) do not exceed 1.15% of the Fund’s average daily net assets with respect to the SMI Conservative Allocation Fund and 1.45% with respect to the SMI 50/40/10 Fund. The contractual arrangement for the SMI 50/40/10 Fund is in place through February 28, 2019, and the contractual arrangement for the SMI Conservative Allocation Fund is in place through February 29, 2020. Each waiver or reimbursement by the Adviser (including those made by the Adviser with respect to a Predecessor Fund) is subject to repayment by the applicable Fund within the three fiscal years following the fiscal year in which the particular expense or reimbursement was incurred; provided that such Fund is able to make the repayment without exceeding the applicable expense limitation. The Board believes this expense limitation agreement will benefit shareholders.

A discussion of the factors that the Board considered in approving each Fund’s advisory agreement is available in the Funds’ semi-annual report to shareholders dated April 30, 2017.

22

Comparison of Service Providers to the Funds

The service providers to the Funds are the same and are listed below.

Custodian. Huntington National Bank, 41 South High Street, Columbus, Ohio 43215, is Custodian of each Fund’s investments. The Custodian acts as the Funds’ depository, safekeeps portfolio securities, collects all income and other payments with respect thereto, disburses funds at the Funds’ request and maintains records in connection with its duties.

Transfer Agent, Fund Accountant and Administrator. Ultimus Asset Services, LLC (“Ultimus”), 225 Pictoria Dr., Suite 450, Cincinnati, Ohio 45246, acts as the Funds’ transfer agent, dividend disbursing agent, fund accountant, and administrator. Ultimus is a wholly-owned subsidiary of Ultimus Fund Solutions, LLC, the parent company of the Distributor (defined below). The officers of the Trust also are officers and/or employees of Ultimus.