SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement | |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| x | Definitive Proxy Statement | |

| ¨ | Definitive Additional Materials | |

| ¨ | Soliciting Material Pursuant to Sec. 240.14a-12 | |

Valued Advisers Trust

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. | |||

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| 1) | Title of each class of securities to which transactions applies:

| |||

| 2) | Aggregate number of securities to which transaction applies:

| |||

| 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

| 4) | Proposed maximum aggregate value of transaction:

| |||

| 5) | Total fee paid:

| |||

| ¨ | Fee paid previously with preliminary materials. | |||

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identity the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| 1) | Amount Previously Paid:

| |||

| 2) | Form, Schedule or Registration Statement No.:

| |||

| 3) | Filing Party:

| |||

| 4) | Date Filed:

| |||

Valued Advisers Trust

LS Opportunity Fund

c/o Huntington Asset Services, Inc.

2960 N. Meridian Street, Suite 300

Indianapolis, Indiana 46208

(877) 336-6763

August 3, 2015

Dear Shareholder:

On behalf of the Board of Trustees (the “Board”) of Valued Advisers Trust (the “Trust”), we are pleased to invite you to a special meeting of shareholders (the “Special Meeting”) of the LS Opportunity Fund (the “Fund”). The Special Meeting is scheduled for September 17, 2015 at 9:00 a.m., Eastern Time, at 2960 N. Meridian Street, Suite 300, Indianapolis, Indiana 46208.

The Trust’s Board of Trustees is seeking your vote for the approval of a new sub-advisory agreement for the Fund and of a “multi-manager” arrangement whereby the investment adviser to the Fund, under certain circumstances, would be able to hire and replace sub-advisers without obtaining shareholder approval.

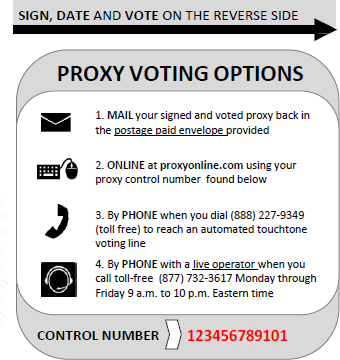

We urge you to complete, sign and return the enclosed proxy card promptly. A postage-paid envelope is enclosed for this purpose. Whether or not you plan to be present at the Special Meeting, your vote is important and you are, therefore, strongly encouraged to return a proxy card for the Fund.

If your shares are held in street name, only your bank or broker can vote your shares and generally only upon receipt of your specific instructions. Please contact the person responsible for your account and instruct him or her to execute a proxy card today.

We look forward to receiving your proxy so that your shares may be voted at the meeting.

Sincerely,

Carol J. Highsmith

Secretary

Valued Advisers Trust

LS Opportunity Fund

c/o Huntington Asset Services, Inc.

2960 N. Meridian Street, Suite 300

Indianapolis, Indiana 46208

(877) 336-6763

Important Notice Regarding Availability of Proxy Materials for the

Shareholder Meeting to be held on September 17, 2015:

This Proxy Statement is Available online at the Following Website:

https://www.proxyonline.com/docs/LSOpportunityFund.pdf

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS

To Shareholders of the LS Opportunity Fund (the “Fund”):

Notice is hereby given that a special meeting of the shareholders (the “Special Meeting”) of the Fund, a portfolio series of Valued Advisers Trust (the “Trust”) will be held on September 17, 2015 at the offices of the Fund (2960 N. Meridian St., Suite 300, Indianapolis, Indiana), at 9:00 a.m., Eastern Time, for the following purposes, which are more fully described in the accompanying Proxy Statement:

| 1. | To approve a new sub-advisory agreement between Long Short Advisors, LLC and Prospector Partners, LLC on behalf of the Fund; |

| 2. | To approve the implementation of a “multi-manager” arrangement whereby Long Short Advisors, LLC, under certain circumstances, would be able to hire and replace sub-advisers for the Fund without obtaining shareholder approval; and |

| 3. | To transact such other business as may properly come before the Special Meeting and any postponement or adjournment thereof. |

The Board of Trustees recommends that you vote FOR the Proposals identified in this Proxy Statement. The Board of Trustees of the Trust has fixed the close of business on July 15, 2015 as the record date for the determination of shareholders entitled to notice of, and to vote at, the Special Meeting or any postponement or adjournment thereof. Copies of these proxy materials, including this notice of the Special Meeting, the Proxy Statement, and the proxy card, also are available to you at https://www.proxyonline.com/docs/LSOpportunityFund.pdf. Information on how to obtain directions to attend the Special Meeting and vote in person can be obtained by calling 1-877-732-3617.

We urge you to mark, sign, date and mail the enclosed proxy in the postage-paid envelope provided as soon as possible so that you will be represented at the Special Meeting. If you desire to vote in person at the Special Meeting, you may revoke your proxy at any time before it is exercised. Your vote is important no matter how many shares you own. In order to avoid the additional expense of further solicitation, we ask your cooperation in completing your proxy card promptly.

By order of the Board of Trustees of the Trust,

Carol J. Highsmith

Secretary

August 3, 2015

PROXY STATEMENT

VALUED ADVISERS TRUST

LS Opportunity Fund (the “Fund”)

2960 N. Meridian St., Suite 300

Indianapolis, Indiana 46208

INTRODUCTION

The enclosed proxy is solicited by the Board of Trustees (the “Board”) of Valued Advisers Trust (the “Trust”) for use at the Special Meeting of Shareholders (the “Special Meeting”) of the LS Opportunity Fund (the “Fund”) to be held on September 17, 2015 at 9:00 a.m., Eastern Time, and any postponement or adjournment thereof, for action upon the matters set forth in the accompanying Notice of the Special Meeting of Shareholders (the “Notice”). Shareholders of record at the close of business on July 15, 2015 are entitled to be present and to vote at the Special Meeting or any postponed or adjourned session thereof. The Notice, this Proxy Statement and the enclosed proxy card are first being mailed to shareholders on approximately August 3, 2015.

The Trustees recommend that you vote:

| 1. | For the new sub-advisory agreement between Long Short Advisors, LLC and Prospector Partners, LLC on behalf of the Fund. |

| 2. | For the implementation of a “multi-manager” arrangement whereby Long Short Advisors, LLC (the “Adviser”), under certain circumstances, would be able to hire and replace sub-advisers for the Fund without obtaining shareholder approval. |

| 3. | In the discretion of the persons named as proxies in connection with any other matters that may properly come before the Special Meeting or any postponement or adjustment thereof. |

Each whole share of the Fund is entitled to one vote as to any matter on which it is entitled to vote and each fractional share is entitled to a proportionate fractional vote. Shares represented by your duly executed proxy will be voted in accordance with your instructions. If no instructions are made on a submitted proxy, the proxy will be voted FOR the Proposals.

1

PROPOSAL 1

APPROVAL OF A NEW SUB-ADVISORY AGREEMENT

Long Short Advisors, LLC (“LSA” or “Adviser”), the investment adviser of the Fund, has proposed, and the Board of Trustees of the Trust has approved, changing the Fund’s sub-adviser to Prospector Partners, LLC (“Prospector Partners”). LSA and the Board were informed of that Jim Hillary, one of the portfolio managers of the Fund, would no longer be serving as a portfolio manager for any of the previous sub-adviser’s client accounts, including the Fund and that, as a result, the previous sub-adviser would no longer be able to serve as the sub-adviser to the Fund. As such, the Board terminated the previous sub-advisory agreement on April 23, 2015 and that termination became effective on May 28, 2015. At a special meeting held on April 28, 2015, the Board met to approve an interim sub-advisory agreement with Prospector Partners so that it may provide sub-advisory services to the Fund. Prospector Partners commenced providing sub-advisory services to the Fund on May 28, 2015.

The new sub-advisory agreement with Prospector Partners is being submitted to shareholders for approval as required by the Investment Company Act of 1940, as amended (the “1940 Act”).

Previous Sub-Adviser

Independence Capital Asset Partners, LLC (“ICAP”) previously served as the Fund’s sub-adviser pursuant to a sub-advisory agreement between LSA and ICAP dated April 23, 2010 (the “ICAP Sub-Advisory Agreement”). ICAP is located at 1400 16th Street, Suite 520, Denver, Colorado 80202. ICAP is controlled by Mr. Jim Hillary. As of May 31, 2014, ICAP had approximately $711.6 million under management. The ICAP Sub-Advisory Agreement was last approved by the Board of Trustees of the Trust at its March 10-11, 2015 board meeting and by the sole shareholder of the Fund on September 28, 2010 in connection with the establishment of the Fund.

ICAP received a fee from LSA for sub-advisory services computed and paid quarterly according to the below schedule based on the amount LSA received from the Fund taking into consideration any expense limitation or fee waiver arrangements. Other than reduction in compensation as set forth in the below schedule, ICAP was not responsible for making reimbursements to the Fund pursuant to any expense limitation and/or expense reimbursement agreement that LSA may be obligated to make.

Schedule of Fee Split

| Tiered | Estimated bp split Subadviser |

Estimated bp split Manager |

% split Subadviser |

% split Manager | ||||

| Tier 1 ($0 - <$200,000,000) |

0.88% | 0.88% | 50% | 50% | ||||

| Tier 2 (>$200,000,000 - <$300,000,000) |

1.25% | 0.50% | 71% | 29% | ||||

| Tier 3 (>$300,000,000 - <$400,000,000) |

1.00% | 0.75% | 57% | 43% | ||||

| Tier 4 (>$400,000,000 - <$500,000,000) |

1.50% | 0.25% | 86% | 14% | ||||

| Tier 5 (>$500,000,000 - <$600,000,000) |

1.10% | 0.65% | 63% | 37% | ||||

| Tier 6 (>$600,000,000 - <$700,000,000) |

1.10% | 0.65% | 63% | 37% | ||||

| Tier 7 (>$700,000,000 - <$800,000,000) |

1.60% | 0.15% | 91% | 9% | ||||

| Tier 8 (>$800,000,000 - <$900,000,000) |

1.65% | 0.10% | 94% | 6% | ||||

| Tier 9 (>$900,000,000 - <$1,000,000,000) |

1.55% | 0.20% | 89% | 11% | ||||

| Tier 10 (>$1,000,000,000) |

1.25% | 0.50% | 71% | 29% | ||||

2

ICAP received and/or is scheduled to receive the following payments from LSA for its services as sub-adviser to the Fund for each of the years set forth below ending on May 31:

| 2015 | 2014 | 2013 | ||||||||||

| Sub-Advisory Fees |

$ | 1,437,570 | $ | 569,552 | $ | 385,466 | ||||||

Proposed New Sub-Adviser

LSA and the Board are recommending that shareholders approve Prospector Partners as the new sub-adviser for the Fund. Prospector Partners was organized in 1997 as a Delaware limited liability company and its address is 370 Church Street, Guilford, Connecticut 06437. As of May 31, 2015, Prospector Partners had approximately $1.5 billion in assets under management. The names, addresses and principal occupation of the principal executive officers of Prospector Partners as of the date of this proxy statement are set forth below.

| Name and Address | Principal Occupation | |

|

John D. Gillespie 370 Church Street Guilford, Connecticut 06437 |

Managing Member | |

|

Kevin R. O’Brien 370 Church Street Guilford, Connecticut 06437 |

Portfolio Manager | |

|

Jason A. Kish 370 Church Street Guilford, Connecticut 06437 |

Portfolio Manager | |

|

Peter N. Perugini 370 Church Street Guilford, Connecticut 06437 |

Chief Financial Officer | |

|

Kim Just 370 Church Street Guilford, Connecticut 06437 |

Chief Compliance Officer | |

Prospector Partners does not advise any other registered investment companies with similar investment objectives to the Fund.

The Interim Sub-Advisory Agreement

On April 23, 2015, the Board terminated the sub-advisory relationship with ICAP. At its April 28, 2015 special meeting, the Board, including by separate vote of a majority of the Independent Trustees, appointed Prospector Partners as the new sub-adviser to the Fund on an interim basis pursuant to an interim sub-advisory agreement effective May 28, 2015 (the “Interim Sub-Advisory Agreement”). Because the new Sub-Advisory Agreement with Prospector Partners (the “New Sub-Advisory Agreement”) has not been approved by shareholders of the Fund, the Interim Agreement will continue in effect for a term ending on the earlier of 150 days from April 28, 2015 or when the shareholders of the Fund approve the New Sub-Advisory Agreement.

The terms of the Interim Sub-Advisory Agreement are substantially the same as those of the prior Sub-Advisory Agreement with ICAP, except for certain provisions that are required by law. The provisions required by law include a requirement that fees payable under the Interim Sub-Advisory Agreement be paid into an escrow account. If the Fund’s shareholders approve the New Sub-Advisory Agreement by the end of the 150-day period, the compensation (plus interest) payable under the Interim Sub-Advisory Agreement will be paid to Prospector Partners, but if the New Sub-Advisory Agreement is not so approved, only the lesser of the costs incurred (plus interest) or the amount in the escrow account (including interest) will be paid to Prospector Partners.

3

Comparison of Previous Sub-Advisory Agreement and New Sub-Advisory Agreement

At its June 30, 2015 meeting, the Board, including by separate vote of a majority of the Independent Trustees, reviewed and approved the New Sub-Advisory Agreement between Prospector Partners and LSA, subject to shareholder approval. The New Sub-Advisory Agreement will become effective upon its approval by Fund shareholders. The New Sub-Advisory Agreement is similar to the previous sub-advisory agreement with ICAP, except for the date, the parties, and certain other terms described below. Set forth below is a summary of all material terms of the New Sub-Advisory Agreement. The form of the New Sub-Advisory Agreement is included as Appendix A. The summary of all material terms of the New Sub-Advisory Agreement below is qualified in its entirety by reference to the form of New Sub-Advisory Agreement included as Appendix A.

The fee rate under the previous sub-advisory agreement as compared to the New Sub-Advisory Agreement has been changed. The fee rate paid to ICAP is described above under the section entitled “Previous Sub-Adviser.” Under the New Sub-Advisory Agreement, LSA will pay Prospector Partners pursuant to the same fee schedule noted above. Pursuant to separate agreements between LSA and Prospector Partners, Prospector Partners has agreed that Prospector Partners will temporarily forgo partial sub-advisory fees until the Adviser, under the terms of an expense limitation agreement, is no longer required to reimburse the Fund expenses. That is, under the terms of the expense limitation agreement, the Adviser is required to waive fees and then reimburse expenses such that the net operating expense ratio of the Fund will not exceed the current operating expense limit of 1.95% - insofar as the assets of the Fund are at a level that requires reimbursement of expense, the Adviser will be waiving its entire fee and Prospector Partners will also waive its fee owed to it from the Adviser. However, where assets rise to the level that the Adviser is collecting its fee (either in whole or part), Prospector Partners will collect a corresponding amount of its sub-advisory fee. Further, fees that have been waived by Prospector Partners can be recaptured for up to three years as asset levels of the Fund increase subject to, among other conditions, the ability of LSA to recapture fees waived and expenses reimbursed pursuant to an expense limitation agreement that it has in place for the Fund.

The New Sub-Advisory Agreement would require Prospector Partners to provide substantially the same services as provided by ICAP. Unlike the previous sub-advisory agreement, the New Sub-Advisory Agreement provides that Prospector Partners may provide assistance to LSA with regard to valuation of portfolio securities. Additionally, Prospector Partners is required to recommend brokers to LSA for inclusion on an approved broker list. Prospector Partners is also specifically required to vote proxies on behalf of the Fund in a manner consistent with Prospector Partner’s proxy voting policy and the Fund’s disclosure documents and to assist in the compilation of certain proxy voting records. The New Sub-Advisory Agreement also provides for specific notifications to the Adviser or the Sub-Adviser upon the occurrence of certain events such as one of the parties’ failure to continue to be registered as an investment adviser under the Investment Advisers Act of 1940, changes to certain personnel or service providers within a party to the Agreement, among other things. Unlike the previous sub-advisory agreement, the New Sub-Advisory Agreement does not prevent the sub-adviser from supporting or commencing any other relationship with, among others, an open end management investment company with similar investment objectives to that of the Fund. Notwithstanding the foregoing sentence, the Adviser and Sub-Adviser do contemplate an on-going relationship whereby the Sub-Adviser would not establish any competing products. See section below entitled “Agreement Between LSA and Prospector Partners”. Finally, the termination provisions of the New Sub-Advisory Agreement differ from the previous sub-advisory agreement because ability of the Sub-Adviser to terminate the New Sub-Advisory Agreement is different compared to the previous sub-advisory agreement, which could have been terminated on sixty days’ notice after an initial three-year term.

Prospector Partners shall, subject to the control and supervision of the Board of Trustees of the Trust and LSA, continuously furnish to the Fund an investment program for assets allocated to it by LSA from time to time. With respect to these assets, Prospector Partners will make investment decisions and will place all brokerage orders for the purchase and sale of portfolio securities.

With respect to the Trust and LSA, the New Sub-Advisory Agreement has the same duration provisions as the previous sub-advisory agreement. The termination provisions of the New Sub-Advisory Agreement for the Trust and the Adviser are substantially similar to the previous sub-advisory agreement. The New Sub-Advisory

4

Agreement will have an initial term of two years from its effective date and will continue from year to year so long as its renewal is specifically approved by (a) a majority of the Trustees who are not parties to the New Sub-Advisory Agreement and who are not “interested persons” (as defined in the 1940 Act) of any party to the New Sub-Advisory Agreement, cast in person at a meeting called for the purpose of voting on such approval and a majority vote of the Trustees or (b) by vote of a majority of the voting securities of the Fund. The termination provisions of the New Sub-Advisory Agreement for the Trust and the Adviser are substantially similar to the previous sub-advisory agreement. It may be terminated by the Trust, without the payment of any penalty, by a vote of the Board or, upon the affirmative vote of a majority of the outstanding voting securities of the Fund. It may also be terminated at any time upon 60 days’ notice by LSA.

As noted above, the ability of Prospector to terminate the New Sub-Advisory Agreement is different as compared to the previous sub-advisory agreement. Effectively, Prospector may not terminate the New Sub-Advisory Agreement until the third anniversary of this agreement and then only upon one year’s advance notice. The New Sub-Advisory Agreement then has a rolling two-year term which is also each subject to one year’s advance notice. The New Sub-Advisory Agreement may also be terminated by Prospector without the payment of any penalty upon 60 days’ notice in the event of an SEC enforcement action being taken against the Adviser or any of the Fund’s other service providers, provided however, in certain circumstances there is no such right where the Adviser has taken measures to remedy the situation seeking to replace the service providers that are the subject of the enforcement action.

The New Sub-Advisory Agreement will terminate automatically in the event of its assignment.

The New Sub-Advisory Agreement subjects Prospector Partners to the same standard of care and liability to which ICAP was subject under the previous sub-advisory agreement. Specifically, it states that Prospector Partners, in the absence of its bad faith, negligence or reckless disregard of its obligations and duties under the Sub-Advisory Agreement, shall not be subject to any liability to LSA, the Fund or their directors, the Board, officers or shareholders, for any act or omission in the course of, or connected with, rendering services. However, the Sub-Advisory Agreement provides that Prospector Partners shall indemnify and hold harmless such parties from all claims, losses, expenses, obligations and liabilities (including reasonable attorney’s fees) which arise or result from Prospector Partner’s bad faith, negligence, willful misconduct or reckless disregard of its duties under the Agreement.

Agreement between LSA and Prospector Partners

Pursuant to the New Sub-Advisory Agreement between LSA and Prospector Partners, Prospector Partners will assume the day-to-day investment management responsibilities for the Fund under the New Sub-Advisory Agreement with LSA. In addition, LSA and Prospector Partners contemplate an on-going relationship between the parties pursuant to a separate agreement wherein, among other things: (i) LSA agrees to recommend to the Board that Prospector Partners continue to serve as sub-adviser for the Fund subject to Board approval and other conditions, insofar as recommendation is consistent with LSA’s fiduciary duties; (ii) Prospector Partners agrees not to provide advisory or sub-advisory services to other open-end investment management companies with similar investment objectives to that of the Fund; (iii) Prospector Partners makes certain investment contributions to the Fund; (iv) Prospector Partners makes certain concessions related to the expense limitation arrangements for the Fund; and (v) Prospector Partners agrees to share in certain expenses that are absorbed by the Adviser related to marketing and distribution.

If the Fund’s shareholders approve the New Sub-Advisory Agreement, it is expected that the New Sub-Advisory Agreement would become effective on or about September 18, 2015.

Board Consideration of the New Sub-Advisory Agreement

At an in-person meeting held on June 30, 2015 the Board considered the approval of the New Sub-Advisory Agreement between LSA and Prospector Partners on behalf of the Fund. LSA and Prospector Partners provided written information to the Board to assist the Board in its considerations.

5

The Board discussed the arrangements between LSA and Prospector Partners with respect to the Fund. The Board reviewed a memorandum from Counsel, and addressed to the Trustees that summarized, among other things, the fiduciary duties and responsibilities of the Board in reviewing and approving the New Sub-Advisory Agreement. A copy of this memorandum was circulated to the Trustees in advance of the Meeting. Counsel discussed with the Trustees the types of information and factors that should be considered by the Board in order to make an informed decision regarding the approval of the New Sub-Advisory Agreement, including the following material factors: (i) the nature, extent, and quality of the services to be provided by Prospector Partners; (ii) the investment performance of the Fund, (iii) the costs of the services to be provided and profits to be realized by Prospector from the relationship with the Fund; (iv) the extent to which economies of scale would be realized if the Fund grows and whether sub-advisory fee levels reflect those economies of scale for the benefit of the Fund’s investors; and (v) Prospector Partners’ practices regarding possible conflicts of interest.

In assessing these factors and reaching its decisions, the Board took into consideration information furnished for the Board’s review and consideration at the June 30 meeting, as well as information furnished for their review at meetings of the Board held on April 28, 2015 and June 2-3, 2015. The Trustees recalled and reflected upon presentations by representatives of Prospector Partners and LSA at the previous meetings. They also considered the information provided for their review in advance of the meeting, which included, among other things, a letter from counsel to Prospector Partners, Prospector Partners’ response to that letter, financial statements of Prospector Partners, Prospector Partners’ Form ADV Part I and II, Prospector Partners’ Compliance Manual, and a certification regarding its Code of Ethics. The Board did not identify any particular information that was most relevant to its consideration to approve the New Sub-Advisory Agreement and each Trustee may have afforded different weight to the various factors.

| 1. | The nature, extent, and quality of the services to be provided by Prospector Partners. In this regard, the Board considered responsibilities that Prospector Partners would have under the New Sub-Advisory Agreement. The Trustees considered the services proposed to be provided by Prospector Partners to the Fund, including without limitation: Prospector Partners’ procedures for formulating investment recommendations and assuring compliance with the Fund’s investment objectives and limitations; the efforts of Prospector Partners during the period of the Interim Sub-Advisory Agreement, and its anticipated efforts to promote the Fund and grow its assets. The Trustees considered Prospector Partners’ continuity of, and commitment to retain, qualified personnel and Prospector Partners’ commitment to maintain its resources and systems, and Prospector Partners’ cooperation with the Board and Counsel for the Fund. The Trustees considered Prospector Partners’ personnel, including the education and experience of the personnel and Prospector Partners’ compliance program, policies and procedures. The Trustees considered the arrangements between the Adviser and Prospector Partners pursuant to which it would have an on-going arrangement with respect to the Fund in which it would agree to waive, to a degree, a portion of its sub-advisory fees and commit to an exclusivity arrangement between itself and the Adviser with respect to managing other mutual funds with similar objectives. After considering the foregoing information and further information in the Meeting materials provided by Prospector Partners (including its Form ADV), the Board concluded that, in light of all the facts and circumstances, the nature, extent, and quality of the services proposed to be provided by Prospector Partners will be satisfactory and adequate for the Fund. |

| 2. | Investment Performance of the Fund and Prospector Partners. The Board noted that while Prospector Partners had very recently begun managing the Fund under an interim agreement, the Board could consider the investment performance of Prospector Partners in managing an account similar to the manner in which the Fund would be managed. The Board observed that the other account, which is a private investment fund, is not subject to the same operations, expenses and restrictions as the Fund, and the investment strategy is not exactly the same. The Board noted that, for the year ended December 31, 2014, the private fund had outperformed its benchmark, but had underperformed as compared to the S&P 500. After reviewing the performance, the Board concluded, in light of the foregoing factors, that the investment performance of Prospector Partners was satisfactory. |

6

| 3. | The costs of the services to be provided and profits to be realized by Prospector Partners from the relationship with the Fund. In this regard, the Board considered: a balance sheet of Prospector Partners and the level of commitment to the Fund and Prospector Partners by the principals of Prospector Partners; the current and projected asset levels of the Fund; and the overall anticipated expenses of the Fund, including the expected nature and frequency of sub-advisory fee payments. The Board also considered potential benefits for Prospector Partners in managing the Fund. The Board compared the expected fees and expenses of the Fund (including the sub-advisory fee) to other private fund accounts managed by Prospector Partners, and determined that the fee arrangements were relatively comparable in light of the differing structures. The Trustees reviewed information provided by Prospector Partners regarding its anticipated profits and other benefits associated with managing the Fund. Following this comparison and upon further consideration and discussion of the foregoing, the Board concluded that the fees to be paid to Prospector partners by LSA were fair and reasonable. |

| 4. | The extent to which economies of scale would be realized as the Fund grows and whether advisory fee levels reflect these economies of scale for the benefit of the Fund’s investors. In this regard, the Board considered the Fund’s fee arrangements with Prospector Partners. The Board considered that while the sub-advisory fee changed with changes in the Fund’s assets, the Fund’s shareholders did not realize any changes in their overall expenses as Prospector Partners’ fee was paid entirely from the advisory fee paid to LSA, which was fixed. The Board considered the sub-advisory fees in light of the overall arrangement with the Fund’s investment adviser. In light of the foregoing, the Board determined that the Fund’s fee arrangements for Prospector Partners, in light of all the facts and circumstances, were fair and reasonable in relation to the nature and quality of the services to be provided by Prospector Partners. |

| 5. | Possible conflicts of interest and benefits to Prospector Partners. In evaluating the possibility for conflicts of interest, the Board considered such matters as: the experience and ability of the advisory personnel assigned to the Fund; the basis of decisions to buy or sell securities for the Fund and/or Prospector Partners’ other accounts; the substance and administration of Prospector Partners’ code of ethics and other relevant policies described in Prospector Partners’ Form ADV, and affiliations and associations of Prospector Partners and its principals. The Board concluded that the foregoing matters were appropriately disclosed and managed by Prospector Partners. With respect to benefits to Prospector Partners (in addition to the fees under the New Sub-Advisory Agreement), the Board noted that Prospector Partners would benefit from its relationship with the Fund as the Fund would provide a more diversified investor base and an alternative vehicle in which to place clients with initial investments below the minimum for its private funds. Following further consideration and discussion, the Board determined that Prospector Partners’ standards and practices relating to the identification and mitigation of potential conflicts of interest were satisfactory and the anticipated benefits to be realized by Prospector Partners from managing the Fund were acceptable. |

If this Proposal is approved, subject to the supervision of LSA, Prospector Partners will be responsible for the execution of specific investment strategies and day-to-day investment operations for the Fund. Prospector Partners will manage the portfolio of the Fund using a team of analysts and portfolio managers. John D. Gillespie, Kevin R. O’Brien and Jason A. Kish will serve as portfolio managers to the Fund.

John D. Gillespie. Mr. Gillespie has been the managing member of Prospector Partners since its formation in 1997 and has been a portfolio manager and securities analyst for more than twenty-five years. From 1999 to 2015, Mr. Gillespie served as Director of White Mountains Insurance Group. Ltd. (“White Mountains”). In addition, from 2002 to 2005, Mr. Gillespie served as non-executive Deputy Chairman of White Mountains, Chairman and President of White Mountains Advisors (known as OneBeacon Asset Management, Inc. prior to March 2003), the registered investment advisory subsidiary of White Mountains, and as an officer of various other subsidiaries of White Mountains. From 1986 through 1997, Mr. Gillespie was an employee of T. Rowe Price Associates, Inc. where he began as an investment analyst (1986-1987), served as an Assistant Vice President (1987-1988) and Vice President (1988-1997). At the end of Mr. Gillespie’s tenure at T. Rowe Price, Mr. Gillespie’s responsibilities included the management of assets of institutional investors, mutual funds and closed-end investment companies. Specifically, Mr. Gillespie was the chairman of the investment committee of the T. Rowe Price Growth Stock Fund from 1994 to

7

April 30, 1996, and president of the New Age Media Fund from October 1993 until July 1997. From 1980 through 1984, Mr. Gillespie was a Senior Financial Analyst at Geico Corporation. Mr. Gillespie received a B.A. cum laude from Bates College in 1980 and an M.B.A. from Stanford University Graduate School of Business in 1986. In addition, Mr. Gillespie serves on the Board of Trustees of Bates College and Pomfret School.

Kevin R. O’Brien. Mr. O’Brien has been a portfolio manager at Prospector Partners since 2003 and has been a portfolio manager or securities analyst for more than twenty years. In addition, from April 2003 through August 2005, Mr. O’Brien served as a Managing Director of White Mountains Advisors, LLC. From April 1996 through April 2003, Mr. O’Brien was an employee of Neuberger Berman, where he began as an investment analyst (1996-1999), served as Vice President (1999-2001), and Managing Director (2001-2003). At the end of Mr. O’Brien’s tenure at Neuberger Berman, Mr. O’Brien’s responsibilities included the co-management of equity assets of institutional investors and mutual funds. At Neuberger Berman, Mr. O’Brien served as co-manager of the Neuberger Berman Genesis Fund. Mr. O’Brien was responsible for following stocks in the financial services, consumer, and technology sectors. From 1991 through 1996, Mr. O’Brien was an employee of Alex, Brown & Sons, where he was an analyst following the financial services industry. His coverage universe included property-casualty insurance, specialty finance, asset management, and diversified financial services. Mr. O’Brien received a B.S. magna cum laude from Central Connecticut State University in 1986. Additionally, Mr. O’Brien received a Chartered Financial Analyst designation in 1995.

Jason A. Kish. Mr. Kish has been a portfolio manager at Prospector Partners since 2013. When Mr. Kish joined Prospector Partners in 1997, he began as a junior analyst, covering all industries, eventually serving as the property-casualty analyst and became the Director of Research in 2010. From 1995 to 1997, Mr. Kish worked as an auditor at Coopers & Lybrand, LLP in Hartford, CT. Mr. Kish received a B.S.B.A. from Providence College in 1995. He received his Certified Public Accountant designation in 2000 and his Chartered Financial Analyst designation in 2004.

Required Vote. Approval of this Proposal requires the vote of the “majority of the outstanding voting securities” of the Fund. Under the 1940 Act, a “majority of the outstanding voting securities” is defined as the lesser of: (1) 67% or more of the voting securities of the Fund entitled to vote present in person or by proxy at the Special Meeting, if the holders of more than 50% of the outstanding voting securities entitled to vote thereon are present in person or represented by proxy; or (2) more than 50% of the outstanding voting securities of the Fund entitled to vote thereon.

THE BOARD OF TRUSTEES UNANIMOUSLY RECOMMENDS A VOTE “FOR” THE PROPOSED NEW SUB-ADVISORY AGREEMENT

8

PROPOSAL 2

APPROVAL OF THE IMPLEMENTATION OF A “MULTI-MANAGER” ARRANGEMENT

WHEREBY THE FUND’S INVESTMENT ADVISER, UNDER CERTAIN CIRCUMSTANCES,

WOULD BE ABLE TO HIRE AND REPLACE SUB-ADVISERS FOR THE

FUND WITHOUT OBTAINING SHAREHOLDER APPROVAL

Introduction

The Fund’s investment strategy is to employ a research-driven, bottom-up stock selection process on both the long and short side whereby investment decisions are based upon extensive analysis of the business and financial fundamentals concerning particular companies and their industries. The Fund seeks to capitalize on significant differences between the current market price of a company’s stock and its current or expected future investment value. The Fund’s approach is designed to achieve capital growth during periods of rising or stable prices and capital preservation during periods of declining stock prices. LSA, the Fund’s investment adviser, allocates the Fund’s assets to a sub-adviser. LSA has the discretion, subject to Board approval, to change the investment strategies, including whether a strategy should be employed by the Adviser or a sub-adviser.

Unless shareholders approve this Proposal 2, shareholder approval would be required before the Adviser could allocate the Fund’s assets to another sub-adviser as it is doing in Proposal 1. Accordingly, Proposal 2 seeks shareholder approval to implement a “multi-manager” arrangement to enable the Adviser to hire and replace sub-advisers in the future that are either unaffiliated or “wholly-owned” without shareholder approval.

“Multi-Manager” Arrangement

Currently, hiring or replacing a sub-adviser generally requires shareholder approval of the sub- advisory agreement, pursuant to Section 15(a) of the Investment Company Act of 1940, as amended (the “1940 Act”). Because the process of seeking shareholder approval of sub-advisory agreements is administratively burdensome and costly to a fund (and therefore indirectly to the fund’s shareholders), it may cause delays in executing changes that the fund’s board and the investment adviser have determined are necessary or desirable. As a result, many mutual funds and their investment advisers have requested and obtained orders from the Securities and Exchange Commission (the “SEC”) exempting them from certain requirements of Section 15(a) of the 1940 Act, and the rules thereunder, to permit them to hire and replace sub-advisers without shareholder approval.

On July 14, 2015, LSA and the Trust filed an application for exemptive relief with the SEC (the “Application”). If granted, LSA and the Trust would receive an Order from the SEC, upon which the Fund may rely, subject to certain conditions and approval by the Board, to enter into and materially amend sub-advisory agreements with sub-advisers who are unaffiliated or wholly-owned without obtaining shareholder approval. If granted, the order would also provide that it is not necessary to disclose the sub-advisory fee payable by LSA.

NOTE: Before the Fund may rely on any exemptive relief, however, the proposed “multi-manger” arrangement must be approved by a majority of the outstanding voting securities (as defined in the 1940 Act) of the Fund. In addition, there is no guarantee that the exemptive application will be granted by the SEC.

Conditions of the “Multi-Manager Arrangement”

If the multi-manager arrangement is approved by Fund shareholders, LSA will continue to provide investment management of the Fund’s portfolio in accordance with the Fund’s investment objective and policies, and, subject to review and approval of the Board, will: (i) set the Fund’s overall investment strategies; (ii) evaluate, select, and recommend any sub-advisers to manage all or a part of the Fund’s assets; and (iii) implement procedures reasonably designed to ensure that sub-advisers comply with the Fund’s investment objective, policies and restrictions. Subject to review by the Board, LSA will (a) when appropriate, allocate the Fund’s assets to one or more sub-advisers; and (b) monitor and evaluate the performance of sub-advisers.

Under the proposed “multi-manager” arrangement, the Board would evaluate and approve all sub-advisory agreements, as well as any amendment to an existing sub-advisory agreement. In reviewing a new sub-advisory

9

agreement or amendment to an existing sub-advisory agreement, the Board will consider certain information, including the advisory services to be provided by the sub-adviser and the sub-adviser’s composite performance, as applicable, for other portfolios that were comparable to the Fund with respect to its investment mandate. LSA, as is currently the case, would bear the cost of the sub-advisory fee payable to any such sub-adviser.

Operation of the Fund under the proposed “multi-manager” arrangement would not: (1) permit the investment advisory fee paid by the Fund to LSA to be increased without shareholder approval; or (2) diminish LSA’s responsibilities to the Fund, including its overall responsibility for the portfolio management services furnished by a sub-adviser. Under the “multi-manager” arrangement, shareholders would receive notice of, and information pertaining to, any new sub-advisory agreement. In particular, shareholders would receive the same information about a new sub-advisory agreement and a new sub-adviser that they would receive in a proxy statement related to their approval of a new sub-advisory agreement in the absence of a “multi-manager” arrangement.

Further, while the Trust and LSA expect that the conditions of the application would be materially consistent to those provided in Appendix B, there could be differences and the conditions listed in the Appendix are subject to modification and approval by the SEC. Should there be any material differences in the conditions of the application, upon granting of the final order by the SEC, shareholders will be notified.

Benefits of a “Multi-Manager” Arrangement

This type of arrangement may benefit shareholders of the Fund in that it will allow LSA the additional flexibility to implement sub-adviser changes or materially modify sub-advisory agreements when needed, and to avoid numerous and expensive proxy solicitations. Such an arrangement may also allow the Fund to operate with greater efficiency by allowing the Adviser to employ sub-advisers best suited to the needs of the Fund, without incurring the expense and delays associated with obtaining shareholder approval.

In addition, if a sub-adviser to the Fund is acquired or there is a change of control of the sub-adviser that results in the “assignment” of the sub-advisory agreement with the Adviser, the Trust currently must seek approval of a new sub-advisory agreement from shareholders of the Fund, even when there will be no change in the persons managing the Fund. This process can be time-consuming and costly, and some of the costs may be borne by the Fund. Without the delay inherent in holding a shareholder meeting, the Adviser and the Fund would be able to act more quickly to appoint a sub-adviser with less expense when the Board and the Adviser believe that the appointment would benefit the Fund.

Evaluation of the Arrangement by the Board of Trustees

In determining whether or not it was appropriate to approve the proposed “multi-manager” arrangement and to recommend the approval of such arrangement to the shareholders, the Board, including the Independent Trustees, considered certain information and representations provided by the Adviser.

After carefully considering the Fund’s contractual arrangement under which the Adviser has been engaged as an investment adviser, and the Adviser’s experience in recommending and monitoring sub-advisers, the Board believes that it is appropriate to allow the recommendation, supervision and evaluation of sub-advisers to be conducted by the Adviser. The Board also believes that this approach would be consistent with shareholders’ expectations that the Adviser will use its expertise to recommend to the Board qualified candidates to serve as sub-advisers. The Board will continue to provide oversight of the sub-adviser selection and engagement process. The Board, including a majority of the Independent Trustees, will continue to evaluate and consider for approval all new or amended sub-advisory agreements. In addition, under the 1940 Act and the terms of the sub-advisory agreements, the Board, including a majority of the Independent Trustees, are required to review annually and consider for renewal the agreement after the initial term. Upon entering into, renewing or amending a sub-advisory agreement, the Adviser and the sub-adviser have a legal duty to provide to the Board information on pertinent factors.

If Proposal 2 is not approved by the shareholders of the Fund or if the Fund does not receive the order from the SEC granting the exemptive relief, shareholder approval would continue to be required for LSA to enter into or materially amend a sub-advisory agreement with respect to the Fund, such as the approval being sought in Proposal 1.

10

Additional Information About the Adviser

Long Short, LLC (“LSA” or “Adviser”), located at 1818 Market Street, 33rd Floor, Suite 3323, Philadelphia, Pennsylvania 19103 serves as the investment adviser to the Fund. LSA is a Pennsylvania limited liability company and a registered investment adviser founded in 2010.

Pursuant to an Investment Advisory Agreement with the Trust, dated June 17, 2010, and subject to the supervision and approval of the Board, the Adviser provides the Fund with investment research, advice and supervision and shall furnish continuously an investment program for the Fund consistent with the investment objectives and policies for the Fund. The Investment Advisory Agreement is subject to annual approval by (i) the Board or (ii) vote of a majority of the Fund’s outstanding voting securities (as defined in the 1940 Act), provided that in either event the continuance also is approved by a majority of the Trustees who are not “interested persons” (as that term is defined in the 1940 Act) of the Fund or the Adviser (the “Independent Trustees”), by vote cast in person at a meeting called for the purpose of voting on such approval. The Investment Advisory Agreement is terminable without penalty, on 60 days’ notice, by the Board or by vote of the holders of a majority of the Fund’s outstanding voting securities, or, upon not less than 60 days’ notice, by the Adviser. The Investment Advisory Agreement will terminate automatically in the event of its assignment (as defined in the 1940 Act). The Investment Advisory Agreement provides that the Adviser shall exercise its best judgment in rendering services to the Fund and that the Adviser will not be liable for any error of judgment or mistake of law or for any loss suffered by the Fund, except by reason of willful misfeasance, bad faith or gross negligence in the performance of its duties. The Investment Advisory Agreement was last approved by the Board at a meeting held on March 10-11, 2015, and by the Fund’s initial shareholder on September 28, 2010. A discussion regarding the basis for the Board approving the Investment Advisory Agreement is available in the Fund’s annual report for the fiscal year ended May 31, 2014 and will be available in the Fund’s annual report for the fiscal year ended May 31, 2015 when that report is produced. The Fund has agreed to pay the Adviser an investment advisory fee at the annual rate of 1.75% of the value of the Fund’s average daily net assets. For the fiscal year ended May 31, 2015, the Fund paid the Adviser an investment advisory fee of $2,875,140.

The Adviser has contractually agreed to waive or limit its fee and to reimburse certain Fund operating expenses, until September 30, 2016 so that the ratio of total annual operating expenses does not exceed 1.95%. This operating expense limitation does not apply to: (i) interest, (ii) taxes, (iii) brokerage commissions, (iv) other expenditures which are capitalized in accordance with generally accepted accounting principles, (v) other extraordinary expenses not incurred in the ordinary course of the Fund’s business, (vi) dividend expense on short sales, and (vii) expenses that the Fund has incurred but did not actually pay because of an expense offset arrangement, if applicable, incurred by the Fund in any fiscal year. The operating expense limitation also excludes any “Acquired Fund Fees and Expenses” and 12b-1 fees. Acquired Fund Fees and Expenses represent the pro rata expense indirectly incurred by the Fund as a result of investing in other investment companies, including ETFs, closed-end funds and money market funds that have their own expenses.

The names, addresses and principal occupation of the principal executive officers of LSA as of the date of this proxy statement are set forth below.

| Name and Address | Principal Occupation | |

|

Christopher J. Topolewski 1818 Market Street, 33rd Floor, Suite 3323 Philadelphia, Pennsylvania 19103 |

Chief Compliance Officer | |

|

Matthew E. West 1818 Market Street, 33rd Floor, Suite 3323 Philadelphia, Pennsylvania 19103 |

Managing Member, Chief Executive Officer | |

|

Dane F. Czaplicki, CFA 1818 Market Street, 33rd Floor, Suite 3323 Philadelphia, Pennsylvania 19103 |

Director of Research | |

11

Required Vote. Approval of this Proposal requires the vote of the “majority of the outstanding voting securities” of the Fund. Under the 1940 Act, a “majority of the outstanding voting securities” is defined as the lesser of: (1) 67% or more of the voting securities of the Fund entitled to vote present in person or by proxy at the Special Meeting, if the holders of more than 50% of the outstanding voting securities entitled to vote thereon are present in person or represented by proxy; or (2) more than 50% of the outstanding voting securities of the Fund entitled to vote thereon.

THE BOARD OF TRUSTEES UNANIMOUSLY RECOMMENDS A VOTE “FOR” THE

IMPLEMENTATION OF A “MULTI-MANAGER” ARRANGEMENT WHEREBY THE

FUND’S INVESTMENT ADVISER, UNDER CERTAIN CIRCUMSTANCES, WOULD BE

ABLE TO HIRE AND REPALCE SUB-ADVISERS FOR THE FUND WITHOUT

OBTAINING SHAREHOLDER APPROVAL

12

FURTHER INFORMATION ABOUT VOTING AND THE SPECIAL MEETING

Quorum and Methods of Tabulation. Only shareholders of record on July 15, 2015 (the record date) are entitled to notice and to vote at the Special Meeting. Pursuant to the Trust’s Declaration of Trust and By-Laws, one-third of the outstanding shares entitled to vote, present in person or represented by proxy, shall constitute a quorum for the transaction of business at the Special Meeting.

Shareholders of the Fund vote as a single class on the Proposals. Votes cast by proxy or in person at the Special Meeting will be counted by persons appointed by the Trust as tellers (the “Tellers”) for the Special Meeting. The Tellers will count the total number of votes cast “for” approval of each Proposal for purposes of determining whether sufficient affirmative votes have been cast. The Tellers will count shares represented by proxies that reflect abstentions and “broker non-votes” (i.e., shares held by brokers or nominees as to which (i) instructions have not been received from the beneficial owners or the persons entitled to vote and (ii) the broker or nominee does not have discretionary voting power on a particular matter) as shares that are present on the matter for purposes of determining the presence of a quorum. However, since such shares are not voted in favor of a Proposal, they have the effect of counting as a vote AGAINST that Proposal.

Vote Required. Approval of each Proposal requires the affirmative vote of the lesser of: (i) 67% or more of the voting securities present at the Special Meeting, provided that more than 50% of the voting securities are present in person or represented by proxy at the Special Meeting; or (ii) a majority of the voting securities entitled to vote.

Other Business. The Trustees know of no other business to be brought before the Special Meeting. However, if any other matters properly come before the Special Meeting, they intend that proxies that do not contain specific restrictions to the contrary be voted on such matters in accordance with the judgment of the persons named in the proxy card. The Trust does not have annual meetings and, as such, does not have a policy relating to the attendance by the Trustees at shareholder meetings.

Revocation of Proxies. Proxies may be revoked at any time before they are voted either (i) by a written revocation delivered to the Trust, (ii) by a properly executed later-dated proxy received by the Trust, (iii) by an in-person vote at the Special Meeting, or (iv) by written notice of death or incapacity of the maker of the proxy received by the Trust before the vote pursuant to the proxy is counted. Attendance at the Special Meeting will not in and of itself revoke a proxy. Shareholders may revoke a proxy as often as they wish before the Special Meeting. Only the latest dated, properly executed proxy card received prior to or at the Special Meeting will be counted.

Shareholder Proposals. Any shareholder proposals to be included in the proxy statement for the Trust’s next meeting of shareholders must be received by the Trust within a reasonable period of time before the Trust begins to print and send its proxy materials.

Adjournment. If a quorum is not present or represented at the Special Meeting, or if a quorum is present but sufficient votes to approve the proposal are not received, or if other matters arise that require shareholder attention, the persons named as proxy agents, the Chairperson of the meeting, or other Trust officers present at the Special Meeting may propose one or more adjournments to permit further solicitation of proxies. Any such adjournment will require the affirmative vote of one-third of those shares present at the Special Meeting or represented by proxy. The persons named as proxies will vote those proxies that are entitled to vote in favor of such an adjournment, provided that they determine that such an adjournment and additional solicitation is reasonable and in the interest of shareholders based on a consideration of all relevant factors. At such adjourned meeting at which a quorum shall be present or represented, any business may be transacted that might have been transacted at the meeting as originally notified.

Annual and Semi-Annual Reports. The most recent annual and semi-annual reports to shareholders of the Fund (when available) will be provided to shareholders at no cost. To request a report, please call us toll-free at (877) 336-6763 or write to us at 2960 N. Meridian St., Suite 300, Indianapolis, Indiana 46208.

13

Proxy Solicitation Costs. The costs of solicitation of proxies and expenses incurred in connection with the preparation of proxy materials are being borne by the Fund. In addition to soliciting proxies by mail, the Trustees and employees of the Trust may solicit proxies in person or by telephone. The Trust has engaged AST Fund Solutions to provide shareholder meeting services, including the distribution of this Proxy Statement and related materials to shareholders as well as vote tabulation. The costs of these services are expected be approximately $10,967. By voting immediately, you can help the Trust avoid the additional expense of a second proxy solicitation.

Only one copy of this Proxy Statement may be mailed to a shareholder holding shares in multiple accounts within the Fund. Additionally, unless the Trust has received contrary instructions, only one copy of this Proxy Statement will be mailed to a given address where two or more shareholders share that address. Additional copies of the Proxy Statement will be delivered promptly upon request. Requests may be sent to AST Fund Solutions, LLC, 55 Challenger Road, Ridgefield Park, NJ 07660 or made by telephone by calling 1-877-732-3617.

Outstanding Shares. The shares outstanding of the Fund as of July 15, 2015 are: 5,255,634.44.

Security Ownership of Certain Beneficial Owners and Management.

Unless otherwise noted below, as of the Record Date, the current officers and Trustees of the Trust in the aggregate beneficially owned less than 1% of the shares of the Fund.

As of the Record Date, the following persons owned of record or beneficially 5% or more of the outstanding shares of the Fund:

| Name and Address of Owner | Number of Shares | Percentage Ownership | ||

|

National Financial Services, LLC 200 Liberty Street, 5th Floor One World Financial Center New York, New York 10281 |

4,202,307.94 | 79.96% | ||

INVESTMENT ADVISER AND FUND INFORMATION

Investment Advisers. Long Short Advisors, LLC, 1818 Market Street, 33rd Floor, Suite 3323, Philadelphia, Pennsylvania 19103 serves as the investment adviser to the Fund.

Information on the current and proposed sub-advisers can be found in Proposal 1. Additional information on the Adviser can be found in Proposal 2.

Administrator, Transfer Agent, Dividend Disbursing Agent and Fund Accountant. Huntington Asset Services, Inc., 2960 N. Meridian St., Suite 300, Indianapolis, Indiana 46208 serves as the Trust’s administrator, transfer agent, dividend disbursing agent and fund accountant.

Distributor. Unified Financial Securities, Inc., 2960 N. Meridian St., Suite 300, Indianapolis, Indiana 46208 serves as the distributor for shares of the Fund.

Custodian. Citibank, N.A., 388 Greenwich St., New York, New York 10013, serves as Custodian of the investments of the Fund.

14

Independent Registered Public Accounting Firm. Cohen Fund Audit Services, Ltd., 1350 Euclid Avenue, Suite 800, Cleveland, OH 44115 serves as the independent registered public accounting firm for the Fund.

Legal Counsel. The Law Offices of John H. Lively & Associates, Inc., a member firm of The 1940 Act Law GroupTM, 11300 Tomahawk Creek Parkway, Suite 310, Leawood, Kansas 66211 serves as legal counsel to the Trust and the Fund.

PLEASE EXECUTE AND RETURN THE ENCLOSED PROXY PROMPTLY TO ENSURE

THAT A QUORUM IS PRESENT AT THE MEETING. A SELF-ADDRESSED, POSTAGE

PREPAID ENVELOPE IS ENCLOSED FOR YOUR CONVENIENCE.

15

APPENDIX A

SUB-ADVISORY AGREEMENT

THIS SUB-ADVISORY AGREEMENT (“Agreement”) is made as of September , 2015 (the “Effective Date”), by and between Long Short Advisors, LLC, a Pennsylvania limited liability company (“Manager”), and Prospector Partners, LLC, a Delaware limited liability company (“Sub-Adviser”).

WHEREAS, Manager has by separate contract agreed to serve as the investment adviser to the LS Opportunity Fund (the “Fund”), a series portfolio of the Valued Advisers Trust (the “Trust”), a Delaware statutory trust registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as an open-end diversified management investment company;

WHEREAS, Manager’s contract with the Trust allows it to delegate certain investment advisory services to other parties; and

WHEREAS, Manager desires to retain Sub-Adviser to perform certain discretionary investment sub-advisory services for the Fund, and Sub-Adviser is willing to perform such services;

NOW, THEREFORE, in consideration of the premises and mutual covenants herein contained, it is agreed between the parties hereto as follows:

| 1. | SERVICES TO BE RENDERED BY SUB-ADVISER. |

| (a) | INVESTMENT PROGRAM. Subject to the control and supervision of the Board of Trustees of the Fund (the “Board”) and Manager, Sub-Adviser shall, at its expense, continuously furnish to the Fund an investment program for such portion, if any, of Fund assets that are allocated to it by Manager from time to time. With respect to such assets, Sub-Adviser will make investment decisions and will place all brokerage orders for the purchase and sale of portfolio securities. |

In the performance of its duties, Sub-Adviser will act in the best interests of the Fund and will comply with:

| (i) | applicable laws and regulations, including, but not limited to, the 1940 Act; |

| (ii) | the terms of this Agreement; |

| (iii) | the stated investment objective, policies and restrictions of the Fund, as stated in the then-current registration statement of the Fund; and |

| (iv) | such other guidelines as the Board or Manager may establish. |

Manager shall be responsible for providing Sub-Adviser with the Trust’s Declaration of Trust, as filed with the Secretary of State of Delaware on June 13, 2008, and all amendments thereto or restatements thereof, the Trust’s Bylaws and amendments thereto, resolutions of the Trust’s Board authorizing the appointment of Sub-Adviser and approving this Agreement and current copies of the materials specified in Subsections (a)(iii) and (iv) of this Section 1. At such times as may be reasonably requested by the Board or Manager, Sub-Adviser will provide them with economic and macro investment analysis and reports, and make available to the Board any economical, statistical, or investment services.

| (b) | AVAILABILITY OF SUB-ADVISER. Sub-Adviser, at its expense, will provide or make available to Manager and/or the Board information and access to its portfolio managers and other appropriate personnel for periodic commentaries regarding the performance of the Fund as may be reasonably requested from time to time by Manager, the Board, Chief Compliance Officer of the Trust (“Trust CCO”) or as otherwise may be specified by Manager in any due diligence and oversight procedures, including any quarterly certifications and compliance reports, that the Manager and/or Trust CCO may establish and amend from time to time (the “Procedures”). |

A-1

| (c) | SUB-ADVISER EXPENSES. Sub-Adviser, at its expense, will pay for all expenses that are required for it to execute its duties under this Agreement and any other expenses the Sub-Adviser agrees in writing to bear. Sub-Adviser shall not be obligated pursuant to this Agreement to pay any expenses of or for the Fund not expressly assumed by Sub-Adviser pursuant to this Agreement. |

| (d) | COMPLIANCE REPORTS. Sub-Adviser, at its expense, will provide Manager and/or Trust CCO with periodic compliance reports relating to its duties under this Agreement and on an as needed basis, but shall furnish such compliance reports at least on a quarterly basis. Such compliance reports shall, at a minimum, contain information required by the Procedures, and they shall be delivered as frequently as the Procedures may call for or as frequently as may be reasonably requested by the Manager, Board and/or the Trust CCO. |

| (e) | VALUATION. As may be reasonably requested from time to time by the Manager and the Fund’s other service providers, Sub-Adviser shall assist in the valuation of the portfolio securities of the Fund and obtain information about securities that may be purchased for the Fund by the Sub-Adviser with respect to which reliable prices are not available through customary pricing services and otherwise assist the Fund in pricing such assets appropriately. Sub-Adviser agrees to make commercially reasonable efforts to promptly bring to the attention of Manager any events that Sub-Adviser determines to be “significant events” that may come to the attention of Sub-Adviser and that Sub-Adviser believes are reasonably likely to affect the price of such securities. Manager acknowledges and agrees that (i) any such information provided by Sub-Adviser may be proprietary to Sub-Adviser or otherwise consist of nonpublic information, (ii) nothing in this Agreement shall require Sub-Adviser to provide any information in contravention of applicable legal or contractual requirements, and (iii) any such information will be used only for the purpose of pricing portfolio securities and will be maintained as confidential; provided, however, that none of the conditions in this sentence shall preclude the Trust’s CCO (x) from having access to such information, (y) from making appropriate public disclosures or (z) from maintaining such information as part of the Trust’s books and records as required by federal securities laws. |

| (f) | EXECUTING PORTFOLIO TRANSACTIONS. Sub-Adviser will place all orders pursuant to its investment determinations for the Fund either directly with the issuer or through broker-dealers selected by Manager. Additional broker-dealers may be suggested by Sub-Adviser, and Manager’s approval of such broker-dealers may not be unreasonably withheld. Sub-Adviser shall use its best efforts to obtain for the Fund the most favorable price and execution available, except to the extent it may be permitted to pay higher brokerage commissions for brokerage and research services as described below. In using its best efforts to obtain the most favorable price and execution available, Sub-Adviser, bearing in mind the Fund’s best interests at all times, shall consider all factors it deems relevant, including by way of illustration, price, the size of the transaction, the nature of the market for the security, the amount of the commission and dealer’s spread or mark-up, the timing of the transaction taking into account market prices and trends, the reputation, experience and financial stability of the broker-dealer involved, the general execution and operational facilities of the broker- dealer and the quality of service rendered by the broker-dealer in other transactions. Subject to such policies as the Board may determine, Sub-Adviser shall not be deemed to have acted unlawfully or to have breached any duty created by this Agreement or otherwise solely by reason of its having caused the Fund to pay a broker-dealer that provides brokerage and research services to Sub-Adviser an amount of commission for effecting a portfolio investment transaction in excess of the amount of commission another broker-dealer offering equally good execution capability in the portfolio investment would have charged for effecting that transaction if Sub-Adviser determines in good faith that such amount of commission was reasonable in relation to the value of the brokerage and research services provided by such broker-dealer, viewed in terms of either that particular transaction or Sub-Adviser’s overall responsibilities with respect to the Fund and to other clients of Sub-Adviser as to which Sub-Adviser exercises investment discretion. Any entity or person associated with Manager or Sub-Adviser that is a member of a national securities exchange is authorized to effect any transaction on such exchange for the account of the Fund that is permitted by Section 11(a) of the Securities Exchange Act of 1934, as amended, and Sub-Adviser and/or Manager may retain compensation for such transactions. |

A-2

Sub-Adviser shall recommend brokers for inclusion on an approved broker list for the Fund, subject to approval by the Manager.

| (g) | PROXY VOTING. Sub-Adviser shall vote proxies for the Fund in a manner consistent with the Sub-Adviser’s Proxy Voting Policy and the Fund’s disclosure documents and keep the Fund and Manager informed as to such voting. Sub-Adviser shall assist the Trust CCO in compiling the proxy voting record for submission to the SEC on Form N-PX on a periodic basis and shall, upon request, review drafts of such submission prior to filing |

| 2. | CODE OF ETHICS. Sub-Adviser has adopted a written code of ethics (“Sub-Adviser’s Code of Ethics”) that complies with the requirements of Rule 17j-1 under the 1940 Act. Sub-Adviser shall provide the Sub-Adviser’s Code of Ethics to the Trust prior to this Agreement being presented to the Board for initial approval, as well as the certification contemplated by Rule 17j-1. Sub-Adviser shall seek to ensure that its Access Persons (as defined in the Sub-Adviser’s Code of Ethics) comply in all material respects with the Sub-Adviser’s Code of Ethics, as in effect from time to time. Thereafter, upon request, Sub-Adviser shall provide the Trust with a (i) copy of Sub-Adviser’s Code of Ethics, as in effect from time to time, and any proposed amendments thereto that the Trust CCO determines should be presented to the Board, and (ii) certification that it has adopted procedures reasonably necessary to prevent Access Persons from engaging in any conduct prohibited by Sub-Adviser’s Code of Ethics. Annually, Sub-Adviser shall furnish a written report to the Board, which complies with the requirements of Rule 17j-1, concerning Sub-Adviser’s Code of Ethics. Sub-Adviser shall respond to requests for information from the Trust as to violations of Sub-Adviser’s Code of Ethics by Access Persons and the sanctions imposed by Sub-Adviser. Sub-Adviser shall notify the Trust as soon as practicable after it becomes aware of any material violation of Sub-Adviser’s Code of Ethics, whether or not such violation relates to a security held by any Fund. |

| 3. | BOOKS AND RECORDS. Pursuant to applicable rules under the 1940 Act and other relevant laws, including the Investment Advisers Act of 1940 (the “Advisers Act”), Sub-Adviser agrees that: (a) all records it maintains for the Fund are the property of the Fund; (b) it will surrender promptly to the Trust or Manager any such records (or copies of such records) upon request from the Manager, Trust or the Trust’s CCO; (c) it will maintain the records that the Fund and the Adviser are required to maintain pursuant to the 1940 Act and the Advisers Act insofar as such records relate to Sub-Adviser’s services pursuant to this Agreement; and (d) it will preserve for the periods prescribed by the 1940 Act and the Advisers Act the records it maintains for the Fund. Notwithstanding subsection (b) above, Sub-Adviser may maintain copies of such records to comply with its recordkeeping obligations. |

| 4. | OTHER RELATIONSHIPS. It is understood that Sub-Adviser and persons controlled by or under common control with Sub-Adviser have, and will continue to have, advisory, management service and other agreements with other organizations and persons, as well as other interests and businesses. Nothing in this Agreement is intended to preclude such other business relationships. |

| 5. | REPRESENTATIONS AND WARRANTIES. |

| (a) | Sub-Adviser represents and warrants to Manager as follows: |

| (i) | PROPERLY REGISTERED. Sub-Adviser is registered with the Securities and Exchange Commission (“SEC”) as an investment adviser under the Advisers Act, and will remain so registered for the duration of this Agreement. Sub-Adviser is not prohibited by the Advisers Act or the 1940 Act from performing the services contemplated by this Agreement, and to the best knowledge of Sub-Adviser, there is no proceeding or investigation that is reasonably likely to result in Sub-Adviser being prohibited from performing the services contemplated by this Agreement. Sub-Adviser agrees to promptly notify the Trust of the occurrence of any event that would disqualify Sub-Adviser from serving as an investment adviser to an investment company. Sub-Adviser is in compliance in all material respects with all applicable federal and state law in connection with its investment management operations. |

A-3

| (ii) | ADV DISCLOSURE. Sub-Adviser has provided the Board with a copy of its Form ADV and will, promptly after amending its Form ADV, furnish a copy of such amendments to the Trust. The information contained in Sub-Adviser’s Form ADV is accurate and complete in all material respects and does not omit to state any material fact necessary in order to make the statements made, in light of the circumstances under which they were made, not misleading. The Manager on behalf of itself and on behalf of the Fund acknowledges receipt of a copy of Part 2a and Part 2b of the Sub-Adviser’s Form ADV in compliance with Rule 204-3(b) under the Investment Advisor’s Act of 1940, as amended. |

| (iii) | FUND DISCLOSURE DOCUMENTS. Sub-Adviser has reviewed and will in the future review the registration statement and any amendments or supplements thereto, the annual or semi-annual reports to shareholders, other reports filed with the Commission and any marketing material of the Fund (collectively the “Disclosure Documents”) and represents and warrants that with respect to disclosure about Sub-Adviser, the manner in which Sub-Adviser manages the Fund or information relating directly or indirectly to Sub-Adviser, such information provided by Sub-Adviser in connection with the preparation of such Disclosure Documents contain or will contain, as of the date thereof, no untrue statement of any material fact and does not and will not omit any statement of material fact which was required to be stated therein or necessary to make the statements contained therein not misleading. |

| (iv) | INSURANCE. Sub-Adviser maintains errors and omissions insurance coverage in an appropriate amount and shall provide prior written notice to the Trust (i) of any material changes in its insurance policies or insurance coverage, or (ii) if any material claims will be made on its insurance policies. Furthermore, Sub-Adviser shall, upon reasonable request, provide the Trust and Manager with any information it may reasonably require concerning the amount of or scope of such insurance. |

| (v) | NO DETRIMENTAL AGREEMENT. Other than allocation and aggregation policies and procedures that are reasonably designed to seek to treat all of the Sub Advisor’s clients equitably, Sub-Adviser has no arrangement or understanding with any party, other than Manager and the Trust, that would influence the decision of Sub-Adviser with respect to its selection of securities for the Fund and its management of the assets of the Fund, and that all selections shall be done in accordance with what is in the best interest of the Fund. |

| (vi) | CONFLICTS. Sub-Adviser shall act honestly, in good faith and in the best interests of its clients and the Fund. Sub-Adviser maintains a Code of Ethics, which defines the standards by which Sub-Adviser conducts its operations consistent with its fiduciary duties and other obligations under applicable law. |

| (vii) | REPRESENTATIONS. The representations and warranties in this Section 5(a) shall be deemed to be made on the date this Agreement is executed and at the time of delivery of the quarterly compliance report required by Section 1(d). |

| (b) | Manager represents and warrants to Sub-Adviser as follows: |

| (i) | PROPERLY REGISTERED. Manager is registered with the SEC as an investment adviser under the Advisers Act, and will remain so registered for the duration of this Agreement. Adviser is not prohibited by the Advisers Act or the 1940 Act from performing the services contemplated by this Agreement, and to the best knowledge of Manager, there is no proceeding or investigation that is reasonably likely to result in Manager being prohibited from performing the services contemplated by this Agreement. Manager agrees to promptly notify Sub-Adviser of the occurrence of any event that would disqualify Manager from serving as an investment adviser to an investment company. Manager is in compliance in all material respects with all applicable federal and state law in connection with its investment management operations. |

| (ii) | ADV DISCLOSURE. Manager has provided the Board with a copy of its Form ADV and will, promptly after amending its Form ADV, furnish a copy of such amendments to the Sub-Adviser. |

A-4

| The information contained in Manager’s Form ADV is accurate and complete in all material respects and does not omit to state any material fact necessary in order to make the statements made, in light of the circumstances under which they were made, not misleading. |

| (iii) | FUND DISCLOSURE DOCUMENTS. Manager has reviewed and will in the future review the Disclosure Documents and represents and warrants that with respect to disclosure about Manager, the manner in which Manager overseas the Fund or information relating directly or indirectly to Manager, such information provided by Manager in connection with the preparation of such Disclosure Documents contain or will contain, as of the date thereof, no untrue statement of any material fact and does not and will not omit any statement of material fact which was required to be stated therein or necessary to make the statements contained therein not misleading. |

| (iv) | INSURANCE. Manager maintains errors and omissions insurance coverage in an appropriate amount and shall provide prior written notice to the Sub-Adviser (i) of any material changes in its insurance policies or insurance coverage, or (ii) if any material claims will be made on its insurance policies. |

| (v) | CONFLICTS. Manager shall act honestly, in good faith and in the best interests of its clients and the Fund. Manager maintains a Code of Ethics, which defines the standards by which Manager conducts its operations consistent with its fiduciary duties and other obligations under applicable law. |

| (vi) | REPRESENTATIONS. The representations and warranties in this Section 5(b) shall be deemed to be made on the date this Agreement is executed. |