UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-22208

Valued Advisers Trust

(Exact name of registrant as specified in charter)

| Huntington Asset Services, Inc. 2960 N. Meridian Street, Suite 300 |

Indianapolis, IN 46208 | |

| (Address of principal executive offices) | (Zip code) |

Capitol Services, Inc.

615 S. Dupont Hwy.

Dover, DE 19901

(Name and address of agent for service)

With a copy to:

John H. Lively, Esq.

The Law Offices of John H. Lively & Associates, Inc.

A member firm of The 1940 Act Law GroupTM

11300 Tomahawk Creek Parkway,

Suite 310

Leawood, KS 66221

Registrant’s telephone number, including area code: 317-917-7000

Date of fiscal year end: 10/31

Date of reporting period: 10/31/14

| Item 1. | Reports to Stockholders. |

BRC

Large Cap

Focus Equity Fund

Annual Report

October 31, 2014

Fund Adviser:

BRC Investment Management LLC

8400 East Prentice Avenue, Suite 1401

Greenwood Village, Colorado 80111

Toll Free (877) 272-1214

MANAGEMENT’S DISCUSSION OF FUND PERFORMANCE – (Unaudited)

The investment strategy of the BRC Large Cap Focus Equity Fund (the “Fund”) is based on our belief that future investor expectations are strongly influenced by the opinions, forecasts and announcements of perceived market experts, including Wall Street analysts and company management. By incorporating a combination of proprietary behavioral valuation techniques, we seek to invest in companies that are likely to be the beneficiaries of future favorable earnings announcements and upward earnings estimate revisions. Regardless of market conditions, so long as the predictive abilities of the quantitative models remain strong and investors continue to react to industry experts, the management team expects this investment strategy to provide above average returns over a typical 3-5 year investment cycle.

For the year ending October 31, 2014, the management team was satisfied with the overall predictive abilities of the quantitative model and the implementation of the investment process. As the period ended, the Fund held 33 U.S. large cap equity positions representing those securities that were highly ranked by our quantitative models and were evaluated and selected by our fundamental equity analysts.

Despite this good predictive ability of the models, successful implementation of the process and strong performance through August, the Fund experienced significantly weaker performance in September and October. The magnitude of underperformance was not outside a range of what the management team of the Adviser would expect given our historical alpha and tracking error. The underperformance was primarily attributable to the following four factors:

| • | Outperformance of Large Cap Stocks – During the month of September the largest capitalization quintile of our large cap investment universe outperformed the smallest cap quintile by 3.8%. When the largest capitalization companies outperform the breadth of our universe by such a large margin it is very difficult for this strategy to beat a cap-weighted benchmark. |

| • | Negative Returns to Momentum – In three sectors (Energy, Materials and Diversified Financials), returns to medium-term momentum were significantly negative in October. Although we do not explicitly incorporate price change in our process, our performance has historically lagged when negative momentum stocks perform well. |

| • | Relatively Low Predictive Ability of Analyst Behavior Models – Our process depends on our ability to predict the future behavior of sell-side security analysts. During October, our efforts to accurately predict future positive estimate changes were significantly below normal. |

| • | Stock Specific Effects in the Energy and Materials Sectors – The factors noted above expressed themselves in the poor performance of several specific holdings. These stocks, which had provided very strong returns earlier in the year, declined sharply as investors sought to realize profits. |

For the 12-month period ending October 31, 2014, the Fund’s return was 15.60% versus the S&P 500 Index return of 17.27%.

The Adviser has proprietary tools for tacking and monitoring risk factors. Using analytical tools that are distinct from those of portfolio management, the risk management process assesses the risks embedded in the strategy on an on-going basis. Some of the factors we focus on include; value factors (Price to Book, Price to Earnings, Price to Sales, Price to Cash Flow, etc.); medium-term and short-term momentum; market capitalization; beta; and volatility, among others. The Adviser also monitors the levels and trends of fundamental factor exposures, economic sector exposures, and the composition and magnitude of residual risk versus various benchmarks and indices. For the reporting period, this risk management process resulted in stable sector and style exposures.

On behalf of the management team of the Adviser, I would like to thank you for your continued support. You have our commitment to the consistent application of our investment process and to a proprietary research agenda that will drive our ongoing effort to add value for our clients.

John R. Riddle, CFA

Managing Principal and Chief Investment Officer

1

INVESTMENT RESULTS – (Unaudited)

| Total

Returns* (for the periods ended October 31, 2014) |

||||||||

| One Year | Since Inception (December 21, 2012) |

|||||||

| BRC Large Cap Focus Equity Fund - Institutional Class |

15.60 | % | 21.21 | % | ||||

| S&P 500 Index®** |

17.27 | % | 22.18 | % | ||||

Total annual operating expenses, as disclosed in the Fund’s prospectus were 6.44% of net assets for the Institutional Class (0.55% after fee waivers/expense reimbursements by the Adviser based on an expense limitation that was put into effect on October 6, 2014). The Adviser has contractually agreed to waive or limit its fees and to assume other expenses of the Fund until February 28, 2018, so that the Total Annual Fund Operating Expenses does not exceed 0.55%. This operating expense limitation does not apply to interest, taxes, brokerage commissions, other expenditures which are capitalized in accordance with generally accepted accounting principles, other extraordinary expenses not incurred in the ordinary course of the Fund’s business, dividend expense on short sales, expenses incurred under a Rule 12b-1 plan of distribution, “acquired fund fees and expenses,” and expenses that the Fund has incurred but did not actually pay because of an expense offset arrangement.

The performance quoted represents past performance, which does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling (877) 272-1214.

| * | Return figures reflect any change in price per share and assume the reinvestment of all distributions. |

| ** | The S&P 500® Index is a widely recognized unmanaged index of equity securities and is representative of a broader domestic equity market and range of securities than is found in the Fund’s portfolio. Individuals cannot invest directly in an Index; however, an individual can invest in exchange traded funds or other investment vehicles that attempt to track the performance of a benchmark index. |

The Fund’s investment objectives, strategies, risks, charges and expenses must be considered carefully before investing. The prospectus contains this and other important information about the Fund and may be obtained by calling the same number as above. Please read it carefully before investing.

The Fund is distributed by Unified Financial Securities, Inc., member FINRA.

2

INVESTMENT RESULTS – (Unaudited)

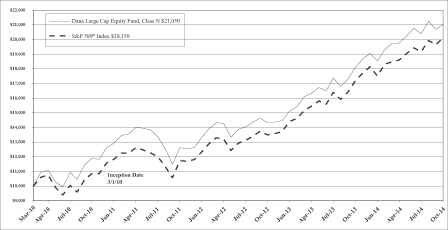

Comparison of the Growth of a $10,000 Investment in the BRC Large Cap Focus Equity Fund - Institutional Class and the S&P 500® Index (Unaudited)

The chart above assumes an initial investment of $10,000 made on December 21, 2012 (commencement of Institutional Class operations) and held through October 31, 2014. The S&P 500® Index is a widely recognized unmanaged index of equity securities and is representative of a broader domestic equity market and range of securities than is found in the Fund’s portfolio. Individuals cannot invest directly in an Index; however, an individual can invest in exchange traded funds or other investment vehicles that attempt to track the performance of a benchmark index. THE FUND’S RETURN REPRESENTS PAST PERFORMANCE AND DOES NOT GUARANTEE FUTURE RESULTS. The returns shown do not reflect deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Investment returns and principal values will fluctuate so that your shares, when redeemed, may be worth more or less than their original purchase price.

Current performance may be lower or higher than the performance data quoted. For more information on the Fund, and to obtain performance data current to the most recent month end or to request a prospectus, please call (877) 272-1214. You should carefully consider the investment objectives, potential risks, management fees, and charges and expenses of the Fund before investing. The Fund’s prospectus contains this and other information about the Fund, and should be read carefully before investing.

The Fund is distributed by Unified Financial Securities, Inc., member FINRA.

3

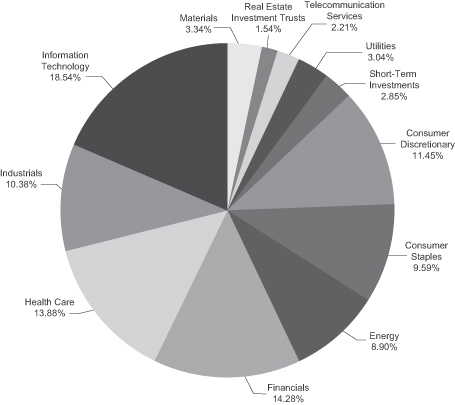

FUND HOLDINGS – (Unaudited)

| 1 | As a percentage of net assets. |

The investment objective of the BRC Large Cap Focus Equity Fund is to seek long-term capital appreciation that will exceed the S&P 500® Index over a three-to-five year time horizon.

Availability of Portfolio Schedule – (Unaudited)

The Fund files its complete schedule of portfolio holdings with the Securities and Exchange Commission (“SEC”) for the first and third quarters of each fiscal year on Form N-Q. The Fund’s Forms N-Q are available at the SEC’s website at www.sec.gov. The Fund’s Forms N-Q may be reviewed and copied at the SEC’s Public Reference Room in Washington DC. Information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330.

4

SUMMARY OF FUND’S EXPENSES – (Unaudited)

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, such as short-term redemption fees; and (2) ongoing costs, including management fees and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 invested at the beginning and held for the entire period from May 1, 2014 to October 31, 2014.

Actual Expenses

The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = $8.60), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During the Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only. Therefore, the second line of the table below is useful in comparing ongoing costs only and will not help you determine the relative costs of owning different funds.

| BRC Large Cap Focus Equity Fund – Institutional Class |

Beginning Account Value May 1, 2014 |

Ending Account Value October 31, 2014 |

Expenses Paid October 31, 2014 |

|||||||||

|

Actual* |

$ | 1,000.00 | $ | 1,050.20 | $ | 2.84 | ||||||

|

Hypothetical** |

$ | 1,000.00 | $ | 1,022.43 | $ | 2.80 | ||||||

| * | Expenses are equal to the Fund’s annualized expense ratio of 0.55%, multiplied by the average account value over the period, multiplied by 184/365. |

| ** | Assumes a 5% return before expenses. |

5

BRC LARGE CAP FOCUS EQUITY FUND

SCHEDULE OF INVESTMENTS

October 31, 2014

| COMMON STOCKS – 97.16% | Shares | Fair Value | ||||||

| Consumer Discretionary – 14.99% |

| |||||||

| Foot Locker, Inc. |

8,540 | $ | 478,325 | |||||

| Gannett Co., Inc. |

14,350 | 452,025 | ||||||

| Hanesbrands, Inc. |

4,427 | 467,536 | ||||||

| Jarden Corp. * |

7,825 | 509,329 | ||||||

| Walt Disney Co./The |

5,577 | 509,626 | ||||||

|

|

|

|||||||

| 2,416,841 | ||||||||

|

|

|

|||||||

| Consumer Staples – 5.92% |

||||||||

| Constellation Brands, Inc. – Class A * |

5,420 | 496,147 | ||||||

| Kroger Co./The |

8,240 | 459,050 | ||||||

|

|

|

|||||||

| 955,197 | ||||||||

|

|

|

|||||||

| Energy – 8.31% |

| |||||||

| FMC Technologies, Inc. * |

8,456 | 473,874 | ||||||

| Helmerich & Payne, Inc. |

4,165 | 361,605 | ||||||

| Marathon Petroleum Corp. |

5,552 | 504,677 | ||||||

|

|

|

|||||||

| 1,340,156 | ||||||||

|

|

|

|||||||

| Financials – 17.38% |

| |||||||

| Goldman Sachs Group, Inc./The |

2,522 | 479,155 | ||||||

| Jones Lang LaSalle, Inc. |

3,487 | 471,477 | ||||||

| Lincoln National Corp. |

8,749 | 479,095 | ||||||

| Prudential Financial, Inc. |

4,828 | 427,471 | ||||||

| SunTrust Banks, Inc. |

12,100 | 473,594 | ||||||

| Travelers Cos., Inc./The |

4,680 | 471,744 | ||||||

|

|

|

|||||||

| 2,802,536 | ||||||||

|

|

|

|||||||

| Health Care – 12.49% |

| |||||||

| Aetna, Inc. |

6,100 | 503,311 | ||||||

| Amgen, Inc. |

3,486 | 565,360 | ||||||

| Biogen Idec, Inc. * |

1,481 | 475,520 | ||||||

| Laboratory Corp. of America Holdings * |

4,300 | 469,947 | ||||||

|

|

|

|||||||

| 2,014,138 | ||||||||

|

|

|

|||||||

| Industrials – 11.48% |

| |||||||

| Boeing Co./The |

3,704 | 462,667 | ||||||

| Caterpillar, Inc. |

4,252 | 431,195 | ||||||

| FedEx Corp. |

2,858 | 478,429 | ||||||

| Snap-on, Inc. |

3,618 | 478,083 | ||||||

|

|

|

|||||||

| 1,850,374 | ||||||||

|

|

|

|||||||

See accompanying notes which are an integral part of these financial statements.

6

BRC LARGE CAP FOCUS EQUITY FUND

SCHEDULE OF INVESTMENTS – (continued)

October 31, 2014

| COMMON STOCKS – 97.16%– continued | Shares | Fair Value | ||||||

| Information Technology – 15.53% |

| |||||||

| Apple, Inc. |

4,372 | $ | 472,176 | |||||

| Avago Technologies Ltd. |

6,250 | 539,063 | ||||||

| Electronic Arts, Inc. * |

11,787 | 482,913 | ||||||

| FleetCor Technologies, Inc. * |

3,590 | 540,510 | ||||||

| Global Payments, Inc. |

5,839 | 470,040 | ||||||

|

|

|

|||||||

| 2,504,702 | ||||||||

|

|

|

|||||||

| Materials – 4.85% |

| |||||||

| Lyondellbasell Industries NV – Class A |

4,444 | 407,204 | ||||||

| Westlake Chemical Corp. |

5,312 | 374,762 | ||||||

|

|

|

|||||||

| 781,966 | ||||||||

|

|

|

|||||||

| Telecommunication Services – 2.90% |

| |||||||

| Verizon Communications, Inc. |

9,289 | 466,772 | ||||||

|

|

|

|||||||

| Utilities – 3.31% |

| |||||||

| Edison International |

8,540 | 534,433 | ||||||

|

|

|

|||||||

| TOTAL COMMON STOCKS (Cost $14,490,284) |

|

15,667,115 | ||||||

|

|

|

|||||||

| MONEY MARKET SECURITIES – 2.93% |

| |||||||

| Fidelity Institutional Money Market Portfolio – Institutional shares, 0.08% (a) |

472,131 | 472,131 | ||||||

|

|

|

|||||||

| TOTAL MONEY MARKET SECURITIES (Cost $472,131) |

472,131 | |||||||

|

|

|

|||||||

| TOTAL INVESTMENTS – 100.09% (Cost $14,962,415) |

16,139,246 | |||||||

|

|

|

|||||||

| Liabilities in Excess of Other Assets – (0.09)% | (15,250) | |||||||

|

|

|

|||||||

| TOTAL NET ASSETS – 100.00% | $ | 16,123,996 | ||||||

|

|

|

|||||||

| (a) | Rate disclosed is the seven day yield as of October 31, 2014. |

| * | Non-income producing security. |

See accompanying notes which are an integral part of these financial statements.

7

BRC LARGE CAP FOCUS EQUITY FUND

STATEMENT OF ASSETS AND LIABILITIES

October 31, 2014

| Assets |

||||

| Investments in securities at fair value (cost $14,962,415) |

$ | 16,139,246 | ||

| Receivable for investments sold |

1,844,259 | |||

| Dividends receivable |

9,401 | |||

| Receivable from Adviser |

10,980 | |||

| Prepaid expenses |

2,497 | |||

|

|

|

|||

| Total Assets |

18,006,383 | |||

|

|

|

|||

| Liabilities |

||||

| Payable for investments purchased |

1,853,138 | |||

| Payable to administrator, fund accountant, and transfer agent |

8,370 | |||

| Payable to custodian |

617 | |||

| Payable to trustees |

117 | |||

| Other accrued expenses |

20,145 | |||

|

|

|

|||

| Total Liabilities |

1,882,387 | |||

|

|

|

|||

| Net Assets |

$ | 16,123,996 | ||

|

|

|

|||

| Net Assets consist of: |

||||

| Paid-in capital |

$ | 13,846,077 | ||

| Accumulated undistributed net investment income |

90,722 | |||

| Accumulated undistributed net realized gain from investment transactions |

1,010,366 | |||

| Net unrealized appreciation on investments |

1,176,831 | |||

|

|

|

|||

| Net Assets |

$ | 16,123,996 | ||

|

|

|

|||

| Institutional Class: |

||||

| Shares outstanding (unlimited number of shares authorized, no par value) |

1,133,635 | |||

|

|

|

|||

| Net asset value, offering and redemption price per share |

$ | 14.22 | ||

|

|

|

|||

See accompanying notes which are an integral part of these financial statements.

8

BRC LARGE CAP FOCUS EQUITY FUND

STATEMENT OF OPERATIONS

For the year ended October 31, 2014

| Investment Income |

||||

| Dividend income |

$ | 182,297 | ||

|

|

|

|||

| Total investment income |

182,297 | |||

|

|

|

|||

| Expenses |

||||

| Investment Adviser |

58,884 | |||

| Administration |

37,501 | |||

| Fund accounting |

24,999 | |||

| Transfer agent |

40,359 | |||

| Custodian |

7,147 | |||

| Trustee |

6,086 | |||

| Pricing |

2,338 | |||

| Legal |

16,766 | |||

| Registration |

22,754 | |||

| Audit |

14,500 | |||

| Offering costs |

6,169 | |||

| Miscellaneous |

16,641 | |||

|

|

|

|||

| Total expenses |

254,144 | |||

|

|

|

|||

| Fees waived and reimbursed by Adviser |

(185,217 | ) | ||

|

|

|

|||

| Net operating expenses |

68,927 | |||

|

|

|

|||

| Net investment income |

113,370 | |||

|

|

|

|||

| Net Realized and Unrealized Gains on Investments |

||||

| Net realized gains on investment securities transactions |

1,010,366 | |||

| Net change in unrealized appreciation of investment securities |

402,177 | |||

|

|

|

|||

| Net realized and unrealized gains on investments |

1,412,543 | |||

|

|

|

|||

| Net increase in net assets resulting from operations |

$ | 1,525,913 | ||

|

|

|

|||

See accompanying notes which are an integral part of these financial statements.

9

BRC LARGE CAP FOCUS EQUITY FUND

STATEMENTS OF CHANGES IN NET ASSETS

| For the Year Ended October 31, 2014 |

For

the Period Ended October 31, 2013 (a) |

|||||||

| Increase in Net Assets due to: |

||||||||

| Operations |

||||||||

| Net investment income |

$ | 113,370 | $ | 32,747 | ||||

| Net realized gains on investment transactions |

1,010,366 | 242 | ||||||

| Net change in unrealized appreciation of investments |

402,177 | 774,654 | ||||||

|

|

|

|

|

|||||

| Net increase in net assets resulting from operations |

1,525,913 | 807,643 | ||||||

|

|

|

|

|

|||||

| Distributions |

||||||||

| Net investment income – Institutional Class |

(55,395 | ) | – | |||||

| Net realized gains – Institutional Class |

(242 | ) | – | |||||

|

|

|

|

|

|||||

| Total distributions |

(55,637 | ) | – | |||||

|

|

|

|

|

|||||

| Capital Transactions – Institutional Class |

||||||||

| Proceeds from shares sold |

8,031,528 | 7,316,024 | ||||||

| Reinvestment of distributions |

54,011 | – | ||||||

| Amount paid for shares redeemed |

(1,543,486 | ) | (12,000 | ) | ||||

|

|

|

|

|

|||||

| Net increase in net assets resulting from capital transactions |

6,542,053 | 7,304,024 | ||||||

|

|

|

|

|

|||||

| Total Increase in Net Assets |

8,012,329 | 8,111,667 | ||||||

|

|

|

|

|

|||||

| Net Assets |

||||||||

| Beginning of period |

8,111,667 | – | ||||||

|

|

|

|

|

|||||

| End of period |

$ | 16,123,996 | $ | 8,111,667 | ||||

|

|

|

|

|

|||||

| Accumulated undistributed net investment income |

$ | 90,722 | $ | 32,747 | ||||

|

|

|

|

|

|||||

| Share Transactions – Institutional Class |

||||||||

| Shares sold |

586,219 | 656,072 | ||||||

| Shares issued in reinvestment of distributions |

4,152 | – | ||||||

| Shares redeemed |

(111,818 | ) | (990 | ) | ||||

|

|

|

|

|

|||||

| Net increase in shares |

478,553 | 655,082 | ||||||

|

|

|

|

|

|||||

| (a) | For the period December 21, 2012 (commencement of operations) to October 31, 2013. |

See accompanying notes which are an integral part of these financial statements.

10

BRC LARGE CAP FOCUS EQUITY FUND

FINANCIAL HIGHLIGHTS – INSTITUTIONAL CLASS

(For a share outstanding during the period)

| For the Year Ended October 31, 2014 |

For

the Period Ended October 31, 2013 (a) |

|||||||

| Selected Per Share Data: |

||||||||

| Net asset value, beginning of period |

$ | 12.38 | $ | 10.00 | ||||

|

|

|

|

|

|||||

| Investment Operations: |

||||||||

| Net investment income |

0.11 | 0.05 | ||||||

| Net realized and unrealized gain on investments |

1.81 | 2.33 | ||||||

|

|

|

|

|

|||||

| Total from investment operations |

1.92 | 2.38 | ||||||

|

|

|

|

|

|||||

| Less distributions to shareholders from: |

||||||||

| Net investment income |

(0.08 | ) | – | |||||

| Net realized gains |

– | (b) | – | |||||

|

|

|

|

|

|||||

| Total distributions |

(0.08 | ) | – | |||||

|

|

|

|

|

|||||

| Net asset value, end of period |

$ | 14.22 | $ | 12.38 | ||||

|

|

|

|

|

|||||

| Total Return (c) |

15.60 | % | 23.80 | %(d) | ||||

| Ratios and Supplemental Data: |

||||||||

| Net assets, end of period (000) |

$ | 16,124 | $ | 8,112 | ||||

| Ratio of net expenses to average net assets |

0.55 | % | 0.56 | %(e) | ||||

| Ratio of expenses to average net assets before waiver and reimbursement |

2.03 | % | 6.49 | %(e) | ||||

| Ratio of net investment income to average net assets |

0.90 | % | 0.98 | %(e) | ||||

| Portfolio turnover rate |

192 | % | 154 | %(d) | ||||

| (a) | For the period December 21, 2012 (commencement of operations) to October 31, 2013. |

| (b) | Amount is less than $0.005. |

| (c) | Total return in the above table represents the rate that the investor would have earned or lost on an investment in the Fund, assuming reinvestment of distributions. |

| (d) | Not annualized. |

| (e) | Annualized. |

See accompanying notes which are an integral part of these financial statements.

11

BRC LARGE CAP FOCUS EQUITY FUND

NOTES TO THE FINANCIAL STATEMENTS

October 31, 2014

NOTE 1. ORGANIZATION

The BRC Large Cap Focus Equity Fund (the “Fund”) is an open-end diversified series of the Valued Advisers Trust (the “Trust”). The Trust is a management investment company established under the laws of Delaware by an Agreement and Declaration of Trust dated June 13, 2008 (the “Trust Agreement”). The Trust Agreement permits the Trust to issue an unlimited number of shares of beneficial interest of separate series without par value. The Fund is one of a series of funds authorized by the Board of Trustees (the “Board”). The Fund commenced operations December 21, 2012. The Fund’s investment adviser is BRC Investment Management LLC. (the “Adviser”). The investment objective of the Fund is to seek long-term capital appreciation that will exceed the S&P 500® Index over a three-to five-year time horizon.

The Fund is authorized to offer two classes of shares: Institutional Class and Advisor Class. Each share represents an equal proportionate interest in the assets and liabilities belonging to the Fund and is entitled to such dividends and distributions out of income belonging to the applicable class as are declared by the Trustees. Expenses attributable to any class are borne by that class. Income, expenses, and realized and unrealized gains/losses are allocated to the respective classes on the basis of relative daily net assets. On matters that affect the Fund as a whole, each class has the same voting and other rights and preferences as any other class. On matters that affect only one class, only shareholders of that class may vote. Each class votes separately on matters affecting only that class, or on matters expressly required to be voted on separately by state or federal law. Shares of each class of a series have the same voting and other rights and preferences as the other classes and series of the Trust for matters that affect the Trust as a whole. As of October 31, 2014, only Institutional Class shares have commenced operations. The Fund may offer additional classes of shares, including the Advisor class, in the future.

NOTE 2. SIGNIFICANT ACCOUNTING POLICIES

The following is a summary of significant accounting policies followed by the Fund in the preparation of its financial statements. These policies are in conformity with generally accepted accounting principles in the United States of America (“GAAP”).

Securities Valuation – All investments in securities are recorded at their estimated fair value as described in Note 3.

Federal Income Taxes – The Fund makes no provision for federal income or excise tax. The Fund intends to qualify each year as a regulated investment company (“RIC”) under subchapter M of the Internal Revenue Code of 1986, as amended, by complying with the requirements applicable to RICs and by distributing substantially all of its taxable income. The Fund also intends to distribute sufficient net investment income and net capital gains, if any, so that it will not be subject to excise tax on undistributed income and gains. If the required amount of net investment income or gains is not distributed, the Fund could incur a tax expense.

As of, and during the year ended, October 31, 2014, the Fund did not have a liability for any unrecognized tax benefits. The Fund recognizes interest and penalties, if any, related to unrecognized tax benefits as income tax expense in the Statement of Operations. During the year, the Fund did not incur any interest or penalties. The Fund is subject to examination by U.S. federal tax authorities for all tax years since inception.

12

BRC LARGE CAP FOCUS EQUITY FUND

NOTES TO THE FINANCIAL STATEMENTS – (continued)

October 31, 2014

NOTE 2. SIGNIFICANT ACCOUNTING POLICIES – continued

Expenses – Expenses incurred by the Trust that do not relate to a specific fund of the Trust are allocated to the individual funds based on each fund’s relative net assets or other appropriate basis (using procedures approved by the Board of Trustees).

Security Transactions and Related Income – The Fund follows industry practice and records security transactions on the trade date for financial reporting purposes. The first in, first out accounting method is used for determining gains or losses for financial statements and income tax purposes. Dividend income is recorded on the ex-dividend date and interest income is recorded on an accrual basis. Discounts and premiums on securities purchased are amortized or accreted using the effective interest method. Withholding taxes on foreign dividends, if any, have been provided for in accordance with the Fund’s understanding of the applicable country’s tax rules and rates. The ability of issuers of debt securities held by the Fund to meet their obligations may be affected by economic and political developments in a specific country or region.

Dividends and Distributions – The Fund intends to distribute substantially all of its net investment income, net realized long-term capital gains and its net realized short-term capital gains, if any, to its shareholders on at least an annual basis. Dividends to shareholders, which are determined in accordance with income tax regulations, are recorded on the ex-dividend date. The treatment for financial reporting purposes of distributions made to shareholders during the year from net investment income or net realized capital gains may differ from their ultimate treatment for federal income tax purposes. These differences are caused primarily by differences in the timing of the recognition of certain components of income, expense or realized capital gain for federal income tax purposes. Where such differences are permanent in nature, they are reclassified among the components of net assets based on their ultimate characterization for federal income tax purposes. Any such reclassifications have no effect on net assets, results of operations or net asset values per share of the Fund. There were no such material reclassifications made as of October 31, 2014.

NOTE 3. SECURITIES VALUATION AND FAIR VALUE MEASUREMENTS

Fair value is defined as the price that a Fund would receive upon selling an investment in a orderly transaction to an independent buyer in the principal or most advantageous market of the investment. GAAP established a three-tier hierarchy to maximize the use of observable market data and minimize the use of unobservable inputs and to establish classification of fair value measurements for disclosure purposes.

Inputs refer broadly to the assumptions that market participants would use in pricing the asset or liability, including assumptions about risk (ex., the risk inherent in a particular valuation technique used to measure fair value including items such as a pricing model and/or the risk inherent in the inputs to the valuation technique). Inputs may be observable or unobservable. Observable inputs are inputs that reflect the assumptions market participants would use in pricing the asset or liability developed based on market data obtained from sources independent of the reporting entity. Unobservable inputs are inputs that reflect the reporting entity’s own assumptions about the assumptions market participants would use in pricing the asset or liability developed based on the best information available in the circumstances.

Various inputs are used in determining the value of the Fund’s investments. These inputs are summarized in the three broad levels listed below.

| • | Level 1 – quoted prices in active markets for identical securities |

13

BRC LARGE CAP FOCUS EQUITY FUND

NOTES TO THE FINANCIAL STATEMENTS – (continued)

October 31, 2014

NOTE 3. SECURITIES VALUATION AND FAIR VALUE MEASUREMENTS – continued

| • | Level 2 – other significant observable inputs (including, but not limited to, quoted prices for an identical security in an inactive market, quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.) |

| • | Level 3 – significant unobservable inputs (including the Fund’s own assumptions in determining fair value of investments based on the best information available) |

The inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the level in the fair value hierarchy within which the fair value measurement falls in its entirety, is determined based on the lowest level input that is significant to the fair value measurement in its entirety.

Equity securities, including common stocks, are generally valued by using market quotations, furnished by a pricing service. Securities that are traded on any stock exchange are generally valued at the last quoted sale price. Lacking a last sale price, an exchange traded security is generally valued at its last bid price. Securities traded in the NASDAQ over-the-counter market are generally valued at the NASDAQ Official Closing Price. When using the market quotations or close prices provided by the pricing service and when the market is considered active, the security is classified as a Level 1 security. Sometimes, an equity security owned by the Fund will be valued by the pricing service with factors other than market quotations or when the market is considered inactive. When this happens, the security is classified as a Level 2 security. When market quotations are not readily available, when the Fund determines that the market quotation or the price provided by the pricing service does not accurately reflect the current fair value, or when restricted or illiquid securities are being valued, such securities are valued as determined in good faith by the Fund, in conformity with guidelines adopted by and subject to review by the Board. These securities are generally categorized as Level 3 securities.

Investments in open-end mutual funds, including money market mutual funds, are generally priced at the ending net asset value (NAV) provided by the service agent of the funds. These securities will be categorized as Level 1 securities.

In accordance with the Trust’s good faith pricing guidelines, the Fund is required to consider all appropriate factors relevant to the value of securities for which it has determined other pricing sources are not available or reliable as described above. No single standard exists for determining fair value, because fair value depends upon the circumstances of each individual case. As a general principle, the current fair value of an issue of securities being valued by the Fund would appear to be the amount which the owner might reasonably expect to receive for them upon their current sale. Methods which are in accordance with this principle may, for example, be based on (i) a multiple of earnings; (ii) a discount from market of a similar freely traded security (including a derivative security or a basket of securities traded on other markets, exchanges or among dealers); or (iii) yield to maturity with respect to debt issues, or a combination of these and other methods. Good faith pricing is permitted if, in the Fund’s opinion, the validity of market quotations appears to be questionable based on factors such as evidence of a thin market in the security based on a small number of quotations, a significant event occurs after the close of a market but before a Fund’s NAV calculation that may affect a security’s value, or the Fund is aware of any other data that calls into question the reliability of market quotations. Good faith pricing may also be used in instances when the bonds the Fund invests in may default or otherwise cease to have market quotations readily available. Any fair value pricing done outside the Fund’s approved pricing methods must be approved by the Pricing Committee of the Board.

14

BRC LARGE CAP FOCUS EQUITY FUND

NOTES TO THE FINANCIAL STATEMENTS – (continued)

October 31, 2014

NOTE 3. SECURITIES VALUATION AND FAIR VALUE MEASUREMENTS – continued

The following is a summary of the inputs used to value the Fund’s investments as of October 31, 2014:

| Valuation Inputs | ||||||||||||||||

| Assets | Level 1 – Quoted Prices in |

Level 2 – Other |

Level 3 – Significant |

Total | ||||||||||||

| Common Stocks* |

$ | 15,667,115 | $ | – | $ | – | $ | 15,667,115 | ||||||||

| Money Market Securities |

472,131 | – | – | 472,131 | ||||||||||||

|

Total |

$ | 16,139,246 | $ | – | $ | – | $ | 16,139,246 | ||||||||

| * | Refer to the Schedule of Investments for industry classifications. |

The Fund did not hold any investments at any time during the reporting period in which significant unobservable inputs were used in determining fair value; therefore, no reconciliation of Level 3 securities is included for this reporting period. The Fund recognizes transfers between fair value hierarchy levels at the reporting period end. There were no transfers between any Levels for the year ended October 31, 2014 and the previous measurement period.

NOTE 4. ADVISER FEES AND OTHER TRANSACTIONS

Under the terms of the management agreement, on behalf of the Fund (the “Agreement”), the Adviser manages the Fund’s investments subject to approval of the Trustees. As compensation for its management services, the Fund is obligated to pay the Adviser a fee computed and accrued daily and paid monthly at an annual rate of 0.47% of the average daily net assets of the Fund. For the year ended October 31, 2014, the Adviser earned a fee of $58,884 from the Fund before the reimbursement described below.

The Adviser has contractually agreed to waive its management fee and/or reimburse expenses through February 28, 2018, so that total annual fund operating expenses, excluding interest, taxes, brokerage commissions, other expenditures which are capitalized in accordance with GAAP, other extraordinary expenses not incurred in the ordinary course of the Fund’s business, dividend expense on short sales, 12b-1 expenses, and expenses that the Fund has incurred but did not actually pay because of an expense offset arrangement, if applicable, incurred by the Fund in any fiscal year, do not exceed 0.55% of the Fund’s average daily net assets. The operating expense limitation also excludes any fees and expenses of acquired funds. For the year ended October 31, 2014, expenses totaling $185,217 were waived or reimbursed by the Adviser and may be subject to potential recoupment by the Adviser until October 31, 2017. At October 31, 2014, the Adviser owed the Fund $10,980.

The amount subject to repayment by the Fund pursuant to the aforementioned conditions are as follows:

| Amount |

Recoverable through October 31, | |

| $198,220 |

2016 | |

| 185,217 |

2017 |

15

BRC LARGE CAP FOCUS EQUITY FUND

NOTES TO THE FINANCIAL STATEMENTS – (continued)

October 31, 2014

NOTE 4. ADVISER FEES AND OTHER TRANSACTIONS – continued

The Trust retains Huntington Asset Services, Inc. (“HASI”) to manage the Fund’s business affairs and provide the Fund with administrative services, including all regulatory reporting and necessary office equipment and personnel. For the year ended October 31, 2014, HASI earned fees of $37,501 for administrative services provided to the Fund. At October 31, 2014, HASI was owed $3,125 from the Fund for administrative services. Certain officers and trustees of the Trust are members of management and/or employees of HASI. HASI is a wholly-owned subsidiary of Huntington Bancshares, Inc., the parent company of Unified Financial Securities, Inc. (the “Distributor”) and Huntington National Bank, the custodian of the Fund’s investments (the “Custodian”). For the year ended October 31, 2014, the Custodian earned fees of $7,147 for custody services provided to the Fund. At October 31, 2014, the Custodian was owed $617 from the Fund for custody services.

The Trust also retains HASI to act as the Fund’s transfer agent and to provide transfer agent and fund accounting services. For the year ended October 31, 2014, HASI earned fees of $40,359 for transfer agent services to the Fund. At October 31, 2014, the Fund owed HASI $3,163 for transfer agent services. For the year ended October 31, 2014, HASI earned fees of $24,999 from the Fund for fund accounting services. At October 31, 2014, HASI was owed $2,082 from the Fund for fund accounting services.

Unified Financial Securities, Inc. acts as the principal underwriter of the Fund’s shares. There were no payments made by the Fund to the Distributor during the year ended October 31, 2014. An officer of the Trust is also an officer of the Distributor.

NOTE 5. PURCHASES AND SALES

For the year ended October 31, 2014, purchases and sales of investment securities, other than short-term investments and short-term U.S. government obligations, were as follows:

| Purchases |

||||

| U.S. Government Obligations |

$ | – | ||

| Other |

29,913,120 | |||

| Sales |

||||

| U.S. Government Obligations |

$ | – | ||

| Other |

23,676,813 |

NOTE 6. ESTIMATES

The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates.

NOTE 7. BENEFICIAL OWNERSHIP

The beneficial ownership, either directly or indirectly, of 25% or more of the voting securities of a fund creates a presumption of control of a fund, under Section 2(a) (9) of the Investment Company Act of 1940. At October 31, 2014, Charles Schwab & Co., Inc. for the benefit of its customers, owned 50.58% and Band & Co. owned 26.69%. It is not known whether Charles Schwab & Co., Band & Co., or any of the underlying beneficial owners controlled 25% or more of the voting securities of the Fund.

16

BRC LARGE CAP FOCUS EQUITY FUND

NOTES TO THE FINANCIAL STATEMENTS – (continued)

October 31, 2014

NOTE 8. FEDERAL TAX INFORMATION

At October 31, 2014, the net unrealized appreciation (depreciation) of investments for tax purposes was as follows:

| Gross Appreciation |

$ | 1,217,343 | ||

| Gross (Depreciation) |

(41,707 | ) | ||

|

|

|

|||

| Net Appreciation (Depreciation) on Investments |

$ | 1,175,636 | ||

|

|

|

At October 31, 2014, the aggregate cost of securities for federal income tax purposes was $14,963,610 for the Fund.

The tax characterization of distributions for the fiscal year ended October 31, 2014 was as follows:

| 2014 | ||||

| Distributions paid from: |

||||

| Ordinary income* |

$ | 55,637 | ||

| Long-Term Capital Gain |

– | |||

|

|

|

|||

| $ | 55,637 | |||

|

|

|

|||

| * | Short-term capital gain distributions are treated as ordinary income for tax purposes. |

At October 31, 2014, the components of distributable earnings (accumulated losses) on a tax basis were as follows:

| Undistributed ordinary income |

$ | 568,501 | ||

| Undistributed long-term capital gains |

533,782 | |||

| Net unrealized appreciation (depreciation) |

1,175,636 | |||

|

|

|

|||

| $ | 2,277,919 | |||

|

|

|

At October 31, 2014, the difference between book basis and tax basis unrealized appreciation (depreciation) is primarily attributable to the tax deferral of losses on wash sales in the amount of $1,195.

At October 31, 2014, for federal income tax purposes, the Fund has no capital loss carryforwards.

NOTE 9. COMMITMENTS AND CONTINGENCIES

The Fund indemnifies its officers and trustees for certain liabilities that may arise from the performance of their duties to the Fund. Additionally, in the normal course of business, the Fund enters into contracts that contain a variety of representations and warranties which provide general indemnifications. The Fund’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Fund that have not yet occurred.

NOTE 10. SUBSEQUENT EVENTS

Management of the Fund has evaluated the need for disclosures and/or adjustments resulting from subsequent events through the date these financial statements were issued. A special meeting of the shareholders of the Trust

17

BRC LARGE CAP FOCUS EQUITY FUND

NOTES TO THE FINANCIAL STATEMENTS – (continued)

October 31, 2014

NOTE 10. SUBSEQUENT EVENTS – continued

was held on December 19, 2014, for the purpose of electing the Board of Trustees, the results of the meeting can be can be found in the Proxy Voting Results Note (below).

NOTE 11. PROXY VOTING RESULTS (Unaudited)

On December 19, 2014 a special meeting of the shareholders of the Trust was held at the offices of the Trust for the purpose of electing each nominee to the Board of Trustees.

Below are the voting results for all funds from the special meeting of the Trust:

| To elect each nominee to the Board of Trustees: | ||||||||||||

| For | Against | Abstain | ||||||||||

| Ira Cohen | 280,591,916 | 20,930,930 | – | |||||||||

| Andrea N. Mullins | 296,332,857 | 5,189,989 | – | |||||||||

| R. Jeffrey Young | 280,517,160 | 21,005,685 | – | |||||||||

18

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Shareholders of BRC Large Cap Focus Equity Fund and

Board of Trustees of Valued Advisers Trust

We have audited the accompanying statement of assets and liabilities, including the schedule of investments, of BRC Large Cap Focus Equity Fund (the “Fund”), a series of Valued Advisers Trust, as of October 31, 2014, and the related statement of operations for the year then ended, and the statements of changes in net assets and the financial highlights for each of the two periods in the period then ended. These financial statements and financial highlights are the responsibility of the Fund’s management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of October 31, 2014, by correspondence with the custodian and brokers. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of BRC Large Cap Focus Equity Fund as of October 31, 2014, the results of its operations for the year then ended, and the changes in its net assets and financial highlights for each of the two periods in the period then ended, in conformity with accounting principles generally accepted in the United States of America.

COHEN FUND AUDIT SERVICES, LTD.

Cleveland, Ohio

December 23, 2014

19

TRUSTEES AND OFFICERS (Unaudited)

The Board of Trustees supervises the business activities of the Trust. Each Trustee serves as a trustee until termination of the Trust unless the Trustee dies, resigns, retires or is removed. The following tables provide information regarding the Trustees and Officers.

The following table provides information regarding each of the Independent Trustees.

| Name, Address*, (Age), Position with Trust**, Term of Position with Trust |

Principal Occupation During Past 5 Years |

Other Directorships | ||

| Andrea N. Mullins, 47, Independent Trustee, December 2013 to present. |

Private investor; Independent Contractor, Seabridge Wealth Management, LLC, since April 2014; Principal Financial Officer, Treasurer, and Secretary, Eagle Family of Funds (mutual fund family) and Vice President, Eagle Asset Management, Inc. (investment adviser) each from 2004 to 2010. | None. | ||

| Ira Cohen, 55, Independent Trustee, June 2010 to present. |

Independent financial services consultant (Feb. 2005 – present). | Trustee and Audit Committee Chairman, Griffin Institutional Access Real Estate Fund since May 2014. Trustee for the Angel Oak Funds Trust since October 2014. |

| * | The address for each trustee and officer is 2960 N. Meridian St., Suite 300, Indianapolis, IN 46208. |

| ** | As of the date of this SAI, the Trust consists of 14 series. |

20

The following table provides information regarding the Trustee who is considered an “interested person” of the Trust, as that term is defined under the 1940 Act. Based on the experience of the Trustee, the Trust concluded that the individual described below should serve as a Trustee.

| Name, Address*, (Age), Position with Trust**, Term of Position with Trust |

Principal Occupation During Past 5 Years |

Other Directorships | ||

| R. Jeffrey Young, 50, Trustee and Chairman, June 2010 to present; Principal Executive Officer and President, Valued Advisers Trust February 2010 to present. |

Senior Vice President, Huntington Asset Services, Inc., the Trust’s administrator, since January 2010, Director since May 2014; Director, Unified Financial Securities, Inc., the Trust’s distributor, since May 2014; Chief Executive Officer, Huntington Funds since February 2010; Chief Executive Officer, Huntington Strategy Shares since November 2010; President and Chief Executive Officer, Dreman Contrarian Funds, March 2011 to February 2013; Trustee, Valued Advisers Trust, August 2008 to January 2010; and Managing Director of WealthStone, from 2007 to 2010. | Trustee and Chairman, Capitol Series Trust, since September 2013. |

| * | The address for each trustee and officer is 2960 N. Meridian St., Suite 300, Indianapolis, IN 46208. |

| ** | As of the date of this SAI, the Trust consists of 14 series. |

21

The following table provides information regarding the Officers of the Trust:

| Name, Address*, (Age), Position with Trust,** Term of Position with Trust |

Principal Occupation During Past 5 Years |

Other Directorships | ||

| R. Jeffrey Young, 50, Trustee and Chairman, June 2010 to present; Principal Executive Officer and President, Valued Advisers Trust February 2010 to present. |

Senior Vice President, Huntington Asset Services, Inc., the Trust’s administrator, since January 2010, Director since May 2014; Director, Unified Financial Securities, Inc., the Trust’s distributor, since May 2014; Chief Executive Officer, Huntington Funds since February 2010; Chief Executive Officer, Huntington Strategy Shares since November 2010; President and Chief Executive Officer, Dreman Contrarian Funds March 2011 to February 2013; Trustee, Valued Advisers Trust, August 2008 to January 2010; and Managing Director of WealthStone, from 2007 to 2010. | Trustee and Chairman, Capitol Series Trust, since September 2013. | ||

| John C. Swhear, 53, Chief Compliance Officer, AML Officer and Vice President, August 2008 to present. |

Vice President of Legal Administration and Compliance, Huntington Asset Services, Inc., the Trust’s administrator, since April 2007, Director since May 2014; Chief Compliance Officer, Unified Financial Securities, Inc., the Trust’s distributor, since May 2007, Director since May 2014; President, Unified Series Trust since March 2012, Senior Vice President from May 2007 to March 2012; Chief Compliance Officer and AML Officer, Capitol Series Trust, since September 2013; Secretary, Huntington Funds from April 2010 to February 2012; President and Chief Executive Officer, Dreman Contrarian Funds from March 2010 to March 2011, Vice President and Acting Chief Executive Officer, 2007 to March 2010. | None. |

22

| Name, Address*, (Age), Position with Trust,** Term of Position with Trust |

Principal Occupation During Past 5 Years |

Other Directorships | ||

| Carol J. Highsmith, 50, Vice President, August 2008 to present; Secretary, March 2014 to present. |

Employed in various positions with Huntington Asset Services, Inc., the Trust’s administrator, since November of 1994; currently Vice President of Legal Administration; Secretary, Cross Shore Discovery Fund since May 2014. | None. | ||

| Matthew J. Miller, 38, Vice President, December 2011 to present. |

Employed in various positions with Huntington Asset Services, Inc., the Trust’s administrator, since July of 1998; currently Vice President of Relationship Management; Vice President, Huntington Funds since February 2010; President and Chief Executive Officer, Capitol Series Trust, since September 2013. | None. | ||

| Bryan W. Ashmus, 41, Principal Financial Officer and Treasurer, December 2013 to present. |

Vice President, Financial Administration, Huntington Asset Services, Inc., the Trust’s administrator, since September 2013; Chief Financial Officer and Treasurer, Huntington Strategy Shares and Huntington Funds, since November 2013; Vice President, Treasurer Services, Citi Fund Services Ohio, Inc., from 2005 to 2013. | None. |

| * | The address for each trustee and officer is 2960 N. Meridian St., Suite 300, Indianapolis, IN 46208. |

| ** | As of the date of this SAI, the Trust consists of 14 series. |

23

MANAGEMENT AGREEMENT RENEWAL (Unaudited)

At a meeting held on September 16, 2014, the Board of Trustees (the “Board”) considered the renewal of the Investment Advisory Agreement (the “Agreement”) between the Trust and BRC Investment Management, Inc. (the “Adviser” or “BRC”) with respect to the BRC Large Cap Focus Equity Fund (the “Fund”). Counsel noted that the 1940 Act requires the approval of the investment advisory agreement between the Trust and its investment adviser by the Board, including a majority of the Independent Trustees. The Board discussed the arrangements between the Adviser and the Trust with respect to the Fund.

Counsel discussed with the Trustees the types of information and factors that should be considered by the Board in order to make an informed decision regarding the approval of the Agreement, including the following material factors: (i) the nature, extent, and quality of the services to be provided by BRC; (ii) the investment performance of the Fund; (iii) the costs of the services to be provided and anticipated profits to be realized by BRC from the relationship with the Fund; (iv) the extent to which economies of scale would be realized if the Fund grows and whether advisory fee levels reflect those economies of scale for the benefit of the Fund’s investors; and (v) BRC’s practices regarding possible conflicts of interest and potential benefits derived from its relationship with the Fund.

In assessing the factors and reaching its decision, the Board took into consideration information furnished for the Board’s review and consideration throughout the year at regular Board meetings, as well as information specifically requested and prepared and/or presented in connection with the annual renewal process, including information presented at the meeting. The Board was provided with, and reflected on, information and reports relevant to the annual renewal of the Agreement, including (i) reports regarding the services and support provided to the Fund and its shareholders by BRC; (ii) quarterly assessments of the investment performance of the Fund by personnel of BRC; (iii) commentary on the reasons for the performance; (iv) presentations by BRC addressing investment philosophy, investment strategy, personnel and operations of BRC; (v) compliance and audit reports concerning the Fund and BRC; (vi) disclosure information contained in the registration statement of the Trust with respect to the Fund and the Form ADV of BRC; and (vii) a memorandum from Counsel, that summarized the fiduciary duties and responsibilities of the Board in reviewing and approving the Agreement, including the material factors set forth above and the types of information included in each factor that should be considered by the Board in order to make an informed decision. The Board also requested and received various informational materials including, without limitation: (i) documents containing information about BRC, including financial information, a description of personnel and the managerial services provided to the Fund, information on investment advice, performance, summaries of Fund expenses, compliance program, current legal matters, and other general information; (ii) comparative expense and performance information for other mutual funds with strategies similar to the Fund, as well as for separate accounts managed by BRC; and (iii) benefits to be realized by BRC from its relationship with the Fund. The Board did not identify any particular information that was most relevant to its consideration to approve the Agreement and each Trustee may have afforded different weight to the various factors.

| 1. | The nature, extent, and quality of the services to be provided by the Adviser. In this regard, the Board considered the Adviser’s responsibilities under the Advisory Agreement. The Board reviewed the services being provided by BRC to the Fund including, without limitation: BRC’s procedures for formulating investment recommendations and assuring compliance with the Fund’s investment objectives and limitations; its anticipated coordination of services for the Fund among the Fund’s service providers, and its efforts to promote the Fund, grow its assets, and assist in the distribution of the Fund shares. The Board considered: BRC’s staffing, personnel, and methods of operating; the education and experience of BRC’s personnel; and BRC’s compliance program, policies, and procedures. The Trustees also discussed BRC’s continued cooperation with the Independent Trustees and Counsel for the Fund. After reviewing the foregoing and further information from BRC (including BRC’s Form ADV), the Board concluded that, in light of all the facts and circumstances, the quality, extent, and nature of the services provided by BRC were satisfactory and adequate for the Fund. |

24

| 2. | Investment Performance of the Fund and the Adviser. In evaluating the investment performance of the Fund and the Adviser, the Trustees compared the short-term performance, including the year-to-date, one month, three month, and 1-year cumulative return and since inception annualized returns of the Fund (for the periods ending July 31, 2014) with the performance of funds with similar objectives managed by other investment advisers, as well as with aggregated peer group data. The Trustees also considered the consistency of BRC’s management of the Fund with its investment objective, strategies, and limitations. The Trustees noted that the Fund’s performance was above the median and the average of its peers for all periods presented. It was also noted that the Fund outperformed its benchmark for all periods presented. The Board also considered the performance of BRC’s separate accounts that were managed in a manner similar to that of the Fund and they noted that the performance was very comparable. Following further discussion regarding the performance of the Fund, BRC’s experience managing the Fund, the Fund’s historical performance, and other relevant factors, the Board concluded, in light of all the facts and circumstances, that the investment performance of the Fund and BRC was satisfactory. |

| 3. | The costs of the services to be provided and profits to be realized by the Adviser from the relationship with the Fund. In considering the costs of services to be provided and the profits to be realized by the Adviser from the relationship with the Fund, the Trustees considered: (1) BRC’s financial condition; (2) the asset levels of the Fund; (3) the overall expenses of the Fund; and (4) the nature and frequency of advisory fee payments. The Trustees reviewed information provided by BRC regarding its profits associated with managing the Fund. The Trustees also considered potential benefits for BRC in managing the Fund. The Trustees compared the fees and expenses of the Fund (including the management fee) to other comparable mutual funds. The Trustees noted that the Fund’s management fee was among the lowest in its peer group, and it was lower than its peer average and median. They also discussed the fact that BRC had, during the initial two-year term of the Advisory Agreement, voluntarily proposed an amendment to the Fund’s management agreement to lower the advisory fee. The Trustees also noted that the advisory fee paid by the Fund was lower than the fee paid by BRC’s separate account clients at the current asset level of the Fund. Based on the foregoing, the Board concluded that the fees to be paid to BRC by the Fund and the profits to be realized by the Fund, in light of all the facts and circumstances, were fair and reasonable in relation to the nature and quality of the services provided by BRC. |

| 4. | The extent to which economies of scale would be realized as the Fund grows and whether advisory fee levels reflect these economies of scale for the benefit of the Fund’s investors. In this regard, the Board considered the Fund’s fee arrangements with the Adviser. The Board noted that the management fee remained the same as asset levels increased, although it also noted that the shareholders of the Fund had experienced benefits from the Expense Limitation Agreement. The Board noted that the Adviser had voluntarily proposed to the Trust to lower its advisory fee during the initial two-year term of the Advisory Agreement. The Trustees also noted BRC’s willingness to extend the Expense Limitation Agreement for an additional two years. The Board also noted that the Fund would benefit from economies of scale under its agreements with service providers other than BRC. Based on its ongoing consideration of the Fund’s asset levels, expectations for growth, and fee levels, the Board determined that the Fund’s fee arrangements with BRC were fair and reasonable in relation to the nature and quality of the services provided by BRC. |

| 5. | Possible conflicts of interest and benefits to the Adviser. In considering the Adviser’s practices regarding conflicts of interest, the Trustees evaluated the potential for conflicts of interest and considered such matters as the experience and ability of the advisory personnel assigned to the Fund; the basis of decisions to buy or sell securities for the Fund and/or BRC’s other accounts; and the substance and administration of BRC’s code of ethics. The Trustees also considered disclosure in the registration statement of the Trust relating to BRC’s potential conflicts of interest. The Trustees discussed BRC’s practices with regard to soft dollars. The Trustees noted that BRC benefited from the Fund in that it is able to utilize the Fund as a vehicle into which to direct defined contribution plans. The Trustees did not identify any other potential benefits (other than the management fee) that would be realized by BRC. Based on the foregoing, the Board determined |

25

| that the standards and practices of BRC relating to the identification and mitigation of potential conflicts of interest and the benefits that it derives from managing the Fund are acceptable. |

After additional consideration of the factors delineated in the memorandum provided by Counsel and further discussion among the Board, the Board determined to approve the continuation of the Agreement between the Trust and the Adviser.

26

OTHER FEDERAL INCOME TAX INFORMATION (Unaudited)

The Form 1099-DIV you receive in January 2015 will show the tax status of all distributions paid to your account in calendar year 2014. Shareholders are advised to consult their own tax adviser with respect to the tax consequences of their investment in the Fund. As required by the Internal Revenue Code and/or regulations, shareholders must be notified regarding the status of qualified dividend income for individuals and the dividends received deduction for corporations.

Qualified Dividend Income. For the Fund’s fiscal year 2014 the Fund designates approximately 29.73% or up to the maximum amount of such dividends allowable pursuant to the Internal Revenue Code, as qualified dividend income eligible for the reduced tax rate of 15%.

Dividends Received Deduction. Corporate shareholders are generally entitled to take the dividends received deduction on the portion of the Fund’s dividend distribution that qualifies under tax law. For the Fund’s fiscal year 2014 ordinary income dividends, 29.32% qualifies for the corporate dividends received deduction.

For the year ended October 31, 2014, the Fund designated $242 as short-term capital gain distributions.

27

OTHER INFORMATION

The Fund’s Statement of Additional Information (“SAI”) includes additional information about the trustees and is available without charge, upon request. You may call toll-free at (877) 272-1214 to request a copy of the SAI or to make shareholder inquiries.

PROXY VOTING

A description of the policies and procedures that the Fund uses to determine how to vote proxies relating to portfolio securities and information regarding how the Fund voted those proxies is available without charge upon request by (1) calling the Fund at (877) 272-1214 and (2) from Fund documents filed with the Securities and Exchange Commission (“SEC”) on the SEC’s website at www.sec.gov.

This report is intended only for the information of shareholders or those who have received the Fund’s prospectus which contains information about the Fund’s management fee and expenses. Please read the prospectus carefully before investing.

Distributed by Unified Financial Securities, Inc.

Member FINRA/SIPC

28

PRIVACY POLICY

The following is a description of the Fund’s policies regarding disclosure of nonpublic personal information that you provide to the Fund or that the Fund collects from other sources. In the event that you hold shares of the Fund through a broker-dealer or other financial intermediary, the privacy policy of your financial intermediary would govern how your nonpublic personal information would be shared with nonaffiliated third parties.

Categories of Information the Fund Collects. The Fund collects the following nonpublic personal information about you:

| • | Information the Fund receives from you on applications or other forms, correspondence, or conversations (such as your name, address, phone number, social security number, and date of birth); and |

| • | Information about your transactions with the Fund, its affiliates, or others (such as your account number and balance, payment history, cost basis information, and other financial information). |

Categories of Information the Fund Discloses. The Fund does not disclose any nonpublic personal information about its current or former shareholders to unaffiliated third parties, except as required or permitted by law. The Fund is permitted by law to disclose all of the information it collects, as described above, to service providers (such as the Fund’s custodian, administrator, transfer agent, accountant and legal counsel) to process your transactions and otherwise provide services to you.

Confidentiality and Security. The Fund restricts access to your nonpublic personal information to those persons who require such information to provide products or services to you. The Fund maintains physical, electronic, and procedural safeguards that comply with federal standards to guard your nonpublic personal information.

Disposal of Information. The Fund, through its transfer agent, has taken steps to reasonably ensure that the privacy of your nonpublic personal information is maintained at all times, including in connection with the disposal of information that is no longer required to be maintained by the Fund. Such steps shall include, whenever possible, shredding paper documents and records prior to disposal, requiring off-site storage vendors to shred documents maintained in such locations prior to disposal, and erasing and/or obliterating any data contained on electronic media in such a manner that the information can no longer be read or reconstructed.

29

Annual Report

October 31, 2014

Fund Adviser:

Granite Investment Advisors, Inc.

11 South Main Street, Suite 501

Concord, New Hampshire 03301

Toll Free (888) 442-9893

DISCUSSION – (Unaudited)

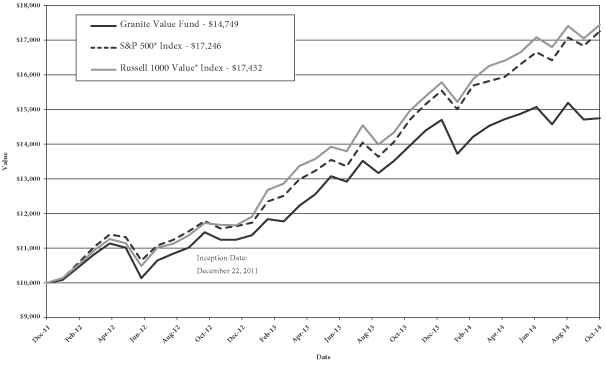

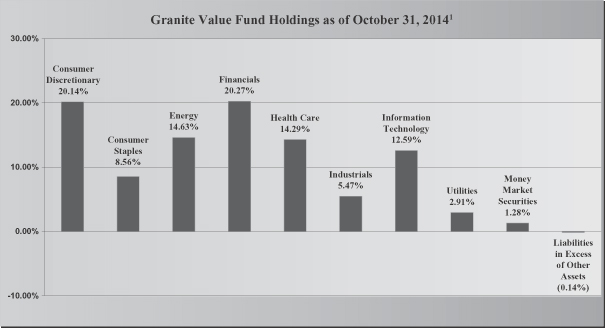

Our fiscal year ended October 31, 2014 has been an unsatisfactory year for our performance. This is my responsibility as the Chief Investment Officer, and one which I take very seriously. The buck stops here. As of the end of October, we were up 5.7% in the Granite Value Fund versus the S&P 500 which was up 17.3% and the Russell 1000 Value which was up 16.5%. On the year, against the Dow Jones Industrial Average we look a little better, as it was up 14.5%. Our performance gap has closed somewhat in October, but still exists. While we are trailing these indices, we are closer to the Russell 2000 (a small/mid cap index), which is up 8.1% through the end of October. It is our responsibility to you, our client, to look into periods of both underperformance and over performance to see what we can learn from them. How much can be attributed to great research? Or errors in our research conclusions? Was our timing off? Or was it simply luck (good or bad)?

As we have stated in past, because we run a concentrated portfolio, there will be times when we deviate from the indices: both up and down. However, if you look at our long-term track record net of fees, we are still ahead of the S&P 500. Closer examination reveals three other periods where we underperformed by a similar magnitude and one where we underperformed more than we did this year. Following those periods, we outperformed the market and made up for lost ground. While we cannot guarantee results, we are confident in our disciplined investment process and our ability to bounce back.

In the fall of 1984, Warren Buffett gave a lecture at Columbia Business School titled, “The Superinvestors of Graham-and-Doddsville.” In this speech, he chronicled the investment performance of Benjamin Graham’s (the grandfather of value investing) former students. Included in this group were Warren Buffett, Charlie Munger, Bill Ruane, and six others. It was no surprise to learn that they all had fantastic long-term track records. What was surprising was to learn that they all underperformed their benchmarks 30-40% of the time during their careers. One reason for this is that if you want to beat the indices, your holdings must differ from them. However, by deviating from the indices, performance is almost guaranteed to be different: sometimes you will outperform and other times you will underperform. Like these well-known investors, we attempt to beat the market over time by differentiating ourselves from the indices. Therefore, some aspects of our shortfall this year can be attributed to the natural path of our investment process and philosophy.

Upon closer inspection, some of our issues were self-inflicted: we made mistakes in our research process. Three companies had a significant negative impact on our performance: Coach, Tesco, and Weight Watchers. While each company is different, we made a similar mistake with all three: we believed that their issues were cyclical (tied to the economy), when in fact they were secular (competitive and/or industry trends that are longer lasting). While we still believe all three companies are great businesses, it will take longer for these companies to fix their issues than we originally estimated.

Tesco is a great example: it has long been viewed as one of the best and largest retailers in the world, second only to Wal-Mart. Our research showed Tesco to have many of the attributes and indications that have led to successful investment outcomes in the past: an attractive valuation, high profitability, a high dividend to compensate investors for their patience, a historically stable business, dominant market share, strong international growth, and innovation in a stodgy industry (through its delivery and online ordering options). We also believed that we had a large margin of safety: our analysis concluded that Tesco’s real estate holdings were worth more than the entire company’s valuation. Our belief at the time was that the hardships Tesco faced had more to do with the overall British and European economies. We knew Tesco was under some pressure in the U.K. from discounters, but assumed that the company could maintain its dominant market share. We also believed that like the U.S. consumer, the U.K. consumer would move away from discounters when their confidence and their country’s economy improved. Another comforting sign was that Berkshire Hathaway was, and still is, one of Tesco’s largest shareholders. Given our long term focus, we tried to remain as patient as possible. However, once Tesco began to exhibit significant market share losses, we began to look into another scenario: what would happen if management cut prices to match the discounters? Our research indicated that if they did indeed slash prices, the company would no longer be able to sustain its sizeable dividend. Therefore, we sold our position. We still believe that Tesco will have its day in the sun. However, until new management finalizes and communicates a new, concrete strategy and addresses other significant operational issues, the stock

1

is not an investable idea. While it resulted in a loss, our average sale price was 32% higher than where the stock currently trades; we avoided further losses by exiting our position before additional price deterioration.

Apple is a great example of why having a long-term focus is important. It has been our second best performer this calendar year and is up more than 25%. Conversely, it was one of our worst performers last year: in 2013, the market was up more than 30%, whereas Apple was up only 5%. After reassessing our initial investment thesis last year, we determined that the company remained an innovative powerhouse, with an incredibly valuable brand, and that it was still trading at a very attractive price. Therefore, we decided to hold our position, and it paid off this year.

As value investors, we are constantly faced with challenging decisions. There are times where we have to admit that we are wrong and cut our losses, as was the case with Tesco. On the contrary, there are times where we must have the courage to remain steadfast in our initial beliefs, even when the market does not agree with us. Apple is a prime example.