UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-22208

Valued Advisers Trust

(Exact name of registrant as specified in charter)

| Huntington Asset Services, Inc. 2960 N. Meridian Street, Suite 300 |

Indianapolis, IN 46208 | |

| (Address of principal executive offices) | (Zip code) |

Capitol Services, Inc.

615 S. Dupont Hwy.

Dover, DE 19901

(Name and address of agent for service)

With a copy to:

John H. Lively, Esq.

The Law Offices of John H. Lively & Associates, Inc.

A member firm of The 1940 Act Law GroupTM

11300 Tomahawk Creek Parkway,

Suite 310

Leawood, KS 66221

Registrant’s telephone number, including area code: 317-917-7000

Date of fiscal year end: 10/31

Date of reporting period: 04/30/14

| Item 1. | Reports to Stockholders. |

-2-

BRC

Large Cap

Focus Equity Fund

Semi-Annual Report

April 30, 2014

Fund Adviser:

BRC Investment Management LLC

8400 East Prentice Avenue, Suite 1401

Greenwood Village, Colorado 80111

Toll Free (877) 272-1214

LETTER FROM CHIEF INVESTMENT OFFICER – (Unaudited)

The investment strategy of the BRC Large Cap Focus Equity Fund (the “Fund”) is based on our belief that future investor expectations are strongly influenced by the opinions, forecasts and announcements of perceived market experts, including Wall Street analysts and company management. By incorporating a combination of proprietary behavioral valuation techniques, we seek to invest in companies that are likely to be the beneficiaries of future favorable earnings announcements and upward earnings estimate revisions. Regardless of market conditions, so long as the predictive abilities of the quantitative models remain strong and investors continue to react to industry experts, the management team expects this investment strategy to provide above average returns over a typical 3-5 year investment cycle.

For this reporting period, the management team was satisfied with the predictive abilities of the quantitative model and the implementation of the investment process. The Fund held equity positions representing those securities that were highly ranked by our quantitative models and were evaluated and approved by our fundamental analysts.

| • | Holdings in the Fund’s portfolio received significantly more upward analyst revisions compared to a hypothetical portfolio of stocks randomly selected from the large-cap universe would have been expected to receive. |

| • | On the earnings-surprise front, a significant number of portfolio companies announced earnings that were materially higher than analyst expectations, with only a few companies reporting materially negative earnings surprises. |

As a result of our ability to select and manage the securities in the portfolio, the performance results exceeded the benchmark for the reporting period. The behavior we seek to identify and monetize was evident and achieved the intended results.

The Adviser has proprietary tools for tacking and monitoring risk factors. Some of the factors we focus on include; value factors (P/B, P/E, P/S, P/CF etc.); medium-term and short-term momentum; market capitalization; beta; and volatility, among others. Using analytical tools that are distinct from those of portfolio management, the risk management process assesses the risks embedded in the strategy.

We monitor the levels and trends of fundamental factor exposures, economic sector exposures, and the composition and magnitude of residual risk versus various benchmarks and indices. For the reporting period, this risk management process resulted in even sector and style exposures and a realized beta significantly lower than the market.

On behalf of the management team, I would like to thank you for your continued support. You have our commitment to the consistent application of our investment process and to a proprietary research agenda that will drive our ongoing effort to add value for our clients.

John R. Riddle, CFA

Managing Principal and Chief Investment Officer

1

INVESTMENT RESULTS – (Unaudited)

| Total

Returns* (for the periods ended April 30, 2014) |

||||||||||||

| Six Months | One Year | Since Inception (December 21, 2012) |

||||||||||

| BRC Large Cap Focus Equity Fund - Institutional Class |

10.07 | % | 22.76 | % | 25.57 | % | ||||||

| S&P 500 Index®** |

8.36 | % | 20.44 | % | 24.17 | % | ||||||

Total annual operating expenses, as disclosed in the Fund’s prospectus dated February 28, 2014, were 6.44% of net assets for the Institutional Class (0.55% after fee waivers/expense reimbursements by the Adviser). The Adviser has contractually agreed to waive or limit its fees and to assume other expenses of the Fund until February 29, 2016, so that the Total Annual Fund Operating Expenses does not exceed 0.55%. This operating expense limitation does not apply to interest, taxes, brokerage commissions, other expenditures which are capitalized in accordance with generally accepted accounting principles, other extraordinary expenses not incurred in the ordinary course of the Fund’s business, dividend expense on short sales, expenses incurred under a Rule 12b-1 plan of distribution, “acquired fund fees and expenses,” and expenses that the Fund has incurred but did not actually pay because of an expense offset arrangement.

The performance quoted represents past performance, which does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Current performance of the Fund may be lower or higher than the performance quoted. The Fund’s investment objectives, risks, charges and expenses must be considered carefully before investing. Performance data current to the most recent month end may be obtained by calling (877) 272-1214.

| * | Return figures reflect any change in price per share and assume the reinvestment of all distributions. |

| ** | The S&P 500® Index is a widely recognized unmanaged index of equity securities and are representative of a broader domestic equity market and range of securities than is found in the Fund’s portfolio. Individuals cannot invest directly in an Index; however, an individual can invest in exchange traded funds or other investment vehicles that attempt to track the performance of a benchmark index. |

The Fund’s investment objectives, strategies, risks, charges and expenses must be considered carefully before investing. The prospectus contains this and other important information about the Fund and may be obtained by calling the same number as above. Please read it carefully before investing.

The Fund is distributed by Unified Financial Securities, Inc., member FINRA.

2

INVESTMENT RESULTS – (Unaudited)

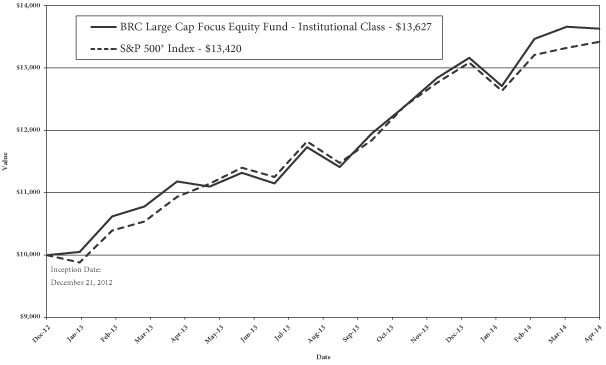

Comparison of the Growth of a $10,000 Investment in the BRC Large Cap Focus Equity Fund - Institutional Class and the S&P 500® Index (Unaudited)

The chart above assumes an initial investment of $10,000 made on December 21, 2012 (commencement of Institutional Class operations) and held through April 30, 2014. The S&P 500® Index is a widely recognized unmanaged index of equity securities and is representative of a broader domestic equity market and range of securities than is found in the Fund’s portfolio. Individuals cannot invest directly in an Index; however, an individual can invest in exchange traded funds or other investment vehicles that attempt to track the performance of a benchmark index. THE FUND’S RETURN REPRESENTS PAST PERFORMANCE AND DOES NOT GUARANTEE FUTURE RESULTS. The returns shown do not reflect deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Investment returns and principal values will fluctuate so that your shares, when redeemed, may be worth more or less than their original purchase price.

Current performance may be lower or higher than the performance data quoted. For more information on the Fund, and to obtain performance data current to the most recent month end or to request a prospectus, please call (877) 272-1214. You should carefully consider the investment objectives, potential risks, management fees, and charges and expenses of the Fund before investing. The Fund’s prospectus contains this and other information about the Fund, and should be read carefully before investing.

The Fund is distributed by Unified Financial Securities, Inc., member FINRA.

3

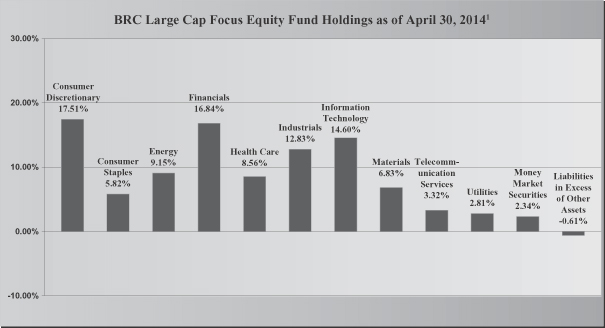

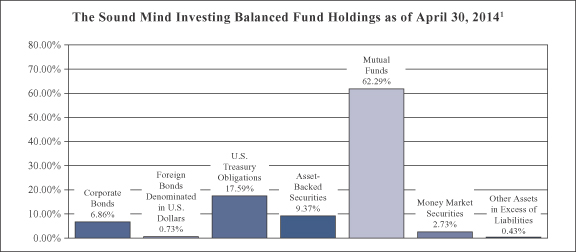

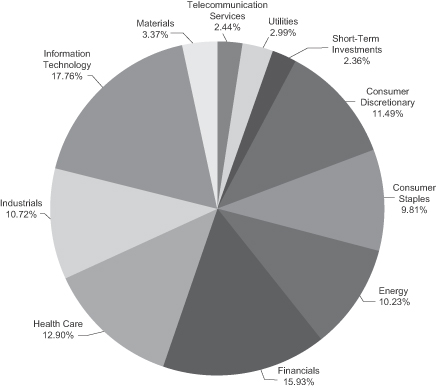

FUND HOLDINGS – (Unaudited)

| 1 | As a percentage of net assets. |

The investment objective of the BRC Large Cap Focus Equity Fund is to seek long-term capital appreciation that will exceed the S&P 500 Index over a three-to-five year time horizon.

Availability of Portfolio Schedule – (Unaudited)

The Fund files its complete schedule of portfolio holdings with the Securities and Exchange Commission (“SEC”) for the first and third quarters of each fiscal year on Form N-Q. The Fund’s Forms N-Q are available at the SEC’s website at www.sec.gov. The Fund’s Forms N-Q may be reviewed and copied at the SEC’s Public Reference Room in Washington DC. Information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330.

Summary of Fund’s Expenses – (Unaudited)

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, such as short-term redemption fees; and (2) ongoing costs, including management fees and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 invested at the beginning and held for the entire period from November 1, 2013 to April 30, 2014.

4

Actual Expenses

The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = $8.60), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During the Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only. Therefore, the second line of the table below is useful in comparing ongoing costs only and will not help you determine the relative costs of owning different funds.

| BRC Large Cap Focus Equity Fund – Institutional |

Beginning November 1, 2013 |

Ending Account Value April 30, 2014 |

Expenses Paid April 30, 2014 |

|||||||||

|

Actual* |

$ | 1,000.00 | $ | 1,100.70 | $ | 2.86 | ||||||

|

Hypothetical** |

$ | 1,000.00 | $ | 1,022.07 | $ | 2.76 | ||||||

| * | Expenses are equal to the Fund’s annualized expense ratio of 0.55%, multiplied by the average account value over the period, multiplied by 181/365. |

| ** | Assumes a 5% return before expenses. |

5

BRC LARGE CAP FOCUS EQUITY FUND

SCHEDULE OF INVESTMENTS

April 30, 2014 (Unaudited)

| COMMON STOCKS – 98.27% | Shares | Fair Value | ||||||

| Consumer Discretionary – 17.51% |

| |||||||

| BorgWarner, Inc. |

6,826 | $ | 424,168 | |||||

| Foot Locker, Inc. |

9,139 | 425,238 | ||||||

| Home Depot, Inc./The |

4,358 | 346,505 | ||||||

| Michael Kors Holdings Ltd. * |

3,946 | 359,875 | ||||||

| Viacom, Inc. – Class B |

4,403 | 374,167 | ||||||

| Wyndham Worldwide Corp. |

5,165 | 368,471 | ||||||

|

|

|

|||||||

| 2,298,424 | ||||||||

|

|

|

|||||||

| Consumer Staples – 5.82% |

| |||||||

| Constellation Brands, Inc. – Class A * |

4,738 | 378,282 | ||||||

| CVS Caremark Corp. |

5,302 | 385,561 | ||||||

|

|

|

|||||||

| 763,843 | ||||||||

|

|

|

|||||||

| Energy – 9.15% |

| |||||||

| EOG Resources, Inc. |

4,083 | 400,134 | ||||||

| Helmerich & Payne, Inc. |

3,640 | 395,486 | ||||||

| Valero Energy Corp. |

7,100 | 405,907 | ||||||

|

|

|

|||||||

| 1,201,527 | ||||||||

|

|

|

|||||||

| Financials – 16.84% |

| |||||||

| Discover Financial Services |

6,658 | 372,182 | ||||||

| Lincoln National Corp. |

7,649 | 371,053 | ||||||

| Prudential Financial, Inc. |

4,220 | 340,470 | ||||||

| T. Rowe Price Group, Inc. |

4,692 | 385,354 | ||||||

| Travelers Cos., Inc./The |

3,885 | 351,903 | ||||||

| Wells Fargo & Co. |

7,862 | 390,270 | ||||||

|

|

|

|||||||

| 2,211,232 | ||||||||

|

|

|

|||||||

| Health Care – 8.56% |

| |||||||

| Aetna, Inc. |

5,333 | 381,043 | ||||||

| Biogen Idec, Inc. * |

1,295 | 371,820 | ||||||

| Cardinal Health, Inc. |

5,333 | 370,697 | ||||||

|

|

|

|||||||

| 1,123,560 | ||||||||

|

|

|

|||||||

| Industrials – 12.83% |

| |||||||

| ManpowerGroup |

4,754 | 386,690 | ||||||

| Northrop Grumman Corp. |

3,794 | 461,009 | ||||||

| Raytheon Co. |

4,266 | 407,318 | ||||||

| Snap-on, Inc. |

3,702 | 429,432 | ||||||

|

|

|

|||||||

| 1,684,449 | ||||||||

|

|

|

|||||||

See accompanying notes which are an integral part of these financial statements.

6

BRC LARGE CAP FOCUS EQUITY FUND

SCHEDULE OF INVESTMENTS – (continued)

April 30, 2014 (Unaudited)

| COMMON STOCKS – 98.27%– continued | Shares | Fair Value | ||||||

| Information Technology – 14.60% |

| |||||||

| Accenture PLC – Class A |

4,403 | $ | 353,209 | |||||

| Amdocs Ltd. |

8,453 | 393,318 | ||||||

| Intuit, Inc. |

4,890 | 370,417 | ||||||

| Microchip Technology, Inc. |

9,110 | 433,089 | ||||||

| TE Connectivity Ltd. |

6,216 | 366,620 | ||||||

|

|

|

|||||||

| 1,916,653 | ||||||||

|

|

|

|||||||

| Materials – 6.83% |

| |||||||

| Lyondellbasell Industries NV – Class A |

4,693 | 434,102 | ||||||

| Westlake Chemical Corp. |

6,490 | 462,088 | ||||||

|

|

|

|||||||

| 896,190 | ||||||||

|

|

|

|||||||

| Telecommunication Services – 3.32% |

| |||||||

| Level 3 Communications, Inc. * |

10,120 | 435,464 | ||||||

|

|

|

|||||||

| Utilities – 2.81% |

| |||||||

| Public Service Enterprise Group, Inc. |

9,019 | 369,508 | ||||||

|

|

|

|||||||

| TOTAL COMMON STOCKS (Cost $11,752,859) |

|

12,900,850 | ||||||

|

|

|

|||||||

| MONEY MARKET SECURITIES – 2.34% |

| |||||||

| Fidelity Institutional Money Market Portfolio – Institutional Class, 0.06% (a) |

307,697 | 307,697 | ||||||

|

|

|

|||||||

| TOTAL MONEY MARKET SECURITIES (Cost $307,697) |

307,697 | |||||||

|

|

|

|||||||

| TOTAL INVESTMENTS – 100.61% (Cost $12,060,556) |

13,208,547 | |||||||

|

|

|

|||||||

| Liabilities in Excess of Other Assets – (0.61)% | (80,704) | |||||||

|

|

|

|||||||

| TOTAL NET ASSETS – 100.00% | $ | 13,127,843 | ||||||

|

|

|

|||||||

| (a) | Rate disclosed is the seven day yield as of April 30, 2014. |

| * | Non-income producing security. |

See accompanying notes which are an integral part of these financial statements.

7

BRC LARGE CAP FOCUS EQUITY FUND

STATEMENT OF ASSETS AND LIABILITIES

April 30, 2014 (Unaudited)

| Assets |

||||

| Investments in securities at fair value (cost $12,060,556) |

$ | 13,208,547 | ||

| Receivable for investments sold |

814,325 | |||

| Dividends receivable |

16,410 | |||

| Interest receivable |

18 | |||

| Receivable from Adviser |

9,409 | |||

| Prepaid expenses |

17,027 | |||

|

|

|

|||

| Total Assets |

14,065,736 | |||

|

|

|

|||

| Liabilities |

||||

| Payable for investments purchased |

919,893 | |||

| Payable to administrator, fund accountant, and transfer agent |

7,383 | |||

| Payable to custodian |

2,223 | |||

| Payable to trustees |

927 | |||

| Other accrued expenses |

7,467 | |||

|

|

|

|||

| Total Liabilities |

937,893 | |||

|

|

|

|||

| Net Assets |

$ | 13,127,843 | ||

|

|

|

|||

| Net Assets consist of: |

||||

| Paid-in capital |

$ | 11,486,063 | ||

| Accumulated undistributed net investment income |

35,811 | |||

| Accumulated undistributed net realized gain from investments |

457,978 | |||

| Net unrealized appreciation on investments |

1,147,991 | |||

|

|

|

|||

| Net Assets |

$ | 13,127,843 | ||

|

|

|

|||

| Institutional Class: |

||||

| Shares outstanding (unlimited number of shares authorized, no par value) |

969,704 | |||

|

|

|

|||

| Net asset value, offering and redemption price per share |

$ | 13.54 | ||

|

|

|

|||

See accompanying notes which are an integral part of these financial statements.

8

BRC LARGE CAP FOCUS EQUITY FUND

STATEMENT OF OPERATIONS

For the six months ended April 30, 2014 (Unaudited)

| Investment Income |

||||

| Dividend income (net of foreign taxes withheld of $486) |

$ | 85,639 | ||

| Interest income |

116 | |||

|

|

|

|||

| Total investment income |

85,755 | |||

|

|

|

|||

| Expenses |

||||

| Investment Adviser |

23,316 | |||

| Administration |

20,102 | |||

| Fund accounting |

12,408 | |||

| Transfer agent |

18,825 | |||

| Legal |

8,590 | |||

| Registration |

8,401 | |||

| Custodian |

3,583 | |||

| Audit |

7,363 | |||

| Trustee |

4,067 | |||

| Pricing |

1,117 | |||

| Offering costs |

6,169 | |||

| Miscellaneous |

2,790 | |||

|

|

|

|||

| Total expenses |

116,731 | |||

|

|

|

|||

| Fees waived and reimbursed by Adviser |

(89,435 | ) | ||

|

|

|

|||

| Net operating expenses |

27,296 | |||

|

|

|

|||

| Net investment income |

58,459 | |||

|

|

|

|||

| Net Realized and Unrealized Gains on Investments |

| |||

| Net realized gains on investment securities transactions |

457,978 | |||

| Net change in unrealized appreciation of investment securities |

373,337 | |||

|

|

|

|||

| Net realized and unrealized gains on investments |

831,315 | |||

|

|

|

|||

| Net increase in net assets resulting from operations |

$ | 889,774 | ||

|

|

|

|||

See accompanying notes which are an integral part of these financial statements.

9

BRC LARGE CAP FOCUS EQUITY FUND

STATEMENTS OF CHANGES IN NET ASSETS

| For the Six Months Ended April 30, 2014 (Unaudited) |

For the Period Ended October 31, 2013 (a) |

|||||||

| Increase in Net Assets due to: |

||||||||

| Operations |

||||||||

| Net investment income |

$ | 58,459 | $ | 32,747 | ||||

| Net realized gains on investment transactions |

457,978 | 242 | ||||||

| Net change in unrealized appreciation of investments |

373,337 | 774,654 | ||||||

|

|

|

|

|

|||||

| Net increase in net assets resulting from operations |

889,774 | 807,643 | ||||||

|

|

|

|

|

|||||

| Distributions from: |

||||||||

| Net investment income – Institutional Class |

(55,395 | ) | – | |||||

| Net realized gains – Institutional Class |

(242 | ) | – | |||||

|

|

|

|

|

|||||

| Total distributions |

(55,637 | ) | – | |||||

|

|

|

|

|

|||||

| Capital Transactions – Institutional Class |

||||||||

| Proceeds from shares sold |

4,374,598 | 7,316,024 | ||||||

| Reinvestment of distributions |

54,011 | – | ||||||

| Amount paid for shares redeemed |

(246,570 | ) | (12,000 | ) | ||||

|

|

|

|

|

|||||

| Net increase in net assets resulting from capital transactions |

4,182,039 | 7,304,024 | ||||||

|

|

|

|

|

|||||

| Total Increase in Net Assets |

5,016,176 | 8,111,667 | ||||||

|

|

|

|

|

|||||

| Net Assets |

||||||||

| Beginning of period |

8,111,667 | – | ||||||

|

|

|

|

|

|||||

| End of period |

$ | 13,127,843 | $ | 8,111,667 | ||||

|

|

|

|

|

|||||

| Accumulated undistributed net investment income |

$ | 35,811 | $ | 32,747 | ||||

|

|

|

|

|

|||||

| Share Transactions – Institutional Class |

||||||||

| Shares sold |

329,720 | 656,072 | ||||||

| Shares issued in reinvestment of distributions |

4,152 | – | ||||||

| Shares redeemed |

(19,250 | ) | (990 | ) | ||||

|

|

|

|

|

|||||

| Net increase in shares |

314,622 | 655,082 | ||||||

|

|

|

|

|

|||||

| (a) | For the period December 21, 2012 (commencement of operations) to October 31, 2013. |

See accompanying notes which are an integral part of these financial statements.

10

BRC LARGE CAP FOCUS EQUITY FUND

FINANCIAL HIGHLIGHTS – INSTITUTIONAL CLASS

(For a share outstanding during the period)

| For the Six Months Ended April 30, 2014 (Unaudited) |

For the Period Ended October 31, 2013 (a) |

|||||||

| Selected Per Share Data: |

||||||||

| Net asset value, beginning of period |

$ | 12.38 | $ | 10.00 | ||||

|

|

|

|

|

|||||

| Investment Operations: |

||||||||

| Net investment income |

0.07 | 0.05 | ||||||

| Net realized and unrealized gain on investments |

1.17 | 2.33 | ||||||

|

|

|

|

|

|||||

| Total from investment operations |

1.24 | 2.38 | ||||||

|

|

|

|

|

|||||

| Less distributions to shareholders from: |

||||||||

| Net investment income |

(0.08 | ) | – | |||||

| Net realized gains |

– | (b) | – | |||||

|

|

|

|

|

|||||

| Total distributions |

(0.08 | ) | – | |||||

|

|

|

|

|

|||||

| Net asset value, end of period |

$ | 13.54 | $ | 12.38 | ||||

|

|

|

|

|

|||||

| Total Return (c) |

10.07 | %(d) | 23.80 | %(d) | ||||

| Ratios and Supplemental Data: |

||||||||

| Net assets, end of period (000) |

$ | 13,128 | $ | 8,112 | ||||

| Ratio of net expenses to average net assets |

0.55 | %(e) | 0.56 | %(e) | ||||

| Ratio of expenses to average net assets before waiver and reimbursement |

2.35 | %(e) | 6.49 | %(e) | ||||

| Ratio of net investment income to average net assets |

1.18 | %(e) | 0.98 | %(e) | ||||

| Portfolio turnover rate |

71 | %(d) | 154 | %(d) | ||||

| (a) | For the period December 21, 2012 (commencement of operations) to October 31, 2013. |

| (b) | Amount is less than $0.005. |

| (c) | Total return in the above table represents the rate that the investor would have earned or lost on an investment in the Fund, assuming reinvestment of distributions. |

| (d) | Not annualized. |

| (e) | Annualized. |

See accompanying notes which are an integral part of these financial statements.

11

BRC LARGE CAP FOCUS EQUITY FUND

NOTES TO THE FINANCIAL STATEMENTS

April 30, 2014 (Unaudited)

NOTE 1. ORGANIZATION

The BRC Large Cap Focus Equity Fund (the “Fund”) is an open-end non-diversified series of the Valued Advisers Trust (the “Trust”). The Trust is a management investment company established under the laws of Delaware by an Agreement and Declaration of Trust dated June 13, 2008 (the “Trust Agreement”). The Trust Agreement permits the Trustees to issue an unlimited number of shares of beneficial interest of separate series without par value. The Fund is one of a series of funds authorized by the Board of Trustees (the “Board”). The Fund commenced operations December 21, 2012. The Fund’s investment adviser is BRC Investment Management LLC. (the “Adviser”). The investment objective of the Fund is to seek long-term capital appreciation that will exceed the S&P 500 Index over a three-to five-year time horizon.

The Fund is authorized to offer two classes of shares: Institutional Class and Advisor Class. Each share represents an equal proportionate interest in the assets and liabilities belonging to the Fund and is entitled to such dividends and distributions out of income belonging to the applicable class as are declared by the Trustees. Expenses attributable to any class are borne by that class. Income, expenses, and realized and unrealized gains/losses are allocated to the respective classes on the basis of relative daily net assets. On matters that affect the Fund as a whole, each class has the same voting and other rights and preferences as any other class. On matters that affect only one class, only shareholders of that class may vote. Each class votes separately on matters affecting only that class, or on matters expressly required to be voted on separately by state or federal law. Shares of each class of a series have the same voting and other rights and preferences as the other classes and series of the Trust for matters that affect the Trust as a whole. As of April 30, 2014, only Institutional Class shares are available for purchase. The Fund may offer additional classes of shares in the future.

NOTE 2. SIGNIFICANT ACCOUNTING POLICIES

The following is a summary of significant accounting policies followed by the Fund in the preparation of its financial statements. These policies are in conformity with generally accepted accounting principles in the United States of America (“GAAP”).

Securities Valuation – All investments in securities are recorded at their estimated fair value as described in Note 3.

Federal Income Taxes – The Fund makes no provision for federal income or excise tax. The Fund intends to qualify each year as a regulated investment company (“RIC”) under subchapter M of the Internal Revenue Code of 1986, as amended, by complying with the requirements applicable to RICs and by distributing substantially all of its taxable income. The Fund also intends to distribute sufficient net investment income and net capital gains, if any, so that it will not be subject to excise tax on undistributed income and gains. If the required amount of net investment income or gains is not distributed, the Fund could incur a tax expense.

As of and during the period ended April 30, 2014, the Fund did not have a liability for any unrecognized tax benefits. The Fund recognizes interest and penalties, if any, related to unrecognized tax benefits as income tax expense in the Statement of Operations. During the year, the Fund did not incur any interest or penalties. The Fund is subject to examination by U.S. federal tax authorities for all tax years since inception.

Expenses – Expenses incurred by the Trust that do not relate to a specific fund of the Trust are allocated to the individual funds based on each fund’s relative net assets or other appropriate basis (as determined by the Board of Trustees).

12

BRC LARGE CAP FOCUS EQUITY FUND

NOTES TO THE FINANCIAL STATEMENTS – (continued)

April 30, 2014 (Unaudited)

NOTE 2. SIGNIFICANT ACCOUNTING POLICIES – continued

Security Transactions and Related Income – The Fund follows industry practice and records security transactions on the trade date for financial reporting purposes. The average cost method is used for determining gains or losses for financial statements and income tax purposes. Dividend income is recorded on the ex-dividend date and interest income is recorded on an accrual basis. Discounts and premiums on securities purchased are amortized or accreted using the effective interest method. Withholding taxes on foreign dividends, if any, have been provided for in accordance with the Fund’s understanding of the applicable country’s tax rules and rates. The ability of issuers of debt securities held by the Fund to meet their obligations may be affected by economic and political developments in a specific country or region.

Dividends and Distributions – The Fund intends to distribute substantially all of its net investment income, net realized long-term capital gains and its net realized short-term capital gains, if any, to its shareholders on at least an annual basis. Dividends to shareholders, which are determined in accordance with income tax regulations, are recorded on the ex-dividend date. The treatment for financial reporting purposes of distributions made to shareholders during the year from net investment income or net realized capital gains may differ from their ultimate treatment for federal income tax purposes. These differences are caused primarily by differences in the timing of the recognition of certain components of income, expense or realized capital gain for federal income tax purposes. Where such differences are permanent in nature, they are reclassified in the components of net assets based on their ultimate characterization for federal income tax purposes. Any such reclassifications will have no effect on net assets, results of operations or net asset values per share of the Fund. There were no such material reclassifications made as of April 30, 2014.

NOTE 3. SECURITIES VALUATION AND FAIR VALUE MEASUREMENTS

Fair value is defined as the price that a Fund would receive upon selling an investment in a orderly transaction to an independent buyer in the principal or most advantageous market of the investment. GAAP established a three-tier hierarchy to maximize the use of observable market data and minimize the use of unobservable inputs and to establish classification of fair value measurements for disclosure purposes.

Inputs refer broadly to the assumptions that market participants would use in pricing the asset or liability, including assumptions about risk, (ex., the risk inherent in a particular valuation technique used to measure fair value including items such as a pricing model and/or the risk inherent in the inputs to the valuation technique). Inputs may be observable or unobservable. Observable inputs are inputs that reflect the assumptions market participants would use in pricing the asset or liability developed based on market data obtained from sources independent of the reporting entity. Unobservable inputs are inputs that reflect the reporting entity’s own assumptions about the assumptions market participants would use in pricing the asset or liability developed based on the best information available in the circumstances.

Various inputs are used in determining the value of the Fund’s investments. These inputs are summarized in the three broad levels listed below.

| • | Level 1 – quoted prices in active markets for identical securities |

| • | Level 2 – other significant observable inputs (including, but not limited to, quoted prices for an identical security in an inactive market, quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.) |

13

BRC LARGE CAP FOCUS EQUITY FUND

NOTES TO THE FINANCIAL STATEMENTS – (continued)

April 30, 2014 (Unaudited)

NOTE 3. SECURITIES VALUATION AND FAIR VALUE MEASUREMENTS – continued

| • | Level 3 – significant unobservable inputs (including the Fund’s own assumptions in determining fair value of investments based on the best information available) |

The inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the level in the fair value hierarchy within which the fair value measurement falls in its entirety, is determined based on the lowest level input that is significant to the fair value measurement in its entirety.

Equity securities, including common stocks, are generally valued by using market quotations, furnished by a pricing service. Securities that are traded on any stock exchange are generally valued at the last quoted sale price. Lacking a last sale price, an exchange traded security is generally valued at its last bid price. Securities traded in the NASDAQ over-the-counter market are generally valued at the NASDAQ Official Closing Price. When using the market quotations or close prices provided by the pricing service and when the market is considered active, the security is classified as a Level 1 security. Sometimes, an equity security owned by the Fund will be valued by the pricing service with factors other than market quotations or when the market is considered inactive. When this happens, the security is classified as a Level 2 security. When market quotations are not readily available, when the Fund determines that the market quotation or the price provided by the pricing service does not accurately reflect the current fair value, or when restricted or illiquid securities are being valued, such securities are valued as determined in good faith by the Fund, in conformity with guidelines adopted by and subject to review by the Board. These securities may be categorized as Level 3 securities.

Investments in open-end mutual funds, including money market mutual funds, are generally priced at the ending net asset value (NAV) provided by the service agent of the funds. These securities will be categorized as Level 1 securities.

Fixed income securities when valued using market quotations in an active market, will be categorized as Level 1 securities. However, they may be valued on the basis of prices furnished by a pricing service when the Fund believes such prices more accurately reflect the fair value of such securities. A pricing service uses various inputs and techniques, which include broker-dealer quotations, live trading levels, recently executed transactions in securities of the issuer or comparable issuers, and option adjusted spread models that include base curve and spread curve inputs. Adjustments to individual bonds can be applied to recognize trading differences compared to other bonds issued by the same issuer. The broker-dealer quotations received are supported by credit analysis of the issuer that takes into consideration credit quality assessments, daily trading activity, and the activity of the underlying equities, listed bonds and sector-specific trends. To the extent that these inputs are observable, the values of fixed income securities are categorized as Level 2 securities. If the Fund decides that a price provided by the pricing service does not accurately reflect the fair value of the securities, when prices are not readily available from a pricing service, or when restricted or illiquid securities are being valued, securities are valued at fair value as determined in good faith by the Fund, in conformity with guidelines adopted by and subject to review of the Board. These securities may be categorized as Level 3 securities.

Short-term investments in fixed income securities (those with maturities of less than 60 days when acquired, or which subsequently are within 60 days of maturity), including certificates of deposit and U.S. government securities, are valued by using the amortized cost method of valuation, which the Board has determined represents fair value. These securities will be classified as Level 2 securities.

14

BRC LARGE CAP FOCUS EQUITY FUND

NOTES TO THE FINANCIAL STATEMENTS – (continued)

April 30, 2014 (Unaudited)

NOTE 3. SECURITIES VALUATION AND FAIR VALUE INSTRUMENTS – continued

In accordance with the Trust’s good faith pricing guidelines, the Fund is required to consider all appropriate factors relevant to the value of securities for which it has determined other pricing sources are not available or reliable as described above. No single standard exists for determining fair value, because fair value depends upon the circumstances of each individual case. As a general principle, the current fair value of an issue of securities being valued by the Fund would appear to be the amount which the owner might reasonably expect to receive for them upon their current sale. Methods which are in accordance with this principle may, for example, be based on (i) a multiple of earnings; (ii) a discount from market of a similar freely traded security (including a derivative security or a basket of securities traded on other markets, exchanges or among dealers); or (iii) yield to maturity with respect to debt issues, or a combination of these and other methods. Good faith pricing is permitted if, in the Fund’s opinion, the validity of market quotations appears to be questionable based on factors such as evidence of a thin market in the security based on a small number of quotations, a significant event occurs after the close of a market but before a Fund’s NAV calculation that may affect a security’s value, or the Fund is aware of any other data that calls into question the reliability of market quotations. Good faith pricing may also be used in instances when the bonds the Fund invests in may default or otherwise cease to have market quotations readily available. Any fair value pricing done outside the Fund’s approved pricing methods must be approved by the Pricing Committee of the Board.

The following is a summary of the inputs used to value the Fund’s investments as of April 30, 2014:

| Valuation Inputs | ||||||||||||||||

| Assets | Level 1 – Quoted Prices in Active Markets |

Level 2 – Other Significant Observable Inputs |

Level 3 – Significant |

Total | ||||||||||||

| Common Stocks* |

$ | 12,900,850 | $ | – | $ | – | $ | 12,900,850 | ||||||||

| Money Market Securities |

307,697 | – | – | 307,697 | ||||||||||||

|

Total |

$ | 13,208,547 | $ | – | $ | – | $ | 13,208,547 | ||||||||

| * | Refer to the Schedule of Investments for industry classifications. |

The Fund did not hold any investments at any time during the reporting period in which significant unobservable inputs were used in determining fair value; therefore, no reconciliation of Level 3 securities is included for this reporting period. The Trust recognizes transfers between fair value hierarchy levels at the reporting period end. There were no transfers between any Levels for the period ended April 30, 2014 and the previous measurement period.

NOTE 4. ADVISER FEES AND OTHER TRANSACTIONS

Under the terms of the management agreement, on behalf of the Fund (the “Agreement”), the Adviser manages the Fund’s investments subject to approval of the Trustees. As compensation for its management services, the Fund is obligated to pay the Adviser a fee computed and accrued daily and paid monthly at an annual rate of 0.47% of the average daily net assets of the Fund. For the period ended April 30, 2014, the Adviser earned a fee of $23,316 from the Fund before the reimbursement described below.

15

BRC LARGE CAP FOCUS EQUITY FUND

NOTES TO THE FINANCIAL STATEMENTS – (continued)

April 30, 2014 (Unaudited)

NOTE 4. ADVISER FEES AND OTHER TRANSACTIONS – continued

The Adviser has contractually agreed to waive its management fee and/or reimburse expenses through February 29, 2016, so that total annual fund operating expenses, excluding interest, taxes, brokerage commissions, other expenditures which are capitalized in accordance with GAAP, other extraordinary expenses not incurred in the ordinary course of the Fund’s business, dividend expense on short sales, 12b-1 expenses, and expenses that the Fund has incurred but did not actually pay because of an expense offset arrangement, if applicable, incurred by the Fund in any fiscal year, do not exceed 0.55% of the Fund’s average daily net assets. The operating expense limitation also excludes any fees and expenses of acquired funds. For the period ended April 30, 2014, expenses totaling $89,435 were waived or reimbursed by the Adviser and may be subject to potential recoupment by the Adviser until October 31, 2017. At April 30, 2014, the Adviser owed the Fund $9,409.

The amount subject to repayment by the Fund pursuant to the aforementioned conditions are as follows:

| Amount |

Recoverable through October 31, | |

| $ 198,220 |

2016 | |

| 89,435 |

2017 |

The Trust retains Huntington Asset Services, Inc. (“HASI”) to manage the Fund’s business affairs and provide the Fund with administrative services, including all regulatory reporting and necessary office equipment and personnel. For the period ended April 30, 2014, HASI earned fees of $18,613 for administrative services provided to the Fund. At April 30, 2014, HASI was owed $2,988 from the Fund for administrative services. Certain officers and trustees of the Trust are members of management and/or employees of HASI. HASI is a wholly-owned subsidiary of Huntington Bancshares, Inc., the parent company of Unified Financial Securities, Inc. (the “Distributor”) and Huntington National Bank, the custodian of the Fund’s investments (the “Custodian”). For the period ended April 30, 2014, the Custodian earned fees of $3,583 for custody services provided to the Fund. At April 30, 2014, the Custodian was owed $2,223 from the Fund for custody services.

The Trust also retains HASI to act as the Fund’s transfer agent and to provide fund accounting services. For the period ended April 30, 2014, HASI earned fees of $18,825 for transfer agent services to the Fund. At April 30, 2014, the Fund owed HASI $2,403 for transfer agent services. For the period ended April 30, 2014, HASI earned fees of $12,408 from the Fund for fund accounting services. At April 30, 2014, HASI was owed $1,992 from the Fund for fund accounting services.

Unified Financial Securities, Inc. acts as the principal underwriter of the Fund’s shares. There were no payments made by the Fund to the Distributor during period ended April 30, 2014. An officer of the Trust is also an officer of the Distributor.

16

BRC LARGE CAP FOCUS EQUITY FUND

NOTES TO THE FINANCIAL STATEMENTS – (continued)

April 30, 2014 (Unaudited)

NOTE 5. PURCHASES AND SALES

For the period ended April 30, 2014, purchases and sales of investment securities, other than short-term investments and short-term U.S. government obligations, were as follows:

| Purchases |

||||

| U.S. Government Obligations |

$ | – | ||

| Other |

11,123,490 | |||

| Sales |

||||

| U.S. Government Obligations |

$ | – | ||

| Other |

7,072,220 |

NOTE 6. ESTIMATES

The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates.

NOTE 7. BENEFICIAL OWNERSHIP

The beneficial ownership, either directly or indirectly, of 25% or more of the voting securities of a fund creates a presumption of control of a fund, under Section 2(a) (9) of the Investment Company Act of 1940. At April 30, 2014, Charles Schwab & Co., Inc. for the benefit of its customers, owned 54.17%. It is not known whether Charles Schwab & Co. or any of the underlying beneficial owners controlled 25% or more of the voting securities of the Fund.

NOTE 8. FEDERAL TAX INFORMATION

At April 30, 2014, the net unrealized appreciation (depreciation) of investments for tax purposes was as follows:

| Gross Appreciation |

$ | 1,186,695 | ||

| Gross (Depreciation) |

(38,704 | ) | ||

|

|

|

|||

| Net Appreciation (Depreciation) on Investments |

$ | 1,147,991 | ||

|

|

|

At April 30, 2014, the aggregate cost of securities for federal income tax purposes was $12,060,556 for the Fund.

At October 31, 2013, the components of distributable earnings (accumulated losses) on a tax basis were as follows:

| Undistributed ordinary income |

$ | 32,989 | ||

| Net unrealized appreciation (depreciation) |

774,654 | |||

|

|

|

|||

| $ | 807,643 | |||

|

|

|

17

BRC LARGE CAP FOCUS EQUITY FUND

NOTES TO THE FINANCIAL STATEMENTS – (continued)

April 30, 2014 (Unaudited)

NOTE 9. COMMITMENTS AND CONTINGENCIES

The Fund indemnifies its officers and trustees for certain liabilities that may arise from the performance of their duties to the Fund. Additionally, in the normal course of business, the Fund enters into contracts that contain a variety of representations and warranties which provide general indemnifications. The Fund’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Fund that have not yet occurred.

NOTE 10. SUBSEQUENT EVENTS

Management of the Fund has evaluated the need for disclosures and/or adjustments resulting from subsequent events through the date these financial statements were issued. There were no items requiring adjustment of the financial statements or additional disclosure.

18

VALUED ADVISERS TRUST

PRIVACY POLICY

The following is a description of the policies of the Valued Advisers Trust (the “Trust”) regarding disclosure of nonpublic personal information that shareholders provide to a series of the Trust (each, a “Fund”) or that the Fund collects from other sources. In the event that a shareholder holds shares of a Fund through a broker-dealer or other financial intermediary, the privacy policy of the financial intermediary would govern how shareholder nonpublic personal information would be shared with nonaffiliated third parties.

Categories of Information A Fund May Collect. A Fund may collect the following nonpublic personal information about its shareholders:

| • | Information the Fund receives from a shareholder on applications or other forms, correspondence, or conversations (such as the shareholder’s name, address, phone number, social security number, and date of birth); and |

| • | Information about the shareholder’s transactions with the Fund, its affiliates, or others (such as the shareholder’s account number and balance, payment history, cost basis information, and other financial information). |

Categories of Information A Fund May Disclose. A Fund may not disclose any nonpublic personal information about its current or former shareholders to unaffiliated third parties, except as required or permitted by law. A Fund is permitted by law to disclose all of the information it collects, as described above, to its service providers (such as the Fund’s custodian, administrator, transfer agent, accountant and legal counsel) to process shareholder transactions and otherwise provide services to the shareholder.

Confidentiality and Security. Each Fund shall restrict access to shareholder nonpublic personal information to those persons who require such information to provide products or services to the shareholder. Each Fund shall maintain physical, electronic, and procedural safeguards that comply with federal standards to guard shareholder nonpublic personal information.

Disposal of Information. The Funds, through their transfer agent, have taken steps to reasonably ensure that the privacy of a shareholder’s nonpublic personal information is maintained at all times, including in connection with the disposal of information that is no longer required to be maintained by the Funds. Such steps shall include, whenever possible, shredding paper documents and records prior to disposal, requiring off-site storage vendors to shred documents maintained in such locations prior to disposal, and erasing and/or obliterating any data contained on electronic media in such a manner that the information can no longer be read or reconstructed.

19

OTHER INFORMATION

The Fund’s Statement of Additional Information (“SAI”) includes additional information about the trustees and is available without charge, upon request. You may call toll-free at (877) 272-1214 to request a copy of the SAI or to make shareholder inquiries.

PROXY VOTING

A description of the policies and procedures that the Fund uses to determine how to vote proxies relating to portfolio securities and information regarding how the Fund voted those proxies is available without charge upon request by (1) calling the Fund at (877) 272-1214 and (2) from Fund documents filed with the Securities and Exchange Commission (“SEC”) on the SEC’s website at www.sec.gov.

This report is intended only for the information of shareholders or those who have received the Fund’s prospectus which contains information about the Fund’s management fee and expenses. Please read the prospectus carefully before investing.

Distributed by Unified Financial Securities, Inc.

Member FINRA/SIPC

20

Semi-Annual Report

April 30, 2014

Fund Adviser:

Granite Investment Advisors, Inc.

11 South Main Street, Suite 501

Concord, New Hampshire 03301

Toll Free (888) 442-9893

INVESTMENT RESULTS – (Unaudited)

| Average Annual Total

Returns* (for the periods ended April 30, 2014) |

||||||||||||

| Six Month | One Year | Since Inception (December 22, 2011) |

||||||||||

| Granite Value Fund |

5.43 | % | 17.20 | % | 17.80 | % | ||||||

| S&P 500® Index** |

8.36 | % | 20.44 | % | 21.84 | % | ||||||

| Russell 1000® Value Index** |

9.61 | % | 20.90 | % | 23.35 | % | ||||||

Total annual operating expenses, as disclosed in the Fund’s prospectus dated February 28, 2014, were 3.32% of average daily net assets (1.35% after fee waivers/expense reimbursements by the adviser). The adviser has contractually agreed to waive or limit its fees and to assume other expenses of the Fund until February 28, 2015, so that the Total Annual Fund Operating Expenses does not exceed 1.35%. This operating expense limitation does not apply to interest, taxes, brokerage commissions, other expenditures which are capitalized in accordance with generally accepted accounting principles, other extraordinary expenses not incurred in the ordinary course of the Fund’s business, dividend expense on short sales, expenses incurred under a Rule 12b-1 plan of distribution, “acquired fund fees and expenses,” and expenses that the Fund has incurred but did not actually pay because of an expense offset arrangement.

The performance quoted represents past performance, which does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Current performance of the Fund may be lower or higher than the performance quoted. The Fund’s investment objectives, risks, charges and expenses must be considered carefully before investing. Performance data current to the most recent month end may be obtained by calling 1-888-442-9893.

| * | Return figures reflect any change in price per share and assume the reinvestment of all distributions. |

| ** | The S&P 500® Index and the Russell 1000® Value Index are widely recognized unmanaged indices of equity securities and are representative of a broader domestic equity market and range of securities than is found in the Fund’s portfolio. Individuals cannot invest directly in an Index; however, an individual can invest in exchange traded funds or other investment vehicles that attempt to track the performance of a benchmark index. |

The Fund’s investment objectives, strategies, risks, charges and expenses must be considered carefully before investing. The prospectus contains this and other important information about the Fund and may be obtained by calling the same number as above. Please read it carefully before investing.

The Fund is distributed by Unified Financial Securities, Inc., member FINRA.

1

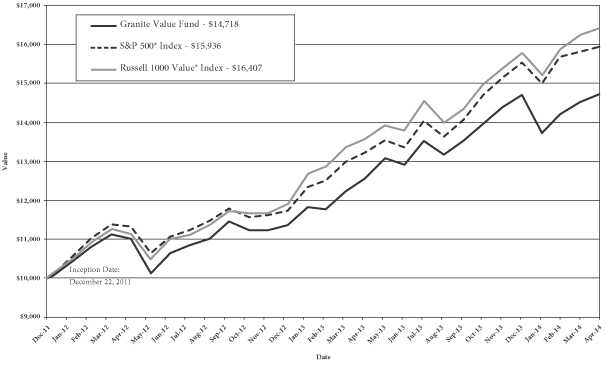

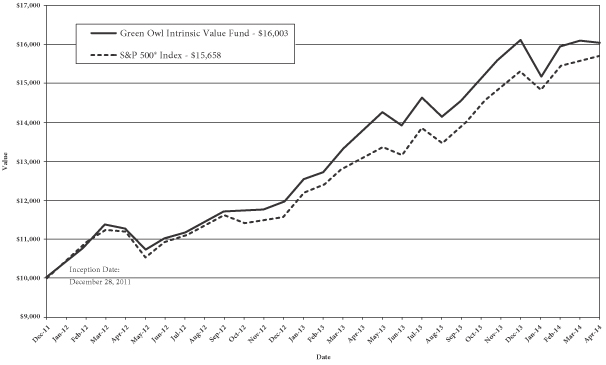

Comparison of the Growth of a $10,000 Investment in the Granite Value Fund,

the Russell 1000® Value Index, and the S&P 500® Index (Unaudited)

The chart above assumes an initial investment of $10,000 made on December 22, 2011 (commencement of Fund operations) and held through April 30, 2014. The S&P 500® Index and Russell 1000® Value Index are widely recognized unmanaged indices of equity securities and are representative of a broader domestic equity market and range of securities than is found in the Fund’s portfolio. Individuals cannot invest directly in an Index; however, an individual can invest in exchange traded funds or other investment vehicles that attempt to track the performance of a benchmark index. THE FUND’S RETURN REPRESENTS PAST PERFORMANCE AND DOES NOT GUARANTEE FUTURE RESULTS. The returns shown do not reflect deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Investment returns and principal values will fluctuate so that your shares, when redeemed, may be worth more or less than their original purchase price.

Current performance may be lower or higher than the performance data quoted. For more information on the Fund, and to obtain performance data current to the most recent month end or to request a prospectus, please call 1-888-442-9893. You should carefully consider the investment objectives, potential risks, management fees, and charges and expenses of the Fund before investing. The Fund’s prospectus contains this and other information about the Fund, and should be read carefully before investing.

The Fund is distributed by Unified Financial Securities, Inc., member FINRA.

2

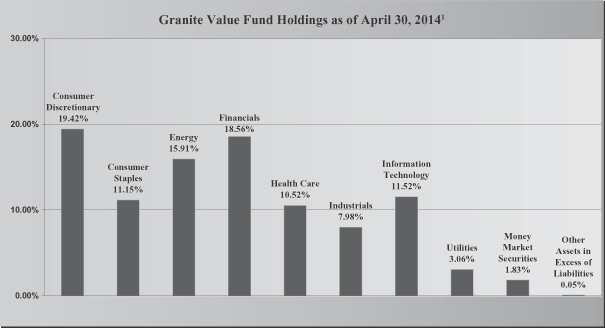

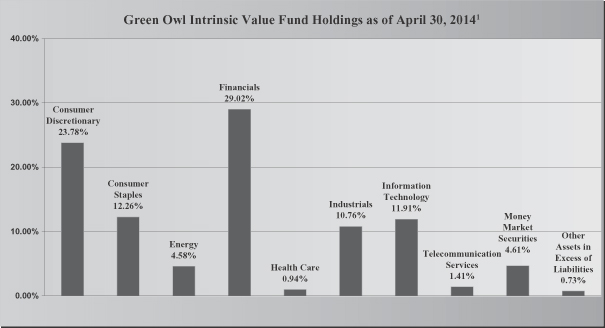

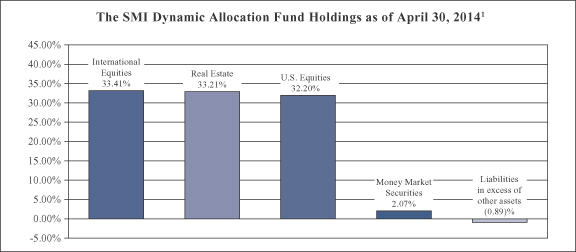

FUND HOLDINGS – (Unaudited)

| 1 | As a percentage of net assets. |

The investment objective of the Granite Value Fund is to seek long-term capital appreciation.

Availability of Portfolio Schedule – (Unaudited)

The Fund files its complete schedule of portfolio holdings with the Securities and Exchange Commission (“SEC”) for the first and third quarters of each fiscal year on Form N-Q. The Fund’s Forms N-Q are available at the SEC’s website at www.sec.gov. The Fund’s Forms N-Q may be reviewed and copied at the SEC’s Public Reference Room in Washington DC. Information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330.

Summary of Fund’s Expenses – (Unaudited)

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, such as short-term redemption fees; and (2) ongoing costs, including management fees and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 invested at the beginning and held for the six month period, November 1, 2013 to April 30, 2014.

3

Actual Expenses

The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = $8.60), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During the Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only. Therefore, the second line of the table below is useful in comparing ongoing costs only and will not help you determine the relative costs of owning different funds.

| Granite Value Fund |

Beginning November 1, 2013 |

Ending Account Value April 30, 2014 |

Expenses Paid November 1, 2013 – |

|||||||||

| Actual* |

$ | 1,000.00 | $ | 1,054.30 | $ | 6.88 | ||||||

|

Hypothetical** |

$ | 1,000.00 | $ | 1,018.10 | $ | 6.75 | ||||||

| * | Expenses are equal to the Fund’s annualized expense ratio of 1.35%, multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period). |

| ** | Assumes a 5% return before expenses. |

4

GRANITE VALUE FUND

SCHEDULE OF INVESTMENTS

April 30, 2014 (Unaudited)

| COMMON STOCKS – 98.12% | Shares | Fair Value | ||||||

| Consumer Discretionary – 19.42% |

||||||||

| Bed Bath & Beyond, Inc. * |

5,550 | $ | 344,822 | |||||

| Coach, Inc. |

7,010 | 312,997 | ||||||

| Comcast Corp. – Class A |

6,300 | 326,088 | ||||||

| Foot Locker, Inc. |

8,700 | 404,811 | ||||||

| General Motors Co. |

12,390 | 427,207 | ||||||

| News Corp. – Class A * |

20,830 | 354,527 | ||||||

| TRW Automotive Holdings Corp. * |

3,500 | 281,225 | ||||||

|

|

|

|||||||

| 2,451,677 | ||||||||

|

|

|

|||||||

| Consumer Staples – 11.15% |

| |||||||

| Coca-Cola Co. / The |

9,150 | 373,229 | ||||||

| Tesco PLC ADR |

20,870 | 308,876 | ||||||

| Unilever PLC ADR |

8,720 | 390,133 | ||||||

| Wal-Mart Stores, Inc. |

4,210 | 335,579 | ||||||

|

|

|

|||||||

| 1,407,817 | ||||||||

|

|

|

|||||||

| Energy – 15.91% |

| |||||||

| Apache Corp. |

4,065 | 352,842 | ||||||

| Exxon Mobil Corp. |

4,640 | 475,182 | ||||||

| Southwestern Energy Co. * |

7,840 | 375,379 | ||||||

| Ultra Petroleum Corp. * |

15,555 | 463,539 | ||||||

| Unit Corp. * |

5,175 | 341,291 | ||||||

|

|

|

|||||||

| 2,008,233 | ||||||||

|

|

|

|||||||

| Financials – 18.56% |

| |||||||

| Alleghany Corp. * |

925 | 377,381 | ||||||

| American Express Co. |

2,765 | 241,744 | ||||||

| American International Group, Inc. |

9,730 | 516,955 | ||||||

| Berkshire Hathaway, Inc. – Class B * |

3,855 | 496,717 | ||||||

| Citigroup, Inc. |

7,640 | 366,032 | ||||||

| Franklin Resources, Inc. |

6,575 | 344,201 | ||||||

|

|

|

|||||||

| 2,343,030 | ||||||||

|

|

|

|||||||

| Health Care – 10.52% |

| |||||||

| Baxter International, Inc. |

5,450 | 396,705 | ||||||

| Johnson & Johnson |

2,590 | 262,341 | ||||||

| Sanofi ADR |

6,595 | 354,811 | ||||||

| UnitedHealth Group, Inc. |

4,185 | 314,042 | ||||||

|

|

|

|||||||

| 1,327,899 | ||||||||

|

|

|

|||||||

See accompanying notes which are an integral part of these financial statements.

5

GRANITE VALUE FUND

SCHEDULE OF INVESTMENTS – (continued)

April 30, 2014 (Unaudited)

| COMMON STOCKS – 98.12% – continued | Shares | Fair Value | ||||||

| Industrials – 7.98% |

| |||||||

| Boeing Co. / The |

2,530 | $ | 326,421 | |||||

| FedEx Corp. |

2,550 | 347,438 | ||||||

| Kennametal, Inc. |

7,140 | 333,652 | ||||||

|

|

|

|||||||

| 1,007,511 | ||||||||

|

|

|

|||||||

| Information Technology – 11.52% |

| |||||||

| Apple, Inc. |

680 | 401,261 | ||||||

| Cisco Systems, Inc. |

16,385 | 378,657 | ||||||

| Microsoft Corp. |

8,395 | 339,158 | ||||||

| Western Union Co. / The |

21,170 | 335,968 | ||||||

|

|

|

|||||||

| 1,455,044 | ||||||||

|

|

|

|||||||

| Utilities – 3.06% |

| |||||||

| Calpine Corp. * |

16,875 | 386,944 | ||||||

|

|

|

|||||||

| TOTAL COMMON STOCKS (Cost $10,210,958) |

12,388,155 | |||||||

|

|

|

|||||||

| MONEY MARKET SECURITIES – 1.83% |

||||||||

| Fidelity Institutional Money Market Funds – Prime Money Market Portfolio – Institutional Class, 0.06% (a) |

230,616 | 230,616 | ||||||

|

|

|

|||||||

| TOTAL MONEY MARKET SECURITIES (Cost $230,616) |

230,616 | |||||||

|

|

|

|||||||

| TOTAL INVESTMENTS – 99.95% (Cost $10,441,574) |

$ | 12,618,771 | ||||||

|

|

|

|||||||

| Other Assets in Excess of Liabilities – 0.05% | 6,011 | |||||||

|

|

|

|||||||

| TOTAL NET ASSETS – 100.00% | $ | 12,624,782 | ||||||

|

|

|

|||||||

| (a) | Rate disclosed is the seven day yield as of April 30, 2014. |

| * | Non-income producing security. |

ADR – American Depositary Receipt

See accompanying notes which are an integral part of these financial statements.

6

GRANITE VALUE FUND

STATEMENT OF ASSETS AND LIABILITIES

April 30, 2014 (Unaudited)

| Assets |

||||

| Investments in securities at fair value (cost $10,441,574) |

$ | 12,618,771 | ||

| Dividends receivable |

13,803 | |||

| Interest receivable |

15 | |||

| Receivable from Adviser |

106 | |||

| Prepaid expenses |

8,303 | |||

|

|

|

|||

| Total Assets |

12,640,998 | |||

|

|

|

|||

| Liabilities |

||||

| Payable to administrator, fund accountant, and transfer agent |

6,629 | |||

| Payable to custodian |

1,954 | |||

| Payable to trustees |

548 | |||

| Other accrued expenses |

7,085 | |||

|

|

|

|||

| Total Liabilities |

16,216 | |||

|

|

|

|||

| Net Assets |

$ | 12,624,782 | ||

|

|

|

|||

| Net Assets consist of: |

||||

| Paid-in capital |

$ | 10,339,143 | ||

| Accumulated undistributed net investment income |

3,707 | |||

| Accumulated undistributed net realized gains from investments |

104,735 | |||

| Net unrealized appreciation on investments |

2,177,197 | |||

|

|

|

|||

| Net Assets |

$ | 12,624,782 | ||

|

|

|

|||

| Shares outstanding |

889,421 | |||

|

|

|

|||

| Net asset value (“NAV”) and offering price per share |

$ | 14.19 | ||

|

|

|

|||

| Redemption price per share (NAV * 98%) (a) |

$ | 13.91 | ||

|

|

|

|||

| (a) | The Fund charges a 2.00% redemption fee on shares redeemed in 60 days or less of purchase. Share are redeemed at the NAV if held longer than 60 calendar days. |

See accompanying notes which are an integral part of these financial statements.

7

GRANITE VALUE FUND

STATEMENT OF OPERATIONS

For the six months ended April 30, 2014 (Unaudited)

| Investment Income |

||||

| Dividend income |

$ | 89,451 | ||

| Interest income |

71 | |||

|

|

|

|||

| Total investment income |

89,522 | |||

|

|

|

|||

| Expenses |

||||

| Investment Adviser |

57,672 | |||

| Administration |

18,596 | |||

| Fund accounting |

12,397 | |||

| Transfer agent |

18,396 | |||

| Legal |

6,444 | |||

| Registration |

7,929 | |||

| Custodian |

2,628 | |||

| Audit |

7,438 | |||

| Trustee |

3,874 | |||

| Pricing |

1,047 | |||

| Miscellaneous |

4,639 | |||

|

|

|

|||

| Total expenses |

141,060 | |||

|

|

|

|||

| Fees waived and reimbursed by Adviser |

(63,194 | ) | ||

|

|

|

|||

| Net operating expenses |

77,866 | |||

|

|

|

|||

| Net investment income |

11,656 | |||

|

|

|

|||

| Net Realized and Unrealized Gains on Investments |

||||

| Net realized gains on investment securities transactions |

116,479 | |||

| Net change in unrealized appreciation of investment securities |

521,515 | |||

|

|

|

|||

| Net realized and unrealized gains on investments |

637,994 | |||

|

|

|

|||

| Net increase in net assets resulting from operations |

$ | 649,650 | ||

|

|

|

|||

See accompanying notes which are an integral part of these financial statements.

8

GRANITE VALUE FUND

STATEMENTS OF CHANGES IN NET ASSETS

| For the Six Months Ended April 30, 2014 (Unaudited) |

For the Year Ended October 31, 2013 |

|||||||

| Increase in Net Assets due to: |

||||||||

| Operations |

||||||||

| Net investment income |

$ | 11,656 | $ | 20,979 | ||||

| Net realized gain on investment transactions |

116,479 | 307,429 | ||||||

| Net change in unrealized appreciation of investments |

521,515 | 1,365,378 | ||||||

|

|

|

|

|

|||||

| Net increase in net assets resulting from operations |

649,650 | 1,693,786 | ||||||

|

|

|

|

|

|||||

| Distributions |

||||||||

| From net investment income |

(17,291 | ) | (48,544 | ) | ||||

| From net realized gains |

(287,895 | ) | – | |||||

|

|

|

|

|

|||||

| Total distributions |

(305,186 | ) | (48,544 | ) | ||||

|

|

|

|

|

|||||

| Capital Transactions |

||||||||

| Proceeds from shares sold |

1,639,277 | 5,330,630 | ||||||

| Reinvestment of distributions |

261,021 | 46,272 | ||||||

| Amount paid for shares redeemed |

(197,075 | ) | (1,194,939 | ) | ||||

|

|

|

|

|

|||||

| Net increase in net assets resulting from capital transactions |

1,703,223 | 4,181,963 | ||||||

|

|

|

|

|

|||||

| Total Increase in Net Assets |

2,047,687 | 5,827,205 | ||||||

|

|

|

|

|

|||||

| Net Assets |

||||||||

| Beginning of period |

10,577,095 | 4,749,890 | ||||||

|

|

|

|

|

|||||

| End of period |

$ | 12,624,782 | $ | 10,577,095 | ||||

|

|

|

|

|

|||||

| Accumulated undistributed net investment income |

$ | 3,707 | $ | 9,342 | ||||

|

|

|

|

|

|||||

| Share Transactions |

||||||||

| Shares sold |

120,411 | 435,459 | ||||||

| Shares issued in reinvestment of distributions |

19,067 | 4,120 | ||||||

| Shares redeemed |

(14,233 | ) | (97,956 | ) | ||||

|

|

|

|

|

|||||

| Net increase in shares |

125,245 | 341,623 | ||||||

|

|

|

|

|

|||||

See accompanying notes which are an integral part of these financial statements.

9

GRANITE VALUE FUND

FINANCIAL HIGHLIGHTS

For a share outstanding during each period

| For the Six Months Ended April 30, 2014 (Unaudited) |

For the Year Ended October 31, 2013 |

For the Period Ended October 31, 2012 (a) |

||||||||||

| Selected Per Share Data: |

||||||||||||

| Net asset value, beginning of period |

$ | 13.84 | $ | 11.24 | $ | 10.00 | ||||||

|

|

|

|

|

|

|

|||||||

| Income from investment operations: |

||||||||||||

| Net investment income |

0.01 | 0.02 | 0.05 | (b) | ||||||||

| Net realized and unrealized gains on investments |

0.72 | 2.68 | 1.19 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total Income from investment operations |

0.73 | 2.70 | 1.24 | |||||||||

|

|

|

|

|

|

|

|||||||

| Less Distributions to shareholders from: |

||||||||||||

| Net investment income |

(0.02 | ) | (0.10 | ) | – | |||||||

| Net realized gains |

(0.36 | ) | – | – | ||||||||

|

|

|

|

|

|

|

|||||||

| Total distributions |

(0.38 | ) | (0.10 | ) | – | |||||||

|

|

|

|

|

|

|

|||||||

| Paid in capital from redemption fees |

– | – | – | (c) | ||||||||

|

|

|

|

|

|

|

|||||||

| Net asset value, end of period |

$ | 14.19 | $ | 13.84 | $ | 11.24 | ||||||

|

|

|

|

|

|

|

|||||||

| Total Return (d) |

5.43 | %(e) | 24.21 | % | 12.40 | %(e) | ||||||

| Ratios and Supplemental Data: |

||||||||||||

| Net assets, end of period (000) |

$ | 12,625 | $ | 10,577 | $ | 4,750 | ||||||

| Ratio of net expenses to average net assets |

1.35 | %(f) | 1.35 | % | 1.35 | %(f) | ||||||

| Ratio of expenses to average net assets before waiver and reimbursement |

2.45 | %(f) | 3.32 | % | 8.11 | %(f) | ||||||

| Ratio of net investment income to average net assets |

0.20 | %(f) | 0.27 | % | 0.55 | %(f) | ||||||

| Portfolio turnover rate |

9 | %(e) | 33 | % | 20 | %(e) | ||||||

| (a) | For the period December 22, 2011 (commencement of operations) to October 31, 2012. |

| (b) | Calculated using the average shares method. |

| (c) | Resulted in less than $0.005 per share. |

| (d) | Total return in the above table represents the rate that the investor would have earned or lost on an investment in the Fund, assuming reinvestment of distributions. |

| (e) | Not annualized. |

| (f) | Annualized. |

See accompanying notes which are an integral part of these financial statements.

10

GRANITE VALUE FUND

NOTES TO THE FINANCIAL STATEMENTS

April 30, 2014 (Unaudited)

NOTE 1. ORGANIZATION

The Granite Value Fund (the “Fund”) is an open-end diversified series of the Valued Advisers Trust (the “Trust”). The Trust is a management investment company established under the laws of Delaware by an Agreement and Declaration of Trust dated June 13, 2008 (the “Trust Agreement”). The Trust Agreement permits the Trustees to issue an unlimited number of shares of beneficial interest of separate series without par value. The Fund is one of a series of funds authorized by the Board of Trustees (the “Board”). The Fund commenced operations December 22, 2011. The Fund’s investment adviser is Granite Investment Advisors, Inc. (the “Adviser”). The investment objective of the Fund is to provide long-term capital appreciation.

NOTE 2. SIGNIFICANT ACCOUNTING POLICIES

The following is a summary of significant accounting policies followed by the Fund in the preparation of its financial statements. These policies are in conformity with generally accepted accounting principles in the United States of America (“GAAP”).

Securities Valuation – All investments in securities are recorded at their estimated fair value as described in Note 3.

Federal Income Taxes – The Fund makes no provision for federal income or excise tax. The Fund intends to qualify each year as a regulated investment company (“RIC”) under subchapter M of the Internal Revenue Code of 1986, as amended, by complying with the requirements applicable to RICs and by distributing substantially all of its taxable income. The Fund also intends to distribute sufficient net investment income and net capital gains, if any, so that it will not be subject to excise tax on undistributed income and gains. If the required amount of net investment income or gains is not distributed, the Fund could incur a tax expense.

As of and during the period ended April 30, 2014, the Fund did not have a liability for any unrecognized tax benefits. The Fund recognizes interest and penalties, if any, related to unrecognized tax benefits as income tax expense in the Statement of Operations. During the period, the Fund did not incur any interest or penalties. The Fund is subject to examination by U.S. federal tax authorities for all tax years since inception.

Expenses – Expenses incurred by the Trust that do not relate to a specific fund of the Trust are allocated to the individual funds based on each fund’s relative net assets or other appropriate basis.

Security Transactions and Related Income – The Fund follows industry practice and records security transactions on the trade date for financial reporting purposes. The First In, First Out method is used for determining gains or losses for financial statements and income tax purposes. Dividend income is recorded on the ex-dividend date and interest income is recorded on an accrual basis. Discounts and premiums on securities purchased are amortized or accreted using the effective interest method. Withholding taxes on foreign dividends have been provided for in accordance with the Fund’s understanding of the applicable country’s tax rules and rates. The ability of issuers of debt securities held by the Fund to meet their obligations may be affected by economic and political developments in a specific country or region.

Redemption Fees – The Fund charges a 2.00% redemption fee for shares redeemed within 60 days. These fees are deducted from the redemption proceeds otherwise payable to the shareholder. The Fund will retain the fee charged as an increase in paid-in capital and such fees become part of the Fund’s daily NAV calculation.

11

GRANITE VALUE FUND

NOTES TO THE FINANCIAL STATEMENTS – (continued)

April 30, 2014 (Unaudited)

NOTE 2. SIGNIFICANT ACCOUNTING POLICIES – continued