UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-22208

Valued Advisers Trust

(Exact name of registrant as specified in charter)

Huntington Asset Services, Inc. 2960 N. Meridian Street, Suite 300

Indianapolis, IN 46208

(Address of principal executive offices)(Zip code)

Capitol Services, Inc.

615 S. Dupont Hwy.

Dover, DE 19901

(Name and address of agent for service)

With a copy to:

John H. Lively, Esq.

The Law Offices of John H. Lively & Associates, Inc.

A member firm of The 1940 Act Law Group

2041 W. 141st Terrace

Suite 119

Leawood, KS 66224

Registrant’s telephone number, including area code: 317-917-7000

Date of fiscal year end: 5/31

Date of reporting period: 11/30/2012

Item 1. Reports to Stockholders.

Semi-Annual Report

November 30, 2012

Longview Global Allocation Fund

Longview Capital Management, LLC

2 Mill Road, Suite 105

Wilmington, Delaware 19806

Toll Free (877) 460 6423

Investment Results – (Unaudited)

|

Total Returns* (For the periods ended November 30, 2012) |

||||||||||||

| Cumulative | Average Annual Returns |

|||||||||||

| Six Months | One Year | Since Inception (June 27, 2011) |

||||||||||

| Longview Global Allocation Fund with load |

-7.14 | % | -4.12 | % | -11.85 | % | ||||||

| Longview Global Allocation Fund without load |

-1.45 | % | 1.71 | % | -8.12 | % | ||||||

| Dow Jones Global Moderate Portfolio Index** |

7.30 | % | 10.13 | % | 5.09 | % | ||||||

| S&P 500® Index*** |

9.32 | % | 16.13 | % | 10.47 | % | ||||||

Total annual operating expenses, as disclosed in the Fund’s prospectus dated September 28, 2012, were 2.72% of average daily net assets. Longview Capital Management LLC (the “Adviser”) has contractually agreed to waive or limit its fees and to assume other expenses of the Fund until September 30, 2013, so that Total Annual Fund Operating Expenses does not exceed 2.20%. This operating expense limitation does not apply to brokerage fees and commissions, borrowing costs (such as interests and dividends expenses on securities sold short), taxes, extraordinary expenses, fees and expenses paid under a distribution plan adopted pursuant to Rule 12b-1, and indirect expenses (such as “Acquired Fund Fees and Expenses”). The Adviser may be entitled to the reimbursement of any fees waived or expenses reimbursed pursuant to the agreement provided overall expenses fall below the limitations set forth above. The Adviser may recoup the sum of all fees previously waived or expenses reimbursed during any of the previous three (3) years, less any reimbursement previously paid, provided total expenses do not exceed the limitation set forth above. This agreement may be only terminated by mutual consent of the Adviser and the Fund.

Effective December 13, 2012, the Adviser has agreed to amend its existing expense limitation agreement. Under the terms of the amended expense limitation agreement, the Adviser will waive its fees and/or reimburse other expenses of the Fund until September 30, 2014, so that Total Annual Fund Operating Expenses does not exceed 1.99%. Prior to December 13, 2012, the expense cap was 2.20%.

The performance quoted represents past performance, which does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The Fund’s investment objectives, risks, charges and expenses must be considered carefully

1

before investing. Current performance of a Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 1-877-460-6423.

* Return figures reflect any change in price per share and assume the reinvestment of all distributions. Total returns, with loads, include the maximum 5.75% sales charge.

** The Dow Jones Global Moderate Portfolio Index is a benchmark that takes 60% of the risk of the global securities market. It is a total returns index that is a time-varying weighted average of stocks, bonds, and cash. The Index is the efficient allocation of stocks, bonds, and cash in a portfolio with 60% of the risk of the Dow Jones Aggressive Portfolio Index. The Index is an unmanaged benchmark that assumes reinvestment of all distributions and excludes the effect of taxes and fees. Individuals cannot invest directly in this Index; however, an individual can invest in exchange traded funds or other investment vehicles that attempt to track the performance of a benchmark index.

***The S&P 500® Index is a widely recognized unmanaged index of equity prices and is representative of a broader market and range of securities than is found in the Fund’s portfolio. The Index is an unmanaged benchmark that assumes reinvestment of all distributions and excludes the effect of taxes and fees. Individuals cannot invest directly in this Index; however, an individual can invest in exchange traded funds or other investment vehicles that attempt to track the performance of a benchmark index.

The Fund’s investment objectives, risks, charges and expenses must be considered carefully before investing. The prospectus contains this and other important information about the investment company and may be obtained by calling 1-877-460-6423. Please read it carefully before investing.

The Fund is distributed by Unified Financial Securities, Inc., Member FINRA.

2

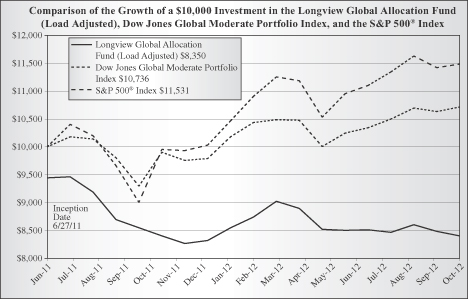

The chart above assumes an initial investment of $10,000 made on June 27, 2011 (commencement of Fund operations) and held through November 30, 2012. THE FUND’S RETURNS REPRESENT PAST PERFORMANCE AND DO NOT GUARANTEE FUTURE RESULTS. The returns shown do not reflect deduction of taxes that a shareholder would pay on the Fund’s distributions or the redemption of the Fund’s shares. Investment returns and principal values will fluctuate so that your shares, when redeemed, may be worth more or less than their original purchase price.

Current performance may be lower or higher than the performance data quoted. For more information on the Fund, and to obtain performance data current to the most recent month-end, or to request a prospectus, please call 1-877-460-6423. You should carefully consider the investment objectives, potential risks, management fees, and charges and expenses of the Fund before investing. The Fund’s prospectus contains this and other information about the Fund, and should be read carefully before investing.

The Fund is distributed by Unified Financial Securities, Inc., member FINRA.

3

FUND HOLDINGS – (Unaudited)

| 1 | As a percent of net assets. |

The investment objective of the Longview Global Allocation Fund is to provide long-term capital appreciation with capital preservation as a secondary objective.

AVAILABILITY OF PORTFOLIO SCHEDULE – (Unaudited)

The Fund files its complete schedule of portfolio holdings with the Securities and Exchange Commission (“SEC”) for the first and third quarters of each fiscal year on Form N-Q. The Fund’s Forms N-Q are available at the SEC’s website at www.sec.gov. The Forms N-Q may be reviewed and copied at the Public Reference Room in Washington DC. Information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330.

ABOUT THE FUND’S EXPENSES – (Unaudited)

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs (such as short-term redemption fees); and (2) ongoing costs, including management fees; and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The Example is based on an investment of $1,000 invested at the beginning of the period, and held for the entire period from June 1, 2012 to November 30, 2012.

Actual Expenses

The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount

4

ABOUT THE FUND’S EXPENSES – (Unaudited) (continued)

you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.60), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratios and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees, or exchange fees. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

|

Longview Global Allocation Fund |

Beginning June 1, 2012 |

Ending Account Value November 30, 2012 |

Expenses Paid During the Period Ended November 30, 2012* |

|||||||||

| Actual |

$ | 1,000.00 | $ | 985.50 | $ | 10.52 | ||||||

|

Hypothetical ** (5% return before expenses) |

$ | 1,000.00 | $ | 1,014.48 | $ | 10.67 | ||||||

* Expenses are equal to the Fund’s annualized expense ratio of 2.11%, multiplied by the average account value over the period, multiplied by 183/365.

**Assumes a 5% return before expenses.

5

Longview Global Allocation Fund

Schedule of Investments

November 30, 2012

(Unaudited)

| Shares | Fair Value | |||||||

| Exchange-Traded Funds – 43.28% |

||||||||

| Consumer Discretionary Select Sector SPDR Fund |

41,305 | $ | 1,963,227 | |||||

| Consumer Staples Select Sector SPDR Fund |

54,987 | 1,981,732 | ||||||

| Health Care Select Sector SPDR Fund |

25,565 | 1,028,736 | ||||||

| PIMCO Total Return Exchange-Traded Fund |

36,710 | 4,042,872 | ||||||

| PowerShares S&P 500 Low Volatility Portfolio |

108,650 | 3,040,027 | ||||||

| ProShares VIX Mid-Term Futures ETF (a) |

19,855 | 694,726 | ||||||

|

|

|

|||||||

| TOTAL EXCHANGE-TRADED FUNDS (Cost $12,756,560) |

12,751,320 | |||||||

|

|

|

|||||||

| Exchange-Traded Notes – 10.28% |

||||||||

| iPath S&P 500 VIX Short-Term Futures ETN (a) |

29,054 | 860,579 | ||||||

| PowerShares DB Crude Oil Short ETN (a) |

16,300 | 728,610 | ||||||

| VelocityShares Daily Inverse VIX Short-Term ETN (a) |

74,973 | 1,440,981 | ||||||

|

|

|

|||||||

| TOTAL EXCHANGE-TRADED NOTES (Cost $2,984,970) |

3,030,170 | |||||||

|

|

|

|||||||

| Money Market Securities – 47.14% |

||||||||

| Fidelity Institutional Money Market Portfolio – Institutional Shares, 0.18% (b) |

13,891,629 | 13,891,629 | ||||||

|

|

|

|||||||

| TOTAL MONEY MARKET SECURITIES (Cost $13,891,629) |

13,891,629 | |||||||

|

|

|

|||||||

| TOTAL INVESTMENTS (Cost $29,633,159) – 100.70% |

$ | 29,673,119 | ||||||

|

|

|

|||||||

| Liabilities in excess of other assets – (0.70)% |

(207,357 | ) | ||||||

|

|

|

|||||||

| TOTAL NET ASSETS – 100.00% |

$ | 29,465,762 | ||||||

|

|

|

|||||||

| (a) | Non-income producing. |

| (b) | Variable rate security; the rate shown represents the seven day yield at November 30, 2012. |

See accompanying notes which are an integral part of these financial statements.

6

Longview Global Allocation Fund

Statement of Assets and Liabilities

November 30, 2012

(Unaudited)

| Assets |

||||

| Investments in securities, at value (cost $29,633,159) |

$ | 29,673,119 | ||

| Receivable for investments sold |

1,623,653 | |||

| Receivable for fund shares sold |

177 | |||

| Dividends receivable |

9,506 | |||

| Prepaid expenses |

25,549 | |||

|

|

|

|||

| Total assets |

31,332,004 | |||

|

|

|

|||

| Liabilities |

||||

| Payable for investments purchased |

1,822,897 | |||

| Payable to Adviser (a) |

28,042 | |||

| Payable to administrator, fund accountant, and transfer agent (a) |

8,725 | |||

| Payable to custodian (a) |

411 | |||

| 12b-1 fees accrued (a) |

6,096 | |||

| Other accrued expenses |

71 | |||

|

|

|

|||

| Total liabilities |

1,866,242 | |||

|

|

|

|||

| Net Assets |

$ | 29,465,762 | ||

|

|

|

|||

| Net Assets consist of: |

||||

| Paid in capital |

$ | 32,375,819 | ||

| Accumulated net investment loss |

(274,271 | ) | ||

| Accumulated net realized loss from investment transactions |

(2,675,746 | ) | ||

| Net unrealized appreciation on investments |

39,960 | |||

|

|

|

|||

| Net Assets |

$ | 29,465,762 | ||

|

|

|

|||

| Shares Outstanding (unlimited number of shares authorized, no par value) |

3,330,290 | |||

|

|

|

|||

| Net Asset Value (“NAV”) per share |

$ | 8.85 | ||

|

|

|

|||

| Public offering price per share (NAV/94.25%) (b) |

$ | 9.39 | ||

|

|

|

|||

| Redemption price per share (NAV * 98%) (c) |

$ | 8.67 | ||

|

|

|

|||

| (a) | See Note 4 in the Notes to the Financial Statements. |

| (b) | The Fund imposes a maximum sales charge of 5.75% on purchases. |

| (c) | A redemption fee of 2.00% is charged on shares held less than 30 days. |

See accompanying notes which are an integral part of these financial statements.

7

Longview Global Allocation Fund

Statement of Operations

For the six months ended November 30, 2012

(Unaudited)

| Investment Income |

||||

| Dividend income |

$ | 225,328 | ||

|

|

|

|||

| Total Investment Income |

225,328 | |||

|

|

|

|||

| Expenses |

||||

| Investment Adviser fee (a) |

181,165 | |||

| 12b-1 fees (a) |

39,384 | |||

| Transfer agent expenses (a) |

21,670 | |||

| Administration expenses (a) |

18,801 | |||

| Registration expenses |

17,746 | |||

| Fund accounting expenses (a) |

12,534 | |||

| Legal expenses |

10,373 | |||

| Report printing expenses |

10,071 | |||

| Audit expenses |

7,619 | |||

| Custodian expenses (a) |

4,016 | |||

| Trustee expenses |

2,507 | |||

| Insurance expense |

2,083 | |||

| Offering expenses |

2,023 | |||

| Excise tax expense |

909 | |||

| Pricing expenses |

750 | |||

| Miscellaneous expenses |

636 | |||

| CCO expense |

247 | |||

| 24f-2 expense |

86 | |||

|

|

|

|||

| Total Expenses |

332,620 | |||

|

|

|

|||

| Net Investment Loss |

(107,292 | ) | ||

|

|

|

|||

| Realized & Unrealized Loss on Investments |

||||

| Net realized loss on investment transactions |

(222,752 | ) | ||

| Net change in unrealized depreciation of investments |

(130,805 | ) | ||

|

|

|

|||

| Net realized and unrealized loss on investments |

(353,557 | ) | ||

|

|

|

|||

| Net decrease in net assets resulting from operations |

$ | (460,849 | ) | |

|

|

|

|||

| (a) | See Note 4 in the Notes to the Financial Statements. |

See accompanying notes which are an integral part of these financial statements.

8

Longview Global Allocation Fund

Statements of Changes In Net Assets

| Six Months Ended November 30, 2012 (Unaudited) |

For the period ended May 31, 2012 (a) |

|||||||

| Decrease to Net Assets due to: |

||||||||

| Operations |

||||||||

| Net investment loss |

$ | (107,292 | ) | $ | (153,300 | ) | ||

| Distributions of long-term realized gains by other investment companies |

– | 3,066 | ||||||

| Net realized loss on investment transactions |

(222,752 | ) | (2,457,568 | ) | ||||

| Net change in unrealized appreciation (depreciation) of investments |

(130,805 | ) | 170,765 | |||||

|

|

|

|

|

|||||

| Net decrease in net assets resulting from operations |

(460,849 | ) | (2,437,037 | ) | ||||

|

|

|

|

|

|||||

| Distributions |

||||||||

| From net investment income |

– | (30,293 | ) | |||||

|

|

|

|

|

|||||

| Total distributions |

– | (30,293 | ) | |||||

|

|

|

|

|

|||||

| Capital Transactions |

||||||||

| Proceeds from shares sold |

1,628,057 | 38,557,775 | ||||||

| Reinvestment of distributions |

– | 266 | ||||||

| Amount paid for shares redeemed |

(4,178,219 | ) | (3,622,093 | ) | ||||

| Proceeds from redemption fees (b) |

4,309 | 3,846 | ||||||

|

|

|

|

|

|||||

| Net increase (decrease) in net assets resulting from capital transactions |

(2,545,853 | ) | 34,939,794 | |||||

|

|

|

|

|

|||||

| Total Increase (Decrease) in Net Assets |

(3,006,702 | ) | 32,472,464 | |||||

|

|

|

|

|

|||||

| Net Assets |

||||||||

| Beginning of period |

32,472,464 | – | ||||||

|

|

|

|

|

|||||

| End of period |

$ | 29,465,762 | $ | 32,472,464 | ||||

|

|

|

|

|

|||||

| Accumulated net investment loss included in net assets at the end of period |

$ | (274,271 | ) | $ | (166,979 | ) | ||

|

|

|

|

|

|||||

| Capital Share Transactions |

||||||||

| Shares sold |

181,173 | 4,010,270 | ||||||

| Shares issued in reinvestment of distributions |

– | 30 | ||||||

| Shares redeemed |

(465,019 | ) | (396,164 | ) | ||||

|

|

|

|

|

|||||

| Net increase (decrease) from capital share transactions |

(283,846 | ) | 3,614,136 | |||||

|

|

|

|

|

|||||

| (a) | For the period June 27, 2011 (commencement of operations) to May 31, 2012. |

| (b) | A redemption fee of 2.00% is charged on shares held less than 30 days. |

See accompanying notes which are an integral part of these financial statements.

9

Longview Global Allocation Fund

Financial Highlights

(For a share outstanding during the period)

| Six Months Ended November 30, 2012 (Unaudited) |

For the period ended May 31, 2012 (a) |

|||||||

| Selected Per Share Data: |

||||||||

| Net asset value, beginning of period |

$ | 8.98 | $ | 10.00 | ||||

|

|

|

|

|

|||||

| Loss from investment operations: |

||||||||

| Net investment loss |

(0.04 | ) | (0.05 | ) | ||||

| Net realized and unrealized loss on investments |

(0.09 | ) | (0.96 | ) | ||||

|

|

|

|

|

|||||

| Total from investment operations |

(0.13 | ) | (1.01 | ) | ||||

|

|

|

|

|

|||||

| Less Distributions to shareholders: |

||||||||

| From net investment income |

– | (0.01 | ) | |||||

|

|

|

|

|

|||||

| Total distributions |

– | (0.01 | ) | |||||

|

|

|

|

|

|||||

| Paid in capital from redemption fees |

– | (b) | – | (b) | ||||

|

|

|

|

|

|||||

| Net asset value, end of period |

$ | 8.85 | $ | 8.98 | ||||

|

|

|

|

|

|||||

| Total Return (c) |

(1.45 | )% (d) | (10.11 | )% (d) | ||||

| Ratios and Supplemental Data: |

||||||||

| Net assets, end of period (000) |

$ | 29,466 | $ | 32,472 | ||||

| Ratio of expenses to average net assets |

2.11 | % (e)(f) | 2.17 | % (e) | ||||

| Ratio of net investment loss to average net assets |

(0.68 | )% (e) | (0.58 | )% (e) | ||||

| Portfolio turnover rate |

583.73 | % (d) | 719.93 | % (d) | ||||

| (a) | For the period June 27, 2011 (commencement of operations) to May 31, 2012. |

| (b) | Redemption fees resulted in less than $0.005 per share. |

| (c) | Total return in the above table represents the rate that the investor would have earned or lost on an investment in the Fund, assuming reinvestment of dividends, and excludes the maximum sales charge. |

| (d) | Not annualized. |

| (e) | Annualized. |

| (f) | Does not include the effect of expenses of underlying funds. |

See accompanying notes which are an integral part of these financial statements.

10

Longview Global Allocation Fund

Notes to the Financial Statements

November 30, 2012

(Unaudited)

NOTE 1. ORGANIZATION

The Longview Global Allocation Fund (the “Fund”) is an open-end non-diversified series of the Valued Advisers Trust (the “Trust”). The Trust is a management investment company established under the laws of Delaware by an Agreement and Declaration of Trust dated June 13, 2008 (the “Trust Agreement”). The Trust Agreement permits the Trustees to issue an unlimited number of shares of beneficial interest of separate series without par value. The Fund is one of a series of funds authorized by the Board of Trustees (the “Board”). The Fund’s investment adviser is Longview Capital Management, LLC (the “Adviser”). The investment objective of the Fund is long-term capital appreciation with capital preservation as a secondary objective.

The Fund’s prospectus provides a description of the Fund’s investment objective, policies and strategies, along with information on the class of shares currently being offered. The Fund currently offers one share class that has a maximum sales charge on purchases of 5.75% as a percentage of the original purchase price.

NOTE 2. SIGNIFICANT ACCOUNTING POLICIES

The following is a summary of significant accounting policies consistently followed by the Fund in the preparation of its financial statements.

Securities Valuation – All investments in securities are recorded at their estimated fair value as described in Note 3.

Federal Income Taxes – The Fund makes no provision for federal income or excise tax. The Fund intends to qualify each year as a regulated investment company (“RIC”) under subchapter M of the Internal Revenue Code of 1986, as amended, by complying with the requirements applicable to RICs and by distributing substantially all of its taxable income. The Fund also intends to distribute sufficient net investment income and net capital gains, if any, so that it will not be subject to excise tax on undistributed income and gains. If the required amount of net investment income or gains is not distributed, the Fund could incur a tax expense.

As of and during the six months ended November 30, 2012, the Fund did not have a liability for any unrecognized tax benefits. The Fund recognizes interest and penalties, if any, related to unrecognized tax benefits as income tax expense in the statement of operations. During the period, the Fund did not incur any interest or penalties. The Fund is subject to examination by U.S. federal tax authorities for all tax years since inception.

11

Longview Global Allocation Fund

Notes to the Financial Statements - (continued)

November 30, 2012

(Unaudited)

NOTE 2. SIGNIFICANT ACCOUNTING POLICIES – (continued)

Expenses – Expenses incurred by the Trust that do not relate to a specific fund of the Trust are allocated to the individual funds based on each fund’s relative net assets or another appropriate basis (as determined by the Board).

Security Transactions and Related Income – The Fund follows industry practice and records security transactions on the trade date. The first in, first out (“FIFO”) method is used for determining gains or losses for financial statements and income tax purposes. Dividend income is recorded on the ex-dividend date and interest income is recorded on an accrual basis. Discounts and premiums on securities purchased are accreted or amortized using the effective interest method. Withholding taxes on foreign dividends have been provided for in accordance with the Fund’s understanding of the applicable country’s tax rules and rates. The ability of issuers of debt securities held by the Fund to meet their obligations may be affected by economic and political developments in a specific country or region.

Dividends and Distributions – The Fund intends to distribute substantially all of its net investment income, if any, as dividends to its shareholders on at least an annual basis. The Fund intends to distribute its net realized long term capital gains and its net realized short term capital gains, if any, at least once a year. Dividends to shareholders, which are determined in accordance with income tax regulations, are recorded on the ex-dividend date. The treatment for financial reporting purposes of distributions made to shareholders during the year from net investment income or net realized capital gains may differ from their ultimate treatment for federal income tax purposes. These differences are caused primarily by differences in the timing of the recognition of certain components of income, expense or realized gains for federal income tax purposes. Where such differences are permanent in nature, they are reclassified in the components of the net assets based on their ultimate characterization for federal income tax purposes. Any such reclassifications will have no effect on net assets, results of operations or net asset values per share of the Fund.

Redemption Fees – The Fund charges a 2.00% redemption fee for shares redeemed within 30 days. These fees are deducted from the redemption proceeds otherwise payable to the shareholder. The Fund will retain the fee charged as an increase in paid-in capital and such fees become part of the Fund’s daily Net Asset Value (“NAV”) calculation.

Contingent Deferred Sales Charge (“CDSC”) – There is no initial sales charge on purchases of shares of $1 million or more, or purchases by qualified retirement plans

12

Longview Global Allocation Fund

Notes to the Financial Statements - (continued)

November 30, 2012

(Unaudited)

NOTE 2. SIGNIFICANT ACCOUNTING POLICIES – (continued)

with at least 200 employees; however, a contingent deferred sales charge (“CDSC”) of 1.00% will be imposed if such shares are redeemed within eighteen (18) months of their purchase, based on the lower of the shares’ cost or current net asset value. Any shares acquired by reinvestment of distributions will be redeemed without a CDSC.

NOTE 3. SECURITIES VALUATION AND FAIR VALUE MEASUREMENTS

Fair value is defined as the price that a Fund would receive upon selling an investment in an orderly transaction to an independent buyer in the principal or most advantageous market of the investment. Generally Accepted Accounting Principles in the United States of America (“GAAP”) establish a three-tier hierarchy to maximize the use of observable market data and minimize the use of unobservable inputs and to establish classification of fair value measurements for disclosure purposes.

Inputs refer broadly to the assumptions that market participants would use in pricing the asset or liability, including assumptions about risk (the risk inherent in a particular valuation technique used to measure fair value such as pricing model and/or the risk inherent in the inputs to the valuation technique). Inputs may be observable or unobservable. Observable inputs are inputs that reflect the assumptions market participants would use in pricing the asset or liability developed based on market data obtained from sources independent of the reporting entity. Unobservable inputs are inputs that reflect the reporting entity’s own assumptions about the assumptions market participants would use in pricing the asset or liability developed based on the best information available in the circumstances.

Various inputs are used in determining the value of the Fund’s investments. These inputs are summarized in the three broad levels listed below.

| • | Level 1 – quoted prices in active markets for identical securities |

| • | Level 2 – other significant observable inputs (including, but not limited to, quoted prices for an identical security in an inactive market, quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.) |

| • | Level 3 – significant unobservable inputs (including the Fund’s own assumptions in determining fair value of investments based on the best information available) |

The inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the level in the fair value hierarchy

13

Longview Global Allocation Fund

Notes to the Financial Statements - (continued)

November 30, 2012

(Unaudited)

NOTE 3. SECURITIES VALUATION AND FAIR VALUE MEASUREMENTS – (continued)

within which the fair value measurement falls in its entirety, is determined based on the lowest level input that is significant to the fair value measurement in its entirety.

Equity securities, including exchange-traded funds and exchange-traded notes, are generally valued by using market quotations, but may be valued on the basis of prices furnished by a pricing service when the Fund believes such prices more accurately reflect the fair value of such securities. Securities that are traded on any stock exchange are generally valued by the pricing service at the last quoted sale price. Lacking a last sale price, an exchange traded security is generally valued by the pricing service at its last bid price. Securities traded in the NASDAQ over-the-counter market are generally valued by the pricing service at the NASDAQ Official Closing Price. When using the market quotations or close prices provided by the pricing service and when the market is considered active, the security will be classified as a Level 1 security. Sometimes, an equity security owned by the Fund will be valued by the pricing service with factors other than market quotations or when the market is considered inactive. When this happens, the security will be classified as a Level 2 security. When market quotations are not readily available, when the Fund determines that the market quotation or the price provided by the pricing service does not accurately reflect the current fair value, or when certain restricted or illiquid securities are being valued, such securities are valued as determined in good faith by the Fund, in conformity with guidelines adopted by and subject to review by the Board. These securities will be categorized as Level 3 securities.

Investments in mutual funds, including money market mutual funds, are generally priced at the ending NAV provided by the service agent of the Fund. These securities will be categorized as Level 1 securities.

Short-term investments in fixed income securities, (those with maturities of less than 60 days when acquired, or which subsequently are within 60 days of maturity), are valued by using the amortized cost method of valuation, which the Board has determined will represent fair value. These securities will be classified as Level 2 securities.

In accordance with the Trust’s good faith pricing guidelines, the Fund is required to consider all appropriate factors relevant to the value of securities for which it has determined other pricing sources are not available or reliable as described above. No single standard exists for determining fair value, because fair value depends upon the circumstances of each individual case. As a general principle, the current fair value of

14

Longview Global Allocation Fund

Notes to the Financial Statements - (continued)

November 30, 2012

(Unaudited)

NOTE 3. SECURITIES VALUATION AND FAIR VALUE MEASUREMENTS – (continued)

an issue of securities being valued by the Fund would appear to be the amount which the owner might reasonably expect to receive for them upon their current sale. Methods which are in accordance with this principle may, for example, be based on (i) a multiple of earnings; (ii) a discount from market of a similar freely traded security (including a derivative security or a basket of securities traded on other markets, exchanges or among dealers); or (iii) yield to maturity with respect to debt issues, or a combination of these and other methods. Good faith pricing is permitted if, in the Fund’s opinion, the validity of market quotations appears to be questionable based on factors such as evidence of a thin market in the security based on a small number of quotations, a significant event occurs after the close of a market but before a Fund’s NAV calculation that may affect a security’s value, or the Fund is aware of any other data that calls into question the reliability of market quotations. Good faith pricing may also be used in instances when the bonds the Fund invests in may default or otherwise cease to have market quotations readily available. Any fair valuation pricing done outside the Fund’s approved pricing methods must be approved by the Pricing Committee of the Board.

The following is a summary of the inputs used to value the Fund’s investments as of November 30, 2012:

| Valuation Inputs | ||||||||||||||||

| Assets | Level 1 - Quoted Prices in Active Markets |

Level 2 - Other Significant Observable Inputs |

Level 3 - Significant Unobservable Inputs |

Total | ||||||||||||

| Exchanged - Traded Funds |

$ | 12,751,320 | $ | – | $ | – | $ | 12,751,320 | ||||||||

| Exchanged - Traded Notes |

3,030,170 | – | – | 3,030,170 | ||||||||||||

| Money Market Securities |

13,891,629 | – | – | 13,891,629 | ||||||||||||

| Total |

29,673,119 | $ | – | – | $ | 29,673,119 | ||||||||||

The Fund did not hold any investments at any time during the reporting period in which significant unobservable inputs were used in determining fair value; therefore, no reconciliation of Level 3 securities is included for this reporting period. The Fund did not hold any derivative instruments during the reporting period.

The Trust recognizes transfers between fair value hierarchy levels at the reporting period end. There were no transfers between any levels for the period ended November 30, 2012.

15

Longview Global Allocation Fund

Notes to the Financial Statements - (continued)

November 30, 2012

(Unaudited)

NOTE 4. FEES AND OTHER TRANSACTIONS WITH AFFILIATES

Under the terms of the management agreement (the “Agreement”), on behalf of the Fund, the Adviser manages the Fund’s investments subject to oversight of the Trustees. As compensation for its management services, the Fund is obligated to pay the Adviser a fee computed and accrued daily and paid monthly at an annual rate of 1.15% of the average daily net assets of the Fund. For the six months ended November 30, 2012, the Adviser earned a fee of $181,165 from the Fund. At November 30, 2012, the Fund owed the Adviser $28,042 for advisory fees.

The Adviser has contractually agreed to waive or limit its fees and to assume other expenses of the Fund until September 30, 2013, so that Total Annual Fund Operating Expenses does not exceed 2.20%. This operating expense limitation does not apply to brokerage fees and commissions, borrowing costs (such as interest and dividend expenses on securities sold short), taxes, 12b-1 fees, other capital expenditures in accordance with GAAP, and extraordinary expenses and indirect expenses (such as “acquired funds fees and expenses”). There were no waived or reimbursed advisory fees for the six months ended November 30, 2012.

The waiver and/or reimbursement by the Adviser with respect to the Fund is subject to repayment by the Fund within the three fiscal years following the fiscal year in which that particular waiver and/or reimbursement occurred, provided that the Fund is able to make the repayment without exceeding the expense limitations described above.

The Trust retains Huntington Asset Services, Inc. (“HASI”) to manage the Fund’s business affairs and provide the Fund with administrative services, including all regulatory reporting and necessary office equipment and personnel. For the six months ended November 30, 2012, HASI earned fees of $18,801 for administrative services provided to the Fund. At November 30, 2012, HASI was owed $3,176 from the Fund for administrative services.

Certain officers of the Trust are members of management and/or employees of HASI. HASI is a wholly-owned subsidiary of Huntington Bancshares, Inc., the parent company of Unified Financial Securities, Inc. (the “Distributor”) and Huntington National Bank, the custodian of the Fund’s investments (the “Custodian”). For the six months ended November 30, 2012, the Custodian earned fees of $4,016 for custody services provided to the Fund. At November 30, 2012, the Custodian was owed $411 from the Fund for custody services.

The Trust also retains HASI to act as the Fund’s transfer agent and to provide fund accounting services. For the six months ended November 30, 2012, HASI earned fees

16

Longview Global Allocation Fund

Notes to the Financial Statements - (continued)

November 30, 2012

(Unaudited)

NOTE 4. FEES AND OTHER TRANSACTIONS WITH AFFILIATES – (continued)

of $21,670 for transfer agent services and reimbursement for out-of-pocket expenses incurred in providing transfer agent services to the Fund. At November 30, 2012, the Fund owed HASI $3,432 for transfer agent services and out-of-pocket expenses.

For the six months ended November 30, 2012, HASI earned fees of $12,534 from the Fund for fund accounting services. At November 30, 2012, HASI was owed $2,117 from the Fund for fund accounting services.

The Fund has adopted a Distribution Plan (the “Plan”) pursuant to Rule 12b-1 under the 1940 Act. The Plan provides that the Fund will pay the Distributor and/or any registered securities dealer, financial institution or any other person (the “Recipient”) a shareholder servicing fee of 0.25% of the average daily net assets of the Fund in connection with the promotion and distribution of the Fund’s shares or the provision of personal services to shareholders, including, but not necessarily limited to, advertising, compensation to underwriters, dealers and selling personnel, the printing and mailing of prospectuses to other than current Fund shareholders, the printing and mailing of sales literature and servicing shareholder accounts. The Fund or Adviser may pay all or a portion of these fees to any Recipient who renders assistance in distributing or promoting the sale of shares, or who provides certain shareholder services, pursuant to a written agreement. The Plan is a compensation plan, which means that compensation is provided regardless of 12b-1 expenses actually incurred. It is anticipated that the Plan will benefit shareholders because an effective sales program typically is necessary in order for the Fund to reach and maintain a sufficient size to achieve efficiently its investment objectives and to realize economies of scale. For the six months ended November 30, 2012, the 12b-1 expense incurred by the Fund was $39,384. The Fund owed $6,096 for 12b-1 fees as of November 30, 2012.

The Distributor acts as the principal distributor of the Fund’s shares. There were no payments made to the Distributor by the Fund for the six months ended November 30, 2012. An officer of the Trust is an officer of the Distributor and such person may be deemed to be an affiliate of the Distributor. For the six months ended November 30, 2012, there was $8,581 in sales charges deducted from the proceeds of sales of capital shares. There were no CDSC fees deducted from the redemption of capital shares for the six months ended November 30, 2012.

17

Longview Global Allocation Fund

Notes to the Financial Statements - (continued)

November 30, 2012

(Unaudited)

NOTE 5. PURCHASES AND SALES OF SECURITIES

For the six months ended November 30, 2012, purchases and sales of investment securities, other than short-term investments and short-term U.S. government obligations, were as follows:

| Purchases | Sales | |||||||

| U.S. Government Obligations |

$ | – | $ | – | ||||

| Other |

124,156,760 | 125,388,377 | ||||||

At November 30, 2012, the net unrealized appreciation (depreciation) of investments for tax purposes was as follows:

| Gross Unrealized Appreciation |

$ | 408,378 | ||

| Gross Unrealized (Depreciation) |

(1,243,561 | ) | ||

|

|

|

|||

| Net Unrealized Depreciation on Investments |

$ | (835,183 | ) | |

|

|

|

At November 30, 2012, the aggregate cost of securities for federal income tax purposes was $30,508,302 for the Fund.

NOTE 6. ESTIMATES

The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates.

NOTE 7. BENEFICIAL OWNERSHIP

The beneficial ownership, either directly or indirectly, of 25% or more of the voting securities of a fund creates a presumption of control of a fund, under Section 2(a) (9) of the Investment Company Act of 1940. At November 30, 2012, FOLIOfn Investments, Inc. (“FOLIOfn”) owned, as record shareholder, 87.39% of the outstanding shares of the Longview Global Allocation Fund. The Trust does not know whether FOLIOfn or any of the underlying beneficial owners owned or controlled 25% or more of the voting securities of the Longview Global Allocation Fund.

NOTE 8. DISTRIBUTIONS TO SHAREHOLDERS

On December 24, 2012, an income distribution of $0.0073 per share was made to shareholders of record on December 21, 2012.

18

Longview Global Allocation Fund

Notes to the Financial Statements - (continued)

November 30, 2012

(Unaudited)

NOTE 8. DISTRIBUTIONS TO SHAREHOLDERS – (continued)

The tax characterization of distributions paid for the fiscal period ended May 31, 2012 was as follows:

| 2012 | ||||

| Distributions paid from: |

||||

| Ordinary Income |

$ | 30,293 | ||

|

|

|

|||

| $ | 30,293 | |||

|

|

|

|||

At May 31, 2012, the components of distributable earnings (accumulated losses) on a tax basis were as follows:

| Capital loss carryforward |

$ | (1,577,851 | ) | |

| Unrealized depreciation |

(704,378 | ) | ||

| Other accumulated losses |

(163,479 | ) | ||

|

|

|

|||

| Total |

$ | (2,445,708 | ) | |

|

|

|

The difference between book basis and tax basis unrealized appreciation (depreciation) was attributable primarily to the tax deferral of losses on wash sales of $875,143. Qualified late year losses are certain capital and ordinary losses incurred after October 31 and December 31. For the taxable year ended May 31, 2012, the Fund plans to defer late year losses in the amount of $(163,479).

NOTE 9. CAPITAL LOSS CARRYFORWARD

At May 31, 2012, the Fund had available for federal tax purposes unused capital loss carryforwards of $1,577,851, which are available to offset future realized gains. To the extent that these carryforwards are used to offset future gains, it is probable that the amount offset will not be distributed to shareholders. Capital losses generated during the fiscal year ended May 31, 2013, will be subject to the provisions of the Regulated Investment Company Modernization Act of 2010. Capital losses generated in the current year are all short-term in character.

NOTE 10. SUBSEQUENT EVENTS

At its December 11-12, 2012 board meeting, the Board approved a change to the expense limitation agreement of the Fund. Effective December 13, 2012, the Adviser has contractually agreed to lower the Fund’s expense cap from 2.20% to 1.99% and extended the term of the expense limitation agreement such that the new contractual agreement is in effect through September 30, 2014.

19

OTHER INFORMATION

The Fund’s Statement of Additional Information (“SAI”) includes additional information about the trustees and is available without charge, upon request. You may call toll-free at (877) 460-6423 to request a copy of the SAI or to make shareholder inquiries.

20

PROXY VOTING

A description of the policies and procedures that the Fund uses to determine how to vote proxies relating to portfolio securities and information regarding how the Fund voted those proxies during the most recent twelve month period ended June 30, is available without charge upon request by (1) calling the Fund at (877) 460-6423 and (2) from Fund documents filed with the Securities and Exchange Commission (“SEC”) on the SEC’s website at www.sec.gov.

TRUSTEES

R. Jeffrey Young, Chairman

Dr. Merwyn R. Vanderlind

Ira Cohen

OFFICERS

R. Jeffrey Young, Principal Executive Officer and President

John C. Swhear, Chief Compliance Officer, AML Officer and Vice-President

Carol J. Highsmith, Vice President

Matthew J. Miller, Vice President

William J. Murphy, Principal Financial Officer and Treasurer

Heather Bonds, Secretary

INVESTMENT ADVISER

Longview Capital Management, LLC

2 Mill Road, Suite 105

Wilmington, DE 19806

DISTRIBUTOR

Unified Financial Securities, Inc.

2960 North Meridian Street, Suite 300

Indianapolis, IN 46208

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

Cohen Fund Audit Services, Ltd.

1350 Euclid Avenue, Suite 800

Cleveland, OH 44115

LEGAL COUNSEL

The Law Offices of John H. Lively & Associates, Inc.

A member firm of The 1940 Act Law Group TM

11300 Tomahawk Creek Parkway, Ste. 310

Leawood, KS 66224

CUSTODIAN

Huntington National Bank

41 S. High St.

Columbus, OH 43215

ADMINISTRATOR, TRANSFER AGENT AND FUND ACCOUNTANT

Huntington Asset Services, Inc.

2960 North Meridian Street, Suite 300

Indianapolis, IN 46208

This report is intended only for the information of shareholders or those who have received the Fund’s prospectus which contains information about the Fund’s management fee and expenses. Please read the prospectus carefully before investing.

Distributed by Unified Financial Securities, Inc.

Member FINRA/SIPC

SEMI-ANNUAL REPORT

November 30, 2012

CLOUD CAPITAL FUNDS

Cloud Capital Strategic Large Cap Fund

Cloud Capital Strategic Mid Cap Fund

Fund Adviser:

Cloud Capital LLC

5314 South Yale, Suite 606

Tulsa, OK 74135

Toll Free (877) 670-2227

Cloud Capital Strategic Large Cap Fund

Investment Results – (Unaudited)

Total Returns *

(For the periods ended November 30, 2012)

| Cumulative | Average Annual Returns | |||||

| Six Months | One Year | Since Inception (June 29, 2011) | ||||

| Cloud Capital Strategic Large Cap Fund – Institutional Class |

8.78% | 12.35% | 3.75% | |||

| S&P 500® Index** |

9.32% | 16.13% | 8.81% | |||

Total annual operating expenses, as disclosed in the Fund’s prospectus dated September 28, 2012, were 1.41% of average daily net assets. Cloud Capital LLC (the “Adviser”) contractually agreed to waive or limit its fees and to assume other expenses of the Fund until May 31, 2014, so that Total Annual Fund Operating Expenses does not exceed 1.40%. This operating expense limitation does not apply to brokerage fees and commissions, borrowing costs (such as interest and dividend expenses on securities sold short), taxes, extraordinary expenses, fees and expenses paid under a distribution plan adopted pursuant to Rule 12b-1, and indirect expenses (such as “Acquired Fund Fees and Expenses”). The Adviser may be entitled to reimbursement of any fees waived or expenses reimbursed pursuant to the agreement provided overall expenses fall below the limitations set forth above. The Adviser may recoup the sum of all fees previously waived or expenses reimbursed during any of the previous three (3) years, less any reimbursement previously paid, provided total expenses do not exceed the limitation set forth above. This agreement may only be terminated by mutual consent of the Adviser and the Fund.

The performance quoted represents past performance, which does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The Fund’s investment objectives, risks, charges and expenses must be considered carefully before investing. Current performance of a Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 1-877-670-2227.

* Return figures reflect any change in price per share and assume the reinvestment of all distributions.

** The S&P 500® Index is a widely recognized unmanaged index of equity prices and is representative of a broader market and range of securities than is found in the Fund’s portfolio. The Index is an unmanaged benchmark that assumes reinvestment of all distributions and excludes the effect of taxes and fees. Individuals cannot invest directly in this Index; however, an individual can invest in exchange traded funds or other investment vehicles that attempt to track the performance of a benchmark index.

The Fund’s investment objectives, risks, charges and expenses must be considered carefully before investing. The prospectus contains this and other important information about the investment company and may be obtained by calling 1-877-670-2227. Please read it carefully before investing.

The Fund is distributed by Unified Financial Securities, Inc., Member FINRA.

1

The chart above assumes an initial investment of $1,000,000 made on June 29, 2011 (commencement of Fund operations) and held through November 30, 2012. THE FUND’S RETURNS REPRESENT PAST PERFORMANCE AND DO NOT GUARANTEE FUTURE RESULTS. The returns shown do not reflect deduction of taxes that a shareholder would pay on the Fund’s distributions or the redemption of the Fund’s shares. Investment returns and principal values will fluctuate so that your shares, when redeemed, may be worth more or less than their original purchase price.

Current performance may be lower or higher than the performance data quoted. For more information on the Fund, and to obtain performance data current to the most recent month-end, or to request a prospectus, please call 1-877-670-2227. You should carefully consider the investment objectives, potential risks, management fees, and charges and expenses of the Fund before investing. The Fund’s prospectus contains this and other information about the Fund, and should be read carefully before investing.

The Fund is distributed by Unified Financial Securities, Inc., member FINRA.

2

Cloud Capital Strategic Mid Cap Fund

Investment Results – (Unaudited)

Total Returns *

(For the periods ended November 30, 2012)

| Cumulative | Average Annual Returns |

|||||||||||

| Six Months | One Year | Since Inception (June 29, 2011) |

||||||||||

| Cloud Capital Strategic Mid Cap Fund – Institutional Class |

8.60 | % | 9.86 | % | 1.36 | % | ||||||

| S&P MidCap 400® Index** |

8.93 | % | 14.93 | % | 4.12 | % | ||||||

Total annual operating expenses, as disclosed in the Fund’s prospectus dated September 28, 2012, were 1.69% of average daily net assets (1.41% after fee waiver/expense reimbursements). Cloud Capital LLC (the “Adviser”) contractually agreed to waive or limit its fees an to assume other certain operating expenses of the Fund until May 31, 2014, so that Total Annual Operating Expenses does not exceed 1.40%. This operating expense limitation does not apply to brokerage fees and commissions, borrowing costs (such as interest and dividend expenses on securities sold short), taxes, extraordinary expenses, fees and expenses paid under a distribution plan adopted pursuant to Rule 12b-1, and indirect expenses (such as “Acquired Fund Fees and Expenses”). The Adviser may be entitled to reimbursement of any fees waived or expenses reimbursed pursuant to the agreement provided overall expenses fall below the limitations set forth above. The Adviser may recoup the sum of all fees previously waived or expenses reimbursed during any of the previous three (3) years, less any reimbursement previously paid, provided total expenses do not exceed the limitation set forth above. This agreement may only be terminated by mutual consent of the Adviser and the Fund.

The performance quoted represents past performance, which does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The Fund’s investment objectives, risks, charges and expenses must be considered carefully before investing. Current performance of a Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 1-877-670-2227.

* Return figures reflect any change in price per share and assume the reinvestment of all distributions.

** The S&P MidCap 400® Index is a widely recognized unmanaged index of equity prices and is representative of a broader market and range of securities than is found in the Fund’s portfolio. The Index is an unmanaged benchmark that assumes reinvestment of all distributions and excludes the effect of taxes and fees. Individuals cannot invest directly in this Index; however, an individual can invest in exchange traded funds or other investment vehicles that attempt to track the performance of a benchmark index.

The Fund’s investment objectives, risks, charges and expenses must be considered carefully before investing. The prospectus contains this and other important information about the investment company and may be obtained by calling 1-877-670-2227. Please read it carefully before investing.

The Fund is distributed by Unified Financial Securities, Inc., Member FINRA.

3

The chart above assumes an initial investment of $1,000,000 made on June 29, 2011 (commencement of Fund operations) and held through November 30, 2012. THE FUND’S RETURNS REPRESENT PAST PERFORMANCE AND DO NOT GUARANTEE FUTURE RESULTS. The returns shown do not reflect deduction of taxes that a shareholder would pay on the Fund’s distributions or the redemption of the Fund’s shares. Investment returns and principal values will fluctuate so that your shares, when redeemed, may be worth more or less than their original purchase price.

Current performance may be lower or higher than the performance data quoted. For more information on the Fund, and to obtain performance data current to the most recent month-end, or to request a prospectus, please call 1-877-670-2227. You should carefully consider the investment objectives, potential risks, management fees, and charges and expenses of the Fund before investing. The Fund’s prospectus contains this and other information about the Fund, and should be read carefully before investing.

The Fund is distributed by Unified Financial Securities, Inc., member FINRA.

4

FUND HOLDINGS – (Unaudited)

1 As a percent of net assets.

The investment objective of the Cloud Capital Strategic Large Cap Fund is to consistently deliver excess returns relative to the S&P 500® Index over three- to five-year time horizons.

1 As a percent of net assets.

The investment objective of the Cloud Capital Strategic Mid Cap Fund is to consistently deliver excess returns relative to the S&P MidCap 400® Index over three- to five-year time horizons.

5

AVAILABILITY OF PORTFOLIO SCHEDULE – (Unaudited)

Each Fund files its complete schedule of portfolio holdings with the Securities and Exchange Commission (“SEC”) for the first and third quarters of each fiscal year on Form N-Q. The Funds’ Forms N-Q is available at the SEC’s website at www.sec.gov. The Forms N-Q may be reviewed and copied at the Public Reference Room in Washington DC. Information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330.

ABOUT THE FUND’S EXPENSES – (Unaudited)

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs (such as short-term redemption fees); and (2) ongoing costs, including management fees; and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The Example is based on an investment of $1,000 invested at the beginning of the period, and held for the entire period from June 1, 2012 to November 30, 2012.

Actual Expenses

The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.60), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratios and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

6

ABOUT THE FUND’S EXPENSES – (Unaudited) (continued)

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees, or exchange fees. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| Cloud Capital Strategic Large Cap Fund – |

Beginning June 1, 2012 |

Ending Account Value November 30, 2012 |

Expenses Paid During the Period Ended November 30, 2012* |

|||||||||

| Actual |

$ | 1,000.00 | $ | 1,087.80 | $ | 7.33 | ||||||

| Hypothetical ** (5% return before expenses) |

$ | 1,000.00 | $ | 1,018.05 | $ | 7.09 | ||||||

* Expenses are equal to the Cloud Capital Strategic Large Cap Fund’s annualized expense ratio of 1.40%, multiplied by the average account value over the period, multiplied by 183/365.

** Assumes a 5% return before expenses.

| Cloud Capital Strategic Mid Cap Fund – Institutional Class |

Beginning June 1, 2012 |

Ending Account Value November 30, 2012 |

Expenses Paid During the Period Ended November 30, 2012* |

|||||||||

| Actual |

$ | 1,000.00 | $ | 1,086.00 | $ | 7.33 | ||||||

| Hypothetical ** (5% return before expenses) |

$ | 1,000.00 | $ | 1,018.04 | $ | 7.09 | ||||||

* Expenses are equal to the Cloud Capital Strategic Mid Cap Fund’s annualized expense ratio of 1.40%, multiplied by the average account value over the period, multiplied by 183/365.

** Assumes a 5% return before expenses.

7

Cloud Capital Strategic Large Cap Fund

Schedule of Investments

November 30, 2012

(Unaudited)

| Shares | Value | |||||||

| Common Stocks – 98.3% |

| |||||||

| Consumer Discretionary – 10.2% |

| |||||||

| Abercrombie & Fitch Co., Class A |

839 | $ | 38,488 | |||||

| Amazon.com, Inc. * |

316 | 79,729 | ||||||

| Apollo Group, Inc., Class A * |

1,967 | 37,746 | ||||||

| AutoNation, Inc. * |

1,949 | 75,912 | ||||||

| AutoZone, Inc. * |

99 | 38,140 | ||||||

| Bed Bath & Beyond, Inc. * |

1,312 | 77,049 | ||||||

| Best Buy Co., Inc. |

2,961 | 38,816 | ||||||

| Big Lots, Inc. * |

1,378 | 38,818 | ||||||

| Cablevision Systems Corp. |

2,746 | 38,000 | ||||||

| CarMax, Inc. * |

1,065 | 38,602 | ||||||

| Carnival Corp. |

983 | 38,002 | ||||||

| CBS Corp., Class B |

1,071 | 38,517 | ||||||

| Chipotle Mexican Grill, Inc. * |

292 | 76,921 | ||||||

| Coach, Inc. |

646 | 37,344 | ||||||

| Comcast Corp., Class A |

2,129 | 79,146 | ||||||

| D.R. Horton, Inc. |

1,899 | 36,961 | ||||||

| Darden Restaurants, Inc. |

710 | 37,539 | ||||||

| DeVry, Inc. |

2,964 | 77,264 | ||||||

| DIRECTV, Class A * |

765 | 38,033 | ||||||

| Discovery Communications, Inc., Class A * |

1,335 | 80,638 | ||||||

| Dollar Tree, Inc. * |

1,830 | 76,365 | ||||||

| Expedia, Inc. |

624 | 38,609 | ||||||

| Family Dollar Stores, Inc. |

544 | 38,699 | ||||||

| Ford Motor Co. |

3,381 | 38,715 | ||||||

| GameStop Corp., Class A |

1,412 | 37,072 | ||||||

| Gannett Co., Inc. |

2,168 | 38,806 | ||||||

| Gap, Inc./The |

2,176 | 74,982 | ||||||

| Genuine Parts Co. |

612 | 39,815 | ||||||

| Goodyear Tire & Rubber Co./The * |

3,244 | 40,874 | ||||||

| H & R Block, Inc. |

2,083 | 37,548 | ||||||

| Harley-Davidson, Inc. |

809 | 38,009 | ||||||

| Harman International Industries, Inc. |

2,005 | 79,332 | ||||||

| Hasbro, Inc. |

2,018 | 77,600 | ||||||

| Home Depot, Inc./The |

1,206 | 78,466 | ||||||

See accompanying notes which are an integral part of these financial statements.

8

Cloud Capital Strategic Large Cap Fund

Schedule of Investments – (continued)

November 30, 2012

(Unaudited)

| Shares | Value | |||||||

| Consumer Discretionary – (continued) |

| |||||||

| International Game Technology |

2,881 | $ | 39,965 | |||||

| Interpublic Group of Cos., Inc./The |

3,637 | 39,355 | ||||||

| JC Penney Co., Inc. |

2,163 | 38,812 | ||||||

| Johnson Controls, Inc. |

1,415 | 38,967 | ||||||

| Kohl’s Corp. |

1,500 | 66,973 | ||||||

| Leggett & Platt, Inc. |

1,391 | 38,748 | ||||||

| Lennar Corp., Class A |

970 | 36,910 | ||||||

| Limited Brands, Inc. |

2,777 | 144,841 | ||||||

| Lowe’s Companies, Inc. |

1,076 | 38,842 | ||||||

| Macy’s, Inc. |

951 | 36,806 | ||||||

| Marriott International, Inc., Class A |

2,217 | 80,461 | ||||||

| Mattel, Inc. |

1,033 | 38,763 | ||||||

| McDonald’s Corp. |

441 | 38,374 | ||||||

| McGraw-Hill Cos., Inc./The |

731 | 38,836 | ||||||

| Meredith Corp. |

1,238 | 38,602 | ||||||

| Netflix, Inc. * |

937 | 76,582 | ||||||

| Newell Rubbermaid, Inc. |

1,784 | 38,913 | ||||||

| News Corp., Class A |

1,581 | 38,966 | ||||||

| NIKE, Inc., Class B |

389 | 37,951 | ||||||

| Nordstrom, Inc. |

694 | 37,528 | ||||||

| Omnicom Group, Inc. |

794 | 39,506 | ||||||

| O’Reilly Automotive, Inc. * |

837 | 78,762 | ||||||

| Priceline.com, Inc. * |

121 | 80,225 | ||||||

| Pulte Group, Inc. * |

2,198 | 36,946 | ||||||

| Ralph Lauren Corp. |

238 | 37,463 | ||||||

| Ross Stores, Inc. |

1,360 | 77,405 | ||||||

| Scripps Networks Interactive, Inc., Class A |

1,293 | 76,321 | ||||||

| Sears Holdings Corp. * |

816 | 34,266 | ||||||

| Staples, Inc. |

6,561 | 76,761 | ||||||

| Starbucks Corp. |

748 | 38,778 | ||||||

| Starwood Hotels & Resorts Worldwide, Inc. |

715 | 38,594 | ||||||

| Target Corp. |

604 | 38,141 | ||||||

| Tiffany & Co. |

1,232 | 72,678 | ||||||

| Time Warner Cable, Inc., Class A |

828 | 78,557 | ||||||

| Time Warner, Inc. |

811 | 38,380 | ||||||

| TJX Cos., Inc./The |

875 | 38,794 | ||||||

See accompanying notes which are an integral part of these financial statements.

9

Cloud Capital Strategic Large Cap Fund

Schedule of Investments – (continued)

November 30, 2012

(Unaudited)

| Shares | Value | |||||||

| Consumer Discretionary – (continued) |

| |||||||

| TripAdvisor, Inc. * |

1,001 | $ | 38,220 | |||||

| Urban Outfitters, Inc. * |

992 | 37,416 | ||||||

| VF Corp. |

243 | 38,968 | ||||||

| Viacom, Inc., Class B |

750 | 38,685 | ||||||

| Walt Disney Co./The |

772 | 38,320 | ||||||

| Washington Post Co./The, Class B |

110 | 40,234 | ||||||

| Whirlpool Corp. |

768 | 78,186 | ||||||

| Wyndham Worldwide Corp. |

772 | 37,900 | ||||||

| Wynn Resorts Ltd. |

711 | 79,863 | ||||||

| Yum! Brands, Inc. |

513 | 34,412 | ||||||

|

|

|

|||||||

| 4,105,533 | ||||||||

|

|

|

|||||||

| Consumer Staples – 11.1% |

| |||||||

| Altria Group, Inc. |

4,102 | 138,691 | ||||||

| Archer-Daniels-Midland Co. |

2,676 | 71,461 | ||||||

| Avon Products, Inc. |

5,097 | 71,101 | ||||||

| Beam, Inc. |

1,329 | 74,592 | ||||||

| Brown-Forman Corp., Class B |

1,035 | 72,661 | ||||||

| Campbell Soup Co. |

3,743 | 137,543 | ||||||

| Clorox Co./The |

956 | 72,971 | ||||||

| Coca-Cola Co./The |

1,893 | 71,785 | ||||||

| Coca-Cola Enterprises, Inc. |

2,327 | 72,562 | ||||||

| Colgate-Palmolive Co. |

1,262 | 136,883 | ||||||

| ConAgra Foods, Inc. |

2,410 | 71,972 | ||||||

| Constellation Brands, Inc., Class A * |

3,907 | 140,168 | ||||||

| Costco Wholesale Corp. |

1,406 | 146,222 | ||||||

| CVS Caremark Corp. |

3,016 | 140,293 | ||||||

| Dean Foods Co. * |

4,240 | 72,676 | ||||||

| Dr. Pepper Snapple Group, Inc. |

1,605 | 71,992 | ||||||

| Estee Lauder Cos., Inc./The, Class A |

2,310 | 134,537 | ||||||

| General Mills, Inc. |

1,750 | 71,736 | ||||||

| H.J. Heinz Co. |

1,231 | 71,957 | ||||||

| Hershey Co./The |

1,889 | 138,413 | ||||||

| Hillshire Brands Co. |

2,571 | 71,608 | ||||||

| Hormel Foods Corp. |

4,463 | 138,390 | ||||||

| JM Smucker Co./The |

826 | 73,071 | ||||||

See accompanying notes which are an integral part of these financial statements.

10

Cloud Capital Strategic Large Cap Fund

Schedule of Investments – (continued)

November 30, 2012

(Unaudited)

| Shares | Value | |||||||

| Consumer Staples – (continued) |

||||||||

| Kellogg Co. |

2,450 | $ | 135,870 | |||||

| Kimberly-Clark Corp. |

828 | 70,979 | ||||||

| Kroger Co./The |

2,858 | 74,996 | ||||||

| Lorillard, Inc. |

583 | 70,653 | ||||||

| McCormick & Co., Inc. |

1,095 | 70,717 | ||||||

| Mead Johnson Nutrition Co. |

2,035 | 138,790 | ||||||

| Molson Coors Brewing Co., Class B |

3,383 | 140,257 | ||||||

| Mondelez International, Inc., Class A |

5,383 | 139,374 | ||||||

| PepsiCo, Inc. |

1,014 | 71,187 | ||||||

| Philip Morris International, Inc. |

1,524 | 136,969 | ||||||

| Procter & Gamble Co. |

3,737 | 260,933 | ||||||

| Reynolds American, Inc. |

1,654 | 72,295 | ||||||

| Safeway, Inc. |

8,225 | 140,732 | ||||||

| SUPERVALU, Inc. |

26,293 | 62,576 | ||||||

| Sysco Corp. |

4,361 | 138,038 | ||||||

| Tyson Foods, Inc., Class A |

3,818 | 73,194 | ||||||

| Walgreen Co. |

4,144 | 140,533 | ||||||

| Wal-Mart Stores, Inc. |

1,960 | 141,130 | ||||||

| Whole Foods Market, Inc. |

1,492 | 139,329 | ||||||

|

|

|

|||||||

| 4,481,837 | ||||||||

|

|

|

|||||||

| Energy – 10.5% |

||||||||

| Alpha Natural Resources, Inc. * |

20,475 | 153,150 | ||||||

| Anadarko Petroleum Corp. |

983 | 71,960 | ||||||

| Apache Corp. |

1,884 | 145,240 | ||||||

| Baker Hughes, Inc. |

1,735 | 74,872 | ||||||

| Cabot Oil & Gas Corp. |

1,515 | 71,367 | ||||||

| Cameron International Corp. * |

1,364 | 73,590 | ||||||

| Chesapeake Energy Corp. |

4,183 | 71,243 | ||||||

| Chevron Corp. |

1,397 | 147,607 | ||||||

| ConocoPhillips |

2,568 | 146,244 | ||||||

| Consol Energy, Inc. |

2,290 | 71,776 | ||||||

| Denbury Resources, Inc. * |

4,798 | 74,029 | ||||||

| Devon Energy Corp. |

1,367 | 70,613 | ||||||

| Diamond Offshore Drilling, Inc. |

2,166 | 149,454 | ||||||

| Energy Transfer Partners LP (a) |

1,695 | 74,394 | ||||||

See accompanying notes which are an integral part of these financial statements.

11

Cloud Capital Strategic Large Cap Fund

Schedule of Investments – (continued)

November 30, 2012

(Unaudited)

| Shares | Value | |||||||

| Energy – (continued) |

| |||||||

| EOG Resources, Inc. |

629 | $ | 74,012 | |||||

| EQT Corp. |

1,189 | 71,407 | ||||||

| Exxon Mobil Corp. |

1,657 | 146,039 | ||||||

| FMC Technologies, Inc. * |

1,774 | 72,489 | ||||||

| Halliburton Co. |

4,537 | 151,305 | ||||||

| Helmerich & Payne, Inc. |

2,900 | 151,369 | ||||||

| Hess Corp. |

1,466 | 72,744 | ||||||

| Kinder Morgan, Inc. |

2,151 | 72,715 | ||||||

| Marathon Oil Corp. |

4,710 | 145,289 | ||||||

| Marathon Petroleum Corp. |

2,473 | 147,264 | ||||||

| Murphy Oil Corp. |

1,268 | 71,962 | ||||||

| Nabors Industries Ltd. * |

5,257 | 77,274 | ||||||

| National Oilwell Varco, Inc. |

2,072 | 141,484 | ||||||

| Newfield Exploration Co. * |

2,994 | 72,882 | ||||||

| Noble Corp. |

2,121 | 73,149 | ||||||

| Noble Energy, Inc. |

757 | 74,004 | ||||||

| Occidental Petroleum Corp. |

1,934 | 145,449 | ||||||

| Peabody Energy Corp. |

2,971 | 74,603 | ||||||

| Pioneer Natural Resources Co. |

688 | 73,616 | ||||||

| QEP Resources, Inc. |

2,548 | 71,659 | ||||||

| Range Resources Corp. |

1,084 | 69,416 | ||||||

| Rowan Cos. PLC * |

2,346 | 74,449 | ||||||

| Schlumberger Ltd. |

1,041 | 74,550 | ||||||

| Southwestern Energy Co. * |

2,044 | 70,955 | ||||||

| Spectra Energy Corp. |

5,249 | 146,703 | ||||||

| Tesoro Corp. |

3,491 | 147,579 | ||||||

| Valero Energy Corp. |

4,648 | 149,938 | ||||||

| Williams Cos., Inc./The |

2,220 | 72,905 | ||||||

| WPX Energy, Inc. * |

4,547 | 71,799 | ||||||

|

|

|

|||||||

| 4,254,548 | ||||||||

|

|

|

|||||||

| Financials – 8.5% |

||||||||

| ACE Ltd. |

512 | 40,545 | ||||||

| Aflac, Inc. |

779 | 41,297 | ||||||

| Allstate Corp./The |

985 | 39,880 | ||||||

| American Express Co. |

1,456 | 81,413 | ||||||

See accompanying notes which are an integral part of these financial statements.

12

Cloud Capital Strategic Large Cap Fund

Schedule of Investments – (continued)

November 30, 2012

(Unaudited)

| Shares | Value | |||||||

| Financials – (continued) |

| |||||||

| American International Group, Inc. * |

1,226 | $ | 40,616 | |||||

| Ameriprise Financial, Inc. |

661 | 40,079 | ||||||

| Aon PLC |

1,410 | 80,101 | ||||||

| Assurant, Inc. |

1,174 | 40,151 | ||||||

| Bank of America Corp. |

4,091 | 40,340 | ||||||

| Bank of New York Mellon Corp./The |

1,655 | 39,620 | ||||||

| BB&T Corp. |

1,417 | 39,921 | ||||||

| Berkshire Hathaway, Inc., Class B * |

454 | 39,996 | ||||||

| BlackRock, Inc. |

409 | 80,682 | ||||||

| Capital One Financial Corp. |

694 | 39,994 | ||||||

| CBRE Group, Inc. * |

2,232 | 42,251 | ||||||

| Charles Schwab Corp./The |

3,087 | 40,442 | ||||||

| Chubb Corp./The |

524 | 40,355 | ||||||

| Cincinnati Financial Corp. |

1,003 | 40,650 | ||||||

| Citigroup, Inc. |

1,134 | 39,200 | ||||||

| CME Group, Inc. |

1,467 | 81,056 | ||||||

| Comerica, Inc. |

1,340 | 39,660 | ||||||

| Discover Financial Services |

982 | 40,851 | ||||||

| E*Trade Financial Corp. * |

4,762 | 40,095 | ||||||

| Federated Investors, Inc., Class B |

2,019 | 40,081 | ||||||

| Fifth Third Bancorp |

5,452 | 79,820 | ||||||

| First Horizon National Corp. |

4,159 | 39,346 | ||||||

| Franklin Resources, Inc. |

304 | 40,151 | ||||||

| Genworth Financial, Inc., Class A * |

7,073 | 42,084 | ||||||

| Goldman Sachs Group, Inc./The |

665 | 78,280 | ||||||

| Hartford Financial Services Group, Inc./The |

1,905 | 40,358 | ||||||

| Hudson City Bancorp, Inc. |

9,897 | 79,772 | ||||||

| IntercontinentalExchange, Inc. * |

613 | 80,975 | ||||||

| Invesco Ltd. |

3,221 | 80,502 | ||||||

| JPMorgan Chase & Co. |

1,956 | 80,371 | ||||||

| KeyCorp |

9,593 | 77,514 | ||||||

| Legg Mason, Inc. |

3,113 | 79,468 | ||||||

| Leucadia National Corp. |

1,921 | 42,556 | ||||||

| Lincoln National Corp. |

1,637 | 40,429 | ||||||

| Loews Corp. |

981 | 40,093 | ||||||

| M&T Bank Corp. |

407 | 39,792 | ||||||

See accompanying notes which are an integral part of these financial statements.

13

Cloud Capital Strategic Large Cap Fund

Schedule of Investments – (continued)

November 30, 2012

(Unaudited)

| Shares | Value | |||||||

| Financials – (continued) |

| |||||||

| Marsh & McLennan Cos., Inc. |

2,261 | $ | 79,632 | |||||

| MetLife, Inc. |

1,226 | 40,688 | ||||||

| Moody’s Corp. |

1,702 | 82,663 | ||||||

| Morgan Stanley |

2,396 | 40,426 | ||||||

| NASDAQ OMX Group, Inc./The |

3,387 | 82,066 | ||||||

| Northern Trust Corp. |

1,667 | 80,062 | ||||||

| NYSE Euronext |

3,502 | 81,781 | ||||||

| People’s United Financial, Inc. |

6,582 | 80,232 | ||||||