d1263507_ex99-b.htm

Exhibit A

SHARE PURCHASE AGREEMENT

by and among

SEANERGY MARITIME HOLDINGS CORP.

as Seller

and

UNITED CAPITAL INVESTMENTS CORP.

and

ATRION SHIPHOLDING S.A.

and

PLAZA SHIPHOLDING CORP.

and

COMET SHIPHOLDING INC.

as Purchasers

Dated as of January 4, 2012

TABLE OF CONTENTS

|

ARTICLE 1

|

PURCHASE AND SALE OF SHARES

|

1

|

| |

Section 1.01

|

Authorization of Issuance and Sale of Shares

|

1

|

| |

Section 1.02

|

Sale and Purchase

|

1

|

| |

Section 1.03

|

Purchase Price

|

1

|

| |

Section 1.04

|

Computation of Purchase Price Per Share

|

1

|

| |

Section 1.05

|

Time and Place of Closing

|

2

|

| |

Section 1.06

|

Closing Payments and Delivery of Shares

|

2

|

|

ARTICLE II

|

CONDITIONS TO CLOSING

|

2

|

| |

Section 2.01

|

Mutual Conditions

|

2

|

| |

Section 2.02

|

Company's Conditions

|

2

|

|

ARTICLE III

|

REPRESENTATIONS, WARRANTIES AND AGREEMENTS OF THE COMPANY

|

3

|

| |

Section 3.01

|

Organization

|

3

|

| |

Section 3.02

|

Authorization; Enforcement

|

3

|

| |

Section 3.03

|

No Conflicts

|

3

|

|

ARTICLE IV

|

REPRESENTATIONS, WARRANTIES AND AGREEMENTS OF THE PURCHASERS

|

3

|

| |

Section 4.01

|

Organization

|

3

|

| |

Section 4.02

|

Authorization; Enforcement

|

4

|

| |

Section 4.03

|

No Conflicts

|

4

|

| |

Section 4.04

|

Investment Representations

|

4

|

|

ARTICLE V

|

OTHER AGREEMENTS

|

6

|

| |

Section 5.01

|

Legend

|

6

|

| |

Section 5.02

|

Indemnification by the Purchasers

|

6

|

| |

Section 5.03

|

Disclosure

|

6

|

| |

Section 5.04

|

Public Announcements

|

6

|

| |

Section 5.05

|

Expenses

|

6

|

| |

Section 5.06

|

Sales and Transfer Taxes

|

6

|

|

ARTICLE VI

|

MISCELLANEOUS

|

7

|

| |

Section 6.01

|

Notices

|

7

|

| |

Section 6.02

|

Further Assurances

|

8

|

| |

Section 6.03

|

Successors and Assigns

|

8

|

| |

Section 6.04

|

Entire Agreement

|

8

|

| |

Section 6.05

|

Amendments and Waivers

|

8

|

| |

Section 6.06

|

Governing Law

|

8

|

| |

Section 6.07

|

Submission to Jurisdiction

|

8

|

| |

Section 6.08

|

Waiver of Jury Trial

|

8

|

| |

Section 6.09

|

Captions; Counterparts, Execution

|

8

|

SCHEDULE A SHARE AND PURCHASE PRICE ALLOCATION

SHARE PURCHASE AGREEMENT

THIS SHARE PURCHASE AGREEMENT (this "Agreement"), dated as of January 4, 2012, by and among SEANERGY MARITIME HOLDINGS CORP., a corporation organized under the laws of the Republic of the Marshall Islands (the "Company"), and United Capital Investments Corp., a corporation organized under the laws of the Republic of Liberia ("United Capital"), Atrion Shipholding S.A., a corporation organized under the laws of the Republic of the Marshall Islands ("Atrion"), Plaza Shipholding Corp., a corporation organized under the laws of the Republic of the Marshall Islands ("Plaza"), and Comet Shipholding Inc., a corporation organized under the laws of the Republic of the Marshall Islands ("Comet" and together with United Capital, Atrion and Plaza, the "Purchasers" and each a "Purchaser").

WHEREAS, the Purchasers are companies owned and controlled by members of the Restis family, the majority beneficial owners of the Company.

WHEREAS, the Company desires to raise additional equity capital through the issuance and sale of 4,641,620 of the Company's common shares, par value $0.0001 per share (the "Shares"), at a per share price computed in accordance with Section 1.04 below, to the Purchasers, and the Purchasers desire by buy the Shares, subject to the terms and conditions set forth in this Agreement.

NOW, THEREFORE, in consideration of the mutual covenants herein contained, and for such other good and valuable consideration, the receipt of which is hereby acknowledged, the parties hereto hereby agree as follows:

ARTICLE I

PURCHASE AND SALE OF SHARES

Section 1.01 Authorization of Issuance and Sale of Shares. The Company's board of directors, acting through a special independent committee, has authorized the issuance and sale of the Shares to the Purchasers.

Section 1.02 Sale and Purchase. Upon the terms and subject to the conditions of this Agreement, the Company hereby agrees to issue and sell the Shares to the Purchasers, and the Purchasers agree to purchase the Shares from the Company, allocable between the Purchasers in the manner set forth on Schedule A.

Section 1.03 Purchase Price. The aggregate purchase price for the Shares shall be in an amount equal to ten million United States Dollars (U.S.$ 10,000,000) (the "Purchase Price"), allocable between the Purchasers in the manner set forth on Schedule A.

Section 1.04 Computation of Purchase Price Per Share. The purchase price of each Share will be computed by taking the average of the reported last sale price of the Company's common shares as quoted on the NASDAQ Global Market for each of the five (5) trading days immediately prior to the date of this Agreement.

Section 1.05 Time and Place of Closing. Upon the terms and subject to satisfaction or waiver of the conditions contained in this Agreement, the closing of the transactions contemplated by this Agreement (the "Closing") will take place on a date to be agreed in writing not later than by the close of business on January 31st, 2012 at the offices of Seward & Kissel LLP or at such other place or time as the parties may agree in writing. The date on which the Closing occurs is herein referred to as the "Closing Date" and the Closing shall be deemed to have occurred as of the close of business on the Closing Date.

Section 1.06 Closing Payments and Delivery of Securities. Upon the terms and subject to the satisfaction of the conditions contained in this Agreement, the Purchasers shall deliver to the Company, pursuant to wire instructions furnished separately, an amount equal to the Purchase Price in immediately available U.S. funds, and the Company shall issue and deliver to the Purchasers stock certificates representing the Shares, allocable between the Purchasers in the manner set forth on Schedule A.

ARTICLE II

CONDITIONS TO CLOSING

Section 2.01 Mutual Conditions. The respective obligations of each party to consummate the issuance and sale and the purchase of the Shares shall be subject to the satisfaction of each of the following conditions (any or all of which may be waived by a particular party on behalf of itself in writing, in whole or in part, to the extent permitted by applicable law):

(a) the Company and the Purchasers shall have entered into and shall have executed a registration rights agreement with respect to the Shares in the form attached hereto as Schedule B (the "Registration Rights Agreement");

(b) no statute, rule, order, decree or regulation shall have been enacted or promulgated, and no action shall have been taken, by any federal, state, local or foreign political subdivision, court, administrative agency, board, bureau, commission or department or other governmental authority or instrumentality (each, a "Governmental Authority") which temporarily, preliminarily or permanently restrains, precludes, enjoins or otherwise prohibits the consummation of the transactions contemplated by this Agreement or makes the transactions contemplated hereby illegal;

(c) there shall not be pending any suit, action or proceeding by any Governmental Authority or any person seeking to restrain, preclude, enjoin or prohibit the transactions contemplated by this Agreement; and

(d) all other consents, authorizations, waivers, orders and approvals of, notices to, filings or registrations with and the expiration of all waiting periods imposed by, any third person, including any Governmental Authority, which are required for or in connection with the execution and delivery by the parties of this Agreement and the consummation the transactions contemplated by this Agreement shall have been obtained or made, in form and substance reasonably satisfactory to each of the parties, and shall be in full force and effect.

Section 2.02 Company's Conditions. The obligation of the Company to consummate the issuance and sale of the Shares to the Purchasers shall be subject to the satisfaction of the condition (which may be waived by the Company in writing, in whole or in part, to the extent permitted by applicable law) that the representations and warranties of the Purchasers contained in this Agreement shall be true and correct in all material respects at and as of the Closing Date as if made on and as of the Closing Date (except that representations made as of a specific date shall be required to be true and correct as of such date only).

ARTICLE III

REPRESENTATIONS, WARRANTIES AND AGREEMENTS OF THE COMPANY

The Company hereby represents and warrants to, and agrees with, each of the Purchasers, as of the date hereof and as of the Closing Date, as follows:

Section 3.01 Organization. The Company is an entity duly incorporated, validly existing and in good standing under the laws of the Republic of the Marshall Islands, with the requisite power and authority to enter into this Agreement and the transactions contemplated hereby.

Section 3.02 Authorization; Enforcement. The Company has the requisite corporate power and authority to enter into and to consummate the transactions contemplated by this Agreement and otherwise to carry out its obligations hereunder. The execution and delivery of this Agreement by the Company and the consummation by it of the transactions contemplated hereby have been duly authorized by all necessary corporate action. No other corporate or other action or proceeding on the part of the Company is necessary to authorize this Agreement or the consummation of the transactions contemplated hereby. This Agreement has been duly executed by the Company and, when delivered, will constitute the valid and binding obligation of the Company, enforceable against the Company in accordance with its terms, except (i) as limited by applicable bankruptcy, insolvency, reorganization, moratorium, fraudulent conveyance and any other laws of general application affecting enforcement of creditors' rights generally, (ii) as limited by laws relating to the availability of a specific performance, injunctive relief or other equitable remedies or (iii) to the extent the indemnification provisions contained in this Agreement may be limited by applicable federal or state securities laws, public policy and other equitable considerations.

Section 3.03 No Conflicts. The execution, delivery and performance of this Agreement by the Company and the consummation by the Company of the transactions contemplated hereby do not and will not, (i) conflict with or violate any provision of its Amended and Restated Articles of Incorporation or Amended and Restated Bylaws, (ii) conflict with, or constitute a default (or an event that with notice or lapse of time or both would become a default) under, or give to others any rights of termination, amendment, acceleration or cancellation with or without notice, lapse of time or both) of, any contract to which the Company is a party or by which any property or asset of the Company is bound or affected, (iii) result in a violation of any law, rule, statute or regulation to which the Company is subject (including federal and state securities laws and regulations) or (iv) result in any violation of any order, judgment, injunction, decree or other restriction of any Governmental Authority to which the Company is subject, or by which any property or asset of the Company is bound or affected.

ARTICLE IV

REPRESENTATIONS, WARRANTIES AND AGREEMENTS OF THE PURCHASERS

Each Purchaser, severally and not jointly, hereby represents and wan-ants to, and agrees with, the Company, as of the date hereof and as of the Closing Date, as follows:

Section 4.01 Organization. Such Purchaser is an entity duly incorporated, validly existing and in good standing under the laws of the Republic of Liberia or the Republic of the Marshall Islands, as the case may be, with the requisite power and authority to enter into this Agreement and the transactions contemplated hereby.

Section 4.02 Authorization; Enforcement. Such Purchaser has the requisite corporate power and authority to enter into and to consummate the transactions contemplated by this Agreement and otherwise to carry out its obligations hereunder. The execution and delivery of this Agreement by such Purchaser and the consummation by it of the transactions contemplated by this Agreement have been duly authorized by all necessary corporate action. No other corporate or other action or proceeding on the part of a Purchaser is necessary to authorize this Agreement or the consummation of the transactions contemplated by this Agreement. This Agreement and has been duly executed by such Purchaser and when delivered, will constitute the valid and binding obligation of such Purchaser enforceable against such Purchaser in accordance with its terms, except: (i) as may be limited by applicable bankruptcy, insolvency, reorganization, moratorium, fraudulent conveyance and any other laws of general application affecting enforcement of creditors' rights generally; (ii) as limited by laws relating to the availability of specific performance, injunctive relief or other equitable remedies; or (iii) to the extent the indemnification provisions contained in this Agreement may be limited by applicable federal or state securities laws, public policy and other• equitable considerations.

Section 4.03 No Conflicts. The execution, delivery and performance of this Agreement by such Purchaser and the consummation of the transactions contemplated hereby do not and will not: (i) conflict with or violate any provision of its articles of incorporation, bylaws or other charter documents; (ii) conflict with, or constitute a default (or an event that with notice or lapse of time or both would become a default) under, or give to others any rights of termination, amendment, acceleration or cancellation (with or without notice, lapse of time or both) of, any contract to which such Purchaser is a party; (iii) result in a violation of any law, rule, statute or regulation to which such Purchaser is subject (including federal and state securities laws and regulations); or (iv) result in any violation of any order, judgment, injunction, decree or other restriction of any Governmental Authority to which such Purchaser is subject, or by which any respective property or asset of the Purchaser• is bound or affected.

Section 4.04 Investment Representations.

(a) Investment Intent. Such Purchaser is acquiring the Shares for its own account, for investment purposes only and not with a view to or for distributing or reselling the Shares or any part thereof, without prejudice, however, to such Purchaser's right at all times to sell or otherwise dispose of all or any part of the Shares in compliance with applicable federal and state securities laws. None of the Purchasers has any agreement or understanding, directly or indirectly, with any person to distribute any of the Shares.

(b) Affiliate of the Company. Such Purchaser is an "affiliate" of the Company (as defined in Rule 144 under the U.S. Securities Act of 1933, as amended (the "Securities Act")) or acting on behalf of such an affiliate and agrees that it shall not resell, transfer, pledge, hypothecate or otherwise dispose of any Shares except as shall be permitted under all applicable laws, rules and regulations and in accordance with the provisions of Section 4.04(g) below. In addition, such Purchaser understands that none of the Shares may be pledged unless: (i) the Shares have been registered under the Securities Act and any applicable state securities law or (ii) the Company has received an opinion of counsel satisfactory to the Company and its counsel that such pledge is exempt from, or not subject to, such registration.

(c) General Solicitation. Such Purchaser is not purchasing the Shares as a result of any advertisement, article, notice or other communication regarding the Shares published in any newspaper, magazine or similar media or broadcast over television or radio or presented at any seminar or any other general solicitation or general advertisement.

(d) Access to Information. Such Purchaser acknowledges that it has had the opportunity to review this Agreement and has been afforded: (i) the reasonable opportunity to ask such questions as it has deemed necessary of, and to receive answers from, representatives of the Company concerning the terms and conditions of the Securities and the merits and risks of investing in the Securities; (ii) reasonable access to information about the Company and its financial condition, results of operations, business, properties, management and prospects sufficient to enable it to evaluate its investment; and (iii) the opportunity to obtain such additional information that the Company possesses or can acquire without unreasonable effort or expense that is necessary to make an informed investment decision with respect to the transactions contemplated hereby.

(e) Independent Investment Decision. Such Purchaser has independently evaluated the merits of its decision to acquire the Shares pursuant to this Agreement, such decision has been independently made by such Purchaser and such Purchaser confirms that it has only relied on the advice of its own counsel and not on the advice of the Company or its counsel in making such decision.

(f) Reliance upon Representation and Warranties. Such Purchaser understands that the Shares are being offered and sold to such Purchaser in reliance on exemptions from the registration requirements of United States federal and state securities laws, and that the Company is relying upon the truth and accuracy of, and the compliance by such Purchaser with, the representations, warranties and agreements of such Purchaser set forth herein in order to determine the availability of such exemptions and the eligibility of such Purchaser to acquire the Shares.

(g) Unregistered Shares. Such Purchaser understands that: (a) the Shares have not been registered under the Securities Act or any state securities laws, and may not be offered for sale, sold, assigned or transferred, unless: (A) subsequently registered thereunder pursuant to the Registration Rights Agreement or (B) sold in reliance on an exemption therefrom, provided that the Company shall receive an opinion of counsel satisfactory to the Company and its counsel that such registration is not required; and (b) except as shall be provided under the Registration Rights Agreement, neither the Company nor any other person is under any obligation to register the Shares under the Securities Act or any state securities laws or to comply with the terms and conditions of any exemption thereunder.

ARTICLE V

OTHER AGREEMENTS

Section 5.01 Legend

Each Purchaser hereby acknowledges and agrees that the share certificates representing the Shares will bear the following legend:

| |

THE SHARES REPRESENTED BY THIS CERTIFICATE HAVE NOT BEEN REGISTERED UNDER THE SECURITIES

ACT OF 1933, AS AMENDED, OR ANY STATE SECURITIES LAWS, AND MAY NOT BE SOLD OR OFFERED FOR SALE IN THE ABSENCE OF SUCH REGISTRATION OR UNLESS THE COMPANY HAS RECEIVED AN OPINION OF COUNSEL SATISFACTORY TO THE COMPANY AND ITS COUNSEL THAT SUCH TRANSACTION IS EXEMPT FROM, OR NOT SUBJECT TO, REGISTRATION.

|

|

Section 5.02 Indemnification by the Purchasers. Each Purchaser agrees, severally and not jointly, to indemnify the Company and its officers, directors, employees, agents, counsel, accountants, and other representatives from, and hold each of them harmless against, any and all losses, actions, suits, proceedings (including any investigations, litigation or inquiries), demands, and causes of action, and promptly upon demand, pay or reimburse each of them for all reasonable costs, losses, liabilities, damages, or expenses of any kind or nature whatsoever, including, without limitation, the reasonable fees and disbursements of counsel and all other reasonable expenses incurred in connection with investigating, defending or preparing to defend any such matter that may be incurred by them or asserted against or involve any of them as a result of, arising out of, or in any way related to the breach of any of the representations, warranties or covenants of such Purchaser contained herein; provided that the liability of a Purchaser shall not be in an amount greater than its allocable Purchase Price, as set forth on Schedule A.

Section 5.03 Disclosure. Disclosure to the public or to any third party of the existence or terms of this Agreement and the transactions contemplated hereby and any other information relating to any party hereto shall be at the sole and complete discretion of the Company. The Purchaser acknowledges that the Company will file this Agreement with the U.S. Securities and Exchange Commission as an exhibit to a Report on Form 6-K.

Section 5.04 Public Announcements. The issuance of any press release or any other public statement thereafter with respect to this Agreement and the transactions contemplated hereby shall be at the Company's sole and complete discretion.

Section 5.05 Expenses. Except as otherwise provided herein, the Company and each Purchaser shall each bear their own costs and expenses incurred in connection with this Agreement and the transactions contemplated hereby.

Section 5.06 Sales and Transfer Taxes. All sales and transfer taxes (including all stock transfer taxes, if any) incurred in connection with this Agreement and the transactions contemplated hereby will be borne by the Company, and the Company will, at its own expense, file all necessary tax returns and other documentation with respect to all such sales and transfer taxes, and, if required by applicable law, the Purchasers will join in the execution of any such tax returns or other documentation.

ARTICLE VI

MISCELLANEOUS

Section 6.01 Notices. All notices, requests, consents and other communications under this Agreement shall be in writing and shall be deemed delivered (i) upon delivery when delivered personally, (ii) upon receipt if by facsimile transmission (with confirmation of receipt thereof), or (iii) one business day after being sent via a reputable nationwide overnight courier service guaranteeing next business day delivery, in each case to the intended recipient as set forth below:

If to the Company:

1-3 Patriarchou Grigoriou Street 16674 Glyfada

Athens, Greece

Attention: Chief Executive Officer

Facsimile: +30 210 963-8450

With a copy (which shall not constitute notice) to:

Seward & Kissel LLP

One Battery Park Plaza

New York, New York 10004

Attention: Gary J. Wolfe

Facsimile: +1 212 480-8421

If to any Purchaser:

11 Poseidonos Avenue

Athens 167 77 Greece

Attention: Evan Breibart

Facsimile: +30 210 8985430

Any party may change the address to which notices, requests, consents or other communications hereunder are to be delivered by giving the other parties notice in the manner set forth in this Section 6.01.

Section 6.02 Further Assurances. Each party agrees that it will execute and deliver, or cause to be executed and delivered, on or after the date of this Agreement, all such other documents and instruments as are reasonably required for the performance of such party's obligations hereunder and will take all commercially reasonable actions as may be necessary to consummate the transactions contemplated hereby and to effectuate the provisions and purposes hereof.

Section 6.03 Successors and Assigns. This Agreement shall be binding upon, inure to the benefit of and be enforceable by the parties hereto and their respective successors and assigns; provided, that none of the parties hereto may assign any of its obligations hereunder without the prior written consent of the other party.

Section 6.04 Entire Agreement. This Agreement constitutes the entire agreement by the parties hereto and supersedes any other agreement, whether written or oral, that may have been made or entered into between them relating to the matters contemplated hereby.

Section 6.05 Amendments and Waivers. This Agreement may be amended, modified, superseded, or canceled, and any of the terms, representations, warranties or covenants hereof may be waived, only by written instrument executed by both of the parties hereto or, in the case of a waiver, by the party waiving compliance.

Section 6.06 Governing Law. This Agreement shall be governed by and construed in accordance with the laws of the State of New York without regard to conflicts of laws principles.

Section 6.07 Submission to Jurisdiction. Any legal action or proceeding in connection with this Agreement or the performance hereof may be brought in the state and federal courts located in the Borough of Manhattan, City, County and State of New York, and the parties hereby irrevocably submit to the non-exclusive jurisdiction of such courts for the purpose of any such action or proceeding.

Section 6.08 Waiver of Jury Trial. The parties hereby irrevocably waive trial by jury in any action, proceeding or claim brought by any party hereto or beneficiary hereof on any matter whatsoever arising out of or in any way connected with this Agreement.

Section 6.09 Captions; Counterparts, Execution. The captions in this Agreement are for convenience only and shall not be considered a part of or affect the construction or interpretation of any provision of this Agreement. This Agreement may be executed in one or more counterparts, each of which shall be an original, but all of which together shall constitute one and the same instrument. All such counterparts may be delivered between the parties hereto by facsimile or other electronic transmission, which shall not affect the validity thereof.

[Signature Page Follows]

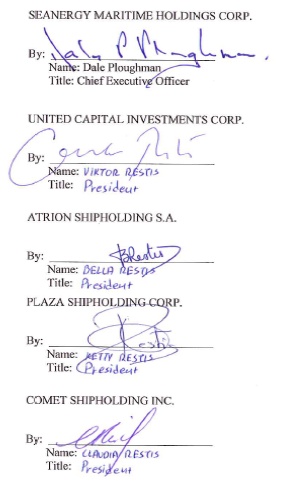

IN WITNESS WHEREOF, the Company and each of the Purchasers have caused this Agreement to be duly executed as of the date first above written.

|

[Signature Page to the Stock Purchase Agreement]

|

Schedule A

SHARE AND PURCHASE PRICE ALLOCATION

| |

Purchaser

|

Shares

|

Purchase Price

|

|

| |

United Capital Investments Corp.

|

1,160,405

|

$2,500,000

|

|

| |

Atrion Shipholding S.A.

|

1,160,405

|

$2,500,000

|

|

| |

Plaza Shipholding Corp.

|

1,160,405

|

$2,500,000

|

|

| |

Comet Shipholding Inc.

|

1,160,405

|

$2,500,000

|

|

| |

TOTAL:

|

4,641,620

|

$10,000,000

|

|

Schedule B

Form of Registration Rights Agreement

[THE REMAINDER OF THIS PAGE INTENTIONALLY LEFT BLANK]