mg-202312310001436126false2023FYP5DP4YP4Yhttp://fasb.org/us-gaap/2023#OtherAssetsNoncurrenthttp://fasb.org/us-gaap/2023#OtherAssetsNoncurrenthttp://fasb.org/us-gaap/2023#OtherAssetsNoncurrenthttp://fasb.org/us-gaap/2023#OtherAssetsNoncurrenthttp://www.mistrasgroup.com/20231231#AccruedExpensesAndOtherLiabilitiesCurrenthttp://www.mistrasgroup.com/20231231#AccruedExpensesAndOtherLiabilitiesCurrenthttp://fasb.org/us-gaap/2023#OtherLiabilitiesNoncurrenthttp://fasb.org/us-gaap/2023#OtherLiabilitiesNoncurrent00014361262023-01-012023-12-3100014361262023-06-30iso4217:USD00014361262024-03-06xbrli:shares00014361262023-12-3100014361262022-12-31iso4217:USDxbrli:shares00014361262022-01-012022-12-3100014361262021-01-012021-12-310001436126us-gaap:CommonStockMember2020-12-310001436126us-gaap:AdditionalPaidInCapitalMember2020-12-310001436126us-gaap:RetainedEarningsMember2020-12-310001436126us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-12-310001436126us-gaap:ParentMember2020-12-310001436126us-gaap:NoncontrollingInterestMember2020-12-3100014361262020-12-310001436126us-gaap:RetainedEarningsMember2021-01-012021-12-310001436126us-gaap:ParentMember2021-01-012021-12-310001436126us-gaap:NoncontrollingInterestMember2021-01-012021-12-310001436126us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-01-012021-12-310001436126us-gaap:AdditionalPaidInCapitalMember2021-01-012021-12-310001436126us-gaap:CommonStockMember2021-01-012021-12-310001436126us-gaap:CommonStockMember2021-12-310001436126us-gaap:AdditionalPaidInCapitalMember2021-12-310001436126us-gaap:RetainedEarningsMember2021-12-310001436126us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-12-310001436126us-gaap:ParentMember2021-12-310001436126us-gaap:NoncontrollingInterestMember2021-12-3100014361262021-12-310001436126us-gaap:RetainedEarningsMember2022-01-012022-12-310001436126us-gaap:ParentMember2022-01-012022-12-310001436126us-gaap:NoncontrollingInterestMember2022-01-012022-12-310001436126us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-01-012022-12-310001436126us-gaap:AdditionalPaidInCapitalMember2022-01-012022-12-310001436126us-gaap:CommonStockMember2022-01-012022-12-310001436126us-gaap:CommonStockMember2022-12-310001436126us-gaap:AdditionalPaidInCapitalMember2022-12-310001436126us-gaap:RetainedEarningsMember2022-12-310001436126us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-310001436126us-gaap:ParentMember2022-12-310001436126us-gaap:NoncontrollingInterestMember2022-12-310001436126us-gaap:RetainedEarningsMember2023-01-012023-12-310001436126us-gaap:ParentMember2023-01-012023-12-310001436126us-gaap:NoncontrollingInterestMember2023-01-012023-12-310001436126us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-012023-12-310001436126us-gaap:AdditionalPaidInCapitalMember2023-01-012023-12-310001436126us-gaap:CommonStockMember2023-01-012023-12-310001436126us-gaap:CommonStockMember2023-12-310001436126us-gaap:AdditionalPaidInCapitalMember2023-12-310001436126us-gaap:RetainedEarningsMember2023-12-310001436126us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-12-310001436126us-gaap:ParentMember2023-12-310001436126us-gaap:NoncontrollingInterestMember2023-12-31mg:segment00014361262023-10-012023-12-310001436126us-gaap:VariableInterestEntityPrimaryBeneficiaryMembermg:LimitedPartnershipMember2020-07-012020-07-31xbrli:pure0001436126us-gaap:VariableInterestEntityPrimaryBeneficiaryMember2023-12-310001436126us-gaap:VariableInterestEntityPrimaryBeneficiaryMember2023-01-012023-12-310001436126us-gaap:ComputerSoftwareIntangibleAssetMember2023-12-310001436126us-gaap:SellingGeneralAndAdministrativeExpensesMember2023-01-012023-12-310001436126us-gaap:SellingGeneralAndAdministrativeExpensesMember2022-01-012022-12-310001436126us-gaap:SellingGeneralAndAdministrativeExpensesMember2021-01-012021-12-3100014361262024-01-012023-12-310001436126mg:OilGasMembermg:NorthAmericaSegmentMemberus-gaap:OperatingSegmentsMember2023-01-012023-12-310001436126mg:InternationalMembermg:OilGasMemberus-gaap:OperatingSegmentsMember2023-01-012023-12-310001436126mg:ProductsandSystemsMembermg:OilGasMemberus-gaap:OperatingSegmentsMember2023-01-012023-12-310001436126mg:OilGasMembermg:CorporateAndEliminationsMember2023-01-012023-12-310001436126mg:OilGasMember2023-01-012023-12-310001436126mg:AerospaceandDefenseMembermg:NorthAmericaSegmentMemberus-gaap:OperatingSegmentsMember2023-01-012023-12-310001436126mg:InternationalMembermg:AerospaceandDefenseMemberus-gaap:OperatingSegmentsMember2023-01-012023-12-310001436126mg:ProductsandSystemsMembermg:AerospaceandDefenseMemberus-gaap:OperatingSegmentsMember2023-01-012023-12-310001436126mg:AerospaceandDefenseMembermg:CorporateAndEliminationsMember2023-01-012023-12-310001436126mg:AerospaceandDefenseMember2023-01-012023-12-310001436126mg:IndustrialsMembermg:NorthAmericaSegmentMemberus-gaap:OperatingSegmentsMember2023-01-012023-12-310001436126mg:InternationalMembermg:IndustrialsMemberus-gaap:OperatingSegmentsMember2023-01-012023-12-310001436126mg:ProductsandSystemsMembermg:IndustrialsMemberus-gaap:OperatingSegmentsMember2023-01-012023-12-310001436126mg:IndustrialsMembermg:CorporateAndEliminationsMember2023-01-012023-12-310001436126mg:IndustrialsMember2023-01-012023-12-310001436126mg:NorthAmericaSegmentMembermg:PowerGenerationAndTransmissionMemberus-gaap:OperatingSegmentsMember2023-01-012023-12-310001436126mg:InternationalMembermg:PowerGenerationAndTransmissionMemberus-gaap:OperatingSegmentsMember2023-01-012023-12-310001436126mg:ProductsandSystemsMembermg:PowerGenerationAndTransmissionMemberus-gaap:OperatingSegmentsMember2023-01-012023-12-310001436126mg:CorporateAndEliminationsMembermg:PowerGenerationAndTransmissionMember2023-01-012023-12-310001436126mg:PowerGenerationAndTransmissionMember2023-01-012023-12-310001436126mg:OtherProcessIndustriesMembermg:NorthAmericaSegmentMemberus-gaap:OperatingSegmentsMember2023-01-012023-12-310001436126mg:InternationalMembermg:OtherProcessIndustriesMemberus-gaap:OperatingSegmentsMember2023-01-012023-12-310001436126mg:ProductsandSystemsMembermg:OtherProcessIndustriesMemberus-gaap:OperatingSegmentsMember2023-01-012023-12-310001436126mg:OtherProcessIndustriesMembermg:CorporateAndEliminationsMember2023-01-012023-12-310001436126mg:OtherProcessIndustriesMember2023-01-012023-12-310001436126mg:NorthAmericaSegmentMembermg:InfrastructureResearchandEngineeringMemberus-gaap:OperatingSegmentsMember2023-01-012023-12-310001436126mg:InternationalMembermg:InfrastructureResearchandEngineeringMemberus-gaap:OperatingSegmentsMember2023-01-012023-12-310001436126mg:ProductsandSystemsMembermg:InfrastructureResearchandEngineeringMemberus-gaap:OperatingSegmentsMember2023-01-012023-12-310001436126mg:InfrastructureResearchandEngineeringMembermg:CorporateAndEliminationsMember2023-01-012023-12-310001436126mg:InfrastructureResearchandEngineeringMember2023-01-012023-12-310001436126mg:NorthAmericaSegmentMembermg:PetrochemicalMemberus-gaap:OperatingSegmentsMember2023-01-012023-12-310001436126mg:InternationalMembermg:PetrochemicalMemberus-gaap:OperatingSegmentsMember2023-01-012023-12-310001436126mg:ProductsandSystemsMembermg:PetrochemicalMemberus-gaap:OperatingSegmentsMember2023-01-012023-12-310001436126mg:PetrochemicalMembermg:CorporateAndEliminationsMember2023-01-012023-12-310001436126mg:PetrochemicalMember2023-01-012023-12-310001436126mg:OtherProductsandServicesMembermg:NorthAmericaSegmentMemberus-gaap:OperatingSegmentsMember2023-01-012023-12-310001436126mg:OtherProductsandServicesMembermg:InternationalMemberus-gaap:OperatingSegmentsMember2023-01-012023-12-310001436126mg:ProductsandSystemsMembermg:OtherProductsandServicesMemberus-gaap:OperatingSegmentsMember2023-01-012023-12-310001436126mg:OtherProductsandServicesMembermg:CorporateAndEliminationsMember2023-01-012023-12-310001436126mg:OtherProductsandServicesMember2023-01-012023-12-310001436126mg:NorthAmericaSegmentMemberus-gaap:OperatingSegmentsMember2023-01-012023-12-310001436126mg:InternationalMemberus-gaap:OperatingSegmentsMember2023-01-012023-12-310001436126mg:ProductsandSystemsMemberus-gaap:OperatingSegmentsMember2023-01-012023-12-310001436126mg:CorporateAndEliminationsMember2023-01-012023-12-310001436126mg:OilGasMembermg:NorthAmericaSegmentMemberus-gaap:OperatingSegmentsMember2022-01-012022-12-310001436126mg:InternationalMembermg:OilGasMemberus-gaap:OperatingSegmentsMember2022-01-012022-12-310001436126mg:ProductsandSystemsMembermg:OilGasMemberus-gaap:OperatingSegmentsMember2022-01-012022-12-310001436126mg:OilGasMembermg:CorporateAndEliminationsMember2022-01-012022-12-310001436126mg:OilGasMember2022-01-012022-12-310001436126mg:AerospaceandDefenseMembermg:NorthAmericaSegmentMemberus-gaap:OperatingSegmentsMember2022-01-012022-12-310001436126mg:InternationalMembermg:AerospaceandDefenseMemberus-gaap:OperatingSegmentsMember2022-01-012022-12-310001436126mg:ProductsandSystemsMembermg:AerospaceandDefenseMemberus-gaap:OperatingSegmentsMember2022-01-012022-12-310001436126mg:AerospaceandDefenseMembermg:CorporateAndEliminationsMember2022-01-012022-12-310001436126mg:AerospaceandDefenseMember2022-01-012022-12-310001436126mg:IndustrialsMembermg:NorthAmericaSegmentMemberus-gaap:OperatingSegmentsMember2022-01-012022-12-310001436126mg:InternationalMembermg:IndustrialsMemberus-gaap:OperatingSegmentsMember2022-01-012022-12-310001436126mg:ProductsandSystemsMembermg:IndustrialsMemberus-gaap:OperatingSegmentsMember2022-01-012022-12-310001436126mg:IndustrialsMembermg:CorporateAndEliminationsMember2022-01-012022-12-310001436126mg:IndustrialsMember2022-01-012022-12-310001436126mg:NorthAmericaSegmentMembermg:PowerGenerationAndTransmissionMemberus-gaap:OperatingSegmentsMember2022-01-012022-12-310001436126mg:InternationalMembermg:PowerGenerationAndTransmissionMemberus-gaap:OperatingSegmentsMember2022-01-012022-12-310001436126mg:ProductsandSystemsMembermg:PowerGenerationAndTransmissionMemberus-gaap:OperatingSegmentsMember2022-01-012022-12-310001436126mg:CorporateAndEliminationsMembermg:PowerGenerationAndTransmissionMember2022-01-012022-12-310001436126mg:PowerGenerationAndTransmissionMember2022-01-012022-12-310001436126mg:OtherProcessIndustriesMembermg:NorthAmericaSegmentMemberus-gaap:OperatingSegmentsMember2022-01-012022-12-310001436126mg:InternationalMembermg:OtherProcessIndustriesMemberus-gaap:OperatingSegmentsMember2022-01-012022-12-310001436126mg:ProductsandSystemsMembermg:OtherProcessIndustriesMemberus-gaap:OperatingSegmentsMember2022-01-012022-12-310001436126mg:OtherProcessIndustriesMembermg:CorporateAndEliminationsMember2022-01-012022-12-310001436126mg:OtherProcessIndustriesMember2022-01-012022-12-310001436126mg:NorthAmericaSegmentMembermg:InfrastructureResearchandEngineeringMemberus-gaap:OperatingSegmentsMember2022-01-012022-12-310001436126mg:InternationalMembermg:InfrastructureResearchandEngineeringMemberus-gaap:OperatingSegmentsMember2022-01-012022-12-310001436126mg:ProductsandSystemsMembermg:InfrastructureResearchandEngineeringMemberus-gaap:OperatingSegmentsMember2022-01-012022-12-310001436126mg:InfrastructureResearchandEngineeringMembermg:CorporateAndEliminationsMember2022-01-012022-12-310001436126mg:InfrastructureResearchandEngineeringMember2022-01-012022-12-310001436126mg:NorthAmericaSegmentMembermg:PetrochemicalMemberus-gaap:OperatingSegmentsMember2022-01-012022-12-310001436126mg:InternationalMembermg:PetrochemicalMemberus-gaap:OperatingSegmentsMember2022-01-012022-12-310001436126mg:ProductsandSystemsMembermg:PetrochemicalMemberus-gaap:OperatingSegmentsMember2022-01-012022-12-310001436126mg:PetrochemicalMembermg:CorporateAndEliminationsMember2022-01-012022-12-310001436126mg:PetrochemicalMember2022-01-012022-12-310001436126mg:OtherProductsandServicesMembermg:NorthAmericaSegmentMemberus-gaap:OperatingSegmentsMember2022-01-012022-12-310001436126mg:OtherProductsandServicesMembermg:InternationalMemberus-gaap:OperatingSegmentsMember2022-01-012022-12-310001436126mg:ProductsandSystemsMembermg:OtherProductsandServicesMemberus-gaap:OperatingSegmentsMember2022-01-012022-12-310001436126mg:OtherProductsandServicesMembermg:CorporateAndEliminationsMember2022-01-012022-12-310001436126mg:OtherProductsandServicesMember2022-01-012022-12-310001436126mg:NorthAmericaSegmentMemberus-gaap:OperatingSegmentsMember2022-01-012022-12-310001436126mg:InternationalMemberus-gaap:OperatingSegmentsMember2022-01-012022-12-310001436126mg:ProductsandSystemsMemberus-gaap:OperatingSegmentsMember2022-01-012022-12-310001436126mg:CorporateAndEliminationsMember2022-01-012022-12-310001436126mg:OilGasMembermg:NorthAmericaSegmentMemberus-gaap:OperatingSegmentsMember2021-01-012021-12-310001436126mg:InternationalMembermg:OilGasMemberus-gaap:OperatingSegmentsMember2021-01-012021-12-310001436126mg:ProductsandSystemsMembermg:OilGasMemberus-gaap:OperatingSegmentsMember2021-01-012021-12-310001436126mg:OilGasMembermg:CorporateAndEliminationsMember2021-01-012021-12-310001436126mg:OilGasMember2021-01-012021-12-310001436126mg:AerospaceandDefenseMembermg:NorthAmericaSegmentMemberus-gaap:OperatingSegmentsMember2021-01-012021-12-310001436126mg:InternationalMembermg:AerospaceandDefenseMemberus-gaap:OperatingSegmentsMember2021-01-012021-12-310001436126mg:ProductsandSystemsMembermg:AerospaceandDefenseMemberus-gaap:OperatingSegmentsMember2021-01-012021-12-310001436126mg:AerospaceandDefenseMembermg:CorporateAndEliminationsMember2021-01-012021-12-310001436126mg:AerospaceandDefenseMember2021-01-012021-12-310001436126mg:IndustrialsMembermg:NorthAmericaSegmentMemberus-gaap:OperatingSegmentsMember2021-01-012021-12-310001436126mg:InternationalMembermg:IndustrialsMemberus-gaap:OperatingSegmentsMember2021-01-012021-12-310001436126mg:ProductsandSystemsMembermg:IndustrialsMemberus-gaap:OperatingSegmentsMember2021-01-012021-12-310001436126mg:IndustrialsMembermg:CorporateAndEliminationsMember2021-01-012021-12-310001436126mg:IndustrialsMember2021-01-012021-12-310001436126mg:NorthAmericaSegmentMembermg:PowerGenerationAndTransmissionMemberus-gaap:OperatingSegmentsMember2021-01-012021-12-310001436126mg:InternationalMembermg:PowerGenerationAndTransmissionMemberus-gaap:OperatingSegmentsMember2021-01-012021-12-310001436126mg:ProductsandSystemsMembermg:PowerGenerationAndTransmissionMemberus-gaap:OperatingSegmentsMember2021-01-012021-12-310001436126mg:CorporateAndEliminationsMembermg:PowerGenerationAndTransmissionMember2021-01-012021-12-310001436126mg:PowerGenerationAndTransmissionMember2021-01-012021-12-310001436126mg:OtherProcessIndustriesMembermg:NorthAmericaSegmentMemberus-gaap:OperatingSegmentsMember2021-01-012021-12-310001436126mg:InternationalMembermg:OtherProcessIndustriesMemberus-gaap:OperatingSegmentsMember2021-01-012021-12-310001436126mg:ProductsandSystemsMembermg:OtherProcessIndustriesMemberus-gaap:OperatingSegmentsMember2021-01-012021-12-310001436126mg:OtherProcessIndustriesMembermg:CorporateAndEliminationsMember2021-01-012021-12-310001436126mg:OtherProcessIndustriesMember2021-01-012021-12-310001436126mg:NorthAmericaSegmentMembermg:InfrastructureResearchandEngineeringMemberus-gaap:OperatingSegmentsMember2021-01-012021-12-310001436126mg:InternationalMembermg:InfrastructureResearchandEngineeringMemberus-gaap:OperatingSegmentsMember2021-01-012021-12-310001436126mg:ProductsandSystemsMembermg:InfrastructureResearchandEngineeringMemberus-gaap:OperatingSegmentsMember2021-01-012021-12-310001436126mg:InfrastructureResearchandEngineeringMembermg:CorporateAndEliminationsMember2021-01-012021-12-310001436126mg:InfrastructureResearchandEngineeringMember2021-01-012021-12-310001436126mg:NorthAmericaSegmentMembermg:PetrochemicalMemberus-gaap:OperatingSegmentsMember2021-01-012021-12-310001436126mg:InternationalMembermg:PetrochemicalMemberus-gaap:OperatingSegmentsMember2021-01-012021-12-310001436126mg:ProductsandSystemsMembermg:PetrochemicalMemberus-gaap:OperatingSegmentsMember2021-01-012021-12-310001436126mg:PetrochemicalMembermg:CorporateAndEliminationsMember2021-01-012021-12-310001436126mg:PetrochemicalMember2021-01-012021-12-310001436126mg:OtherProductsandServicesMembermg:NorthAmericaSegmentMemberus-gaap:OperatingSegmentsMember2021-01-012021-12-310001436126mg:OtherProductsandServicesMembermg:InternationalMemberus-gaap:OperatingSegmentsMember2021-01-012021-12-310001436126mg:ProductsandSystemsMembermg:OtherProductsandServicesMemberus-gaap:OperatingSegmentsMember2021-01-012021-12-310001436126mg:OtherProductsandServicesMembermg:CorporateAndEliminationsMember2021-01-012021-12-310001436126mg:OtherProductsandServicesMember2021-01-012021-12-310001436126mg:NorthAmericaSegmentMemberus-gaap:OperatingSegmentsMember2021-01-012021-12-310001436126mg:InternationalMemberus-gaap:OperatingSegmentsMember2021-01-012021-12-310001436126mg:ProductsandSystemsMemberus-gaap:OperatingSegmentsMember2021-01-012021-12-310001436126mg:CorporateAndEliminationsMember2021-01-012021-12-310001436126country:USmg:NorthAmericaSegmentMemberus-gaap:OperatingSegmentsMember2023-01-012023-12-310001436126mg:InternationalMembercountry:USus-gaap:OperatingSegmentsMember2023-01-012023-12-310001436126mg:ProductsandSystemsMembercountry:USus-gaap:OperatingSegmentsMember2023-01-012023-12-310001436126country:USmg:CorporateAndEliminationsMember2023-01-012023-12-310001436126country:US2023-01-012023-12-310001436126mg:OtherAmericasMembermg:NorthAmericaSegmentMemberus-gaap:OperatingSegmentsMember2023-01-012023-12-310001436126mg:OtherAmericasMembermg:InternationalMemberus-gaap:OperatingSegmentsMember2023-01-012023-12-310001436126mg:ProductsandSystemsMembermg:OtherAmericasMemberus-gaap:OperatingSegmentsMember2023-01-012023-12-310001436126mg:OtherAmericasMembermg:CorporateAndEliminationsMember2023-01-012023-12-310001436126mg:OtherAmericasMember2023-01-012023-12-310001436126mg:NorthAmericaSegmentMembersrt:EuropeMemberus-gaap:OperatingSegmentsMember2023-01-012023-12-310001436126mg:InternationalMembersrt:EuropeMemberus-gaap:OperatingSegmentsMember2023-01-012023-12-310001436126mg:ProductsandSystemsMembersrt:EuropeMemberus-gaap:OperatingSegmentsMember2023-01-012023-12-310001436126mg:CorporateAndEliminationsMembersrt:EuropeMember2023-01-012023-12-310001436126srt:EuropeMember2023-01-012023-12-310001436126mg:NorthAmericaSegmentMembersrt:AsiaPacificMemberus-gaap:OperatingSegmentsMember2023-01-012023-12-310001436126mg:InternationalMembersrt:AsiaPacificMemberus-gaap:OperatingSegmentsMember2023-01-012023-12-310001436126mg:ProductsandSystemsMembersrt:AsiaPacificMemberus-gaap:OperatingSegmentsMember2023-01-012023-12-310001436126srt:AsiaPacificMembermg:CorporateAndEliminationsMember2023-01-012023-12-310001436126srt:AsiaPacificMember2023-01-012023-12-310001436126country:USmg:NorthAmericaSegmentMemberus-gaap:OperatingSegmentsMember2022-01-012022-12-310001436126mg:InternationalMembercountry:USus-gaap:OperatingSegmentsMember2022-01-012022-12-310001436126mg:ProductsandSystemsMembercountry:USus-gaap:OperatingSegmentsMember2022-01-012022-12-310001436126country:USmg:CorporateAndEliminationsMember2022-01-012022-12-310001436126country:US2022-01-012022-12-310001436126mg:OtherAmericasMembermg:NorthAmericaSegmentMemberus-gaap:OperatingSegmentsMember2022-01-012022-12-310001436126mg:OtherAmericasMembermg:InternationalMemberus-gaap:OperatingSegmentsMember2022-01-012022-12-310001436126mg:ProductsandSystemsMembermg:OtherAmericasMemberus-gaap:OperatingSegmentsMember2022-01-012022-12-310001436126mg:OtherAmericasMembermg:CorporateAndEliminationsMember2022-01-012022-12-310001436126mg:OtherAmericasMember2022-01-012022-12-310001436126mg:NorthAmericaSegmentMembersrt:EuropeMemberus-gaap:OperatingSegmentsMember2022-01-012022-12-310001436126mg:InternationalMembersrt:EuropeMemberus-gaap:OperatingSegmentsMember2022-01-012022-12-310001436126mg:ProductsandSystemsMembersrt:EuropeMemberus-gaap:OperatingSegmentsMember2022-01-012022-12-310001436126mg:CorporateAndEliminationsMembersrt:EuropeMember2022-01-012022-12-310001436126srt:EuropeMember2022-01-012022-12-310001436126mg:NorthAmericaSegmentMembersrt:AsiaPacificMemberus-gaap:OperatingSegmentsMember2022-01-012022-12-310001436126mg:InternationalMembersrt:AsiaPacificMemberus-gaap:OperatingSegmentsMember2022-01-012022-12-310001436126mg:ProductsandSystemsMembersrt:AsiaPacificMemberus-gaap:OperatingSegmentsMember2022-01-012022-12-310001436126srt:AsiaPacificMembermg:CorporateAndEliminationsMember2022-01-012022-12-310001436126srt:AsiaPacificMember2022-01-012022-12-310001436126country:USmg:NorthAmericaSegmentMemberus-gaap:OperatingSegmentsMember2021-01-012021-12-310001436126mg:InternationalMembercountry:USus-gaap:OperatingSegmentsMember2021-01-012021-12-310001436126mg:ProductsandSystemsMembercountry:USus-gaap:OperatingSegmentsMember2021-01-012021-12-310001436126country:USmg:CorporateAndEliminationsMember2021-01-012021-12-310001436126country:US2021-01-012021-12-310001436126mg:OtherAmericasMembermg:NorthAmericaSegmentMemberus-gaap:OperatingSegmentsMember2021-01-012021-12-310001436126mg:OtherAmericasMembermg:InternationalMemberus-gaap:OperatingSegmentsMember2021-01-012021-12-310001436126mg:ProductsandSystemsMembermg:OtherAmericasMemberus-gaap:OperatingSegmentsMember2021-01-012021-12-310001436126mg:OtherAmericasMembermg:CorporateAndEliminationsMember2021-01-012021-12-310001436126mg:OtherAmericasMember2021-01-012021-12-310001436126mg:NorthAmericaSegmentMembersrt:EuropeMemberus-gaap:OperatingSegmentsMember2021-01-012021-12-310001436126mg:InternationalMembersrt:EuropeMemberus-gaap:OperatingSegmentsMember2021-01-012021-12-310001436126mg:ProductsandSystemsMembersrt:EuropeMemberus-gaap:OperatingSegmentsMember2021-01-012021-12-310001436126mg:CorporateAndEliminationsMembersrt:EuropeMember2021-01-012021-12-310001436126srt:EuropeMember2021-01-012021-12-310001436126mg:NorthAmericaSegmentMembersrt:AsiaPacificMemberus-gaap:OperatingSegmentsMember2021-01-012021-12-310001436126mg:InternationalMembersrt:AsiaPacificMemberus-gaap:OperatingSegmentsMember2021-01-012021-12-310001436126mg:ProductsandSystemsMembersrt:AsiaPacificMemberus-gaap:OperatingSegmentsMember2021-01-012021-12-310001436126srt:AsiaPacificMembermg:CorporateAndEliminationsMember2021-01-012021-12-310001436126srt:AsiaPacificMember2021-01-012021-12-310001436126mg:RestrictedStockUnitsRSUsandPerformanceStockUnitsPSUsMember2023-01-012023-12-310001436126mg:RestrictedStockUnitsRSUsandPerformanceStockUnitsPSUsMember2022-01-012022-12-310001436126mg:RestrictedStockUnitsRSUsandPerformanceStockUnitsPSUsMember2021-01-012021-12-310001436126us-gaap:EmployeeStockOptionMember2023-01-012023-12-310001436126us-gaap:EmployeeStockOptionMember2022-01-012022-12-310001436126us-gaap:EmployeeStockOptionMember2021-01-012021-12-310001436126mg:TexasCustomerMember2019-12-310001436126mg:TexasCustomerMember2019-12-012019-12-310001436126us-gaap:LandMember2023-12-310001436126us-gaap:LandMember2022-12-310001436126srt:MinimumMemberus-gaap:BuildingAndBuildingImprovementsMember2023-12-310001436126us-gaap:BuildingAndBuildingImprovementsMembersrt:MaximumMember2023-12-310001436126us-gaap:BuildingAndBuildingImprovementsMember2023-12-310001436126us-gaap:BuildingAndBuildingImprovementsMember2022-12-310001436126mg:OfficeFurnitureAndEquipmentMembersrt:MinimumMember2023-12-310001436126mg:OfficeFurnitureAndEquipmentMembersrt:MaximumMember2023-12-310001436126mg:OfficeFurnitureAndEquipmentMember2023-12-310001436126mg:OfficeFurnitureAndEquipmentMember2022-12-310001436126srt:MinimumMemberus-gaap:MachineryAndEquipmentMember2023-12-310001436126us-gaap:MachineryAndEquipmentMembersrt:MaximumMember2023-12-310001436126us-gaap:MachineryAndEquipmentMember2023-12-310001436126us-gaap:MachineryAndEquipmentMember2022-12-310001436126mg:NorthAmericaSegmentMember2021-12-310001436126mg:InternationalMember2021-12-310001436126mg:ProductsandSystemsMember2021-12-310001436126mg:NorthAmericaSegmentMember2022-01-012022-12-310001436126mg:InternationalMember2022-01-012022-12-310001436126mg:ProductsandSystemsMember2022-01-012022-12-310001436126mg:NorthAmericaSegmentMember2022-12-310001436126mg:InternationalMember2022-12-310001436126mg:ProductsandSystemsMember2022-12-310001436126mg:NorthAmericaSegmentMember2023-01-012023-12-310001436126mg:InternationalMember2023-01-012023-12-310001436126mg:ProductsandSystemsMember2023-01-012023-12-310001436126mg:NorthAmericaSegmentMember2023-12-310001436126mg:InternationalMember2023-12-310001436126mg:ProductsandSystemsMember2023-12-310001436126mg:InternationalMember2023-01-012023-12-310001436126mg:NorthAmericaSegmentMember2023-12-310001436126mg:NorthAmericaSegmentMember2022-12-310001436126mg:InternationalMember2022-12-310001436126mg:InternationalMember2023-12-310001436126mg:ProductsandSystemsMember2022-12-310001436126mg:ProductsandSystemsMember2023-12-310001436126us-gaap:CustomerRelationshipsMembersrt:MinimumMember2023-12-310001436126us-gaap:CustomerRelationshipsMembersrt:MaximumMember2023-12-310001436126us-gaap:CustomerRelationshipsMember2023-12-310001436126us-gaap:CustomerRelationshipsMember2022-12-310001436126srt:MinimumMemberus-gaap:ComputerSoftwareIntangibleAssetMember2023-12-310001436126us-gaap:ComputerSoftwareIntangibleAssetMembersrt:MaximumMember2023-12-310001436126us-gaap:ComputerSoftwareIntangibleAssetMember2022-12-310001436126us-gaap:NoncompeteAgreementsMembersrt:MinimumMember2023-12-310001436126us-gaap:NoncompeteAgreementsMembersrt:MaximumMember2023-12-310001436126us-gaap:NoncompeteAgreementsMember2023-12-310001436126us-gaap:NoncompeteAgreementsMember2022-12-310001436126srt:MinimumMemberus-gaap:OtherIntangibleAssetsMember2023-12-310001436126us-gaap:OtherIntangibleAssetsMembersrt:MaximumMember2023-12-310001436126us-gaap:OtherIntangibleAssetsMember2023-12-310001436126us-gaap:OtherIntangibleAssetsMember2022-12-310001436126us-gaap:ComputerSoftwareIntangibleAssetMember2023-01-012023-12-310001436126us-gaap:ComputerSoftwareIntangibleAssetMember2022-01-012022-12-310001436126us-gaap:ComputerSoftwareIntangibleAssetMember2021-01-012021-12-310001436126us-gaap:RevolvingCreditFacilityMember2023-12-310001436126us-gaap:RevolvingCreditFacilityMember2022-12-310001436126us-gaap:RevolvingCreditFacilityMembermg:TermALoanFacilityMember2023-12-310001436126us-gaap:RevolvingCreditFacilityMembermg:TermALoanFacilityMember2022-12-310001436126mg:OtherLongTermDebtMember2023-12-310001436126mg:OtherLongTermDebtMember2022-12-310001436126us-gaap:LineOfCreditMemberus-gaap:RevolvingCreditFacilityMember2021-05-190001436126us-gaap:SecuredDebtMemberus-gaap:LineOfCreditMembermg:TheCreditAgreementJPMorganChaseBankMember2021-05-190001436126us-gaap:LineOfCreditMembermg:TheCreditAgreementJPMorganChaseBankMemberus-gaap:RevolvingCreditFacilityMember2022-08-010001436126us-gaap:LineOfCreditMembermg:TheCreditAgreementJPMorganChaseBankMemberus-gaap:RevolvingCreditFacilityMember2022-08-012022-08-010001436126us-gaap:SecuredDebtMemberus-gaap:LineOfCreditMembermg:TheCreditAgreementJPMorganChaseBankMember2022-08-010001436126us-gaap:RevolvingCreditFacilityMembermg:TheCreditAgreementJPMorganChaseBankMember2023-12-310001436126us-gaap:LineOfCreditMemberus-gaap:LetterOfCreditMembermg:TheCreditAgreementJPMorganChaseBankMember2022-08-010001436126us-gaap:LineOfCreditMembersrt:MinimumMembermg:TheCreditAgreementJPMorganChaseBankMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMembermg:VariableRateComponentMember2022-08-012022-08-010001436126us-gaap:LineOfCreditMembermg:TheCreditAgreementJPMorganChaseBankMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMembermg:VariableRateComponentMembersrt:MaximumMember2022-08-012022-08-010001436126us-gaap:LineOfCreditMembermg:TheCreditAgreementJPMorganChaseBankMember2022-08-010001436126us-gaap:LineOfCreditMembermg:DebtCovenantPeriodOneMembermg:TheCreditAgreementJPMorganChaseBankMember2022-08-012022-08-010001436126us-gaap:LineOfCreditMembermg:DebtCovenantPeriodTwoMembermg:TheCreditAgreementJPMorganChaseBankMember2022-08-012022-08-010001436126us-gaap:LineOfCreditMembermg:TheCreditAgreementJPMorganChaseBankMember2022-08-012022-08-010001436126us-gaap:LineOfCreditMembermg:TheCreditAgreementJPMorganChaseBankMember2023-12-312023-12-310001436126us-gaap:LineOfCreditMembermg:DebtCovenantPeriodThreeMembermg:TheCreditAgreementJPMorganChaseBankMember2022-08-012022-08-010001436126us-gaap:LineOfCreditMembermg:DebtCovenantPeriodFourMembermg:TheCreditAgreementJPMorganChaseBankMember2022-08-012022-08-010001436126us-gaap:LineOfCreditMembermg:DebtCovenantPeriodFiveMembermg:TheCreditAgreementJPMorganChaseBankMember2022-08-012022-08-010001436126us-gaap:RevolvingCreditFacilityMembermg:CreditAgreementMember2022-07-012022-09-300001436126srt:MinimumMembermg:OtherLongTermDebtMember2023-01-012023-12-310001436126mg:OtherLongTermDebtMembersrt:MaximumMember2023-01-012023-12-310001436126srt:MinimumMembermg:OtherLongTermDebtMember2023-12-310001436126mg:OtherLongTermDebtMembersrt:MaximumMember2023-12-310001436126mg:ContingentConsiderationMemberus-gaap:FairValueInputsLevel3Member2022-12-310001436126mg:ContingentConsiderationMemberus-gaap:FairValueInputsLevel3Member2021-12-310001436126mg:ContingentConsiderationMemberus-gaap:FairValueInputsLevel3Member2023-01-012023-12-310001436126mg:ContingentConsiderationMemberus-gaap:FairValueInputsLevel3Member2022-01-012022-12-310001436126mg:ContingentConsiderationMemberus-gaap:FairValueInputsLevel3Member2023-12-31mg:plan0001436126mg:LongTermIncentivePlan2009Member2023-12-310001436126mg:LongTermIncentivePlan2016Member2020-05-192020-05-190001436126mg:LongTermIncentivePlan2016Member2022-05-230001436126mg:LongTermIncentivePlan2016Member2023-12-310001436126srt:ChiefExecutiveOfficerMember2023-01-012023-12-310001436126us-gaap:EmployeeStockOptionMembersrt:ChiefExecutiveOfficerMember2023-10-112023-10-110001436126us-gaap:EmployeeStockOptionMembersrt:ChiefExecutiveOfficerMember2023-10-012023-12-310001436126us-gaap:EmployeeStockOptionMember2021-01-012021-12-310001436126us-gaap:EmployeeStockOptionMember2022-01-012022-12-310001436126us-gaap:EmployeeStockOptionMember2023-01-012023-12-310001436126us-gaap:EmployeeStockOptionMember2023-12-310001436126us-gaap:CommonStockMembersrt:DirectorMember2023-01-012023-12-310001436126us-gaap:CommonStockMembersrt:DirectorMember2022-01-012022-12-310001436126us-gaap:CommonStockMembersrt:DirectorMember2021-01-012021-12-310001436126us-gaap:RestrictedStockUnitsRSUMember2023-01-012023-12-310001436126us-gaap:RestrictedStockUnitsRSUMember2022-01-012022-12-310001436126us-gaap:RestrictedStockUnitsRSUMember2021-01-012021-12-310001436126us-gaap:RestrictedStockUnitsRSUMember2023-12-310001436126us-gaap:RestrictedStockUnitsRSUMember2022-12-310001436126us-gaap:RestrictedStockUnitsRSUMember2021-12-310001436126us-gaap:RestrictedStockUnitsRSUMember2020-12-310001436126us-gaap:PerformanceSharesMembersrt:MinimumMembermg:ExecutiveAndSeniorOfficersMember2023-12-310001436126us-gaap:PerformanceSharesMembermg:ExecutiveAndSeniorOfficersMembersrt:MaximumMember2023-12-310001436126us-gaap:PerformanceSharesMembermg:ExecutiveAndSeniorOfficersMember2023-01-012023-12-310001436126us-gaap:PerformanceSharesMembermg:ExecutiveAndSeniorOfficersMember2022-01-012022-12-31mg:entity0001436126us-gaap:PerformanceSharesMembermg:ExecutiveAndSeniorOfficersMember2021-01-012021-12-310001436126us-gaap:RestrictedStockUnitsRSUMembermg:ExecutiveAndSeniorOfficersMember2022-01-012022-12-310001436126us-gaap:PerformanceSharesMembersrt:ExecutiveOfficerMember2023-01-012023-12-31mg:metric0001436126us-gaap:PerformanceSharesMember2022-12-310001436126us-gaap:PerformanceSharesMember2021-12-310001436126us-gaap:PerformanceSharesMember2020-12-310001436126us-gaap:PerformanceSharesMember2023-01-012023-12-310001436126us-gaap:PerformanceSharesMember2022-01-012022-12-310001436126us-gaap:PerformanceSharesMember2021-01-012021-12-310001436126us-gaap:PerformanceSharesMember2023-12-310001436126us-gaap:PerformanceSharesMembermg:ExecutiveAndSeniorOfficersMember2023-12-3100014361262020-01-012020-12-310001436126us-gaap:DomesticCountryMember2023-12-310001436126us-gaap:StateAndLocalJurisdictionMember2023-12-310001436126us-gaap:ForeignCountryMember2023-12-310001436126srt:MinimumMemberus-gaap:PensionPlansDefinedBenefitMembermg:BoilermakersandPipefittersPlansMember2023-12-310001436126us-gaap:PensionPlansDefinedBenefitMembermg:BoilermakersandPipefittersPlansMember2023-01-012023-12-310001436126us-gaap:PensionPlansDefinedBenefitMembermg:BoilermakersandPipefittersPlansMember2022-01-012022-12-310001436126us-gaap:BuildingMemberus-gaap:RelatedPartyMember2023-01-012023-12-310001436126srt:DirectorMembermg:ConsultingServicesMembermg:CapitalManagementEnterpriseCMEMember2023-01-012023-12-310001436126us-gaap:BuildingMembermg:OperatingLeaseArrangementMember2023-12-310001436126us-gaap:BuildingMembermg:OperatingLeaseArrangementMember2022-12-310001436126us-gaap:BuildingMembermg:OperatingLeaseArrangementMember2022-01-012022-12-310001436126us-gaap:BuildingMembermg:OperatingLeaseArrangementMember2022-02-012022-02-280001436126mg:TexasCustomerMemberus-gaap:CollectibilityOfReceivablesMember2019-12-31mg:weld0001436126mg:TexasCustomerMemberus-gaap:CollectibilityOfReceivablesMember2020-12-310001436126mg:VariousPipelineProjectsForTexasCustomerMemberus-gaap:CollectibilityOfReceivablesMember2019-12-012019-12-310001436126mg:VariousPipelineProjectsForTexasCustomerMembermg:TexasCustomerMemberus-gaap:CollectibilityOfReceivablesMember2019-12-012019-12-310001436126mg:VariousPipelineProjectsForTexasCustomerMembermg:TexasCustomerMemberus-gaap:CollectibilityOfReceivablesMember2023-04-252023-04-250001436126mg:VariousPipelineProjectsForTexasCustomerMembermg:TexasCustomerMemberus-gaap:CollectibilityOfReceivablesMember2023-04-250001436126mg:VariousPipelineProjectsForTexasCustomerMembermg:TexasCustomerMemberus-gaap:CollectibilityOfReceivablesMember2022-01-012022-12-310001436126mg:ClassActionMember2023-01-012023-12-31mg:claim0001436126mg:ClassActionOnBehalfOfCurrentAndFormerEmployeesMember2023-01-012023-12-310001436126mg:ClassActionOnBehalfOfStateOfCaliforniaMember2023-01-012023-12-310001436126mg:ClassActionMember2021-10-052021-10-050001436126mg:ClassActionMember2021-01-012021-03-310001436126mg:ClassActionMember2020-10-012020-12-310001436126us-gaap:WithdrawalFromMultiemployerDefinedBenefitPlanMember2023-12-310001436126us-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMembermg:ProductsandSystemsMembermg:DisposalOfForeignSubsidiariesMembermg:AcquisitionRelatedContingenciesMember2018-01-012018-12-310001436126us-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMembermg:ProductsandSystemsMembermg:DisposalOfForeignSubsidiariesMembermg:AcquisitionRelatedContingenciesMember2018-12-310001436126us-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMembermg:ProductsandSystemsMembermg:DisposalOfForeignSubsidiariesMembermg:AcquisitionRelatedContingenciesMember2021-08-032021-08-030001436126mg:NorthAmericaSegmentMemberus-gaap:OperatingSegmentsMember2023-12-310001436126mg:NorthAmericaSegmentMemberus-gaap:OperatingSegmentsMember2022-12-310001436126mg:InternationalMemberus-gaap:OperatingSegmentsMember2023-12-310001436126mg:InternationalMemberus-gaap:OperatingSegmentsMember2022-12-310001436126mg:ProductsandSystemsMemberus-gaap:OperatingSegmentsMember2023-12-310001436126mg:ProductsandSystemsMemberus-gaap:OperatingSegmentsMember2022-12-310001436126mg:CorporateAndEliminationsMember2023-12-310001436126mg:CorporateAndEliminationsMember2022-12-310001436126country:US2023-12-310001436126country:US2022-12-310001436126mg:OtherAmericasMember2023-12-310001436126mg:OtherAmericasMember2022-12-310001436126srt:EuropeMember2023-12-310001436126srt:EuropeMember2022-12-3100014361262023-07-012023-09-3000014361262023-04-012023-06-3000014361262023-01-012023-03-3100014361262022-10-012022-12-3100014361262022-07-012022-09-3000014361262022-04-012022-06-3000014361262022-01-012022-03-3100014361262021-10-012021-12-3100014361262021-07-012021-09-3000014361262021-04-012021-06-3000014361262021-01-012021-03-310001436126us-gaap:LineOfCreditMembermg:DebtCovenantPeriodFourMemberus-gaap:SubsequentEventMembermg:TheCreditAgreementJPMorganChaseBankMember2024-02-272024-02-270001436126us-gaap:LineOfCreditMemberus-gaap:SubsequentEventMembermg:DebtCovenantPeriodFiveMembermg:TheCreditAgreementJPMorganChaseBankMember2024-02-272024-02-270001436126mg:DebtCovenantPeriodSixMemberus-gaap:LineOfCreditMemberus-gaap:SubsequentEventMembermg:TheCreditAgreementJPMorganChaseBankMember2024-02-272024-02-270001436126us-gaap:LineOfCreditMemberus-gaap:SubsequentEventMembermg:DebtCovenantPeriodOneMembermg:TheCreditAgreementJPMorganChaseBankMember2024-02-272024-02-270001436126us-gaap:LineOfCreditMemberus-gaap:SubsequentEventMembermg:DebtCovenantPeriodTwoMembermg:TheCreditAgreementJPMorganChaseBankMember2024-02-272024-02-270001436126us-gaap:LineOfCreditMembermg:DebtCovenantPeriodThreeMemberus-gaap:SubsequentEventMembermg:TheCreditAgreementJPMorganChaseBankMember2024-02-272024-02-27

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2023

or

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ___ to ___

Commission File Number 001-34481

Mistras Group, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | | 22-3341267 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification Number) |

195 Clarksville Road

Princeton Junction, New Jersey 08550

(Address of principal executive offices) (Zip Code)

(609) 716-4000

(Registrant's telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol | | Name of each exchange on which registered |

| Common Stock, par value $.01 par value | | MG | | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No ý

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No o

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ý No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer”, “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.:

| | | | | | | | | | | |

Large accelerated filer o | | Accelerated filer | x |

Non-accelerated filer o | | Smaller reporting company | ☐ |

| | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. Yes ☐ No ý

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant's executive officers during the relevant recovery period pursuant to § 240.10D-1(b). Yes ☐ No ý

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ý

The aggregate market value of the voting and non-voting common stock held by non-affiliates of the registrant, based on the closing price of $7.72 on June 30, 2023, the last business day of the registrant's most recently completed second fiscal quarter, as reported on the New York Stock Exchange, was approximately $158.4 million.

As of March 6, 2024, the Registrant had 30,634,785 shares of common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Information required by Part III (Items 10, 11, 12, 13 and 14) is incorporated by reference to portions of the registrant’s definitive proxy statement for its 2024 annual meeting of stockholders (the “Proxy Statement”), which is expected to be filed not later than 120 days after the registrant’s fiscal year ended December 31, 2023. Except as expressly incorporated by reference, the Proxy Statement shall not be deemed to be a part of this report on Form 10-K.

Auditor Name: PricewaterhouseCoopers LLP Auditor Location: Philadelphia, Pennsylvania Auditor Firm ID: 238

MISTRAS GROUP, INC.

ANNUAL REPORT ON FORM 10-K

TABLE OF CONTENTS

| | | | | | | | | | | |

| | |

| | | | |

| | | | |

| | | | |

| | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | DISCLOSURES REGARDING FOREIGN JURISDICTIONS THAT PREVENT INSPECTIONS | |

| | | | |

| | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | |

| | | | |

| | | |

ITEM 1. BUSINESS

FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K (this "Annual Report") contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the "Securities Act"), and Section 21E of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), regarding Mistras Group, Inc. ("Mistras," "MISTRAS," "the Company," "us," "we," "our" and similar expressions) and our business, financial condition, results of operations and prospects. Such forward-looking statements include those that express plans, anticipation, intent, contingency, goals, targets or future development and/or otherwise are not statements of historical fact. These forward-looking statements are based on our current expectations and projections about future events and they are subject to risks and uncertainties known and unknown that could cause actual results and developments to differ materially from those expressed or implied in such statements.

In some cases, you can identify forward-looking statements by terminology, such as “goals,” “expects,” “anticipates,” “intends,” “plans,” “believes,” “seeks,” “estimates,” “may,” “could,” “should,” “would,” “predicts,” “appears,” “projects,” or the negative of such terms or other similar expressions, although the absence of such words does not mean that a statement is not forward-looking. Factors that could cause or contribute to differences in results and outcomes from those in our forward-looking statements include, without limitation, those discussed elsewhere in this Annual Report in Part I, Item 1A. “Risk Factors,” Part II, Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and in this Item 1. We undertake no obligation to (and expressly disclaim any obligation to) revise or update any forward-looking statements made herein whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws. However, you should consult any further disclosures we may make on these or related topics in our reports on Form 8-K or Form 10-Q filed with the Securities and Exchange Commission ("SEC").

The following discussions should be read in conjunction with the sections of this Annual Report entitled “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Risk Factors.”

OUR BUSINESS

Overview

Mistras Group, Inc. is a leading "one source" multinational provider of integrated technology-enabled asset protection solutions, helping to maximize the safety and operational uptime for civilization’s most critical industrial and civil assets.

Backed by an innovative, data-driven asset protection portfolio, proprietary technologies, and a decades-long legacy of industry leadership, the Company helps customers with asset-intensive infrastructure in the oil and gas, petrochemical, aerospace and defense, industrials, power generation and transmission (including alternative and renewable energy), other process industries and infrastructure, research and engineering and other industries towards achieving and maintaining operational excellence. By supporting these customers that help fuel our vehicles and power our society; inspecting components that are trusted for commercial, defense, and private space; and building monitoring equipment to help avoid catastrophic incidents, the Company helps the world at large.

The Company enhances value for its customers by providing data driven solutions that digitalize the asset protection process and provide valuable insights to our customers that maximize uptime of the assets monitored. Our data analytical solutions offerings, coupled with the traditional non-destructive testing ("NDT"), provide us a competitive advantage over our competitors. With our ability to integrate asset protection throughout supply chains and centralizing data management, we are able to provide insights and actionable recommendations to our customers through a suite of Industrial Internet of Things ("IoT")-connected digital software and monitoring solutions, including OneSuite™, which serves as an ecosystem platform, pulling together all of the Company’s software and data services capabilities, for the benefit of its customers.

The Company’s core capabilities also include NDT field inspections enhanced by advanced robotics, laboratory quality control, laboratory materials services, shop laboratory assurance testing, sensing technologies and NDT equipment, asset and mechanical integrity engineering services, and light mechanical maintenance and access services.

Given the role our solutions play in enhancing the safe and efficient operation of our customers' infrastructure, we have historically provided a majority of our solutions to our customers on a regular, recurring basis. We perform these services largely at our customers’ facilities, while primarily servicing our aerospace customers at our network of state-of-the-art, in-house laboratories. These solutions typically include NDT and inspection services, and can also include a wide range of

mechanical services, including heat tracing, pre-inspection insulation stripping, coating applications, re-insulation, engineering assessments and long-term condition-monitoring. Our traditional NDT solutions, coupled with our data analytical solutions offerings, allow us to provide accessible and easily understood data to our customers that allows them to identify when an asset may fail, in order to prioritize inspections and repair.

Under our business model, many customers outsource their inspection to us on a “run and maintain” basis. We have established long-term relationships as a critical solutions provider to many of the leading companies with asset-intensive infrastructure in our target markets. These markets include companies in the oil and gas, aerospace and defense, industrials, power generation and transmission (including alternative and renewable energy), other process industries and infrastructure, research and engineering and other industries.

We have focused on providing our advanced asset protection solutions to our customers using proprietary, technology-enabled software and testing instruments, including those developed by our Products and Systems segment. In the past, we have made numerous acquisitions in an effort to grow our base of experienced, certified personnel, expand our service lines and technical capabilities, increase our geographical reach, complement our existing offerings, and leverage our fixed costs. We have increased our capabilities and the size of our customer base through the development of applied technologies and managed support services, organic growth and the integration of acquired companies. These acquisitions have provided us with additional service lines, technologies, resources and customers, which we believe will enhance our advantages over our competition.

We believe long-term growth can be realized in our target markets. Our business and financial results are impacted by world-wide macro- and micro-economic conditions generally, as well as those within our target markets. Among other things, we expect the timing of our oil and gas customers inspection expenditures to be impacted by oil price fluctuations.

We have continued providing our customers with an innovative asset protection software ecosystem through our MISTRAS OneSuite platform. The OneSuite platform offers functions of MISTRAS' software and services brands as integrated applications on a cloud environment. OneSuite serves as a single access portal for customers' data activities and provides access to 90 plus applications being offered on one centralized platform.

We have established long-term relationships as a critical solutions provider to many of the leading companies with asset-intensive infrastructure in our target markets. These markets primarily consist of:

•Oil and Gas (Downstream, Midstream and Upstream)

•Aerospace and Defense

•Industrial

•Power Generation and Transmission

•Infrastructure, Research and Engineering

•Other Process Industries

•Petrochemical

A majority of our revenues are generated by deploying technicians at our customers' locations. A majority of our revenues from aerospace and defense as well as certain manufacturing customers are generated by performing inspections and testing at our various in-house laboratories.

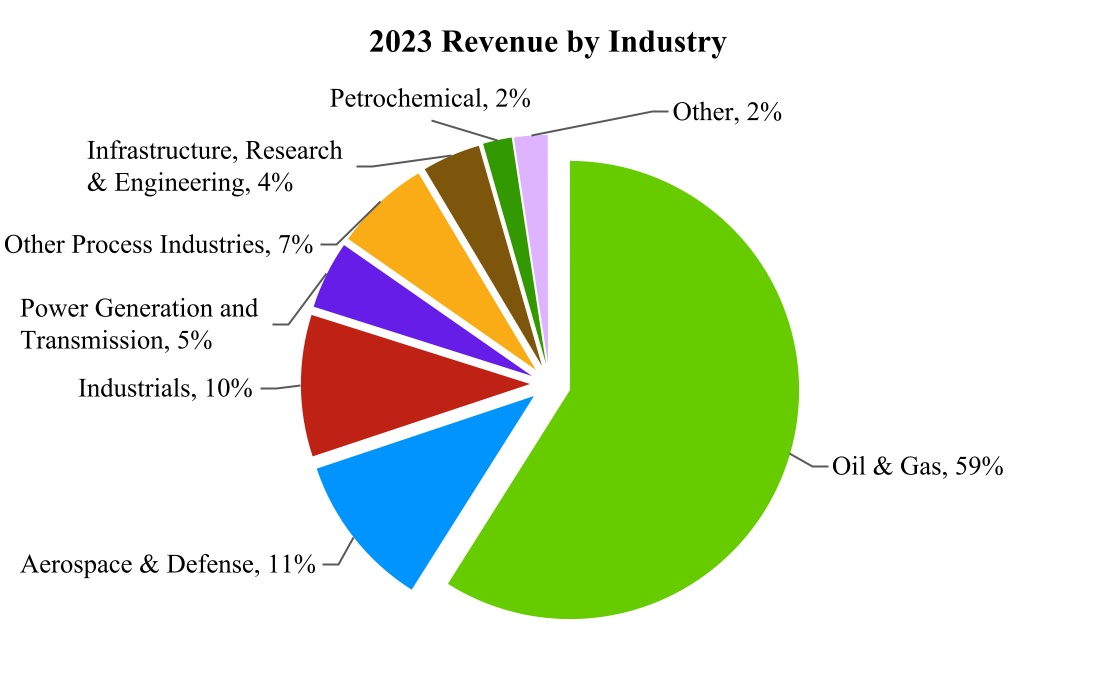

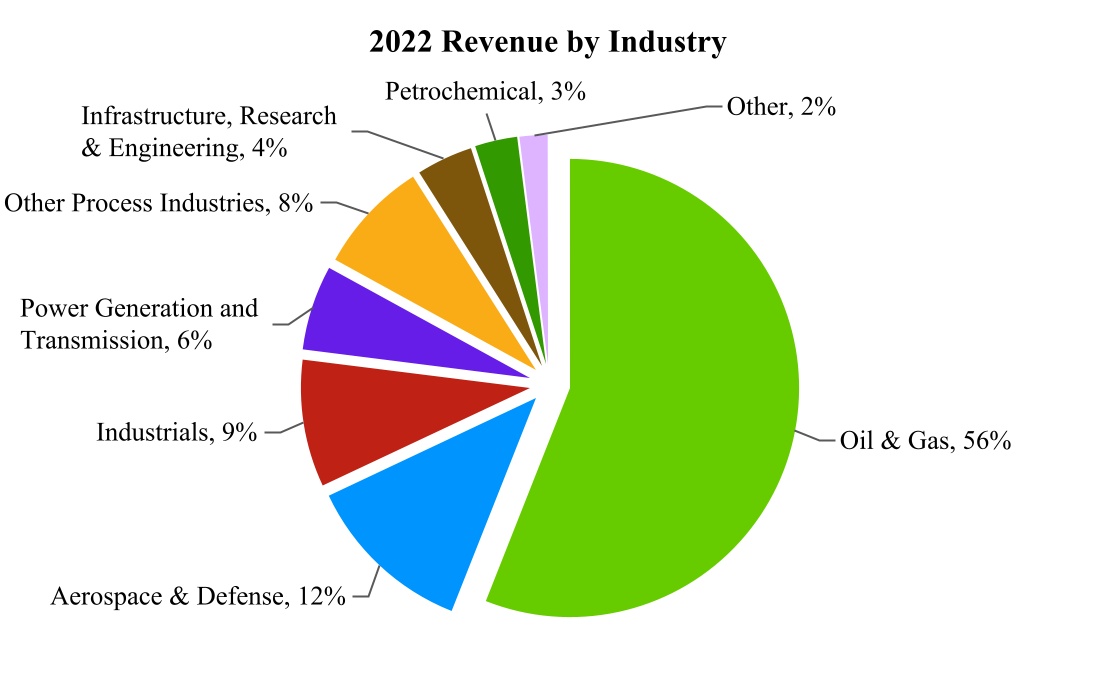

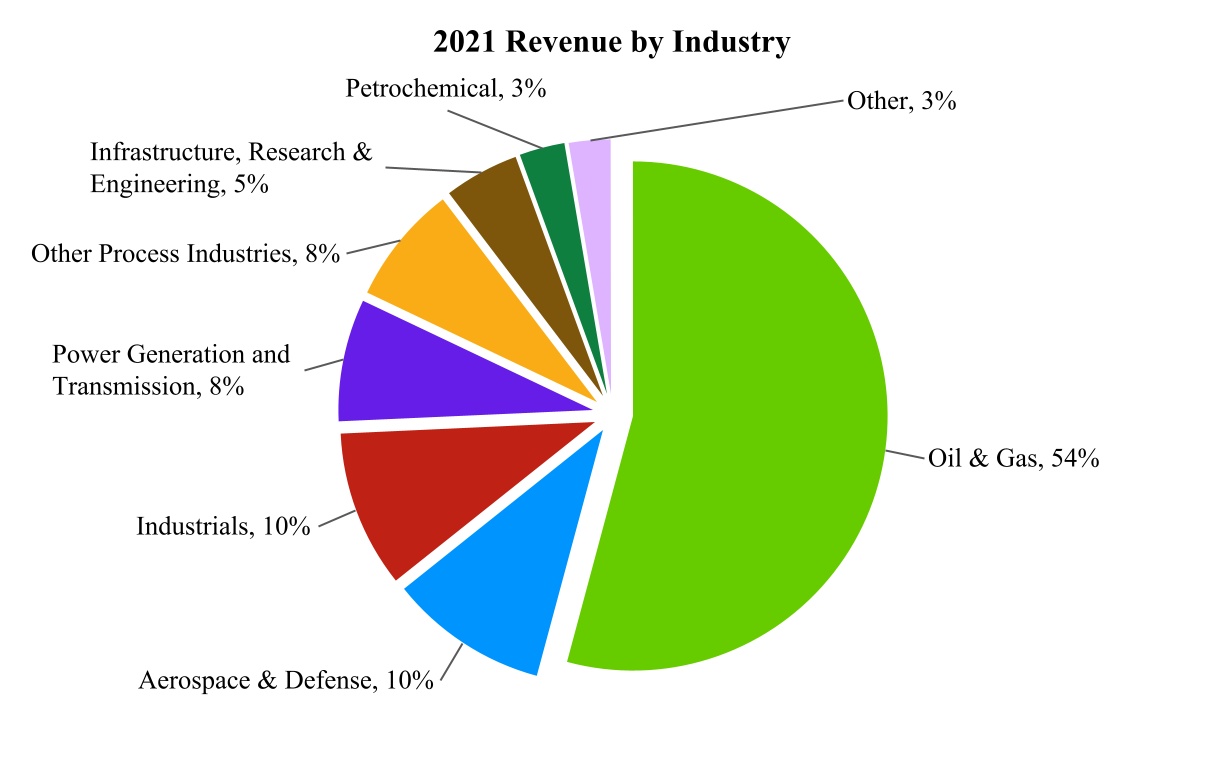

We generated revenues of $705.5 million, $687.4 million and $677.1 million for the years ended December 31, 2023, 2022 and 2021, respectively. We generated net loss of $17.4 million, a net income of $6.6 million and net loss of $3.9 million for the years ended December 31, 2023, 2022, and 2021, respectively. For the years ended December 31, 2023, 2022 and 2021, we generated approximately 82%, 83% and 82%, respectively, of our revenues from our North America segment. Our revenues are diversified, with our top ten customers accounting for approximately 35%, 33% and 33% of our revenues during the years ended December 31, 2023, 2022 and 2021, respectively, with no customer accounting for greater than 10% of our revenues in any such year.

OUR SPECIALIZED SOLUTIONS

As a provider of asset protection solutions, we combine our industry-leading services, products, data management and analytical solutions technologies to provide a unique and custom-tailored solution for each customer’s individual asset protection needs, ranging from routine inspections to complex, plant-wide asset integrity management programs.

Field Inspections

Our field inspections portfolio includes traditional and advanced NDT techniques and inline inspection for pipelines. We offer these solutions on an individual basis, or as parts of enterprise inspection and testing programs.

NDT is the examination of an asset without materially impacting its structural integrity. The ability to inspect infrastructure assets and not interfere with their operating performance makes NDT a highly-attractive alternative to many traditional techniques, which may require shutting down an asset or entire facility. Typical issues for which our technicians inspect include potential corrosion, cracking, pitting, leaking, faults and flaws in piping, storage tanks and pressure vessels, as well as a wide range of other industrial assets and public infrastructure.

Our automated data acquisition solutions utilize smart sensing and monitoring, robotic inspection systems, and digitized spot inspections to provide asset integrity data with greater insight into current and potentially future asset conditions.

Field inspection services lend themselves to integration with our other offerings, and as such have often served as the initial entry point to more advanced customer engagements that require additional solutions. After an initial field inspection is performed, we are able to provide multiple supplemental solutions, such as maintenance services, engineering consulting and data analytical solutions services we provide, that further serve to solidify our relationships with our customers and drive additional revenue.

Data Analytical Solutions

The asset protection solutions that we provide throughout our customers’ asset lifecycles generate mechanical integrity data that needs to be effectively archived, managed, and analyzed. A common difficulty that our customers face is the ability to easily access and analyze large volumes of data from multiple data collection and input sources. We recognize that this data is most valuable to our customers when it is accessible and integrated (regardless of vendor, tool, or facility), and we have taken significant steps to digitalizing asset protection processes through our data analytical solutions product offerings.

Our data acquisition capabilities capture asset data to help our customers follow regulatory compliance, ensure mechanical integrity, and reduce unplanned outages. We capture data using manned and automated techniques that minimize the impact on our customers' operations. Customers can access our collected data for all facilities, structures, and assets that we manage from one easy to use dashboard, which enables customers to evaluate trending and benchmarking across multiple sites seamlessly.

Customer data is managed in our asset protection software ecosystem, OneSuite. Our OneSuite software platform offers functions of our popular software and services brands as integrated applications in a cloud environment. Our OneSuite software platform serves as a single access portal for customers' data activities and provides access to 90 plus integrated applications being offered in one centralized platform.

Many customers take advantage of our data analytics capabilities that utilize technology to automatically generate insights and actionable recommendations that can be implemented to improve our customers' overall productivity. Our managed services integrate our data capabilities with data analysts, field personnel and engineers to provide a comprehensive solution to our customers that reduces our customers' overall costs.

Our customers within the oil and gas and petrochemical industries take advantage of our industry-leading application Plant Condition Management Software (PCMS®). This application is one of the most widely used asset integrity management systems (“AIMS”). We estimate that our PCMS application is currently used by approximately 50% of the U.S. refiners, as well as by leading midstream pipeline energy companies and major oil and gas companies in Canada and Europe. This allows us to provide our customers with industry-leading insights across all their facilities and enables us to provide additional software and solutions to these customers and perform recurring maintenance where necessary.

Our pipeline customers utilize our Onstream® services and New Century® software platform to capture, manage and analyze pipeline integrity data in the midstream and upstream sectors of the oil and gas industry. We provide among the most comprehensive, data-driven pipeline protection solutions available to the industry. Our proprietary pipeline data analysis solutions enable deep integration of inline inspection ("ILI") big data with real-time risk analytics and business intelligence ("BI") to provide capabilities for supporting pipeline integrity, which we believe provides us with an important competitive advantage.

Our wind, power and infrastructure customers implement our online condition-monitoring solutions that provide real-time reports and analysis of infrastructure to alert facility personnel to damages before critical failures occur, while our flexible, IIoT compatible, cloud-based online monitoring portal centralizes and analyzes all collected monitoring data. These monitoring solutions are often installed in hazardous or hard-to-reach locations, helping to enhance safety by reducing the need to send technicians into unsafe locations.

Laboratory Testing

Our network of in-house laboratories located across North America and Europe offers quality assurance and quality control ("QA/QC") solutions for new and existing metal and alloy components, materials, and composites.

Our in-house laboratories work with our customers to test and measure utilized components throughout their lifetimes, from preparation and production to post-processing and in-service component monitoring. Our laboratory QA/QC solutions help to meet customer needs throughout their manufacturing cycles, with a focus on optimizing production logistics. Our in-house laboratory solutions include:

•Non-destructive evaluation/inspection ("NDE"/"NDI")

•Destructive testing ("DT")

•Metallurgical testing

•Chemical analysis testing

•Mechanical services

•Machining services

•Pre-machining

•Casting repair solutions

•Finishing services

We often inspect and test components prior to assembly to screen for defects and discontinuities introduced in the manufacturing process. We also inspect existing components to ensure they remain fit-for-purpose.

Our laboratories hold a wide variety of certifications, such as: Nadcap (formerly NADCAP, the National Aerospace and Defense Contractors Accreditation Program), AS9100/ISO-9001, Federal Aviation Administration Repair Station, and the International Traffic in Arms Regulations/Export Administration Regulations, that allow us to perform inspections which meet or exceed stringent regulatory and manufacturers' requirements. With these certifications come a comprehensive range of approvals from prime contractors of major projects, militaries and internationally-renowned original equipment manufacturers ("OEMs") from many of our key markets, including the oil and gas, aerospace and defense, power generation and industrial markets.

Maintenance

We perform maintenance and light mechanical services to prepare assets for inspection and to return them to working condition post inspection. These services include corrosion removal, mitigation and prevention; insulation installation and removal; electrical services; heat tracing, industrial cleaning; pipefitting; and welding. Our light mechanical services are often offered as complementary, value-added solutions to inspections, such as removing insulation in order to inspect piping, then re-installing insulation.

Our multi-disciplined technicians offer maintenance and light mechanical services in hard-to-access areas, in combination with rope access or diving strategies.

Mechanical services are still a small part of our business, and we carefully try to avoid providing any such services that conflict with our inspection services.

Engineering Consulting

We provide a broad range of engineering consulting services, primarily for process equipment, technologies and facilities. Our engineering consultations include plant operations and management support, turnaround/shutdown planning, profit improvement, facilities planning studies, engineering design, process safety reviews, energy optimization evaluations, benchmarking/key performance indicator development and technical training.

Our Asset Integrity Management ("AIMS") and Mechanical Integrity ("MI") services help improve asset reliability and regulatory compliance through a systematic, engineering-based approach to ensure the ongoing integrity and safety of equipment and industrial facilities. AIMS/MI services can include conducting an inventory of infrastructure assets; developing, implementing and training personnel in executing inspection and maintenance procedures; and managing MI programs. We help to identify gaps between existing and desired practices and establish quality assurance standards for fabrication, engineering and installation of infrastructure assets.

Access

Much of our work is conducted in hard-to-access locations, including those in at-height, subsea and confined locations. We utilize scaffolding and rope access to access at-height and confined assets; certified divers for subsea inspection and maintenance; and unmanned (drone) aerial, land-based and subsea systems to deliver a wide range of inspection applications, with an emphasis on minimizing at-height access and confined space entry.

Equipment

We design and manufacture portable, handheld, wireless and turnkey NDT equipment, along with corresponding data acquisition sensors and software, for spot inspections and long-term, unattended monitoring applications.

We sell these solutions as individual components, or as complete systems, which include a combination of sensors, amplifiers, signal processing electronics, knowledge-based software and decision and feedback electronics. We also sell integrated service-and-system technology packages, in which our field technicians utilize our proprietary and specialized testing procedures and hardware, advanced pattern recognition, neural network software and databases to compare test results against our prior testing data or industry standards.

We provide a range of acoustic emission ("AE") products and are a leader in the design and manufacture of AE sensors, instruments and turnkey systems used for monitoring and testing materials, pressure components, processes, and structures. We also design and manufacture ultrasonic testing ("UT") equipment.

Most of our hardware products are fabricated, assembled and tested in our ISO-9001-certified facility in Princeton Junction, New Jersey. We also design and manufacture automated ultrasonic systems and scanners in France.

Centers of Excellence

Another differentiator in our business model is our Centers of Excellence ("COEs"), which offer support for asset, technology or industry-specific solutions. Our subject matter experts engage in strategic sales opportunities to offer customers value-added solutions using advanced technologies and methods. The COEs help to standardize our approach to common problems in our key market segments. Our COEs include:

•Acoustic Emission

•American Petroleum Institute ("API") Turnarounds

•AIMS/MI/Engineering

•Automated Ultrasonics

•Fossil Power

•Guided Wave Ultrasonics

•Mechanical Services

•Nuclear Power

•Phased Array

•Rope Access

•Wind

•Tank Inspection

•Tube Inspection

•Unmanned Systems

ASSET PROTECTION INDUSTRY OVERVIEW

Asset protection plays a crucial role in assuring the integrity and reliability of critical infrastructure. As an asset protection solutions provider, we seek to maximize the uptime and safety of critical infrastructure, by helping customers to detect, locate, mitigate, and prevent damages such as corrosion, cracks, leaks, manufacturing flaws and other concerns to operating and structural integrity. In addition to these core utilities, the storage and analysis of collected inspection and MI data is also a key aspect of asset protection.

NDT has historically been a prominent solution in the asset protection industry due to its capacity to detect defects without compromising the structural integrity of the tested materials or equipment. Traditionally, the supply of NDT inspection services has been provided by many relatively small vendors, who provide services in a more localized geographic region. A trend has emerged, however, for customers to increasingly engage a select few vendors capable of providing a wider spectrum of asset protection solutions for global infrastructure, in addition to an increased demand for advanced non-destructive testing ("ANDT") solutions and data acquisition software, both of which require a highly-trained workforce.

Due to these trends, those vendors offering integrated solutions, scalable operations, skilled personnel and a global footprint are expected to have a distinct competitive advantage. Moreover, we believe that vendors that are able to effectively deliver both

advanced solutions and data analytics, by virtue of their access to customers’ data, create a significant barrier to entry for competitors, leading to the opportunity to further create significant recurring revenues.

Key Dynamics of the Asset Protection Industry

We believe the following represent key dynamics of the asset protection industry, and that the market available to us will continue to grow as these macro-market trends continue to develop:

Digital Transformation of Asset Protection. Plants in the oil and gas, petrochemical and other process industries are recognizing the need to evolve their traditional, paper-based mechanical integrity programs in favor of digitalized solutions. The rise of big data intelligence, and our data analytical solutions offerings, provide our customers with actionable insights from raw asset integrity data. The growing digitization of asset protection provides opportunities for contractors with a wide range of asset protection expertise and integrated data platforms to provide customers with data analytical solutions to help customers maximize uptime while controlling costs.

Extending the Useful Life of Aging Infrastructure While Increasing Utilization. Due to the prohibitive costs and challenges of building new infrastructure, many companies have chosen to extend the useful life of existing assets through enhancements, rather than replacing these assets. This has resulted in the significant aging and increased utilization of existing infrastructure in our target markets. Because aging infrastructure requires more frequent inspection and maintenance in comparison to new infrastructure, companies and public authorities continue to spend on asset protection to ensure their aging infrastructure assets continue to operate effectively.

Outsourcing of Non-Core Activities and Technical Resource Constraints. Due to the increasing sophistication and automation of NDT programs, a decreasing supply of skilled professionals and increasing governmental regulations, companies are increasingly outsourcing NDT to third-party providers with advanced solution portfolios, engineering expertise and trained workforces.

Increasing Corrosion from Low-Quality Inputs. The increased availability and low cost of crude oil from areas such as shale plays and oil sands resources have led to the use of lower-grade raw materials and feedstock. This leads to higher rates of corrosion, especially in refining processes involving petroleum with higher sulfur content, which increases the need for asset protection solutions to detect and/or proactively prevent corrosion-related issues.

Increasing Use of Advanced Materials. Customers in various target markets - particularly aerospace and defense - are increasingly utilizing advanced materials, such as composites and other unique technologies in their assets. These materials often cannot be tested using traditional NDT techniques. We believe that demand for more advanced testing and assessment solutions will increase as the utilization of these advanced materials increases during the design, manufacturing, operating and quality control phases.

Meeting Safety Regulations. Owners and operators of refineries, pipelines and petrochemical and chemical plants increasingly face strict government regulations and more stringent process safety enforcement standards. This includes the continued implementation of the Occupational Safety and Health Administration’s National Emphasis Program. Failure to meet these standards can result in significant financial liabilities, increased scrutiny by government and industry regulators, higher insurance premiums and tarnished corporate brand value. As a result, these owners and operators are seeking highly-reliable asset protection suppliers with a track record of assisting customers in meeting increasingly stringent regulations. Our customers benefit from our extensive engineering consulting base that supports them in devising mechanical integrity programs that both meet regulatory compliance standards and enable enhanced safety and uptime at the customer's facilities.

Expanding Addressable End-Markets. The continued emergence of and advances in asset protection technologies and software-based systems are increasing the demand for asset protection solutions in applications where existing techniques were previously ineffective.

Expanding Aerospace and Defense Industry. We believe that increased demand will continue to come over the next several years from the commercial industry due to the approximately decade-long backlog for next-generation commercial aircraft to be built, driving the need for advanced solutions that drive cost and quality efficiencies. Demand continues to be stable in the defense industry while demand in the private space industry is growing.

Crude Oil Prices. Volatility in the energy sector has been profound during the 2015-2022 period with moderation occurring during 2023. The collapse of world oil prices in 2015 and 2016 undermined industry expansion. While energy prices recovered in 2017 and 2018, they once more declined, and subsequently rebounded in the second half of 2021 and the first half of 2022 with near record high prices and crack spreads. This resulted in refineries delaying turnarounds during 2022 until oil prices decreased and stabilized in the second half of 2022. The stabilization continued throughout 2023 without major peaks and fluctuations as seen in prior periods. The on-going war in Ukraine and the conflict in the Middle East between Israel and

Hamas, coupled with continued macroeconomic uncertainty in 2024, are expected to continue to significantly influence oil prices for the foreseeable future.

Expanding Pipeline Integrity Regulations: The United States Pipeline & Hazardous Materials Safety Administration’s “Mega Rule” adopted in October 2019, expands pipeline integrity regulations on more than 500,000 miles of pipelines that carry natural gas, oil and other hazardous materials throughout the United States. Some of these requirements will take operators decades to fulfill. These regulations require inspection and integrity data records throughout a pipeline’s lifetime to be “reliable, traceable, verifiable, and complete,” increasing the demand for integrated inspection, engineering, monitoring, and data management and analysis solutions.

Consolidation of Refineries: Consolidation of refinery ownership will create both pressure on refinery service providers due to increased customer purchasing power and provide an opportunity to those same refinery service providers to become preferred providers to these larger customers.

Our Competitive Strengths

We believe the following competitive strengths contribute to our being a leading provider of asset protection solutions and will allow us to further capitalize on growth opportunities in our industry:

OneSource Provider for Asset Protection Solutions. We believe we have one of the most comprehensive portfolios of integrated asset protection solutions worldwide, which positions us to be a leading single-source provider for our customers’ asset protection requirements. This is particularly a competitive strength in regards to turnarounds and shutdowns - during which facilities temporarily cease portions of their operations in order to perform plant-wide inspections, maintenance and repairs - as the services being requested and performed during these work stoppages make up significant portions of refinery, process and power plant maintenance budgets. Demand for our solutions increases during these outages, as facilities seek third-party providers to perform a wide spectrum of asset protection operations while the plant is offline. In addition, as companies are increasingly outsourcing their NDT needs to third-party providers, we believe that the ability to offer a comprehensive package of solutions provides us with a competitive advantage.

Integrated Data Management: Our expertise and proprietary research and development in data analytical solutions throughout the asset protection cycle provides a competitive advantage. With solutions for integrated data acquisition, storage, visualization and analytics, our integrated data analytical solutions well-position us for the oil and gas increasing movement towards digitalizing and centralizing asset protection to fewer, highly-skilled and multi-disciplined vendors. Many of our data analytical solutions are platform-agnostic, allowing us to integrate into customers' existing operations, and thereby expanding the potential customer pool for our solutions. Our expertise and experience also allow us to tailor our offerings to meet specific customer needs, which sets us apart from our competitors. Our presence in our customers’ operations throughout their asset lifecycles also ideally positions us to be their primary vendor to centralize their asset integrity data collection, management and analysis, creating mutually-beneficial opportunities to scale our relationships.

Long-Standing Trusted Provider to a Diversified and Growing Customer Base. We have become a trusted partner to a large and growing customer base across numerous global markets through our proven, decades-long track record of successful operations. Our customers include some of the largest and most well-recognized firms in the oil and gas, chemicals, power generation and transmission and aerospace and defense industries, as well as public authorities.

Repository of Customer-Specific Inspection Data. Through our world-class enterprise data management and analysis software, PCMS, we have accumulated extensive, proprietary process data that allows us to provide our customers with value-added services, such as benchmarking, "RBI" and reliability-centered maintenance.

Proprietary Products, Software and Technology Packages. Our deep knowledge base in asset protection services and equipment enables us to offer technology packages, in which our field technicians utilize our proprietary and specialized testing procedures and hardware, advanced pattern recognition, neural network software and databases to compare test results against our prior testing data or national and international structural integrity standards.

Deep Domain Knowledge and Extensive Industry Experience. We have extensive asset protection experience and data, dating back several decades of operations. We have gained this through our industry leadership in developing advanced asset protection solutions, including research and development of advanced NDT technologies and applications, process engineering technologies, online plant asset integrity management with sensor fusion; and enterprise software solutions for plant-wide and fleet-wide inspection data archiving and management.

Technological Research and Development. The NDT industry continues to move towards more advanced, automated solutions, requiring service providers to find safer and more cost-efficient inspection techniques. We believe that we remain ahead of the

technological curve by backing our extensive industry expertise with the investment of resources in research and development. Some of the advanced inspection technologies developed by our internal research and development teams include an automated radiographic testing ("aRT") crawler for corrosion under insulation ("CUI") inspections in above ground pipelines and piping; our Large Structure Inspection ("LSI") scanner, and our real-time radiography ("RTR") crawler for 360° inspections of pipeline girth welds.

Collaborating with Our Customers. We have historically expanded our asset protection solution portfolio in response to our customers’ unique performance specifications. Our technology packages have often been developed in close cooperation and partnership with key customers and industry organizations.

Experienced Management Team. Our management team has a track record of asset protection organizational leadership. These individuals also have successfully driven operational growth organically and through acquisitions, which we believe is important to facilitate future growth in the asset protection industry.

Our Growth Strategy

Our growth strategy emphasizes the following key elements:

Continue to Digitalize Asset Protection Data and Processes. We place a data-centric focus on asset protection, enabling our customers to ease some of their biggest areas of concern (particularly the timely and accurate transfer of asset integrity data from the field to their IDMS, as well as the data’s visibility and accessibility once uploaded). We expect that the demand for our data analytical solutions which provides big data intelligence and remote data visibility will continue to grow, and we are investing in data analytical solutions that help our customers visualize and generate actionable insight from their asset integrity data, regardless of data input. We are also actively seeking to optimize our customers’ asset protection workflows and processes, by creating digital paths between data applications to increase data visibility and reduce manual data entry and human error.

Expand Our Focus in the Aerospace and Defense Industries. We believe that the introduction of next-generation airframes and aircraft engines has created an inherent demand for inspection, testing, machining and mechanical services required for the production of parts. The recent interest in the use of additive manufacturing techniques to create components also necessitates advanced inspection and testing solutions.