UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended May 31, 2012

Commission File Number 001-34481

Mistras Group, Inc.

(Exact name of registrant as specified in its charter)

|

Delaware |

|

22-3341267 |

|

(State or other jurisdiction of |

|

(I.R.S. Employer |

195 Clarksville Road

Princeton Junction, New Jersey 08550

(609) 716-4000

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class |

|

Name of each exchange on which registered |

|

Common Stock, par value $.01 par value |

|

New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark whether the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act of 1933. Yes o No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Securities Exchange Act of 1934 (the “Exchange Act”). Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of Registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

Large accelerated filer o |

|

Accelerated filer x |

|

|

|

|

|

Non-accelerated filer o |

|

Smaller reporting company o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No x

The aggregate market value of the voting and non-voting common stock held by non-affiliates of the Registrant as of November 30, 2011, based upon the closing price of the common stock as reported by New York Stock Exchange on such date was approximately $389.0 million.

As of August 1, 2012, a total of 28,038,007 shares of the Registrant’s common stock were outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Information required by Part III (Items 10, 11, 12, 13 and 14) is incorporated by reference to portions of the registrant’s definitive Proxy Statement for its 2012 Annual Meeting of Shareholders (the “Proxy Statement”), which is expected to be filed not later than 120 days after the registrant’s fiscal year ended May 31, 2012. Except as expressly incorporated by reference, the Proxy Statement shall not be deemed to be a part of this report on Form 10-K.

MISTRAS GROUP, INC.

ANNUAL REPORT ON FORM 10-K

FORWARD-LOOKING STATEMENTS

This Report on Form 10-K contains forward-looking statements regarding us and our business, financial condition, results of operations and prospects within the meaning of the Private Securities Litigation Reform Act of 1995. Such forward-looking statements include those that express plans, anticipation, intent, contingency, goals, targets or future development and/or otherwise are not statements of historical fact. These forward-looking statements are based on our current expectations and projections about future events and they are subject to risks and uncertainties known and unknown that could cause actual results and developments to differ materially from those expressed or implied in such statements.

In some cases, you can identify forward-looking statements by terminology, such as “goals,” “expects,” “anticipates,” “intends,” “plans,” “believes,” “seeks,” “estimates,” “may,” “could,” “should,” “would,” “predicts,” “appears,” “projects,” or the negative of such terms or other similar expressions. Factors that could cause or contribute to differences in results and outcomes from those in our forward-looking statements include, without limitation, those discussed elsewhere in this Report in Part I, Item 1A. “Risk Factors” and in this Item 1, as well as those discussed in our other Securities and Exchange Commission (SEC) filings. We undertake no obligation to (and expressly disclaim any obligation to) revise or update any forward-looking statements made herein whether as a result of new information, future events or otherwise. However, you should consult any further disclosures we may make on these or related topics in our reports on Form 8-K or Form 10-Q filed with the SEC.

The following discussions should be read in conjunction with the sections of this Report entitled “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Risk Factors”.

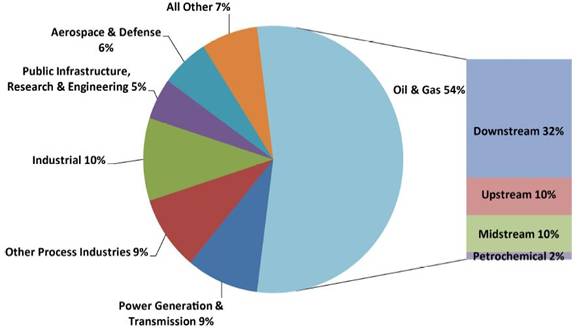

Our Business

We offer our customers “one source for asset protection solutions” ® and are a leading global provider of technology-enabled asset protection solutions used to evaluate the structural integrity and reliability of critical energy, industrial and public infrastructure. We combine industry-leading products and technologies, expertise in mechanical integrity (MI) and Non-Destructive Testing (NDT) services, predictive maintenance (PdM) services, proprietary data analysis and enterprise inspection warehousing software to deliver a comprehensive portfolio of customized solutions, ranging from routine inspections to complex, plant-wide asset integrity management and assessments. These mission critical solutions enhance our customers’ ability to comply with governmental safety and environmental regulations, extend the useful life of their assets, increase productivity, minimize repair costs, manage risk and avoid catastrophic disasters. Given the role our solutions play in ensuring the safe and efficient operation of infrastructure, we have historically provided a majority of our services to our customers on a regular, recurring basis. We serve a global customer base of companies with asset-intensive infrastructure, including companies in the oil and gas (downstream, midstream, upstream and petrochemical), power generation (natural gas, fossil, nuclear, alternative, renewable, and transmission and distribution), public infrastructure, chemicals, aerospace and defense, transportation, primary metals and metalworking, pharmaceutical/biotechnology, food processing industries and research and engineering institutions. As of May 31, 2012, we had approximately 3,500 employees, including approximately 30 Ph.D.’s and 100 other degreed engineers and certified technicians, in approximately 80 offices across 15 countries. We have established long-term relationships as a critical solutions provider to many of the leading companies in our target markets. The following chart represents the percentage of consolidated revenues we generated from our various markets for fiscal 2012.

Mistras Revenues by End Market

(Fiscal 2012)

Our asset protection solutions continuously evolve over time as we combine the disciplines of NDT, PdM, MI services and data analysis and enterprise warehousing software to provide value to our customers. The foundation of our business is NDT, which is the examination of assets without impacting current and future usefulness or impairing the integrity of these assets. The ability to inspect infrastructure assets and not interfere with their operating performance makes NDT a highly attractive alternative to many traditional intrusive inspection techniques, which may require dismantling equipment or shutting down a plant, mill or site. Our MI services are a systematic engineering-based approach to developing best practices for ensuring the on-going integrity and safety of equipment and industrial facilities. MI services involve conducting an inventory of infrastructure assets, developing and implementing inspection and maintenance procedures, training personnel in executing these procedures and managing inspections, testing and assessments of customer assets. By assisting customers in implementing MI programs we enable them to identify gaps between existing and desired practices, find and track deficiencies and degradations to be corrected and establish quality assurance standards for fabrication, engineering and installation of infrastructure assets. We believe our MI services improve plant safety and reliability and regulatory compliance, and in so doing reduce maintenance costs. Our solutions also incorporate comprehensive data analysis from our proprietary asset protection software to provide customers with detailed, integrated and cost-effective solutions that rate the risks of alternative maintenance approaches and recommend actions in accordance with consensus industry codes and standards and help to establish and support key performance indicators (KPI’s) to ensure continued safe and economic operations.

We differentiate ourselves by delivering these solutions under our “One Source” umbrella, utilizing a proven systematic method that creates a closed loop life cycle for addressing continuous asset protection and improvement. Under this business model, customers outsource their inspection to us on a “run and maintain” basis. As a global asset protection leader, we provide a comprehensive range of solutions that includes:

· traditional and advanced outsourced NDT services conducted by our technicians, mechanical integrity assessments, above-ground storage tank inspection and American Petroleum Institute (API) visual inspections and PdM program development;

· advanced asset protection solutions, in most cases involving proprietary acoustic emission (AE), digital radiography, infrared, wireless and/or automated ultrasonic sensors, which are operated by our highly trained technicians;

· a proprietary and customized portfolio of software products for testing and analyzing data captured in real-time by our technicians and sensors, including advanced features such as pattern recognition and neural networks;

· enterprise software and relational databases to store and analyze inspection data, comparing it to prior operations and testing of similar assets, industrial standards and specific risk conditions, such as use with highly flammable or corrosive materials,

and developing asset integrity management plans based on risk-based inspection that specify an optimal schedule for the testing, maintenance and retirement of assets; and

· on-line monitoring systems that provide secure web-based remote or on-site asset inspection, real-time reports and analysis of plant or enterprise-wide structural integrity data, comparison of integrity data to our library of historical inspection data and analysis to better assess structural integrity and provide alerts for and prioritize future inspections and maintenance.

We offer our customers a customized package of services, products and systems, or our enterprise software and other niche high-value products on a stand-alone basis. For example, customers can purchase most of our sensors and accompanying software to integrate with their own systems, or they can purchase a complete turn-key solution, including installation, monitoring and assessment services. Importantly, however, we do not sell certain of our advanced and proprietary software and other products as stand-alone offerings; instead, we embed them in our comprehensive service offerings to protect our investment in intellectual property while providing an added value which generates a substantial source of recurring revenues.

We generated revenues of $436.9 million, $338.6 million and $272.1 million, net income of $21.4 million, $16.4 million, and $16.9 million, and adjusted EBITDA of $65.2 million, $52.3 million and $39.5 million for fiscal 2012, 2011 and 2010, respectively. An explanation of adjusted EBITDA and a reconciliation of these amounts to net income are set forth in Item 6, Selected Financial Data. For fiscal 2012, we generated approximately 80% of our revenues from our Services segment. Our revenues are diversified, with our top ten customers accounting for approximately 39%, 44% and 45% of our revenues during fiscal 2012, 2011 and 2010, respectively.

Asset Protection Industry Overview

Asset protection is a large and rapidly growing industry that consists of NDT inspection, PdM and MI services and inspection data warehousing and analysis. NDT plays a crucial role in assuring the operational and structural integrity and reliability of critical infrastructure without compromising the usefulness of the tested materials or equipment. The evolution of NDT services, in combination with broader industry trends, including increased asset utilization and aging of infrastructure, the desire by companies to extend the useful life of their existing infrastructure, new construction projects, enhanced government regulation and the shortage of certified NDT professionals, have made NDT an integral and increasingly outsourced part of many asset-intensive industries. Well-publicized industrial and public infrastructure failures and accidents such as the Deepwater Horizon oil spill in the Gulf of Mexico and the I-35W Mississippi River bridge collapse in Minnesota have raised the level of safety awareness of regulators, and owners and operators are recognizing the benefits that asset protection solutions can provide.

Historically, NDT solutions predominantly used qualitative testing methods aimed primarily at detecting defects in the tested materials. This methodology, which we categorize as “traditional NDT,” is typically labor intensive and, as a result, considerably dependent upon the availability and skill level of the certified technicians, engineers and scientists performing the inspection services. The traditional NDT market has been highly fragmented, with a significant number of small vendors providing inspection services to divisions of companies or local governments situated in close proximity to the vendor’s field inspection engineers and technicians. The current trend, however, is for customers to look for a select few vendors capable of providing a wider spectrum of asset protection solutions for their global infrastructure that we call “one source”. This shift in underlying demand, which began in the early 1990s, has contributed to a transition from traditional NDT solutions to more advanced solutions that employ automated digital sensor technologies and accompanying enterprise software, allowing for the effective capture, storage, analysis and reporting of inspection and engineering results electronically and in digital formats. These advanced techniques, taken together with advances in wired and wireless communication and information technologies, have further enabled the development of remote monitoring systems, asset-management and predictive maintenance capabilities and other data analytics and management. We believe that as advanced asset protection solutions continue to gain acceptance among asset-intensive organizations, those vendors offering broad, complete and integrated solutions, scalable operations and a global footprint will have a distinct competitive advantage. Moreover, we believe that vendors that are able to effectively deliver both advanced solutions and data analytics, by virtue of their access to customers’ data, create a significant barrier to entry for competitors, and lead the opportunity to generate create significant recurring revenues.

We believe the following represent key dynamics driving the growth of the asset protection industry:

· Extending the Useful Life of Aging Infrastructure. The prohibitive cost and challenge of building new infrastructure has resulted in the significant aging of existing infrastructure and caused companies to seek ways to extend the useful life of existing assets. For example, due to the significant cost associated with constructing new refineries, stringent environmental regulations which have increased the costs of managing them and difficulty in finding suitable locations on which to build them, no new refineries have been constructed in the United States since 1976. Another example is in the area of power transmission and distribution. The Smart Grid initiative in the United States is causing increased loading on aging transformers that are more than 30 years old in most cases. The need to test and monitor these units to ensure their reliability until replacement is instrumental in support of a reliable Smart Grid network. Because aging infrastructure requires relatively higher levels of maintenance and repair in comparison to new infrastructure, as well as more frequent, extensive

and ongoing testing, companies and public authorities are increasing spending to ensure the operational and structural integrity of existing infrastructure.

· Outsourcing of Non-Core Activities and Technical Resource Constraints. The increasing sophistication and automation of NDT programs, together with a decreasing supply of skilled professionals and stricter governmental regulations, has caused many companies and public authorities to outsource NDT rather than recruit and train such capabilities internally. Owners and operators of infrastructure are increasingly contracting with third party providers that have the necessary technical product portfolio, engineering expertise, technical workforce and proven track record of results-oriented performance to effectively meet their increasing requirements.

· Increasing Asset and Capacity Utilization. Due to high energy prices, high repair and replacement costs and the limited construction of new infrastructure, existing infrastructure in some of our target markets is being used at higher capacities, causing increased stress and fatigue that accelerate deterioration. These higher prices and costs also motivate our customers to complete repairs, maintenance, replacements and upgrades more quickly. For example, increasing demand for refined petroleum products, combined with high plant utilization rates, is driving refineries to upgrade facilities to make them more efficient and expand capacity. In order to sustain high capacity utilization rates, customers are increasingly using asset protection solutions to efficiently ensure the integrity and safety of their assets. Implementation of asset protection solutions can also lead to increased productivity as a result of reduced maintenance-related downtime.

· Increasing Corrosion from Low-Quality Inputs. High commodities prices and increasing energy demands have led to the use of lower grade raw materials and feedstock’s used in refinery and power generation processes. These lower grade raw materials and feedstock’s, especially in the case of the refining process, can rapidly corrode the infrastructure they come into contact with, which in turn increases the need for asset protection solutions to identify such corrosion and enable infrastructure owners to proactively combat the problems caused by such corrosion.

· Increasing Use of Advanced Materials. Customers in our target markets are increasingly utilizing advanced materials, such as composites, and other unique technologies in the manufacturing and construction of new infrastructure and aerospace applications. As a result, they require advanced testing, assessment and maintenance technologies to inspect and to protect these assets, since many of these advanced materials cannot be tested using traditional NDT techniques. We believe that demand for NDT solutions will increase as companies and public authorities continue to use these advanced materials, not only during the operating phase of the lifecycle of their assets, but also during the design, manufacturing and quality control phases and integrating and embedding sensors directly into the end product in support of total life cycle asset management.

· Meeting Safety Regulations. Owners and operators of infrastructure assets increasingly face strict government regulations and safety requirements. Failure to meet these standards can result in significant financial liabilities, increased scrutiny by OSHA and other regulators, higher insurance premiums and tarnished corporate brand value. There have been several industrial accidents, including explosions and fires, in recent years. These accidents created significant damage to the reputation of refineries and coupled with concern by owners, led OSHA to strengthen process safety enforcement standards with the implementation of the National Emphasis Program (NEP) that also extends to chemical plants for compliance with applicable regulations. As a result, these owners and operators are seeking highly reliable asset protection suppliers with a proven track record of providing asset protection services, products and systems to assist them in meeting these increasingly stringent regulations.

· Expanding Addressable End-Markets. Advances in NDT sensor technology and asset protection software systems, and the continued emergence of new technologies, are creating increased demand for asset protection solutions in applications where existing techniques were previously ineffective. Further, we expect increased demand in relatively new markets, such as the pharmaceutical and food processing industries, where infrastructure is now beginning to age to a point where significant maintenance may be required.

· Expanding Addressable Geographies. We believe that a substantial driver of incremental demand will come from international markets, including Canada, Asia, Europe and Latin America. Specifically, as companies and governments in these markets build and maintain infrastructure and applications that require the use of asset protection solutions, we believe demand for our solutions will increase.

We believe that the market available to us will continue to grow as a result of macro-market trends, including aging infrastructure, use of more advanced materials, such as composites, and the increasing outsourcing of asset protection solutions by companies who historically performed these services using internal resources.

Our Target Markets

We focus our sales, marketing and product development efforts on a range of infrastructure-intensive industries and governmental authorities. With our portfolio of asset protection services, products and systems, we can effectively serve our customer base throughout the lifecycle of their assets, beginning at the design stage, through the construction and maintenance phase and, as necessary, through the decommissioning of their infrastructure. In general, our largest market in broad terms is energy related infrastructure.

The rapid increase in world energy demand and prices from 2003 to 2011, combined with concerns about the environmental consequences of greenhouse gas emissions, has led to renewed interest in alternatives to traditional fossil fuels—particularly nuclear power and renewable resources. As a result, long-term prospects continue to improve for generation from both nuclear and renewable energy sources—supported by government incentives and by higher fossil fuel prices. The discovery of large shale gas reserves, which are considered by some as a clean energy alternative, has driven the increase in the use of natural gas to fuel gas turbines in combined cycle power generation plants.

Electricity from coal-fired generation, mainly in global emerging markets, is also expected to increase, making coal the second fastest-growing source for electricity generation. The outlook for coal could be altered substantially, however, by any future legislation that would reduce or limit the release of greenhouse gas emissions related to fossil fuels. There is a progressive shift from traditional gas energy to unconventional gas energy sources.

Oil and Gas

Liquids including oil and gas remain the world’s largest energy source given their importance in the transportation and industrial end-use sectors. World crude oil and liquid fuels consumption grew by an estimated 0.8 million barrels per day in 2011 to 87.92 million barrels per day. The United States Energy Information Administration (EIA) expects that world liquid fuels consumption will grow by 1.0 million barrels per day in 2012 and by an additional 1.2 million barrels per day in 2013 with China, the Middle East, Central and South America, and other countries outside of the Organization for Economic Cooperation and Development (OECD) accounting for essentially all consumption growth.

According to the EIA, in 2011 coal, oil and gas still supplied approximately 84% of the global primary energy demand. The EIA also predicted growth of 53% in total global demand for energy by 2035. Because oil, gas, and coal will continue to be the primary energy sources during this time, the energy industry will have to continue increasing the supply of these fuels to meet this increasing demand. In addition, there were approximately 700 crude oil refineries in the world, with 141 refineries operating in the United States. High energy prices are driving consistently high utilization rates at these facilities. With aging infrastructure and growing capacity constraints, asset protection continues to grow as an indispensable tool in maintenance planning, quality control and prevention of catastrophic failure in refineries and petrochemical plants. Recent high oil and fossil fuel input prices have placed additional pressure on industry participants to increase capacity, focus on production efficiency and cost reductions and shorten shut-down time or “turnarounds.” Asset protection solutions are used for both off-stream inspections, or inspection when the tested infrastructure is shut-down, and increasingly, on-stream inspections, or inspection when the tested infrastructure is operating at normal levels. While we expect off-stream inspection of vessels and piping during a plant shut-down or turnaround to remain a routine practice by companies in these industries, we expect the areas of greatest future growth to occur as a result of on-stream inspections and monitoring of facilities, such as offshore platforms, transport systems and oil and gas transmission lines, because of the substantial opportunity costs of shutting them down. On-stream inspection enables companies to avoid the costs associated with shutdowns during testing while enabling the economic and safety advantages of advanced planning or predictive maintenance.

Power Generation and Transmission

Asset protection in the power industry has traditionally been associated with the inspection of high-energy, critical steam piping, boilers, rotating equipment, and various other plant components, utility aerial man-lift devices, large transformer testing and various other applications for nuclear and fossil-fuel based power plants. We believe that in recent years the use of asset protection solutions have grown rapidly in this industry due to the aging of critical power generation and transmission infrastructure. For instance, the average age of a nuclear power plant in the United States is over 30 years. Furthermore, global demand for power generation and transmission has grown rapidly and is expected to continue, primarily as a result of the energy needs of emerging economies such as China and India. The areas of traditional power generation and transmission that we focus our efforts on are natural gas, fossil, nuclear, alternative, renewable, and wind.

Process Industries

The process industries, or industries in which raw materials are treated or prepared in a series of stages, include chemicals, pharmaceuticals, food processing, paper and pulp and metals and mining, have a need for our products and services. As with oil and gas processing facilities, chemical processing facilities require significant spending on maintenance and monitoring. Given their aging infrastructure, growing capacity constraints and increasing capital costs, we believe asset protection solutions will continue to grow in importance in maintenance planning, quality and cost control and prevention of catastrophic failure in the chemicals industry. Although the pharmaceuticals and food processing industries have historically not employed asset protection solutions as much as other industries, we are now seeing these industries increase the use of asset protection solutions throughout their manufacturing and other processes.

Public Infrastructure, Research and Engineering

We believe that high profile infrastructure catastrophes, such as the collapse of the I-35W Mississippi River Bridge in Minneapolis, have caused public authorities to more actively seek ways to prevent similar events from occurring. Public authorities tasked with the construction of new, and maintenance of existing, public infrastructure, including bridges and highways, increasingly use asset protection solutions to test and inspect these assets. Importantly, these authorities now employ asset protection solutions throughout the life of these assets, from their original design and construction, with the use of embedded sensing devices to enable on-line monitoring, through ongoing maintenance requirements. Nearly 11% of the approximately 700,000 public roads and bridges in the U.S. are classified as “deficient,” according to the U.S. Federal Highway Administration. An immediate “cost-beneficial” investment aimed at replacing or repairing deficient bridges may cost as much as $70 billion, according to the U.S. Department of Transportation.

This is a target market for our application technology and experience. Over the last ten years, we have provided testing and health monitoring on hundreds of bridges and structures worldwide, among which include some of the largest and well-known bridges in the United Kingdom, Pennsylvania and the greater New York metropolitan area. This year we delivered a large continuous on-line Structural Health Monitoring System to the California Department of Transportation that is monitoring the San Francisco Oakland Bay Bridge. As a result of our continued efforts to offer cost-effective application technology to address the need for increased safety measures, we continue to develop products in connection with a $6.9 million project awarded in 2009 under the National Institute of Standards and Technology (NIST) Innovation Program that is intended to bring a transformational impact in the area of civil infrastructure structural health monitoring using affordable self-powered wireless sensors.

The use of asset protection solutions within the transportation industry is primarily focused in the automotive and rail segments. Within the automotive segment, manufacturers use asset protection solutions throughout the entire design and development process, including the inspection of raw material inputs, during in-process manufacturing and, finally, during end-product testing and analysis. Although asset protection technologies have been utilized in the automobile industry for a number of decades, we believe growth in this market will increase as automobile manufacturers begin to outsource their asset protection requirements and take advantage of new technologies that enable them to more thoroughly inspect their products throughout the manufacturing process, reduce costs and shorten time to market. Within the rail subdivision, asset protection solutions are used primarily to test rails and passenger and tank cars.

Aerospace and Defense

The operational safety, reliability, structural integrity and maintenance of aircraft and associated products is critical to the aerospace and defense industries. Industry participants increasingly use asset protection solutions to perform inspections upon delivery, and also periodically employ asset protection solutions during the operational service of aircraft, using advanced ultrasonic immersion systems or digital radiography in order to precisely detect structural defects. Industry participants also use asset protection solutions for the inspection of advanced composites found in new classes of aircraft, x-ray of critical engine components, ultrasonic fatigue testing of complete aircraft structures, corrosion detection and on-board monitoring of landing gear and other critical components. We expect increased demand for our solutions from the aerospace industry to result from wider use of these advanced composites and distributed on-line sensor networks and other embedded analytical applications built into the structure of assets to enable real-time performance monitoring and condition-based maintenance. We serve this rapidly growing target market by providing our state of the art fully integrated inspection systems to original equipment manufacturers (OEMs). For the OEM that prefers to outsource this inspection we provide a full range of in-house services through our four regional facilities that combined have eighteen immersion inspection tank systems and two gantry systems. These facilities have obtained numerous accreditations and certifications required to meet the stringent inspection criteria that this industry demands.

Industrial

The quality control requirements driven by the low defect tolerance within automated, robotic intensive metalwork industries, such as screw machining, serve as key drivers for the recent growth of NDT technologies, such as ultrasonics and radiography. We expect that

increasingly stringent quality control requirements and competitive forces will drive the demand for more costly finishing and polishing which, in turn, will promote greater use of NDT throughout the production lifecycle.

Our Competitive Strengths

We believe the following competitive strengths contribute to our being a leading provider of asset protection solutions and will allow us to further capitalize on growth opportunities in our industry:

· One Source Provider for Asset Protection Solutions® Worldwide. We believe we have the most comprehensive portfolio of proprietary and integrated asset protection solutions, including services, products and systems worldwide, which positions us to be the leading single source provider for a customer’s asset protection requirements. Through our network of 80 offices and independent representatives in 15 countries around the world, we offer an extensive portfolio of solutions that enables our customers to consolidate all their inspection and maintenance requirements and the associated data storage and analytics on a single system that spans the customers’ entire enterprise.

· Long-Standing Trusted Provider to a Diversified and Growing Customer Base. By providing critical and reliable NDT services, products and systems for more than 30 years and expanding our asset protection solutions, we have become a trusted partner to a large and growing customer base across numerous infrastructure-intensive industries globally. Our customers include some of the largest and most well-recognized firms in the oil and gas, chemicals, fossil and nuclear power, and aerospace and defense industries as well as the largest public authorities.

· Repository of Customer-Specific Inspection Data. Our enterprise software solutions, PCMS, enable us to capture and warehouse our customers’ testing and inspection data in a centralized database. As a result, we have accumulated large amounts of proprietary process data and information that allows us to provide our customers with value-added services, such as benchmarking, reliability centered maintenance solutions including predictive maintenance, inspection scheduling, data analytics and regulatory compliance.

· Proprietary Products, Software and Technology Packages. We have developed systems that have become the cornerstone of several high value-added unique NDT applications, such as those used for the testing of above-ground storage tanks (the TANKPAC technology package). These proprietary products allow us to efficiently and effectively provide highly valued solutions to our customers’ complex applications, resulting in a significant competitive advantage. In addition to the proprietary products and systems that we sell to customers on a stand-alone basis, we also develop a range of proprietary sensors, instruments, systems and software used exclusively by our Services segment.

· Deep Domain Knowledge and Extensive Industry Experience. We are an industry leader in developing advanced asset protection solutions, including acoustic emission testing for non-intrusive on-line monitoring of storage tanks and pressure vessels, bridges and transformers, portable corrosion mapping, ultrasonic testing (UT) systems, on-line plant asset integrity management with sensor fusion, enterprise software solutions for plant-wide and fleet-wide inspection data archiving and management, advanced and thick composites inspection and ultrasonic phased array inspection of thick wall boilers.

· Collaborating with Our Customers. Our asset protection solutions have historically been designed in response to our customers’ unique performance specifications and are supported by our proprietary technologies. Important technology packages, such as TANKPAC, and products, such as VPAC, were developed in close cooperation and partnership with key Mistras customers. Our sales and engineering teams work closely with our customers’ research and design staff during the design phase in order to incorporate our products into specified infrastructure projects, as well as with facilities maintenance personnel to ensure that we are able to provide the asset protection solutions necessary to meet these customers’ changing demands.

· Experienced Management Team. Our management team has a track record of leadership in NDT, averaging over 20 years experience in the industry. These individuals also have extensive experience in growing businesses organically and in acquiring and integrating companies, which we believe is important to facilitate future growth in the fragmented asset protection industry. In addition, our senior managers are supported by highly experienced project managers who are responsible for delivering our solutions to customers.

Our Growth Strategy

Our growth strategy emphasizes the following key elements:

· Continue to Develop Technology-Enabled Asset Protection Services, Products, Software and Systems. We intend to maintain and enhance our technological leadership by continuing to invest in the internal development of new services, products, software and systems. Our highly trained team of Ph.D.’s, engineers, application software developers and certified technicians has been instrumental in developing numerous significant asset protection standards. We believe their knowledge base will continue to enable us to innovate a wide range of new asset protection solutions.

· Increase Revenues from Our Existing Customers. Many of our customers are multinational corporations with asset protection requirements from multiple divisions at multiple locations across the globe. Currently, we believe we capture a relatively small portion of their overall expenditures on these solutions. We believe our superior services, products and systems, combined with the trend of outsourcing asset protection solutions to a small number of trusted service providers, position us to significantly expand both the number of divisions and locations that we serve as well as the types of solutions we provide. We strive to be the preferred global partner for our customers and aim to become the single source provider for their asset protection solution requirements.

· Add New Customers in Existing Target Markets. Our current customer base represents a small fraction of the total number of companies in most of our target markets with asset protection requirements. Our scale, scope of products and services and expertise in creating technology-enabled solutions have allowed us to build a reputation for high-quality and have increased customer awareness about us and our asset protection solutions. We intend to leverage our reputation and solutions offerings to win new customers within our existing target markets, especially as asset protection solutions are adopted internationally. We intend to continue to leverage our competitive strengths to win new business as customers in our existing target markets continue to seek a single source and trusted provider of advanced asset protection solutions.

· Expand Our Customer Base into New End Markets. We believe we have significant opportunities to rapidly expand our customer base in relatively new end markets, including the maritime shipping, nuclear, wind turbine and other alternative energy and natural gas transportation industries and the market for public infrastructure, such as highways and bridges. The expansion of our addressable markets is being driven by the increased recognition and adoption of asset protection services, products and systems, and new NDT technologies enabling further applications in industries such as healthcare and compressed and liquefied natural gas transportation, and the aging of infrastructure, such as construction and loading cranes and ports, to the point where visual inspection has proven inadequate and new asset protection solutions are required. We expect to continue to expand our global sales organization, grow our inspection data management and data mining services and find new high-value applications, such as embedding our sensor technology in assembly lines for electronics and distributed sensor networks for aerospace applications. As companies in these emerging end markets realize the benefits of our asset protection solutions, we expect to expand our leadership position by addressing customer needs and winning new business.

· Continue to Capitalize on Acquisitions. We intend to continue employing a disciplined acquisition strategy to broaden, complement and enhance our product and service offerings, add new customers and certified personnel, expand our sales channels, supplement our internal development efforts and accelerate our expected growth. We believe the market for asset protection solutions is highly fragmented with a large number of potential acquisition opportunities. We have a proven ability to integrate complementary businesses, as demonstrated by the success of our past acquisitions, which have often contributed entirely new products and services that have added significantly to our revenues and profitability. In addition, we have begun to offer and sell our advanced asset protection solutions to customers of companies we acquired that had previously relied on traditional NDT solutions. Importantly, we believe we have improved the operational performance and profitability of our acquired businesses by successfully integrating and selling a comprehensive suite of solutions to the customers of these acquired businesses.

Our Segments

The Company has three operating segments:

· Services. This segment provides asset protection solutions primarily in North America with the largest concentration in the United States, consisting primarily of non-destructive testing and inspection services that are used to evaluate the structural integrity and reliability of critical energy, industrial and public infrastructure.

· Products and Systems. This segment designs, manufactures, sells, installs and services our asset protection products and systems, including equipment and instrumentation, predominantly in the United States.

· International. This segment offers services, products and systems similar to those of our Services and Products and Systems segments to global markets, principally in Europe, the Middle East, Africa, Asia and South America, but not to customers in China and South Korea, which are served by our Products and Systems segment.

For discussion of segment revenues, operating results and other financial information, including geographic areas in which we recorded revenues, see Management’s Discussion and Analysis of Financial Condition and Results of Operations, as well as Note 18, Segment Disclosure, to the consolidated financial statements.

Our Solutions

We have the ability to provide comprehensive asset protection solutions to a diverse customer base. Through our operating segments, we are able to offer the strengths of our proprietary products, industry expertise, a suite of software solutions and our highly skilled and experienced technicians and engineers to deliver a broad range of inspection, engineering and information technology services that address the complex business challenges faced by our customers. Depending on the requirements of our customers, we can provide them our software and other products on a stand-alone basis or as a complete end-to-end solution consisting of sensor products, services and software. Importantly, as part of our solutions, we are increasingly providing on-line asset monitoring and management software enabling our customers to have real-time access to assess the structural health of their infrastructure.

Our Services

Our Services segment provides a range of testing and inspection services to a diversified customer base across energy-related, industrial and public infrastructure industries. We either deploy our services directly at the customer’s location or through our own extensive network of field testing facilities. Our global footprint allows us to provide asset protection solutions through local offices in close proximity to our customers, permitting us to keep response time and travel, living and per diem costs to a minimum, while maximizing our ability to develop meaningful, collaborative customer relationships. Examples of our comprehensive portfolio of services include: testing components of new construction as they are built or assembled; providing corrosion monitoring data to help customers determine whether to repair or retire infrastructure; providing material analysis to ensure the integrity of infrastructure components; and supplying non-invasive on-stream techniques that enable our customers to pinpoint potential problem areas prior to failure. In addition, we also provide services to assist in the planning and scheduling of resources for repairs and maintenance activities. Our experienced inspection professionals perform these services, which are supported by our advanced proprietary software and hardware products.

Traditional NDT Services

Our certified personnel provide a range of traditional inspection services. For example, our visual inspectors provide comprehensive assessments of the condition of our customers’ plant equipment during capital construction projects and maintenance shutdowns. Of the broad set of traditional NDT techniques that we provide, several lend themselves to integration with our other offerings and often serve as the initial entry point to more advanced customer engagements. For example, we provide a comprehensive program for the inspection of above-ground storage tanks designed to meet stringent industry standards for the inspection, repair, alteration and reconstruction of oil and petrochemical storage tanks. This program includes magnetic flux exclusion for the rapid detection of floor plate corrosion, advanced ultrasonic systems and leak detection of floor defects, remote ultrasonic crawlers for shell and roof inspections and trained, certified inspectors for visual inspection and documentation.

Advanced NDT Services

In addition to traditional NDT services, we provide a broad range of proprietary advanced NDT services that we offer on a stand-alone basis or in combination with software solutions such as our proprietary enterprise data warehousing and plant condition monitoring software and systems (PCMS). We also provide on-line monitoring capabilities and other solutions that enable the delivery of accurate and real-time information to our customers. Our advanced NDT services require more complex equipment and more skilled inspection professionals to operate this equipment and interpret test results. Some of the technologies and techniques we use include:

|

· Automated ultrasonic testing |

· Wireless on-line data acquisition |

|

· Guided Ultrasonic Long wave testing |

· On-line plant asset integrity monitoring |

|

· Infrared thermography and inspection |

· Risk-based inspection (RBI) |

|

· Phased array ultrasonic testing |

· Computed and Digital radiography |

|

· Acoustic emission testing |

· Sensor fusion (multi-sensor data integration) |

|

· Automated Ultrasonic Phased Array Inspection |

· Ground Penetrating Radar |

|

· Predictive Maintenance (PdM) |

· Line Scanning Thermography (LST) |

|

· Reliability centered maintenance services (RCM) |

· Professional Rope Access teams |

|

· Fitness for Service (FFS) engineering services |

· Large Structure Inspection (LSI) |

|

· Internal Rotating Inspection System (IRIS) |

|

Mechanical Integrity Services

We provide a broad range of MI services that enable our customers to meet stringent regulatory requirements. These services increase plant safety, minimize unscheduled downtime and allow our customers to plan for, repair and replace critical components and systems before failure occurs. Our services are designed to complement a comprehensive predictive and preventative inspection and maintenance program that we can provide for our customers in addition to the MI services. Customers of our MI services have, in many instances, also licensed our PCMS software, which allows for the storage and analysis of data captured by our testing and inspection products and services, and implemented this solution to complement our inspection services.

As a result of the information captured by PCMS and our risk-based inspection software module we are able to provide a professional service known as “Mechanical Integrity Gap Analysis” for process facilities. Our Mechanical Integrity Gap Analysis service offers insight into the level of plant readiness, how best to manage and monitor the integrity of process facility assets, and how to extend the useful lives of such assets. Our Mechanical Integrity Gap Analysis service also assists customers in benchmarking and managing their infrastructure through key performance indicators and metrics.

Our Products and Systems

Software

Our software solutions are designed to meet the demands of our customers’ data analysis and asset integrity management requirements. Some of our key software solutions include:

PCMS enterprise software: asset protection and reliability

Our PCMS application is an enterprise software system that allows for the warehousing and analysis of data as captured by our testing and inspection products and services and convert it to valuable information for our plant personnel and by plant management using our enterprise information dashboards. PCMS allows our customers to design and develop asset integrity management plans that include:

· optimal systematic testing schedules for their infrastructure based on real-time data captured by our sensors;

· alerts that notify customers when to perform special testing services on suspect areas, enabling them to identify and resolve flaws on a timely basis by using our PCMS risk-based inspection (RBI) software module; and

· schedules for the maintenance and retirement of assets.

PCMS also offers advantages by allowing the information it develops and stores to be organized, linked and synchronized with enterprise software systems such as SAP and IBM’s Maximo. We believe PCMS is one of the more widely used process condition management software systems in the world. We estimate that approximately 40% of U.S. refineries, by capacity, currently use PCMS. This provides us not only with recurring maintenance and support fees, but also marketing opportunities for additional software, asset integrity management and other asset protection solutions.

Application-Based Software

We provide a comprehensive portfolio of worldwide AcousticEmission/Ultrasonic application-specific software products that cover a broad range of materials testing and analysis methods, for neural networks, pattern recognition, wavelet analysis and moment tensor analysis.

Some of the key software solutions we offer include:

· Advanced Data Analysis Pattern Recognition and Neural Networks Software (NOESIS), which enables our AE experts to develop automated remote monitoring systems for our customers.

· AE Software Platform (AEwin and AEwinPost), a Windows-based real time applications software for detection, processing and analysis, which locates the general location of flaws on or in our customers’ structures.

· Loose Parts Monitoring Software (LPMS), which is a software program for monitoring, detecting and evaluating metallic loose parts in nuclear reactor coolant systems in accordance with strict industry standards.

· Automated UT and Imaging Analysis Software (UTwin and UTIA), which is a software platform for analyzing ultrasonic inspection data and visualizing and identifying the location and size of potential flaws.

Radiography

We provide a wide array of digital radiographic systems to solve specific industrial problems, including Computed Radiography (CR), Real-Time Radiography (RTR), Direct Radiography (DR), and Computed Tomography (CT). Digital Radiography is one of the newest forms of radiographic imaging. Thickness profiles of piping systems, both insulated and un-insulated, are performed using computed radiography, while large production runs of smaller parts are inspected using direct radiography. Real time radiography is utilized for large “real time” inspections of insulated piping systems looking for areas of pipe degradation.

Technology Packages

In order to address some of the more common problems faced by our customers, we have developed a number of robust technology solutions. These packages generally allow more rapid and effective testing of infrastructure because they minimize the need for service professionals to customize and integrate asset protection solutions with the infrastructure and interpret test results. These packaged solutions use proprietary and specialized testing procedures and hardware, advanced pattern recognition, neural network software and databases to compare test results against our prior testing data or national and international structural integrity standards.

One such package is our ACTMS (Acoustic Combustion Turbine Monitoring System), an on-line system to detect stator blade cracks in gas turbines. Others include TANKPAC for tank inspections and POWERPAC for monitoring discharges in critical power grid transformers.

AE Products

We are a leader in the design and manufacture of AE sensors, instruments and turn-key systems used for the monitoring and testing of materials, pressure components, processes and structures. Though we principally sell our products as a system, which includes a combination of sensors, an amplifier, signal processing electronics, knowledge-based software and decision and feedback electronics, we can also sell these as individual components to certain customers that have the in-house expertise to perform their own services. Our sensors “listen” to structures and materials to detect real-time AE activity and to determine the presence of active corrosion or structural flaws in the inspected materials. Such components include pressure vessels, storage tanks, heat exchangers, piping, turbine blades and reactors.

In addition, we provide leak monitoring and detection systems used in diverse applications, including the detection and location of both gaseous and liquid leaks in valves, vessels, pipelines, boilers and tanks. AE leak monitoring and detection, when applied in a systematic preventive maintenance program, has proven to substantially reduce costs by eliminating the need for visual valve inspection and unscheduled down-time. In addition, the U.S. Environmental Protection Agency (EPA) requirements regarding fugitive emissions such as the new 40 CFR Part 98 Subpart W regulation for gas monitoring, helps drive the market for this leak detection equipment.

UT Technology

We design, manufacture and market a complete line of ultrasonic equipment. While AE technology detects flaws and pinpoints their location, our UT technology has the ability to size defects in three-dimensional geometric representations. Our line of UT systems include our line of Automated UT scanners, our unique portable UT handheld system with motion control to run our many inspection scanners, and our immersion systems including small bench top units to large UT and Gantry systems over 50 feet long.

Vibration Sensors and Systems

We design, manufacture and market a broad portfolio of vibration sensing products under our Vibra-Metrics brand name. These include a full line of accelerometers (vibration sensors), on-line condition-based management systems, data delivery systems and a comprehensive assortment of ancillary support products.

On-line Monitoring

Our on-line monitoring offerings combine all of our asset protection services, products and systems. We provide temporary, periodic and continuous monitoring of static infrastructures such as bridges, pipes, and transformers, as well as dynamic or rotating assets such as pumps, motors, gearboxes, steam and gas turbines. Temporary monitoring is typically used when there is a known defect or problem and the condition needs to be monitored until repaired or new equipment can be placed in service. Periodic monitoring, or “walk around” monitoring, is used as a preventative maintenance tool to take machine and device readings, on a periodic basis, to observe any change in the assets’ condition such as increased vibration or unusual heat buildup and dissipation. Continuous monitoring is applied “24/7” on critical assets to observe the earliest onset of a defect and to track its progression to avoid catastrophic failure.

Customers

During fiscal 2012, we provided our asset protection solutions to approximately 6,600 different customers. The following table lists some of our larger customers by revenues for fiscal 2012, in each of our target markets.

|

Oil & Gas, including Petrochemicals |

|

Power Generation & Transmission |

|

Process Industries |

|

BP |

|

Bechtel |

|

Air Products |

|

Chevron |

|

Duke Energy |

|

Bayer |

|

Conoco Phillips |

|

Entergy |

|

CHM2 Hill |

|

ExxonMobil |

|

Exelon |

|

Dow, Rohm, & Haas |

|

LyondellBasel |

|

G.E. Wind Energy |

|

Dupont |

|

Marathon Oil |

|

PP&L |

|

Equistar |

|

Petrobras |

|

PSE&G |

|

Hemlock Semiconductor |

|

Shell |

|

SGT, LLC |

|

Honeywell |

|

Suncor |

|

Siemens |

|

INEOS |

|

Sunoco |

|

Southern California Edison |

|

LyondellBasel |

|

Industrial |

|

Aerospace & Defense |

|

Public Infrastructure, Research and |

|

Alcan |

|

AMSEC |

|

AGL Services |

|

Hemlock Semiconductor |

|

California Amforge |

|

Amey |

|

Kaiser |

|

Carlton Forge Works |

|

Caltrans Department of Transportation |

|

Newmont Gold |

|

Chen-Tech Industries |

|

CH2M Hill |

|

Nouvelle Autoroute 30 |

|

Danner |

|

Department of Transportation |

|

Spartan Constructors |

|

Electric Boat |

|

HDR Engineering |

|

Strike Construction |

|

U.S. Navy |

|

IS |

|

Verwater |

|

Rolls Royce |

|

Patterson Wilder |

|

Wollostan Alloys |

|

Schlosser Forge Company |

|

Samarco |

|

Wooster Tool & Supply |

|

Snecma |

|

Willbros Engineers |

The percentage in each column heading represents the approximate percentage that each target market comprises of our total revenues. The companies listed under each target market comprise, in total, the following percentages of the fiscal 2012 revenues for that target market:

Oil & Gas: 61%

Power Generation & Transmission: 47%

Process Industries: 27%

Industrial: 22%

Aerospace & Defense: 36%

Public Infrastructure, Research and Engineering: 26%

We have one customer, BP p.l.c. (BP), which accounted for approximately 16%, 18%, and 18% of our total revenues for fiscal 2012, 2011 and 2010, respectively. Our relationship with BP is comprised of separate contracts for non-destructive testing and inspection services with multiple affiliated entities within the broad BP organization. We conduct business with various divisions or affiliates of

the BP organization through numerous contracts covering many segments of BP’s business including downstream (refinery), midstream (pipelines) and upstream (exploration). These contracts are typically negotiated locally with the specific location, are of varying lengths, have different start and end dates and differ in terms of the scope of work and nature of services provided. Most contracts are based on time and materials. No other customer accounted for more than 10% of our revenues in fiscal 2012, 2011, or 2010.

Geographic Areas

We conduct our business in 15 different countries, but our revenues and income are primarily derived from our U.S. operations. No individual foreign country or region accounted for a material portion of our revenues. No individual foreign country or region, with the exception of our subsidiaries in Brazil, had a material amount of our long-lived assets. Long-lived assets in Brazil, including property, plant, and equipment, intangible assets, and goodwill, accounted for approximately $20.9 million, or 11%, of our long-lived assets. Note 18 to our consolidated financial statements in our annual report on Form 10-K for the year ended May 31, 2012 sets forth our revenues, long-lived assets and other financial information regarding our international operations.

Seasonality

Our business is seasonal. This seasonality relates primarily to our Services segment. Our first and third fiscal quarter revenues for our Services segment are typically lower than our revenues in the second and fourth fiscal quarters because demand for our asset protection solutions from the oil and gas as well as the fossil and nuclear power industries increases during their non-peak production periods. Because we are increasing our work in the second and fourth fiscal quarters, our cash flows are lower in those quarters than in our first and third quarters, as collections of receivables lag behind revenues. For instance, U.S. refineries’ non-peak periods are generally in our second fiscal quarter, when they are retooling to produce more heating oil for winter, and in our fourth fiscal quarter, when they are retooling to produce more gasoline for summer. Our quarterly Services segment revenues for fiscal 2012, as a percentage of total Services revenues for fiscal 2012, were 22% (first quarter), 28% (second quarter), 22% (third quarter), and 28% (fourth quarter). We expect that the impact of seasonality on our first and third fiscal quarter revenues and profitability and second and fourth fiscal quarter cash flows will continue.

Competition

We operate in a highly competitive, but fragmented, market. Our primary competitors are divisions of large companies, and many of our other competitors are small companies, limited to a specific product or technology and focused on a niche market or geographic region. We believe that none of our competitors currently provides the full range of asset protection and NDT products, enterprise software (PCMS) and the traditional and advanced services solutions that we offer. Our competition with respect to NDT services include the Acuren division of Rockwood Service Corporation, SGS Group, the TCM division of Team, Inc. and APPLUS RTD, which is majority-owned by The Carlyle Group. Our competition with respect to our PCMS software includes UltraPIPE, a division of Siemens, Lloyd’s Register Capstone, Inc. and Meridium Systems. Our competition with respect to our ultrasonic and radiography products are GE Inspection Technologies and Olympus NDT. In the traditional NDT market, we believe the principal competitive factors are project management, availability of qualified personnel, execution, price, reputation and quality. In the advanced NDT market, reputation, quality and size are more significant competitive factors than price. We believe that the NDT market has significant barriers to entry which would make it difficult for new competitors to enter the market. These barriers include: (1) having to acquire or develop advanced NDT services, products and systems technologies, which in our case occurred over many years of customer engagements and at significant internal research and development expense, (2) complex regulations and safety codes that require significant industry experience, (3) license requirements and evolved quality and safety programs, (4) costly and time-consuming certification processes, (5) capital requirements and (6) emphasis by large customers on size and critical mass, length of relationship and past service record.

Centers of Excellence

Another differentiator in our business model is the formation of our Centers of Excellence (COEs), which we consider to be incubators of inspection technology. The COEs are focused around target applications in our key market segments. They are supported by subject matter experts that will engage in strategic sales opportunities offering customers value-added solutions using advanced technologies and methods providing oversight, management and consultation. The COEs have a blueprint for their areas that can be replicated throughout the world by delivering procedures, equipment, reports, certifications, etc. insuring a standardized approach to implementation yielding higher margin business.

Sales and Marketing

We sell our asset protection solutions through our experienced and highly trained direct sales and marketing teams within all of our offices worldwide. In addition, our project and laboratory managers as well as our management are trained on our solutions and often are the source of sales leads and customer contacts. Our direct sales and marketing teams work closely with our customers’ research and design personnel, reliability engineers and facilities maintenance engineers to demonstrate the benefits and capabilities of our asset protection solutions, refine our asset protection solutions based on changing market and customer needs and identify potential sales opportunities. We divide our sales and marketing efforts into services sales, software and products sales and marketing.

Manufacturing

Most of our hardware products are manufactured in our Princeton Junction, New Jersey facility. Our Princeton Junction facility includes the capabilities and personnel to fully produce all of our AE products, NDT Automation Ultrasonic equipment and Vibra-Metrics vibration sensing products and systems. We recently expanded our manufacturing facilities to handle the assembly and manufacturing of our larger UT systems due to growth in this segment. Certain other hardware is manufactured by a third party and then loaded by us with our proprietary software.

We also design and manufacture automated ultrasonic systems and scanners as a result of the acquisition of Eurosonic in Vitrolles, France during fiscal 2012. This facility is expected to become the manufacturing headquarters of our European operations.

Intellectual Property

Our success depends, in part, on our ability to maintain and protect our proprietary technology and to conduct our business without infringing on the proprietary rights of others. We utilize a combination of intellectual property safeguards, including patents, copyrights, trademarks and trade secrets, as well as employee and third-party confidentiality agreements, to protect our intellectual property.

As of May 31, 2012, we held 8 patents, all in the United States, which will expire at various times between fiscal 2013 and 2026, and license certain other patents. However, we currently do not principally rely on these patents or licenses to provide our proprietary asset protection solutions. Our trademarks and service marks provide us and our products and services with a certain amount of brand recognition in our markets. However, we do not consider any single patent, trademark or service mark material to our financial condition or results of operations.

As of May 31, 2012, the primary trademarks and service marks that we held in the United States included Mistras® and our stylized globe design. Other trademarks or service marks that we utilize in localized markets or product advertising include PCMS®, Physical Acoustics Corporation and the PAC logo, Ropeworks®, NOESIS, Pocket AE®, Pocket UT®, AEwin®, AEwinPost, UTwin®, UTIA, LST, Vibra-Metrics®, Field CAL®, MONPAC, PERFPAC, TANKPAC®, Valve-Squeak®,VPAC, POWERPAC, Sensor Highway, Quality Services Laboratories Inc. (QSL), NDT Automation, and One Source for Asset Projection Solutions®.

Many elements of our asset protection solutions involve proprietary know-how, technology or data that are not covered by patents or patent applications because they are not patentable, or patents covering them would be difficult to enforce, including technical processes, equipment designs, algorithms and procedures. We believe that this proprietary know-how, technology and data is the most important component of our intellectual property assets used in our asset protection solutions, and is a primary differentiator of our asset protection solutions from those of our competitors. We rely on various trade secret protection techniques and agreements with our customers, service providers and vendors to protect these assets. All of our employees in our Products and Systems segment and our other employees involved in the development of our intellectual property have entered into confidentiality and proprietary information agreements with us. These agreements require our employees not to use or disclose our confidential information, to assign to us all of the inventions, designs and technologies they develop during the course of employment with us, and otherwise address intellectual property protection issues. We also seek confidentiality agreements from our customers and business partners before we disclose any sensitive aspects of our asset protection solutions technology or business strategies. We are not currently involved in any material intellectual property claims.

Research and Development

Our research and development is principally conducted by engineers and scientists at our Princeton Junction, New Jersey headquarters, and supplemented by other employees in the United States and throughout the world, including France, Greece, Japan, Russia and the United Kingdom, who have other primary responsibilities. Our total professional staff includes approximately 30 employees who hold Ph.D.’s and over 100 engineers and employees who hold Level III certification, the highest level of certification from the American Society of Non-Destructive Testing.

We work with many of our customers on developing new products or applications for our technology. Research and development expenses are reflected on our consolidated statements of operations as research and engineering expenses. Our company-sponsored

research and engineering expenses were approximately $2.1 million, $2.2 million and $2.4 million for fiscal 2012, 2011 and 2010, respectively. While we have historically funded most of our research and development expenditures, we also receive customer-sponsored research and development funding. For example, in February 2009, the National Institute of Standards and Technology (NIST) awarded us and our university partners a $6.9 million research award under their new Technology Innovation Program (TIP) for the development and research of advanced technologies to enable monitoring and inspection of the structural health of bridges, roadways and water systems.

We have a number of other paid research contracts throughout the world, including Greece, Brazil, France, the United Kingdom, Japan and the Netherlands, for various industries and applications, including testing of new composites, detecting crack propagation, mapping discontinuities and carbon defect characterization, development of new sensor, actuator, signal processing, wireless and communications technologies, as well as the development of permanently embedded inspection systems using acoustic emission and acousto-ultrasonics to provide continuous on-line in-service full coverage monitoring of critical structural components. Most of the projects are in our target markets; however, a few of the projects could lead to other future market opportunities.

Employees

Providing our asset protection solutions requires a highly-skilled and technically proficient employee base. As of May 31, 2012, we had approximately 3,500 employees worldwide and approximately 72% of our employees were based within the United States, of which approximately 82% were hourly. Less than 10% of our employees in the United States are unionized. We believe that we have good relations with our employees.

Environmental Matters

We are subject to numerous environmental, legal and regulatory requirements related to our operations worldwide. In the United States, these laws and regulations include, among others: the Comprehensive Environmental Response, Compensation, and Liability Act, the Resources Conservation and Recovery Act, the Clean Air Act, the Federal Water Pollution Control Act, the Toxic Substances Control Act, the Atomic Energy Act, the Energy Reorganization Act of 1974, as amended, and applicable state regulations. In addition to the federal laws and regulations, states and other countries where we do business often have numerous environmental, legal and regulatory requirements by which we must abide. We evaluate and address the environmental impact of our operations by assessing properties in order to avoid future liabilities and comply with environmental, legal and regulatory requirements.

We have received notice of a governmental investigation concerning an environmental incident which occurred in February 2011, outside on the premises of our Cudahy, California facility. We acquired this facility as part of the acquisition in October 2010 of the assets and ongoing business operations of General Testing and Inspection, Inc. (GTI), a business which provides in-house or shop inspection and nondestructive testing at the Cudahy premises. On February 11, 2011, while liquid hazardous waste was being pumped into the tanker truck of an unaffiliated certified hazardous waste transporter at the Cudahy facility, a chemical reaction occurred that caused an emission of a vapor cloud. No human injury or property damage was reported or appears to have been caused as a result of the incident. The incident was investigated by the L.A. County Fire Department (the Fire Department) and the U.S. Environmental Protection Agency (EPA). At the conclusion of the Fire Department’s investigation, the Fire Department imposed on a fine on us in the amount of $4,000 for alleged violations of the California Health and Safety Code in April 2011, which was paid shortly thereafter.

We had received no further governmental communications or notices concerning fines or sanctions related to the incident until January 13, 2012, when we received grand jury subpoenas from the U.S. Attorney’s Office for the Central District of California addressed to us, GTI and one of our employees. These subpoenas were issued in connection with an EPA criminal investigation. The subpoena received by us requested documents and information relating to, among other things, our handling, identification, storage and disposal of hazardous waste, training records, corporate environmental policies, acquisition of GTI and any ongoing organizational relationship with GTI, and analytical results of the tests concerning the hazardous materials involved in the incident. We have been informed by the U.S. Attorney’s Office for the Central District of California that we are a target of a criminal investigation into potential violations of the Resource Conservation and Recovery Act. The violations are purportedly related to alleged improper storage and labeling of hazardous waste at the Cudahy facility. The U.S. Attorney’s Office also raised a concern about a possible obstruction of justice issue involving the conduct of one or more of our employees at this facility. Upon receiving the subpoenas, we engaged our outside legal counsel to assist us in conducting an investigation concerning the incident, including interviews with our current employees. To date, we have produced documents in response to the subpoena, and are aware of at least one of our employees having testified before the grand jury.

While management cannot predict the ultimate outcome of this matter, based on our internal investigation to date, management does not believe the outcome will have a material effect on our financial condition or results of operations.

Our Website and Available Information