UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington D.C. 20549

FORM 10-Q

| x | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended: September 30, 2018

or

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from ______to______.

| XG SCIENCES, INC. | ||||

| (Exact name of registrant as specified in its charter) |

| Michigan | 333-209131 | 20-4998896 | ||

| (State or other jurisdiction of incorporation or organization) |

(Commission File No.) | (I.R.S. Employer Identification No.) |

3101 Grand Oak Drive

Lansing, MI 48911

(Address of principal executive offices) (zip code)

(517) 703-1110

(Issuer Telephone number)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company filer. See definition of “accelerated filer” and “large accelerated filer” in Rule 12b-2 of the Exchange Act (Check one):

| Large accelerated filer | ¨ | Accelerated filer | ¨ |

| Non-accelerated filer | ¨ | Smaller reporting company | þ |

| (Do not check if a smaller reporting company) |

Emerging growth company | þ |

If an emerging growth company, indicate by checkmark if the registrant has not elected to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. þ

Indicate by check mark whether the registrant is a shell company as defined in Rule 12b-2 of the Exchange Act. Yes ☐ No ☒

As of November 7, 2018, there were 3,745,018 shares of the registrant’s common stock outstanding.

XG SCIENCES, INC.

FORM 10-Q

September 30, 2018

INDEX

| 2 |

FORWARD-LOOKING STATEMENTS

The information in this Quarterly Report on Form 10-Q contains “forward-looking statements” and information within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) relating to XG Sciences, Inc., a Michigan corporation and its subsidiary, XG Sciences IP, LLC, a Michigan limited liability company (collectively referred to as “we”, “us”, “our”, “XG Sciences”, “XGS”, or the “Company”), which are subject to the “safe harbor” created by those sections. These forward-looking statements include, but are not limited to, statements concerning our strategy, future operations, future financial position, future revenue, projected costs, prospects and plans and objectives of management. The words “anticipates,” “believes,” “estimates,” “expects,” “intends,” “may,” “plans,” “projects,” “will,” “would” and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words. We may not actually achieve the plans, intentions or expectations disclosed in our forward-looking statements and you should not place undue reliance on our forward-looking statements. These forward-looking statements involve known and unknown risks and uncertainties that could cause our actual results, performance or achievements to differ materially from those expressed or implied by the forward-looking statements, including, without limitation, the risks set forth on beginning on page 13 under the section entitled “Risk Factors” in Post-Effective Amendment No. 6 (declared effective June 26, 2018) to our registration statement on Form S-1 (File No. 333-209131) as filed with the Securities and Exchange Commission (the “SEC”) on June 1, 2018, and declared effective on June 26, 2018 (the “Registration Statement”), and the risks set forth on beginning on page 13 under the section entitled “Risk Factors” in our annual report on Form 10-K as filed with the Securities and Exchange Commission (the “SEC”) on April 2, 2018.

| 3 |

XG SCIENCES, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

| September 30, 2018 | December 31, 2017 | |||||||

| ASSETS | (unaudited) | |||||||

| CURRENT ASSETS | ||||||||

| Cash | $ | 3,262,554 | $ | 2,845,798 | ||||

| Accounts receivable, less allowance for doubtful accounts of $65,000 at September 30, 2018 and $40,000 at December 31, 2017 | 868,496 | 468,623 | ||||||

| Inventories | 255,822 | 171,864 | ||||||

| Other current assets | 132,295 | 15,781 | ||||||

| Total current assets | 4,519,167 | 3,502,066 | ||||||

| PROPERTY, PLANT AND EQUIPMENT, NET | 4,651,474 | 2,601,571 | ||||||

| RESTRICTED CASH FOR LETTER OF CREDIT | 190,068 | 195,792 | ||||||

| LEASE DEPOSIT | 20,156 | 20,156 | ||||||

| INTANGIBLE ASSETS, NET | 657,546 | 571,938 | ||||||

| TOTAL ASSETS | $ | 10,038,411 | $ | 6,891,523 | ||||

| LIABILITIES AND STOCKHOLDERS’ EQUITY | ||||||||

| CURRENT LIABILITIES | ||||||||

| Accounts payable and other current liabilities | $ | 1,257,705 | $ | 858,077 | ||||

| Deferred revenue | — | 7,298 | ||||||

| Current portion of capital lease obligations | 34,881 | 118,553 | ||||||

| Total current liabilities | 1,292,586 | 983,928 | ||||||

| LONG-TERM LIABILITIES | ||||||||

| Long-term portion of capital lease obligations | 12,833 | 15,527 | ||||||

| Long term debt | 5,023,505 | 4,794,596 | ||||||

| Total long-term liabilities | 5,036,338 | 4,810,123 | ||||||

| TOTAL LIABILITIES | 6,328,924 | 5,794,051 | ||||||

| STOCKHOLDERS’ EQUITY | ||||||||

| Series A convertible preferred stock, 3,000,000 shares authorized, 1,882,759 and 1,857,816 shares issued and outstanding, liquidation value of $22,593,108 and $22,293,792 at September 30, 2018 and December 31, 2017, respectively | 22,216,343 | 21,917,046 | ||||||

| Common stock, no par value, 25,000,000 shares authorized, 3,331,018 and 2,353,350 shares issued and outstanding at September 30, 2018 and December 31, 2017, respectively | 26,817,412 | 19,116,012 | ||||||

| Additional paid-in capital | 8,032,938 | 7,831,958 | ||||||

| Accumulated deficit | (53,357,206 | ) | (47,767,544 | ) | ||||

| Total stockholders’ equity | 3,709,487 | 1,097,472 | ||||||

| TOTAL LIABILITIES AND STOCKHOLDERS’ EQUITY | $ | 10,038,411 | $ | 6,891,523 | ||||

See notes to unaudited condensed consolidated financial statements

| 4 |

XG SCIENCES, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(unaudited)

| For the Three Months ended September 30, | For the Nine Months ended September 30, | |||||||||||||||

| 2018 | 2017 | 2018 | 2017 | |||||||||||||

| REVENUE | ||||||||||||||||

| Product sales | $ | 1,126,385 | $ | 446,795 | $ | 2,863,575 | $ | 863,574 | ||||||||

| Grants | — | 25,466 | — | 124,955 | ||||||||||||

| Licensing revenue | — | — | — | 50,000 | ||||||||||||

| Total revenue | 1,126,385 | 472,261 | 2,863,575 | 1,038,529 | ||||||||||||

| COST OF GOODS SOLD | ||||||||||||||||

| Direct costs | 708,249 | 266,462 | 1,739,700 | 476,774 | ||||||||||||

| Unallocated manufacturing expenses | 544,867 | 449,799 | 1,834,138 | 1,236,101 | ||||||||||||

| Total cost of goods sold | 1,253,116 | 716,261 | 3,573,838 | 1,712,875 | ||||||||||||

| GROSS LOSS | (126,731 | ) | (244,000 | ) | (710,263 | ) | (674,346 | ) | ||||||||

| OPERATING EXPENSES | ||||||||||||||||

| Research and development | 435,956 | 215,949 | 1,000,101 | 706,575 | ||||||||||||

| Sales, general and administrative | 1,297,179 | 1,466,505 | 3,631,652 | 3,386,857 | ||||||||||||

| Total operating expenses | 1,733,135 | 1,682,454 | 4,631,753 | 4,093,432 | ||||||||||||

| OPERATING LOSS | (1,859,866 | ) | (1,926,454 | ) | (5,342,016 | ) | (4,767,778 | ) | ||||||||

| OTHER INCOME (EXPENSE) | ||||||||||||||||

| Interest expense, net | (81,926 | (62,814 | ) | (250,900 | ) | (176,347 | ) | |||||||||

| Loss from change in fair value of derivative liability – warrants | (43,154 | ) | — | (46,612 | ) | |||||||||||

| Government incentives, net | — | 3,253 | (74,024 | ) | ||||||||||||

| Total other expense | (81,926 | ) | (105,968 | ) | (247,647 | ) | (296,983 | ) | ||||||||

| NET LOSS | (1,941,792 | ) | $ | (2,032,422 | ) | $ | (5,589,663 | ) | $ | (5,064,761 | ) | |||||

WEIGHTED AVERAGE NUMBER OF SHARES OUTSTANDING – Basic and diluted | 3,044,815 | 2,110,546 | 2,716,713 | 2,028,373 | ||||||||||||

| NET LOSS PER SHARE – Basic and diluted | (0.64 | ) | $ | (0.96 | ) | $ | (2.06 | ) | $ | (2.50 | ) | |||||

See notes to unaudited condensed consolidated financial statements

| 5 |

XG SCIENCES, INC.

CONDENSED CONSOLIDATED STATEMENT OF CHANGES IN STOCKHOLDERS’ EQUITY

(unaudited)

| Preferred stock (A) | Common stock | Additional paid-in | Accumulated | |||||||||||||||||||||||||

| Shares | Amount | Shares | Amount | capital | deficit | Total | ||||||||||||||||||||||

| Balances, December 31, 2017 | 1,857,816 | $ | 21,917,046 | 2,353,350 | $ | 19,116,012 | $ | 7,831,958 | $ | (47,767,544 | ) | $ | 1,097,472 | |||||||||||||||

| Stock issued for cash | — | — | 967,668 | 7,741,344 | — | — | 7,741,344 | |||||||||||||||||||||

| Stock issuance fees and expenses | — | — | — | (99,943 | ) | — | — | (99,943 | ) | |||||||||||||||||||

| Preferred stock issued to pay capital lease obligations | 24,943 | 299,297 | — | — | — | — | 299,297 | |||||||||||||||||||||

| Stock-based compensation | — | — | 10,000 | 60,000 | 200,980 | — | 260,980 | |||||||||||||||||||||

| Net loss | — | — | — | — | — | (5,589,663 | ) | (5,589,663 | ) | |||||||||||||||||||

| Balances, September 30, 2018 | 1,882,759 | $ | 22,216,343 | 3,331,018 | $ | 26,817,413 | $ | 8,032,938 | $ | (53,357,207 | ) | $ | 3,709,487 | |||||||||||||||

See notes to unaudited condensed consolidated financial statements

| 6 |

XG SCIENCES, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(unaudited)

For the Nine Months Ended September 30, | ||||||||

| 2018 | 2017 | |||||||

| CASH FLOWS FROM OPERATING ACTIVITIES | ||||||||

| Net loss | $ | (5,589,663 | ) | $ | (5,064,761 | ) | ||

| Adjustments to reconcile net loss to net cash used in operating activities: | ||||||||

| Depreciation and amortization | 710,731 | 665,813 | ||||||

| Amortization of intangible assets | 39,934 | 31,770 | ||||||

| Provision for bad debts | 25,000 | — | ||||||

| Stock-based compensation expense | 260,980 | 764,870 | ||||||

| Non-cash interest expense | 252,672 | 177,188 | ||||||

| Non-cash equipment rent expense | 106,164 | — | ||||||

| Gain from change in fair value of derivative liability – warrants | — | 46,612 | ||||||

| Changes in current assets and liabilities: | ||||||||

| Accounts receivable | (424,873 | ) | (279,608 | ) | ||||

| Inventory | (83,959 | ) | 12,750 | |||||

| Other current and non-current assets | (116,515 | ) | 145,266 | |||||

| Accounts payable and other liabilities | 392,331 | (303,580 | ) | |||||

| NET CASH USED IN OPERATING ACTIVITIES | (4,427,198 | ) | (3,803,680 | ) | ||||

| CASH FLOWS FROM INVESTING ACTIVITIES | ||||||||

| Purchases of property and equipment | (2,665,268 | ) | (428,016 | ) | ||||

| Purchases of intangible assets | (125,542 | ) | (115,470 | ) | ||||

| NET CASH USED IN INVESTING ACTIVITIES | (2,790,810 | ) | (543,486 | ) | ||||

| CASH FLOWS FROM FINANCING ACTIVITIES | ||||||||

| Repayments of capital lease obligations | (12,361 | ) | (14,625 | ) | ||||

| Proceeds from long-term loan | — | 2,000,000 | ||||||

| Proceeds from issuance of common stock | 7,741,344 | 2,140,400 | ||||||

| Common stock issuance fees and expenses | (99,943 | ) | (245,972 | ) | ||||

| NET CASH PROVIDED BY FINANCING ACTIVITIES | 7,629,040 | 3,879,803 | ||||||

| NET CHANGE IN CASH, CASH EQUIVALENTS AND RESTRICTED CASH | 411,032 | (467,363 | ) | |||||

| CASH, CASH EQUIVALENTS AND RESTRICTED CASH, BEGINNING OF PERIOD | 3,041,590 | 1,980,842 | ||||||

| CASH, CASH EQUIVALENTS AND RESTRICTED CASH, END OF PERIOD | $ | 3,452,622 | $ | 1,513,479 | ||||

| SUPPLEMENTAL DISCLOSURE OF CASH FLOW INFORMATION: | ||||||||

| Cash paid for interest | $ | 629 | $ | — | ||||

| SUPPLEMENTAL DISCLOSURE OF NON-CASH INVESTING AND FINANCING ACTIVITIES: | ||||||||

| Value of preferred stock issued for AAOF capital lease obligations | $ | 299,297 | $ | 257,014 | ||||

| Reclassification of derivative liability warrants to equity – ASU 2017-11 (see note 2) | $ | — | $ | 7,650,442 | ||||

| Reclassification of derivative liability warrants to equity – Series B Amendment | $ | — | $ | 296,419 | ||||

| Warrants issued with long and short-term financings | $ | — | $ | 145,800 | ||||

See notes to unaudited condensed consolidated financial statements

| 7 |

XG SCIENCES, INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

NOTE 1 – NATURE OF BUSINESS AND BASIS OF PRESENTATION

XG Sciences, Inc., a Michigan company located in Lansing, Michigan and its subsidiary, XG Sciences IP, LLC (collectively referred to as “we”, “us”, “our”, or the “Company”) manufactures graphene nanoplatelets made from graphite, using two proprietary manufacturing processes to split natural flakes of crystalline graphite into very small and thin particles, which we sell as xGnP® graphene nanoplatelets. We sell our nanoplatelets in the form of bulk powders or dispersions to other companies for use as additives to make composite and other materials with specially engineered characteristics. We also manufacture and sell integrated, value-added products containing these graphene nanoplatelets such as greases, composites, thin sheets, inks and coating formulations that we sell to other companies. Additionally, we have licensed our technology to other companies in exchange for royalties and other fees.

Basis of Presentation

The accompanying interim condensed consolidated financial statements are unaudited and have been prepared in accordance with accounting principles generally accepted in the United States of America (“GAAP”) for interim financial information and the instructions to Form 10-Q and do not include all of the information and footnotes required by GAAP for complete financial statements. All intercompany transactions have been eliminated in consolidation.

Certain information and footnote disclosures normally included in our annual audited consolidated financial statements and accompanying notes have been condensed or omitted in these interim condensed consolidated financial statements. Accordingly, the unaudited condensed consolidated financial statements included herein should be read in conjunction with the audited consolidated financial statements for the year ended December 31, 2017, as filed with the Securities and Exchange Commission (“SEC”) on Form 10-K on April 2, 2018.

The results of operations presented in this quarterly report are not necessarily indicative of the results of operations that may be expected for any future periods. In the opinion of management, these unaudited condensed consolidated financial statements include all adjustments and accruals, consisting only of normal recurring adjustments that are necessary for a fair statement of the results of all interim periods reported herein.

NOTE 2 – SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Liquidity

We have historically incurred losses from operations and we may continue to generate negative cash flows as we implement our business plan. Our condensed consolidated financial statements are prepared using US GAAP as applicable to a going concern, which contemplates the realization of assets and liquidation of liabilities in the normal course of business.

We originally filed a Registration Statement on Form S-1 (File No. 333-209131) with the SEC on April 11, 2016 which was declared effective by the SEC on April 13, 2016 (as amended, the “Registration Statement”). The Registration Statement registered up to 3,000,000 shares of common stock at a fixed price of $8.00 per share to the general public in a self-underwritten offering (the “Offering” or our “IPO”). Post-Effective Amendment No. 1 to the Registration Statement was declared effective August 26, 2016, Post-Effective Amendment No. 2 was declared effective August 31, 2016, Post-Effective Amendment No. 3 was declared effective January 17, 2017, and Post-Effective Amendments No. 4 and No. 5 were dated April 12, 2017. Post-Effective Amendment No. 5 was declared effective April 14, 2017. Post-Effective Amendment No. 6 was declared effective June 26, 2018. Although we are currently selling shares of our common stock in our IPO pursuant to the Registration Statement, we have not yet listed the company for trading on any exchanges.

In December 2016, we entered into a draw loan note and agreement (the “Dow Facility”) with The Dow Chemical Company (“Dow”) to provide up to $10 million of secured debt financing at an interest rate of 5% per year, drawable at our request under certain conditions. As of September 30, 2018, we had drawn $5 million under the Dow Facility. As a condition of the Dow Facility, Dow required that we raise $10 million of equity capital after October 31, 2016 in order to access the second tranche of $5 million. As of September 30, 2018, we had raised $12,274,968 from our IPO since November 1, 2016, and thus have met this requirement. Therefore, the remaining $5 million under the Dow Facility is now available to us.

As of September 30, 2018, we had cash on hand of $3,262,554. As of November 7, 2018, we had cash on hand of $5.7 million. We believe our cash from increasing commercial sales activity and various financing sources will fund our operations for at least the next 12 months. We intend that the primary means for raising funds will be through our ongoing IPO and the remaining $5 million of availability under the Dow Facility. As of November 7, 2018, there are 651,500 more shares of common stock available to sell pursuant to the IPO Registration Statement. If all of such shares were sold, it would result in additional gross proceeds of $5,212,000.

| 8 |

XG SCIENCES, INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

Use of Estimates

The preparation of our condensed consolidated financial statements in conformity with GAAP requires us to make estimates, judgments and assumptions that affect the reported amounts of assets, liabilities, revenue and expenses, together with amounts disclosed in the related notes to the financial statements. Actual results and outcomes may differ from our estimates, judgments and assumptions. Significant estimates, judgments and assumptions used in these condensed consolidated financial statements include, but are not limited to, those related to revenue, accounts receivable and related allowances, contingencies, useful lives and recovery of long-term assets, including intangible assets, income taxes, and the fair value of stock-based compensation. These estimates, judgments, and assumptions are reviewed periodically and the effects of material revisions in estimates are reflected in the financial statements prospectively from the date of the change in estimate.

Inventory

Inventory consists of raw materials and finished goods, all of which are stated at the lower of cost or market. Cost is determined on a first in, first out basis.

| The following amounts were included in inventory at the end of the period: | ||||||||

| September 30, | December 31, | |||||||

| 2018 | 2017 | |||||||

| Raw materials | $ | 99,622 | $ | 39,841 | ||||

| Finished goods | 156,200 | 132,023 | ||||||

| Total | $ | 255,822 | $ | 171,864 | ||||

Derivative Financial Instruments

We do not use derivative instruments to hedge exposures to cash flow, market or foreign currency risk. The terms of convertible preferred stock and convertible notes that we issue are reviewed to determine whether or not they contain embedded derivative instruments that are required by ASC 815: “Derivatives and Hedging” to be accounted for separately from the host contract and recorded at fair value. In addition, freestanding warrants are also reviewed to determine if they achieve equity classification. Certain stock warrants that we issued did not meet the conditions for equity classification at inception and were classified as derivative instrument liabilities measured at fair value.

In July 2017, the FASB issued Accounting Standards Update No. 2017-11, Earnings Per Share (Topic 260), Distinguishing Liabilities From Equity (Topic 480), Derivatives and Hedging (Topic 815) (“ASU 2017-11”). This update changes the classification analysis of certain equity-linked financial instruments with down-round features. We elected to early adopt ASU 2017-11 at September 30, 2017 by applying the standard retrospectively to outstanding financial instruments with a down round feature by means of a cumulative-effect adjustment to the Company’s beginning accumulated deficit as of January 1, 2017. There were 972,720 warrants indexed to Series A Preferred Stock which were originally recorded as derivative liabilities because of their anti-dilution features. We chose to early adopt ASU 2017-11 because it permitted these warrants to be recorded as equity rather than derivative liabilities.

Fair Value Measurements

The Company utilizes a valuation hierarchy that prioritizes fair value measurements based on the types of inputs used for the various valuation techniques related to its financial assets and financial liabilities in accordance to Accounting Standards Codification (“ASC”) Topic 820 Fair Value Measurements and Disclosures.

For financial instruments such as cash, accounts payable and other current liabilities, the Company considers the recorded value of such financial instruments approximate to the current fair value because of their short-term nature. The carrying value of the Company’s long-term debt obligations approximates fair value based on current market conditions for similar obligations.

Recent Accounting Pronouncements

ASU No. 2014-09 (ASC 606), Revenue from Contracts with Customers became effective for us January 1, 2018, and we adopted the new accounting standard using the modified retrospective transition approach. The modified retrospective transition approach recognized any changes from the beginning of the year of initial application through retained earnings with no restatement of comparative periods. We record revenue under ASC 606 at a single point in time, when control is transferred to the customer, which is consistent with past practice. We will continue to apply our current business processes, policies, systems and controls to support recognition and disclosure under the new standard. Based on the results of the evaluation, we have determined that the adoption of the new standard presents no material impact on our consolidated financial statements. Application of the transition requirements of the new standard did not have a material impact on opening retained earnings.

| 9 |

XG SCIENCES, INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

ASU No. 2016-18, Restricted Cash Flows provides guidance on the presentation of restricted cash and restricted cash equivalents, which are now included with cash and cash equivalents when reconciling the beginning and ending cash amounts shown on the statements of cash flows. Using the retrospective transition method required under the standard, the Company has adjusted the presentation of its Condensed Consolidated Statements of Cash Flows for all periods presented. The adoption of ASU No. 2016-18 did not have any other impact on the Company’s condensed consolidated financial statements.

The following table provides additional detail by financial statement line item of the ASU 2016-18 impact on our condensed consolidated statement of cash flows for the nine months ended September 30, 2018 and 2017:

| (In thousands) | As Reported (Pre-Adoption) | ASU 2016-18 Impact | Reported (Post-Adoption) | |||||||||

| Nine Months Ended September 30, 2018 | ||||||||||||

| Cash, cash equivalents and restricted cash, beginning of period | $ | 2,845,798 | $ | 195,792 | $ | 3,041,590 | ||||||

| Nine Months Ended September 30, 2017 | ||||||||||||

| Net change in cash, cash equivalents and restricted cash | $ | (467,582 | ) | $ | 219 | $ | (467,363 | ) | ||||

| Cash, cash equivalents and restricted cash, beginning of period | 1,785,343 | 195,499 | 1,980,842 | |||||||||

| Cash, cash equivalents and restricted cash, end of period | $ | 1,317,761 | $ | 195,718 | $ | 1,513,479 | ||||||

ASU No. 2016-15, Statement of Cash Flows – Classification of Certain Cash Receipts and Cash Payments applies to how certain cash receipts and cash payments are presented and classified in the statement of cash flows. The Company adopted the new standard on January 1, 2018. The adoption of this standard for the year ending December 31, 2018 did not have a significant effect on the Company’s condensed consolidated financial statements.

ASU No. 2016-02, Leases requires a lessee to recognize assets and liabilities for leases with lease terms of more than 12 months. Consistent with current Generally Accepted Accounting Principles (GAAP), the recognition, measurement, and presentation of expenses and cash flows arising from a lease by a lessee primarily will depend on its classification as a finance or operating lease. However, unlike current GAAP, which requires only capital leases to be recognized on the balance sheet, this new ASU will require both types of leases to be recognized on the balance sheet. This standard will be effective for the Company beginning January 1, 2019. The Company is in the process of evaluating how significant the impact of the adoption of this standard will be on its balance sheet as it recognizes lease assets and lease liabilities related to its operating leases and whether there will be any significant impact on its results of operations and cash flows.

NOTE 3 – WARRANTS AND FINANCING AGREEMENTS

Dow Facility

In December 2016, we entered into the Dow Facility, which provides us with up to $10 million of secured debt financing at an interest rate of 5% per year, drawable at our request under certain conditions. We received $2 million at closing and an additional $1 million on each of July 18, 2017, September 22, 2017 and December 4, 2017, respectively. An additional $5 million is currently available to us.

The Dow Facility is senior to most of our other debt and is secured by all of our assets (Dow is subordinate only to the capital lease with Aspen Advanced Opportunity Fund, LP (“AAOF”). The loan matures on December 1, 2021 (subject to certain mandatory prepayments based on our equity financing activities). Interest is payable beginning January 1, 2017 although we have elected to capitalize interest through January 1, 2019. Dow received warrant coverage of one share of common stock for each $40 in loans received by us, equating to 20% warrant coverage, with an exercise price of $8.00 per share for the warrants issued at closing of the initial $2 million draw. After the initial closing, the strike price of future warrants issued is subject to adjustment if we sell shares of common stock at a lower price. As of September 30, 2018, we had issued 125,000 warrants to Dow, which are exercisable on or before the expiration date of December 1, 2023.

| 10 |

XG SCIENCES, INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

The aforementioned warrants meet the criteria for classification within stockholders’ equity. Proceeds were allocated between the debt and the warrants at their relative fair value. During the fiscal year ended December 31, 2017, we recognized amortization expense of $161,702, and the resulting carrying value of the Dow Facility on our balance sheet as of December 31, 2017 was $4,794,596. During the nine months ended September 30, 2018, we recognized amortization expense of $228,908, and the resulting carrying value of the Dow Facility on our balance sheet as of September 30, 2018 was $5,023,505.

NOTE 4 – STOCK WARRANTS ACCOUNTED FOR AS EQUITY INSTRUMENTS

The following table summarizes the warrants (including the warrants previously accounted for as derivatives) outstanding at September 30, 2018, which are accounted for as equity instruments, all of which are exercisable:

| Date Issued | Expiration Date |

Indexed Stock |

Exercise Price | Number of Warrants |

||||||||

| 07/01/2009 | 07/01/2019 | Common | $ | 8.00 | 6,000 | |||||||

| 10/08/2012 | 10/08/2027 | Common | $ | 12.00 | 5,000 | |||||||

| 01/15/2014 - 12/31/2014 | 01/15/2024 | Series A Convertible Preferred | $ | 6.40 | 972,720 | |||||||

| 04/30/2015- 05/26/2015 | 04/30/2022 | Common | $ | 16.00 | 218,334 | |||||||

| 06/30/2015 | 06/30/2022 | Common | $ | 16.00 | 6,563 | |||||||

| 12/31/2015 | 12/31/2020 | Common | $ | 8.00 | 20,625 | |||||||

| 03/31/2016 | 03/31/2021 | Common | $ | 10.00 | 10,600 | |||||||

| 04/30/2016 | 04/30/2021 | Common | $ | 10.00 | 895 | |||||||

| 12/14/2016 | 12/01/2023 | Common | $ | 8.00 | 50,000 | |||||||

| 07/18/2017 | 12/01/2023 | Common | $ | 8.00 | 25,000 | |||||||

| 09/22/2017 | 12/01/2023 | Common | $ | 8.00 | 25,000 | |||||||

| 12/04/2017 | 12/01/2023 | Common | $ | 8.00 | 25,000 | |||||||

| 1,365,737 | ||||||||||||

Each warrant indexed to Series A Convertible Preferred Stock is currently exercisable and exchangeable into 1.875 shares of common stock.

NOTE 5 – STOCKHOLDERS’ EQUITY (DEFICIT)

Common Stock

The Company is authorized to issue 25,000,000 shares of common stock, no par value per share of which 3,331,018 and 2,353,350 shares were issued and outstanding as of September 30, 2018 and December 31, 2017, respectively.

During the nine months ended September 30, 2018 the Company issued 967,668 shares of common stock pursuant to the Offering. As of September 30, 2018 the Company had sold 1,934,500 shares of common stock in its IPO at a price of $8.00 per share for gross proceeds of $15,476,000.

Potentially dilutive securities consist of shares potentially issuable pursuant to stock options and warrants as well as shares that would result from full conversion of all outstanding convertible securities. These potentially dilutive securities were 2,894,742 and 2,804,372 as of September 30 2018 and 2017, respectively, and are excluded from diluted net loss per share calculations because they are anti-dilutive.

Series A Convertible Preferred Stock

The Company is authorized to issue up to 3,000,000 shares of Series A Convertible Preferred Stock (the “Series A Preferred”). Each share of the Series A Preferred, which has a liquidation preference of $12.00 per share, is convertible at any time, at the option of the holder, into one share of common stock at the lower of: (a) $12.00 per share, or (b) 80% of the price at which the Company sells any equity or equity-linked securities in the future. The Series A Preferred also contains typical anti-dilution provisions that provide for adjustment of the conversion price to reflect stock splits, stock dividends, or similar events. The Series A Preferred is subject to mandatory conversion into common stock upon the listing of the Company’s common stock on a Qualified National Exchange. However, the Series A Preferred is not subject to the mandatory conversion until all outstanding convertible securities are also converted into common stock. The Series A Preferred ranks senior to all other equity or equity equivalent securities of the Company other than those securities which are explicitly senior or pari passu in rights and liquidation preference to the Series A Preferred and pari passu with the Company’s Series B Preferred Stock.

| 11 |

XG SCIENCES, INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

The Company issued 1,456,126 shares of Series A Preferred in connection with the conversion of certain convertible notes on December 31, 2015.

In December 2015, the conversion price of the Series A Preferred was reduced from $12.00 to $6.40 (80% of $8.00), and thus, each share of Series A Preferred Stock is convertible into 1.875 shares of common stock.

As of September 30, 2018 and December 31, 2017, the Company had 1,882,759 and 1,857,816 shares of Series A Preferred Stock issued and outstanding, respectively.

During the nine months ended September 30, 2018, the Company issued 24,943 shares of Series A Preferred to AAOF as payment under the terms of their Master Leasing Agreement.

Series B Convertible Preferred Stock

As of September 30, 2018 and December 31, 2017, 1,500,000 shares have been designated as Series B Convertible Preferred Stock (“Series B Preferred”), of which no shares were issued and outstanding. Each share of the Series B Preferred, which has a liquidation preference of $16.00 per share, is convertible at any time, at the option of the holder, into one share of common stock at $16.00 per share. The Series B Preferred also contains typical anti-dilution provisions that provide for adjustment of the conversion price to reflect stock splits, stock dividends, or similar events. Each share of Series B Preferred is subject to mandatory conversion into common stock at the then-effective Series B conversion rate upon the public listing by the Company of its common stock on a Qualified National Exchange. However, the Series B Preferred is not subject to the mandatory conversion until all outstanding convertible securities are also converted into common stock. The Series B Preferred ranks senior to all other equity or equity equivalent securities of the Company other than those securities which are explicitly senior or pari passu in rights and liquidation preference to the Series B Preferred and pari passu with the Company’s Series A Preferred.

NOTE 6 – EQUITY INCENTIVE PLAN

We previously established the 2007 Stock Option Plan (the “2007 Plan”), which was scheduled to expire on October 30, 2017 and under which we granted key employees and directors options to purchase shares of our common stock at not less than fair market value as of the grant date. On May 4, 2017, the Board approved the 2017 Equity Incentive Plan (the “2017 Plan”) to replace the 2007 Plan, which became effective upon the approval of the stockholders holding a majority of the voting power in the Company on July 18, 2017. The 2017 Plan replaced the 2007 Plan and authorizes the Company to grant awards (stock options and restricted stock) up to a maximum of 1,200,000 shares of common stock.

On July 24, 2017, certain stock options from the 2007 Plan were cancelled and replacement stock options were awarded. The replacement stock option awards have an exercise price of $8.00 per share and a seven-year term. Fifty percent of such awards vested on the date of grant with the remaining vesting over a 4-year period, subject to certain other terms. Each option holder received options equal to 150% of the number of cancelled stock options.

On August 10, 2017 and September 30, 2018, the Company granted stock options and restricted stock to each of its Board members as part of its Board compensation package. On each issuance date, the four independent Board members received 2,500 stock options with a grant price of $8.00 per share and 2,500 shares of restricted stock for Board services. The stock options had an aggregate grant date fair value of $26,120 and $29,580 on August 10, 2017 and September 30, 2018, respectively. The options vest ratably over a four-year period beginning on the one-year anniversary. The restricted stock issued to the Board members has an aggregate fair value of $160,000 and vest ratably in arrears over four quarters on the last day of each fiscal quarter following the grant date. As of September 30, 2018, 12,500 shares of restricted stock had vested, resulting in total compensation expense of $100,000.

A summary of the stock option activity for the nine months ended September 30, 2018 is as follows:

| Weighted | ||||||||

| Number | Average | |||||||

| Of | Exercise | |||||||

| Options | Price | |||||||

| Options outstanding at December 31, 2017 | 677,125 | $ | 8.00 | |||||

| Changes during the period: | ||||||||

| Expired | (27,500 | ) | 8.00 | |||||

| New Options Granted – at market price | 28,250 | 8.00 | ||||||

| Options outstanding at September 30, 2018 | 677,875 | $ | 8.00 | |||||

| Options exercisable at September 30, 2018 | 388,400 | $ | 8.00 | |||||

| 12 |

XG SCIENCES, INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

All options granted thus far under the 2017 Plan have an exercise price of $8.00 per share and vesting of the options ranges from immediate to 25% per year, with most options vesting 25% per year beginning on the one-year anniversary of the grant date. The options expire in seven years from the date of grant.

During the three months ended September 30, 2018, the Company granted 2,000 employee stock options with an aggregate grant date fair value of $5,916. During the nine months ended September 30, 2018, the Company granted 18,250 employee stock options with an aggregate grant date fair value of $52,907. The fair value of the options granted was estimated on the date of grant using the Black Scholes option-pricing model using the following assumptions: Stock price: $8.00, Exercise Price: $8.00, Expected Term: 4.75 years, Volatility: 37.34%-38.09%, Risk free rate: 2.65%-2.94%, Dividend rate: 0%. As of September 30, 2018, 677,875 stock options and 20,000 shares of restricted stock awards were outstanding under our 2017 Plan.

Stock-based compensation expense was $86,750 and $260,980 for the three and nine months ended September 30, 2018, respectively, compared to $588,128 and $764,870 for the three and nine months ended September 30, 2017, respectively. As of September 30, 2018, there was approximately $797,000 in unrecognized compensation cost related to the options granted under the 2017 plan. We expect to recognize these costs over the remaining vesting terms, ranging from 3 to 4 years.

NOTE 7 – CAPITAL LEASES

As of September 30, 2018 and December 31, 2017, we have capital lease obligations as follows:

| September 30, 2018 | December 31, 2017 | |||||||

| Capital lease obligations | $ | 48,194 | $ | 149,120 | ||||

| Unamortized warrant discount | (480 | ) | (15,040 | ) | ||||

| Net obligations | 47,714 | 134,080 | ||||||

| Short-term portion of obligations | (34,881 | ) | (118,553 | ) | ||||

| Long-term portion of obligations | $ | 12,833 | $ | 15,527 | ||||

NOTE 8 – Customer, Supplier, country, and Product Concentrations

Grants and Licensing Revenue Concentration

There was no grant revenue for the three and nine months ended September 30, 2018. There was $25,466 of grant revenue for the three months ended September 30, 2017 from one grantor and $124,955 from two grantors for the nine months ended September 30, 2017; of this total 75% was from one grantor and 25% from another. There was no licensing revenue for the three and nine months ended September 30, 2018. There was no licensing revenue for the three months ended September 30, 2017, and one licensor accounted for the licensing revenue reported for the nine months ended September 30, 2017 of $50,000.

Product Concentration

Concentrations of product sales revenue greater than 10% of total product sales revenue are shown in the table below. We attempt to minimize the risk associated with product concentrations by continuing to develop new products to add to our portfolio.

| For the Three Months Ended September 30, | For the Nine Months Ended September 30, | ||||||

| 2018 | 2017 | 2018 | 2017 | ||||

| Graphene nanoplatelets –powders/cakes/slurries | 98% | 96% | 93% | 91% | |||

| Integrated products | * | * | * | * | |||

| Developmental products | * | * | * | * | |||

In the table above * denotes no concentration greater than 10% of total sales revenue.

| 13 |

XG SCIENCES, INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

Customer Concentration

During the three months ended September 30, 2018, we had one customer whose purchases accounted for 91% of product sales. During the three months ended September 30, 2017, we had two customers whose purchases accounted for 65% and 17% of product sales.

For the nine months ended September 30, 2018, we had one customer whose purchases accounted for 87% of product sales. During the nine months ended September 30, 2017, we had two customers whose purchases accounted for 36% and 17% of product sales.

At September 30, 2018, there were two customers who each had an accounts receivable balance greater than 10% of our total outstanding receivable balance. At September 30, 2017, there were two customers who each had an accounts receivable balance greater than 10% of our total outstanding receivable balance.

Country Concentration

We sell our products on a worldwide basis. All sales are denominated in U.S. dollars.

International sales for the three months ended September 30, 2018 were 5% of product sales as compared with 33% for the three months ended September 30, 2017. No foreign countries accounted for greater than 10% of total product sales for the three months ended September 30, 2018, and one country, China, accounted for 19% of product sales for the three months ended September 30, 2017.

International sales for the nine months ended September 30, 2018 were 5% of product sales as compared with 46% for the nine months ended September 30, 2017. No foreign countries accounted for greater than 10% of total product sales for the nine months ended September 30, 2018, and two countries, China and South Korea, accounted for 17% and 10%, respectively, of product sales for the nine months ended September 30, 2017.

Suppliers

We buy raw materials used in manufacturing from several sources. These materials are available from a large number of sources. Thus, we believe a change in suppliers would have no material effect on our operations. We did not have purchases from one supplier that were more than 10% of total purchases for the three months and nine months ended September 30, 2018 and 2017.

NOTE 9 – RELATED PARTY TRANSACTIONS

We have a licensing agreement for exclusive use of patents and pending patents with Michigan State University (“MSU”), a shareholder of the Company via the MSU Foundation. During the three months ended September 30, 2018 and 2017 we recorded licensing expense of $12,500 per quarter. During the nine months ended September 30, 2018 and 2017 we recorded licensing expense of $37,500 in each period.

We have also entered into product licensing agreements with certain other shareholders. No royalty revenue or expenses have been recognized related to these agreements during the three and nine months ended September 30, 2018 or the three months ended September 30, 2017. For the nine months ended September 30, 2017, we recorded $50,000 of royalty revenue from POSCO, a shareholder.

During the three months ended September 30, 2018 and 2017, respectively, we issued 10,663 and 7,140 shares of Series A Preferred stock to AAOF as payment for lease financing obligations under the terms of the Master Lease Agreement, dated March 18, 2013. Of the 10,663 shares issued during the three months ended September 30, 2018, 7,947 shares were for the purchase of equipment when the term for two of the lease schedules expired. The purchase amount for the equipment was $95,364. For the nine months ended September 30, 2018 and 2017 we issued a total of 24,943 and 21,420 shares, respectively, as payment for lease obligations.

On April 19, 2018 and June 27, 2018, Arnold Allemang, the Chairman of our Board of Directors, purchased 62,500 and 125,000 shares, respectively, in our IPO through his trust, for a total of $1,500,000 in proceeds to the Company.

On June 27, 2018 and during the period August 21 - August 29, 2018, Steve Jones, a Board Member, and various affiliates of Mr. Jones purchased 56,000 and 77,243 shares, respectively, in our IPO for a total of $1,065,944 in proceeds to the Company.

On August 13, 2018, Philip Rose, an Officer and Board Member, purchased 6,250 shares in our IPO, for a total of $50,000 in proceeds to the Company.

NOTE 10 – SUBSEQUENT EVENTS

During the period from October 1 through November 7, 2018, we received proceeds of $3,312,000 for the sale of 414,000 shares of common stock in our IPO.

| 14 |

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations

Forward-Looking Statements

In this Quarterly Report on Form 10-Q, unless otherwise indicated, the words “we”, “us”, “our”, “XG”, “XGS”, “XG Sciences” or the “Company” refer to XG Sciences, Inc. and its wholly owned subsidiary, XG Sciences IP, LLC, a Michigan limited liability company.

Introduction

The following discussion and analysis should be read in conjunction with the unaudited condensed consolidated financial statements, and the notes thereto included herein. The information contained below includes statements of the Company’s or management’s beliefs, expectations, hopes, goals and plans that, if not historical, are forward-looking statements subject to certain risks and uncertainties that could cause actual results to differ materially from those anticipated in the forward-looking statements. For a discussion on forward-looking statements, see the information set forth in the introductory note to this quarterly report on Form 10-Q under the caption “Forward-Looking Statements”, which information is incorporated herein by reference.

Overview of our Business

XG Sciences was formed in May 2006 for the purpose of commercializing certain technology to produce graphene nanoplatelets and integrated, value-added products containing graphene nanoplatelets. First isolated and characterized in 2004, graphene is a single layer of carbon atoms configured in an atomic-scale honeycomb lattice. Among many noted properties, monolayer graphene is harder than diamonds, lighter than steel but significantly stronger, and conducts electricity better than copper. Graphene nanoplatelets are particles consisting of multiple layers of graphene. Graphene nanoplatelets have unique capabilities for energy storage, thermal conductivity, electrical conductivity, barrier properties, lubricity and the ability to impart physical property improvements when incorporated into plastics, metals or other matrices.

We believe the unique properties of graphene and graphene nanoplatelets will enable numerous new product applications and the market for such products will quickly grow to be a significant market opportunity. Our business model is to design, manufacture and sell advanced materials we call xGnP® graphene nanoplatelets and value-added products incorporating xGnP® nanoplatelets. We currently have hundreds of customers trialing our products for numerous applications, including, but not limited to lithium ion batteries, lead acid batteries, thermally conductive adhesives, composites, automotive, packaging, sporting goods, industrial, inks and coatings, printed electronics, construction materials, cement, and military uses. We believe our proprietary processes have enabled us to be a low-cost producer of high quality, graphene nanoplatelets and that we are well positioned to address a wide range of end-use applications.

Our Customers

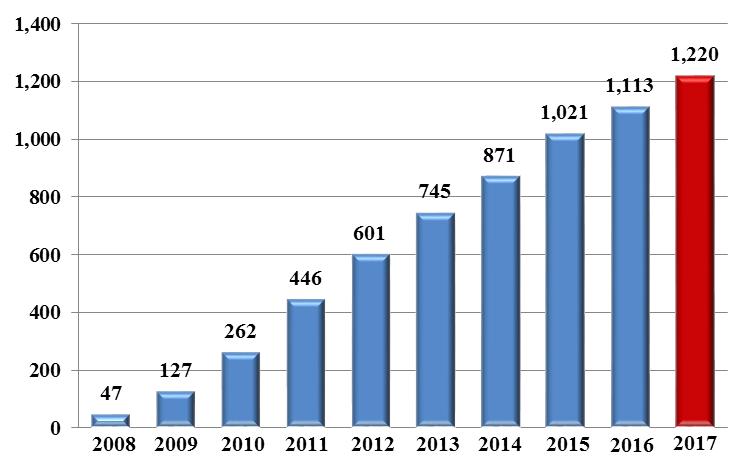

We sell products to customers around the world and have sold materials to over 1,000 customers in 47 countries since 2008. Some of these customers are research organizations and some are commercial organizations. Our customers have included well-known automotive and OEM suppliers around the world (Ford, Johnson Controls, Magna, Honda Engineering), global-scale lithium ion battery manufacturers in the U.S., South Korea and China (Samsung SDI, LG Chemical, Lishen, A123) and diverse specialty material companies (3M, BASF, Henkel, Dow Chemical, DuPont), as well as leading research centers such as Lawrence Livermore National Laboratory and Oakridge National Laboratory. We have also licensed some of our base manufacturing technology to other companies, and we consider technology licensing a component of our business model. Our licensees include POSCO, the fourth largest steel manufacturer in the world by volume of output, and Cabot Corporation (“Cabot”), a leading global specialty chemicals and performance materials company. These licensees further extend our technology through their customer networks. Ultimately, we believe we will benefit in terms of royalties on sales of xGnP® nanoplatelets produced and sold by our licensees. As can be seen in the below bar chart, the cumulative number of customers has steadily grown over the last ten years.

| 15 |

Cumulative Customers, By Year

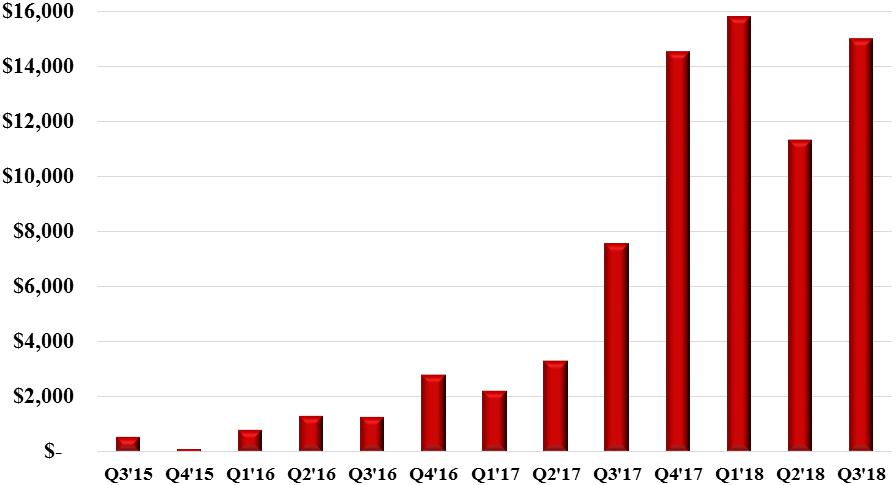

We believe average order size is an early indicator of commercial traction. The majority of our customers are still ordering in smaller quantities consistent with their development and engineering qualification work. As can be seen in the chart below, our quarterly average order size was relatively modest until the second half of 2017, when a number of customers reached commercial status with different product applications. The data below represents orders shipped in the respective quarter and exclude no charge orders targeted mainly for R&D purposes. The data shows that the average order size has increased steadily over the last two years, and we believe that it will continue to increase as more customers commercialize products using our materials. In the three months ending September 30, 2018 the average order size was $15,018, an increase from $7,445 in the three months ending September 30, 2017 and an increase from $11,345 for the three months ending June 30, 2018, which resulted from changes in customer and product mix in sequential quarters. In 2017 our customer shipments increased by over 600% to almost 18 metric tons (MT) of products from the 2.5 MT shipped in 2016. In the 3 months ending September 30, 2018 we shipped 15.7 MT of product, primarily in the form of dry powder, an increase of 178% over the 3 months ending September 30, 2017 (5.6 MT mostly in the form of dry powder) and a sequential increase of 2% for all products shipped and an increase of 32% based on dry powder shipments as compared to the 3 months ending June 30, 2018. There were no integrated product shipments in the 3 months ending September 30, 2018 as compared to the 3.5 MT shipped in the previous quarter.

| 16 |

Average Order Size of Fulfilled Orders

Our Products

Bulk Materials. We target our xGnP® nanoplatelets for use in a wide range of large and growing end-use markets. Our proprietary manufacturing processes allow us to produce nanoplatelets with varying performance characteristics that can be tuned to specific end-use applications based on customer requirements. We currently offer four commercial “grades” of bulk materials, each of which is available in various particle sizes and thickness, which allows for surface areas ranging from approximately 50 to approximately 800 square meters per gram of material depending on the product. Other grades may be made available, depending on the needs for specific applications and end-customer performance requirements. In addition, we sell our xGnP® graphene nanoplatelets in the form of pre-dispersed mixtures with water, alcohol, or other organic solvents and resins. In addition to selling bulk graphene nanoplatelets, we also offer the following integrated, value-added products that contain our graphene nanoplatelets in various forms:

Composites. These consist of compositions of specially designed xGnP® graphene nanoplatelets formulated in pre-dispersed mixtures that can be easily dispersed in various polymers. Our integrated composites portfolio includes pre-compounded resins derived from a range of thermoplastics as well as master batches of resins and xGnP® nanoplatelets and their combination with resins and fibers for use in various end-use applications that may include industrial, automotive and sporting goods and which have demonstrated efficacy in standard injection molding, compression molding, blow molding and 3-D processes, to name but a few. Our current product portfolio of polymer resins containing various forms of our xGnP® graphenene nanoplatelets and in varying concentration includes: polyurethane (XGPU), polypropylene (XGPP), polyethylene terephthalate (XGPET), vinyl ester (XGVE), polyetherimide (XGPEI) and high density polyethylene (XGHDPE). Others polymers may be added over time depending on the end-market and customer needs. In addition, we offer various bulk materials with demonstrated efficacy in plastic composites to impart improved physical performance to such matrices, which may be supplied as dry powders or as aqueous or solvent-based dispersions or cakes. We have also targeted use of our graphene nanoplatelets as an additive in cement mixtures, which we believe results in improved barrier resistance, durability, toughness and corrosion protection. Our GNP® Concrete Additive promotes the formation of more uniform and smaller grain structure in cement. This fine-grain and uniform structure gives the concrete improvements in flexural and compressive strength. In addition, the embedded graphene nanoplatelets will stop cracks from forming and retard crack propagation, should any cracks form – the combination of which will improve lifetime and durability of cement.

Energy Storage Materials. These consist of specialty advanced materials that have been formulated for specific applications in the energy storage segment. Chief among these is our proprietary, specially formulated silicon-graphene composite material (also referred to as “SiG” or “XG SiG®”) for use in lithium-ion battery anodes. XG SiG® targets the never-ending need for higher battery capacity and longer life. In several customer trials, our SiG material has demonstrated the potential to increase battery energy storage capacity by 3-5x what is currently available with conventional lithium ion batteries today. Additionally, we offer various bulk materials for use as conductive additives for cathodes and anodes in lithium-ion batteries, as an additive to anode slurries for lead-carbon batteries, as a component in coatings for current collectors in lithium-ion batteries and we are investigating the use of our materials as part of other battery components.

| 17 |

Inks and Coatings. These consist of specially-formulated dispersions of xGnP® together with solvents, binders, and other additives to make electrically or thermally conductive products designed for printing or coating and which are showing promise in diverse customer applications such as automotive primers, advanced packaging, electrostatic dissipation and thermal management. We also offer a set of standardized ink formulations suitable for printing. These inks offer the capability to print electrical circuits or antennas and may be suitable for other electrical or thermal applications. All of these formulations can be customized for specific customer requirements.

Thermal Management Materials. These consist mainly of two types of products, our XG Leaf® sheet products and various thermal interface materials (“TIM”) in the form of custom greases or pastes. XG Leaf® is a family of sheet products ideally suited for use in thermal management in portable electronics, which may include cell phones, tablets and notebook PC’s. As these devices continue to adopt faster electronics, higher data management capabilities, brighter displays with ever increasing definition, they generate more and more heat. Managing that heat is a key requirement for the portable electronics market and our XG Leaf® product line is well suited to address the need. These sheets are made using special formulations of xGnP® graphene nanoplatelets as precursors, along with other materials for specific applications. There are several different types of XG Leaf® available in various thicknesses, depending on the end-use requirements for thermal conductivity, electrical conductivity, or resistive heating. Our custom XG TIM® greases and pastes are also designed to be used in various high temperature environments. Additionally, we offer various bulk materials for use as active components in adhesives, liquids, coatings and plastic composites to impart improved thermal management performance to such matrices.

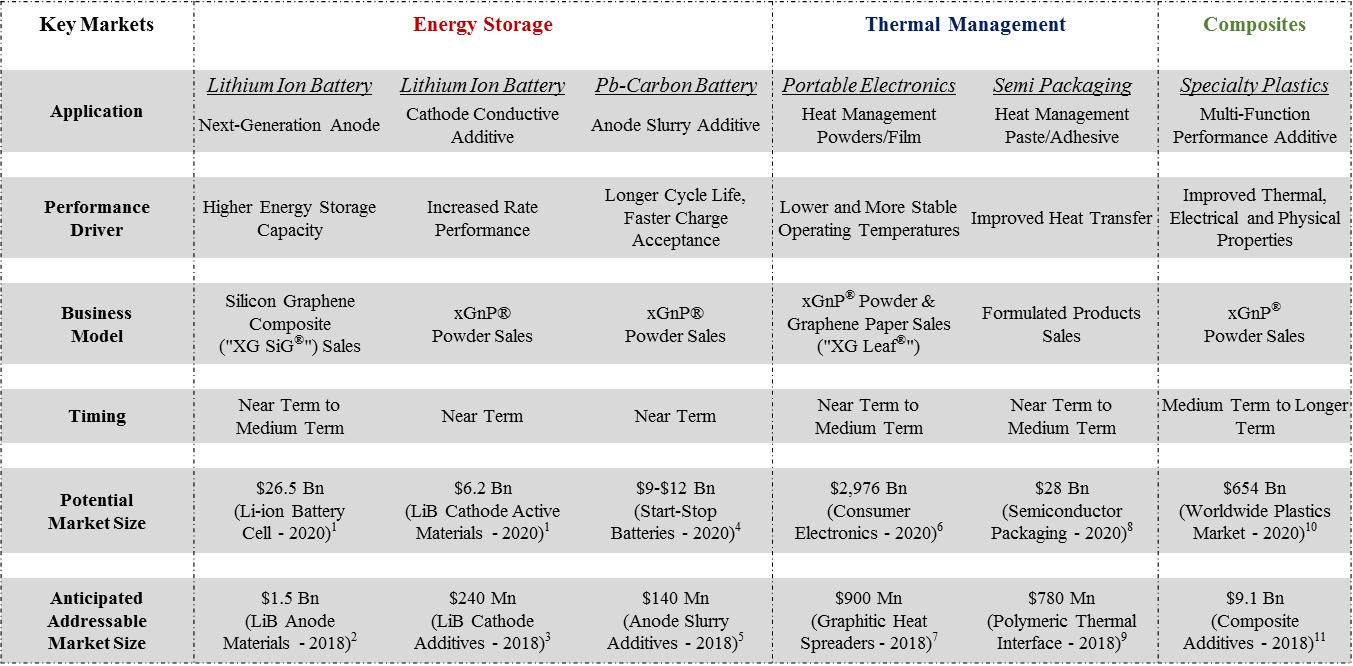

Our Focus Areas

We believe we are a “platform play” in advanced materials, because our proprietary processes allow us to produce varying grades of graphene nanoplatelets that can be mapped to a variety of applications in many market segments. However, we are prioritizing our efforts in specific areas and with specific customers that we believe represent opportunities for either relatively near-term revenue or especially large and attractive markets. At this time, we are focused on three high priority areas: Composites, Energy Storage, and more broadly, Thermal Management. The following table shows examples of the types of applications we are pursuing, the expecting timing of revenue and the addressable market size of selected market opportunities.

| 18 |

XGS Market/Application Focus Areas & 2018 Market Size

| (1) Avicenne Energy, "The Worldwide Rechargeable Battery Market 2014 - 2025", 24th Edition - V3, July 2015. |

| (2) Avicenne Energy, The Battery Show; Novi, MI; September, 2017. |

| (3) Avicenne Energy, The Battery Show; Novi, MI; September, 2017. & Internal Estimates. |

| (4) ArcActive via Nanalyze, April 3, 2015. |

| (5) ArcActive via Nanalyze, April 3, 2015 & Internal Estimates. |

|

(6) Future Markets Insights, "Consumer Electronics Market: Global Industry Analysis and opportunity Assessment 2015 – 2020", May 8, 2015. |

| (7) Prismark, "Market Assessment: Thin Carbon-Based Heat Spreaders", August 2014. |

| (8) Reporterlink.com, "Semiconductor & IC Packaging Materials Market…", May 2014. |

| (9) Prismark, 2015. |

| (10) Grand View Research, "Global Plastics Market Analysis…", August 2014. |

|

(11) From (10) and internal estimates: 2018 = 305 million tons of plastic, if 10% of the market adopted xGnP to enhance their properties, and at only 1% by weight as an additive, then in 2018 305,000 tons or 305,000,000 kilos of xGnP would be required. At $30 a Kg - the value is $9.1 Bn per year. |

Commercialization Process

Because graphene is a new material, most of our customers are still developing applications that use our products. Commercialization is a process, the exact timing of which is often difficult to predict. It starts with our own internal R&D to validate performance for an identified market or customer-specific need. Our customers then validate the performance of our materials and determine whether our products can be incorporated into their manufacturing processes. This is initially done at pilot production scale levels. Our customers then have to introduce products that incorporate our materials to their own customers to validate performance. After their customers have validated performance, our customers will then move to commercial scale production. Every customer goes through the same process, but will do so at varying speeds, depending on the customer, the product application and the end-use market. Thus, we are not always able to predict when our customers will begin ordering commercial volumes of our materials or predict their expected volumes over time. However, as customers move through the process, we generally receive feedback and gain greater insights regarding their commercialization plans. The following are examples where our products are providing value to our customers at levels that are either in commercial production or we believe will warrant their use on a commercial basis.

| • | Callaway Golf Company (Callaway) incorporated our graphene nanoplatelets into the outer core of their Chrome Soft golf balls, resulting in a new class of golf ball that enables higher driving speeds, greater distance and increased control, which is allowing Callaway to command a premium price for their golf balls in the marketplace, and |

| • | Ford Motor Company for polyurethane based foams for use in “over ten under hood components on the Ford F-150 and Mustang” going into production this quarter and “eventually, other Ford vehicles” demonstrating a 17 percent reduction in noise, a 20 percent improvement in mechanical properties and a 30 percent improvement in heat endurance properties, compared with that of the foam used without graphene, and |

| 19 |

| • | Light emitting diode module and product company demonstrated approximately 50% improvement in thermal management capability when compared to existing commercial thermal management products, translating into a 15% improvement in thermal management at the device level, and |

| • | Lead acid battery manufacturer demonstrating approximately 90% improvement in measured cycle life, appreciable improvement in capacity and charge acceptance and without any loss in water retention performance, and |

| • | U.S. bottling company adopting commercial use of our graphene nanoplatelets in PET water bottles to improve modulus (10% with minimal affect to color and up to 200% with color change), shelf life and energy savings during processing. |

| • | Construction company demonstrating less than one weight percent of our product in construction material composites improves flexural strength by more than 30%, and |

| • | Plastics composite part manufacturer demonstrating 7-30% improvement in strength and 40% improvement in modulus when used in sheet molding compound, and |

| • | Engineering design firm for automotive manufacturers found approximately 20% reduction in operating temperature and in thermal uniformity when XG Leaf® replaces standard cooling fins in lithium ion battery packs, and |

| • | Plastic composite parts manufacturer demonstrating 25% increase in tensile strength and 15% improvement in flex modulus for a high-density polyethylene composite. |

The process of “designing-in” new materials is relatively complex and involves the use of relatively small amounts of the new material in laboratory and engineering development for an extended period of time. Following successful development, customers that incorporate our materials into their products will then order much larger quantities of material to support commercial production. Although, our customers are under no obligation to report to us on the usage of our materials, some have indicated that they have introduced or will soon introduce commercial products that use our materials. Thus, while many of our customers are currently purchasing our materials in kilogram (one or two pound) quantities, some are now ordering at multiple ton quantities and we believe many will require tens of tons or even hundreds of tons of material as they commercialize products that incorporate our materials. We also believe that those customers already in production will increase their order volume as demand increases and others will begin to move into commercial volume production as they gain more experience in working with our materials and engage new customers. For example, in the first half of 2017 we shipped 3.4 metric tons of product for various end-use customers and in the second half of 2017 we shipped just shy of 14 metric tons. In the first three quarters of 2018, we shipped 45.9 metric tons of products comprising 38.0 metric tons of dry powders and approximately 7.9 metric tons of additional product in the form of slurry, cake or other integrated products. In the quarter ending September 30, 2018, we shipped 15.7 metric tons of products comprised mainly of dry powders. This demand profile is further evidence that we are transitioning into higher-volume commercial production. Based on customer forecasts and management estimates, we expect to ship from 50 to 100 metric tons of product in 2018.

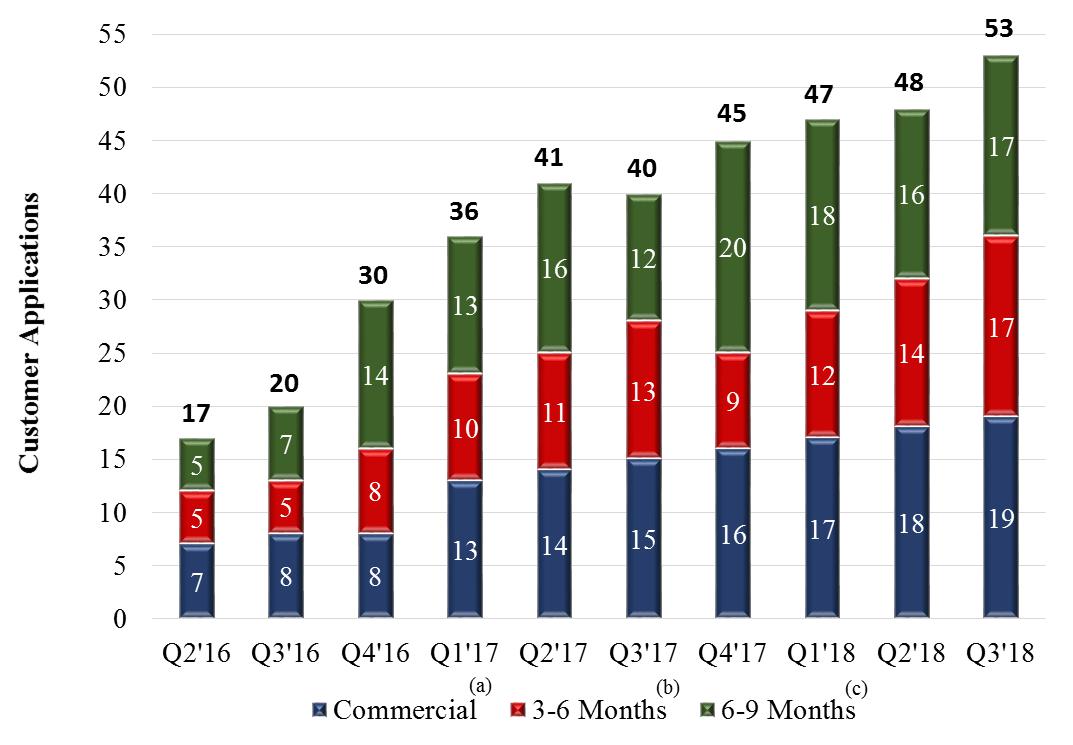

2018 Expected Revenue

We are tracking the commercial and development status of more than 75 different customer applications using our materials with some customers pursuing multiple applications. As of September 30, 2018, we had nineteen specific customer applications where our materials are incorporated into our customers’ products and such customers are actively selling these products to their own customers. In addition, we have another seventeen customer applications where our customers have indicated that they expect to begin shipping product incorporating our materials in the next 3 – 6 months and have another seventeen customer applications where our customers have indicated an intent to commercialize in the next 6 – 9 months. We are also working with numerous additional customers that have not yet indicated an exact date for commercialization, but we believe have the potential to contribute to revenue in 2018. The following graphic demonstrates the trend over the past 10 quarters as an increasing number of customers indicate their intent to commercialize applications and move into actively selling products for future sales. As a result, we believe we will begin shipping significantly greater quantities of our products, and thus continue scaling revenue through 2018. Based on the status of current discussions with customers and their feedback on the performance of our materials in their products, we believe we will be able to recognize approximately $5 – $7 million of revenue in 2018, although this cannot be assured.

| 20 |

(a) Customer applications where our materials are used in customer products and they are actively selling them to their customers.

(b) Customer applications where our customers are indicating that they expect to begin shipping products incorporating our materials in the next 3-6 months.

(c) Customer applications where our customers are indicating an intent to commercialize in the next 6-9 months.

Additional 10’s of customers demonstrating efficacy and moving through qualification process.

Manufacturing Capacity

We have completed the first phase of expansion in our newest 64,000 square-foot facility. The expansion has added 90 metric tons of graphene nanoplatelet production capacity, bringing the total capacity of the facility up to approximately 180 metric tons and enabling the formulation of up to 18 million kilograms of advanced materials per year (at 1 weight percent loading). Phase two of the expansion is expected to be complete by year-end and will result in up to 400 metric tons of total graphene nanoplatelet output capacity at the facility. Our total graphene nanoplatelet output capacity across both of our manufacturing facilities, as of September 30, 2018, exceeds 200 metric tons per year and will more than double over the next three months, reaching up to an approximate 450 metric tons by year-end. The expansions support our mission to continue commercializing the use of graphene in customer products across diverse industries. XG’s increasing capacity will support the growing demand for our products over the next several quarters.

Addressable Markets

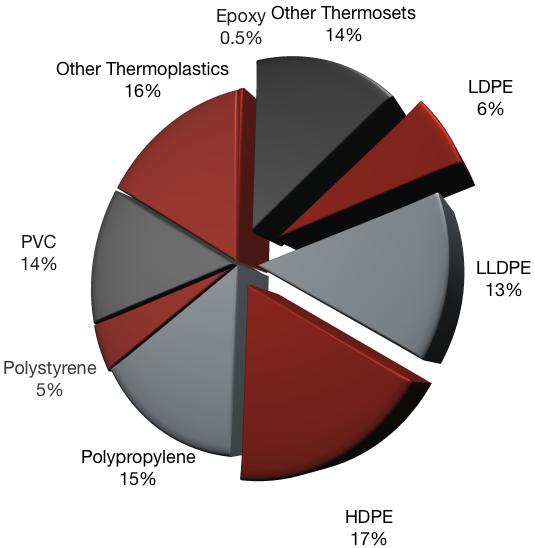

The markets that we serve are large and rapidly growing. For example, according to the American Chemistry Council, total global polymer production reached 345 million metric ton in 2017 and with a compound annual growth rate of 4-5% (see figure below). The advanced composite application market which includes bulk materials, engineered materials, and advanced materials generated approximately $85B in global sales in 2016 (Composites Manufacturing, 2016). $30B of the composites applications market is in bulk materials and $6B of those composite materials are polymeric in nature. XG Sciences targets applications where our products are added to polymers costing more than two dollars per kilogram and also applications requiring varying material performance such as improved tensile strength and flame retardancy. Targeting applications at more than the $2/Kg price point will keep the potential cost increase of adding xGnP® to the base material below 30%, an acceptable range while adding significant performance improvements unmatched by any single additive.

| 21 |

2017 Global Polymer Production: 345 million metric tons (Source: American Chemistry Council)

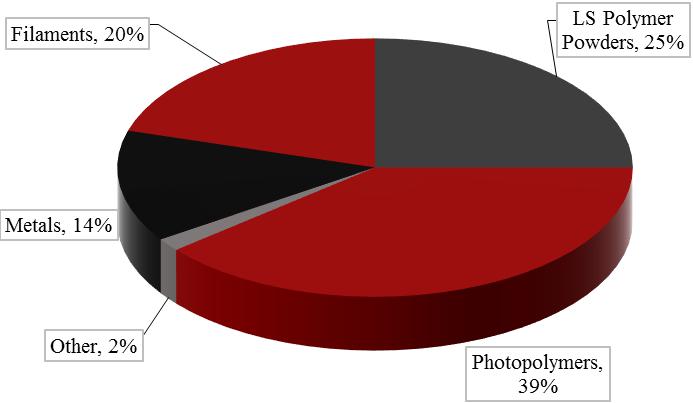

The 3D printing market has seen a compounded annual growth rate for the past 28 years of 25.9% (Wohler’s Associates 2017). The overall industry grew by 17.4% to $6B in 2016. The materials sold for 3D printing use grew by 17.5% to ~$1B of the industry total in 2016. These materials primarily include epoxy-based resins, powders and filaments. All of these matrices are well suited for xGnP® as an additive solution.

2017 3D Printing Materials Market: $1 Billion (Source: Wohler’s Associates)

The addition of xGnP® graphene nanoplatelets to various polymer matrices such as polypropylene (PP) and polyethylene terephthalate (PET) has been shown to increase the mechanical properties by up to 40%. In addition, we have demonstrated 2-3X improvement in functional behaviors in other thermoset and elastomer materials. We target applications using neat resin systems incorporating glass and carbon fiber fillers systems where addition of our materials will realize various property improvements. For example, in applications where customers may have previously been required to use multiple fillers to generate improved mechanical performance, processability, and flame resistance, we believe they may now have the option of using only xGnP® graphene nanoplatelets to realize many of the same performance benefits. We believe these characteristics will enable bulk polymer materials to perform like engineered plastic materials which command higher price points than their commoditized neighbors.

| 22 |

Our Intellectual Property

Some of our proprietary manufacturing processes were developed at Michigan State University (MSU) and licensed to us in 2006. We license three U.S. patents and patent applications from MSU. On August 8, 2016, we signed an agreement acquiring an exclusive license to Metna’s background IP for use of graphene nanoplatelets as additives to concrete mixtures. For purposes of the agreement, Metna’s background IP relates to the U.S. Patent 8,951,343. Also, on August 8, 2016, we entered into a second agreement for an exclusive license related to all Metna’s background technology and foreground technology, including any jointly-owned foreground technology where the end use is known to be any graphite additive dispersed in concrete mixtures. Over time, our scientists and engineers have made many further discoveries and inventions that are embodied in the form of (and as of September 30, 2018): ten (10) additional U.S. patents, thirteen (13) foreign patents, eleven (11) additional U.S. patent applications and numerous trade secrets. For many of the applications filed in the U.S., additional filings are made in other countries such as the European Union, Japan, South Korea, China, Taiwan or other applicable countries. As of September 30, 2018, we maintained twenty five (25) international patent applications. These filings and analyses are made on a case-by-case basis. Typically, patents that are defensive in nature are not filed abroad, while those that are protective of active XGS products or applications are filed in relevant countries abroad. Our general IP strategy is to keep as trade secrets those manufacturing processes that are difficult to enforce should they be disclosed and to seek patent coverage for other manufacturing processes, materials derived from those processes, unique combinations of materials and end uses of materials containing graphene nanoplatelets. We believe that the combination of our rights under the MSU license, our patents and patent applications, and our trade secrets create a strong intellectual property position.

Operating Segment

We have one reportable operating segment that manufactures xGnP® graphene nanoplatelets and value-added products produced therefrom, conducts research on graphene nanoplatelets and related products, and licenses our technology as appropriate. As of September 30, 2018, we shipped products on a worldwide basis, but all of our assets were located within the United States.

Results of Operations for the Three and Nine Months Ended September 30, 2018 compared with the Three and Nine Months Ended September 30, 2017

| Summary Income Statement | For the Three Months Ended September 30, |

For the Nine Months Ended September 30, |

||||||||||||||||||||||

| (unaudited) | 2018 | 2017 | Change | 2018 | 2017 | Change | ||||||||||||||||||

| Total Revenue | $ | 1,126,385 | $ | 472,261 | $ | 654,124 | $ | 2,863,575 | $ | 1,038,529 | $ | 1,825,046 | ||||||||||||

| Cost of Goods Sold | 1,253,116 | 716,261 | 536,855 | 3,573,838 | 1,712,875 | 1,860,993 | ||||||||||||||||||

| Gross Loss | (126,731 | ) | (244,000 | ) | 117,269 | (710,263) | (674,346 | ) | (35,917) | |||||||||||||||

| Research & Development Expense | 435,956 | 215,949 | 220,007 | 1,000,101 | 706,575 | 293,526 | ||||||||||||||||||

| Sales, General & Administrative Expense | 1,297,179 | 1,466,505 | (169,326 | ) | 3,631,652 | 3,386,857 | 244,795 | |||||||||||||||||

| Total Operating Expense | 1,733,135 | 1,682,454 | 50,681 | 4,631,753 | 4,093,432 | 538,321 | ||||||||||||||||||

| Operating Loss | (1,859,866 | ) | (1,926,454 | ) | 66,588 | (5,342,016) | (4,767,778 | ) | (574,238) | |||||||||||||||

| Other Income (Expense) | (81,926 | ) | (105,968 | ) | 24,042 | (247,647) | (296,983 | ) | 49,336 | |||||||||||||||

| Net Loss | $ | (1,941,792 | ) | $ | (2,032,422 | ) | $ | 90,630 | $ | (5,589,663) | $ | (5,064,761 | ) | $ | (524,902) | |||||||||

Revenue

Revenue for the three and nine months ended September 30, 2018 and 2017, by category, are shown below.

| Summary of Revenue | For the Three Months Ended September 30, |

For the Nine Months Ended September 30, |

||||||||||||||||||||||

| (unaudited) | 2018 | 2017 | Change | 2018 | 2017 | Change | ||||||||||||||||||

| Product Sales | $ | 1,126,385 | $ | 446,795 | $ | 679,590 | $ | 2,863,575 | $ | 863,574 | $ | 2,000,001 | ||||||||||||

| Grants | — | 25,466 | (25,466 | ) | — | 124,955 | (124,955) | |||||||||||||||||

| Licensing | — | — | — | — | 50,000 | (50,000) | ||||||||||||||||||

| Total Revenue | $ | 1,126,385 | $ | 472,261 | $ | 654,124 | $ | 2,863,575 | $ | 1,038,529 | $ | 1,825,046 | ||||||||||||

| 23 |

Product sales consist of two broad categories: (1) material sold to customers for research or development purposes; and (2) production orders for customers. Typically, the order sizes for the first category are relatively small, however we expect orders in the second category to be much larger in the future. For the three months ended September 30, 2018, product sales increased by $679,590, or 152% from the comparable period in the prior year. For the nine months ended September 30, 2018, product sales increased by $2,000,001 or 232% from the comparable period in the prior year. The main reason for the increase was customers moving through development programs towards commercialization, requiring larger quantities of our materials for advanced testing, pilot production and commercial-scale production activities. We believe that those customers already in production will increase their order volume as demand increases and others will begin to move into commercial volume production as they gain more experience in working with our materials and engage their own customers. As a result of this movement, we shipped 10.4 metric tons of graphene nanoplatelets in the form of dry powders in the first quarter of 2018 and an additional 4.4 tons of slurries, cakes and other integrated products containing graphene nanoplatelets, 11.9 metric tons of graphene nanoplatelets in the form of dry powders in the second quarter of 2018 and an additional 3.5 metric tons of slurries, cakes and other integrated products containing graphene nanoplatelets and 15.7 metric tons in the third quarter of 2018, primarily in the form of dry powder .

We ship our products from our Lansing, MI manufacturing facilities to customers around the world. During the three months ended September 30, 2018, we shipped materials to customers in 15 countries, as compared to 16 countries during the same three-month period in 2017. During the nine months ended September 30, 2018, we shipped materials to customers in 23 different countries, versus 29 countries in 2017. For the three months ended, September 30, 2018, no foreign countries accounted for more than 10% of product sales, and during the same period in 2017, shipments to China accounted for more than 10% of product sales. For the nine months ended September 30, 2018, no foreign countries accounted for more than 10% of product sales, and during the same period in 2017, shipments to two countries accounted for more than 10% of product sales. China and South Korea accounted for approximately 27% of total product sales during the nine months ended September 30, 2017.

Order Summary