| As Filed with the Securities and Exchange Commission on August 31, 2016 | Registration No. 333-209131 |

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

________________

POST EFFECTIVE AMENDMENT NO. 2

TO

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

________________

XG Sciences, INC.

(Exact name of registrant as specified in its charter)

| Michigan | 2821 | 20-4998896 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

3101 Grand Oak Drive

Lansing, MI 48911

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Philip L. Rose

Chief Executive Officer

XG Sciences, Inc.

3101 Grand Oak Drive

Lansing, MI 48911

Telephone: (517) 703-1110

(Name, address, including zip code, and telephone number, including area code, of agent for service)

________________

Copies to:

Clayton E. Parker, Esq.

Matthew Ogurick, Esq.

K&L Gates LLP

200 South Biscayne Boulevard, Suite 3900

Miami, Florida 33131-2399

Telephone: (305) 539-3306

Facsimile: (305) 358-7095

________________

Approximate date of commencement of proposed sale to the public: As soon as practicable after this Registration Statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act of 1933, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act of 1933, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act of 1933, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ¨ | Accelerated filer ¨ | Non-accelerated filer ¨ | Smaller reporting company x | |||

| (Do not check if a smaller reporting company) | ||||||

The Registrant amends this registration statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this registration statement shall hereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, or until the registration statement shall become effective on such date as the Commission, acting pursuant to Section 8(a), may determine.

EXPLANATORY NOTE

XG Sciences, Inc. (the “Company”) previously filed a Registration Statement on Form S-1 (File No. 333-209131) with the U.S. Securities and Exchange Commission (the “SEC”) on April 11, 2016 which was declared effective by the SEC on April 13, 2016 (the “Existing Registration Statement”). The Existing Registration Statement registered up to 3,000,000 shares of common stock at a fixed price of $8.00 per share to the general public in a self-underwritten, best efforts offering.

As of the date of this prospectus, the Company has sold 322,254 shares under the Existing Registration Statement at a price of $8.00 per share for proceeds of $2,578,032.

This Registration Statement constitutes Post-Effective Amendment No. 2 to the Existing Registration Statement and is primarily being filed to update, among other things, the Company’s financial statements for the periods ended June 30, 2016 and 2015, to reflect all sales of the Company’s securities that have been made by the Company under the Existing Registration Statement as of the date hereof, to include certain disclosures required by certain State securities regulators, to extend the offering from 180 to 365 days and to modify our investor presentation materials.

| 2 |

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission becomes effective. This prospectus is not an offer to sell these securities and we are not soliciting offers to buy these securities in any state where the offer or sale is not permitted.

PRELIMINARY PROSPECTUS

Subject to completion, dated August 31, 2016

2,677,746 shares of Common Stock of

XG SCIENCES, INC.

This is the initial public offering of common stock of XG Sciences, Inc., and no public market currently exists for the securities being offered. We originally registered for sale a total of 3,000,000 shares of common stock at a fixed price of $8.00 per share to the general public in a self-underwritten, best efforts offering. As of the date of this prospectus, we have sold 322,254 shares at $8.00 per share for total proceeds of $2,578,032. Therefore, we are registering the remaining 2,677,746 shares hereunder in this Post Effective Amendment No. 2 to the Existing Registration Statement. We have and intend to continue to engage the services of non-exclusive sales agents to assist us with selling the shares. We intend to pay a commission fee of up to 8% to each sales agent. Only one sales agent shall receive a commission for each share sold. For additional information please see the “Plan of Distribution”.

We estimate our total offering expenses to be approximately $1,400,000, assuming we pay sales agents an 8% commission fee on fifty percent of the shares sold in this offering and dealer managers that introduce other broker dealers to serve as sales agents a 2% commission fee on twenty five percent (25%) of the shares sold in this offering. There is no minimum number of shares that must be sold by us for the offering to proceed, and we will retain the proceeds (net of any sales agent commissions) from the sale of any of the offered shares.

The offering shall terminate on the earlier of (i) when the offering period ends (365 days from the effective date of the Existing Registration Statement, or April 13, 2017), (ii) the date when the sale of all of the remaining 2,677,746 shares is completed, and (iii) when our Board of Directors decides that it is in the best interest of the Company to terminate the offering prior to the completion of the sale of all of the shares registered under the Registration Statement of which this prospectus is part.

There has been no public market for our securities and a public market may never develop, or, if any market does develop, it may not be sustained. Our common stock is not currently quoted on or traded on any exchange or on any over-the-counter market.

After this offering is completed, we intend to seek either (i) a listing of our common stock on a securities exchange registered with the Securities and Exchange Commission (SEC) under Section 6(a) of the Securities Exchange Act of 1934, as amended, such as the NASDAQ Capital Market or the New York Stock Exchange (NYSE), or (ii) the quotation of our common stock on the OTCQB or OTCQX marketplaces operated by OTC Markets Group, Inc. (any of the foregoing generally referred to as a “Qualified National Exchange” and the act of achieving such listing or quotation, generally referred to hereafter as a “Public Listing” in this prospectus). In order to achieve a Public Listing, we will have to meet certain initial listing qualifications of the Qualified National Exchange on which we are seeking the Public Listing. In addition, we will need to have market makers agree to make a market in our common stock and file a FINRA Form 15c211 with the SEC on our behalf before we can achieve a Public Listing, and we will also need to remain current in our quarterly and annual filings with the SEC.

There can be no assurance that our common stock will ever be quoted or traded on a Qualified National Exchange or that any market for our common stock will develop.

We are an “emerging growth company” as that term is used in the Jumpstart Our Business Startups Act of 2012 and, as such, may elect to comply with certain reduced public company reporting requirements for future filings. Please refer to discussions under “Prospectus Summary” on page 1 and “Risk Factors” on page 13 of how and when we may lose emerging growth company status and the various exemptions that are available to us.

| 3 |

Investing in our securities involves a high degree of risk. You should purchase these securities only if you can afford a complete loss of your investment. See the section entitled “Risk Factors” on page 13 of this prospectus and in the documents we filed with the Securities and Exchange Commission that are incorporated in this prospectus by reference for certain risks and uncertainties you should consider.

Neither the SEC nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2016.

| 4 |

TABLE OF CONTENTS

Until April 13, 2017, all dealers that effect transactions in these securities, whether or not participating in this offering, may be required to deliver a prospectus. This is in addition to each dealer’s obligation to deliver a prospectus when acting as underwriters and with respect to their unsold allotments or subscriptions.

You should rely only on the information contained in this prospectus. We have not authorized any person to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely on it. This prospectus is not an offer to sell securities in any state where the offer or solicitation is not permitted. The information contained in this prospectus is complete and accurate as of the date on the front cover of this prospectus, but information may have changed since that date. We are responsible for updating this prospectus to ensure that all material information is included and will update this prospectus to the extent required by law.

| 5 |

This prospectus of XG Sciences, Inc., a Michigan corporation (together with its sole subsidiary, the “Company”, “XG Sciences”, “XGS” or “we”, “us”, or “our”) is a part of a registration statement on Form S-1 that we filed with the Securities and Exchange Commission (SEC). This summary highlights selected information contained elsewhere in this prospectus. This summary does not contain all the information that you should consider before investing in our common stock. You should carefully read the entire prospectus, including “Risk Factors”, “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the financial statements and related notes beginning on page F-1 before making an investment decision.

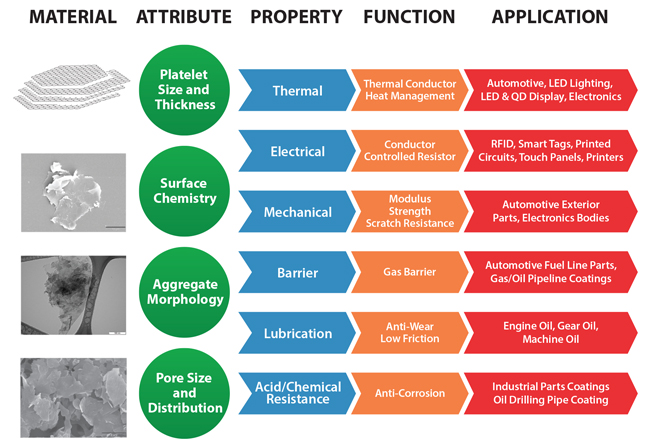

XG Sciences was formed in May 2006 for the purpose of commercializing certain technology to produce graphene nanoplatelets. First isolated and characterized in 2004, graphene is a single layer of carbon atoms configured in an atomic-scale honeycomb lattice. Among many noted properties, monolayer graphene is harder than diamonds, lighter than steel but significantly stronger, and conducts electricity better than copper. Graphene nanoplatelets are particles consisting of multiple layers of graphene. Graphene nanoplatelets have unique capabilities for energy storage, thermal conductivity, electrical conductivity, barrier properties, lubricity and the ability to impart strength when incorporated into plastics or other matrices.

We believe the unique properties of graphene and graphene nanoplatelets will enable numerous new product applications and the market for such products will quickly grow to be a significant market opportunity. Our business model is to design, manufacture and sell advanced materials we call xGnP® graphene nanoplatelets and value-added products based on these nanoplatelets. We currently have hundreds of customers trialing our products for numerous applications, including, but not limited to lithium ion batteries, supercapacitors, thermal shielding and heat transfer, inks and coatings, printed electronics, construction materials, composites, and military uses. We believe our proprietary processes have enabled us to be a low cost producer of high quality, graphene nanoplatelets and that we are well positioned to address a wide range of end-use applications.

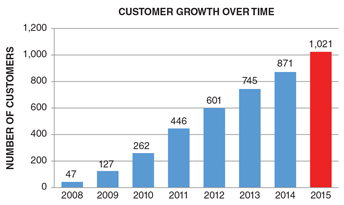

Our Customers

We sell products to customers around the world and have sold materials to over 1,000 customers in 47 countries since 2008. Some of these customers are research organizations and some are commercial organizations. Our customers have included well-known automotive and OEM suppliers around the world (Ford, Johnson Controls, Magna, Honda Engineering) world-scale lithium ion battery manufacturers in the US, South Korea and China (Samsung SDI, LG Chemical, Lishen, A123) and diverse specialty material companies (3M, BASF, Henkel, Dow Chemical, DuPont) as well as leading research centers such as Lawrence Livermore National Laboratory and Oakridge National Laboratory. We have also licensed some of our base manufacturing technology to other companies and we consider technology licensing a component of our business model. Our licensees include POSCO, the fourth largest steel manufacturer in the world by volume of output, and Cabot Corporation (“Cabot”), a leading global specialty chemicals and performance materials company. These licensees further extend our technology through their customer networks. Ultimately, we expect to benefit in terms of royalties on sales of xGnP® nanoplatelets produced and sold by our licensees.

Our Products

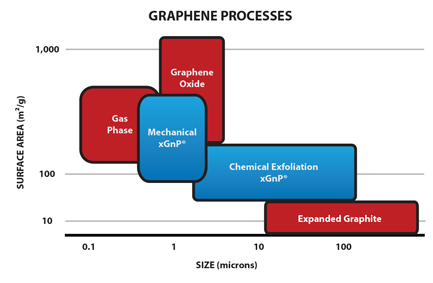

We target our xGnP® nanoplatelets for use in a wide range of large and growing end-use markets. Our proprietary manufacturing processes allow us to produce nanoplatelets with varying performance characteristics that can be tuned to specific end-use applications based on customer requirements. We currently offer four commercial “grades” of bulk materials, each of which is available in various particle sizes, which allows for surface areas ranging from 50 to 800 square meters per gram of material depending on the product. Other grades may be made available, depending on the needs for specific applications. In addition, we sell our material in the form of pre-dispersed mixtures with water, alcohol, or other organic solvents and resins. In addition to selling bulk graphene nanoplatelets, we also offer the following value added products that contain our graphene nanoplatelets in various forms:

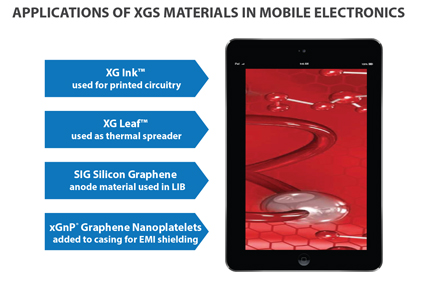

| Energy Storage Materials. These consist of specialty advanced materials that have been formulated for specific applications in the energy storage segment. Chief among these is our proprietary, specially formulated silicon-graphene composite material (also referred to as “SiG” or “XG SiG®”) for use in lithium-ion battery anodes. XG SiG® targets the never-ending need for higher battery capacity and longer life. In several customer trials, our SiG material has demonstrated the potential to increase battery energy storage capacity by 3-5x what is currently available with conventional lithium ion batteries today. Additionally, we offer various bulk materials for use as conductive additives for cathodes and anodes in li-ion batteries, as an additive to anode slurries for lead-carbon batteries, and we are investigating the use of our materials as part of other battery components. |

| 6 |

| Thermal Management Materials. These consist mainly of two types of products, our XG Leaf® sheet products and various thermal interface materials (“TIM”) in the form of custom greases or pastes. XG Leaf® is a family of sheet products ideally suited for use in thermal management in portable electronics, which may include cell phones, tablets and notebook PC’s. As these devices continue to adopt faster electronics, higher data management capabilities, brighter displays with ever increasing definition, they generate more and more heat. Managing that heat is a key requirement for the portable electronics market and our XG Leaf® product line is well suited to address the need. These sheets are made using special formulations of xGnP® graphene nanoplatelets as precursors, along with other materials for specific applications. There are several different types of XG Leaf® available in various thicknesses, depending on the end-use requirements for thermal conductivity, electrical conductivity, or resistive heating. Our custom TIM greases and pastes are also designed to be used in various high temperature environments. Additionally, we offer various bulk materials for use as active components in liquids, coatings and plastic composites to impart improved thermal management performance to such matrices. |

| Inks and Coatings. These consist of specially-formulated dispersions of xGnP® together with solvents, binders, and other additives to make electrically or thermally conductive products designed for printing or coating and which are showing promise in diverse customer applications such as advanced packaging, electrostatic dissipation and thermal management. We also offer a set of standardized ink formulations suitable for printing. These inks offer the capability to print electrical circuits or antennas, or might be suitable for other electrical or thermal applications. All of these formulations can be customized for specific customer requirements. |

Our Focus Areas

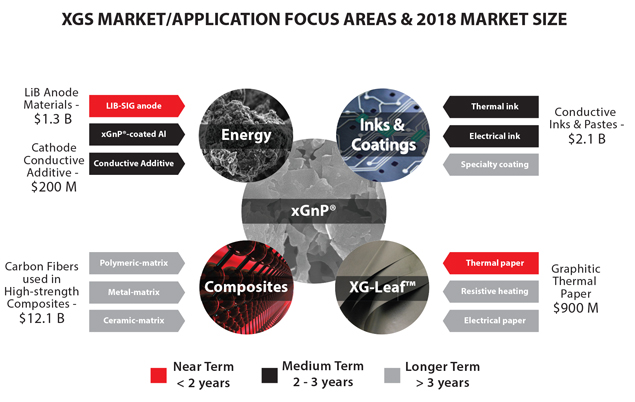

We believe we are a “platform play” in advanced materials, because our proprietary processes allow us to produce varying grades of graphene nanoplatelets that can be mapped to a variety of applications in many market segments. However, we are prioritizing our efforts in specific areas and with specific customers that we believe represent opportunities for either relatively near-term revenue or especially large and attractive markets. At this time, we are focused on three high priority areas:

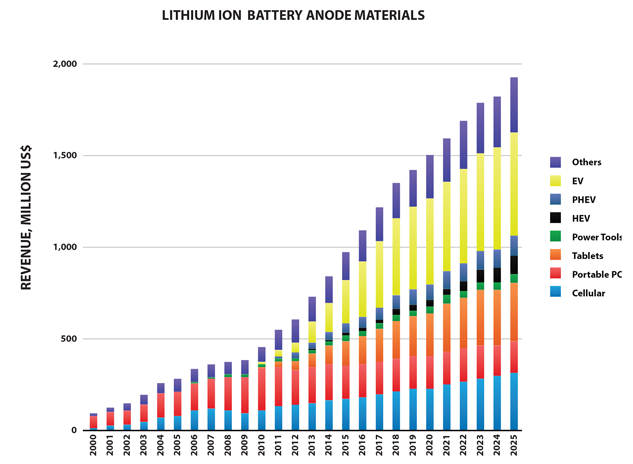

| · | Energy Storage: Within energy storage we focus on lead acid batteries and lithium ion batteries. Within lithium ion batteries, we develop silicone-graphene composite materials for lithium-ion battery anodes. This is a material that has shown superior early results in laboratory and early prototype battery testing. Although there is still scientific development, testing and prototyping that remains to be done, we perceive a significant market opportunity for this new anode material. We also develop a cathode conductive additive to improve rate capability, especially for higher power applications. XG Sciences’ graphene nanoplatelets demonstrate higher discharge capacity at high rates, which translates into more battery power needed during heavy power requirements: start-up, acceleration, and/or elevation ascent. In lead acid batteries we develop anode conductive additives demonstrating improved performance for lifetime and charge acceptance. |

| · | Thermal Management. Thermal management products may take on many forms. Their underlying intent is to improve the movement of heat where excessive heat may cause a reduction in product lifetime and/or performance. XG Leaf® materials for thermal applications in electronics is one such product. XG Leaf® is a paper-like product comprised of xGnP® graphene nanoplatelets. Early testing with customers has produced promising results in applications requiring high thermal conductivity in thin (20–50 microns) and thick (50–120 microns) sheets, depending upon the end-use application. Typical applications include the use of these materials in smart phones, tablets, and portable computers. While there are many other applications for XG Leaf®, including electrostatic dissipation (“ESD”), electromagnetic interference (“EMI”) shielding and resistive heating, our initial focus is on thermal management. TIM, or thermal interface materials, in the form of greases or pastes is another product in this category. XG Sciences’ TIM’s have been shown to improve the thermal dissipation of heat generated by light emitting diodes when incorporated in various lighting devices. Other products may include inks or coating formulations specifically designed for use in such applications as portable electronics, heaters and other industrial equipment benefiting from the use of coatings to improvement heat dissipation. |

| 7 |

| · | Composites. Incorporation of our xGnP® graphene nanoplatelets into various polymers have been shown to impart improvements in strength, electrical conductivity, thermal conductivity and/or barrier performance. The company pursues several end-use applications that may benefit from one or more properties and believes that composites represent a potentially large opportunity for commercial sales. |

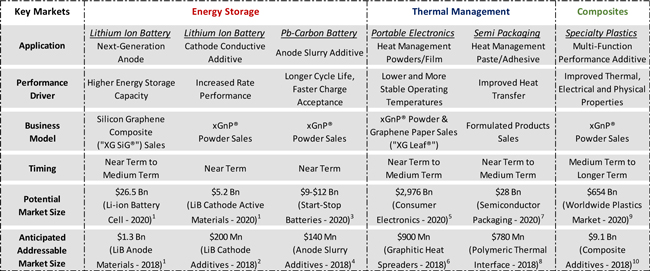

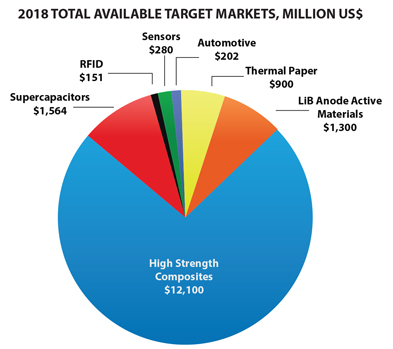

XGS Market/Application Focus Areas & 2018 Market Size

Commercialization Process

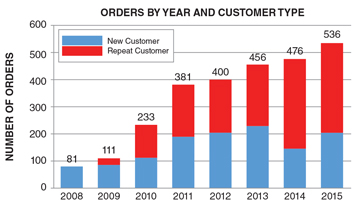

Because graphene is a new material, most of our customers are still developing applications that use our products, and thus historically most customers have purchased products in quantities consistent with development purposes. The process of “designing-in” new materials is relatively complex and involves the use of relatively small amounts of the new material in laboratory and engineering development for an extended period of time. Following successful development, we expect customers that incorporate our materials into their products will then order much larger quantities of material to support commercial production. Thus, while many of our customers are currently purchasing our materials in kilogram (one or two pound) quantities, we expect many will require tons or even hundreds of tons of material when they commercialize products that incorporate our materials. Although, our customers are under no obligation to report to us on the usage of our materials, some have indicated that they have introduced or will soon introduce commercial products that use our materials.

Commercialization is a process, the exact timing of which is often difficult to predict. It starts with our own internal R&D to validate performance for an identified market or customer-specific need. Our customers then validate the performance of our materials and determine that our products can be incorporated into their manufacturing processes. This is initially done at the pilot scale. Our customers then have to introduce products that incorporate our materials to their own customers to validate performance. After their customers have validated performance, our customers will then move to commercial scale production. Every customer goes through the same process, but will do so at varying speeds, depending on the customer, the product and the end-use market. Thus, we are not always able to predict when our customers will begin ordering commercial volumes of our materials or their expected volumes over time. However, as customers move through the process, we generally receive a lot of feedback and gain greater insights regarding their commercialization plans. The following are recent examples of where our products are providing value to our customers at levels that we believe will warrant their use on a commercial basis (see also exhibit 99.1 for our Summary Customer Pipeline validating the value of our products in various end-use markets and applications):

1 Avicenne Energy, "The Worldwide Rechargeable Battery Market 2014 - 2025", 24th Edition - V3, July 2015.

2 Avicenne Energy, "The Worldwide Rechargeable Battery Market 2014 - 2025", 24th Edition - V3, July 2015 & Internal Estimates.

3 ArcActive via Nanalyze, April 3, 2015.

4 ArcActive via Nanalyze, April 3, 2015 & Internal Estimates.

5 Future Markets Insights, "Consumer Electronics Market: Global Industry Analysis and opportunity Assessment 2015 - 2020", May 8, 2015.

6 Prismark, "Market Assessment: Thin Carbon-Based Heat Spreaders", August 2014.

7 Reporterlink.com, "Semiconductor & IC Packaging Materials Market…", May 2014.

8 Prismark, 2015.

9 Grand View Research, "Global Plastics Market Analysis…", August 2014.

10 From (9) and internal estimates: 2018 = 305 million tons of plastic, if 10% of the market adopted xGnP to enhance their properties, and at only 1% by weight as an additive, then in 2018 305,000 tons or 305,000,000 kilos of xGnP would be required. At $30 a Kg - the value is $9.1 Bn per year.

| 8 |

| · | Lead acid battery manufacturer demonstrating approximately 90% improvement in measured cycle life, appreciable improvement in capacity and charge acceptance and without any loss in water retention performance, and |

| · | Light emitting diode module and product company demonstrated approximately 50% improvement in thermal management capability when compared to existing commercial thermal management products, translating into a 15% improvement in thermal management at the device level, and |

| · | Automotive parts supplier demonstrating improvements in thermal stability for polymer composites incorporating our materials, allowing for approximately 20% higher operating temperatures and a 50% improvement in strength at the elevated temperature, and |

| · | Industrial refrigeration equipment supplier demonstrating improved heat transfer efficiency and energy savings when our xGnP® graphene nanoplatelets are incorporated as a component in the thermal-transfer fluids, and |

| · | Construction company demonstrating less than one weight percent of our product in construction material composites improves flexural strength by more than 30%, and |

| · | Large oil and lubricant supplier showing gear and friction improvements when incorporated into industrial and automotive greases, and |

| · | Engineering design firm for automotive manufacturers found approximately 20% reduction in operating temperature and in thermal uniformity when XG Leaf® replaces standard cooling fins in lithium ion battery packs, and |

| · | Auto manufacturer showing increased tensile and flexural strength and reduced weight in automotive composites. |

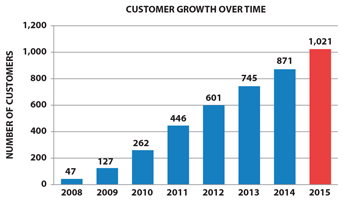

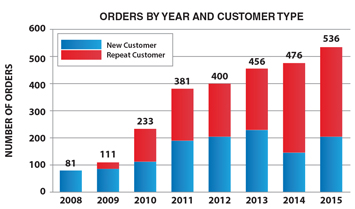

The below graphs show total orders and customers based on actual purchases of our materials and do not include free samples or materials used in joint development programs. Since the majority of our customers are still in the development stage, our product sales to date have consisted mainly of orders for relatively small quantities of materials being used in a variety of research or development activities and in early phase limited commercial applications. The average order size for the first six months of 2016 was $865, as compared to $600 for the full year 2015, which indicates these orders were for materials that were not yet incorporated into large-volume commercial products.

|

|

| 9 |

Expected 2016 and 2017 Revenue

We are tracking the commercial and development status of more than 100 customer/product engagements. We currently have five customers who are using our materials in their products and actively selling them to their customers or actively promoting them for future sales. We anticipate that the average order size for these customers will increase in the second half of 2016 and 2017 as their demand grows. We have another five customers who have indicated they expect to begin shipping products incorporating our materials in the second half of 2016, and we have another seven customers who have indicated they intend to commercialize products using our materials in early 2017. We have many other customers with whom we are working that have not yet indicated an exact date for commercialization, but we believe have the potential to contribute to revenue in 2017 as well. As a result, we expect to begin shipping significantly greater quantities of our products, and thus begin scaling revenue, in the second half of 2016 and into 2017. Based on the status of current discussions with customers and their feedback on the performance of our materials in their products, we believe we will be able to recognize approximately $2-4 million of revenue in 2016 and approximately $10-25 million of revenue in 2017.11

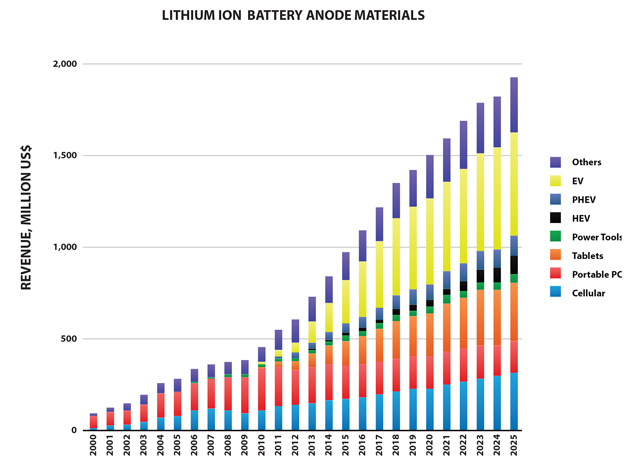

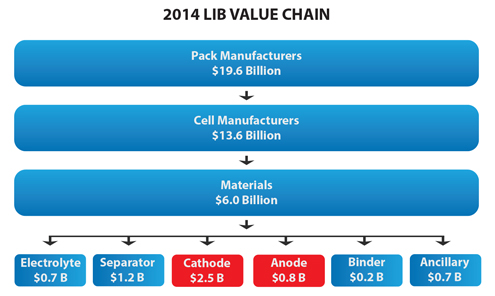

Addressable Markets

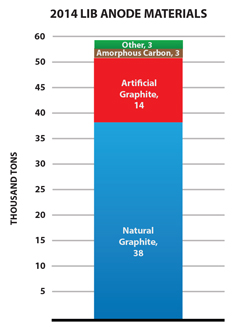

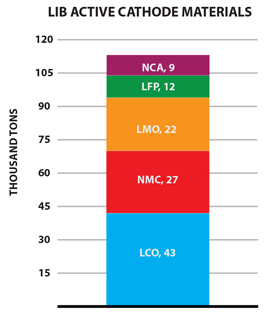

The markets that we serve are large and rapidly growing. For example, as shown in the figure below, Avicenne Energy(1) estimates that the market for materials used in lithium ion battery anodes is currently approximately $1 billion, but is expected to approximately double over the next ten years. We believe our ability to address next generation anode materials represents a significant opportunity for us.

11 For Pennsylvania investors, this statement should not be read as prospective market and financial information within the meaning of 64 Pa. Code§ 609.010(d)(l)-(9). These statements are based solely on management’s discussion with customers regarding future demand.

| 10 |

According to Prismark Partners, LLC, a leading electronics industry consulting firm specializing in advanced materials, the 2014 market for finished graphitic heat spreaders as sold to the OEM and EMS companies with adhesive, PET, and/or copper backing for selected portable applications was $600 million, and is expected to reach $900 million in 2018(6). The market is currently in a significant expansion period driven by the demand for portable devices. In a press release dated March 3, 2015, Gartner, Inc., a leading research organization, estimated the 2014 global cell phone market at 1.88 billion units. Every cell phone has some form of thermal management system, and we believe many of the new smart phones being developed can benefit from the thermal management properties of our XG Leaf® product line. In August 2015, International Data Corporation (IDC) in their Worldwide Quarterly Tablet Tracker, estimated the global shipment of tablets in 2015 at 212 million units. Thus, we believe our XG Leaf® product line is well positioned to address a very large and rapidly growing market.

Our Intellectual Property

Some of our proprietary manufacturing processes were developed at Michigan State University (MSU) and licensed to us in 2006. We licensed three U.S. patents and patent applications from MSU. However, over time, our scientists and engineers have made many further discoveries and inventions that are embodied in the form of four additional U.S. patents, two China patents, one U.S. patent application that is allowed but not yet granted, one Taiwan application of a U.S. patent for which the patent is allowed but not yet granted and 17 additional U.S. patent applications, and numerous trade secrets. For each patent application filed in the U.S., we make a determination on the nature and value of the patent. For many of the applications filed in the U.S., additional filings are made in other countries such as the European Union, Japan, South Korea, China, Taiwan or other applicable countries. These filings and analyses are made on a case-by-case basis. Typically, patents that are defensive in nature are not filed abroad, while those that are protective of active XGS products or applications are filed in relevant countries abroad. Our general IP strategy is to keep as trade secrets those manufacturing processes that are difficult to enforce should they be disclosed and to seek patent coverage for other manufacturing processes, materials derived from those processes, unique combinations of materials and end uses of materials containing graphene nanoplatelets. We believe that the combination of our rights under the MSU license, our patents and patent applications, and our trade secrets create a strong intellectual property position.

Our Manufacturing Capacity

We have developed and scaled-up capacity for two proprietary manufacturing processes — one based on chemical intercalation of graphite and subsequent exfoliation and classification; and the second based on a high-shear mechanical process. In March 2012, we took possession of a production facility under terms of a long-term lease and moved our headquarters to this new location. Initial production commenced in this facility in September 2012. Currently, this facility is capable of producing approximately 30 – 50 tons per year of intercalated materials (depending on product mix) if operated on a continuous basis. We also operate a separate production facility in leased manufacturing space which is used for the production of certain specialty materials. This facility is capable of producing approximately 30 – 60 tons per year of materials (depending on product mix) if operated on a continuous basis. We believe these manufacturing facilities will be sufficient to meet demands for the majority of our bulk materials for a number of years, with suitable additions of capital equipment as warranted. However, additional manufacturing capabilities for certain value-added products and certain bulk materials remain to be developed and will likely require the acquisition of additional facilities. In particular, the production processes for XG Leaf®, XG SiG® and our conductive inks will require additional capital and additional facilities to meet expected future customer demand.

Many of the Company’s products are new products that have not yet been fully developed and for which manufacturing operations have not yet been fully scaled. This means that investors are subject to the risks incident to the creation and development of multiple new products and their associated manufacturing processes. As of the date of this prospectus, we have not yet demonstrated sales of products at a level capable of covering our fixed expenses. Although we expect to begin to significantly scale revenue beginning in late 2016 and in 2017, we have not yet demonstrated the capability to produce sufficient materials to generate the ongoing revenues necessary to sustain our operations in the long-term. For additional information please see “Risk Factors”.

| 11 |

Our Lead Investors and Strategic Partners

Since inception, we have raised approximately $38 million of capital through the issuance of equity and equity-linked securities and through licensing fees. Notable investors and licensees in the Company include:

| · | Hanwha Chemical Corporation - $3 million equity investment (December 2010) |

| · | Aspen Advanced Opportunity Fund and affiliates - $18.5 million in various equity investments (2010 – 2016) |

| · | POSCO Corporation - $5.2 million in equity investments/license agreement (June 2011 and March 2014) |

| · | Samsung Ventures - $3 million equity investment (January 2014) |

Our Competitive Strengths

We believe that we are a world leader in the emerging global market for graphene nanoplatelets. The following competitive strengths distinguish us in our industry:

The strength of our intellectual property. Because of our focus on manufacturing process development, we believe we have one of the world’s strongest internal knowledge bases in graphene nanoplatelet manufacturing, with most of our proprietary knowledge maintained as trade secrets to avoid the disclosures required by patenting. The 25 US patents and patent applications that we are currently managing (including those under license from MSU) add value by protecting specific equipment, or high-value end-user product applications. The fact that two global companies have evaluated and licensed our production technology provides independent evidence of our technology’s effectiveness.

The breadth of our product offering. As far as we are aware, we have the broadest product offering in our industry. In addition to offering four standard particle sizes in three different grades of bulk materials, we offer four different grades of XG Leaf® in multiple thicknesses, two different grades of silicon-graphene composite materials, three standard ink formulations, and optional custom dispersions and formulations of our bulk materials.

The low-cost nature of our manufacturing processes. As far as we are aware, our manufacturing processes have the potential to be the lowest-cost approaches to the manufacture of graphene nanoplatelets (subject to economies of scale) based on our internal modelling of competitive processes as well as our analysis of alternative technologies.

Our corporate and strategic partners. Three global corporations (Samsung, POSCO, and Hanwha Chemical) have invested over $11 million in XGS, giving us a significant global reach as well as the ability to leverage the assets of our partners.

Our licensees will accelerate our entry into large markets. Cabot Corporation, the largest U.S.-based manufacturer of carbon particles, and POSCO, one of the world’s largest steel producers, have licensed parts of our production technology. We believe these licensees will help us distribute our products and value-added products made with our xGnP® nanoplatelets more rapidly than we could do on our own.

The number of development partners that are working with our materials. As of June 30, 2016, we had supplied materials to 233 universities or government laboratories in 40 different countries around the world. A recent search of the U.S. patent database revealed 327 citations of XG Sciences in patents filed by other organizations. These other organizations include Goodrich Corporation, PPG Industries, ExxonMobil Research & Engineering, Toray, Solvay, Honda, Eastman Kodak, Baker Hughes, GM, Rohm and Haas and Sekisui Chemical.

The number of customers purchasing and working with our materials. As of June 30, 2016, we have supplied materials to nearly 850 commercial companies around the world (in addition to universities and research laboratories) who are assessing their performance and potentially designing them into products. We have more than 100 active development relationships where we are working with end-use customers to design products for commercial use. We expect that these relationships will continue to expand.

Our know-how and ability to tailor our products for use in multiple applications. Many of our products and product-development activities target use of our xGnP® graphene nanoplatelets in various matrices to form composite products that are then used by our customers. We have extensive knowledge of how to tailor our products to deliver performance as composite products in various applications and we also have knowledge of how to tailor other components of a composite to adjust the performance of the composite for use in various applications.

| 12 |

We believe that the combination of these factors show that XGS is a world leader in the emerging global graphene particle industry. Other independent observers have agreed with this assessment. For example, Lux Research, in a July 2015 release listed XGS as a leading worldwide player in its review of the graphene industry. Further, Lux analysts wrote: “XG’s march of strategic relationship announcements — Hanwha Chemical in December 2010, POSCO in June 2011, and Cabot in November 2011 — arguably give it the strongest partnership portfolio in the space, and its recent expansion (see the May 7, 2012 LRMJ) makes it one of the low cost and capacity leaders.”

Our Significant Accomplishments

Since our founding in May 2006, we have been one of the global pioneers in graphene nanoplatelet markets. As a prospective manufacturer of a newly discovered advanced material, our development efforts required us to invent appropriate manufacturing processes and methods to scale these processes at economic costs, to hire world-class employees, to introduce our products to customers around the world, and to demonstrate the scientific merits of our materials. Specific accomplishments related to these tasks include, but are not limited to, the following:

| · | Developed and launched four grades of xGnP® graphene nanoplatelets bulk powders. |

| · | Developed and launched five higher-margin, value-added product families: |

| - | XG Leaf® sheet products for a variety of electronics and industrial applications. |

| - | XG SiG™ Silicon-graphene composite anode materials for lithium-ion batteries. |

| - | Custom formulated inks and coatings designed to take advantage of the special properties of our graphene nanoplatelets in targeted customer applications. |

| - | XG TIM™ thermal interface materials in the form of greases and pastes targeting a range of thermal management applications in light emitting diode and semiconductor packaging. |

| - | GnP™ cement additive package offering tougher, longer lasting cement for commercial and retail applications. |

| · | Established sales distributors in Japan, South Korea, Taiwan, Italy, Germany and China. |

| · | Completed a research contract from the US Air Force for high energy-density ultra-capacitors. |

| · | Won a competition that resulted in a research contract from the U.S. Department of Energy (DOE) for ongoing development of high-capacity anode materials for electric vehicles based on the Company’s SiG material. Secured an additional $1.0 million grant from the DOE for further research into silicon graphene. Collaborated with Oak Ridge National Laboratory to explore metal-matrix materials using xGnP® graphene nanoplatelets to modify the properties of metals like titanium. |

| · | Was recognized as a world leader in the graphene market space by Lux Research and named one of the “Top Ten Innovative Companies” profiled by Lux for two years in a row. |

| · | In March 2015 was named a “Michigan 50 Companies to Watch” by Michigan Celebrates Small Businesses. |

| · | Hired Dr. Philip L. Rose as CEO. Prior to joining XGS, Dr. Rose was President of SAFC Hitech, a $100 million division of Sigma-Aldrich Corporation that makes precursors and performance materials for the LED, energy and display, and semiconductor markets. |

| 13 |

Our Financing History

Since our inception we have incurred annual losses every year and have accumulated a deficit from operations of $(43,371,368) through December 31, 2015 and $(46,087,345) through June 30, 2016. As of December 31, 2015 and June 30, 2016, our total stockholder’s deficit was $(4,071,624) and $(4,364,223), respectively.

In 2013 and 2014, we issued and sold approximately $13.7 million of convertible notes to four investors. These convertible notes, as amended, were mandatorily convertible into Series A Convertible Preferred Stock (“Series A Preferred Stock”) at the earlier of the date on which the Company raised $12 million from disinterested third parties or December 31, 2015. All of the convertible notes plus accrued interest thereon were converted into 1,456,126 shares of Series A Preferred Stock on December 31, 2015. The Series A Preferred Stock is convertible into common stock at the lower of: (a) $12.00 per share, or (b) 80% of the price at which XGS sells any equity or equity-linked securities in the future while such Series A Convertible Preferred Stock is outstanding (See “Description of Securities — Series A Preferred Stock”). We also issued and sold another 112,107 shares of Series A Preferred Stock for $1.3 million pursuant to certain pre-emptive rights.

In April 2015, we commenced a private placement offering of up to $18,000,000 in Series B Units consisting of up to 1,125,000 shares of Series B convertible preferred stock (“Series B Preferred Stock”) and warrants to purchase common stock (the “Warrants”) at an offering price of $16.00 per Unit (See “Description of Securities — Series B Units”). The offering terminated on August 31, 2015 and as of such date, we had sold 269,987 shares of Series B Preferred Stock and Warrants to purchase 224,987 shares of common stock, for aggregate gross proceeds of $4,319,792.

The Series B Preferred Stock has a stated value of $16.00 per share and is convertible, at the option of the holder into common shares, at a conversion price of $16.00 per share, subject to adjustments for stock dividends, splits, combinations and similar events. The Warrants have an exercise price of $16.00 per share and expire 7 years from issuance. Pursuant to the Certificate of Designation for the Series B Preferred Stock, as amended, during the period from closing of the offering and ending on the earlier of i) December 31, 2017 and ii) the date the Company consummates the sale of new securities resulting in gross proceeds of at least $18,000,000, each holder has the right to exchange their Series B Preferred Stock into any future equity or equity-linked securities sold by the Company (excluding options and warrants) sold to third parties at the same relative price per share and other terms at which such new security is sold to such third parties (the “Series B Exchange Rights”).

From December 31, 2015 through April 7, 2016, the Company entered into private placement bridge financings with 14 investors, seven of whom are board members or affiliates of board members, totaling $1,124,750 (the “Bridge Financings”). The investors in the Bridge Financings received common stock warrant coverage of 30% for investments made prior to December 31, 2015 with an exercise price of $8.00 per share, and 20% coverage thereafter with an exercise price of $10.00 per share. During June 2016 the Company repaid i) outstanding principal of $550,000 plus accrued interest of $22,000 to the December 2015 Bridge Financing investors and ii) outstanding principal of $200,000 plus accrued interest of $5,032 to two of the March 2016 Bridge Financing investors. These repayments were not made with funds raised in this offering. These investors, who are also members of the board of directors of the Company, used the proceeds from repayment of their notes, plus additional funds, to purchase 199,879 additional shares of the Company’s common stock in this offering for approximately $1.6 million.

We made no sales or issuances of equity during the first quarter of 2016. However, during the second quarter of 2016, we issued 14,280 shares of Series A Preferred Stock to As per Advanced Opportunity Fund as payment for lease financing obligations. We also issued and sold 285,629 shares of common stock in this offering for proceeds of $2,285,032. As a result, we had cash on hand of $959,787 as of June 30, 2016. As of the date of this prospectus, we have cash on hand of $528,621 which is only sufficient to fund our operations through mid-October 2016. We also believe that we will need approximately $5 million to sustain us for the next 12 months. The Company’s financial projections show that the Company may need to raise an additional $15 million or more before it is capable of achieving sustainable cash flow from operations. We intend that the primary means for raising such funds will be through this offering. However, there is no assurance that the Company will be able to raise these funds or that the terms and conditions of future financing will be workable or acceptable for the Company and its stockholders.

As a result of the Bridge Financings and this offering, the conversion price of our Series A Preferred Stock was adjusted to $6.40 per share. In addition, as a result of this offering, holders of Series B Preferred Stock will have the right to exchange each share of Series B Preferred Stock for two shares of unregistered common stock pursuant to the Series B Exchange Rights, and any such Series B Preferred Stock so exchanged will be cancelled.

| 14 |

Pursuant to the Certificates of Designation for the Series A and Series B Preferred Stock, as amended, all then-outstanding shares of Series A and Series B Preferred Stock, respectively, will automatically convert into shares of common stock upon the listing of the Company’s common stock on a Qualified National Exchange (a securities exchange registered with the SEC under Section 6(a) of the Securities Exchange Act of 1934, as amended (“Exchange Act”), such as the NASDAQ Capital Market or the New York Stock Exchange, or (ii) the quotation of our common stock on the OTCQB or OTCQX marketplaces operated by OTC Markets Group, Inc. (“OTC Markets”), and the act of achieving such listing or quotation, generally referred to hereafter as a “Public Listing” in this prospectus). As a result, there will only be one class of equity securities outstanding — common stock — after the Company achieves a Public Listing. Prior to any such listing, the Series A and Series B Preferred Stock may be voluntarily converted into shares of common stock at their respective then-current conversion rates (current rate for the Series A Preferred Stock is 1.875 for 1, current rate for Series B Preferred Stock is 1 for 1).

Although holders of Series B Preferred Stock have no obligation to do so, we expect that most, if not all, of such holders will exchange their Series B Preferred Stock into common stock pursuant to their Series B Exchange Rights, because each share of Series B Preferred Stock not exchanged would automatically convert into only one share of common stock upon Public Listing or a voluntary conversion at the current rate, whereas they would receive two shares if they exercised their Series B Exchange Rights.

Public Listing

In order to achieve a Public Listing, we will have to meet certain initial listing qualifications of the Qualified National Exchange on which we are seeking the Public Listing. In addition, we will need to have market makers agree to make a market in our common stock and file a FINRA Form 15c211 with the SEC on our behalf before we can achieve a Public Listing, and we will also need to remain current in our quarterly and annual filings with the SEC. Although we intend to seek a Public Listing in 2017, we cannot make any assurances that our common stock will ever be quoted or traded on Qualified National Exchange or that any market for our common stock will develop.

Employees

As of the date of this prospectus, we had 22 full-time employees. Employees include the following four senior managers that report to the CEO: a Vice President of Operations, a Vice President of Energy Markets, a Vice President of Research & Development, and a Controller. The Company employs a total of 6 full-time scientists and technicians in its R&D group, including the Vice President of Research & Development.

Corporate Information

XG Sciences, Inc. was incorporated on May 23, 2006 in the State of Michigan and is organized as a “C” corporation under the applicable laws of the United States and State of Michigan. We do not currently have any affiliated companies or joint venture partners, and we have one wholly-owned subsidiary called XG Sciences IP, LLC. This subsidiary was created in 2014 for the purpose of holding our intellectual property. Our headquarters and principal executive offices are located at 3101 Grand Oak Drive, Lansing, Michigan, 48911 and our telephone number is (517) 703-1110.

Our website address is http://www.xgsciences.com, although the information contained in, or that can be accessed through, our website is not part of this prospectus. You may also contact Dr. Philip L. Rose, our Chief Executive Officer via email at p.rose@xgsciences.com.

| 15 |

| Common stock to be offered by the Company | 2,677,746 shares | |

| Common stock issued and outstanding before the offering(1) | 1,158,798 shares | |

| Offering price | $8.00 per share | |

| Duration of offering | This offering shall commence on the effective date of this prospectus and terminate on the earlier of (i) 365 days from the effective date of this prospectus, (ii) the date when the sale of all of the remaining 2,677,746 shares is completed, and (iii) when the Board of Directors decides that it is in the best interest of the Company to terminate the offering prior the completion of the sale of all of the shares registered under the Registration Statement of which this prospectus is part. | |

| Common stock issued and outstanding after the offering after giving effect to the sale of 2,677,746 shares by the Company(1) | 3,836,544 shares | |

| Pro forma common stock issued and outstanding after the offering after giving effect to the sale of 2,677,746 shares by the Company assuming the conversion of all issued and issuable shares of Series A and the exchange of all Series B Preferred Stock(2) | 9,799,862 | |

| Ticker Symbol and Market for our common stock | This is our initial public offering and no public market currently exists for our shares and a public market may never develop, or, if any market does develop, it may not be sustained. | |

| After this offering is completed, we intend to seek either (i) a listing of our common stock on a securities exchange registered with the SEC under Section 6(a) of the Exchange Act, such as the NASDAQ Capital Market or NYSE, or (ii) the quotation of our common stock on the OTCQB or OTCQX marketplaces operated by OTC Markets Group, Inc. (each of the foregoing, a “Qualified National Exchange”). In order to achieve such a Public Listing, we will have to meet certain initial listing qualifications of such Qualified National Exchange on which we are seeking the Public Listing. In addition, we will need to have market makers agree to make a market in our common stock and file a FINRA Form 15c211 with the SEC on our behalf before we can achieve a Public Listing. No market maker has agreed to file such application. We will also need to remain current in our quarterly and annual filings with the SEC to achieve and maintain a Public Listing. There can be no assurance that our common stock will ever be quoted on Qualified National Exchange or that any market for our common stock will develop. | ||

| Offering use of proceeds | We intend to use the net proceeds from the sale of the remaining 2,677,746 shares by the Company for (a) capital expenditures in 2016 and 2017, working capital, and other general corporate purposes. Pending such use, we reserve the right to temporarily invest the proceeds. See “Use of Proceeds” beginning on page 34. |

| 16 |

| Subscriptions | All subscriptions, once accepted by us, are irrevocable. | |

| Risk Factors | The common stock offered hereby involves a high degree of risk and should not be purchased by investors who cannot afford the loss of their entire investment. See “Risk Factors” beginning on page 13. | |

| Dividend policy | We do not intend to pay dividends on our common stock. We plan to retain any earnings for use in the operation of our business and to fund future growth. |

____________

| (1) | Includes the actual number of shares outstanding as of August 18, 2016 and, for the avoidance of doubt, does not include the conversion or exchange of any preferred shares or the exercise of any options or warrants. |

| (2) | This figure includes (a) 1,158,798 shares of common stock currently outstanding as of August 18, 2016, (b) the issuance of 3,411,999 shares of common stock upon conversion of all 1,819,736 shares of Series A Preferred Stock currently outstanding at the current Series A Conversion Rate (see “Description of Securities — Series A Convertible Preferred Stock”), (c) the issuance of 2,011,345 shares upon the conversion of 1,072,720 shares of Series A Preferred Stock (at the Series A Conversion Rate) issued upon the exercise of 1,072,720 warrants to purchase Series A Preferred Stock (the “Series A warrants”) and (d) the issuance of 539,974 shares of common stock upon the voluntary exchange of all 269,987 shares of Series B Preferred Stock. This figure does not include 268,017 currently exercisable warrants to purchase common stock with an average exercise price of $14.87 per share, and 235,487 currently exercisable stock options with an average exercise price of $11.83 per share. |

There is no assurance that we will raise the $21,421,968 anticipated from the sale by the Company of 2,677,746 shares, and there is no guarantee that we will receive any proceeds from the offering. We may sell only a small portion or none of the offered shares.

Emerging Growth Company

In April 2012, the Jumpstart Our Business Startups Act of 2012, or the JOBS Act, was enacted. Section 107 of the JOBS Act provides that an “emerging growth company,” or EGC, can take advantage of the extended transition period for complying with new or revised accounting standards. Thus, an EGC can delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. We have irrevocably elected not to avail ourselves of this extended transition period and, as a result, we will adopt new or revised accounting standards on the relevant dates on which adoption of such standards is required for other public companies.

We are in the process of evaluating the benefits of relying on other exemptions and reduced reporting requirements under the JOBS Act. Subject to certain conditions, as an EGC, we intend to rely on certain of these exemptions, including exemptions from the requirement to provide an auditor’s attestation report on our system of internal controls over financial reporting pursuant to Section 404(b) of the Sarbanes-Oxley Act and from any requirement that may be adopted by the Public Company Accounting Oversight Board regarding mandatory audit firm rotation or a supplement to the auditor’s report providing additional information about the audit and the financial statements, known as the auditor discussion and analysis. We will remain an EGC until the earlier of: the last day of the fiscal year in which we have total annual gross revenues of $1.0 billion or more; the last day of the fiscal year following the fifth anniversary of the date of the completion of this offering; the date on which we have issued more than $1.0 billion in nonconvertible debt during the previous three years; or the date on which we are deemed to be a large accelerated filer under the rules of the SEC.

| 17 |

THE SECURITIES BEING OFFERED INVOLVE A HIGH DEGREE OF RISK AND, THEREFORE, SHOULD BE CONSIDERED EXTREMELY SPECULATIVE. THEY SHOULD NOT BE PURCHASED BY PERSONS WHO CANNOT AFFORD THE POSSIBILITY OF THE LOSS OF THEIR ENTIRE INVESTMENT. PROSPECTIVE INVESTORS SHOULD READ THE ENTIRE PROSPECTUS, INCLUDING ALL EXHIBITS, AND CAREFULLY CONSIDER, AMONG OTHER FACTORS, THE FOLLOWING RISK FACTORS.

Risks Relating to Our Business and Industry

We are a young company with a limited operating history, making it difficult for you to evaluate our business and your investment.

XG Sciences, Inc. was incorporated on May 23, 2006. We have not yet demonstrated sales of products at a level capable of covering our fixed expenses. Since inception, we have not demonstrated the capability to produce sufficient materials to generate the ongoing revenues necessary to sustain our operations in the long-term. Nor have we demonstrated the ability to generate sufficient sales to sustain the business. There can be no assurance that the Company will ever produce a profit.

Many of the Company’s products represent new products that have not yet been fully developed and for which manufacturing operations have not yet been fully scaled. This means that investors are subject to all the risks incident to the creation and development of multiple new products and their associated manufacturing processes, and each investor should be prepared to withstand a complete loss of their investment.

Because we are subject to these uncertainties, there may be risks that management has failed to anticipate and you may have a difficult time evaluating our business and your investment in our Company. Our ability to become profitable depends primarily on our ability to successfully commercialize our products in the future. Even if we successfully develop and market our products, we may not generate sufficient or sustainable revenue to achieve or sustain profitability, which could cause us to cease operations and you will lose all of your investment.

We have no sustainable base of products approved for commercial use by our customers, have never generated significant product revenues and may never achieve sufficient revenues for profitable operations, which could cause us to cease operations.

XG Sciences primarily sells bulk materials or products made with these materials to other companies for incorporation into their products. To date, there has been no significant incorporation of our materials or products into customer products that are released for commercial sale. Because there is no demonstrated history of commercial success for our products, it is possible that such commercial success may never happen and that we will never achieve the level of revenues necessary to sustain our business.

We will need to raise substantial additional capital in the future to fund our operations and we may be unable to raise such funds when needed and on acceptable terms, which could have a materially adverse effect on our business.

| 18 |

Developing, manufacturing and selling nanomaterials in commercially-viable quantities requires substantial funding. From December 31, 2015 through April 7, 2016, the Company entered into private placement bridge financings with 14 investors, seven of whom are board members or affiliates of board members, totaling $1,124,750 (the “Bridge Financings”). The investors in the Bridge Financings received common stock warrant coverage of 30% for investments made prior to December 31, 2015 with an exercise price of $8.00 per share, and 20% coverage thereafter with an exercise price of $10.00 per share. During June 2016 the Company repaid i) outstanding principal of $550,000 plus accrued interest of $22,000 to the December 2015 Bridge Financing investors and ii) outstanding principal of $200,000 plus accrued interest of $5,032 to two of the March 2016 Bridge Financing investors. These investors, who are also members of the board of directors of the Company, used the proceeds from repayment of their notes, plus additional funds, to purchase 199,879 additional shares of the Company’s common stock in this offering for approximately $1.6 million. We intend that the primary means for raising such funds will be through this offering. As of the date of this prospectus, we issued and sold 322,254 shares under the Existing Registration Statement at $8.00 per share for total proceeds of $2,578,032 and we had cash on hand that is only sufficient to fund our operations through mid-October 2016. We also believe that we will need approximately $5 million to sustain us for the next twelve months. The Company’s financial projections show that the Company may need to raise an additional $15 million or more before it is capable of achieving sustainable cash flow from operations. The Company can make no assurance that it will be able to raise any additional funds or that the terms and conditions of future financing will be workable or acceptable for the Company and its stockholders. In the event that the Company is not able to raise substantial additional funds in the future on terms that are acceptable or adjust its business model accordingly, the Company may be forced to curtail or cease operations and you could lose all or a significant part of your investment.

We currently have an accumulated deficit and a stockholders’ deficit

As of December 31, 2015 and June 30, 2016, XG Sciences has an accumulated deficit of $(43,371,368) and $(46,087,345), respectively, and total stockholders’ deficit of $(4,071,524) and $(4,364,223), respectively. The deficit reflects net losses in each period since the Company’s inception incurred through development of nanomaterials without the presence of a large scale market to generate substantial revenues to cover development costs and generate a profit. XG Sciences has never paid a dividend.

Investing in a company with a current deficit involves risk, as the Company needs to raise capital to continue funding operations. We cannot guarantee that the company will be able to raise the capital to continue operating at the current deficit or that the revenue from operations and the value of our assets will increase enough to eliminate the deficit.

If we are unable to continue as a going concern, our securities will have little or no value.

The report of our independent registered public accounting firm that accompanies our consolidated financial statements for the year ended December 31, 2015 contains a going concern qualification in which such firm expressed substantial doubt about our ability to continue as a going concern. We currently anticipate that our cash and cash equivalents will be sufficient to fund our operations through mid-October 2016, without raising additional capital. Our continuation as a going concern is dependent upon continued financial support from our shareholders, the ability of us to obtain necessary equity and/or debt financing to continue operations, and the attainment of profitable operations. These factors raise substantial doubt regarding our ability to continue as a going concern. We cannot make any assurances that additional financings will be available to us and, if available, completed on a timely basis, on acceptable terms or at all. If we are unable to complete an equity or debt offering, or otherwise obtain sufficient financing when and if needed, it would negatively impact our business and operations, which would likely cause the price of our common stock to decline. It could also lead to the reduction or suspension of our operations and ultimately force us to cease our operations.

| 19 |

We have limited experience in the higher volume manufacturing that will be required to support profitable operations, and the risks associated with scaling to larger production quantities may be substantial.

We have limited experience manufacturing our products. We have established small-scale commercial or pilot-scale production facilities for our bulk powders, thermal interface materials (“XG TIM™” or TIM), XG Leaf® and SiG materials, but these facilities do not have the existing production capacity to produce sufficient quantities of materials for us to reach sustainable sales levels. In order to develop the capacity to produce much higher volumes, it will be necessary to produce multiples of existing processes or engineer new production processes in some cases. There is no guarantee that we will be able to economically scale-up our production processes to the levels required. If we are unable to scale-up our production processes and facilities to support sustainable sales levels, the Company may be forced to curtail or cease operations and you could lose all or a significant part of your investment.

Projection of fixed monthly expenses and operating losses for the near future means that investors may not earn a return on their investment or may lose all of their investment.

Because of the nature of the Company’s business, the Company projects considerable fixed expenses that lead to projected monthly deficits for the near future. Fixed manufacturing expenses to maintain production facilities, compensation expenses for scientists and other critical personnel, and ongoing rent and utilities amount to several hundred thousand dollars per month, and the Company believes that such expenses are required as a precursor to significant customer sales. However, there can be no assurance that monthly sales will ever reach a sufficient level to cover the cost of ongoing monthly expenses. If sufficient regular monthly sales are not generated to cover these fixed expenses, we will continue to experience monthly profit deficits which, if not eliminated, will require continuing new investment in the Company. If monthly deficits continue beyond levels that investors find tolerable, we may not be able to raise additional funds may be forced to curtail or cease operations and you could lose all or a significant part of your investment.

We have a long and complex sales cycle and have not demonstrated the ability to operate successfully in this environment.

It has been our experience since our inception that the average sales cycle for our products can range from one to seven years from the time a customer begins testing our products until the time that they could be successfully used in a commercial product. The product introduction timing will vary based on the target market, with automotive uses typically being toward the long end and consumer electronics toward the shorter end. We have not demonstrated a track record of

success in completing customer development projects, which makes it difficult for you to evaluate the likelihood of our future success. The sales and development cycle for our products is subject to customer budgetary constraints, internal acceptance procedures, competitive product assessments, scientific and development resource allocations, and other factors beyond our control. If we are not able to successfully accommodate these factors to enable customer development success, we will be unable to achieve sufficient sales to reach profitability. In this case, the Company may not be able to raise additional funds and may be forced to curtail or cease operations and you could lose all or a significant part of your investment.

We could be adversely affected by our exposure to customer concentration risk.

We are subject to customer concentration risk as a result of our reliance on a relatively small number of customers for a significant portion of our revenues. For 2015 we had one customer (one of our Asian distributors) whose purchases accounted for 9% of total product revenues. In 2014 we had another customer that represented 69% of total product revenues. Due to the nature of our business and the relatively large size of many of the applications our customers are developing, we anticipate that we will be dependent on a relatively small number of customers for the majority of our revenues for the next several years. It is possible that only one or two customers could place orders sufficient to utilize most or all of our existing manufacturing capacity.

In this case, there would be a risk of significant loss of future revenues if one or more of these customers were to stop ordering our materials, which could in turn have a material adverse effect on our business and on your investment.

| 20 |

Our revenues often fluctuate significantly based on one-off orders from customers or from the recognition of grant revenues which vary from period-to-period, which may materially impact our financial results from period to period.

Because of the potential for large revenue swings from one-time large orders or grants it may be difficult to accurately forecast the needs for inventory, working capital, and other financial resources from period-to-period. Such orders would require a significant short-term increase in our production capacity and would require the financial resources to add staff and support the associated working capital. If such large one-time orders were not handled smoothly, customer confidence in us as a viable supplier could be reduced and we might not succeed in capturing the additional larger orders that may be reflected in our business plan.

We operate in an advanced technology arena where hypothesized properties and benefits of our products may not be achieved in practice, or in which technological change may alter the attractiveness of our products.

Because there is no sustained history of successful use of our products in commercial applications, there is no assurance that broad successful commercial applications may be technically feasible. Most, if not all, of the scientific and engineering data related to our products has been generated in our own laboratories or in laboratory environments at our customers or third-parties, like universities and national laboratories. It is well known that laboratory data is not always representative of commercial applications.

Likewise, we operate in a market that is subject to rapid technological change. Part of our business strategy is to monitor such change and take steps to remain technologically current, but there is no assurance that such strategy will be successful. If the Company is not able to adapt to new advances in materials sciences, or if unforeseen technologies or materials emerge that are not compatible with our products and services or that could replace our products and services, our revenues and business prospects would likely be adversely affected. Such an occurrence may have severe consequences, including the potential for our investors to lose all of their investment.

Competitors that are larger and better funded may cause the Company to be unsuccessful in selling its products.

The Company operates in a market that is expected to have significant competition in the future. Global research is being conducted by substantially larger companies who have greater financial, personnel, technical, and marketing resources. There can be no assurance that the Company’s strategy of offering better materials based on the Company’s proprietary exfoliated graphite nanoplatelets will be able to compete with other companies, many of whom will have significantly greater resources, on a continuing basis. In the event that we cannot compete successfully, the Company may be forced to cease operations and investors may lose some or all of their investment.

Because of our small size and limited operating history, we are dependent on key employees.

The Company’s operations and development are dependent upon the experience and knowledge of Philip L. Rose, our Chief Executive Officer. If he was to resign or be terminated, the Company’s business would be adversely affected in the short term, and his departure could disrupt the business enough to endanger your investment. The Company also depends on Dr. Liya Wang, Vice President of Research & Development, Robert Privette, Vice President of Energy Markets, Scott Murray, Vice President of Operations, and Dr. Hiroyuki Fukushima, Technical Director. If the services of any of these individuals should become unavailable, the Company’s business operations might be adversely affected. The company does not hold any “Key Person” insurance, and if several of these individuals became unavailable at the same time, the ability of the Company to continue normal business operations might be adversely affected to the extent that revenue or profits could be diminished and you could lose all or a significant amount of your investment.

Our success depends in part on our ability to protect our intellectual property rights, and our inability to enforce these rights could have a material adverse effect on our competitive position.

We rely on the patent, trademark, copyright and trade-secret laws of the United States and the countries where we do business to protect our intellectual property rights. We may be unable to prevent third parties from using our intellectual property without our authorization. The unauthorized use of our intellectual property could reduce any competitive advantage we have developed, reduce our market share or otherwise harm our business. In the event of unauthorized use of our intellectual property, litigation to protect or enforce our rights could be costly, and we may not prevail.

| 21 |

Many of our technologies are not covered by any patent or patent application, and our issued and pending U.S. and non-U.S. patents may not provide us with any competitive advantage and could be challenged by third parties. Our inability to secure issuance of our pending patent applications may limit our ability to protect the intellectual property rights these pending patent applications were intended to cover. Our competitors may attempt to design around our patents to avoid liability for infringement and, if successful, our competitors could adversely affect our market share. Furthermore, the expiration of our patents may lead to increased competition.

Our pending trademark applications may not be approved by the responsible governmental authorities and, even if these trademark applications are granted, third parties may seek to oppose or otherwise challenge these trademark applications. A failure to obtain trademark registrations in the United States and in other countries could limit our ability to protect our products and their associated trademarks and impede our marketing efforts in those jurisdictions.

In addition, effective patent, trademark, copyright and trade secret protection may be unavailable or limited in some foreign countries. In some countries, we do not apply for patent, trademark or copyright protection. We also rely on unpatented proprietary manufacturing expertise, continuing technological innovation and other trade secrets to develop and maintain our competitive position. Although we generally enter into confidentiality agreements with our employees and third parties to protect our intellectual property, these confidentiality agreements are limited in duration and could be breached, and may not provide meaningful protection of our trade secrets or proprietary manufacturing expertise. Adequate remedies may not be available if there is an unauthorized use or disclosure of our trade secrets and manufacturing expertise. In addition, others may obtain knowledge about our trade secrets through independent development or by legal means. The failure to protect our processes, apparatuses, technology, trade secrets and proprietary manufacturing expertise, methods and compounds could have a material adverse effect on our business by jeopardizing critical intellectual property.

Where a product formulation or process is kept as a trade secret, third parties may independently develop or invent and patent products or processes identical to our trade-secret products or processes. This could have an adverse impact on our ability to make and sell products or use such processes and could potentially result in costly litigation in which we might not prevail.

We could face intellectual property infringement claims that could result in significant legal costs and damages and impede our ability to produce key products, which could have a material adverse effect on our business, financial condition and results of operations.