Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-Q

x QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended June 30, 2014

OR

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission file number: 001-35986

Esperion Therapeutics, Inc.

(Exact name of registrant as specified in its charter)

|

Delaware |

|

26-1870780 |

|

(State or other jurisdiction of

incorporation or organization) |

|

(I.R.S. Employer

Identification No.) |

3891 Ranchero Drive, Suite 150

Ann Arbor, MI 48108

(Address of principal executive office) (Zip Code)

Registrant’s telephone number, including area code:

(734) 887-3903

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer o |

|

Accelerated filer o |

|

|

|

|

|

Non-accelerated filer x |

|

Smaller reporting company o |

|

(Do not check if a smaller reporting company) |

|

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No x

As of August 1, 2014, there were 15,445,003 shares of the registrant’s Common Stock, $0.001 par value per share, outstanding.

Table of Contents

Esperion Therapeutics, Inc.

Condensed Balance Sheets

(in thousands, except share data)

|

|

|

June 30,

2014 |

|

December 31,

2013 |

|

|

|

|

(Unaudited) |

|

|

|

|

Assets |

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

47,944 |

|

$ |

56,537 |

|

|

Short-term investments |

|

11,780 |

|

3,525 |

|

|

Prepaid clinical development costs |

|

1,330 |

|

196 |

|

|

Other prepaid and current assets |

|

265 |

|

362 |

|

|

Total current assets |

|

61,319 |

|

60,620 |

|

|

|

|

|

|

|

|

|

Property and equipment, net |

|

851 |

|

81 |

|

|

Intangible assets |

|

56 |

|

56 |

|

|

Long-term investments |

|

7,061 |

|

17,537 |

|

|

Total assets |

|

$ |

69,287 |

|

$ |

78,294 |

|

|

|

|

|

|

|

|

|

Liabilities and stockholders’ equity |

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

Accounts payable |

|

$ |

4,211 |

|

$ |

2,232 |

|

|

Accrued clinical development costs |

|

360 |

|

884 |

|

|

Other accrued liabilities |

|

885 |

|

1,087 |

|

|

Total current liabilities |

|

5,456 |

|

4,203 |

|

|

|

|

|

|

|

|

|

Long-term debt, net of discount |

|

4,922 |

|

— |

|

|

Total liabilities |

|

$ |

10,378 |

|

$ |

4,203 |

|

|

|

|

|

|

|

|

|

Commitments and contingencies (Note 5) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Stockholders’ equity: |

|

|

|

|

|

|

Preferred stock, $0.001 par value; 5,000,000 shares authorized as of June 30, 2014 and December 31, 2013; no shares issued or outstanding at June 30, 2014 and December 31, 2013 |

|

— |

|

— |

|

|

Common stock, $0.001 par value; 120,000,000 shares authorized as of June 30, 2014 and December 31, 2013; 15,445,003 shares issued and 15,431,876 outstanding at June 30, 2014 and 15,357,413 shares issued and 15,340,710 outstanding at December 31, 2013 |

|

15 |

|

15 |

|

|

Additional paid-in capital |

|

144,064 |

|

142,142 |

|

|

Accumulated other comprehensive income (loss) |

|

5 |

|

(3 |

) |

|

Accumulated deficit |

|

(85,175 |

) |

(68,063 |

) |

|

Total stockholders’ equity |

|

58,909 |

|

74,091 |

|

|

Total liabilities and stockholders’ equity |

|

$ |

69,287 |

|

$ |

78,294 |

|

See accompanying notes to the condensed financial statements.

3

Table of Contents

Esperion Therapeutics, Inc.

Condensed Statements of Operations and Comprehensive Loss

(Unaudited)

(in thousands, except share and per share data)

|

|

|

Three Months Ended

June 30, |

|

Six Months Ended

June 30, |

|

|

|

|

2014 |

|

2013 |

|

2014 |

|

2013 |

|

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

|

Research and development |

|

$ |

6,528 |

|

$ |

3,100 |

|

$ |

11,928 |

|

$ |

5,193 |

|

|

General and administrative |

|

2,726 |

|

1,172 |

|

5,216 |

|

2,423 |

|

|

Total operating expenses |

|

9,254 |

|

4,272 |

|

17,144 |

|

7,616 |

|

|

Loss from operations |

|

(9,254 |

) |

(4,272 |

) |

(17,144 |

) |

(7,616 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense |

|

(1 |

) |

(108 |

) |

(1 |

) |

(936 |

) |

|

Change in fair value of warrant liability |

|

— |

|

(2,545 |

) |

— |

|

(2,587 |

) |

|

Other income (expense), net |

|

17 |

|

4 |

|

33 |

|

(21 |

) |

|

Net loss |

|

$ |

(9,238 |

) |

$ |

(6,921 |

) |

$ |

(17,112 |

) |

$ |

(11,160 |

) |

|

Net loss per common share (basic and diluted) |

|

$ |

(0.60 |

) |

$ |

(19.82 |

) |

$ |

(1.11 |

) |

$ |

(32.09 |

) |

|

Weighted-average shares outstanding (basic and diluted) |

|

15,399,018 |

|

349,170 |

|

15,385,009 |

|

347,831 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Other comprehensive loss: |

|

|

|

|

|

|

|

|

|

|

Unrealized loss on investments |

|

$ |

(8 |

) |

$ |

— |

|

$ |

(5 |

) |

$ |

— |

|

|

Total comprehensive loss |

|

$ |

(9,246 |

) |

$ |

(6,921 |

) |

$ |

(17,117 |

) |

$ |

(11,160 |

) |

See accompanying notes to the condensed financial statements.

4

Table of Contents

Esperion Therapeutics, Inc.

Condensed Statements of Cash Flows

(Unaudited)

(in thousands)

|

|

|

Six Months Ended June 30, |

|

|

|

|

2014 |

|

2013 |

|

|

Operating activities |

|

|

|

|

|

|

Net loss |

|

$ |

(17,112 |

) |

$ |

(11,160 |

) |

|

Adjustments to reconcile net loss to net cash used in operating activities: |

|

|

|

|

|

|

Depreciation expense |

|

53 |

|

49 |

|

|

Amortization of debt discount and beneficial conversion feature |

|

— |

|

459 |

|

|

Amortization of debt issuance costs |

|

— |

|

18 |

|

|

Amortization of premiums and discounts on investments |

|

106 |

|

— |

|

|

Revaluation of warrants |

|

— |

|

2,587 |

|

|

Noncash interest expense on convertible notes |

|

— |

|

459 |

|

|

Stock-based compensation expense |

|

1,676 |

|

153 |

|

|

Loss related to assets held for sale |

|

29 |

|

29 |

|

|

(Gain)/Loss on sale of assets |

|

1 |

|

(5 |

) |

|

Changes in assets and liabilities: |

|

|

|

|

|

|

Prepaids and other assets |

|

(992 |

) |

214 |

|

|

Accounts payable |

|

1,789 |

|

288 |

|

|

Other accrued liabilities |

|

(732 |

) |

1,103 |

|

|

Net cash used in operating activities |

|

(15,182 |

) |

(5,806 |

) |

|

|

|

|

|

|

|

|

Investing activities |

|

|

|

|

|

|

Purchases of investments |

|

(4,800 |

) |

— |

|

|

Proceeds from sales/maturities of investments |

|

6,926 |

|

— |

|

|

Proceeds from sale of assets |

|

12 |

|

56 |

|

|

Purchase of property and equipment |

|

(638 |

) |

(18 |

) |

|

Net cash provided by investing activities |

|

1,500 |

|

38 |

|

|

|

|

|

|

|

|

|

Financing activities |

|

|

|

|

|

|

Payments for offering costs in connection with initial public offering |

|

— |

|

(1,067 |

) |

|

Proceeds from issuance of preferred stock, net of issuance costs |

|

— |

|

16,827 |

|

|

Proceeds from exercise of common stock options |

|

142 |

|

123 |

|

|

Proceeds from warrant issuance |

|

78 |

|

— |

|

|

Proceeds from debt issuance, net of issuance costs |

|

4,869 |

|

— |

|

|

Net cash provided by financing activities |

|

5,089 |

|

15,883 |

|

|

|

|

|

|

|

|

|

Net increase (decrease) in cash and cash equivalents |

|

(8,593 |

) |

10,115 |

|

|

Cash and cash equivalents at beginning of period |

|

56,537 |

|

6,512 |

|

|

Cash and cash equivalents at end of period |

|

$ |

47,944 |

|

$ |

16,627 |

|

|

|

|

|

|

|

|

|

Supplemental disclosure of cash flow information: |

|

|

|

|

|

|

Conversion of convertible promissory notes, including accrued interest of $923 into Series A preferred stock |

|

$ |

— |

|

$ |

16,623 |

|

|

Conversion of convertible long-term Pfizer note, including accrued interest of $274 into Series A-1 preferred stock |

|

$ |

— |

|

$ |

7,803 |

|

|

Deferred offering costs not yet paid |

|

$ |

— |

|

$ |

1,383 |

|

See accompanying notes to the condensed financial statements.

5

Table of Contents

Esperion Therapeutics, Inc.

Notes to the Condensed Financial Statements

(Unaudited)

1. The Company and Basis of Presentation

The Company is a clinical stage biopharmaceutical company whose planned principal operations are focused on developing and commercializing first in class, oral, low density lipoprotein cholesterol (LDL-cholesterol) lowering therapies for the treatment of patients with hypercholesterolemia and other cardiometabolic risk markers. ETC-1002, the Company’s lead product candidate, is a unique, first in class, orally available, once daily small molecule designed to lower LDL-cholesterol levels and avoid the side effects associated with currently available LDL-cholesterol lowering therapies. ETC-1002 is being developed primarily for patients with hypercholesterolemia and a history of statin intolerance. Phase 2b clinical trials for ETC-1002 are currently underway and build upon the successful and comprehensive Phase 1 and Phase 2a programs. The Company owns the exclusive worldwide rights to ETC-1002 and its other product candidates. Its facilities are located in Ann Arbor and Plymouth, Michigan.

The Company’s primary activities since incorporation have been conducting research and development activities, including nonclinical and clinical testing, performing business and financial planning, recruiting personnel, and raising capital. Accordingly, the Company has not commenced principal operations and is subject to risks and uncertainties which include the need to research, develop, and clinically test potential therapeutic products; obtain regulatory approvals for its products and commercialize them, if approved; expand its management and scientific staff; and finance its operations with an ultimate goal of achieving profitable operations.

The Company has sustained operating losses since inception and expects such losses to continue over the foreseeable future. Management plans to continue to finance operations with a combination of public and private equity issuances, debt arrangements, collaborations and strategic and licensing arrangements. If adequate funds are not available, the Company may not be able to continue the development of its current or future product candidates, or to commercialize its current or future product candidates, if approved.

Basis of Presentation

The accompanying condensed financial statements are unaudited and were prepared by the Company in accordance with generally accepted accounting principles in the United States of America (GAAP). In the opinion of management, the Company has made all adjustments, which include only normal recurring adjustments necessary for a fair statement of the Company’s financial position and results of operations for the interim periods presented. Certain information and disclosures normally included in the annual financial statements prepared in accordance with GAAP have been condensed or omitted. These condensed interim financial statements should be read in conjunction with the audited financial statements as of and for the year ended December 31, 2013 and the notes thereto, which are included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2013. The results of operations for the interim periods are not necessarily indicative of the results to be expected for a full year, any other interim periods or any future year or period.

Reverse Stock Split

On June 11, 2013, in connection with its initial public offering (the IPO), the Company effectuated a 1-for-6.986 reverse stock split of its outstanding common stock, which was approved by the Company’s board of directors on June 5, 2013. The reverse stock split resulted in an adjustment to the Series A preferred stock and Series A-1 preferred stock conversion prices to reflect a proportional decrease in the number of shares of common stock to be issued upon conversion. The accompanying financial statements and notes to the financial statements give effect to the reverse stock split for all periods presented. The shares of common stock retained a par value of $0.001 per share. Accordingly, stockholders’ equity reflects the reverse stock split by reclassifying from “common stock” to “Additional paid-in capital” in an amount equal to the par value of the decreased shares resulting from the reverse stock split.

6

Table of Contents

Initial Public Offering

On July 1, 2013, the Company completed its IPO whereby the Company sold 5,000,000 shares of common stock at a price of $14.00 per share. The shares began trading on the Nasdaq Global Market on June 26, 2013. On July 11, 2013, the underwriters exercised their over-allotment option in full and purchased an additional 750,000 shares of common stock at a price of $14.00 per share. The Company received approximately $72.2 million in net proceeds from the IPO, including proceeds from the exercise of the underwriters’ over-allotment option, net of underwriting discounts and commissions and offering expenses. Upon closing of the IPO, all outstanding shares of preferred stock converted into 9,210,999 shares of common stock; and warrants exercisable for convertible preferred stock were automatically converted into warrants exercisable for 277,690 shares of common stock, resulting in the reclassification of the related convertible preferred stock warrant liability of $2.9 million to additional paid-in capital (See Note 4).

The following table summarizes the Company’s capitalization upon closing of its initial public offering:

|

Total common stock issued as of June 30, 2013 |

|

396,414 |

|

|

Conversion of Series A preferred stock into common stock upon closing of IPO |

|

8,244,781 |

|

|

Conversion of Series A-1 preferred stock into common stock upon closing of IPO |

|

966,218 |

|

|

Sales of common stock through IPO |

|

5,000,000 |

|

|

Common stock issued as of July 1, 2013 |

|

14,607,413 |

|

|

Issuance of common stock to underwriters due to exercise of over-allotment |

|

750,000 |

|

|

Total common stock issued as of July 11, 2013 |

|

15,357,413 |

|

2. Summary of Significant Accounting Policies

Recent Accounting Pronouncements

In June 2014, the Financial Accounting Standards Board issued Accounting Standards Update (ASU) 2014-10 which improves financial reporting by reducing the cost and complexity associated with the incremental reporting requirements for development stage entities without reducing the relevance of information provided to users of financial statements. Under the amended guidance, issuers are no longer required to (1) present inception-to-date information in the statements of income, cash flows, and shareholder equity, (2) label the financial statements as those of a development stage entity, (3) disclose a description of the development stage activities in which the entity is engaged, and (4) disclose in the first year in which the entity is no longer a development stage entity that in prior years it had been in the development stage. The Company adopted the amendment which resulted in a reduction in disclosures previously relating to a development stage entity.

There have been no other material changes to the significant accounting policies previously disclosed in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2013.

3. Debt

Credit Facility

In June 2014, the Company entered into a loan and security agreement (the “Credit Facility”) with Oxford Finance LLC which provides for initial borrowings of $5.0 million under term loans (“Term A Loan”) and additional borrowings of $15.0 million (“Term B Loan”) at the Company’s option, for a maximum of $20.0 million. On June 30, 2014, the Company received proceeds of $5.0 million from the issuance of secured promissory notes under the Term A Loan. The remaining $15.0 million available under Term B Loan becomes available to be drawn down, at the Company’s sole discretion, until March 31, 2015, upon achieving positive development results in either of the Company’s ongoing Phase 2b clinical studies (a “Milestone Event”). All secured promissory notes issued under the Credit Facility are due on July 1, 2018 and are collateralized by substantially all of the Company’s personal property, other than its intellectual property.

The Company is obligated to make monthly, interest-only payments on Term A Loan until July 1, 2015 and, thereafter, to pay 36 months consecutive, equal monthly installments of principal and interest from August 1, 2015 through July 1, 2018. Upon a Milestone Event, and the subsequent borrowing under the Term B Loan, the term of monthly, interest-only payments will be extended until January 1, 2016. Term A Loan bears interest at an annual rate of 6.40%. In the event the Company enters into Term B Loan, the interest rate will be the greater of (i) 6.40% or (ii) three month LIBOR rate three business days prior to the funding of the new term loan plus an additional 6.17%. In addition, a final payment equal to 8.0% of any amounts drawn under the Credit Facility is due upon the earlier of the maturity date or prepayment of the term loans. The Company is recognizing the final payment as interest expense using the effective interest method over the life of the Credit Facility.

There are no financial covenants associated to the Credit Facility. However, there are negative covenants that limit or restrict the Company’s activities, which include limitations on incurring indebtedness, granting liens, mergers or acquisitions, dispositions of assets, making certain investments, entering into certain transactions with affiliates, paying dividends or distributions, encumbering or pledging interest in its intellectual property and certain other business transactions. Additionally, the Credit Facility also includes events of default, the occurrence and continuation of any of which provides the lenders the right to exercise remedies against the

7

Table of Contents

Company and the collateral securing the loans under the Credit Facility, which includes cash. These events of default include, among other things, non-payment of any amounts due under the Credit Facility, insolvency, the occurrence of a material adverse event, inaccuracy of representations and warranties, cross default to material indebtedness and a material judgment against the Company. Upon the occurrence of an event of default, all obligations under the Credit Facility shall accrue interest at a rate equal to the fixed annual rate plus five percentage points.

In connection with the borrowing of Term A Loan, the Company issued a warrant (the “Warrant”) to purchase 8,230 shares of common stock at an exercise price of $15.19 (see Note 4). The Warrant resulted in a debt discount of $0.1 million which is amortized into interest expense using the effective interest method over the life of Term A Loan. In addition, deferred financing costs of $0.1 million included in other prepaid and current assets on the consolidated balance sheet as of June 30, 2014 are amortized to interest expense using the effective-interest method over the same term. As of June 30, 2014, the remaining unamortized discount and debt issuance costs associated with the debt were $0.1 million and $0.1 million, respectively.

Estimated future principal payments due under the Credit Facility are as follows:

|

Years Ending December 31, |

|

(in thousands) |

|

|

2014 |

|

$ |

— |

|

|

2015 |

|

638 |

|

|

2016 |

|

1,604 |

|

|

2017 |

|

1,709 |

|

|

2018 |

|

1,049 |

|

|

Total |

|

$ |

5,000 |

|

During the six months ended June 30, 2014, the Company recognized $1,000 of interest expense related to the Credit Facility.

Convertible Notes

In January 2012, the Company issued $6.0 million of 10% convertible promissory notes to certain existing investors for cash. In September and November 2012, the Company issued the aggregate of $9.7 million of 10% convertible promissory notes that mature on September 4, 2013 for cash to certain existing investors. In connection with the September convertible note financing, the Company and the holders of the January 2012 convertible promissory notes agreed to extend the maturity date of the January 2012 notes to September 4, 2013. In February 2013, these convertible promissory notes, with an outstanding principal of $15.7 million and accrued interest of $0.9 million, were amended and then converted into 16,623,092 shares of Series A preferred stock, in accordance with their terms and at their conversion price of $1.00 per share, and following such conversion, the notes were cancelled.

The holders of the September convertible promissory notes received the benefit of a deemed conversion price of the September convertible promissory notes that were below the estimated fair value of the Series A convertible preferred stock at the time of their issuance. The fair value of this beneficial conversion feature was estimated to be $0.3 million. The fair value of this beneficial conversion feature was recorded to debt discount and amortized to interest expense using the effective interest method over the term of the convertible promissory notes. As a result of the conversion of the convertible promissory notes into shares of Series A preferred stock in February 2013, the Company recorded an accretion of the beneficial conversion feature of $0 and $0.2 million as interest expense during the six months ended June 30, 2014 and 2013, respectively.

In connection with the issuance of the September and the November 2012 convertible promissory notes, the Company issued warrants to purchase shares of Series A preferred stock for an aggregate price of $9,700. The estimated fair value of the warrants at issuance was $0.3 million. The proceeds from the sale of the preferred stock and warrants were allocated with $9.4 million to the convertible promissory notes and $0.3 million to warrants. This resulted in a discount on the convertible promissory notes which was amortized into interest expense, using the effective interest method, over the life of the convertible promissory notes (see Note 4). As a result of the conversion of the convertible promissory notes into shares of Series A preferred stock in February 2013, the Company recorded $0 and $0.2 million of interest expense for the accretion of this discount during the six months ended June 30, 2014 and 2013, respectively.

In April 2008, the Company acquired all of the capital stock of Esperion from Pfizer in exchange for a non-subordinated convertible note in the original principal amount of $5.0 million. This convertible promissory note had a maturity date of April 28, 2018. The note bore interest at 8.931% annually, payable semiannually on June 30 and December 31 by adding such unpaid interest to the principal of the note, which would thereafter accrue interest.

In May 2013 the Company entered into a stock purchase agreement with Pfizer Inc. and sold 6,750,000 shares of Series A-1 preferred stock at a price of $1.1560 per share, which was the fair value at the transaction date. The purchase price was paid through

8

Table of Contents

the cancellation of all outstanding indebtedness, including accrued interest, under the Pfizer convertible promissory note, which had an outstanding balance, including accrued interest, of $7.8 million as of May 29, 2013. The Series A-1 preferred stock issued in connection with this transaction was subsequently converted into 966,218 shares of common stock upon completion of the IPO on July 1, 2013.

4. Warrants

In connection with the Credit Facility entered into in June 2014, the Company issued a warrant to purchase 8,230 shares of common stock at an exercise price of $15.19. The Warrant will terminate on the earlier of June 30, 2019 and the closing of a merger or consolidation transaction in which the Company is not the surviving entity. The warrants were recorded at fair value of $0.1 million to additional-paid-in-capital in accordance with ASC 815-10 based upon the allocation of the debt proceeds. The Company estimated the fair value of the warrants using a Black-Scholes option-pricing model, which is based, in part, upon subjective assumptions including but not limited to stock price volatility, the expected life of the warrants, the risk-free interest rate and the fair value of the common stock underlying the warrants. The Company estimates the volatility of its stock based on public company peer group historical volatility that is in line with the expected remaining life of the warrants. The risk-free interest rate is based on the U.S. Treasury zero-coupon bond for a maturity similar to the expected remaining life of the warrants. The expected remaining life of the warrants is assumed to be equivalent to their remaining contractual term.

In connection with its various convertible note financing transactions, the Company issued warrants to purchase shares of preferred stock which had provisions where the underlying issuance was contingently redeemable based on events outside the Company’s control and were recorded as a liability in accordance with ASC 480-10. The warrants were classified as liabilities and were recorded on the Company’s balance sheet at fair value on the date of issuance and marked- to-market on each subsequent reporting period, with the fair value changes recognized in the statement of operations. Subsequent to the pricing of the IPO, the Company estimated the fair values of the warrants at each reporting period using a Black-Scholes option-pricing model, which is based, in part, upon subjective assumptions including but not limited to stock price volatility, the expected life of the warrants, the risk-free interest rate and the fair value of the common stock underlying the warrants. The Company estimates the volatility of its stock based on public company peer group historical volatility that is in line with the expected remaining life of the warrants. The risk-free interest rate is based on the U.S. Treasury zero-coupon bond for a maturity similar to the expected remaining life of the warrants. The expected remaining life of the warrants is assumed to be equivalent to their remaining contractual term. Prior to the pricing of the IPO, a Monte Carlo valuation model was utilized to estimate the fair value of the warrants based on the probability and timing of future financings.

The assumptions used in calculating the estimated fair market value at each reporting period prior to the closing of the Company’s IPO represented the Company’s best estimate, however, do involve inherent uncertainties. The estimated fair value of the warrants was determined using the Monte Carlo valuation model which totaled $0.3 million and was comprised of $0.1 million and $0.2 million as of and for the September and November 2012 financing, respectively, and was recorded as a discount on the related convertible promissory notes and amortized as interest expense over the term of the convertible promissory notes. Inherent in the Monte Carlo valuation model are assumptions related to expected stock-price volatility, expected life and risk-free interest rate. The Company estimates the volatility of its stock based on public company peer group historical volatility that is in line with the expected remaining life of the warrants. The risk-free interest rate is based on the U.S. Treasury zero-coupon bond on the grant date for a maturity similar to the expected remaining life of the warrants. The expected life of the warrants is assumed to be equivalent to their remaining contractual term. The dividend rate is based on the historical rate, which the Company anticipates to remain at zero. The Monte Carlo model was used prior to the closing of the Company’s IPO to appropriately value the potential future exercise price based on various exit scenarios. This requires Level 3 inputs which are based on the Company’s estimates of the probability and timing of potential future financings.

Upon the closing of the Company’s IPO, all warrants exercisable for 1,940,000 shares of Series A preferred stock, at an exercise price of $1.00 per share, were automatically converted into warrants exercisable for 277,690 shares of common stock, at an exercise price of $6.99 per share. As a result, the Company concluded the warrants outstanding no longer met the criteria to be classified as liabilities and were reclassified to additional paid-in capital at fair value on the date of reclassification. The 277,690 warrants outstanding as of June 30, 2014 expire in February 2018. During the three and six months ended June 30, 2014 and 2013, the Company recognized a loss of $0, $0, $2.5 million and $2.6 million, respectively, relating to the change in the fair value of the warrant liability.

As of June 30, 2014, the Company had warrants outstanding that were exercisable for a total of 285,920 shares of common stock at a weighted-average exercise price of $7.23 per share.

9

Table of Contents

5. Commitments and contingencies

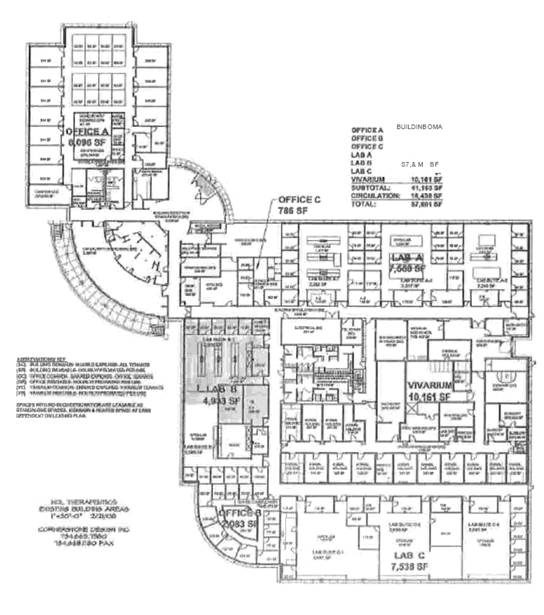

In February 2014, the Company entered into an operating lease agreement for its principal executive offices located in Ann Arbor, Michigan commencing in April 2014 with a term of 63 months. The Company’s lease provides for fixed monthly rent for the term of the lease, with monthly rent increasing every 12 months subsequent to the first three months of the lease, and also provides for certain rent adjustments to be paid as determined by the landlord.

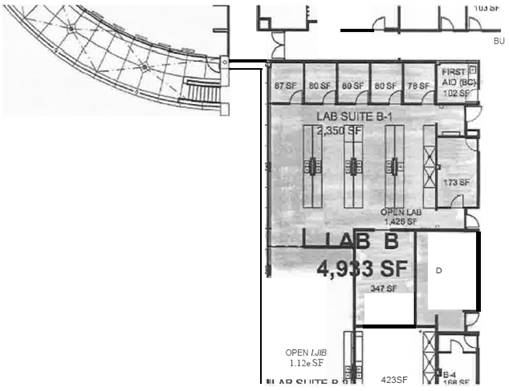

In May 2014, the Company entered into the third amendment to the operating lease agreement for its laboratory facility in Plymouth, Michigan. The amendment provides in part that (i) the expiration date of the term of the lease is extended from April 2014 to April 2017, (ii) the rentable laboratory space is adjusted to 3,045 square feet, (iii) the Company’s proportionate share of the landlord’s expenses and taxes is adjusted to 7.40%, (iv) the Company may exercise its option to renew the lease for one term of three years through written notice to the landlord by February 2017 and (v) the annual base rent under the lease is decreased to $37,000, subject to increase and adjustments provided in the lease.

The following table summarizes the Company’s future minimum lease payments as of June 30, 2014:

|

|

|

Total |

|

Less than

1 Year |

|

1-3 Years |

|

3-5 Years |

|

More than

5 Years |

|

|

|

|

(in thousands) |

|

|

Operating leases |

|

$ |

615 |

|

$ |

128 |

|

$ |

267 |

|

$ |

211 |

|

$ |

9 |

|

|

Total |

|

$ |

615 |

|

$ |

128 |

|

$ |

267 |

|

$ |

211 |

|

$ |

9 |

|

6. Investments

The following table summarizes the Company’s cash equivalents and investments:

|

|

|

June 30, 2014 |

|

|

|

|

Amortized

Cost |

|

Gross

Unrealized

Gains |

|

Gross

Unrealized

Losses |

|

Estimated

Fair

Value |

|

|

|

|

(in thousands) |

|

|

Cash equivalents: |

|

|

|

|

|

|

|

|

|

|

Money market funds |

|

$ |

357 |

|

$ |

— |

|

$ |

— |

|

$ |

357 |

|

|

Short-term investments: |

|

|

|

|

|

|

|

|

|

|

Certificates of deposit |

|

237 |

|

— |

|

— |

|

237 |

|

|

U.S. treasury notes |

|

9,101 |

|

5 |

|

— |

|

9,106 |

|

|

U.S. government agency securities |

|

2,437 |

|

— |

|

— |

|

2,437 |

|

|

Long-term investments: |

|

|

|

|

|

|

|

|

|

|

U.S. treasury notes |

|

1,998 |

|

4 |

|

— |

|

2,002 |

|

|

U.S. government agency securities |

|

5,063 |

|

— |

|

(4 |

) |

5,059 |

|

|

Total |

|

$ |

19,193 |

|

$ |

9 |

|

$ |

(4 |

) |

$ |

19,198 |

|

|

|

|

December 31, 2013 |

|

|

|

|

Amortized

Cost |

|

Gross

Unrealized

Gains |

|

Gross

Unrealized

Losses |

|

Estimated

Fair

Value |

|

|

|

|

(in thousands) |

|

|

Cash equivalents: |

|

|

|

|

|

|

|

|

|

|

Money market funds |

|

$ |

5,356 |

|

$ |

— |

|

$ |

— |

|

$ |

5,356 |

|

|

Short-term investments: |

|

|

|

|

|

|

|

|

|

|

U.S. treasury notes |

|

2,071 |

|

— |

|

— |

|

2,071 |

|

|

U.S. government agency securities |

|

1,454 |

|

— |

|

— |

|

1,454 |

|

|

Long-term investments: |

|

|

|

|

|

|

|

|

|

|

Certificates of deposit |

|

238 |

|

— |

|

— |

|

238 |

|

|

U.S. treasury notes |

|

9,116 |

|

3 |

|

(2 |

) |

9,117 |

|

|

U.S. government agency securities |

|

8,187 |

|

1 |

|

(5 |

) |

8,183 |

|

|

Total |

|

$ |

26,422 |

|

$ |

4 |

|

$ |

(7 |

) |

$ |

26,419 |

|

At June 30, 2014 and December 31, 2013, remaining contractual maturities of available for sale investments classified as current on the balance sheet were less than 12 months, and remaining contractual maturities of available for sale investments classified as long term were less than two years.

10

Table of Contents

There were no unrealized gains or losses on investments reclassified from accumulated other comprehensive income (loss) to other income (expense) in the Statement of Operations during the six months ended June 30, 2014 and 2013.

7. Fair Value Measurements

The Company follows accounting guidance that emphasizes that fair value is a market-based measurement, not an entity-specific measurement. Fair value is defined as “the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date.” Fair value measurements are defined on a three level hierarchy:

|

Level 1 inputs: |

|

Quoted prices for identical assets or liabilities in active markets; |

|

|

|

|

|

Level 2 inputs: |

|

Observable inputs other than Level 1 prices, such as quoted market prices for similar assets or liabilities or other inputs that are observable or can be corroborated by market data; and |

|

|

|

|

|

Level 3 inputs: |

|

Unobservable inputs that are supported by little or no market activity and require the reporting entity to develop assumptions that market participants would use when pricing the asset or liability. |

The following table presents the Company’s financial assets and liabilities that have been measured at fair value on a recurring basis:

|

Description |

|

Total |

|

Level 1 |

|

Level 2 |

|

Level 3 |

|

|

|

|

(in thousands) |

|

|

June 30, 2014 |

|

|

|

|

|

|

|

|

|

|

Assets: |

|

|

|

|

|

|

|

|

|

|

Money market funds |

|

$ |

357 |

|

$ |

357 |

|

$ |

— |

|

$ |

— |

|

|

Available for sale securities: |

|

|

|

|

|

|

|

|

|

|

Certificates of deposit |

|

237 |

|

237 |

|

— |

|

— |

|

|

U.S. treasury notes |

|

11,108 |

|

11,108 |

|

— |

|

— |

|

|

U.S. government agency securities |

|

7,496 |

|

— |

|

7,496 |

|

— |

|

|

Total assets at fair value |

|

$ |

19,198 |

|

$ |

11,702 |

|

$ |

7,496 |

|

$ |

— |

|

|

December 31, 2013 |

|

|

|

|

|

|

|

|

|

|

Assets: |

|

|

|

|

|

|

|

|

|

|

Money market funds |

|

$ |

5,356 |

|

$ |

5,356 |

|

$ |

— |

|

$ |

— |

|

|

Available for sale securities: |

|

|

|

|

|

|

|

|

|

|

Certificates of deposit |

|

238 |

|

238 |

|

— |

|

— |

|

|

U.S. treasury notes |

|

11,188 |

|

11,188 |

|

— |

|

— |

|

|

U.S. government agency securities |

|

9,637 |

|

— |

|

9,637 |

|

— |

|

|

Total assets at fair value |

|

$ |

26,419 |

|

$ |

16,782 |

|

$ |

9,637 |

|

$ |

— |

|

There were no transfers between Levels 1, 2 or 3 during the six months ended June 30, 2014 and 2013.

Fair Value Measurements on a Nonrecurring Basis

In addition to items that are measured at fair value on a recurring basis, the Company also measures assets held for sale at the lower of its carrying amount or fair value on a nonrecurring basis. During the six months ended June 30, 2014 and 2013, the Company recognized impairment expense of $0 and $27,000, respectively, related to the assets held for sale. The fair value of assets held for sale was estimated using a market approach, considering the estimated fair value for other comparable equipment which are Level 3 inputs.

8. Convertible Preferred Stock and Stockholders’ Equity

On April 19, 2013, the Company issued and sold an aggregate of 17,000,000 shares of Series A preferred stock at a price of $1.00 per share for proceeds of $16.9 million, which is net of issuance costs of $0.1 million, to funds affiliated with Longitude Capital and certain existing investors. Each share of Series A preferred stock issued in the financing was convertible into 0.143 shares of common stock as of June 30, 2013. Upon the closing of the financing, Patrick Enright of Longitude Capital became a member of the board of directors.

On May 29, 2013, the Company entered into a stock purchase agreement with Pfizer Inc. and issued and sold 6,750,000 shares of Series A-1 preferred stock at a price of $1.1560 per share. The purchase price was paid through the cancellation of all

11

Table of Contents

outstanding indebtedness, including accrued interest, under the Pfizer convertible promissory note, which had an aggregate balance, including accrued interest, of $7.8 million as of May 29, 2013. Each share of Series A-1 preferred stock issued in the agreement was convertible into 0.143 shares of common stock upon the closing of the Company’s IPO.

Upon the closing of the Company’s IPO on July 1, 2013, all of the outstanding shares of convertible preferred stock were converted into 9,210,999 shares of common stock. As of June 30, 2014, the Company did not have any convertible preferred stock issued or outstanding.

9. Stock Compensation

2013 Stock Option and Incentive Plan

On June 7, 2013, the Company’s stockholders approved the 2013 Stock Option and Incentive Plan (the “2013 Plan”), which became effective on June 25, 2013. The number of shares of stock reserved and available for issuance under the 2013 Plan is the sum of (i) 1,100,000, plus (ii) 54,129 shares originally reserved under the Company’s 2008 Incentive Stock Option and Restricted Stock Plan (the “2008 Plan”) that became available for issuance under the 2013 Plan upon completion of the Company’s initial public offering, plus (iii) the shares underlying any awards granted under the 2008 Plan that are forfeited, canceled, held back upon the exercise of an option or settlement of an award to cover the exercise price or tax withholding, reacquired by the Company prior to vesting, satisfied without the issuance of stock or otherwise terminated (other than be exercise). Additionally, on January 1, 2014 and each January 1 thereafter, the number of shares reserved and available for issuance under the 2013 Plan shall be cumulatively increased by two and a half percent of the number of shares issued and outstanding on the immediately preceding December 31 or such lesser number of shares as determined by the plan administrator. On January 1, 2014, the number of shares of stock reserved and available for issuance under the 2013 Plan increased by 383,935 shares.

Under the 2013 Plan the vesting of options granted or restricted awards given will be determined individually with each option grant. Stock options have a 10 year life and expire if not exercised within that period, or if not exercised within 90 days of cessation of employment with the Company.

The following table summarizes the activity relating to the Company’s options to purchase common stock for the six months ended June 30, 2014:

|

|

|

Number of

Options |

|

Weighted-Average

Price

Per Share |

|

Weighted-Average

Remaining

Contractual

Term (Years) |

|

Aggregate

Intrinsic

Value |

|

|

|

|

|

|

|

|

|

|

(in thousands) |

|

|

Outstanding at December 31, 2013 |

|

1,401,101 |

|

$ |

9.59 |

|

8.95 |

|

$ |

7,755 |

|

|

Granted |

|

251,500 |

|

$ |

14.67 |

|

|

|

|

|

|

Forfeited or expired (vested and unvested) |

|

(38,771 |

) |

$ |

6.17 |

|

|

|

|

|

|

Exercised |

|

(87,590 |

) |

$ |

1.62 |

|

|

|

|

|

|

Outstanding at June 30, 2014 |

|

1,526,240 |

|

$ |

10.98 |

|

8.69 |

|

$ |

8,150 |

|

The following table summarizes information about the Company’s stock option plan as of June 30, 2014:

|

|

|

Number of

Options |

|

Weighted-Average

Price

Per Share |

|

Weighted-Average

Remaining

Contractual

Term (Years) |

|

Aggregate

Intrinsic

Value |

|

|

|

|

|

|

|

|

|

|

(in thousands) |

|

|

Vested and expected to vest at June 30, 2014 |

|

1,465,510 |

|

$ |

10.90 |

|

8.67 |

|

$ |

7,928 |

|

|

Exercisable at June 30, 2014 |

|

609,994 |

|

$ |

4.59 |

|

7.78 |

|

$ |

6,956 |

|

As of June 30, 2014, there was approximately $8.4 million of unrecognized compensation cost related to unvested options, adjusted for forfeitures, which will be recognized over a weighted-average period of approximately 3 years.

10. Income Taxes

There was no provision for income taxes for the three or six months ended June 30, 2014 and 2013 because the Company has incurred operating losses since inception. At June 30, 2014, the Company has concluded that it is more likely than not that the Company will not realize the benefit of its deferred tax assets due to its history of losses. Accordingly, the net deferred tax assets have been fully reserved.

11. Net Loss Per Common Share

Basic net loss per share is calculated by dividing net loss by the weighted-average number of common shares outstanding during the period, without consideration for common stock equivalents. Diluted net loss per share is computed by dividing net loss by

12

Table of Contents

the weighted-average number of common stock equivalents outstanding for the period determined using the treasury-stock method. For purposes of this calculation, warrants for common stock, stock options and unvested restricted stock are considered to be common stock equivalents and are only included in the calculation of diluted net loss per share when their effect is dilutive. Interest expense for convertible debt that is dilutive is added back to net income in the calculation of diluted net loss per share.

The shares outstanding at the end of the respective periods presented below, after giving effect for the 1-for-6.986 reverse stock split, were excluded from the calculation of diluted net loss per share due to their anti-dilutive effect:

|

|

|

June 30,

2014 |

|

December 31,

2013 |

|

|

|

|

|

|

|

|

|

Warrants for common stock |

|

285,920 |

|

277,690 |

|

|

Common shares under option |

|

1,526,240 |

|

1,401,101 |

|

|

Unvested restricted stock |

|

13,127 |

|

16,703 |

|

|

Total potential dilutive shares |

|

1,825,287 |

|

1,695,494 |

|

13

Table of Contents

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations

The following discussion and analysis of our financial condition and results of operations should be read in conjunction with our condensed financial statements and related notes appearing elsewhere in this Quarterly Report on Form 10-Q and our annual report on Form 10-K dated December 31, 2013.

Forward-Looking Statements

This Quarterly Report on Form 10-Q contains “forward-looking statements” within the meaning of Section 27A of the Securities Act and Section 21E of the Securities Exchange Act of 1934, as amended (the Exchange Act). These forward-looking statements are based on our management’s belief and assumptions and on information currently available to management. Although we believe that the expectations reflected in these forward-looking statements are reasonable, these statements relate to future events, including our clinical development plans, or our future financial performance, and involve known and unknown risks, uncertainties and other factors that may cause our actual results, performance or achievements, including in relation to the clinical development of ETC-1002, to be materially different from any future results, performance or achievements, including in relation to the clinical development of ETC-1002, expressed or implied by these forward-looking statements.

Forward-looking statements are often identified by the use of words such as, but not limited to, “may,” “will,” “should,” “expects,” “intends,” “plans,” “anticipates,” “believes,” “estimates,” “predicts,” “potential,” “continue” or the negative of these terms or other similar terminology. These statements are only predictions. You should not place undue reliance on forward-looking statements because they involve known and unknown risks, uncertainties and other factors, which are, in some cases, beyond our control and that could materially affect results. Factors that may cause actual results to differ materially from current expectations include, among other things, those referred to or discussed in the section titled “Risk Factors” included in Item 1A of Part II of this Quarterly Report on Form 10-Q. If one or more of these risks or uncertainties occur, or if our underlying assumptions prove to be incorrect, actual events or results may vary significantly from those implied or projected by the forward-looking statements. No forward-looking statement is a guarantee of future performance.

The forward-looking statements in this report represent our views as of the date of this quarterly report. Except as required by law, we undertake no obligation to update any forward-looking statements to reflect events or circumstances after the date of such statements.

Overview

Corporate Overview

We are a clinical stage biopharmaceutical company focused on developing and commercializing first in class, oral, low density lipoprotein cholesterol (LDL-cholesterol) lowering therapies for the treatment of patients with hypercholesterolemia and other cardiometabolic risk markers. ETC-1002, our lead product candidate, is a unique, first in class, orally available, once-daily small molecule designed to lower LDL-cholesterol levels and avoid the side effects associated with currently available LDL-cholesterol lowering therapies. ETC-1002 is being developed primarily for patients with hypercholesterolemia and a history of statin intolerance. Phase 2b clinical trials for ETC-1002 are currently underway and build upon the successful and comprehensive Phase 1 and Phase 2a programs. We hold the exclusive worldwide rights to ETC-1002 and our other product candidates.

We were incorporated in Delaware in January 2008 and commenced our operations in April 2008. Since our inception, we have devoted substantially all of our resources to developing ETC-1002 and our other product candidates, business planning, raising capital and providing general and administrative support for these operations. We have funded our operations primarily through the issuance of preferred stock, our initial public offering of common stock, which we closed in July 2013, convertible promissory notes, secured promissory notes, and warrants to purchase shares of preferred stock.

On July 1, 2013, we completed the initial public offering, or IPO, of our common stock pursuant to a registration statement on Form S-1. In the IPO, we sold an aggregate of 5,000,000 shares of common stock under the registration statement at a public offering price of $14.00 per share. Net proceeds from the IPO were approximately $62.7 million, after deducting underwriting discounts and commissions and offering expenses. Upon the closing of the IPO, all outstanding shares of our preferred stock were converted into 9,210,999 shares of common stock. Additionally, as part of the IPO, we granted the underwriters a 30-day option to purchase up to 750,000 additional shares of common stock at the IPO price to cover over-allotments, if any. On July 11, 2013, the underwriters exercised this option in full. As a result of this exercise, we received an additional $9.5 million in proceeds, net of underwriting discounts and commissions and offering expenses.

We have not commenced principal operations and do not have any products approved for sale. To date, we have not generated any revenue. We have never been profitable and our net losses were $9.2 million and $6.9 million for the three months ended June 30, 2014 and 2013, and were $17.1 million and $11.2 million for the six months ended June 30, 2014 and 2013, respectively. Substantially all of our net losses resulted from costs incurred in connection with research and development programs, general and administrative costs associated with our operations and the mark-to-market of our liability classified warrants. We expect to incur significant expenses and increasing operating losses for the foreseeable future. We expect our expenses to increase in connection with our ongoing activities, including, among others:

· conducting additional clinical studies of ETC-1002 to complete its development;

14

Table of Contents

· seeking regulatory approval for ETC-1002;

· commercializing ETC-1002; and

· operating as a public company.

Accordingly, we will need additional financing to support our continuing operations. We will seek to fund our operations through public or private equity or debt financings or through other sources, which may include collaborations with third parties. Adequate additional financing may not be available to us on acceptable terms, or at all. Our failure to raise capital as and when needed would have a material adverse effect on our financial condition and our ability to pursue our business strategy or continue operations. We will need to generate significant revenues to achieve profitability, and we may never do so.

Product Overview

ETC-1002, our lead product candidate, is a novel, first in class, orally available, once-daily small molecule therapy designed to target known lipid and carbohydrate metabolic pathways to lower levels of LDL-cholesterol and to avoid side effects associated with currently available LDL-cholesterol lowering therapies to improve cardiometabolic risk markers. We acquired the rights to ETC-1002 from Pfizer in 2008. We own the exclusive worldwide rights to ETC-1002 and we are not obligated to make any royalty or milestone payments to Pfizer.

During the six months ended June 30, 2013, we incurred $4.3 million in expenses related to our Phase 2a proof-of-concept clinical study in patients with hypercholesterolemia and Type 2 diabetes (ETC-1002-005) which reported top-line results in January 2013, our Phase 2a proof-of-concept clinical study in patients with hypercholesterolemia and a history of statin intolerance (ETC-1002-006) which reported top-line results in June 2013 and our Phase 2a clinical study in patients with hypercholesterolemia already taking atorvastatin 10 mg (ETC-1002-007) which reported top-line results in September 2013.

During the six months ended June 30, 2014, we incurred $7.5 million in expenses related to our Phase 2b clinical study in patients with hypercholesterolemia with or without statin intolerance (ETC-1002-008), our Phase 2b clinical study in patients with hypercholesterolemia already receiving statin therapy (ETC-1002-009), our Phase 2 clinical study in patients with hypercholesterolemia and hypertension (ETC-1002-014) and other clinical pharmacology studies (ETC-1002-012 and ETC-1002-013).

We also have two other product candidates in preclinical development. We licensed one of these product candidates from the Cleveland Clinic Foundation, or CCF, and are obligated to make certain royalty and milestone payments (consisting of cash and common stock) to CCF, including a minimum annual cash payment of $50,000 during years when a milestone payment is not met. No milestone or royalty payments will be due to any third-party in connection with the development and commercialization of our other preclinical product candidate, ESP41091.

Program Developments

ETC-1002-008 — Phase 2b clinical study in patients with hypercholesterolemia with or without statin intolerance

The ETC-1002-008 Phase 2b clinical study randomized 349 patients at 62 sites across the U.S. and is evaluating parallel doses of 120 mg or 180 mg of ETC-1002 as monotherapy or in combination with ezetimibe. The primary objective of this study is to assess the LDL-cholesterol lowering efficacy of ETC-1002 monotherapy versus ezetimibe monotherapy in patients with hypercholesterolemia with or without statin intolerance treated for 12 weeks. Secondary objectives include assessing the dose response of ETC-1002, assessing the effect of ETC-1002 on additional lipid and cardiometabolic biomarkers including hsCRP (high sensitivity C-reactive protein), characterizing the tolerability and safety of ETC-1002 and assessing the safety and efficacy of ETC-1002 in combination with ezetimibe. We initiated ETC-1002-008 in October 2013 and expect to report top-line results from this study in October 2014.

ETC-1002-009 — Phase 2b clinical study in patients with hypercholesterolemia already receiving statin therapy

The ETC-1002-009 Phase 2b clinical study is a randomized, double-blind, placebo-controlled study that is evaluating parallel doses of 120 mg or 180 mg of ETC-1002 versus placebo for 12 weeks in approximately 132 patients with hypercholesterolemia who are already receiving statin therapy. The primary objective of the study is to assess the LDL-cholesterol lowering efficacy of ETC-1002 in patients with hypercholesterolemia already receiving statin therapy. Secondary objectives include assessing the dose response of ETC-1002, assessing the effect of ETC-1002 on additional lipid and cardiometabolic risk markers including hsCRP and characterizing the tolerability and safety of ETC-1002. We initiated ETC-1002-009 in March 2014 and expect to report top-line results from this study in the first quarter of 2015.

15

Table of Contents

ETC-1002-014 — Phase 2 clinical study in patients with hypercholesterolemia and hypertension

The ETC-1002-014 Phase 2 clinical trial is a randomized, double-blind, multi-center, placebo-controlled study that is evaluating parallel doses of 120 mg or 180 mg of ETC-1002 versus placebo for six weeks in approximately 144 patients with both hypercholesterolemia and hypertension. The primary objective of the study is to assess the LDL-cholesterol lowering efficacy of ETC-1002 monotherapy versus placebo and secondary objectives include assessing the effect of ETC-1002 on blood pressure, other lipid and cardiometabolic risk markers and characterizing the tolerability and safety of ETC-1002. We initiated ETC-1002-014 in July 2014 and expect to report top-line results from this study in the second quarter of 2015.

ETC-1002 Nonclinical Studies

In the second quarter of 2014, we submitted final reports for the long term, chronic safety studies in monkeys (12 months) and rats (6 months) to FDA. There were no unexpected findings in these studies. The two-year carcinogenicity studies in mice and rats were completed in the second quarter of 2014 and we expect final results and reports from these studies to be filed with FDA in December 2014.

Financial Operations Overview

Revenue

To date, we have not generated any revenue. In the future, we may generate revenue from the sale of ETC-1002 or our other product candidates. If we fail to complete the development of ETC-1002 or our other product candidates and secure approval from regulatory authorities, our ability to generate future revenue and our results of operations and financial position will be adversely affected.

Research and Development Expenses

Since our inception, we have focused our resources on our research and development activities, including conducting preclinical and clinical studies. Our research and development expenses consist primarily of costs incurred in connection with the development of ETC-1002, which include:

· expenses incurred under agreements with consultants, contract research organizations, or CROs, and investigative sites that conduct our preclinical and clinical studies;

· the cost of acquiring, developing and manufacturing clinical study materials;

· employee-related expenses, including salaries, benefits, stock-based compensation and travel expenses;

· allocated expenses for rent and maintenance of facilities, insurance and other supplies; and

· costs related to compliance with regulatory requirements.

We expense research and development costs as incurred. To date, substantially all of our research and development work has been related to ETC-1002. Costs for certain development activities, such as clinical studies, are recognized based on an evaluation of the progress to completion of specific tasks using data such as patient enrollment, clinical site activations or information provided to us by our vendors. Our direct research and development expenses consist principally of external costs, such as fees paid to investigators, consultants, central laboratories and CROs in connection with our clinical studies. We do not allocate acquiring and manufacturing clinical study materials, salaries, stock-based compensation, employee benefits or other indirect costs related to our research and development function to specific programs.

Our research and development expenses are expected to increase in the foreseeable future. Costs associated with ETC-1002 will increase as we continue to conduct our Phase 2b clinical studies and initiate our Phase 3 clinical studies. We cannot determine with certainty the duration and completion costs associated with the ongoing or future clinical studies of ETC-1002. Also, we cannot conclude with certainty if, or when, we will generate revenue from the commercialization and sale of ETC-1002 or our other product candidates for which we obtain regulatory approval, if ever. We may never succeed in obtaining regulatory approval for any of our product candidates, including ETC-1002. The duration, costs and timing associated with the development and commercialization of ETC-1002 and our other product candidates will depend on a variety of factors, including uncertainties associated with the results of our clinical studies and our ability to obtain regulatory approval. For example, if the FDA or another regulatory authority were to require us to conduct clinical studies beyond those that we currently anticipate will be required for the completion of clinical development or post-commercialization clinical studies of ETC-1002, or if we experience significant delays in enrollment in any of

16

Table of Contents

our clinical studies, we could be required to expend significant additional financial resources and time on the completion of clinical development or post-commercialization clinical studies of ETC-1002.

General and Administrative Expenses

General and administrative expenses primarily consist of salaries and related costs for personnel, including stock-based compensation and travel expenses, associated with our executive, accounting and finance, operational and other administrative functions. Other general and administrative expenses include facility related costs, communication expenses and professional fees for legal, patent prosecution, protection and review, consulting and accounting services.

We anticipate that our general and administrative expenses will increase in the future in connection with the continued research and development and commercialization of ETC-1002, increases in our headcount, expansion of our information technology infrastructure, increased legal, compliance, accounting and investor and public relations expenses associated with being a public company.

Interest Expense

Interest expense consists primarily of non-cash interest costs associated with our convertible promissory notes, cash interest costs associated with our Credit Facility and non-cash interest costs associated to the amortization of the related debt discount, deferred issuance costs and final payment fee.

Critical Accounting Policies and Significant Judgments and Estimates

Our discussion and analysis of our financial condition and results of operations is based on our financial statements, which have been prepared in accordance with generally accepted accounting principles in the United States, or U.S. GAAP. The preparation of these financial statements requires us to make estimates and judgments that affect the reported amounts of assets, liabilities and expenses and the disclosure of contingent assets and liabilities in our financial statements. We evaluate our estimates and judgments on an ongoing basis, including those related to accrued expenses and stock-based compensation. We base our estimates on historical experience, known trends and events, contractual milestones and other various factors that are believed to be reasonable under the circumstances, the results of which form the basis for making judgments about the carrying values of assets and liabilities that are not readily apparent from other sources. Our actual results may differ from these estimates under different assumptions or conditions.

In June 2014, the Financial Accounting Standards Board issued Accounting Standards Update (ASU) 2014-10 which improves financial reporting by reducing the cost and complexity associated with the incremental reporting requirements for development stage entities without reducing the relevance of information provided to users of financial statements. Under the amended guidance, we are no longer required to (1) present inception-to-date information in the statements of income, cash flows, and shareholder equity, (2) label the financial statements as those of a development stage entity, (3) disclose a description of the development stage activities in which the entity is engaged, and (4) disclose in the first year in which the entity is no longer a development stage entity that in prior years it had been in the development stage. We adopted the amendment which resulted in a reduction in disclosures previously relating to a development stage entity.

With the exception of the Company’s adoption of the accounting standard noted above, there have been no material changes to the significant accounting policies previously disclosed in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2013.

17

Table of Contents

Results of Operations

Comparison of the Three Months Ended June 30, 2014 and 2013

The following table summarizes our results of operations for the three months ended June 30, 2014 and 2013:

|

|

|

Three Months Ended June 30, |

|

|

|

|

|

|

2014 |

|

2013 |

|

Change |

|

|

|

|

(Unaudited, in thousands) |

|

|

Operating Expenses: |

|

|

|

|

|

|

|

|

Research and development |

|

$ |

6,528 |

|

$ |

3,100 |

|

$ |

3,428 |

|

|

General and administrative |

|

2,726 |

|

1,172 |

|

1,554 |

|

|

Loss from operations |

|

(9,254 |

) |

(4,272 |

) |

(4,982 |

) |

|

Interest expense |

|

(1 |

) |

(108 |

) |

107 |

|

|

Change in fair value of warrant liability |

|

— |

|

(2,545 |

) |

2,545 |

|

|

Other income (expense), net |

|

17 |

|

4 |

|

13 |

|

|

Net loss |

|

$ |

(9,238 |

) |

$ |

(6,921 |

) |

$ |

(2,317 |

) |

Research and development expenses

Research and development expenses for the three months ended June 30, 2014 were $6.5 million, compared to $3.1 million for the three months ended June 30, 2013, an increase of $3.4 million. The increase in research and development expenses is primarily related to the further clinical development of ETC-1002 in our Phase 2 clinical program.

General and administrative expenses

General and administrative expenses for the three months ended June 30, 2014 were $2.7 million, compared to $1.2 million for the three months ended June 30, 2013, an increase of $1.5 million. The increase in general and administrative expenses was primarily attributable to costs to support public company operations, increases in our headcount, which includes increased stock-based compensation expense, and other costs to support our growing organization.

Interest expense

We incurred $1,000 in interest expense for the three months ended June 30, 2014 compared to $0.1 million for the three months ended June 30, 2013. The decrease in interest expense was primarily related the conversion of our convertible promissory notes issued in January, September and November 2012, into an aggregate of 16,623,092 shares of Series A preferred stock in February 2013, as well as the elimination of accrued interest on the 8.931% convertible promissory note issued to Pfizer, which converted into 6,750,000 shares of Series A-1 preferred stock in May 2013. This was partially offset by interest expense related to our Credit Facility during the three months ended June 30, 2014.

Change in fair value of warrant liability

The outstanding warrants at June 30, 2013 to purchase 277,690 shares of our common stock required liability classification and mark-to-market accounting at each reporting period in accordance with ASC 480-10 prior to the completion of our IPO. The fair values of the warrants were determined using the Monte Carlo simulation valuation model and resulted in the recognition of a loss of $2.5 million related to the change in fair values for the three months ended June 30, 2013.

Other income (expense), net

Other income (expense), net for the three months ended June 30, 2014 was income of $17,000 compared to $4,000 for the three months ended June 30, 2013, an increase of $13,000. This increase was primarily related to an increase in interest income earned on our cash and cash equivalents.

Comparison of the Six Months Ended June 30, 2014 and 2013

The following table summarizes our results of operations for the six months ended June 30, 2014 and 2013:

|

|

|

Six Months Ended June 30, |

|

|

|

|

|

|

2014 |

|

2013 |

|

Change |

|

|

|

|

(Unaudited, in thousands) |

|

|

Operating Expenses: |

|

|

|

|

|

|

|

|

Research and development |

|

$ |

11,928 |

|

$ |

5,193 |

|

$ |

6,735 |

|

|

General and administrative |

|

5,216 |

|

2,423 |

|

2,793 |

|

|

Loss from operations |

|

(17,144 |

) |

(7,616 |

) |

(9,528 |

) |

|

Interest expense |

|

(1 |

) |

(936 |

) |

935 |

|

|

Change in fair value of warrant liability |

|

— |

|

(2,587 |

) |

2,587 |

|

|

Other income (expense), net |

|

33 |

|

(21 |

) |

54 |

|

|

Net loss |

|

$ |

(17,112 |

) |

$ |

(11,160 |

) |

$ |

(5,952 |

) |

18

Table of Contents

Research and development expenses

Research and development expenses for the six months ended June 30, 2014 were $11.9 million, compared to $5.2 million for the six months ended June 30, 2013, an increase of $6.7 million. The increase in research and development expenses is primarily related to the further clinical development of ETC-1002 in our Phase 2 clinical program.

General and administrative expenses