UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 1

FORM 10-K/A

(Mark One)

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2017

or

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission File No. 1-34062

ILG, INC.

(Exact name of registrant as specified in its charter)

|

Delaware |

|

26-2590997 |

|

(State or other jurisdiction of |

|

(I.R.S. Employer |

|

|

|

|

|

6262 Sunset Drive, Miami FL |

|

33143 |

|

(Address of Registrant’s principal executive offices) |

|

(Zip code) |

(305) 666-1861

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

|

Title of Each Class: |

|

Name of Each Exchange on Which Registered: |

|

Common Stock, $0.01 par value per share |

|

The NASDAQ Stock Market |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No o

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

Large accelerated filer x |

|

Accelerated filer o |

|

|

|

|

|

Non-accelerated filer o |

|

Smaller Reporting Company o |

|

(Do not check if a smaller reporting company) |

|

Emerging Growth Company o |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to section 13(a) of the Exchange Act. o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No x

As of June 30, 2017, the aggregate market value of the registrant’s common stock held by non-affiliates of the registrant was $2,892,928,788. As of April 24, 2018, 124,207,141 shares of the registrant’s common stock were outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

None.

EXPLANATORY NOTE

This Amendment No. 1 on Form 10-K/A (“Amendment”) is being filed to amend our Annual Report on Form 10-K for the fiscal year ended December 31, 2017 (“Form 10-K”), filed with the U.S. Securities and Exchange Commission (“SEC”) on March 1, 2018 (“Original Filing Date”). The sole purpose of this Amendment is to include the information not previously included in Part III of the Form 10-K.

In addition, as required by Rule 12b-15 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), new certifications by our principal executive officer and principal financial officer are filed as exhibits to this Amendment.

No changes have been made in this Amendment to modify or update the other disclosures presented in the Form 10-K. This Amendment does not reflect events occurring after the filing of the original Form 10-K or modify or update those disclosures that may be affected by subsequent events. This Amendment should be read in conjunction with the Form 10-K and our other filings with the SEC.

PART III

Item 10. Directors, Executive Officers and Corporate Governance.

Directors

Craig M. Nash, age 64, President and Chief Executive Officer of ILG; Chairman of the ILG Board of Directors. Mr. Nash, has served as President and Chief Executive Officer of ILG since May 2008 and as Chairman of the Board of ILG since August 2008. Mr. Nash served as President of Interval from August 1989 until September 2014. Prior to assuming this role, Mr. Nash served in a series of increasingly significant roles with Interval International, including as General Counsel. Mr. Nash joined Interval in 1982. Mr. Nash serves on the Board of Directors of the American Resort Development Association and is also a member of its Executive Committee.

David Flowers, age 63, Director since August 2008. Prior to December 31, 2014, Mr. Flowers served as Senior Vice President and Managing Director, Alternative Investments of Liberty Media Corporation, which holds ownership interests in a broad range of electronic retailing, media, communication and entertainment businesses, since October 2000, Treasurer since April 1997 and Vice President since June 1995. He also served as Senior Vice President and Treasurer of Discovery Holding Company from May 2005 to September 2008. Mr. Flowers was a member of the board of directors of Sirius XM Radio Inc., a subscription satellite radio company March 2009 until December 2014. Since October 2015, he has served on the board and as chairman of the audit committee and on the remuneration committee of Digital Global Services Ltd., a London AIM-listed provider of outsourced online customer acquisition solutions. Mr. Flowers was nominated as a director of ILG by Qurate Retail Group (formerly Liberty Interactive Corporation).

Victoria L. Freed, age 61, Director since October 2012. Ms. Freed has also served as Senior Vice President, Sales, Trade Support and Service for Royal Caribbean International, a global cruise vacation company, since January 2008. Prior to joining Royal Caribbean, she spent 29 years with Carnival Cruise Lines, where she was Senior Vice President of Sales and Marketing for 15 years. From 1998 to 2000, Ms. Freed also served as the first female chairman of the Cruise Line International Association, the marketing and travel agent training arm of the North American cruise industry. Ms. Freed earned a bachelor’s degree in business with an emphasis in marketing from the University of Colorado. She also holds a Certified Travel Counselor (CTC) designation.

Lizanne Galbreath, age 60, Director since May 2016. Ms. Galbreath has been the Managing Partner of Galbreath & Company, a real estate investment firm, since 1999. From April 1997 to 1999, Ms. Galbreath was Managing Director of LaSalle Partners/Jones Lang LaSalle, a real estate services and investment management firm, where she also served as a director. From 1984 to 1997, Ms. Galbreath served in a variety of leadership positions including as a Managing Director, Chairman and Chief Executive Officer of The Galbreath Company, the predecessor entity of Galbreath & Company. Ms. Galbreath is also currently a director of Paramount Group, Inc. Ms. Galbreath has been a director of Starwood Hotels & Resorts Worldwide, LLC (“Starwood”) from 2005 to September 2016 and served on its Capital Committee, Compensation and Option Committee and Corporate Governance and Nominating Committee. Ms. Galbreath was nominated as a director of ILG by Starwood.

Chad Hollingsworth, age 41, Director since February 2015. Mr. Hollingsworth has been senior vice president of Qurate, Liberty Media Corporation, Liberty TripAdvisor Holdings, Inc. and Liberty Broadband Corporation since January 2016. He previously served as vice president of Qurate and Liberty Media Corporation since December 2011, having joined the company in November 2007, as well as vice president of Liberty TripAdvisor Holdings, Inc. since August 2014 and Liberty Broadband Corporation since October 2014. He also serves as a director of CommerceHub, Inc., a Nasdaq-listed distributed commerce network. Mr. Hollingsworth focuses on transaction and structuring opportunities, strategic advisory work and venture capital investment evaluation. He received his bachelor’s degree from Stanford University in human biology, with honors, and earned the right to use the CFA® designation. Mr. Hollingsworth was nominated as a director of ILG by Qurate Retail Group (formerly Liberty Interactive Corporation).

Lewis J. Korman, age 73, Director since August 2008. Mr. Korman is and has been a business advisor to various companies. From 2006 until December 2017, he was a business advisor to Sandler Travis Trade Advisory Services, a customs management, consulting and trade compliance company, and he continues to act as a consultant to the company that represents the interests of the former shareholders of this business since its acquisition by UPS, Inc. From 2002 until September 2017, Mr. Korman was a business advisor to Trident Media Group, a literary agency. From 1999 until its sale in April 2015, Mr. Korman was a director of Learning Express LLC, a company engaged in test preparation for occupational

certification and test assessment for educational institutions through the internet. From 1998 through 2007, Mr. Korman served as Vice Chairman of RAB Holdings, which owned Millbrook Distribution Services (a distributor of specialty foods and health and beauty products to supermarkets), and The B. Manischewitz Company (a manufacturer of kosher and related ethnic food products). From 1997 to 2009, he was an advisor to X.L. Capital, Ltd., a reinsurance company. From 1992 to 1997, until acquired by a predecessor of IAC/InterActiveCorp (IAC), Mr. Korman was President and Chief Operating Officer of Savoy Pictures Entertainment, motion picture distributor and owner of four Fox-affiliated television stations. He served as Senior Executive Vice President and Chief Operating Officer of Columbia Pictures Entertainment (motion picture and television production and distribution) from 1988 until 1989, and as Senior Executive Vice President of its predecessor, TriStar Pictures from 1987. Mr. Korman was a partner in a law firm until 1986.

Thomas J. Kuhn, age 55, Director since August 2008. Mr. Kuhn is of counsel at the law firm of Covington & Burling, LLP. Prior to joining Covington in February 2017, Mr. Kuhn was the managing member of Doorbrook, LLC, an advisory and investment firm beginning in January 2014. From 2000 through December 2013, Mr. Kuhn was a Managing Director at Allen & Company LLC, an investment banking firm. Prior to joining Allen, he was the Senior Vice President and General Counsel of USA Networks, Inc. (a predecessor to IAC).

Thomas J. McInerney, age 53, Director since May 2008. Since June 2017, Mr. McInerney has served as Chief Executive Officer of Altaba Inc., a publicly-traded non diversified closed end management investment company and has been a member of its board since 2012. From April 2012 through May 2017, Mr. McInerney was a private investor. Mr. McInerney previously served as Executive Vice President and Chief Financial Officer of IAC from January 2005 through March 2012. Mr. McInerney served as Chief Executive Officer of IAC’s Retailing sector from January 2003 through December 2005. Prior to this time, Mr. McInerney served as Executive Vice President and Chief Financial Officer of Ticketmaster (prior to it becoming a wholly owned subsidiary of IAC in January 2003) and its predecessor company, Ticketmaster Online-Citysearch, Inc., since May 1999. Prior to joining Ticketmaster, Mr. McInerney worked at Morgan Stanley, most recently as a Principal. Mr. McInerney previously served as a director of Cardlytics, Inc., a purchase-based data intelligence platform, and HSN Inc., a television and online retailer. He currently serves as a director of Match Group, Inc., a leading provider of dating products.

Thomas P. Murphy, Jr., age 69, Director since August 2008. Mr. Murphy is Chairman and Chief Executive Officer of Coastal Construction Group, a construction company, which he founded in 1989. Mr. Murphy has over 40 years of construction and development experience, which encompasses hospitality, resort, office, retail, industrial, institutional and residential projects. Mr. Murphy is an honorary board member of Baptist Health Systems of South Florida and is a member of the National Construction Industry Round Table, the National Association of Home Builders and the Florida Home Builders Association. He also serves as a director of The St. Joe Company, a New York Stock Exchange (NYSE) listed real estate developer.

Stephen R. Quazzo, age 58, Director since May 2016. Mr. Quazzo is the Chief Executive Officer and has been the Managing Director and co-founder of Pearlmark Real Estate, LLC, formerly known as Transwestern Investment Company, L.L.C., a real estate principal investment firm, since March 1996. From April 1991 to March 1996, Mr. Quazzo was President of Equity Institutional Investors, Inc., a private investment firm and a subsidiary of Equity Group Investments, Inc. Mr. Quazzo is also currently a director of Phillips Edison & Company Inc. and was a director of Starwood from 1995 to September 2016 serving terms as the Chair of the Capital and Governance Committees as well as serving on the Audit Committee. Mr. Quazzo holds undergraduate and MBA degrees from Harvard University, where he serves as a member of the Board of Dean’s Advisors for the business school. He is a member and Trustee of the Urban Land Institute, chairman of the ULI Foundation, a member of the Pension Real Estate Association, and is a licensed real estate broker in Illinois. He is a Trustee of Rush University Medical Center, an Investment Committee member of the Chicago Symphony Orchestra endowment and pension plans, a Trustee of Deerfield Academy, and a Chicago advisory Board member of City Year, a national service organization since 1994. Mr. Quazzo was nominated as a director of ILG by Starwood Hotels & Resorts Worldwide, LLC.

Sergio D. Rivera, age 55, Director since May 2016. Mr. Rivera has served as a director of ILG since May 2016 and President and chief executive officer of the Vacation Ownership segment since November 2016. Prior to joining ILG, Mr. Rivera was President of The Americas for Starwood. He was previously Co-President, The Americas for Starwood from July 2012 to February 2014, and President and Chief Executive Officer of Starwood Vacation Ownership (now known as Vistana Signature Experiences), now a wholly owned subsidiary of ILG. Prior to 2008, Mr. Rivera held progressively senior management roles within Starwood, including Controller, Vice President of Sales and Marketing, Senior Vice President of International Operations, and President of Global Real Estate. Mr. Rivera began his career with Starwood through its

predecessor company, Vistana Resorts, in 1989. Mr. Rivera is a member of the board of directors of Welltower, Inc., a NYSE-listed REIT that invests with leading senior housing operators, post-acute providers and health systems. He also serves as a member of the Urban Land Institute, trustee of The Nature Conservancy Florida Chapter, a member of the University of Central Florida Rosen College of Hospitality Management Advisory Board, as well as the Florida International University Chaplin School of Hospitality & Tourism Management Dean’s Advisory Council. Mr. Rivera was nominated as a director of ILG by Starwood Hotels & Resorts Worldwide, LLC.

Thomas O. Ryder, age 73, Director since May 2016. Mr. Ryder has served as a director of ILG since May 2016. Mr. Ryder retired as Chairman of the Board of The Reader’s Digest Association, Inc., a global media and direct marketing company, in January 2007, a position he had held since January 2006. Mr. Ryder was Chairman of the Board and Chief Executive Officer of that company from April 1998 through December 2005. In addition, Mr. Ryder was Chairman of the Board and Chairman of the Audit Committee of Virgin Mobile USA, Inc., a wireless service provider, from October 2007 to November 2009. Mr. Ryder was President, American Express Travel Related Services International, a division of American Express Company, which provides travel, financial and network services, from October 1995 to April 1998. In the past five years, Mr. Ryder also served as a director of Quad/Graphics, Inc., World Color Press, Inc., a company acquired by Quad/Graphics, Inc. in July 2010, and RPX Corporation. Mr. Ryder is also currently a director of Amazon.com, Inc. Mr. Ryder was a director of Starwood from 2001 to September 2016 and served on its Capital Committee and the Compensation and Option Committee. Mr. Ryder was nominated as a director of ILG by Starwood Hotels & Resorts Worldwide, LLC.

Avy H. Stein, age 63, Lead Director. Mr. Stein has served as a director of ILG since August 2008 and as Lead Director since December 2008. Mr. Stein is co-founder and co-chairman of Cresset Wealth Advisors which launched May 2017. He also serves as Chief Executive Officer of Willis Stein & Partners, a Chicago based private equity firm that invests in companies in the consumer, education, healthcare and specialized business service industries. Mr. Stein co founded Willis Stein & Partners with John Willis in 1994. Mr. Stein serves many philanthropic organizations. He is a member of the Board of Trustees, former Treasurer, and chairman of the Investment Committee of the Ravinia Festival; a member of the Harvard Law School Leadership Council of Chicago; and provides fundraising and strategic counsel for B.U.I.L.D. (Broader Urban Involvement in Leadership Development), an organization that provides career and educational development for inner city youth. He is also a director for the Western Golf Association. Mr. Stein served on the Board of Directors and compensation and nominating and corporate governance committees of Roundy’s, Inc., a NYSE listed grocer in the Midwest until December 2015 and currently serves the board of directors of, the following privately held companies, FDH VelociTel, Education Corporation of America and Hilco Global, a privately held international financial services company. Mr. Stein is a certified public accountant, and received his law degree from Harvard University.

Qualifications. Our board of directors is comprised of individuals with an array of operating, finance, sales and legal experience in a variety of industries, as well as serving on public company boards. As such, they each bring an informed perspective on matters we face as a public company, including experience reading and understanding and/or preparing financial statements, compensation determinations, regulatory compliance, corporate governance, public affairs and legal matters. Our board of directors believes that each of the directors is qualified to serve as a director and member of the committees on which each serves because of the skills and qualifications acquired, based on the following experience:

· Mr. Flower’s financial, investment and public company experience as a senior finance executive of a large public company;

· Ms. Freed’s sales, marketing, and consumer insight experience in the leisure and tourism industry as a senior executive with two major cruise companies;

· Ms. Galbreath’s senior leadership experience as manager of Galbreath & Company, real estate investment, development and strategy experience, and management and corporate governance experience, having served as a Director of another publicly-traded company;

· Mr. Hollingsworth’s merger and acquisition transaction experience, financial analysis skills and experience with corporate governance and management compensation plans;

· Mr. Korman’s business and legal experience as a business advisor and senior operating executive in areas involving strategy, financial analysis and planning, capital formation, acquisition and sale of companies, and in

a variety of business transactions. He also has experience in corporate governance, serving as a director of other publicly-traded companies;

· Mr. Kuhn’s financial, legal and public company experience and his experience reading and understanding financial statements as a managing director at an investment banking firm and as the general counsel of a public company;

· Mr. McInerney’s financial and public company experience as the chief executive officer and chief financial officer of public companies and his familiarity with ILG’s business and operations as an executive of our former parent company. He also has broad experience in corporate governance, serving as a director of other publicly-traded companies;

· Mr. Murphy’s operational and related industry experience in development of resorts as the chief executive officer of a construction and development company. He also has experience in corporate governance serving as a director of another publicly-traded company;

· Mr. Nash’s industry, strategic, operational and legal experience as our chief executive officer and as a member of the executive committee of the American Resort Development Association as well as his role in promoting the foundation of constructive regulation regarding the shared ownership industry;

· Mr. Quazzo’s real estate, investment, development and strategy experience as chief executive officer of Pearlmark Real Estate, LLC and his senior leadership experience. He also has broad experience in corporate governance, serving as a director of other publicly-traded companies;

· Mr. Rivera’s senior leadership, operational and industry experience as former Starwood Hotels & Resorts Worldwide, LLC President, The Americas as well as president and chief executive officer of the Vistana business. He also has experience in corporate governance serving as a director of another publicly-traded company;

· Mr. Ryder’s branding, development and strategy experience coupled with his global business, media and marketing knowledge. He also has broad experience in corporate governance serving as chief executive officer and a director of other publicly-traded companies; and,

· Mr. Stein’s financial, accounting and legal experience as a managing partner in a private equity firm and as a certified public accountant and lawyer, and his familiarity with ILG’s business and operations as a principal of the private equity firm that previously owned Interval. He also has experience in corporate governance serving as a director of another publicly-traded company.

Many of our directors also serve or have in the past served on the boards of one or more other publicly traded companies. We believe ILG benefits from the experience and expertise our directors gain from serving on those boards. The board of directors also believes that it is important to effective board governance and collaboration to have our chief executive officer serve on the board.

Executive Officers

The following information about ILG’s executive officers and certain other key personnel is as of April 24, 2018. For Mr. Nash and Mr. Rivera please see their information above under “Directors.”

Kelly Frank, age 56, has served as Chief Human Resources Officer of ILG since October 2016. Prior to joining ILG, she served as Senior Vice President of Human Resources at Starwood from October 2006 to September 2016. During this time period she was responsible for leading the human resources function for the largest division in the company, including North America, Latin America and the vacation ownership business. Prior to this role she was the Senior Vice President of Human Resources Corporate Shared Services responsible for leading these global functions: recruiting, ethics and compliance, human resources service center and the human resources generalist function. She also serves as a director and President of the ILG Relief Fund.

John A. Galea, age 62, has served as Chief Accounting Officer of ILG since August 2008 and as Senior Vice President and Treasurer of ILG since June 2009. He has served as Chief Financial Officer for Interval since October 2006. Prior to this appointment, Mr. Galea served as Interval’s Vice President and Chief Accounting Officer from January 2004. Mr. Galea joined Interval in 2000 as its Vice President, Accounting and Corporate Controller. Mr. Galea also serves as the Treasurer of the ILG Relief Fund.

William L. Harvey, age 62, has served as Chief Financial Officer of ILG since August 2008 and as Executive Vice President since June 2009. Prior to joining ILG in June 2008, Mr. Harvey served as the Chief Financial Officer for TrialGraphix, Inc., a Miami-based litigation support firm from August 2006 through November 2007. Between June 2003 and July 2006, Mr. Harvey served as a Vice President at LNR Property Corporation, a Miami-based diversified real estate and finance company, managing various financial and accounting units. From September 1992 through February 2003, Mr. Harvey served as the Executive Vice President and Chief Financial Officer of Pan Am International Flight Academy, Inc., a private provider of flight training services. Mr. Harvey is a registered CPA who began his professional career at Deloitte & Touche and was a partner in their Miami office prior to September 1992. Prior to June 2014, Mr. Harvey was a member of the Board of Directors of Summit Financial Services Group, Inc. and chair of the audit committee.

Victoria J. Kincke, age 62, has served as Secretary of ILG since May 2008 and as Senior Vice President and General Counsel of ILG since August 2008 and has served as Senior Vice President and General Counsel of Interval since May 2005. Prior to this time, Ms. Kincke served as General Counsel of Interval from July 1999. Ms. Kincke joined Interval in 1997. She also serves as a director and Secretary of the ILG Relief Fund.

Marie A. Lee, age 62 has served as Chief Information Officer of ILG since August 2008 and as Senior Vice President since June 2009. Since May 2005, she has served as Chief Information Officer and Senior Vice President, U.S. Operations of Interval. Prior to this time, Ms. Lee served as Chief Information Officer of Interval from January 2004 and Senior Vice President, Information Technology of Interval from May 2000 to December 2003.

Jeanette E. Marbert, age 61, has served as the President and Chief Executive Officer of the Exchange and Rental Segment since November 2017 and has been Executive Vice President of ILG since June 2009. Previously she was Chief Operating Officer of ILG from August 2008 to November 2017 and served as a Director of ILG from February 2015 to May 2016. She served as Chief Operating Officer for Interval beginning June 1999. Prior to her tenure as Chief Operating Officer, Ms. Marbert served as General Counsel of Interval from 1994 to 1999. Ms. Marbert joined Interval in 1984. She also serves as a director and Chairperson of the ILG Relief Fund.

Corporate Governance

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Exchange Act requires our directors and executive officers, and owners of more than 10% of a registered class of ILG’s equity securities, to file with the SEC initial reports of ownership and reports of changes in ownership of common shares and other equity securities of ILG. Executive officers, directors and owners of more than 10% of the common shares are required by SEC regulations to furnish ILG with copies of all forms they file pursuant to Section 16(a). We file Section 16(a) reports on behalf of our directors and executive officers to report their initial and subsequent changes in beneficial ownership of our common stock. To our knowledge, based solely on review of the reports that we filed, written representations that no other reports were required and all Section 16(a) reports provided to us, all Section 16(a) filing requirements applicable to our executive officers, directors and greater than 10% beneficial owners were complied with during the fiscal year ended December 31, 2017, with the exception of one Form 4 for vesting of equity for Mr. Rivera that was filed late due to administrative error.

Code of Ethics.

Our code of business conduct and ethics, which applies to all employees, including all executive officers and senior financial officers (including ILG’s CFO, CAO and Controller) and directors, is posted on the Corporate Governance section of our website at www.ilg.com. The code of ethics complies with Item 406 of SEC Regulation S-K and the rules of The NASDAQ Stock Market. Any changes to the code of ethics that affect the provisions required by Item 406 of Regulation

S-K, and any waivers of the code of ethics for ILG’s executive officers, directors or senior financial officers, will also be disclosed on ILG’s website.

Audit Committee.

The members of the audit committee during 2017 were Mr. Korman (chair), Mr. Kuhn, Mr. McInerney and Mr. Quazzo. Our board of directors has determined that Mr. McInerney meets the requirements for an audit committee financial expert under Item 407 of Regulation S-K promulgated under the Securities Act of 1933, as amended (the “Securities Act”) and is independent, as defined under the independence standards of the NASDAQ Stock Market and the SEC applicable to audit committee members.

Process for Stockholder Nominations

There have been no material changes to the procedures by which stockholders may recommend nominees to our board of directors.

Item 11. Executive Compensation

Compensation Discussion and Analysis

The following compensation discussion and analysis discusses our executive compensation programs for 2017. The design and administration of these programs is overseen by ILG’s Compensation Committee. This section focuses on the compensation decisions made for the following individuals who are referred to as the named executive officers:

|

Craig M. Nash |

|

Chairman, President and Chief Executive Officer |

|

Sergio D. Rivera |

|

Executive Vice President, ILG |

|

Jeanette E. Marbert |

|

Executive Vice President, ILG |

|

William L. Harvey |

|

Executive Vice President and Chief Financial Officer |

|

John A. Galea |

|

Executive Vice President and Chief Accounting Officer |

|

Victoria J. Kincke |

|

Executive Vice President, General Counsel and Secretary |

Overview Highlights of 2017 ILG performance:

Growing the Business

· Increased revenues by $430 million to $1.8 billion

· Opened two world-class resorts, The Westin Nanea Ocean Villas and Westin Los Cabos Resort Villas and Spa, and expanded several other properties, growing the number of vacation ownership units by nearly 700, or 11%

· Enhanced our product offering through the introduction of two new multi-site programs, Westin Aventuras and Hyatt Residence Club Portfolio Program

· Leveraged opportunities to drive revenue and share best practices across businesses

· Interval International added 63 resorts in 20 countries and launched its hotel exchange product

· Positioned ILG for long-term sustainable growth.

Deploying Capital Wisely

· Invested $350 million in the business to drive vacation ownership sales and related recurring revenues

· Returned $102 million to shareholders through dividends and stock repurchases

· Increased the quarterly dividend by 25% to $0.15 per share from $0.12

Managing through Hurricanes

· Maintained operations through a series of destructive hurricanes, while keeping guests and associates safe

· Created the ILG Relief Fund to assist those in need following the storms, which has provided grants to over 460 associates in Puerto Rico, the U.S. Virgin Islands and Florida

The following charts summarize key financial results for 2017 compared to 2016 and 2015 (dollars in millions except per share and percentage data):

|

|

|

Year Ended December 31 |

| |||||||||||

|

|

|

2017 |

|

Year over |

|

2016 |

|

Year over |

|

2015 |

| |||

|

Revenue |

|

$ |

1,786 |

|

32 |

% |

$ |

1,356 |

|

95 |

% |

$ |

697 |

|

|

Revenue excluding cost reimbursements |

|

$ |

1,446 |

|

34 |

% |

$ |

1,082 |

|

99 |

% |

$ |

545 |

|

|

Net income attributable to common stockholders |

|

$ |

168 |

|

(37 |

)% |

$ |

265 |

|

263 |

% |

$ |

73 |

|

|

Adjusted net income(1) |

|

$ |

139 |

|

7 |

% |

$ |

130 |

|

71 |

% |

$ |

76 |

|

|

Adjusted EBITDA reported(2) |

|

$ |

346 |

|

15 |

% |

$ |

302 |

|

63 |

% |

$ |

185 |

|

|

Adjusted EBITDA long-term incentive calculation(3) |

|

$ |

345 |

|

19 |

% |

$ |

290 |

|

58 |

% |

$ |

184 |

|

|

Diluted earnings per share |

|

$ |

1.34 |

|

(48 |

)% |

$ |

2.60 |

|

106 |

% |

$ |

1.26 |

|

|

Adjusted diluted earnings per share(4) |

|

$ |

1.10 |

|

(14 |

)% |

$ |

1.28 |

|

(3 |

)% |

$ |

1.32 |

|

|

Price per share at last trading day(5) |

|

$ |

28.48 |

|

57 |

% |

$ |

18.17 |

|

16 |

% |

$ |

15.61 |

|

(1) Adjusted net income is defined as net income attributable to common stockholders excluding, without duplication (a) acquisition related and restructuring costs, (b) other non-operating foreign currency remeasurements, (c) the impact of the application of purchase accounting, (d) goodwill and asset impairments and/or permitted reversals, and (e) other special items. Other special items include (i) the gain on bargain purchase price recognized as part of the Vistana acquisition, (ii) costs related to non-ordinary course litigation matters described in the notes to our financial statements, (iii) impact to our financial statements related to natural disasters, including Hurricane Irma and other named storms, (iv) costs related to activist defense, (v) the net provisional tax benefit related to Tax Reform and (vi) the impact of the substantial liquidation of our Venezuela subsidiary. Reconciliation to net income attributable to common stockholders is provided in Appendix A.

(2) Adjusted EBITDA is defined as net income attributable to common stockholders, excluding, if applicable (a) non-operating interest income and interest expense, (b) income taxes, (c) depreciation expense, (d) amortization expense of intangibles, (e) non-cash compensation expense, (f) goodwill and asset impairments and/or permitted reversals, (g) acquisition related and restructuring costs, (h) other non-operating income and expense, (i) the impact of application of purchase accounting, and (j) other special items, which includes items (i) through (iv) in footnote 1. Reconciliation to net income attributable to common stockholders is provided in Appendix A. ILG’s presentation of Adjusted EBITDA may not be comparable to similarly-titled measures used by other companies.

(3) For purposes of calculation of the long-term incentive awards that were earned based on Adjusted EBITDA performance from 2015-2018, Adjusted EBITDA is defined as net income attributable to common stockholders excluding, if applicable: (1) non-cash compensation expense, (2) depreciation expense, (3) amortization expense,

(4) goodwill and asset impairments, (5) income tax provision, (6) interest income and interest expense, (7) acquisition related and restructuring costs, (8) other non-operating income, and (9) one time charges. Reconciliation to net income attributable to common stockholders is provided in Appendix A.

(4) Adjusted diluted earnings per share is defined as Adjusted net income divided by the weighted average number of shares of common stock and dilutive securities outstanding during the period. Reconciliation to diluted earnings per share is provided in Appendix A.

(5) Based on the closing price for ILG shares on The NASDAQ Stock Market on the last trading day of the applicable year.

Compensation Program Highlights:

The following table summarizes the specific features of our executive compensation program.

|

What We DO |

|

What We DON’T Do |

|

Pay for performance philosophy and practice, by including performance conditions on 83% of the 2017 target compensation of the chief executive officer and an average of over 64% for the other named executive officers |

|

Guarantee bonus payments for our named executive officers |

|

Maintain robust stock ownership guidelines (6x multiple for CEO) |

|

Allow hedging or pledging of ILG stock |

|

Maintain a long-standing “clawback” policy |

|

Pay tax gross-ups on severance arrangements and perquisites |

|

Require “double trigger” for change of control protection |

|

Provide ongoing supplemental executive retirement plans |

|

Impose caps for all performance-based awards of no more than 200% of target |

|

|

|

Provide only limited perquisites, which provide nominal additional assistance to allow executives to focus on their duties |

|

|

|

Conduct a comprehensive annual risk assessment of our compensation program |

|

|

|

Utilize an independent compensation consultant to assist the Compensation Committee in evaluating executive compensation |

|

|

Philosophy and Objectives of Compensation

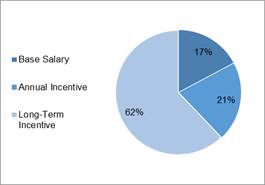

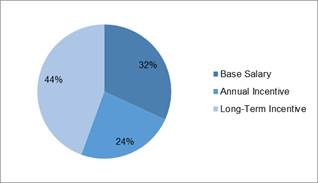

ILG is focused on growing our business of providing memorable vacation experiences to our customers and delivering shareholder value. To further these objectives, ILG’s executive officer compensation program is designed to attract, reward, motivate, and retain top executives. In order to provide appropriate incentives, a significant portion of each executive’s pay is based on corporate performance. The following charts show the pay mix at target for the chief executive officer and the average pay mix at target for the other named executive officers.

|

CEO Target Compensation |

|

Other NEO Average Target |

|

|

|

Compensation |

|

|

|

|

|

|

|

|

ILG’s compensation program rewards annual performance through an annual cash incentive program and long-term value creation through performance-contingent equity grants. ILG reviewed all components of our executive pay program and made changes that align with market, introducing more contemporary terms, and bringing greater uniformity to severance and change-of-control provisions. Based on the most recent benchmarking analyses, the total compensation opportunities at target levels of performance are provided at or near the median of the peer group, with individual differentiation to reflect, among other things, executive experience, performance, internal equity, and unique customer relationships that may be difficult to replace.

Compensation Methodology

Roles and Responsibilities. Our executive officer compensation program is administered by our Compensation Committee. In 2017, the Compensation Committee engaged Meridian Compensation Partners, LLC (“Meridian”) to provide executive compensation advisory services to the Compensation Committee. Meridian also prepared a report for ILG’s nominating committee on director compensation.

Meridian provides the Compensation Committee with support on market information and perspective on executive pay practices. At the request of the Compensation Committee, Meridian participated in select discussions during the Compensation Committee’s meetings with respect to reviewing and modifying incentive programs.

Our chief executive officer makes recommendations to the Compensation Committee regarding salary and bonus payments for the other named executive officers. In addition, our chief executive officer, then chief operating officer and chief financial officer make recommendations on performance goals based on board approved budgets and internal forecasts, and provide information and recommendations as to whether performance goals were achieved. The Compensation Committee evaluates these recommendations and approves the compensation for the named executive officers. With respect to the chief executive officer, this review is conducted in executive session without the presence of the chief executive officer.

Benchmarking. In 2016, under the direction of the Compensation Committee, Meridian conducted a benchmarking study of compensation levels and design practices for the top executive positions. Meridian provided the Compensation Committee with an analysis based on a comparator group that reflects the scope, industry and financial characteristics of ILG and represents a key market for competitive executive talent. While the comparator group does include a number of companies in the Hotels, Restaurants & Leisure industry (as defined by Standard & Poor’s GICS industry classifications), it does not include restaurant companies as these are not businesses similar to ILG and are not a source of competition for executive talent. Within this comparator group, ILG’s revenues place it at the 51st percentile.

2017 Comparator Group

|

Choice Hotels Intl Inc. |

|

Marriott Vacations Worldwide, Inc. |

|

Diamond Resorts International |

|

Norwegian Cruise Line Holdings Ltd. |

|

Hospitality Properties Trust |

|

Pinnacle Entertainment Inc. |

|

Hyatt Hotels Corporation |

|

Ryman Hospitality Properties, Inc. |

|

Intercontinental Hotels, Inc. |

|

Vail Resorts Inc. |

|

Isle of Capri Casinos Inc. |

|

Viad Corp. |

|

La Quinta Holdings Inc. |

|

Wyndham Worldwide Corp. |

The Compensation Committee reviewed both the levels of total compensation for the chief executive officer, then chief operating officer, chief financial officer, chief accounting officer and general counsel and as well as the relative contribution of each different element of such individual’s compensation against similarly situated individuals within the comparator group. Prior to the Vistana transaction, these named executive officers were an average of 20% below the market median levels for total targeted compensation. Our chief executive officer’s total target compensation mix aligned with the median of the market, as did the mix for our other named executive officers. The compensation for Mr. Rivera was individually negotiated in contemplation of joining ILG in late 2016.

Elements of Compensation

Our pay philosophy is supported by the following elements of our executive compensation:

|

Element |

|

Form |

|

Purpose |

|

Base Salary |

|

Cash |

|

Provides a competitive level of fixed pay reflecting the executive’s experience, responsibilities, and performance |

|

Annual Incentive |

|

Cash |

|

Rewards executives for achieving annual revenue and earnings goals, and for certain executives, individual performance goals |

|

Long-Term Incentives |

|

Equity |

|

Provide equity-based incentives that reward management for achieving longer-term financial and strategic growth goals while also aligning management interests with stockholders’ interests |

Base Salary

Management and the Compensation Committee consider a number of factors in recommending and determining base salaries of named executive officers, including corporate performance and with respect to an individual executive the assumption of additional responsibilities, internal equity, periodic benchmarking, historical compensation for executives of acquired companies and other factors which demonstrate an executive’s value to ILG.

2017 Base Salary Decisions:

In March 2017, in connection with the cessation of gross-up benefits for disability insurance, the amounts of base salary for Mr. Nash and Ms. Marbert were adjusted. Mr. Galea and Ms. Kincke received a 3% increase in base salary effective in July 2017 consistent with increases provided to executives generally on an annual basis. All of the named executive officers had received increases the prior year in connection with the acquisition of Vistana other than Mr. Rivera, whose base salary was determined as a result of arm’s length negotiations with him to attract him to join ILG in late 2016. Note that Ms. Marbert had been the Chief Operating Officer for ILG until November 2017 when she became the President and Chief Executive Officer, Exchange & Rental. No changes were made to her compensation at that time. The following shows the original annual base salaries as of the beginning of 2017 and the adjusted annual base salaries effective in March 2017:

|

Name |

|

Original Base |

|

Adjusted Base Salary |

| ||

|

Craig M. Nash(1) |

|

$ |

865,000 |

|

$ |

875,000 |

|

|

Sergio D. Rivera |

|

$ |

550,000 |

|

— |

| |

|

Jeanette E. Marbert(1) |

|

$ |

475,000 |

|

$ |

480,000 |

|

|

William L. Harvey |

|

$ |

420,000 |

|

— |

| |

|

John A. Galea(2) |

|

$ |

300,000 |

|

$ |

309,000 |

|

|

Victoria J. Kincke(2) |

|

$ |

300,000 |

|

$ |

309,000 |

|

(1) Adjustment effective March 25, 2017.

(2) Adjustment effective July 1, 2017.

Annual Incentives

ILG’s annual incentive program is designed to reward performance on an annual basis. The annual incentive program represents an important incentive tool to achieve ILG’s annual objectives and to attract, motivate and retain executive talent with significant upside opportunity for executives if performance goals are exceeded.

Our annual incentive program, implemented under our 2013 Stock and Incentive Compensation Plan, provides for a cash payment based upon ILG financial performance, and, for certain named executive officers, their specific businesses and individual performance. Mr. Rivera’s annual incentive compensations are based, in part, on the performance of the Vistana and Hyatt Vacation Ownership businesses, referred to in this section as Vacation Ownership. ILG generally pays bonuses during the first quarter following finalization of financial results for the prior year and Compensation Committee approval.

2017 Annual Incentives:

For 2017, the Compensation Committee established target bonuses for each of the named executive officers expressed as a percentage of base salary. These incentives were determined based on ILG’s consolidated Adjusted EBITDA and revenue performance, the Vacation Ownership Adjusted EBITDA and revenue performance and individual performance as described below.

|

Name |

|

Target |

|

% Based |

|

% Based |

|

% Based |

|

% Based |

|

% Based |

|

|

Craig M. Nash |

|

120 |

% |

85 |

% |

15 |

% |

— |

|

— |

|

— |

|

|

Sergio D. Rivera |

|

100 |

% |

25 |

% |

— |

|

60 |

% |

15 |

% |

— |

|

|

Jeanette E. Marbert |

|

100 |

% |

85 |

% |

15 |

% |

— |

|

— |

|

— |

|

|

William L. Harvey |

|

80 |

% |

60 |

% |

10 |

% |

— |

|

— |

|

30 |

% |

|

John A. Galea |

|

55 |

% |

60 |

% |

10 |

% |

— |

|

— |

|

30 |

% |

|

Victoria J. Kincke |

|

55 |

% |

60 |

% |

10 |

% |

— |

|

— |

|

30 |

% |

Adjusted EBITDA and revenue excluding cost reimbursements were selected by the Compensation Committee as the performance measures because they reflect the financial focus of ILG and align the program with ILG’s key business goals. These targets are designed to reward both top line growth and expense controls. The target Adjusted EBITDA and revenue levels were based on the 2017 budget approved by the board of directors. Please see Appendix A for a reconciliation of Adjusted EBITDA.

The following table shows the Adjusted EBITDA goals for 2017 for the annual incentive program. Potential payouts range from a minimum of 0% to a maximum of 200% of target, with results interpolated for points in between established goals:

|

ILG Adjusted EBITDA |

|

Annual Incentive |

|

|

Below $302.6 |

|

0 |

% |

|

$302.6 |

|

50 |

% |

|

$329.3 |

|

75 |

% |

|

$356.0 |

|

100 |

% |

|

$391.6 |

|

125 |

% |

|

$427.2 |

|

150 |

% |

|

$462.8 |

|

175 |

% |

|

$498.4 |

|

200 |

% |

|

Above $498.4 |

|

200 |

% |

|

VO Adjusted EBITDA |

|

Annual Incentive Payout |

|

|

Below $164.7 |

|

0 |

% |

|

$164.7 |

|

50 |

% |

|

$179.3 |

|

75 |

% |

|

$193.8 |

|

100 |

% |

|

$213.2 |

|

125 |

% |

|

$232.6 |

|

150 |

% |

|

$251.9 |

|

175 |

% |

|

$271.3 |

|

200 |

% |

|

Above $271.3 |

|

200 |

% |

The following table shows the revenue excluding cost reimbursements goals for 2017 for the annual incentive program. Payouts range from a minimum of 0% to a maximum of 140% of target, with results interpolated for points in between established goals:

|

ILG Revenue (Millions) |

|

|

Below $1,245.8 |

|

|

$1,245.8 |

|

|

$1,355.8 |

|

|

$1,465.7 |

|

|

$1,612.3 |

|

|

$1,758.8 |

|

|

Above $1,758.8 |

|

|

VO Revenue (Millions) |

|

|

Below $850.1 |

|

|

$850.1 |

|

|

$925.1 |

|

|

$1,000.1 |

|

|

$1,100.1 |

|

|

$1,200.1 |

|

|

Above $1,200.1 |

|

|

Annual Incentive Payout |

|

|

0% |

|

|

50% |

|

|

75% |

|

|

100% |

|

|

120% |

|

|

140% |

|

|

140% |

|

|

Annual Incentive Payout |

|

|

0% |

|

|

50% |

|

|

75% |

|

|

100% |

|

|

120% |

|

|

140% |

|

|

140% |

|

Actual 2017 Consolidated ILG Adjusted EBITDA was $345.2 million, or 97.0% of the target Adjusted EBITDA and revenue excluding cost reimbursements was $1.449 billion, or 98.9% of target revenue excluding cost reimbursements. Therefore, the annual incentives earned based on Consolidated ILG Adjusted EBITDA and revenue performance were 89.9% and 96.2% of the respective target amounts. These results were negatively impacted by the hurricanes that made landfall during the third quarter of 2017 in the amount of approximately $9 million to Adjusted EBITDA and approximately $21 million to consolidated revenue.

Actual 2017 Vacation Ownership Adjusted EBITDA was $191.9 million, or 99.0% of the target Adjusted EBITDA and revenue excluding cost reimbursements was $988.0 billion, or 98.8% of target revenue excluding cost reimbursements. Therefore, the annual incentives earned based on Vacation Ownership Adjusted EBITDA and revenue performance were 96.7% and 96.0% of the respective target amounts.

With respect to the portion of the incentives based on subjective individual performance, the Compensation Committee determined, following a discussion with the chief executive officer regarding the individual performance of each Mr. Harvey, Mr. Galea and Ms. Kincke, that Mr. Harvey had earned the 111% of the target amount and Mr. Galea and Ms. Kincke had earned 121% of the target amount. In determining these amounts, the Compensation Committee considered the leadership roles that each of them played in the integration efforts and the establishment of shared services functions across the enterprise, similar to other leaders of shared service functions.

The following table shows the component and total cash incentive amounts for each of these named executive officers:

|

|

|

Annual |

|

Annual |

|

Annual |

|

Annual |

|

Annual |

|

Total Cash |

|

|

Craig M. Nash |

|

802,336 |

|

151,554 |

|

NA |

|

NA |

|

NA |

|

953,890 |

|

|

Sergio D. Rivera |

|

123,609 |

|

NA |

|

319,164 |

|

79,169 |

|

NA |

|

521,942 |

|

|

Jeanette E. Marbert |

|

366,782 |

|

69,282 |

|

NA |

|

NA |

|

NA |

|

436,064 |

|

|

|

|

Annual |

|

Annual |

|

Annual |

|

Annual |

|

Annual |

|

Total Cash |

|

|

William L. Harvey |

|

181,233 |

|

32,332 |

|

NA |

|

NA |

|

111,435 |

|

325,000 |

|

|

John A. Galea |

|

91,669 |

|

16,353 |

|

NA |

|

NA |

|

61,928 |

|

169,950 |

|

|

Victoria J. Kincke |

|

91,669 |

|

16,353 |

|

NA |

|

NA |

|

61,928 |

|

169,950 |

|

Long-Term Incentives

In determining ILG’s long-term incentive programs, the Compensation Committee believes that by providing a meaningful portion of an executive officer’s compensation in stock, his or her incentives are aligned with our stockholders’ interests in a manner that drives better performance over time. In setting individual award levels, important considerations include effective retention, market competitiveness, performance, motivating strong future performance and issues of internal compensation equity.

Our long-term incentive program, implemented under our 2013 Stock and Incentive Compensation Plan, generally consists of two components, each of which is subject to performance hurdles.

Annual RSUs: The annual Restricted Stock Units (“RSUs”) are performance-based restricted stock units that are granted during the first quarter of the fiscal year and are deemed earned only after a determination by the Compensation Committee that the specified performance conditions have been met during the performance year in which they are granted. Once earned, these annual RSUs vest in equal portions over several years, subject to continued employment. Beginning in 2017, these awards vest over three years instead of the four year vesting schedule used in prior years. The Compensation Committee believes that the time based vesting of the performance-based RSUs promotes executive retention and encourages long-term performance because the value of the RSUs will only be realized upon ultimate vesting.

Long-term Performance RSUs: These long-term performance-based RSUs are granted during the first quarter of the fiscal year and vest on the third anniversary of the grant date, following a determination by the Compensation Committee of the number of shares earned based on the specified, multi-year performance conditions.

2017 Grants

For 2017, 50% of the value of the total long-term incentive opportunity for each of the named executive officers was granted through annual RSUs and 50% was granted through performance RSUs. This split provides greater weight to the performance RSUs than the 75% to 25% split used in prior years and was determined to be in line with market practice. The allocation reflects the Compensation Committee’s goal of aligning our executives’ and stockholders’ interests, while recognizing the goal of moving ILG in the right direction to thrive in the evolving business environment within the leisure industry.

For Mr. Nash, Ms. Marbert, Mr. Harvey, Mr. Galea and Ms. Kincke, the Compensation Committee determined in February 2017 to increase the first quarter RSU grant in terms of the dollar value between 25% and 75% from the prior year. The Vistana acquisition that closed in May 2016 materially changed the size of the enterprise and the responsibilities of the named executive officers and additional performance-based grants had been provided to these named executive officers upon closing in May 2016. For Mr. Rivera, the prior year grant was made in connection with his hiring and was not part of the annual process. All of these 2017 grant amounts were converted to a number of units based on the average of the closing ILG stock price for the trailing twenty days ending on the date prior to determination of the amount of grant by the Compensation Committee on February 14, 2017.

The following table summarizes the 2017 grant levels which were determined based on the particular experience, performance, roles and responsibilities of the individual executives and the other factors described above.

|

|

|

Total Dollar |

|

Annual |

|

Long-Term |

|

Total |

|

|

Craig M. Nash |

|

2,800,000 |

|

74,962 |

|

74,963 |

|

149,925 |

|

|

Sergio D. Rivera |

|

1,000,000 |

|

26,772 |

|

26,773 |

|

53,545 |

|

|

Jeanette E. Marbert |

|

700,000 |

|

20,079 |

|

20,079 |

|

40,158 |

|

|

William L. Harvey |

|

600,000 |

|

16,064 |

|

16,063 |

|

32,127 |

|

|

John A. Galea |

|

300,000 |

|

8,031 |

|

8,032 |

|

16,063 |

|

|

Victoria J. Kincke |

|

300,000 |

|

8,031 |

|

8,032 |

|

16,063 |

|

Annual RSUs. If earned, the annual RSUs will vest one-third each year with full vesting occurring three years after the date of grant. This is a change from prior years when annual awards vested ratably over four years. This change was made following a review of market practice, noting that companies are changing at a faster pace and it is difficult to set targets longer than three years. For 2017, the requirement for earning the annual RSUs was achievement of at least two of the following performance conditions that were set in mid-February of 2017: (1) Interval membership count as of the end of the second, third or fourth fiscal quarter of 2017 exceeding the specified amount, (2) the number of enterprise-wide exchange transactions during 2017 exceeding a specified amount; (3) the retention rate of Interval members for the 12 month period ended as of the end of the second, third or fourth fiscal quarter of 2017 exceeding a specified percentage; (4) the number of managed resorts as of the end of the second, third or fourth fiscal quarter exceeding the specified amount, or (5) Vacation Ownership achieving at least a specified amount of total timeshare contract sales for 2017. During 2018, management provided a schedule of the relevant metrics in order for the Compensation Committee to certify that the relevant targets have been met for the 2017 grant. These awards were earned and will vest as described above.

Long-Term Performance RSUs. The long-term performance RSUs granted in February 2017 as part of the long-term incentives have two components: 60% vest based on a cumulative three-year consolidated ILG Adjusted EBITDA target for 2017-2019 that is set based on expected 2017 results and a set growth rate for 2018 and 2019, and the remaining 40% vest based on relative total shareholder return of our common stock against two peer groups over the period from December 31, 2016 through December 31, 2019. The Compensation Committee selected these metrics to encourage bottom line growth and reward shareholder returns.

For the 2017 relative total shareholder return (“TSR”) performance, the returns are compared to a broad industry peer group as well as the Russell 2000 index companies as a whole. The broad industry peer group includes those companies in the Russell 2000 that have the Hotels, Restaurant and Leisure GICS Code 253010, referred to as the industry peer group. These two groups are equally weighted to determine the relative return.

Long-Term Equity Awards Earned in 2017. The 2015 long-term performance RSUs were granted by the Compensation Committee based on a cumulative three-year Adjusted EBITDA target for 60% of the awards and on the relative three-year total shareholder return for 40% of the awards.

Adjusted EBITDA Awards. For the Adjusted EBITDA-based awards, if a higher or lower level of cumulative Adjusted EBITDA performance was achieved for 2015-2017, the number of shares earned was increased or decreased accordingly. The following table describes the relationship between the target cumulative Adjusted EBITDA for 2015-2017 for the long-term performance RSUs, to be interpolated for points in between, based on ILG’s Adjusted EBITDA performance:

|

Adjusted EBITDA (Millions) |

|

Performance |

|

|

Below T-20% |

|

0 |

% |

|

T-20% |

|

50 |

% |

|

T-10% |

|

75 |

% |

|

Target Cumulative Adj. EBITDA(T) |

|

100 |

% |

|

T+10% |

|

150 |

% |

|

Adjusted EBITDA (Millions) |

|

Performance |

|

|

T+20% |

|

200 |

% |

|

Above T+20% |

|

200 |

% |

For this purpose, as for the annual incentives, Adjusted EBITDA is defined as net income attributable to common stockholders excluding, if applicable: (1) non-cash compensation expense, (2) depreciation expense, (3) amortization expense, (4) goodwill and asset impairments, (5) income tax provision, (6) interest income and interest expense, (7) acquisition related and restructuring costs, (8) other non-operating income and expense, and (9) one time charges. See Appendix A for reconciliation.

Shares earned based on cumulative Adjusted EBITDA for 2015-2017 performance vested on the third anniversary of the grant date, following certification of performance by the Compensation Committee and subject to continued employment. The combined Adjusted EBITDA for 2015 through 2017 of $818.9 million was greater than the cumulative target of $600.8 million and the maximum amount of Adjusted EBITDA of $720.9 million for 2015 through 2017. Therefore, the 2015 long-term performance RSUs were earned at 200% of target amounts.

TSR awards. For long-term performance RSUs earned based on the relative TSR on ILG stock measured against the Russell 2000 index and the industry peer group for the period from December 31, 2014 through December 31, 2015, the relative TSR is determined as the annualized rate of return as measured by stock price appreciation over the measurement period described above, taking dividends into account and using a 20 trading-day average of reported closing prices. The first peer group is the Russell 2000 Index, of which ILG is a component. The second peer group is the subset of Russell 2000 companies, including ILG, with the Hotels, Restaurant and Leisure GICS Code 253010. In crafting this performance measure, the Compensation Committee noted the small number of publicly traded peer companies for ILG and determined that the industry peer group provided an externally defined group of companies in aligned businesses with similar market capitalization for measuring market performance while the full Russell 2000 provided a broad market perspective. The Compensation Committee determined to weigh these two peer groups equally. The relative TSR against each peer group will be measured as follows with percentiles being interpolated for amounts in between:

|

Relative Percentile Rank |

|

Percent of |

|

|

Greater than 75th percentile |

|

200 |

% |

|

75th Percentile (Maximum) |

|

200 |

% |

|

50th Percentile (Target) |

|

100 |

% |

|

40th Percentile (Threshold) |

|

50 |

% |

|

Less than 40th Percentile |

|

0 |

% |

For the December 31, 2014 through December 31, 2017 period, ILG stock ranked at the 62nd percentile against the index and the 68th percentile against the industry group, which resulted in a 159.4% payout on these RSUs.

Dividends. During 2017, ILG maintained a regular quarterly dividend of $0.15 per share. Under the award agreements for the RSUs, these awards accrue dividend equivalents and the Compensation Committee determined such accrual be made in additional RSUs which vest at the times and subject to the conditions of the underlying awards. These amounts are included under the heading “Summary Compensation Table” in this Form 10-K pursuant to applicable rules.

Compensation Related Policies

Stock Ownership Guidelines. To further align the interests of our executives with the interests of stockholders, our board of directors, upon recommendation of the Compensation Committee, adopted stock ownership guidelines for all executive officers. The guidelines require each senior executive to own a multiple of his or her base salary in the form of ILG common stock and certain unvested equity, generally within five years of assuming his or her position. Prior to attaining the required level, the executive is required to hold 50% of shares acquired upon settlement of equity awards. The required

levels of ownership are designed to reflect the level of responsibility that the executive positions entail. In February 2017, ILG updated its stock ownership guidelines for our executive officer positions as shown in the table below:

|

Position Level |

|

Prior Stock |

|

New Stock |

|

Chief Executive Officer |

|

5 × base salary |

|

6 × base salary |

|

Chief Operating Officer |

|

3 × base salary |

|

3 × base salary |

|

Chief Financial Officer and ILG Executive Vice Presidents |

|

2 × base salary |

|

3 × base salary |

|

Chief Executive Officer and President of Segment |

|

NA |

|

3 × base salary |

|

Presidents of Subsidiary Businesses |

|

2 × base salary |

|

2 × base salary |

|

Senior Vice Presidents at ILG/Operating Segment |

|

1 × base salary |

|

2 × base salary |

|

Interval International Executive Vice Presidents and Senior Vice Presidents |

|

1 × base salary |

|

1 × base salary |

The guidelines are administered by the Compensation Committee. As of April 24, 2018, all of our named executive officers were in compliance with the guidelines.

Recoupment Provisions. The Compensation Committee adopted a recoupment policy for annual and long-term incentive compensation in the event of certain financial restatements. This policy provides that the Compensation Committee may require the reimbursement or forfeiture of any annual incentive payment and any long-term incentive payment or award to an executive for the three years prior to a material restatement of financial results. This policy applies if that executive engaged in fraud or intentional misconduct that caused the need for a material restatement of results, the payment was based on achieving results that were the subject of the material restatement and a lower or no payment would have been made based upon the restated results.

In addition, the granted RSUs have recoupment provisions in the event an executive is terminated for cause or it is determined that during the two-year period prior to termination there was an event or circumstance that would have been grounds for termination for cause. In such event, ILG has the right to cancel all annual and performance RSUs that have not yet vested. Also, to the extent any RSUs vested within two years following the event that was or would have been grounds for termination for cause, ILG may cause such executive to return any shares or pay amounts realized from the settlement of shares issued upon vesting of such RSUs.

Hedging and Pledging Policies. Under our Policy on Securities Trading, our directors, executives and other employees are prohibited from pledging ILG stock or engaging in hedging transactions involving ILG stock or derivatives as well as engaging in short sales involving ILG stock.

Change of Control and Severance

ILG believes that providing executives with severance and change of control protection is important to allowing executives to fully value the forward-looking elements of their compensation packages, and therefore limit retention risk during uncertain times. During 2017 following a market analysis, the Compensation Committee approved amendments to existing employment agreements with Mr. Nash, Mr. Rivera, Ms. Marbert and Mr. Harvey and entered into employment agreements to replace existing severance agreements with Mr. Galea and Ms. Kincke, in each case, to:

· accelerate vesting of RSUs following a change of control only if there is a qualifying termination,

· remove the tax gross-up provision for Mr. Nash’s agreement, and

· revise the amounts payable upon a qualifying termination and a qualifying termination following a change of control.

These employment arrangements provide for payments in the event of either a termination by ILG other than for death, disability or cause or a termination by the executive for good reason, referred to as a qualifying termination. In the event of a qualifying termination, amounts payable include a multiple of base salary and target annual incentive, payment of a pro-rata portion of the annual incentive for the year of termination, continuation of benefits for severance period, and vesting of certain equity awards based on the severance period (determined as if all such awards vested in equal annual installments)

for a qualifying termination for Mr. Nash, Mr. Rivera, Ms. Marbert, and Mr. Harvey (all awards if following a change of control), subject to compliance with restrictive covenants. The multiples of salary and target annual incentive are as follows:

|

Name |

|

Qualifying |

|

Qualifying |

|

|

Craig M. Nash |

|

2x |

|

3x |

|

|

Sergio D. Rivera |

|

2x |

|

2.5x |

|

|

Jeanette E. Marbert |

|

2x |

|

2.5x |

|

|

William L. Harvey |

|

1x |

|

2x |

|

|

John A. Galea |

|

1x |

|

1.5x |

|

|

Victoria J. Kincke |

|

1x |

|

1.5x |

|

The terms and conditions of the RSUs held by our named executive officers provide that the vesting of such RSUs will be accelerated upon a qualifying termination following a change of control.

Prior to March 2017, Mr. Nash’s employment agreement required either (1) a decrease of payments upon a change of control if such payments would have exceeded 2.99 times the base amount under Section 280G of the Internal Revenue Code by no more than 110% or (2) a gross-up of payments subject to excise tax if the payments due upon a change of control would have exceeded 2.99 times the base amount by more than 110%. In addition, the employment agreements, with each of Mr. Nash, Mr. Rivera, Ms. Marbert, and Mr. Harvey previously provided that vesting of RSUs would accelerate upon a change of control if the vest date (determined as if all such RSUs vested in equal annual installments) would have occurred during the two years following the change of control.

Other Compensation

During 2017, we provided a limited number of perquisites and other compensation to our named executive officers. These perquisites included group term life insurance policies for each named executive officer, supplemental disability policies, and an auto allowance for our chief executive officer. The values of these benefits, and the accrued dividend equivalents described above, are reported under the heading “Summary Compensation Table” in this Form 10-K pursuant to applicable rules.

The executive officers do not participate in any deferred compensation or retirement program other than ILG’s 401(k) plan. ILG has established a 401(k) plan for our employees that is intended to qualify under Sections 401(a) and 401(k) of the Internal Revenue Code of 1986, as amended (the “Code”) and has a separate 401(k) plan that covers the Vistana associates. Generally, all employees, including the named executive officers, are eligible to participate in the applicable 401(k) plan from their start of service, or for the Vistana plan upon completion of 90 days of service. Eligible employees electing to participate in the 401(k) plan may defer from one percent of their compensation up to the statutorily prescribed limit, on a pre-tax basis, by making a contribution to the plan. ILG’s discretionary matching contributions equal 50% of each participant’s contribution of up to 6% of the participant’s salary, while the Vistana plan also matches 100% of the first 1% of the participant’s salary. Employer matching contributions vest after two years of service.

Our chief executive officer has on occasion used the private aircraft in which ILG owns a fractional interest for personal trips. In each case, he reimburses ILG for the costs of such use.

Tax Deductibility. Our Compensation Committee’s practice generally has been to structure ILG’s compensation program in such a manner so that the compensation may be deductible by ILG for federal income tax purposes. Section 162(m) of the Internal Revenue Code generally places a $1 million limit on the amount of compensation a company can deduct in any one year for certain executive officers. The exemption from Section 162(m)’s deduction limit for performance-based compensation has been repealed, effective for taxable years beginning after December 31, 2017, such that compensation paid to our covered executive officers in excess of $1 million will not be deductible unless it qualifies for transition relief applicable to certain arrangements in place as of November 2, 2017. Despite the Compensation Committee’s prior efforts to structure compensation in a manner intended to be exempt from Section 162(m) and therefore not subject to its deduction limits, because of ambiguities and uncertainties as to the application and interpretation of Section 162(m) and

the regulations issued thereunder, including the uncertain scope of the transition relief under the legislation repealing Section 162(m)’s exemption from the deduction limit, no assurance can be given that compensation intended to satisfy the requirements for exemption from Section 162(m) in fact will.

Committee Consideration of Results of Stockholder Advisory Vote. At our 2017 Annual Meeting of stockholders, our executive compensation program received the support of nearly 98% of shares represented at the meeting. The Compensation Committee has considered the results of this vote and views this outcome as evidence of stockholder support of its executive compensation decisions and policies. Our stockholders will again be asked to provide a non-binding advisory vote on our executive compensation at our 2018 Annual Meeting of stockholders. Also at our 2017 Annual Meeting of stockholders, stockholders over 83% of shares represented at the meeting voted for the frequency of such non-binding advisory votes to be on an annual basis. The Compensation Committee recommended and our Board of Directors approved a recommendation for the advisory vote on executive compensation to be held annually going forward.

Compensation Decisions for 2017: