UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark One)

| x | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended June 30, 2016

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from ______________ to _______________

Commission File Number 001-35521

CLEARSIGN COMBUSTION CORPORATION

(Exact name of registrant as specified in its charter)

|

WASHINGTON (State or other jurisdiction of |

26-2056298 (I.R.S. Employer |

12870 Interurban Avenue South

Seattle, Washington 98168

(Address of principal executive offices)

(Zip Code)

(206) 673-4848

(Registrant’s telephone number, including area code)

No change

(Former name, former address and former fiscal year, if changed since last report)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period than the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer,” and “large accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer ¨ | Accelerated filer ¨ | |

| Non-accelerated filer ¨ | Smaller reporting company x | |

| (Do not check if a smaller reporting company) |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

As of August 11, 2016 the issuer has 12,956,882 shares of common stock, par value $.0001, issued and outstanding.

PART I-FINANCIAL INFORMATION

| ITEM 1. | CONDENSED FINANCIAL STATEMENTS |

ClearSign Combustion Corporation

Condensed Balance Sheets

(Unaudited)

| June 30, | December 31, | |||||||

| 2016 | 2015 | |||||||

| ASSETS | ||||||||

| Current Assets: | ||||||||

| Cash and cash equivalents | $ | 5,373,000 | $ | 10,985,000 | ||||

| Prepaid expenses | 535,000 | 203,000 | ||||||

| Total current assets | 5,908,000 | 11,188,000 | ||||||

| Fixed assets, net | 117,000 | 123,000 | ||||||

| Patents and other intangible assets, net | 3,276,000 | 2,881,000 | ||||||

| Other assets | 10,000 | 10,000 | ||||||

| Total Assets | $ | 9,311,000 | $ | 14,202,000 | ||||

| LIABILITIES AND STOCKHOLDERS' EQUITY | ||||||||

| Current Liabilities: | ||||||||

| Accounts payable and accrued liabilities | $ | 598,000 | $ | 495,000 | ||||

| Accrued compensation and taxes | 719,000 | 1,109,000 | ||||||

| Deferred rent | 11,000 | 20,000 | ||||||

| Total current liabilities | 1,328,000 | 1,624,000 | ||||||

| Commitments | ||||||||

| Stockholders' Equity: | ||||||||

| Preferred stock, $0.0001 par value, zero shares issued and outstanding | - | - | ||||||

| Common stock, $0.0001 par value, 12,956,882 and 12,868,943 shares issued and outstanding at June 30, 2016 and December 31, 2015, respectively | 1,000 | 1,000 | ||||||

| Additional paid-in capital | 42,160,000 | 41,735,000 | ||||||

| Accumulated deficit | (34,178,000 | ) | (29,158,000 | ) | ||||

| Total stockholders' equity | 7,983,000 | 12,578,000 | ||||||

| Total Liabilities and Stockholders' Equity | $ | 9,311,000 | $ | 14,202,000 | ||||

The accompanying notes are an integral part of these condensed financial statements.

| 2 |

ClearSign Combustion Corporation

Condensed Statements of Operations

(Unaudited)

| For the Three Months Ended June 30, | For the Six Months Ended June 30, | |||||||||||||||

| 2016 | 2015 | 2016 | 2015 | |||||||||||||

| Operating expenses: | ||||||||||||||||

| Research and development | $ | 1,216,000 | $ | 714,000 | $ | 2,541,000 | $ | 1,287,000 | ||||||||

| General and administrative | 1,226,000 | 1,096,000 | 2,502,000 | 2,115,000 | ||||||||||||

| Total operating expenses | 2,442,000 | 1,810,000 | 5,043,000 | 3,402,000 | ||||||||||||

| Loss from operations | (2,442,000 | ) | (1,810,000 | ) | (5,043,000 | ) | (3,402,000 | ) | ||||||||

| Other income: | ||||||||||||||||

| Interest income | 11,000 | 14,000 | 23,000 | 23,000 | ||||||||||||

| Net Loss | $ | (2,431,000 | ) | $ | (1,796,000 | ) | $ | (5,020,000 | ) | $ | (3,379,000 | ) | ||||

| Net Loss per share - basic and fully diluted | $ | (0.19 | ) | $ | (0.14 | ) | $ | (0.39 | ) | $ | (0.28 | ) | ||||

| Weighted average number of shares outstanding - basic and fully diluted | 12,917,410 | 12,799,666 | 12,893,251 | 12,085,478 | ||||||||||||

The accompanying notes are an integral part of these condensed financial statements.

| 3 |

ClearSign Combustion Corporation

Condensed Statement of Stockholders' Equity

(Unaudited)

For the Six Months Ended June 30, 2016

| Common Stock | Additional | Accumulated | Total Stockholders' | |||||||||||||||||

| Shares | Amount | Paid-In Capital | Deficit | Equity | ||||||||||||||||

| Balances at December 31, 2015 | 12,868,943 | $ | 1,000 | $ | 41,735,000 | $ | (29,158,000 | ) | $ | 12,578,000 | ||||||||||

| Shares issued for services ($3.40 per share) | 22,056 | - | 75,000 | - | 75,000 | |||||||||||||||

| Shares issued for services ($3.96 per share) | 5,000 | - | 20,000 | - | 20,000 | |||||||||||||||

| Shares issued upon exercise of warrants ($2.20 per share) | 60,883 | - | - | - | - | |||||||||||||||

| Share based compensation | - | - | 330,000 | - | 330,000 | |||||||||||||||

| Net loss | - | - | - | (5,020,000 | ) | (5,020,000 | ) | |||||||||||||

| Balances at June 30, 2016 | 12,956,882 | $ | 1,000 | $ | 42,160,000 | $ | (34,178,000 | ) | $ | 7,983,000 | ||||||||||

The accompanying notes are an integral part of these condensed financial statements.

| 4 |

ClearSign Combustion Corporation

Condensed Statements of Cash Flows

(Unaudited)

| For the Six Months Ended June 30, | ||||||||

| 2016 | 2015 | |||||||

| Cash flows from operating activities: | ||||||||

| Net loss | $ | (5,020,000 | ) | $ | (3,379,000 | ) | ||

| Adjustments to reconcile net loss to net cash used in operating activities: | ||||||||

| Common stock issued for services | 95,000 | 62,000 | ||||||

| Share based payments | 330,000 | 355,000 | ||||||

| Depreciation and amortization | 90,000 | 112,000 | ||||||

| Abandonment of capitalized patents pending | 232,000 | 5,000 | ||||||

| Deferred rent | (9,000 | ) | (6,000 | ) | ||||

| Change in operating assets and liabilities: | ||||||||

| Prepaid expenses | (332,000 | ) | (145,000 | ) | ||||

| Accounts payable | 103,000 | 174,000 | ||||||

| Accrued compensation | (390,000 | ) | (340,000 | ) | ||||

| Net cash used in operating activities | (4,901,000 | ) | (3,162,000 | ) | ||||

| Cash flows from investing activities: | ||||||||

| Acquisition of fixed assets | (60,000 | ) | (30,000 | ) | ||||

| Disbursements for patents and other intangible assets | (651,000 | ) | (611,000 | ) | ||||

| Net cash used in investing activities | (711,000 | ) | (641,000 | ) | ||||

| Cash flows from financing activities: | ||||||||

| Proceeds from issuance of common stock for cash, net of offering costs | - | 16,279,000 | ||||||

| Proceeds from exercise of stock options | - | 285,000 | ||||||

| Net cash provided by financing activities | - | 16,564,000 | ||||||

| Net increase (decrease) in cash and cash equivalents | (5,612,000 | ) | 12,761,000 | |||||

| Cash and cash equivalents, beginning of period | 10,985,000 | 1,845,000 | ||||||

| Cash and cash equivalents, end of period | $ | 5,373,000 | $ | 14,606,000 | ||||

Supplemental disclosure of non-cash operating and financing activities:

During the six months ended June 30, 2016, the Company issued 60,883 shares of common stock through net settlement cashless exercises of warrants to purchase 118,959 shares at $2.20 per share when the closing prices on the date of exercises were a weighted average of $4.51 per share.

The accompanying notes are an integral part of these condensed financial statements.

| 5 |

ClearSign Combustion Corporation

Notes to Unaudited Condensed Financial Statements

Note 1 – Organization and Description of Business

ClearSign Combustion Corporation (ClearSign or the Company) designs and develops technologies for the purpose of improving key performance characteristics of combustion systems, including emission and operational performance, energy efficiency and overall cost-effectiveness. The Company’s primary technologies include its Duplex™ technology, which achieves very low emissions without the need of external flue gas recirculation, selective catalytic reduction, or higher excess air operation, and its Electrodynamic Combustion Control™ or ECC™ technology, which introduces a computer-controlled electric field into the combustion region which may better control gas-phase chemical reactions and improve system performance and cost-effectiveness. The Company is headquartered in Seattle, Washington and was incorporated in the state of Washington in 2008.

The Company’s Duplex technology is currently in field development and has generated de minimis revenues from operations to date to meet operating expenses. In order to generate meaningful revenues, the technologies must be fully developed, gain market recognition and acceptance, and develop a critical level of successful sales and product installations. The Company has historically financed its operations primarily through issuances of equity securities. The Company has incurred losses since its inception totaling $34,178,000 and expects to experience operating losses and negative cash flow for the foreseeable future. Management believes that the successful growth and operation of the Company’s business is dependent upon its ability to obtain adequate sources of funding through co-development agreements, strategic partnering agreements, or equity or debt financing to adequately support research and development efforts, protect intellectual property, form relationships with strategic partners, and provide for working capital and general corporate purposes. There can be no assurance that the Company will be successful in achieving its long-term plans as set forth above, or that such plans, if consummated, will enable the Company to obtain profitable operations or continue in the long-term as a going concern.

Note 2 – Summary of Significant Accounting Policies

Basis of Presentation

The accompanying unaudited condensed financial statements have been prepared in accordance with the rules and regulations of the Securities and Exchange Commission for Form 10-Q. Accordingly, certain information and footnote disclosures normally included in financial statements prepared in accordance with generally accepted accounting principles have been condensed or omitted pursuant to such rules and regulations. The condensed balance sheet at December 31, 2015 has been derived from the Company’s audited financial statements.

In the opinion of management, these financial statements reflect all normal recurring and other adjustments necessary for a fair presentation. These financial statements should be read in conjunction with the audited financial statements included in our Annual Report on Form 10-K for the year ended December 31, 2015. Operating results for interim periods are not necessarily indicative of operating results for an entire fiscal year or any other future periods.

Use of Estimates

The preparation of financial statements in conformity with accounting principles generally accepted in the United States requires management to make certain estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

| 6 |

Revenue Recognition and Cost of Revenue

Revenues from design and installation of the Company’s products are recognized on the completed contract method. Revenues from contracts and related costs of goods sold are recognized once the contract is completed or substantially completed. Contract costs include all direct material and labor costs and those indirect costs related to contract performance, such as indirect labor, supplies, and depreciation costs. Provisions for estimated losses on uncompleted contracts are made in the period in which such losses are determined.

Cash and Cash Equivalents

Highly liquid investments purchased with an original maturity of three months or less are considered cash equivalents. Cash is maintained with a commercial bank where accounts are generally guaranteed by the Federal Deposit Insurance Corporation up to $250,000. The Company’s deposits may at times exceed this limit. The Company has not experienced losses in such accounts and believes it is not exposed to any significant credit risk on cash and cash equivalents.

Fixed Assets

Fixed assets are recorded at cost. Depreciation is computed using the straight-line method over the estimated useful lives of the respective assets. Leasehold improvements are depreciated over the life of the lease or their useful life, whichever is shorter. All other fixed assets are depreciated over two to four years. Maintenance and repairs are expensed as incurred.

Patents and Trademarks

Patents and trademarks are recorded at cost. Amortization is computed using the straight-line method over the estimated useful lives of the assets once they are awarded.

Impairment of Long-Lived Assets

The Company tests long-lived assets for impairment whenever events or changes in circumstances indicate that the carrying amount of an asset may not be recoverable through the estimated undiscounted cash flows expected to result from the use and eventual disposition of the assets. In that event, a loss is recognized based on the amount by which the carrying amount exceeds the fair value of the long-lived assets. Fair value is determined based on the present value of estimated expected cash flows using a discount rate commensurate with the risks involved, quoted market prices, or appraised values depending upon the nature of the assets. Loss on long-lived assets to be disposed of is determined in a similar manner, except that fair values are reduced for the cost of disposal.

Fair Value of Financial Instruments

Fair value is the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. Assets and liabilities measured at fair value are categorized based on whether or not the inputs are observable in the market and the degree that the inputs are observable. The categorization of financial assets and liabilities within the valuation hierarchy is based upon the lowest level of input that is significant to the fair value measurement.

The Company's financial instruments primarily consist of cash and cash equivalents, accounts payable and accrued expenses. As of the balance sheet dates, the estimated fair values of the financial instruments were not materially different from their carrying values as presented on the balance sheets. This is primarily attributable to the short term maturities of these instruments. The Company did not identify any other non-recurring assets and liabilities that are required to be presented in the balance sheets at fair value.

| 7 |

Research and Development

The cost of research and development is expensed as incurred. Research and development costs consist of salaries, benefits, share based compensation, consulting fees, rent, utilities, depreciation, and consumables used in laboratory and field testing.

Deferred Rent

Operating lease agreements which contain provisions for future rent increases or periods in which rent payments are reduced or abated are recorded in monthly rent expense in the amount of the total payments over the lease term divided by the number of months of the lease term. The difference between rent expense recorded and the amount paid is credited or charged to deferred rent which is reflected on the accompanying balance sheets.

Income Taxes

The Company accounts for income taxes using an asset and liability approach which allows for the recognition and measurement of deferred tax assets based upon the likelihood of realization of tax benefits in future years. Under the asset and liability approach, deferred taxes are provided for the net tax effects of temporary differences between the carrying amounts of assets and liabilities for financial reporting purposes and the amounts used for income tax purposes. A valuation allowance is provided for deferred tax assets if it is more likely than not these items will either expire before the Company is able to realize their benefits, or that future deductibility is uncertain. Tax benefits from an uncertain tax position are recognized only if it is more likely than not that the tax position will be sustained on examination by the taxing authorities based on the technical merits of the position. The tax benefits recognized in the financial statements from such a position are measured based on the largest benefit that has a greater than 50 percent likelihood of being realized upon ultimate resolution.

Stock-Based Compensation

The costs of all employee stock options, as well as other equity-based compensation arrangements, are reflected in the financial statements based on the estimated fair value of the awards on the grant date. That cost is recognized over the period during which an employee is required to provide service in exchange for the award. Stock compensation for stock granted to non-employees is determined as the fair value of the consideration received or the fair value of equity instruments issued, whichever is more reliably measured.

Net Loss per Common Share

Basic loss per share is computed by dividing loss available to common stockholders by the weighted-average number of common shares outstanding. Diluted loss per share is computed similar to basic loss per share except that the denominator is increased to include additional common shares available upon exercise of stock options and warrants using the treasury stock method, except for periods for which no common share equivalents are included because their effect would be anti-dilutive. At June 30, 2016 and 2015, potentially dilutive shares outstanding amounted to 1,333,363 and 1,392,352, respectively.

Recently Issued Accounting Pronouncements

In February 2016, the Financial Accounting Standards Board issued Accounting Standards Update No. 2016-02 regarding leases. The new standard requires lessee recognition on the balance sheet of a right-of-use asset and a lease liability, initially measured at the present value of the lease payments. It further requires recognition in the income statement of a single lease cost, calculated so that the cost of the lease is allocated over the lease term on a generally straight-line basis. Finally, it requires classification of all cash payments within operating activities in the statement of cash flows. It is effective for fiscal years commencing after December 15, 2018 and early adoption is permitted. Management does not believe that this standard or any other recently issued, but not yet effective standards, if adopted, will have a material effect on the financial statements.

| 8 |

Emerging Growth Company

The Company is an emerging growth company as defined under the Jumpstart Our Business Startups Act of 2012 (JOBS Act). An emerging growth company may delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. The Company will remain an emerging growth company until December 31, 2017, although it will lose that status sooner if its revenues exceed $1 billion, if it issues more than $1 billion in non-convertible debt in a three year period, or if the market value of its common stock that is held by non-affiliates exceeds $700 million as of any June 30. At June 30, 2016, the market value of the Company’s common stock held by non-affiliates totaled $62 million.

Note 3 – Fixed Assets

Fixed assets are summarized as follows:

| June 30, | December 31, | |||||||

| 2016 | 2015 | |||||||

| (unaudited) | ||||||||

| Machinery and equipment | $ | 639,000 | $ | 639,000 | ||||

| Office furniture and equipment | 133,000 | 115,000 | ||||||

| Leasehold improvements | 130,000 | 130,000 | ||||||

| Accumulated depreciation and amortization | (827,000 | ) | (761,000 | ) | ||||

| 75,000 | 123,000 | |||||||

| Construction in progress | 42,000 | - | ||||||

| $ | 117,000 | $ | 123,000 | |||||

Note 4 – Patents and Other Intangible Assets

Patents and other intangible assets are summarized as follows:

| June 30, | December 31, | |||||||

| 2016 | 2015 | |||||||

| (unaudited) | ||||||||

| Patents | ||||||||

| Patents pending | $ | 2,927,000 | $ | 2,730,000 | ||||

| Issued patents | 337,000 | 115,000 | ||||||

| 3,264,000 | 2,845,000 | |||||||

| Trademarks | ||||||||

| Trademarks pending | 18,000 | 18,000 | ||||||

| Registered trademarks | 23,000 | 23,000 | ||||||

| 41,000 | 41,000 | |||||||

| Other | 8,000 | 8,000 | ||||||

| 3,313,000 | 2,894,000 | |||||||

| Accumulated amortization | (37,000 | ) | (13,000 | ) | ||||

| $ | 3,276,000 | $ | 2,881,000 | |||||

| 9 |

Future amortization expense associated with issued patents and registered trademarks as of June 30, 2016 is estimated as follows:

| 2016 | $ | 31,000 | ||

| 2017 | 62,000 | |||

| 2018 | 63,000 | |||

| 2019 | 63,000 | |||

| 2020 | 60,000 | |||

| Thereafter | 44,000 | |||

| $ | 323,000 |

During the three and six months ended June 30, 2016 and 2015, the Company recorded an impairment loss of $167,000, $232,000, $5,000 and $5,000, respectively, from abandonment of capitalized patents.

Note 5 – Termination of Employment Agreement

The Company and its former Chief Executive Officer, Richard F. Rutkowski, entered into an agreement in December 2014 terminating a prior employment agreement. Under this agreement, Mr. Rutkowski will be paid his annual salary of $359,000 through December 31, 2016, was paid a bonus of $60,000 in 2015, has received employee benefits through December 2015, and received accelerated vesting on 15,625 stock options with an exercise price of $4.88 per share and 14,219 stock options with an exercise price of $9.90 per share. The options were not exercised prior to March 2015, therefore, pursuant to the terms of the option agreements and the ClearSign Combustion Company 2011 Equity Incentive Plan, the right to exercise the options terminated.

The liability incurred under this agreement totaled $943,000 which was recognized in general and administrative expense in 2014 and included a fair value of $50,000 attributable to the stock option provisions. At June 30, 2016, the remaining liability totaled $182,000 and is due through December 2016.

Note 6 – Stockholders’ Equity

Common Stock and Preferred Stock

The Company is authorized to issue 62,500,000 shares of common stock and 2,000,000 shares of preferred stock. Preferences, limitations, voting powers and relative rights of any preferred stock to be issued may be determined by the Company’s Board of Directors. The Company has not issued any shares of preferred stock.

In February 2015, the Company completed an underwritten public offering of common stock whereby 2,990,000 shares were issued at $5.85 per share. Gross proceeds from the offering totaled $17.5 million and net cash proceeds approximated $16.3 million. Expenses of the offering approximated $1.2 million, including underwriting fees of $1,049,000, underwriter legal fees and other costs of $55,000, and other costs of $108,000.

Equity Incentive Plan

The Company has an Equity Incentive Plan (the Plan) which provides for the granting of options to purchase shares of common stock, stock awards to purchase shares at no less than 85% of the value of the shares, and stock bonuses to officers, employees, board members, consultants, and advisors. The Compensation Committee of the Board of Directors is authorized to administer the Plan and establish the grant terms, including the grant price, vesting period and exercise date. As of June 30, 2016, the number of shares reserved for issuance under the Plan totaled 1,398,476 shares. The Plan provides for quarterly increases in the available number of authorized shares equal to the lesser of 10% of any new shares issued by the Company during the quarter immediately prior to the adjustment date or such lesser amount as the Board of Directors shall determine.

| 10 |

In the three months ended June 30, 2016, the Company granted 169,900 stock options under the Plan to employees. The stock options have exercise prices at the grant date fair value of $4.21 per share, contractual lives of 10 years, and vest over 4 years. The fair value of stock options granted estimated on the date of grant using the Black-Scholes option valuation model was $414,000. The recognized compensation expense associated with these grants for the three months ended June 30, 2016 was $26,000. The following weighted-average assumptions were utilized in the calculation of the fair value of the stock options:

| Expected life | 6.25 years | |||

| Weighted average volatility | 73 | % | ||

| Forfeiture rate | 12 | % | ||

| Weighted average risk-free interest rate | 1.56 | % | ||

| Expected dividend rate | 0 | % |

In March 2016, the Company authorized 44,112 shares of common stock to be issued under the Plan to its three independent directors in accordance with board agreements and which will be earned quarterly for service in 2016. The fair value of the stock at the time of grant was $3.40 per share for a total value of $150,000. The Company recognized $38,000 and $75,000 in general and administrative expense for the three and six months ended June 30, 2016 and will recognize the remaining $75,000 in the remainder of 2016.

In accordance with the Plan, options for the purchase of 7,504 shares of common stock were exercised in 2014 prior to vesting and the shares of common stock purchased were issued with a declining repurchase right in favor of the Company at the exercise price of $4.88 per share. The Company may repurchase shares if, prior to December 31, 2016, the employee terminates employment or certain other designated events occur. At June 30, 2016, 2,502 shares remained subject to this repurchase right.

Outstanding stock option grants at June 30, 2016 and December 31, 2015 totaled 888,050 shares and 723,400 shares with the right to purchase 495,974 shares and 257,391 shares being vested and exercisable at June 30, 2016 and December 31, 2015, respectively. Stock grants made to date through June 30, 2016 and December 31, 2015 totaled 235,514 shares and 213,458 shares, respectively. Of these amounts, 4,000 shares and 12,000 shares at June 30, 2016 and December 31, 2015, respectively, are subject to declining repurchase rights by the Company at $0.0001 per share through September 30, 2016. The recognized compensation expense associated with these grants for the three and six months ended June 30, 2016 and 2015 totaled $200,000, $405,000, $276,000 and $417,000, respectively. At June 30, 2016, the number of shares reserved under the Plan but unissued totaled 274,912. At June 30, 2016, there was $1,000,000 of total unrecognized compensation cost related to non-vested share based compensation arrangements granted under the Plan. That cost is expected to be recognized over a weighted average period of 2.4 years.

Consultant Stock Plan

The Company has a 2013 Consultant Stock Plan (the Consultant Plan) which provides for the granting of shares of common stock to consultants who provide services related to capital raising, investor relations, and making a market in or promoting the Company’s securities. The Company’s officers, employees, and board members are not entitled to receive grants from the Consultant Plan. The Compensation Committee of the Board of Directors is authorized to administer the Consultant Plan and establish the grant terms. The number of shares reserved for issuance under the Consultant Plan on June 30, 2016 totaled 116,004 with 87,754 of those shares unissued. The Consultant Plan provides for quarterly increases in the available number of authorized shares equal to the lesser of 1% of any new shares issued by the Company during the quarter immediately prior to the adjustment date or such lesser amount as the Board of Directors shall determine. In August 2016, the Company granted 10,000 shares of common stock under the Consultant Stock Plan to a consultant for services from June 2016 to May 2017 and subject to completion of service each quarter. The fair value of the stock at the time of grant was $4.85 per share for a total value of $49,000 which the Company will recognize in general and administrative expense on a pro-rated quarterly basis. The Consultant Plan expense for the three and six months ended June 30, 2016 and 2015 was $10,000, $20,000, $0, and $0, respectively.

| 11 |

Warrants

The Company has the following warrants outstanding at June 30, 2016:

| Total Outstanding Warrants | ||||||||||||||

| Exercise Price | Warrants | Weighted Average Exercise Price | Life (in years) | |||||||||||

| $ | 1.80 | 80,000 | $ | 1.80 | 4.64 | |||||||||

| $ | 5.00 | 345,000 | $ | 5.00 | 0.82 | |||||||||

| $ | 10.00 | 20,313 | $ | 10.00 | 2.68 | |||||||||

| 445,313 | $ | 4.65 | ||||||||||||

During the three months ended June 30, 2016, the Company issued 60,883 shares of common stock through net settlement cashless exercises of warrants to purchase 118,959 shares at $2.20 per share when the closing prices on the date of exercises were a weighted average of $4.51 per share.

Note 7 – Related Party Transactions

In connection with the February 2015 underwritten public offering described in Note 6, the Company paid the underwriter, MDB Capital Group, LLC (MDB), underwriting fees of $1,049,000 and underwriter legal fees and other costs of $55,000. As of their last public filing in May 2016, MDB and its chief executive officer beneficially own, in the aggregate, approximately 7.5% of the Company's common stock.

Note 8 – Commitments

On February 3, 2015, the Company and its Chief Executive Officer, Stephen E. Pirnat, entered into an employment agreement (the Agreement) which terminates on December 31, 2017, unless earlier terminated. Compensation under the Agreement includes an annual salary of $350,000 with annual cost-of-living adjustments, a grant of stock options to purchase 300,000 shares of the Company’s common stock, annual cash bonuses that may equal up to 60% of his annual salary and equity bonuses based on performance standards established by the Compensation Committee of the Board of Directors, medical and dental benefits for Mr. Pirnat and his family, other employee benefits offered to employees generally and relocation expenses up to approximately $100,000. The Agreement may be terminated by the Company without cause under certain circumstances, as defined in the Agreement, whereby a severance payment would be due in the amount of compensation that would have been due had employment not been terminated or one year of the current annual compensation, whichever is greater. In the event of a change in control, Mr. Pirnat would receive one year’s compensation and all previously granted stock options would vest in full.

The Company has a triple net lease for office and laboratory space in Seattle, Washington through February 2017. Under the terms of the lease, the Company paid no rent for the period November 2011 to February 2012 and for February 2014. Rent escalates annually by 3%. The Company records monthly rent expense equal to the total of the payments over the lease term divided by the number of months of the lease term. For the six months ended June 30, 2016 and 2015, the deferred rent was reduced by $9,000 and $6,000, respectively. Under the terms of the lease, the Company also pays monthly triple net operating costs which currently approximate $3,000 per month. In the quarter ended June 30, 2016, the Company entered into a three-year lease commencing September 2016 for office space in Tulsa, Oklahoma with monthly rent of $2,000 per month plus triple net operating costs. Minimum future payments under the Company’s leases at June 30, 2016 are as follows:

| 2016 | $ | 79,000 | ||

| 2017 | 49,000 | |||

| 2018 | 26,000 | |||

| 2019 | 17,000 | |||

| $ | 171,000 |

| 12 |

For the three and six months ended June 30, 2016 and 2015, rent expense amounted to $46,000, $97,000, $40,000, and $82,000, respectively.

The Company has a field test agreement with a customer to demonstrate and test the Duplex technology in a once through steam generator (OTSG) used to facilitate a thermally enhanced oil recovery process. Under the terms of the agreement, the Company has retrofitted an OTSG unit in order to achieve certain performance criteria. The agreement also includes time-sensitive pricing, delivery and installation terms, if elected, that will apply to future purchases of this Duplex application by this customer.

Note 9 – Subsequent Event

In August 2016 the Company received an order from a prime contractor for the end user, a major California oil producer, to retrofit flares. Including a test installation that is nearing completion, the multi-flare order exceeds $1 million and is expected to be completed over six to twelve months depending on the customer’s schedule.

| 13 |

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS AND OTHER INFORMATION

CONTAINED IN THIS REPORT

This report contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 and the provisions of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements give our current expectations or forecasts of future events. You can identify these statements by the fact that they do not relate strictly to historical or current facts. You can find many (but not all) of these statements by looking for words such as “approximates,” “believes,” “hopes,” “expects,” “anticipates,” “estimates,” “projects,” “intends,” “plans,” “would,” “should,” “could,” “may,” or other similar expressions in this report. In particular, these include statements relating to future actions; prospective products, applications, customers, or technologies; future performance or results of anticipated products; anticipated expenses; and future financial results. These forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from our historical experience and our present expectations or projections. Factors that could cause actual results to differ materially from those discussed in the forward-looking statements include, but are not limited to:

| · | our limited cash and our history of losses; |

| · | our ability to successfully develop and implement our technology and achieve profitability; |

| · | our limited operating history; |

| · | emerging competition and rapidly advancing technology in our industry that may outpace our technology; |

| · | customer demand for the products and services we develop; |

| · | the impact of competitive or alternative products, technologies and pricing; |

| · | our ability to manufacture any products we design; |

| · | general economic conditions and events and the impact they may have on us and our potential customers; |

| · | our ability to obtain adequate financing in the future; |

| · | our ability to continue as a going concern; |

| · | our success at managing the risks involved in the foregoing items; and |

| · | other factors discussed in this report. |

Forward-looking statements may appear throughout this report, including, without limitation, Item 2 “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” The forward-looking statements are based upon management’s beliefs and assumptions and are made as of the date of this report. We undertake no obligation to publicly update or revise any forward-looking statements included in this report. You should not place undue reliance on these forward-looking statements.

Unless otherwise stated or the context otherwise requires, the terms “ClearSign,” “we,” “us,” “our” and the “Company” refer to ClearSign Combustion Corporation.

14

| ITEM 2. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

The following discussion and analysis of our financial condition and results of operations should be read in conjunction with the unaudited condensed financial statements and related notes included elsewhere in this Quarterly Report on Form 10-Q as well as our audited financial statements and related notes included in our Annual Report on Form 10-K. In addition to historical information, this discussion and analysis here and throughout this Form 10-Q contains forward-looking statements that involve risks, uncertainties and assumptions. Our actual results may differ materially from those anticipated in these forward-looking statements due to a number of factors, including but not limited to, the risks described in the section titled “Risk Factors” in our Annual Report on Form 10-K.

OVERVIEW

We design and develop technologies for the purpose of improving key performance characteristics of combustion systems, including emission and operational performance, energy efficiency and overall cost-effectiveness. Our patent-pending Duplex™ and Electrodynamic Combustion Control™ (ECC™) platform technologies enhance the performance of combustion systems in a broad range of markets, including the refinery, petrochemical, chemical, power and commercial boiler industries. Our Duplex technology uses a porous ceramic tile above a standard burner to significantly reduce flame length and achieve very low emissions without the need for external flue gas recirculation, selective catalytic reduction, or excess air systems. Our ECC technology introduces a computer-controlled high voltage electric field into a combustion volume in order to better control gas-phase chemical reactions and improve system performance and cost-effectiveness. To date, our operations have been funded primarily through sales of our common stock. We have earned no significant revenue since inception on January 23, 2008. We are headquartered in Seattle, Washington with an office in Tulsa, Oklahoma.

Plan of Operation

In order to enable future sales of our Duplex technology, we have been engaged in (i) a number of field development projects where we have successfully demonstrated our proprietary technology operating with thermal output of up to 52 million BTU/hr., and (ii) business development and marketing activities with established entities that use steam generators, process heaters, enclosed flares, boilers, and other combustion systems as well as original equipment manufacturers.

We currently have eight field test projects using our Duplex technology: three related to OTSGs in the enhanced oil recovery industry, one related to wellhead enclosed flares, and four related to process heaters in the oil refining industry. Four of these projects are in the design phase and four are in the fieldwork stage. Our fieldwork has been successful to date in registering NOx emission levels within the specifications of the customer and relevant regulatory bodies. However, there remains certain additional fieldwork required before we can complete the installations and commissioning processes. Six of the eight field test project agreements include payments once the project is completed and the installed unit is operating to the customer’s satisfaction. As each of these trials are completed, we expect to recognize small amounts of revenue. As we move forward with commercial sales of Duplex, we anticipate more traditional sales terms, but will continue to recognize the revenue only following customer acceptance. We believe that successful completion of field development projects is critical to the commercialization of a Duplex product.

Our field test application of Duplex on a wellhead enclosed flare is nearing completion. In August 2016, we received an order from the prime contractor for the end user, a major California oil producer. The total value of the order, including the initial test unit, exceeds $1 million and is expected to be completed within six to twelve months following the order date depending on the customer’s schedule. This represents our first major order.

We intend to continue field validation of our Duplex technology in a number of vertical markets in order to produce sufficient data to demonstrate product attributes and dependability.

15

Our business plan contemplates licensing our technology after we prove commercial viability and generate interest from original equipment manufacturers (OEMs). Licensing would significantly change the makeup of our revenue mix, revenue recognition, and margins. Licensing our technology within one or an array of selected vertical markets (e.g. packaged boilers) could dramatically accelerate the global sales and market adoption rate of our technology. However, in order to create channel flexibility and meet end user demand for our technologies, we intend to continue to pursue end user customers through direct sales, sub-contractors, or channel partners. While we are currently pursuing various licensing arrangements, we have no agreements at this time and do not anticipate entering into any such agreements prior to completion of the field development projects discussed above and, in most cases, completing a meaningful number of installations and sales. We believe that the continuing development of Duplex, the completion of sales and an increase in end-users will enhance our ability to license our technology.

Our initial target markets center on the energy sector, including upstream crude oil production through the use of OTSGs and wellhead enclosed flares upstream and oil refineries downstream through the use of process heaters. In recent years, the energy sector has been significantly affected by the volatile market price of crude oil. According to the U.S. Energy Information Administration, the spot price of West Texas intermediate crude oil in the last five years has ranged from approximately $110 per barrel to approximately $25 per barrel. Regardless of the effect of crude oil prices, based upon our experience and feedback from prospective customers, we believe that the market continues to validate the appeal of our Duplex technology to oil producers due to the technology’s lower emissions and certain operational efficiencies.

We believe that operators in all of our target markets are under intense pressure to meet current and proposed federal, state and local emissions standards. As a result, we believe that these standards are a significant driver in our development and sales efforts and that our Duplex technology can provide a unique, cost-effective pollution control solution for operators in comparison to competing products.

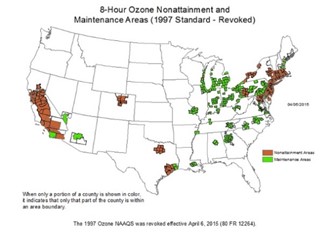

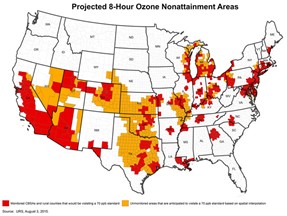

Emissions standards largely emanate from the Clean Air Act, which is administered by the Environmental Protection Agency (EPA) and regulates six common criteria air pollutants, including ground-level ozone. These regulations are enforced by state and local air quality districts as part of their compliance plans. As a precursor to ground-level ozone, nitrogen oxides (NOx) are regulated emissions by local air quality districts in order to achieve the EPA limits. The 8-hour ground-level ozone regulations have been reduced from 84 parts per billion (ppb) in 1997, to 75 ppb in 2008, and 70 ppb in 2015, with the requirement of realizing these levels approximately 25 years following the year of legislation. The areas of non-attainment related to this 1997 limit of 84 ppb are depicted below in the map on the left and the projected areas of non-attainment related to the 2015 limit of 70 ppb are depicted below in the map on the right.

Non-attainment areas under the 1997 limit of 84 ppb Source: EPA, August 2016 |

Projected non-attainment areas under the 2015 limit of 70 ppb Source: URS, August 2015 |

16

We have noted that local air quality districts in severe non-attainment zones in California are uncertain as to how they will achieve the 2015 standard. As such, we believe that local regulators are in search of additional means beyond those included in the current regulations to comply with the impending standards. For example, although NOx emissions from refineries and other oil production and processing operations are highly regulated since they are historically a significant source of stationary NOx emissions, enclosed ground flares have not historically been viewed as a source requiring the same level of regulation. We believe that our Duplex technology is uniquely able to address the emissions challenges being faced by oil producers and other industries as those challenges relate to both current and reasonably predictable future local air emission standards.

We are pursuing development of our ECC technology through laboratory research where we have demonstrated certain attributes of our proprietary technology operating in our research facility with thermal output of up to 2 million BTU/hr. ECC appears to be appropriate for established entities that use solid fuel burners or related combustion systems. We intend to continue our laboratory research and to enter into collaborative arrangements which would enable us to work closely with established companies in targeted industries to apply solutions developed in our laboratory.

Historically, we have funded our operations through the sale of our common stock, including the following sales of common stock in the public market:

| - | In April and May 2012, we completed an initial public offering (IPO) of our common stock whereby we sold 3,450,000 shares of common stock at $4.00 per share, which included the exercise of the underwriter’s overallotment option, resulting in gross proceeds of $13.8 million and, after deducting certain costs paid with common stock, net proceeds of $11.6 million. |

| - | In March 2014, we completed a registered direct offering of our common stock whereby we sold 812,500 shares of common stock at $8.00 per share resulting in gross proceeds of $6.5 million and net proceeds of approximately $5.8 million. |

| - | In February 2015, we completed an underwritten public offering of our common stock whereby we sold 2,990,000 shares of common stock at $5.85 per share resulting in gross proceeds of $17.5 million and net proceeds of approximately $16.3 million. |

Our costs include but, depending on new or changed circumstances may not be limited to, employee salaries and benefits, compensation paid to consultants, capital costs for research and other equipment, costs associated with development activities including travel and administration, legal expenses, sales and marketing costs, general and administrative expenses, and other costs associated with an early stage, publicly-traded technology company. We currently have 23 full-time employees and 1 part-time employee. We anticipate increasing the number of employees required to support our activities in the areas of operations, research and development, sales and marketing, and general and administrative functions. We expect to incur increasing consulting expenses related to technology development and increasing expenses to protect our intellectual property.

17

The amount that we spend for any specific purpose may vary significantly, and could depend on a number of factors including, but not limited to, the pace of progress of our commercialization and development efforts, actual needs with respect to product testing, development and research, market conditions, and changes in or revisions to our marketing strategies.

Research, development, and commercial acceptance of new technologies are, by their nature, unpredictable. Although we will undertake development and commercialization efforts with reasonable diligence, there can be no assurance that the net proceeds from our securities offerings will be sufficient to enable us to develop our technology to the extent needed to create future sales to sustain operations. If the net proceeds from these offerings are insufficient for this purpose, we will consider other options to continue our path to commercialization, including, but not limited to, additional financing through follow-on equity offerings, debt financing, co-development agreements, sale or licensing of developed intellectual or other property, or other alternatives.

If management is unable to implement its proposed business plan or employ alternative financing strategies, it does not presently have any alternative proposals. In that case, we may be required to scale back our development plans by reducing expenditures for employees, consultants, business development and marketing efforts, and other expenditures or curtail or even suspend our operations.

We cannot assure that our technology will be accepted, that we will ever earn revenues sufficient to support our operations, or that we will ever be profitable. Furthermore, we have no committed source of financing and we cannot assure that we will be able to raise money as and when we need it to continue our operations. If we cannot raise funds as and when we need them, we may be required to severely curtail, or even to cease, our operations.

CRITICAL ACCOUNTING POLICIES

The following discussion and analysis of financial condition and results of operations is based upon our financial statements, which have been prepared in conformity with accounting principles generally accepted in the United States of America. Certain accounting policies and estimates are particularly important to the understanding of our financial position and results of operations and require the application of significant judgment by our management or can be materially affected by changes from period to period in economic factors or conditions that are outside of our control. As a result, they are subject to an inherent degree of uncertainty. In applying these policies, our management uses their judgment to determine the appropriate assumptions to be used in the determination of certain estimates. Those estimates are based on our historical operations, our future business plans and projected financial results, the terms of existing contracts, our observance of trends in the industry, information provided by our customers and information available from other outside sources, as appropriate. See Note 2 to our unaudited condensed financial statements for a more complete description of our significant accounting policies.

Revenue Recognition and Cost of Revenue. Revenues from design and installation of the Company’s products are recognized on the completed contract method. Revenues from contracts and related costs of goods sold are recognized once the contract is completed or substantially completed. Contract costs include all direct material and labor costs and those indirect costs related to contract performance, such as indirect labor, supplies, and depreciation costs. Provisions for estimated losses on uncompleted contracts are made in the period in which such losses are determined.

Research and Development. The cost of research and development is expensed as incurred. Research and development costs consist of salaries, benefits, share based compensation, consulting fees, rent, utilities, depreciation, and consumables used in laboratory and field testing.

Patents and Trademarks. Patents and trademarks are recorded at cost. Amortization is computed using the straight-line method over the estimated useful lives of the assets once they are issued.

18

Stock-Based Compensation. The costs of all employee stock options, as well as other equity-based compensation arrangements, are reflected in the financial statements based on the estimated fair value of the awards on the grant date. That cost is recognized over the period during which an employee is required to provide service in exchange for the award. Stock compensation for stock granted to non-employees is determined as the fair value of the consideration received or the fair value of equity instruments issued, whichever is more reliably measured.

Fair Value of Financial Instruments. Fair value is the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. Assets and liabilities measured at fair value are categorized based on whether or not the inputs are observable in the market and the degree that the inputs are observable. The categorization of financial assets and liabilities within the valuation hierarchy is based upon the lowest level of input that is significant to the fair value measurement.

The Company's financial instruments primarily consist of cash and cash equivalents, accounts payable and accrued expenses. As of the balance sheet dates, the estimated fair values of the financial instruments were not materially different from their carrying values as presented on the balance sheets. This is primarily attributed to the short maturities of these instruments. The Company did not identify any other non-recurring assets and liabilities that are required to be presented in the balance sheets at fair value.

RESULTS OF OPERATIONS

Comparison of the Three and Six Months Ending June 30, 2016 and 2015

Operating Expenses. Operating expenses, consisting of research and development (R&D) and general and administrative (G&A) expenses, increased by approximately $632,000 to $2,442,000 for the three months ended June 30, 2016, referred to herein as Q2 2016, compared to the same period in 2015 (Q2 2015). The Company increased its R&D expenses by $502,000 to $1,216,000 for Q2 2016 primarily due to increased field testing costs of our Duplex technology. Specifically, personnel levels increased from 9.5 full time equivalent employees (FTEs) to 17.5 FTEs increasing personnel costs by $408,000 and field testing and consulting costs increased by $77,000. G&A expenses increased by $130,000 to $1,226,000 in Q2 2016 resulting primarily from $162,000 in impairment loss from abandoned capitalized patents, $126,000 of increased consulting fees, and $28,000 of increased costs as a public company, offset by a $197,000 decrease in personnel costs related to personnel changes from higher to lower salary bases.

Operating expenses increased by $1,641,000 to $5,043,000 for the six months ended June 30, 2016 compared to the same period in 2015. The Company increased its R&D expenses by $1,254,000 to $2,541,000 for the six months ended June 30, 2016 primarily due to increased field testing costs of our Duplex technology. Specifically, personnel levels increased from 9.5 FTEs to 17.5 FTEs increasing personnel costs by $700,000 and field testing and consulting costs increased by $495,000. G&A expenses increased by $387,000 to $2,502,000 for the six months ended June 30, 2016. G&A expenses rose primarily due to $295,000 of increased consulting fees, $227,000 in impairment loss from abandoned capitalized patents, and $82,000 of increased costs as a public company, offset by a $226,000 decrease in personnel costs related to personnel changes from higher to lower salary bases.

Loss from Operations. Due to the increase in operating expenses, our loss from operations increased during Q2 2016 by $632,000 to $2,442,000 and increased for the six months ended June 30, 2016 by $1,641,000 to $5,043,000.

Net Loss. Primarily as a result of the increase in operating expenses, our net loss for Q2 2016 was $2,431,000 as compared to a net loss of $1,796,000 for Q2 2015, resulting in an increased net loss of $635,000, and our net loss for the six months ended June 30, 2016 was $5,020,000 as compared to a net loss of $3,379,000 for the same period in 2015, resulting in an increased net loss of $1,641,000.

19

Liquidity and Capital Resources

At June 30, 2016, our cash and cash equivalent balance totaled $5,373,000 compared to $10,985,000 at December 31, 2015. This decrease resulted primarily from our operating costs for the six months ended June 30, 2016 associated with the ongoing research and development of our technology.

Although we are pursuing sales, licensing and co-development agreements, there is no assurance that we will be successful in pursuing these strategies or that, even if we are successful, they will be adequate to fund our operations and commercialize our technology. To the extent sales, licensing and co-development agreement funding is insufficient for these purposes, we may undertake offerings of our securities, debt financing, selling or licensing our developed intellectual or other property, or other alternatives. The Company filed a Form S-3 shelf registration statement with the Securities and Exchange Commission on December 29, 2015 that was declared effective on January 7, 2016. The registration statement allows the Company to offer up to an aggregate of $30,000,000 of common stock, preferred stock, warrants or units from time to time as market conditions permit. We expect to use this equity funding to enable further investment in our technology and product development and to maintain a strong balance sheet. This information does not constitute an offer of any securities for sale.

At June 30, 2016, our current assets were in excess of current liabilities resulting in working capital of $4,580,000 compared to $9,564,000 at December 31, 2015. The decrease in working capital resulted primarily from the funds used in operations and invested in intangible and fixed assets.

Operating activities for the six months ended June 30, 2016 resulted in cash outflows of $4,901,000 which were due primarily to the loss for the period of $5,020,000 and net changes in working capital, exclusive of cash, which reduced cash flow by $619,000. These were offset by services paid with common stock and stock options of $425,000, and other non-cash expenses of $313,000. Operating activities for the six months ended June 30, 2015 resulted in cash outflows of $3,162,000, which were due primarily to the loss for the period of $3,379,000 and net changes in working capital (exclusive of cash) which reduced cash flow by $311,000 and were partially offset by services paid with common stock and stock options of $417,000 and other non-cash expenses of $111,000.

Investing activities for the six months ended June 30, 2016 resulted in cash outflows of $651,000 for development of patents and $60,000 for acquisition of fixed assets, compared to $611,000 and $30,000 during the same period of 2015.

There were no financing activities for the six months ended June 30, 2016, compared to cash inflows of $16,564,000 from issuance of common stock and exercise of stock options during the same period in 2015.

Off-Balance Sheet Transactions

We do not have any off-balance sheet transactions.

20

| ITEM 3. | QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK |

As a smaller reporting company we are not required to provide this information.

| ITEM 4. | CONTROLS AND PROCEDURES |

Disclosure controls and procedures

Disclosure controls and procedures include, without limitation, controls and procedures designed to ensure that information required to be disclosed by an issuer in the reports that it files or submits under the Securities Exchange Act of 1934, as amended (the “Act”) is accumulated and communicated to the issuer’s management, including its principal executive and principal financial officers, or persons performing similar functions, as appropriate to allow timely decisions regarding required disclosure. Our management, with the participation of our Chief Executive Officer (CEO)(principal executive officer) and our Chief Financial Officer (CFO)(principal financial and accounting officer), has concluded that, as of June 30, 2016, our disclosure controls and procedures are effective.

Changes in Internal Control over Financial Reporting

There have been no material changes in our internal controls over financial reporting that occurred during the quarter ended June 30, 2016 that have materially affected, or are reasonably likely to materially affect, our internal controls over financial reporting.

Inherent Limitations on Effectiveness of Controls

Our management, including the CEO and CFO, does not expect that our disclosure controls and procedures or our internal control over financial reporting will prevent or detect all errors and all fraud. A control system, no matter how well-designed and operated, can provide only reasonable, not absolute, assurance that the control system’s objectives will be met. The design of a control system must reflect the fact that there are resource constraints, and the benefits of controls must be considered relative to their costs. Further, because of the inherent limitations in all control systems, no evaluation of controls can provide absolute assurance that misstatements due to error or fraud will not occur or that all control issues and instances of fraud, if any, have been detected. The design of any system of controls is based in part on certain assumptions about the likelihood of future events, and there can be no assurance that any design will succeed in achieving its stated goals under all potential future conditions. Projections of any evaluation of the effectiveness of controls to future periods are subject to risks. Over time, controls may become inadequate because of changes in conditions or deterioration in the degree of compliance with policies or procedures.

PART II-OTHER INFORMATION

ITEM 1. LEGAL PROCEEDINGS

From time to time we may become involved in various lawsuits and legal proceedings which arise in the ordinary course of business. However, litigation is subject to inherent uncertainties and an adverse result in these or other matters may arise from time to time that may harm our business. We are currently not aware of any such legal proceedings or claims that we believe will have a material adverse effect on our business, financial condition or operating results.

ITEM 1A. RISK FACTORS

We incorporate herein by reference the risk factors included under Item 1A of our Annual Report on Form 10-K for the year ended December 31, 2015 which we filed with the Securities and Exchange Commission on March 3, 2016.

21

| ITEM 2. | UNREGISTERED SALES OF EQUITY SECURITIES AND USE OF PROCEEDS |

Not applicable.

| ITEM 3. | DEFAULTS UPON SENIOR SECURITIES |

Not applicable.

| ITEM 4. | MINE SAFETY DISCLOSURES |

Not applicable.

| ITEM 5. | OTHER INFORMATION |

Not applicable.

22

| ITEM 6. | EXHIBITS |

| Exhibit Number |

Document | |

| 3.1 | Articles of Incorporation of ClearSign Combustion Corporation, amended on February 2, 2011 (1) | |

| 3.1.1 | Articles of Amendment to Articles of Incorporation of ClearSign Combustion Corporation filed on December 22, 2011 (1) | |

|

3.2 |

Bylaws (1) | |

| 31.1 | Rule 13a-14(a)/15d-14(a) Certification of Chief Executive Officer* | |

| 31.2 | Rule 13a-14(a)/15d-14(a) Certification of Chief Financial Officer* | |

| 32.1 | Section 1350 Certification of Chief Executive Officer and Chief Financial Officer+ | |

|

101.INS

101.SCH

101.CAL

101.DEF

101.LAB

101.PRE |

XBRL Instant Document*

XBRL Taxonomy Extension Schema Document*

XBRL Taxonomy Extension Calculation Linkbase Document*

XBRL Taxonomy Extension Definition Linkbase Document*

XBRL Taxonomy Extension Label Linkbase Document*

XBRL Taxonomy Extension Presentation Linkbase Document* |

*Filed herewith

+Furnished herewith

| (1) | Incorporated by reference from the registrant’s registration statement on Form S-1, as amended, file number 333-177946, originally filed with the Securities and Exchange Commission on November 14, 2011. |

23

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| CLEARSIGN COMBUSTION CORPORATION | ||

| (Registrant) | ||

| Date: August 11, 2016 | By: | /s/ Stephen E. Pirnat |

| Stephen E. Pirnat | ||

| Chief Executive Officer | ||

| By: | /s/ James N. Harmon | |

| James N. Harmon | ||

| Chief Financial Officer | ||

24