Table of Contents

As filed with the Securities and Exchange Commission on December 9, 2011

Registration No. 333-176958

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 3 to

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Fulcrum BioEnergy, Inc.

(Exact name of Registrant as specified in its charter)

| Delaware | 2860 | 33-1173733 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

4900 Hopyard Road, Suite 220

Pleasanton, CA 94588

(925) 730-0150

(Address, including zip code, and telephone number, including area

code, of registrant’s principal executive offices)

E. James Macias

President and Chief Executive Officer

Fulcrum BioEnergy, Inc.

4900 Hopyard Road, Suite 220

Pleasanton, CA 94588

(925) 730-0150

(Name, address including zip code, and telephone number including area code, of agent for service)

Copies to:

| Alan Talkington, Esq. | Jeffrey D. Saper, Esq. | |

| Karen Dempsey, Esq. | Allison B. Spinner, Esq. | |

| Orrick, Herrington & Sutcliffe LLP | Wilson Sonsini Goodrich & Rosati, P.C. | |

| 405 Howard Street | 650 Page Mill Road | |

| San Francisco, CA 94105 | Palo Alto, CA 94304 | |

| (415) 773-5700 | (650) 493-9300 |

Approximate date of commencement of proposed sale to the public:

As soon as practicable after the effective date of this Registration Statement.

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ¨

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b2 of the Exchange Act.

| Large accelerated filer ¨ |

Accelerated filer ¨ | |

| Non-accelerated filer þ (Do not check if a smaller reporting company) |

Smaller reporting company ¨ |

CALCULATION OF REGISTRATION FEE

|

| ||||

| Title Of Each Class Of Securities To Be Registered | Proposed Maximum Aggregate Offering Price(1)(2) |

Amount Of Registration Fee(3) | ||

| Common Stock, par value $0.001 per share |

$115,000,000.00 | $13,351.50 | ||

|

| ||||

|

| ||||

| (1) | Includes shares of Common Stock issuable upon exercise of the Underwriters’ overallotment option. |

| (2) | Estimated solely for the purpose of computing the amount of the registration fee pursuant to Rule 457(o) under the Securities Act. |

| (3) | Previously paid. |

The Registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until this registration statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

The information in this preliminary prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and we are not soliciting offers to buy these securities in any jurisdiction where the offer or sale is not permitted.

| PRELIMINARY PROSPECTUS | Subject to Completion | December 9, 2011 |

Shares

Common Stock

This is the initial public offering of our common stock. No public market currently exists for our common stock. We are offering all of the shares of common stock offered by this prospectus. We expect the public offering price to be between $ and $ per share.

We intend to list our common stock on The NASDAQ Global Market under the symbol “FLCM.”

Investing in our common stock involves a high degree of risk. Before buying any shares, you should carefully read the discussion of material risks of investing in our common stock in “Risk factors” beginning on page 11 of this prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| Per Share |

Total | |||

| Public offering price |

$ | $ | ||

| Underwriting discounts and commissions |

$ | $ | ||

| Proceeds, before expenses, to us | $ | $ |

The underwriters may also purchase up to an additional shares of our common stock at the public offering price, less the underwriting discounts and commissions payable by us, to cover over-allotments, if any, within 30 days from the date of this prospectus. If the underwriters exercise this option in full, the total underwriting discounts and commissions will be $ and our total proceeds, after underwriting discounts and commissions but before expenses, will be $ .

The underwriters are offering the common stock as set forth under “Underwriting.” Delivery of the shares will be made on or about , 2012.

| UBS Investment Bank | BofA Merrill Lynch | Citigroup |

Raymond James

, 2012

Table of Contents

You should rely only on the information contained in this prospectus. We and the underwriters have not authorized anyone to provide you with additional information or information different from that contained in this prospectus. We are offering to sell, and seeking offers to buy, shares of common stock only in jurisdictions where offers and sales are permitted.

| 1 | ||||

| 11 | ||||

| 29 | ||||

| 30 | ||||

| 31 | ||||

| 31 | ||||

| 32 | ||||

| 34 | ||||

| 36 | ||||

| Management’s Discussion and Analysis of Financial Condition and Results of Operations |

38 | |||

| 60 | ||||

| 64 | ||||

| 80 |

| 84 | ||||

| 91 | ||||

| 106 | ||||

| 111 | ||||

| 113 | ||||

| 117 | ||||

| Material U.S. Federal Tax Considerations for Non-U.S. Holders of Common Stock |

119 | |||

| 123 | ||||

| 130 | ||||

| 130 | ||||

| 130 | ||||

| F-1 |

Table of Contents

This summary highlights information contained elsewhere in this prospectus and does not contain all of the information that you should consider in making your investment decision. Before investing in our common stock, you should carefully read this entire prospectus, including our consolidated financial statements and the related notes included elsewhere in this prospectus and the information set forth under the headings “Risk factors” and “Management’s discussion and analysis of financial condition and results of operations.”

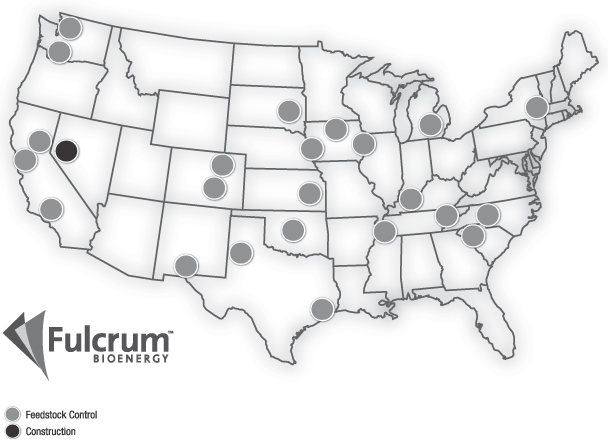

OUR BUSINESS

We produce advanced biofuel from garbage. Our innovative business model combines our proprietary process and zero-cost municipal solid waste, or MSW, feedstock to provide us with a significant competitive advantage over companies using alternative feedstocks such as corn, sugarcane and other sources of biomass in the production of renewable fuel, which are subject to commodity and other pricing risks. We have entered into a long-term agreement with Waste Connections, Inc. to procure MSW at zero cost throughout the United States in quantities sufficient to produce more than 700 million gallons of ethanol per year, assuming that we had approximately 15 commercial production facilities in operation. Our stable cost structure, based on long-term agreements to procure MSW feedstock at zero cost, will allow us to enter into fixed-price offtake contracts or hedges to secure attractive unit economics. We expect our first commercial-scale facility, the Sierra BioFuels Plant, or Sierra, to begin production in the second half of 2013 and to be at full capacity, producing approximately 10 million gallons of ethanol per year, within three years after commencement of ethanol production.

At Sierra, we expect to produce approximately 10 million gallons of ethanol per year at a cash operating cost of less than $1.25 per gallon, net of revenue from the sale of co-products, such as renewable energy credits and recyclables, of approximately $0.45 per gallon. We entered into an agreement with a third party entitling it to up to 80 million renewable energy credits per calendar year generated during the first 15 years of Sierra’s operation in exchange for an upfront contribution of $10 million to help fund the construction of Sierra. The value of those credits is included in the revenue from the sale of co-products above. Our estimated cash operating costs at Sierra and other facilities do not require any improvement in MSW-to-ethanol yields or process efficiencies and we believe reflect a substantially lower cost per gallon than production costs for traditional transportation fuels. In addition, we will benefit from certain federal and state incentives that are available for the production of advanced biofuels, but such incentives are not reflected in our estimated cash operating costs.

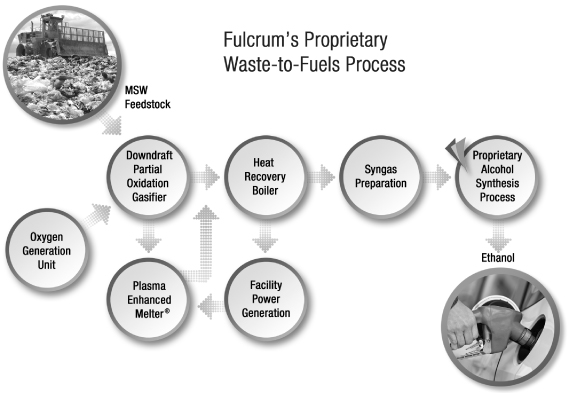

Our proprietary process converts MSW into ethanol. This process, built around numerous commercial systems available today, has been tested, demonstrated and will be deployed on a commercial scale at facilities that we will build, own and operate. We utilize sorted, post-recycled MSW and convert it into ethanol using a two-step process that consists of gasification followed by alcohol synthesis. In the first step, the gasification process converts the MSW into a synthesis gas, or syngas. We have licensed and purchased the gasification system from a third party. In the second step, the syngas is catalytically converted into ethanol using our proprietary alcohol synthesis process. Our alcohol synthesis process demonstration unit has operated at full scale for more than 8,000 hours utilizing a full-scale reactor tube of the same size that will be deployed in our systems at Sierra and future production facilities. We have filed patent applications for the integration of the MSW-to-ethanol process. We believe this may provide us with a significant advantage over competitors looking to replicate our process.

1

Table of Contents

In addition, we will generate electricity to power our plants and reduce our reliance on external electricity sources. By taking this approach to power production, we believe many of our facilities will qualify for renewable energy credits that may provide additional revenue opportunities. Taking into account the feedstock used for electricity generation, we believe our process will produce ethanol at net yields of approximately 70 gallons per ton of MSW, which is sufficient for us to operate profitably in the absence of economic subsidies. Furthermore, an August 2009 independent analysis prepared by Life Cycle Associates, LLC concluded that our process is projected to provide a more than 75% reduction in greenhouse gas, or GHG, emissions compared to traditional gasoline production.

We recently began construction of Sierra, located approximately 20 miles east of Reno, in Storey County, Nevada, where we have acquired approximately 17 acres of vacant property. The construction cost of this facility is estimated at $180 million, which we expect to finance through existing equity capital, net proceeds from this offering and a federal loan guarantee that we are pursuing or, if we do not obtain a federal loan guarantee, a project loan facility for Sierra. We expect to produce approximately 10 million gallons of ethanol per year from Sierra using zero-cost MSW feedstock contractually procured from affiliates of Waste Management, Inc. and Waste Connections, Inc. We have entered into a contract with Tenaska BioFuels, LLC, or Tenaska, to market and sell all ethanol produced at Sierra for three years commencing on the date of the first ethanol delivery. We have designed our technology to allow us to replicate the design of Sierra and efficiently construct future facilities with up to six times the production capacity of Sierra. We believe we can lower our cash operating costs from less than $1.25 per gallon at Sierra to less than $0.70 per gallon at our full-scale commercial facilities, net of revenue from the sale of co-products, such as renewable energy credits and recyclables, of approximately $0.45 per gallon, assuming economies of scale and a 60 million gallon per year facility. These estimates do not require any improvement in MSW-to-ethanol yields or process efficiencies.

Our production facilities will provide numerous social and environmental benefits. By providing a reliable source of domestic renewable transportation fuels, our facilities will help the United States reduce its dependence on foreign oil. In addition, we expect our process will reduce GHG emissions by more than 75% compared to traditional gasoline production. Our process does not compete with recycling programs available today. We use MSW feedstock after it has been processed for conventional recyclables, such as cans, bottles, plastic containers, paper and cardboard, that would otherwise be landfilled. By diverting MSW from landfills, our facilities will help mitigate the need for new landfills and extend the life of existing landfills. Lastly, our MSW feedstock does not have the land-use issues or adverse impact on food prices generally associated with other feedstocks used to produce ethanol, such as corn and sugarcane.

We are a development stage company and have not yet generated any revenue. As of September 30, 2011, we had a deficit accumulated during development stage of $76.7 million and expect our losses to continue at least through the second half of 2013, when Sierra is expected to commence production.

RECENT DEVELOPMENTS

In November 2011, we closed our Series C preferred stock financing, pursuant to which we raised an aggregate of approximately $93.0 million from both existing and new investors, including affiliates of USRG Management Company, LLC and Rustic Canyon Partners, as well as a subsidiary of Waste Management, Inc., or Waste Management, the largest waste management company in the United States. We also entered into a credit agreement with a subsidiary Waste Management to provide a project loan facility of up to $70 million to be available to fund a portion of the construction costs of Sierra, which will be secured by a first priority security interest in all assets of Sierra and a pledge of our equity interest in Sierra. We will utilize this project loan facility only if we do not enter into a federal loan guarantee

2

Table of Contents

that we are pursuing. For a discussion of the material terms of this project loan facility for Sierra, including certain additional restrictive covenants and certain required cash sweeps if and when such facility is utilized, please see “Management’s discussion and analysis of financial condition and results of operations—Liquidity and Capital Resources—Project loan facility”. We also entered into a master project development agreement with a subsidiary of Waste Management to cooperate to jointly develop Fulcrum projects in various locations throughout the United States using MSW supplied by subsidiaries of Waste Management under long-term feedstock agreements.

OUR MARKET OPPORTUNITY

According to the National Renewable Energy Laboratory, the global market for transportation fuels was approximately $4 trillion in 2010. According to the U.S. Energy Information Administration, in 2010 there was a 138 billion gallon market for gasoline and a 52 billion gallon market for diesel in the United States alone.

The most common biofuel used in the global transportation sector is ethanol, which has been blended into gasoline since the 1970s, when it was used primarily to increase fuel performance as an octane booster. Today, its primary use is to accelerate the displacement of petroleum gasoline with a domestic, renewable alternative. Federal law established the Renewable Fuel Standards program, or RFS2, and the Clean Air Act Amendments of 1990, which require that gasoline used in the United States have additives that oxygenate the fuel.

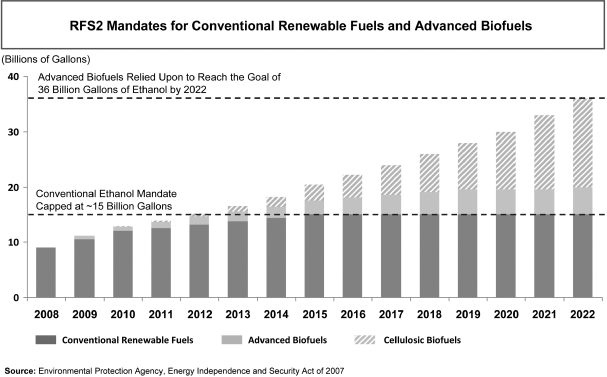

In 2010, approximately 13 billion gallons of ethanol was blended into the gasoline supply of the United States, most of which was produced from corn. Ethanol derived from corn does not satisfy RFS2 advanced biofuel requirements. Under RFS2, any refiner or importer of gasoline or diesel fuel in the U.S. mainland or Hawaii must comply on an annual basis with volume requirements for both renewable fuels as a whole, as well as those for each renewable fuel category, including advanced biofuel, which is a subset of renewable fuels that reduces lifecycle GHG emissions by at least 50%, and cellulosic biofuel, which is a subset of advanced biofuel that reduces lifecycle GHG emissions by at least 60% and is derived from any cellulose, hemicelluloses or lignin. The RFS2 requirement for the volume of all renewable fuel is 13.95 billion gallons in 2011, increasing to 20.5 billion gallons in 2015 and reaching 36 billion gallons in 2022, 21 billion gallons of which must be advanced biofuel.

Outside of RFS2, state and local programs and incentives have mandated the use of renewable fuels. The most notable state program is the California Low Carbon Fuel Standard, or LCFS, which was enacted in January 2007. The LCFS directive calls for a reduction of at least 10% in the carbon intensity of California’s transportation fuels by 2020, placing a high demand on low-carbon fuels such as ours. This required reduction is applicable across 100% of California’s transportation fuel volume. As a result, the continued use of traditional gasoline for a significant portion of California’s transportation fuel would lead to greater demand for lower carbon intensity blendstock. For example, the 10% ethanol component of E10 would require approximately 100% carbon intensity reduction to allow for LCFS compliance in the event the remaining 90% fuel volume remained unchanged. Thus, blendstocks with significant carbon intensity reductions will be very attractive in meeting these standards.

OUR SOLUTION

Our business strategy is based on securing long-term, zero-cost MSW feedstock and employing our proprietary process to efficiently convert the MSW into an advanced biofuel. We believe our product will be markedly superior to traditional and other advanced biofuels from both an economic and an environmental perspective.

3

Table of Contents

Our competitive strengths

We believe our business model benefits from a number of competitive strengths, including the following:

| Ø | Attractive feedstock. The use of MSW affords us numerous benefits: |

| ¡ | Contracted at zero cost. We have executed a feedstock agreement with Waste Connections, Inc. that will supply us with sufficient feedstock, at zero cost, to produce more than 700 million gallons of advanced biofuel annually for up to 20 years. Our use of MSW at zero cost removes the largest, and most volatile, component of traditional renewable fuels production cost from our cost structure. We believe this provides us with a significant cost advantage over competitors paying for feedstock or utilizing purpose-grown feedstocks. |

| ¡ | Transportation advantage. Significant volumes of MSW are generated near metropolitan areas, providing us with a transportation advantage compared to feedstocks harvested or grown in rural areas that must ultimately transport either the feedstock or the fuel to metropolitan areas. |

| ¡ | Reliable supply. The United States generates more than 243 million tons of MSW annually, the majority of which is rich in organic carbon. This supply would provide sufficient feedstock to produce approximately 12 billion gallons of advanced biofuel annually if all such MSW was converted to advanced biofuel using our process, though Sierra is expected to produce only 10 million gallons annually. |

| ¡ | Established infrastructure. By using MSW, we benefit from existing infrastructure for collection, hauling and handling. No new logistical networks would be required to transport the feedstock to our facilities. |

| ¡ | No competing use. We produce advanced biofuel from a true waste product that has no competing use, is not sought after by food producers and has no impact on food prices. |

| Ø | Clear path to commercialization. Our first commercial-scale ethanol production facility is expected to begin production in the second half of 2013. We expect to construct additional commercial-scale production facilities across the United States that will be supplied with MSW under our existing contractual arrangements with Waste Connections, Inc. We have designed our technology in a manner that significantly reduces scale-up risk and will also allow us to construct new facilities and deploy our capital efficiently to capture a meaningful share of the ethanol market in the United States. |

| Ø | Proprietary process not dependent on yield improvement. Our process integrates a catalyst that converts syngas into ethanol, and at our demonstration facility we have demonstrated the success of this process at full scale utilizing a full-scale reactor tube of the same size that will be deployed in our systems at Sierra and future production facilities. We believe our process will produce ethanol at net yields of approximately 70 gallons per ton of MSW, which we believe is sufficient for us to operate profitably in the absence of economic subsidies. |

| Ø | Business model built for long-term and sustainable profitability. We do not rely on government subsidies to make our product commercially viable. While we benefit from policies such as RFS2 and the LCFS, and will access incentives available for the production of our advanced biofuel, we expect our product to be sold on a cost-competitive basis with existing transportation fuels without any reliance on subsidies. We also believe we have greater certainty around our cost structure compared to traditional ethanol producers due to our existing contractual arrangements for zero-cost MSW feedstock. We expect this certainty regarding our cost structure will allow us to enter into financial and/or physical ethanol hedges to lock in a portion of our unit economics. |

| Ø | Flexible production process. We have designed our proprietary alcohol synthesis process to give us the flexibility to produce alcohols other than ethanol and take advantage of opportunities in other renewable fuels and chemical markets. |

4

Table of Contents

Benefits for our customers

The key benefits we intend to provide to our customers include:

| Ø | Zero-cost feedstock; stable cost structure. With our long-term, zero-cost MSW feedstock, we will be able to sustain strong margins with very little production cost volatility. This enables our customers to have greater certainty relating to their ongoing access to a stable and reliable supply of ethanol. |

| Ø | Access to domestically-produced advanced biofuel. We will produce our ethanol domestically, offering customers a pricing advantage over those relying on Brazilian ethanol, which is subject to higher feedstock and transportation costs and tariffs imposed by the U.S. government for RFS2 compliance. |

| Ø | Large-scale development program. We have a robust project development pipeline based on the existing MSW under contract across 19 states that will support more than 700 million gallons of annual ethanol production, assuming that we are able to finance and construct approximately 15 production facilities. |

Benefits for our suppliers

The key benefits we provide to MSW suppliers that work with us include:

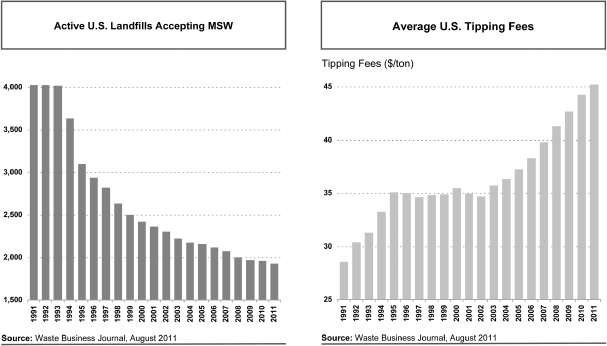

| Ø | Cost savings. We provide a cheaper source of waste diversion than traditional landfill disposal. In addition, our ability to site closer to where waste is collected than landfills allows us to pass on a portion of transportation and disposal cost savings to our suppliers. |

| Ø | Extend landfill life at existing capacity levels. Landfills are increasingly expensive and politically contentious assets to permit, expand and maintain. By offering our suppliers the ability to divert large volumes of waste to us, we help them extend the future life of their existing landfills, reduce the need for new landfills and save on the day-to-day costs of managing a landfill. |

| Ø | Avoidance of methane gas emissions. We provide an alternative to traditional decomposition of organic materials that creates methane gas, allowing integrated waste service companies the ability to lessen their GHG emissions footprint. |

OUR STRATEGY

Our objective is to become a leading producer of renewable transportation fuels in the United States by building, owning and operating commercial production facilities. The principal elements of our strategy include:

| Ø | Commence production at Sierra. We recently commenced construction of our first commercial-scale ethanol production facility, with ethanol production expected to begin in the second half of 2013. We have entered into agreements with an affiliate of Waste Connections, Inc. and a subsidiary of Waste Management to provide zero-cost MSW feedstock for Sierra, and we have entered into a three-year contract with Tenaska to market and sell all ethanol produced at Sierra. We have designed Sierra to produce approximately 10 million gallons annually, using a design that will be scalable in our subsequent facilities. |

| Ø | Expand production capacity. We have designed our technology to enable us to construct new, larger facilities that will allow us to expand production capacity to 30- and 60-million gallons per year at future facilities quickly and efficiently while minimizing scale-up risk. Such larger facilities would also lower both the capital cost per gallon and the fixed cost component of per gallon production costs, enhancing our economics. |

5

Table of Contents

| Ø | Execute fixed-price offtake and hedging contracts. For each facility, we intend to enter into physical and/or financial fixed-price arrangements to lock in sufficient economics to cover a substantial portion of our fixed costs, including debt service. |

| Ø | Secure additional MSW contracts. Longer term, we intend to expand our business by entering into additional MSW feedstock agreements to increase the amount of resources we have available to supply our commercial facilities. |

| Ø | Explore new market opportunities. We believe significant opportunities for value creation exist outside of our base model to build, own, and operate facilities within the United States. Our process will be attractive to international markets with heavy reliance on oil, poor access to alternative fuels and expensive MSW disposal options. We may license our technology to third parties and/or partner with large strategic players, such as major oil and chemical companies. |

RISKS AFFECTING US

Our business is subject to a number of risks and uncertainties including those highlighted in the section entitled “Risk factors” immediately following this prospectus summary. These risks include the following:

| Ø | we have a limited operating history and have not yet built a commercial-scale facility or achieved commercial-scale production; |

| Ø | we have not yet generated any revenue, have incurred losses to date, anticipate continuing to incur losses in the future and may never achieve or sustain profitability; |

| Ø | our proprietary process has not been demonstrated on a fully-integrated basis as a single, complete system at a single location, and may perform below expectations when implemented on a commercial scale; |

| Ø | there are significant risks associated with the construction and completion of Sierra, which may cost more to build, maintain or operate than we have currently budgeted or estimated, or there may be delays in the completion of the facility; |

| Ø | we will need substantial additional capital in the future in order to finance the construction of our planned future facilities and to expand our business and we may be unable to draw down from a project loan facility or obtain such capital on terms acceptable to us or at all; |

| Ø | the growth of our business depends on locating and obtaining control of suitable sites for our additional facilities and the continuing supply of MSW as a feedstock; |

| Ø | we may be unable to obtain patent or other protection for our proprietary technologies and, even if we obtain such protection, we may be unable to prevent third parties from infringing on any issued patents and other proprietary rights; |

| Ø | we may be unable to successfully scale up production capacity and develop, own and operate additional production facilities, which could harm our growth prospects; |

| Ø | fluctuations in the price of and demand for ethanol and petroleum will impact our results of operations; |

| Ø | changes in government regulations, including subsidies and economic incentives, could have a material adverse effect on demand for our ethanol, and negatively impact our results of operations; and |

| Ø | we are a development stage company with limited headcount and accounting resources, which was identified as a significant deficiency in our internal controls, and will need to hire additional personnel to successfully execute our business strategy. |

6

Table of Contents

CORPORATE INFORMATION

We were incorporated in the State of Delaware on July 19, 2007. Our principal executive offices are located at 4900 Hopyard Road, Suite 220, Pleasanton, California 94588, and our telephone number at this location is (925) 730-0150. Our website address is www.fulcrum-bioenergy.com. Information contained on our website is not a part of this prospectus and the inclusion of our website address in this prospectus is an inactive textual reference only. Unless the context requires otherwise, the words “Fulcrum,” “we,” “Company,” “us” and “our” refer to Fulcrum BioEnergy, Inc., Fulcrum Sierra BioFuels, LLC and our other wholly-owned subsidiaries and affiliates.

The Fulcrum logo and other trademarks or service marks of Fulcrum appearing in this prospectus are the property of Fulcrum. Trade names, trademarks and service marks of other companies appearing in this prospectus are the property of the respective holders.

7

Table of Contents

The offering

| Common stock offered by us |

shares |

| Common stock to be outstanding after this offering |

shares |

| Overallotment option to be offered by us |

shares |

| Use of proceeds |

We intend to use a substantial portion of the net proceeds from this offering to fund the construction of our first commercial-scale ethanol production facility, the Sierra BioFuels Plant. We intend to use any remaining net proceeds for general corporate purposes and working capital. See “Use of proceeds” for additional information. |

| Risk factors |

See “Risk factors” and other information included in this prospectus for a discussion of factors you should carefully consider before deciding to invest in shares of our common stock. |

| Proposed NASDAQ Global Market symbol |

“FLCM” |

The number of shares of our common stock to be outstanding after this offering is based on 76,102,588 shares outstanding as of September 30, 2011, and excludes:

| Ø | as of September 30, 2011, 6,884,091 shares of common stock issuable upon the exercise of options to purchase our common stock at a weighted average exercise price of $1.16 per share under our 2007 Stock Incentive Plan; and |

| Ø | shares of common stock reserved for future issuance under our 2012 Equity Incentive Plan, which will become effective upon the completion of this offering, as more fully described in “Executive compensation—Stock plans.” |

Unless otherwise indicated, this prospectus reflects or assumes the following:

| Ø | no exercise of options outstanding at September 30, 2011; |

| Ø | the conversion of our outstanding preferred stock as of September 30, 2011 into an aggregate of 48,053,269 shares of common stock immediately prior to the completion of this offering; |

| Ø | the issuance of 24,733,022 additional shares of Series C-1 preferred stock in October and November 2011, as more fully described in “Management’s discussion and analysis of financial condition and results of operations—Liquidity and capital resources—Series C preferred stock financing,” and the conversion of such shares of preferred stock into an aggregate of 24,733,022 shares of common stock immediately prior to completion of this offering and the release from escrow of 1,947,565 shares of common stock; |

| Ø | no exercise of the over-allotment option by the underwriters; and |

| Ø | that our amended and restated certificate of incorporation, which we will file in connection with the completion of this offering, is in effect. |

8

Table of Contents

Summary consolidated financial data

The following table presents our summary consolidated financial data for the periods indicated. You should read this data together with our consolidated financial statements and related notes, “Selected consolidated financial data,” and “Management’s discussion and analysis of financial condition and results of operations” included elsewhere in this prospectus.

The consolidated statements of operations data for each of the years ended December 31, 2008, 2009 and 2010, are derived from our audited consolidated financial statements included elsewhere in this prospectus. The consolidated statements of operations data for each of the nine months ended September 30, 2010 and 2011, and the consolidated balance sheet data as of September 30, 2011, are derived from our unaudited consolidated financial statements included elsewhere in this prospectus. We have prepared the unaudited financial information on the same basis as the audited consolidated financial statements and have included, in our opinion, all adjustments, consisting of normally recurring adjustments that we consider necessary for a fair presentation of the financial information set forth in those statements. Our historical results for any prior period are not necessarily indicative of results to be expected in any future period, and our results for any interim period are not necessarily indicative of results for a full fiscal year.

| Year ended December 31, | Nine months ended September 30, |

|||||||||||||||||||

| Consolidated statements of operations data: | 2008 | 2009 | 2010 | 2010 | 2011 |

|||||||||||||||

| (in thousands, except per share data) | ||||||||||||||||||||

| Operating expenses(1): |

||||||||||||||||||||

| Research and development expenses |

$ | 8,041 | $ | 8,939 | $ | 12,015 | $ | 8,564 | $ | 13,125 | ||||||||||

| General and administrative expenses |

4,206 | 6,327 | 4,570 | 3,209 | 5,958 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total operating expenses |

12,247 | 15,266 | 16,585 | 11,773 | 19,083 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Loss from operations |

(12,247 | ) | (15,266 | ) | (16,585 | ) | (11,773 | ) | (19,083 | ) | ||||||||||

| Other income (expense): |

||||||||||||||||||||

| Interest (expense) |

(288 | ) | (1,278 | ) | (1,638 | ) | (1,340 | ) | (1,399 | ) | ||||||||||

| Interest income |

148 | 24 | 8 | 6 | 2 | |||||||||||||||

| Change in fair value of forward sale—preferred stock—net |

— | — | — | — | (6,674 | ) | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total other income (expense) |

(140 | ) | (1,254 | ) | (1,630 | ) | (1,334 | ) | (8,072 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net loss |

(12,387 | ) | (16,520 | ) | (18,215 | ) | (13,107 | ) | (27,155 | ) | ||||||||||

| Preferred stock accretion |

— | — | — | — | (35 | ) | ||||||||||||||

| Less net loss attributable to non-controlling interest in subsidiary |

— | 2 | 187 | 105 | 424 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net loss attributable to common stockholders |

$ | (12,387 | ) | $ | (16,518 | ) | $ | (18,028 | ) | $ | (13,002 | ) | $ | (26,766 | ) | |||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net loss per share—basic and diluted(2) |

$ | (23.04 | ) | $ | (15.08 | ) | $ | (14.46 | ) | $ | (10.56 | ) | $ | (19.86 | ) | |||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Weighted-average shares used in EPS calculation—basic and diluted(2) |

538 | 1,095 | 1,247 | 1,231 | 1,348 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Pro forma loss per share—basic and diluted (unaudited)(2) |

$ | (0.43 | ) | $ | (0.52 | ) | ||||||||||||||

|

|

|

|

|

|||||||||||||||||

| Pro forma weighted-average shares used in EPS calculation—basic and diluted (unaudited)(2) |

42,409 | 51,349 | ||||||||||||||||||

|

|

|

|

|

|||||||||||||||||

9

Table of Contents

| As of September 30, 2011 | ||||||||||||

| Consolidated balance sheet data: | Actual | Pro forma adjusted(3) |

Pro forma as further adjusted(4) |

|||||||||

| (in thousands) | ||||||||||||

| Current assets |

$ | 384 | $ | 68,258 | $ | |||||||

| Property and equipment, net |

2,894 | 2,894 | ||||||||||

| Intangible assets, net |

6,550 | 6,550 | ||||||||||

| Deposits |

831 | 831 | ||||||||||

| Capitalized offering costs |

1,072 | — | ||||||||||

| Current liabilities |

2,662 | 2,662 | ||||||||||

| Long-term liabilities |

7 | 10,007 | ||||||||||

| Redeemable convertible preferred stock |

76,118 | — | ||||||||||

| Total stockholders’ equity (deficit) |

(72,918 | ) | 65,533 | |||||||||

| (1) | Includes stock-based compensation expense as follows: |

| Year ended December 31, | Nine months ended September 30, |

|||||||||||||||||||

| 2008 | 2009 | 2010 |

2010 |

2011 |

||||||||||||||||

| (in thousands) | ||||||||||||||||||||

| Research and development expenses |

$ | — | $ | — | $ | — | $ | — | $ | 13 | ||||||||||

| General and administrative expenses |

57 | 151 | 105 | 79 | 123 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total |

$ | 57 | $ | 151 | $ | 105 | $ | 79 | $ | 136 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| (2) | See Note 2 to our annual consolidated financial statements and Note 1 to our interim condensed consolidated financial statements appearing elsewhere in this prospectus for an explanation of the method used to calculate basic and diluted net loss per share and the number of shares used in the computation of per share amounts on a historical and pro forma basis. |

| (3) | Reflects on a pro forma as adjusted basis the (i) conversion of all of our outstanding preferred stock as of September 30, 2011 into an aggregate of 48,053,269 shares of common stock immediately prior to the completion of this offering, (ii) the issuance of 24,733,022 additional shares of Series C-1 preferred stock in October and November 2011, and the conversion of such Series C-1 preferred stock shares into 24,733,022 shares of our common stock, (iii) the release from escrow of 1,947,565 shares of common stock and (iv) receipt of the $10 million contribution from Barrick Goldstrike Mines Inc. in exchange for 100% of the Class B membership interests in Fulcrum Sierra BioFuels, LLC. |

| (4) | Reflects on a pro forma as further adjusted basis the conversion and issuance described in note (3) above and, on an adjusted basis, the receipt by us of the estimated net proceeds from the sale of shares of common stock by us in this offering at an assumed initial public offering price of $ per share, which is the mid-point of the price range set forth on the cover of this prospectus, after deducting estimated underwriting discounts, commissions and estimated offering expenses payable by us. A $1.00 increase or decrease in the assumed public offering price of $ per share would increase or decrease current assets and total stockholders’ deficit by $ million, assuming that the number of shares offered by us, as set forth on the cover page of this prospectus, remains the same and after deducting estimated underwriting discounts and commissions and estimated offering costs payable by us. |

10

Table of Contents

Investing in our common stock involves a high degree of risk. You should carefully consider the risks described below and all other information contained in this prospectus before making an investment decision. Our business could be harmed by any of these risks. In that event, the trading price of our common stock could decline, and you may lose all or part of your investment. In assessing these risks, you should also refer to the other information contained in this prospectus, including our consolidated financial statements and related notes.

RISKS RELATED TO OUR BUSINESS AND INDUSTRY

We are a development stage company with a limited operating history and have not yet achieved commercial-scale production, and our business will not succeed if we are unable to successfully commercialize our process.

We are a development stage company with a limited operating history, and we have not yet generated any revenue. We recently began constructing our first commercial ethanol production facility, the Sierra BioFuels Plant, or Sierra, and expect to begin production in the second half of 2013. To date, the components of our process have been demonstrated or used separately, but we have not previously demonstrated the processes on a fully-integrated basis as a single, complete system at a single location or on a commercial scale. Certain factors that could, alone, or in combination, delay or prevent us from successfully commercializing our proprietary process, and thus generating revenue or otherwise impact our financial results, include:

| Ø | our ability to achieve commercial-scale production of ethanol on a cost-effective basis; |

| Ø | our ability to successfully integrate our gasification and alcohol synthesis processes; |

| Ø | our process, including the integrated gasification and alcohol synthesis processes, does not produce sufficient quantities of ethanol on a commercial scale; |

| Ø | the manufacturer of our gasification system does not deliver the system on a timely basis or at all; |

| Ø | increased capital costs, including construction costs, of developing Sierra and subsequent facilities; |

| Ø | construction of Sierra or subsequent facilities takes longer than expected to achieve commercial results; |

| Ø | our ability to obtain sufficient quantities of high-quality feedstock on a timely and cost-efficient basis; |

| Ø | ethanol prices and/or demand are lower than expected; |

| Ø | changes to, or elimination of, federal and/or state subsidies or other programs promoting renewable biofuels or ethanol; and |

| Ø | actions of direct and indirect competitors that may seek to enter the renewable biofuels market in competition with us. |

We have not yet generated any revenue, have incurred losses to date, anticipate continuing to incur losses in the future and may never achieve or sustain profitability.

We have not yet generated any revenue and have incurred substantial net losses since our inception, including net losses attributable to common stockholders of $12.4 million, $16.5 million, and $18.0 million for the years ended December 31, 2008, 2009 and 2010, respectively and $26.8 million for the nine months ended September 30, 2011. We expect these losses to continue. As of September 30, 2011, we had a deficit accumulated during development stage of $76.7 million. We expect to incur significant additional costs and expenses related to the development and construction of Sierra, as well as the

11

Table of Contents

Risk factors

expansion of our business, including the development of additional facilities. There can be no assurance that we will ever generate any revenue or achieve or sustain profitability on a quarterly or annual basis.

Our project loan facility for Sierra requires us to meet certain conditions precedent to borrowing which we may be unable to do, and if we utilize this project loan facility for Sierra, we will be subject to certain cash sweeps and other covenants that may restrict our operations.

If we utilize our project loan facility for Sierra with an affiliate of Waste Management Inc., or Waste Management, because we are unable to obtain a federal loan guarantee, our ability to draw down funds from such facility is subject to certain conditions precedent to borrowing, including confirmation of the Sierra budget, schedule and projections prior to initial funding, as well as requirements that we obtain a minimum credit rating for the project debt and that this offering be completed with proceeds of at least $100 million and a company valuation following the offering of at least $450 million. The loan will also be secured by a first priority security interest in all assets of Sierra and a pledge of our equity interests in Sierra.

Furthermore, if we utilize our project loan facility for Sierra and draw down funds from such loan, we will be subject to certain additional affirmative and negative covenants in the loan facility, including limits on distributions, as well as covenants limiting leverage and requiring the maintenance of certain debt service coverage ratios. The loan facility also includes a requirement that until the outstanding loan balance is reduced to $45 million, 100% of the net operating cash flows of Sierra BioFuels will be used to prepay the outstanding loan balance in addition to scheduled amortization, which we expect would continue for approximately 18 months from the time funds are drawn down under the loan facility. After that, the amount of this cash sweep is reduced in steps to 50% of net operating cash flows when the loan balance has been reduced to $15 million, which we expect would continue for approximately five years from the time funds are drawn down under the loan facility. In addition, the loan facility requires that the full amount of any cash grant in lieu of investment tax credit that we receive be used to prepay a portion of the loan. These restrictions will limit the amount of cash from operations available to us, which may limit our ability to use such cash to fund additional facilities and development programs and may prevent us from taking actions we believe are necessary from a competitive standpoint or that we otherwise believe are necessary to grow our business.

Our process has not been demonstrated on a fully-integrated basis, and may perform below our current expectations when implemented on a commercial scale.

Our proprietary process for converting municipal solid waste, or MSW, into ethanol is comprised of two core components, one involving the gasification of the MSW into synthesis gas, or syngas, and the second involving the alcohol synthesis process to convert the syngas into ethanol. To date, these core components have been demonstrated or used separately, but we have not previously demonstrated the process on a fully-integrated basis as a single, complete system at a single location or on a commercial scale, and we have not tested the equipment to be used to clean the syngas. Although we conducted extensive testing of the gasification system at a process demonstration unit, or PDU, of a third party, which converted the feedstock into syngas, that PDU is no longer in operation. In addition, we designed, constructed and have been operating an alcohol synthesis PDU to test our alcohol synthesis process and proprietary catalyst. However, we have not established a fully-integrated PDU for the entire process. As a result, we may experience technological problems that neither we nor any of the third-party engineers that have reviewed the project are able to foresee. If the fully-integrated, commercial-scale implementation of our proprietary process is unsuccessful, or does not achieve acceptable yields, we will be unable to generate sufficient revenue and our business will be harmed.

12

Table of Contents

Risk factors

We will need substantial additional capital in order to fund the construction of Sierra and to expand our business in the future, and we may be unable to raise sufficient additional funds or obtain sufficient financing on acceptable terms or at all.

We will require substantial additional capital to construct Sierra and grow our business, particularly as we build additional facilities following the completion of Sierra. We currently expect to finance the cost of construction of Sierra through existing equity capital, net proceeds from this offering and a federal loan guarantee that we are pursuing or, if we do not obtain a federal loan guarantee, a project loan facility for Sierra. Such federal loan guarantees may not be obtained on terms that are acceptable to us or at all.

We will also need to raise substantial additional funds to construct, own and operate additional commercial-scale production facilities and to continue the development of our technology and process. The extent of our need for additional capital to grow our business will depend on many factors, including the amount of net proceeds we receive from this offering, whether we obtain additional project financing or loan commitments or guarantees, whether we succeed in producing ethanol on a commercial scale, our ability to control costs, the progress and scope of our development projects, the effect of any acquisitions of other technologies that we may make in the future and the filing, prosecution and enforcement of patent claims. Future financings that involve the issuance of equity securities would cause our existing stockholders to suffer dilution. In addition, debt financing sources, including government loan guarantee programs, may be unavailable to us and any debt financing may subject us to restrictive covenants that limit our ability to conduct our business. If we are unable to raise sufficient funds, our ability to fund our operations, take advantage of strategic opportunities, develop products or technologies, or otherwise respond to competitive pressures could be significantly limited. If this happens, we may be forced to delay the construction of new facilities, delay, scale back or terminate research or development activities, curtail or cease operations or obtain funds through collaborative and licensing arrangements that may require us to relinquish commercial rights or grant licenses on terms that are unfavorable to us. We may be unable to raise sufficient additional funds on acceptable terms or at all. If adequate funds are unavailable, we will be unable to execute successfully our business plan or to continue to grow our business.

If we are unable to obtain a federal loan guarantee that we are pursuing or we obtain a federal loan guarantee with terms that are less favorable than the project loan facility from a subsidiary of Waste Management, then we will be subject to the restrictive covenants of that loan which may negatively impact our ability to pursue additional development projects or raise additional financing.

We are currently pursuing a federal loan guarantee to fund a portion of the construction costs associated with Sierra which may include terms that are more favorable than those in our project loan facility with a subsidiary of Waste Management. As part of the federal loan guarantee process, the applicable federal agency and its independent consultants conduct due diligence on projects, which includes a rigorous investigation and analysis of the technical, financial, contractual, market and legal strengths and weaknesses of each project. We cannot assure you that we will obtain a federal loan guarantee on terms that are acceptable to us or at all, or that such terms will be more favorable than our project loan facility with a subsidiary of Waste Management. If we do not obtain a federal loan guarantee, we expect to utilize our project loan facility for Sierra with a subsidiary of Waste Management, which, as described above, would subject us to certain cash sweeps and other covenants that may restrict our operations.

If we are unable to obtain a federal loan guarantee, or our project loan facility with a subsidiary of Waste Management is unavailable to us or we are otherwise unable to obtain other sources of project

13

Table of Contents

Risk factors

financing for Sierra, we may need to obtain additional or alternative financing to complete construction of Sierra. Such additional or alternative financing may not be available on attractive terms, if at all, and could be more costly for us to obtain. As a result, our plans for constructing Sierra could be significantly delayed which would materially adversely affect our business, prospects, financial condition and operating results.

There are significant risks associated with the construction and completion of Sierra, which may cause budget overruns or delays in the completion of the facility, which in turn may harm our financial condition and results of operations.

The scheduled completion date for Sierra, and the budgeted costs necessary to construct Sierra, assumes that there are no material unforeseen or unexpected difficulties or delays. Construction, equipment or staffing problems or difficulties in obtaining or maintaining any of the requisite licenses, permits or authorizations from regulatory authorities could delay the commencement or completion of construction or commencement of operations or otherwise affect the design and features of Sierra. Furthermore, given that third-party contractors will be assembling first-of-its kind systems using new technologies and processes, there may be potential construction delays and unforeseen cost overruns. Such delays or other unexpected difficulties could involve additional costs and result in a delay in the commencement of commercial operations at Sierra. Significant delays or cost overruns in completing Sierra will delay our development of additional facilities. Failure to complete Sierra within our estimated construction budget or on schedule may harm our financial condition and results of operations.

We are dependent on third parties to manufacture and deliver the main components of our process. If the delivery of such components for Sierra or future facilities are delayed, if the components do not meet our quality standards or specifications, or if our suppliers are unable to meet our demand for Sierra or future facilities, our business would be harmed.

We are depending on third parties to manufacture and deliver the gasification system we currently intend to use at our facilities, including Sierra, and the catalyst needed for our alcohol synthesis process. We currently have an agreement with a single third party to manufacture the gasification system. If such gasification systems are delayed or do not initially meet our quality specifications or expectations, the completion and commencement of operations at the facility would also be delayed, which would delay our ability to generate revenue and our business would be harmed. Furthermore, if our current manufacturer is delayed or unable to deliver the gasification systems, locating a new manufacturer for the gasification systems would require a significant amount of time, which would result in further delays to the completion and commencement of operations at the facility. In addition, if a third party fails to manufacture and deliver gasification systems to meet our demand and timing for future facilities, we may be unable to grow our business and our financial condition and results of operations may be harmed.

We will rely on contract manufacturers to manufacture substantially all of the catalyst needed for Sierra. The failure of these manufacturers, or any manufacturer we use for future facilities, to manufacture and supply the catalyst on a timely basis or at all, in compliance with our quality specifications or expectations, or in volumes sufficient to meet demand for Sierra or future facilities, would adversely affect our ability to produce ethanol and our business would be harmed. If we require additional manufacturing capacity and are unable to obtain it in sufficient quantity, we may not be able to increase our production of ethanol, and we may be forced to contract with other manufacturers on terms that may be less favorable than the terms we currently have. We do not currently have any long-term supply contracts with catalyst manufacturers, but are seeking to enter into such arrangements. However, we cannot guarantee that we will be able to enter into long-term supply contracts on commercially reasonable terms or at all.

14

Table of Contents

Risk factors

If the operating costs of our plants are higher than expected or our plant availability is lower than expected, our results of operations may be harmed.

We have not yet built and operated a commercial-scale facility employing our integrated process, and the operating costs of such facilities may be higher than we currently expect, due to labor costs, labor shortages or delays, costs of equipment, materials and supplies, maintenance costs, weather delays, inflation or other factors, which could be material. Significant unexpected increases in such costs will result in the need to obtain higher selling prices for our ethanol in order to be profitable. If the price of ethanol is below such levels, our results of operations would be harmed.

Other operating and maintenance costs, including fuel costs and downtime, may be significantly higher than we anticipate and plant availability will significantly impact our estimated operating costs per gallon. We currently expect that our process will generate enough electricity to fully supply each facility’s electrical usage requirements. If we are not able to generate sufficient electricity through our process, we will be required to purchase additional natural gas to generate electricity or additional electricity in order to operate our facilities, which could increase our operating costs and harm our results of operations. In addition, our facilities may not operate as efficiently as we expect and may experience unplanned downtime, which may be significant and could adversely affect our business and results of operations.

We are dependent on third parties to deliver MSW feedstock for use in our projects, and if the supply of feedstock is disrupted or delayed or does not meet our quality standards, or we are required to pay for our feedstock, our business may suffer.

In order to produce sufficient yields of ethanol to make our facilities economically viable, we will require large volumes of MSW feedstock. Though we have entered into long-term MSW feedstock supply agreements with waste companies to provide enough feedstock at zero cost to produce more than 700 million gallons of ethanol annually, deliveries by such companies may be disrupted due to weather, transportation or labor issues or other reasons outside of our control. If we do not have sufficient supplies of feedstock on hand, the volume of ethanol we can produce will be decreased. In addition, the MSW we require must meet certain quality standards with respect to the type of materials included in the MSW. If the MSW delivered by the waste companies regularly contains a high portion of unusable materials, we may not have sufficient supplies of usable feedstock on hand and the volume of ethanol we can produce will be decreased. Further, one of our supply agreements for Sierra provides that we are responsible for the transportation costs of delivering the feedstock to the facility, but that the supplier will pay us a tipping fee for the MSW feedstock that we accept. If transportation costs increase faster than the tipping fees and we are not able to obtain zero-cost feedstock from another source, our results of operations may be harmed. In the future, we may also be required to pay for MSW feedstock, transportation fees and related costs. In addition, there can be no assurance that our current zero-cost providers will not breach their agreements with us if they are able to sell the MSW to another party, and we may not be able to find a suitable replacement for a given facility on a timely basis or at all. Our business may suffer as a result of any decreases in the volume of ethanol we can produce due to shortages of feedstock or an increase in the cost of our feedstock.

If we are unable to locate and obtain site control of suitable locations for additional facilities, we may be unable to grow our business and our operating results may be harmed.

We seek sites for our facilities based on a number of factors, including the cost to obtain land for the facility, local permitting process, distance to waste processing facilities, distance to oil and gas refinery and blending facilities, access to utilities and existing infrastructure, available work force and local and state development incentives. Once we have identified a suitable site for a facility, purchasing or leasing

15

Table of Contents

Risk factors

the land requires us to negotiate with landowners and local government officials. These negotiations can take place over a long period of time, are not always successful and sometimes require economic concessions not in our original plans. In addition, our ability to obtain the site may be subject to competition from other industrial developers. If a competitor or other party obtains the site, or if we are unable to obtain adequate permits for the site, we could incur losses as a result of development costs for sites we do not develop, which we would have to write off. If we are unable to locate sites that meet our criteria, we may have to select sites that are less advantageous to us, and we may be unable to grow our business and our operating results may be harmed.

If we are unable to successfully scale up production capacity at future facilities and develop, own and operate additional production facilities, we may not be able to decrease the cost of production per gallon, which could harm our results of operations and growth prospects.

Our long-term business plan contemplates that we will be able to significantly decrease the cost of production per gallon of ethanol from what we expect to achieve at Sierra, based on achieving certain economies of scale by increasing the production capacity at our future facilities. Sierra is expected to produce approximately 10 million gallons of ethanol per year and we expect that future facilities will be built at three times and eventually six times the scale of Sierra. We expect to utilize the improved profitability and cash flows contemplated for such larger-scale facilities to help fund our future growth and development plans. In addition, though we have sufficient MSW feedstock currently under contract to produce more than 700 million gallons of advanced biofuel per year, to achieve such volumes, we will need to construct and operate approximately 15 production facilities, in addition to Sierra. Our ability to construct and operate such additional facilities will be dependent upon, among other things, the timing, amount and availability of equity capital and project financing for such additional facilities, as well as the timing of site control, permitting and construction of such facilities, and may not occur in a timely manner or at all. If the scale-up of our process and technology is unsuccessful or we are otherwise unable to increase our production capacity through the construction and operation of additional facilities, we may not be able to decrease the cost of production per gallon, which could harm our results of operations and growth prospects.

Fluctuations in the price of and demand for ethanol and petroleum will impact our results of operations.

The market price of ethanol is volatile and can fluctuate significantly. The market price of ethanol is dependent upon many factors, including the supply of ethanol and the price of gasoline, which is in turn dependent on the price of petroleum, which is highly volatile and difficult to forecast. In addition, there has been a substantial increase in ethanol production in recent years, and increases in the demand for ethanol may not be commensurate with increases in the supply of ethanol, thus leading to lower ethanol prices. Demand for ethanol could be impaired due to a number of factors, including regulatory developments and reduced U.S. gasoline consumption. Reduced gasoline consumption has occurred in the past and could occur in the future as a result of increased gasoline or oil prices. Fluctuations in the price of ethanol may cause our financial results to fluctuate significantly.

Changes in government regulations, including subsidies and economic incentives, could have a material adverse effect on demand for our ethanol, business and results of operations.

The market for renewable biofuels is heavily influenced by foreign and U.S. federal, state and local government regulations and policies. Changes to existing or adoption of new domestic or foreign federal,

16

Table of Contents

Risk factors

state or local legislative initiatives that impact the production, distribution, sale or import and export of renewable biofuels may harm our business.

For example, the Energy Independence and Security Act of 2007, or EISA, set targets for alternative sourced liquid transportation fuels (approximately 14 billion gallons in 2011, increasing to 36 billion gallons by 2022) as part of the Renewable Fuel Standards program, or RFS2. Of the 2022 target amount, a minimum of 21 billion gallons must be advanced biofuels which, as defined in EISA, is any renewable fuel, other than ethanol derived from cornstarch, having lifecycle greenhouse gas emissions that are at least 50 percent less than baseline greenhouse gas emissions. Ethanol produced from the cellulosic components of separated MSW has been approved by the Environmental Protection Agency or, EPA, as an eligible form of ethanol for meeting the cellulosic biofuel targets under EISA. Cellulosic biofuel is one kind of advanced biofuel, and in 2022, a minimum of 16 billion gallons of the 21 billion gallons of advanced biofuels blended into gasoline or diesel fuel must be cellulosic biofuels. However, RFS2 requires the EPA to conduct an annual evaluation of the volume of qualifying cellulosic biofuel that can be made available. If the projected available volume of cellulosic biofuel is less than the required volume under RFS2, the EPA must lower the required volume. For 2011, the EPA lowered the cellulosic biofuel volume requirement to 6.6 million gallons from 250 million gallons, though the 243.4 million gallons continue to be required under the advanced biofuel mandate.

In addition, we and other companies in the industry are petitioning the EPA for separate and additional confirmation that ethanol produced from any separated MSW (not just the cellulosic components) qualifies as an advanced biofuel for the purpose of meeting the advanced biofuel targets, though the EPA has previously stated that MSW qualifies as “Renewable Biomass”, a key component of qualifying as advanced biofuel. There is no assurance at this time that we will obtain that confirmation in a timely manner or at all, or that our facilities will be certified. We will need to register and receive producer and facility identification numbers, the receipt of which may be delayed.

We will also apply to the State of California to have our ethanol certified under California’s Low Carbon Fuel Standard, or LCFS, which would make our ethanol eligible for the carbon intensity reduction credits that will be available under this program for reducing the carbon intensity of California’s transportation fuels.

In the United States and in a number of other countries, these regulations and policies have been modified in the past and may be modified again in the future. The elimination of or any reduction in mandated requirements for alternative fuels and additives to gasoline may cause demand for renewable biofuels to decline. However, there is no assurance that this or any other favorable legislation will remain in place. For example, the biodiesel tax credit expired in December 2009, and its extension was not approved until March 2010 and only through December 31, 2011. The failure of our ethanol to qualify as advanced biofuel or to be certified under LCFS, any reduction in, phasing out or elimination of existing tax credits, subsidies, mandates and other incentives in the United States and foreign markets for renewable fuels, or any inability of our customers to access such credits, subsidies, mandates and incentives, may adversely affect demand for our product, which would adversely affect our business. Any inability to address these requirements and any regulatory or policy changes could have a material adverse effect on our business, financial condition and results of operations.

Conversely, government programs could increase investment and competition in the market for our ethanol. For example, various governments have recently announced a number of spending programs focused on the development of clean technology, including alternatives to petroleum-based fuels and the reduction of GHG emissions, which could lead to increased funding for our competitors or the rapid increase in the number of competitors within our market.

17

Table of Contents

Risk factors

The price of renewable fuel credits may decline, reducing our revenues.

The Renewable Fuel Standards program, or RFS2, assigns renewable fuel credits to each gallon of qualifying renewable fuel that is produced, including our products. Refiners and importers are required to blend into their products an amount of renewable fuel that is specified annually by the EPA, or to purchase RFS2 credits representing such amounts. The value of RFS2 credits depends upon the amount of renewable fuel required by the EPA to be blended into petroleum-based fuels and the availability of renewable fuels (and RFS2 credits). If excess qualifying renewable fuels are produced in a year, then excess RFS2 credits may be created, resulting in a decline in the value of RFS2 credits generally. The trading prices of renewable fuel and advanced biofuel credits are influenced by, among other factors, the transportation costs associated with renewable fuels, the mandated level of renewable fuel use for a specific year, the possibility of waivers of renewable fuel mandates, the ability to use credits from prior years and the expected supply of renewable fuel products. If the price of RFS2 credits declines as a result of oversupply of renewable transportation fuels (and associated RFS2 credits), then the prices at which we are able to sell our renewable transportation fuels (or associated RFS2 credits) will also decline. Our revenues could therefore depend upon market conditions, including the amount of renewable transportation fuels and RFS2 credits supplied by all producers in the market.

Our future success may depend on our ability to produce our renewable transportation fuel without government incentives on a cost-competitive basis with petroleum-based fuels. If current or anticipated government incentives are reduced significantly or eliminated and petroleum-based fuel prices are lower or comparable to the cost of our renewable transportation fuel, demand for our products may decline, which could adversely affect our future results of operations.

Our competitive position may depend on our ability to effectively obtain and enforce patents related to our proprietary processes. If we are unable to obtain patents or we or our licensors fail to otherwise adequately protect this intellectual property, our business may be harmed.

Our success may depend in part on our ability to obtain and maintain patent protection sufficient to prevent others from utilizing our integrated process to convert MSW into ethanol. In order to protect our process from unauthorized use by third parties, we must hold patent rights that cover our technologies and processes. We have filed three U.S. patent applications and one international application under the Patent Cooperation Treaty, all filed in 2011.

Because our patent applications are at a very early stage in the patent examination process, we cannot assess whether or not any or all of these patent applications will be allowed, or the precise time frame in which any patents may ultimately issue. In the United States, patent prosecution generally takes from two to five years from the filing date until the first patent can be issued. During the course of examination, at least some or all of our claims may be rejected, abandoned, or significantly revised. We may not be issued patents for our filed applications, and may not be able to obtain patents regarding other inventions we may seek to protect.

The patent position of biotechnology and bio-industrial companies can be highly uncertain because obtaining and determining the scope of patent rights involves complex legal and factual questions. The standards applied by the United States Patent and Trademark Office in granting patents are not always applied uniformly or predictably. There is no uniform worldwide policy regarding patentable subject matter, the scope of claims allowable in bio-industrial patents, or the formal requirements to obtain such patents. Consequently, patents may not issue from our pending patent applications. Furthermore, in the process of seeking patent protection or even after a patent is granted, we could become subject to expensive and protracted proceedings, including patent interference, opposition and re-examination

18

Table of Contents

Risk factors

proceedings, which could invalidate or narrow the scope of our patent rights. As such, we do not know nor can we predict the scope and/or breadth of patent protection that we might obtain on our proprietary processes.

Changes either in patent laws or in interpretations of patent laws in the United States may diminish the value of our intellectual property rights. Depending on the decisions and actions taken by the U.S. Congress, the federal courts, and the United States Patent and Trademark Office, the laws and regulations governing patents could change in unpredictable ways that would weaken our ability to obtain new patents or to enforce patents that we might obtain in the future.

Confidentiality agreements with employees and third parties may not prevent unauthorized disclosure of proprietary information and trade secrets.

In addition to patents, we rely on confidentiality agreements to protect our technical know-how and other proprietary information. Confidentiality agreements are used, for example, when we talk to potential development partners, consultants, contractors and vendors. In addition, each of our employees has signed a confidentiality agreement. Nevertheless, there can be no guarantee that an employee or a third party will not make an unauthorized disclosure of our proprietary confidential information. This might happen intentionally or inadvertently. It is possible that a competitor will make use of such information, and that our competitive position will be compromised, in spite of any legal action we might take against persons making such unauthorized disclosures.