Business Overview

Shenzhen Wonhe is a high-tech enterprise which specializes in research and development and the marketing of high-end business and personal IT products that provide third party application services. All of our revenues to date have been derived from sales of our Home Media Center 660 (“HMC660”). Our HMC660 is a data storage, management and control center for household equipment, and a central processing center which uses remote wireless technology to allow a user to control various devices while at home or remotely when away from home. HMC660 provides a software platform that has the functional characteristics of both a family security device and a direct TV receiver, with the ability to access TV and video on demand, as well as to function as a game console and storage facility for family and business information. To date, we have sold the HMC660 primarily to electronic products distributors, and we expect to renew those relationships when we introduce the second generation HMC660 this year.

HMC 660 can be used to watch ground satellite programs, read CD-ROMs and video files, support Wifi functions, share broadband access, support 3G module functions, and can be adapted to include other applications. We believe our HMC 660 has the following favorable traits and advantages compared to other similar products currently available in the marketplace:

|

|

1.

|

Excellent performance: good audio and video decoding capability equipped with high-performance CPU and AV chips, supporting 1080P high definition play and 7.1 sound track HIFI effect.

|

|

|

2.

|

Ultralow power: the incorporation of the INTEL ATOM ultralow power master chip series along with advanced inner thermal design reduces power consumption to only one-tenth of a typical desktop computer. In addition, the fine heat dissipation and structural design ensure the surface temperature remains below 35℃ even while working for a long time. Avoidance of extreme temperatures contributes to the chip’s performance and minimizes disruptions.

|

|

|

3.

|

Complete functions: our HMC 660 combines a PC set top box (“STB”), DVD, multimedia computer, security monitor HZJTHY and visual telephone into one comprehensive digital home furnishing solution with a fashionable appearance and compact size.

|

|

|

4.

|

Abundant applications: the application software combines telecommunication, radio and television and the internet, provides abundant video content themed by television, movies and information programs, households themed by family security, smart home, motion sports and videophone; and value-added services themed by telemedicine, online instruction, auto repair and E-shopping.

|

During the last quarter of 2013, the Company discontinued the production of HMC660 pending the introduction of a second generation HMC660, which is being developed in order to meet government purchasing standards in additional provinces, and thus allow the expansion of the market for the HMC660.

Our major product under development is a computer set-top-box (“PC-STB”), which combines the system architecture of a multimedia computer with that of a digital set-top box, and features wireless remote control, fully integrating a family’s multimedia application requirements into a single device. In addition, we have seven other hardware products that are in various stages of research and development, including a domestic mini-terminal server, a minicomputer, an All-In-One PC, an ARM panel personal computer and an Android smartphone, We are also developing a Wonhe applications platform and a metropolis business information operating website.

Our Industry

In the description below we rely on certain information and statistics regarding our industry and the economy in China that we derived from the 2012 Statistical Report of Electronic Information Industry published by the Ministry of Industry and Information Technology of the People’s Republic of China. We have no reason to believe that the information and statistics we cite are not accurate.

In recent years the electronic information products industry has achieved growth rates above that of the overall Chinese economy. In 2012, the PRC electronic information products industry achieved 11 trillion RMB in sales revenue and the larger companies achieved sales revenue of 8.5 trillion RMB with year-over-year earnings growth of 13.0%. With the anticipated continuation of the growth of the PRC national economy and the transformation of the Chinese society to a more western style information economy, market demand for electronic information products is expected to continue to experience rates of growth in excess of the economy generally.

Nowadays, the electronic information industry is viewed by many countries as a leading and strategic industry. The rapid promotion of informatization around the globe, the development of transnational investment and transnational transmission of information, have enhanced the value of the electronic information industry. As the Chinese electronic information industry has grown, international competition has continued to increase. Despite the growth in the Chinese electronic information industry, some bottle-neck issues have developed, such as the limitations of technology, capital, availability of personnel, as well as increasing costs and a decrease in foreign-funded investment in recent years as a result of the macro-environment changes in China and abroad. Despite these problems, we believe the electronics information industry will continue to grow, based on the following trends:

1. Electronic Information Industry has a solid history of growth.

Since 2000, the Chinese domestic electronic information industry has consistently experienced rapid growth and has always been a leading industry in the whole national economy. By the end of 2010 the total number of patent applications from the PRC nationwide information technology field was over 1.1 million, more than 10% above the number of patents filed by the industry in 2009. Several companies in this field have received Chinese National Prizes for Progress in Science and Technology, and achieved new breakthroughs in servers, carriage communication installation and software, demonstrating a good industry development trend.

2. Technology innovation capabilities are improving.

Since 2000, the rate of innovation in the electronic information industry has increased. R&D and industrialization of CPU, Chinese Linux, the third generation mobile communications, trunking communications and digital TV, have proven successful in creating technology and products with proprietary intellectual property rights and closing the gap with the advanced world standard. The technology of TD-SCDMA (Time Division-Synchronization Code Division Multiple Access) has also made significant progress. Setting its own independent criteria and establishing industry wide standards has made the PRC industry increasingly competitive, especially those domestic PRC companies which are market leaders.

3. Regional industrial clusters are emerging.

The potentially huge domestic PRC electronic information products market, abundant low-priced manpower and continuously improving investment environment are key factors attracting foreign companies and investors to set up business bases in China. Foreign capital accelerated the development of the PRC electronic information industry, particularly in the Pearl River Delta, Yangtze River Delta and Bohai Rim. These areas have a good industry foundation, strong ability to provide the auxiliary items necessary for growth, and the strong service consciousness from government, to attract foreign investment to increase investments, and promote the development of local industries into a positive cycle.

The specific niche in the electronic information products market occupied by Shenzhen Wonhe should benefit from this confluence of positive trends. More than 10 year ago, tri-networks integration (film and cable TV, video communication, web browser) was proposed by the government. This goal has been listed as a priority in each of the “ninth,” ”tenth” and “eleventh” five-year plans. In the tenth five-year plan, the government emphasized that industry should promote the integration of the telecommunication and broadcast networks with the capabilities of the computer. The eleventh five-year plan reiterated this goal and stated that in order to impel tri-network integration, industry should integrate infrastructure resources in the development of technology. At the same time, all of the relevant departments in the country are actively implementing the tri-networks integration project.

Competition

Our products will compete with other manufacturers and providers of electronic furniture and digital/multimedia home entertainment systems, such as Shenzhen Huawei Technology Co., Ltd, Datang Tele-Communication Technology Co., Ltd., Haier Group, TCL Group Co., and Lenovo Group Co., Ltd. We compete on the basis of style, price, quality, comfort and brand name prestige and recognition, among other considerations.

Our home media center (“HMC”) entertainment system competes with numerous well-known domestic brands such as Huawei, Haier, TCL and Lenovo, as well as well-known foreign brands such as Samsung and Apple iPad. Due to the lower costs and labor expenses in Asia Pacific regions, many international HMC manufacturers are establishing plants in Asia. This allows large manufacturers to compete with local manufacturers in pricing. Many of our competitors are larger in scale, have been in existence for a longer period of time, have achieved greater recognition for their brand names, have captured greater market shares and/or have substantially greater financial, distribution, marketing and other resources than we do. We introduced our HMC 660 products in December 2011. Due to the short period of time this product has been offered, we have not been able to establish a significant market share and strong market competitive strength. During the last quarter of 2013, the Company discontinued the production of HMC660 pending introduction of a second generation HMC660, a transition which is likely to adversely effect our market share. There can be no guarantee that we can compete successfully now or in the future, or that competitive pressures will not have a material adverse effect on our business, financial condition and results of operations.

Our Growth Strategy

For the foreseeable future we intend to continue to emphasize the development of multimedia devices capable of integrating telecommunication, broadcast and computer (internet) networks. In addition, we intend to focus on the development of panel personal computers (i.e. portable pads,“PPC’s”) and smartphones. The telecommunications market in China is undergoing rapid development and there is a growing demand for portable media devices to be integrated into GSM and TD-SCDMA networks. If we are successful in developing such products, in addition to offering them to electronic products distributors, we will seek to enter into joint marketing or other cooperative agreements with mobile telecom carriers in China.

Business Partnerships

The company intends to utilize its social resources in an effort to develop business partnerships with China’s largest telecom operators. Among the programs that our strategic development staff will pursue are:

|

|

·

|

Research into the preferences of China Mobile with regard to PPC and smart phone design, followed by intensive development efforts to resolve the technological problems that currently prevent China Mobile from satisfying those preferences.

|

|

|

·

|

Cooperation with the government-enterprise customer departments of China Mobile, which is the largest mobile telecom carrier in China based on the GSM and TD-SCDMA network.

|

|

|

·

|

Efforts to establish business partnership with China United Network Communications Group Co, Ltd., the largest telecom operator in China, and China Telecommunications Corporation, a large state-owned telecommunication company, to combine our sales of smart phone products with telecommunication services provided by those operators.

|

Although we intend to make efforts to establish these business relationships, there is no guarantee that we will succeed.

Since 2010, agencies of the Chinese government have expressed a national policy favoring tri-network integration (i.e. film and cable TV, video communication, web browser) throughout China in order to improve communications content, increase network security, and promote the Chinese telecommunications industry. Participants in the telecommunications industry have also stressed the need for further advances in this area. For this reason, we intend to focus our development efforts on products that will help to achieve this goal. To date our development efforts have been carried out by our in-house research and development staff. If, in the future, we require special expertise in order to provide customers with special tri-network applications, we will seek a cooperative arrangement with an application service provider capable of providing the necessary technical expertise.

Our Marketing Strategy

To date, most of our marketing effort has been limited to Guangdong Province. Currently we are developing a second generation of the HMC660 that will meet the purchasing standards of the local State Administration of Radio Film and Television in other provinces. Our marketing strategy will entail the establishment of a national network of dedicated sales agencies and distributors. As we introduce products, Shenzhen Wonhe will first sell the product to local sales agencies and distributors to introduce the products to the market. As demand grows, we will transition to exclusive distribution and sales channels. Support for the marketing effort will involve a five prong program:

| |

1.

|

Design a “Wonhe Vision Identity”;

|

| |

2.

|

Build “Wonhe” brand image by unifying the appearance of all regional agents as well as the website of Wonhe;

|

| |

3.

|

Secure product reviews on influential IT websites, such as PConline, 3G sina, to enhance the brand image and awareness of Wonhe;

|

| |

4.

|

Engage film stars and celebrities to be image spokespersons to promote Wonhe branded products;

|

| |

5.

|

Seek to place articles about Shenzhen Wonhe and its products in newspapers and elite fashion magazines (e.g. Modern Weekly, Fashion; Popular Science, etc.) in major cities.

|

Production

During 2013 Shenzhen Wonhe outsourced the manufacture of its products to two producers: Shenzhen Tehuilong Electronic R&D Center and Weiyida Electronic Product (Shanzhen) Co., Ltd. Shenzhen Wonhe does not engage in manufacturing, but provides technology and purchase orders to qualified manufacturers, which manufacture to our order. Our manufacturers are independent third parties with no relationship to Shenzhen Wonhe or its owners.

Relying on two manufacturers is a risk to our business. However, in determining to assign all of our initial manufacturing to Shenzhen Tehuilong and Weiyida Electronic, we considered these factors:

|

|

·

|

Each manufacturer’s production capacity and manufacturing strength are sufficient to satisfy our current annual sales plan.

|

|

|

·

|

Every month we ordered a sufficient quantity of products to meet the next month’s demand, which protected us from the risk of non-delivery.

|

|

|

·

|

We have been able to maintain close relations with other manufacturers that possess good production technology, and so could secure a replacement for our contracted manufacturers if necessary.

|

During the third quarter of 2013 we announced our plan to introduce the second generation of HMC660. This caused the level of sales of the first generation product to fall sharply. As a result, we have allowed our contracts with our manufacturers to lapse. However, when we are ready to introduce the second generation HMC660, we believe that these two manufacturers will be available to fill our orders on terms similar to those that governed our prior relationship.

Intellectual Property

Research and Development

Shenzhen Wonhe possesses a core technology team, most of whom have been engaged in the IT industry for more than 10 years. The members of our technology team specialize in development of hardware, system drivers, industrial design, application software systems and backstage data service.

Producers of information technology products face strong pressure to respond quickly to industry demands with new designs and product innovations that support rapidly changing technical demand and regulatory requirements. Shenzhen Wonhe spent approximately $156,000, $574,000 and $409,000 on its research and development efforts for the years ended December 31, 2013, 2012 and 2011, respectively.

Shenzhen Wonhe has produced prototypes of domestic media centers, set top boxes, minicomputers, X86 panel personal computers and ARM panel personal computers, each of which is ready for the production development stage. The initial development of our All-in-One computers and domestic smart servers has been completed and these products have entered into the engineering test stage. However, before we initiate marketing of any of these products, we will have to assess the market demand for the product. We will also have to obtain government approval. The process of applying for and securing government approval of a product can be lengthy; so we cannot predict when we will introduce any new product to the market.

We have developed client-side application software equipped with the characteristics of mellow human-computer interface, humanized menu design and handy function switchover. We are simultaneously proceeding with cross-platform transplanting to adapt to Windows, Linux and Android OS; software such as resources search engine, video filtering and processing technology, resource allocation and management, disposition and scheme of backstage application and data server are all completed by the Shenzhen Wonhe Application Center.

Protection of IP

We protect our intellectual property primarily by maintaining strict control over the use of production processes. All our employees, including key employees and engineers, have signed our standard form of labor contracts, pursuant to which they are obligated to hold in confidence any of our trade secrets, know-how or other confidential information and not to compete with us. In addition, for each project, only the personnel associated with the project have access to the related intellectual property. Access to proprietary data is limited to authorized personnel to prevent unintended disclosure or otherwise using our intellectual property without proper authorization. We will continue to take steps to protect our intellectual property.

In April 2011, the company submitted two patent applications to the appropriate Chinese government agency (“SIPO”): tri-networks integration equipment (patent number: ZL 2011 2 0095525.X) and TV system and remote control (patent number: ZL 2011 2 0130608.8). Each of these officially received utility model patent certifications from the SIPO on September 21, 2011 and October 19, 2011, respectively.

Shenzhen Wonhe has registered the trademark “Woner,” composed of an image and the Chinese characters “网尔,” for use on its HMC860 product.

Regulation

Because our operating affiliate, Shenzhen Wonhe, is located in the PRC, our business is regulated by the national and local laws of the PRC. We believe our conduct of business complies with existing PRC laws, rules and regulations.

General Regulation of Businesses

We believe we are in material compliance with all applicable labor and safety laws and regulations in the PRC, including the PRC Labor Contract Law, the PRC Production Safety Law, the PRC Regulation for Insurance for Labor Injury, the PRC Unemployment Insurance Law, the PRC Provisional Insurance Measures for Maternity of Employees, PRC Interim Provisions on Registration of Social Insurance, PRC Interim Regulation on the Collection and Payment of Social Insurance Premiums and other related regulations, rules and provisions issued by the relevant governmental authorities from time to time.

According to the PRC Labor Contract Law, we are required to enter into labor contracts with our employees. We are required to pay no less than local minimum wages to our employees. We are also required to provide employees with labor safety and sanitation conditions meeting PRC government laws and regulations and carry out regular health examinations of our employees engaged in hazardous occupations.

Foreign Currency Exchange

The principal regulation governing foreign currency exchange in China is the Foreign Currency Administration Rules (1996), as amended (2008). Under these Rules, RMB is freely convertible for current account items, such as trade and service-related foreign exchange transactions, but not for capital account items, such as direct investment, loan or investment in securities outside China unless the prior approval of, and/or registration with, the State Administration of Foreign Exchange of the People’s Republic of China, or SAFE, or its local counterparts (as the case may be) is obtained.

Pursuant to the Foreign Currency Administration Rules, foreign invested enterprises, or FIEs, in China may purchase foreign currency without the approval of SAFE for trade and service-related foreign exchange transactions by providing commercial documents evidencing these transactions. They may also retain foreign exchange (subject to a cap approved by SAFE) to satisfy foreign exchange liabilities or to pay dividends. In addition, if a foreign company acquires a subsidiary in China, the acquired company will also become an FIE. However, the relevant PRC government authorities may limit or eliminate the ability of FIEs to purchase and retain foreign currencies in the future. In addition, foreign exchange transactions for direct investment, loan and investment in securities outside China are still subject to limitations and require approvals from, and/or registration with, SAFE.

Regulation of Income Taxes

On March 16, 2007, the National People’s Congress of China passed the Enterprise Income Tax Law, or the EIT Law, and its implementing rules, both of which became effective on January 1, 2008. The EIT Law and its implementing rules impose a unified EIT rate of 25.0% on all domestic-invested enterprises and FIEs, unless they qualify under certain limited exceptions.

Under the EIT Law, companies designated as High- and New-Technology Enterprises may enjoy a reduced national EIT rate of 15%. The Administrative Measures for Assessment of High-New Tech Enterprises and Catalogue of High/New Tech Domains Strongly Supported by the State (2008), jointly issued by the Ministry of Science and Technology and the Ministry of Finance and State Administration of Taxation set forth general guidelines regarding criteria as well as application procedures for qualification as a High- and New-Tech Enterprise under the EIT Law.

In addition to the changes to the current tax structure, under the EIT Law, an enterprise established outside of China with “de facto management bodies” within China is considered a resident enterprise and will normally be subject to an EIT of 25% on its global income. The implementing rules define the term “de facto management bodies” as “an establishment that exercises, in substance, overall management and control over the production, business, personnel, accounting, etc., of a Chinese enterprise.” If, therefore, the PRC tax authorities determine that we should be classified as a resident enterprise, then our organization’s global income will be subject to PRC income tax of 25%.

Dividend Distribution

Under applicable PRC regulations, FIEs in China may pay dividends only out of their accumulated profits, if any, determined in accordance with PRC accounting standards and regulations. In addition, a FIE in China is required to set aside at least 10% of its after-tax profit based on PRC accounting standards each year to its general reserves until the cumulative amount of such reserves reach 50% of its registered capital. These reserves are not distributable as cash dividends.

Through 2007 an FIE in China was required to accrue 14% of gross payroll as an employee benefit fund, which could be used only for certain specified purposes beneficial to the employees. That requirement resulted in a limitation on the profits that the FIE could distribute as dividends. However, the government terminated that accrual obligation effective at the beginning of 2008. Today the management of an FIE has the discretion to develop an employee benefit fund, but has no legal obligation to do so. Shenzhen Wonhe has not implemented any reserve for employee benefits, and does not anticipate implementing such a reserve in the future.

The EIT Law and its implementing rules generally provide that a 10% withholding tax applies to China-sourced income derived by non-resident enterprises for PRC enterprise income tax purposes unless the jurisdiction of incorporation of such enterprises’ shareholder has a tax treaty with China that provides for a different withholding arrangement. Shengshihe Consulting is considered a FIE and is directly held by our subsidiary in Hong Kong, Kuayu. According to a 2006 tax treaty between the Mainland and Hong Kong, dividends payable by an FIE in China to the company in Hong Kong who directly holds at least 25% of the equity interests in the FIE will be subject to a no more than 5% withholding tax. We expect that such 5% withholding tax will apply to dividends paid to Kuayu by Shengshihe Consulting, but this treatment will depend on our status as a non-resident enterprise.

PRC M&A Rule, Circular 75 and Circular 638

On August 8, 2006, six Chinese government agencies, namely, the Ministry of Commerce, the State Administration for Industry and Commerce, the China Securities Regulatory Commission (“CRSC”), the State Administration of Foreign Exchange, the State Assets Supervision and Administration Commission, and the State Administration for Taxation jointly issued the Regulations on Mergers and Acquisitions of Domestic Enterprises by Foreign Investors, referred to as the “New M&A Rules,” which became effective on September 8, 2006. The New M&A Rules purport, among other things, to require offshore “special purpose vehicles,” that are (1) formed for the purpose of overseas listing of the equity interests of Chinese companies via acquisition and (2) are controlled directly or indirectly by Chinese companies and/or Chinese individuals, to obtain the approval of the CSRC prior to the listing and trading of their securities on overseas stock exchanges. Based on our understanding of current Chinese Laws and pursuant to a legal opinion issued by Jinlin Changchun Law Firm dated June 2012, (i) Shengshihe Consulting was incorporated by a foreign investor and therefore has no Chinese shareholders; (ii) the share exchange between World Win and the Company is between two offshore companies and is not deemed as a transaction to acquire equity or assets of a “Chinese domestic company” as defined under the New M&A Rules and (iii) no provision in the New M&A Rules clearly classifies the contractual arrangements between Shengshihe Consulting and Shenzhen Wonhe as a type of transaction falling within the New M&A Rules.

The SAFE issued a public notice in October 2005 (“Circular 75”) requiring Chinese residents to register with the local SAFE branch before establishing or controlling any company outside of China for the purpose of capital financing with assets or equities of Chinese companies, referred to in Circular 75 as special purpose vehicles, or SPVs. Further, Chinese residents are required to file amendments to their registrations with the local SAFE branch if their SPVs undergo a material event involving changes in capital, such as changes in share capital, mergers and acquisitions, share transfers or exchanges, spin-off transactions or long-term equity or debt investments.

Pursuant to Circular 698, where a foreign investor transfers the equity interests of a Chinese resident enterprise indirectly by disposing of the equity interests of an overseas holding company, which we refer to as an “Indirect Transfer,” and such overseas holding company is located in a tax jurisdiction that: (i) has an effective tax rate less than 12.5% or (ii) does not tax foreign income of its residents, the foreign investor shall report such Indirect Transfer to the competent tax authority of the Chinese resident enterprise. The Chinese tax authority will examine the true nature of the Indirect Transfer, and if the tax authority considers that the foreign investor has adopted an abusive arrangement in order to avoid Chinese tax, it will disregard the existence of the overseas holding company and re-characterize the Indirect Transfer and as a result, gains derived from such Indirect Transfer may be subject to Chinese withholding tax at the rate of up to 10%. Circular 698 also provides that, where a non-Chinese resident enterprise transfers its equity interests in a Chinese resident enterprise to its related parties at a price lower than the fair market value, the competent tax authority has the power to make a reasonable adjustment to the taxable income of the transaction.

Employees

We have a total of 53 full-time employees and no part-time employees.

ITEM 1A RISK FACTORS

Investing in our common stock involves risk. You should carefully consider the risks described below together with all of the other information contained in this Report, including the financial statements and the related notes, before deciding whether to purchase any shares of our common stock. If any of the following risks occurs, our business, financial condition or operating results could materially suffer. In that event, the trading price of our common stock could decline and you may lose all or part of your investment.

RISKS RELATED TO OUR BUSINESS

Our management has limited experience in managing and operating a public company. Any failure to comply with federal securities laws, rules or regulations could subject us to fines or regulatory actions, which may materially adversely affect our business, results of operations and financial condition.

Prior to 2012, our current management had no experience managing and operating a public company and has relied in many instances on the professional experience and advice of third parties including our attorneys and accountants. Few members of our middle and top management staff were educated and trained in the Western system, and we may have difficulty hiring new employees in the PRC with such training. As a result, we may experience difficulty in establishing management, legal and financial controls, collecting financial data and preparing financial statements, books of account and corporate records and instituting business practices that meet Western standards. Therefore, we may, in turn, experience difficulties in implementing and maintaining adequate internal controls as required under Section 404 of the Sarbanes-Oxley Act of 2002, as amended. This may result in significant deficiencies or material weaknesses in our internal controls, which could impact the reliability of our financial statements and prevent us from complying with the U.S. Securities and Exchange Commission ("SEC") rules and regulations and the requirements of the Sarbanes-Oxley Act of 2002, as amended. Failure to comply comply with any laws, rules, or regulations applicable to our business may result in fines or regulatory actions, which may materially adversely affect our business, results of operation, or financial condition and could result in delays in developing of an active and liquid trading market for our common stock. To the extent that the market place perceives that we do not have a strong financial staff and financial controls, the market for, and price of, our stock may be impaired.

The lack of expertise in U.S. GAAP among the staff of our finance department could result in errors in our filings.

The books and records of Shenzhen Wonhe, our operating entity, are maintained in accordance with bookkeeping practices that are customary in China. The financial statements of Shenzhen Wonhe and Shengshihe Consulting are prepared in accordance with accounting principles generally accepted in China. The staff of our finance department, which prepares those financial statements, has extensive experience with Chinese GAAP, but very limited experience with U.S. GAAP. Therefore, in order to file with the SEC consolidated financial statements prepared in accordance with U.S. GAAP, we have engaged an independent consultant who makes the adjustments to the financial statements of Shenzhen Wonhe and Shengshihe Consulting necessary to achieve compliance with U.S. GAAP, then performs the consolidation required to produce the consolidated financial statements of Wonhe High-Tech International, Inc. Because that consultant, who is not present in our executive offices, is the only participant in the preparation of our financial statements possessing a familiarity with U.S. GAAP, there is a risk that the persons responsible for the initial classifications of the elements of our financial results will err in making those classifications, which will cause our reported financial statements to be erroneous. Any such errors, besides being misleading to investors, could result in subsequent restatements, which could have an adverse effect on the perception of the Company among investors.

We encounter substantial competition in our business and any failure to compete effectively could adversely affect our results of operations.

The electronics and information technology industry is highly competitive, and we may not be able to compete successfully against current or potential competitors. We compete with large PRC electronics companies, such as Shenzhen Huawei Technology Co., Ltd., Datang Telecom Technology Co., Ltd., as well as a large number of small firms. Many of our competitors have greater financial resources than we do. We anticipate that our competitors will continue to expand and seek to obtain additional market share with competitive price and performance characteristics. Aggressive expansion by our competitors or the entrance of new competitors into our markets could have a material adverse effect on our business, results of operations and financial condition.

We require highly qualified personnel and, if we are unable to hire or retain qualified personnel, we may not be able to grow effectively.

Our future success also depends upon our ability to attract and retain highly qualified personnel. Expansion of our business and the proposed growth of our business will require additional managers and employees with industry experience, and our success will be highly dependent on our ability to attract and retain skilled management personnel and other employees. We may not be able to attract or retain highly qualified personnel. Competition for skilled information technology personnel is significant. This competition may make it more difficult and expensive to attract, hire and retain qualified managers and employees.

The loss of the services of our key employees, particularly the services rendered by Qing Tong, our chairman, Nanfang Tong, our chief executive officer, or Chahua Yuan, our chief financial officer, could harm our business.

Our success depends to a significant degree on the services rendered to us by our key employees. If we fail to attract, train and retain sufficient numbers of these qualified people, our prospects, business, financial condition and results of operations will be materially and adversely affected. In particular, we are heavily dependent on the continued services of Qing Tong, our chairman, Nanfang Tong, our chief executive officer and Chahua Yuan, our chief financial officer. We currently do not have key employee insurance for our officers and directors. The loss of any these key employees, including members of our senior management team, and our inability to attract highly skilled personnel with sufficient experience in our industry could harm our business.

We rely on two third-party manufacturers to manufacture our products.

During 2013 we depended on two contract manufacturers to manufacture the products that we sell. Our contracts with those manufacturers have lapsed, and we will not seek renewals until we are ready to introduce the second generation HMC660. If we are unable to secure terms similar to the lapsed contracts, or if any significant problems occur at the production facility of one of our third-party manufacturers, our ability to deliver our products could be adversely affected. If a contract manufacturer is unable to maintain adequate manufacturing and shipping capacity, it may be unable to provide us with timely delivery of products of acceptable quality. Our inability to meet our customers’ demand for our products could have a material adverse impact on our business, financial condition and results of operations. In addition, if the prices charged by our contractors increase for reasons such as increases in labor costs or currency fluctuations, our cost of manufacturing would increase, adversely affecting our results of operations. We require our contract manufacturers to meet our standards in terms of product quality and other matters. Any failure by our contract manufacturers to meet these standards, to adhere to labor or other laws or to diverge from our mandated practices, and the potential negative publicity relating to any of these events, could harm our business and reputation.

We also depend on third parties to transport and deliver our products. Due to the fact that we do not have any independent transportation or delivery capabilities of our own, if these third parties are unable to transport or deliver our products for any reason, or if they increase the price of their services, including as a result of increases in the cost of fuel, our operations and financial performance may be adversely affected.

We will incur significant costs to ensure compliance with United States corporate governance and accounting requirements.

We will incur significant costs associated with our public company reporting requirements, costs associated with newly applicable corporate governance requirements, including requirements under the Sarbanes-Oxley Act of 2002 and other rules implemented by the SEC. Since we had no obligations as a public company prior to the reverse acquisition in June 2012, we did not have any such expenses prior to that date. We expect all of these applicable rules and regulations to significantly increase our legal and financial compliance costs and to make some activities more time consuming and costly. We also expect that these applicable rules and regulations may make it more difficult and more expensive for us to obtain director and officer liability insurance and we may be required to accept reduced policy limits and coverage or incur substantially higher costs to obtain the same or similar coverage. As a result, it may be more difficult for us to attract and retain qualified individuals to serve on our board of directors or as executive officers. We are currently evaluating and monitoring developments with respect to these newly applicable rules, and we cannot predict or estimate the amount of additional costs we may incur or the timing of such costs.

We may not be able to meet the internal control reporting requirements imposed by the SEC resulting in a possible decline in the price of our common stock and our inability to obtain future financing.

As directed by Section 404 of the Sarbanes-Oxley Act, the SEC adopted rules requiring each public company to include a report of management on the company’s internal controls over financial reporting in its annual reports. Although the Dodd-Frank Wall Street Reform and Consumer Protection Act exempts companies with a public float of less than $75 million from the requirement that our independent registered public accounting firm attest to our financial controls, this exemption does not affect the requirement that we include a report of management on our internal control over financial reporting and does not affect the requirement to include the independent registered public accounting firm’s attestation if our public float exceeds $75 million.

While we expect to expend significant resources in developing the necessary documentation and testing procedures required by Section 404 of the Sarbanes-Oxley Act, there is a risk that we may not be able to comply timely with all of the requirements imposed by this rule. Regardless of whether we are required to receive a positive attestation from our independent registered public accounting firm with respect to our internal controls, if we are unable to do so, investors and others may lose confidence in the reliability of our financial statements and our stock price and ability to obtain equity or debt financing as needed could suffer.

In addition, in the event that our independent registered public accounting firm is unable to rely on our internal controls in connection with its audit of our financial statements, and in the further event that it is unable to devise alternative procedures in order to satisfy itself as to the material accuracy of our financial statements and related disclosures, it is possible that we would be unable to file our Annual Report on Form 10-K with the SEC, which could also adversely affect the market for and the market price of our common stock and our ability to secure additional financing as needed.

We do not carry business interruption or other insurance, so we have to bear losses ourselves.

We are subject to risk inherent to our business, including equipment failure, theft, natural disasters, industrial accidents, labor disturbances, business interruptions, property damage, product liability, personal injury and death. We do not carry any business interruption insurance or third-party liability insurance or other insurance to cover risks associated with our business. As a result, if we suffer losses, damages or liabilities, including those caused by natural disasters or other events beyond our control and we are unable to make a claim against a third party, we will be required to bear all such losses from our own funds, which could have a material adverse effect on our business, financial condition and results of operations.

We compete in an industry that is brand-conscious, and unless we are able to establish and maintain brand name recognition our sales may be negatively impacted.

Our business is substantially dependent upon awareness and market acceptance of our brand by our targeted consumers. In 2011 we obtained the trademark right for the image of “Woner”, composed of an image and the Chinese characters “网尔.” Although we believe that we have made progress towards establishing market recognition for our brand in the Chinese electronics and information technology industry, it is too early in the product life cycle of our brand to determine whether our products and brand will achieve and maintain satisfactory levels of acceptance by independent distributors and retail consumers.

Our inability to protect our trademarks, patent and trade secrets may prevent us from successfully marketing our products and competing effectively.

Failure to protect our intellectual property could harm our brands and our reputation, and adversely affect our ability to compete effectively. Further, enforcing or defending our intellectual property rights, including our trademarks, patents, copyrights and trade secrets, could result in the expenditure of significant financial and managerial resources. We produce, market and sell our products under the brand “Woner” (“网尔” in Chinese). We have obtained the trademark right for the image of “Woner,” composed of an image and the Chinese characters of “网尔”, and are currently applying for trademark protection for other marks in China. We cannot provide any assurance that trademark protection will be granted or that the grant of trademark protection will provide adequate protection for our brands. We regard our intellectual property, particularly our trademarks and trade secrets, to be of considerable value and importance to our business and our success. We rely on a combination of trademark, patent, and trade secrecy laws, and contractual provisions to protect our intellectual property rights. There can be no assurance that the steps taken by us to protect these proprietary rights will be adequate or that third parties will not infringe or misappropriate our trademarks, trade secrets or similar proprietary rights. In addition, there can be no assurance that other parties will not assert infringement claims against us, and we may have to pursue litigation against other parties to assert our rights. Any such claim or litigation could be costly and we may lack the resources required to defend against such claims. In addition, any event that would jeopardize our proprietary rights or any claims of infringement by third parties could have a material adverse effect on our ability to market or sell our brands, and profitably exploit our products.

We may be exposed to liabilities under the Foreign Corrupt Practices Act and Chinese anti-corruption law, and any determination that we violated these laws could have a material adverse effect on our business.

We are subject to the U.S. Foreign Corrupt Practices Act, (“FCPA”) and other laws that prohibit improper payments or offers of payments to foreign governments and their officials and political parties by U.S. persons and issuers for the purpose of obtaining or retaining business. We are also subject to Chinese anti-corruption law, which strictly prohibits the payment of bribes to government officials.

We principally have operations, agreements with third parties and make sales in China, which may experience corruption. Our activities in China create the risk of unauthorized payments or offers of payments by one of the employees, consultants or distributors of our company, because these parties are not always subject to our control. We are in process of implementing an anticorruption program, which prohibits the offering or giving of anything of value to foreign officials, directly or indirectly, for the purpose of obtaining or retaining business. We believe that to date we have complied in all material respects with the provisions of the FCPA and Chinese anti-corruption law. However, our existing safeguards and any future improvements may prove to be less than effective, and the employees, consultants or distributors of our Company may engage in conduct for which we might be held responsible. Violations of the FCPA or Chinese anti-corruption law may result in severe criminal or civil sanctions, and we may be subject to other liabilities, which could negatively affect our business, operating results and financial condition. In addition, the government may seek to hold our Company liable for successor liability FCPA violations committed by companies in which we invest or that we acquire.

RISKS RELATED TO DOING BUSINESS IN CHINA

Uncertainties with respect to the PRC legal system could limit the legal protections available to you and us.

We conduct substantially all of our business through our operating subsidiary and affiliate in the PRC. Our operating subsidiary and affiliate are generally subject to laws and regulations applicable to foreign investments in China and, in particular, laws applicable to foreign-invested enterprises. The PRC legal system is based on written statutes, and prior court decisions may be cited for reference but have limited precedential value. Since 1979, a series of new PRC laws and regulations have significantly enhanced the protections afforded to various forms of foreign investments in China. However, since the PRC legal system continues to rapidly evolve, the interpretations of many laws, regulations and rules are not always uniform and enforcement of these laws, regulations and rules involve uncertainties, which may limit legal protections available to you and us. In addition, any litigation in China may be protracted and result in substantial costs and diversion of resources and management attention.

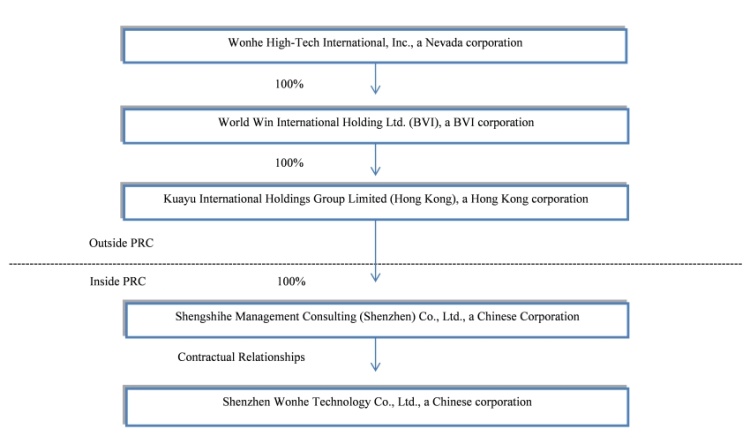

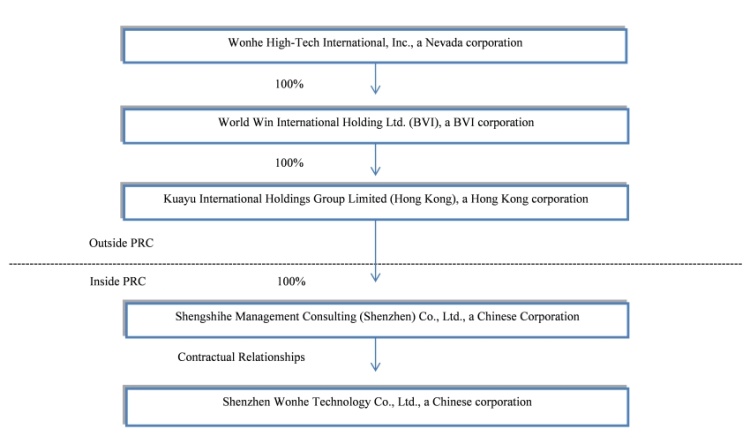

We are a Nevada holding company and most of our assets are located outside of the United States. All of our current business operations are conducted in the PRC through our VIE entity, Shenzhen Wonhe Technology Co., Ltd. (“Shenzhen Wonhe”). In addition, all of our directors and officers are nationals and residents of countries other than the United States. A substantial portion of the assets of these persons is located outside the United States. As a result, it may be difficult for you to effect service of process within the United States upon these persons. It may also be difficult for you to enforce in U.S. courts judgments on the civil liability provisions of the U.S. federal securities laws against us and our officers and directors, most of whom are not residents in the United States and the substantial majority of whose assets are located outside of the United States. In addition, there is uncertainty as to whether the courts of the PRC would recognize or enforce judgments of U.S. courts. Courts in China may recognize and enforce foreign judgments in accordance with the requirements of the PRC Civil Procedures Law based on treaties between China and the country where the judgment is made or on reciprocity between jurisdictions. China does not have any treaties or other arrangements that provide for the reciprocal recognition and enforcement of foreign judgments with the United States. In addition, according to the PRC Civil Procedures Law, courts in the PRC will not enforce a foreign judgment against us or our directors and officers if they decide that the judgment violates basic principles of PRC law or national sovereignty, security or the public interest. So it is uncertain whether a PRC court would enforce a judgment rendered by a court in the United States.

Restrictions on currency exchange may limit our ability to receive and use our sales revenue effectively.

All our sales revenue and expenses are denominated in RMB. Under PRC law, the RMB is currently convertible under the “current account,” which includes dividends and trade and service-related foreign exchange transactions, but not under the “capital account,” which includes foreign direct investment and loans. Currently, our PRC operating subsidiary and affiliate may purchase foreign currencies for settlement of current account transactions, including payments of dividends to us, without the approval of the State Administration of Foreign Exchange, or SAFE, by complying with certain procedural requirements. However, the relevant PRC government authorities may limit or eliminate our ability to purchase foreign currencies in the future. Since a significant amount of our future revenue will be denominated in RMB, any existing and future restrictions on currency exchange may limit our ability to utilize revenue generated in RMB to fund our business activities outside China that are denominated in foreign currencies.

Foreign exchange transactions by our PRC operating subsidiary under the capital account continue to be subject to significant foreign exchange controls and require the approval of or need to register with PRC government authorities, including SAFE. In particular, if our PRC operating subsidiary borrows foreign currency through loans from us or other foreign lenders, these loans must be registered with SAFE, and if we finance the subsidiary by means of additional capital contributions, these capital contributions must be approved by certain government authorities, including the Ministry of Commerce, or MOFCOM, or their respective local counterparts. These limitations could affect their ability to obtain foreign exchange through debt or equity financing.

Fluctuations in exchange rates could adversely affect our business and the value of our securities.

The value of our common stock will be indirectly affected by the foreign exchange rate between U.S. dollars and RMB and between those currencies and other currencies in which our sales may be denominated. Appreciation or depreciation in the value of the RMB relative to the U.S. dollar would affect our financial results reported in U.S. dollar terms without giving effect to any underlying change in our business or results of operations. Fluctuations in the exchange rate will also affect the relative value of any dividend we issue that will be exchanged into U.S. dollars as well as earnings from, and the value of, any U.S. dollar-denominated investments we make in the future.

Since July 2005, the RMB is no longer pegged to the U.S. dollar. Although the People’s Bank of China regularly intervenes in the foreign exchange market to prevent significant short-term fluctuations in the exchange rate, the RMB may appreciate or depreciate significantly in value against the U.S. dollar in the medium to long term. Moreover, it is possible that in the future PRC authorities may lift restrictions on fluctuations in the RMB exchange rate and lessen intervention in the foreign exchange market.

Very limited hedging transactions are available in China to reduce our exposure to exchange rate fluctuations. To date, we have not entered into any hedging transactions. While we may enter into hedging transactions in the future, the availability and effectiveness of these transactions may be limited, and we may not be able to successfully hedge our exposure at all. In addition, our foreign currency exchange losses may be magnified by PRC exchange control regulations that restrict our ability to convert RMB into foreign currencies.

Restrictions under PRC law on our PRC subsidiary's ability to make dividend and other distributions could materially and adversely affect our ability to grow, make investments or complete acquisitions that could benefit our business, pay dividends to you, and otherwise fund and conduct our businesses.

Substantially all of our revenues are earned by our PRC subsidiary. However, PRC regulations restrict the ability of our PRC subsidiary to make dividend and other payments to its offshore parent company. PRC legal restrictions permit payments of dividend by our PRC subsidiary only out of its accumulated after-tax profits, if any, determined in accordance with PRC accounting standards and regulations. Our PRC subsidiary is also required under PRC laws and regulations to allocate at least 10% of our annual after-tax profits determined in accordance with PRC GAAP to a statutory general reserve fund until the amounts in said fund reaches 50% of our registered capital. Allocations to these statutory reserve funds can only be used for specific purposes and are not transferable to us in the form of loans, advances or cash dividends. Any limitations on the ability of our PRC subsidiary to transfer funds to us could materially and adversely limit our ability to grow, make investments or acquisitions that could be beneficial to our business, pay dividends and otherwise fund and conduct our business.

Under the EIT Law, we may be classified as a "resident enterprise" of China. Such classification will likely result in unfavorable tax consequences to us and our non-PRC stockholders.

Under the New Income Tax Law, enterprises established outside the PRC whose “de facto management bodies” are located in the PRC are considered “resident enterprises” and their global income will generally be subject to the uniform 25% enterprise income tax rate. On December 6, 2007, the PRC State Council promulgated the Implementation Regulations on the New Income Tax Law, which define “de facto management bodies” as bodies that have material and overall management control over the business, personnel, accounts and properties of an enterprise. In addition, a circular issued by the State Administration of Taxation on April 22, 2009 provides that a foreign enterprise controlled by a PRC company or a PRC company group will be classified as a “resident enterprise” with its “de facto management bodies” located within the PRC if the following requirements are satisfied:

| |

(i)

|

the senior management and core management departments in charge of its daily operations function mainly in the PRC;

|

| |

(ii)

|

its financial and human resources decisions are subject to determination or approval by persons or bodies in the PRC;

|

| |

(iii)

|

its major assets, accounting books, company seals, and minutes and files of its board and shareholders' meetings are located or kept in the PRC; and

|

| |

(iv)

|

more than half of the enterprise's directors or senior management with voting rights reside in the PRC.

|

Because the EIT Law, its implementing rules and the recent circular are relatively new, no official interpretation or application of this new “resident enterprise” classification is available. Therefore, it is unclear how tax authorities will determine tax residency based on the facts of each case.

If the PRC tax authorities determine that we are a “resident enterprise” for PRC enterprise income tax purposes, a number of unfavorable PRC tax consequences could follow. First, we may be subject to the enterprise income tax at a rate of 25% on our worldwide taxable income as well as PRC enterprise income tax reporting obligations. In our case, this would mean that non-China source income would be subject to PRC enterprise income tax at a rate of 25%. Second, although under the EIT Law and its implementing rules dividends paid to us from our PRC subsidiary would qualify as “tax-exempt income,” we cannot guarantee that such dividends will not be subject to a 10% withholding tax, as the PRC foreign exchange control authorities, which enforce the withholding tax, have not yet issued guidance with respect to the processing of outbound remittances to entities that are treated as resident enterprises for PRC enterprise income tax purposes. Finally, it is possible that future guidance issued with respect to the new “resident enterprise” classification could result in a situation in which a 10% withholding tax is imposed on dividends we pay to our non-PRC stockholders and with respect to gains derived by our non-PRC stockholders from transferring our shares.

If we were treated as a “resident enterprise” by PRC tax authorities, we would be subject to taxation in both the U.S. and China, and our PRC tax may not be creditable against our U.S. tax.

If the China Securities Regulatory Commission (“ CSRC”) or another PRC regulatory agency determines that CSRC approval was required in connection with the reverse acquisition of World Win, the reverse acquisition may be unwound, or we may become subject to penalties.

On August 8, 2006, six PRC regulatory agencies, including the CSRC, promulgated the Provisions Regarding Mergers and Acquisitions of Domestic Enterprises by Foreign Investors (the “M&A Rule”), which became effective on September 8, 2006. The M&A Rule, among other things, requires that an offshore company controlled by PRC companies or individuals that have acquired a PRC domestic company for the purpose of listing the PRC domestic company's equity interest on an overseas stock exchange must obtain the approval of the CSRC prior to the listing and trading of such offshore company's securities on an overseas stock exchange. In addition, when an offshore company acquires a PRC domestic company, the offshore company is generally required to pay the acquisition consideration within three months after the issuance of the foreign-invested company license unless certain ratification from the relevant PRC regulatory agency is obtained. On September 21, 2006, the CSRC, pursuant to the M&A Rule, published on its official web site procedures specifying documents and materials required to be submitted to it by offshore companies seeking CSRC approval of their overseas listings.

We believe the M&A Rule mandating CSRC approval for acquisition of a PRC domestic company by an offshore company controlled by PRC companies or individuals should not apply to our reverse acquisition of World Win because none of World Win, Kuayu or Shengshihe Consulting was a “Special Purpose Vehicle” or an “offshore company controlled by PRC companies or individuals” at the moment of acquisition. However, we cannot assure you that we would be able to obtain the approval required from MOFCOM. If the PRC regulatory authorities take the view that the reverse acquisition of World Win constituted a round-trip investment without MOFCOM approval, they could invalidate our acquisition and ownership of World Win.

The M&A Rule establishes more complex procedures for some acquisitions of Chinese companies by foreign investors, which could make it more difficult for us to pursue growth through acquisitions in China.

The M&A Rule establishes additional procedures and requirements that could make some acquisitions of Chinese companies by foreign investors more time-consuming and complex, including requirements in some instances that the PRC Ministry of Commerce be notified in advance of any change-of-control transaction, and in some situations require approval of the PRC Ministry of Commerce when a foreign investor takes control of a Chinese domestic enterprise. In the future, we may grow our business in part by acquiring complementary businesses, although we do not have any plans to do so at this time. The M&A Rule also requires PRC Ministry of Commerce anti-trust review of any change-of-control transactions involving certain types of foreign acquirers. Complying with the requirements of the M&A Rule to complete such transactions could be time-consuming, and any required approval processes, including obtaining approval from the PRC Ministry of Commerce, may delay or inhibit our ability to complete such transactions, which could affect our ability to expand our business or maintain our market share.

Failure to comply with PRC regulations relating to the establishment of offshore special purpose companies by PRC residents may subject our PRC resident shareholders to personal liability, limit our ability to acquire PRC companies or to inject capital into our PRC subsidiary or affiliate, limit our PRC subsidiary’s and affiliate’s ability to distribute profits to us or otherwise materially adversely affect us.

In October 2005, SAFE issued the Notice on Relevant Issues in the Foreign Exchange Control over Financing and Return Investment Through Special Purpose Companies by Residents Inside China, generally referred to as Circular 75, which required PRC residents to register with the competent local SAFE branch before establishing or acquiring control over an offshore special purpose company, or SPV, for the purpose of engaging in an equity financing outside of China on the strength of domestic PRC assets originally held by those residents. Internal implementing guidelines issued by SAFE, which became public in June 2007 (known as Notice 106), expanded the reach of Circular 75 by (1) purporting to cover the establishment or acquisition of control by PRC residents of offshore entities which merely acquire “control” over domestic companies or assets, even in the absence of legal ownership; (2) adding requirements relating to the source of the PRC resident’s funds used to establish or acquire the offshore entity; covering the use of existing offshore entities for offshore financings; (3) purporting to cover situations in which an offshore SPV establishes a new subsidiary in China or acquires an unrelated company or unrelated assets in China; and (4) making the domestic affiliate of the SPV responsible for the accuracy of certain documents which must be filed in connection with any such registration, notably, the business plan which describes the overseas financing and the use of proceeds. Amendments to registrations made under Circular 75 are required in connection with any increase or decrease of capital, transfer of shares, mergers and acquisitions, equity investment or creation of any security interest in any assets located in China to guarantee offshore obligations, and Notice 106 makes the offshore SPV jointly responsible for these filings. In the case of an SPV which was established, and which acquired a related domestic company or assets, before the implementation date of Circular 75, a retroactive SAFE registration was required to have been completed before March 31, 2006; this date was subsequently extended indefinitely by Notice 106, which also required that the registrant establish that all foreign exchange transactions undertaken by the SPV and its affiliates were in compliance with applicable laws and regulations. Failure to comply with the requirements of Circular 75, as applied by SAFE in accordance with Notice 106, may result in fines and other penalties under PRC laws for evasion of applicable foreign exchange restrictions. Any such failure could also result in the SPV’s affiliates being impeded or prevented from distributing their profits and the proceeds from any reduction in capital, share transfer or liquidation to the SPV, or from engaging in other transfers of funds into or out of China.

We have advised our shareholders who are PRC residents, as defined in Circular 75, to register with the relevant branch of SAFE, as currently required, in connection with their equity interests in us and our acquisitions of equity interests in our PRC subsidiary and affiliate. However, we cannot provide any assurances that their existing registrations have fully complied with, and they have made all necessary amendments to their registration to fully comply with, all applicable registrations or approvals required by Circular 75. Moreover, because of uncertainty over how Circular 75 will be interpreted and implemented, and how or whether SAFE will apply it to us, we cannot predict how it will affect our business operations or future strategies. For example, our present and prospective PRC subsidiary’s and affiliate’s ability to conduct foreign exchange activities, such as the remittance of dividends and foreign currency-denominated borrowings, may be subject to compliance with Circular 75 by our PRC resident beneficial holders. In addition, such PRC residents may not always be able to complete the necessary registration procedures required by Circular 75. We also have little control over either our present or prospective direct or indirect shareholders or the outcome of such registration procedures. A failure by our PRC resident beneficial holders or future PRC resident shareholders to comply with Circular 75, if SAFE requires it, could subject these PRC resident beneficial holders to fines or legal sanctions, restrict our overseas or cross-border investment activities, limit our subsidiary’s and affiliate’s ability to make distributions or pay dividends or affect our ownership structure, which could adversely affect our business and prospects.

RISKS RELATING TO THE VIE AGREEMENTS

The PRC government may determine that the VIE Agreements are not in compliance with applicable PRC laws, rules and regulations.

Shengshihe Consulting provides support and consulting service to Shenzhen Wonhe pursuant to the VIE Agreements. Almost all economic benefits and risks arising from Shenzhen Wonhe’s operations are transferred to Shengshihe Consulting under these agreements. There are risks involved with the operation of our business in reliance on the VIE Agreements, including the risk that the VIE Agreements may be determined by PRC regulators or courts to be unenforceable. Our PRC counsel has provided a legal opinion that the VIE Agreements are binding and enforceable under PRC law, but has further advised that if the VIE Agreements were for any reason determined to be in breach of any existing or future PRC laws or regulations, the relevant regulatory authorities would have broad discretion in dealing with such breach, including:

| |

●

|

imposing economic penalties;

|

| |

●

|

discontinuing or restricting the operations of Shengshihe Consulting or Shenzhen Wonhe;

|

| |

●

|

imposing conditions or requirements in respect of the VIE Agreements with which Shengshihe Consulting or Shenzhen Wonhe may not be able to comply;

|

| |

●

|

requiring our company to restructure the relevant ownership structure or operations;

|

| |

●

|

taking other regulatory or enforcement actions that could adversely affect our company’s business; and

|

| |

●

|

revoking the business licenses and/or the licenses or certificates of Shenzhen Wonhe, and/or voiding the VIE Agreements.

|

Any of these actions could adversely affect our ability to manage, operate and gain the financial benefits of Shenzhen Wonhe, which would have a material adverse impact on our business, financial condition and results of operations.

Our ability to control Shenzhen Wonhe under the VIE Agreements may not be as effective as direct ownership.

We conduct our business in the PRC and generate virtually all of our revenues through the VIE Agreements. Our plans for future growth are based substantially on growing the operations of Shenzhen Wonhe. However, the VIE Agreements may not be as effective in providing us with control over Shenzhen Wonhe as direct ownership. The VIE Agreements do not provide us with day-to-day control over the operations of Shenzhen Wonhe. Under the current VIE arrangements, as a legal matter, if Shenzhen Wonhe fails to perform its obligations under these contractual arrangements, we may have to (i) incur substantial costs and resources to enforce such arrangements, and (ii) rely on legal remedies under PRC law, which we cannot be sure would be effective. Therefore, if we are unable to effectively control Shenzhen Wonhe, it may have an adverse effect on our ability to achieve our business objectives and grow our revenues.

As the VIE Agreements are governed by PRC law, we would be required to rely on PRC law to enforce our rights and remedies under them; PRC law may not provide us with the same rights and remedies as are available in contractual disputes governed by the law of other jurisdictions.

The VIE Agreements are governed by PRC law and provide for the resolution of disputes through the jurisdiction of courts in the PRC. If Shenzhen Wonhe or its shareholders fail to perform the obligations under the VIE Agreements, we would be required to resort to legal remedies available under PRC law, including seeking specific performance or injunctive relief, or claiming damages. We cannot be sure that such remedies would provide us with effective means of causing Shenzhen Wonhe or its shareholder to meet their obligations, or recovering any losses or damages as a result of non-performance. Further, the legal environment in China is not as developed as in other jurisdictions. Uncertainties in the application of various laws, rules, regulations or policies in PRC legal system could limit our liability to enforce the VIE Agreements and protect our interests.

The payment arrangement under the VIE Agreements may be challenged by the PRC tax authorities.

We generate our revenues through the payments we receive pursuant to the VIE Agreements. We could face adverse tax consequences if the PRC tax authorities determine that the VIE Agreements were not entered into based on arm’s length negotiations. For example, PRC tax authorities may adjust our income and expenses for PRC tax purposes which could result in our being subject to higher tax liability, or cause other adverse financial consequences.

Our Shareholders have potential conflicts of interest with our company which may adversely affect our business.

Qing Tong is our Chairman, Nanfang Tong is our CEO and one of our directors, and Jingwu Li is one of our directors, and they are also three of the four shareholders of Shenzhen Wonhe. There could be conflicts that arise from time to time between our interests and the interests of Messrs. Tong, Tong and Li. There could also be conflicts that arise between us and Shenzhen Wonhe that would require our shareholders and Shenzhen Wonhe's shareholders to vote on corporate actions necessary to resolve the conflict. There can be no assurance in any such circumstances that Messrs. Tong, Tong and Li will vote their shares in our best interest or otherwise act in the best interests of our company. If Messrs. Tong, Tong and Li fail to act in our best interests, our operating performance and future growth could be adversely affected.

We rely on the approval certificates and business license held by Shengshihe Consulting and any deterioration of the relationship between Shengshihe Consulting and Shenzhen Wonhe could materially and adversely affect our business operations.

We operate our business in China on the basis of the approval certificates, business and other requisite licenses held by Shengshihe Consulting and Shenzhen Wonhe. There is no assurance that Shengshihe Consulting and Shenzhen Wonhe will be able to renew their licenses or certificates when their terms expire with substantially similar terms as the ones they currently hold.

Further, our relationship with Shenzhen Wonhe is governed by the VIE Agreements that are intended to provide us with effective control over the business operations of Shenzhen Wonhe. However, the VIE Agreements may not be effective in providing control over the application for and maintenance of the licenses required for our business operations. Shenzhen Wonhe could violate the VIE Agreements, go bankrupt, suffer from difficulties in its business or otherwise become unable to perform its obligations under the VIE Agreements and, as a result, our operations, reputation and business could be severely harmed.

RISKS RELATED TO THE MARKET FOR OUR STOCK GENERALLY

There is only a very limited market for our Common Stock.

While our common stock is listing for quotation on the OTCQB, there is currently little trading in our common stock. We cannot provide any assurances as to when an active market will develop for our common stock.

Our common stock is subject to penny stock rules.

Our common stock is subject to Rule 15g-1 through 15g-9 under the Exchange Act, which imposes certain sales practice requirements on broker-dealers which sell our common stock to persons other than established customers and “accredited investors” (generally, individuals with net worth's in excess of $1,000,000 or annual incomes exceeding $200,000 (or $300,000 together with their spouses)). For transactions covered by this rule, a broker-dealer must make a special suitability determination for the purchaser and have received the purchaser's written consent to the transaction prior to the sale. This rule adversely affects the ability of broker-dealers to sell our common stock and the ability of our stockholders to sell their shares of common stock.

Additionally, our common stock is subject to the SEC regulations for “penny stock.” Penny stock includes any equity security that is not listed on a national exchange and has a market price of less than $5.00 per share, subject to certain exceptions. The regulations require that prior to any non-exempt buy/sell transaction in a penny stock, a disclosure schedule set forth by the SEC relating to the penny stock market must be delivered to the purchaser of such penny stock. This disclosure must include the amount of commissions payable to both the broker-dealer and the registered representative and current price quotations for the common stock. The regulations also require that monthly statements be sent to holders of penny stock that disclose recent price information for the penny stock and information of the limited market for penny stocks. These requirements adversely affect the market liquidity of our common stock.

Certain provisions of our Articles of Incorporation may make it more difficult for a third party to effect a change-of-control.

Our Articles of Incorporation authorizes the board of directors to issue up to 10,000,000 shares of preferred stock in one or more series. The terms of the preferred stock may include preferences as to dividends and liquidation, conversion rights, redemption rights and sinking fund provisions. The issuance of any preferred stock could diminish the rights of holders of our common stock, and therefore could reduce the value of such common stock. In addition, specific rights granted to future holders of preferred stock could be used to restrict our ability to merge with, or sell assets to, a third party. The ability of the board of directors to issue preferred stock could make it more difficult, delay, discourage, prevent or make it more costly to acquire or effect a change-in-control, which in turn could prevent our stockholders from recognizing a gain in the event that a favorable offer is extended and could materially and negatively affect the market price of our common stock.

ITEM 1B UNRESOLVED STAFF COMMENTS

Not Applicable.

ITEM 2. DESCRIPTION OF PROPERTY

We occupy our principal executive offices in Shenzhen, China at a current monthly rental of approximately $9,579. Our lease for the premises expires on August 31, 2014.

We expect that our current facilities will be adequate for our operations for the foreseeable future.

ITEM 3. LEGAL PROCEEDINGS

None.

ITEM 4. MINE SAFETY DISCLOSURES

Not Applicable.

PART II

ITEM 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES.

(a) Market Information