f10q0313_wonhe.htm

U. S. Securities and Exchange Commission

Washington, D. C. 20549

FORM 10-Q

| x QUARTERLY REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| For the quarterly period ended March 31, 2013 |

| o TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| For the transition period from _____ to _____ |

Commission File No. 0-54744

| |

|

WONHE HIGH-TECH INTERNATIONAL, INC.

(Name of Registrant in its Charter)

|

| |

|

Nevada

|

26-0775642

|

|

(State of Other Jurisdiction of

incorporation or organization)

|

(I.R.S.) Employer I.D. No.)

|

| |

|

Room 1001, 10th Floor, Resource Hi-Tech Building South Tower

No. 1 Songpingshan Road, North Central Avenue North High-Tech Zone

Nanshan District, Shenzhen, Guangdong Province, P.R. China 518057

|

|

(Address of Principal Executive Offices)

|

Issuer's Telephone Number: 852-2815-0191

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Sections 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files.) Yes x No o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act) Yes o No x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check One)

Large accelerated filer o Accelerated filer o Non-accelerated filer o Smaller reporting company x

APPLICABLE ONLY TO CORPORATE ISSUERS: Indicate the number of shares outstanding of each of the Registrant's classes of common stock, as of the latest practicable date:

May 15, 2013

Common Voting Stock: 38,380,130

WONHE HIGH-TECH INTERNATIONAL, INC.

QUARTERLY REPORT ON FORM 10-Q

FOR THE FISCAL QUARTER ENDED MARCH 31, 2013

TABLE OF CONTENTS

| |

|

Page No

|

|

Part I

|

Financial Information

|

|

|

Item 1.

|

Financial Statements (unaudited):

|

|

| |

Consolidated Balance Sheets (Unaudited) – March 31, 2013 and December 31, 2012

|

2

|

|

|

Consolidated Statements of Income and Other Comprehensive Income (Unaudited) - for the Three Months Ended March 31, 2013 and 2012

|

3

|

| |

Consolidated Statements of Cash Flows (Unaudited) – for the Three Months Ended March 31, 2013 and 2012

|

4

|

| |

Notes to Consolidated Financial Statements (Unaudited)

|

5

|

|

Item 2.

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations

|

23

|

|

Item 3

|

Quantitative and Qualitative Disclosures about Market Risk

|

30

|

|

Item 4.

|

Controls and Procedures

|

30

|

| |

|

|

|

Part II

|

Other Information

|

|

|

Item 1.

|

Legal Proceedings

|

31

|

|

Items 1A.

|

Risk Factors

|

31

|

|

Item 2.

|

Unregistered Sales of Equity Securities and Use of Proceeds

|

31

|

|

Item 3.

|

Defaults upon Senior Securities

|

31

|

|

Item 4.

|

Mine Safety Disclosures

|

31

|

|

Item 5.

|

Other Information

|

31

|

|

Item 6.

|

Exhibits

|

31

|

| |

|

|

| |

Signatures

|

32

|

WONHE HIGH-TECH INTERNATIONAL, INC. AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

(IN U.S.$)

|

ASSETS

|

|

March 31,

2013

|

|

|

December 31,

2012

|

|

| |

|

(Unaudited)

|

|

|

|

|

|

Current assets:

|

|

|

|

|

|

|

|

Cash

|

|

$ |

12,925,136 |

|

|

$ |

5,215,738 |

|

|

Accounts receivable

|

|

|

3,077,534 |

|

|

|

4,033,576 |

|

|

Inventory

|

|

|

271,712 |

|

|

|

265,665 |

|

|

Advances to suppliers

|

|

|

1,891,376 |

|

|

|

5,282,712 |

|

|

Prepaid expenses

|

|

|

10,119 |

|

|

|

72,811 |

|

| |

|

|

|

|

|

|

|

|

|

Total current assets

|

|

|

18,175,877 |

|

|

|

14,870,502 |

|

| |

|

|

|

|

|

|

|

|

|

Fixed assets

|

|

|

476,636 |

|

|

|

473,942 |

|

|

Less: accumulated depreciation

|

|

|

(143,451 |

) |

|

|

(123,251 |

) |

| |

|

|

|

|

|

|

|

|

|

Fixed assets, net

|

|

|

333,185 |

|

|

|

350,691 |

|

| |

|

|

|

|

|

|

|

|

|

Other assets:

|

|

|

|

|

|

|

|

|

|

Intangible assets

|

|

|

23,349 |

|

|

|

25,328 |

|

|

Other assets – principally security deposits

|

|

|

51,202 |

|

|

|

53,908 |

|

|

Prepaid income taxes

|

|

|

501,348 |

|

|

|

- |

|

| |

|

|

|

|

|

|

|

|

|

Total other assets

|

|

|

575,899 |

|

|

|

79,236 |

|

| |

|

|

|

|

|

|

|

|

|

TOTAL ASSETS

|

|

$ |

19,084,961 |

|

|

$ |

15,300,429 |

|

| |

|

|

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS’ EQUITY

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Current liabilities:

|

|

|

|

|

|

|

|

|

|

Accounts payable

|

|

$ |

14,418 |

|

|

$ |

14,241 |

|

|

Payroll payable

|

|

|

56,944 |

|

|

|

36,101 |

|

|

Taxes payable

|

|

|

116,436 |

|

|

|

793,723 |

|

|

Accrued expenses and other payables

|

|

|

191,187 |

|

|

|

163,549 |

|

| |

|

|

|

|

|

|

|

|

|

Total current liabilities

|

|

|

378,985 |

|

|

|

1,007,614 |

|

| |

|

|

|

|

|

|

|

|

|

Commitments and Contingencies

|

|

|

- |

|

|

|

- |

|

|

Stockholders’ equity:

|

|

|

|

|

|

|

|

|

|

Preferred stock: $0.001 par value; 10,000,000 shares authorized; none issued and outstanding

|

|

|

- |

|

|

|

- |

|

|

Common stock: $0.001 par value; 90,000,000 shares authorized; 23,900,130 shares issued and outstanding at March 31, 2013 and December 31, 2012

|

|

|

23,900 |

|

|

|

23,900 |

|

|

Additional paid-in capital

|

|

|

7,113,611 |

|

|

|

7,113,611 |

|

|

Statutory reserve fund

|

|

|

1,010,711 |

|

|

|

600,844 |

|

|

Retained earnings

|

|

|

9,172,468 |

|

|

|

5,469,214 |

|

|

Other comprehensive income

|

|

|

453,198 |

|

|

|

373,062 |

|

|

Stockholders’ equity before noncontrolling interests

|

|

|

17,773,888 |

|

|

|

13,580,631 |

|

|

Noncontrolling interests

|

|

|

932,088 |

|

|

|

712,184 |

|

| |

|

|

|

|

|

|

|

|

|

Total stockholders’ equity

|

|

|

18,705,976 |

|

|

|

14,292,815 |

|

| |

|

|

|

|

|

|

|

|

|

TOTAL LIABILITIES AND STOCKHOLDERS’ EQUITY

|

|

$ |

19,084,961 |

|

|

$ |

15,300,429 |

|

See accompanying notes to the consolidated financial statements.

WONHE HIGH-TECH INTERNATIONAL, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF INCOME AND OTHER COMPREHENSIVE INCOME (UNAUDITED)

FOR THE THREE MONTHS ENDED MARCH 31, 2013 AND 2012 (IN U.S.$)

| |

|

Three Months Ended

March 31,

|

|

|

|

|

2013

|

|

|

2012

|

|

| |

|

|

|

|

|

|

|

Sales

|

|

$ |

9,617,400 |

|

|

$ |

3,354,356 |

|

|

Cost of sales

|

|

|

(4,922,413 |

) |

|

|

(1,714,981 |

) |

| |

|

|

|

|

|

|

|

|

|

Gross profit

|

|

|

4,694,987 |

|

|

|

1,639,375 |

|

| |

|

|

|

|

|

|

|

|

|

Operating expenses:

|

|

|

|

|

|

|

|

|

|

Research and development expenses

|

|

|

60,288 |

|

|

|

69,326 |

|

|

Selling and marketing

|

|

|

81,976 |

|

|

|

85,125 |

|

|

General and administrative

|

|

|

219,065 |

|

|

|

291,056 |

|

| |

|

|

|

|

|

|

|

|

|

Total operating expenses

|

|

|

361,329 |

|

|

|

445,507 |

|

| |

|

|

|

|

|

|

|

|

|

Income from operations

|

|

|

4,333,658 |

|

|

|

1,193,868 |

|

| |

|

|

|

|

|

|

|

|

|

Interest income

|

|

|

- |

|

|

|

112,067 |

|

| |

|

|

|

|

|

|

|

|

|

Income before provision for income taxes

|

|

|

4,333,658 |

|

|

|

1,305,935 |

|

|

Provision for income taxes

|

|

|

4,818 |

|

|

|

326,484 |

|

| |

|

|

|

|

|

|

|

|

|

Net income

|

|

|

4,328,840 |

|

|

|

979,451 |

|

|

Noncontrolling interests

|

|

|

(215,719 |

) |

|

|

- |

|

| |

|

|

|

|

|

|

|

|

|

Net income attributable to common stockholders

|

|

|

4,113,121 |

|

|

|

979,451 |

|

|

Foreign currency translation adjustment

|

|

|

84,321 |

|

|

|

43,792 |

|

|

Total comprehensive income

|

|

$ |

4,197,442 |

|

|

$ |

1,023,243 |

|

| |

|

|

|

|

|

|

|

|

|

Earnings per common share, basic and diluted

|

|

$ |

0.17 |

|

|

$ |

0.05 |

|

| |

|

|

|

|

|

|

|

|

|

Weighted average shares outstanding, basic and diluted

|

|

|

23,900,130 |

|

|

|

19,128,130 |

|

See accompanying notes to the consolidated financial statements.

WONHE HIGH-TECH INTERNATIONAL, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS (UNAUDITED)

FOR THE THREE MONTHS ENDED MARCH 31, 2013 AND 2012 (IN U.S.$)

| |

|

Three Months Ended

March 31,

|

|

| |

|

2013

|

|

|

2012

|

|

| |

|

|

|

|

|

|

|

Cash flows from operating activities:

|

|

|

|

|

|

|

|

Net income

|

|

$ |

4,328,840 |

|

|

$ |

979,451 |

|

|

Adjustment to reconcile net income to net cash

provided by (used in) operating activities:

|

|

|

|

|

|

|

|

|

|

Depreciation and amortization

|

|

|

21,609 |

|

|

|

19,152 |

|

|

Deferred income taxes

|

|

|

- |

|

|

|

294,674 |

|

|

Change in operating assets and liabilities:

|

|

|

|

|

|

|

|

|

|

Decrease (increase) in accounts receivable

|

|

|

958,748 |

|

|

|

(2,176,756 |

) |

|

(Increase) in interest receivable

|

|

|

- |

|

|

|

(1,958 |

) |

|

(Increase) in inventory

|

|

|

(6,047 |

) |

|

|

(25,116 |

) |

|

Decrease (increase) in advances to suppliers

|

|

|

3,391,336 |

|

|

|

(3,764,061 |

) |

|

Decrease (increase) in prepaid expenses

|

|

|

62,692 |

|

|

|

(225,047 |

) |

|

(Increase) in prepaid income taxes

|

|

|

(501,348 |

) |

|

|

- |

|

|

Increase (decrease) in accounts payable

|

|

|

177 |

|

|

|

(2,306 |

) |

|

Increase in payroll payable

|

|

|

20,843 |

|

|

|

9,778 |

|

|

(Decrease) increase in taxes payable

|

|

|

(677,287 |

) |

|

|

144,223 |

|

|

Increase (decrease) in accrued expenses and other payables

|

|

|

12,543 |

|

|

|

(54,206 |

) |

|

Increase in advances from customers

|

|

|

- |

|

|

|

62,999 |

|

| |

|

|

|

|

|

|

|

|

|

Net cash provided by (used in) operating activities

|

|

|

7,612,106 |

|

|

|

(4,739,173 |

) |

| |

|

|

|

|

|

|

|

|

|

Cash flows from investing activities:

|

|

|

|

|

|

|

|

|

|

Purchase of fixed assets

|

|

|

- |

|

|

|

(2,183 |

) |

| |

|

|

|

|

|

|

|

|

|

Net cash (used in) investing activities

|

|

|

- |

|

|

|

(2,183 |

) |

| |

|

|

|

|

|

|

|

|

|

Cash flows from financing activities:

|

|

|

|

|

|

|

|

|

|

Loans from (to) related parties

|

|

|

15,000 |

|

|

|

(365,220 |

) |

|

Repayment of related party loans

|

|

|

- |

|

|

|

5,294,891 |

|

| |

|

|

|

|

|

|

|

|

|

Net cash provided by financing activities

|

|

|

15,000 |

|

|

|

4,929,671 |

|

| |

|

|

|

|

|

|

|

|

|

Effect of exchange rate changes on cash

|

|

|

82,292 |

|

|

|

39,486 |

|

| |

|

|

|

|

|

|

|

|

|

Net increase in cash

|

|

|

7,709,398 |

|

|

|

227,801 |

|

|

Cash, beginning

|

|

|

5,215,738 |

|

|

|

76,084 |

|

| |

|

|

|

|

|

|

|

|

|

Cash, ending

|

|

$ |

12,925,136 |

|

|

$ |

303,885 |

|

| |

|

|

|

|

|

|

|

|

|

Supplemental disclosure of cash flow information:

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Cash paid for income taxes

|

|

$ |

1,154,277 |

|

|

$ |

- |

|

| |

|

|

|

|

|

|

|

|

|

Cash paid for interest

|

|

$ |

- |

|

|

$ |

- |

|

See accompanying notes to the consolidated financial statements.

WONHE HIGH-TECH INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

FOR THE THREE MONTHS ENDED MARCH 31, 2013 AND 2012

1. ORGANIZATION

Wonhe High-Tech International, Inc. (the “Company” or “Wonhe High-Tech”) was incorporated in the State of Nevada on August 13, 2007 under the name “Baby Fox International, Inc.” as a specialty retailer, developer, and designer of fashionable, value-priced women’s apparel and accessories. The Company changed its name from Baby Fox International, Inc. to Wonhe High-Tech International, Inc. on April 20, 2012.

On June 27, 2012, the Company entered into and closed an exchange agreement with World Win International Holding Ltd. or “World Win,” all of the stockholders of World Win, and Super-stable Group Holdings Limited, or “Super-stable”, the majority stockholder of the Company (the “Exchange Agreement”), pursuant to which the stockholders of World Win transferred all of the issued and outstanding stock of World Win to the Company, and Super-stable transferred to such stockholders all of its 19,128,130 shares of the Company’s common stock (the “Share Exchange”). The Company currently has 23,900,130 shares of common stock issued and outstanding. The funds used by Super-stable to purchase its 19,128,130 shares of the Company’s common stock were loaned to it by Shenzhen Wonhe Technology Co., Ltd., or “Shenzhen Wonhe”, the Company’s indirect, consolidated affiliate.

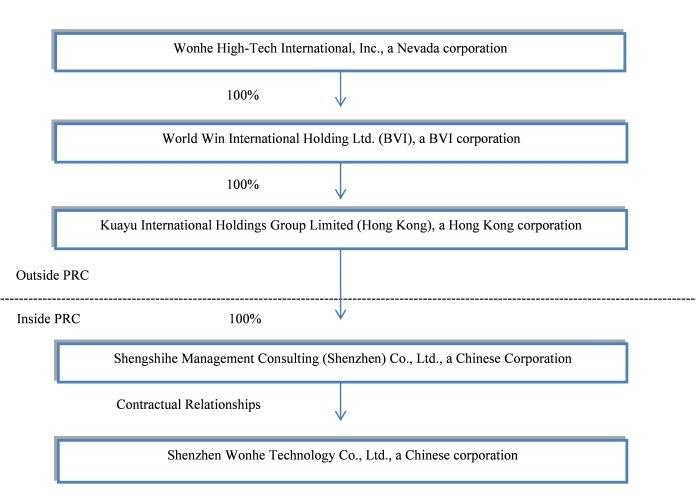

As a result of the acquisition, the Company’s consolidated subsidiaries include World Win, the Company’s wholly-owned subsidiary which is incorporated under the laws of the British Virgin Island (“BVI”), Kuayu International Holdings Group Limited (Hong Kong), or “Kuayu”, a wholly-owned subsidiary of World Win which is incorporated under the laws of Hong Kong, Shengshihe Management Consulting (Shenzhen) Co., Ltd., or “Shengshihe Consulting”, a wholly-owned subsidiary of Kuayu which is incorporated under the laws of the People’s Republic of China (“PRC”). The Company also consolidates the financial condition and results of operations of Shenzhen Wonhe Technology Co., Ltd., or “Shenzhen Wonhe”, a limited liability company incorporated under the laws of the PRC which is effectively and substantially controlled by Shengshihe Consulting through a series of captive agreements. Shenzhen Wonhe is considered a variable interest entity (“VIE”) of Shengshihe Consulting.

Shenzhen Wonhe Technology Co., Ltd. is a Chinese entity established on November 16, 2010 with registered capital of $7,495,000. It specializes in the research and development, outsourced-manufacturing and trade of hi-tech products based on x86 (instruction set architecture based on Intel 8086 CPU) and ARM (32-bit reduced instruction set architecture). Current products still under research and development include a Smart Media Box (SMB), Home Smart Server (HSS), Mini PC (MPC), All in One PC (AIO-PC), Business PAD (B-PAD), and Portable PAD (P-PAD). The product we currently offer to market is the Home Media Center (HMC). The Company is located in Shenzhen, Guangdong Province, China.

WONHE HIGH-TECH INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

FOR THE THREE MONTHS ENDED MARCH 31, 2013 AND 2012

1. ORGANIZATION (continued)

On May 30, 2012, Shenzhen Wonhe entered into (i) an Exclusive Technical Service and Business Consulting Agreement; (ii) a Proxy Agreement, (iii) Share Pledge Agreement, (iv) Call Option Agreement with Shengshihe Consulting. The foregoing agreements are collectively referred to as the “Management and Control Agreements.”

Exclusive Technical Service and Business Consulting Agreement: Pursuant to the Exclusive Technical Service and Business Consulting Agreement, Shengshihe Consulting provides technical support, consulting, training, marketing and business consulting services to Shenzhen Wonhe as related to its business activities. In consideration for such services, Shenzhen Wonhe has agreed to pay as an annual service fee to Shengshihe Consulting an amount equal 95% of Shenzhen Wonhe’s annual net income with an additional payment of approximately $7,910 (RMB 50,000) each month. The agreement has an unlimited term and can only be terminated upon written agreement of both parties.

Proxy Agreement: Pursuant to the Proxy Agreement, the stockholders of Shenzhen Wonhe agreed to irrevocably entrust Shengshihe Consulting to designate a qualified person acceptable under PRC law and foreign investment policies, to vote all of the equity interests in Shenzhen Wonhe held by each of the stockholders of Shenzhen Wonhe. The Agreement has an unlimited term and only can be terminated upon the written agreement of both parties.

Share Pledge Agreement: Pursuant to the Share Pledge Agreement, each of the stockholders of Shenzhen Wonhe pledged his shares to Shengshihe Consulting to secure the obligations of Shenzhen Wonhe under the Exclusive Technical Service and Business Consulting Agreement. In addition, the stockholders of Shenzhen Wonhe agreed not to transfer, sell, pledge, dispose of or create any encumbrance on their interests in Shenzhen Wonhe that would affect Shengshihe Consulting’s interests. This Agreement remains effective until the obligations under the Exclusive Technical Service and Business Consulting Agreement, Call Option Agreement and Proxy Agreement have been fulfilled or terminated.

Call Option Agreement: Pursuant to the Call Option Agreement, Shengshihe Consulting has an exclusive option to purchase, or to designate a purchaser for, to the extent permitted by PRC law and foreign investment policies, part or all of the equity interests in Shenzhen Wonhe held by each of the stockholders of Shenzhen Wonhe. To the extent permitted by PRC laws, the purchase price for the entire equity interest is approximately $0.16 (RMB1.00) or the minimum amount required by the PRC law or government practice. This Agreement remains effective until all the call options under the Agreement have been transferred to Shengshihe Consulting or its designated entities or natural persons.

WONHE HIGH-TECH INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

FOR THE THREE MONTHS ENDED MARCH 31, 2013 AND 2012

1. ORGANIZATION (continued)

After the Share Exchange, the Company’s current organization structure is as follows:

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Basis of Accounting and Presentation

The accompanying consolidated financial statements have been prepared on the accrual basis of accounting. The unaudited consolidated financial statements as of and for the three months ended March 31, 2013 include Wonhe High-Tech, World Win, Kuayu, Shengshihe Consulting and its VIE, Shenzhen Wonhe. The unaudited financial statements for the three months ended March 31, 2012 include Shenzhen Wonhe only, as World Win and Shengshihe Consulting were not in existence and Kuayu had no operations at that time. All significant intercompany accounts and transaction have been eliminated in consolidation when applicable.

The unaudited interim consolidated financial statements of the Company as of March 31, 2013 and for the three months ended March 31, 2013 and 2012, have been prepared in accordance with accounting principles generally accepted in the United States of America and the rules and regulations of the SEC which apply to interim financial statements.

WONHE HIGH-TECH INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

FOR THE THREE MONTHS ENDED MARCH 31, 2013 AND 2012

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (continued)

Basis of Accounting and Presentation (continued)

Accordingly, they do not include all of the information and footnotes normally required by accounting principles generally accepted in the United States of America for annual financial statements. The interim consolidated financial information should be read in conjunction with the consolidated financial statements and the notes thereto, included in the Company’s Form 10-K for the fiscal year ended December 31, 2012, previously filed with the SEC. In the opinion of management, the interim information contains all adjustments, consisting only of normal recurring adjustments, necessary for a fair presentation of the results for the periods presented. The results of operations for the three months ended March 31, 2013 are not necessarily indicative of the results to be expected for future quarters or for the year ending December 31, 2013.

Variable Interest Entity

Pursuant to Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) 810, “Consolidation” (“ASC 810”), the Company is required to include in its consolidated financial statements the financial statements of its variable interest entities (“VIEs”). ASC 810 requires a VIE to be consolidated by a company if that company is subject to a majority of the risk of loss for the VIE or is entitled to receive a majority of the VIE’s residual returns. VIEs are those entities in which a company, through contractual arrangements, bears the risk of, and enjoys the rewards normally associated with ownership of the entity, and therefore the company is the primary beneficiary of the entity.

Under ASC 810, an enterprise has a controlling financial interest in a VIE, and must consolidate that VIE, if the enterprise has both of the following characteristics: (a) the power to direct the activities of the VIE that most significantly affected the VIE’s economic performance; and (b) the obligation to absorb losses, or the right to receive benefits, that could potentially be significant to the VIE. The enterprise’s determination of whether it has this power is not affected by the existence of kick-out rights or participating rights, unless a single enterprise, including its related parties and de facto agents, have the unilateral ability to exercise those rights. Shenzhen Wonhe’s actual stockholders do not hold any kick-out rights that affect the consolidation determination.

Through the VIE agreements as disclosed in Note 1, the Company is deemed the primary beneficiary of Shenzhen Wonhe and accordingly, their results have been included in the accompanying consolidated financial statements. The following are financial statement amounts and balances of Shenzhen Wonhe that have been included in the accompanying consolidated financial statements. Shenzhen Wonhe has no assets that are collateral for or restricted solely to settle their obligations. The creditors of Shenzhen Wonhe do not have recourse to the Company’s general credit.

WONHE HIGH-TECH INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

FOR THE THREE MONTHS ENDED MARCH 31, 2013 AND 2012

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (continued)

Variable Interest Entity (continued)

|

ASSETS

|

|

March 31,

2013

|

|

|

December 31,

2012

|

|

| |

|

(Unaudited,

In U.S. $)

|

|

|

(In U.S. $)

|

|

|

Current assets:

|

|

|

|

|

|

|

|

Cash

|

|

$ |

12,849,726 |

|

|

$ |

5,159,917 |

|

|

Accounts receivable

|

|

|

3,077,534 |

|

|

|

4,033,576 |

|

|

Inventory

|

|

|

271,712 |

|

|

|

265,665 |

|

|

Advances to suppliers

|

|

|

1,891,376 |

|

|

|

5,282,712 |

|

|

Prepaid expenses

|

|

|

10,119 |

|

|

|

72,811 |

|

| |

|

|

|

|

|

|

|

|

|

Total current assets

|

|

|

18,100,467 |

|

|

|

14,814,681 |

|

| |

|

|

|

|

|

|

|

|

|

Fixed assets

|

|

|

476,636 |

|

|

|

473,942 |

|

|

Less: accumulated depreciation

|

|

|

(143,451 |

) |

|

|

(123,251 |

) |

| |

|

|

|

|

|

|

|

|

|

Fixed assets, net

|

|

|

333,185 |

|

|

|

350,691 |

|

| |

|

|

|

|

|

|

|

|

|

Other assets:

|

|

|

|

|

|

|

|

|

|

Intangible assets

|

|

|

23,349 |

|

|

|

25,328 |

|

|

Other assets – principally security deposits

|

|

|

51,202 |

|

|

|

53,908 |

|

|

Prepaid income taxes

|

|

|

501,348 |

|

|

|

- |

|

| |

|

|

|

|

|

|

|

|

|

Total other assets

|

|

|

575,899 |

|

|

|

79,236 |

|

| |

|

|

|

|

|

|

|

|

|

TOTAL ASSETS

|

|

$ |

19,009,551 |

|

|

$ |

15,244,608 |

|

| |

|

|

|

|

|

|

|

|

|

LIABILITIES

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Current liabilities:

|

|

|

|

|

|

|

|

|

|

Accounts payable

|

|

$ |

14,418 |

|

|

$ |

14,241 |

|

|

Payable to WFOE(1)

|

|

|

10,946,928 |

|

|

|

6,848,259 |

|

|

Payroll payable

|

|

|

55,479 |

|

|

|

34,645 |

|

|

Taxes Payable

|

|

|

101,048 |

|

|

|

783,212 |

|

|

Accrued expenses and other payables

|

|

|

196,855 |

|

|

|

168,838 |

|

| |

|

|

|

|

|

|

|

|

|

Total current liabilities

|

|

|

11,314,728 |

|

|

|

7,849,195 |

|

| |

|

|

|

|

|

|

|

|

|

TOTAL LIABILITIES

|

|

$ |

11,314,728 |

|

|

$ |

7,849,195 |

|

WONHE HIGH-TECH INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

FOR THE THREE MONTHS ENDED MARCH 31, 2013 AND 2012

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (continued)

Variable Interest Entity (continued)

|

(1)

|

Payable to WFOE represents amounts due to Shengshihe Consulting under the Exclusive Technical Service and Business Consulting Agreement for consulting services provided to Shenzhen Wonhe in exchange for 95% of Shenzhen Wonhe’s net income. Monthly payments for the three months ended March 31, 2013 of RMB 50,000 (approximately US$7,955) were paid in full as of March 31, 2013.

|

| |

|

Three Months Ended March 31,

|

|

|

|

|

2013

|

|

|

2012

|

|

|

|

|

|

|

|

|

|

|

Sales

|

|

$ |

9,617,400 |

|

|

$ |

3,354,356 |

|

|

Net income(2)

|

|

|

4,314,388 |

|

|

|

979,451 |

|

|

(2)

|

Under the Exclusive Technical Service and Business Consulting Agreement, 95% of the net income is to be remitted to WFOE.

|

| |

|

Three Months Ended March 31,

|

|

| |

|

2013

|

|

|

2012

|

|

| |

|

|

|

|

|

|

|

Net cash provided by (used in) operating activities

|

|

$ |

7,593,147 |

|

|

$ |

(4,739,173 |

) |

|

Net cash (used in) investing activities

|

|

|

- |

|

|

|

(2,183 |

) |

|

Net cash provided by financing activities

|

|

|

15,000 |

|

|

|

4,929,671 |

|

|

Effect of exchange rate changes on cash

|

|

|

81,662 |

|

|

|

39,486 |

|

| |

|

|

|

|

|

|

|

|

|

Net increase in cash

|

|

$ |

7,689,809 |

|

|

$ |

227,801 |

|

The Company believes that Shengshihe Consulting’s contractual agreements with Shenzhen Wonhe are in compliance with PRC law and are legally enforceable. The stockholders of Shenzhen Wonhe are also the senior management of the Company and therefore the Company believes that they have no current interest in seeking to act contrary to the contractual arrangements. However, Shenzhen Wonhe and its stockholders may fail to take certain actions required for the Company’s business or to follow the Company’s instructions despite their contractual obligations to do so. Furthermore, if Shenzhen Wonhe or its stockholders do not act in the best interests of the Company under the contractual arrangements and any dispute relating to these contractual arrangements remains unresolved, the Company will have to enforce its rights under these contractual arrangements through the operations of PRC law and courts and therefore will be subject to uncertainties in the PRC legal system. All of these contractual arrangements are governed by PRC law and provide for the resolution of disputes through arbitration in the PRC. Accordingly, these contracts would be interpreted in accordance with PRC law and any disputes would be resolved in accordance with PRC legal procedures. As a result, uncertainties in the PRC legal system could limit the Company’s ability to enforce these contractual arrangements, which may make it difficult to exert effective control over Shenzhen Wonhe, and its ability to conduct business may be adversely affected.

WONHE HIGH-TECH INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

FOR THE THREE MONTHS ENDED MARCH 31, 2013 AND 2012

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (continued)

Use of Estimates

The preparation of financial statements in accordance with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect certain reported amounts of assets and liabilities and disclosures of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting periods. Actual results could differ from those estimates.

Foreign Currency Translation

Almost all of the Company’s assets are located in the PRC. The functional currency for the majority of the operations is the Renminbi (“RMB”). For Kuayu, the functional currency for the majority of its operations is the Hong Kong Dollar (“HKD”). The Company uses the US Dollar for financial reporting purposes. The unaudited consolidated financial statements of the Company have been translated into US dollars in accordance with FASB ASC 830, “Foreign Currency Matters.”

All asset and liability accounts have been translated using the exchange rate in effect at the balance sheet date. Equity accounts have been translated at their historical exchange rates when the capital transactions occurred. Statements of operations and other comprehensive income amounts have been translated using the average exchange rate for the periods presented. Adjustments resulting from the translation of the Company’s consolidated financial statements are recorded as other comprehensive income.

The exchange rates used to translate amounts in RMB into US dollars for the purposes of preparing the consolidated financial statements are as follows:

| |

|

March 31,

2013

|

|

|

December 31,

2012

|

|

|

March 31,

2012

|

|

| |

|

RMB

|

|

|

HKD

|

|

|

RMB

|

|

|

HKD

|

|

|

RMB

|

|

|

HKD

|

|

|

Balance sheet items, except for stockholders’ equity, as of periods end

|

|

|

0.1592 |

|

|

|

0.1288 |

|

|

|

0.1583 |

|

|

|

0.1290 |

|

|

|

0.1581 |

|

|

|

N/A |

|

|

Amounts included in the statements of income and cash flows for the periods

|

|

|

0.1591 |

|

|

|

0.1289 |

|

|

|

N/A |

|

|

|

N/A |

|

|

|

0.1582 |

|

|

|

0.1288 |

|

WONHE HIGH-TECH INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

FOR THE THREE MONTHS ENDED MARCH 31, 2013 AND 2012

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (continued)

Foreign Currency Translation (continued)

For the three months ended March 31, 2013 and 2012, foreign currency translation adjustments of $84,321 and $43,792, respectively, have been reported as other comprehensive income.

Although government regulations now allow convertibility of the RMB for current account transactions, significant restrictions still remain. Hence, such translations should not be construed as representations that the RMB could be converted into US dollars at that rate or any other rate.

The value of the RMB against the US dollar and other currencies may fluctuate and is affected by, among other things, changes in the PRC’s political and economic conditions. Any significant revaluation of the RMB may materially affect the Company’s financial condition in terms of US dollar reporting.

Revenue and Cost Recognition

The Company receives revenue from sales of electronic products. The Company's revenue recognition policies are in compliance with SEC Staff Accounting Bulletin (“SAB”) 104 (codified in FASB ASC Topic 605). Sales revenue is recognized when the products are delivered and when customer acceptance occurs, the price is fixed or determinable, no other significant obligations of the Company exist and collectability is reasonably assured. Finished goods are delivered from outsourced manufacturers to the Company. Revenue is recognized when the title to the products has been passed to customers, which is the date the products are picked up by the customers at the Company’s location or delivered to the designated locations by Company employees and accepted by the customers and the previously discussed requirements are met. The customers’ acceptance occurs upon inspection at the time of pickup or delivery by signing an acceptance form. The Company does not provide the customers with the right of return. A 36-month warranty is offered to customers for exchange or repair of defective products, the cost of which is substantially covered by the outsourced manufacturers’ warranty policies as specified in the contract between the Company and outsourced manufacturers. As a result, the Company does not recognize a warranty liability. Payments received before all of the relevant criteria for revenue recognition are met are recorded as advances from customers.

The Company follows the guidance set forth by FASB ASC 605-45-45 to assess whether the Company acts as the principal or agent in the transaction. The determination involves judgment and is based on an evaluation of whether the Company has the substantial risks and rewards of ownership under the terms of arrangement. Based on the assessment, the Company determined it acts as principal in the transaction and reports revenues on the gross basis.

WONHE HIGH-TECH INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

FOR THE THREE MONTHS ENDED MARCH 31, 2013 AND 2012

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (continued)

Revenue and Cost Recognition (continued)

FASB ASC 605-45-45 sets forth eight criteria that support reporting recognition of gross revenue (i.e. principal sales) and three that support reporting net revenue (i.e. agent sales). As applied to the relationship between the Company and its manufacturers, seven of the criteria that support reporting gross revenue are satisfied as follows:

|

●

|

Shenzhen Wonhe is the primary obligor in each sale, as it is responsible for fulfillment of customer orders, including the acceptability of the products purchased by the customer.

|

|

●

|

Shenzhen Wonhe has general inventory risk, as it takes title to a product before that product is ordered by or delivered to a customer.

|

|

●

|

Shenzhen Wonhe establishes its own pricing for its products.

|

|

●

|

Shenzhen Wonhe has discretion in supplier selection.

|

|

●

|

Shenzhen Wonhe designed HMC660 and is responsible for all specifications.

|

|

●

|

Shenzhen Wonhe has physical loss inventory risk until the product is delivered to the customer.

|

|

●

|

Shenzhen Wonhe has full credit risk for amounts billed to its customers.

|

The only criterion supporting recognition of gross revenue that is not satisfied by the relationship between the Company and its manufacturers is: entity changes the product or performs part of the service. Moreover, none of the three criteria supporting recognition of net revenue is present in the Company’s sales transactions. For this reason, the Company records gross revenue with respect to sales of Shenzhen Wonhe.

Fair Value of Financial Instruments

FASB ASC 820, “Fair Value Measurement,” defines fair value as the price that would be received upon sale of an asset or paid upon transfer of a liability in an orderly transaction between market participants at the measurement date and in the principal or most advantageous market for that asset or liability. The fair value should be calculated based on assumptions that market participants would use in pricing the asset or liability, not on assumptions specific to the entity.

Advertising Costs

Advertising costs are charged to operations when incurred. Advertising costs were $65,637 and $583 for the three months ended March 31, 2013 and 2012, respectively.

WONHE HIGH-TECH INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

FOR THE THREE MONTHS ENDED MARCH 31, 2013 AND 2012

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (continued)

Research and Development Costs

The Company develops software to be marketed as part of its products, and that is not for internal use. The software is essential to the functionality of the Company’s tangible products. Therefore, the Company accounts for research and development costs incurred in development of its software in accordance with FASB ASC 985-20.

Research and development costs are charged to operations when incurred. Development costs of computer software to be sold, leased, or otherwise marketed are subject to capitalization beginning when a product’s technological feasibility has been established and ending when a product is available for general release to customers. In most instances, the Company’s products are released soon after technological feasibility has been established. Therefore, costs incurred subsequent to achievement of technological feasibility are usually not significant, and generally most software development costs have been expensed as incurred. Research and development costs were $60,288 and $69,326 for the three months ended March 31, 2013 and 2012, respectively.

Cash and Cash Equivalents

The Company considers all demand and time deposits and all highly liquid investments with an original maturity of three months or less to be cash equivalents.

Accounts Receivable

Accounts receivable is stated at cost, net of an allowance for doubtful accounts. Receivables outstanding longer than the payment terms are considered past due. The Company maintains an allowance for doubtful accounts for estimated losses resulting from the failure of customers to make required payments. The Company reviews the accounts receivable on a periodic basis and makes allowances where there is doubt as to the collectability of the outstanding balance. In evaluating the collectability of an individual receivable balance, the Company considers many factors, including the age of the balance, the customer’s payment history, its current credit-worthiness and current economic trends. The Company considers all accounts receivable at March 31, 2013 and December 31, 2012 to be fully collectible and, therefore, did not provide for an allowance for doubtful accounts. For the periods presented, the Company did not write off any accounts receivable as bad debts.

WONHE HIGH-TECH INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

FOR THE THREE MONTHS ENDED MARCH 31, 2013 AND 2012

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (continued)

Inventory

Inventory, comprised principally of computer components, is valued at the lower of cost or market value. The value of inventories is determined using the first-in, first-out method.

The Company estimates an inventory allowance for estimated unmarketable inventories. Inventory amounts are reported net of such allowances, if any. There were no allowances for inventory as of March 31, 2013 and December 31, 2012.

Advances to Suppliers

Advances to suppliers consist of payments made to suppliers for future deliveries.

Prepaid Expenses

Prepaid expenses primarily consist of prepaid consulting fees for listing on the American stock exchange and an advance to an advertising company.

Fixed Assets and Depreciation

Fixed assets are recorded at cost, less accumulated depreciation. Cost includes the price paid to acquire the asset, and any expenditure that substantially increases the asset’s value or extends the useful life of an existing asset. Leasehold improvements are amortized over the lesser of the term of the related lease or the estimated useful lives of the improvements. Depreciation is computed using the straight-line method over the estimated useful lives of the assets. Major repairs and betterments that significantly extend original useful lives or improve productivity are capitalized and depreciated over the periods benefited. Maintenance and repairs are generally expensed as incurred.

The estimated useful lives for fixed asset categories are as follows:

|

Office equipment

|

5 years

|

|

Motor vehicles

|

5 years

|

|

Leasehold improvements

|

Shorter of the length of lease or life of the improvements

|

Impairment of Long-lived Assets

The Company applies FASB ASC 360, “Property, Plant and Equipment,” which addresses the financial accounting and reporting for the recognition and measurement of impairment losses for long-lived assets. In accordance with ASC 360, long-lived assets are reviewed for impairment whenever events or changes in circumstances indicate that the carrying amount of an asset may not be recoverable. The Company may recognize

WONHE HIGH-TECH INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

FOR THE THREE MONTHS ENDED MARCH 31, 2013 AND 2012

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (continued)

Impairment of Long-lived Assets (continued)

the impairment of long-lived assets in the event the net book value of such assets exceeds the future undiscounted cash flows attributable to those assets. No impairment of long-lived assets was recognized for the periods presented.

Statutory Reserve Fund

Pursuant to corporate law of the PRC, the Company’s VIE is required to transfer 10% of its net income, as determined under PRC accounting rules and regulations, to a statutory reserve fund until such reserve balance reaches 50% of the VIE’s registered capital. The statutory reserve fund is non-distributable other than during liquidation and can be used to fund prior years’ losses, if any, and may be utilized for business expansion or used to increase registered capital, provided that the remaining reserve balance after such issue is not less than 25% of the registered capital. As of March 31, 2013, $409,867 was transferred from retained earnings to statutory reserve fund.

Income Taxes

The Company accounts for income taxes in accordance with FASB ASC 740, “Income Taxes” (“ASC 740”), which requires the recognition of deferred income taxes for differences between the basis of assets and liabilities for financial statement and income tax purposes. Deferred tax assets and liabilities represent the future tax consequence for those differences, which will either be taxable or deductible when the assets and liabilities are recovered or settled. Deferred taxes are also recognized for operating losses that are available to offset future taxable income. Valuation allowances are established when necessary to reduce deferred tax assets to the amount expected to be realized.

ASC 740 addresses the determination of whether tax benefits claimed or expected to be claimed on a tax return should be recorded in the financial statements. Under ASC 740, the Company may recognize the tax benefit from an uncertain tax position only if it is more likely than not that the tax position will be sustained on examination by the taxing authorities, based on the technical merits of the position. The tax benefits recognized in the financial statements from such a position would be measured based on the largest benefit that has a greater than 50% likelihood of being realized upon ultimate settlement. ASC 740 also provides guidance on de-recognition of income tax assets and liabilities, classification of current and deferred income tax assets and liabilities, and accounting for interest and penalties associated with tax positions. As of March 31, 2013 and December 31, 2012, the Company does not have any uncertain tax positions.

The income tax laws of various jurisdictions in which the Company and its subsidiaries operate are summarized as follows:

WONHE HIGH-TECH INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

FOR THE THREE MONTHS ENDED MARCH 31, 2013 AND 2012

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (continued)

Income Taxes (continued)

United States

The Company is subject to United States tax at graduated rates from 15% to 35%. No provision for income tax in the United States has been made as the Company had no U.S. taxable income for the three months ended March 31, 2013 and 2012.

BVI

World Win is incorporated in the BVI and is governed by the income tax laws of the BVI. According to current BVI income tax law, the applicable income tax rate for the Company is 0%.

Hong Kong

Kuayu International is incorporated in Hong Kong. Pursuant to the income tax laws of Hong Kong, the Company is not subject to tax on non Hong Kong source income.

PRC

Shenzhen Wonhe and Shengshihe Consulting are subject to an Enterprise Income Tax at 25% and file their own tax returns. Consolidated tax returns are not permitted in China.

Noncontrolling Interests

The Company evaluated and determined that under the VIE agreements as disclosed in Note 1, it is deemed to be the primary beneficiary of Shenzhen Wonhe. The noncontrolling interest, representing 5% of the net assets in Shenzhen Wonhe not attributable, directly or indirectly to the Company, is measured at its carrying value in the equity section of the consolidated balance sheets.

Reclassifications

Certain amounts in the prior periods financial statements have been reclassified for comparative purposes to conform to the presentation in the current periods financial statements. These reclassifications had no effect on previously reported earnings.

WONHE HIGH-TECH INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

FOR THE THREE MONTHS ENDED MARCH 31, 2013 AND 2012

3. RECENTLY ISSUED ACCOUNTING STANDARDS

On March 5, 2013, the FASB issued ASU 2013-05 to provide guidance for whether to release cumulative translation adjustments (“CTA”) upon certain derecognition events. The update was issued to resolve the diversity in practice about whether Subtopic ASC 810-10, “Consolidation-Overall,” or ASC 830-30, “Foreign Currency Matters-Translation of Financial Statements,” applies to such transactions. ASU 2013-05 is effective prospectively for all entities with derecognition events after the effective date. For public entities, the guidance is effective for fiscal years, and interim periods within those years, beginning after December 31, 2013. ASC 830-30 applies when an entity ceases to have a controlling financial interest in a subsidiary or group of assets that is a business within a foreign entity. Consequently, the CTA is released into net income only if the transaction results in complete or substantially complete liquidation of the foreign entity in which the subsidiary or group of assets resided. Otherwise, no portion of the CTA is released. The adoption of this pronouncement is not expected to have a significant impact on the Company’s consolidated financial condition or results of operations.

4. FIXED ASSETS

Fixed assets at March 31, 2013 and December 31, 2012 are summarized as follows:

| |

|

March 31,

2013

|

|

|

December 31,

2012

|

|

| |

|

|

|

|

|

|

|

Office equipment

|

|

$ |

154,547 |

|

|

$ |

153,674 |

|

|

Motor vehicles

|

|

|

214,963 |

|

|

|

213,748 |

|

|

Leasehold improvements

|

|

|

107,126 |

|

|

|

106,520 |

|

| |

|

|

|

|

|

|

|

|

| |

|

|

476,636 |

|

|

|

473,942 |

|

|

Less: Accumulated depreciation

|

|

|

(143,451 |

) |

|

|

(123,251 |

) |

| |

|

|

|

|

|

|

|

|

|

Fixed assets, net

|

|

$ |

333,185 |

|

|

$ |

350,691 |

|

Depreciation expense charged to operations for the three months ended March 31, 2013 and 2012 was $19,486 and $19,152, respectively.

WONHE HIGH-TECH INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

FOR THE THREE MONTHS ENDED MARCH 31, 2013 AND 2012

5. INTANGIBLE ASSETS

Intangible assets at March 31, 2013 and December 31, 2012 are summarized as follows:

| |

|

March 31,

2013

|

|

|

December 31,

2012

|

|

| |

|

|

|

|

|

|

|

Software

|

|

$ |

25,472 |

|

|

$ |

25,328 |

|

| |

|

|

|

|

|

|

|

|

| |

|

|

25,472 |

|

|

|

25,328 |

|

|

Less: Accumulated amortization

|

|

|

(2,123 |

) |

|

|

- |

|

| |

|

|

|

|

|

|

|

|

|

Intangible assets, net

|

|

$ |

23,349 |

|

|

$ |

25,328 |

|

Software was purchased in December, 2012, and is being amortized over three years, beginning in January, 2013. Amortization expense charged to operations for the three months ended March 31, 2013 and 2012 was $2,123 and $0, respectively.

6. LEASE OBLIGATIONS

The Company leases its offices in Shenzhen from an unrelated third party at a monthly rental of $14,833 under an operating lease, which expires on February 28, 2019. The Company also leases one apartment at a monthly rental of $1,618, which expires in the second quarter of 2014. The Company had a lease for office space in Beijing at a monthly rent of $712 that expired in September 2012 and was not renewed.

The minimum future rentals under these leases as of March 31, 2013, are as follows:

|

Year Ending

|

|

|

|

|

December 31,

|

|

Amount

|

|

| |

|

|

|

|

2013

|

|

$ |

143,659 |

|

|

2014

|

|

|

182,852 |

|

|

2015

|

|

|

177,999 |

|

|

2016

|

|

|

177,999 |

|

|

2017

|

|

|

177,999 |

|

|

Thereafter

|

|

|

207,666 |

|

| |

|

|

|

|

| |

|

$ |

1,068,174 |

|

Rent expense for the three months ended March 31, 2013 and 2012 was $44,500 and $44,248, respectively.

WONHE HIGH-TECH INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

FOR THE THREE MONTHS ENDED MARCH 31, 2013 AND 2012

7. RELATED PARTY TRANSACTIONS

On December 16, 2010, the Company entered into a twelve month loan agreement with a third party in the amount of $7,560,000, which matured on December 31, 2011 with interest at 12% per annum. Prepaid interest of $393,120 was received upon signing of the agreement. The loan was guaranteed by Guowang Xinke Venture Capital Investment (Jiangsu) Co., Ltd. (“Guowang Capital”), an entity related to the Company through certain stockholders. The agreement provided for the interest rate to increase to 15% on the amount not repaid by December 31, 2011. In May 2011, Guowang Capital assumed the loan.

At March 31, 2012, the loan was fully repaid. Interest charged by the Company for the three months ended March 31, 2013 and 2012, included in interest income was $0 and $112,067, respectively.

On April 25, 2011, the Company entered into a twelve month non-interest bearing loan agreement with Guowang Capital in the amount of $314,200, due April 27, 2012. The loan was fully paid at March 31, 2012.

On April 30, 2011, the Company entered into a twelve month non-interest bearing loan agreement with Zhongshan Puruisi Power Equipment Technology Co., Ltd. (“Puruisi Power”), an entity related to the Company through one of its stockholders, in the amount of $141,390, due May 2, 2012. On March 14, 2012, the Company lent additional $79,000 to Zhongshan Puruisi and the two loans were fully repaid on March 19, 2012.

8. FAIR VALUE MEASUREMENTS

FASB ASC 820 specifies a hierarchy of valuation techniques based upon whether the inputs to those valuation techniques reflect assumptions other market participants would use based upon market data obtained from independent sources (observable inputs). In accordance with ASC 820, the following summarizes the fair value hierarchy:

|

|

Level 1 Inputs – Unadjusted quoted market prices for identical assets and liabilities in an active market that the Company has the ability to access.

|

|

|

Level 2 Inputs – Inputs other than the quoted prices in active markets that are observable either directly or indirectly.

|

|

|

Level 3 Inputs – Inputs based on prices or valuation techniques that are both unobservable and significant to the overall fair value measurements.

|

WONHE HIGH-TECH INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

FOR THE THREE MONTHS ENDED MARCH 31, 2013 AND 2012

8. FAIR VALUE MEASUREMENTS (continued)

ASC 820 requires the use of observable market data, when available, in making fair value measurements. When inputs used to measure fair value fall within different levels of the hierarchy, the level within which the fair value measurement is categorized is based on the lowest level input that is significant to the fair value measurements. Valuation techniques used need to maximize the use of observable inputs and minimize the use of unobservable inputs. As of March 31, 2013 and December 31, 2012, none of the Company’s assets and liabilities were required to be reported at fair value on a recurring basis. Carrying values of non-derivative financial instruments, including cash, receivables and various payables, approximate their fair values due to the short term nature of these financial instruments. There were no changes in methods or assumptions during the periods presented.

9. INCOME TAXES

The Company is required to file income tax returns in both the United States and the PRC. Its operations in the United States have been insignificant and income taxes have not been accrued. In the PRC, the Company files tax returns for Shenzhen Wonhe and Shengshihe Consulting. Shenzhen Wonhe received a tax preferential tax treatment from the PRC State Administration of Taxation under which starting from its first profitable year, Shenzhen Wonhe is entitled to a two-year exemption from the Enterprise Income Tax followed by a three year 50% reduction in its Enterprise Income Tax rate. Payments already made for the tax year ended December 31, 2012 may be applied to future income tax due, contingent upon the PRC State Administration of Taxation’s approval.

The following is a reconciliation of the statutory rate with the effective income tax rate for the three months ended March 31, 2013. The effective tax rate was the same as statutory tax rate for the three months ended March 31, 2012.

| |

|

Tax Provision

|

|

|

Rate of Tax

|

|

|

Tax at statutory rate

|

|

$ |

1,083,415 |

|

|

|

25.00 |

% |

|

VIE tax holiday

|

|

|

(1,078,597 |

) |

|

|

(24.89 |

%) |

| |

|

|

|

|

|

|

|

|

|

Tax at effective tax rate

|

|

$ |

4,818 |

|

|

|

0.11 |

% |

The Company’s PRC tax filings for the tax years ended December 31, 2011 and 2010 were examined by the tax authorities in April 2012 and 2011, respectively. The examinations were completed and resulted in no adjustments.

Because the Company did not generate any income in the United States or otherwise have any U.S. taxable income, the Company does not believe that it has any U.S. federal income tax liabilities with respect to any transactions that the Company or any of its subsidiaries may have engaged in through March 31, 2013. However, there can be no assurance that the IRS will agree with this position, and therefore the Company ultimately could be liable for U.S. federal income taxes, interest and penalties.

WONHE HIGH-TECH INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

FOR THE THREE MONTHS ENDED MARCH 31, 2013 AND 2012

10. CONTINGENCIES

Concentration of Credit Risk

Substantially all of the Company’s bank accounts are in banks located in The People’s Republic of China and are not covered by protection similar to that provided by the FDIC on funds held in United States banks.

Vulnerability Due to Operations in PRC

The Company’s operations may be adversely affected by significant political, economic and social uncertainties in the PRC. Although the PRC government has been pursuing economic reform policies for more than twenty years, no assurance can be given that the PRC government will continue to pursue such policies or that such policies may not be significantly altered, especially in the event of a change in leadership, social or political disruption or unforeseen circumstances affecting the PRC’s political, economic and social conditions. There is also no guarantee that the PRC government’s pursuit of economic reforms will be consistent or effective in the future.

11. MAJOR CUSTOMERS

During the three months ended March 31, 2013, no sales to a single customer exceeded 10% of the Company’s gross revenue. However, the combined sales to five customers accounted for approximately 38% of sales for the three months ended March 31, 2013. Three of these five customers accounted for approximately 49% of accounts receivable as of March 31, 2013.

During the three months ended March 31, 2012, the combined sales to six customers accounted for approximately 79% of sales for the three months ended March 31, 2012. Five of these six accounted for 100% of accounts receivable as of March 31, 2012.

12. SUBSEQUENT EVENT

On May 2, 2013, the Company sold 14,480,000 shares of common stock to 32 unrelated individuals in a private offering. The purchase price for the shares was 4.2 Renminbi (approx. $.68) per share, or a total of 60,816,000 Renminbi (approx. $9,912,000). The shares were sold to individuals who are accredited investors and were purchasing for their own accounts. The offering, therefore, was exempt from registration under the Securities Act of 1933 pursuant to Section 4(2) and Section 4(5) of the Securities Act. The offering was also sold in compliance with the exemption from registration provided by Regulation S, as all of the purchasers are residents of the People’s Republic of China.

ITEM 2. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITIONS AND RESULTS OF OPERATIONS

Overview

We conduct our operations through our consolidated affiliate Shenzhen Wonhe Technology Co., Ltd. (hereinafter referred to as “Shenzhen Wonhe”). Shenzhen Wonhe, founded in November 2010, is a high tech enterprise which specializes in research and development and the marketing of high-end business and personal IT products that provide third party application services. Most of our revenues to date have been derived from sales of our Home Media Center 660 (“HMC660”). Our HMC660 is a data storage, management and control center for household equipment, and a central processing center which uses remote wireless technology to allow a user to control various devices while at home or remotely when away from home. HMC660 provides a software platform that has the functional characteristics of both a family security device and a direct TV receiver, with the ability to access TV and video on demand, as well as to function as a game console and storage facility for family and business information.

Our major product under development is a computer set-top-box (“PC-STB”), which combines the system architecture of a multimedia computer with that of a digital set-top box, and features wireless remote control, fully integrating a family’s multimedia application requirements into a single device. In addition, we have seven other hardware products that are in various stages of research and development, including a domestic mini-terminal server, a minicomputer, an All-In-One PC, an ARM panel personal computer and an Android smartphone, We are also developing a Wonhe applications platform and a metropolis business information operating website.

Corporate Structure

Wonhe High-Tech International, Inc. is a Nevada corporation that was, until June 30, 2011, a specialty retailer, developer, and designer of fashionable, value-priced women’s apparel and accessories. On June 30, 2011, Wonhe High-Tech International disposed of its prior business operations and became a shell company. Then on June 27, 2012 Wonhe High-Tech International acquired ownership of World Win International Holding Ltd. (BVI), a holding company organized in the British Virgin Islands (“World Win”). World Win, in turn, is the owner of Kuayi International Holding Group, Ltd. (Hong Kong), an entity organized in Hong Kong that, in April 2012, acquired ownership of Shengshihe Management Consulting (Shenzhen) Co., Ltd. (“Shengshihe Consulting”). The only business of Shengshihe Consulting is to provide management services to Shenzhen Wonhe pursuant to the VIE Agreements described below.

Accounting for Variable Interest Entity

On May 30, 2012, Shengshihe Consulting and Shenzhen Wonhe and its shareholders Youliang Wang, Qing Tong, Jingwu Li and Nanfang Tong (together referred to as “Shenzhen Wonhe Shareholders”) entered into a series of agreements known as variable interest agreements (the “VIE Agreements”) pursuant to which Shenzhen Wonhe became Shengshihe Consulting’s contractually controlled affiliate. The use of VIE agreements is a common structure used to acquire PRC corporations, particularly in certain industries in which foreign investment is restricted or forbidden by the PRC government. The VIE Agreements included:

|

(1)

|

Exclusive Technical Service and Business Consulting Agreement between Shengshihe Consulting and Shenzhen Wonhe pursuant to which Shengshihe Consulting is granted the exclusive right and undertakes the obligation to provide technical support and management consulting services to Shenzhen Wonhe, such services being designed to encompass all aspects of the business of Shenzhen Wonhe. In exchange for the services to be provided by Shengshihe Consulting, Shenzhen Wonhe is requied to pay to Shengshihe Consulting (i) 95% of the total annual net profit of Shenzhen Wonhe and (ii) RMB50,000 per month ($7,942). The fee for services payable to Shengshihe Consulting, therefore, represents all but a small percentage of the net income generated by Shenzhen Wonhe. The Exclusive Technical Service and Business Consulting Agreement can be terminated only by mutual agreement of the two parties.

|

|

(2)

|

Call Option Agreement among the Shenzhen Wonhe Shareholders and Shengshihe Consulting under which the Shenzhen Wonhe Shareholders have granted to Shengshihe Consulting the irrevocable right and option to acquire all of the equity interests in Shenzhen Wonhe to the extent permitted by PRC law. If PRC law limits the percentage of Shenzhen Wonhe that Shengshihe Consulting may purchase at any time, then Shengshihe Consulting may repeatedly exercise its option in such increments as may be allowed by PRC law. The exercise price of the option is RMB1.00 ($0.16) or any lower price permitted by PRC law. The Shenzhen Wonhe Shareholders agreed to refrain from taking certain actions which might harm the value of Shenzhen Wonhe or Shengshihe Consulting’s option. In addition, the Call Option Agreement gives to Shengshihe Consulting the right of prior approval of any significant action by Shenzhen Wonhe, including appointment of management, sale of assets or equity, distribution of profits, or entry into any material agreement. The Call Option Agreement will not terminate until the option is exercised.

|

| |

|

|

(3)

|

Proxy Agreement by the Shenzhen Wonhe Shareholders pursuant to which they each authorize Shengshihe Consulting to designate someone to exercise all of his shareholder rights with respect to Shenzhen Wonhe. The Proxy Agreement states that Shengshihe Consulting will be entitled to all information regarding Shenzhen Wonhe’s operations, business, clients, accounting and employees in order to perform its function under the Proxy Agreement. The Proxy Agreement has no termination date nor any termination clause, and is binding on each Shenzhen Wonhe Shareholder as long as he owns equity in Shenzhen Wonhe.

|

| |

|

|

(4)

|

Share Pledge Agreement among the Shenzhen Wonhe Shareholders, Shenzhen Wonhe, and Shengshihe Consulting under which the Shenzhen Wonhe Shareholders have pledged all of their equity in Shenzhen Wonhe to Shengshihe Consulting to guarantee Shenzhen Wonhe’s and Shenzhen Wonhe Shareholders’ performance of their obligations under the Exclusive Technical Service and Business Consulting Agreement, the Call Option Agreement and the Proxy Agreement. In the event of a default under any of those agreements, Shengshihe Consulting will be entitled to auction the equity interests of the Shenzhen Wonhe Shareholders and shall receive a priority payment from the auction proceeds to the extent of its unpaid receivable. The Share Pledge Agreement will not terminate until all obligations under the three other agreements have been satisfied.

|