Table of Contents

Filed pursuant to Rule 424(b)(3)

Registration No. 333-279438

ELECTRONIC TRANSMISSION DISCLAIMER

STRICTLY NOT TO BE FORWARDED TO ANY OTHER PERSONS

IMPORTANT: You must read the following disclaimer before continuing. The following disclaimer applies to the prospectus (the “Prospectus”) attached to this electronic transmission relating to the voluntary takeover offer by John Bean Technologies Europe B.V. (the “Offeror”), on behalf of John Bean Technologies Corporation (“JBT”), to the shareholders of Marel hf. (“Marel”) to acquire all of Marel’s issued and outstanding ordinary shares. You are advised to read this disclaimer carefully before reading, accessing or making any other use of the attached Prospectus. In accessing the attached Prospectus, you agree to be bound by the following terms and conditions, including any modifications to them from time to time, each time you receive any information from us as a result of such access. You acknowledge that this electronic transmission, and the delivery of the attached Prospectus, is confidential and intended only for you, and you agree not to forward, reproduce, copy, download or publish (in each case whether in whole or part) this electronic transmission or the attached Prospectus (electronically or otherwise) to any other person.

IF YOU ARE NOT THE INTENDED RECIPIENT OF THIS ELECTRONIC TRANSMISSION, PLEASE DO NOT DISTRIBUTE OR COPY THE INFORMATION CONTAINED IN THIS ELECTRONIC TRANSMISSION, BUT INSTEAD DELETE AND DESTROY ALL COPIES OF THIS ELECTRONIC TRANSMISSION.

THE ATTACHED PROSPECTUS MAY NOT BE FORWARDED OR DISTRIBUTED TO ANY OTHER PERSON AND MAY NOT BE REPRODUCED IN ANY MANNER WHATSOEVER. DISTRIBUTION OR REPRODUCTION OF THE ATTACHED PROSPECTUS IN WHOLE OR IN PART IS UNAUTHORIZED. FAILURE TO COMPLY WITH THIS DIRECTIVE MAY RESULT IN A VIOLATION OF THE APPLICABLE SECURITIES LAWS IN CERTAIN JURISDICTIONS.

THE OFFER (AS DEFINED IN THE ATTACHED PROSPECTUS) IS NOT BEING MADE, AND THE MAREL SHARES (AS DEFINED IN THE ATTACHED PROSPECTUS) WILL NOT BE ACCEPTED FOR PURCHASE FROM OR ON BEHALF OF PERSONS, IN ANY JURISDICTION IN WHICH THE MAKING OR ACCEPTANCE THEREOF WOULD NOT BE IN COMPLIANCE WITH THE SECURITIES OR OTHER LAWS OR REGULATIONS OF SUCH JURISDICTION OR WOULD REQUIRE ANY REGISTRATION, APPROVAL OR FILING WITH ANY REGULATORY AUTHORITY NOT EXPRESSLY CONTEMPLATED BY THE PROSPECTUS (EACH, A “RESTRICTED JURISDICTION”). PERSONS OBTAINING THE PROSPECTUS AND/OR INTO WHOSE POSSESSION THE PROSPECTUS COMES ARE REQUIRED TO TAKE DUE NOTE AND OBSERVE ALL SUCH RESTRICTIONS AND OBTAIN ANY NECESSARY AUTHORISATIONS, APPROVALS OR CONSENTS. NEITHER JBT NOR ANY OF ITS ADVISORS ACCEPT ANY LIABILITY FOR ANY VIOLATION BY ANY PERSON OF ANY SUCH RESTRICTION. ANY PERSON (INCLUDING, WITHOUT LIMITATION, CUSTODIANS, NOMINEES AND TRUSTEES) WHO INTENDS TO FORWARD THE PROSPECTUS OR ANY RELATED DOCUMENT TO ANY JURISDICTION OUTSIDE ICELAND SHOULD INFORM THEMSELVES OF THE LAWS OF THE RELEVANT JURISDICTION BEFORE TAKING ANY ACTION. THE DISTRIBUTION OF THE PROSPECTUS IN JURISDICTIONS OTHER THAN ICELAND MAY BE RESTRICTED BY LAW, AND, THEREFORE, PERSONS WHO COME INTO POSSESSION OF THE PROSPECTUS SHOULD INFORM THEMSELVES ABOUT AND OBSERVE SUCH RESTRICTIONS. ANY FAILURE TO COMPLY WITH ANY SUCH RESTRICTIONS MAY CONSTITUTE A VIOLATION OF THE SECURITIES LAWS AND REGULATIONS OF ANY SUCH JURISDICTION.

NEITHER THE U.S. SECURITIES AND EXCHANGE COMMISSION (the “SEC”) NOR ANY U.S. STATE SECURITIES COMMISSION OR REGULATORY AUTHORITY HAS APPROVED OR DISAPPROVED ANY OF THE SECURITIES TO BE ISSUED IN CONNECTION WITH THE TRANSACTION OR PASSED UPON THE ADEQUACY OR ACCURACY OF THIS PROSPECTUS OR ANY OTHER DOCUMENTS REGARDING THE OFFER (INCLUDING THE OFFER DOCUMENT). ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE UNDER U.S. LAW.

i

Table of Contents

The Offer will be carried out under Icelandic law and applicable provisions of the securities laws of the United States of America (the “U.S.”), including the Securities Exchange Act of 1934, as amended, and the rules and the regulations promulgated thereunder (the “Exchange Act”), and the Securities Act of 1933, as amended, and the rules and regulations promulgated thereunder, and JBT has not taken any action and will not take any action in any jurisdiction, with the exception of Iceland, the Netherlands, Denmark and the U.S., that is intended to result in a public offering of the JBT Offer Shares. This prospectus will be validly passported into Denmark in accordance with the procedure presented by Articles 24 and 25 of the Prospectus Regulation (Regulation (EU) 2017/1129 of the European Parliament and of the Council of 14 June 2017 as amended) pursuant to a certificate of approval issued by the Icelandic FSA.

The Offer is being made in the U.S. pursuant to Section 14(e) of, and Regulation 14E promulgated under, the Exchange Act, subject to the exemptions provided by Rule 14d-1(d) under the Exchange Act, to the extent applicable, and in accordance with the requirements of Icelandic law. The Offer is not subject to Section 14(d)(1) of, or Regulation 14D promulgated under, the Exchange Act. Marel is not currently subject to the periodic reporting requirements under the Exchange Act, and is not required to, and does not, file any reports with the SEC. The Offer is being made to Marel Shareholders (as defined in the attached Prospectus) residing in the U.S. on the same terms, and subject to the same conditions, as are applicable to all other Marel Shareholders to whom the Offer is made.

In any member state of the European Economic Area other than Iceland, the Netherlands and Denmark (each, a “Relevant State”), the Offer Document and this Prospectus are only addressed to and are only directed at Marel Shareholders in that Relevant State that fulfil the criteria for exemption from the obligation to publish a prospectus, including qualified investors, within the meaning of Regulation (EU) 2017/1129.

Confirmation of your representation: By accessing the attached Prospectus, you have confirmed to JBT that (i) you have understood and agree to the terms set out herein, (ii) you and any electronic mail address you have given to us are not located in a Restricted Jurisdiction, (iii) you consent to delivery by electronic transmission of any information documents, including the Prospectus, (iv) you will not transmit the attached Prospectus, in whole or in part (or any copy thereof), or disclose, whether orally or in writing, any of its contents to any other person and (v) you acknowledge that you will make your own assessment regarding any legal, taxation or other economic considerations with respect to any decision by you in relation to the Offer.

You are reminded that the attached Prospectus has been delivered to you on the basis that you are a person into whose possession the attached Prospectus may be lawfully delivered in accordance with the laws of the jurisdiction in which you are located and you may not, nor are you authorised to, deliver the attached Prospectus, electronically or otherwise, to any other person. Any failure to comply with these restrictions may constitute a violation of applicable securities laws. It is the responsibility of all persons obtaining the information documents, including the Prospectus, and/or other documents relating to the Prospectus or to the Offer or into whose possession such documents otherwise come, to inform themselves of and observe all such restrictions. Any recipient of the Prospectus who is in any doubt in relation to these restrictions should consult his or her professional advisors in the relevant jurisdiction. Neither JBT nor the advisors to JBT accept or assume any responsibility or liability for any violation by any person whomsoever of any such restriction.

The attached Prospectus has been sent to you in an electronic form. You are reminded that documents transmitted via this medium may be altered or changed during the process of electronic transmission and, consequently, neither JBT nor any director, officer, employee or agent of JBT or any of its affiliates accepts any liability or responsibility whatsoever in respect of any difference between the Prospectus distributed to you in electronic format and any hard copy version of the Prospectus. By accessing the linked document, you consent to receiving it in electronic form. Nothing in this electronic transmission constitutes, and this electronic transmission may not be used in connection with, an offer of securities for sale to persons other than the specified categories described above and to whom it is directed, and access has been limited so that it shall not constitute a general solicitation. If you have gained access to these documents contrary to the foregoing restrictions, you will be unable to purchase any of the securities described therein.

ii

Table of Contents

None of the Offeror, JBT or Marel have authorised any person to give any information or make any representation not contained in the Prospectus. The Offeror, JBT and Marel do not accept any liability for any such information or representation. Further, the Offeror, JBT and Marel do not accept any responsibility for, and can make no assurances as to, the reliability, accuracy or completeness of any information provided by others, nor the fairness or appropriateness of any forecasts, views or opinions expressed by others regarding the Transaction (as defined in the attached Prospectus), JBT, Marel or (when applicable) the combined company. None of the Offeror, JBT or Marel make any representation as to the appropriateness, accuracy, completeness or reliability of any such information or publication. The making of the Offer and the delivery of the attached Prospectus shall not, under any circumstances, create any implication that there has been no change in the affairs of the Offeror, JBT or Marel since the date of the attached Prospectus or that the information in the attached Prospectus or in the documents referred to therein is correct as of any time subsequent to the date thereof.

You are responsible for protecting against viruses and other destructive items. Your receipt of this electronic transmission is at your own risk, and it is your responsibility to take precautions to ensure that it is free from viruses and other items of a destructive nature.

iii

Table of Contents

John Bean Technologies Corporation

and

John Bean Technologies Europe B.V.

Offering of shares issued by John Bean Technologies Corporation to the shareholders of Marel hf. in connection with a voluntary public takeover offer by John Bean Technologies Corporation, through John Bean Technologies Europe B.V., for the entire issued share capital of Marel hf.

Admission to listing and trading on Nasdaq Iceland hf. of shares issued by John Bean Technologies Corporation

This document (the “Prospectus”) relates to (i) the offering of shares of common stock, par value $0.01 per share, of John Bean Technologies Corporation (“JBT”) (such offered shares, the “JBT Offer Shares”) to the shareholders of Marel hf. (“Marel,” and such shareholders, the “Marel Shareholders”) in connection with the proposed acquisition of the entire issued share capital of Marel by JBT through a voluntary public takeover offer (the “Offer”) made by JBT through John Bean Technologies Europe B.V. (the “Offeror”), on behalf of JBT, to the Marel Shareholders whereby each issued and outstanding ordinary share of Marel (the “Marel Shares”), excluding any treasury shares held by Marel, is exchanged, at the election of Marel Shareholders, for (a) cash consideration in the amount of EUR 3.60, (b) stock consideration consisting of 0.0407 newly and validly issued, fully paid and non-assessable JBT Offer Shares or (c) cash consideration in the amount of EUR 1.26 along with stock consideration consisting of 0.0265 newly and validly issued, fully paid and non-assessable JBT Offer Shares, subject to the proration provisions, as applicable, described in this Prospectus, and (ii) the admission to trading of the JBT Offer Shares on the main market of Nasdaq Iceland hf. (“Nasdaq Iceland”).

On 4 April 2024, JBT, the Offeror and Marel entered into the transaction agreement (as it may be amended from time to time, the “Transaction Agreement”), pursuant to which, among other things, the parties have agreed to bring about a business combination of JBT, Marel and their respective subsidiaries (such transactions contemplated by the Transaction Agreement, the “Transaction”). Pursuant to the Transaction Agreement, and upon the terms and subject to the conditions set forth therein, the Offeror will make a voluntary public takeover offer, within the meaning of Article 101 of the Icelandic Takeover Act no. 108/2007, as amended (in Icelandic: lög um yfirtökur) (the “Icelandic Takeover Act”), to Marel Shareholders to acquire all of the issued and outstanding Marel Shares, not including any treasury shares held by Marel. Upon the consummation of the Offer, if at least 90% of the issued and outstanding Marel Shares are acquired by the Offeror, the Offeror will redeem any Marel Shares not tendered into the Offer for, at the election of the holder and subject to the proration provisions, as applicable, described in the Offer Document, (a) JBT Offer Shares, (b) cash or (c) a mix of JBT Offer Shares and cash (or, for those holders that do not make an election, a mix of JBT Offer Shares and cash in the same proportion as the average mix of the Offer), under Icelandic law by way of a squeeze-out transaction at the same price as offered in the Offer. The squeeze-out transaction would eliminate any minority shareholder interests in Marel remaining after the settlement of the Offer. If the Minimum Acceptance Condition (as defined in this Prospectus) is not satisfied at the 90% threshold but is waived to a lower threshold (which will not be reduced below 80% without Marel’s consent), the Offeror (or a subsidiary thereof) may initiate a merger between the Offeror and Marel in accordance with Icelandic laws pursuant to which Marel would be the surviving entity and a wholly owned subsidiary of JBT.

In addition to this Prospectus, the Offeror, on behalf of JBT, has published, with respect to the Offer, an associated offer document which has been prepared under Directive 2004/25/EC of the European Parliament and of the Council of 21 April 2004 on takeover bids, as amended, as implemented in Icelandic law by the Icelandic

iv

Table of Contents

Takeover Act, and which has been approved by the Financial Supervisory Authority of the Central Bank of Iceland (the “Icelandic FSA”) in accordance with the Icelandic Takeover Act prior to its publication (such offer document, the “Offer Document”). This Prospectus forms part of the Offer Document.

The offer period for the Offer (the “Offer Period”) is expected to commence on 24 June 2024 (such date, the “Commencement Date”). The Offer Period will initially end at 5.00 p.m. Icelandic time on 2 September 2024, the date that is ten weeks after the Commencement Date (such ending date, as it may be extended from time to time pursuant to the Transaction Agreement and paragraph 6 of Article 103 of the Icelandic Takeover Act, the “Expiration Date”), except that (a) the Expiration Date will occur no earlier than 20 business days (as defined in Rule 14d-1(g)(3) under the Securities Exchange Act of 1934, as amended (the “Exchange Act”)) after (and including the date of) the Commencement Date, (b) the Offeror will extend the Offer Period as required by any law, or any rule, regulation or other applicable legal requirement of the Icelandic FSA or the U.S. Securities and Exchange Commission (the “SEC”) or of Nasdaq Iceland, the New York Stock Exchange (the “NYSE”) or the Euronext Amsterdam N.V. (“Euronext Amsterdam”), in any such case, which is applicable to the Offer or to the extent necessary to resolve any comments of the Icelandic FSA or the SEC and (c) at or prior to any then-applicable Expiration Date, the Offeror will (subject to the required approval from the Icelandic FSA) extend the Offer Period (i) by one or more additional periods of not less than ten days per extension (or such shorter period as mutually agreed by JBT, the Offeror and Marel in writing) if additional time is required to permit the satisfaction of the Closing Conditions (as defined in this Prospectus) (other than the Minimum Acceptance Condition) or (ii) by at least an additional three periods of not less than ten days each if all the Closing Conditions (other than the Minimum Acceptance Condition) have either been satisfied or waived in accordance with the Transaction Agreement or if, by their nature, are to be satisfied at the Expiration Date, would have been satisfied at the Expiration Date or else validly waived. However, in no event will the Offeror be required to extend the Offer Period beyond the Drop Dead Date (as defined in this Prospectus). For clarity, the Offeror may, in its reasonable discretion (subject to any required approval from the Icelandic FSA), extend the acceptance period for any duration (or repeated periods) in order to permit time for the satisfaction of the Closing Conditions. Subject to the prior satisfaction or waiver of the Closing Conditions, the Offeror will promptly settle the Offer in accordance with its terms and applicable law, and accept for exchange, and exchange, all Marel Shares validly tendered and not validly withdrawn pursuant to the Offer.

Completion of the Offer is subject to the Closing Conditions which include, among other things, the satisfaction of the Minimum Acceptance Condition, the receipt of certain regulatory approvals as well as the approval of the Share Issuance Proposal (as defined in this Prospectus). The Closing Conditions to the Offer must be satisfied or waived by the Offeror (only following approval by both JBT and Marel), JBT and/or Marel, as applicable, prior to the Expiration Date. For further details on the terms and conditions of the Offer, including acceptance procedures, see section 8 “The Takeover Offer” as well as the Offer Document, when published, which will set out the terms and conditions of the Offer.

Some of the terms and conditions of the Offer described in this Prospectus are subject to important limitations and exceptions. Marel Shareholders are urged to read the Offer Document, along with this Prospectus, including any appendices and exhibits, in their entirety prior to making any decision as to the matters described herein and therein. The description of the terms of the Offer is qualified in its entirety by the description of the Offer in the Offer Document under which the Offeror intends to make the Offer.

Deciding whether or not to accept the Offer involves a high degree of risk. Marel Shareholders are advised to examine all the risks and legal requirements described in this Prospectus in connection with a decision to accept the Offer and should read this Prospectus and the documents incorporated by reference herein in their entirety and, in particular, section 1 “Risk Factors” for a discussion of certain risks and other factors that should be considered in connection with a decision to accept the Offer.

JBT intends to take the steps necessary for JBT Offer Shares to be admitted to trading and official listing on the main market of Nasdaq Iceland and for the common stock of JBT, par value $0.01 per share (the “JBT Shares”)

v

Table of Contents

to remain listed on the NYSE. To effect such admission to trading and official listing, JBT intends to, prior to completion of the Offer, submit an application to Nasdaq Iceland for the admission to trading and official listing of the JBT Offer Shares. Such steps and the admission to trading and the official listing of the JBT Offer Shares on Nasdaq Iceland will be subject to, among other things, the completion of the Offer.

Settlement of the Offer will be made as promptly as possible but shall take place no later than three Business Days (as defined in this Prospectus) from the Expiration Date (provided that the Offeror may apply for an extension as permitted under paragraph 8 of Article 103 of the Icelandic Takeover Act) (the “Settlement Date”).

On the Settlement Date, the Offeror shall promptly settle the Offer in accordance with its terms and applicable laws, and accept for exchange, and exchange, all Marel Shares validly tendered and not validly withdrawn pursuant to the Offer (such settlement and exchange, the “Closing,” and the time that the Offeror accepts for exchange, and exchanges, all of the Marel Shares validly tendered and not validly withdrawn, the “Offer Closing Time”). The share register of JBT shall be updated immediately following the Offer Closing Time. No fractional JBT Offer Shares will be exchanged for any Marel Shares tendered in the Offer by any Marel Shareholder. Notwithstanding any other provision of the Transaction Agreement, each Marel Shareholder who would otherwise have been entitled to receive a fraction of a share of JBT Offer Shares will receive, in lieu thereof, cash (without interest) in an amount representing such holder’s proportionate interest in the net proceeds from the sale for the account of all such holders of JBT Offer Shares which would otherwise be issued.

None of the Offeror, JBT or Marel has authorised any person to give any information or to make any representations other than those contained in this Prospectus. The Offeror, JBT and Marel do not accept any liability for any such information or representation. Further, the Offeror, JBT and Marel do not accept any responsibility for, and can make no assurances as to, the reliability, accuracy or completeness of any information provided by others, nor the fairness or appropriateness of any forecasts, views or opinions expressed by others regarding the Transaction, JBT, Marel or (when applicable) the combined company. The Offeror, JBT and Marel make no representation as to the as to the appropriateness, accuracy, completeness or reliability of any such information or publication. Any delivery of this Prospectus shall not, under any circumstances, create any implication that there has been no change in the affairs of the Offeror, JBT and/or Marel since, or that the information herein is correct at any time subsequent to, the date of this Prospectus.

The language of this Prospectus is English. Certain legislative references and technical terms have been cited in their original language in order that the correct technical meaning may be escribed to them under applicable law.

Certain terms used in this Prospectus, including certain technical and other terms, are explained and defined in the “Definitions and Glossary” section in this Prospectus.

This Prospectus has been prepared under Icelandic law and has been drawn up as a prospectus in accordance with Articles 3 and 6 of Regulation (EU) 2017/1129 of the European Parliament and of the Council of 14 June 2017, as amended (the “Prospectus Regulation”), and in compliance with the requirements set out in Commission Delegated Regulation (EU) 2019/980 of 14 March 2019 and has been approved by the Icelandic FSA in accordance with Article 20 of the Prospectus Regulation. JBT has requested the Icelandic FSA to notify its approval in accordance with Article 25(1) of the Prospectus Regulation to the competent authority in the Netherlands, the Netherlands Authority for the Financial Markets, with a certificate of approval attesting that this Prospectus has been prepared in accordance with the Prospectus Regulation.

This Prospectus does not constitute an offer to sell or the solicitation of an offer to buy any securities in any jurisdiction where, or to any person to whom, it is unlawful to make such an offer or solicitation. The distribution of this Prospectus and the acceptance of the Offer in certain jurisdictions is restricted by law. Persons into whose possession this Prospectus comes are advised to inform themselves about and to observe such restrictions.

vi

Table of Contents

NEITHER THE SEC NOR ANY U.S. STATE SECURITIES COMMISSION OR REGULATORY AUTHORITY HAS APPROVED OR DISAPPROVED ANY OF THE SECURITIES TO BE ISSUED IN CONNECTION WITH THE TRANSACTION OR PASSED UPON THE ADEQUACY OR ACCURACY OF THIS PROSPECTUS OR ANY OTHER DOCUMENTS REGARDING THE OFFER (INCLUDING THE OFFER DOCUMENT). ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE UNDER U.S. LAW.

This Prospectus is dated 20 June 2024

vii

Table of Contents

| SUMMARY | 2 | |||||

| 1. | 11 | |||||

| 2. | 60 | |||||

| 3. | 67 | |||||

| 4. | 68 | |||||

| 5. | 69 | |||||

| 6. | 72 | |||||

| 7. | 130 | |||||

| 8. | 148 | |||||

| 9. | EXPECTED TIMETABLE OF THE TAKEOVER OFFER AND THE TRANSACTION |

155 | ||||

| 10. | 156 | |||||

| 11. | 157 | |||||

| 12. | 174 | |||||

| 13. | 199 | |||||

| 14. | 205 | |||||

| 15. | 209 | |||||

| 16. | 228 | |||||

| 17. | UNAUDITED PRO FORMA CONDENSED COMBINED FINANCIAL INFORMATION |

250 | ||||

| 18. | 276 | |||||

| 19. | 279 | |||||

| 20. | 280 | |||||

| 21. | 285 | |||||

| 22. | 300 | |||||

| 23. | 305 | |||||

| 24. | 307 | |||||

| 25. | 308 | |||||

| 26. | 310 | |||||

| 27. | 311 | |||||

| 28. | 335 | |||||

| 29. | 336 | |||||

| 30. | 337 | |||||

| 31. | 348 | |||||

| 32. | THIRD-PARTY INFORMATION, EXPERT STATEMENTS AND DECLARATIONS OF INTEREST |

350 | ||||

| 33. | 351 | |||||

| 34. | 352 | |||||

| 35. | 353 | |||||

| DEFINITIONS AND GLOSSARY | 355 | |||||

1

Table of Contents

| Section A — Introductions and Warnings | ||

| Warnings | This summary should be read as an introduction to this prospectus (the “Prospectus”). Any decision to invest in the JBT Offer Shares (as defined below) should be based on consideration of the Prospectus, including the documents incorporated by reference herein, as a whole by the investor. Investors could lose all or part of their invested capital. Where a claim relating to the information in the Prospectus is brought before a court, the plaintiff investor might, under the national legislation of the member states of European Economic Area, have to bear the costs of translating the Prospectus before the legal proceedings are initiated. Civil liability attaches only to those persons who have tabled the summary, including any translation thereof, but only if the summary is misleading, inaccurate or inconsistent when read together with the other parts of the Prospectus or it does not provide, when read together with the other parts of the Prospectus, key information in order to aid investors when considering whether to invest in such securities. | |

| The Issuer, the Offeror and the Securities | This Prospectus relates to (i) the offering of shares of common stock, par value $0.01 per share (the “JBT Shares”), of John Bean Technologies Corporation, with its registered address at 70 West Madison Street, Suite 4400, Chicago, Illinois 60602, United States, registered under the legal entity identifier (“LEI”) 5493007CT6ATBZ2L6826 (“JBT”) (such offered shares, the “JBT Offer Shares”), to the shareholders of Marel hf., with its registered address at Austurhraun 9, 210 Garðabær, Iceland, registered under the LEI 5299008YTLEN09WTHW26 (“Marel,” and such shareholders, the “Marel Shareholders”) in connection with the voluntary public takeover offer (the “Offer”) made by JBT through John Bean Technologies Europe B.V., a subsidiary of JBT, with its registered address at Deccaweg 32, 1042 AD Amsterdam, the Netherlands, registered under the Dutch Trade Register under no. 63675013 (the “Offeror”), to the Marel Shareholders whereby each issued and outstanding ordinary share of Marel (the “Marel Shares”), other than any treasury shares held by Marel, is exchanged, at the election of Marel Shareholders, for (a) cash consideration in the amount of EUR 3.60, (b) stock consideration consisting of 0.0407 newly and validly issued, fully paid and non-assessable JBT Offer Shares or (c) cash consideration in the amount of EUR 1.26 along with stock consideration consisting of 0.0265 newly and validly issued, fully paid and non-assessable JBT Offer Shares, subject to the proration provisions, as applicable, described in this Prospectus, and (ii) the admission to trading of the JBT Offer Shares on the main market of Nasdaq Iceland hf. (“Nasdaq Iceland”). | |

| Competent authority | The Prospectus has been approved by the Icelandic Financial Supervisory Authority of the Central Bank of Iceland (Icel. Fjármálaeftirlit Seðlabanka Íslands) (the “FSA”) on 20 June 2024. The FSA has its registered office at Kalkofnsvegur 1, 101 Reykjavík, Iceland, with telephone number +354 569 9600. | |

| Section B — Key information on the companies | ||

| Who is the issuer of the JBT Offer Shares? | ||

| Domicile and legal form | JBT is a corporation incorporated under the laws of Delaware, with its registered address at 70 West Madison Street, Suite 4400, Chicago, Illinois 60602, United States, registered under the LEI 5493007CT6ATBZ2L6826.

Marel is a public limited liability company incorporated under the laws of Iceland, with its registered address at Austurhraun 9, 210 Garðabær, Iceland, registered under the LEI 5299008YTLEN09WTHW26. | |

2

Table of Contents

| Principal activities | JBT is a leading global technology solutions and service provider to high-value segments of the food and beverage industry. JBT designs, produces, and services sophisticated products and systems for a broad range of end markets, generating roughly one-half of its annual revenue from recurring parts, service, rebuilds and leasing operations. As of 31 December 2023, JBT employed approximately 5,100 people worldwide and operated sales, service and manufacturing and sourcing operations in more than 25 countries.

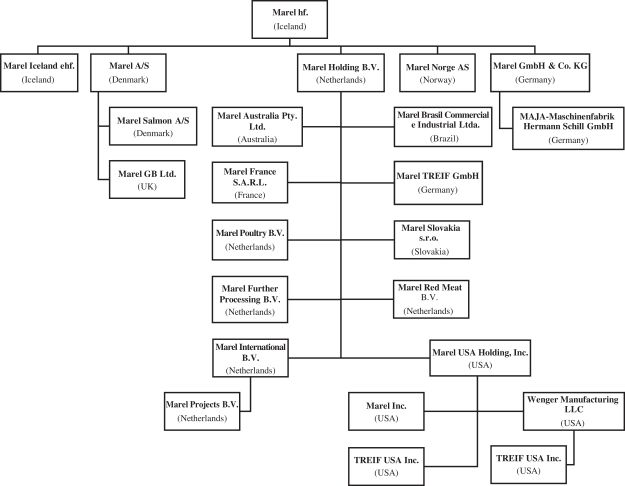

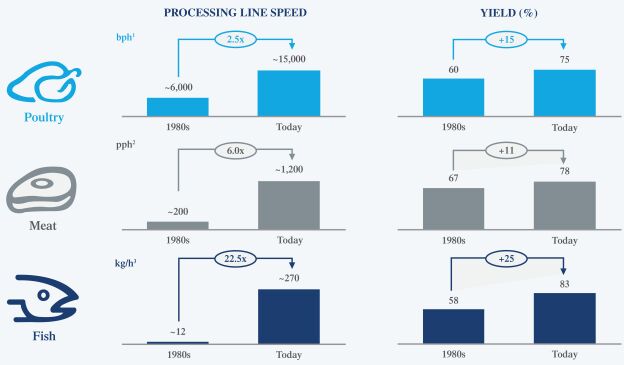

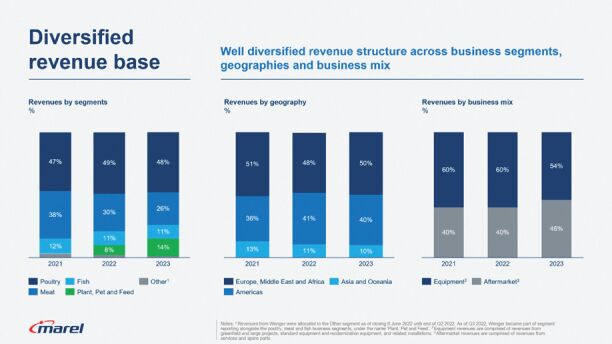

Marel is a leading global provider of advanced processing equipment, systems, software and services to the food processing industry as well as a leading provider in processing solutions for pet food, plant-based proteins and aqua feed, with a presence in over 30 countries and six continents and around 7,300 employees. Marel designs, manufactures, sells and services technologically advanced processing solutions ranging from standard equipment to full-line processing systems, with sophisticated software capabilities and aftermarket services. | |

| Major shareholders | Pursuant to the knowledge of JBT, the following two shareholders beneficially own more than 5% of JBT’s Shares, based on the most recent holdings beneficial ownership filings filed with the SEC. The percentages are calculated on the basis of the number of outstanding JBT Shares plus JBT Shares deemed outstanding pursuant to Rule 13d-3(d)(1) under the Securities Exchange Act of 1934, as amended, as of 31 December 2023: | |

| Name of shareholder | Number of JBT Shares |

Percent of class |

||||||

| BlackRock, Inc. |

5,183,478 | 16.28 | % | |||||

| The Vanguard Group |

3,492,828 | 10.97 | % | |||||

| Pursuant to the latest publicly available data as of 31 December 2023, the following Marel Shareholders currently beneficially hold more than 5% of the outstanding Marel Shares: |

| Name of Marel Shareholder | Number of shares (million) |

In ISK | In EUR | Total | ||||||||||||

| ABN AMRO on behalf of Euroclear |

236.2 | 30.6 | % | — | — | |||||||||||

| Eyrir Invest hf. |

98.4 | 12.8 | % | 11.9 | % | 24.7 | % | |||||||||

| Gildi – Lifeyrissjodur |

51.2 | 6.7 | % | — | — | |||||||||||

| The Pension Fund of Commerce |

51.0 | 6.6 | % | — | — | |||||||||||

| LSR A & B divisions |

41.4 | 5.4 | % | — | — | |||||||||||

| Key managing directors | JBT’s key management comprises of the following members: Brian A. Deck, CEO, President and Board Director; Matthew J. Meister, Executive Vice President and Chief Financial Officer; Shelley Bridarolli, Executive Vice President and Chief Human Resources Officer; Luiz “Augusto” Rizzolo, Executive Vice President and President, Diversified Food and Health; Robert Petrie, Executive Vice President and President, Protein; James L. Marvin, Executive Vice President and General Counsel and Assistant Secretary; Kristina Paschall, Executive Vice President, Chief Information and Digital Officer; Jack Martin, Executive Vice President, Supply Chain; and Jessi L. Corcoran, Vice President, Corporate Controller and Chief Accounting Officer.

Marel’s key management comprises of the following members: Arni Sigurdsson, CEO; Sebastian Boelen, Chief Financial Officer; David Freyr Oddsson, Chief Human Resources Officer; Arni Sigurjonsson, General Counsel; Sofie Cammers, Executive Vice President Meat; Roger Claessens, Executive Vice President Poultry; Vidar Erlingsson, Executive Vice President Software Solutions; Tatiana Gillitzer, Executive Vice President Service; Jesper Hjortshøj, Executive Vice President Retail and Food Service Solutions & Wenger Group; Ivo Rothkrantz, |

3

Table of Contents

| Executive Vice President Corporate Development; Olafur Karl Sigurdarson, Executive Vice President Fish. | ||

| Statutory auditors | PricewaterhouseCoopers LLP, One North Wacker Drive, Chicago, Illinois 60606, United States of America, is JBT’s statutory auditor.

KPMG ehf., Borgartún 27, 105 Reykjavík, Iceland, is Marel’s statutory auditor. | |

| What is the key financial information regarding the issuer? | ||

| Key financial information | The key financial information shown below has been derived from (i) JBT’s consolidated financial statements as of and for the years ended 31 December 2023, 2022 and 2021, and the related notes thereto audited by PricewaterhouseCoopers LLP, independent registered accounting firm to JBT, which are incorporated by reference to JBT’s Current Report on Form 8-K, filed on 18 June 2024, (ii) Marel’s consolidated financial statements and notes as at and for each of the years ended 31 December 2023, 2022 and 2021, which were prepared by Marel in accordance with IFRS, (iii), the unaudited pro forma condensed combined financial information for the combined company as at and for the financial year ended 31 December 2023 which were prepared in accordance with the Prospectus Regulation to give an inherently illustrative estimated and hypothetical presentation of the combined company’s assets, liabilities, financial position and results of operations, (iv) JBT’s condensed consolidated financial statements as of 31 March 2024 and for the quarterly periods ended 31 March 2024 and 2023 and the related notes thereto, which are incorporated by reference to JBT’s Quarterly Report on Form 10-Q for the three months ended 31 March 2024, filed on 2 May 2024 and (v) Marel’s condensed consolidated interim financial statements as at and for the three months ended 31 March 2024 with comparative figures as at and for the three months ended 31 March 2023, which were prepared by Marel in accordance with IFRS. | |

| Key financial information for JBT: |

Year Ended 31 December | |||||||||||

| (In USD millions) | 2023 | 2022 | 2021 | |||||||||

| Revenue |

1,664.4 | 1,590.3 | 1,400.8 | |||||||||

| Gross profit |

585.7 | 529.4 | 482.1 | |||||||||

| Operating income |

164.7 | 132.6 | 125.6 | |||||||||

| Net income before income taxes |

153.1 | 120.0 | 119.5 | |||||||||

| Income from continuing operations |

129.3 | 103.8 | 92.5 | |||||||||

| Net income |

582.6 | 137.4 | 119.1 | |||||||||

|

|

|

|

|

|

|

|||||||

| Adjusted EBITDA from continuing operations |

$ | 273.1 | $ | 227.7 | 212.2 | |||||||

| As of 31 December | ||||||||||||

| (In USD millions) | 2023 | 2022 | 2021 | |||||||||

| Total assets |

2,710.4 | 2,641.0 | 2,185.1 | |||||||||

| Total stockholders’ equity |

1,488.9 | 905.4 | 786.4 | |||||||||

4

Table of Contents

| Year Ended 31 December | ||||||||||||

| (In USD millions) | 2023 | 2022 | 2021 | |||||||||

| Cash provided by continuing operating activities |

74.2 | 135.2 | 174.9 | |||||||||

| Cash provided (required) by continuing investing activities |

729.3 | (413.2 | ) | (270.5 | ) | |||||||

| Cash (required) provided by continuing financing activities |

(354.1 | ) | 270.6 | 80.8 | ||||||||

| Effect of foreign exchange rate changes on cash and cash equivalents |

(1.2 | ) | (2.5 | ) | (2.3 | ) | ||||||

|

|

|

|

|

|

|

|||||||

| Net increase (decrease) in cash from continuing operations |

448.2 | (9.9 | ) | (17.1 | ) | |||||||

|

|

|

|

|

|

|

|||||||

| Three Months Ended 31 March |

||||||||

| (In USD millions) | 2024 | 2023 | ||||||

| Revenue |

392.3 | 388.5 | ||||||

| Gross profit |

140.3 | 132.9 | ||||||

| Operating income |

29.1 | 28.4 | ||||||

| Income from continuing operations before income taxes |

30.9 | 21.7 | ||||||

| Income from continuing operations |

22.7 | 17.1 | ||||||

| Net income |

22.8 | 27.2 | ||||||

|

|

|

|

|

|||||

| Adjusted EBITDA from continuing operations |

57.4 | 54.4 | ||||||

| As of 31 March | ||||||||

| (In USD millions) | 2024 | 2023 | ||||||

| Total assets |

2,690.7 | 2,710.4 | ||||||

| Total stockholders’ equity |

1,491.1 | 1,488.9 | ||||||

| Three Months Ended 31 March |

||||||||

| (In USD millions) | 2024 | 2023 | ||||||

| Cash provided by continuing operating activities |

10.4 | 11.4 | ||||||

| Cash required by continuing investing activities |

(7.2 | ) | (17.3 | ) | ||||

| Cash required by continuing financing activities |

(6.1 | ) | (30.0 | ) | ||||

| Effect of foreign exchange rate changes on cash and cash equivalents |

(1.2 | ) | (0.1 | ) | ||||

|

|

|

|

|

|||||

| Net decrease in cash from continuing operations |

(4.1 | ) | (36.0 | ) | ||||

|

|

|

|

|

|||||

Key financial information for Marel:

| (In EUR million) | 2023 | 2022 | 2021 | |||||||||

| Revenues |

1,721.4 | 1,708.7 | 1,360.8 | |||||||||

| Gross profit |

596.4 | 578.3 | 493.8 | |||||||||

| Result from operations |

93.6 | 97.0 | 130.3 | |||||||||

| Result before income tax |

36.1 | 75.1 | 120.7 | |||||||||

| Net result |

31.0 | 58.7 | 96.2 | |||||||||

5

Table of Contents

| (In EUR million) | 2023 | 2022 | 2021 | |||||||||

| Net cash from operating activities |

138.1 | 51.4 | 176.2 | |||||||||

| Net cash provided by / (used in) investing activities |

(95.9 | ) | (567.2 | ) | (121.4 | ) | ||||||

| Net cash provided by / (used in) financing activities |

(45.1 | ) | 505.9 | (64.3 | ) | |||||||

| Net increase (decrease) in net cash |

(2.9 | ) | (9.9 | ) | (9.5 | ) | ||||||

| Exchange (loss) / gain on net cash |

(2.9 | ) | 8.5 | 8.0 | ||||||||

| Net cash at end of the period |

69.9 | 75.7 | 77.1 | |||||||||

| (In EUR million) | 2023 | 2022 | 2021 | |||||||||

| Total assets |

2,599.8 | 2,696.4 | 2,005.0 | |||||||||

| Total shareholders’ equity |

1,041.6 | 1,028.1 | 1,015.1 | |||||||||

| Three months ended 31 March |

||||||||

| (In EUR million) | 2024 | 2023 | ||||||

| Revenues |

412.6 | 447.4 | ||||||

| Gross profit |

148.5 | 152.7 | ||||||

| Result from operations |

11.9 | 23.1 | ||||||

| Result before income tax |

(2.0 | ) | 10.0 | |||||

| Net result |

(3.2 | ) | 9.1 | |||||

| Three months ended 31 March |

||||||||

| (In EUR million) | 2024 | 2023 | ||||||

| Net cash from operating activities |

6.5 | 16.8 | ||||||

| Net cash provided by / (used in) investing activities |

(11.3 | ) | (31.8 | ) | ||||

| Net cash provided by / (used in) financing activities |

(28.3 | ) | 5.2 | |||||

| Net increase (decrease) in net cash |

(33.1 | ) | (9.8 | ) | ||||

| Exchange (loss) / gain on net cash |

(0.9 | ) | (2.1 | ) | ||||

| Net cash at end of the period |

35.9 | 63.8 | ||||||

| (In EUR million) | 31 March 2024 |

31 March 2023 |

||||||

| Total assets |

2,562.0 | 2,599.8 | ||||||

| Total shareholders’ equity |

1,039.7 | 1,041.6 | ||||||

6

Table of Contents

Unaudited pro forma financial information for the financial year ended 31 December 2023:

| (In USD millions, except per share data) |

Historical JBT |

Historical Marel (IFRS) Adjusted For Reclassifications |

IFRS to GAAP Adjustments |

Transaction Accounting Adjustments |

Transaction Financing Adjustments |

Pro Forma Combined |

||||||||||||||||||

| Revenues |

1,664.4 | 1,879.1 | — | — | — | 3,543.5 | ||||||||||||||||||

| Operating income |

164.7 | 102.2 | (12.5 | ) | (170.9 | ) | — | 83.5 | ||||||||||||||||

| Net income (loss) from continuing operations |

129.3 | 33.8 | (8.2 | ) | (100.4 | ) | (130.4 | ) | (75.9 | ) | ||||||||||||||

| Basic earnings per share from continuing operations |

4.04 | 0.04 | — | — | — | (1.46 | ) | |||||||||||||||||

| Diluted earnings per share from continuing operations |

4.02 | 0.04 | — | — | — | (1.46 | ) | |||||||||||||||||

Unaudited pro forma financial information for the three months ended 31 March 2024:

| (In USD millions, except per share data) |

Historical JBT |

Historical Marel (IFRS) Adjusted For Reclassifications |

IFRS to GAAP Adjustments |

Transaction Accounting Adjustments |

Transaction Financing Adjustments |

Pro Forma Combined |

||||||||||||||||||

| Revenues |

392.3 | 448.5 | — | — | — | 840.8 | ||||||||||||||||||

| Operating income |

29.1 | 13.0 | — | (14.9 | ) | — | 27.2 | |||||||||||||||||

| Net income (loss) from continuing operations |

22.7 | (3.4 | ) | 0.2 | (0.8 | ) | (23.5 | ) | (4.8 | ) | ||||||||||||||

| Basic earnings per share from continuing operations |

0.71 | 0.00 | — | — | — | (0.09 | ) | |||||||||||||||||

| Diluted earnings per share from continuing operations |

0.71 | 0.00 | — | — | — | (0.09 | ) | |||||||||||||||||

| (In USD millions, except per share data) |

Historical JBT |

Historical Marel (IFRS) Adjusted For Reclassifications |

IFRS to GAAP Adjustments |

Transaction Accounting Adjustments |

Transaction Financing Adjustments |

Pro Forma Combined |

||||||||||||||||||

| Total assets |

2,690.7 | 2,762.8 | (109.7 | ) | 364.1 | 1,542.3 | 7,250.2 | |||||||||||||||||

| Total stockholders’ equity |

1,491.1 | 1,121.2 | (82.3 | ) | 773.5 | — | 3,303.5 | |||||||||||||||||

| What are the key risks that are specific to the Offer? | ||

| Key risks | • The Offer is subject to conditions that neither JBT nor Marel can control.

• The Transaction is conditioned on the receipt of certain required governmental and regulatory approvals and clearances, which, if delayed, not granted or granted with unfavorable conditions, may delay or jeopardize the completion of the Transaction, result in additional costs and expenses and/or reduce the anticipated benefits of the Transaction.

• Each of JBT, Marel and the Offeror may waive one or more of the Closing Conditions without JBT Stockholder approval or Marel Shareholder approval. | |

7

Table of Contents

|

• The Transaction may not be as successful as anticipated, and the combined company may not achieve the intended benefits or do so within the intended timeframe and the integration costs may exceed estimates.

• The indebtedness of the combined company following the consummation of the Transaction is expected to be substantially greater than the current indebtedness of JBT or Marel on a standalone basis and greater than JBT and Marel’s combined indebtedness prior to the Transaction. This increased level of indebtedness could adversely affect the combined company’s operational flexibility and increase its borrowing costs.

• The combined company may not be able to retain customers or suppliers, and customers or suppliers may seek to modify contractual obligations with the combined company, either of which could have an adverse effect on the combined company’s business and operations. Third parties may terminate or alter existing contracts or relationships with JBT or Marel in anticipation of or as a result of the Transaction.

• JBT’s financial results are subject to fluctuations caused by many factors that could result in JBT failing to achieve anticipated financial results and cause a drop in JBT’s stock price.

• The cumulative loss of several significant contracts may negatively affect JBT’s business, financial condition, results of operations, and cash flows.

• The loss of key personnel or any inability to attract and retain additional personnel could affect JBT’s ability to successfully grow its business.

• If Marel is unable to continue to develop and deliver innovative, technologically advanced solutions to its customers, Marel’s business, results of operations and financial condition could be materially adversely affected.

• Marel relies on its ability to successfully grow its installed base through long-term customer relationships.

• Marel earns a significant amount of aftermarkets revenues. If it is unable to maintain the size and reliability of this part of its business, Marel’s business, results of operations and financial condition may be materially adversely affected. | ||

| Section C — Key information on the securities | ||

| What are the main features of the securities? | ||

| Type, class and ISIN | The newly issued JBT Offer Shares to be delivered as stock consideration in connection to the Offer will be shares of common stock of JBT, delivered in registered form, book-entered in the Nasdaq Iceland securities system, under a ticker symbol and ISIN to be determined prior to the closing of the Offer. | |

| Currency, denomination and par value | The JBT Offer Shares issued in connection with the Offer and submitted for listing on Nasdaq Iceland will be denominated in ISK. The par value of the JBT Offer Shares to be listed on Nasdaq Iceland will be determined prior to the closing of the Offer. | |

| Rights attaching to the shares | The holders of JBT Shares are entitled to one vote per share on all matters to be voted upon by JBT Stockholders. Subject to preferences that may be applicable to any outstanding shares of JBT Preferred Stock, the holders of JBT Shares are entitled to receive ratably such dividends, if any, as may be declared from time to time by the JBT Board out of funds legally available for that purpose. In the event of JBT’s liquidation, dissolution or winding-up, JBT Stockholders are entitled to share ratably in all assets remaining after payment of liabilities, subject to prior distribution rights of the JBT Preferred Stock, if any, then outstanding. The holders of JBT Shares have no preemptive or similar subscription rights or conversion rights. There are no redemption or sinking fund provisions applicable to JBT Shares. | |

8

Table of Contents

| Transfer restriction | No restrictions on transferability of the JBT Shares apply. | |

| Dividend policy | JBT does not have in place a formal policy on dividend distributions. JBT Board may from time to time declare, and JBT may pay, dividends on its outstanding shares in the manner and upon the terms and conditions provided by law and the JBT Charter. | |

| Where will the securities be traded? | ||

| Admission to trading | The JBT Shares are currently listed on the NYSE under the symbol “JBT.” JBT intends to maintain the listing of JBT Shares on the NYSE under the symbol “JBT” upon completion of the Transaction. JBT intends to take the steps necessary to list all or a portion of the JBT Offer Shares on Nasdaq Iceland under a ticker symbol and ISIN code to be determined prior to the closing of the Offer. | |

| What are the key risks that are specific to the securities? | ||

| Key risks | Marel Shareholders who receive JBT Offer Shares in the Transaction will have rights as JBT Stockholders that differ from their current rights as Marel Shareholders.

Nasdaq Iceland may not list JBT Offer Shares on its exchange, which may limit the ability of shareholders to transact in the JBT Offer Shares. | |

| Section D — Key information on the offer and admission to trading on a regulated market | ||

| Under which conditions and timetable can I invest in this security? | ||

| Terms and conditions, expected timetable of the offer and details of the admission to trading on a regulated market | Pursuant to the terms of the Offer, Marel Shareholders may exchange each Marel Share, at their election, for (i) cash consideration in the amount of EUR 3.60, (ii) stock consideration consisting of 0.0407 JBT Offer Shares or (iii) cash consideration in the amount of EUR 1.26 along with stock consideration consisting of 0.0265 JBT Offer Shares, subject to the proration provisions, as applicable, described in this Prospectus. Marel Shareholders can choose to receive JBT Offer Shares listed on either the NYSE or Nasdaq Iceland (subject to the approval of the JBT Offer Shares being listed on Nasdaq Iceland).

JBT intends to take the steps necessary to list all or a portion of the JBT Offer Shares on Nasdaq Iceland under a ticker symbol and ISIN code to be determined prior to the closing of the Offer. To effect such admission to trading and official listing, JBT will submit an application to Nasdaq Iceland for the admission to trading and official listing of the JBT Offer Shares as well as prepare and publish any supplement necessary to this Prospectus. Such steps and the admission to trading and official listing of the JBT Offer Shares on Nasdaq Iceland will be subject to, among other things, the completion of the Offer. | |

| The expected timetable of the Offer and the transaction is as follows:

24 June 2024: Launch of the Offer 2 September 2024: Expiry of Offer Period (unless extended) 5 September 2024: Expected announcement of the results of the Offer 5 September 2024: Expected settlement of the Offer | ||

| Dilution | Upon the Offer Closing Time, and assuming that all of the outstanding Marel Shares are tendered into the Offer, it is expected that JBT Stockholders as of immediately prior to the completion of the Transaction will hold approximately 62% of the outstanding JBT Shares and Marel Shareholders as of immediately prior to the completion of the Transaction will hold approximately 38% of the aggregate outstanding JBT Shares after giving effect to the issuance of JBT Offer Shares in connection with the Offer. | |

9

Table of Contents

| Estimated expenses | JBT estimates that it will incur approximately $85 million to $90 million of costs in connection with the Transaction through the Offer Closing Time. This cost estimate includes assumptions for advisory costs, legal costs, regulatory filing costs and certain pre-close integration costs. This cost estimate also includes certain costs that are contingent upon the successful close of the Transaction. This estimate excludes any assumptions related to the cost of any longer term or more permanent debt financing. | |

| Why is this prospectus being produced? | ||

| Reasons for offering and admission to trading | This Prospectus is prepared (i) due to the offering of the JBT Offer Shares as consideration to Marel Shareholders in connection to the offer and (ii) to enable the JBT Offer Shares to be admitted to trading on the main market of Nasdaq Iceland. | |

| Use of proceeds | Not applicable. | |

| Underwriting | Not applicable. | |

| Material and conflicting interests | There are no material conflicts of interest pertaining to the Offer or the admission of the JBT Offer Shares to trading. | |

10

Table of Contents

Any decision to accept the Offer is subject to a number of risks and involves a high degree of financial risk. Accordingly, Marel Shareholders should consider and review this Prospectus carefully and in its entirety and consider all information included in the Offer Document together with this Prospectus (including any information or material incorporated by reference), including the risks described below, before they decide to accept the Offer or invest in the JBT Offer Shares. A number of factors affect the business, financial condition, results of operations and prospects of each of the JBT Group, the Marel Group and the combined company and the industry in which they operate.

This section describes the risk factors considered to be material in relation to the JBT Group and the Marel Group as discrete groups based on the information known as at the date of this Prospectus and each of these risks will continue to be relevant to the combined company. The risk factors described in this section have been organized beginning with those deemed most serious by JBT considering their potential negative impact on the issuer and the probability of their occurrence. If any of these risks actually materialise, the JBT Group’s, the Marel Group’s or, following completion of the Transaction, the combined company’s business, financial condition, results of operations and prospects could be materially adversely affected and the value of JBT Shares, including the JBT Offer Shares, could decline. Further, this section describes certain risks relating to the Transaction and the Offer and the JBT Shares, including the JBT Offer Shares, which could also adversely impact the value of the JBT Shares, including the JBT Offer Shares.

The risks described below are not the only ones faced and should be used as guidance only. Additional risks in relation to the JBT Group and/or the Marel Group not presently known to JBT’s management or that JBT’s management currently deem immaterial may also, whether individually or cumulatively, have a material adverse effect on the JBT Group’s or the Marel Group’s business, financial condition, results of operations and prospects or those of the combined company, and could negatively affect the JBT Group’s, the Marel Group’s and, following completion of the Transaction, the combined company’s business, financial condition, results of operations and prospects resulting in a decline in the value of the JBT Shares, including the JBT Offer Shares, and a loss of part or all of an investor’s investment.

Except as specifically set out in the specific risk factors, it has not, due to the nature of the risks and the business of the JBT Group and the Marel Group, been possible for JBT to make specific and accurate assessments of the probability of occurrence of each individual risk factor.

Prospective investors should carefully read the entire Prospectus and should reach their own views before making an investment decision with respect to any JBT Offer Shares. Furthermore, before making an investment decision with respect to any JBT Offer Shares, prospective investors should consult their own stockbroker, bank manager, lawyer, auditor or other financial, legal and tax advisers, and carefully review the risks associated with an investment in the JBT Offer Shares and consider such an investment decision in light of their personal circumstances.

| 1.1 | Risks relating to the Transaction |

| 1.1.1 | The Offer is subject to conditions that neither JBT nor Marel can control. |

The Offer is subject to the Closing Conditions, which include, among others, the approval of the Share Issuance Proposal at the Special Meeting, the Minimum Acceptance Condition and the Regulatory Approvals Condition (each as defined in this Prospectus). The Closing Conditions to the Offer must be satisfied or validly waived by the Offeror (only following approval by both JBT and Marel), JBT and/or Marel, as applicable, prior to the Expiration Date. No assurance can be given that the Closing Conditions will be satisfied or waived or, if they are, as to the timing of the Offer Closing Time. If the Closing Conditions are not satisfied or waived, then the Transaction may not be consummated. See section 7.9 “Conditions to Closing” and section 8 “The Offer”.

11

Table of Contents

| 1.1.2 | The Transaction is conditioned on the receipt of certain required governmental and regulatory approvals and clearances, which, if delayed, not granted or granted with unfavorable conditions, may delay or jeopardize the completion of the Transaction, result in additional costs and expenses and/or reduce the anticipated benefits of the Transaction. |

Completion of the Transaction is conditioned on, among other things, receipt of approvals and/or clearances from certain antitrust authorities or expiration or termination of any statutory waiting period (including any extension thereof), as well as clearances from certain authorities under foreign direct investment regimes. The governmental and regulatory agencies from which JBT and Marel seek certain of these approvals and clearances have broad discretion in administering the governing regulations. Neither JBT nor Marel can provide any assurance that all required approvals and clearances will be obtained. Moreover, as a condition to the approvals, the governmental or regulatory agencies may impose requirements, limitations or costs on, or require divestitures or place restrictions on the conduct of, the combined company’s business after the completion of the Transaction. These requirements, limitations, costs, divestitures or restrictions could jeopardize or delay the completion of the Transaction. Further, no assurance can be given as to the terms, conditions and timing of the approvals. If JBT and Marel agree to any material requirements, limitations, costs, divestitures or restrictions to obtain any approvals or clearances required to consummate the Transaction, these requirements, limitations, costs, divestitures or restrictions could adversely affect JBT’s ability to integrate Marel’s operations with JBT’s operations and/or reduce the anticipated benefits of the Transaction. This could have a material adverse effect on the combined company’s business, results of operations, financial condition and cash flows.

| 1.1.3 | Each of JBT, Marel and the Offeror may waive one or more of the Closing Conditions without JBT Stockholder approval or Marel Shareholder approval. |

As provided in the Transaction Agreement, each of JBT, Marel and the Offeror (only following approval by both JBT and Marel) may waive, in whole or in part, one or more of the Closing Conditions, to the extent permitted by applicable laws and the terms of the Transaction Agreement. Each of JBT and Marel will evaluate the materiality of any such waiver and its effect on its shareholders in light of the facts and circumstances at the time to determine whether any amendment of this Prospectus and the Offer Document is required or warranted. Waiver of a Closing Condition could occur prior to the Special Meeting. If JBT, Marel or the Offeror determines to waive any Closing Condition after JBT receives JBT Stockholder approval at the Special Meeting, JBT may have the discretion to complete the Transaction without seeking further JBT Stockholder approval. In addition, any such waiver will not require Marel Shareholder approval. Any such waiver could have an adverse effect on the combined company.

| 1.1.4 | The number of JBT Offer Shares that Marel Shareholders will receive in the Offer is based on a fixed exchange ratio. The market value of the JBT Offer Shares to be issued upon the Offer Closing Time is unknown, and therefore, Marel Shareholders and JBT Stockholders cannot be certain of the value of the portion of the consideration to be paid in JBT Offer Shares. |

In the Offer, Marel Shareholders may exchange each Marel Share for, at the election of each Marel Shareholder, (i) cash consideration in the amount of EUR 3.60, (ii) stock consideration consisting of 0.0407 newly and validly issued, fully paid and non-assessable JBT Offer Shares or (iii) cash consideration in the amount of EUR 1.26 along with stock consideration consisting of 0.0265 newly and validly issued, fully paid and non-assessable JBT Offer Shares, subject to the proration provisions, as applicable, described in this Prospectus. This exchange ratio is fixed and will not vary even if the market price of JBT Shares or Marel Shares fluctuates. The market value of JBT Shares and Marel Shares at the time of the completion of the Offer may vary significantly from their market value on the date of the execution of the Transaction Agreement, the date of this Prospectus, the date on which JBT Stockholders vote on the Share Issuance Proposal, the date on which Marel Shareholders tender their shares in the Offer or the Expiration Date. Because the Offer exchange ratio will not be adjusted to reflect any changes in the market price of JBT Shares or Marel Shares, the value of the consideration paid to Marel Shareholders who tender their shares in the Offer may be lower than the market value of their Marel Shares on earlier dates. Furthermore, there is a certain risk of fluctuations in exchange rates prior to settlement.

12

Table of Contents

Changes in share prices may result from a variety of factors that are beyond the control of JBT or Marel, including their respective business, operations and prospects, market conditions, economic development, geopolitical events, regulatory considerations, governmental actions, legal proceedings and other developments. Market assessments of the benefits of the Transaction and of the likelihood that the Transaction will be completed, as well as general and industry-specific market and economic conditions, may also have an adverse effect on share prices.

In addition, it is possible that the Transaction may not be completed until a significant period of time has passed after the date of this Prospectus. As a result, the market values of JBT Shares or Marel Shares may vary significantly from the date of this Prospectus to the date of the completion of the Transaction.

Investors are urged to obtain up-to-date prices for JBT Shares, which are listed and traded on the NYSE under the symbol “JBT,” and Marel Shares, which are listed on Nasdaq Iceland and Euronext Amsterdam under the symbol “MAREL.”

| 1.1.5 | Marel Shareholders may receive a form of consideration different from what they elect to receive in the Offer. |

In the Offer, Marel Shareholders may exchange each Marel Share, at their election, for (i) cash consideration in the amount of EUR 3.60, (ii) stock consideration consisting of 0.0407 newly and validly issued, fully paid and non-assessable JBT Offer Shares or (iii) cash consideration in the amount of EUR 1.26 along with stock consideration consisting of 0.0265 newly and validly issued, fully paid and non-assessable JBT Offer Shares, with such consideration amounts based on the value of JBT Shares as of the date JBT issued its notice of intention. However, such elections will be subject to proration and adjustment procedures, as applicable, such that the Marel Shareholders immediately prior to the closing of the Offer will receive an aggregate of approximately EUR 950 million in cash and approximately a 38% interest in the combined company. As a result, Marel Shareholders who have elected to receive cash consideration may instead receive stock consideration, or vice versa. This could result in, among other things, tax consequences that differ from those that would have resulted if such shareholders had received the form of consideration that they had elected. For a more detailed description of how the proration and adjustment procedures apply, see section 7.3 “Consideration Offered to Marel Shareholders”.

| 1.1.6 | The Marel Shares held by any Marel Shareholders that do not tender their Marel Shares in the Offer may be acquired by the Offeror pursuant to the Merger or the Squeeze-Out with respect to Marel or Marel Shares after the Offer Closing Time. |

Following the Offer Closing Time, the Offeror may, by way of the Merger or the Squeeze-Out, acquire any remaining outstanding Marel Shares which were not acquired in the Offer. The Merger or the Squeeze-Out, as applicable, could eliminate any minority shareholder interests in Marel remaining after the settlement of the Offer.

Due to the statutory legal framework applicable to the Merger or the Squeeze-Out, Marel Shareholders who do not exchange their shares in the Offer may receive a different (including a lower) amount or a different form of consideration than they would have received had they exchanged their Marel Shares in the Offer. If the value of JBT Shares offered as compensation has declined after the completion of the Transaction, there may be no obligation of JBT to pay Marel Shareholders who did not exchange their shares in the Offer the implied value of the consideration received by Marel Shareholders who exchanged their shares in the Offer.

Furthermore, it may take a substantial amount of time for the Merger or the Squeeze-Out to be consummated. Accordingly, Marel Shareholders may have to wait significantly longer than expected to receive consideration for their Marel Shares during which time such Marel Shareholders will continue to hold an illiquid security.

13

Table of Contents

| 1.1.7 | Any failure by the Offeror to acquire at least 90% of the issued and outstanding Marel Shares could lead to Marel not becoming a wholly owned subsidiary of JBT and might prevent the delisting of Marel Shares from Nasdaq Iceland and/or Euronext Amsterdam. |

The Offer is conditioned upon, among other things, the Minimum Acceptance Condition. If such condition is waived, at the Offer Closing Time, the Offeror may own 90% or less of the issued and outstanding Marel Shares.

Pursuant to the Icelandic Takeover Act, the Offeror must own at least 90% of the issued and outstanding Marel Shares to implement the Squeeze-Out with respect to the remaining outstanding Marel Shares. While the Offeror may be able to exercise the Squeeze-Out if it subsequently acquires at least 90% of the issued and outstanding Marel Shares, for instance where it acquires further Marel Shares through an additional voluntary tender offer or otherwise or where Marel repurchases Marel Shares, there can be no guarantee that this will happen. Additionally, there is no guarantee that the Offeror will (or will be able to) initiate the Merger following the Offer Closing Time. If the Offeror fails to acquire all of the issued and outstanding Marel Shares, Marel will not be a wholly owned subsidiary of JBT and minority Marel Shareholders will have certain minority protection rights under Icelandic law. Any temporary or permanent delay in acquiring all Marel Shares could adversely affect JBT’s ability to integrate Marel’s business, including achieving expected benefits and synergies, as well as the market value of JBT Shares and JBT’s access to capital and other sources of funding on acceptable terms. Failure to acquire at least 90% of the issued and outstanding Marel Shares could also result in JBT not succeeding in removing the Marel Shares from trading and official listing on Nasdaq Iceland or Euronext Amsterdam. Nasdaq Iceland and/or Euronext Amsterdam may refuse to delist the Marel Shares, which would result in more onerous regulatory compliance obligations for the combined company and may increase the expenses of the Transaction and the overall expenses of the combined company.

In addition, if the Offer is consummated but not all of the outstanding Marel Shares have been tendered, then the free float in Marel Shares will be significantly lower than the current free float in such Marel Shares, thereby reducing the liquidity of any remaining Marel Shares that were not acquired in the Offer (the “Remaining Marel Shares”). Reduced liquidity could make it more difficult for the remaining Marel Shareholders to sell their shares and could adversely affect the market value of those remaining shares. A lower level of liquidity in the trading in Marel Shares could result in greater price fluctuations of such shares than in the past. The value of Marel Shares implied by the Offer does not guarantee that the value of such shares not held by JBT or the Offeror following the Offer will remain at that level or exceed that value in the future and share prices may vary materially.

If, immediately following the Offer Closing Time, the Offeror owns at least 90% of the issued and outstanding Marel Shares, the Offeror will be able to initiate the Squeeze-Out under Icelandic law whereby the remaining outstanding Marel Shares are acquired on the same terms as offered in the Offer. If the Squeeze-Out is initiated within three months of the Offer Closing Time, the Offer Price is deemed to be a fair price for the purposes of the Squeeze-Out.

| 1.1.8 | If the Transaction Agreement is terminated under certain circumstances, JBT may be obligated to pay Marel a reverse termination fee and each of JBT and Marel may be required to reimburse the other party for out-of-pocket costs and expenses, which could adversely impact JBT’s or Marel’s financial condition, as applicable. |

If the Transaction Agreement is terminated by JBT or Marel because the Regulatory Approvals Condition has not been satisfied or waived by the Expiration Date and other specific circumstances and conditions set forth in the Transaction Agreement are met, then JBT will be required to pay Marel a reverse termination fee of (i) EUR 85 million if the Drop Dead Date is the Initial Drop Dead Date at the time of such termination or (ii) EUR 110 million if the Drop Dead Date is the Extended Drop Dead Date at the time of such termination.

Additionally, each of JBT and Marel will reimburse the other party for out-of-pocket costs and expenses incurred, directly or indirectly, by JBT and its subsidiaries, or Marel and its subsidiaries, as applicable, up to an aggregate amount of EUR 35 million or EUR 15 million, in specific circumstances.

14

Table of Contents

Payment of the reverse termination fee by JBT or the reimbursement of expenses by JBT or Marel could adversely affect JBT’s or Marel’s financial position, as applicable.

| 1.1.9 | The issuance of JBT Offer Shares will dilute the ownership and voting interests of existing JBT Stockholders and may cause the market price of JBT Shares to decline. |

After the completion of the Transaction, JBT Stockholders and Marel Shareholders will own a smaller percentage of the combined company than they currently own of JBT and Marel, respectively. Based on the estimated number of JBT Offer Shares issued in connection with the Transaction (assuming 100% of Marel Shares are tendered into the Offer), it is expected that JBT Stockholders will hold approximately 62%, and Marel Shareholders will hold approximately 38%, of the shares in the combined company. Consequently, JBT Stockholders, as a group, and Marel Shareholders, as a group, will each have reduced ownership and voting power in the combined company compared to their ownership and voting power in JBT and Marel, respectively. In particular, Marel Shareholders, as a group, will have less than a majority of the ownership and voting power of the combined company post-Transaction and, therefore, will be able to exercise less collective influence over the management and policies of the combined company than they currently exercise over the management and policies of Marel.

| 1.1.10 | Certain of the directors and executive officers of JBT and Marel may have interests in the Transaction that may be different from, or in addition to, those of JBT Stockholders and Marel Shareholders generally. |

Certain of the directors and executive officers of JBT and Marel may have interests in the Transaction that may be different from, or in addition to, the interests of JBT Stockholders and Marel Shareholders generally. In the case of JBT’s directors and executive officers, these interests include the continued service of certain directors and executive officers following the completion of the Transaction, arrangements with JBT that provide for certain severance payments or benefits, accelerated vesting of certain equity-based awards and other rights and other payments or benefits upon completion of the Transaction and if their service is terminated under certain circumstances in connection with the Transaction and the right to continued indemnification by the combined company. In the case of Marel directors, these interests include four independent directors from the pre-closing Marel Board, as selected by Marel, being appointed to the board of directors of the combined company (such directors, together with their successors, the “Marel Independents”). In addition, members of the Marel executive management have in place remuneration agreements that were negotiated prior to the launch of the Offer. Marel’s executive management’s remuneration will, as before, be determined in accordance with Marel’s remuneration policy, subject to any restrictions in the Transaction. The JBT Board and the Marel Board were aware of these interests and considered them, among other matters, in evaluating, negotiating and approving the Transaction and in recommending that JBT Stockholders approve the Share Issuance Proposal and that Marel Shareholders tender their Marel Shares in the Offer, respectively. See section 6 “The Transaction” for more information.

| 1.1.11 | The announcement and pendency of the Transaction, during which JBT and Marel are subject to certain operating restrictions, could have an adverse effect on JBT’s and Marel’s businesses, results of operations, financial condition and cash flows. |

The announcement and pendency of the Transaction could disrupt JBT’s and Marel’s businesses, and uncertainty about the effect of the Transaction may have an adverse effect on JBT and Marel. These uncertainties could cause suppliers, vendors, partners, customers and others that deal with JBT and Marel to defer entering into contracts with or making other decisions concerning JBT and Marel or seek to change or cancel existing business relationships with the companies. In addition, JBT’s and Marel’s employees may depart either before or after the completion of the Transaction because of uncertainty regarding their roles after the Transaction or because of a desire not to remain following the Transaction. If key employees of either company terminate their employment, or if an insufficient number of employees are retained to maintain effective operations, JBT’s, Marel’s and the

15

Table of Contents

combined company’s business activities may be adversely affected and management’s attention may be diverted from successfully completing the Transaction or integrating JBT and Marel to hiring suitable replacements, all of which may cause JBT’s, Marel’s and the combined company’s business to suffer. In addition, JBT and Marel may not be able to locate suitable replacements for any key employees that leave either company or offer employment to potential replacements on reasonable terms.

Additionally, the attention of JBT’s and Marel’s management may be directed towards the completion of the Transaction and may be diverted from the day-to-day business operations of JBT and Marel. Matters related to the Transaction may require commitments of time and resources that could otherwise have been devoted to other opportunities that might have been beneficial to JBT or Marel. The Transaction Agreement also requires JBT and Marel to refrain from taking certain specified actions while the Transaction is pending, subject to limited exceptions described in the Transaction Agreement. These restrictions may prevent Marel or JBT from pursuing otherwise attractive business opportunities or capital structure alternatives and from executing certain business strategies prior to the completion of the Transaction. Further, the Transaction may give rise to potential liabilities, including those that may result from shareholder (or other stakeholder) lawsuits relating to the Transaction or a potential post-completion reorganization. Any of these matters could adversely affect the businesses of, or harm the results of operations, financial condition or cash flows of, JBT and Marel.

Further, certain adverse changes in the businesses of JBT and Marel may occur in the period prior to completion of the Transaction that would not result in JBT or Marel having the right to terminate the Transaction Agreement or the Offer. If adverse changes occur but JBT and Marel are still required to complete the Transaction, the market value of JBT Shares or Marel Shares may decrease.

| 1.1.12 | Negative publicity related to the Transaction may adversely affect JBT and Marel. |

From time to time, political and public sentiment in connection with the Transaction may result in a significant amount of adverse press coverage and other adverse public statements affecting JBT and Marel. Adverse press coverage and public statements, whether or not driven by political or popular sentiment, may also result in legal claims or in investigations by regulators, legislators and law enforcement officials. Responding to these investigations and lawsuits, regardless of the ultimate outcome of the proceedings, can divert the time and effort of senior management from operating their businesses. Addressing any adverse publicity, governmental scrutiny or enforcement or other legal proceedings could be time-consuming and expensive and, regardless of the factual basis for the assertions being made, could have a negative impact on the reputation of JBT and Marel, on the morale and performance of their employees and on their relationships with regulators, suppliers and customers. It may also have a negative impact on their ability to take timely advantage of various business and market opportunities. The direct and indirect effects of negative publicity, and the demands of responding to and addressing it, may have a material adverse effect on JBT’s and Marel’s respective business, results of operations, financial condition or cash flows.