Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-22209

Global X Funds

(Exact name of registrant as specified in charter)

399 Park Avenue, 32nd Floor

New York, NY 10022

(Address of principal executive offices) (Zip code)

SEI Investments Global Fund Services

One Freedom Valley Drive

Oaks, PA 19456

(Name and address of agent for service)

Registrant’s telephone number, including area code: (888) 493-8631

Date of fiscal year end: October 31, 2011

Date of reporting period: October 31, 2011

Table of Contents

| Item 1. | Reports to Stockholders. |

Table of Contents

Global X Gold Explorers ETF (ticker: GLDX)

Global X Silver Miners ETF (ticker: SIL)

Global X Copper Miners ETF (ticker: COPX)

Global X Uranium ETF (ticker: URA)

Global X Lithium ETF (ticker: LIT)

Global X Aluminum ETF (ticker: ALUM)

Global X Pure Gold Miners ETF (ticker: GGGG)

(formerly, Global X Gold Miners ETF)

Global X Oil Equities ETF (ticker: XOIL)

Global X S&P/TSX Venture 30 Canada ETF (ticker: TSXV)

(formerly, Global X S&P/TSX Venture Canada ETF)

Global X Fertilizers/Potash ETF (ticker: SOIL)

Annual Report

October 31, 2011

Table of Contents

| 1 | ||

| Schedules of Investments |

||

| 11 | ||

| 13 | ||

| 15 | ||

| 18 | ||

| 20 | ||

| 22 | ||

| 25 | ||

| 28 | ||

| 30 | ||

| 33 | ||

| 36 | ||

| 39 | ||

| 41 | ||

| 45 | ||

| 47 | ||

| 61 | ||

| 62 | ||

| 64 | ||

| 68 | ||

| 72 | ||

| 75 | ||

The Funds file their complete schedules of Fund holdings with the Securities and Exchange Commission (the “Commission”) for the first and third quarters of each fiscal year on Form N-Q within sixty days after the end of the period. The Funds’ Forms N-Q are available on the Commission’s website at http://www.sec.gov, and may be reviewed and copied at the Commission’s Public Reference Room in Washington, DC. Information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330.

A description of the policies and procedures that Global X Funds uses to determine how to vote proxies relating to Fund securities, as well as information relating to how the Funds voted proxies relating to Fund securities during the most recent 12-month period ended June 30, will be available (i) without charge, upon request, by calling 1-888-GXFund-1; and (ii) on the Commission’s website at http://www.sec.gov.

Table of Contents

| MANAGEMENT DISCUSSION OF FUND PERFORMANCE |

| GLOBAL X GOLD EXPLORERS ETF |

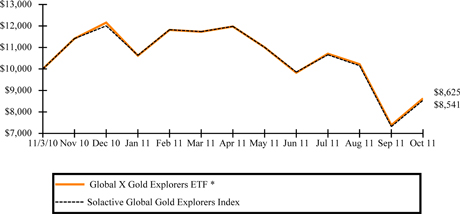

Global X Gold Explorers ETF

The Global X Gold Explorers ETF (the “Fund”) seeks to provide investment results that correspond generally to the price and yield performance, before fees and expenses, of the Solactive Global Gold Explorers Index (the “Index”). The Fund generally seeks to replicate the Index but may at times invest in a representative sample of securities that collectively has an investment profile similar to the Index and as a result may or may not hold all the securities that are included in the Index.

The Solactive Global Gold Explorers Index is designed to track the performance of the largest and most liquid listed companies that are active in the exploration for gold.

For the 12-month period ended October 31, 2011 (the “reporting period”), the Fund decreased 13.75%, while the Index decreased 14.59%. The Fund had a net asset value of $15.49 per share on November 3, 2010 and ended the period with a net asset value of $13.36 on October 31, 2011.

Sixteen of the Fund’s twenty-seven holdings as of October 31, 2011 increased in value for the reporting period, led by Newstrike Capital and Gold Canyon Resources, which returned 477.35% and 199.24% respectively. The worst performers were Atac Resources and East Asia Minerals, which returned -46.48% and -86.82% respectively.

Growth of a $10,000 Investment

| AVERAGE ANNUAL TOTAL RETURN FOR THE PERIOD ENDED OCTOBER 31, 2011* |

||||||

| Cumulative Inception to Date | ||||||

| Global X Gold Explorers ETF |

Net Asset Value |

Market Price | ||||

| (13.75%) |

(13.49%) | |||||

| Solactive Global Gold Explorers Index |

(14.59%) |

(14.59%) | ||||

*Fund commenced operations on November 3, 2010.

The performance data quoted herein represents past performance and the return and value of an investment in the Fund will fluctuate so that, when redeemed, may be worth less than its original cost. Past performance is no guarantee of future performance and should not be considered as a representation of the future results of the Fund. The Fund’s performance assumes the reinvestment of all dividends and all capital gains. Index returns assume reinvestment of dividends and, unlike a Fund’s returns, do not reflect any fees or expenses. If such fees and expenses were included in the index returns, the performance would have been lower. Please note that one cannot invest directly in an unmanaged index.

There are no assurances that the Fund will meet its stated objectives.

The Fund’s holdings and allocations are subject to change and should not be considered recommendations to buy individual securities.

Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

See definition of comparative index above.

1

Table of Contents

| MANAGEMENT DISCUSSION OF FUND PERFORMANCE |

| GLOBAL X SILVER MINERS ETF |

Global X Silver Miners ETF

The Global X Silver Miners ETF (the “Fund”) seeks to provide investment results that correspond generally to the price and yield performance, before fees and expenses, of the Solactive Global Silver Miners Index (the “Index”). The Fund generally seeks to replicate the Index but may at times invest in a representative sample of securities that collectively has an investment profile similar to the Index and as a result may or may not hold all the securities that are included in the Index.

The Index is designed to reflect the performance of the silver mining industry. It is comprised of selected companies globally that are actively engaged in some aspect of the silver mining industry, such as silver mining, refining, or exploration. The Fund is the first ETF globally focused exclusively on the silver mining sector.

For the 12-month period ended October 31, 2011 (the “reporting period”), the Fund increased 18.20%, while the Index increased 18.68%. The Fund had a net asset value of $20.20 per share on October 31, 2010 and ended the period with a net asset value of $23.66 on October 31, 2011.

Twenty-two of the Fund’s thirty-three holdings as of October 31, 2011 increased in value for the reporting period, led by Wildcat Silver and Scorpio Mining, which returned 289.74% and 137.88% respectively. The worst performers were Bear Creek Mining and Golden Minerals, which returned -49.08% and -73.30% respectively.

Growth of a $10,000 Investment

|

AVERAGE ANNUAL TOTAL RETURN FOR THE YEAR ENDED OCTOBER 31, 2011* |

||||||||||

| One Year Return | Annualized Inception to Date | |||||||||

| Global X Silver Miners ETF |

Net Asset Value | Market Price | Net Asset Value | Market Price | ||||||

| 18.20% | 17.80% | 38.52% | 38.57% | |||||||

| Solactive Global Silver Miners Index |

18.68% | 18.68% | 39.25% | 39.25% | ||||||

*Fund commenced operations on April 19, 2010.

The performance data quoted herein represents past performance and the return and value of an investment in the Fund will fluctuate so that, when redeemed, may be worth less than its original cost. Past performance is no guarantee of future performance and should not be considered as a representation of the future results of the Fund. The Fund’s performance assumes the reinvestment of all dividends and all capital gains. Index returns assume reinvestment of dividends and, unlike a Fund’s returns, do not reflect any fees or expenses. If such fees and expenses were included in the index returns, the performance would have been lower. Please note that one cannot invest directly in an unmanaged index.

There are no assurances that the Fund will meet its stated objectives.

The Fund’s holdings and allocations are subject to change and should not be considered recommendations to buy individual securities.

Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

See definition of comparative index above.

2

Table of Contents

MANAGEMENT DISCUSSION OF FUND PERFORMANCE

GLOBAL X COPPER MINERS ETF

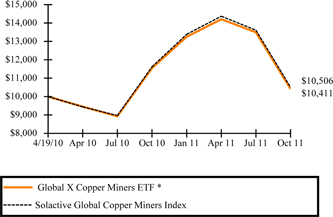

Global X Copper Miners ETF

The Global X Copper Miners ETF (the “Fund”) seeks to provide investment results that correspond generally to the price and yield performance, before fees and expenses, of the Solactive Global Copper Miners Index (the “Index”). The Fund generally seeks to replicate the Index but may at times invest in a representative sample of securities that collectively has an investment profile similar to the Index and as a result may or may not hold all the securities that are included in the Index.

The Index is designed to reflect the performance of the copper mining industry. It is comprised of selected companies globally that are actively engaged in some aspect of the copper mining industry, such as copper mining, refining, or exploration.

For the 12-month period ended October 31, 2011 (the “reporting period”), the Fund decreased 9.85%, while the Index decreased 9.56%. The Fund had a net asset value of $16.63 per share on October 31, 2010 and ended the period with a net asset value of $14.92 on October 31, 2011.

Eleven of the Fund’s thirty-three holdings as of October 31, 2011 increased in value for the reporting period, led by Metorex and Cudeco, which returned 65.63% and 41.75% respectively. The worst performers were Lundin Mining and Taseko Mines, which returned -37.99% and -42.00% respectively.

Growth of a $10,000 Investment

| AVERAGE ANNUAL TOTAL RETURN FOR THE YEAR

ENDED OCTOBER 31, 2011* | ||||||||

| One Year Return | Annualized Inception to Date | |||||||

| Net Asset Value | Market Price | Net Asset Value | Market Price | |||||

| Global X Copper Miners ETF |

(9.85%) | (11.26%) | 2.66% | 1.85% | ||||

| Solactive Global Copper Miners Index |

(9.56%) | (9.56%) | 3.27% | 3.27% | ||||

*Fund commenced operations on April 19, 2010.

The performance data quoted herein represents past performance and the return and value of an investment in the Fund will fluctuate so that, when redeemed, may be worth less than its original cost. Past performance is no guarantee of future performance and should not be considered as a representation of the future results of the Fund. The Fund’s performance assumes the reinvestment of all dividends and all capital gains. Index returns assume reinvestment of dividends and, unlike a Fund’s returns, do not reflect any fees or expenses. If such fees and expenses were included in the index returns, the performance would have been lower. Please note that one cannot invest directly in an unmanaged index.

There are no assurances that the Fund will meet its stated objectives.

The Fund’s holdings and allocations are subject to change and should not be considered recommendations to buy individual securities.

Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

See definition of comparative index above.

3

Table of Contents

MANAGEMENT DISCUSSION OF FUND PERFORMANCE

GLOBAL X URANIUM ETF

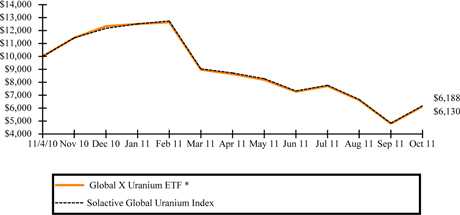

Global X Uranium ETF

The Global X Uranium ETF (the “Fund”) seeks to provide investment results that correspond generally to the price and yield performance, before fees and expenses, of the Solactive Global Uranium Index (the “Index”). The Fund generally seeks to replicate the Index but may at times invest in a representative sample of securities that collectively has an investment profile similar to the Index and as a result may or may not hold all the securities that are included in the Index.

The Solactive Global Uranium Index is designed to reflect the performance of the uranium mining industry. It is comprised of selected companies globally that are primarily engaged in some aspect of the uranium mining industry, such as mining, refining, exploration, and manufacturing of equipment for the uranium industry. The Fund is the nation’s first ETF focused exclusively on the uranium industry.

For the 12-month period ended October 31, 2011 (the “reporting period”), the Fund decreased 38.70%, while the Index decreased 38.12%. The Fund had a net asset value of $16.78 per share on November 4, 2010 and ended the period with a net asset value of $10.09 on October 31, 2011.

Six of the Fund’s twenty-two holdings as of October 31, 2011 increased in value for the reporting period, led by Hathor Exploration and Kalahari Minerals, which returned 72.71% and 24.43% respectively. The worst performers were Energy Resources of Australia and Berkeley Resources, which returned -75.70% and -80.93% respectively.

Growth of a $10,000 Investment

| AVERAGE ANNUAL TOTAL RETURN FOR THE PERIOD ENDED OCTOBER 31, 2011* |

||||||

| Cumulative Inception to Date | ||||||

| Net Asset Value | Market Price | |||||

| Global X Uranium ETF | (38.70%) | (39.93%) | ||||

| Solactive Global Uranium Index | (38.12%) | (38.12%) | ||||

*Fund commenced operations on November 4, 2010.

The performance data quoted herein represents past performance and the return and value of an investment in the Fund will fluctuate so that, when redeemed, may be worth less than its original cost. Past performance is no guarantee of future performance and should not be considered as a representation of the future results of the Fund. The Fund’s performance assumes the reinvestment of all dividends and all capital gains. Index returns assume reinvestment of dividends and, unlike a Fund’s returns, do not reflect any fees or expenses. If such fees and expenses were included in the index returns, the performance would have been lower. Please note that one cannot invest directly in an unmanaged index.

There are no assurances that the Fund will meet its stated objectives.

The Fund’s holdings and allocations are subject to change and should not be considered recommendations to buy individual securities.

Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

See definition of comparative index above.

4

Table of Contents

| MANAGEMENT DISCUSSION OF FUND PERFORMANCE |

| GLOBAL X LITHIUM ETF |

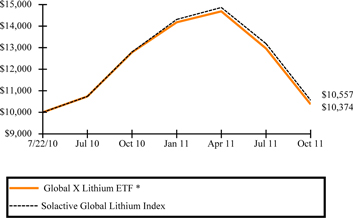

Global X Lithium ETF

The Global X Lithium ETF (the “Fund”) seeks to provide investment results that correspond generally to the price and yield performance, before fees and expenses, of the Solactive Global Lithium Index (the “Index”). The Fund generally seeks to replicate the Index but may at times invest in a representative sample of securities that collectively has an investment profile similar to the Index and as a result may or may not hold all the securities that are included in the Index.

The Index is designed to reflect the performance of the largest and most liquid listed companies that are active in the exploration and/or mining of Lithium or the production of Lithium batteries. The Fund is the first ETF globally focused exclusively on the lithium sector.

For the 12-month period ended October 31, 2011 (the “reporting period”), the Fund decreased 18.86%, while the Index decreased 17.52%. The Fund had a net asset value of $19.83 per share on October 31, 2010 and ended the period with a net asset value of $15.90 on October 31, 2011.

Three of the Fund’s twenty-one holdings as of October 31, 2011 increased in value for the reporting period, led by Rockwood Holdings and Sociedad Quimica y Minera de Chile ADR, which returned 35.73% and 17.18% respectively. The worst performers were Advanced Battery Technologies and Ener1, which returned -75.94% and -96.66% respectively.

Growth of a $10,000 Investment

|

AVERAGE ANNUAL TOTAL RETURN FOR THE YEAR ENDED OCTOBER 31, 2011* | ||||||||

| One Year Return | Annualized Inception to Date | |||||||

| Net Asset Value | Market Price | Net Asset Value | Market Price | |||||

| Global X Lithium ETF | (18.86%) | (20.82%) | 2.92% | 1.16% | ||||

| Solactive Global Lithium Index | (17.52%) | (17.52%) | 4.34% | 4.34% | ||||

*Fund commenced operations on November 4, 2010.

The performance data quoted herein represents past performance and the return and value of an investment in the Fund will fluctuate so that, when redeemed, may be worth less than its original cost. Past performance is no guarantee of future performance and should not be considered as a representation of the future results of the Fund. The Fund’s performance assumes the reinvestment of all dividends and all capital gains. Index returns assume reinvestment of dividends and, unlike a Fund’s returns, do not reflect any fees or expenses. If such fees and expenses were included in the index returns, the performance would have been lower. Please note that one cannot invest directly in an unmanaged index.

There are no assurances that the Fund will meet its stated objectives.

The Fund’s holdings and allocations are subject to change and should not be considered recommendations to buy individual securities.

Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

See definition of comparative index above.

5

Table of Contents

| MANAGEMENT DISCUSSION OF FUND PERFORMANCE |

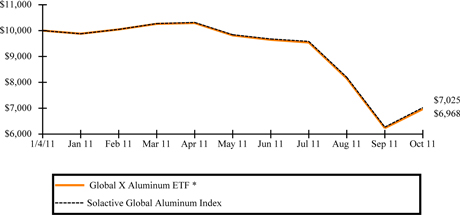

| GLOBAL X ALUMINUM ETF |

Global X Aluminum ETF

The Global X Aluminum ETF (the “Fund”) seeks to provide investment results that correspond generally to the price and yield performance, before fees and expenses, of the Solactive Global Aluminum Index (the “Index”). The Fund generally seeks to replicate the Index but may at times invest in a representative sample of securities that collectively has an investment profile similar to the Index and as a result may or may not hold all the securities that are included in the Index.

The Index is designed to reflect the performance of the global aluminum industry. The Solactive Global Aluminum Index tracks the performance of the largest and most liquid listed companies that are active in some aspect of the aluminum industry, such as bauxite aluminum ore mining, production, or refinement. The Fund is the nation’s first ETF focused exclusively on the aluminum industry.

For the period from the Fund’s commencement date on January 4, 2011 through October 31, 2011 (the “reporting period”), the Fund decreased 30.32% while the Index decreased 29.75%. The Fund commenced operations with a net asset value of $15.27 per share on January 4, 2011 and ended the period with a net asset value of $10.64 on October 31, 2011.

Three of the Fund’s twenty-two holdings as of October 31, 2011 increased in value for the reporting period, led by Alconix and Daiki Aluminum Industry, which returned 9.18% and 9.00% respectively. The worst performers were Aluminum Corp of China and Midas Holdings, which returned -46.02% and -55.82% respectively.

Growth of a $10,000 Investment

| AVERAGE ANNUAL TOTAL RETURN FOR THE PERIOD ENDED OCTOBER 31, 2011* | ||||

| Cumulative Inception to Date | ||||

| Net Asset Value | Market Price | |||

| Global X Aluminum ETF | (30.32%) | (31.37%) | ||

| Solactive Global Aluminum Index | (29.75%) | (29.75%) | ||

*Fund commenced operations on January 4, 2011.

The performance data quoted herein represents past performance and the return and value of an investment in the Fund will fluctuate so that, when redeemed, may be worth less than its original cost. Past performance is no guarantee of future performance and should not be considered as a representation of the future results of the Fund. The Fund’s performance assumes the reinvestment of all dividends and all capital gains. Index returns assume reinvestment of dividends and, unlike a Fund’s returns, do not reflect any fees or expenses. If such fees and expenses were included in the index returns, the performance would have been lower. Please note that one cannot invest directly in an unmanaged index.

There are no assurances that the Fund will meet its stated objectives.

The Fund’s holdings and allocations are subject to change and should not be considered recommendations to buy individual securities.

Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

See definition of comparative index above.

6

Table of Contents

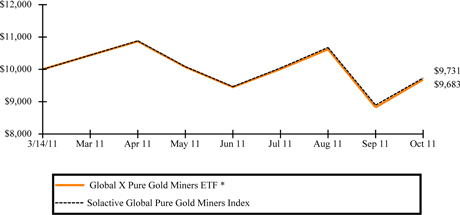

MANAGEMENT DISCUSSION OF FUND PERFORMANCE

GLOBAL X PURE GOLD MINERS ETF

Global X Pure Gold Miners ETF

The Global X Pure Gold Miners ETF (the “Fund”) seeks to provide investment results that correspond generally to the price and yield performance, before fees and expenses, of the Solactive Global Pure Gold Miners Index (the “Index”). The Fund generally seeks to replicate the Index but may at times invest in a representative sample of securities that collectively has an investment profile similar to the Index and as a result may or may not hold all the securities that are included in the Index.

The Solactive Global Pure Gold Miners Index tracks the performance of the largest and most liquid gold mining companies globally. Only companies that generate the vast majority of their business from gold mining are eligible to be included in the index. As of 2010, over 95% of the revenues from the companies in the Underlying Index were derived from gold mining, according to Structured Solutions AG.

For the period from the Fund’s commencement date on March 14, 2011 through October 31, 2011 (the “reporting period”), the Fund decreased 3.17% while the Index decreased 2.69%. The Fund commenced operations with a net asset value of $15.15 per share on March 14, 2011 and ended the period with a net asset value of $14.67 on October 31, 2011.

Sixteen of the Fund’s thirty holdings as of October 31, 2011 increased in value for the reporting period, led by Randgold Resources ADR and Alacer Gold, which returned 50.85% and 36.21% respectively. The worst performers were Zhaojin Mining Industry and Lake Shore Gold, which returned -61.01% and -62.98% respectively.

Growth of a $10,000 Investment

| AVERAGE ANNUAL TOTAL RETURN FOR THE PERIOD ENDED OCTOBER 31, 2011* |

||||||

| Cumulative Inception to Date | ||||||

| Net Asset Value | Market Price | |||||

| Global X Pure Gold Miners ETF |

(3.17%) | (3.43%) | ||||

| Solactive Global Pure Gold Miners Index |

(2.69%) | (2.69%) | ||||

*Fund commenced operations on March 14, 2011.

The performance data quoted herein represents past performance and the return and value of an investment in the Fund will fluctuate so that, when redeemed, may be worth less than its original cost. Past performance is no guarantee of future performance and should not be considered as a representation of the future results of the Fund. The Fund’s performance assumes the reinvestment of all dividends and all capital gains. Index returns assume reinvestment of dividends and, unlike a Fund’s returns, do not reflect any fees or expenses. If such fees and expenses were included in the index returns, the performance would have been lower. Please note that one cannot invest directly in an unmanaged index.

There are no assurances that the Fund will meet its stated objectives.

The Fund’s holdings and allocations are subject to change and should not be considered recommendations to buy individual securities.

Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

See definition of comparative index above.

7

Table of Contents

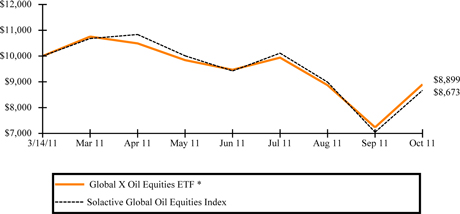

MANAGEMENT DISCUSSION OF FUND PERFORMANCE

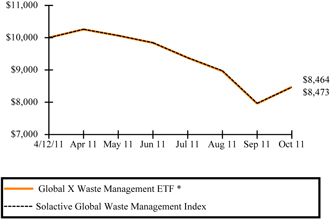

GLOBAL X OIL EQUITIES ETF

Global X Oil Equities ETF

The Global X Oil Equities ETF (the “Fund”) seeks to provide investment results that correspond generally to the price and yield performance, before fees and expenses, of the Solactive Global Oil Equities Index (the “Index”). The Fund generally seeks to replicate the Index but may at times invest in a representative sample of securities that collectively has an investment profile similar to the Index and as a result may or may not hold all the securities that are included in the Index.

The Solactive Global Oil Equities Index tracks the performance of 25 equal-weighted companies globally that have shown a high correlation to the spot price of oil. It is comprised of companies that derive the majority of their revenues from the exploration and production of oil and/or have significant oil reserves.

For the period from the Fund’s commencement date on March 14, 2011 through October 31, 2011 (the “reporting period”), the Fund decreased 11.01%, while the Index decreased 13.27%. The Fund commenced operations with a net asset value of $15.08 per share on March 14, 2011 and ended the period with a net asset value of $13.42 on October 31, 2011.

Six of the Fund’s twenty-five holdings as of October 31, 2011 increased in value for the reporting period, led by Petrohawk Energy and Range Resources, which returned 80.78%% and 38.09% respectively. The worst performers were Newfield Exploration and Forest Oil, which returned -43.34% and -51.19% respectively.

Growth of a $10,000 Investment

| AVERAGE ANNUAL TOTAL RETURN FOR THE PERIOD ENDED OCTOBER 31, 2011* |

||||||

| Cumulative Inception to Date | ||||||

| Net Asset Value | Market Price | |||||

| Global X Oil Equities ETF |

(11.01%) | (11.34%) | ||||

| Solactive Global Oil Equities Index |

(13.27%) | (13.27%) | ||||

*Fund commenced operations on March 14, 2011.

The performance data quoted herein represents past performance and the return and value of an investment in the Fund will fluctuate so that, when redeemed, may be worth less than its original cost. Past performance is no guarantee of future performance and should not be considered as a representation of the future results of the Fund. The Fund’s performance assumes the reinvestment of all dividends and all capital gains. Index returns assume reinvestment of dividends and, unlike a Fund’s returns, do not reflect any fees or expenses. If such fees and expenses were included in the index returns, the performance would have been lower. Please note that one cannot invest directly in an unmanaged index.

There are no assurances that the Fund will meet its stated objectives.

The Fund’s holdings and allocations are subject to change and should not be considered recommendations to buy individual securities.

Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

See definition of comparative index above.

8

Table of Contents

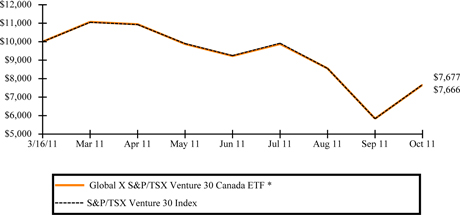

| MANAGEMENT DISCUSSION OF FUND PERFORMANCE |

| GLOBAL X S&P/TSX VENTURE 30 CANADA ETF |

Global X S&P/TSX Venture 30 Canada ETF

The Global X S&P/TSX Venture 30 Canada ETF (the “Fund”) seeks to provide investment results that correspond generally to the price and yield performance, before fees and expenses, of the S&P/TSX Venture 30 Index (the “Index”). The Fund generally seeks to replicate the Index but may at times invest in a representative sample of securities that collectively has an investment profile similar to the Index and as a result may or may not hold all the securities that are included in the Index.

The S&P/TSX Venture 30 Index is designed to provide exposure to 30 most liquid securities of the S&P/TSX Venture Composite Index. The Fund is the nation’s first ETF focused exclusively on the TSX Venture Exchange.

For the period from the Fund’s commencement date on March 16, 2011 through October 31, 2011 (the “reporting period”), the Fund decreased 23.34% while the Index decreased 23.23%. The Fund commenced operations with a net asset value of $15.04 per share on March 16, 2011 and ended the period with a net asset value of $11.53 on October 31, 2011.

Thirteen of the Fund’s thirty-two holdings as of October 31, 2011 increased in value for the reporting period, led by Hathor Exploration and Barisan Gold, which returned 153.89% and 107.50% respectively. The worst performers were Canaco Resources and East Asia Minerals, which returned -66.73% and -84.23% respectively.

| AVERAGE ANNUAL TOTAL RETURN FOR THE PERIOD ENDED OCTOBER 31, 2011* |

||||||

| Cumulative Inception to Date | ||||||

| Net Asset Value | Market Price | |||||

|

Global X S&P/TSX Venture 30 Canada ETF |

(23.34%) | (23.67%) | ||||

| S&P/TSX Venture 30 Index |

(23.23%) | (23.23%) | ||||

*Fund commenced operations on March 16, 2011.

The performance data quoted herein represents past performance and the return and value of an investment in the Fund will fluctuate so that, when redeemed, may be worth less than its original cost. Past performance is no guarantee of future performance and should not be considered as a representation of the future results of the Fund. The Fund’s performance assumes the reinvestment of all dividends and all capital gains. Index returns assume reinvestment of dividends and, unlike a Fund's returns, do not reflect any fees or expenses. If such fees and expenses were included in the index returns, the performance would have been lower. Please note that one cannot invest directly in an unmanaged index.

There are no assurances that the Fund will meet its stated objectives.

The Fund’s holdings and allocations are subject to change and should not be considered recommendations to buy individual securities.

Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

See definition of comparative index above.

9

Table of Contents

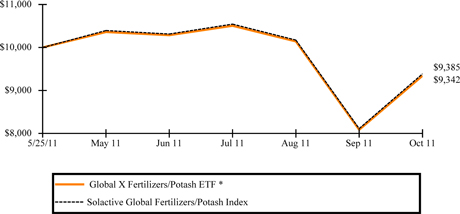

| MANAGEMENT DISCUSSION OF FUND PERFORMANCE |

| GLOBAL X FERTILIZERS/POTASH ETF |

Global X Fertilizers/Potash ETF

The Global X Fertilizers/Potash ETF (the “Fund”) seeks to provide investment results that correspond generally to the price and yield performance, before fees and expenses, of the Solactive Global Fertilizers/Potash Index (the “Index”). The Fund generally seeks to replicate the Index but may at times invest in a representative sample of securities that collectively has an investment profile similar to the Index and as a result may or may not hold all the securities that are included in the Index.

The Solactive Global Fertilizers/Potash Index tracks the performance of the largest and most liquid listed companies globally that are active in some aspect of the fertilizer industry. The Fund is the nation’s first ETF focused exclusively on the fertilizers industry.

For the period from the Fund’s commencement date on May 25, 2011 through October 31, 2011 (the “reporting period”), the Fund decreased 6.58%, while the Index decreased 6.15%. The Fund commenced operations with a net asset value of $15.05 per share on May 25, 2011 and ended the period with a net asset value of $14.06 on October 31, 2011.

Nine of the Fund’s twenty-eight holdings as of October 31, 2011 increased in value for the reporting period, led by Terra Nitrogen and Vale Fertilizantes, which returned 45.03% and 38.57% respectively. The worst performers were Allana Potash and Hanfeng Evergreen, which returned -42.31% and -44.33% respectively.

Growth of a $10,000 Investment

| AVERAGE ANNUAL TOTAL RETURN FOR THE PERIOD ENDED OCTOBER 31, 2011* |

||||||||

| Cumulative Inception to Date | ||||||||

| Net Asset Value | Market Price | |||||||

| Global X Fertilizers/Potash ETF |

(6.58%) | (6.71%) | ||||||

| Solactive Global Fertilizers/Potash Index |

(6.15%) | (6.15%) | ||||||

*Fund commenced operations on May 25, 2011.

The performance data quoted herein represents past performance and the return and value of an investment in the Fund will fluctuate so that, when redeemed, may be worth less than its original cost. Past performance is no guarantee of future performance and should not be considered as a representation of the future results of the Fund. The Fund’s performance assumes the reinvestment of all dividends and all capital gains. Index returns assume reinvestment of dividends and, unlike a Fund’s returns, do not reflect any fees or expenses. If such fees and expenses were included in the index returns, the performance would have been lower. Please note that one cannot invest directly in an unmanaged index.

There are no assurances that the Fund will meet its stated objectives.

The Fund’s holdings and allocations are subject to change and should not be considered recommendations to buy individual securities.

Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

See definition of comparative index above.

10

Table of Contents

| Schedule of Investments | October 31, 2011 |

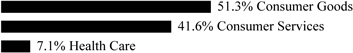

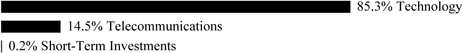

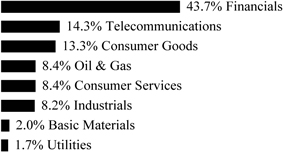

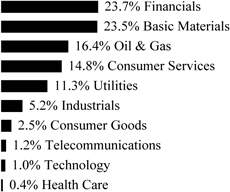

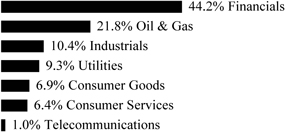

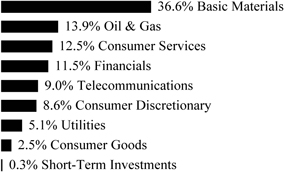

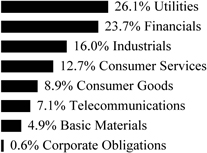

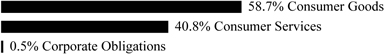

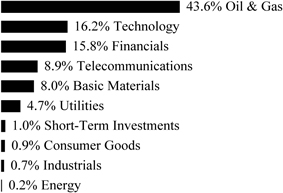

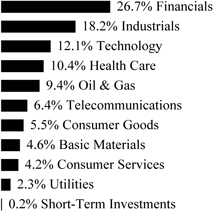

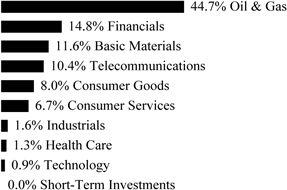

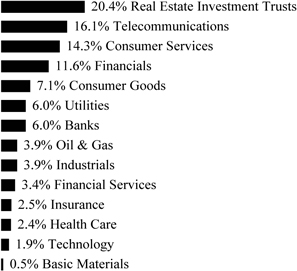

Sector Weightings (unaudited)†:

† Percentages based on total investments.

| Shares | Value | |||||||

| COMMON STOCK — 100.0% |

||||||||

| AUSTRALIA— 8.2% |

||||||||

| Basic Materials — 8.2% |

||||||||

| Ampella Mining * |

571,821 | $ | 1,090,675 | |||||

| Gryphon Minerals * |

783,214 | 1,151,360 | ||||||

|

|

|

|||||||

| TOTAL AUSTRALIA |

2,242,035 | |||||||

|

|

|

|||||||

| CANADA— 86.3% |

||||||||

| Basic Materials — 86.3% |

||||||||

| Atac Resources * |

167,515 | 705,892 | ||||||

| Auryx Gold * |

547,753 | 456,140 | ||||||

| Canaco Resources * |

440,409 | 720,243 | ||||||

| Chesapeake Gold * |

118,294 | 1,609,378 | ||||||

| Continental Gold * |

219,487 | 1,796,944 | ||||||

| Eco Oro Minerals * |

164,172 | 415,083 | ||||||

| Exeter Resource * |

291,296 | 1,052,138 | ||||||

| Extorre Gold Mines * |

127,802 | 951,431 | ||||||

| Gold Canyon Resources * |

273,137 | 802,941 | ||||||

| Guyana Goldfields * |

193,586 | 1,701,428 | ||||||

| International Tower Hill Mines * |

211,891 | 1,067,215 | ||||||

| Kaminak Gold, Cl A * |

234,922 | 700,028 | ||||||

| Keegan Resources * |

201,125 | 1,200,656 | ||||||

| Levon Resources * |

642,983 | 832,194 | ||||||

| Lydian International * |

231,769 | 558,087 | ||||||

| Newstrike Capital * |

213,672 | 621,700 | ||||||

| Novagold Resources * |

161,630 | 1,491,845 | ||||||

| Rainy River Resources * |

138,800 | 1,033,306 | ||||||

| Rubicon Minerals * |

387,658 | 1,571,324 | ||||||

| Sabina Gold & Silver * |

273,110 | 1,183,742 | ||||||

| Seabridge Gold * |

58,060 | 1,378,925 | ||||||

| Tigray Resources * |

53,928 | 78,455 | ||||||

| Trelawney Mining and Exploration * |

310,649 | 1,140,740 | ||||||

| Volta Resources * |

415,374 | 575,114 | ||||||

|

|

|

|||||||

| TOTAL CANADA |

23,644,949 | |||||||

|

|

|

|||||||

The accompanying notes are an integral part of the financial statements.

11

Table of Contents

| Schedule of Investments | October 31, 2011 |

Global X Gold Explorers ETF

| Shares/Face Amount |

Value | |||||||

| COMMON STOCK — continued |

||||||||

| HONG KONG— 5.5% |

||||||||

| Basic Materials — 5.5% |

||||||||

| China Precious Metal Resources Holdings * |

7,684,290 | $ | 1,503,523 | |||||

|

|

|

|||||||

| TOTAL COMMON STOCK |

27,390,507 | |||||||

|

|

|

|||||||

| TIME DEPOSIT — 0.1% |

||||||||

| Brown Brothers Harriman, 0.030% |

$ | 15,042 | 15,042 | |||||

|

|

|

|||||||

| TOTAL INVESTMENTS — 100.1% |

$ | 27,405,549 | ||||||

|

|

|

|||||||

| Percentages are based on Net Assets of $27,391,860. |

||||||||

| * Non-income producing security. |

||||||||

Cl — Class

The following is a summary of the inputs used as of October 31, 2011, in valuing the Fund’s investments carried at value:

| Investments in Securities | Level 1 | Level 2 | Level 3 | Total | ||||||||||||

| Common Stock |

$ | 27,390,507 | $ | — | $ | — | $ | 27,390,507 | ||||||||

| Time Deposit |

— | 15,042 | — | 15,042 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total Investments in Securities |

$ | 27,390,507 | $ | 15,042 | $ | — | $ | 27,405,549 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

For the period ended October 31, 2011, there have been no significant transfers between Level 1 & Level 2 investments.

For the period ended October 31, 2011, there were no Level 3 investments.

The accompanying notes are an integral part of the financial statements.

12

Table of Contents

| Schedule of Investments | October 31, 2011 | |||

Sector Weightings (unaudited)†:

† Percentages based on total investments.

| Shares | Value | |||||||

| COMMON STOCK — 99.9% |

||||||||

| AUSTRALIA— 0.4% |

||||||||

| Basic Materials — 0.4% |

||||||||

| Alcyone Resources * |

12,666,302 | $ | 1,334,770 | |||||

|

|

|

|||||||

| CANADA— 48.9% |

||||||||

| Basic Materials — 48.9% |

||||||||

| Alexco Resource * |

615,758 | 4,716,706 | ||||||

| Aurcana * |

3,860,045 | 2,904,619 | ||||||

| Bear Creek Mining * |

828,692 | 3,184,399 | ||||||

| Endeavour Silver * |

912,017 | 9,886,264 | ||||||

| Excellon Resources * |

3,017,462 | 1,937,570 | ||||||

| First Majestic Silver * |

986,090 | 16,749,778 | ||||||

| Fortuna Silver Mines * |

1,357,778 | 8,623,191 | ||||||

| Great Panther Silver * |

1,451,205 | 3,814,746 | ||||||

| Impact Silver * |

643,756 | 1,324,069 | ||||||

| MAG Silver * |

483,125 | 4,536,544 | ||||||

| Minco Silver * |

310,324 | 716,108 | ||||||

| Minefinders * |

883,884 | 12,524,636 | ||||||

| Orko Silver * |

1,404,712 | 2,875,100 | ||||||

| Pan American Silver |

607,597 | 16,988,412 | ||||||

| Scorpio Mining * |

2,114,701 | 4,285,839 | ||||||

| Silver Standard Resources * |

879,471 | 17,228,837 | ||||||

| Silver Wheaton |

1,261,441 | 43,645,859 | ||||||

| Silvercorp Metals |

1,816,031 | 17,161,493 | ||||||

| Silvermex Resources * |

2,453,371 | 1,206,132 | ||||||

| US Silver * |

3,249,359 | 1,793,065 | ||||||

| Wildcat Silver * |

1,029,656 | 1,570,259 | ||||||

|

|

|

|||||||

| TOTAL CANADA |

177,673,626 | |||||||

|

|

|

|||||||

| MEXICO— 23.2% |

||||||||

| Basic Materials — 23.2% |

||||||||

| Fresnillo |

1,607,582 | 43,898,848 | ||||||

| Industrias Penoles |

998,942 | 40,198,416 | ||||||

|

|

|

|||||||

| TOTAL MEXICO |

84,097,264 | |||||||

|

|

|

|||||||

| PERU— 3.4% |

||||||||

| Basic Materials — 3.4% |

||||||||

| Hochschild Mining |

1,741,736 | 12,540,409 | ||||||

|

|

|

|||||||

The accompanying notes are an integral part of the financial statements.

13

Table of Contents

| Schedule of Investments | October 31, 2011 |

Global X Silver Miners ETF

| Shares/Face Amount |

Value | |||||||

| COMMON STOCK — continued |

||||||||

| RUSSIA— 4.9% |

||||||||

| Basic Materials — 4.9% |

||||||||

| Polymetal GDR * |

1,093,115 | $ | 17,828,706 | |||||

|

|

|

|||||||

| UNITED KINGDOM— 4.1% |

||||||||

| Basic Materials — 4.1% |

||||||||

| Polymetal International * |

1,015,559 | 15,025,720 | ||||||

|

|

|

|||||||

| UNITED STATES— 15.0% |

||||||||

| Basic Materials — 15.0% |

||||||||

| Coeur d’Alene Mines * |

672,428 | 17,193,984 | ||||||

| Golden Minerals * |

211,206 | 1,480,554 | ||||||

| Hecla Mining * |

2,750,468 | 17,245,434 | ||||||

| Mines Management * |

268,007 | 670,018 | ||||||

| Revett Minerals * |

240,443 | 1,001,142 | ||||||

| Tahoe Resources * |

885,548 | 16,712,309 | ||||||

|

|

|

|||||||

| TOTAL UNITED STATES |

54,303,441 | |||||||

|

|

|

|||||||

| TOTAL COMMON STOCK |

362,803,936 | |||||||

|

|

|

|||||||

| TIME DEPOSIT — 0.0% |

||||||||

| Brown Brothers Harriman, 0.030% |

$ | 143,985 | 143,985 | |||||

|

|

|

|||||||

| TOTAL INVESTMENTS — 99.9% |

$ | 362,947,921 | ||||||

|

|

|

|||||||

Percentages are based on Net Assets of $363,105,604.

| * | Non-income producing security. |

GDR — Global Depositary Receipt

The following is a summary of the inputs used as of October 31, 2011, in valuing the Fund’s investments carried at value:

| Investments in Securities | Level 1 | Level 2 | Level 3 | Total | ||||||||||||

| Common Stock |

$ | 362,803,936 | $ | — | $ | — | $ | 362,803,936 | ||||||||

| Time Deposit |

— | 143,985 | — | 143,985 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total Investments in Securities |

$ | 362,803,936 | $ | 143,985 | $ | — | $ | 362,947,921 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

For the year ended October 31, 2011, there have been no significant transfers between Level 1 & Level 2 investments.

For the year ended October 31, 2011, there were no Level 3 investments.

The accompanying notes are an integral part of the financial statements.

14

Table of Contents

| Schedule of Investments | October 31, 2011 | |||

Sector Weightings (unaudited)†:

† Percentages based on total investments.

| Shares | Value | |||||||

| COMMON STOCK — 99.8% |

||||||||

| AUSTRALIA— 7.3% |

||||||||

| Basic Materials — 7.3% |

||||||||

| Aditya Birla Minerals |

220,074 | $ | 228,434 | |||||

| Cudeco * |

187,190 | 617,424 | ||||||

| OZ Minerals |

178,492 | 2,185,655 | ||||||

| Straits Resources * |

361,757 | 264,947 | ||||||

|

|

|

|||||||

| TOTAL AUSTRALIA |

3,296,460 | |||||||

|

|

|

|||||||

| CANADA— 46.6% |

||||||||

| Basic Materials— 46.6% |

||||||||

| Augusta Resource * |

140,237 | 535,705 | ||||||

| Capstone Mining * |

525,431 | 1,781,837 | ||||||

| Copper Mountain Mining (CAD) * |

134,331 | 717,007 | ||||||

| Copper Mountain Mining (USD) * |

12,300 | 67,021 | ||||||

| Duluth Metals * |

153,823 | 412,067 | ||||||

| First Quantum Minerals |

101,374 | 2,126,749 | ||||||

| HudBay Minerals, Cl B |

197,082 | 2,159,261 | ||||||

| Imperial Metals * |

51,224 | 1,081,835 | ||||||

| Inmet Mining |

36,915 | 2,203,715 | ||||||

| Ivanhoe Mines * |

108,364 | 2,222,546 | ||||||

| Katanga Mining * |

350,942 | 499,988 | ||||||

| Lundin Mining * |

551,734 | 2,164,422 | ||||||

| Mercator Minerals * |

387,000 | 788,211 | ||||||

| Northern Dynasty Minerals * |

110,609 | 908,100 | ||||||

| Polymet Mining * |

201,603 | 272,164 | ||||||

| Quadra FNX Mining * |

188,049 | 2,169,724 | ||||||

| Taseko Mines * |

302,053 | 1,105,514 | ||||||

|

|

|

|||||||

| TOTAL CANADA |

21,215,866 | |||||||

|

|

|

|||||||

| CHINA— 4.8% |

||||||||

| Basic Materials— 4.8% |

||||||||

| Jiangxi Copper, Cl H |

882,023 | 2,191,291 | ||||||

|

|

|

|||||||

| MEXICO— 4.7% |

||||||||

| Basic Materials— 4.7% |

||||||||

| Grupo Mexico, Cl B |

770,053 | 2,135,567 | ||||||

|

|

|

|||||||

The accompanying notes are an integral part of the financial statements.

15

Table of Contents

| Schedule of Investments | October 31, 2011 |

Global X Copper Miners ETF

| Shares/Number of Warrants/Face Amount |

Value | |||||||

| COMMON STOCK—continued |

||||||||

| POLAND— 4.6% |

||||||||

| Basic Materials — 4.6% |

||||||||

| KGHM Polska Miedz * |

43,047 | $ | 2,091,303 | |||||

|

|

|

|||||||

| SOUTH AFRICA— 3.1% |

||||||||

| Basic Materials — 3.1% |

||||||||

| Metorex * |

1,305,676 | 1,347,645 | ||||||

| Palabora Mining |

5,554 | 80,284 | ||||||

|

|

|

|||||||

| TOTAL SOUTH AFRICA |

1,427,929 | |||||||

|

|

|

|||||||

| SWITZERLAND— 4.6% |

||||||||

| Basic Materials — 4.6% |

||||||||

| Xstrata |

125,397 | 2,108,402 | ||||||

|

|

|

|||||||

| TURKEY— 1.1% |

||||||||

| Basic Materials — 1.1% |

||||||||

| Park Elektrik Uretim Madencilik Sanayi ve Ticaret * |

235,500 | 510,508 | ||||||

|

|

|

|||||||

| UNITED KINGDOM— 13.6% |

||||||||

| Basic Materials — 13.6% |

||||||||

| Antofagasta |

110,630 | 2,076,281 | ||||||

| Kazakhmys |

137,307 | 2,048,089 | ||||||

| Vedanta Resources |

99,221 | 2,039,279 | ||||||

|

|

|

|||||||

| TOTAL UNITED KINGDOM |

6,163,649 | |||||||

|

|

|

|||||||

| UNITED STATES— 9.4% |

||||||||

| Basic Materials — 9.4% |

||||||||

| Freeport-McMoRan Copper & Gold |

53,144 | 2,139,577 | ||||||

| Southern Copper |

70,073 | 2,149,840 | ||||||

|

|

|

|||||||

| TOTAL UNITED STATES |

4,289,417 | |||||||

|

|

|

|||||||

| TOTAL COMMON STOCK |

45,430,392 | |||||||

|

|

|

|||||||

| WARRANTS — 0.0% |

||||||||

| CANADA — 0.0% |

||||||||

| Duluth Exploration*, expiration date 1/18/13 1,2 |

11,771 | — | ||||||

|

|

|

|||||||

| TIME DEPOSIT — 0.1% |

||||||||

| Brown Brothers Harriman, 0.030% |

$ | 60,821 | 60,821 | |||||

|

|

|

|||||||

| TOTAL INVESTMENTS — 99.9% |

$ | 45,491,213 | ||||||

|

|

|

|||||||

Percentages are based on Net Assets of $45,517,213.

The accompanying notes are an integral part of the financial statements.

16

Table of Contents

| Schedule of Investments | October 31, 2011 |

Global X Copper Miners ETF

| * | Non-income producing security. |

| 1 | Security is fair valued using methods determined in good faith by the Fair Value Committee of the Fund. The total value of such security as of October 31 2011 was $0 and represents 0.0% of Net Assets. |

| 2 | Securities considered illiquid. The total value of such security as of October 31, 2011 was $0 and represents 0.0% of Net Assets. |

CAD — Canadian Dollar

Cl — Class

USD — U.S. Dollar

The following is a summary of the inputs used as of October 31, 2011, in valuing the Fund’s investments carried at value:

| Investments in Securities | Level 1 | Level 2 | Level 3 | Total | ||||||||||||

| Common Stock |

$ | 45,430,392 | $ | — | $ | — | $ | 45,430,392 | ||||||||

| Warrants |

— | — | — | — | ||||||||||||

| Time Deposit |

— | 60,821 | — | 60,821 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total Investments in Securities |

$ | 45,430,392 | $ | 60,821 | $ | — | $ | 45,491,213 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

For the year ended October 31, 2011, there have been no significant transfers between Level 1 & Level 2 investments.

For the year ended October 31, 2011, there were no Level 3 investments.

The accompanying notes are an integral part of the financial statements.

17

Table of Contents

| Schedule of Investments | October 31, 2011 |

Sector Weightings (unaudited)†:

| Shares | Value | |||||||

| COMMON STOCK — 100.1% |

||||||||

| AUSTRALIA— 21.2% |

||||||||

| Basic Materials — 21.2% |

||||||||

| Bannerman Resources * |

5,646,250 | $ | 1,636,249 | |||||

| Berkeley Resources * |

4,437,698 | 1,519,840 | ||||||

| Deep Yellow * |

12,317,039 | 1,622,456 | ||||||

| Energy Resources of Australia * |

3,552,315 | 7,430,682 | ||||||

| Extract Resources * |

1,381,351 | 11,237,715 | ||||||

| Greenland Minerals & Energy * |

7,920,096 | 4,423,469 | ||||||

| Paladin Energy * |

9,060,790 | 14,322,340 | ||||||

|

|

|

|||||||

| TOTAL AUSTRALIA |

42,192,751 | |||||||

|

|

|

|||||||

| CANADA— 53.7% |

||||||||

| Basic Materials — 53.7% |

||||||||

| Cameco |

1,880,949 | 40,366,709 | ||||||

| Denison Mines * |

5,639,724 | 8,883,683 | ||||||

| Forsys Metals * |

1,782,093 | 1,233,715 | ||||||

| Hathor Exploration * |

2,980,223 | 13,724,515 | ||||||

| Laramide Resources * |

1,657,534 | 1,563,241 | ||||||

| Mega Uranium * |

7,879,485 | 2,529,784 | ||||||

| Rockgate Capital* |

3,478,759 | 4,048,721 | ||||||

| Uex * |

4,821,685 | 3,579,860 | ||||||

| Uranium One |

10,321,616 | 31,067,370 | ||||||

|

|

|

|||||||

| TOTAL CANADA |

106,997,598 | |||||||

|

|

|

|||||||

| SOUTH AFRICA— 0.9% |

||||||||

| Basic Materials — 0.9% |

||||||||

| First Uranium * |

6,368,957 | 1,757,262 | ||||||

|

|

|

|||||||

| UNITED KINGDOM— 5.7% |

||||||||

| Basic Materials — 5.7% |

||||||||

| Kalahari Minerals * |

3,115,703 | 11,487,028 | ||||||

|

|

|

|||||||

| UNITED STATES— 18.6% |

||||||||

| Basic Materials — 18.6% |

||||||||

| Uranerz Energy * |

2,875,414 | 6,555,944 | ||||||

| Uranium Energy * |

3,020,489 | 10,148,843 | ||||||

| Uranium Resources * |

6,728,240 | 8,073,888 | ||||||

| Ur-Energy * |

3,808,383 | 4,912,814 | ||||||

The accompanying notes are an integral part of the financial statements.

18

Table of Contents

| Schedule of Investments | October 31, 2011 |

Global X Uranium ETF

| Shares | Value | |||||||

| COMMON STOCK — continued |

||||||||

| Basic Materials — continued |

||||||||

| USEC * |

|

3,496,425 |

|

$ | 7,342,493 | |||

|

|

|

|||||||

| TOTAL UNITED STATES |

37,033,982 | |||||||

|

|

|

|||||||

| TOTAL COMMON STOCK |

199,468,621 | |||||||

|

|

|

|||||||

| TOTAL INVESTMENTS — 100.1% |

$ | 199,468,621 | ||||||

|

|

|

|||||||

| Percentages are based on Net Assets of $199,348,996. |

||||||||

| * | Non-income producing security. |

The following is a summary of the inputs used as of October 31, 2011, in valuing the Fund’s investments carried at value:

| Investments in Securities | Level 1 | Level 2 | Level 3 | Total | ||||||||||||

| Common Stock |

$ | 199,468,621 | $ | — | $ | — | $ | 199,468,621 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total Investments in Securities |

$ | 199,468,621 | $ | — | $ | — | $ | 199,468,621 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Level 1 | Level 2 | Level 3 | Total | |||||||||||||

| Other Financial Instruments** |

$ | — | $ | 44,193 | $ | — | $ | 44,193 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

** Other Financial Instruments includes net unrealized appreciation on spot foreign currency contracts.

For the period ended October 31, 2011, there have been no significant transfers between Level 1 & Level 2 investments.

For the period ended October 31, 2011, there were no Level 3 investments.

The accompanying notes are an integral part of the financial statements.

19

Table of Contents

| Schedule of Investments | October 31, 2011 |

Sector Weightings (unaudited)†:

† Percentages based on total investments.

| Shares | Value | |||||||

| COMMON STOCK — 99.9% |

||||||||

| AUSTRALIA— 11.5% |

||||||||

| Basic Materials — 11.5% |

||||||||

| Galaxy Resources * |

7,058,653 | $ | 4,834,948 | |||||

| Orocobre * |

2,022,540 | 2,536,301 | ||||||

| Reed Resources * |

5,077,303 | 1,952,912 | ||||||

| Talison Lithium * |

854,808 | 2,976,005 | ||||||

|

|

|

|||||||

| TOTAL AUSTRALIA |

12,300,166 | |||||||

|

|

|

|||||||

| CANADA— 10.1% |

||||||||

| Basic Materials — 9.2% |

||||||||

| Avalon Rare Metals * |

849,507 | 2,829,702 | ||||||

| Canada Lithium * |

7,407,619 | 3,790,394 | ||||||

| Lithium Americas * |

1,296,751 | 1,353,086 | ||||||

| Lithium One * |

1,871,434 | 1,933,959 | ||||||

|

|

|

|||||||

| 9,907,141 | ||||||||

|

|

|

|||||||

| Industrials — 0.9% |

||||||||

| Electrovaya * |

801,485 | 997,132 | ||||||

|

|

|

|||||||

| TOTAL CANADA |

10,904,273 | |||||||

|

|

|

|||||||

| CHILE— 24.3% |

||||||||

| Basic Materials — 24.3% |

||||||||

| Sociedad Quimica y Minera de Chile ADR |

446,020 | 26,092,170 | ||||||

|

|

|

|||||||

| CHINA— 1.1% |

||||||||

| Industrials — 1.1% |

||||||||

| China BAK Battery * |

1,261,185 | 1,160,416 | ||||||

|

|

|

|||||||

| FRANCE— 5.3% |

||||||||

| Industrials — 5.3% |

||||||||

| Saft Groupe |

187,961 | 5,723,063 | ||||||

|

|

|

|||||||

| HONG KONG— 1.0% |

||||||||

| Industrials — 1.0% |

||||||||

| Coslight Technology International Group * |

3,667,792 | 1,071,750 | ||||||

|

|

|

|||||||

| JAPAN— 5.2% |

||||||||

| Basic Materials — 5.2% |

||||||||

| GS Yuasa |

1,033,000 | 5,525,902 | ||||||

|

|

|

|||||||

The accompanying notes are an integral part of the financial statements.

20

Table of Contents

| Schedule of Investments | October 31, 2011 |

Global X Lithium ETF

| Shares | Value | |||||||

| COMMON STOCK — continued |

||||||||

| UNITED STATES— 41.4% |

||||||||

| Basic Materials — 29.1% |

||||||||

| FMC |

253,529 | $ | 20,000,903 | |||||

| Rockwood Holdings * |

242,383 | 11,159,313 | ||||||

|

|

|

|||||||

| 31,160,216 | ||||||||

|

|

|

|||||||

| Industrials — 12.3% |

||||||||

| A123 Systems * |

1,083,314 | 3,715,767 | ||||||

| Advanced Battery Technologies * |

2,259,529 | 2,147,682 | ||||||

| Exide Technologies * |

666,838 | 3,000,771 | ||||||

| Ultralife * |

386,893 | 1,748,756 | ||||||

| Valence Technology * |

2,704,644 | 2,593,754 | ||||||

|

|

|

|||||||

| 13,206,730 | ||||||||

|

|

|

|||||||

| TOTAL UNITED STATES |

44,366,946 | |||||||

|

|

|

|||||||

| TOTAL COMMON STOCK |

107,144,686 | |||||||

|

|

|

|||||||

| TOTAL INVESTMENTS — 99.9% |

$ | 107,144,686 | ||||||

|

|

|

|||||||

Percentages are based on Net Assets of $107,300,624.

| * | Non-income producing security. |

ADR — American Depositary Receipt

The following is a summary of the inputs used as of October 31, 2011, in valuing the Fund’s investments carried at value:

| Investments in Securities | Level 1 | Level 2 | Level 3 | Total | ||||||||||||

| Common Stock |

$ | 107,144,686 | $ | — | $ | — | $ | 107,144,686 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total Investments in Securities |

$ | 107,144,686 | $ | — | $ | — | $ | 107,144,686 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

For the year ended October 31, 2011, there have been no significant transfers between Level 1 & Level 2 investments.

For the year ended October 31, 2011, there were no Level 3 investments.

The accompanying notes are an integral part of the financial statements.

21

Table of Contents

| Schedule of Investments | October 31, 2011 |

Sector Weightings (unaudited)†:

† Percentages based on total investments.

| Shares | Value | |||||||

| COMMON STOCK — 100.1% |

||||||||

| AUSTRALIA— 6.1% |

||||||||

| Basic Materials — 6.1% |

||||||||

| Alumina |

144,553 | $ | 225,448 | |||||

|

|

|

|||||||

| CHINA— 15.3% |

||||||||

| Basic Materials — 15.3% |

||||||||

| Aluminum Corp of China, Cl H |

280,062 | 156,461 | ||||||

| China Hongqiao Group * |

369,535 | 218,815 | ||||||

| China Zhongwang Holdings * |

513,860 | 171,981 | ||||||

| XinRen Aluminum Holdings * |

98,666 | 24,370 | ||||||

|

|

|

|||||||

| TOTAL CHINA |

571,627 | |||||||

|

|

|

|||||||

| GREECE— 4.1% |

||||||||

| Basic Materials — 4.1% |

||||||||

| Mytilineos Holdings |

32,843 | 153,638 | ||||||

|

|

|

|||||||

| HONG KONG— 4.9% |

||||||||

| Basic Materials — 4.9% |

||||||||

| Minmetals Resources * 1 |

357,384 | 183,557 | ||||||

|

|

|

|||||||

| JAPAN— 12.8% |

||||||||

| Basic Materials — 12.8% |

||||||||

| Alconix |

1,798 | 39,922 | ||||||

| Nippon Light Metal |

115,349 | 171,237 | ||||||

| Sky Aluminum |

31,799 | 96,040 | ||||||

| Sumitomo Light Metal Industries |

193,517 | 168,405 | ||||||

|

|

|

|||||||

| TOTAL JAPAN |

475,604 | |||||||

|

|

|

|||||||

| MALAYSIA— 1.6% |

||||||||

| Basic Materials — 1.6% |

||||||||

| Press Metal |

94,840 | 59,681 | ||||||

|

|

|

|||||||

| NORWAY— 6.6% |

||||||||

| Basic Materials — 6.6% |

||||||||

| Norsk Hydro |

46,890 | 245,064 | ||||||

|

|

|

|||||||

| RUSSIA— 4.5% |

||||||||

| Basic Materials — 4.5% |

||||||||

| United RUSAL * |

180,046 | 166,870 | ||||||

|

|

|

|||||||

The accompanying notes are an integral part of the financial statements.

22

Table of Contents

| Schedule of Investments | October 31, 2011 |

Global X Aluminum ETF

| Shares | Value | |||||||

| COMMON STOCK — continued |

||||||||

| SINGAPORE— 3.3% |

||||||||

| Basic Materials — 3.3% |

||||||||

| Midas Holdings |

|

372,774 |

|

$ | 123,258 | |||

|

|

|

|||||||

| SOUTH KOREA— 0.9% |

||||||||

| Basic Materials — 0.9% |

||||||||

| Daeho AL |

6,518 | 15,653 | ||||||

| Dayou Smart Aluminum |

12,103 | 15,566 | ||||||

|

|

|

|||||||

| TOTAL SOUTH KOREA |

31,219 | |||||||

|

|

|

|||||||

| UNITED KINGDOM— 16.1% |

||||||||

| Basic Materials — 16.1% |

||||||||

| Rio Tinto |

10,997 | 598,652 | ||||||

|

|

|

|||||||

| UNITED STATES— 23.9% |

||||||||

| Basic Materials — 23.9% |

||||||||

| Alcoa |

34,601 | 372,306 | ||||||

| Century Aluminum * |

18,648 | 208,112 | ||||||

| Kaiser Aluminum |

4,331 | 201,218 | ||||||

| Noranda Aluminum Holding |

11,704 | 108,379 | ||||||

|

|

|

|||||||

| TOTAL UNITED STATES |

890,015 | |||||||

|

|

|

|||||||

| TOTAL COMMON STOCK |

3,724,633 | |||||||

|

|

|

|||||||

| TOTAL INVESTMENTS — 100.1% |

$ | 3,724,633 | ||||||

|

|

|

|||||||

Percentages are based on Net Assets of $3,722,753.

| * | Non-income producing security. |

| 1 | Security is fair valued using methods determined in good faith by the Fair Value Committee of the Fund. The total value of such security as of October 31 2011 was $183,557 and represents 4.9% of Net Assets. |

Cl — Class

The accompanying notes are an integral part of the financial statements.

23

Table of Contents

| Schedule of Investments | October 31, 2011 |

Global X Aluminum ETF

The following is a summary of the inputs used as of October 31, 2011, in valuing the Fund’s investments carried at value:

| Investments in Securities | Level 1 | Level 2 | Level 3 | Total | ||||||||||||

| Common Stock |

||||||||||||||||

| Australia |

$ | 225,448 | $ | - | $ | - | $ | 225,448 | ||||||||

| China |

571,627 | - | - | 571,627 | ||||||||||||

| Greece |

153,638 | - | - | 153,638 | ||||||||||||

| Hong Kong |

- | - | 183,557 | 183,557 | ||||||||||||

| Japan |

475,604 | - | - | 475,604 | ||||||||||||

| Malaysia |

59,681 | - | - | 59,681 | ||||||||||||

| Norway |

245,064 | - | - | 245,064 | ||||||||||||

| Russia |

166,870 | - | - | 166,870 | ||||||||||||

| Singapore |

123,258 | - | - | 123,258 | ||||||||||||

| South Korea |

31,219 | - | - | 31,219 | ||||||||||||

| United Kingdom |

598,652 | - | - | 598,652 | ||||||||||||

| United States |

890,015 | - | - | 890,015 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total Investments in Securities |

$ | 3,541,076 | $ | - | $ | 183,557 | $ | 3,724,633 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

The following is a reconciliation of investments in which significant unobservable inputs (Level 3) were used in determining fair value:

| Hong Kong | ||||

| Investments in Common Stock |

||||

| Beginning balance as of January 4, 2011 |

$ | - | ||

| Accrued discounts/premiums |

- | |||

| Realized gain/(loss) |

- | |||

| Change in unrealized appreciation/(depreciation) |

- | |||

| Net purchases |

- | |||

| Net sales |

- | |||

| Transfers into Level 3 |

183,557 | |||

| Transfers out of Level 3 |

- | |||

|

|

|

|||

| Ending balance as of October 31, 2011 |

$ | 183,557 | ||

|

|

|

|||

Net change in unrealized appreciation (depreciation) from investments (Level 3) still held as of October 31, 2011 is $—.

For the period ended October 31, 2011, there have been no significant transfers between Level 1 & Level 2 investments.

For the period ended October 31, 2011, transfers between Level 1 and Level 3 assets and liabilities totaled $183,557.

The Level 3 investment presented above was considered a Level 1 investment at the beginning of the reporting period. The reason for the transfer was a temporary trading suspension of the investment’s shares, which necessitated a fair value determination by the Fair Value Committee at the end of the reporting period. The Fund’s policy is to transfer investments into/out of Level 3 at the end of the reporting period.

The accompanying notes are an integral part of the financial statements.

24

Table of Contents

| Schedule of Investments | October 31, 2011 |

Sector Weightings (unaudited)†:

† Percentages based on total investments.

| Shares | Value | |||||||

| COMMON STOCK — 99.6% |

||||||||

| AUSTRALIA— 9.4% |

||||||||

| Basic Materials — 9.4% |

||||||||

| Centamin Egypt * |

97,524 | $ | 172,209 | |||||

| CGA Mining * |

27,448 | 68,296 | ||||||

| Medusa Mining |

15,933 | 111,654 | ||||||

| Perseus Mining * |

39,532 | 130,392 | ||||||

|

|

|

|||||||

| TOTAL AUSTRALIA |

482,551 | |||||||

|

|

|

|||||||

| CANADA— 38.0% |

||||||||

| Basic Materials — 38.0% |

||||||||

| Alamos Gold |

11,346 | 210,027 | ||||||

| Aurizon Mines * |

14,999 | 84,874 | ||||||

| Centerra Gold |

12,528 | 248,373 | ||||||

| China Gold International Resources * |

23,665 | 71,467 | ||||||

| Detour Gold * |

7,138 | 236,334 | ||||||

| Eldorado Gold |

13,486 | 253,429 | ||||||

| Kinross Gold |

15,252 | 217,448 | ||||||

| Kirkland Lake Gold * |

5,619 | 105,029 | ||||||

| Lake Shore Gold * |

35,251 | 52,344 | ||||||

| Osisko Mining * |

18,172 | 219,151 | ||||||

| Romarco Minerals * |

49,129 | 48,306 | ||||||

| SEMAFO * |

26,618 | 204,302 | ||||||

|

|

|

|||||||

| TOTAL CANADA |

1,951,084 | |||||||

|

|

|

|||||||

| CHINA— 3.4% |

||||||||

| Basic Materials — 3.4% |

||||||||

| Real Gold Mining 1,2 |

22,800 | 17,433 | ||||||

| Zhaojin Mining Industry |

85,545 | 153,724 | ||||||

|

|

|

|||||||

| TOTAL CHINA |

171,157 | |||||||

|

|

|

|||||||

| JERSEY— 5.4% |

||||||||

| Basic Materials — 5.4% |

||||||||

| Randgold Resources ADR |

2,532 | 277,431 | ||||||

|

|

|

|||||||

| SOUTH AFRICA— 17.0% |

||||||||

| Basic Materials — 17.0% |

||||||||

| AngloGold Ashanti ADR |

5,950 | 269,000 | ||||||

The accompanying notes are an integral part of the financial statements.

25

Table of Contents

| Schedule of Investments | October 31, 2011 |

Global X Pure Gold Miners ETF

| Shares/Face Amount |

Value | |||||||

| COMMON STOCK — continued |

||||||||

| Basic Materials — continued |

||||||||

| Gold Fields ADR |

16,086 | $ | 280,379 | |||||

| Great Basin Gold * |

43,224 | 60,714 | ||||||

| Harmony Gold Mining ADR |

20,085 | 263,716 | ||||||

|

|

|

|||||||

| TOTAL SOUTH AFRICA |

873,809 | |||||||

|

|

|

|||||||

| TURKEY— 4.0% |

||||||||

| Basic Materials — 4.0% |

||||||||

| Koza Altin Isletmeleri |

15,016 | 206,100 | ||||||

|

|

|

|||||||

| UNITED KINGDOM— 5.5% |

||||||||

| Basic Materials — 5.5% |

||||||||

| African Barrick Gold |

10,508 | 91,255 | ||||||

| Petropavlovsk |

16,145 | 191,229 | ||||||

|

|

|

|||||||

| TOTAL UNITED KINGDOM |

282,484 | |||||||

|

|

|

|||||||

| UNITED STATES— 16.9% |

||||||||

| Basic Materials — 16.9% |

||||||||

| Alacer Gold * |

23,863 | 275,333 | ||||||

| Allied Nevada Gold * |

6,308 | 239,578 | ||||||

| Gold Resource |

4,587 | 103,208 | ||||||

| Polyus Gold International GDR * |

75,670 | 248,198 | ||||||

|

|

|

|||||||

| TOTAL UNITED STATES |

866,317 | |||||||

|

|

|

|||||||

| TOTAL COMMON STOCK |

5,110,933 | |||||||

|

|

|

|||||||

| TIME DEPOSIT — 0.2% |

||||||||

| Brown Brothers Harriman, 0.030% |

$ | 11,355 | 11,355 | |||||

|

|

|

|||||||

| TOTAL INVESTMENTS — 99.8% |

$ | 5,122,288 | ||||||

|

|

|

|||||||

Percentages are based on Net Assets of $5,133,986.

| * | Non-income producing security. |

| 1 | Security is fair valued using methods determined in good faith by the Fair Value Committee of the Fund. The total value of such security as of October 31 2011 was $17,433 and represents 0.3% of Net Assets. |

| 2 | Security considered illiquid. The total value of such security as of October 31, 2011 was $17,433 and represents 0.3% of Net Assets. |

ADR — American Depositary Receipt

GDR — Global Depositary Receipt

The accompanying notes are an integral part of the financial statements.

26

Table of Contents

| Schedule of Investments | October 31, 2011 |

Global X Pure Gold Miners ETF

The following is a summary of the inputs used as of October 31, 2011, in valuing the Fund’s investments carried at value:

| Investments in Securities | Level 1 | Level 2 | Level 3 | Total | ||||||||||||

| Common Stock |

||||||||||||||||

| Australia |

$ | 482,551 | $ | - | $ | - | $ | 482,551 | ||||||||

| Canada |

1,951,084 | - | - | 1,951,084 | ||||||||||||

| China |

153,724 | - | 17,433 | 171,157 | ||||||||||||

| Jersey |

277,431 | - | - | 277,431 | ||||||||||||

| South Africa |

873,809 | - | - | 873,809 | ||||||||||||

| Turkey |

206,100 | - | - | 206,100 | ||||||||||||

| United Kingdom |

282,484 | - | - | 282,484 | ||||||||||||

| United States |

866,317 | - | - | 866,317 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total Common Stock |

5,093,500 | - | 17,433 | 5,110,933 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Time Deposit |

- | 11,355 | - | 11,355 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total Investments in Securities |

$ | 5,093,500 | $ | 11,355 | $ | 17,433 | $ | 5,122,288 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

The following is a reconciliation of investments in which significant unobservable inputs (Level 3) were used in determining fair value:

| China | ||||

| Investments in Common Stock |

||||

| Beginning balance as of March 14, 2011 |

$ | - | ||

| Accrued discounts/premiums |

- | |||

| Realized gain/(loss) |

- | |||

| Change in unrealized appreciation/(depreciation) |

- | |||

| Net purchases |

||||

| Net sales |

- | |||

| Transfers into Level 3 |

17,433 | |||

| Transfers out of Level 3 |

- | |||

|

|

|

|||

| Ending balance as of October 31, 2011 |

$ | 17,433 | ||

|

|

|

|||

Net change in unrealized appreciation (depreciation) from investments (Level 3) still held as of October 31, 2011 is $—.

For the period ended October 31, 2011, there have been no significant transfers between Level 1 & Level 2 investments.

For the period ended October 31, 2011, transfers between Level 1 and Level 3 assets and liabilities totaled $17,433.

The Level 3 investment presented above was considered a Level 1 investment at the beginning of the reporting period. The reason for the transfer change was a temporary trading suspension of the investment’s shares, which necessitated a fair value determination by the Fair Value Committee at the end of the reporting period. The Fund’s policy is to transfer investments into/out of Level 3 at the end of the reporting period.

The accompanying notes are an integral part of the financial statements.

27

Table of Contents

| Schedule of Investments | October 31, 2011 |

Sector Weightings (unaudited)†:

† Percentages based on total investments.

| Shares | Value | |||||||

| COMMON STOCK —100.00% |

||||||||

| CANADA— 38.2% |

||||||||

| Oil & Gas — 38.2% |

||||||||

| Baytex Energy |

2,628 | $ | 138,929 | |||||

| Canadian Natural Resources |

3,578 | 126,219 | ||||||

| Cenovus Energy |

3,779 | 129,428 | ||||||

| Crescent Point Energy |

3,003 | 128,280 | ||||||

| Enerplus |

4,681 | 130,188 | ||||||

| Imperial Oil |

3,294 | 136,426 | ||||||

| MEG Energy * |

2,859 | 128,966 | ||||||

| Nexen |

6,283 | 106,721 | ||||||

| Pengrowth Energy |

11,788 | 122,997 | ||||||

| Suncor Energy |

4,207 | 134,026 | ||||||

|

|

|

|||||||

| TOTAL CANADA |

1,282,180 | |||||||

|

|

|

|||||||

| UNITED STATES— 61.8% |

||||||||

| Oil & Gas — 61.8% |

||||||||

| Apache |

1,300 | 129,519 | ||||||

| Berry Petroleum, Cl A |

2,670 | 92,248 | ||||||

| Brigham Exploration * |

4,455 | 162,229 | ||||||

| Clayton Williams Energy * |

2,344 | 153,157 | ||||||

| Concho Resources * |

1,465 | 138,765 | ||||||

| ConocoPhillips |

1,995 | 138,952 | ||||||

| Continental Resources * |

2,335 | 141,618 | ||||||

| Denbury Resources * |

8,367 | 131,362 | ||||||

| Devon Energy |

1,979 | 128,536 | ||||||

| Noble Energy |

1,531 | 136,780 | ||||||

| Northern Oil and Gas * |

6,380 | 154,205 | ||||||

| Pioneer Natural Resources |

1,738 | 145,818 | ||||||

| Range Resources |

2,036 | 140,158 | ||||||

| SM Energy |

1,751 | 145,175 | ||||||

| Whiting Petroleum * |

2,846 | 132,481 | ||||||

|

|

|

|||||||

| TOTAL UNITED STATES |

2,071,003 | |||||||

|

|

|

|||||||

| TOTAL COMMON STOCK |

3,353,183 | |||||||

|

|

|

|||||||

The accompanying notes are an integral part of the financial statements.

28

Table of Contents

| Schedule of Investments | October 31, 2011 |

Global X Oil Equities ETF

| Face Amount | Value | |||||||

| TIME DEPOSIT — 0.0% |

||||||||

| Brown Brothers Harriman, 0.030% |

$ | 941 | $ | 941 | ||||

|

|

|

|||||||

| TOTAL INVESTMENTS — 100.0% |

$ | 3,354,124 | ||||||

|

|

|

|||||||

Percentages are based on Net Assets of $3,355,537.

| * | Non-income producing security. |

Cl — Class

The following is a summary of the inputs used as of October 31, 2011, in valuing the Fund’s investments carried at value:

| Investments in Securities | Level 1 | Level 2 | Level 3 | Total | ||||||||||||

| Common Stock |

$ | 3,353,183 | $ | — | $ | — | $ | 3,353,183 | ||||||||

| Time Deposit |

— | 941 | — | 941 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total Investments in Securities |

$ | 3,353,183 | $ | 941 | $ | — | $ | 3,354,124 | ||||||||