UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

________

FORM N-CSRS

________

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-22209

Global X Funds

(Exact name of registrant as specified in charter)

________

605 Third Avenue, 43rd floor

New York, NY 10158

(Address of principal executive offices) (Zip code)

Luis Berruga

Global X Management Company LLC

605 Third Avenue, 43rd floor

New York, NY 10158

(Name and address of agent for service)

With a copy to:

|

Global X Management Company LLC

605 Third Avenue, 43rd floor

New York, NY 10158

|

Eric S. Purple, Esq.

Stradley Ronon Stevens & Young, LLP

2000 K Street, N.W., Suite 700

Washington, DC 20006-1871

|

Registrant’s telephone number, including area code: (212) 644-6440

Date of fiscal year end: October 31, 2022

Date of reporting period: April 30, 2022

Item 1. Reports to Stockholders.

A copy of the report transmitted to stockholders pursuant to Rule 30e-1 under the Investment Company Act of 1940, as amended (the “Act”) (17 CFR § 270.30e-1), is attached hereto.

|

Global X Blockchain & Bitcoin Strategy ETF (ticker: BITS)

|

Semi-Annual Report

April 30, 2022

As permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Fund’s (defined below) shareholder report will no longer be sent

by mail unless you specifically request paper copies of the reports from your financial intermediary (such as a broker-dealer or bank). Instead, shareholder reports will be available on the Fund’s website (www.globalxetfs.com/explore), and you will

be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to

receive shareholder reports and other communications from the Fund electronically anytime by contacting your financial intermediary.

You may elect to receive all future Fund shareholder reports in paper free of charge. Please contact your financial intermediary to inform them that you wish to

continue receiving paper copies of Fund shareholder reports and for details about whether your election to receive reports in paper will apply to all funds held with your financial intermediary.

|

Table of Contents

|

|

Consolidated Schedule of Investments

|

|

|

Global X Blockchain & Bitcoin Strategy ETF

|

1

|

|

Consolidated Statement of Assets and Liabilities

|

3

|

|

Consolidated Statement of Operations

|

4

|

|

Consolidated Statement of Changes in Net Assets

|

5

|

|

Consolidated Financial Highlights

|

7

|

|

Consolidated Notes to Financial Statements

|

9

|

|

Disclosure of Fund Expenses

|

20

|

|

Approval of Investment Advisory Agreement and Sub-Advisory Agreements

|

22

|

|

Supplemental Information

|

28

|

Shares are bought and sold at market price (not NAV) and are not individually redeemed from the Fund. Shares may only be redeemed directly from the Fund by Authorized Participants,

in very large creation/redemption units. Brokerage commissions will reduce returns.

The Fund files its complete schedule of Fund holdings with the Securities and Exchange Commission (the “SEC” or “Commission”) for the first and third quarters of each fiscal year as

an exhibit to its report on Form N-PORT. The Fund’s Forms N-PORT are available on the Commission’s website at http://www.sec.gov, and may be reviewed and copied at the Commission’s Public Reference Room in Washington, DC. Information on the operation

of the Public Reference Room may be obtained by calling 1-800-SEC-0330.

A description of the policies and procedures that Global X Funds uses to determine how to vote proxies relating to Fund securities, as well as information relating to how the Fund voted proxies relating

to Fund securities during the most recent 12-month period ended June 30, is available (i) without charge, upon request, by calling 1-888-493-8631; and (ii) on the Commission’s website at http://www.sec.gov.

|

Consolidated Schedule of Investments

|

April 30, 2022 (Unaudited)

|

|

|

Global X Blockchain & Bitcoin Strategy ETF

|

|

Shares/Face

Amount

|

Value

|

|||||||

|

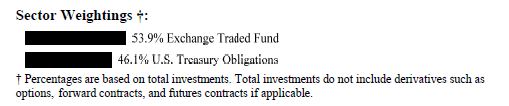

EXCHANGE TRADED FUND — 48.3%

|

||||||||

|

Global X Blockchain ETF(A) (Cost $11,337,937)

|

536,160

|

$

|

6,085,416

|

|||||

|

U.S. TREASURY OBLIGATIONS — 41.2%

|

||||||||

|

U.S Treasury Bills

|

||||||||

|

0.761%, 07/14/22(B)(C)^

|

$

|

2,000,000

|

1,996,841

|

|||||

|

0.395%, 06/02/22(B)

|

2,100,000

|

2,099,407

|

||||||

|

0.200%, 05/05/22(B)

|

1,100,000

|

1,099,991

|

||||||

|

TOTAL U.S. TREASURY OBLIGATIONS

|

||||||||

|

(Cost $5,196,114)

|

5,196,239

|

|||||||

|

TOTAL INVESTMENTS — 89.5%

|

||||||||

|

(Cost $16,534,051)

|

$

|

11,281,655

|

||||||

Percentages are based on Net Assets of $12,600,387.

A list of the futures contracts held by the Fund at April 30, 2022, is as follows:

|

Type of Contract

|

Number of

Contracts |

Expiration

Date |

Notional

Amount

|

Value

|

Unrealized

Depreciation

|

||||||||||||

|

Long Contracts

|

|||||||||||||||||

|

CME BITCOIN FUTURE^

|

34

|

May-2022

|

$

|

6,647,145

|

$

|

6,508,450

|

$

|

(138,695

|

)

|

||||||||

|

^

|

Security is held by the Global X Bitcoin Strategy Subsidiary I, as of April 30, 2022.

|

|

(A)

|

Affiliated investment.

|

|

(B)

|

Interest rate represents the security’s effective yield at the time of purchase.

|

|

(C)

|

Security, or portion thereof, has been pledged as collateral on Futures Contracts.

|

ETF — Exchange Traded Fund

|

The accompanying notes are an integral part of the financial statements.

|

1

|

Consolidated Schedule of Investments

|

April 30, 2022 (Unaudited)

|

|

|

Global X Blockchain & Bitcoin Strategy ETF

|

The following is a summary of the level of inputs used as of April 30, 2022, in valuing the Fund’s investments and other financial instruments carried at value:

|

Investments in Securities

|

Level 1

|

Level 2

|

Level 3

|

Total

|

||||||||||||

|

Exchange Traded Fund

|

$

|

6,085,416

|

$

|

—

|

$

|

—

|

$

|

6,085,416

|

||||||||

|

U.S. Treasury Obligations

|

—

|

5,196,239

|

—

|

5,196,239

|

||||||||||||

|

Total Investments in Securities

|

$

|

6,085,416

|

$

|

5,196,239

|

$

|

—

|

$

|

11,281,655

|

||||||||

|

Other Financial Instruments

|

Level 1

|

Level 2

|

Level 3

|

Total

|

||||||||||||

|

Futures Contracts*

|

||||||||||||||||

|

Unrealized Depreciation

|

$

|

(138,695

|

)

|

$

|

–

|

$

|

–

|

$

|

(138,695

|

)

|

||||||

|

Total Other Financial Instruments

|

$

|

(138,695

|

)

|

$

|

–

|

$

|

–

|

$

|

(138,695

|

)

|

||||||

* Futures contracts are valued at the unrealized depreciation on the instrument.

The following is a summary of the transactions with affiliates for the period ended April 30, 2022:

|

Value at 10/31/21

|

Purchases at

Cost

|

Proceeds from

Sales

|

Changes in Unrealized Appreciation (Depreciation)

|

Realized Gain

(Loss)

|

Value at 4/30/22

|

Shares

|

Income

|

|||||||||||||||||||||||

|

Global X Blockchain ETF

|

||||||||||||||||||||||||||||||

|

$

|

—

|

$

|

11,337,937

|

$

|

—

|

$

|

(5,252,521

|

)

|

$

|

—

|

$

|

6,085,416

|

536,160

|

$

|

164,378

|

|||||||||||||||

Amounts designated as “—“ are $0 or have been rounded to $0.

|

The accompanying notes are an integral part of the financial statements.

|

2

|

Consolidated Statement of Assets and Liabilities

|

||

|

April 30, 2022 (Unaudited)

|

|

Global X Blockchain & Bitcoin Strategy ETF

|

||||

|

Assets:

|

||||

|

Cost of Investments

|

$

|

5,196,114

|

||

|

Affiliated Cost of Investments

|

11,337,937

|

|||

|

Investments, at Value

|

$

|

5,196,239

|

||

|

Affiliated Investments, at Value

|

6,085,416

|

|||

|

Cash

|

1,618,583

|

|||

|

Total Assets

|

12,900,238

|

|||

|

Liabilities:

|

||||

|

Payable for Variation Margin on Futures Contracts

|

295,800

|

|||

|

Payable due to Investment Adviser

|

4,051

|

|||

|

Total Liabilities

|

299,851

|

|||

|

Net Assets

|

$

|

12,600,387

|

||

|

Net Assets Consist of:

|

||||

|

Paid-in Capital

|

$

|

20,520,238

|

||

|

Total Distributable Loss

|

(7,919,851

|

)

|

||

|

Net Assets

|

$

|

12,600,387

|

||

|

Outstanding Shares of Beneficial Interest

|

||||

|

(unlimited authorization — no par value)

|

960,000

|

|||

|

Net Asset Value, Offering and Redemption Price Per Share

|

$

|

13.13

|

||

|

The accompanying notes are an integral part of the financial statements.

|

3

|

Consolidated Statement of Operations

|

||

|

For the period ended April 30, 2022 (Unaudited)

|

|

Global X Blockchain & Bitcoin Strategy ETF‡

|

||||

|

Investment Income:

|

||||

|

Dividend Income, from Affiliated Investments

|

$ |

164,378

|

||

|

Interest Income

|

1,113

|

|||

|

Total Investment Income

|

165,491

|

|||

|

Supervision and Administration Fees(1)

|

25,647

|

|||

|

Custodian Fees(2)

|

1

|

|||

|

Total Expenses

|

25,648

|

|||

|

Reimbursement from Adviser(3)

|

(9,134

|

)

|

||

|

Net Expenses

|

16,514

|

|||

|

Net Investment Income

|

148,977

|

|||

|

Net Realized Loss on:

|

||||

|

Investments(4)

|

(165

|

)

|

||

|

Futures Contracts

|

(2,513,878

|

)

|

||

|

Net Realized Loss on Investments

|

(2,514,043

|

)

|

||

|

Net Unrealized Appreciation (Depreciation) on:

|

||||

|

Investments

|

125

|

|||

|

Affiliated Investments

|

(5,252,521

|

)

|

||

|

Futures Contracts

|

(138,695

|

)

|

||

|

Net Unrealized Depreciation on Investments

|

(5,391,091

|

)

|

||

|

Net Realized and Unrealized Loss on Investments

|

(7,905,134

|

)

|

||

|

Net Decrease in Net Assets Resulting from Operations

|

$

|

(7,756,157

|

)

|

|

|

‡

|

Commenced operations on November 15, 2021.

|

|

(1)

|

The Supervision and Administration fees reflect the supervisory and administrative fee, which includes fees paid by the Fund for the investment advisory services provided by the Adviser. (See

Note 3 in Notes to Financial Statements.)

|

|

(2)

|

See Note 2 in the Notes to Financial Statements.

|

|

(3)

|

See Note 3 in the Notes to Financial Statements.

|

|

(4)

|

Includes realized gains (losses) as a result of in-kind redemptions. (See Note 4 in Notes to Financial Statements.)

|

|

The accompanying notes are an integral part of the financial statements.

|

4

|

Consolidated Statement of Changes in Net Assets

|

||

|

Global X

Blockchain &

Bitcoin Strategy

ETF

|

||||

|

Period Ended

April 30, 2022(1)

(Unaudited)

|

||||

|

Operations:

|

||||

|

Net Investment Income

|

$

|

$148,977

|

||

|

Net Realized Loss on Investments and Futures Contracts(2)

|

(2,514,043

|

)

|

||

|

Net Unrealized Depreciation on Investments and Futures Contracts

|

(5,391,091

|

)

|

||

|

Net Decrease in Net Assets Resulting from Operations

|

(7,756,157

|

)

|

||

|

Distributions

|

(163,694

|

)

|

||

|

Capital Share Transactions:

|

||||

|

Issued

|

20,520,238

|

|||

|

Increase in Net Assets from Capital Share Transactions

|

20,520,238

|

|||

|

Total Increase in Net Assets

|

12,600,387

|

|||

|

Net Assets:

|

||||

|

Beginning of Period

|

—

|

|||

|

End of Period

|

$

|

12,600,387

|

||

|

Share Transactions:

|

||||

|

Issued

|

960,000

|

|||

|

Net Increase in Shares Outstanding from Share Transactions

|

960,000

|

|||

|

(1)

|

The Fund commenced operations on November 15, 2021.

|

|

(2)

|

Includes realized gains (losses) as a result of in-kind redemptions. (See Note 4 in Notes to Financial Statements.)

|

|

The accompanying notes are an integral part of the financial statements.

|

5

This page is intentionally left blank.

|

Consolidated Financial Highlights

|

||

Selected Per Share Data & Ratios

For a Share Outstanding Throughout the Period

|

Net

Asset Value, Beginning

of Period ($) |

Net Investment Income

($)* |

Net Realized and Unrealized Loss on Investments

($) |

Total from Operations

($) |

Distribution from Net Investment Income ($)

|

Distribution from Capital Gains ($)

|

Return of Capital ($)

|

||||||||||||||||||||||

|

Global X Blockchain & Bitcoin Strategy ETF

|

||||||||||||||||||||||||||||

|

2022(1) (Unaudited)

|

29.75

|

0.30

|

(16.55

|

)

|

(16.25

|

)

|

(0.37

|

)

|

—

|

—

|

||||||||||||||||||

|

The accompanying notes are an integral part of the financial statements.

|

7

|

Consolidated Financial Highlights

|

||

|

Total from

Distributions ($)

|

Net

Asset Value, End of Period ($) |

Total Return

(%)**

|

Net Assets

End of Period

($)(000)

|

Ratio of Expenses to

Average Net Assets

(%)

|

Ratio of Net Investment

Income to Average Net Assets (%)

|

Portfolio Turnover

(%)††

|

||||||||||||||||||||

|

(0.37

|

)

|

13.13

|

(55.05

|

)

|

12,600,387

|

0.42

|

†#

|

3.78

|

†

|

0.00

|

||||||||||||||||

|

*

|

Per share data calculated using average shares method.

|

|

**

|

Total Return is for the period indicated and has not been annualized. The return shown does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption

of Fund shares.

|

|

†

|

Annualized.

|

|

††

|

Portfolio turnover rate is for the period indicated and periods of less than one year have not been annualized. Excludes effect of in-kind transfers.

|

|

#

|

The ratio of Expenses to Average Net Assets includes the effect of a reimbursement of acquired fund fees (See Note 3 in Notes to Financial Statements). If these offsets and acquired fund fees

were excluded, the ratio would have been 0.65%.

|

|

(1)

|

The Fund commenced operations on November 15, 2021.

|

|

The accompanying notes are an integral part of the financial statements.

|

8

|

Consolidated Notes to Financial Statements (Unaudited)

|

||

|

April 30, 2022

|

1. ORGANIZATION

The Global X Funds (the “Trust”) is a Delaware statutory trust formed on March 6, 2008. The Trust is registered under the Investment Company Act of 1940, as amended (the “1940 Act”),

as an open-end management investment company. As of April 30, 2022, the Trust had one hundred and two portfolios, ninety-four of which were operational. The financial statements herein and the related notes pertain to the Global X Blockchain &

Bitcoin Strategy ETF (the “Fund”). The Fund has elected non-diversified status under the 1940 Act.

The Fund commenced operations on November 15, 2021.

2. SIGNIFICANT ACCOUNTING POLICIES

The following is a summary of the significant accounting policies followed by the Fund.

USE OF ESTIMATES – The Fund is an investment company that applies the accounting and reporting guidance issued in Topic 946 by the U.S. Financial Accounting Standards Board. The

preparation of financial statements in conformity with U.S. generally accepted accounting principles (“U.S. GAAP”) requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of

contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could materially differ from those estimates.

SECURITY VALUATION — Securities listed on a securities exchange, market or automated quotation system for which quotations are readily available (except for securities traded on the

NASDAQ Stock Market (“NASDAQ”)), including securities traded over the counter, are valued at the last quoted sale price on the primary exchange or market (foreign or domestic) on which they are traded (or at approximately 4:00 pm Eastern time if a

security’s primary exchange is normally open at that time), or, if there is no such reported sale, at the most recent mean between the quoted bid and asked prices, which approximates fair value (absent both bid and asked prices on such exchange, the

bid price may be used).

For securities traded on NASDAQ, the NASDAQ official closing price will be used. If available, debt securities are priced based upon valuations provided by independent, third-party

pricing agents. Such values generally reflect the last reported sales price if the security is actively traded. The third-party pricing agents may also value debt securities at an evaluated bid price by employing methodologies that utilize actual

market transactions, broker-supplied valuations, or other methodologies designed to identify the market value for such securities. Debt obligations with remaining maturities of sixty days or less will be valued at their market value. The prices for

foreign

9

|

Consolidated Notes to Financial Statements (continued)

|

||

|

April 30, 2022 (Unaudited)

|

2. SIGNIFICANT ACCOUNTING POLICIES (continued)

securities are reported in local currency and converted to U.S. dollars using currency exchange rates as of reporting date. The exchange rates used by the Trust for valuation are

captured as of the New York or London close each day. Prices for most securities held in the Fund are provided daily by recognized independent pricing agents. If a security price cannot be obtained from an independent, third-party pricing agent, the

Fund seeks to obtain a bid price from at least one independent broker.

Securities for which market prices are not “readily available” are valued in accordance with Fair Value Procedures established by the Board of Trustees (the “Board”). The Fund’s Fair

Value Procedures are implemented through a Fair Value Committee (the “Committee”) designated by the Board. Some of the more common reasons that may necessitate that a security be valued using the Fair Value Procedures include: the security’s trading

has been halted or suspended; the security has been de-listed from its primary trading exchange; the security’s primary trading market is temporarily closed at a time when, under normal conditions, it would be open; the security has not been traded

for an extended period of time; the security’s primary pricing source is not able or willing to provide a price; or trading of the security is subject to local government-imposed restrictions. In addition, the Fund may fair value a security if an

event that may materially affect the value of the Fund’s security that traded outside of the United States (a “Significant Event”) has occurred between the Fund’s security, the time of the security’s last close and the time that the Fund calculates

its net asset value (“NAV”). A Significant Event may relate to a single issuer or to an entire market sector. Events that may be Significant Events include: government actions, natural disasters, armed conflict, acts of terrorism and significant

market fluctuations. If Global X Management Company LLC, the Fund’s investment adviser (the “Adviser”), becomes aware of a Significant Event that has occurred with respect to a security or group of securities after the closing of the exchange or

market on which the security or securities principally trade, but before the time at which the Fund calculates its NAV, it may request that a Committee meeting be called. When a security is valued in accordance with the Fair Value Procedures, the

Committee will determine the value after taking into consideration all relevant information reasonably available to the Committee. As of April 30, 2022, there were no securities priced using the Fair Value Procedures.

In accordance with the authoritative guidance on fair value measurements and disclosure under U.S. GAAP, the Fund discloses the fair value of its investments in a hierarchy that

prioritizes the inputs to valuation techniques used to measure the fair value. The objective of a fair value measurement is to determine the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction

between market participants at the measurement date (an exit price). Accordingly, the fair value hierarchy gives the highest priority to quoted prices (unadjusted) in active markets for identical assets or liabilities (Level 1) and the lowest

priority to unobservable inputs (Level 3).

10

|

Consolidated Notes to Financial Statements (continued)

|

||

|

April 30, 2022 (Unaudited)

|

2. SIGNIFICANT ACCOUNTING POLICIES (continued)

The three levels of the fair value hierarchy are described below:

Level 1 – Unadjusted quoted prices in active markets for identical, unrestricted assets or liabilities that the Fund has the ability to access at the

measurement date;

Level 2 – Other significant observable inputs (including quoted prices in non-active markets, quoted prices for similar investments, fair value of investments

for which the Fund has the ability to fully redeem tranches at net asset value as of the measurement date or within the near term, and short-term investments valued at amortized cost); and

Level 3 – Significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments and fair value of investments for

which the Fund does not have the ability to fully redeem tranches at NAV as of the measurement date or within the near term).

Investments are classified within the level of the lowest significant input considered in determining fair value. Investments classified within Level 3 whose fair value

measurement considers several inputs may include Level 1 or Level 2 inputs as components of the overall fair value measurement.

The unobservable inputs used to determine fair value of Level 3 assets may have similar or diverging impacts on valuation. Significant increases and decreases in these inputs in

isolation and interrelationships between those inputs could result in significantly higher or lower fair value measurement.

For the period ended April 30, 2022, there have been no significant changes to the Fund’s fair valuation methodologies.

DUE TO/FROM BROKERS — Due to/from brokers includes cash and collateral balances with the Fund’s clearing brokers or counterparties at April 30, 2022. The Fund continuously

monitors the credit standing of each broker or counterparty with whom it conducts business. In the event a broker or counterparty is unable to fulfill its obligations, the Fund would be subject to counterparty credit risk.

FEDERAL INCOME TAXES — It is the Fund’s intention to qualify, or continue to qualify, as a regulated investment company for Federal income tax purposes by complying with the

appropriate provisions of Subchapter M of the Internal Revenue Code of 1986 (the “Code”). Accordingly, no provisions for Federal income taxes have been made in the financial statements except as described below.

The Fund evaluates tax positions taken or expected to be taken in the course of preparing the Fund’s tax returns to determine whether it is “more-likely-than-not” (i.e.,

greater than 50 percent) that each tax position will be sustained upon examination by a taxing authority based on the technical merits of the position. Tax positions not deemed

11

|

Consolidated Notes to Financial Statements (continued)

|

||

|

April 30, 2022 (Unaudited)

|

2. SIGNIFICANT ACCOUNTING POLICIES (continued)

to meet the more-likely-than-not threshold are recorded as a tax benefit or expense in the current year. The Fund did not record any tax positions in the current period; however,

management’s conclusions regarding tax positions may be subject to review and adjustment at a later date based on factors including, but not limited to, examination by tax authorities (i.e., the last three tax year ends, as applicable), and on-going

analysis of and changes to tax laws and regulations, and interpretations thereof. If the Fund has foreign tax filings that have not been made, the tax years that remain subject to examination may date back to the inception of the Fund.

As of and during the reporting period ended April 30, 2022, the Fund did not have a liability for any unrecognized tax benefits. The Fund recognizes interest and penalties, if any,

related to unrecognized tax benefits as income tax expense on the Statement of Operations. During the reporting period, the Fund did not incur any interest or penalties.

SECURITY TRANSACTIONS AND INVESTMENT INCOME – Security transactions are accounted for on the trade date for financial reporting purposes. Costs used in determining realized gains and

losses on the sale of investment securities are based on specific identification. Dividend income is recorded on the ex-dividend date. Interest income is recognized on the accrual basis from the settlement date. Amortization of premiums and

accretion of discounts is included in interest income.

FOREIGN CURRENCY TRANSACTIONS AND TRANSLATION – The books and records of the Fund are maintained in U.S. dollars. Investment securities and other assets and liabilities denominated

in a foreign currency are translated into U.S. dollars on the date of valuation. Purchases and sales of investment securities, income and expenses are translated into U.S. dollars at the relevant rates of exchange prevailing on the respective dates

of such transactions. The Fund does not isolate that portion of realized or unrealized gains and losses resulting from changes in the foreign exchange rate from fluctuations arising from changes in the market prices of the securities. These gains and

losses are included in net realized and unrealized gains and losses on investments on the Statement of Operations. Net realized and unrealized gains and losses on foreign currency transactions and translations represent net foreign exchange gains or

losses from foreign currency spot contracts, disposition of foreign currencies, currency gains or losses realized between trade and settlement dates on securities transactions and the difference between the amount of the investment income and foreign

withholding taxes recorded on the Fund’s books and the U.S. dollar equivalent amounts actually received or paid.

Futures Contracts — To the extent consistent with its investment objective and strategies, the Fund may use futures contracts for tactical hedging purposes as well as to enhance the

Fund’s returns. Initial margin deposits of cash or securities are made upon entering into futures contracts. The contracts are marked to

12

|

Consolidated Notes to Financial Statements (continued)

|

||

|

April 30, 2022 (Unaudited)

|

2. SIGNIFICANT ACCOUNTING POLICIES (continued)

market daily and the resulting changes in value are accounted for as unrealized gains and losses. Variation margin payments are paid or received, depending upon whether unrealized

gains or losses are incurred. When the contract is closed, the Fund records a realized gain or loss equal to the difference between the proceeds from (or cost of) the closing transaction and the amount invested in the contract.

Risks of entering into futures contracts include the possibility that there will be an imperfect price correlation between the futures and the underlying securities. Second, it is

possible that a lack of liquidity for futures contracts could exist in the secondary market, resulting in an inability to close a position prior to its maturity date. Third, the futures contract involves the risk that the Fund could lose more than

the original margin deposit required to initiate a futures transaction.

Finally, the risk exists that losses could exceed amounts disclosed on the Consolidated Statement of Assets and Liabilities. Refer to the Fund’s Consolidated Schedule of Investments

for details regarding open futures contracts as of April 30, 2022, if applicable.

For the period ended April 30, 2022, all futures contracts were subject to currency risk.

For the period ended April 30, 2022, the monthly average cost of the futures contracts held by the Fund were as follows:

|

Short Average

|

Short End

|

Long Average

|

Long End

|

|||||||||||||

|

Global X Blockchain & Bitcoin Strategy ETF

|

$

|

–

|

$

|

–

|

$

|

4,962,804

|

$

|

6,647,145

|

||||||||

DIVIDENDS AND DISTRIBUTIONS TO SHAREHOLDERS – The Fund distributes its net investment income on a pro rata basis. Any net investment income and net realized capital gains are

distributed at least annually. All distributions are recorded on ex-dividend date.

CREATION UNITS – The Fund issues and redeems its shares (“Shares”) on a continuous basis at NAV and only in large blocks of 10,000 Shares, referred to as “Creation Units”. Purchasers

of Creation Units (“Authorized Participants”) at NAV must pay a standard creation transaction fee per transaction. The fee is a single charge and will be the same regardless of the number of Creation Units purchased by an Authorized Participant on

the same day.

An Authorized Participant who holds Creation Units and wishes to redeem at NAV would also pay a standard redemption fee per transaction to Brown Brothers Harriman & Co. (“BBH”),

on the date of such redemption, regardless of the number of Creation Units redeemed that day.

13

|

Consolidated Notes to Financial Statements (continued)

|

||

|

April 30, 2022 (Unaudited)

|

2. SIGNIFICANT ACCOUNTING POLICIES (continued)

If a Creation Unit is purchased or redeemed for cash, an additional variable fee may be charged. The following table discloses Creation Unit breakdown:

|

Creation Unit Shares

|

Creation Fee

|

Value at April 30, 2022

|

Redemption Fee

|

|||||||||||||

|

Global X Blockchain & Bitcoin Strategy ETF

|

10,000

|

$

|

50

|

$

|

131,300

|

$

|

50

|

|||||||||

CASH OVERDRAFT CHARGES – Per the terms of an agreement with BBH, if the Fund has a cash overdraft on a given day, it will be assessed an overdraft charge of LIBOR plus 2.00%. Cash

overdraft charges are included in custodian fees on the Statement of Operations.

3. RELATED PARTY TRANSACTIONS AND SERVICE PROVIDER TRANSACTIONS

On July 2, 2018, the Adviser consummated a transaction pursuant to which it became an indirect, wholly-owned subsidiary of Mirae Asset Global Investments Co., Ltd. (“Mirae”). In this

manner, the Adviser is ultimately controlled by Mirae, which is a leading financial services company in Korea and is the headquarters for the Mirae Asset Global Investments Group.

The Adviser serves as the investment adviser and the administrator for the Fund. Subject to the supervision of the Board, the Adviser is responsible for managing the investment

activities of the Fund and the Fund’s business affairs and other administrative matters and provides or causes to be furnished all supervisory, administrative and other services reasonably necessary for the operation of the Fund, including certain

distribution services (provided pursuant to a separate distribution agreement), certain shareholder and distribution-related services (provided pursuant to a separate Rule 12b-1 Plan and related agreements) and investment advisory services (provided

pursuant to a separate investment advisory agreement), under what is essentially an “all-in” fee structure. For the Adviser’s services to the Fund, under a supervision and administration agreement (the “Supervision and Administration Agreement”),

the Fund pays a monthly fee to the Adviser at the annual rate (stated as a percentage of the average daily net assets of the Fund) (“Supervision and Administration Fee”). In addition, the Fund bears other expenses that are not covered by the

Supervision and Administration Agreement, which may vary and affect the total expense ratios of the Fund, such as taxes, brokerage fees, commissions, acquired fund fees, other transaction expenses, interest expenses and extraordinary expenses (such

as litigation and indemnification expenses).

The Supervision and Administration Agreement for the Fund provides that the Adviser also bears the costs for acquired fund fees and expenses generated by investments by the Global X

Blockchain & Bitcoin Strategy ETF in affiliated investment companies. For the period ended April 30, 2022, the Adviser paid acquired fund fees of $9,134.

14

|

Consolidated Notes to Financial Statements (continued)

|

||

|

April 30, 2022 (Unaudited)

|

3. RELATED PARTY TRANSACTIONS AND SERVICE PROVIDER TRANSACTIONS (continued)

The following table discloses the rate of supervision and administration fees paid by the Fund pursuant to the Supervision and Administration Agreement:

|

Supervision and Administration Fee

|

||||

|

Global X Blockchain & Bitcoin Strategy ETF

|

0.65

|

%

|

||

SEI Investments Global Funds Services (“SEIGFS”) serves as sub-administrator to the Fund. As sub-administrator, SEIGFS provides the Fund with required general administrative

services, including, without limitation: office space, equipment, and personnel; clerical and general back office services; bookkeeping, internal accounting and secretarial services; the calculation of NAV; and assistance with the preparation and

filing of reports, registration statements, proxy statements, and other materials required to be filed or furnished by the Fund under federal and state securities laws. As compensation for these services, SEIGFS receives certain out-of-pocket costs,

transaction fees, and asset-based fees which are accrued daily and paid monthly by the Adviser.

SEI Investments Distribution Co. (“SIDCO”) serves as the Fund’s underwriter and distributor of Creation Units pursuant to a distribution agreement. SIDCO has no obligation to sell

any specific quantity of Fund Shares.

SIDCO bears the following costs and expenses relating to the distribution of Shares: (1) the costs of processing and maintaining records of creations of Creation Units; (2) all costs

of maintaining the records required of a registered broker/dealer; (3) the expenses of maintaining its registration or qualification as a dealer or broker under federal or state laws; (4) filing fees; and (5) all other expenses incurred in

connection with the distribution services as contemplated in the distribution agreement. SIDCO receives no fee from the Fund for its distribution services under the distribution agreement, rather, the Adviser compensates SIDCO for certain expenses,

out-of-pocket costs, and transaction fees.

BBH serves as custodian and transfer agent of the Fund’s assets. As custodian, BBH has agreed to (1) make receipts and disbursements of money on behalf of the Fund; (2) collect and

receive all income and other payments and distributions on account of the Fund’s portfolio investments; (3) respond to correspondence from shareholders, security brokers and others relating to its duties; and (4) make periodic reports to the Fund

concerning the Fund’s operations. BBH does not exercise any supervisory function over the purchase and sale of securities. As transfer agent, BBH has agreed to (1) issue and redeem Shares of the Fund; (2) make dividend and other distributions to

shareholders of the Fund; (3) respond to correspondence by shareholders and others relating to its

15

|

Consolidated Notes to Financial Statements (continued)

|

||

|

April 30, 2022 (Unaudited)

|

3. RELATED PARTY TRANSACTIONS AND SERVICE PROVIDER TRANSACTIONS (continued)

duties; (4) maintain shareholder accounts; and (5) make periodic reports to the Fund. As compensation for these services, BBH receives certain out-of-pocket costs, transaction fees

and asset-based fees which are accrued daily and paid monthly by the Adviser from its fees.

4. BASIS FOR CONSOLIDATION FOR THE GLOBAL X BITCOIN STRATEGY SUBSIDIARY I

The Consolidated Schedule of Investments, Consolidated Statement of Assets and Liabilities, Consolidated Statement of Operations, Consolidated Statement of Changes in Net Assets, and

the Consolidated Financial Highlights of the Global X Blockchain & Bitcoin Strategy ETF include the accounts of the Fund’s Subsidiary. All intercompany accounts and transactions have been eliminated in consolidation for the Fund. The Global X

Bitcoin Strategy Subsidiary I (the “Subsidiary”) has a fiscal year end and conforming tax year end of October 31 for financial statement consolidation purposes.

The Subsidiary is classified as controlled foreign corporation under the Code. The Subsidiary’s taxable income is included in the calculation of the relevant Fund’s taxable income.

Net losses of the Subsidiary are not deductible by the Fund either in the current period or carried forward to future periods.

The Fund may invest up to 25% of its total assets in the Subsidiary.

A summary of the Fund’s investments in the Subsidiary are as follows:

|

Inception Date of Subsidiary

|

Subsidiary Net Assets atApril 30, 2022

|

% of Total Net Assets atApril 30, 2022

|

|||||||

|

GLOBAL X BITCOIN STRATEGY SUBSIDIARY I

|

November 15, 2021

|

$

|

2,311,368

|

18.3

|

%

|

||||

16

|

Consolidated Notes to Financial Statements (continued)

|

||

|

April 30, 2022 (Unaudited)

|

4. BASIS FOR CONSOLIDATION FOR THE GLOBAL X BITCOIN STRATEGY SUBSIDIARY I (continued)

Gains and losses attributed to the Fund’s investments in the Subsidiary are as follows:

|

GLOBAL X

BITCOIN

STRATEGY

SUBSIDIARY I

|

||||

|

Investment Income:

|

||||

|

Interest Income

|

$

|

736

|

||

|

Net Investment Income

|

736

|

|||

|

Net Realized Loss on:

|

||||

|

Investments

|

(166

|

)

|

||

|

Futures Contracts

|

(2,513,878

|

)

|

||

|

Net Realized Loss on Investments

|

(2,514,044

|

)

|

||

|

Net Unrealized Depreciation on:

|

||||

|

Investments

|

(35

|

)

|

||

|

Futures Contracts

|

(138,695

|

)

|

||

|

Net Unrealized Depreciation on Investments and Futures Contracts

|

(138,730

|

)

|

||

|

Net Realized and Unrealized Loss on Investments and Futures Contracts

|

(2,652,774

|

)

|

||

|

Net Decrease in Net Assets Resulting from Operations

|

$

|

(2,652,038

|

)

|

|

5. INVESTMENT TRANSACTIONS

For the period ended April 30, 2022, the purchases and sales of investments in securities excluding in-kind transactions, long-term U.S. Government, and short-term securities, were

|

Purchases

|

Sales and Maturities

|

|||||||

|

Global X Blockchain & Bitcoin Strategy ETF

|

$

|

6,729,781

|

$

|

– | ||||

For the period ended April 30, 2022, in-kind transactions associated with creations and redemptions were:

|

Purchases

|

Sales and Maturities

|

Realized Gain/(Loss)

|

||||||||||

|

Global X Blockchain & Bitcoin Strategy ETF

|

$

|

4,608,156

|

$

|

–

|

$

|

–

|

||||||

6. TAX INFORMATION

The amount and character of income and capital gain distributions to be paid, if any, are determined in accordance with Federal income tax regulations, which may differ from U.S.

GAAP. As a result, net investment income (loss) and net realized gain (loss) on investment transactions for a reporting period may differ significantly from distributions during such period. These book/tax differences may be temporary or permanent.

To the extent these differences are permanent in nature, they are charged or credited to undistributed net investment income (loss), accumulated net realized gain (loss) or paid in capital, as appropriate, in the period that the differences arise.

17

|

Consolidated Notes to Financial Statements (continued)

|

||

|

April 30, 2022 (Unaudited)

|

6. TAX INFORMATION (continued)

The Federal tax cost and aggregate gross unrealized appreciation and depreciation on investments held by the Fund at April 30, 2022 were as follows:

|

Global X Fund

|

Federal Tax Cost

|

Aggregated Gross Unrealized Appreciation

|

Aggregated Gross Unrealized Depreciation

|

Net Unrealized Depreciation

|

||||||||||||

|

Global X Blockchain & Bitcoin Strategy ETF

|

$

|

16,534,051

|

$

|

160

|

$

|

(5,252,556

|

)

|

$

|

(5,252,396

|

)

|

||||||

7. CONCENTRATION OF RISKS

The Fund may invest in securities of foreign issuers in various countries. These investments may involve certain considerations and risks not typically associated with investments in

the United States as a result of, among other factors, the possibility of future political and economic developments, the level of governmental supervision and regulation of securities markets in the respective countries.

The securities markets of emerging countries are less liquid, subject to greater price volatility, and have a smaller market capitalization than those of U.S. securities markets. In

certain countries, there may be fewer publicly traded securities and the market may be dominated by a few issuers or sectors. Issuers and securities markets in such countries are not subject to as extensive and frequent accounting, financial and

other reporting requirements or as comprehensive government regulations as are issuers and securities markets in the United States. In particular, the assets and profits appearing on the financial statements of emerging country issuers may not

reflect their financial position or results of operations in the same manner as financial statements for U.S. issuers. Substantially less information may be publicly available about emerging country issuers than is available about issuers in the

United States.

The Fund may be subject to taxes imposed by countries in which it invests. Such taxes are generally based on either income or gains earned or repatriated. The Fund accrues and

applies such taxes to net investment income, net realized gains and net unrealized gains as income and/or capital gains are earned.

The elimination of the London Inter-Bank Offered Rate (“LIBOR”) may adversely affect the interest rates on, and value of, certain Fund investments for which the value is tied to

LIBOR. The U.K. Financial Conduct Authority has announced that it intends to stop compelling or inducing banks to submit LIBOR rates after 2021. On March 5, 2021, the administrator of LIBOR clarified that the publication of LIBOR on a representative

basis will cease for the one-week and two-month U.S. dollar LIBOR settings immediately after December 31, 2021, and for the remaining U.S. dollar LIBOR settings immediately after June 30, 2023. Alternatives to LIBOR are established or in development

in most major currencies, including the Secured Overnight Financing Rate (“SOFR”), which is intended to replace U.S. dollar LIBOR. Markets are slowly developing in response to these new rates. Questions regarding the impact of this

18

|

Consolidated Notes to Financial Statements (concluded)

|

||

|

April 30, 2022 (Unaudited)

|

7. CONCENTRATION OF RISKS (continued)

transition remain a concern for the Fund. Accordingly, it is difficult to predict the full impact of the transition away from LIBOR on the Fund until new reference rates and

fallbacks for both legacy and new products, instruments and contracts are commercially accepted. Please refer to the Fund’s prospectus and statement of additional information (“SAI”) for a more complete description of risks.

8. CONTRACTUAL OBLIGATIONS

The Fund enters into contracts in the normal course of business that contain a variety of indemnifications. The Fund’s maximum exposure under these contracts is unknown; however, the

Fund has not had prior gains or losses pursuant to these contracts. Management has reviewed the Fund’s existing contracts and expects the risk of loss to be remote.

Pursuant to the Trust’s organizational documents, the Trustees of the Trust (the “Trustees”) and the Trust’s officers are indemnified against certain liabilities that may arise out

of the performance of their duties.

9. REGULATORY MATTERS

In December 2020, the SEC adopted a new rule providing a framework for fund valuation practices (“Rule 2a-5”). Rule 2a-5 establishes requirements for determining fair value in good

faith for purposes of the 1940 Act. Rule 2a-5 will permit fund boards to designate certain parties to perform fair value determinations, subject to board oversight and certain other conditions. Rule 2a-5 also defines when market quotations are

“readily available” for purposes of the 1940 Act and the threshold for determining whether a fund must fair value a security. In connection with Rule 2a-5, the SEC also adopted a related recordkeeping rule, (together with Rule 2a-5, the “Rules”) and

is rescinding previously issued guidance, including with respect to the role of a board in determining fair value and the accounting and auditing of fund investments. The Funds will be required to comply with the Rules by September 8, 2022.

Management is currently assessing the potential impact of the new Rules on the Fund’s financial statements.

10. SUBSEQUENT EVENTS

The Fund has been evaluated by management regarding the need for additional disclosures and/or adjustments resulting from subsequent events. Based on this evaluation, no additional

adjustments were required to the financial statements.

19

|

Disclosure of Fund Expenses (Unaudited)

|

||

All exchange traded funds (“ETFs”) have operating expenses. As a shareholder of an ETF, your investment is affected by these ongoing costs, which include (among others) costs for ETF

management, administrative services, commissions, and shareholder reports like this one. It is important for you to understand the impact of these costs on your investment returns. In addition, a shareholder is responsible for brokerage fees as a

result of the shareholder’s investment in the Fund.

Operating expenses such as these are deducted from an ETF’s gross income and directly reduce its final investment return. These expenses are expressed as a percentage of the ETF’s

average net assets; this percentage is known as the ETF’s expense ratio.

The following examples use the expense ratio and are intended to help you understand the ongoing costs (in dollars) of investing in your Fund and to compare these costs with those of

other funds. The examples are based on an investment of $1,000 made at the beginning of the period shown and held for the entire period (November 15, 2021 to April 30, 2022).

The table on the next page illustrates your Fund’s costs in two ways:

Actual Fund Return. This section helps you to estimate the actual expenses that your Fund incurred over the period. The “Expenses Paid During

Period” column shows the actual dollar expense cost incurred by a $1,000 investment in the Fund, and the “Ending Account Value” number is derived from deducting that expense cost from the Fund’s gross investment return.

You can use this information, together with the actual amount you invested in the Fund, to estimate the expenses you paid over that period. Simply divide your actual account value by

$1,000 to arrive at a ratio (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply that ratio by the number shown for your Fund under “Expenses Paid During Period.”

Hypothetical 5% Return. This section helps you compare your Fund’s costs with those of other funds. It assumes that the Fund had an annual 5%

return before expenses during the year, but that the expense ratio (Column 3) for the period is unchanged. This example is useful in making comparisons because the Securities and Exchange Commission requires all funds to make this 5% calculation. You

can assess your Fund’s comparative cost by comparing the hypothetical result for your Fund in the “Expenses Paid During Period” column with those that appear in the same charts in the shareholder reports for other funds.

NOTE: Because the return is set at 5% for comparison purposes — NOT your Fund’s actual return — the account values shown may not apply to your

specific investment.

20

|

Disclosure of Fund Expenses (Unaudited)

|

||

|

Beginning

Account Value

11/15/2021

|

Ending

Account

Value

4/30/2022

|

Annualized

Expense

Ratios

|

Expenses

Paid During

Period

|

|||||||||||||

|

Global X Blockchain & Bitcoin Strategy ETF‡

|

||||||||||||||||

|

Actual Fund Return

|

$

|

1,000.00

|

$

|

449.50

|

0.42

|

%

|

$

|

1.34

|

(1)

|

|||||||

|

Hypothetical 5% Return

|

1,000.00

|

1,022.71

|

0.42

|

2.11

|

(2)

|

|||||||||||

|

‡

|

Commenced operations on November 15, 2021.

|

|

(1)

|

Expenses are equal to the Fund’s annualized expense ratio multiplied by the average account value over the period, multiplied by 166/365 (to reflect the period from inception

to date).

|

|

(2)

|

Expenses are equal to the Fund’s annualized expense ratio multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year

period).

|

21

|

Approval of Investment Advisory Agreement and Sub-Advisory Agreement (Unaudited)

|

||

Section 15(c) of the Investment Company Act of 1940, as amended (“1940 Act”), requires that the board of trustees of an exchange-traded fund (“ETF”), including a majority of those trustees who are not

“interested persons” of the ETF, as defined in the 1940 Act (“Independent Trustees”), consider on an initial basis and periodically thereafter (as required by the 1940 Act), at an in person meeting called for such purpose, the terms of each ETF’s

investment advisory agreement and whether to approve entering into, or renewing, each agreement.

At a Board meeting of the Global X Funds (the “Trust”) held by videoconference on September 17, 20211

(the “New Fund Board Meeting”), the Board of Trustees (the “Board”) (including the Trust’s Independent Trustees, voting separately) considered and unanimously approved (i) the initial Investment Advisory Agreement (the “New Investment Advisory

Agreement”) for the Global X Blockchain & Bitcoin Strategy ETF (the “New Fund”) and (ii) the initial Supervision and Administration Agreement between the Trust (the “New Supervision and Administration Agreement”), on behalf of the New Fund, and

Global X Management Company LLC (“Global X Management”). The New Investment Advisory Agreement and New Supervision and Administration Agreement are referred to collectively as the “New Fund Agreements.”

In advance of the Board meeting, the Board (including the Trust’s Independent Trustees) and the Independent Trustees’ independent legal counsel requested (in writing) detailed

information from Global X Management in connection with the Board’s consideration of the New Fund Agreements and received and reviewed written responses from Global X Management and supporting materials relating to those requests for information. In

the course of their consideration of the New Fund Agreements, the Trust’s Independent Trustees were advised by their independent legal counsel and, in addition to meetings with management of Global X Management, the Independent Trustees met

separately in executive sessions with their counsel.

|

1

|

This meeting was held via videoconference in reliance on an exemptive order issued by the Securities and Exchange Commission on March 25, 2020. Reliance on the exemptive order is necessary and

appropriate due to circumstances related to current or potential effects of COVID-19. All Trustees participating in the videoconference meeting were able to hear each other simultaneously during the meeting. Reliance on the exemptive order

requires Trustees, including a majority of the Independent Trustees, to ratify actions taken pursuant to the exemptive order by vote cast at the next in-person meeting.

|

22

|

Approval of Investment Advisory Agreement and Sub-Advisory Agreement (Unaudited)

|

||

NEW FUND AGREEMENTS

In determining to approve the New Fund Agreements for the New Fund, the Board considered a variety of factors, including the factors discussed in greater detail below.

Nature, Extent and Quality of Services

|

With respect to this factor, the Board considered:

|

|

|

-

|

the terms of the New Fund Agreements and the range of services proposed to be provided to the New Fund in accordance with the New Fund Agreements;

|

|

-

|

Global X Management’s key personnel and the portfolio managers who would provide investment advisory, supervision and administrative services to the New Fund;

|

|

-

|

Global X Management’s responsibilities under the New Fund Agreements to, among other things, (i) manage the investment operations of the New Fund and the composition of the New Fund’s assets,

including the purchase, retention and disposition of its holdings, (ii) provide quarterly reports to the Trust’s officers and the Board and other reports as the Board deems necessary or appropriate, (iii) vote proxies, exercise consents, and

exercise all other rights appertaining to securities and assets held by the New Fund, (iv) select broker-dealers to execute portfolio transactions for the New Fund when necessary, (v) assist in the preparation and filing of reports and proxy

statements (if any) to the shareholders of the New Fund, and the periodic updating of the registration statements, prospectuses, statements of additional information, and other reports and documents for the New Fund that are required to be

filed by the Trust with the U.S. Securities and Exchange Commission (“SEC”) and other regulatory or governmental bodies, and (vi) monitor anticipated purchases and redemptions of the shares (including Creation Units) of the New Fund by

shareholders and new investors;

|

|

-

|

the nature, extent and quality of all of the services (including advisory, administrative and compliance services) that are proposed to be

|

23

|

Approval of Investment Advisory Agreement and Sub-Advisory Agreement (Unaudited)

|

||

|

provided by Global X Management or made available to the New Fund; and

|

|

|

-

|

the quality of Global X Management’s resources and personnel that would be made available to the New Fund, including Global X Management’s experience and the professional qualifications of

Global X Management’s key personnel.

|

Based on these considerations, the Board concluded, at the New Fund Board Meeting, that it was satisfied with the nature, extent and quality of the services proposed to be provided

to the New Fund by Global X Management.

Performance

The Board determined that, because the New Fund had not yet begun investment operations as of the date of the New Fund Board Meeting, meaningful data relating to the investment

performance of the New Fund was not available and, therefore, could not be a factor in approving the New Fund Agreements.

Cost of Services and Profitability

|

With respect to this factor, the Board considered:

|

|

|

-

|

Global X Management’s expected costs to provide investment management, supervision and administrative and related services to the New Fund;

|

|

-

|

the management fee (including the proposed investment advisory fee) (“Management Fee”) that was proposed to be borne by the New Fund under the respective New Fund Agreement for the various

investment advisory, supervisory and administrative services that the New Fund requires under a unitary fee structure (including the types of fees and expenses that are not included within the unitary fee and would be borne by the New Fund);

and

|

|

-

|

the expected profitability to Global X Management, if any, from all of the services proposed to be provided to the New Fund by Global X

|

24

|

Approval of Investment Advisory Agreement and Sub-Advisory Agreement (Unaudited)

|

||

|

Management and all aspects of the relationship between Global X Management and the New Fund.

|

Based on these considerations, the Board concluded that the proposed Management Fee to be paid by the New Fund to Global X Management, in light of the nature, extent and quality of

the services to be provided, was reasonable and in the best interests of the New Fund’s shareholders.

Comparison of Fees and Services

|

With respect to this factor, the Board considered:

|

|

|

-

|

comparative information with respect to the proposed Management Fee to be paid to Global X Management by the New Fund. In connection with this consideration, Global X Management provided the

Board with comparative expense data for the New Fund, including fees and expenses paid by unaffiliated similar specialized and/or focused ETFs, and/or other similar registered funds. The Board considered Global X Management’s detailed

explanation of the proposed fee structures of any New Fund that was above the average or median for the New Fund’s peer group;

|

|

-

|

the structure of the proposed unitary Management Fee (which includes as one component the proposed investment advisory fee for the New Fund) and the expected total expense ratio for the New

Fund. In this regard, the Board took into consideration that the purpose of adopting a unitary Management Fee structure for the New Fund was to create a simple, all-inclusive fee that would provide a level of predictability with respect to

the overall expense ratios (i.e., the total fees) of the New Fund and that the proposed Management Fee for the New Fund was set at a competitive level to make the New Fund viable in the marketplace; and

|

|

-

|

that, under the proposed unified Management Fee structure, Global X Management would be responsible for most ordinary expenses of the New Fund, including the costs of various third-party

services required by the New Fund, including investment advisory, administrative, audit,

|

25

|

Approval of Investment Advisory Agreement and Sub-Advisory Agreement (Unaudited)

|

||

|

certain custody, portfolio accounting, legal, transfer agency and printing costs, but that the New Fund would bear other expenses not covered under the proposed all-inclusive Management Fee,

such as taxes, brokerage fees, commissions, and other transaction expenses, interest expenses, and extraordinary expenses.

|

Based on these considerations, the Board concluded, at the New Fund Board Meeting, that the services to be received and the fees to be charged under the New Fund Agreements were

reasonable on a comparative basis.

Economies of Scale

|

With respect to this factor, the Board considered:

|

|

|

-

|

the extent to which economies of scale would be realized as the New Fund grows and whether the proposed unitary Management Fee for the New Fund reflected these economies of scale;

|

|

-

|

the significant investment of time, personnel and other resources that Global X Management intends to make in the New Fund in order to seek to assure that the New Fund is attractive to

investors; and

|

|

-

|

that the proposed unitary Management Fee would provide a high level of certainty as to the total level of expenses for the New Fund and its shareholders.

|

Based on these considerations, the Board concluded, at the New Fund Board Meeting, that the proposed unitary Management Fee for the New Fund appropriately addressed economies of

scale.

Other Benefits

In considering each New Fund Agreement, in addition to the factors discussed above, the Board considered other benefits that may be realized by Global X Management as a result of its

relationships with the New Fund. As a result, the Board concluded that, in the case of the New Fund, in the exercise of the Board’s business judgement, all information the Board considered supported approval of the New Fund Agreements.

26

|

Approval of Investment Advisory Agreement and Sub-Advisory Agreement (Unaudited)

|

||

Conclusion

After full consideration of the factors above, as well as other factors that were instructive in their consideration, the Board, including all of the Trust’s Independent Trustees

voting separately, concluded, in the exercise of its business judgement, that the New Fund Agreements were fair and reasonable and in the best interest of the New Fund.

In reaching this decision, the Board did not assign relative weights to the factors above nor did the Board deem any one factor or group of them to be controlling in and of

themselves. Each member of the Board may have assigned different weights to the various factors.

27

|

Supplemental Information (Unaudited)

|

||

NAV is the price per Share at which the Fund issues and redeems Shares. It is calculated in accordance with the standard formula for valuing mutual fund shares. The “Market Price” of

the Fund generally is determined using the midpoint between the highest bid and the lowest offer on the stock exchange on which the Shares of the Fund are listed for trading, as of the time that the Fund’s NAV is calculated. The Fund’s Market Price

may be at, above or below its NAV. The NAV of the Fund will fluctuate with changes in the market value of the Fund’s holdings. The Market Price of the Fund will fluctuate in accordance with changes in its NAV, as well as market supply and demand.

Premiums or discounts are the differences (expressed as a percentage) between the NAV and Market Price of the Fund on a given day, generally at the time NAV is calculated. A premium

is the amount that the Fund is trading above the reported NAV, expressed as a percentage of the NAV. A discount is the amount that the Fund is trading below the reported NAV, expressed as a percentage of the NAV.

Further information regarding premiums and discounts is available on the Fund’s website at www.globalxetfs.com.

28

605 Third Avenue, 43rd Floor

New York, NY 10158

1-888-493-8631

www.globalxetfs.com

Investment Adviser and Administrator:

Global X Management Company LLC

605 Third Avenue, 43rd Floor

New York, NY 10158

Distributor:

SEI Investments Distribution Co.

One Freedom Valley Drive

Oaks, PA 19456

Sub-Administrator:

SEI Investments Global Funds Services

One Freedom Valley Drive

Oaks, PA 19456

Counsel for Global X Funds and the Independent Trustees:

Stradley Ronon Stevens & Young, LLP

2000 K Street, N.W.

Suite 700

Washington, DC 20006

Custodian and Transfer Agent:

Brown Brothers Harriman & Co.

40 Water Street

Boston, MA 02109

Independent Registered Public Accounting Firm:

PricewaterhouseCoopers LLP

Two Commerce Square

Suite 1800

2001 Market Street

Philadelphia, PA 19103

This information must be preceded or accompanied by a current prospectus for the Fund described.

GLX-SA-008-0100

Item 2. Code of Ethics.

Not applicable for semi-annual report.

Item 3. Audit Committee Financial Expert.

Not applicable for semi-annual report.

Item 4. Principal Accountant Fees and Services.

Not applicable for semi-annual report.

Item 5. Audit Committee of Listed Registrants.

Not applicable for semi-annual report.

Item 6. Investments.

Not applicable.

Item 7. Disclosure of Proxy Voting

Policies and Procedures for Closed-End Management Investment Companies.

Not applicable to open-end management investment companies.

Item 8. Portfolio Managers of Closed-End Management Investment Companies.

Not applicable to open-end management investment companies.

Item 9. Purchases of Equity Securities by Closed-End Management Investment Company and Affiliated

Purchasers.

Not applicable to open-end management investment companies.

Item 10. Submission of Matters to a Vote of Security Holders.

There have been no material changes.

Item 11. Controls and Procedures.

(a) The certifying officers, whose certifications are included herewith, have evaluated the registrant’s disclosure controls and procedures within 90 days of the filing date of this report. In their opinion, based on

their evaluation, the registrant’s disclosure controls and procedures are adequately designed, and are operating effectively to ensure, that information required to be disclosed by the registrant in the reports it files or submits under the

Securities Exchange Act of 1934 is recorded, processed, summarized and reported within the time periods specified in the Securities and Exchange Commission’s rules and forms.

(b) There were no significant changes in the registrant’s internal control over financial reporting that occurred during the period covered by this report that has materially affected, or is reasonably likely to

materially affect, the registrant’s internal control over financial reporting.

Item 12. Disclosure of Securities Lending Activities for Closed-End Management Investment Companies.

Not applicable to open-end management investment companies.

Item 13. Exhibits.

(a)(1) Not applicable for semi-annual report.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

(Registrant)

Global X Funds

By (Signature and Title)

/s/ Luis Berruga

Luis Berruga

President

Date: July 7, 2022

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates

indicated.

By (Signature and Title)

/s/ Luis Berruga

Luis Berruga

President

Date: July 7, 2022

By (Signature and Title)

/s/ John Belanger

John Belanger

Chief Financial Officer

Date: July 7, 2022