|

Global X Management Company LLC

605 Third Avenue, 43rd floor

New York, NY 10158

|

Eric S. Purple, Esq.

Stradley Ronon Stevens & Young, LLP

2000 K Street, N.W., Suite 700

Washington, DC 20006-1871

|

|

Global X Social Media ETF (ticker: SOCL)

|

|

Global X Lithium & Battery Tech ETF (ticker: LIT)

|

|

Global X Disruptive Materials ETF (ticker: DMAT)

|

|

Global X E-commerce ETF (ticker: EBIZ)

|

|

Global X Emerging Markets Internet & E-commerce ETF (ticker: EWEB)

|

|

Global X SuperDividend® ETF (ticker: SDIV)

|

|

Global X SuperDividend® U.S. ETF (ticker: DIV)

|

|

Global X MSCI SuperDividend® EAFE ETF (ticker: EFAS)

|

|

Global X MSCI SuperDividend® Emerging Markets ETF (ticker: SDEM)

|

|

Global X SuperDividend® REIT ETF (ticker: SRET)

|

|

Global X NASDAQ 100® Covered Call ETF (ticker: QYLD)

|

|

Global X S&P 500® Covered Call ETF (ticker: XYLD)

|

|

Global X Russell 2000 Covered Call ETF (ticker: RYLD)

|

|

Global X Dow 30® Covered Call ETF (ticker: DJIA)

|

|

Global X Nasdaq 100® Covered Call & Growth ETF (ticker: QYLG)

|

|

Global X S&P 500® Covered Call & Growth ETF (ticker: XYLG)

|

|

Global X SuperIncome™ Preferred ETF (ticker: SPFF)

|

|

Global X Renewable Energy Producers ETF (ticker: RNRG)

|

|

Global X S&P 500® Catholic Values ETF (ticker: CATH)

|

|

Global X S&P Catholic Values Developed ex-U.S. ETF (ticker: CEFA)

|

|

Global X Guru® Index ETF (ticker: GURU)

|

|

Global X S&P 500® Tail Risk ETF (ticker: XTR)

|

|

Global X S&P 500® Risk Managed Income ETF (ticker: XRMI)

|

|

Global X S&P 500® Collar 95-110 ETF (ticker: XCLR)

|

|

Global X NASDAQ 100® Tail Risk ETF (ticker: QTR)

|

|

Global X NASDAQ 100® Risk Managed Income ETF (ticker: QRMI)

|

|

Global X NASDAQ 100® Collar 95-110 ETF (ticker: QCLR)

|

|

Table of Contents

|

|

Schedules of Investments

|

|

|

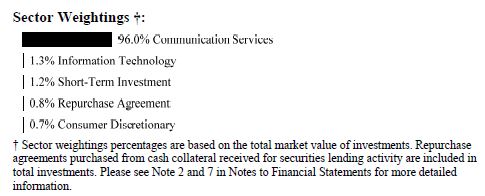

Global X Social Media ETF

|

1

|

|

Global X Lithium & Battery Tech ETF

|

6

|

|

Global X Disruptive Materials ETF

|

11

|

|

Global X E-commerce ETF

|

16

|

|

Global X Emerging Markets Internet & E-commerce ETF

|

21

|

|

Global X SuperDividend® ETF

|

24

|

|

Global X SuperDividend® U.S. ETF

|

34

|

|

Global X MSCI SuperDividend® EAFE ETF

|

39

|

|

Global X MSCI SuperDividend® Emerging Markets ETF

|

45

|

|

Global X SuperDividend® REIT ETF

|

51

|

|

Global X NASDAQ 100® Covered Call ETF

|

54

|

|

Global X S&P 500® Covered Call ETF

|

60

|

|

Global X Russell 2000 Covered Call ETF

|

79

|

|

Global X Dow 30® Covered Call ETF

|

148

|

|

Global X Nasdaq 100® Covered Call & Growth ETF

|

152

|

|

Global X Global X S&P 500® Covered Call & Growth ETF

|

158

|

|

Global X SuperIncome™ Preferred ETF

|

177

|

|

Global X Renewable Energy Producers ETF

|

182

|

|

Global X S&P 500® Catholic Values ETF

|

188

|

|

Global X Guru® Index ETF

|

231

|

|

Global X S&P 500® Tail Risk ETF

|

237

|

|

Global X S&P 500® Risk Managed Income ETF

|

256

|

|

Global X S&P 500® Collar 95-110 ETF

|

275

|

|

Global X Nasdaq 100® Tail Risk ETF

|

294

|

|

Global X Nasdaq 100® Risk Managed Income ETF

|

300

|

|

Global X Nasdaq 100® Collar 95-110 ETF

|

307

|

|

Statements of Assets and Liabilities

|

314

|

|

Statements of Operations

|

321

|

|

Statements of Changes in Net Assets

|

328

|

|

Financial Highlights

|

343

|

|

Notes To Financial Statements

|

361

|

|

Disclosure of Fund Expenses

|

390

|

|

Approval of Investment Advisory Agreegment

|

394

|

|

Supplemental Information

|

403

|

|

Schedule of Investments

|

April 30, 2022 (Unaudited)

|

|

|

Global X Social Media ETF

|

|

Shares

|

Value

|

|||||||

|

COMMON STOCK — 99.4%

|

||||||||

|

CHINA — 27.1%

|

||||||||

|

Communication Services — 27.1%

|

||||||||

|

Baidu ADR *

|

83,215

|

$

|

10,332,807

|

|||||

|

Bilibili ADR * (A)

|

191,039

|

4,649,889

|

||||||

|

Hello Group ADR *

|

119,731

|

636,969

|

||||||

|

HUYA ADR *

|

20,154

|

83,236

|

||||||

|

JOYY ADR

|

29,316

|

1,160,034

|

||||||

|

Kuaishou Technology, Cl B *

|

393,388

|

3,346,692

|

||||||

|

Meitu *

|

1,809,800

|

219,128

|

||||||

|

NetEase ADR

|

117,123

|

11,165,336

|

||||||

|

Tencent Holdings

|

495,327

|

23,825,240

|

||||||

|

Tencent Music Entertainment Group ADR *

|

455,453

|

1,935,675

|

||||||

|

Weibo ADR *

|

66,333

|

1,534,946

|

||||||

|

TOTAL CHINA

|

58,889,952

|

|||||||

|

GERMANY — 1.1%

|

||||||||

|

Communication Services — 1.1%

|

||||||||

|

United Internet

|

72,105

|

2,337,550

|

||||||

|

JAPAN — 5.7%

|

||||||||

|

Communication Services — 5.7%

|

||||||||

|

Coconala *

|

10,600

|

66,107

|

||||||

|

DeNA

|

64,443

|

937,099

|

||||||

|

The accompanying notes are an integral part of the financial statements.

|

|

Schedule of Investments

|

April 30, 2022 (Unaudited)

|

|

|

Global X Social Media ETF

|

|

Shares

|

Value

|

|||||||

|

COMMON STOCK — continued

|

||||||||

|

giftee *(A)

|

13,875

|

$

|

111,912

|

|||||

|

Gree (A)

|

38,574

|

296,838

|

||||||

|

Kakaku.com

|

102,844

|

2,177,378

|

||||||

|

Mixi

|

29,982

|

519,293

|

||||||

|

Nexon

|

360,621

|

8,272,350

|

||||||

|

TOTAL JAPAN

|

12,380,977

|

|||||||

|

RUSSIA — 0.0%

|

||||||||

|

Communication Services — 0.0%

|

||||||||

|

VK GDR *(B)(C)(D)

|

2,524

|

1,422

|

||||||

|

SOUTH KOREA — 12.4%

|

||||||||

|

Communication Services — 12.4%

|

||||||||

|

AfreecaTV

|

5,760

|

504,459

|

||||||

|

Com2uSCorp

|

6,482

|

494,407

|

||||||

|

Kakao

|

143,642

|

10,281,382

|

||||||

|

NAVER

|

68,689

|

15,668,311

|

||||||

|

TOTAL SOUTH KOREA

|

26,948,559

|

|||||||

|

TAIWAN — 0.1%

|

||||||||

|

Consumer Discretionary — 0.1%

|

||||||||

|

PChome Online

|

79,444

|

209,691

|

||||||

|

UNITED ARAB EMIRATES — 0.1%

|

||||||||

|

Communication Services — 0.1%

|

||||||||

|

Yalla Group ADR * (A)

|

70,467

|

288,210

|

||||||

|

UNITED STATES — 52.9%

|

||||||||

|

Communication Services — 51.0%

|

||||||||

|

Alphabet, Cl A *

|

4,314

|

9,845,368

|

||||||

|

Angi, Cl A *

|

59,084

|

260,561

|

||||||

|

Bumble, Cl A *

|

68,982

|

1,654,878

|

||||||

|

IAC *

|

62,980

|

5,219,782

|

||||||

|

Match Group *

|

143,461

|

11,354,938

|

||||||

|

Meta Platforms, Cl A *

|

109,800

|

22,011,606

|

||||||

|

Nextdoor Holdings *

|

47,386

|

213,711

|

||||||

|

Schedule of Investments

|

April 30, 2022 (Unaudited)

|

|

|

Global X Social Media ETF

|

|

Shares

|

Value

|

|||||||

|

COMMON STOCK — continued

|

||||||||

|

Pinterest, Cl A *

|

461,493

|

$

|

9,469,836

|

|||||

|

Snap, Cl A *

|

538,560

|

15,327,418

|

||||||

|

Spotify Technology *

|

79,273

|

8,058,101

|

||||||

|

Twitter *

|

353,693

|

17,338,031

|

||||||

|

Vimeo *

|

105,139

|

1,071,366

|

||||||

|

Yelp, Cl A *

|

52,821

|

1,718,267

|

||||||

|

Zynga, Cl A *

|

870,690

|

7,200,606

|

||||||

|

110,744,469

|

||||||||

|

Consumer Discretionary — 0.6%

|

||||||||

|

Fiverr International *

|

20,320

|

1,082,040

|

||||||

|

Groupon, Cl A * (A)

|

16,818

|

328,119

|

||||||

|

1,410,159

|

||||||||

|

Information Technology — 1.3%

|

||||||||

|

Life360, Cl CDI *

|

77,257

|

221,258

|

||||||

|

Sprinklr, Cl A *

|

50,361

|

687,427

|

||||||

|

Sprout Social, Cl A *

|

30,474

|

1,867,447

|

||||||

|

2,776,132

|

||||||||

|

TOTAL UNITED STATES

|

114,930,760

|

|||||||

|

TOTAL COMMON STOCK

|

||||||||

|

(Cost $325,167,013)

|

215,987,121

|

|||||||

|

SHORT-TERM INVESTMENT(E)(F) — 1.2%

|

||||||||

|

Fidelity Investments Money Market Government Portfolio, Cl Institutional, 0.160%

|

||||||||

|

(Cost $2,579,952)

|

2,579,952

|

2,579,952

|

||||||

|

Schedule of Investments

|

April 30, 2022 (Unaudited)

|

|

|

Global X Social Media ETF

|

|

Face Amount

|

Value

|

|||||||

|

REPURCHASE AGREEMENT(E) — 0.9%

|

||||||||

|

BNP Paribas

|

||||||||

|

0.240%, dated 04/29/2022, to be repurchased on 05/02/2022, repurchase price $1,849,969 (collateralized by various U.S. Treasury Obligations, ranging in par value $147,326 - $198,090, 0.250%,

09/30/2025, with a total market value of $1,885,773)

|

||||||||

|

(Cost $1,849,932)

|

$

|

1,849,932

|

$

|

1,849,932

|

||||

|

TOTAL INVESTMENTS — 101.5%

|

||||||||

|

(Cost $329,596,897)

|

$

|

220,417,005

|

||||||

|

*

|

Non-income producing security.

|

|

(A)

|

This security or a partial position of this security is on loan at April 30, 2022. The total value of securities on loan at April 30, 2022 was $4,637,347.

|

|

(B)

|

Security considered illiquid. The total value of such securities as of April 30, 2022 was $1,422 and represented 0.0% of Net Assets.

|

|

(C)

|

Security is fair valued using methods determined in good faith by the Fair Value Committee of the Fund. The total value of such securities as of April 30, 2022, was $1,422 and represents 0.0% of

Net Assets.

|

|

(D)

|

Level 3 security in accordance with fair value hierarchy.

|

|

(E)

|

Security was purchased with cash collateral held from securities on loan. The total value of such securities as of April 30, 2022 was $4,429,884.

|

|

(F)

|

The rate reported on the Schedule of Investments is the 7-day effective yield as of April 30, 2022.

|

|

Schedule of Investments

|

April 30, 2022 (Unaudited)

|

|

|

Global X Social Media ETF

|

|

Investments in Securities

|

Level 1

|

Level 2

|

Level 3(1)

|

Total

|

||||||||||||

|

Common Stock

|

$

|

203,604,722

|

$

|

12,380,977

|

$

|

1,422

|

$

|

215,987,121

|

||||||||

|

Short-Term Investment

|

2,579,952

|

—

|

—

|

2,579,952

|

||||||||||||

|

Repurchase Agreement

|

—

|

1,849,932

|

—

|

1,849,932

|

||||||||||||

|

Total Investments in Securities

|

$

|

206,184,674

|

$

|

14,230,909

|

$

|

1,422

|

$

|

220,417,005

|

||||||||

|

(1)

|

A reconciliation of Level 3 investments and disclosures of significant unobservable inputs are presented when the Fund has a significant amount of Level 3 investments at the beginning and/or end

of the year in relation to Net Assets. Management has concluded that Level 3 investments are not material in relation to Net Assets.

|

|

Schedule of Investments

|

April 30, 2022 (Unaudited)

|

|

|

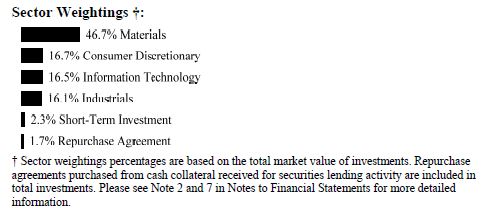

Global X Lithium & Battery Tech ETF

|

|

Shares

|

Value

|

|||||||

|

COMMON STOCK — 100.0%

|

||||||||

|

AUSTRALIA — 8.9%

|

||||||||

|

Materials — 8.9%

|

||||||||

|

Allkem *

|

12,424,112

|

$

|

108,157,830

|

|||||

|

ioneer *

|

35,081,756

|

16,828,353

|

||||||

|

Mineral Resources

|

3,491,208

|

145,239,572

|

||||||

|

Pilbara Minerals *

|

47,156,428

|

95,508,556

|

||||||

|

Vulcan Energy Resources * (A)

|

2,010,283

|

12,114,614

|

||||||

|

TOTAL AUSTRALIA

|

377,848,925

|

|||||||

|

CANADA — 1.5%

|

||||||||

|

Materials — 1.5%

|

||||||||

|

Lithium Americas * (A)

|

1,779,199

|

45,076,846

|

||||||

|

Standard Lithium * (A)

|

2,905,322

|

18,731,547

|

||||||

|

TOTAL CANADA

|

63,808,393

|

|||||||

|

CHILE — 5.3%

|

||||||||

|

Materials — 5.3%

|

||||||||

|

Sociedad Quimica y Minera de Chile ADR

|

3,048,409

|

224,972,584

|

||||||

|

CHINA — 37.1%

|

||||||||

|

Consumer Discretionary — 5.4%

|

||||||||

|

BYD, Cl H

|

7,332,976

|

220,377,604

|

||||||

|

Schedule of Investments

|

April 30, 2022 (Unaudited)

|

|

|

Global X Lithium & Battery Tech ETF

|

|

Shares

|

Value

|

|||||||

|

COMMON STOCK — continued

|

||||||||

|

Consumer Discretionary — continued

|

||||||||

|

Tianneng Power International (A)

|

13,892,600

|

$

|

11,668,428

|

|||||

|

232,046,032

|

||||||||

|

Industrials — 13.0%

|

||||||||

|

Contemporary Amperex Technology, Cl A *

|

2,908,205

|

179,242,320

|

||||||

|

Eve Energy, Cl A

|

15,295,797

|

151,698,232

|

||||||

|

Shenzhen Yinghe Technology, Cl A

|

6,718,410

|

18,126,972

|

||||||

|

Sunwoda Electronic, Cl A

|

22,113,683

|

74,081,853

|

||||||

|

Wuxi Lead Intelligent Equipment, Cl A

|

19,714,037

|

131,403,168

|

||||||

|

554,552,545

|

||||||||

|

Information Technology — 3.3%

|

||||||||

|

NAURA Technology Group, Cl A

|

3,852,937

|

138,647,025

|

||||||

|

Materials — 15.4%

|

||||||||

|

Beijing Easpring Material Technology, Cl A

|

7,086,191

|

71,462,588

|

||||||

|

Ganfeng Lithium, Cl A

|

10,226,134

|

170,397,074

|

||||||

|

Guangzhou Tinci Materials Technology, Cl A

|

9,835,781

|

110,950,015

|

||||||

|

Shanghai Putailai New Energy Technology, Cl A

|

4,034,599

|

72,130,371

|

||||||

|

Shenzhen Capchem Technology, Cl A

|

4,855,346

|

48,877,311

|

||||||

|

Yunnan Energy New Material, Cl A

|

5,940,576

|

181,525,799

|

||||||

|

655,343,158

|

||||||||

|

TOTAL CHINA

|

1,580,588,760

|

|||||||

|

GERMANY — 0.9%

|

||||||||

|

Industrials — 0.9%

|

||||||||

|

Varta (A)

|

382,588

|

36,236,300

|

||||||

|

HONG KONG — 0.0%

|

||||||||

|

Industrials — 0.0%

|

||||||||

|

Honbridge Holdings *

|

10,969,900

|

331,356

|

||||||

|

JAPAN — 10.8%

|

||||||||

|

Consumer Discretionary — 4.4%

|

||||||||

|

Panasonic Holdings

|

20,895,524

|

187,166,221

|

||||||

|

Schedule of Investments

|

April 30, 2022 (Unaudited)

|

|

|

Global X Lithium & Battery Tech ETF

|

|

Shares

|

Value

|

|||||||

|

COMMON STOCK — continued

|

||||||||

|

Industrials — 0.7%

|

||||||||

|

GS Yuasa

|

1,591,383

|

$

|

27,845,518

|

|||||

|

Information Technology — 5.7%

|

||||||||

|

TDK

|

7,778,159

|

244,043,040

|

||||||

|

TOTAL JAPAN

|

459,054,779

|

|||||||

|

NETHERLANDS — 0.6%

|

||||||||

|

Materials — 0.6%

|

||||||||

|

AMG Advanced Metallurgical Group

|

603,888

|

23,915,726

|

||||||

|

NORWAY — 0.5%

|

||||||||

|

Industrials — 0.5%

|

||||||||

|

FREYR Battery * (A)

|

2,260,204

|

20,296,632

|

||||||

|

SOUTH KOREA — 10.9%

|

||||||||

|

Information Technology — 7.4%

|

||||||||

|

Iljin Materials

|

398,081

|

27,891,026

|

||||||

|

L&F * (A)

|

457,620

|

79,901,326

|

||||||

|

Samsung SDI

|

427,410

|

207,919,992

|

||||||

|

315,712,344

|

||||||||

|

Materials — 3.5%

|

||||||||

|

LG Chemical

|

363,954

|

150,391,820

|

||||||

|

TOTAL SOUTH KOREA

|

466,104,164

|

|||||||

|

TAIWAN — 0.8%

|

||||||||

|

Information Technology — 0.8%

|

||||||||

|

Simplo Technology

|

3,370,780

|

33,335,562

|

||||||

|

UNITED STATES — 22.7%

|

||||||||

|

Consumer Discretionary — 7.5%

|

||||||||

|

QuantumScape, Cl A * (A)

|

3,663,783

|

54,736,918

|

||||||

|

Tesla *

|

305,322

|

265,862,185

|

||||||

|

320,599,103

|

||||||||

|

Industrials — 1.7%

|

||||||||

|

EnerSys

|

885,786

|

57,983,552

|

||||||

|

Schedule of Investments

|

April 30, 2022 (Unaudited)

|

|

|

Global X Lithium & Battery Tech ETF

|

|

Shares/Face Amount

|

Value

|

|||||||

|

COMMON STOCK — continued

|

||||||||

|

Industrials — continued

|

||||||||

|

Microvast Holdings * (A)

|

3,134,842

|

$

|

15,548,816

|

|||||

|

73,532,368

|

||||||||

|

Materials — 13.5%

|

||||||||

|

Albemarle

|

2,492,569

|

480,642,080

|

||||||

|

Livent *

|

3,415,275

|

72,950,274

|

||||||

|

Piedmont Lithium * (A)

|

31,034,914

|

20,731,700

|

||||||

|

574,324,054

|

||||||||

|

TOTAL UNITED STATES

|

968,455,525

|

|||||||

|

TOTAL COMMON STOCK

|

||||||||

|

(Cost $4,084,949,781)

|

4,254,948,706

|

|||||||

|

SHORT-TERM INVESTMENT(B)(C) — 2.4%

|

||||||||

|

Fidelity Investments Money Market Government Portfolio, Cl Institutional, 0.160%

|

||||||||

|

(Cost $101,477,470)

|

101,477,470

|

101,477,470

|

||||||

|

REPURCHASE AGREEMENT(B) — 1.7%

|

||||||||

|

BNP Paribas

|

||||||||

|

0.240%, dated 04/29/2022, to be repurchased on 05/02/2022, repurchase price $73,688,601 (collateralized by various U.S. Treasury Obligations, ranging in par value $5,868,344 - $7,890,395,

0.250%, 09/30/2025, with a total market value of $75,114,803)

|

||||||||

|

(Cost $73,687,127)

|

$

|

73,687,127

|

73,687,127

|

|||||

|

TOTAL INVESTMENTS — 104.1%

|

||||||||

|

(Cost $4,260,114,378)

|

$

|

4,430,113,303

|

||||||

|

Schedule of Investments

|

April 30, 2022 (Unaudited)

|

|

|

Global X Lithium & Battery Tech ETF

|

|

*

|

Non-income producing security.

|

|

(A)

|

This security or a partial position of this security is on loan at April 30, 2022. The total value of securities on loan at April 30, 2022 was $166,654,568.

|

|

(B)

|

Security was purchased with cash collateral held from securities on loan. The total value of such securities as of April 30, 2022 was $175,164,597.

|

|

(C)

|

The rate reported on the Schedule of Investments is the 7-day effective yield as of April 30, 2022.

|

|

Investments in Securities

|

Level 1

|

Level 2

|

Level 3

|

Total

|

||||||||||||

|

Common Stock

|

$

|

3,795,893,927

|

$

|

459,054,779

|

$

|

—

|

$

|

4,254,948,706

|

||||||||

|

Short-Term Investment

|

101,477,470

|

—

|

—

|

101,477,470

|

||||||||||||

|

Repurchase Agreement

|

—

|

73,687,127

|

—

|

73,687,127

|

||||||||||||

|

Total Investments in Securities

|

$

|

3,897,371,397

|

$

|

532,741,906

|

$

|

—

|

$

|

4,430,113,303

|

||||||||

|

Schedule of Investments

|

April 30, 2022 (Unaudited)

|

|

|

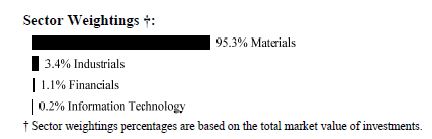

Global X Disruptive Materials ETF

|

|

Shares

|

Value

|

|||||||

|

COMMON STOCK — 99.8%

|

||||||||

|

AUSTRALIA — 11.2%

|

||||||||

|

Materials — 11.2%

|

||||||||

|

Allkem *

|

17,612

|

$

|

153,321

|

|||||

|

IGO

|

19,237

|

180,044

|

||||||

|

Lynas Rare Earths *

|

27,020

|

175,889

|

||||||

|

Syrah Resources *

|

18,266

|

25,637

|

||||||

|

Western Areas *

|

7,454

|

20,341

|

||||||

|

TOTAL AUSTRALIA

|

555,232

|

|||||||

|

CANADA — 2.5%

|

||||||||

|

Materials — 2.5%

|

||||||||

|

HudBay Minerals

|

6,532

|

42,063

|

||||||

|

Lithium Americas *

|

3,184

|

80,668

|

||||||

|

TOTAL CANADA

|

122,731

|

|||||||

|

CHILE — 7.5%

|

||||||||

|

Materials — 7.5%

|

||||||||

|

Antofagasta

|

10,180

|

198,232

|

||||||

|

Lundin Mining

|

19,190

|

176,127

|

||||||

|

TOTAL CHILE

|

374,359

|

|||||||

|

CHINA — 24.8%

|

||||||||

|

Industrials — 1.4%

|

||||||||

|

Fangda Carbon New Material, Cl A *

|

67,200

|

71,634

|

||||||

|

Materials — 23.4%

|

||||||||

|

Beijing Easpring Material Technology, Cl A

|

9,500

|

95,805

|

||||||

|

Schedule of Investments

|

April 30, 2022 (Unaudited)

|

|

|

Global X Disruptive Materials ETF

|

|

Shares

|

Value

|

|||||||

|

COMMON STOCK — continued

|

||||||||

|

Materials — continued

|

||||||||

|

China Minmetals Rare Earth, Cl A *

|

12,100

|

$

|

42,120

|

|||||

|

China Nonferrous Mining

|

36,200

|

18,732

|

||||||

|

China Northern Rare Earth Group High-Tech, Cl A

|

35,100

|

167,422

|

||||||

|

Ganfeng Lithium, Cl H

|

8,730

|

106,592

|

||||||

|

MMG *

|

84,800

|

36,639

|

||||||

|

Nanjing Hanrui Cobalt, Cl A

|

6,000

|

46,253

|

||||||

|

Shenghe Resources Holding, Cl A

|

32,000

|

75,884

|

||||||

|

Sinofibers Technology, Cl A

|

8,700

|

60,976

|

||||||

|

South Manganese Investment *

|

144,000

|

15,784

|

||||||

|

Tongling Nonferrous Metals Group, Cl A

|

179,200

|

94,434

|

||||||

|

Weihai Guangwei Composites, Cl A

|

8,300

|

62,247

|

||||||

|

Western Mining, Cl A

|

46,800

|

84,345

|

||||||

|

Yunnan Tin, Cl A

|

26,100

|

70,420

|

||||||

|

Zhejiang Huayou Cobalt, Cl A

|

15,000

|

185,894

|

||||||

|

1,163,547

|

||||||||

|

TOTAL CHINA

|

1,235,181

|

|||||||

|

FRANCE — 0.7%

|

||||||||

|

Materials — 0.7%

|

||||||||

|

Eramet

|

261

|

35,271

|

||||||

|

GERMANY — 0.3%

|

||||||||

|

Industrials — 0.3%

|

||||||||

|

SGL Carbon *

|

2,609

|

14,477

|

||||||

|

INDONESIA — 0.7%

|

||||||||

|

Materials — 0.7%

|

||||||||

|

Nickel Mines

|

38,054

|

35,562

|

||||||

|

JAPAN — 5.5%

|

||||||||

|

Industrials — 0.3%

|

||||||||

|

Nippon Carbon

|

480

|

15,431

|

||||||

|

Schedule of Investments

|

April 30, 2022 (Unaudited)

|

|

|

Global X Disruptive Materials ETF

|

|

Shares

|

Value

|

|||||||

|

COMMON STOCK — continued

|

||||||||

|

Materials — 5.2%

|

||||||||

|

Nippon Denko

|

5,710

|

$

|

14,015

|

|||||

|

Sumitomo Metal Mining

|

4,542

|

198,809

|

||||||

|

Tokai Carbon

|

5,485

|

45,553

|

||||||

|

258,377

|

||||||||

|

TOTAL JAPAN

|

273,808

|

|||||||

|

NETHERLANDS — 0.7%

|

||||||||

|

Materials — 0.7%

|

||||||||

|

AMG Advanced Metallurgical Group

|

912

|

36,118

|

||||||

|

PERU — 3.2%

|

||||||||

|

Materials — 3.2%

|

||||||||

|

Southern Copper

|

2,562

|

159,536

|

||||||

|

SOUTH AFRICA — 18.9%

|

||||||||

|

Materials — 18.9%

|

||||||||

|

African Rainbow Minerals

|

3,187

|

52,771

|

||||||

|

Anglo American

|

4,712

|

212,144

|

||||||

|

Anglo American Platinum

|

1,627

|

180,502

|

||||||

|

Impala Platinum Holdings

|

14,310

|

186,572

|

||||||

|

Northam Platinum Holdings *

|

10,549

|

126,031

|

||||||

|

Sibanye Stillwater

|

52,217

|

184,189

|

||||||

|

942,209

|

||||||||

|

TOTAL SOUTH AFRICA

|

942,209

|

|||||||

|

SWEDEN — 4.4%

|

||||||||

|

Materials — 4.4%

|

||||||||

|

Boliden

|

4,903

|

215,878

|

||||||

|

TAIWAN — 0.3%

|

||||||||

|

Information Technology — 0.3%

|

||||||||

|

Acme Electronics *

|

12,000

|

12,336

|

||||||

|

Schedule of Investments

|

April 30, 2022 (Unaudited)

|

|

|

Global X Disruptive Materials ETF

|

|

Shares

|

Value

|

|||||||

|

COMMON STOCK — continued

|

||||||||

|

UNITED KINGDOM — 0.3%

|

||||||||

|

Materials — 0.3%

|

||||||||

|

Jubilee Metals Group *

|

87,630

|

$

|

16,668

|

|||||

|

UNITED STATES — 14.7%

|

||||||||

|

Industrials — 1.3%

|

||||||||

|

GrafTech International

|

5,992

|

54,407

|

||||||

|

KULR Technology Group *

|

6,923

|

11,077

|

||||||

|

65,484

|

||||||||

|

Materials — 13.4%

|

||||||||

|

Albemarle

|

1,153

|

222,333

|

||||||

|

Freeport-McMoRan

|

4,754

|

192,775

|

||||||

|

Livent *

|

4,843

|

103,446

|

||||||

|

MP Materials *

|

3,923

|

149,231

|

||||||

|

667,785

|

||||||||

|

TOTAL UNITED STATES

|

733,269

|

|||||||

|

ZAMBIA — 4.1%

|

||||||||

|

Materials — 4.1%

|

||||||||

|

First Quantum Minerals

|

7,015

|

202,154

|

||||||

|

TOTAL COMMON STOCK

|

||||||||

|

(Cost $5,562,067)

|

4,964,789

|

|||||||

|

TOTAL INVESTMENTS — 99.8%

|

||||||||

|

(Cost $5,562,067)

|

$

|

4,964,789

|

||||||

|

*

|

Non-income producing security.

|

|

Schedule of Investments

|

April 30, 2022 (Unaudited)

|

|

|

Global X Disruptive Materials ETF

|

|

Investments in Securities

|

Level 1

|

Level 2

|

Level 3

|

Total

|

||||||||||||

|

Common Stock

|

$

|

4,690,981

|

$

|

273,808

|

$

|

—

|

$

|

4,964,789

|

||||||||

|

Total Investments in Securities

|

$

|

4,690,981

|

$

|

273,808

|

$

|

—

|

$

|

4,964,789

|

||||||||

|

Schedule of Investments

|

April 30, 2022 (Unaudited)

|

|

|

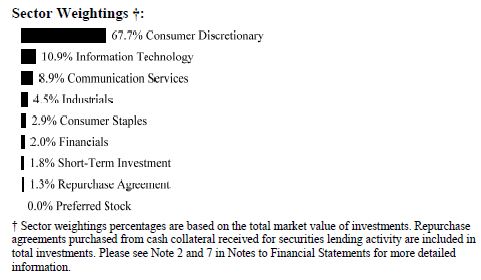

Global X E-commerce ETF

|

|

Shares

|

Value

|

|||||||

|

COMMON STOCK — 99.9%

|

||||||||

|

AUSTRALIA — 0.4%

|

||||||||

|

Consumer Discretionary — 0.4%

|

||||||||

|

Temple & Webster Group * (A)

|

91,264

|

$

|

382,655

|

|||||

|

BRAZIL — 4.8%

|

||||||||

|

Communication Services — 0.4%

|

||||||||

|

VTEX, Cl A * (A)

|

58,279

|

308,296

|

||||||

|

Consumer Discretionary — 4.4%

|

||||||||

|

MercadoLibre *

|

3,695

|

3,597,563

|

||||||

|

TOTAL BRAZIL

|

3,905,859

|

|||||||

|

CANADA — 2.0%

|

||||||||

|

Information Technology — 2.0%

|

||||||||

|

Shopify, Cl A *

|

3,821

|

1,630,879

|

||||||

|

CHINA — 27.0%

|

||||||||

|

Communication Services — 4.9%

|

||||||||

|

NetEase ADR

|

42,208

|

4,023,689

|

||||||

|

Schedule of Investments

|

April 30, 2022 (Unaudited)

|

|

|

Global X E-commerce ETF

|

|

Shares

|

Value

|

|||||||

|

COMMON STOCK — continued

|

||||||||

|

Consumer Discretionary — 21.6%

|

||||||||

|

Alibaba Group Holding ADR *

|

32,460

|

$

|

3,151,541

|

|||||

|

Baozun ADR *

|

67,800

|

517,992

|

||||||

|

JD.com ADR *

|

58,544

|

3,609,823

|

||||||

|

Pinduoduo ADR *

|

74,078

|

3,192,021

|

||||||

|

Trip.com Group ADR *

|

179,910

|

4,254,872

|

||||||

|

Uxin ADR * (A)

|

359,169

|

284,175

|

||||||

|

Vipshop Holdings ADR *

|

344,479

|

2,638,709

|

||||||

|

17,649,133

|

||||||||

|

Financials — 0.5%

|

||||||||

|

LexinFintech Holdings ADR *

|

151,635

|

388,185

|

||||||

|

TOTAL CHINA

|

22,061,007

|

|||||||

|

GERMANY — 0.8%

|

||||||||

|

Consumer Discretionary — 0.8%

|

||||||||

|

Jumia Technologies ADR * (A)

|

89,834

|

635,126

|

||||||

|

JAPAN — 3.8%

|

||||||||

|

Consumer Discretionary — 3.8%

|

||||||||

|

Rakuten Group

|

439,860

|

3,116,637

|

||||||

|

SOUTH KOREA — 0.3%

|

||||||||

|

Information Technology — 0.3%

|

||||||||

|

Cafe24 *

|

15,778

|

238,052

|

||||||

|

UNITED KINGDOM — 4.7%

|

||||||||

|

Consumer Discretionary — 1.7%

|

||||||||

|

ASOS *

|

79,344

|

1,392,629

|

||||||

|

Consumer Staples — 3.0%

|

||||||||

|

Ocado Group *

|

213,762

|

2,479,800

|

||||||

|

TOTAL UNITED KINGDOM

|

3,872,429

|

|||||||

|

UNITED STATES — 56.1%

|

||||||||

|

Communication Services — 3.9%

|

||||||||

|

Angi, Cl A *

|

85,519

|

377,139

|

||||||

|

Schedule of Investments

|

April 30, 2022 (Unaudited)

|

|

|

Global X E-commerce ETF

|

|

Shares

|

Value

|

|||||||

|

COMMON STOCK — continued

|

||||||||

|

Communication Services — continued

|

||||||||

|

TripAdvisor *

|

109,060

|

$

|

2,799,570

|

|||||

|

3,176,709

|

||||||||

|

Consumer Discretionary — 37.0%

|

||||||||

|

1847 Goedeker * (A)

|

149,056

|

189,301

|

||||||

|

Amazon.com *

|

1,354

|

3,365,543

|

||||||

|

Booking Holdings *

|

1,837

|

4,060,339

|

||||||

|

eBay

|

69,564

|

3,611,763

|

||||||

|

Etsy *

|

25,078

|

2,337,019

|

||||||

|

Expedia Group *

|

24,641

|

4,306,015

|

||||||

|

Groupon, Cl A * (A)

|

26,275

|

512,625

|

||||||

|

Lands’ End *

|

17,371

|

243,541

|

||||||

|

Overstock.com *

|

48,529

|

1,628,633

|

||||||

|

PetMed Express (A)

|

22,106

|

484,121

|

||||||

|

Qurate Retail, Cl A *

|

404,600

|

1,703,366

|

||||||

|

Shutterstock

|

27,205

|

2,059,963

|

||||||

|

Wayfair, Cl A * (A)

|

25,319

|

1,948,044

|

||||||

|

Williams-Sonoma

|

29,499

|

3,849,030

|

||||||

|

30,299,303

|

||||||||

|

Financials — 1.5%

|

||||||||

|

eHealth *

|

28,078

|

226,028

|

||||||

|

LendingTree *

|

12,959

|

1,029,204

|

||||||

|

1,255,232

|

||||||||

|

Industrials — 4.7%

|

||||||||

|

CoStar Group *

|

59,774

|

3,802,822

|

||||||

|

Information Technology — 9.0%

|

||||||||

|

BigCommerce Holdings *

|

59,519

|

1,063,605

|

||||||

|

GoDaddy, Cl A *

|

56,189

|

4,540,633

|

||||||

|

LivePerson *

|

76,978

|

1,741,242

|

||||||

|

7,345,480

|

||||||||

|

TOTAL UNITED STATES

|

45,879,546

|

|||||||

|

Schedule of Investments

|

April 30, 2022 (Unaudited)

|

|

|

Global X E-commerce ETF

|

|

Shares/Face Amount

|

Value

|

|||||||

|

COMMON STOCK — continued

|

||||||||

|

TOTAL COMMON STOCK

|

||||||||

|

(Cost $153,515,897)

|

$

|

81,722,190

|

||||||

|

PREFERRED STOCK — 0.0%

|

||||||||

|

UNITED STATES— 0.0%

|

||||||||

|

Consumer Discretionary — 0.0%

|

||||||||

|

Overstock.com, Ser A1, 1.020%

|

||||||||

|

(Cost $3,867)

|

366

|

10,138

|

||||||

|

SHORT-TERM INVESTMENT(B)(C) — 1.9%

|

||||||||

|

Fidelity Investments Money Market Government Portfolio, Cl Institutional, 0.160%

|

||||||||

|

(Cost $1,533,647)

|

1,533,647

|

1,533,647

|

||||||

|

REPURCHASE AGREEMENT(B) — 1.3%

|

||||||||

|

BNP Paribas

|

||||||||

|

0.240%, dated 04/29/2022, to be repurchased on 05/02/2022, repurchase price $1,099,710 (collateralized by various U.S. Treasury Obligations, ranging in par value $87,578 - $117,754, 0.250%,

09/30/2025, with a total market value of $1,120,993)

|

||||||||

|

(Cost $1,099,688)

|

$

|

1,099,688

|

1,099,688

|

|||||

|

TOTAL INVESTMENTS — 103.1%

|

||||||||

|

(Cost $156,153,099)

|

$

|

84,365,663

|

||||||

|

*

|

Non-income producing security.

|

|

(A)

|

This security or a partial position of this security is on loan at April 30, 2022. The total value of securities on loan at April 30, 2022 was $2,053,386.

|

|

(B)

|

Security was purchased with cash collateral held from securities on loan. The total value of such securities as of April 30, 2022 was $2,633,335.

|

|

Schedule of Investments

|

April 30, 2022 (Unaudited)

|

|

|

Global X E-commerce ETF

|

|

(C)

|

The rate reported on the Schedule of Investments is the 7-day effective yield as of April 30, 2022.

|

|

Investments in Securities

|

Level 1

|

Level 2

|

Level 3

|

Total

|

||||||||||||

|

Common Stock

|

$

|

78,605,553

|

$

|

3,116,637

|

$

|

—

|

$

|

81,722,190

|

||||||||

|

Preferred Stock

|

10,138

|

—

|

—

|

10,138

|

||||||||||||

|

Short-Term Investment

|

1,533,647

|

—

|

—

|

1,533,647

|

||||||||||||

|

Repurchase Agreement

|

—

|

1,099,688

|

—

|

1,099,688

|

||||||||||||

|

Total Investments in Securities

|

$

|

80,149,338

|

$

|

4,216,325

|

$

|

—

|

$

|

84,365,663

|

||||||||

|

Schedule of Investments

|

April 30, 2022 (Unaudited)

|

|

|

Global X Emerging Markets Internet & E-commerce ETF

|

|

Shares

|

Value

|

|||||||

|

COMMON STOCK — 99.9%

|

||||||||

|

BRAZIL — 9.3%

|

||||||||

|

Consumer Discretionary — 5.7%

|

||||||||

|

Americanas

|

3,669

|

$

|

17,781

|

|||||

|

Magazine Luiza

|

27,649

|

27,246

|

||||||

|

MercadoLibre *

|

108

|

105,152

|

||||||

|

150,179

|

||||||||

|

Financials — 0.6%

|

||||||||

|

XP, Cl A *

|

653

|

16,070

|

||||||

|

Information Technology — 3.0%

|

||||||||

|

Pagseguro Digital, Cl A *

|

2,368

|

34,833

|

||||||

|

StoneCo, Cl A *

|

1,799

|

16,947

|

||||||

|

TOTVS *

|

3,897

|

25,158

|

||||||

|

76,938

|

||||||||

|

TOTAL BRAZIL

|

243,187

|

|||||||

|

CHILE — 1.0%

|

||||||||

|

Consumer Discretionary — 1.0%

|

||||||||

|

Falabella

|

9,617

|

27,001

|

||||||

|

CHINA — 71.9%

|

||||||||

|

Communication Services — 31.5%

|

||||||||

|

Autohome ADR

|

906

|

26,337

|

||||||

|

Baidu ADR *

|

795

|

98,715

|

||||||

|

Bilibili ADR *

|

3,088

|

75,162

|

||||||

|

China Literature *

|

3,740

|

16,064

|

||||||

|

Hello Group ADR *

|

1,549

|

8,241

|

||||||

|

Schedule of Investments

|

April 30, 2022 (Unaudited)

|

|

|

Global X Emerging Markets Internet & E-commerce ETF

|

|

Shares

|

Value

|

|||||||

|

COMMON STOCK — continued

|

||||||||

|

Communication Services — continued

|

||||||||

|

HUYA ADR *

|

1,602

|

$

|

6,616

|

|||||

|

iQIYI ADR *

|

5,446

|

19,388

|

||||||

|

Kingsoft

|

7,650

|

23,497

|

||||||

|

NetEase ADR

|

2,542

|

242,329

|

||||||

|

Tencent Holdings

|

4,480

|

215,488

|

||||||

|

Tencent Music Entertainment Group ADR *

|

12,313

|

52,330

|

||||||

|

Weibo ADR *

|

1,911

|

44,221

|

||||||

|

828,388

|

||||||||

|

Consumer Discretionary — 37.1%

|

||||||||

|

Alibaba Group Holding ADR *

|

2,304

|

223,695

|

||||||

|

Alibaba Health Information Technology *

|

34,800

|

20,181

|

||||||

|

JD.com ADR *

|

3,384

|

208,657

|

||||||

|

Meituan, Cl B *

|

10,970

|

240,480

|

||||||

|

Pinduoduo ADR *

|

2,338

|

100,744

|

||||||

|

Ping An Healthcare and Technology *

|

4,130

|

10,370

|

||||||

|

Tongcheng Travel Holdings *

|

9,050

|

16,287

|

||||||

|

Trip.com Group ADR *

|

4,696

|

111,060

|

||||||

|

Vipshop Holdings ADR *

|

5,676

|

43,478

|

||||||

|

974,952

|

||||||||

|

Information Technology — 3.3%

|

||||||||

|

Kingdee International Software Group *

|

18,250

|

37,960

|

||||||

|

TravelSky Technology, Cl H

|

24,250

|

36,903

|

||||||

|

Weimob *

|

17,350

|

10,614

|

||||||

|

85,477

|

||||||||

|

TOTAL CHINA

|

1,888,817

|

|||||||

|

SOUTH AFRICA — 4.4%

|

||||||||

|

Communication Services — 0.6%

|

||||||||

|

MultiChoice Group

|

1,951

|

15,950

|

||||||

|

Schedule of Investments

|

April 30, 2022 (Unaudited)

|

|

|

Global X Emerging Markets Internet & E-commerce ETF

|

|

Shares

|

Value

|

|||||||

|

COMMON STOCK — continued

|

||||||||

|

Consumer Discretionary — 3.8%

|

||||||||

|

Naspers, Cl N

|

972

|

$

|

98,805

|

|||||

|

TOTAL SOUTH AFRICA

|

114,755

|

|||||||

|

SOUTH KOREA — 12.1%

|

||||||||

|

Communication Services — 9.9%

|

||||||||

|

Kakao

|

1,549

|

110,872

|

||||||

|

NAVER

|

458

|

104,472

|

||||||

|

NCSoft

|

131

|

43,962

|

||||||

|

259,306

|

||||||||

|

Consumer Discretionary — 2.2%

|

||||||||

|

Coupang, Cl A *

|

4,546

|

58,507

|

||||||

|

TOTAL SOUTH KOREA

|

317,813

|

|||||||

|

URUGUAY — 1.2%

|

||||||||

|

Information Technology — 1.2%

|

||||||||

|

Dlocal, Cl A *

|

1,412

|

32,010

|

||||||

|

TOTAL COMMON STOCK

|

||||||||

|

(Cost $5,010,288)

|

2,623,583

|

|||||||

|

TOTAL INVESTMENTS — 99.9%

|

||||||||

|

(Cost $5,010,288)

|

$

|

2,623,583

|

||||||

|

*

|

Non-income producing security.

|

|

Schedule of Investments

|

April 30, 2022 (Unaudited)

|

|

|

Global X SuperDividend® ETF

|

|

Shares

|

Value

|

|||||||

|

COMMON STOCK — 92.9%

|

||||||||

|

AUSTRALIA — 2.3%

|

||||||||

|

Financials — 2.3%

|

||||||||

|

Magellan Financial Group (A)

|

923,253

|

$

|

10,701,169

|

|||||

|

Platinum Asset Management

|

5,940,618

|

7,936,810

|

||||||

|

TOTAL AUSTRALIA

|

18,637,979

|

|||||||

|

BRAZIL — 8.1%

|

||||||||

|

Consumer Staples — 1.1%

|

||||||||

|

Marfrig Global Foods

|

2,344,033

|

8,874,968

|

||||||

|

Financials — 1.1%

|

||||||||

|

Banco Santander Brasil

|

1,407,129

|

9,021,515

|

||||||

|

Schedule of Investments

|

April 30, 2022 (Unaudited)

|

|

|

Global X SuperDividend® ETF

|

|

Shares

|

Value

|

|||||||

|

COMMON STOCK — continued

|

||||||||

|

Health Care — 1.1%

|

||||||||

|

Qualicorp Consultoria e Corretora de Seguros

|

3,220,840

|

$

|

8,630,618

|

|||||

|

Materials — 2.2%

|

||||||||

|

Dexco

|

3,529,282

|

9,172,057

|

||||||

|

Vale ADR, Cl B

|

524,485

|

8,858,551

|

||||||

|

18,030,608

|

||||||||

|

Utilities — 2.6%

|

||||||||

|

CPFL Energia

|

1,537,507

|

11,223,472

|

||||||

|

Transmissora Alianca de Energia Eletrica

|

1,168,179

|

10,374,483

|

||||||

|

21,597,955

|

||||||||

|

TOTAL BRAZIL

|

66,155,664

|

|||||||

|

CANADA — 1.0%

|

||||||||

|

Materials — 1.0%

|

||||||||

|

Labrador Iron Ore Royalty (A)

|

291,327

|

7,923,420

|

||||||

|

CHILE — 1.0%

|

||||||||

|

Utilities — 1.0%

|

||||||||

|

Colbun

|

116,605,843

|

8,328,696

|

||||||

|

CHINA — 30.3%

|

||||||||

|

Energy — 1.5%

|

||||||||

|

China Shenhua Energy, Cl H

|

3,640,000

|

11,737,222

|

||||||

|

Financials — 2.4%

|

||||||||

|

China Everbright Bank, Cl H

|

25,899,200

|

9,440,517

|

||||||

|

Chongqing Rural Commercial Bank, Cl H

|

26,182,700

|

10,211,258

|

||||||

|

19,651,775

|

||||||||

|

Industrials — 2.6%

|

||||||||

|

Lonking Holdings

|

35,158,900

|

9,768,664

|

||||||

|

Sinopec Engineering Group, Cl H

|

22,170,200

|

11,613,278

|

||||||

|

21,381,942

|

||||||||

|

Materials — 1.2%

|

||||||||

|

China Resources Cement Holdings

|

11,977,200

|

9,998,618

|

||||||

|

Schedule of Investments

|

April 30, 2022 (Unaudited)

|

|

|

Global X SuperDividend® ETF

|

|

Shares

|

Value

|

|||||||

|

COMMON STOCK — continued

|

||||||||

|

Real Estate — 22.6%

|

||||||||

|

Agile Group Holdings (A)

|

21,510,800

|

$

|

10,417,981

|

|||||

|

China Aoyuan Group (A)(B)(C)(D)

|

74,177,600

|

10,040,161

|

||||||

|

China Evergrande Group (A)(B)(C)(D)

|

52,571,300

|

9,949,897

|

||||||

|

China Jinmao Holdings Group

|

36,580,700

|

12,168,468

|

||||||

|

China Overseas Grand Oceans Group

|

18,240,300

|

10,786,818

|

||||||

|

China SCE Group Holdings

|

58,510,200

|

10,589,204

|

||||||

|

Gemdale Properties & Investment

|

104,502,300

|

11,187,899

|

||||||

|

Guangzhou R&F Properties, Cl H (A)

|

26,022,500

|

9,783,955

|

||||||

|

KWG Group Holdings

|

27,696,400

|

10,095,614

|

||||||

|

Logan Group (A)

|

49,794,900

|

15,739,102

|

||||||

|

Midea Real Estate Holding

|

6,385,100

|

12,255,642

|

||||||

|

Powerlong Real Estate Holdings

|

25,954,100

|

8,931,268

|

||||||

|

Shenzhen Investment

|

45,422,100

|

9,841,460

|

||||||

|

Shimao Group Holdings (A)(B)(C)(D)

|

19,468,500

|

9,870,534

|

||||||

|

Times China Holdings

|

36,955,480

|

13,188,040

|

||||||

|

Yuexiu Property

|

9,923,460

|

10,396,289

|

||||||

|

Zhongliang Holdings Group (A)

|

32,591,300

|

10,426,026

|

||||||

|

185,668,358

|

||||||||

|

TOTAL CHINA

|

248,437,915

|

|||||||

|

EGYPT — 1.0%

|

||||||||

|

Consumer Staples — 1.0%

|

||||||||

|

Eastern SAE

|

13,673,187

|

7,964,317

|

||||||

|

HONG KONG — 5.6%

|

||||||||

|

Communication Services — 2.4%

|

||||||||

|

HKBN

|

8,265,000

|

9,659,521

|

||||||

|

PCCW

|

17,332,000

|

9,874,147

|

||||||

|

19,533,668

|

||||||||

|

Consumer Discretionary — 1.1%

|

||||||||

|

Pacific Textiles Holdings

|

21,255,200

|

9,400,221

|

||||||

|

Schedule of Investments

|

April 30, 2022 (Unaudited)

|

|

|

Global X SuperDividend® ETF

|

|

Shares

|

Value

|

|||||||

|

COMMON STOCK — continued

|

||||||||

|

Financials — 0.9%

|

||||||||

|

Haitong International Securities Group

|

45,497,900

|

$

|

7,248,444

|

|||||

|

Information Technology — 1.2%

|

||||||||

|

VTech Holdings

|

1,357,100

|

9,642,732

|

||||||

|

TOTAL HONG KONG

|

45,825,065

|

|||||||

|

ISRAEL — 1.1%

|

||||||||

|

Consumer Discretionary — 1.1%

|

||||||||

|

Delek Automotive Systems

|

652,825

|

9,279,881

|

||||||

|

KAZAKHSTAN — 1.2%

|

||||||||

|

Financials — 1.2%

|

||||||||

|

Halyk Savings Bank of Kazakhstan JSC GDR

|

993,813

|

9,838,749

|

||||||

|

KUWAIT — 1.1%

|

||||||||

|

Consumer Discretionary — 1.1%

|

||||||||

|

Humansoft Holding KSC

|

791,196

|

8,716,194

|

||||||

|

MALAYSIA — 1.0%

|

||||||||

|

Health Care — 1.0%

|

||||||||

|

Hartalega Holdings

|

8,502,836

|

8,593,655

|

||||||

|

MEXICO — 0.9%

|

||||||||

|

Consumer Discretionary — 0.9%

|

||||||||

|

Betterware de Mexico (A)

|

481,565

|

7,676,146

|

||||||

|

NIGERIA — 0.9%

|

||||||||

|

Financials — 0.9%

|

||||||||

|

Zenith Bank

|

131,231,060

|

7,747,376

|

||||||

|

NORWAY — 1.3%

|

||||||||

|

Industrials — 1.3%

|

||||||||

|

Golden Ocean Group

|

839,221

|

10,515,439

|

||||||

|

PAKISTAN — 1.0%

|

||||||||

|

Financials — 1.0%

|

||||||||

|

United Bank

|

11,414,213

|

8,442,523

|

||||||

|

Schedule of Investments

|

April 30, 2022 (Unaudited)

|

|

|

Global X SuperDividend® ETF

|

|

Shares

|

Value

|

|||||||

|

COMMON STOCK — continued

|

||||||||

|

RUSSIA — 0.2%

|

||||||||

|

Consumer Staples — 0.1%

|

||||||||

|

Magnit PJSC GDR (B)(C)(D)

|

33,120

|

$

|

42,952

|

|||||

|

X5 Retail Group GDR (B)(C)(D)

|

411,120

|

636,489

|

||||||

|

679,441

|

||||||||

|

Materials — 0.1%

|

||||||||

|

Magnitogorsk Iron & Steel Works PJSC (B)(C)(D)(E)

|

6,332,020

|

401,691

|

||||||

|

PhosAgro PJSC GDR (B)(C)(D)

|

22,480

|

75,192

|

||||||

|

Severstal PJSC *(B)(C)(D)

|

311,297

|

481,285

|

||||||

|

958,168

|

||||||||

|

Utilities — 0.0%

|

||||||||

|

Unipro PJSC (B)(C)(D)

|

209,276,262

|

424,610

|

||||||

|

TOTAL RUSSIA

|

2,062,219

|

|||||||

|

SINGAPORE — 2.3%

|

||||||||

|

Energy — 1.2%

|

||||||||

|

BW LPG

|

1,530,539

|

9,815,834

|

||||||

|

Health Care — 1.1%

|

||||||||

|

Riverstone Holdings

|

13,303,517

|

9,296,758

|

||||||

|

TOTAL SINGAPORE

|

19,112,592

|

|||||||

|

SOUTH AFRICA — 3.4%

|

||||||||

|

Energy — 1.2%

|

||||||||

|

Exxaro Resources (A)

|

678,544

|

9,717,235

|

||||||

|

Financials — 1.0%

|

||||||||

|

Coronation Fund Managers

|

3,247,705

|

8,587,309

|

||||||

|

Real Estate — 1.2%

|

||||||||

|

Redefine Properties ‡

|

34,402,488

|

9,527,094

|

||||||

|

TOTAL SOUTH AFRICA

|

27,831,638

|

|||||||

|

Schedule of Investments

|

April 30, 2022 (Unaudited)

|

|

|

Global X SuperDividend® ETF

|

|

Shares

|

Value

|

|||||||

|

COMMON STOCK — continued

|

||||||||

|

TURKEY — 1.1%

|

||||||||

|

Materials — 1.1%

|

||||||||

|

Iskenderun Demir ve Celik

|

4,810,576

|

$

|

8,878,971

|

|||||

|

UKRAINE — 1.2%

|

||||||||

|

Materials — 1.2%

|

||||||||

|

Ferrexpo

|

4,850,566

|

10,066,523

|

||||||

|

UNITED KINGDOM — 3.5%

|

||||||||

|

Consumer Staples — 1.2%

|

||||||||

|

Imperial Brands

|

462,853

|

9,681,269

|

||||||

|

Financials — 2.3%

|

||||||||

|

CMC Markets

|

2,883,484

|

10,498,561

|

||||||

|

M&G

|

3,155,523

|

8,486,039

|

||||||

|

18,984,600

|

||||||||

|

TOTAL UNITED KINGDOM

|

28,665,869

|

|||||||

|

UNITED STATES — 23.4%

|

||||||||

|

Communication Services — 1.1%

|

||||||||

|

Lumen Technologies

|

874,056

|

8,793,003

|

||||||

|

Energy — 2.4%

|

||||||||

|

Antero Midstream

|

958,942

|

9,848,334

|

||||||

|

Diversified Energy

|

6,708,515

|

10,191,216

|

||||||

|

20,039,550

|

||||||||

|

Financials — 15.7%

|

||||||||

|

AGNC Investment ‡

|

733,100

|

8,049,438

|

||||||

|

Annaly Capital Management ‡

|

1,333,591

|

8,561,654

|

||||||

|

Apollo Commercial Real Estate Finance ‡

|

696,693

|

8,388,184

|

||||||

|

Arbor Realty Trust ‡

|

541,970

|

9,267,687

|

||||||

|

ARMOUR Residential ‡ (A)

|

1,111,534

|

8,158,660

|

||||||

|

Blackstone Mortgage Trust, Cl A ‡

|

298,048

|

8,953,362

|

||||||

|

Chimera Investment ‡

|

771,104

|

7,726,462

|

||||||

|

Ellington Financial ‡

|

529,082

|

8,565,838

|

||||||

|

Schedule of Investments

|

April 30, 2022 (Unaudited)

|

|

|

Global X SuperDividend® ETF

|

|

Shares

|

Value

|

|||||||

|

COMMON STOCK — continued

|

||||||||

|

Financials — continued

|

||||||||

|

Invesco Mortgage Capital ‡ (A)

|

4,293,479

|

$

|

7,470,653

|

|||||

|

KKR Real Estate Finance Trust ‡

|

475,808

|

9,040,352

|

||||||

|

New York Mortgage Trust ‡

|

2,570,936

|

8,278,414

|

||||||

|

PennyMac Mortgage Investment Trust ‡

|

582,318

|

8,932,758

|

||||||

|

Ready Capital ‡

|

615,941

|

8,974,260

|

||||||

|

Starwood Property Trust ‡

|

411,592

|

9,417,225

|

||||||

|

Two Harbors Investment ‡

|

1,801,295

|

8,664,229

|

||||||

|

128,449,176

|

||||||||

|

Real Estate — 4.2%

|

||||||||

|

Global Net Lease ‡

|

627,798

|

8,808,006

|

||||||

|

Necessity Retail REIT ‡

|

1,246,357

|

9,310,287

|

||||||

|

Office Properties Income Trust ‡

|

380,665

|

8,229,977

|

||||||

|

Omega Healthcare Investors ‡

|

327,282

|

8,339,146

|

||||||

|

34,687,416

|

||||||||

|

TOTAL UNITED STATES

|

191,969,145

|

|||||||

|

TOTAL COMMON STOCK

|

||||||||

|

(Cost $889,813,712)

|

762,669,976

|

|||||||

|

PREFERRED STOCK — 6.9%

|

||||||||

|

BRAZIL— 6.9%

|

||||||||

|

Energy — 1.1%

|

||||||||

|

Petroleo Brasileiro (E)

|

1,489,529

|

9,107,657

|

||||||

|

Materials — 3.4%

|

||||||||

|

Braskem (E)

|

1,058,065

|

8,593,226

|

||||||

|

Gerdau (E)

|

1,644,284

|

9,286,907

|

||||||

|

Unipar Carbocloro (E)

|

517,555

|

10,034,022

|

||||||

|

27,914,155

|

||||||||

|

Utilities — 2.4%

|

||||||||

|

Cia de Transmissao de Energia Eletrica Paulista (E)

|

1,932,695

|

9,819,193

|

||||||

|

Schedule of Investments

|

April 30, 2022 (Unaudited)

|

|

|

Global X SuperDividend® ETF

|

|

Number of Warrants/Shares/Face Amount

|

Value

|

|||||||

|

PREFERRED STOCK — continued

|

||||||||

|

Utilities — continued

|

||||||||

|

Cia Paranaense de Energia (E)

|

6,600,920

|

$

|

9,916,975

|

|||||

|

19,736,168

|

||||||||

|

TOTAL BRAZIL

|

56,757,980

|

|||||||

|

TOTAL PREFERRED STOCK

|

||||||||

|

(Cost $54,935,698)

|

56,757,980

|

|||||||

|

WARRANT — 0.0%

|

||||||||

|

Australia — 0.0%

|

||||||||

|

Magellan Financial Group

|

||||||||

|

Strike Price $35, Expires 4/19/27(Cost $–)

|

113,334

|

126,047

|

||||||

|

SHORT-TERM INVESTMENT(F)(G) — 5.0%

|

||||||||

|

Fidelity Investments Money Market Government Portfolio, Cl Institutional, 0.160%

|

||||||||

|

(Cost $41,116,116)

|

41,116,116

|

41,116,116

|

||||||

|

REPURCHASE AGREEMENT(F) — 3.6%

|

||||||||

|

BNP Paribas

|

||||||||

|

0.240%, dated 04/29/2022, to be repurchased on 05/02/2022, repurchase price $29,482,533 (collateralized by various U.S. Treasury Obligations, ranging in par value $2,347,902 - $3,156,917,

0.250%, 09/30/2025, with a total market value of $30,053,147)

|

||||||||

|

(Cost $29,481,944)

|

$

|

29,481,944

|

29,481,944

|

|||||

|

TOTAL INVESTMENTS — 108.4%

|

||||||||

|

(Cost $1,015,347,470)

|

$

|

890,152,063

|

||||||

|

Schedule of Investments

|

April 30, 2022 (Unaudited)

|

|

|

Global X SuperDividend® ETF

|

|

*

|

Non-income producing security.

|

|

‡

|

Real Estate Investment Trust

|

|

(A)

|

This security or a partial position of this security is on loan at April 30, 2022. The total value of securities on loan at April 30, 2022 was $63,986,441.

|

|

(B)

|

Level 3 security in accordance with fair value hierarchy.

|

|

(C)

|

Security considered illiquid. The total value of such securities as of April 30, 2022 was $31,922,811 and represented 3.9% of Net Assets.

|

|

(D)

|

Security is fair valued using methods determined in good faith by the Fair Value Committee of the Fund. The total value of such securities as of April 30, 2022, was $31,922,811 and represents

3.9% of Net Assets.

|

|

(E)

|

There is currently no stated interest rate.

|

|

(F)

|

Security was purchased with cash collateral held from securities on loan. The total value of such securities as of April 30, 2022 was $70,598,060.

|

|

(G)

|

The rate reported on the Schedule of Investments is the 7-day effective yield as of April 30, 2022.

|

|

Investments in Securities

|

Level 1

|

Level 2

|

Level 3(1)

|

Total

|

||||||||||||

|

Common Stock

|

$

|

696,344,250

|

$

|

34,402,915

|

$

|

31,922,811

|

$

|

762,669,976

|

||||||||

|

Preferred Stock

|

56,757,980

|

—

|

—

|

56,757,980

|

||||||||||||

|

Short-Term Investment

|

41,116,116

|

—

|

—

|

41,116,116

|

||||||||||||

|

Warrant

|

—

|

126,047

|

—

|

126,047

|

||||||||||||

|

Repurchase Agreement

|

—

|

29,481,944

|

—

|

29,481,944

|

||||||||||||

|

Total Investments in Securities

|

$

|

794,218,346

|

$

|

64,010,906

|

$

|

31,922,811

|

$

|

890,152,063

|

||||||||

|

Schedule of Investments

|

April 30, 2022 (Unaudited)

|

|

|

Global X SuperDividend® ETF

|

|

(1)

|

The following is a reconciliation of investments in which significant unobservable inputs (Level 3) were used in determining fair value:

|

|

Investments in Common Stock

|

||||

|

Beginning Balance as of October 31, 2021

|

$

|

−

|

||

|

Transfers out of Level 3

|

−

|

|||

|