As filed with the Securities and Exchange Commission on August 26, 2014.

Registration No. 333-179073

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

POST-EFFECTIVE AMENDMENT NO. 3

TO

FORM S-1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

PERSHING GOLD CORPORATION

(Exact name of registrant as specified in its charter)

|

Nevada |

|

1000 |

|

26-0657736 |

|

(State or other jurisdiction of |

|

(Primary Standard Industrial |

|

(I.R.S. Employer |

1658 Cole Boulevard

Building 6-Suite 210

Lakewood, CO 80401

720-974-7254

(Address, including zip code, and telephone number,

including area code, of registrant’s principal executive offices)

Stephen Alfers

President and Chief Executive Officer

1658 Cole Boulevard

Building 6-Suite 210

Lakewood, CO 80401

720-974-7254

(Name, address, including zip code, and telephone number,

including area code, of agent for service)

With copies to:

Deborah J. Friedman

Davis Graham & Stubbs LLP

1550 Seventeenth Street, Suite 500

Denver, Colorado 80202

303-892-9400

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this Registration Statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act, check the following box: x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

Large accelerated filer o |

|

Accelerated filer o |

|

Non-accelerated filer o |

|

Smaller reporting company x |

The registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the commission, acting pursuant to section 8(a) may determine.

EXPLANATORY NOTE

This Post-Effective Amendment No. 3 to Form S-1 (this “Post-Effective Amendment”) is being filed pursuant to Section 10(a)(3) of the Securities Act to update our registration statement on Form S-1 (the “Registration Statement”), which was initially declared effective by the Securities and Exchange Commission on February 12, 2013, (i) to include the information contained in certain periodic filings filed with the SEC, and (ii) make certain other updating revisions to the information contained herein so that such information is current as of the date of filing.

All filing fees payable in connection with the registration of these securities were previously paid.

24,588,450 Shares

PERSHING GOLD CORPORATION

Common Stock

This prospectus relates to the sale by the selling stockholders identified in this prospectus of up to 24,588,450 shares of our common stock, par value $0.0001 per share, which includes (i) 18,008,802 shares issued to certain selling stockholders in connection with a private placement of our comment stock in June 2012, (ii) 5,898,978 shares of common stock held by Barry Honig, (iii) 500,666 shares of common stock held by GRQ Consultants Inc. 401K Plan, (iv) 160,000 shares of common stock held by GRQ Consultants Inc., and (v) 20,004 shares of common stock held by GRQ Consultants Inc. Roth 401K FBO Barry Honig. GRQ Consultants Inc. 401K Plan, GRQ Consultants Inc., and GRQ Consultants Inc. Roth 401K FBO Barry Honig are all affiliates of Mr. Honig.

The prices at which the selling stockholders may sell shares will be determined by the prevailing market price for the shares or in privately negotiated transactions. We will not receive any proceeds from the sale of these shares by the selling stockholders. All expenses of registration incurred in connection with this offering are being borne by us, but all selling and other expenses incurred by the selling stockholders will be borne by the selling stockholders.

Our common stock is quoted on the regulated quotation service of the OTC Markets’ OTCQB under the symbol “PGLC”. On August 18, 2014, the last reported sale price of our common stock as reported on the OTCQB was $0.33 per share.

Investing in our common stock is highly speculative and involves a high degree of risk. You should carefully consider the risks and uncertainties in the section entitled “Risk Factors” beginning on page 10 of this prospectus before making a decision to purchase our stock.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2014

|

5 | |

|

|

|

|

8 | |

|

|

|

|

9 | |

|

|

|

|

10 | |

|

|

|

|

19 | |

|

|

|

|

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATION |

21 |

|

|

|

|

26 | |

|

|

|

|

35 | |

|

|

|

|

37 | |

|

|

|

|

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT |

41 |

|

|

|

|

43 | |

|

|

|

|

45 | |

|

|

|

|

46 | |

|

|

|

|

48 | |

|

|

|

|

50 | |

|

|

|

|

50 | |

|

|

|

|

50 | |

|

|

|

|

50 |

You should rely only on the information contained in this prospectus. We have not authorized any other person to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely on it. We are not making an offer to sell these securities in any jurisdiction where an offer or sale is not permitted. You should assume that the information appearing in this prospectus is accurate only as of the date on the front cover of this prospectus. Our business, financial condition, results of operations and prospects may have changed since that date.

The following summary highlights information contained elsewhere in this prospectus. It may not contain all the information that may be important to you. You should read this entire prospectus carefully, including the sections entitled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operation,” and our historical financial statements and related notes included elsewhere in this prospectus. As used in this prospectus, unless otherwise specified, references to the “Company,” “we,” “our” and “us” refer to Pershing Gold Corporation and, unless otherwise specified, its subsidiaries.

Overview

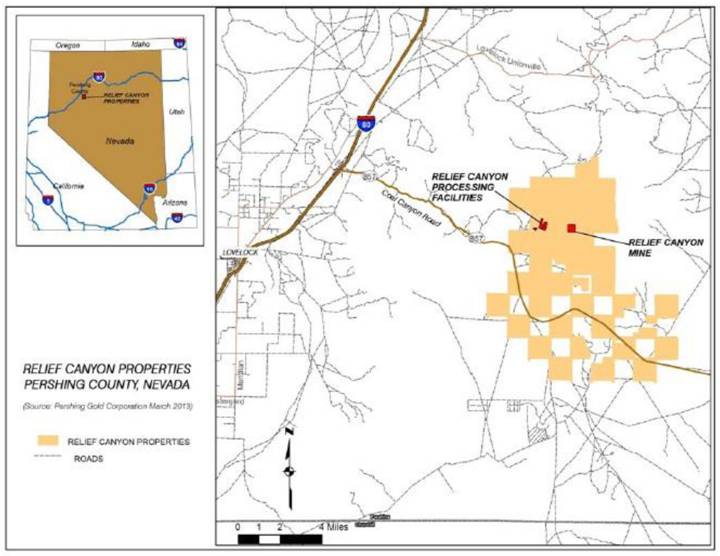

We are a gold and precious metals exploration company pursuing exploration and development opportunities primarily in Nevada. We are currently focused on exploration at our Relief Canyon properties in Pershing County in northwestern Nevada. None of our properties contain proven and probable reserves, and all of our activities on all of our properties are exploratory in nature.

We reported a net loss of approximately $14.1 million for the year ended December 31, 2013 and a net loss of approximately $74.8 million for the period from September 11, 2011 (inception) to December 31, 2013. We reported a net loss of approximately $3.8 million for the quarter ended June 30, 2014 and a net loss of approximately $7.0 million for the six months ended June 30, 2014. We expect to incur significant losses into the foreseeable future and our monthly “burn rate” for general and administrative costs (including all employee salaries, public company expenses, consultants, and land holdings costs) is approximately $575,000. Our monthly burn rate for all costs during 2013 was approximately $800,000 (including $535,000 for general and administrative costs and $265,000 for exploration activities). We expect, based on our current preliminary budget, our monthly burn rate for all costs in 2014 to be approximately $800,000 (including approximately $575,000 for general and administrative costs and $225,000 for exploration, permitting, and plant recommissioning), which may increase as our plans develop. We expect to require additional external funding to fund operations and exploration as early as the third quarter of 2015.

Business Strategy

Our business strategy is to acquire and advance precious metals exploration properties. We seek properties with known mineralization that are in an advanced stage of exploration and have previously undergone some drilling but are under-explored, which we believe we can advance quickly to increase value. We are currently focused on exploration of the Relief Canyon properties, recommissioning the Relief Canyon gold processing facility and, if economically feasible, commencing mining at the Relief Canyon Mine.

Relief Canyon Mine Property

We acquired the former Relief Canyon Mine property in August 2011. The property then consisted of approximately 1,100 acres of unpatented mining claims and millsites and included three open-pit mines and a processing plant that could be used to process material from the Relief Canyon Mine or from other mining operations. We refer to this property as the Relief Canyon Mine property. We significantly expanded our Relief Canyon property position in 2012 with the acquisition of approximately 23,000 additional acres of unpatented mining claims and leased and subleased lands around the Relief Canyon Mine and south of the Mine. We refer to the properties acquired in 2012 as the “Relief Canyon expansion properties”, and to the Relief Canyon Mine property and Relief Canyon expansion properties collectively as the “Relief Canyon properties”. Our Relief Canyon properties total approximately 25,000 acres and are comprised of approximately 940 owned unpatented mining claims, 120 owned millsite claims, 170 leased unpatented mining claims, and leased and subleased private lands.

We conducted an exploration drilling program on the Relief Canyon Mine property in 2011 and 2012, which expanded the Relief Canyon Mine deposit. In January 2013 we reported 32,541,000 tons of mineralized material at an average grade of 0.017 ounces of gold per ton and a cut-off grade of 0.0046 ounces of gold per ton. In the third quarter of 2013, we began a new drilling program on land adjacent to the current deposit. In 2013, we drilled a total of 42 holes for approximately 28,500 feet which consisted of 32 holes, for approximately 22,000 feet, for the purpose of extending and upgrading the current deposit and 10 holes, for approximately 6,500 feet, for the purpose of metallurgical characterization and groundwater studies. We spent approximately $3.1 million on exploration activities at the Relief Canyon Mine property in 2013. As of August 18, 2014, we have drilled a total of 50

drill holes comprising approximately 29,000 feet at the Relief Canyon Mine property. In 2014 we expect to continue exploration efforts to expand the Relief Canyon deposit. Our estimate of 2014 exploration costs on the Relief Canyon Mine property is approximately $1.9 million.

The reopening of the Relief Canyon Mine is dependent on determining that the operation is economically feasible, obtaining sufficient external funding, obtaining permits and permit amendments, and further expanding the deposit above the water table through our exploration efforts. Our current target is to commence gold production in the second half of 2015 from newly mined material, gold-bearing materials stockpiled in the pits and on the dumps. Additional permitting would be needed to mine the deposit below the water table. There is no assurance that we will produce gold in 2015 or at all.

During 2014, we plan to focus primarily on development of an economically feasible mining and processing plan, securing the necessary permits and amendments to our permits to commence production and on additional exploration drilling at the Relief Canyon Mine property. Our preliminary estimate of the costs for these activities for 2014, not including general and administrative costs, is approximately $2.4 million. If we do not obtain adequate external financing beginning in the third quarter of 2015, we would be required to curtail our planned exploration and delay or cancel the planned commencement of mining at Relief Canyon Mine.

In addition we are planning to recommission the gold processing facility and ancillary support facilities on the Relief Canyon Mine site, which are currently in a care and maintenance status. Our preliminary estimate of recommissioning costs in 2014 is approximately $400,000. We expect the cost to recommission the facility will total approximately $3.4 million, and our target is to complete recommissioning in the first half of 2015. If we do not obtain adequate external financing, we would be unable to complete recommissioning in 2015.

Other Exploration

We are conducting generative exploration on the Relief Canyon expansion properties. In 2012, we generated targets through surface sampling, mapping, and geophysics at three specific projects in our Relief Canyon expansion properties: Pershing Pass, Pershing Packard, and South Relief. Based on this work, we drilled four holes in 2012 comprising approximately 3,000 feet and performed soil sampling, and geochemical and geophysical testing to identify new drill-ready targets for approximately $0.5 million. In 2013 we continued reconnaissance-level and detailed mapping, soil and rock-chip sampling, and geophysical surveys to generate targets for future exploration at an approximate cost of $0.1 million. We do not intend to focus on continuing exploration in the Relief Canyon expansion properties in 2014 as we expect to focus our expenditures on Relief Canyon Mine.

Because the Relief Canyon expansion properties are at an early stage of exploration, it would take at least several years to perform sufficient exploration drilling to determine whether these properties contain mineable reserves that could be put into production in the future. Exploration costs in future years may increase or decrease depending on results and available funding. However, because the Relief Canyon properties have a lower priority than expenditures on the Relief Canyon Mine property, if we do not receive adequate funding, we would reduce, postpone or cancel expenditures at our Relief Canyon expansion properties before reducing, postponing or cancelling exploration activity at the Relief Canyon Mine property.

We intend to continue to acquire additional mineral targets in Nevada and elsewhere in locations where we believe we have the potential to quickly expand and advance known mineralization and the potential to discover new deposits. We will require external funding to pursue our exploration programs. There is no assurance we will be able to raise capital on acceptable terms or at all.

If, through our exploration program, we discover an area that may be able to be profitably mined for gold, we would focus most of our activities on determining whether that is feasible, including further delineation of the location, size and economic feasibility of a potential orebody. If our efforts are successful, we anticipate that we would seek additional capital through debt or equity financing to fund further development, or that we would sell or lease the rights to mine to a third party or enter into joint venture, royalty financing, or other arrangements. There is no assurance that we could obtain additional capital or a willing third party.

Listing on a National Exchange

We intend to list our common stock on a U.S. national securities exchange such as the NYSE MKT or The NASDAQ Stock Market, and to do so, we must fulfill certain listing requirements including a minimum stock price for our common stock. At our Annual and Special Meeting of the Stockholders held on December 16, 2013, we received stockholder approval to effect a reverse stock split of the outstanding shares of our common stock at an exchange ratio of not less than 1-for-2 and no more than 1-for-25. We expect that a reverse stock split would initially result in an increase in the price per share of our common stock and substantially reduce the risk that a U.S. national securities exchange would decline to list our common stock on the basis of failure to meet the exchange’s minimum stock price. No assurances can be given that, even if we satisfy this listing requirement, our listing on a U.S. national securities exchange will be approved, or that, if our common stock is listed on a U.S. national securities exchange, we will be able to satisfy the maintenance requirements for continued listing. In addition to the reverse stock split, our stockholders approved our proposal to reduce the number of our shares of authorized common stock to a lower number between 100,000,000 and 250,000,000 shares in connection with the reverse stock split.

Financial Results

We reported a net loss of approximately $14.1 million for the year ended December 31, 2013 and a net loss of approximately $74.8 million for the period from September 11, 2011 (inception) to December 31, 2013. We reported a net loss of approximately $3.8 million for the quarter ended June 30, 2014 and a net loss of approximately $7.0 million for the six months ended June 30, 2014. We expect to incur significant losses into the foreseeable future and our monthly “burn rate” for general and administrative costs (including all employee salaries, public company expenses and consultants) is approximately $575,000. Our monthly burn rate for all costs during 2013 was approximately $800,000 (including $535,000 for general and administrative costs and $265,000 for exploration activities). In August 2013 we completed a private placement of Series E Convertible Preferred Stock and warrants for a total of approximately $11.1 million in gross proceeds and in July 2014 we completed private placements of our common stock and warrants for a total of approximately $12.2 million in gross proceeds. Based on our current plans, we expect to require additional external funding to fund operations and exploration by the third quarter of 2015. If we are unable to raise external funding, and eventually generate significant revenues from our claims and properties, we will not be able to earn profits or continue operations. We have no production history upon which to base any assumption as to the likelihood that we will prove successful, and it is uncertain that we will generate any operating revenues or ever achieve profitable operations. If we are unsuccessful in addressing these risks, our business will most likely fail.

Corporate Information

We were incorporated in Nevada on August 2, 2007 under the name “Excel Global, Inc.” and operated as a web-based service provider and consulting company. On September 27, 2010, we changed our name to “The Empire Sports & Entertainment Holdings Co.” and commenced the promotion and production of sports and entertainment events as our sole line of business which we operated until September 1, 2011 when we exited the sports and entertainment business. We began acquiring mining exploration properties in May 2011, and on May 16, 2011, we changed our name to “Sagebrush Gold Ltd.” and on February 27, 2012 to “Pershing Gold Corporation” due to our focus on exploration for gold in Pershing County, Nevada.

Our principal executive offices are located at 1658 Cole Boulevard, Building 6-Suite 210, Lakewood, CO 80401 and our telephone number is 720-974-7254.

|

Common stock offered by the selling stockholders: |

|

24,588,450 shares, consisting of 18,008,802 shares issued in connection with a June 2012 private placement and 6,579,648 shares held by Mr. Barry Honig or his affiliates. |

|

Common stock outstanding on August 18, 2014: |

|

316,681,754 (1) |

|

Common stock outstanding after this offering: |

|

316,681,754 (1) |

|

Use of proceeds: |

|

We will not receive any proceeds from the sale of shares in this offering by the selling stockholders. |

|

OTC Bulletin Board symbol: |

|

PGLC.OB |

|

Risk factors: |

|

You should carefully consider the information set forth in this prospectus and, in particular, the specific factors set forth in the “Risk Factors” section beginning on page 11 of this prospectus before deciding whether or not to invest in shares of our common stock. |

(1) The number of outstanding shares before and after the offering excludes:

· 28,275,000 shares of common stock issuable upon conversion of the Series E Convertible Preferred Stock;

· 32,900,000 shares of common stock issuable upon the exercise of outstanding options; and

· 38,054,543 shares of common stock issuable upon the exercise of outstanding warrants.

Some information contained in or incorporated by reference into this registration statement on Form S-1 may contain forward-looking statements within the meaning of the United States Private Securities Litigation Reform Act of 1995. These statements include statements relating to our plans, expectations and the timing and budget for exploration and monetization of our Relief Canyon properties, our expected cash needs, and statements concerning our financial condition, operating strategies and operating and legal risks.

We use the words “anticipate,” “continue,” “likely,” “estimate,” “expect,” “may,” “could,” “will,” “project,” “should,” “believe” and similar expressions to identify forward-looking statements. Statements that contain these words discuss our future expectations and plans, including expectations and plans for production from the Relief Canyon, related permitting and exploration activities, expenditures or other matters, or state other forward-looking information. Although we believe the expectations and assumptions reflected in those forward-looking statements are reasonable, we cannot assure you that these expectations and assumptions will prove to be correct. Our actual results could differ materially from those expressed or implied in these forward-looking statements as a result of various factors described in this registration statement on Form S-1, including:

· Risks relating to the 2014 exploration efforts to expand the Relief Canyon deposit, recommissioning of the gold processing facility on the Relief Canyon Mine site, determining the feasibility and economic viability of commencing mining and recommissioning the gold processing facility, our ability to fund future exploration efforts costs or purchase additional equipment, and our ability to obtain or amend the necessary permits, consents, or authorizations needed to advance expansion of the deposit or recommissioning of the gold processing facility;

· Risk relating to our target of commencing gold production in the second half of 2015, including the feasibility and economic viability of commencing gold production in 2015, our ability to develop an economically feasible operating plan, our ability to obtain sufficient external funding, and our ability to obtain the necessary permits and permit amendments.

· Risks related to the Relief Canyon properties other than the Relief Canyon Mine, including our ability to advance gold exploration, discover any deposits of gold of other minerals which can be mined at a profit, maintain our unpatented mining claims and millsites, or commence mining to obtain and maintain any necessary permits, consents, or authorizations needed to continue exploration, and raise the necessary capital to finance exploration and potential expansion;

· Our ability to acquire additional mineral targets;

· Our ability to obtain additional external funding;

· Our ability to achieve any meaningful revenue;

· Our ability to engage or retain geologists, engineers, consultants and other key management and mining personnel necessary to successfully operate and grow our business;

· The volatility of the market price of our common stock or our intention not to pay any cash dividends in the foreseeable future;

· Changes in any federal, state or local laws and regulations or possible challenges by third parties or contests by the federal government that increase costs of operation or limit our ability to explore on certain portions of our property;

· Economic and political events affecting the market prices for gold and other minerals which may be found on our exploration properties; and

· The factors set forth under “Risk Factors” beginning on page 10 of this registration statement on Form S-1.

Many of these factors are beyond our ability to control or predict. Although we believe that the expectations reflected in our forward-looking statements are based on reasonable assumptions, such expectations may prove to be materially incorrect due to known and unknown risk and uncertainties. You should not unduly rely on any of our forward-looking statements. These statements speak only as of the date of this registration statement on Form S-1. Except as required by law, we are not obligated to publicly release any revisions to these forward-looking statements to reflect future events or developments. All subsequent written and oral forward-looking statements attributable to us and persons acting on our behalf are qualified in their entirety by the cautionary statements contained in this section and elsewhere in this registration statement on Form S-1.

Investing in our common stock involves a high degree of risk. Before investing in our common stock you should carefully consider the following risks, together with the financial and other information contained in this prospectus. If any of the following risks actually occurs, our business, prospects, financial condition and results of operations could be adversely affected. In that case, the trading price of our common stock would likely decline and you may lose all or a part of your investment.

Risks Relating to Our Business

We have no proven or probable reserves on our properties and we do not know if our properties contain any gold or other minerals that can be mined at a profit.

The properties on which we have the right to explore for gold and other minerals are not known to have any deposits of gold or other minerals that can be mined at a profit. Whether a gold or other mineral deposit can be mined at a profit depends upon many factors. Some but not all of these factors include: the particular attributes of the deposit, such as size, grade and proximity to infrastructure; operating costs and capital expenditures required to start mining a deposit; the availability and cost of financing; the price of the gold or other minerals which is highly volatile and cyclical; and government regulations, including regulations relating to prices, taxes, royalties, land use, importing and exporting of minerals and environmental protection. We are also obligated to pay production royalties on certain of our mineral production, as described above under “Business and Properties,” which would increase our costs of production and could make our ability to operate profitably more difficult.

We are an exploration stage company and have only recently commenced exploration activities on our claims. We reported a net loss for the year ended December 31, 2013, and expect to incur operating losses for the foreseeable future.

Our evaluation of our Relief Canyon Mine property is primarily based on historical production data and on new exploration data that we have developed since 2011, supplemented by historical exploration data. Our plans for recommencing mining and processing activities at the Relief Canyon Mine property are in their early stages and preliminary, as are our exploration programs on the Relief Canyon expansion properties. Accordingly, we are not yet in a position to estimate expected amounts of minerals, yields or values or evaluate the likelihood that our business will be successful. We have not earned any revenues from mining operations. The likelihood of success must be considered in light of the problems, expenses, difficulties, complications and delays encountered in connection with the exploration of the mineral properties and commencement of mining activities that we plan to undertake. These potential problems include, but are not limited to, unanticipated problems relating to exploration, costs and expenses that may exceed current estimates and the requirement for external funding to continue our business. Prior to completion of our exploration stage, we anticipate that we will incur increased operating expenses without realizing any revenues. We reported a net loss of approximately $14.1 million for the year ended December 31, 2013 and a net loss of approximately $74.8 million for the period from September 11, 2011 (inception) to December 31, 2013. We reported a net loss of approximately $3.8 million for the quarter ended June 30, 2014 and a net loss of approximately $7.0 million for the six months ended June 30, 2014. We expect to incur significant losses into the foreseeable future and our monthly “burn rate” for general and administrative costs (including all employee salaries, public company expenses, consultants, and land holdings costs) is approximately $575,000. Our monthly burn rate for all costs during 2013 was approximately $800,000 (including $535,000 for general and administrative costs and $265,000 for exploration activities). We expect, based on our current preliminary budget, our monthly burn rate for all costs in 2014 to be approximately $800,000 (including approximately $575,000 for general and administrative costs and $225,000 for

exploration, permitting, and plant recommissioning), which may increase as our plans develop. We expect to require additional external funding to fund operations and exploration by the third quarter of 2015. If we are unable to raise external funding, and eventually generate significant revenues from our claims and properties, we will not be able to earn profits or continue operations. We have no production history upon which to base any assumption as to the likelihood that we will prove successful, and it is uncertain that we will generate any operating revenues or ever achieve profitable operations. If we are unsuccessful in addressing these risks, our business will most likely fail.

Exploring for gold and other minerals is inherently speculative, involves substantial expenditures, and is frequently non-productive.

Mineral exploration (currently our only business), and gold exploration in particular, is a business that by its nature is very speculative. There is a strong possibility that we will not discover gold or any other minerals that can be mined or extracted at a profit. Even if we do discover gold or other deposits, the deposit may not be of the quality or size necessary for us or a potential purchaser of the property to make a profit from actually mining and processing it. Few properties that are explored are ultimately developed into producing mines. Unusual or unexpected geological conditions, fires, flooding, explosions, cave-ins, landslides and the inability to obtain suitable or adequate machinery, equipment or labor are just some of the many risks involved in mineral exploration programs and the subsequent development of gold deposits.

The mining industry is capital intensive and we may be unable to raise necessary funding.

We have spent approximately $9.6 million to operate and explore during the year ended December 31, 2013. Our estimated total cost for 2014 for exploration, permitting, landholding, facilities recommissioning and for general and administrative costs is approximately $9.7 million. We expect to require additional financing to fund operations and exploration by the third quarter of 2015. We may be unable to secure additional financing on terms acceptable to us, or at all. Our inability to raise additional funds on a timely basis could prevent us from achieving our business objectives and would have a negative impact on our business, financial condition, results of operations and the value of our securities. If we raise additional funds by issuing additional equity or convertible debt securities, the ownership of existing stockholders may be diluted and the securities that we may issue in the future may have rights, preferences or privileges senior to those of the current holders of our common stock. Such securities may also be issued at a discount to the market price of our common stock, resulting in possible further dilution to the book value per share of common stock. If we raise additional funds by issuing debt, we could be subject to debt covenants that could place limitations on our operations and financial flexibility.

Unanticipated problems or delays in recommissioning our gold processing facility may negatively affect our operations.

If our processing facility recommissioning plans are threatened or delayed because we are unable to finance them or for other reasons, our business may experience a substantial setback. Prolonged problems may fatally threaten the commercial viability of our business plan. Moreover, the occurrence of significant unforeseen conditions or events in connection with the processing facility may require us to re-examine the thoroughness of our due diligence and planning processes. Any change to management’s evaluation of the viability of the project could have a material adverse effect on our business, consolidated financial condition or results of operations.

Projected recommissioning and financing costs for the processing facility may also increase to a level that would make these facilities too expensive to recommission or unprofitable to operate. Currently we expect the total cost to recommission the facility will be approximately $3.4 million. Contractors, engineering firms, construction firms and equipment suppliers also receive requests and orders from other companies and, therefore, we may not be able to secure their services or products on a timely basis or on acceptable financial terms. We may suffer significant delays or cost overruns as a result of a variety of factors, such as increases in the prices or materials, permitting delays, shortages of workers or materials, transportation constraints, adverse weather, equipment failures, fires, damage to or destruction of property and equipment, environmental damage, unforeseen difficulties or labor issues, any of which could delay or prevent us from commencing operations. Any of these factors could have a material adverse effect on our business, consolidated financial conditions or results of operations.

We are a junior exploration company with no mining activities and we may never have any mining activities in the future.

Our primary business is exploring for gold and, to a lesser extent, other minerals. If we discover commercially exploitable gold or other deposits, we will not be able to make any money from mining activities unless the gold or other deposits are actually mined, or we sell our interest. Accordingly, we will need to seek additional capital through debt or equity financing, find some other entity to mine our properties or operate our facilities on our behalf, enter into joint venture or other arrangements with a third party, or sell or lease the property or rights to mine to third parties. Mine development projects typically require a number of years and significant expenditures during the development phase before production is possible. Such projects could experience unexpected problems and delays during development, construction and mine start up. Mining operations in the United States are subject to many different federal, state and local laws and regulations, including stringent environmental, health and safety laws. If and when we assume operational responsibility for mining on our properties, it is possible that we will be unable to comply with current or future laws and regulations, which can change at any time. It is possible that changes to these laws will be adverse to any potential mining operations. Moreover, compliance with such laws may cause substantial delays and require capital outlays in excess of those anticipated, adversely affecting any potential mining operations. Our future mining operations, if any, may also be subject to liability for pollution or other environmental damage. It is possible that we will choose to not be insured against this risk because of high insurance costs or other reasons.

We have a short operating history, have only lost money and may never achieve any meaningful revenue.

We acquired all of our property interests since August 2011. Our operating history consists of our exploration activities. We have no income-producing activities from mining or exploration. We have already lost money because of the expenses we have incurred in acquiring the rights to explore on our property and conducting our exploration activities. Exploring for gold and other minerals or resources is an inherently speculative activity and there is no assurance we will be able to develop an economically feasible operating plan for Relief Canyon Mine. There is a strong possibility that we will not find any other commercially exploitable gold or other deposits on our property. Because we are an exploration company, we may never achieve any meaningful revenue.

We must make annual lease payments, advance royalty and royalty payments and claim maintenance payments or we will lose our rights to our property.

We are required under the terms of the leases covering some of our property interests to make annual lease payments starting in 2014 and advance royalty and royalty payments each year. We are also required to make annual claim maintenance payments to the U.S. Bureau of Land Management (“BLM”) and pay a fee to Pershing County in order to maintain our rights to explore and, if warranted, to develop our unpatented mining claims. If we fail to meet these obligations, we will lose the right to explore for gold and other minerals on our property. Our total annual property maintenance costs payable to the BLM for all of the unpatented mining claims and millsites in the Relief Canyon area in 2013 were approximately $175,000, and we expect our annual maintenance costs to be approximately $185,000 in 2014. Our lease payments, advance royalty and royalty payments and claim maintenance payments are described above under “Business and Properties”.

Our business is subject to extensive environmental regulations that may make exploring, mining or related activities prohibitively expensive, and which may change at any time.

All of our operations are subject to extensive environmental regulations that can substantially delay exploration and make exploration expensive or prohibit it altogether. We may be subject to potential liabilities associated with the pollution of the environment and the disposal of waste products that may occur as the result of exploring and other related activities on our properties, including our plan to process gold at our processing facility. We may have to pay to remedy environmental pollution, which may reduce the amount of money that we have available to use for exploration or other activities, and adversely affect our financial position. If we are unable to fully remedy an environmental problem, we might be required to suspend operations or to enter into interim compliance measures pending the completion of the required remedy. If a decision is made to mine our properties and we retain any operational responsibility for doing so, our potential exposure for remediation may be significant, and this may have a material adverse effect upon our business and financial position. We have not purchased

insurance for potential environmental risks (including potential liability for pollution or other hazards associated with the disposal of waste products from our exploration activities) and such insurance may not be available to us on reasonable terms or at a reasonable price. All of our exploration and, if warranted, development activities may be subject to regulation under one or more local, state and federal environmental impact analyses and public review processes. It is possible that future changes in applicable laws, regulations and permits or changes in their enforcement or regulatory interpretation could have significant impact on some portion of our business, which may require our business to be economically re-evaluated from time to time. These risks include, but are not limited to, the risk that regulatory authorities may increase bonding requirements beyond our financial capability. Inasmuch as posting of bonding in accordance with regulatory determinations is a condition to the right to operate under all material operating permits, increases in bonding requirements could prevent operations even if we are in full compliance with all substantive environmental laws. We have been required to post a substantial bond under various laws relating to mining and the environment and may in the future be required to post a larger bond to pursue additional activities. For example, we must provide BLM and the Nevada Division of Environmental Protection Bureau of Mining Regulation and Reclamation (“NDEP”) additional financial assurance (reclamation bonds) to guarantee reclamation of any new surface disturbance required for drill roads, drill sites, or mine expansion. We have provided BLM and NDEP a reclamation bond in the amount of approximately $5.0 million. Approximately $4.7 million of our reclamation bond covers both exploration and mining at the Relief Canyon Mine property, including the three open-pit mines and associated waste rock disposal areas, the mineral processing facilities, ancillary facilities, and the exploration roads and drill pads. The remaining $300,000 of financial assurance can be used to satisfy, or partially satisfy, future bonding requirements for exploration or mining. Our preliminary estimate of the likely amount of additional financial assurance for future exploration is approximately $75,000, although we expect periodic increases due to effects of inflation. Our preliminary estimate of the likely amount of additional financial assurance to recommence mining operations is $600,000, which may increase as our mining plans are finalized and reviewed by the applicable agencies. Consequently, we will be required to provide additional financial assurance beyond the current $5.0 million bond.

The government licenses and permits which we need to explore on our property may take too long to acquire or cost too much to enable us to proceed with exploration. In the event that we conclude that the Relief Canyon Mine deposit can be profitably mined, or discover other commercially exploitable deposits, we may face substantial delays and costs associated with securing the additional government licenses and permits that could preclude our ability to develop the mine. For example, we seek to amend the permits for our existing gold processing facility, which may be delayed.

Exploration activities usually require the granting of permits from various governmental agencies. For example, exploration drilling on unpatented mining claims requires a permit to be obtained from the United States Bureau of Land Management, which may take several months or longer to grant the requested permit. Depending on the size, location and scope of the exploration program, additional permits may also be required before exploration activities can be undertaken. Prehistoric or Indian graves, threatened or endangered species, archeological sites or the possibility thereof, difficult access, excessive dust and important nearby water resources may all result in the need for additional permits before exploration activities can commence.

In addition, we plan to seek amendments to our permits for our Relief Canyon gold processing facility to add a gold recovery (stripping) system to the facility. If we conclude that the Relief Canyon deposit can be profitably mined, we would seek amendments to the BLM Plan of Operations and the NDEP Reclamation permit to increase the size of the Relief Canyon open pit-mines and waste rock storage areas. If the minable material exceeds 21 million tons, the current capacity of the leach pad, we would also need to seek an amendment of the processing facility to expand the capacity of the leach pad and ponds to accommodate additional material. If there are delays in obtaining the permit to add the gold recovery system, we would sell gold-loaded carbon to another facility that would recover/strip the gold. We estimate the annual cost of holding these permits will be approximately $35,000, and the cost to amend these permits to authorize future mining will be approximately $720,000, which is based on preliminary estimates and may increase as our mining plans are finalized. As with all permitting processes, there is substantial uncertainty about when and if the permits will be issued. There is the risk that unexpected delays and excessive costs may be experienced in obtaining required permits. The needed permits may not be granted, could be challenged by third parties that could result in protracted litigation that could cause substantial delays, or may be granted in an unacceptable timeframe or cost too much. Additionally, proposed mineral exploration and mining projects can become controversial and be opposed by nearby landowners and communities, which can substantially

delay and interfere with the permitting process. Delays in or inability to obtain necessary permits would result in unanticipated costs, which may result in serious adverse effects upon our business.

The value of our property and any other deposits we may seek or locate is subject to volatility in the price of gold.

Our ability to obtain additional and continuing funding, and our profitability if and when we commence mining or sell our rights to mine, will be significantly affected by changes in the market price of gold and other mineral deposits. Gold and other minerals prices fluctuate widely and are affected by numerous factors, all of which are beyond our control. The price of gold may be influenced by:

· fluctuation in the supply of, demand and market price for gold;

· mining activities of our competitors;

· sale or purchase of gold by central banks and for investment purposes by individuals and financial institutions;

· interest rates;

· currency exchange rates;

· inflation or deflation;

· fluctuation in the value of the United States dollar and other currencies;

· global and regional supply and demand, including investment, industrial and jewelry demand; and

· political and economic conditions of major gold or other mineral-producing countries.

The price of gold and other minerals have fluctuated widely in recent years, and a decline in the price of gold or other minerals could cause a significant decrease in the value of our property, limit our ability to raise money, and render continued exploration and development of our property impracticable. If that happens, then we could lose our rights to our property or be compelled to sell some or all of these rights. Additionally, the future development of our mining properties beyond the exploration stage is heavily dependent upon gold prices remaining sufficiently high to make the development of our property economically viable.

Our property title may be challenged. We are not insured against any challenges, impairments or defects to our mining claims or title to our other properties.

Our property is comprised primarily of unpatented lode mining claims and millsites located and maintained in accordance with the federal General Mining Law of 1872. Unpatented lode mining claims and millsites are unique U.S. property interests and are generally considered to be subject to greater title risk than other real property interests because the validity of unpatented mining claims and millsites is often uncertain. This uncertainty arises, in part, out of the complex federal and state laws and regulations with which the owner of an unpatented mining claim or millsite must comply in order to locate and maintain a valid claim. Moreover, if we discover mineralization that is close to the claim boundaries, it is possible that some or all of the mineralization may occur outside the boundaries on lands that we do not control. In such a case we would not have the right to extract those minerals. We do not have title reports or opinions covering all of our Relief Canyon properties. The uncertainty resulting from not having title opinions for all of our Relief Canyon properties or having detailed claim surveys on all of our properties leaves us exposed to potential title defects. Defending challenges to our property title would be costly, and may divert funds that could otherwise be used for exploration activities and other purposes.

In addition, unpatented lode mining claims and millsites are always subject to possible challenges by third parties or contests by the federal government, which, if successful, may prevent us from exploiting any discovery of commercially extractable gold. Challenges to our title may increase our costs of operation or limit our ability to explore on certain portions of our property. We are not insured against challenges, impairments or defects to our property title.

Possible amendments to the General Mining Law could make it more difficult or impossible for us to execute our business plan.

In recent years, the U.S. Congress has considered a number of proposed amendments to the General Mining Law, as well as legislation that would make comprehensive changes to the law. Although no such legislation has been adopted to date, there can be no assurance that such legislation will not be adopted in the future. If adopted,

such legislation, if it includes concepts that have been part of previous legislative proposals, could, among other things, (i) adopt the limitation on the number of millsites that a claimant may use, discussed below, (ii) impose time limits on the effectiveness of plans of operation that may not coincide with mine life, (iii) impose more stringent environmental compliance and reclamation requirements on activities on unpatented mining claims and millsites, (iv) establish a mechanism that would allow states, localities and Native American tribes to petition for the withdrawal of identified tracts of federal land from the operation of the General Mining Law, (v) allow for administrative determinations that mining would not be allowed in situations where undue degradation of the federal lands in question could not be prevented, and (vi) impose royalties on gold and other mineral production from unpatented mining claims or impose fees on production from patented mining claims. Further, it could have an adverse impact on earnings from our operations, could reduce estimates of any reserves we may establish and could curtail our future exploration and development activity on our unpatented claims.

Our ability to conduct exploration, development, mining and related activities may also be impacted by administrative actions taken by federal agencies. With respect to unpatented millsites, for example, the ability to use millsites and their validity has been subject to greater uncertainty since 1997. In November of 1997, the Secretary of the Interior (appointed by President Clinton) approved a Solicitor’s Opinion that concluded that the General Mining Law imposed a limitation that only a single five-acre millsite may be claimed or used in connection with each associated and valid unpatented or patented lode mining claim. Subsequently, however, on November 7, 2003, the new Secretary of the Interior (appointed by President Bush) approved an Opinion by the Deputy Solicitor which concluded that the mining laws do not impose a limitation that only a single five-acre millsite may be claimed in connection with each associated unpatented or patented lode mining claim. Current federal regulations do not include the millsite limitation. There can be no assurance, however, that the Department of the Interior will not seek to re-impose the millsite limitation at some point in the future.

In addition, a consortium of environmental groups has filed a lawsuit in the United District Court for the District of Columbia against the Department of the Interior, the Department of Agriculture, the BLM, and the USFS, asking the court to order the BLM and USFS to adopt the five-acre millsite limitation. That lawsuit also asks the court to order the BLM and the USFS to require mining claimants to pay fair market value for their use of the surface of federal lands where those claimants have not demonstrated the validity of their unpatented mining claims and millsites. If the plaintiffs in that lawsuit were to prevail, that could have an adverse impact on our ability to use our unpatented millsites for facilities ancillary to our exploration, development and mining activities, and could significantly increase the cost of using federal lands at our properties for such ancillary facilities.

Market forces or unforeseen developments may prevent us from obtaining the supplies and equipment necessary to explore for gold and other minerals.

Gold exploration and mineral exploration in general, is a very competitive business. Competitive demands for contractors and unforeseen shortages of supplies and/or equipment could result in the disruption of our planned exploration activities. Current demand for exploration drilling services, equipment and supplies is robust and could result in suitable equipment and skilled manpower being unavailable at scheduled times for our exploration program. Fuel prices are extremely volatile as well. We will attempt to locate suitable equipment, materials, manpower and fuel if sufficient funds are available. If we cannot find the equipment and supplies needed for our various exploration programs, we may have to suspend some or all of them until equipment, supplies, funds and/or skilled manpower become available. Any such disruption in our activities may adversely affect our exploration activities and financial condition.

Our directors and executive officers lack significant experience or technical training in exploring for precious and base metal deposits and in developing mines.

Our directors and executive officers lack significant experience or technical training in exploring for precious and base metal deposits and in developing mines. Accordingly, although our Senior Vice President has significant experience and expertise in environmental permitting and regulatory matters for developing and operating mines, our management may not be fully aware of many of the other specific requirements related to working within this industry. Their decisions and choices may not take into account standard engineering or managerial approaches that mineral exploration companies commonly use. Consequently, our operations, earnings, and ultimate financial success could suffer irreparable harm due to some of our management’s lack of experience in the mining industry.

We may not be able to maintain the infrastructure necessary to conduct exploration activities.

Our exploration activities depend upon adequate infrastructure. Reliable roads, bridges, power sources and water supply are important factors that affect capital and operating costs. Unusual or infrequent weather phenomena, sabotage, government or other interference in the maintenance or provision of such infrastructure could adversely affect our exploration activities and financial condition.

Our exploration activities may be adversely affected by the local climate or seismic events, which could prevent us from gaining access to our property year-round.

Earthquakes, heavy rains, snowstorms, and floods could result in serious damage to or the destruction of facilities, equipment or means of access to our property, or may otherwise prevent us from conducting exploration activities on our property. There may be short periods of time when the unpaved portion of the access road is impassible in the event of extreme weather conditions or unusually muddy conditions. During these periods, it may be difficult or impossible for us to access our property, make repairs, or otherwise conduct exploration activities on them.

Risks Relating to Our Organization and Common Stock

We have relied on a certain stockholders to provide significant investment capital to fund our operations.

We have in the past relied on cash infusions primarily from Frost Gamma Investments Trust (“Frost Gamma”) and the Company’s director, Barry Honig. During the year ended December 31, 2012, Frost Gamma provided approximately $4.6 million to fund operations in consideration for the issuance of certain of our securities. In the year ended December 31, 2013, Mr. Honig provided approximately $5.6 million to us to fund operations in consideration for the issuance of the Series E Preferred Stock. Additionally, Mr. Honig and Frost Gamma provided approximately $1.9 million and $150,000, respectively, to us in consideration for the issuance of shares of common stock and warrants to purchase shares of common stock in July 2014 private placements. Curtailment of cash investments by Frost Gamma or Barry Honig could detrimentally impact our cash availability and our ability to fund our operations.

Our principal shareholder, officers and directors own a substantial interest in our voting stock and investors may have limited voice in our management.

Our principal shareholders Frost Gamma Investments Trust and Barry Honig, as well as our officers and directors, in the aggregate beneficially own in excess of approximately 47% of our outstanding common stock, including shares of common stock issuable upon exercise or conversion within 60 days of August 18, 2014. As of August 18, 2014, Frost Gamma Investment Trust beneficially owns 53,948,997 shares, or approximately 17% of our common stock and Barry Honig, who is also our director, beneficially owns 89,830,487 shares, or approximately 25% of our common stock. Our officers and directors, including Barry Honig, beneficially own 122,117,706 shares, or approximately 32% of our common stock. Additionally, the holdings of our officers and directors may increase in the future upon vesting or other maturation of exercise rights under any of the convertible securities they may hold or in the future be granted or if they otherwise acquire additional shares of our common stock.

As a result of their ownership and positions, our principal shareholder, directors and executive officers collectively may be able to influence all matters requiring shareholder approval, including the following matters:

· election of our directors;

· amendment of our articles of incorporation or bylaws; and

· effecting or preventing a merger, sale of assets or other corporate transaction.

In addition, their stock ownership may discourage a potential acquirer from making a tender offer or otherwise attempting to obtain control of the Company, which in turn could reduce our stock price or prevent our shareholders from realizing a premium over our stock price.

We are subject to the information and reporting requirements of the Securities and Exchange Act of 1934, as amended (the “Exchange Act”), and other federal securities laws, including compliance with the Sarbanes-Oxley Act of 2002 (the “Sarbanes-Oxley Act”).

The costs of preparing and filing annual and quarterly reports and other information with the Securities and Exchange Commission and furnishing audited reports to stockholders will cause our expenses to be higher than they would have been if we were privately held. These costs for the years ended December 31, 2012 and December 31, 2013 were approximately $800,000 and $900,000, respectively, and we expect the costs for 2014 to be approximately $900,000.

It may be time consuming, difficult and costly for us to develop, implement and maintain the internal controls and reporting procedures required by the Sarbanes-Oxley Act. We may need to hire additional financial reporting, internal controls and other finance personnel in order to develop and implement appropriate internal controls and reporting procedures.

If we fail to establish and maintain an effective system of internal control, we may not be able to report our financial results accurately or to prevent fraud. Any inability to report and file our financial results accurately and timely could harm our reputation and adversely impact the trading price of our common stock.

Effective internal control is necessary for us to provide reliable financial reports and prevent fraud. If we cannot provide reliable financial reports or prevent fraud, we may not be able to manage our business as effectively as we would if an effective control environment existed, and our business and reputation with investors may be harmed. As a result, our small size and any current internal control deficiencies may adversely affect our financial condition, results of operation and access to capital. At December 31, 2012, management reported significant deficiencies related to (i) our internal audit functions, and (ii) a lack of segregation of duties within accounting functions. Although as of December 31, 2013, management has concluded that our internal control over financial reporting is effective, there can be no assurance that our internal control over financial reporting will remain effective.

Public company compliance may make it more difficult to attract and retain officers and directors.

The Sarbanes-Oxley Act and rules implemented by the Securities and Exchange Commission have required changes in corporate governance practices of public companies. As a public company, our compliance costs have increased in 2013 and we expect these rules and regulations to further increase our compliance costs and to make certain activities more time consuming and costly. As a public company, we also expect that these rules and regulations may make it more difficult and expensive for us to obtain director and officer liability insurance and we may be required to accept reduced policy limits and coverage or incur substantially higher costs to obtain the same or similar coverage. As a result, it may be more difficult for us to attract and retain qualified persons to serve on our board of directors or as executive officers, and to maintain insurance at reasonable rates, or at all.

Because we became public by a reverse merger, we may not be able to attract the attention of major brokerage firms.

There may be risks associated with us becoming public through a “reverse merger.” Securities analysts of major brokerage firms may not provide coverage of us since there is no incentive to brokerage firms to recommend the purchase of our common stock. No assurance can be given that brokerage firms will, in the future, want to conduct any offerings on our behalf.

Our stock price may be volatile.

The market price of our common stock is likely to be highly volatile and could fluctuate widely in price in response to various factors, many of which are beyond our control, including the following:

· results of our operations and exploration efforts;

· fluctuation in the supply of, demand and market price for gold;

· our ability to obtain working capital financing;

· additions or departures of key personnel;

· limited “public float” in the hands of a small number of persons whose sales or lack of sales could result in positive or negative pricing pressure on the market price for our common stock;

· our ability to execute our business plan;

· sales of our common stock and decline in demand for our common stock;

· regulatory developments;

· economic and other external factors;

· investor perception of our industry or our prospects; and

· period-to-period fluctuations in our financial results.

In addition, the securities markets have from time to time experienced significant price and volume fluctuations that are unrelated to the operating performance of particular companies. These market fluctuations may also materially and adversely affect the market price of our common stock. As a result, you may be unable to resell your shares at a desired price.

We have not paid cash dividends in the past and do not expect to pay dividends in the future. Any return on investment may be limited to the value of our common stock.

We have never paid cash dividends on our common stock and do not anticipate doing so in the foreseeable future. The payment of dividends on our common stock will depend on earnings, financial condition and other business and economic factors affecting us at such time as our board of directors may consider relevant. If we do not pay dividends, our common stock may be less valuable because a return on your investment will only occur if our stock price appreciates.

There is currently a very limited trading market for our common stock and we cannot ensure that one will ever develop or be sustained.

Our shares of common stock are very thinly traded, only a small percentage of our common stock is available to be traded and is held by a small number of holders and the price, if traded, may not reflect our actual or perceived value. There can be no assurance that there will be an active market for our shares of common stock either now or in the future. The market liquidity will be dependent on the perception of our operating business, among other things. We may, in the future, take certain steps, including utilizing investor awareness campaigns, press releases, road shows and conferences to increase awareness of our business and any steps that we might take to bring us to the awareness of investors may require we compensate consultants with cash and/or stock. There can be no assurance that there will be any awareness generated or the results of any efforts will result in any impact on our trading volume. Consequently, investors may not be able to liquidate their investment or liquidate it at a price that reflects the value of the business and trading may be at an inflated price relative to the performance of our company due to, among other things, availability of sellers of our shares. If a market should develop, the price may be highly volatile. Because there may be a low price for our shares of common stock, many brokerage firms or clearing firms may not be willing to effect transactions in the securities or accept our shares for deposit in an account. Even if an investor finds a broker willing to effect a transaction in the shares of our common stock, the combination of brokerage commissions, transfer fees, taxes, if any, and any other selling costs may exceed the selling price. Further, many lending institutions will not permit the use of low priced shares of common stock as collateral for any loans.

We anticipate that our common stock will continue to be quoted for trading on the OTC Bulletin Board or the OTCQB; however, we cannot be sure that such quotations will continue. As soon as is practicable, we intend to list our common stock on the NYSE MKT or other national securities exchange, if we can satisfy the initial listing standards. We currently do not satisfy the initial listing standards, and cannot ensure that we will be able to satisfy the listing standards or that our common stock will be accepted for listing on any exchange. Should we fail to satisfy the initial listing standards, or our common stock is otherwise rejected for listing or is suspended from the OTC Bulletin Board or OTCQB, the trading price of our common stock could suffer, the trading market for our common stock may be less liquid and our common stock price may be subject to increased volatility.

Our common stock is deemed a “penny stock,” which would make it more difficult for our investors to sell their shares.

Our common stock is subject to the “penny stock” rules adopted under Section 15(g) of the Exchange Act. The penny stock rules generally apply to companies whose common stock is not listed on the NASDAQ Stock Market or other national securities exchange and trades at less than $4.00 per share, other than companies that have had average revenue of at least $6,000,000 for the last three years or that have tangible net worth of at least $5,000,000 ($2,000,000 if the company has been operating for three or more years). These rules require, among other things, that brokers who trade penny stock to persons other than “established customers” complete certain documentation, make suitability inquiries of investors and provide investors with certain information concerning trading in the security, including a risk disclosure document and quote information under certain circumstances. Many brokers have decided not to trade penny stocks because of the requirements of the penny stock rules and, as a result, the number of broker-dealers willing to act as market makers in such securities is limited. If we remain subject to the penny stock rules for any significant period, it could have an adverse effect on the market, if any, for our securities. If our securities are subject to the penny stock rules, investors will find it more difficult to dispose of our securities.

Offers or availability for sale of a substantial number of shares of our common stock may cause the price of our common stock to decline.

If our stockholders sell substantial amounts of our common stock in the public market or upon the expiration of any statutory holding period, under Rule 144, or upon expiration of lock-up periods applicable to outstanding shares, or upon the exercise of outstanding options or warrants, it could create a circumstance commonly referred to as an “overhang” in anticipation of which the market price of our common stock could decline. The existence of an overhang, whether or not sales have occurred or are occurring, also could make it more difficult for us to raise additional financing through the sale of equity or equity-related securities in the future at a time and price that we deem reasonable or appropriate.

Conversion of preferred stock and exercise of options or warrants may result in substantial dilution to existing shareholders.

Conversion of our Series E Preferred Stock and, if the price per share of our common stock at the time of exercise of any options or warrants is in excess of the various exercise prices of the options or warrants, exercise of options and warrants, would have a dilutive effect on our common stock. As of August 18, 2014, we have reserved the following number of shares of common stock issuable upon (i) conversion of our Series E Preferred Stock into 28,275,000 shares of our common stock, (ii) exercise of options to purchase 32,900,000 shares of our common stock, and (iii) exercise of warrants to purchase 38,054,543 shares of our common stock. Further, any additional financing that we secure may require the granting of rights, preferences or privileges senior to those of our common stock and which result in additional dilution of the existing ownership interests of our common stockholders.

Our articles of incorporation allow for our board to create new series of preferred stock without further approval by our stockholders, which could adversely affect the rights of the holders of our common stock.

Our board of directors has the authority to fix and determine the relative rights and preferences of preferred stock. Our board of directors also has the authority to issue preferred stock without further stockholder approval. As a result, our board of directors could authorize the issuance of a series of preferred stock that would grant to holders the preferred right to our assets upon liquidation, the right to receive dividend payments before dividends are distributed to the holders of common stock and the right to the redemption of the shares, together with a premium, prior to the redemption of our common stock. In addition, our board of directors could authorize the issuance of a series of preferred stock that has greater voting power than our common stock or that is convertible into our common stock, which could decrease the relative voting power of our common stock or result in dilution to our existing stockholders.

The selling stockholders will receive all of the proceeds from the sale of the shares offered by them under this prospectus. We will not receive any proceeds from the sale of the shares by the selling stockholders covered by this prospectus.

MARKET FOR OUR COMMON STOCK AND RELATED STOCKHOLDER MATTERS

Our common stock commenced trading on August 20, 2009 and was quoted on the OTC Bulletin Board under the symbol EXCX.OB from June 23, 2009 through May 31, 2011. Prior to August 20, 2009, there was no active market for our common stock. Our common stock traded under the symbol SAGE.OB from June 1, 2011 until March 26, 2012. On March 26, 2012, our symbol was changed to PGLC.OB. The following table sets forth the high and low bid prices for the periods indicated as reported on the OTC Markets’ OTCQB. The quotations reflect inter-dealer prices, without retail mark-up, mark-down or commission, and may not necessarily represent actual transactions.

|

Year Ended December 31, 2012 |

|

High |

|

Low |

| ||

|

1st Quarter Ended March 31, 2012 |

|

$ |

0.97 |

|

$ |

0.36 |

|

|

2nd Quarter Ended June 30, 2012 |

|

$ |

0.62 |

|

$ |

0.25 |

|

|

3rd Quarter Ended September 30, 2012 |

|

$ |

0.46 |

|

$ |

0.30 |

|

|

4th Quarter Ended December 31, 2012 |

|

$ |

0.44 |

|

$ |

0.31 |

|

|

|

|

|

|

|

| ||

|

Year Ended December 31, 2013 |

|

High |

|

Low |

| ||

|

1st Quarter Ended March 31, 2013 |

|

$ |

0.60 |

|

$ |

0.39 |

|

|

2nd Quarter Ended June 30, 2013 |

|

$ |

0.46 |

|

$ |

0.34 |

|

|

3rd Quarter Ended September 30, 2013 |

|

$ |

0.40 |

|

$ |

0.34 |

|

|

4th Quarter Ended December 31, 2013 |

|

$ |

0.37 |

|

$ |

0.34 |

|

|

|

|

|

|

|

| ||

|

Year Ended December 31, 2014 |

|

High |

|

Low |

| ||

|

1st Quarter Ended March 31, 2014 |

|

$ |

0.43 |

|

$ |

0.34 |

|

|

2nd Quarter Ended June 30, 2014 |

|

$ |

0.40 |

|

$ |

0.35 |

|

|

3rd Quarter Ended September 30, 2014 (through August 18, 2014) |

|

$ |

0.35 |

|

$ |

0.32 |

|

The last reported sales price of our common stock on the OTC Market’s OTCQB on August 18, 2014, was $0.33 per share.

Holders

As of August 18, 2014, there were 564 holders of record of our common stock.

Dividend Policy

In the past, we have not declared or paid cash dividends on our common stock, and we do not intend to pay any cash dividends on our common stock. Rather, we intend to retain future earnings (if any) to fund the operation and expansion of our business and for general corporate purposes. Subject to legal and contractual limits, our board of directors will make any decision as to whether to pay dividends in the future.

Securities Authorized for Issuance under Equity Compensation Plans

Our Board of Directors and stockholders have adopted three equity incentive plans: (i) the 2010 Equity Incentive Plan, adopted September 29, 2010, pursuant to which 2,800,000 shares of our common stock were reserved for issuance as awards, and as of August 18, 2014, 650,000 shares remain available for issuance; (ii) the 2012 Equity Incentive Plan, adopted February 9, 2012, pursuant to which 40,000,000 shares of our common stock were reserved for issuance as awards, and as of August 18, 2014, 500,000 shares remain available for issuance; and (iii) the 2013 Equity Incentive Plan, adopted February 12, 2013, pursuant to which 40,000,000 shares of our common stock were reserved for issuance as awards, and as of August 18, 2014, 30,425,000 shares remain available for issuance.

The purpose of the 2010 and 2012 Equity Incentive Plans is to provide an incentive to attract and retain directors, officers, consultants, advisors and employees whose services are considered valuable, to encourage a sense of proprietorship and to stimulate an active interest of such persons in our development and financial success. The purpose of the 2013 Equity Incentive Plan is to promote the success of the Company and to increase stockholder

value by providing an additional means through the grant of awards to attract, motivate, retain and reward selected employees and other eligible persons.