UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-Q

(Mark One)

|

☒

|

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the quarterly period ended March 29, 2015

or

|

☐

|

TRANSITION REPORT UNDER SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the transition period from to

Commission file number: 001-35520

GIGOPTIX, INC.

(Exact name of registrant as specified in its charter)

|

Delaware

|

|

26-2439072

|

|

(State or Other Jurisdiction of Incorporation or Organization)

|

|

(I.R.S. Employer Identification No.)

|

130 Baytech Drive

San Jose, CA 95134

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

Large accelerated filer

|

☐ |

Accelerated filer

|

☐ |

| |

|

|

|

|

Non-accelerated filer

|

☐ (Do not check if a smaller reporting company) |

Smaller reporting Company

|

☒ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

The number of shares of Common Stock outstanding as of April 24, 2015, the most recent practicable date prior to the filing of this Quarterly Report on Form 10-Q, was 32,617,947 shares.

| |

|

PAGE

NO

|

|

PART I FINANCIAL INFORMATION

|

|

| |

|

|

|

ITEM 1

|

Financial Statements (unaudited)

|

|

| |

|

|

| |

|

3

|

| |

|

|

| |

|

4

|

| |

|

|

| |

|

5

|

| |

|

|

| |

|

6

|

| |

|

|

| |

|

7

|

| |

|

|

|

ITEM 2

|

|

19

|

| |

|

|

|

ITEM 3

|

|

25

|

| |

|

|

|

ITEM 4

|

|

25

|

| |

|

|

PART II OTHER INFORMATION

|

|

| |

|

|

|

ITEM 1

|

|

25

|

| |

|

|

|

ITEM 1A

|

|

26

|

| |

|

|

|

ITEM 6

|

|

27

|

PART I

FINANCIAL INFORMATION

GIGOPTIX, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(In thousands, except share and per share amounts)

| |

|

March 29,

|

|

|

December 31,

|

|

| |

|

2015

|

|

|

2014

|

|

|

ASSETS

|

|

(Unaudited)

|

|

|

(1) |

|

|

Current assets:

|

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

|

$

|

17,664

|

|

|

$

|

18,438

|

|

|

Accounts receivable, net

|

|

|

8,254

|

|

|

|

7,955

|

|

|

Inventories

|

|

|

5,978

|

|

|

|

5,139

|

|

|

Prepaid and other current assets

|

|

|

738

|

|

|

|

433

|

|

|

Total current assets

|

|

|

32,634

|

|

|

|

31,965

|

|

|

Property and equipment, net

|

|

|

2,134

|

|

|

|

1,916

|

|

|

Intangible assets, net

|

|

|

2,171

|

|

|

|

2,394

|

|

|

Goodwill

|

|

|

10,395

|

|

|

|

10,306

|

|

|

Restricted cash

|

|

|

54

|

|

|

|

53

|

|

|

Other assets

|

|

|

123

|

|

|

|

116

|

|

|

Total assets

|

|

$

|

47,511

|

|

|

$

|

46,750

|

|

| |

|

|

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS’ EQUITY

|

|

|

|

|

|

|

|

|

|

Current liabilities:

|

|

|

|

|

|

|

|

|

|

Accounts payable

|

|

$

|

2,773

|

|

|

$

|

2,731

|

|

|

Accrued compensation

|

|

|

1,269

|

|

|

|

730

|

|

|

Other current liabilities

|

|

|

2,784

|

|

|

|

2,902

|

|

|

Total current liabilities

|

|

|

6,826

|

|

|

|

6,363

|

|

|

Pension liabilities

|

|

|

335

|

|

|

|

326

|

|

|

Other long term liabilities

|

|

|

634

|

|

|

|

556

|

|

|

Total liabilities

|

|

|

7,795

|

|

|

|

7,245

|

|

|

Commitments and contingencies (Note 11)

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Stockholders’ equity:

|

|

|

|

|

|

|

|

|

|

Preferred stock, $0.001 par value; 1,000,000 shares authorized; no shares issued and outstanding as of March 29, 2015 and December 31, 2014, respectively

|

|

|

-

|

|

|

|

-

|

|

|

Common stock, $0.001 par value; 100,000,000 shares authorized; 33,318,633 and 33,112,086 shares issued and outstanding as of March 29, 2015 and December 31, 2014, respectively

|

|

|

33

|

|

|

|

32

|

|

|

Additional paid-in capital

|

|

|

144,487

|

|

|

|

143,661

|

|

|

Treasury stock, at cost; 701,754 shares as of March 29, 2015 and December 31, 2014, respectively

|

|

|

(2,209

|

)

|

|

|

(2,209

|

)

|

|

Accumulated other comprehensive income

|

|

|

305

|

|

|

|

285

|

|

|

Accumulated deficit

|

|

|

(102,900

|

)

|

|

|

(102,264

|

)

|

|

Total stockholders’ equity

|

|

|

39,716

|

|

|

|

39,505

|

|

|

Total liabilities and stockholders’ equity

|

|

$

|

47,511

|

|

|

$

|

46,750

|

|

See accompanying Notes to Condensed Consolidated Financial Statements

|

(1)

|

The condensed consolidated balance sheet as of December 31, 2014 has been derived from the audited consolidated financial statements as of that date.

|

GIGOPTIX, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(In thousands, except per share amounts)

(Unaudited)

| |

|

Three Months Ended

|

|

| |

|

March 29, 2015

|

|

|

March 30, 2014

|

|

|

Total revenue

|

|

|

9,060

|

|

|

|

7,386

|

|

|

Total cost of revenue

|

|

|

3,667

|

|

|

|

3,126

|

|

|

Gross profit

|

|

|

5,393

|

|

|

|

4,260

|

|

|

Operating expenses

|

|

|

|

|

|

|

|

|

|

Research and development expense

|

|

|

3,248

|

|

|

|

3,742

|

|

|

Selling, general and administrative expense

|

|

|

2,770

|

|

|

|

2,398

|

|

|

Loss from operations

|

|

|

(625

|

)

|

|

|

(1,880

|

)

|

|

Interest expense, net

|

|

|

(3

|

)

|

|

|

(17

|

)

|

|

Other income, net

|

|

|

1

|

|

|

|

10

|

|

|

Loss before provision for income taxes

|

|

|

(627

|

)

|

|

|

(1,887

|

)

|

|

Provision for income taxes

|

|

|

9

|

|

|

|

10

|

|

|

Net loss

|

|

$

|

(636

|

)

|

|

$

|

(1,897

|

)

|

| |

|

|

|

|

|

|

|

|

|

Net loss per share—basic and diluted

|

|

$

|

(0.02

|

)

|

|

$

|

(0.06

|

)

|

| |

|

|

|

|

|

|

|

|

|

Weighted average number of shares used in basic and diluted net loss per share calculations

|

|

|

32,525

|

|

|

|

31,435

|

|

See accompanying Notes to Condensed Consolidated Financial Statements

GIGOPTIX, INC.

CONDENSED CONSOLIDATED STATEMENTS OF

COMPREHENSIVE LOSS

(In thousands)

(Unaudited)

| |

|

Three Months Ended

|

|

| |

|

March 29, 2015

|

|

|

March 30, 2014

|

|

|

Net loss

|

|

$

|

(636

|

)

|

|

$

|

(1,897

|

)

|

|

Other comprehensive income (loss), net of tax

|

|

|

|

|

|

|

|

|

|

Foreign currency translation adjustment

|

|

|

20

|

|

|

|

(2

|

)

|

|

Other comprehensive income (loss), net of tax

|

|

|

20

|

|

|

|

(2

|

)

|

|

Comprehensive loss

|

|

$

|

(616

|

)

|

|

$

|

(1,899

|

)

|

See accompanying Notes to Condensed Consolidated Financial Statements

GIGOPTIX, INC.

CONDENSED CONSOLIDATED STATEMENTS OF

CASH FLOWS

(In thousands)

(Unaudited)

| |

|

Three Months Ended

|

|

| |

|

March 29,

|

|

|

March 30,

|

|

| |

|

2015

|

|

|

2014

|

|

|

Cash flows from operating activities:

|

|

|

|

|

|

|

|

Net loss

|

|

$

|

(636

|

)

|

|

$

|

(1,897

|

)

|

|

Adjustments to reconcile net loss to net cash used in operating activities:

|

|

|

|

|

|

|

Depreciation and amortization

|

|

|

890

|

|

|

|

917

|

|

|

Stock-based compensation

|

|

|

889

|

|

|

|

1,010

|

|

|

Change in fair value of warrants

|

|

|

(1

|

)

|

|

|

2

|

|

|

Changes in operating assets and liabilities:

|

|

|

|

|

|

|

|

|

|

Accounts receivable

|

|

|

(299

|

)

|

|

|

(1,044

|

)

|

|

Inventories

|

|

|

(839

|

)

|

|

|

(136

|

)

|

|

Prepaid and other current assets

|

|

|

(557

|

)

|

|

|

(25

|

)

|

|

Other assets

|

|

|

(7

|

)

|

|

|

25

|

|

|

Accounts payable

|

|

|

(168

|

)

|

|

|

1,595

|

|

|

Accrued restructuring

|

|

|

-

|

|

|

|

(29

|

)

|

|

Accrued compensation

|

|

|

539

|

|

|

|

(125

|

)

|

|

Other current liabilities

|

|

|

(217

|

)

|

|

|

(487

|

)

|

|

Other long-term liabilities

|

|

|

79

|

|

|

|

(13

|

)

|

|

Net cash used in operating activities

|

|

|

(327

|

)

|

|

|

(207

|

)

|

|

Cash flows from investing activities:

|

|

|

|

|

|

|

|

|

|

Purchases of property and equipment

|

|

|

(416

|

)

|

|

|

(123

|

)

|

|

Net cash used in investing activities

|

|

|

(416

|

)

|

|

|

(123

|

)

|

|

Cash flows from financing activities:

|

|

|

|

|

|

|

|

|

|

Proceeds from issuance of stock

|

|

|

28

|

|

|

|

10

|

|

|

Taxes paid related to net share settlement of equity awards

|

|

|

(90

|

)

|

|

|

(103

|

)

|

|

Repayment of capital lease

|

|

|

(1

|

)

|

|

|

(89

|

)

|

|

Net cash used in financing activities

|

|

|

(63

|

)

|

|

|

(182

|

)

|

|

Effect of exchange rates on cash and cash equivalents

|

|

|

32

|

|

|

|

-

|

|

|

Net decrease in cash and cash equivalents

|

|

|

(774

|

)

|

|

|

(512

|

)

|

|

Cash and cash equivalents at beginning of period

|

|

|

18,438

|

|

|

|

20,377

|

|

|

Cash and cash equivalents at end of period

|

|

$

|

17,664

|

|

|

$

|

19,865

|

|

|

Supplemental disclosure of cash flow information

|

|

|

|

|

|

|

|

|

|

Interest paid

|

|

$

|

4

|

|

|

$

|

17

|

|

|

Property and equipment acquired with accounts payable

|

|

$

|

289

|

|

|

$

|

406

|

|

See accompanying Notes to Condensed Consolidated Financial Statements

GIGOPTIX, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

NOTE 1—ORGANIZATION AND BASIS OF PRESENTATION

Organization

GigOptix Inc. (“GigOptix” or the “Company”) is a leading fabless supplier of high speed semiconductor components that enable end-to-end information streaming over optical and wireless networks. Its products address the needs of emerging high-growth markets, such as long haul and metro telecommunications (“telecom”) applications, as well as Cloud data communications (“datacom”) and datacenter connectivity, point-to-point wireless backhaul, and interactive high speed applications for the consumer electronics, industrial, defense and avionics industries.

The business is made up of two product lines: the High-Speed Communications (“HSC”) product line and the Industrial product line. Its products are highly customized and typically developed in partnership with key ”Lighthouse” customers, generating engineering project revenues through the development stage and larger future product revenue through these customers and general market availability.

The HSC product line offers a broad portfolio of high performance semiconductor devices and multi-chip-Modules (MCMs) aimed predominantly at the telecom, datacom and consumer-electronics optical communications and wireless markets, and includes, among others, (i) mixed signal radio frequency integrated circuits (“RFIC”) at 50 GHz and above; (ii) 10 to 400 gigabit per second (“Gbps”) laser and optical-modulator drivers, and trans-impedance amplifiers (“TIA”); (iii) power amplifiers and transceivers for microwave and millimeter monolithic microwave integrated circuit (“MMIC”) wireless applications at frequencies higher than 50 GHz; (iv) integrated systems in a package (“SIP”) solutions for both fiber-optic and wireless communication systems; and (v) radio frequency (“RF’) chips for various consumer applications such as global navigation satellite systems (“GNSS”).

The Industrial product line offers a wide range of digital and mixed-signal application specific integrated circuit (“ASIC”) solutions for various industrial applications used in the military, avionics, automotive, security and surveillance, medical and communications markets.

GigOptix, Inc., the successor to GigOptix LLC, was formed as a Delaware corporation in March 2008 in order to facilitate a combination between GigOptix LLC and Lumera Corporation (“Lumera”). Before the combination, GigOptix LLC acquired the assets of iTerra Communications LLC in July 2007 (“iTerra”) and Helix Semiconductors AG (“Helix”) in January 2008. On November 9, 2009, GigOptix acquired ChipX, Incorporated (“ChipX”). On June 17, 2011, GigOptix acquired Endwave Corporation (“Endwave”). As a result of the acquisitions, Helix, Lumera, ChipX and Endwave all became wholly owned subsidiaries of GigOptix. In March 2013, the Company established a German subsidiary, GigOptix GmbH; however it is currently in the process of being dissolved.

In February 2014, together with Fundação CPqD – Centro De Pesquisa e Desenvolvimento em Telecomunicações (“CPqD”), the Company formed a new joint venture of which the Company owns 49% and CPqD owns 51%, BrPhotonics Produtos Optoeletrônicos LTDA. (“BrP”), based in Campinas, Brazil, which will be a provider of advanced high-speed devices for optical communications and integrated transceiver components that enable information streaming over fiber-optics communication networks. This joint venture is also engaged in research and development of Silicon-Photonics (“SiPh”) advanced electro-optical products. During the second quarter of 2014, the Company transferred all of its inventory and assets related to the Thin Film Polymer on Silicon (“TFPSTM”) platform and the production line equipment for use by BrP (see also Note 7).

In June 2014, the Company signed a definitive agreement to acquire, for cash only by way of assuming specified liabilities, substantially all of the assets of Tahoe RF Semiconductor, Inc. (“Tahoe RF”), a provider of RF and analog RFICs, intellectual property, and fully integrated systems and subsystems on a chip. That acquisition closed on June 30, 2014, which was the first day of the Company’s third quarter of fiscal 2014.

The Company’s fiscal year ends on December 31. For quarterly reporting, the Company employs a five-week, four-week, four-week, reporting period. The first quarter of 2015 ended on Sunday, March 29, 2015. The first quarter of 2014 ended on Sunday, March 30, 2014. The condensed consolidated financial statements include the accounts of the Company and its wholly-owned subsidiaries. All significant intercompany accounts and transactions have been eliminated.

The accompanying unaudited condensed consolidated financial statements as of March 29, 2015 and for the three months ended March 29, 2015 and March 30, 2014, have been prepared in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”) for interim financial information and with the instructions to Article 10 of Securities and Exchange Commission (“SEC”) Regulation S-X. The statements include the accounts of the Company and all of its subsidiaries and they do not include all of the information and footnotes required by such accounting principles for annual financial statements. In the opinion of management, these unaudited condensed consolidated financial statements include all adjustments, consisting only of normal recurring adjustments, necessary for a fair presentation of the Company’s financial position as of March 29, 2015, and the results of operations and cash flows for the three months ended March 29, 2015 and March 30, 2014. The condensed consolidated results of operations for the three months ended March 29, 2015 are not necessarily indicative of results that may be expected for any other interim period or for the full fiscal year ending December 31, 2015. It is suggested that these condensed consolidated financial statements be read in conjunction with the financial statements and the notes thereto included in the 2014 Form 10-K.

The preparation of consolidated financial statements in conformity with U.S. GAAP requires management to make estimates, judgments and assumptions that affect the reported amount of assets and liabilities, disclosure of contingent assets and liabilities at the date of the financial statements, and the reported amounts of revenue and expenses during the reported periods. These judgments can be subjective and complex, and consequently, actual results could differ materially from those estimates and assumptions. Descriptions of these estimates and assumptions are included in the 2014 Form 10-K and the Company encourages you to read its 2014 Form 10-K for more information about such estimates and assumptions.

NOTE 2—BALANCE SHEET COMPONENTS

Accounts receivable, net consisted of the following (in thousands):

| |

|

March 29,

|

|

|

December 31,

|

|

| |

|

2015

|

|

|

2014

|

|

|

Accounts receivable

|

|

$

|

8,298

|

|

|

$

|

8,003

|

|

|

Allowance for doubtful accounts

|

|

|

(44

|

)

|

|

|

(48

|

)

|

| |

|

$

|

8,254

|

|

|

$

|

7,955

|

|

Property and equipment, net consisted of the following (in thousands, except depreciable life):

| |

|

Life

|

|

|

March 29,

|

|

|

December 31,

|

|

| |

|

(In years)

|

|

|

2015

|

|

|

2014

|

|

|

Network and laboratory equipment

|

|

|

3 – 5

|

|

|

$

|

11,937

|

|

|

$

|

11,252

|

|

|

Computer software and equipment

|

|

|

2 – 3

|

|

|

|

3,918

|

|

|

|

3,877

|

|

|

Furniture and fixtures

|

|

|

3 – 7

|

|

|

|

165

|

|

|

|

165

|

|

|

Office equipment

|

|

|

3 – 5

|

|

|

|

135

|

|

|

|

131

|

|

|

Leasehold improvements

|

|

|

1 – 5

|

|

|

|

279

|

|

|

|

276

|

|

| |

|

|

|

|

|

|

16,434

|

|

|

|

15,701

|

|

|

Accumulated depreciation and amortization

|

|

|

|

|

|

|

(14,300

|

)

|

|

|

(13,785

|

)

|

|

Property and equipment, net

|

|

|

|

|

|

$

|

2,134

|

|

|

$

|

1,916

|

|

For the three months ended March 29, 2015 and March 30, 2014, depreciation expense related to property and equipment was $415,000 and $543,000, respectively.

In addition to the property and equipment above, the Company has prepaid licenses. For the three months ended March 29, 2015 and March 30, 2014, amortization related to these prepaid licenses was $252,000 and $151,000, respectively.

Inventories consisted of the following (in thousands):

| |

|

March 29,

|

|

|

December 31,

|

|

| |

|

2015

|

|

|

2014

|

|

|

Raw materials

|

|

$

|

2,484

|

|

|

$

|

1,676

|

|

|

Work in process

|

|

|

1,528

|

|

|

|

1,421

|

|

|

Finished goods

|

|

|

1,966

|

|

|

|

2,042

|

|

| |

|

$

|

5,978

|

|

|

$

|

5,139

|

|

Accrued and other current liabilities consisted of the following (in thousands):

| |

|

March 29,

|

|

|

December 31,

|

|

| |

|

2015

|

|

|

2014

|

|

| |

|

|

|

|

|

|

|

Amounts billed to the U.S. government in excess of approved rates

|

|

$

|

191

|

|

|

$

|

191

|

|

|

Warranty liability

|

|

|

369

|

|

|

|

334

|

|

|

Customer deposits

|

|

|

258

|

|

|

|

599

|

|

|

Capital lease obligations, current portion

|

|

|

3

|

|

|

|

3

|

|

|

Sales return reserve

|

|

|

552

|

|

|

|

412

|

|

|

Deferred revenue

|

|

|

337

|

|

|

|

327

|

|

|

Other

|

|

|

1,074

|

|

|

|

1,036

|

|

| |

|

$

|

2,784

|

|

|

$

|

2,902

|

|

The Company generally offers a one-year warranty on its products. The Company records a liability based on estimates of the costs that may be incurred under its warranty obligations and charges to the cost of product revenue the amount of such costs at the time revenues are recognized. The warranty obligation is affected by product failure rates, material usage and service delivery costs incurred in correcting a product failure. The estimates of anticipated rates of warranty claims and costs per claim are primarily based on historical information and future forecasts.

Changes in the Company’s product warranty liability during the three months ended March 29, 2015 and March 30, 2014 are as follows (in thousands):

| |

|

Three months ended

|

|

| |

|

March 29, 2015

|

|

|

March 30, 2014

|

|

|

Beginning balance

|

|

$

|

334

|

|

|

$

|

330

|

|

|

Warranties accrued

|

|

|

158

|

|

|

|

112

|

|

|

Warranties settled or reversed

|

|

|

(123

|

)

|

|

|

(127

|

)

|

|

Ending balance

|

|

$

|

369

|

|

|

$

|

315

|

|

The following table summarizes the Company’s financial assets and liabilities measured at fair value on a recurring basis as of March 29, 2015 and December 31, 2014 (in thousands):

| |

|

|

|

|

Fair Value Measurements Using

|

|

| |

|

Carrying Value

|

|

|

Quoted Prices in

Active

Markets for

Identical

Assets

(Level 1)

|

|

|

Significant

Other

Observable

Inputs

(Level 2)

|

|

|

Significant

Unobservable

Inputs

(Level 3)

|

|

|

March 29, 2015:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Assets:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash equivalents:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Money market funds

|

|

$

|

12,361

|

|

|

$

|

12,361

|

|

|

$

|

-

|

|

|

$

|

-

|

|

| |

|

$

|

12,361

|

|

|

$

|

12,361

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

Current liabilities:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Liability warrants

|

|

$

|

7

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

7

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

December 31, 2014:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Assets:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash equivalents:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Money market funds

|

|

$

|

12,360

|

|

|

$

|

12,360

|

|

|

$

|

-

|

|

|

$

|

-

|

|

| |

|

$

|

12,360

|

|

|

$

|

12,360

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

Current liabilities:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Liability warrants

|

|

$

|

8

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

8

|

|

The Company’s financial assets and liabilities are valued using market prices on active markets (“Level 1”), less active markets (“Level 2”) and unobservable markets (“Level 3”). Level 1 instrument valuations are obtained from real-time quotes for transactions in active exchange markets involving identical assets. Level 2 instrument valuations are obtained from readily-available pricing sources for comparable instruments. Level 3 instruments are valued using unobservable market values in which there is little or no market data, and which require the Company to apply judgment to determine the fair value.

For the three months ended March 29, 2015, the Company did not have any significant transfers between Level 1, Level 2 and Level 3.

The amounts reported as cash and cash equivalents, accounts receivable, accounts payable, accrued compensation and other current liabilities approximate fair value due to their short-term maturities. The carrying value of the Company’s line of credit and capital lease obligations approximates fair value and is based upon borrowing rates currently available to the Company for loans and capital leases with similar terms.

Liability Warrants

The Company issued warrants to Bridge Bank in connection with a waiver of certain events of default that arose under a November 2009 loan and security agreement with Bridge Bank. Certain provisions in the warrant agreements provided for down-round protection if the Company raised equity capital at a per share price which was less than the per share price of the warrants. Such down-round protection also requires the Company to classify the value of the warrants as a liability on the issuance date and then record changes in the fair value through the consolidated statements of operations for each reporting period until the warrants are either exercised or cancelled. The fair value of the liability is recalculated and adjusted each quarter with the differences being charged to other income (expense), net on the consolidated statements of operations. The fair value of these warrants was determined using a Black-Scholes option-pricing model, which requires the use of significant unobservable market values. As a result, these warrants are classified as Level 3 financial instruments. On July 7, 2010, the Company raised additional equity through an offering of 2,760,000 shares at $1.75 per share, thus triggering the down-round protection and adjustment of the number of warrants issued to Bridge Bank. On December 24, 2013, the Company raised additional equity through an offering of 9,573,750 shares at $1.42 per share, thus triggering the down-round protection and adjustment of the number of warrants issued to Bridge Bank.

The fair value of the warrants was estimated using the following assumptions:

| |

|

As of March 29, 2015

|

|

|

As of December 31, 2014

|

|

|

Stock price

|

|

$

|

1.19

|

|

|

$

|

1.20

|

|

|

Exercise price

|

|

$

|

2.51

|

|

|

$

|

2.51

|

|

|

Expected life

|

|

2.31 years

|

|

|

2.55 years

|

|

|

Risk-free interest rate

|

|

|

0.60

|

%

|

|

|

1.10

|

%

|

|

Volatility

|

|

|

69

|

%

|

|

|

69

|

%

|

|

Fair value per share

|

|

$

|

0.24

|

|

|

$

|

0.27

|

|

The following table summarizes the warrants subject to liability accounting as of March 29, 2015 and December 31, 2014 (in thousands, except share and per share amounts) (see also Note 6):

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

March 29, 2015

|

|

|

Three Months Ended

March 30, 2014

|

|

|

|

Holder

|

|

Original

Warrants

|

|

|

Adjusted

Warrants

|

|

Grant Date

|

|

Expiration

Date

|

|

Price per

Share

|

|

|

Fair Value

March 29,

2015

|

|

|

Fair Value

December 31,

2014

|

|

|

Exercise of

Warrants

|

|

|

Change in

Fair Value

|

|

|

Exercise of

Warrants

|

|

|

Change in

Fair Value

|

|

Related

Agreement

|

|

Bridge Bank

|

|

|

20,000

|

|

|

|

29,115

|

|

4/7/2010

|

|

7/7/2017

|

|

$

|

2.51

|

|

|

$

|

7

|

|

|

$

|

8

|

|

|

|

-

|

|

|

$

|

(1

|

)

|

|

|

-

|

|

|

$

|

2

|

|

Credit Agreement

|

The change in the fair value of the Level 3 liability warrants during the three months ended March 29, 2015 is as follows (in thousands):

|

Fair value as of December 31, 2014

|

|

$

|

8

|

|

|

Exercise of warrants

|

|

|

-

|

|

|

Change in fair value

|

|

|

(1

|

)

|

|

Fair value as of March 29, 2015

|

|

$

|

7

|

|

The warrant liability is included in other current liabilities in the condensed consolidated balance sheets.

NOTE 4—INTANGIBLE ASSETS AND GOODWILL

Intangible assets consist of the following (in thousands):

| |

|

March 29, 2015

|

|

|

December 31, 2014

|

|

| |

|

Gross

|

|

|

Accumulated

Amortization

|

|

|

Net

|

|

|

Gross

|

|

|

Accumulated

Amortization

|

|

|

Net

|

|

|

Customer relationships

|

|

$

|

3,277

|

|

|

$

|

(2,224

|

)

|

|

$

|

1,053

|

|

|

$

|

3,277

|

|

|

$

|

(2,119

|

)

|

|

$

|

1,158

|

|

|

Existing technology

|

|

|

3,783

|

|

|

|

(2,982

|

)

|

|

|

801

|

|

|

|

3,783

|

|

|

|

(2,881

|

)

|

|

|

902

|

|

|

Order backlog

|

|

|

732

|

|

|

|

(732

|

)

|

|

|

-

|

|

|

|

732

|

|

|

|

(732

|

)

|

|

|

-

|

|

|

Patents

|

|

|

457

|

|

|

|

(404

|

)

|

|

|

53

|

|

|

|

457

|

|

|

|

(402

|

)

|

|

|

55

|

|

|

Trade name

|

|

|

659

|

|

|

|

(395

|

)

|

|

|

264

|

|

|

|

659

|

|

|

|

(380

|

)

|

|

|

279

|

|

|

Total

|

|

$

|

8,908

|

|

|

$

|

(6,737

|

)

|

|

$

|

2,171

|

|

|

$

|

8,908

|

|

|

$

|

(6,514

|

)

|

|

$

|

2,394

|

|

For the three months ended March 29, 2015 and March 30, 2014, amortization of intangible assets was as follows (in thousands):

| |

|

Three Months Ended

|

|

| |

|

March 29, 2015

|

|

|

March 30, 2014

|

|

|

Cost of revenue

|

|

$

|

103

|

|

|

$

|

103

|

|

|

Selling, general and administrative expense

|

|

|

120

|

|

|

|

120

|

|

| |

|

$

|

223

|

|

|

$

|

223

|

|

Estimated future amortization expense related to intangible assets as of March 29, 2015 is as follows (in thousands):

|

Years ending December 31,

|

|

|

|

|

2015

|

|

$

|

670

|

|

|

2016

|

|

|

869

|

|

|

2017

|

|

|

487

|

|

|

2018

|

|

|

63

|

|

|

2019

|

|

|

54

|

|

|

Thereafter

|

|

|

28

|

|

|

Total

|

|

$

|

2,171

|

|

As of March 29, 2015, the Company had $10.4 million of goodwill in connection with the acquisitions of ChipX, Endwave and Tahoe RF. During the third quarter of 2014, the Company completed its acquisition of Tahoe RF which resulted in $446,000 of goodwill. During 2014, the Company assumed approximately $446,000 of liabilities of Tahoe RF and added RF/analog RFIC technology to the Company’s product portfolio and approximately 10 employees, primarily High-Speed and High-Frequency SiGe RF engineers focused on high growth areas such as wireless – E-Band and V-Band and GPS technologies. The Company agreed to pay up to an additional $254,000 in TahoeRF expenses of which $20,000 had been accrued in other current liabilities on the Company’s condensed consolidated balance sheet as of December 31, 2014. During the first quarter of 2015, the Company assumed an additional $89,000 related to tax and legal expenses which resulted in an increase of Tahoe RF’s goodwill to $535,000. As of March 29, 2015, the Company does not expect any additional changes to the purchase price. Since the final additional assumed grossed up liabilities were less than $254,000, the Company paid $128,000 in bonus payments in the first quarter of 2015 to former employees of Tahoe RF who were eligible as active employees of GigOptix on January 1, 2015, which was recorded as compensation expense. In addition, beginning in July 2016 and continuing annually through July 2020, any former Tahoe RF employee who remains, at that time, as an active employee of the Company will be entitled to a pre-allocated percentage of an aggregate retention bonus of up to approximately $70,000 based on the remaining 8 employees. These payments will be recorded as compensation expense when incurred and are being accrued as they are earned. As of March 29, 2015, approximately $95,000 is included in other long term liabilities.

The consolidated financial statements include the operating results of Tahoe RF from the date of acquisition. Pro forma results of operations for the Tahoe RF acquisition have not been presented because the effect of the acquisition was not material to the Company’s financial results.

NOTE 5—CREDIT FACILITIES

On March 25, 2013, the Company and its wholly owned subsidiaries, ChipX, Incorporated and Endwave Corporation (together with the Company, the “Borrowers”) previously entered into a second amended and restated loan and security agreement (“Loan Agreement”) with Silicon Valley Bank (“SVB”) to replace the amended and restated loan and security agreement entered on December 9, 2011. Pursuant to the Loan Agreement, the total aggregate amount that the Company is entitled to borrow from SVB has increased to $7.0 million, which is now split into two different credit facilities, comprised of (i) the existing Revolving Loan facility which was amended to provide that the Company is entitled to borrow from SVB up to $3.5 million, based on net eligible accounts receivable after an 80% advance rate and subject to limits based on the Company’s eligible accounts as determined by SVB and (ii) a new facility under which the Company is entitled to borrow from SVB up to $3.5 million without reference to accounts receivable under which the principal balance and accrued interest must be repaid within 3 business days after the date of any advance under the facility. In addition, the Loan Agreement eliminates the financial covenants contained in the previous loan agreement.

The Loan Agreement with SVB is secured by all of the Company’s assets, including all accounts, equipment, inventory, receivables, and general intangibles. The Loan Agreement contains certain restrictive covenants that will impose significant operating and financial restrictions on its operations, including, but not limited to restrictions that limit its ability to:

| |

·

|

Sell, lease, or otherwise transfer, or permit any of its subsidiaries to sell, lease or otherwise transfer, all or any part of its business or property, except in the ordinary course of business or in connection with certain indebtedness or investments permitted under the amended and restated loan agreement;

|

| |

·

|

Merge or consolidate, or permit any of its subsidiaries to merge or consolidate, with or into any other business organization, or acquire, or permit any of its subsidiaries to acquire, all or substantially all of the capital stock or property of another person;

|

| |

·

|

Create, incur, assume or be liable for any indebtedness, other than certain indebtedness permitted under the amended and restated loan and security agreement;

|

| |

·

|

Pay any dividends or make any distribution or payment on, or redeem, retire, or repurchase, any capital stock; and

|

| |

·

|

Make any investment, other than certain investments permitted under the amended and restated loan and security agreement.

|

The terms of the Loan Agreement were set to expire on March 9, 2015. On March 9, 2015 SVB and the Borrowers entered into a First Amendment to the Second Restated Loan Agreement (the “First Amendment”) in order to extend the expiration date of the Loan Agreement by sixty (60) days to May 8, 2015. The Borrowers intend to use this period of time to negotiate the terms of a new loan and security agreement with SVB. Other than as set forth herein with regard to the First Amendment, the terms of the Second Restated Loan Agreement remain unchanged and in full force and effect.

The Company had no outstanding balance on its line of credit as of March 29, 2015.

NOTE 6—STOCKHOLDERS’ EQUITY AND STOCK-BASED COMPENSATION

Common and Preferred Stock

In December 2008, the Company’s stockholders approved an amendment to the Certificate of Incorporation to authorize 50,000,000 shares of common stock of par value $0.001. In November 2014, the Company’s stockholders approved an amendment to the Amended and Restated Certificate of Incorporation to increase the number of authorized shares of common stock from 50,000,000 shares to 100,000,000 shares of par value $0.001. In addition, the Company is authorized to issue 1,000,000 shares of preferred stock of $0.001 par value of which 750,000 shares have been designated Series A Junior Preferred Stock with powers, preferences and rights as set forth in the amended and restated certificate of designation dated December 15, 2014; the remainder of the shares of preferred stock are undesignated, for which the Board of Directors is authorized to fix the designation, powers, preferences and rights. As of March 29, 2015 and December 31, 2014, there were no shares of preferred stock issued or outstanding.

On December 16, 2014, the Company entered into an Amended and Restated Rights Agreement to extend the expiration date of its stockholder rights plan that may have the effect of deterring, delaying, or preventing a change in control. The Amended and Restated Rights Agreement amends the Rights Agreement previously adopted by (i) extending the expiration date by three years to December 16, 2017, (ii) decreasing the exercise price per right issued to stockholders pursuant to the stockholder rights plan from $8.50 to $5.25, and (iii) making certain other technical and conforming changes. The Amended and Restated Rights Agreement was not adopted in response to any acquisition proposal. Under the rights plan, the Company issued a dividend of one preferred share purchase right for each share of common stock held by stockholders of record as of January 6, 2012, and the Company will issue one preferred stock purchase right to each share of common stock issued between January 6, 2012 and the earlier of either the rights’ exercisability or the expiration of the Rights Agreement. Each right entitles stockholders to purchase one one-thousandth of the Company’s Series A Junior Preferred Stock.

In general, the exercisability of the rights to purchase preferred stock will be triggered if any person or group, including persons knowingly acting in concert to affect the control of the Company, is or becomes a beneficial owner of 10% or more of the outstanding shares of the Company’s common stock after the Adoption Date. Stockholders or beneficial ownership groups who owned 10% or more of the outstanding shares of common stock of the Company on or before the Adoption Date will not trigger the preferred share purchase rights unless they acquire an additional 1% or more of the outstanding shares of the Company’s common stock. Each right entitles a holder with the right upon exercise to purchase one one-thousandth of a share of preferred stock at an exercise price that is currently set at $5.25 per right, subject to purchase price adjustments as set forth in the rights agreement. Each share of preferred stock has voting rights equal to one thousand shares of common stock. In the event that exercisability of the rights is triggered, each right held by an acquiring person or group would become void. As a result, upon triggering of exercisability of the rights, there would be significant dilution in the ownership interest of the acquiring person or group, making it difficult or unattractive for the acquiring person or group to pursue an acquisition of the Company. These rights expire in December of 2017, unless earlier redeemed or exchanged by the Company.

2008 Equity Incentive Plan

In December 2008, the Company adopted the 2008 Equity Incentive Plan (the “2008 Plan”) for directors, employees, consultants and advisors to the Company or its affiliates. Under the 2008 Plan, 2,500,000 shares of common stock were reserved for issuance upon the completion of a merger with Lumera Corporation (“Lumera”) on December 9, 2008. On January 1 of each year, starting in 2009, the aggregate number of shares reserved for issuance under the 2008 Plan increase automatically by the lesser of (i) 5% of the number of shares of common stock outstanding as of the Company’s immediately preceding fiscal year, or (ii) a number of shares determined by the Board of Directors. The maximum number of shares of common stock to be granted is up to 21,000,000 shares. Forfeited options or awards generally become available for future awards. As of December 31, 2014, the stockholders had approved 16,624,634 shares for future issuance. On January 1, 2015, there was an automatic increase of 1,655,604 shares. As of March 29, 2015, 12,290,653 options to purchase common stock and restricted stock units (“RSUs”) were outstanding and 2,902,824 shares are authorized for future issuance under the 2008 equity incentive plan.

Under the 2008 Plan, the exercise price of a stock option is at least 100% of the stock’s fair market value on the date of grant, and if an incentive stock option (“ISO”) is granted to a 10% stockholder at least 110% of the stock’s fair market value on the date of grant. Vesting periods for awards are recommended by the Chief Executive Officer and generally provide for stock options to vest over a four-year period, with a one year vesting cliff of 25%, and have a maximum life of ten years from the date of grant. The Company has also issued RSUs which generally vest over a three quarters to four year period.

2007 Equity Incentive Plan

In August 2007, GigOptix LLC adopted the GigOptix LLC Equity Incentive Plan (the "2007 Plan"). The 2007 Plan provided for grants of options to purchase membership units, membership awards and restricted membership units to employees, officers and non-employee directors, and upon the completion of the merger with Lumera were converted into grants of up to 632,500 shares of stock. Vesting periods are determined by the Board of Directors and generally provide for stock options to vest over a four-year period and expire ten years from date of grant. Vesting for certain shares of restricted stock is contingent upon both service and performance criteria. The 2007 Plan was terminated upon the completion of merger with Lumera on December 9, 2008 and the remaining 864 stock in options not granted under the 2007 Plan were cancelled. No shares of the Company’s common stock remain available for issuance of new grants under the 2007 Plan other than for satisfying exercises of stock options granted under this plan prior to its termination. As of March 29, 2015, options to purchase a total of 376,436 shares of common stock and 4,125 warrants to purchase common stock were outstanding.

Lumera 2000 and 2004 Stock Option Plan

In December 2008, in connection with the merger with Lumera, the Company assumed the existing Lumera 2000 Equity Incentive Plan and the Lumera 2004 Stock Option Plan (the “Lumera Plan”). All unvested options granted under the Lumera Plan were assumed by the Company as part of the merger. All contractual terms of the assumed options remain the same, except for the converted number of shares and exercise price based on merger conversion ratio of 0.125. As of March 29, 2015, no additional options can be granted under the Lumera Plan, and options to purchase a total of 57,191 shares of common stock were outstanding.

As of March 29, 2015, the Company had a total of 658,240 warrants to purchase common stock outstanding under all warrant arrangements. During the three months ended March 29, 2015, no warrants were exercised and expired. Some of the warrants have anti-dilution provisions which adjust the number of warrants available to the holder such as, but not limited to, stock dividends, stock splits and certain reclassifications, exchanges, combinations or substitutions. These provisions are specific to each warrant agreement.

Stock-based Compensation Expense

The following table summarizes the Company’s stock-based compensation expense for the three months ended March 29, 2015 and March 30, 2014 (in thousands):

| |

|

Three Months Ended

|

|

| |

|

March 29, 2015

|

|

|

March 30, 2014

|

|

|

Cost of revenue

|

|

$

|

82

|

|

|

$

|

76

|

|

|

Research and development expense

|

|

|

247

|

|

|

|

275

|

|

|

Selling, general and administrative expense

|

|

|

560

|

|

|

|

659

|

|

| |

|

$

|

889

|

|

|

$

|

1,010

|

|

The Company did not grant any options during the three months ended March 29, 2015 and March 30, 2014.

During the three months ended March 29, 2015, the Company granted 2,815,822 RSUs with a grant-date fair value of $3.5 million or $1.25 per share. During the three months ended March 30, 2014, the Company granted 1,405,085 RSUs with a grant-date fair value of $2.4 million or $1.70 per share.

As of March 29, 2015, the total compensation cost not yet recognized in connection with unvested stock options and RSUs under the Company’s equity compensation plans was approximately $1.0 million and $5.2 million, respectively. Unrecognized compensation will be amortized on a straight-line basis over a weighted-average period of approximately 1.28 years for stock options and approximately 2.83 years for RSUs.

Stock Option and RSU Activity

The following is a summary of option activity for the Company’s equity incentive plans, including both the 2008 Plan and other prior plans for which there are outstanding options but no new grants since the 2008 Plan was adopted:

| |

|

Options

|

|

|

Weighted-

Average

Exercise Price

|

|

|

Weighted-Average

Remaining

Contractual Term,

in Years

|

|

|

Outstanding, December 31, 2014

|

|

|

8,801,160

|

|

|

$

|

2.35

|

|

|

|

5.91

|

|

|

Granted

|

|

|

-

|

|

|

|

|

|

|

|

|

|

|

Exercised

|

|

|

(28,194

|

)

|

|

$

|

0.97

|

|

|

|

|

|

|

Forfeited/Expired

|

|

|

(505,533

|

)

|

|

$

|

3.15

|

|

|

|

|

|

|

Ending balance, March 29, 2015

|

|

|

8,267,433

|

|

|

$

|

2.31

|

|

|

|

5.63

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Vested and exercisable and expected to vest, March 29, 2015

|

|

|

8,140,894

|

|

|

$

|

2.31

|

|

|

|

5.60

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Vested and exercisable, March 29, 2015

|

|

|

7,456,321

|

|

|

$

|

2.33

|

|

|

|

5.44

|

|

The aggregate intrinsic value of options vested, exercisable and expected to vest, based on the fair value of the underlying stock options as of March 29, 2015 was approximately $443,000. The aggregate intrinsic value reflects the difference between the exercise price of the underlying stock options and the Company’s closing share price of $1.19 as of March 27, 2015.

The total intrinsic value of options exercised during the three months ended March 29, 2015 was $8,000. The total intrinsic value of options exercised during the three months ended March 30, 2014 was $5,000.

RSUs are converted into shares of the Company’s common stock upon vesting on a one-for-one basis. Typically, vesting of RSUs is subject to the employee’s continuing service to the Company. RSUs generally vest over a period of one to four years and are expensed ratably on a straight line basis over their respective vesting period net of estimated forfeitures. The fair value of the RSUs granted is the product of the number of shares granted and the grant date fair value of the Company’s common stock.

The following is a summary of RSU activity for the indicated periods:

| |

|

Number of

Shares

|

|

|

Weighted-

Average Grant

Date Fair Value

|

|

|

Weighted-

Average

Remaining

Vesting Term,

Years

|

|

|

Aggregate

Intrinsic

Value

|

|

| |

|

|

|

|

|

|

|

|

|

|

(In thousands)

|

|

|

Outstanding, December 31, 2014

|

|

|

1,915,858

|

|

|

$

|

1.55

|

|

|

|

3.11

|

|

|

$

|

1,990

|

|

|

Granted

|

|

|

2,815,822

|

|

|

|

1.25

|

|

|

|

|

|

|

|

|

|

|

Released

|

|

|

(257,571

|

)

|

|

|

1.38

|

|

|

|

|

|

|

|

|

|

|

Forfeited/expired

|

|

|

(17,262

|

)

|

|

|

1.50

|

|

|

|

|

|

|

|

|

|

|

Outstanding, March 29, 2015

|

|

|

4,456,847

|

|

|

$

|

1.37

|

|

|

|

2.83

|

|

|

$

|

5,304

|

|

The majority of the RSUs that vested in the three months ended March 29, 2015 were net-share settled such that the Company withheld shares with value equivalent to the employees’ minimum statutory obligation for the applicable income and other employment taxes, and remitted the cash to the appropriate taxing authorities. The total shares withheld were based on the value of the RSUs on their vesting date as determined by the Company’s closing stock price. These net-share settlements had the effect of share repurchases by the Company as they reduced and retired the number of shares that would have otherwise been issued as a result of the vesting and did not represent an expense to the Company. For the three months ended March 29, 2015, 257,571 shares of RSUs vested with an intrinsic value of approximately $307,000. The Company withheld 79,218 shares to satisfy approximately $90,000 of employees’ minimum tax obligation on the vested RSUs.

NOTE 7— INVESTMENT IN UNCONSOLIDATED AFFILIATE

In February 2014, together with CPqD, the Company incepted a new joint venture, named BrP, of which the Company owns 49% and CPqD owns 51% of BrP. It is based in Campinas, Brazil. BrP will be a provider of advanced high-speed devices for optical communications and integrated transceiver components for information networks. It is engaged in research and development of SiPh advanced electro-optical products.

The Company transferred into BrP its knowledge-base and intellectual property of TFPSTM technology. The Company transferred to CPqD, its inventory related to the TFPSTM platform and the complete production line equipment that previously resided at its Bothell, Washington, facility for CPqD to use for the BrP joint venture. As of the transfer date, the Company’s net book value of the inventory and property and equipment was $245,000 and $211,000, respectively, which resulted in a $456,000 investment in BrP.

For the year ended December 31, 2014, the Company had a $456,000 loss on equity investment for the Company’s allocated portion of BrP’s results. Since the Company’s share of the loss exceeded the Company’s carrying cost of its investment in BrP, the Company’s investment in an unconsolidated affiliate was written down to zero as of December 31, 2014.

The Company recorded a provision for income taxes of $9,000 for the three months ended March 29, 2015, and $10,000 for the three months ended March 30, 2014. The Company's effective tax rate was approximately 1% for the three months ended March 29, 2015 and March 30, 2014.

The income tax provision for the three months ended March 29, 2015 and March 30, 2014 was due primarily to state taxes and foreign taxes due. The Company has incurred book losses in all tax jurisdictions and has a full valuation allowance against such losses.

In assessing the potential realization of deferred tax assets, management considers whether it is more likely than not that some portion or all of the deferred tax assets will be realized. In making such a determination, management considers all available positive and negative evidence, including scheduled reversals of deferred tax liabilities, projected future taxable income, tax planning strategies and recent financial performance. In order to support a conclusion that a valuation allowance is not needed, positive evidence of sufficient quantity and quality is necessary to overcome negative evidence. The ultimate realization of deferred tax assets is dependent on the generation of future taxable income during the periods in which those temporary differences become deductible. A valuation allowance has been recorded for the entire deferred tax asset as a result of uncertainties regarding realization of the asset including lack of profitability through March 29, 2015 and the uncertainty over future operating profitability and taxable income. The Company will continue to evaluate the potential realization of the deferred tax assets on a quarterly basis.

The Company files tax returns in the U.S. federal, U.S. state and foreign tax jurisdictions. The Company’s major tax jurisdictions are the U.S., California, Switzerland, Germany and Israel. The Company’s fiscal years through March 29, 2015 remain subject to examination by the tax authorities for U.S. federal, U.S. state and foreign tax purpose.

NOTE 9—NET LOSS PER SHARE

The following table summarizes total securities outstanding which were not included in the calculation of diluted net loss per share because to do so would have been anti-dilutive:

| |

|

March 29,

|

|

|

March 30,

|

|

| |

|

2015

|

|

|

2014

|

|

|

Stock options and RSUs

|

|

|

12,724,280

|

|

|

|

12,743,125

|

|

|

Common stock warrants

|

|

|

658,240

|

|

|

|

1,183,240

|

|

|

Total

|

|

|

13,382,520

|

|

|

|

13,926,365

|

|

NOTE 10—SEGMENT AND GEOGRAPHIC INFORMATION

The Company has determined that it operates as a single operating and reportable segment. The following tables reflect the results of the Company’s reportable segment consistent with the management system used by the Company’s Chief Executive Officer, the chief operating decision maker.

The following table summarizes revenue by geographic region (in thousands):

| |

|

Three Months Ended

|

|

| |

|

March 29, 2015

|

|

|

March 30, 2014

|

|

|

North America

|

|

$

|

3,031

|

|

|

33

|

%

|

|

$

|

2,227

|

|

|

30

|

%

|

|

Asia

|

|

|

2,819

|

|

|

31

|

%

|

|

|

2,158

|

|

|

29

|

%

|

|

Europe

|

|

|

2,953

|

|

|

33

|

%

|

|

|

2,909

|

|

|

40

|

%

|

|

Other

|

|

|

257

|

|

|

3

|

%

|

|

|

92

|

|

|

1

|

%

|

| |

|

$

|

9,060

|

|

|

100

|

%

|

|

$

|

7,386

|

|

|

100

|

%

|

The Company determines geographic location of its revenue based upon the destination of shipments of its products.

For the three months ended March 29, 2015, three customers accounted for 51% of total revenue. For the three months ended March 30, 2014, one customer accounted for 28% of our total revenue. No other customers accounted for more than 10% of total revenue during the periods presented.

During three months ended March 29, 2015, Italy, the United States, Hong Kong, and Taiwan accounted for 29%, 27%, 14% and 11% of revenue, respectively. During three months ended March 30, 2014, Italy, the United States, and Japan accounted for 36%, 28%, and 15% of revenue, respectively. No other countries accounted for more than 10% of the Company’s consolidated revenue during the periods presented.

The following table summarizes revenue by product line (in thousands):

| |

|

Three Months Ended

|

|

| |

|

March 29, 2015

|

|

|

March 30, 2014

|

|

|

HSC

|

|

$

|

6,201

|

|

|

68

|

%

|

|

$

|

5,282

|

|

|

72

|

%

|

|

Industrial

|

|

|

2,859

|

|

|

32

|

%

|

|

|

2,104

|

|

|

28

|

%

|

|

Total revenue

|

|

$

|

9,060

|

|

|

100

|

%

|

|

$

|

7,386

|

|

|

100

|

%

|

The following table summarizes long-lived assets by country (in thousands):

| |

|

March 29, 2015

|

|

|

December 31, 2014

|

|

|

United States

|

|

$

|

1,875

|

|

|

88

|

%

|

|

$

|

1,687

|

|

|

88

|

%

|

|

Switzerland

|

|

|

259

|

|

|

12

|

%

|

|

|

229

|

|

|

12

|

%

|

| |

|

$

|

2,134

|

|

|

100

|

%

|

|

$

|

1,916

|

|

|

100

|

%

|

Long-lived assets, comprised of property and equipment, are reported based on the location of the assets at each balance sheet date.

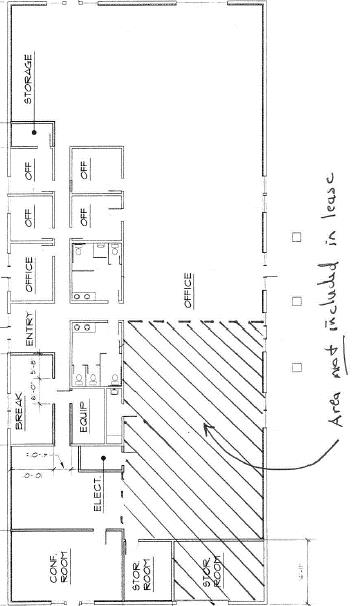

NOTE 11—COMMITMENTS AND CONTINGENCIES

The Company leases its domestic and foreign sales offices under non-cancelable operating leases. These leases contain various expiration dates and renewal options. The Company also leases certain software licenses under operating leases. Total facilities rent expense for the three months ended March 29, 2015 was $111,000, and for the three months ended March 30, 2014 was $141,000.

As of April 2014, the Company moved out of its Bothell, Washington facility which comprised 11,666 square feet and entered into a new one-year lease located in Bellevue, Washington which comprises approximately 2,100 square feet.

Aggregate non-cancelable future minimum rental payments under capital and operating leases are as follows (in thousands):

| |

|

Capital Leases

|

|

|

Operating Leases

|

|

|

Years ending December 31,

|

|

Minimum

lease payments

|

|

|

Minimum lease

payments

|

|

|

2015

|

|

$

|

3

|

|

|

$

|

383

|

|

|

2016

|

|

|

3

|

|

|

|

496

|

|

|

2017

|

|

|

3

|

|

|

|

124

|

|

|

Total minimum lease payments

|

|

|

9

|

|

|

$

|

1,003

|

|

|

Less: Amount representing interest

|

|

|

(1

|

)

|

|

|

|

|

|

Total capital lease obligations

|

|

|

8

|

|

|

|

|

|

|

Less: current portion

|

|

|

(3

|

)

|

|

|

|

|

|

Long-term portion of capital lease obligations

|

|

$

|

5

|

|

|

|

|

|

From time to time, the Company may become involved in legal proceedings, claims and litigation arising in the ordinary course of business. When the Company believes a loss is probable and can be reasonably estimated, the Company accrues the estimated loss in the consolidated financial statements. Where the outcome of these matters is not determinable, the Company does not make a provision in the financial statements until the loss, if any, is probable and can be reasonably estimated or the outcome becomes known. There are no known losses at this time.

| ITEM 2. |

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |