Exhibit 99.1

1 | |

1 | |

CAUTIONARY NOTE TO U.S. INVESTORS REGARDING PREPARATION OF FINANCIAL INFORMATION | 2 |

2 | |

2 | |

3 | |

4 | |

4 | |

5 | |

6 | |

6 | |

7 | |

10 | |

11 | |

13 | |

13 | |

13 | |

13 | |

13 | |

14 | |

14 | |

14 | |

15 | |

15 | |

15 | |

15 | |

15 | |

32 | |

34 | |

34 | |

34 | |

35 | |

35 | |

35 | |

36 | |

37 | |

37 | |

Prior Sales – Securities Not Listed or Quoted on a Marketplace | 38 |

39 | |

39 | |

42 | |

43 | |

| |

| |

| |

43 | |

44 | |

44 | |

44 | |

45 | |

45 | |

45 | |

46 | |

47 | |

48 | |

48 | |

48 | |

49 | |

49 | |

50 | |

50 | |

51 | |

A-1 | |

SCHEDULE "B" OSISKO DEVELOPMENT CORP. AUDIT AND RISK COMMITTEE CHARTER | B-1 |

C-1 | |

D-1 |

| (i) |

|

Unless otherwise indicated, the information contained in this AIF is given as of December 31, 2023, with specific updates post-financial year end where specifically indicated. More current information may be available on the Corporation’s website at www.osiskodev.com, on SEDAR+ at www.sedarplus.ca or on EDGAR at www.sec.gov.

All capitalized terms used in this AIF and not defined herein have the meaning ascribed to such terms in the Schedule A - “Glossary of Terms” or elsewhere in this AIF.

Unless otherwise noted or the context otherwise indicates, the term “Corporation” or “ODV” refers to the Corporation and its subsidiaries.

For reporting purposes, the Corporation presents its financial statements in Canadian dollars and in conformity with IFRS issued by the International Accounting Standards Board.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING INFORMATION

Except for the statements of historical fact contained herein, the information presented in this AIF constitutes Forward-Looking Information within the meaning of applicable Canadian Securities Laws concerning the business, operations, plans and financial performance and condition of the Corporation. Often, but not always, Forward-Looking Information can be identified by words such as “plans”, “expects”, “may”, “should”, “could”, “will”, “budget”, “scheduled”, “estimates”, “forecasts”, “intends”, “anticipates”, “believes”, or variations including negative variations thereof, of such words and phrases that refer to certain actions, events or results that may, could, would, might or will occur or be taken or achieved.

Forward-Looking Information involves known and unknown risks, uncertainties and other factors which may cause the actual plans, results, performance or achievements of the Corporation to differ materially from any future plans, results, performance or achievements expressed or implied by the Forward-Looking Information. Such factors include, among others: the risks relating to mineral exploration, development and operations; industry conditions; uncertainty of mineral resource and mineral estimates; negative operating cash flows; financing risks and additional financing; the ability of the Corporation to meet its financial obligations as they become due; actual operating cash flows, operating costs, free cash flows, total cash, transaction costs, and administrative costs of the Corporation differing materially from those anticipated; failure to obtain licenses, approvals or permitting in a timely manner (or at all); risks relating to project infrastructure requirements and anticipated processing methods, exploration expenditures differing materially from those anticipated; changes in project parameters; the possibility of project cost overruns or unanticipated costs and expenses; accidents, labour disputes, community and stakeholder protests and other risks of the mining industry risks relating to foreign operations and enforcement of judgements; risks related to partnership or other joint operations; actual results of current exploration activities; variations in mineral resources, mineral production, grades or recovery rates or optimization efforts; uninsured risks, including, but not limited to, pollution, cave-ins or hazards for which insurance cannot be obtained; regulatory changes, defects in title; availability or integration of personnel, materials and equipment; inability to recruit or retain management and key personnel; adequacy and access to required infrastructure, equipment and supplies; unanticipated environmental impacts on operations; market prices; operating risks associated with the operations or an expansion of the operations; cybersecurity threats and technological risks; foreign operations risk; impact of any litigation; risks relating to significant shareholder control; dilution due to future equity financings; fluctuations in precious or base metal prices and currency exchange rates; uncertainty relating to future production and cash resources; anticipated timing of events, developments and milestones at the Corporation's properties; inflation; adverse changes to market, political and general economic conditions or laws, rules and regulations applicable to the Corporation; risks relating to climate change; outbreak of diseases and public health crises; risk of an undiscovered defect in title or other adverse claim; factors discussed under the heading "Risk Factors"; and other risks, including those risks set out in the continuous disclosure documents of the Corporation, which are available on SEDAR+ (www.sedarplus.ca) and on EDGAR (www.sec.gov) under the Corporation's issuer profiles.

Page 1 |

|

In addition, Forward-Looking Information herein is based on certain assumptions and involves risks related to the business of the Corporation. Forward-Looking Information contained herein is based on certain assumptions, including, but are not limited to, interest and exchange rates; the price of gold, silver and other metals; competitive conditions in the mining industry; title to mineral properties; financing and funding requirements; general economic, political and market conditions; and changes in laws, rules and regulations applicable to the Corporation.

Although the Corporation has attempted to identify important factors that could cause plans, actions, events or results to differ materially from those described in Forward-Looking Information in this AIF, there may be other factors that cause plans, actions, events or results not to be as anticipated, estimated or intended. There is no assurance that such statements will prove to be accurate as actual plans, results and future events could differ materially from those anticipated in such statements or information. Accordingly, readers should not place undue reliance on Forward-Looking Information in this AIF. All of the Forward-Looking Information in this AIF is qualified by these cautionary statements.

Certain Forward-Looking Information and other information contained herein concerning the mining industry and the expectations of the Corporation concerning the mining industry and the Corporation are based on estimates prepared by the Corporation using data from publicly available industry sources as well as from market research and industry analysis and on assumptions based on data and knowledge of this industry which the Corporation believes to be reasonable. However, although generally indicative of relative market positions, market shares and performance characteristics, this data is inherently imprecise. While the Corporation is not aware of any misstatement regarding any industry data presented herein, the mining industry involves risks and uncertainties that are subject to change based on various factors.

Readers are cautioned not to place undue reliance on Forward-Looking Information. The Corporation does not undertake any obligation to update any of the Forward-Looking Information in this AIF, except as required by law.

CAUTIONARY NOTE TO U.S. INVESTORS REGARDING

PREPARATION OF FINANCIAL INFORMATION

As a Canadian company, the Corporation prepares its financial statements in accordance with IFRS. Consequently, all of the financial information of the Corporation is derived from financial statements of the Corporation that are prepared in accordance with IFRS, which are materially different than financial statements prepared in accordance with U.S. generally accepted accounting principles.

CAUTIONARY NOTE TO U.S. INVESTORS REGARDING

THE USE OF MINERAL RESERVE AND MINERAL RESOURCE ESTIMATES

The Corporation is subject to the reporting requirements of the applicable Canadian Securities Laws and, as such, reports information regarding mineral properties, mineralization and estimates of mineral reserves and mineral resources in accordance with Canadian reporting requirements, which are governed by NI 43-101. As such, the information contained in this AIF concerning mineral properties, mineralization and estimates of mineral reserves and mineral resources is not comparable to similar information made public by U.S. companies subject to the reporting and disclosure requirements of the SEC.

Unless otherwise indicated herein, references to “$”, “C$” or “Canadian dollars” refer to Canadian dollars, and references to “US$” or “U.S. dollars” refer to United States dollars. See “Cautionary Statement Regarding Forward-Looking Information”.

Page 2 |

|

The following table sets forth the high and low exchange rates for one U.S. dollar expressed in Canadian dollars for each period indicated, the average of the exchange rates for each period indicated and the exchange rate at the end of each such period, based upon the exchange rates provided by the Bank of Canada:

| | Year Ended December 31 | ||||

| | 2023 | | 2022 | | 2021 |

| | (C$) | | (C$) | | (C$) |

High |

| 1.3875 |

| 1.3856 |

| 1.2942 |

Low |

| 1.3128 |

| 1.2451 |

| 1.2040 |

Average rate for period |

| 1.3497 |

| 1.3013 |

| 1.2535 |

Rate at end of period |

| 1.3226 |

| 1.3544 |

| 1.2678 |

On March 28, 2024, the daily exchange rate as reported by the Bank of Canada for US$1.00 expressed in Canadian dollars, was C$1.3550.

The average fixing gold and silver prices in U.S. dollars per troy ounce for each of the two years in the period ended December 31, 2023, as quoted by the London Bullion Market Association, were as follows:

| | 2023 | | 2022 |

| | (US$) | | (US$) |

Gold (LBMA pm US$/oz) |

| 1,940.54 |

| 1,800.09 |

Silver (LBMA US$/oz) |

| 23.35 |

| 21.74 |

Page 3 |

|

Name, Address and Incorporation

The Corporation was incorporated on June 13, 2006 under the Business Corporations Act (British Columbia). On November 3, 2011, the Corporation changed its name from “Ringbolt Ventures Ltd.” to “North American Potash Developments Inc.”. On September 20, 2018, the Corporation changed its name from “North American Potash Developments Inc.” to “Barolo Ventures Corp.”

On November 23, 2020, in connection with the spinout transaction by Osisko Gold Royalties and the transfer of certain mining properties and marketable securities by Osisko Gold Royalties (the "Contributed Osisko Assets"), which resulted in a reverse takeover of the Corporation (formerly Barolo Ventures Corp.) by Osisko Gold Royalties (the "RTO"), the Corporation filed articles of amendment to consolidate the common shares on the basis of one post-consolidation common shares for each 60 pre-consolidated common shares and filed articles of amendment to change the name of the Corporation from "Barolo Ventures Corp." to "Osisko Development Corp." On November 25, 2020, the Corporation announced the completion of the RTO.

Subsequent to the RTO, the Corporation continued from under the laws of Province of British Columbia under the Business Corporations Act (British Columbia) to the laws of Canada under the Canada Business Corporations Act under the name "Osisko Development Corp./Osisko Développement Corp." On December 2, 2020, the Common Shares resumed trading with the completion of the RTO under the symbol "ODV" on the TSX-V. On May 27, 2022, the Common Shares commenced trading on the NYSE.

On May 3, 2022, the Corporation amended its articles to give effect to a consolidation of all of its issued and outstanding common shares on the basis of one post-consolidated common share for every three pre-consolidated common shares (the "Consolidation"). The Common Shares commenced trading on a post-Consolidation basis at the open of markets on May 4, 2022. Unless specifically noted otherwise, the references to the Corporation's Common Shares are to post-Consolidation common shares of the Corporation.

As of the date of this AIF, the Corporation is a reporting issuer in all provinces of Canada and is subject to the reporting requirements of the U.S. Securities Exchange Act of 1934, as amended (the “U.S. Exchange Act”).

The Corporation’s head and registered office is located at 1100 avenue des Canadiens-de-Montréal, Suite 300, Montreal, Québec H3B 2S2.

Page 4 |

|

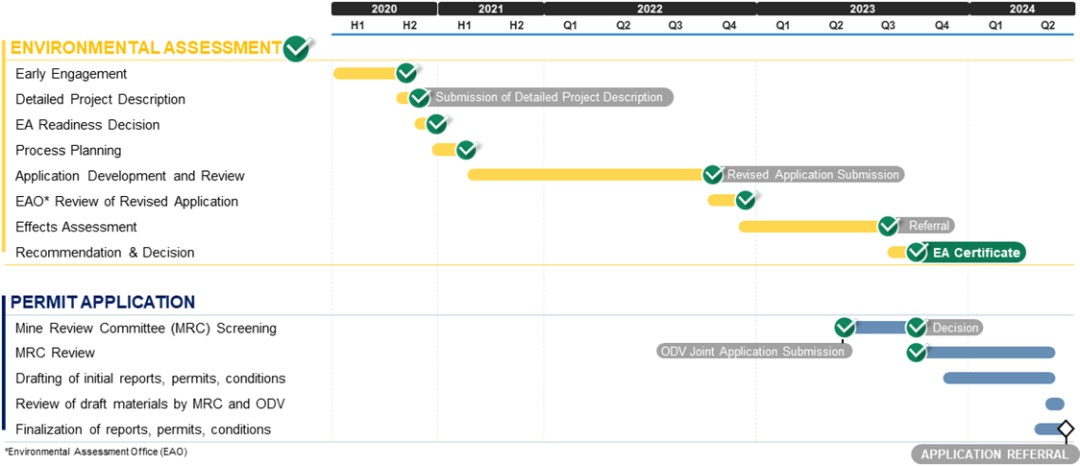

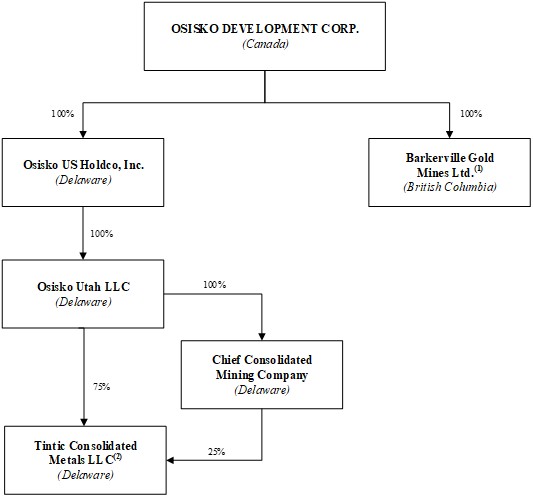

The following chart sets out the legal entity structure of the Corporation for its material subsidiaries, together with the jurisdiction as at December 31, 2023.

Notes:

(1) | Barkerville holds the Cariboo Gold Project. |

(2) | TCM holds the Tintic Project. |

Page 5 |

|

GENERAL DEVELOPMENT OF BUSINESS

The following is a summary of the Corporation's development over the three most recently completed financial years.

Fiscal Year ended December 31, 2021

All numbers relating to the number of security or price per security in this section is provided on a pre-Consolidation basis, unless indicated otherwise.

$80 Million Non-Brokered Private Placement

On January 8, 2021, the Corporation closed the first tranche of a non-brokered private placement of 9,346,464 units at a price of $7.50 per unit for aggregate gross proceeds of approximately $68.6 million. Each unit consisted of one pre-Consolidation Common Share and one-half-of-one (½) Warrant. A Warrant holder will be required to exercise three whole Warrants in order to purchase one whole post-Consolidation Common Share for a total price of $30.00 on or prior to December 1, 2023. The second tranche of this non-brokered private placement closed on February 5, 2021 for aggregate gross proceeds of approximately $11.2 million. Together with this second tranche, the Corporation raised an aggregate of approximately $80 million.

Director Nomination and Officer Appointments

On February 26, 2021, Mr. Alexander Dann was appointed Chief Financial Officer & VP Finance and Mr. André Le Bel was appointed Corporate Secretary following the resignation of Mr. Benoit Brunet. On May 26, 2021, Ms. Marina Katusa was nominated to the Board. On August 16, 2021, Mr. Martin Ménard was appointed as Vice-President, Engineering and Construction.

$33.6 Million Bought Deal Private Placement

On March 18, 2021, the Corporation announced the completion of a bought deal brokered private placement of an aggregate of: (i) 2,055,742 flow-through pre-Consolidation Common Shares of the Corporation at a pre-Consolidation price of $9.05 per Common Share; and (ii) 1,334,500 charity flow-through pre-Consolidation Common Shares of the Corporation at a pre-Consolidation price of $11.24 per Common Share, for aggregate gross proceeds of approximately $33.6 million.

Listing of Warrants

On October 25, 2021, 14,789,258 Warrants were listed for trading on the TSX-V under the symbol “ODV.WT”. Each Warrant entitles the holder thereof to acquire one Common Share at a price of $10.00 per Common Share. A Warrant holder will be required to exercise three whole Warrants in order to purchase one whole post-Consolidation Common Share for a total price of $30.00 at any time on or prior to December 1, 2023. The Warrants expired on December 1, 2023 and delisted from the TSX-V.

Employee Share Purchase Plan

On December 21, 2021, the Corporation announced that the Board had approved amendments to the Corporation’s ESP Plan in order to accelerate the vesting provisions of the shares granted thereunder, subject to a holding period, and to clarify existing provisions of the ESP Plan, without altering the scope, nature and intent of such provisions.

Bonanza Ledge II Project Updates

In March 2021, processing of mineralized material commenced at the Bonanza Ledge II Project, generating $7.7 million in revenues for the year ended December 31, 2021. The Corporation recognized an impairment on its Bonanza Ledge II Project of $58.4 million during the year ended December 31, 2021, triggered by continuing operational challenges leading to lower production and revenues than originally planned.

Page 6 |

|

On October 27, 2021, the Province of British Columbia, Lhtako Dené First Nation and the Corporation announced the approval of amendments to Mines Act Permits M-238 and M-198 allowing for the expansion of the existing Bonanza Ledge II Project underground mine. These amendments supported the ongoing employment of 127 workers at the mine.

In December 2021, the Corporation incurred an impairment charge of $42 million ($34.6 million, net of income taxes) on certain exploration and evaluation properties, including the James Bay properties and the Coulon zinc project in Canada. The Corporation has determined that further exploration and evaluation expenditures are no longer planned in the near term on these properties and that the carrying amount of these assets is unlikely to be recovered from a sale of the project as at the time. As a result, these properties were written down to zero on December 31, 2021. See note 13 of the audited annual financial statements of the Corporation for the year ended December 31, 2021.

Fiscal Year ended December 31, 2022

Acquisition of Tintic Consolidated Metals LLC

On January 25, 2022, the Corporation announced that it had entered into definitive agreements (together, the "Tintic Agreements") with IG Tintic LLC and Ruby Hollow LLC to acquire 100% of TCM, which acquisition was completed on May 30, 2022 (the "Tintic Acquisition"). Concurrently with the announcement of the Tintic Acquisition, the Corporation announced that, through a wholly-owned subsidiary, it had entered into a non-binding metals stream term sheet with a wholly-owned subsidiary of Osisko Gold Royalties, which proceeds from the stream would be used to fund a portion of the cash consideration payable on closing of the Tintic Acquisition. Pursuant to the Tintic Acquisition, the Corporation acquired 100% ownership of the producing Trixie test mine, as well as mineral claims covering more than 17,000 acres (including over 14,200 acres of which are patented) in Central Utah's historic Tintic Mining District (collectively, the "Tintic Project"). Pursuant to the terms of the Tintic Agreements, the Corporation acquired 100% of TCM from IG Tintic LLC and Ruby Hollow LLC. The Corporation funded the Tintic Acquisition through the issuance of (i) 12,049,449 Common Shares, (ii) aggregate cash payments of approximately US$54 million, (iii) the issuance of an aggregate of 2% NSR royalties, with a 50% buyback right in favour of the Corporation exercisable within five years, (iv) US$12.5 million in deferred payments, and (v) the granting of certain other contingent payments, rights and obligations. On May 30, 2022, the Corporation also announced that it had entered into a binding term sheet with Osisko Bermuda Limited ("OBL"), a wholly-owned subsidiary of Osisko Gold Royalties, for a stream on the metals produced from the Tintic Project ("Tintic Stream") for a total cash consideration of US$20 million. The Tintic Stream was closed on September 26, 2022, pursuant to which the Corporation agreed to deliver to OBL 2.5% of all metals produced from the Tintic Project at a purchase price of 25% of the relevant spot metal price. Once 27,150 ounces of refined gold have been delivered, the Tintic Stream rate will decrease to 2.0% on all metals produced.

On July 6, 2023, the Corporation satisfied the first of five deferred payments of US$2,500,000, of which the consideration consisted of US$250,000in cash and US$2,250,000 in Common Shares.

Page 7 |

|

Brokered and Non-Brokered Private Placement

On February 2, 2022, the Corporation announced a non-brokered private placement of initially up to 2,857,142 subscription receipts of the Corporation (the "Non-Brokered Subscription Receipts") at a price of US$3.50 per Non-Brokered Subscription Receipt (the "Non-Brokered Offering"). Each Non-Brokered Subscription Receipt entitled the holder thereof to receive, upon the satisfaction of the Non-Brokered Escrow Release Condition and without payment of additional consideration, one unit of the Corporation (each, a "Non-Brokered Unit"). Each Non-Brokered Unit was comprised of one pre-Consolidation Common Share and one Warrant (a "Non-Brokered Warrant"). A Non-Brokered Warrant holder is required to exercise three whole Non-Brokered Warrants in order to purchase one whole post-Consolidation Common Share for a total price of US$18.00 for a period of five years following the date of issue. On February 7, 2022, the Corporation announced an up-size of the Non-Brokered Offering to 31,500,000 Non-Brokered Subscription Receipts at the same price, for aggregate gross proceeds of US$110.3 million. On March 4, 2022, the Corporation announced the closing of the first tranche of the Non-Brokered Offering, pursuant to which a total of 24,215,099 Non-Brokered Subscription Receipts were issued for gross proceeds of approximately US$84.8 million. On March 29, 2022, the Corporation announced the closing of the second tranche of the Non-Brokered Offering, pursuant to which a total of 9,365,689 Non-Brokered Subscription Receipts were issued for gross proceeds of approximately US$32.8 million. On April 21, 2022, the Corporation announced the closing of the final tranche of the Non-Brokered Offering pursuant to which a total of 512,980 Non-Brokered Subscription Receipts were issued for gross proceeds of approximately US$1.795 million. The total amount of gross proceeds from the three tranches of Non-Brokered Subscription Receipts was approximately US$119.4 million. The gross proceeds of the Non-Brokered Offering were held in escrow pending, among other things, the completion of the listing of the Common Shares on the NYSE (the "Non-Brokered Escrow Release Condition"), which was contingent upon the Corporation meeting the listing requirements of the NYSE and involved, among other things, a consolidation of the Common Shares. The Consolidation was effective May 4, 2022 and the Common Shares began trading on the NYSE on May 27, 2022.

On February 9, 2022, the Corporation announced a bought deal brokered private placement of initially an aggregate 9,000,000 subscription receipts of the Corporation (the "Brokered Subscription Receipts") and/or units of the Corporation (the "Brokered Units" and, together with the Brokered Subscription Receipts, the "Brokered Offered Securities") at a price of $4.45 per Brokered Offered Security (the "Brokered Offering"). Later on February 9, 2022, the Corporation announced an up-size of the Brokered Offering to an aggregate of 20,225,000 Brokered Offered Securities at the same price, for aggregate gross proceeds of $90,001,250. Each Brokered Unit was comprised of one pre-Consolidation Common Share and one Warrant (a "Brokered Warrant"). A Brokered Warrant holder will be required to exercise three whole Brokered Warrants in order to purchase one whole post-Consolidation Common Share for a total price of $22.80 for a period of 60 months following the closing date of the Brokered Offering. Each Brokered Subscription Receipt entitled the holder thereof to receive, upon the satisfaction of the Brokered Escrow Release Condition, and without payment of additional consideration, one Brokered Unit. the Corporation granted the underwriters under the Brokered Offering an option, exercisable in whole or in part up to 48 hours prior to the closing of the Brokered Offering, to purchase up to an additional aggregate amount of 3,033,750 Brokered Subscription Receipts and/or Brokered Units for additional gross proceeds of up to $13,500,187.50. On March 2, 2022, the Corporation announced the completion of the Brokered Offering of an aggregate of (i) 13,732,900 Brokered Subscription Receipts and (ii) 9,525,850 Brokered Units for aggregate gross proceeds of approximately $103.5 million, including the full exercise of the underwriters' option. The gross proceeds from the sale of the Brokered Subscription Receipts, net of expenses of the underwriters and 50% of the commissions payable to the underwriters in respect of the Brokered Subscription Receipts, were placed into escrow and released immediately prior to the completion of the acquisition by the Corporation of TCM (the "Brokered Escrow Release Condition"). On May 30, 2022, the Brokered Escrow Release Condition was met, and the gross proceeds of the Brokered Offering and accrued interest thereon, net of the commission (including accrued interest thereon) and expenses payable to the underwriters of the Brokered Offering, were released to the Corporation and the Brokered Subscription Receipts were converted into the underlying securities.

Share Consolidation

On May 4, 2022 the Corporation announced that, pursuant to a special resolution adopted by Shareholders on April 26, 2022, and to the consolidation ratio subsequently approved by the Board, the consolidation of all of its issued and outstanding common shares on the basis of one post-Consolidation Common Share for every three pre-Consolidation Common Shares was taking effect as of the same day.

Page 8 |

|

The exercise price and number of Common Shares of the Corporation issuable upon the exercise of outstanding stock options, warrants or other convertible securities was proportionately adjusted to reflect the Consolidation in accordance with the terms of the securities.

NYSE Listing

On May 23, 2022, the Corporation announced that it had been approved to list its Common Shares on the NYSE. The Common Shares commenced trading on the NYSE on May 27, 2022 under the trading ticker symbol “ODV”. Listing of the Common Shares on the NYSE satisfied the Non-Brokered Escrow Release Condition, causing the release of US$119.4 million in cash proceeds to the Corporation, and the conversion of the Non-Brokered Subscription Receipts into the underlying securities.

Preliminary Economic Assessment and Permitting for Cariboo Gold Project

On May 24, 2022, the Corporation announced the results from its preliminary economic assessment ("PEA") completed by BBA Engineering Ltd., consultants for the Cariboo Gold Project. The PEA was filed on SEDAR as a technical report and was prepared in accordance with NI 43-101. The PEA recommended that the Corporation continue to work towards a feasibility study.

Tintic Project Technical Report

On June 10, 2022, the Corporation announced that it had filed the technical report titled “Technical Report on the Tintic Project, East Tintic Mining District, Utah County, Utah, USA” dated June 10, 2022, with an effective date of June 7, 2022.

San Antonio Mineral Resource Estimate and Technical Report

On June 30, 2022, the Corporation announced an initial open pit mineral resource estimate for the San Antonio Project and on July 22, 2022, the Corporation announced that it had filed the technical report titled "NI 43-101 Technical Report for the 2022 Mineral Resource Estimate on the San Antonio Project Sonora, Mexico" dated July 12, 2022, with an effective date of June 24, 2022.

Officer Appointment

On July 1, 2022, Laurence Farmer was appointed as General Counsel, Vice President Strategic Development and Corporate Secretary of the Corporation.

Williams Lake First National Participation Agreement

On July 5, 2022, the Corporation announced the entering into of a participation agreement with Williams Lake First Nation relating to the development of the Cariboo Gold Project.

Inaugural Sustainability Report

On August 16, 2022, the Corporation published its inaugural sustainability report for 2020 and 2021, which describes management’s approach to, and performance in, a variety of environmental, social and governance considerations.

Impairment on San Antonio Project

On September 30, 2022, the Corporation recorded an $81 million non-cash impairment charge on the San Antonio Project to reduce its book value to its net estimated recoverable amount of $35.0 million ($nil net of stream financing).

Director Nomination

On December 14, 2022, Mr. David Danziger was appointed as an independent non-executive director of the Board.

Page 9 |

|

Impairment on Cariboo Gold Project

On December 31, 2022, the Corporation recorded an impairment of $59 million on the Cariboo Gold Project to adjust the book value to its realizable value.

Feasibility Study and Technical Report for Cariboo Gold Project

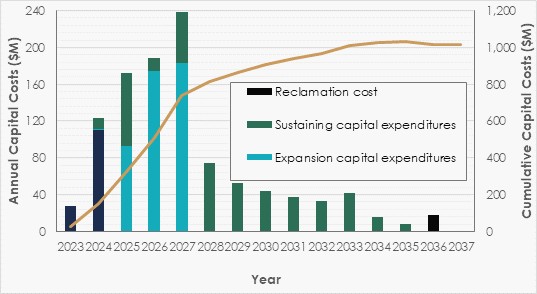

On January 3, 2023, the Corporation announced the results of an independent feasibility study on the Cariboo Gold Project which have been prepared in accordance with NI 43-101. On January 11, 2023, the Corporation announced that it had filed the Cariboo Technical Report. For a summary of the Cariboo Technical Report, see Schedule "C" – “Technical Information – Cariboo Gold Project".

Tintic Project Initial Mineral Resource Estimate and Technical Report

On January 17, 2023, the Corporation announced an initial mineral resource estimate for the Tintic Project. On January 31, 2023, the Corporation announced that it had filed the Tintic Technical Report. For a summary of the Tintic Technical Report, see Schedule “D” – “Technical Information – Tintic Project”.

Share Issuance Pursuant to Participation Agreement with Williams Lake First Nation

On February 24, 2023, the Corporation announced that it had issued 10,000 Common Shares in accordance with the terms of a participation agreement dated June 10, 2022 with the Williams Lake First Nation relating to the Cariboo Gold Project.

$51.8 Million Bought Deal Public Offering

On March 2, 2023, the Corporation announced the completion of a bought deal public offering of an aggregate of 7,841,850 units of the Corporation at a price of $6.60 per unit, for aggregate gross proceeds of approximately $51.8 million, including the full exercise of the over-allotment option (the “Bought Deal Offering”). Each unit was comprised of one Common Share and one Warrant (a “Bought Deal Warrant”), with each Bought Deal Warrant entitling the holder thereof to purchase one additional Common Share at a price of $8.55 per Common Share for a period of 36 months following the closing date of the Bought Deal Offering, subject to adjustments.

Warrant Repricing

On March 14, 2023, the Corporation announced that, subject to the final approval of the TSX-V, it intended to amend the exercise prices of the Brokered Warrants and Non-Brokered Warrants such that (i) the exercise price of the Brokered Warrants is reduced from $22.80 per Common Share to $14.75 per Common Share and (ii) the exercise price of the Non-Brokered Warrants is reduced from US$18.00 per Common Share to US$10.70 per Common Share (the “Warrant Repricing”). The Warrant Repricing was completed on March 17, 2023.

Warrant Listings

Effective on May 8, 2023, the Non-Brokered Warrants and the Brokered Warrants were listed and posted for trading on the TSX-V under the trading symbols "ODV.WT.U" and "ODV.WT.A" respectively. Effective on May 19, 2023, the Bought Deal Warrants were listed and posted on trading on the TSX-V under the trading symbol "ODV.WT.B". Subsequently, on November 10, 2023, the Non-Brokered Warrants were also listed and posted for trading on Nasdaq under the trading symbol "ODVWZ".

Permitting Agreements for Cariboo Gold Project

On May 8, 2023, the Corporation announced that it has entered into two landmark permitting agreements in respect of the Cariboo Gold Project: (i) the process charter with the BC Major Mines Office; and (ii) the joint information requirements table with the Ministry of Energy, the Mines and Low-Carbon Innovation and the Ministry of Environment.

Page 10 |

|

Environmental Assessment Certificate for Cariboo Gold Project

On October 10, 2023, the Corporation announced that it has received an environmental assessment certificate for the Cariboo Gold Project.

Asset Spin-Out and Formation of Electric Elements Mining Corp.

On November 15, 2023, the Corporation announced the spin out of all its shares and partnership units in certain subsidiaries holding the rights and title and interest in its James Bay properties and the formation, jointly with O3 Mining Inc., of "Electric Elements Mining Corp."

Management Updates

On December 28, 2023, the Corporation announced that Mr. Luc Lessard would resign from his position as Chief Operating Officer effective as of December 31, 2023 and Mr. Chris Pharness, Vice-President, Sustainable Development has departed from his position. Effective as of December 31, 2023, Mr. Eric Tremblay, who is a director of the Corporation and chair of the environmental and sustainability committee, assumed the role of interim Chief Operating Officer.

Events Subsequent to December 31, 2023 Fiscal Year End

Management Updates

On February 2, 2024, the Corporation announced that Mr. Francois Vézina resigned from his position as Senior Vice President, Project Development, Technical Services and Environment effective as of March 1, 2024.

Impairment Analysis

On February 21, 2024, the Corporation announced that based on a preliminary review, a non-cash impairment exists to the carrying value of the Trixie mine. For more details relating to the final impairment analysis, see note 10 of the Corporation's annual financial statements for the year ended December 31, 2023.

US$50 Million Credit Facility

On March 4, 2024, the Corporation announced that the Corporation, as guarantor, and Barkerville, its wholly-owned subsidiary, as borrower, entered into a credit agreement dated March 1, 2024 (the "Credit Agreement") with National Bank of Canada, as lender and administrative agent, and National Bank Financial Markets, as mandated lead arranger and sole bookrunner, in connection with a US$50 million delayed draw term loan (the "Credit Facility"). The Credit Facility will be used to fund ongoing detailed engineering and pre-construction activities at the Cariboo Gold Project.

The key terms of the Credit Facility include:

| ● | Credit Limit: US$50 million. |

| ● | Term & Maturity Date: 12 months from the closing date, being March 1, 2025, which may be extended to August 1, 2025, upon written request by Barkerville to National Bank of Canada at any time between December 1, 2024, and February 1, 2025 (the "Maturity Date"). |

| ● | Repayment: The full outstanding credit under the Credit Facility, and all accrued and unpaid interest thereon, shall be repaid on the Maturity Date. |

| ● | Interest rate: The draws under the Credit Facility can be by way of a base rate loan or a term benchmark loan, on which differing interest rate will apply. Interest will be payable on the outstanding principal amount at a rate per annum equal to the following, provided that each such rate shall be increased by 0.50% per annum each 90 days following March 1, 2024: |

Page 11 |

|

| o | For a Base Rate Loan: the greater of (i) the federal funds effective rate plus 0.50% and (ii) the National Bank variable rate of interest for United States dollar loans in Canada, plus (iii) 4.00% per annum. |

| o | For a Term Benchmark Loan: (i) the Secured Overnight Financing Rate; plus (ii) an additional 0.10% / 0.15% / 0.25% per annum for one / three / six month draws, respectively, plus (iii) 5.00% per annum. |

| ● | Voluntary Prepayments: Subject to the terms and conditions of the Credit Agreement, Barkerville may prepay the outstanding loans under the Credit Facility at any time, subject to a minimum prepayment amount of US$1 million. |

| ● | Mandatory Prepayments: Mandatory prepayments are required in certain events, including in the case of asset dispositions, debt incurrence and equity raises, for which 100% of the net cash proceeds must be prepaid and a change of control, for which all of the obligations under the Credit Facility must be prepaid. |

| ● | Security: The obligations under Credit Facility are secured against all of the present and future assets and property of Barkerville and the shares of Barkerville as held by the Corporation. |

| ● | Representations, Warranties and Covenants: The Credit Agreement contains terms and conditions with respect to the Credit Facility customary for a transaction of this nature, including representations, warranties, borrower covenants, permitted liens and indebtedness, assignment rights and events of default. Specifically, the Corporation covenants to maintain its tangible net worth (being shareholders' equity less goodwill and intangible assets) to be at least C$500 million as calculated as at the last day of each fiscal quarter and the Corporation and Barkerville, on a consolidated basis, shall maintain liquidity (being all unrestricted cash plus available credit under the Credit Facility) of at least C$25 million as of the last day of each fiscal quarter. |

| ● | Fees: In connection with the Credit Facility and National Bank's services, the Company agreed to pay the following fees to National Bank: (a) an upfront fee of 2.00% per annum on the principal amount, which has been paid in full; (b) a ticking fee equal to 1.00% of the committed principal amount of the Credit Facility, calculated on annualized basis, accruing daily commencing 30 days from the December 20, 2023 until January 31, 2024, which amount has been paid in full by the Company; and (c) duration fees of: (i) 0.75% of the committed principal amount, payable as of May 30, 2024 if the Credit Facility remains outstanding on such date; (ii) 1.00% of committed principal amount, payable as of August 28, 2024 if the Credit Facility remains outstanding on such date; and (iii) 1.25% of committed amount, payable as of November 26, 2024 if the Credit Facility remains outstanding on such date. |

The summary of the key terms of the Credit Facility above is qualified in its entirety by the full text of the Credit Agreement, a copy of which will be available on SEDAR+ (www.sedarplus.ca) under the Corporation's issuer profile.

Updated Mineral Resource Estimate for the Tintic Project

On March 15, 2024, the Corporation announced an updated mineral resource estimate for the Tintic Project (the “2024 Trixie MRE”). The Corporation intends to file an updated technical report in respect of the 2024 Trixie MRE within 34 days from the date of the news release. As of the date hereof, the Tintic Technical Report remains to be the current technical report of the Corporation within the meaning of NI 43-101 until such time as a technical report in respect of the 2024 Trixie MRE is filed. Once a technical report in respect of the 2024 Trixie MRE is filed on SEDAR+ (www.sedarplus.ca) under the Corporation's issuer profile, it will automatically supersede the Tintic Technical Report.

For more details relating to the 2024 Trixie MRE, please refer to the news release of the Corporation dated March 15, 2024, a copy of which will be available on SEDAR+ (www.sedarplus.ca) under the Corporation's issuer profile.

Page 12 |

|

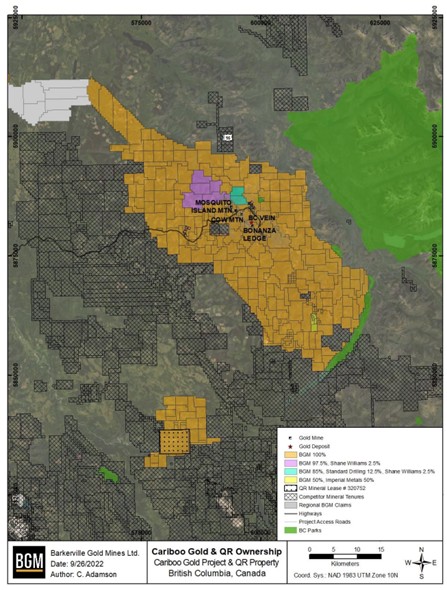

The Corporation is a North American gold development company focused on high-quality past-producing properties located in mining friendly jurisdictions with district scale potential. The Corporation's objective is to become a North American intermediate producer of precious metals, through curating and advancing a portfolio of development projects and investments with potential for value creation. Its flagship mining asset is the Cariboo Gold Project, located in the District of Wells, British Columbia, Canada. the Corporation's project pipeline is complemented by the Tintic Project, located in Utah, United States of America.

As of the date of this AIF, the Corporation considers the Cariboo Gold Project and the Tintic Project to be its only material mineral properties for the purposes of NI 43-101. The board of directors has recently authorized a strategic review of the San Antonio Project, which includes exploring the potential for a financial or strategic partner in the asset or for a full or partial sale of the asset. The Corporation has engaged a financial advisor in connection with such strategic review.

For further details regarding the material mineral projects of the Corporation, see Schedule “C” – Technical Information – Cariboo Gold Project and Schedule “D” – Technical Information – Tintic Project.

The Corporation's current strategy is to advance and develop the Cariboo Gold Project and the Tintic Project towards the next phase of development and if at all, to a construction decision. In line with its strategy, the Corporation intends to continue advancing various permits and further exploration activities as well as test mining at the Tintic Project.

The Corporation’s assets also include a portfolio of shares, mainly of Canadian publicly traded exploration and development mining companies. The Corporation may, from time to time and without further notice, except as required by law or regulations, increase or decrease its investments at its discretion.

The following table presents the main investments of the Corporation in marketable securities as at March 28, 2024:

Name of Company |

| Number of Shares Held |

| Ownership |

Falco Resources Ltd. |

| 46,885,240 |

| 17.3% |

Cornish Metals Inc. | | 41,487,833 | | 7.8% |

Niobay Metals Inc. | | 9,857,143 | | 12.3% |

Barksdale Resources Corp. |

| 3,828,261 |

| 4.2% |

Notes:

(1) | These securities are held by Barkerville. |

Social and Environmental Policies

The Corporation views sustainability as a key part of its strategy to create value for its Shareholders and other stakeholders. The Corporation focuses on the following key areas: (i) promoting social and environmental sustainability in its business and operations; (ii) maintaining strong relationships with the Federal, Provincial, Municipal and First Nations governments where the Corporation has activities and projects; (iii) supporting the economic development of regions where it operates; (iv) promoting diversity and integrity throughout the organization and the mining industry; and (vi) encouraging investee companies to adhere to the same areas of focus in sustainability.

Page 13 |

|

Environmental Protection

The Corporation's exploration and development activities are subject to the federal, state, provincial, territorial, regional and local environmental laws and regulations in jurisdictions in which the Corporation's activities and facilities are located. This includes requirements relating to air and water quality, waste disposal, planning and implementing the closure and reclamation of mining properties and related financial assurance. Each mineral property is subject to environmental assessment and permitting processes. In 2023, the Corporation obtained an environmental assessment certificate for the Cariboo Gold Project from the Environmental Assessment Officer in British Columbia.

The Corporation's Environmental and Sustainability Committee is responsible for overseeing certain health, safety, corporate social responsibility and environmental matters and to recommend to the Board the steps to be taken in connection with these areas of activity. The Environmental and Sustainability Committee held 3 meetings during the financial year ended December 31, 2023.

The Corporation's Environmental Policy and Environmental and Sustainability Committee Charter are available on the Corporation's website at https://osiskodev.com/about/#governance.

Sustainable Development

The Corporation is committed to promoting ethical, responsible and safe operations focusing on the quality of its operations, respect of human rights and local community and cultures as well as the well-bring of its employees. The Corporation's Code of Ethics and Health and Safety Policy requires, among other things, that all employees follow all applicable laws and regulations wherever the Corporation does business, work safely in accordance with regulatory and other industry standards, treat everyone fairly and equitably, work in an environmentally responsible manner and respect the cultures and rights of communities where the Corporation operates its business. The Corporation respects and supports the dignity, well-being and rights of its employees, their families and the communities in which it operates. The Corporation also sets out to build enduring relationships with its neighbours that demonstrate mutual respect, active partnership, and long-term commitment. The Corporation respects the diversity of Indigenous peoples acknowledging the unique and important interests that they have in the land, waters and environment as well as their history, culture and traditional ways. The Corporation has positive maintained relationships with the Lhtako Dene Nation, Xatsull First Nation and Williams Lake Indian Band. The Corporation's Code of Ethics and Health and Safety Policy are available on the Corporation's website at https://osiskodev.com/about/#governance.

The mining business is subject to global macro-economic cycles which affect the marketability of products derived from mining. The Corporation's current exploration and development operations is not cyclical and may be conducted all year round.

One of Osisko Development's material projects, the Tintic Project, is located in Utah, United States. In addition, the Corporation also holds interests in other properties located outside Canada, including the San Antonio Project and Guerrero Properties located in Mexico. See "Risk Factors – Risk Factors Related to the Corporation – Enforcing Judgments" and "Risk Factors – Risk Factors Related to the Corporation – Foreign Operations Risks".

The Corporation’s business requires specialized skills and knowledge in the areas of geology, mining, mineral processing, environmental management, permitting, First Nations relations and the global commodity markets. To date, the Corporation has been able to locate and retain such professionals in Canada, the United States and Mexico, and believes it will be able to continue to do so.

Page 14 |

|

The Corporation’s business is not dependent on any contract to sell a major part of its products or to purchase a major part of its requirements for goods, services or raw materials, or on any franchise or license or other agreement to use a patent, formula, trade secret, process or trade name upon which its business depends. It is not expected that the Corporation’s business will be affected in the current financial year by the renegotiation, amendment or termination of contracts or subcontracts.

As at December 31, 2023, the Corporation had 118 employees. The Corporation evaluates on an ongoing basis the required expertise and skills to execute its business strategy and will seek to attract and retain the individuals required to meet the Corporation's goals.

The Corporation believes it has adequate personnel with the specialized skills required to carry out its business and operations and, anticipates making ongoing efforts to match its workforce capabilities with its business strategy as it evolves.

The precious metal exploration and mining industry is highly competitive. The Corporation competes with other companies in connection with the discovery, acquisition, development and advancement of mining properties, the sourcing of raw materials and supplies used in connection with mining operations, the recruitment and retention of qualified personnel and suitable contractors, technical and engineering sources and necessary exploration and mining equipment. See "Risk Factors – Risks Factors Related to the Corporation – Competition".

The Corporation’s business, being the acquisition, exploration and development of mineral properties in Canada and worldwide, is speculative and involves a high degree of risk. The risk factors listed below could materially affect the Corporation’s financial condition and/or future operating results, and could cause actual events to differ materially from those described in Forward-Looking Information relating to or made by the Corporation.

In evaluating the Corporation and its business, the readers should carefully consider the risk factors which follow and the risks set forth in the Corporation’s continuous disclosure documents filed on SEDAR+ and EDGAR. These risk factors may not be a definitive list of all risk factors associated with an investment in the Corporation or in connection with its business and operations.

The risks described herein and in other documents forming part of the Corporation’s disclosure record are not the only risks facing the Corporation. Additional risks and uncertainties not currently known to the Corporation, or that the Corporation currently deems immaterial, may also materially and adversely affect its business. Prospective purchasers or holders of Common Shares should give careful consideration to all risk factors enumerated below.

Risk Factors Related to the Corporation

Mineral Exploration and Development

Mineral exploration and development is speculative and involves a high degree of risk. While the discovery of an ore body may result in substantial rewards, few properties which are explored are commercially mineable and ultimately developed into producing mines. There is no assurance that any exploration properties will be commercially mineable.

Page 15 |

|

Should any mineral resources exist, substantial expenditures will be required to confirm mineral reserves which are sufficient to commercially mine and to obtain the required environmental approvals and permitting required to commence commercial operations. The decision as to whether a property contains a commercially viable mineral deposit and should be brought into production will depend upon the results of exploration programs, preliminary economic assessment and/or feasibility studies, and the recommendations of duly qualified engineers and/or geologists, all of which involves significant expense. This decision will involve consideration and evaluation of several significant factors including, but not limited to: (a) costs of bringing a property into production, including exploration and development work, preparation of, if applicable, preliminary economic assessment and production feasibility studies and construction of production facilities; (b) availability and costs of financing; (c) ongoing costs of production; (d) metal prices; (e) environmental compliance regulations and restraints (including potential environmental liabilities associated with historical exploration activities); and (f) political climate and/or governmental regulation and control. Development projects are also subject to the successful completion of engineering studies, issuance of necessary governmental permits, and availability of adequate financing. Development projects have no operating history upon which to base estimates of future cash flow.

Mining Operations

Mining operations are and will be subject to all the hazards and risks normally incidental to exploration, development and production of mineral resources and mineral reserves including unusual or unexpected geological formations, geotechnical challenges and other conditions such as formation pressures, fire, power outages, flooding, explosions, cave-ins, landslides and the inability to obtain suitable machinery, equipment or labour, any of which could result in work stoppages, damage to property, and possible environmental damage that even a combination of careful evaluation, experience and knowledge may not eliminate or adequately mitigate. The Corporation may be subject to liability for pollution, cave-ins or hazards against which it cannot insure or against which it may elect not to insure. The payment of such liabilities may have a material adverse effect on the financial position of the Corporation.

Major expenditures are required to develop metallurgical processes and to construct mining and processing facilities at a particular site. Whether a mineral deposit will be commercially viable depends on a number of factors, some of which are: the particular attributes of the deposit, such as size, grade and proximity to infrastructure; metal prices, which are highly volatile; and governmental regulations, including those relating to prices, taxes, royalties, land tenure, land use, allowable production, importing and exporting of minerals and environmental protection.

Operations Not Supported by a Feasibility Study

Certain operations of the Corporation including the test mining at Bonanza Ledge II Project and the Tintic Project, have been operated without the benefit of a feasibility study including mineral reserves, demonstrating economic and technical viability, and, as a result, there may be increased uncertainty of achieving any particular level of recovery of material or the cost of such recovery. Historically, such projects have a much higher risk of economic and technical failure. There is no guarantee that commercial production will commence, continue as anticipated or at all or that anticipated production costs will be achieved. The failure to commence or continue production would have a material adverse impact on the Corporation’s ability to generate revenue and cash flow to fund operations. Failure to achieve the anticipated production costs would have a material adverse impact on the Corporation’s cash flow and potential profitability.

Unanticipated Metallurgical Processing Problems

Unanticipated metallurgical processing problems may occur during operations, including, without limitation, mechanical problems with milling or extraction equipment, unexpected grade anomalies in processed material, contaminants in processing or processed material, and the inability to operate tested processes at scale which can lead to lower metallurgical recoveries than expected and delay and impede operations, which may affect the potential profitability of the Corporation's material mineral properties. In addition, further metallurgical testing or operations may determine that the metals cannot be extracted as economically as anticipated.

Page 16 |

|

Industry Conditions

The exploration for and development of mineral deposits involve significant risks and while the discovery of an ore body may result in substantial rewards, few properties that are explored are ultimately developed into producing mines. All of the Corporation's properties are in the development or exploration stage and the Corporation is presently not commercially exploiting any of its properties and its future success will depend on its capacity to generate revenues from an exploited property.

The discovery of mineral deposits depends on a number of factors, including the professional qualification of its personnel in charge of exploration. Whether a mineral deposit will be commercially viable depends on a number of factors, some of which are the particular attributes of the deposit, such as size, grade and proximity to infrastructure, as well as metal prices which are highly cyclical and government regulations, including regulations relating to prices, taxes, royalties, land tenure, land use, importing and exporting of minerals and environmental protection. In the event that the Corporation wishes to commercially exploit one of its properties, the exact effect of these factors cannot be accurately predicted, but the combination of these factors may result in the Corporation not receiving an adequate return on invested capital. The Corporation's operations will be subject to all the hazards and risks normally encountered in the exploration and development of mineral deposits. Mining operations generally involve a high degree of risk, including unusual and unexpected geological formations.

Uncertainty of Mineral Resource and Mineral Reserve Estimates

Mineral resource and mineral reserve figures are only estimates. Mineral resource and mineral reserve estimates have inherent uncertainty. Such estimates are expressions of judgment based on knowledge, mining experience, analysis of drilling results and industry practices. While the Corporation believes that the mineral resource and mineral reserve estimates, as applicable, in respect of properties in which the Corporation holds a direct interest reflect best estimates, the estimating of mineral resources and mineral reserves is a subjective process and the accuracy of mineral resource and mineral reserve estimates is a function of the quantity and quality of available data, the accuracy of statistical computations, and the assumptions used and judgments made in interpreting available engineering and geological information. There is significant uncertainty in any mineral resource and mineral reserve estimate and the actual deposits encountered and the economic viability of a deposit may differ materially from estimates. Estimated mineral resources and mineral reserves may have to be re-estimated based on changes in prices of gold or other minerals, further exploration or development activity or actual production experience. This could materially and adversely affect estimates of the volume or grade of mineralization, estimated recovery rates or other important factors that influence such estimates. In addition, mineral resources are not mineral reserves and there is no assurance that any mineral resource estimate will ultimately be reclassified as proven or probable mineral reserves. Mineral resources which are not mineral reserves do not have demonstrated economic viability.

Page 17 |

|

Negative Operating Cash Flow

For the financial year ended December 31, 2022 and 2023, the Corporation had negative operating cash flow of $50.3 million and $43.8 million, respectively, and also reported a net loss of $192.5 million and $181.9 million, respectively. For the same ending periods, the Corporation had approximately $19.1 million and $18.6 million, respectively, in outstanding debt mainly related to leasing and equipment financing obligations. As a result of the expected expenditures to be incurred by the Corporation for the development of the Corporation's material projects, the Corporation anticipates that negative operating cash flows will continue until one or both of the Corporation's material projects enters commercial production. There can be no assurance that the Corporation will generate positive cash flow from operations in the future. The Corporation will require additional capital in order to fund its future activities for its material projects. To the extent that the Corporation continues to have negative operating cash flow in future periods, it may need to allocate a portion of its cash reserves to fund such negative cash flow. Furthermore, additional financing, whether through the issue of additional equity and/or debt securities and/or project level debt, will be required to continue the development of the Corporation's material projects and there is no assurance that additional capital or other types of financing will be available or that these financings will be on terms at least as favourable to the Corporation as those previously obtained, or at all. Failure to obtain additional financing or to achieve profitability and positive operating cash flows will have a material adverse effect on its financial condition and results of operations.

No Earnings and History of Losses

The business of developing and exploring resource properties involves a high degree of risk and, therefore, there is no assurance that current exploration and test mining programs will result in profitable operations. The Corporation has not determined whether any of its properties contain economically recoverable reserves of mineralized material and currently has minimal or no revenues from its projects; therefore, the Corporation does not generate sufficient cash flows from its operations. There can be no assurance that significant additional losses will not occur in the future. The Corporation’s operating expenses and capital expenditures may increase in future years with advancing exploration, development, and/or production from the Corporation’s properties. The Corporation does not anticipate to receive sufficient revenues from operations to offset operational expenditures in the foreseeable future and expects to incur losses until such time as one or more of its properties enters into commercial production and generates sufficient revenues to fund continuing operations. There is no assurance that any of the Corporation’s properties will eventually graduate to commercial operation. There is also no assurance that new capital will become available, and if it is not, the Corporation may be forced to substantially curtail or cease operations.

Financing Risks and Additional Financing

The Corporation's operations are subject to financing risks and additional financing may result in dilution or partial sale of assets. At the present time, the Corporation has exploration and development assets which may generate periodic revenues through test mining, but has no mines in the commercial production stage. The Corporation cautions that test mining at its operations could be suspended at any time. The Corporation's ability to explore for and find potential economic projects, and then to bring them into production is highly dependent upon its ability to raise equity and debt capital in the financial markets. Any projects that the Corporation develops will require significant capital expenditures. Currently, the Corporation does not have any producing projects and no sources of revenue and any projects it develops will require significant capital expenditures. As a result, the Corporation may be required to seek additional sources of debt and equity financing in the near future. To obtain such funds, the Corporation may sell additional securities including, but not limited to, the Corporation's shares or some form of convertible security, the effect of which could result in a substantial dilution of the equity interests of the Corporation's shareholders. Alternatively, the Corporation may also sell a part of its interest in an asset in order to raise capital. There is no assurance that the Corporation will be able to raise the funds required to continue its exploration programs and finance the development of any potentially economic deposit that is identified on acceptable terms or at all. The failure to obtain the necessary financing could have a material adverse effect on the Corporation's growth strategy, results of operations, financial condition and project scheduling. The development of the Corporation's material mineral properties remains subject to, among other things, Osisko Development securing adequate financing on conditions acceptable to it.

Page 18 |

|

Regulatory Matters

The Corporation’s activities are subject to governmental laws and regulations. These activities can be affected at various levels by governmental regulation governing prospecting and development, price control, taxes, labour standards and occupational health, expropriation, mine safety, compliance with securities matters and other matters. Exploration and commercialization are subject to various federal, provincial and local laws and regulations relating to the protection of the environment. These laws impose high standards on the mining industry to monitor the discharge of wastewater and report the results of such monitoring to regulatory authorities, to reduce or eliminate certain effects on or into land, water or air, to progressively rehabilitate mine properties, to manage hazardous wastes and materials and to reduce the risk of worker accidents.

Failure to comply with applicable laws and regulations may result in civil or criminal fines or penalties or enforcement actions, including orders issued by regulatory or judicial authorities enjoining or curtailing operations or requiring corrective measures, installation of additional equipment or remedial actions, any of which could result in significant expenditures. The Corporation may also be required to compensate private parties suffering loss or damage by reason of a breach of such laws, regulations or permitting requirements. It is also possible that future laws and regulations, or more stringent enforcement of current laws and regulations by governmental authorities, could cause additional expense, capital expenditures, restrictions on or suspensions of the Corporation’s activities and delays in the exploration and development of the projects and properties.

Amendments to current laws, regulations and permits governing operations and activities of mining companies, or more stringent implementation thereof, could have a material adverse impact on the Corporation and cause increases in capital expenditures or development costs or require abandonment or delays in development of new mining properties.

Also, no assurance can be made that the Canada Revenue Agency and provincial agencies will agree with the Corporation’s characterization of expenses as Canadian exploration expenses or Canadian development expenses or the eligibility of such expenses as Canadian exploration expenses under the Tax Act or any provincial equivalent.

Taxation Laws or Reviews

The Corporation has operations and conducts business in multiple jurisdictions and it is subject to the taxation laws of each such jurisdiction. These taxation laws are complicated and subject to change. The Corporation may also be subject to review, audit and assessment in the ordinary course. Any such changes in taxation law or reviews and assessments could result in higher taxes being payable or require payment of taxes due from previous years, which could adversely affect the Corporation’s liquidities. Taxes may also adversely affect the Corporation’s ability to repatriate earnings and otherwise deploy its assets.

Changes in Economic and Political Conditions and Regulations

The economics of the exploration and development of mining projects are affected by many factors, including the costs of exploration and development, variations of grade of mineralized material discovered, fluctuations in metal prices, foreign exchange rates and the prices of goods and services, applicable laws and regulations, including regulations relating to royalties, allowable production and importing and exporting goods and services. Depending on the price of minerals, the Corporation may determine that it is neither potentially profitable nor advisable to acquire or develop properties.

The Corporation’s mineral properties are located in Canada, the United States and Mexico. Economic and political conditions in these countries could adversely affect the business activities of the Corporation. These conditions are beyond the Corporation’s control, and there can be no assurance that any mitigating actions by the Corporation will be effective.

Page 19 |

|

Changing laws and regulations relating to the mining industry or shifts in political conditions may increase the costs related to the Corporation’s activities including the cost of maintaining its properties. Operations may also be affected to varying degrees by changes in government regulations with respect to restrictions on exploration and development activities, price controls, export controls, income taxes, royalties, expropriation of property, environmental legislation (including specifically legislation enacted to address climate change) and mine safety. The effect of these factors cannot be accurately predicted. Economic instability could result from current global economic conditions and could contribute to currency volatility and potential increases to income tax rates, both of which could significantly impact the Corporation’s potential profitability.

The Corporation’s activities are subject to extensive laws and regulations governing worker health and safety, employment standards, waste disposal, protection of historic and archaeological sites, mine development, protection of endangered and protected species and other matters. Regulators have broad authority to shut down and/or levy fines against facilities that do not comply with regulations or standards.

Risk factors specific to certain jurisdictions are described throughout, including specifically "Foreign Operations Risks". The occurrence of the various factors and uncertainties related to economic and political risks of operating in the Corporation's jurisdictions cannot be accurately predicted and could have a material adverse effect on the Corporation.

Enforcing Judgments

As the Corporation is a Canadian corporation and most of its directors and officers reside in Canada, it may be difficult or impossible for investors in the United States to effect service or to realize on judgments obtained in the United States predicated upon the civil liability provisions of the U.S. federal securities laws. A judgment of a U.S. court predicated solely upon such civil liabilities may be enforceable in Canada by a Canadian court if the U.S. court in which the judgment was obtained had jurisdiction, as determined by the Canadian court, in the matter. Investors should not assume that Canadian courts: (i) would enforce judgments of U.S. courts obtained in actions against the Corporation or such persons predicated upon the civil liability provisions of the U.S. federal securities laws or the securities or blue-sky laws of any state within the United States, or (ii) would enforce, in original actions, liabilities against the Corporation or such persons predicated upon the U.S. federal securities laws or any such state securities or blue-sky laws.

Similarly, some of the Corporation’s directors and officers are residents of countries other than Canada and all or a substantial portion of the assets of such persons are located outside Canada and some of the Corporation’s mineral assets, including the Tintic Project, are located outside of Canada and are held indirectly through foreign affiliates. As a result, it may be difficult or impossible for Canadian investors to initiate a lawsuit within Canada against these persons or to enforce judgments in Canada against such assets. In addition, it may not be possible for Canadian investors to collect from these persons or assets judgments obtained in courts in Canada predicated on the civil liability provisions of securities legislation of certain of the provinces and territories of Canada. It may also be difficult or impossible for Canadian investors to succeed in a lawsuit in the United States based solely on violations of Canadian Securities Laws.

Permits, Licences and Approvals

The operations of the Corporation require licences and permits from various governmental authorities. The Corporation believes it holds or is in the process of obtaining all necessary licences and permits to carry on the activities, which it is currently conducting under applicable laws and regulations. Such licences and permits are subject to changes in regulations and in various operating circumstances. There can be no guarantee that the Corporation will be able to obtain all necessary licences and permits that may be required to maintain its business operations, mining activities, construct mines or milling facilities and commence operations of any of its exploration properties. In addition, if the Corporation proceeds to production on any exploration property, it must obtain and comply with permits and licences which may contain specific conditions concerning operating procedures, water use, the discharge of various materials into or on land, air or water, waste disposal, spills, environmental studies, abandonment and restoration plans and financial assurances. There can be no assurance that the Corporation will be able to obtain such permits and licences or that it will be able to comply with any such conditions.

Page 20 |

|

Local Communities, Indigenous Peoples and First Nations

Indigenous title claims, rights to consultation/accommodation and the Corporation’s relationship with local communities may affect the Corporation’s existing exploration and development projects. Governments in many jurisdictions must consult with Indigenous peoples and First Nations with respect to grants of mineral rights or surface rights and the issuance or amendment of project authorizations. Consultation and other rights of Indigenous peoples and First Nations may require accommodations, including undertakings regarding employment, royalty payments and other matters. This may affect the Corporation’s ability to acquire, within a reasonable time frame, effective mineral titles or surface rights in these jurisdictions, including in some parts of Canada, Mexico and the United States, in which Indigenous or local communities’ titles are claimed, and may affect the timetable and costs of development of mineral properties in these jurisdictions. The risk of unforeseen Indigenous title claims also could affect exploration and development projects. These legal requirements may also affect the Corporation’s ability to transfer existing projects or to develop new projects.

The Corporation’s relationship with the communities in which it conducts activities are critical to ensure the future success of its existing activities and the exploration and development of its projects. There is an increasing level of public concern relating to the perceived effect of mining activities on the environment and on communities impacted by such activities. Adverse publicity relating to the mining industry generated by non-governmental organizations and others could have an adverse effect on the Corporation’s reputation or financial condition and may impact its relationship with the communities in which it conducts activities. While the Corporation is committed to working in a socially responsible manner, there is no guarantee that the Corporation’s efforts in this regard will mitigate this potential risk.

The inability of the Corporation to maintain positive relationships with local communities may result in additional obstacles to permitting, increased legal challenges, or other disruptive operational issues at any of the Corporation’s projects, and could have a significant adverse impact on the Corporation’s share price and financial condition.

Environmental Risks and Hazards

The Corporation is subject to environmental regulation in the jurisdictions in which it operates. These regulations mandate, among other things, the maintenance of air and water quality standards and land reclamation. They also set forth limitations on the general, transportation, storage and disposal of solid and hazardous waste. Environmental legislation is evolving in a manner which will require stricter standards and enforcement, increased fines and penalties for non-compliance, more stringent environmental assessments of proposed projects and a heightened degree of responsibility for companies and their officers, directors and employees. There is no assurance that future changes in environmental regulation, if any, will not adversely affect the Corporation's operations. Environmental hazards may exist on the properties which are unknown to the Corporation at present and which have been caused by previous or existing owners or operators of the properties. Reclamation costs are uncertain and planned expenditures estimated by management may differ from the actual expenditures required.

Competition

The Corporation’s activities are directed towards the exploration, evaluation and development of mineral deposits. There is no certainty that the expenditures to be made by the Corporation will result in discoveries of commercial quantities of mineral deposits. There is aggressive competition within the mining industry for the discovery and acquisition of properties considered to have commercial potential. The Corporation will compete with other interests, many of which have greater financial resources than it will have, for the opportunity to participate in promising projects. Significant capital investment is required to achieve commercial production from successful exploration efforts, and the Corporation may not be able to successfully raise funds required for any such capital investment.

Page 21 |

|

Anti-Bribery Laws

The Canadian Corruption of Foreign Public Officials Act, the U.S. Foreign Corrupt Practices Act and anti-bribery laws in other jurisdictions where the Corporation does business, prohibit companies and their intermediaries from making improper payments for the purposes of obtaining or retaining business or other commercial advantage. The Corporation’s policies mandate compliance with these anti-bribery laws, which often carry substantial penalties. The Corporation operates in jurisdictions that have experienced governmental and private sector corruption to some degree, and, in certain circumstances, strict compliance with anti-bribery laws may conflict with certain local customs and practices. There can be no assurances that the Corporation’s internal control policies and procedures will always protect it from reckless or other inappropriate acts committed by the Corporation’s affiliates, employees or agents. Violations of these laws, or allegations of such violations, could have a material adverse effect on the Corporation’s business, financial position and results of operations.

Management

The Corporation is dependent on certain members of its management, particularly its Chief Executive Officer. The loss of their services could adversely affect the Corporation.