UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐ | | | Preliminary Proxy Statement |

☐ | | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

☒ | | | Definitive Proxy Statement |

☐ | | | Definitive Additional Materials |

☐ | | | Soliciting Material Pursuant to §240.14a-12 |

(Name of Registrant as Specified In Its Charter) |

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

Payment of Filing Fee (Check the appropriate box):

☒ | | | No fee required. | |||

☐ | | | Fee paid previously with preliminary materials. | |||

☐ | | | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

|

Notice of Annual Meeting

of Stockholders

To be Held on June 20, 2024

Dear Fellow Stockholders,

You are cordially invited to attend the 2024 Annual Meeting of Stockholders (the “Annual Meeting”) of Olo Inc., a Delaware corporation (“Olo”). The Annual Meeting will be held virtually, via live webcast at www.virtualshareholdermeeting.com/OLO2024, on Thursday, June 20, 2024 at 10:00 a.m., Eastern Time. We believe hosting a virtual meeting enables enhanced stockholder access and engagement while reducing the environmental impact of our Annual Meeting. Stockholders attending the virtual meeting will be afforded the same rights and opportunities to participate as they would at an in-person meeting. We encourage you to attend online and participate. We recommend that you log in a few minutes before 10:00 a.m., Eastern Time, on June 20, 2024 to ensure your attendance.

The Annual Meeting will be held for the following purposes:

1. | To elect three Class III directors: Brandon Gardner, David Frankel, and Zuhairah Washington, each to hold office until our annual meeting of stockholders in 2027. |

2. | To ratify the selection by the audit committee of our board of directors of Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2024. |

3. | To approve an amendment to our Amended and Restated Certificate of Incorporation to limit liability of certain officers as permitted by Delaware law. |

4. | To approve, on a non-binding advisory basis, the compensation of our named executive officers. |

5. | To conduct any other business properly brought before the meeting. |

These items of business are more fully described in the accompanying proxy statement.

The Record Date for the Annual Meeting is the close of business on April 22, 2024. Only stockholders of record at the close of business on that date may vote at the Annual Meeting or any adjournment thereof.

We appreciate your continued support of Olo.

| | | By Order of the Board of Directors, | |

| | |  | |

| | | Noah H. Glass Founder, Chief Executive Officer, and Director |

99 Hudson Street, 10th Floor

New York, New York 10013

April 25, 2024

You are cordially invited to attend the Annual Meeting. Whether or not you expect to attend the meeting, PLEASE VOTE YOUR SHARES. As an alternative to voting online during the meeting, you may vote your shares in advance of the Annual Meeting through the internet, by telephone, or, if you receive a paper proxy card in the mail, by mailing the completed proxy card. Voting instructions are provided in the Notice of Internet Availability of Proxy Materials or, if you receive a paper proxy card by mail, the instructions are printed on your proxy card. |

Even if you have voted by proxy, you may still vote online if you attend the meeting. Please note, however, that if your shares are held of record by a broker, bank, or other agent and you wish to vote at the meeting, you must follow the instructions from such organization and will need to obtain a proxy issued in your name from that record holder. |

ESG HIGHLIGHTS | |

We are committed to shaping the evolution of digital hospitality by aligning our products, resources, and employees to drive positive change and create a more sustainable future. We strive to uphold our social responsibility to the communities in which we live, work, and service, as well as reduce our impact on the environment. Our ESG efforts are reflected throughout this Proxy Statement. Key topics include: | |

|

2024 Annual Meeting of

Stockholders

To Be Held at 10:00 a.m., Eastern Time, on

Thursday, June 20, 2024

Our board of directors is soliciting your proxy to vote at the 2024 Annual Meeting of Stockholders (the “Annual Meeting”) of Olo Inc., a Delaware corporation (“Olo”), to be held virtually, via live webcast at www.virtualshareholdermeeting.com/OLO2024, on Thursday, June 20, 2024 at 10:00 a.m., Eastern Time, and any adjournment or postponement thereof. Only stockholders of record at the close of business on April 22, 2024 (the “Record Date”) will be entitled to vote at the Annual Meeting.

For the Annual Meeting, we have elected to furnish our proxy materials, including this proxy statement and our Annual Report on Form 10-K for the fiscal year-ended December 31, 2023 (the “Annual Report”), to our stockholders primarily via the internet. On or about April 25, 2024, we expect to mail to our stockholders a Notice of Internet Availability of Proxy Materials (the “Notice”) that contains notice of the Annual Meeting and instructions on how to access our proxy materials on the internet, how to vote, and how to request printed copies of the proxy materials. Stockholders may request to receive all future materials in printed form by mail, or by email, by following the instructions contained in the Notice. A stockholder’s election to receive proxy materials by mail or email will remain in effect until revoked. We encourage stockholders to take advantage of the availability of the proxy materials on the internet to help reduce the environmental impact and cost of our Annual Meeting.

In this proxy statement, we refer to Olo Inc. as “Olo,” “we,” or “us” and the board of directors of Olo as “our board of directors.” The Annual Report, which contains consolidated financial statements as of and for the fiscal year-ended December 31, 2023, accompanies this proxy statement. You also may obtain a copy of the Annual Report without charge by emailing InvestorRelations@olo.com. Exhibits will be provided upon written request and payment of an appropriate processing fee.

2024 Proxy Statement | 1 |

The information provided in the “question and answer” format below is for your convenience only and is merely a summary of the information contained in this proxy statement. You should read this entire proxy statement carefully. Information contained on, or that can be accessed through, our website is not intended to be incorporated by reference into this proxy statement and references to our website address in this proxy statement are inactive textual references only.

Q: | Why did I receive a notice regarding the availability of proxy materials on the internet? |

A: | Pursuant to rules adopted by the Securities and Exchange Commission (the “SEC”), we have elected to provide access to our proxy materials over the internet. Accordingly, we have sent you the Notice because our board of directors is soliciting your proxy to vote at the Annual Meeting, including at any adjournments or postponements thereof. All stockholders will have the ability to access the proxy materials on the website referred to in the Notice or to request a printed set of the proxy materials. Instructions on how to access the proxy materials over the internet or to request a printed copy may be found in the Notice. |

We intend to mail the Notice on or about April 25, 2024 to all stockholders of record as of the Record Date that are entitled to vote at the Annual Meeting.

Q: | Will I receive any other proxy materials by mail? |

A: | We may send you a proxy card, along with a second Notice, after ten calendar days have passed since our first mailing of the Notice. |

Q: | Can I access the proxy statement and annual report on the internet? |

A: | Our proxy statement and annual report are available on our website at investors.olo.com. |

Q: | Can I request a paper copy of the proxy materials? |

A: | Yes. To facilitate timely delivery of paper copies, all requests must be received by June 6, 2024. If you are a stockholder of record as of the Record Date, you may request a copy of the proxy materials by going to www.proxyvote.com, entering your 16-digit control number, and selecting “Delivery Settings” or otherwise following the instructions on your Notice. If you are not a stockholder of record, please refer to |

the information provided by your broker, bank, or other agent for instructions.

Q: | How do I attend, participate in, and ask questions during the Annual Meeting? |

A: | We will be hosting the Annual Meeting via live webcast only. Any stockholder of record, as of the Record Date, can attend the Annual Meeting live online at www.virtualshareholdermeeting.com/OLO2024. The Annual Meeting will start at 10:00 a.m., Eastern Time, on Thursday, June 20, 2024. Stockholders attending the Annual Meeting will be afforded the same rights and opportunities to participate as they would at an in-person meeting. |

In order to enter the Annual Meeting, you will need the 16-digit control number included on your Notice, on your proxy card, or on the instructions that accompanied your proxy materials. If you hold your shares in “street name,” your control number is included with your voting instruction card and voting instructions received from your broker, bank, or other agent. Instructions on how to attend and participate at the Annual Meeting are available at www.virtualshareholdermeeting.com/OLO2024. We recommend that you log in a few minutes before 10:00 a.m., Eastern Time, to ensure you are logged in when the Annual Meeting starts. The webcast will open 15 minutes before the start of the Annual Meeting.

If you would like to submit a question for the Annual Meeting, you may log in at www.proxyvote.com before the Annual Meeting or www.virtualshareholdermeeting.com/OLO2024 during the Annual Meeting, then using your 16-digit control number, type your question into the “Ask a Question” field, and click “Submit.”

Q: | Why won’t there be an in-person meeting? |

A: | We believe hosting a virtual Annual Meeting enables participation by more of our stockholders, while reducing the environmental costs of conducting an in-person meeting. There will not be a physical meeting location. We encourage you to attend online and participate. We have designed the format of the virtual Annual Meeting to try to provide stockholders with the same rights and opportunities to vote and participate as they would have at a physical meeting. |

2 |  |

Questions and Answers About These Proxy Materials and Voting

In order to encourage stockholder participation and transparency, subject to our rules of conduct and procedures, we will:

• | Enable the ability to submit questions online before and during the meeting, providing stockholders with the opportunity for meaningful engagement with us. |

• | Provide management with the ability to answer as many questions as possible in the time allotted during the Annual Meeting. |

• | Address technical and logistical issues related to accessing the virtual meeting platform. |

• | Provide procedures for accessing technical support to assist in the event of any difficulties accessing the Annual Meeting. |

Q: | Are there rules of conduct for the Annual Meeting? |

A: | Yes, the rules of conduct for the Annual Meeting will be posted at www.virtualshareholdermeeting.com/OLO2024 |

on the date of the Annual Meeting. The rules of conduct will provide information regarding the rules and procedures for participating in the Annual Meeting and will help ensure that we have a productive and efficient meeting. These rules of conduct will include the following guidelines:

• | You may submit questions electronically through the meeting portal before and during the Annual Meeting. |

• | Only stockholders with the 16-digit control number may submit questions. |

• | Please direct all questions to Noah H. Glass, our Founder, Chief Executive Officer, and Director. |

• | Please include your name and affiliation, if any, when submitting a question. |

• | Please limit your remarks to one brief question that is relevant to the Annual Meeting and/or our business. |

• | Questions may be grouped by topic by our management. |

• | Questions may also be ruled as out of order if they are, among other things, irrelevant to our business, related to pending or threatened litigation, disorderly, repetitious of statements already made, or in furtherance of the speaker’s own personal, political, or business interests. |

• | Please be respectful of your fellow stockholders and Annual Meeting participants. |

• | No audio or video recordings of the Annual Meeting are permitted. A webcast playback will be available at www.virtualshareholdermeeting.com/OLO2024, for one year following the Annual Meeting. |

Q: | What if I have technical difficulties or trouble accessing the Annual Meeting? |

A: | We will have technicians ready to assist you with any technical difficulties you may have accessing the Annual Meeting. If you encounter any difficulties accessing the Annual Meeting during the check-in or meeting time, please call the technical support number that will be posted at www.virtualshareholdermeeting.com/OLO2024, or at www.proxyvote.com. Technical support will be available starting at 9:45 a.m., Eastern Time, on June 20, 2024. |

Q: | Will a list of stockholders of record as of the Record Date be available? |

A: | A list of our stockholders of record, as of the close of business on the Record Date, will be made available to stockholders during the Annual Meeting at www.virtualshareholdermeeting.com/OLO2024. In addition, for the ten days prior to the Annual Meeting, the list will be available for examination by any stockholder of record for a legally valid purpose at our corporate headquarters during regular business hours or by emailing us at InvestorRelations@olo.com. |

Q: | Who can vote at the Annual Meeting? |

A: | Only stockholders of record at the close of business on the Record Date, April 22, 2024, will be entitled to vote at the Annual Meeting. On the Record Date, there were 106,152,092 shares of Class A common stock and 54,891,834 shares of Class B common stock outstanding and entitled to vote (together, the “common stock”). |

• | Stockholder of Record: Shares Registered in Your Name. If, on the Record Date, your shares were registered directly in your name with our transfer agent, Computershare Trust Company, N.A., then you are a stockholder of record. As a stockholder of record, you may vote online during the Annual Meeting or by proxy in advance. Whether or not you plan to attend the Annual Meeting, we urge you to vote your shares by proxy in advance of the Annual Meeting through the internet, by telephone, or by completing and returning a printed proxy card that you may |

2024 Proxy Statement | 3 |

Questions and Answers About These Proxy Materials and Voting

request or that we may elect to deliver at a later time to ensure your vote is counted.

• | Beneficial Owner: Shares Registered in the Name of a Broker or Bank. If, on the Record Date, your shares were not held in your name, but rather in an account at a brokerage firm, bank, or other similar organization, then you are the beneficial owner of shares held in “street name” and the Notice should be forwarded to you by that organization. The organization holding your account is considered to be the stockholder of record for purposes of voting at the Annual Meeting. As a beneficial owner, you have the right to direct your broker, bank, or other agent regarding how to vote the shares in your account. You may do so before or during the Annual Meeting by following the voting instructions provided by your broker, bank, or other agent. Whether or not you plan to attend the Annual Meeting, we urge you to direct your broker, bank, or other agent in advance. |

Q: | How many votes do I have? |

A: | Each holder of shares of our Class A common stock will have one vote per share of Class A common stock held as of the Record Date, and each holder of shares of our Class B common stock will have ten votes per share of Class B common stock held as of the Record Date. The holders of the shares of our Class A common stock and Class B common stock will vote as a single class on all matters described in this proxy statement for which your vote is being solicited. Stockholders are not permitted to cumulate votes with respect to the election of directors or any other matter to be considered at the Annual Meeting. |

Q: | What proposals will be voted on at the virtual Annual Meeting? |

A: | There are four matters scheduled for a vote: |

• | Proposal 1: Election of three Class III directors, each to hold office until our annual meeting of stockholders in 2027; |

• | Proposal 2: Ratification of the selection by the audit committee of our board of directors of Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year-ending December 31, 2024; |

• | Proposal 3: To approve an amendment to our Amended and Restated Certificate of Incorporation to limit the liability of certain officers as permitted by Delaware law; and |

• | Proposal 4: To approve, on a non-binding advisory basis, the compensation of our named executive officers. |

Q: | How does the board of directors recommend I vote on these proposals? |

A: | Our board of directors recommends voting: |

• | Proposal 1: “FOR” the election of Brandon Gardner, David Frankel, and Zuhairah Washington as Class III directors. |

• | Proposal 2: “FOR” the ratification of the selection of Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year-ending December 31, 2024. |

• | Proposal 3: “FOR” the approval of an amendment to our Amended and Restated Certificate of Incorporation to limit the liability of certain officers as permitted by Delaware law. |

• | Proposal 4: “FOR” the approval of, on a non-binding advisory basis, the compensation of our named executive officers. |

Q: | What if another matter is properly brought before the Annual Meeting? |

A: | Our board of directors knows of no other matters that will be presented for consideration at the Annual Meeting. If any other matters are properly brought before the Annual Meeting, it is the intention of the persons named in the accompanying proxy to vote on those matters in accordance with their best judgment. |

Q: | How do I vote? |

A: | Stockholder of Record: Shares Registered in Your Name. If you are a stockholder of record, you may vote (i) online during the Annual Meeting or (ii) in advance of the Annual Meeting by proxy through the internet, by telephone, or by using a proxy card that you may request or that we may elect to deliver at a later time. Whether or not you plan to attend the Annual Meeting, we urge you to vote by proxy to ensure your vote is counted. You may still attend the Annual Meeting and vote online even if you have already voted by proxy. |

• | To vote online during the Annual Meeting, follow the provided instructions to join the Annual Meeting and vote online at www.virtualshareholdermeeting.com/OLO2024, starting at 10:00 a.m., Eastern Time, on Thursday, June 20, 2024. The webcast will open 15 minutes before the start of the Annual Meeting. |

4 |  |

Questions and Answers About These Proxy Materials and Voting

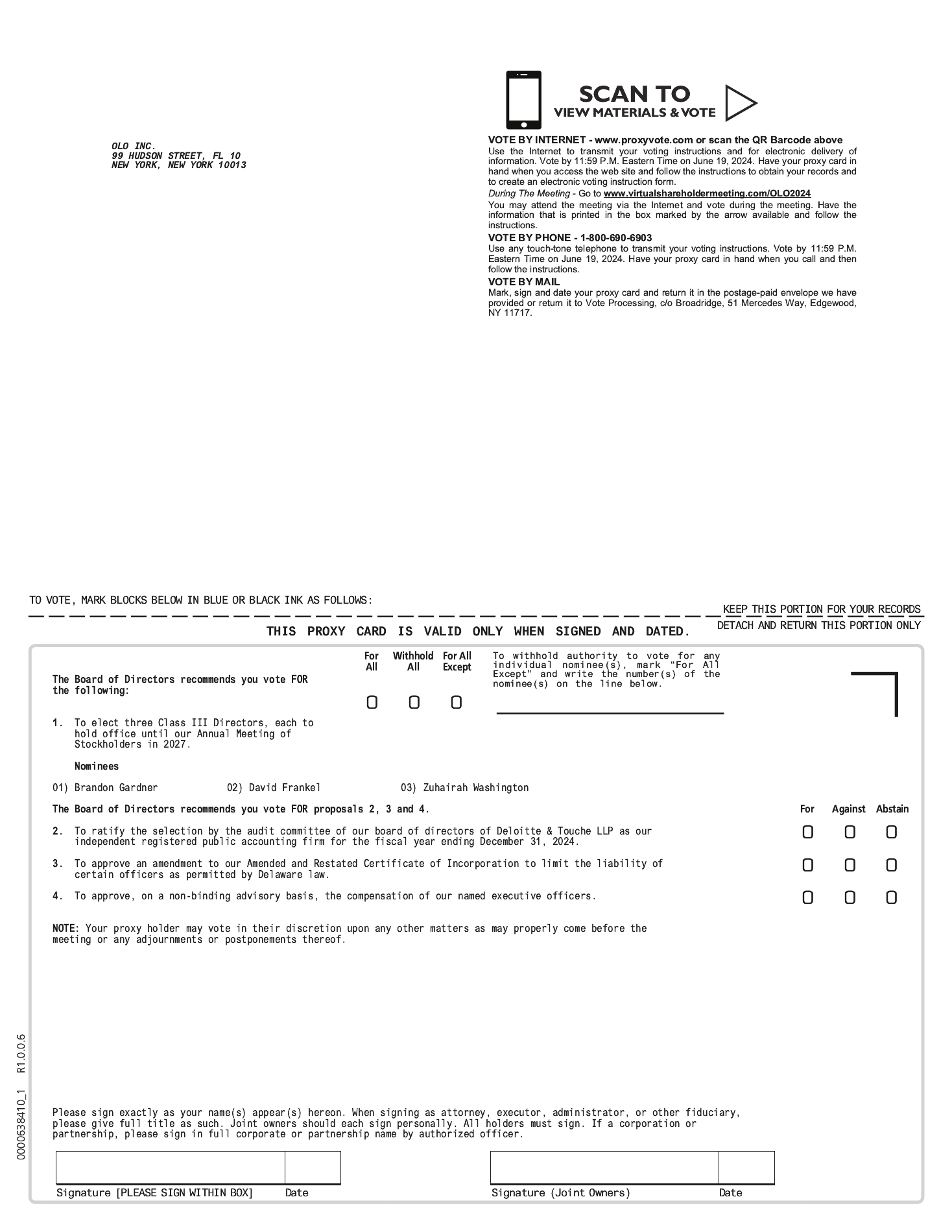

• | To vote in advance of the Annual Meeting through the internet, go to www.proxyvote.com to complete an electronic proxy card. You will be asked to provide the 16-digit control number from your Notice or your printed proxy card. Your internet vote must be received by 11:59 p.m., Eastern Time, on Wednesday, June 19, 2024 to be counted. |

• | To vote in advance of the Annual Meeting by telephone, dial 1-800-690-6903 using a touch-tone phone and follow the recorded instructions. You will be asked to provide the 16-digit control number from your Notice or your printed proxy card. Your telephone vote must be received by 11:59 p.m., Eastern Time, on Wednesday, June 19, 2024 to be counted. |

• | To vote in advance of the Annual Meeting using a printed proxy card that may be delivered to you, simply complete, sign, and date the proxy card, and return it promptly in the envelope provided. If you return your signed proxy card to us before the Annual Meeting, we will vote your shares as you direct. Proxies submitted by U.S. mail must be received before the start of the Annual Meeting. |

Beneficial Owner: Shares Registered in the Name of Broker or Bank. If you are a beneficial owner of shares registered in the name of your broker, bank, or other agent, you should have received a Notice containing voting instructions from that organization rather than from us. As a beneficial owner, you have the right to direct your broker, bank, or other agent regarding how to vote the shares in your account. You may do so before or during the Annual Meeting by following the voting instructions provided by your broker, bank, or other agent. Whether or not you plan to attend the Annual Meeting, we urge you to direct your broker, bank, or other agent in advance on how to vote the shares in your account.

Internet voting during the Annual Meeting and/or internet proxy voting in advance of the Annual Meeting allows you to vote your shares online, with procedures designed to ensure the authenticity and correctness of your vote instructions. Please be aware that you must bear any costs associated with your internet access.

Q: | Can I vote my shares by filling out and returning the Notice? |

A: | No. The Notice identifies the items to be voted on at the Annual Meeting, but you cannot vote by marking the Notice and returning it. The Notice provides |

instructions on how to vote by proxy in advance of the Annual Meeting or online during the Annual Meeting.

Q: | What does it mean if I receive more than one Notice? |

A: | If you receive more than one Notice, your shares may be registered in more than one name or in different accounts. Please follow the voting instructions on the Notices to ensure that all of your shares are voted. |

Q: | If I am a stockholder of record and I do not vote, or if I return a proxy card or otherwise vote without giving specific voting instructions, what happens? |

A: | If you are a stockholder of record and do not vote through the internet, by telephone, by completing the proxy card that may be delivered to you, or online during the Annual Meeting, your shares will not be voted. |

If you return a signed and dated proxy card or otherwise vote without marking voting selections, your shares will be voted in accordance with the recommendations of our board of directors: “FOR” the election of each of the three nominees for director; “FOR” the ratification of the selection of Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2024; “FOR” the approval of an amendment to our Amended and Restated Certificate of Incorporation to limit the liability of certain officers as permitted by Delaware law; and “FOR” the approval of, on a non-binding advisory basis, the compensation of our named executive officers. If any other matter is properly presented at the Annual Meeting, your proxyholder (one of the individuals named on your proxy card) will vote your shares using their best judgment.

Q: | If I am a beneficial owner of shares held in “street name” and I do not provide my broker or bank with voting instructions, what happens? |

A: | Brokers, banks, and other agents that hold shares in “street name” for customers may have the discretion to vote those shares with respect to certain matters if they have not received instructions from the beneficial owners. Under the rules of the New York Stock Exchange (“NYSE”), brokers, banks, and other securities intermediaries that are subject to NYSE rules may use their discretion to vote your “uninstructed” shares on matters considered to be “routine” under NYSE rules, but not with respect to “non-routine” matters. A broker non-vote occurs when a broker, bank, or other agent has not received voting instructions from the beneficial owner of the |

2024 Proxy Statement | 5 |

Questions and Answers About These Proxy Materials and Voting

shares and the broker, bank, or other agent cannot vote the shares because the matter is considered “non-routine.”

The effect of broker non-votes is discussed below. Proposal 2 is considered to be a “routine” matter under NYSE rules and thus if you do not return voting instructions to your broker by its deadline, your shares may be voted by your broker in its discretion on Proposal 2. Proposals 1, 3, and 4 are considered to be “non-routine” under NYSE rules such that your broker, bank, or other agent may not vote your shares on those proposals in the absence of your voting instructions.

If you are a beneficial owner of shares held in “street name,” and you do not plan to attend the Annual Meeting, in order to ensure your shares are voted in the way you would prefer, you must provide voting instructions to your broker, bank, or other agent by the deadline provided in the materials you receive from your broker, bank, or other agent.

Q: | What are “broker non-votes”? |

A: | A broker non-vote occurs when a broker, bank, or other agent has not received voting instructions from the beneficial owner of the shares and the broker, bank, or other agent cannot vote the shares because the matter is considered “non-routine” under NYSE rules. |

Q: | Can I change my vote after submitting my proxy? |

A: | Stockholder of Record: Shares Registered in Your Name. If you are a stockholder of record, then yes, you can revoke your proxy at any time before the final vote at the Annual Meeting. You may revoke your proxy in any one of the following ways: |

• | Submit another properly completed proxy card with a later date. |

• | Grant a subsequent proxy by telephone or through the internet. |

• | Send a timely written notice that you are revoking your proxy via email at InvestorRelations@olo.com. |

• | Attend the Annual Meeting and vote online during the meeting. Simply attending the Annual Meeting will not, by itself, revoke your proxy. Even if you plan to attend the Annual Meeting, we recommend that you also submit your proxy or voting instructions or vote in advance of the Annual Meeting by telephone or through the internet so that your vote will be counted if you later decide not to attend the Annual Meeting. |

Your most current proxy card, telephone, or internet proxy is the one that is counted.

Beneficial Owner: Shares Registered in the Name of Broker or Bank. If you are a beneficial owner and your shares are held in “street name” by your broker, bank, or other agent, you should follow the instructions provided by your broker, bank, or other agent.

Q: | How many votes are needed to approve each proposal? |

A: | The following table summarizes the minimum vote needed to approve each proposal and the effect of abstentions and broker non-votes. |

6 |  |

Questions and Answers About These Proxy Materials and Voting

Proposal Number | | | Proposal Description | | | Voting Options | | | Vote Required for Approval | | | Effect of “Withhold” Votes | | | Effect of Abstentions | | | Effect of Broker Non-Votes |

1 | | | Election of Directors | | | “FOR” or “WITHHOLD” | | | At least one “FOR” vote. The three nominees receiving the most “FOR” votes will be elected. If nominees are unopposed, election requires only a single “FOR” vote. | | | No effect | | | Not applicable | | | No effect |

2 | | | Ratification of the selection of Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2024 | | | “FOR,” “AGAINST,” or “ABSTAIN” | | | Must receive “FOR” votes from the holders of a majority of the voting power of the outstanding shares of common stock present virtually or represented by proxy and voting on the proposal. | | | Not applicable | | | No effect | | | No effect(1) |

3 | | | Approval of an amendment to our Amended and Restated Certificate of Incorporation to limit the liability of certain officers as permitted by Delaware law | | | “FOR,” “AGAINST,” or “ABSTAIN” | | | Must receive “FOR” votes from the holders of a majority of the voting power of the outstanding shares of common stock entitled to vote thereon. | | | Not applicable | | | Against | | | Against |

4 | | | Approval, on a non-binding advisory basis, of the compensation of our named executive officers | | | “FOR,” “AGAINST,” or “ABSTAIN” | | | Must receive “FOR” votes from the holders of a majority of the voting power of the outstanding shares of common stock present virtually or represented by proxy and voting on the proposal. | | | Not applicable | | | No effect | | | No effect |

(1) | This proposal is considered to be a “routine” matter. Accordingly, if you hold your shares in “street name” and do not provide voting instructions to your broker, bank, or other agent that holds your shares, your broker, bank, or other agent has discretionary authority to vote your shares on this proposal. |

2024 Proxy Statement | 7 |

Questions and Answers About These Proxy Materials and Voting

Q: | What is the quorum requirement? |

A: | A quorum of stockholders is necessary to hold a valid meeting. A quorum will be present if stockholders holding a majority of the voting power of the outstanding shares of common stock entitled to vote are present at the Annual Meeting virtually or represented by proxy. On the Record Date, there were 106,152,092 shares of our Class A common stock and 54,891,834 shares of our Class B common stock outstanding and entitled to vote. Each holder of a share of our Class A common stock will be entitled to one vote for each share and each holder of a share of our Class B common stock will be entitled to ten votes for each share. |

Your shares will be counted towards the quorum only if you submit a valid proxy (or one is submitted on your behalf by your broker, bank, or other agent) or if you vote online during the Annual Meeting. Abstentions and broker non-votes will be counted towards the quorum requirement. If there is no quorum, the chairperson of the Annual Meeting or the holders of a majority of the voting power of shares present at the Annual Meeting or represented by proxy may adjourn the Annual Meeting to another date.

Q: | How can I find out the results of the voting at the Annual Meeting? |

A: | Preliminary voting results will be announced at the Annual Meeting. In addition, final voting results will be published in a current report on Form 8-K that we expect to file within four business days after the Annual Meeting. If final voting results are not available to us in time to file a Form 8-K within four business days after the Annual Meeting, we intend to file a Form 8-K to publish preliminary results and, within four business days after the final results are known to us, file an additional Form 8-K to publish the final results. |

Q: | Who is paying for this proxy solicitation? |

A: | We will pay for the entire cost of soliciting proxies. In addition to these proxy materials, our directors and employees may also solicit proxies in person, by telephone, or by other means of communication. Directors and employees will not be paid any additional compensation for soliciting proxies. We may also reimburse brokerage firms, banks, and other agents for the cost of forwarding proxy materials to beneficial owners. |

Q: | When are stockholder proposals and director nominations due for next year’s annual meeting? |

A: | Proposals of stockholders intended to be presented at the 2025 annual meeting of stockholders, pursuant to Rule 14a-8 promulgated under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), must be received by us no later than December 26, 2024 in order to be included in the proxy statement and form of proxy relating to that meeting. Rule 14a-8 proposals must be delivered by mail to our principal executive offices at 99 Hudson Street, 10th Floor, New York, New York 10013, Attention: Corporate Secretary and we also encourage you to supplementally submit any such proposals via email to Legal@olo.com. |

Pursuant to our amended and restated bylaws, if you wish to submit a proposal (including a director nomination) at the 2025 annual meeting of stockholders that is not to be included in our proxy materials next year, we must receive notice no later than the close of business on March 22, 2025, nor earlier than the close of business on February 20, 2025. However, if the date of our 2025 annual meeting of stockholders is not held between May 21, 2025 and July 20, 2025, to be timely, notice by the stockholder must be received (A) not earlier than the close of business on the 120th day prior to the 2025 annual meeting of stockholders and (B) not later than the close of business on the later of the 90th day prior to the 2025 annual meeting of stockholders or the tenth day following the day on which public announcement of the date of the 2025 annual meeting of stockholders is first made. You are also advised to review our amended and restated bylaws, which contain additional requirements about advance notice of stockholder proposals and director nominations.

Additionally, to comply with universal proxy rules, if you intend to solicit proxies in support of director nominees other than our director nominees in accordance with Rule 14a-19 under the Exchange Act, you must provide notice to the Corporate Secretary at the address no later than 60 calendar days prior to the anniversary of the previous year’s annual meeting (no later than April 21, 2025 for the 2025 annual meeting of stockholders). Any such notice of intent to solicit proxies must comply with all the requirements of Rule 14a-19 under the Exchange Act.

8 |  |

Our board of directors currently consists of nine members and is divided into three classes. Each class consists, as nearly as possible, of one-third of the total number of directors, and each class has a three-year term. At each annual meeting of stockholders, the successors to directors whose terms then expire will be elected to serve from the time of election until the third annual meeting following their election.

Our directors are divided into the three classes as follows:

• | Class III directors: Brandon Gardner, David Frankel, and Zuhairah Washington, whose terms will expire at the upcoming Annual Meeting; |

• | Class I directors: Noah H. Glass, David Cancel, and Linda Rottenberg, whose terms will expire at the annual meeting of stockholders to be held in 2025; and |

• | Class II directors: Lee Kirkpatrick, Daniel Meyer, and Colin Neville, whose terms will expire at the annual meeting of stockholders to be held in 2026. |

Any additional directorships resulting from an increase in the number of directors will be distributed among the three classes so that, as nearly as possible, each class will consist of one-third of the directors. Vacancies on our board of directors may be filled only by persons elected by a majority of the remaining directors then in office, even if less than a quorum. A director elected by our board of directors to fill a vacancy in a class, including vacancies created by an increase in the number of directors, shall serve for the remainder of the full term of that class and until the director’s successor is duly elected and qualified. The division of our board of directors into three classes with staggered three-year terms may delay or prevent a change of our management or a change in control of Olo.

Each of Messrs. Gardner and Frankel and Ms. Washington is currently a member of our board of directors and has been nominated for reelection to serve as a Class III director. Each of these nominees has agreed to stand for reelection at the Annual Meeting. Our management has no reason to believe that any nominee will be unable to serve. If elected at the Annual Meeting, then each of these nominees would serve until the annual meeting of stockholders to be held in 2027 and until their successor has been duly elected, or if sooner, until the director’s death, resignation, or removal.

In accordance with our amended and restated bylaws, directors are elected by the affirmative vote of the stockholders representing a plurality of the voting power of outstanding shares of common stock present virtually or represented by proxy and entitled to vote on the election of directors. Accordingly, the three nominees receiving the most “FOR” votes will be elected. Each director must receive at least one “FOR” vote and if nominees are unopposed, election requires only a single “FOR” vote. Shares represented by executed proxies will be voted, if authority to do so is not withheld, “FOR” the election of the three nominees named above. If any nominee becomes unavailable for election as a result of an unexpected occurrence, shares that would have been voted for that nominee will instead be voted for the election of a substitute nominee proposed by us.

| | | OUR BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” EACH CLASS III DIRECTOR NOMINEE NAMED ABOVE. |

2024 Proxy Statement | 9 |

Deloitte & Touche LLP as our

Independent Registered Public

Accounting Firm

Our audit committee appointed Deloitte & Touche LLP (“Deloitte”) as our independent registered public accounting firm to perform the audit of our consolidated financial statements for the fiscal year-ending December 31, 2024, and we are asking you, and our other stockholders, to ratify this appointment. Deloitte has served as our independent registered public accounting firm since 2022.

Representatives of Deloitte are expected to be present at the Annual Meeting. They will have an opportunity to make a statement if they so desire and will be available to respond to appropriate questions.

Neither our amended and restated bylaws nor other governing documents or law require stockholders to ratify the selection of Deloitte as our independent registered public accounting firm. However, our audit committee is submitting the selection of Deloitte to the stockholders for ratification as a matter of good corporate practice. If the stockholders fail to ratify the selection, our audit committee will reconsider whether or not to retain that firm. Even if the selection is ratified, our audit committee, in its discretion, may appoint different independent auditors at any time during the year if they determine that such a change would be in the best interests of us and our stockholders.

The affirmative vote of the stockholders representing a majority of the voting power of the outstanding shares of common stock present virtually or represented by proxy (excluding abstentions and broker non-votes) at the Annual Meeting will be required to ratify the selection of Deloitte.

The following table represents the fees billed to us by Deloitte for the period ended December 31, 2023 and the period ended December 31, 2022.

| | | Fiscal Year-Ended December 31, | ||||

| | | 2023 | | | 2022 | |

| | | (in thousands) | ||||

Audit Fees(1) | | | $1,472 | | | $1,375 |

Audit-related Fees | | | — | | | — |

Tax Fees | | | — | | | — |

All Other Fees | | | — | | | — |

Total Fees | | | $1,472 | | | $1,375 |

(1) | Audit fees consist of fees for professional services provided in connection with the audit of our annual consolidated financial statements, the review of our quarterly consolidated financial statements, and audit services that are normally provided by an independent registered public accounting firm in connection with statutory and regulatory filings or engagements for those fiscal years. |

All fees described above were pre-approved by our audit committee.

10 |  |

PROPOSAL 2: Ratification of Deloitte & Touche LLP as our Independent Registered Public Accounting Firm

Our audit committee has adopted a policy and procedures for the pre-approval of audit and non-audit services rendered by our independent registered public accounting firm. The policy generally permits pre-approval of specified services in the defined categories of audit services, audit-related services, tax services, and permitted non-audit services. Pre-approval may also be given as part of our audit committee’s approval of the scope of the engagement of the independent registered public accounting firm or on an individual, explicit, case-by-case basis before the independent registered public accounting firm is engaged to provide each service. The pre-approval of services may be delegated to one or more of the members of our audit committee, but any pre-approval decision made pursuant to such delegation must be reported to our full audit committee at its next scheduled meeting.

| | | OUR BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE RATIFICATION OF DELOITTE & TOUCHE LLP AS OUR INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM. |

2024 Proxy Statement | 11 |

PROPOSAL 3: Approval of an Amendment to our Amended and Restated Certificate of Incorporation to Limit the Liability of Certain Officers as Permitted by Delaware Law

The State of Delaware, which is our state of incorporation, recently enacted legislation that enables Delaware companies to limit the liability of certain officers in limited circumstances under Section 102(b)(7) of the General Corporation Law of the State of Delaware (“DGCL”). Amended DGCL Section 102(b)(7) only permits exculpation for direct claims brought by stockholders for breach of an officer's fiduciary duty of care, including class actions, but does not eliminate officers’ monetary liability for breach of fiduciary duty claims brought by the corporation itself or for derivative claims brought by stockholders in the name of the corporation. Furthermore, the limitation on liability does not apply to breaches of the duty of loyalty, acts or omissions not in good faith or that involve intentional misconduct or a knowing violation of law, or any transaction in which the officer derived an improper personal benefit. Our Amended and Restated Certification of Incorporation currently provides for the exculpation of directors as permitted by the DGCL, but it does not include a provision that allows for the exculpation of officers.

Our board of directors believes it is important to provide protection from certain liabilities and expenses that may discourage prospective or current officers from serving corporations. In the absence of such protection, qualified officers might be deterred from serving as officers due to exposure to personal liability and the risk that substantial expense will be incurred in defending lawsuits, regardless of merit. In particular, our board of directors took into account the narrow class and type of claims that such officers would be exculpated from liability pursuant to amended DGCL Section 102(b)(7), the limited number of our officers that would be impacted, and the benefits our board of directors believes would accrue to us by providing exculpation in accordance with DGCL Section 102(b)(7), including, without limitation, the ability to attract and retain key officers and the potential to reduce litigation costs associated with frivolous lawsuits.

Our board of directors balanced these considerations with our corporate governance guidelines and practices and determined that it is advisable and in the best interests of us and our stockholders to amend our Amended and Restated Certificate of Incorporation to include a new Article IX (“Certificate Amendment”) and give exculpation protection to our officers, in addition to our directors, as permitted by amended DGCL Section 102(b)(7).

The Certificate Amendment would amend our Amended and Restated Certification of Incorporation by adding a new article as follows:

“IX.

A. To the fullest extent permitted by the DGCL, an Officer (as defined below) of the Corporation shall not be personally liable to the Corporation or its stockholders for monetary damages for breach of his or her fiduciary duty as an officer of the Corporation, except for liability (a) for any breach of the Officer’s duty of loyalty to the Corporation or its stockholders, (b) for acts or omissions not in good faith or which involve intentional misconduct or a knowing violation of law, (c) for any transaction from which the Officer derived an improper personal benefit, or (d) in any action brought by or in the right of the Corporation. If the DGCL is amended after the effective date of this Certificate of Incorporation to authorize corporate action further eliminating or limiting the personal liability of Officers, then the liability of an Officer of the Corporation shall be eliminated or limited to the fullest extent permitted by the DGCL, as so amended. For purposes of this Article IX, “Officer” shall mean an individual who has been duly

12 |  |

PROPOSAL 3: Approval of an Amendment to our Amended and Restated Certificate of Incorporation to Limit the

Liability of Certain Officers as Permitted by Delaware Law

appointed as an officer of the Corporation and who, at the time of an act or omission as to which liability is asserted, is deemed to have consented to service of process to the registered agent of the Corporation as contemplated by 10 Del. C. § 3114(b).

B. Any amendment, repeal or modification of this Article IX by either (i) the stockholders of the Corporation or (ii) an amendment to the DGCL, shall not adversely affect any right or protection existing at the time of such amendment, repeal, or modification with respect to any acts or omissions occurring before such amendment, repeal, or modification of a person serving as an Officer at the time of such amendment, repeal, or modification.”

The proposed Certificate Amendment is attached as Appendix A to this proxy statement.

Our board of directors believes that the Certificate Amendment is necessary to continue to attract and retain experienced and qualified officers. Our board of directors believes that in the absence of such protection, qualified officers might be deterred from serving as our officers due to exposure to personal liability. The nature of the role of officers often requires them to make decisions on crucial matters. Frequently, officers must make decisions in response to time-sensitive opportunities and challenges, which can create substantial risk of investigations, claims, actions, suits, or proceedings seeking to impose liability on the basis of hindsight, especially in the current litigious environment and regardless of merit. Limiting concern about personal risk would empower officers to best exercise their business judgment in furtherance of stockholder interests. We expect our peers to adopt exculpation clauses that limit the personal liability of officers in their certificates of incorporation, and failing to adopt the proposed Certificate Amendment could impact our recruitment and retention of exceptional officer candidates that conclude that the potential exposure to liabilities, costs of defense, and other risks of proceedings exceeds the benefits of serving as an officer of Olo. Further, our board of directors believes that the Certificate Amendment would not negatively impact shareholder rights, particularly taking into account the narrow class and type of claims for which officers’ liability would be exculpated.

Accordingly, on March 5, 2024, the board of directors determined that the proposed Certificate Amendment is advisable and in the best interests of us and our stockholders and authorized and approved the proposed Certificate Amendment, subject to approval by stockholders at the Annual Meeting.

The proposed Certificate Amendment is not being proposed in response to any specific resignation, threat of resignation, or refusal to serve by any officer.

If the proposed Certificate Amendment is approved by our stockholders, it will become effective immediately upon its filing with the Secretary of State of the State of Delaware, which we expect to file promptly after the Annual Meeting. Other than the inclusion of the new proposed Article IX, the remainder of our Amended and Restated Certificate of Incorporation will remain unchanged after effectiveness of the Certificate Amendment. If the proposed Certificate Amendment is not approved by our stockholders, our Amended and Restated Certificate of Incorporation will remain unchanged. In accordance with the DGCL, our board of directors may elect to abandon the proposed Certificate Amendment without further action by the stockholders at any time prior to the effectiveness of its filing with the Secretary of State of the State of Delaware, notwithstanding stockholder approval of the proposed Certificate Amendment.

The affirmative vote of the stockholders representing a majority of the voting power of the outstanding shares of common stock entitled to vote thereon will be required to approve and adopt the proposed Certificate Amendment.

| | | OUR BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE APPROVAL OF AN AMENDMENT TO OUR AMENDED AND RESTATED CERTIFICATE OF INCORPORATION TO LIMIT THE LIABILITY OF CERTAIN OFFICERS AS PERMITTED BY DELAWARE LAW. |

2024 Proxy Statement | 13 |

Vote on the Compensation of our

Named Executive Officers

We are seeking a non-binding advisory vote on the compensation of our named executive officers, referred to as a “Say-on-Pay” vote, as disclosed in this proxy statement, in accordance with the requirements of Section 14A of the Exchange Act.

Our executive compensation program and the compensation paid to our named executive officers are described in detail in the section “Executive Compensation—Compensation Discussion and Analysis”. Our compensation programs are overseen by our compensation committee and reflect our philosophy of paying for demonstrable performance. We strive to provide an executive compensation program that is competitive, rewards achievement of our business objectives, and aligns our executive officers’ interests with those of our stockholders. Consistent with this philosophy, we have designed our executive compensation program to achieve the following primary objectives:

• | provide market competitive compensation and benefit levels that will attract, motivate, reward, and retain a highly talented team of executive officers within the context of responsible cost management; |

• | establish a direct link between our financial and operational results and strategic objectives and the compensation of our executive officers; |

• | align the interests and objectives of our executive officers with those of our stockholders by linking their long-term incentive compensation opportunities to stockholder value creation and their annual cash bonus opportunities to our annual performance; and |

• | offer total compensation opportunities to our executive officers that are competitive, internally consistent, and fair. |

To help achieve these objectives, we structure our named executive officers’ compensation to reward the achievement of short-term and long-term strategic and operational goals.

Based on the above, we request that stockholders approve on a non-binding advisory basis, the compensation of our named executive officers as described in this proxy statement pursuant to the following resolution:

“RESOLVED, that the compensation paid to our named executive officers, as disclosed in this proxy statement pursuant to Item 402 of Regulation S-K, including the “Compensation Discussion and Analysis” section, compensation tables, and narrative discussion, is hereby APPROVED.”

The affirmative vote of the stockholders representing a majority of the voting power of the outstanding shares of common stock present virtually or represented by proxy (excluding abstentions and broker non-votes) at the Annual Meeting will be required to approve the compensation of our named executive officers.

As an advisory vote, this proposal is non-binding. Although the vote is non-binding, our board of directors and our compensation committee value the opinions of our stockholders and will consider the outcome of the vote when making future compensation decisions for our named executive officers. Stockholders should be aware that this non-binding advisory vote occurs after significant executive officer compensation decisions have been made in the current fiscal year. In addition, because the compensation elements integrate into an overall compensation package, it may not be possible or appropriate to change the compensation package to reflect the results of one year’s non-binding advisory vote on the compensation of our named executive officers before the next annual meeting of stockholders.

| | | OUR BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE APPROVAL OF, ON A NON-BINDING ADVISORY BASIS, THE COMPENSATION OF OUR NAMED EXECUTIVE OFFICERS. |

14 |  |

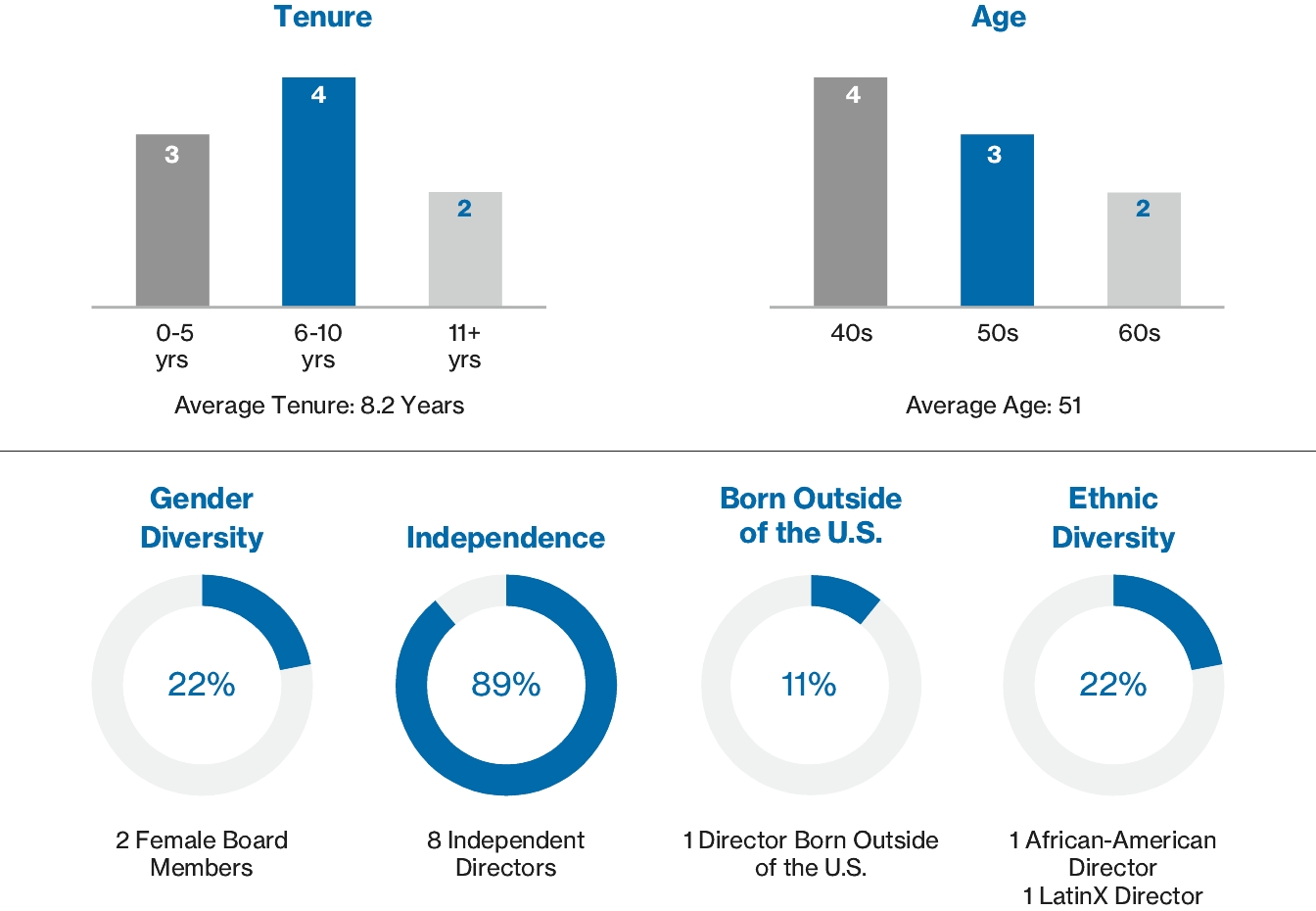

Our board of directors currently consists of nine members and is divided into three classes. Each class consists, as nearly as possible, of one-third of the total number of directors, and each class has a three-year term. At each annual meeting of stockholders, the successors to directors whose terms then expire will be elected to serve from the time of election until the third annual meeting following their election. The below graphic shows key attributes for our three nominees and the six other members of our board of directors whose service is continuing.

2024 Proxy Statement | 15 |

Board of Directors and Corporate Governance

The following table identifies, as of the date of this proxy statement, each of the nominees for election at the Annual Meeting:

Name | | | Age | | | Principal Occupation/Position | | | Class | | | Current Term Expires | | | Expiration of Term for Which Nominated |

Brandon Gardner | | | 49 | | | Director (Chair) | | | III | | | 2024 | | | 2027 |

David Frankel | | | 53 | | | Director | | | III | | | 2024 | | | 2027 |

Zuhairah Washington | | | 46 | | | Director | | | III | | | 2024 | | | 2027 |

The following table identifies, as of the date of this proxy statement, each of the remaining members of our board of directors whose terms continue beyond the Annual Meeting:

Name | | | Age | | | Principal Occupation/Position | | | Class | | | Current Term Expires | | | |

Noah H. Glass | | | 42 | | | Founder, Chief Executive Officer, and Director | | | I | | | 2025 | | | |

David Cancel | | | 52 | | | Director | | | I | | | 2025 | | | |

Linda Rottenberg | | | 55 | | | Director | | | I | | | 2025 | | | |

Lee Kirkpatrick | | | 63 | | | Director | | | II | | | 2026 | | | |

Daniel Meyer | | | 66 | | | Director | | | II | | | 2026 | | | |

Colin Neville | | | 40 | | | Director | | | II | | | 2026 | | |

Our nominating and corporate governance committee seeks to assemble a board of directors that possesses the appropriate balance of professional and industry knowledge, financial expertise, diversity, and high-level management experience necessary to oversee and direct our business. To that end, our nominating and corporate governance committee has identified and evaluated nominees in the broader context of the overall composition of our board of directors, with the goal of recruiting members who complement and strengthen the skills of other members and who also exhibit integrity, collegiality, sound business judgment, and other qualities that our nominating and corporate governance committee views as critical to effective functioning of our board of directors. These qualifications may be modified from time to time. Candidates for director nominees are reviewed in the context of the current composition of our board of directors, our operating requirements, and the long-term interests of our stockholders.

Our board of directors also recognizes the importance of diversity within our board of directors and believes that our business benefits from a wide range of skills and a variety of different backgrounds that contribute to the total mix of viewpoints and experience represented on the board of directors. A diverse composition contributes to a well-balanced decision-making process and proper functioning board of directors. Although we do not have a formal policy to consider diversity in identifying director nominees, in conducting its assessment, our nominating and corporate governance committee considers diversity (including, but not limited to, diversity of gender, ethnic background, and country of origin), age, skills, and other factors that it deems appropriate to maintain a balance of knowledge, experience, and capability on our board of directors.

16 |  |

Board of Directors and Corporate Governance

STEP 1 Collect Candidate Pool |

Independent search firms Independent search firms  Independent director recommendations Independent director recommendations Shareholder recommendations Shareholder recommendations  Management recommendations Management recommendations |

STEP 2 Holistic Candidate Review |

Potential candidates are comprehensively reviewed and are the subject of rigorous discussion during nominating and corporate governance committee and board of directors meetings. Our nominating and corporate governance committee also evaluates whether the nominee is independent for NYSE purposes, based upon applicable NYSE listing standards, applicable SEC rules and regulations, and the advice of counsel, if necessary. The candidates that emerge from this process are interviewed by our nominating and corporate governance committee, other members of our board of directors, and members of management. Simultaneous due diligence is conducted, including conducting any appropriate and necessary inquiries into the backgrounds and qualifications of possible candidates. |

STEP 3 Recommendation to our Board of Directors |

Our nominating and corporate governance committee presents qualified candidates to our board of directors for review and approval. |

Since 2020, four nominees have completed this process. |

50% from underrepresented ethnicities 50% from underrepresented ethnicities 100% experience as senior executives of high-growth technology companies 100% experience as senior executives of high-growth technology companies 50% experience as former Chief Financial Officers of public technology companies 50% experience as former Chief Financial Officers of public technology companies 25% experience as a former Chief Executive Officer of a high-growth company 25% experience as a former Chief Executive Officer of a high-growth company 100% international business experience 100% international business experience |

In the case of incumbent directors whose terms of office are set to expire, our nominating and corporate governance committee reviews these directors’ overall service to us during their terms, including the number of meetings attended, level of participation, quality of performance, and any other relationships and transactions that might impair the directors’ independence.

2024 Proxy Statement | 17 |

Board of Directors and Corporate Governance

Set forth below is biographical information, as of the date of this proxy statement, for the director nominees and each person whose term of office as a director will continue after the Annual Meeting. This includes information regarding each director and nominee’s experience, qualifications, attributes, or skills that led our board of directors to recommend them for board service.

We believe each nominee meets the qualifications, skills, and expertise established by our nominating and governance committee for service on our board of directors, including regarding areas that are critical to our strategy and operations. We also believe that such nominees, combined with the qualifications, skills, and expertise of the continuing directors, will position our board of directors to continue to serve the best interests of us and our stockholders.

Brandon Gardner | |

Independent Chair Director Since: 2016 Age: 49 Term Ends: 2024 Committees: • Compensation | Biography: Brandon Gardner has served as a member of our board of directors since January 2016 and as chair of our board of directors since June 2017. Mr. Gardner is a Founding Partner and has served as the President of The Raine Group (“Raine”), a global merchant bank dedicated to the technology, media, and telecommunications sectors, since 2009. Mr. Gardner was also Chief Operating Officer of Raine from 2009 until December 2023. Prior to Raine, Mr. Gardner founded and was the Senior Operating Officer of Serengeti Asset Management LP (“Serengeti”), a multi-strategy investment advisor. During his tenure at Serengeti, Mr. Gardner was an active member of the investment team, managing sector- and strategy-specific portfolios as well as the firm’s private investment opportunities. Prior to joining Serengeti in 2007, Mr. Gardner was a practicing attorney at Cleary Gottlieb Steen & Hamilton LLP from 1999 to 2007. Mr. Gardner serves on the boards of numerous companies held in the Raine investment portfolio. Additionally, Mr. Gardner served on the board of directors of Marquee Raine Acquisition Corp (formerly NASDAQ: MRAC) from 2020 until 2021. Mr. Gardner holds a B.A. from the College of Arts and Sciences at the University of Pennsylvania, a B.S. from the Wharton School at the University of Pennsylvania, and a J.D. from Columbia University. Qualifications: We believe Mr. Gardner is qualified to serve on the board of directors due to his experience in advising private and public companies in the technology space and structuring securities transactions. |

18 |  |

Board of Directors and Corporate Governance

David Frankel | |

Independent Director Since: 2005 Age: 53 Term Ends: 2024 Committees: • Nominating and Corporate Governance | Biography: David Frankel has served as a member of our board of directors since August 2005. Mr. Frankel is a Managing Partner of Founder Collective, a seed-stage venture capital firm, which he co-founded in 2009. Previously, Mr. Frankel was the co-founder and Chief Executive Officer of Internet Solutions, an internet service provider acquired by Dimension Data, which was later acquired by NTT Group. Mr. Frankel serves on the boards of numerous companies held in the Founder Collective investment portfolio. Mr. Frankel holds a B.S. in Electrical Engineering from the University of Witwatersrand and an M.B.A. from Harvard University. Qualifications: We believe Mr. Frankel is qualified to serve on the board of directors due to his experience building, financing, and advising companies from the earliest stages of growth. |

Zuhairah Washington | |

Independent Director Since: 2020 Age: 46 Term Ends: 2024 Committees: • Audit | Biography: Zuhairah Washington has served as a member of our board of directors since November 2020. Ms. Washington serves as an adviser and corporate officer at Otrium, an online fashion marketplace. From May 2023 until January 2024, she served as the Chief Executive Officer of Otrium and from 2021 until May 2023, she served as President and Chief Operating Officer of Otrium. From 2019 to 2021, Ms. Washington served as the SVP and Global Head of Strategic Partners at Expedia Group (NASDAQ: EXPE), whose brands include Expedia, Hotels.com, Orbitz, and VRBO. Prior to her tenure at Expedia Group, from 2018 to 2019, she was at Egon Zehnder, a global management consulting and leadership advisory firm. From 2013 to 2018, Ms. Washington was at Uber (NYSE: UBER), where she grew businesses from startup to scale and ran one of the top five U.S. markets. She also founded Kahnoodle, which was named to Entrepreneur Magazine’s 100 Brilliant Companies of 2012. Since September 2020, Ms. Washington has served on the board of directors of Five Below, Inc. (NASDAQ: FIVE). Ms. Washington graduated magna cum laude from UCLA with a B.A. in political science and public policy, and earned a joint graduate degree: a J.D. from Harvard Law School and an M.B.A. from Harvard Business School. Qualifications: We believe that Ms. Washington is qualified to serve on our board of directors due to her 20 years of operations and leadership experience in the technology and consumer space. |

2024 Proxy Statement | 19 |

Board of Directors and Corporate Governance

Noah H. Glass | |

Director Since: 2005 Age: 42 Term Ends: 2025 Committees: • None | Biography: Noah H. Glass is our Founder and Chief Executive Officer. He has served as a member of our board of directors since our inception in 2005. Prior to founding Olo Inc., Mr. Glass held the position of International Expansion Manager for Endeavor Global Inc. (“Endeavor”), a leading global community of, by, and for high-impact entrepreneurs, where he launched the first African Endeavor affiliate. In addition to serving as our Chief Executive Officer, Mr. Glass has served on the board of directors of Portillo’s Inc. (NASDAQ: PTLO) since 2017. Additionally, Mr. Glass is on the board of directors of Share Our Strength, a non-profit focused on ending childhood hunger in the United States, as well as the board of trustees for the Culinary Institute of America, providing guidance and advice to the world’s premier culinary college. Mr. Glass holds a B.A. in Political Science (International Relations) from Yale University. Qualifications: We believe that Mr. Glass is qualified to serve on our board of directors due to his experience building and leading our business as well as his insight into corporate matters as our Chief Executive Officer. |

David Cancel | |

Independent Director Since: 2022 Age: 52 Term Ends: 2025 Committees: • Compensation | Biography: David Cancel has served as a member of our board of directors since March 2022. Mr. Cancel is best known for creating hypergrowth products and product teams. Mr. Cancel is the co-founder of Drift.com, Inc. (“Drift”) and has been its Executive Chairman since 2022. Previously, Mr. Cancel served as Chief Executive Officer of Drift from 2015 until 2022. Prior to co-founding Drift, he served as the Chief Product Officer at HubSpot, Inc. (NYSE: HUBS) and has spent much of his over 25-year career as a serial entrepreneur, founding multiple technology companies including Performable, Inc., Ghostery, Inc., and Compete, Inc. Mr. Cancel is also a podcast host, advisor, guest lecturer, and author on topics relevant to scaling and growing technology companies. Additionally, Mr. Cancel is a member of and proud advocate for the LatinX technology community. Mr. Cancel attended Queens College of The City University of New York. Qualifications: We believe Mr. Cancel is qualified to serve on our board of directors due to his deep experience in enterprise software as a service (“SaaS”) product innovation and his operational experience in executive leadership. |

20 |  |

Board of Directors and Corporate Governance

Linda Rottenberg | |

Independent Director Since: 2016 Age: 55 Term Ends: 2025 Committees: • Compensation (Chair) • Nominating and Corporate Governance | Biography: Linda Rottenberg has served as a member of our board of directors since October 2016. Ms. Rottenberg is the co-founder and has served as the Chief Executive Officer of Endeavor since 1997. With offices in 40 countries, Endeavor identifies, selects, scales up, and co-invests in the most promising high-growth founders across all verticals. Ms. Rottenberg also oversees the Endeavor Catalyst LP Fund, a fund with over $500M assets under management, which co-invests in the equity financing rounds of Endeavor Entrepreneurs. In addition to her responsibilities at Endeavor, Ms. Rottenberg is a member of the Young Presidents’ Organization and serves as Vice Chair of the Yale President’s Committee on International Activities and on the board of Yale Ventures. Ms. Rottenberg sits on the boards of various technology companies, including Globant S.A. (NYSE: GLOB) which she has served on since 2017. Additionally, Ms. Rottenberg sat on the board of Zayo Group Holdings, Inc. (formerly NYSE: ZAYO) from 2014 to 2020, at which point the Zayo Group went private. Ms. Rottenberg holds a B.A. in Social Studies from Harvard University and a J.D. from Yale Law School. Qualifications: We believe that Ms. Rottenberg is qualified to serve on our board of directors due to her extensive experience in entrepreneurship, innovation, business development, and leadership. |

Lee Kirkpatrick | |

Independent Director Since: 2023 Age: 62 Term Ends: 2026 Committees: • Audit (Chair) | Biography: Lee Kirkpatrick has served as a member of our board of directors since June 2023. Mr. Kirkpatrick is a retired executive with extensive experience in the technology industry and demonstrated experience in financial oversight and reporting. Prior to his retirement, Mr. Kirkpatrick was the Chief Financial Officer of Twilio Inc. (NYSE: TWLO). He joined Twilio Inc. in May 2012 and took them public in June 2016, before retiring in December 2018. Mr. Kirkpatrick has also held senior executive roles at a number of companies, including SAY Media, Inc., VideoEgg, Inc., Kodak Imaging Network Inc., Ofoto Inc., iOwn, Inc., and HyperParallel, Inc. Mr. Kirkpatrick began his career at the Atlantic Richfield Company and Reuters America Inc. Mr. Kirkpatrick serves on the boards of numerous private companies and nonprofit organizations. Mr. Kirkpatrick previously served on the boards of directors of TWC Tech Holdings II Corp. (formerly NASDAQ: TWCTU) from 2020 until 2021 and Bilander Acquisition Corp. (formerly NASDAQ: TWCB) from 2021 until 2023. Mr. Kirkpatrick holds a B.S. in Business Administration from the University of Southern California and an M.B.A. in Finance from Columbia University. Qualifications: We believe that Mr. Kirkpatrick is qualified to serve on our board of directors due to his track record in executive management in the technology sector and his extensive experience in financial oversight and reporting. |

2024 Proxy Statement | 21 |

Board of Directors and Corporate Governance

Daniel Meyer | |

Independent Director Since: 2014 Age: 66 Term Ends: 2026 Committees: • Nominating and Corporate Governance (Chair) | Biography: Daniel Meyer has served as a member of our board of directors since October 2014. In 1985, Mr. Meyer founded Union Square Hospitality Group (“USHG”), which owns and operates an event services business, Union Square Events, as well as the following restaurants: Union Square Cafe, Gramercy Tavern, Blue Smoke, The Modern, the Cafes at MOMA, Porchlight, Manhatta, Ci Siamo, Daily Provisions, Cedric’s at the Shed, and Tacocina. The restaurants have earned 28 James Beard Awards among them. Mr. Meyer has served as Executive Chairman of USHG since 2022 and previously held the position of Chief Executive Officer from 1985 until 2022. Mr. Meyer is also the founder of Shake Shack Inc. (NYSE: SHAK), where he has been the Chairperson of the Board since 2015. Mr. Meyer previously served as the Chairperson of the board of directors of USHG Acquisition Corp. (formerly NYSE: HUGS) from 2020 to 2022, on the board of directors of The Container Store Group, Inc. (NYSE: TCS) from 2013 to 2017, and OpenTable, Inc. (formerly NASDAQ: OPEN) from 2000 through 2014, as well as the following organizations: Trinity College, Share Our Strength, Union Square Partnership, Madison Square Park Conservancy, and NYC & Co. Mr. Meyer holds a B.A. in Political Science from Trinity College. Qualifications: We believe Mr. Meyer is qualified to serve on our board of directors due to his long career in hospitality, his wealth of restaurant technology experience, his particular experience in strategic planning and leadership of complex organizations, and his experience with board practices of other major corporations. |

Colin Neville | |

Independent Director Since: 2016 Age: 40 Term Ends: 2026 Committees: • Audit | Biography: Colin Neville has served as a member of our board of directors since January 2016. Mr. Neville is a Partner at Raine and has been with the firm since its inception in 2009. Prior to joining Raine, Mr. Neville worked in the Mergers and Acquisitions group at Bank of America Corp. (NYSE: BAC) with a focus on technology, media, and telecom. Mr. Neville has been on the boards of several companies held in the Raine investment portfolio. Mr. Neville holds a B.A. in Political Science from Yale University. Qualifications: We believe that Mr. Neville is qualified to serve on the board of directors due to his deep understanding of technology trends and his experience investing in technology companies. |

22 |  |

Board of Directors and Corporate Governance

Our governance structure reflects our commitment to accountability, diversity, ethical conduct, and the alignment of the interests of our board of directors with the long-term interests of our stockholders. Highlights of our governance profile include:

Our Class A common stock is listed on the NYSE. Under the NYSE listing standards, a majority of the members of our board of directors must qualify as “independent,” as affirmatively determined by our board of directors. Our board of directors consults with our counsel to ensure that its determinations are consistent with relevant securities and other laws and regulations regarding the definition of “independent,” including those set forth in pertinent listing standards of NYSE, as in effect from time to time.

Consistent with these considerations, after review of all relevant identified transactions or relationships between each director, and any of their family members, and Olo, our executive officers, and our independent auditors, and following the recommendation of our nominating and corporate governance committee, our board of directors has affirmatively determined that the following eight directors are independent directors within the meaning of the applicable NYSE listing standards: Messrs. Gardner, Cancel, Frankel, Kirkpatrick, Meyer, and Neville, and Mses. Rottenberg and Washington. In making these independence determinations, our board of directors considered the applicable NYSE rules and the current and prior relationships that each non-employee director has with us and all other facts and circumstances our board of directors deemed relevant in determining their independence, including their beneficial ownership of our capital stock. Mr. Glass is not independent due to his position as our Chief Executive Officer. Accordingly, a majority of our directors are independent, as required under applicable NYSE rules.

Our board of directors has an independent chair, Mr. Gardner. The primary responsibilities of the chair of our board of directors are to: work with our Chief Executive Officer, Mr. Glass, to develop board meeting schedules and agendas; provide our Chief Executive Officer with feedback on the quality, quantity, and timeliness of the information provided to our board of directors; develop the agenda for, and moderate executive sessions of, the independent members of our board of directors; preside over board meetings; act as principal liaison between the independent members of our board of directors and Chief Executive Officer; convene meetings of the independent directors as appropriate; and perform other duties as our board of directors may determine from time to time. Accordingly, Mr. Gardner has substantial ability to shape the work of our board of directors.

2024 Proxy Statement | 23 |

Board of Directors and Corporate Governance

We believe that separation of the positions of the chair of our board of directors and Chief Executive Officer reinforces the independence of our board of directors in its oversight of our business affairs. In addition, we believe that having an independent chair of our board of directors creates an environment that is conducive to objective evaluation and oversight of management’s performance, increasing management’s accountability, and improving the ability of our board of directors to monitor whether management’s actions are in the best interests of Olo and our stockholders. As a result, we believe that having an independent chair of our board of directors can enhance the effectiveness of our board of directors as a whole.

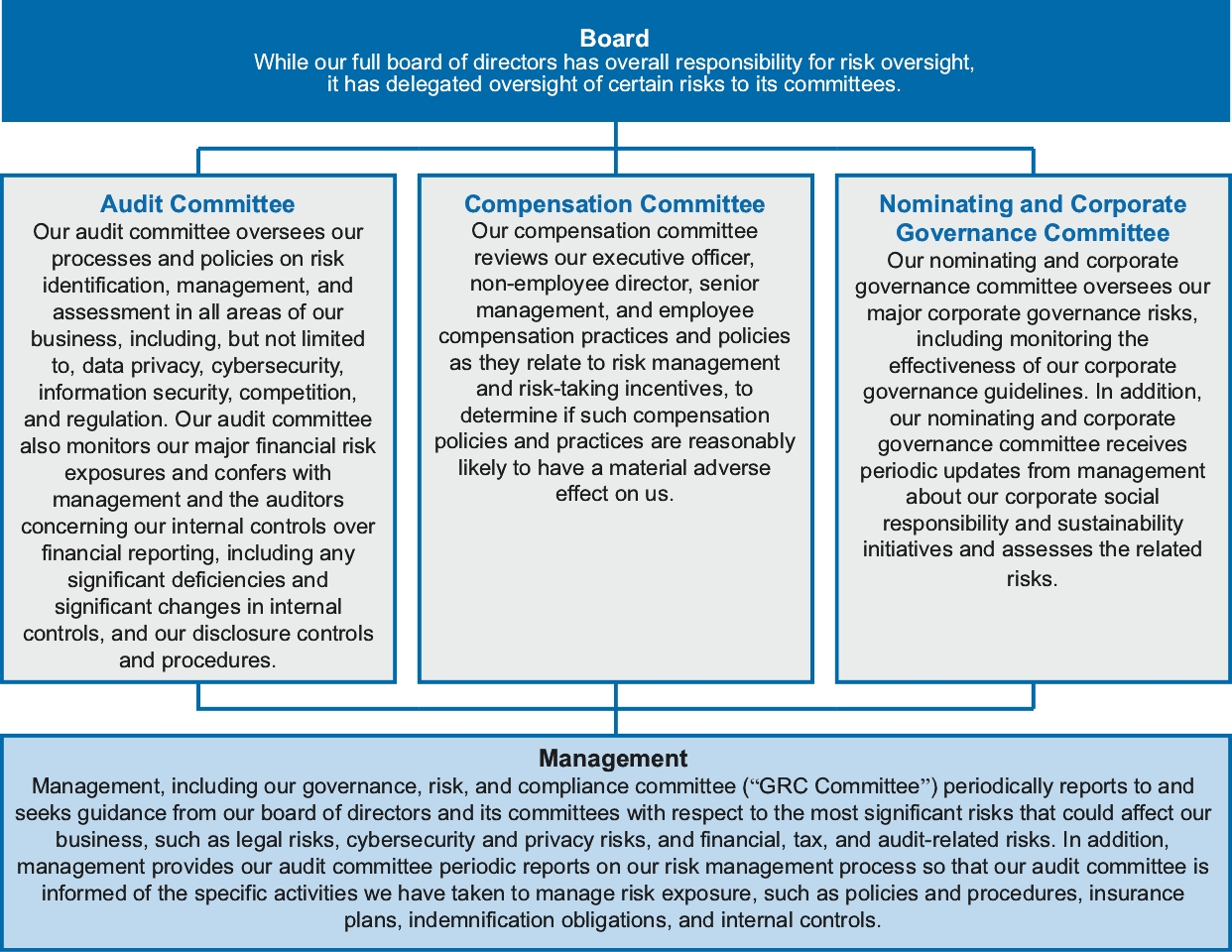

One of the key functions of our board of directors is informed oversight of our risk management process. Our board of directors does not have a standing risk management committee, but rather administers this oversight function directly through our board of directors as a whole, as well as through its various standing committees that address risks inherent in their respective areas of oversight. In particular, our board of directors is responsible for monitoring and assessing strategic risk exposure, including a determination of the nature and level of risk appropriate for Olo and the implementation of appropriate processes to administer day-to-day risk management.

Data Privacy, Security, and Compliance

Cybersecurity risk management is a significant part of our overall risk management process. Our cybersecurity risk management program is informed by security frameworks and standards, such as PCI DSS, ISO 27001, and CIS Controls. We have designed and implemented various information security processes that are intended to protect the confidentiality, integrity, security, and availability of our critical systems and information and provide a cross-functional framework for identifying, preventing, and mitigating cybersecurity threats and incidents, including threats and incidents associated with the use of applications developed and services provided by third-party service providers.

24 |  |

Board of Directors and Corporate Governance